Attached files

Table of Contents

As filed with the Securities and Exchange Commission on June 29, 2015

Registration No. 333-202298

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 3

to

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Barnes & Noble Education, Inc.

(Exact name of registrant as specified in its Charter)

| Delaware | 451211 | 46-0599018 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification No.) |

120 Mountain View Blvd

Basking Ridge, NJ 07920

(908) 991-2665

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive office)

General Counsel and Corporate Secretary

Barnes & Noble Education, Inc.

120 Mountain View Blvd

Basking Ridge, NJ 07920

(908) 991-2665

(Name, address, including zip code, and telephone number, including area code, of agent for service)

With a copy to:

Kris Heinzelman

Andrew R. Thompson

Cravath, Swaine & Moore LLP

Worldwide Plaza

825 Eighth Avenue

New York, NY 10019

(212) 474-1000

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (check one)

| Large Accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | x (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | |||

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to Section 8(a), may determine.

Table of Contents

The information in this Prospectus is not complete and may be changed. We may not issue these securities until the registration statement filed with the Securities and Exchange Commission is effective. This Prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION

PRELIMINARY PROSPECTUS DATED JUNE 29, 2015

Barnes & Noble Education, Inc.

Common Stock

(par value $0.01)

This Prospectus is being furnished to you as a stockholder of Barnes & Noble, Inc. (“Barnes & Noble”) in connection with the planned distribution (the “Spin-Off” or the “Distribution”) by Barnes & Noble to its stockholders of all the shares of common stock, par value $0.01 per share (the “Common Stock”), of Barnes & Noble Education, Inc. (the “Company”) held by Barnes & Noble immediately prior to the Spin-Off. Immediately prior to the time of the Distribution, Barnes & Noble will hold 100% of the outstanding shares of Common Stock. On May 1, 2015, we distributed to Barnes & Noble all of the membership interests in NOOK Digital LLC (formerly known as barnesandnoble.com llc), which owns the digital business and which will continue to be owned by Barnes & Noble. At such time, we ceased to own any interest in the digital business.

At the time of the Spin-Off, Barnes & Noble will distribute all the outstanding shares of Common Stock held by it on a pro rata basis to holders of Barnes & Noble’s common stock. Each share of Barnes & Noble’s common stock outstanding as of 5:00 p.m., New York City time, on , 2015, the record date for the Spin-Off (the “Record Date”), will entitle the holder thereof to receive 0.632 shares of Common Stock. The Distribution will be made in book-entry form by a distribution agent. Fractional shares of Common Stock will not be distributed in the Spin-Off. The distribution agent will aggregate fractional shares into whole shares, sell the whole shares in the open market at prevailing market prices and distribute the aggregate cash proceeds of the sales, net of brokerage fees and other costs, pro rata to each holder (net of any required withholding for taxes applicable to each holder) who would otherwise have been entitled to receive a fractional share in the distribution.

The Spin-Off will be effective after the close of trading on the New York Stock Exchange (the “NYSE”) on , 2015 (the “Distribution Date”). Immediately after the Spin-Off, the Company will be an independent publicly-traded company.

Holders of Barnes & Noble’s Senior Convertible Redeemable Series J Preferred Stock (“Series J Preferred Stock,” and each holder of such Series J Preferred Stock, a “Series J Holder”) have the option to exchange their holdings of the Series J Preferred Stock for a series of convertible preferred stock of the Company (the “Mirror Preferred Stock”) having terms and rights that are identical, or as nearly so as is practicable, to those of the Series J Preferred Stock, subject to certain exceptions, together with a new series of preferred stock of Barnes & Noble (“Exchange Preferred Stock”). Barnes & Noble is obligated to give notice to Series J Holders of the Spin-Off not more than 60 business days and not less than 20 business days prior to the effective date of the Spin-Off, and upon receipt of such notice, Series J Holders may elect to exchange all or a portion of their Series J Preferred Stock for an equivalent number of shares of Mirror Preferred Stock and Exchange Preferred Stock. Series J Holders may make such an election by sending notice, in the form specified in Barnes & Noble’s notice to Series J Holders, to Barnes & Noble, which notice must be received by 5:00 p.m., New York City time, on the date of the Spin-Off. Any exchange of Series J Preferred Stock for Mirror Preferred Stock and Exchange Preferred Stock will be effective as of the Distribution Date.

Barnes & Noble’s stockholders are not required to vote on or take any other action in connection with the Spin-Off. We are not asking you for a proxy, and we request that you do not send us a proxy. Barnes & Noble stockholders will not be required to pay any consideration for the Common Stock they receive in the Spin-Off, and they will not be required to surrender or exchange their shares of Barnes & Noble’s common stock or take any other action in connection with the Spin-Off.

Barnes & Noble currently owns all the outstanding shares of Common Stock. Accordingly, there is currently no public market for the Common Stock. We anticipate, however, that trading in the Common Stock will begin on a “when-issued” basis as early as two trading days prior to the Record Date for the Distribution and will continue up to and including the Distribution Date. “When-issued” trades generally settle within four trading days after the Distribution Date. On the first trading day following the Distribution Date, any “when-issued” trading of the Common Stock will end and “regular-way” trading will begin. We intend to list the Common Stock on the NYSE under the symbol “BNED.”

In reviewing this Prospectus, you should carefully consider the matters described in the section titled “Risk Factors” beginning on page 13 of this Prospectus.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED THESE SECURITIES OR DETERMINED IF THIS PROSPECTUS IS TRUTHFUL OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

This Prospectus is not an offer to sell, or a solicitation of an offer to buy, any securities.

The date of this Prospectus is , 2015.

Table of Contents

| Page | ||||

| i | ||||

| 1 | ||||

| 13 | ||||

| 24 | ||||

| 26 | ||||

| MATERIAL U.S. FEDERAL INCOME TAX CONSEQUENCES OF THE SPIN-OFF |

32 | |||

| 35 | ||||

| 35 | ||||

| 35 | ||||

| 35 | ||||

| 37 | ||||

| 40 | ||||

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

44 | |||

| 59 | ||||

| 71 | ||||

| 79 | ||||

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT |

105 | |||

| 108 | ||||

| 113 | ||||

| 121 | ||||

| 122 | ||||

| 122 | ||||

| 122 | ||||

| F-1 | ||||

Table of Contents

QUESTIONS AND ANSWERS ABOUT THE SPIN-OFF

The following questions and answers briefly address some commonly asked questions about the Spin-Off. They may not include all the information that is important to you. We encourage you to read carefully this entire Prospectus and the other documents to which we have referred you. We have included references in certain parts of this section to direct you to a more detailed discussion of each topic presented in this section.

| Q: | What is the Spin-Off? |

| A: | The Spin-Off is the method by which we will separate from Barnes & Noble. In the Spin-Off, Barnes & Noble will distribute to holders of its common stock all the outstanding shares of our Common Stock and will distribute shares of the Mirror Preferred Stock and the Exchange Preferred Stock to electing Series J Holders, if any. Following the Spin-Off, we will be an independent publicly-traded company, and Barnes & Noble will not retain any ownership interest in us. |

| Q: | Will the number of Barnes & Noble shares of common stock I own change as a result of the Spin-Off? |

| A: | No, the number of shares of Barnes & Noble common stock you own will not change as a result of the Spin-Off. |

| Q: | What are the reasons for the Spin-Off? |

| A: | The Barnes & Noble board of directors considered the following potential benefits in deciding to pursue the Spin-Off: |

| • | The opportunities and challenges we expect to arise in the immediate future of the Barnes & Noble retail business differ markedly from those of our business. For Barnes & Noble, increasing foot traffic in existing locations, adapting offerings to shifting consumer tastes and patterns and harmonizing the in-store, online and digital experiences will require a fully engaged board of directors and management team that has a different skill set and experience than those required to execute our goals and strategic initiatives. We believe the Spin-Off will enhance the ability of Barnes & Noble and the Company to focus on their respective strategies. |

| • | Our near-term goals for our business include the expansion of both the scale and the scope of the historic business model and also pursuing growth opportunities more broadly in the education sector, including by enhancing and expanding our digital assets. Achieving these goals will likely require acquisitions or mergers funded, in part, with capital raises and strategic alliances with other companies. Our business will be separate and distinct from Barnes & Noble’s business and, accordingly, we believe that pursuing such growth opportunities will be greatly facilitated with a capital structure that is tailored for the Company’s needs, separate from those of Barnes & Noble. |

| • | The Spin-Off will establish the Company as an independent publicly traded corporation, which we believe will meaningfully enhance its industry market perception, thereby providing greater growth opportunities for us than our consolidated operation as a division of Barnes & Noble. |

| Q: | Why is the separation of the Company structured as a spin-off? |

| A: | Barnes & Noble believes that a tax-free distribution of our Common Stock is the most efficient way to separate our business from Barnes & Noble in a manner that will achieve the above benefits. |

| Q: | What will I receive in the Spin-Off? |

| A: | As a holder of Barnes & Noble common stock, you will receive a dividend of 0.632 shares of our Common Stock for every share of Barnes & Noble common stock you hold on the Record Date (as defined below). The distribution agent will distribute only whole shares of our Common Stock in the Spin-Off. See |

i

Table of Contents

| “Questions and Answers About the Spin-Off—How will fractional shares be treated in the Spin-Off?” for more information on the treatment of the fractional share you may be entitled to receive in the Spin-Off. Your proportionate interest in Barnes & Noble will not change as a result of the Spin-Off. For a more detailed description, see “The Spin-Off.” |

| Q: | What is being distributed to holders of Barnes & Noble common stock in the Spin-Off? |

| A: | Barnes & Noble will distribute approximately 44.4 million shares of our Common Stock in the Spin-Off, based on the approximately 70.2 million shares of Barnes & Noble common stock outstanding as of May 31, 2015 (which total includes the 6,117,347 New Barnes & Noble Shares to be issued on or around July 9, 2015, as described further under “Summary—Recent Developments”). The actual number of shares of our Common Stock that Barnes & Noble will distribute will depend on the number of shares of Barnes & Noble common stock outstanding on the Record Date. The shares of our Common Stock that Barnes & Noble distributes will constitute all of the issued and outstanding shares of our Common Stock immediately prior to the Spin-Off. For more information on the shares being distributed in the Spin-Off, see “Description of Our Capital Stock—Common Stock.” |

| Q: | What is the record date for the Distribution? |

| A: | Barnes & Noble will designate 5:00 p.m., New York City time, on , 2015, which we refer to as the “Record Date”, as the record ownership date for the Distribution. |

| Q: | When will the Distribution to holders of Barnes & Noble common stock occur? |

| A: | The Distribution will be effective after the close of trading on the NYSE on , 2015, which we refer to as the “Distribution Date.” On or shortly after the Distribution Date, the whole shares of our Common Stock will be credited in book-entry accounts for stockholders entitled to receive those shares in the Distribution. See “Questions and Answers About the Spin-Off—How will Barnes & Noble distribute shares of our Common Stock?” for more information on how to access your book-entry account or your bank, brokerage or other account holding the Common Stock you will receive in the Distribution. |

| Q: | What do I have to do to participate in the Distribution? |

| A: | You are not required to take any action, but we urge you to read this Prospectus carefully. Holders of Barnes & Noble common stock on the Record Date will not need to pay any cash or deliver any other consideration, including any shares of Barnes & Noble common stock, in order to receive shares of our Common Stock in the Distribution. No stockholder approval of the Distribution is required. We are not asking you for a vote, and we request that you do not send us a proxy card. |

| Q: | If I sell my shares of Barnes & Noble common stock on or before the Distribution Date, will I still be entitled to receive shares of the Common Stock in the Distribution? |

| A: | If you hold shares of Barnes & Noble common stock on the Record Date and decide to sell them on or before the Distribution Date, you may choose to sell your Barnes & Noble common stock with or without your entitlement to our Common Stock. You should discuss these alternatives with your bank, broker or other nominee. See “The Spin-Off—Trading Prior to the Distribution Date” for more information. |

| Q: | How will Barnes & Noble distribute shares of our Common Stock? |

| A: | Registered stockholders: If you are a registered stockholder (meaning you own your shares of Barnes & Noble common stock directly through Barnes & Noble’s transfer agent, Computershare), our distribution agent will credit the whole shares of our Common Stock you receive in the Distribution to a new book-entry account with our transfer agent on or shortly after the Distribution Date. Our distribution agent will mail you a book-entry account statement that reflects the number of whole shares of our Common Stock you own. You will be able to access information regarding your book-entry account holding our Common Stock at Computershare. |

ii

Table of Contents

“Street name” or beneficial stockholders: If you own your shares of Barnes & Noble common stock beneficially through a bank, broker or other nominee, your bank, broker or other nominee will credit your account with the whole shares of our Common Stock you receive in the Distribution on or shortly after the Distribution Date. Please contact your bank, broker or other nominee for further information about your account.

We will not issue any physical stock certificates to any stockholders, even if requested. See “The Spin-Off—When and How You Will Receive Company Common Stock” for a more detailed explanation.

| Q: | How will fractional shares be treated in the Distribution? |

| A: | The distribution agent will not distribute any fractional shares of our Common Stock in connection with the Spin-Off. Instead, the distribution agent will aggregate all fractional shares into whole shares and sell the whole shares in the open market at prevailing market prices on behalf of Barnes & Noble stockholders entitled to receive a fractional share. The distribution agent will then distribute the aggregate cash proceeds of the sales, net of brokerage fees and other costs, pro rata to these holders (net of any required withholding for taxes applicable to each holder). We anticipate that the distribution agent will make these sales in the “when-issued” market, and “when-issued” trades will generally settle within four trading days following the Distribution Date. See “Questions and Answers About the Spin-Off—How will the Common Stock trade?” for additional information regarding “when-issued” trading and “The Spin-Off—Treatment of Fractional Shares” for a more detailed explanation of the treatment of fractional shares. |

| Q: | What are the U.S. federal income tax consequences to me of the Distribution? |

| A: | For U.S. federal income tax purposes, no gain or loss should be recognized by, or be includible in the income of, a U.S. Holder (as defined in “Material U.S. Federal Income Tax Consequences of the Spin-Off”) as a result of the Distribution, except with respect to any cash received by Barnes & Noble stockholders in lieu of fractional shares. In addition, the aggregate tax basis of the Barnes & Noble common stock and our Common Stock held by each U.S. Holder immediately after the Distribution will be the same as the aggregate tax basis of the Barnes & Noble common stock held by the U.S. Holder immediately before the Distribution, allocated between the Barnes & Noble common stock and our Common Stock in proportion to their relative fair market values on the Distribution Date (subject to certain adjustments). |

See “Material U.S. Federal Income Tax Consequences of the Spin-Off” for more information regarding the potential tax consequences to you of the Spin-Off.

| Q: | Does the Company intend to pay cash dividends? |

| A: | Following the Spin-Off, we do not anticipate paying any dividends on our Common Stock in the foreseeable future. See “Dividend Policy” for more information. |

| Q: | How will the Common Stock trade? |

| A: | Currently, there is no public market for our Common Stock. We intend to list our Common Stock on the NYSE under the symbol “BNED.” |

We anticipate that trading in our Common Stock will begin on a “when-issued” basis as early as two trading days prior to the Record Date for the Distribution and will continue up to and including the Distribution Date. “When-issued” trading in the context of a spin-off refers to a sale or purchase made conditionally on or before the Distribution Date because the securities of the spun-off entity have not yet been distributed. “When-issued” trades generally settle within four trading days after the Distribution Date. On the first trading day following the Distribution Date, any “when-issued” trading of our Common Stock will end and “regular-way” trading will begin. Regular-way trading refers to trading after the security has been

iii

Table of Contents

distributed and typically involves a trade that settles on the third full trading day following the date of the trade. See “The Spin-Off—Trading Prior to the Distribution Date” for more information. We cannot predict the trading prices for our Common Stock before, on or after the Distribution Date.

| Q: | Will the Spin-Off affect the trading price of my Barnes & Noble common stock? |

| A: | We expect the trading price of shares of Barnes & Noble common stock immediately following the Spin-Off to be lower than immediately prior to the Spin-Off because the trading price will no longer reflect the value of Barnes & Noble Education, Inc. and our subsidiaries. Furthermore, until the market has fully analyzed the value of Barnes & Noble without the Company, the trading price of shares of Barnes & Noble common stock may fluctuate. We cannot assure you that, following the Spin-Off, the combined trading prices of the Barnes & Noble common stock and our Common Stock will equal or exceed what the trading price of Barnes & Noble common stock would have been in the absence of the Spin-Off. It is possible that after the Spin-Off, the combined equity value of Barnes & Noble and the Company will be less than Barnes & Noble’s equity value before the Spin-Off. In addition, since the liquidation preference for any Mirror Preferred Stock issued to Series J Holders (and the related Exchange Preferred Stock) will be based on the relative trading values of our Common Stock and the Barnes & Noble common stock during the five trading days immediately following the Spin-Off, the trading price of the Barnes & Noble common stock and our Common Stock could be affected during this period. See “Risk Factors—We may have shares of preferred stock convertible into Common Stock.” |

| Q: | Do I have appraisal rights in connection with the Spin-Off? |

| A: | No. Holders of Barnes & Noble common stock are not entitled to appraisal rights in connection with the Spin-Off. |

| Q: | Who is the transfer agent and registrar for the Common Stock? |

| A: | Computershare is the transfer agent and registrar for the Common Stock. |

| Q: | Are there risks associated with owning shares of the Common Stock? |

| A: | Yes. Our business faces both general and specific risks and uncertainties. Our business also faces risks relating to the Spin-Off. Following the Spin-Off, we will also face risks associated with being an independent publicly-traded company. Accordingly, you should read carefully the information set forth in the section titled “Risk Factors” in this Prospectus. |

| Q: | Are there any conditions to completing the Spin-Off? |

| A: | Yes. The Spin-Off is conditional upon a number of matters, including the authorization and approval of the board of directors of Barnes & Noble, the consent of the lenders to Barnes & Noble under its existing credit agreement and the declaration of effectiveness of our Registration Statement on Form S-1, of which this Prospectus is a part, by the Securities and Exchange Commission. See “Summary of the Spin-Off— Conditions to the Spin-Off” for a more detailed explanation of the conditions to completing the Spin-Off. |

| Q: | Could there be any other classes of capital stock of the Company outstanding after the Spin-Off? |

| A: | Yes. Series J Holders have the option to exchange all or a portion of their holdings of Barnes & Noble’s Series J Preferred Stock for Mirror Preferred Stock of the Company having terms and rights that are identical, or as nearly as practicable, to the Series J Preferred Stock, subject to certain exceptions. Series J Holders are not required to elect to receive Mirror Preferred Stock until the effective date of the Spin-Off. See “Risk Factors—We may have shares of preferred stock that will be convertible into Common Stock” and “Description of Our Capital Stock—Preferred Stock” for more information regarding the Series J Preferred Stock and the Mirror Preferred Stock. |

iv

Table of Contents

| Q: | What is happening to the NOOK digital business? |

| A: | On May 1, 2015, the NOOK digital business was transferred to Barnes & Noble. Therefore, the digital business will continue to be owned by Barnes & Noble after the Spin-Off. |

| Q: | Where can I get more information? |

| A: | Before the Spin-Off, if you have any questions relating to the Spin-Off, you should contact: |

Investor Relations

Barnes & Noble, Inc.

122 Fifth Avenue

New York, New York 10011

Andy Milevoj

amilevoj@bn.com

After the Spin-Off, if you have any questions relating to the Company, you should contact:

Investor Relations

Barnes & Noble Education, Inc.

120 Mountain View Blvd.

Basking Ridge, NJ 07920

Thomas D. Donohue

tdonohue@bncollege.com

v

Table of Contents

This summary of certain information contained in this Prospectus may not include all the information that is important to you. To understand fully and for a more complete description of the terms and conditions of the Spin-Off, you should read this Prospectus in its entirety and the documents to which you are referred. See “Where You Can Find More Information.”

In this Prospectus, unless the context otherwise requires:

| • | “Barnes & Noble” refers to Barnes & Noble, Inc. and its consolidated subsidiaries other than, for all periods following the Spin-Off, Barnes & Noble Education, Inc., |

| • | “Company,” “we,” “our” and “us” refer to Barnes & Noble Education, Inc. and its consolidated subsidiaries, |

| • | “our business” and “the college business” refers to our college bookstore business operated through our subsidiary Barnes & Noble College Booksellers, LLC, and |

| • | The “NOOK digital business” and “digital business” refer to our historical digital business that is operated through NOOK Digital LLC (formerly known as barnesandnoble.com llc) but prior to the Spin-Off will no longer be owned by us. |

| • | Our fiscal year is comprised of 52 or 53 weeks, ending on the Saturday closest to the last day of April. “Fiscal 2015” means the 52 weeks ended May 2, 2015, “Fiscal 2014” means the 53 weeks ended May 3, 2014, “Fiscal 2013” means the 52 weeks ended April 27, 2013, “Fiscal 2012” means the 52 weeks ended April 28, 2012, and “Fiscal 2011” means the 52 weeks ended April 30, 2011. |

| • | Any reference to our Amended and Restated Certificate of Incorporation and Amended and Restated By-laws give effect to the proposed amendments thereto which will not become effective until immediately prior to the Distribution. |

Unless otherwise indicated, market and industry information contained in this Prospectus is based on information provided by the National Association of College Stores (NACS) and management estimates of market shares.

Overview

On February 26, 2015, Barnes & Noble announced plans for the complete legal and structural separation of the Company from Barnes & Noble. Barnes & Noble will distribute all of our Common Stock to Barnes & Noble’s common stockholders and, at the election of Series J Holders, Mirror Preferred Stock and Exchange Preferred Stock to such Series J Holders. Thereupon, we will be an independent publicly traded company.

Our Company

We are one of the largest contract operators of bookstores on college and university campuses in the United States. We create and operate campus stores that are focal points for college life and learning, enhancing the educational mission of the institution, enlivening campus culture and delivering an important revenue stream to our partner colleges and universities. We typically operate our stores under multi-year management service agreements granting us the right to operate the official bookstore on campus. In turn, we pay the school a percentage of store sales and, in certain cases, a minimum fixed guarantee.

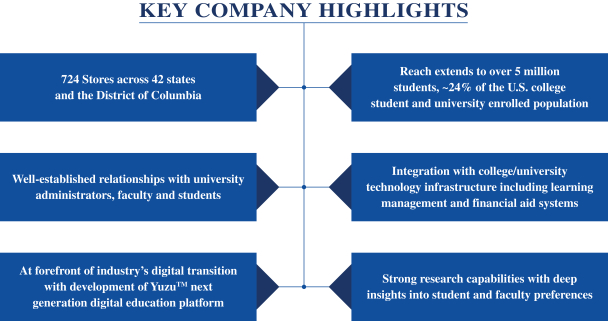

As of May 2, 2015, we operated 724 stores nationwide, which reach 24% of the total United States college and university student enrolled population. Our stores are operated under 453 contracts, some of which cover multiple store locations, and 154 of our college and university affiliated bookstores are co-branded with the Barnes & Noble name. We build relationships and derive sales by actively engaging and marketing to over 5 million students and their faculty on the campuses we serve and offer a full assortment of items in our campus stores, including course-related materials, which include new and used print textbooks and digital textbooks, all

1

Table of Contents

of which are available for sale or rent, emblematic apparel and gifts, trade books, computer products, school and dorm supplies, convenience and café items and graduation products. We are a multi-channel marketer, and our largest growth area is sales through the school-branded e-commerce sites we operate for each store, allowing students and faculty to purchase textbooks, course materials and other products online.

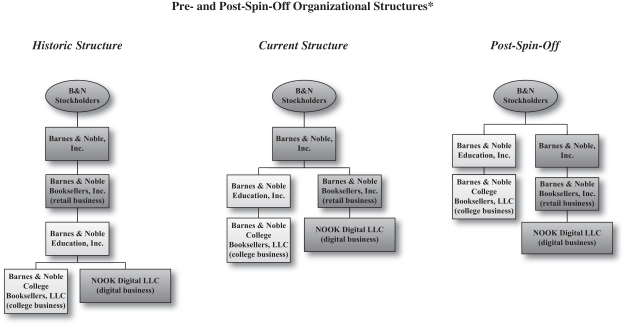

* Organizational charts show our simplified capital structure, giving effect to the distribution of the digital business and the Spin-Off. Barnes & Noble Education, Inc. was formerly known as NOOK Media Inc. NOOK Digital LLC was formerly known as barnesandnoble.com llc.

Market Opportunity

We are positioned for growth based on both the strength of the current traditional campus bookstore business and current competitive dynamics in the market for digital distribution of course materials.

| • | A Majority of Traditional Campus Bookstores Have Yet to be Outsourced: Approximately 52% of college and university affiliated bookstores in the United States are operated by their respective institutions. This presents a significant opportunity to increase market share and to continue to expand our store footprint. |

| • | Third-Party Operators Are Better Able to Manage the Increasingly Complex Operations of Campus Bookstores: It takes an increasing amount of technological and operational expertise to operate a modern campus bookstore that meets the needs of today’s students and faculty. As the delivery of educational materials continues to evolve, driven in large part by the growth of rentals and digital content, during the current fiscal year there has been an increasing trend towards outsourcing of bookstore operations to third party operators (including operators who have not traditionally operated campus bookstores). |

| • | Direct Relationship with a Coveted Demographic: Due to their disproportionate impact on trendsetting and early adoption, marketing to college students is important for many brands as they seek more effective methods of engaging this audience. The importance of this demographic provides a significant opportunity to further monetize our direct relationship with more than 5 million students, both during and beyond their college years. |

2

Table of Contents

| • | Increased Use of Online and Digital Platforms: Students and faculty are increasingly relying on online and digital platforms as a means to discover, consume and share educational content. We benefit from our direct relationship with students and faculty and expect the adoption of our developing YuzuTM digital education platform and its innovative solutions to increase significantly as students and faculty become more reliant on online and digital platforms. |

| • | Ability to Deliver Non-Traditional Educational Content: Rising educational costs and changing market dynamics are driving demand for non-traditional educational content, including online coursework and supplemental materials. We believe our experience, understanding of customer needs and trends and strong customer and publisher relationships position us well to meet this demand. |

| • | Highly-Fragmented Educational Content Market Presents Opportunity for Consolidation: As the market for educational content evolves, we believe there will be a significant opportunity to increase our market share. |

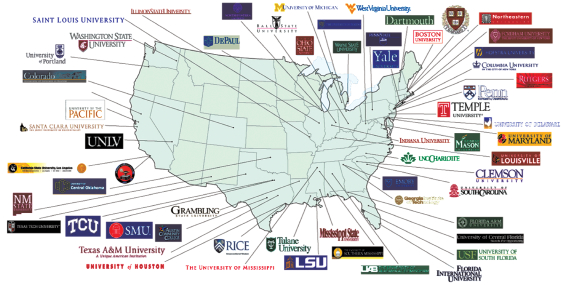

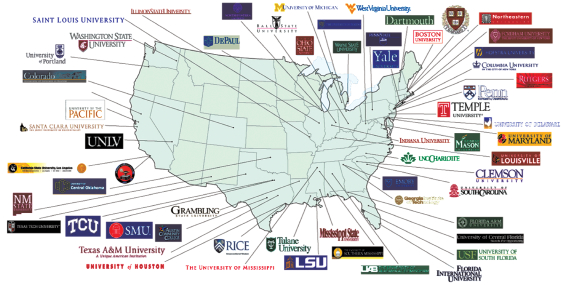

Our National Campus Footprint

Beyond the anticipated growth of the traditional campus bookstore business, we have made, and will continue to make, significant investments in digital education, including the launch of YuzuTM, our digital education platform that provides access to a wide range of rich, engaging content, including one of the largest catalogs of digital textbooks and consumer titles applicable to the higher education market.

Our Ecosystem

We leverage our physical bookstores, e-commerce sites and digital platform to serve and interact with the key constituents in our business ecosystem.

We work with colleges and universities to transform the campus bookstore into a destination that enhances social and academic experiences. We offer students a customized retail experience, including, we believe, the largest inventory of used and rental titles, as well as a number of other affordable textbook solutions, including digital textbooks and our Flexible Course Fee Solution. We also operate and manage our schools’ websites for course materials and general merchandise which includes emblematic apparel and gifts and school supplies. We provide faculty with valuable tools, resources and insights that allow them to gain a deeper understanding of student needs and higher education trends. We also offer over 7,000 publishers access to one of the largest distribution networks of college education materials in the United States, which includes access to YuzuTM, the next generation digital content distribution platform that we are developing.

3

Table of Contents

Strengths

We are more than just a provider of course materials and merchandise; we work as a true partner with colleges and universities, acting as a valuable support system for students and faculty. We deliver an attractive retail and digital learning experience driven by innovation, advanced technologies and a deep understanding of the evolving needs and behaviors of our customers. We believe our competitive strengths to be:

| • | Large Footprint with Well-Recognized Brand: We are one of the largest operators of bookstores on college and university campuses in the United States, with 724 stores in 42 states and the District of Columbia as of May 2, 2015, which reach 24% of the total United States college and university student enrolled population. Our brand, Barnes & Noble, is virtually synonymous with bookselling, and we believe it is one of the most widely recognized and respected brands in the United States. Our large footprint and well-known brand not only support our marketing efforts to universities, students and faculty but it is also important for leading publishers who value and rely on us as one of their primary distribution channels. |

| • | Stable, Long-Term Contracts: We operate our stores under management contracts with colleges and universities that are typically for five year terms with renewal options. From Fiscal 2013 through Fiscal 2015, 93% of these contracts were renewed or extended, often before their termination dates. In addition, these contracts are financially beneficial to us as we typically pay the college or university a percentage of our sales, including certain contracts with minimum guarantee payments. Therefore, the occupancy costs for each space are primarily a function of how successful each store is. This arrangement is also beneficial to the colleges and universities, providing them with an incentive to encourage their students and faculty to shop at our affiliated stores. |

| • | Well-Established Relationships: We have strong partnerships with college and university administrators, which are reflected by our average relationship tenure of 15 years. We generate value for our college and university partners, and our relationships are supported by innovative engagement |

4

Table of Contents

| programs and educational initiatives together with a decentralized management structure that empowers local teams to make decisions based on the local campus needs and foster collaborative working relationships. We have long term relationships with over 7,000 publishers as well as a unique strategic partnership with Pearson Education, Inc., the largest publisher of higher educational course material. In addition, our stores serve as social hubs for over 5 million students and their faculty that we serve, allowing us to forge deep customer relationships and incorporate systems that seamlessly link bookstore technology with most student and faculty facing platforms. |

| • | Attractive Business Model: We have a flexible business model with excellent visibility based on a deep understanding of our customers and their needs, minimal sensitivity to the economic cycle and ability to typically achieve profitability within the first year of operation. As the official, contracted provider for bookstore services, we have an established position with direct access to the students and faculty on the campuses we serve. This translates into relatively modest customer acquisition costs and high customer conversion and retention rates, unlike an online-only competitor that typically invests millions of dollars to gain access to its target customers, and then increases its customer retention costs to convert and retain those customers. Millennials (born between 1981 and 2000) are our core student customer, representing over $170 billion of purchasing power per year, according to comScore, and are just forming brand loyalties. |

| • | Agile Technologies: Our highly-adaptable technology platforms allow us to effectively address the ever-changing landscape of course materials and formats and to be responsive to emerging sales trends and changing customer behaviors. |

| • | Track Record of Innovation: Our flexible research channels help us stay ahead of the rapidly changing needs and behaviors of our customers and proactively respond with dynamic solutions to the needs of the customer constituency we serve. This commitment fuels our innovation and leadership in areas such as digital education with YuzuTM, affordable course materials and student engagement. |

| • | Seasoned Management Team: We have an experienced senior management team with a proven track record, an expertise in college bookstore outsourcing and content distribution and demonstrated marketing and retail operational expertise. |

Strategies

Our primary business strategies to grow our business are as follows:

| • | Increase Sales at Existing Bookstores: We intend to increase sales at our existing bookstores through new product offerings, enhanced marketing efforts using mobile and other technologies, increased local social and promotional offerings and expanded sales channels to both new customers and alumni. We expect sales growth at our existing bookstores will be a driver for growth in our business. |

| • | Increase Market Share with New Accounts: Historically, new store openings have been an important driver of growth in our business. For example, we increased our number of stores from 636 at the beginning of Fiscal 2012 to 724 as of May 2, 2015. Looking forward, approximately 52% of college and university affiliated bookstores in the United States are operated by their respective institutions. Moreover, we operate bookstores representing only 18% of all college and university affiliated bookstores in the United States. As more and more universities decide to outsource the management of their bookstores, we intend to aggressively pursue these opportunities and bid on these contracts. Based on the continuing trend towards outsourcing in the campus bookstore market, we expect awards of new accounts resulting in new store openings will continue to be an important driver of future growth in our business. We are in a unique position to offer academic superstores to colleges and universities. |

5

Table of Contents

| • | Grow digital sales by accelerating marketing, product development efforts and the acquisition of content to support the YuzuTM digital education product: YuzuTM, our digital education platform, offers not only electronic reading and note-taking functionality but also engaging supplemental content that we provide in conjunction with strategic publisher partners. Accelerating our product development and content acquisition efforts for YuzuTM will enable us to access the growing educational technology market on a national level by leveraging our existing campus relationships with faculty and students. We believe that as textbooks continue to convert to digital and students and faculty demand increased functionality and content from their online platforms, the digital solutions we offer through YuzuTM will help grow digital sales both on a school-by-school basis in the institutions we serve and on a national basis. |

| • | Expand opportunities through acquisitions and strategic partnerships: We believe that acquisitions and strategic partnerships will be a pillar of our growth strategy in the future. We intend to pursue strategic relationships with companies that enhance our educational services or distribution platform or that create compelling content offerings. For example, our recently announced strategic investment in Flashnotes.com, an online marketplace for college students to buy and sell student created, course-specific study materials, aligns with one of the key objectives of the separation, which is to pursue opportunities in the growing educational services market. We will promote Flashnotes.com at partner schools to help improve academic outcomes and drive the power of peer to peer learning. We may also expand our current suite of digital content offerings and platform through acquisitions, internal or third party software development and strategic partnerships. Expansion into new educational verticals and markets, such as K-12, vocational and international markets, will be opportunistically evaluated. |

Our History

On September 30, 2009, Barnes & Noble acquired Barnes & Noble College Booksellers, LLC from Leonard and Louise Riggio. From that date until October 4, 2012, Barnes & Noble College Booksellers, LLC was owned by Barnes & Noble Booksellers, Inc. In July 2012, NOOK Media Inc. was incorporated to hold Barnes & Noble’s college and digital businesses. On October 4, 2012, Microsoft Corporation (“Microsoft”) acquired a 17.6% preferred membership interest in our subsidiary NOOK Media LLC (the “LLC”), and through us, Barnes & Noble continued to own 82.4% of the businesses.

On January 22, 2013, Pearson Education, Inc. (“Pearson”) acquired a 5% preferred membership interest in the LLC, entered into a commercial agreement with the LLC relating to the college business and received warrants to purchase an additional preferred membership interest in the LLC.

On December 4, 2014, we re-acquired Microsoft’s interest in the LLC in exchange for cash and common stock of Barnes & Noble. On December 22, 2014, we also re-acquired Pearson’s interest in the LLC and the related warrants for cash and Barnes & Noble common stock. In connection with these transactions, Barnes & Noble entered into contingent payment agreements with Microsoft and Pearson providing for additional payments to them upon the occurrence of certain events, including upon a sale of the digital business. As a result of these transactions, Barnes & Noble owns, and expects to own prior to the Spin-Off, 100% of our stock.

In February 2015, we changed our name from NOOK Media Inc. to Barnes & Noble Education, Inc. and the LLC’s name to B&N Education, LLC.

On May 1, 2015, we distributed to Barnes & Noble all of the membership interests in NOOK Digital LLC (formerly known as barnesandnoble.com llc), which owns the digital business and which will continue to be owned by Barnes & Noble. At such time, we ceased to own any interest in the digital business.

6

Table of Contents

Recent Developments

On June 5, 2015, Barnes & Noble entered into conversion agreements with certain of the Series J Holders, pursuant to which such Series J Holders agreed to convert an aggregate of 103,995 shares of Series J Preferred Stock (the “Converted Preferred Shares”) into 6,117,347 shares of Barnes & Noble common stock (the “New Barnes & Noble Shares”). Barnes & Noble currently expects the conversion will take place on or around July 9, 2015, at which time the Converted Preferred Shares will be retired by Barnes & Noble. As of June 26, 2015, after giving effect to the expected conversion, there would have been 100,005 shares of Series J Preferred Stock outstanding.

Other Information

We are a Delaware corporation. Our principal executive offices are located at 120 Mountain View Blvd., Basking Ridge, NJ 07920. Our telephone number is (908) 991-2665. Our website address is bned.com. Information contained on, or connected to, our website or Barnes & Noble’s website does not and will not constitute part of this Prospectus or the Registration Statement on Form S-1 of which this Prospectus is a part.

7

Table of Contents

Summary of the Spin-Off

| Distributing Company |

Barnes & Noble, Inc., a Delaware corporation, which holds all of our Common Stock issued and outstanding prior to the Distribution. After the Distribution, Barnes & Noble will not own any shares of our Common Stock or our preferred stock. |

| Distributed Company |

Barnes & Noble Education, Inc., a Delaware corporation and a wholly owned subsidiary of Barnes & Noble. At the time of the Distribution, we will hold, directly or through our wholly owned subsidiaries, the assets and liabilities of the college business. After the Distribution, we will be an independent publicly traded company. |

| Distributed Securities |

All of the shares of our Common Stock owned by Barnes & Noble, which will be 100% of our Common Stock issued and outstanding immediately prior to the Distribution. Based on the approximately 70.2 million shares of Barnes & Noble common stock outstanding on May 31, 2015 (after giving effect to the New Barnes & Noble Shares), and applying the Distribution Ratio of 0.632 shares of Common Stock for every share of Barnes & Noble common stock, approximately 44.4 million shares of our Common Stock will be distributed. The actual number of shares of our Common Stock distributed will depend on the number of shares of Barnes & Noble common stock outstanding on the Record Date. |

| Record Date |

The Record Date is 5:00 p.m., New York City time, on , 2015. |

| Distribution Date |

The Distribution Date is , 2015. |

| Distribution Ratio |

Each holder of Barnes & Noble common stock will receive 0.632 shares of our Common Stock for every share of Barnes & Noble common stock it holds on the Record Date. The distribution agent will distribute only whole shares of our Common Stock in the Spin-Off. See “The Spin-Off—Treatment of Fractional Shares” for more detail. Please note that if you sell your shares of Barnes & Noble common stock on or before the Distribution Date, the buyer of those shares may in some circumstances be entitled to receive the shares of our Common Stock to be distributed in respect of the Barnes & Noble shares that you sold. See “The Spin-Off—Trading Prior to the Distribution Date” for more detail. |

| The Distribution |

On the Distribution Date, Barnes & Noble will release the shares of our Common Stock to the distribution agent to distribute to Barnes & Noble stockholders. Barnes & Noble will distribute our shares in book-entry form, and thus we will not issue any physical stock certificates. We expect that it will take the distribution agent up to two weeks to electronically issue shares of our Common Stock to you or your bank or brokerage firm on your behalf by way of direct registration in book-entry form. You will not be required to make any |

8

Table of Contents

| payment, surrender or exchange your shares of Barnes & Noble common stock or take any other action to receive your shares of our Common Stock. |

| Fractional Shares |

The distribution agent will not distribute any fractional shares of our Common Stock to Barnes & Noble stockholders. Instead, the distribution agent will first aggregate fractional shares into whole shares, then sell the whole shares in the open market at prevailing market prices on behalf of Barnes & Noble stockholders entitled to receive a fractional share, and finally distribute the aggregate cash proceeds of the sales, net of brokerage fees and other costs, pro rata to these holders (net of any required withholding for taxes applicable to each holder). See “The Spin-Off—Treatment of Fractional Shares” for more detail. If you receive cash in lieu of fractional shares, you will not be entitled to any interest on the payments. The cash you receive in lieu of fractional shares generally will, for U.S. federal income tax purposes, be taxable as described under “Material U.S. Federal Income Tax Consequences of the Spin-Off.” |

| Conditions to the Spin-Off |

The Spin-Off is subject to the satisfaction, or the Barnes & Noble board of directors’ waiver, of the following conditions: |

| • | the Barnes & Noble board of directors shall have authorized and approved the Spin-Off and not withdrawn such authorization and approval, and shall have declared the dividend of our Common Stock to Barnes & Noble stockholders; |

| • | the Separation Agreement and the ancillary agreements contemplated by the Separation Agreement shall have been executed by each party thereto; |

| • | we shall have entered into a credit facility and any other financing we determine to be necessary or advisable, in each case, on terms and conditions acceptable to us; |

| • | Barnes & Noble shall have obtained an amendment to or replacement of its Credit Agreement, dated April 29, 2011, among Barnes & Noble, Bank of America, N.A., as administrative agent, collateral agent and swing line lender and other lenders party thereto (the “B&N Credit Facility”) permitting the Spin-Off; |

| • | the Securities and Exchange Commission (the “SEC”) shall have declared effective our Registration Statement on Form S-1, of which this Prospectus is a part, under the Securities Act of 1933, as amended (the “Securities Act”), and no stop order suspending the effectiveness of our Registration Statement shall be in effect and no proceedings for that purpose shall be pending before or threatened by the SEC; |

| • | our Common Stock shall have been accepted for listing on the NYSE or another national securities exchange approved by Barnes & Noble, subject to official notice of issuance; |

9

Table of Contents

| • | Barnes & Noble shall have received the written opinions of Cravath, Swaine & Moore LLP and KPMG LLP, which shall remain in full force and effect, that, subject to the accuracy of and compliance with certain representations, warranties and covenants, the Spin-Off will qualify for non-recognition of gain and loss to Barnes & Noble and its stockholders; |

| • | the Barnes & Noble board of directors shall have received a solvency opinion from a financial advisor, in form and substance acceptable to the board of directors, which shall opine that, among other things and subject to certain customary qualifications and assumptions, immediately prior to and after giving effect to the Spin-Off, the Company and Barnes & Noble will each be solvent; |

| • | no order, injunction or decree issued by any governmental authority of competent jurisdiction or other legal restraint or prohibition preventing consummation of the Spin-Off shall be in effect, and no other event outside the control of Barnes & Noble shall have occurred or failed to occur that prevents the consummation of the Spin-Off; |

| • | no other events or developments shall have occurred prior to the Distribution Date that, in the judgment of the Barnes & Noble board of directors, would result in the Spin-Off having a material adverse effect on Barnes & Noble or its stockholders; |

| • | prior to the Distribution Date, this Prospectus shall have been mailed to the holders of Barnes & Noble common stock; |

| • | Barnes & Noble shall have duly elected the individuals to be listed as members of our post-Spin-Off board of directors in this Prospectus, and such individuals shall be the members of our board of directors, which we refer to as our “Board,” immediately after the Spin-Off; provided that our current directors shall appoint at least one independent director to serve on our Board and Audit and Finance Committee prior to the date on which “when-issued” trading of our Common Stock commences; |

| • | immediately prior to the Distribution Date, our Amended and Restated Certificate of Incorporation and Amended and Restated By-laws, each in substantially the form filed as an exhibit to the Registration Statement on Form S-1, of which this Prospectus is a part, shall be in effect; and |

| • | Barnes & Noble shall have received a certificate signed by our Chief Financial Officer, dated as of the Distribution Date, certifying the satisfaction of certain conditions. |

| The fulfillment of the foregoing conditions will not create any obligation on the part of Barnes & Noble to effect the Spin-Off. We are not aware of any material federal, foreign or state regulatory requirements with which we must comply, other than SEC rules and |

10

Table of Contents

| regulations, or any material approvals that we must obtain, other than the approval for listing of our Common Stock and the SEC’s declaration of the effectiveness of the Registration Statement, in connection with the Spin-Off. Barnes & Noble has the right not to complete the Spin-Off if, at any time, the Barnes & Noble board or directors determines, in its sole and absolute discretion, that the Spin-Off is not in the best interests of Barnes & Noble or its stockholders or is otherwise not advisable. For a more detailed description, see “The Spin-Off—Conditions to the Spin-Off.” |

| Trading Market and Symbol |

We have filed an application to list our Common Stock on the NYSE under the symbol “BNED.” We anticipate that, as early as two trading days prior to the Record Date, trading of shares of our Common Stock will begin on a “when-issued” basis and will continue up to and including the Distribution Date, and we expect that “regular-way” trading of our Common Stock will begin the first trading day after the Distribution Date. |

| We also anticipate that, as early as two trading days prior to the Record Date, there will be two markets in Barnes & Noble common stock: (i) a “regular-way” market on which shares of Barnes & Noble common stock will trade with an entitlement for the purchaser of Barnes & Noble common stock to receive shares of our Common Stock to be distributed in the Distribution, and (ii) an “ex-distribution” market on which shares of Barnes & Noble common stock will trade without an entitlement for the purchaser of Barnes & Noble common stock to receive shares of our Common Stock. See “The Spin-Off—Trading Prior to the Distribution Date.” |

| Tax Consequences to Barnes & Noble Stockholders |

For U.S. federal income tax purposes, no gain or loss should be recognized by, or be includible in the income of, a U.S. Holder (as defined in “Material U.S. Federal Income Tax Consequences of the Spin-Off”) as a result of the Distribution, except with respect to any cash received in lieu of a fractional share. In addition, the aggregate tax basis of the Barnes & Noble common stock and our Common Stock held by each U.S. Holder immediately after the Distribution will be the same as the aggregate tax basis of the Barnes & Noble common stock held by the U.S. Holder immediately before the Distribution, allocated between the Barnes & Noble common stock and our Common Stock in proportion to their relative fair market values on the date of the Distribution (subject to certain adjustments). See “Material U.S. Federal Income Tax Consequences of the Spin-Off.” |

| We urge you to consult your tax advisor as to the specific tax consequences of the Distribution to you, including the effect of any U.S. federal, state, local or foreign tax laws and of changes in applicable tax laws. |

11

Table of Contents

| Relationship with Barnes & Noble after the Spin-Off |

We intend to enter into several agreements with Barnes & Noble related to the Spin-Off, which will govern the relationship between Barnes & Noble and us up to and after completion of the Spin-Off and allocate between Barnes & Noble and us various assets, liabilities, rights and obligations. These agreements include: |

| • | a Separation Agreement that will set forth Barnes & Noble’s and our agreements regarding the principal actions that both parties will take in connection with the Spin-Off and aspects of our relationship following the Spin-Off; |

| • | a Transition Services Agreement pursuant to which Barnes & Noble and we will provide each other specified services on a transitional basis to help ensure an orderly transition following the Spin-Off; |

| • | a Tax Matters Agreement that will govern the respective rights, responsibilities and obligations of Barnes & Noble and us after the Spin-Off with respect to all tax matters and will include restrictions to preserve the tax-free status of the Spin-Off; |

| • | an Employee Matters Agreement that will address employment, compensation and benefits matters, including the allocation and treatment of assets and liabilities arising out of employee compensation and benefits programs in which our employees participated prior to the Spin-Off; and |

| • | a Trademark License Agreement pursuant to which Barnes & Noble will grant us an exclusive license to use in our business certain licensed trademarks and a non-exclusive license to use in our business other licensed trademarks. |

| We describe these arrangements in greater detail under “Certain Relationships and Related Party Transactions—Agreements with Barnes & Noble,” and describe some of the risks of these arrangements under “Risk Factors—Risks Relating to the Spin-Off.” |

| Dividend Policy |

Following the Spin-Off, we do not anticipate paying any cash dividends on our Common Stock in the foreseeable future. See “Dividend Policy” for more information. |

| Transfer Agent |

Computershare. |

| Risk Factors |

Our business faces both general and specific risks and uncertainties. Our business also faces risks relating to the Spin-Off. Following the Spin-Off, we will also face risks associated with being an independent publicly-traded company. Accordingly, you should read carefully the information set forth under “Risk Factors.” |

12

Table of Contents

You should carefully consider all of the information in this Prospectus and each of the risks described below, which we believe are the principal risks that we face. Some of the risks relate to our business, others to the Spin-Off. Some risks relate principally to the securities markets and ownership of our Common Stock. The risks and uncertainties described below are not the only ones faced by us. Additional risks and uncertainties not presently known or that are currently deemed immaterial also may impair our business operations. If any of the following risks occur, our business, financial condition, operating results and cash flows and the trading price of our Common Stock could be materially adversely affected.

Risks Relating to Our Business

We face significant competition in our business, and we expect such competition to increase.

The market for course materials, including textbooks and supplemental materials, is intensely competitive and subject to rapid change. We are experiencing growing competition from alternative media and alternative sources of textbooks and course-related materials, such as websites that sell textbooks, eBooks, digital content and other merchandise directly to students; online resources; publishers bypassing the bookstore distribution channel by selling directly to students and educational institutions; print-on-demand textbooks; textbook rental companies; and student-to-student transactions over the Internet. We also have competition from other college bookstore operators and educational content providers, including Follett Corporation, a contract operator of campus bookstores, which recently acquired Nebraska Book Company, a contract operator of on-campus and off-campus bookstores; Amazon.com, an e-commerce operator and a provider of contract services to colleges and universities, BBA Solutions, a college textbook retailer; Chegg.com, an online textbook rental company; CourseSmart, a digital course materials provider; Akademos, a virtual bookstore and marketplace for academic institutions; Rafter, a course materials management solution for higher educational institutions; bn.com, the e-commerce platform of Barnes & Noble and MBS Direct, an online bookstore provider; providers of eTextbooks, such as Apple iTunes, CourseSmart, Blackboard, Rafter and Google; and various private textbook rental websites. In addition, Amazon, Akademos and Rafter have recently begun to develop relationships with colleges and universities to provide online bookstore solutions. Many students purchase from multiple textbook providers, are highly price sensitive and can easily shift spending from one provider or format to another. As a consequence, in addition to being competitive in the service we provide to our customers, our textbook business faces significant price competition. Some of our competitors have adopted, and may continue to adopt, aggressive pricing policies and devote substantial resources to marketing, website and systems development. In addition, a variety of business models are being pursued for the provision of print textbooks, some of which may be more profitable or successful than our business model.

We may not be able to enter into new contracts and contracts for existing or additional college and university affiliated bookstores may not be profitable.

An important part of our business strategy is to expand sales for our college bookstore operations by being awarded additional contracts to manage bookstores for colleges and universities. Our ability to obtain those additional contracts is subject to a number of factors that we are not able to control. In addition, the anticipated strategic benefits of new and additional college and university bookstores may not be realized at all or may not be realized within the time frames contemplated by management. In particular, contracts for additional managed stores may involve a number of special risks, including adverse short-term effects on operating results, diversion of management’s attention and other resources, standardization of accounting systems, dependence on retaining, hiring and training key personnel, unanticipated problems or legal liabilities, and actions of our competitors and customers. Because certain terms of any contract are generally fixed for the initial term of the contract and involve judgments and estimates that may not be accurate, including for reasons outside of our control, we have contracts that are not profitable and may have such contracts in the future. Even if we have the right to terminate a contract, we may be reluctant to do so even when a contract is unprofitable due to, among other factors, the potential effect on our reputation.

13

Table of Contents

We may not be able to successfully retain or renew our managed bookstore contracts on profitable terms.

We face significant competition in retaining existing store contracts and when renewing those contracts as they expire. Our contracts are typically for five years with renewal options but can range from two to 15 years, and most contracts are cancelable by either party without penalty, typically with 120 days’ notice. We may not be successful in retaining our current contracts, renewing our current contracts or renewing our current contracts on terms that provide us the opportunity to improve or maintain the profitability of managing the store.

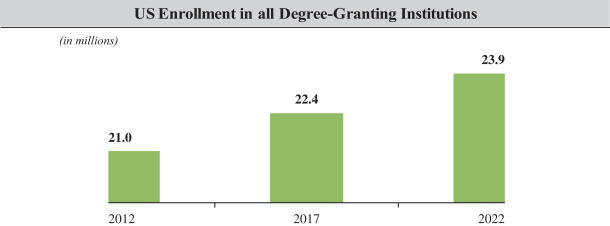

Our business is dependent on the overall economic environment, college enrollment and consumer spending patterns.

A deterioration of the current economic environment could have a material adverse effect on our financial condition and operating results, as well as our ability to fund our growth and strategic business initiatives. Our business is affected by funding levels at colleges and universities and by changes in enrollments at colleges and universities, changes in student enrollments and lower spending on textbooks and general merchandise. The growth of our business depends on our ability to attract new students and to increase the level of engagement by existing students. To the extent we are unable to attract new students or students spend less generally, our business could be adversely affected.

We face the risk of disruption of supplier relationships and/or supply chain and/or inventory surplus.

The products that we sell originate from a wide variety of domestic and international vendors. During Fiscal 2015, our four largest suppliers accounted for approximately 47% of our merchandise purchased, with the largest supplier accounting for approximately 19% of our merchandise purchased. While we believe that our relationships with our suppliers are good, suppliers may modify the terms of these relationships due to general economic conditions or otherwise.

We do not have long-term arrangements with most of our suppliers to guarantee availability of merchandise, content or services, particular payment terms or the extension of credit limits. If our current suppliers were to stop selling merchandise, content or services to us on acceptable terms, including as a result of one or more supplier bankruptcies due to poor economic conditions, we may be unable to procure the same merchandise, content or services from other suppliers in a timely and efficient manner and on acceptable terms, or at all. In addition, our business is dependent on the continued supply of textbooks. The publishing industry generally has suffered recently due to, among other things, changing consumer preferences away from the print medium and the economic climate. A significant disruption in this industry generally or a significant unfavorable change in our relationships with key suppliers could adversely impact our business. In addition, any significant change in the terms that we have with our key suppliers including, payment terms, return policies, the discount or margin on products or changes to the distribution model of textbooks, could adversely affect our financial condition and liquidity. Furthermore, certain of our merchandise is sourced indirectly from outside the United States. Political or financial instability, merchandise quality issues, product safety concerns, trade restrictions, work stoppages, tariffs, foreign currency exchange rates, transportation capacity and costs, inflation, civil unrest, natural disasters, outbreaks of pandemics and other factors relating to foreign trade are beyond our control and could disrupt our supply of foreign-sourced merchandise.

In addition, we have significantly increased our textbook rental business, offering students a lower cost alternative to purchasing textbooks, which is also subject to certain inventory risks such as textbooks not being resold or re-rented due to delayed returns or poor condition, or faculty members not continuing to adopt or use certain textbooks.

Our business relies on certain key personnel.

Management believes that our continued success will depend to a significant extent upon the efforts and abilities of certain of our key personnel. The loss of the services of any of these key personnel could have a material adverse effect on our business. We do not maintain “key man” life insurance on any of our officers or other employees.

14

Table of Contents

Our business is seasonal.

Our business is seasonal, with sales generally highest in the second and third fiscal quarters, when college students generally purchase textbooks for the upcoming semesters, and lowest in the first and fourth fiscal quarters. Less than satisfactory net sales during our peak fiscal quarters could have a material adverse effect on our financial condition or operating results for the year, and our results of operations from those quarters may not be sufficient to cover any losses that may be incurred in the other fiscal quarters of the year.

Our results also depend on the successful implementation of our strategic initiatives. We may not be able to implement these strategies successfully, on a timely basis or at all.

Our ability to grow depends upon a number of factors, including our ability to implement our strategic initiatives to retain and expand existing customer relationships, acquire new accounts, expand sales channels and marketing efforts, develop and market YuzuTM and other higher education digital products and adapt to changing industry trends. While we believe we have the capital resources, experience, management resources and internal systems to successfully operate our business, we may not be successful in implementing these strategies. Further, even if successfully implemented, our business strategy may not ultimately produce positive results.

We face data security risks with respect to personal information.

Our business involves the receipt, storage, processing and transmission of personal information about customers and employees. We may share information about such persons with vendors and third parties that assist with certain aspects of our business. Also, in connection with our student financial aid platform and the processing of university debit cards, we secure and have access to certain student personal information that has been provided to us by the universities we serve. Our handling and use of personal information is regulated at the international, federal and state levels. Privacy and information security laws, regulations, and standards such as the Payment Card Industry Data Security Standard change from time to time, and compliance with them may result in cost increases due to necessary systems changes and the development of new processes and may be difficult to achieve. If we fail to comply with these laws, regulations and standards, we could be subjected to legal risk. In addition, even if we fully comply with all laws, regulations and standards and even though we have taken significant steps to protect personal information, we could experience a data security breach, and our reputation could be damaged, possibly resulting in lost future sales or decreased usage of credit and debit card products. Because the techniques used to obtain unauthorized access, disable or degrade service, or sabotage systems change frequently and often are not recognized until launched against a target, we may be unable to anticipate these techniques or to implement adequate preventative measures. A party that is able to circumvent our security measures could misappropriate our or our users’ proprietary information and cause interruption in our operations. Any compromise of our data security could result in a violation of applicable privacy and other laws or standards, significant legal and financial exposure beyond the scope or limits of insurance coverage, increased operating costs associated with remediation, equipment acquisitions or disposal and added personnel, and a loss of confidence in our security measures, which could harm our business or affect investor confidence. Data security breaches may also result from non-technical means, for example, actions by an employee.

Our business could be impacted by changes in federal, state, local or international laws, rules or regulations.

We are subject to general business regulations and laws relating to all aspects of our business. These regulations and laws may cover taxation, privacy, data protection, our access to student financial aid, pricing and availability of educational materials, competition and/or antitrust, content, copyrights, distribution, college distribution, mobile communications, electronic contracts and other communications, consumer protection, the provision of online payment services, unencumbered Internet access to our services, the design and operation of websites, digital content (including governmental investigations and litigation relating to the agency pricing model for digital content distribution), the characteristics and quality of products and services and employee benefits (including the costs associated with complying with the Patient Protection and Affordable Care Act). Changes in federal, state, local or international laws, rules or regulations relating to these matters could increase our costs of doing business or otherwise impact our business.

15

Table of Contents

Changes in tax laws and regulations might adversely impact our businesses or financial performance.

We collected sales tax on the majority of the products and services that we sold in our respective prior fiscal years that were subject to sales tax, and we generally have continued the same policies for sales tax within the current fiscal year. While management believes that the financial statements included elsewhere in this Prospectus reflect management’s best current estimate of any potential additional sales tax liability based on current discussions with taxing authorities, we cannot assure you that the outcome of any discussions with any taxing authority will not result in the payment of sales taxes for prior periods or otherwise, or that the amount of any such payments will not be materially in excess of any liability currently recorded. In the future, our businesses may be subject to claims for not collecting sales tax on the products and services we currently sell for which sales tax is not collected. In addition, our provision for income taxes and our obligation to pay income tax is based on existing federal, state and local tax laws. Changes to these laws, in particular as they relate to depreciation, amortization and cost of goods sold, could have a significant impact on our income tax provision, our projected cash tax liability, or both.

Our expansion into new products, services and technologies subjects us to additional business, legal, financial and competitive risks.

We may require additional capital in the future to sustain or grow our business. Our gross profits and margins in our newer activities may be lower than in our traditional activities, and we may not be successful enough in these newer activities to recoup our investments in them. In addition, we may have limited or no experience in our newer products and services, and our customers may not adopt our new product or service offerings. Some of these offerings, such as our commercial digital agreement with Pearson, may present new and difficult technological challenges, and we may be subject to claims if customers of these offerings experience service disruptions or failures or other quality issues.

We may not be able to adequately protect our intellectual property rights or may be accused of infringing upon intellectual property rights of third parties.

We regard our trademarks, service marks, copyrights, patents, trade dress, trade secrets, proprietary technology and similar intellectual property as important to our success, and we rely on trademark, copyright and patent law, domain name regulations, trade secret protection and confidentiality or license agreements to protect our proprietary rights, including our use of the Barnes & Noble trademark. Laws and regulations may not adequately protect our trademarks and similar proprietary rights. We may be unable to prevent third parties from acquiring domain names that are similar to, infringe upon or diminish the value of our trademarks and other proprietary or licensed rights.

We may not be able to discover or determine the extent of any unauthorized use of our proprietary rights. The protection of our intellectual property may require the expenditure of significant financial and managerial resources. Moreover, the steps we take to protect our intellectual property may not adequately protect our rights or prevent third parties from infringing or misappropriating our proprietary rights. We also cannot be certain that others will not independently develop or otherwise acquire equivalent or superior technology or other intellectual property rights.