Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Net Element, Inc. | v411759_8-k.htm |

Exhibit 99.1

Powering Global Commerce Company Overview – May 2015

www.netelement.com NASDAQ: NETE This presentation and comments made by management contain forward - looking statements including, among others, statements regarding the expected future operating results of Net Element, Inc. (“Net Element” or the “Company”). These statements are based on management’s current expectations and assumptions and are subject to risks, uncertainties and changes in circumstances. Forward - looking statements include all statements that are not historical facts and can be identified by the use of forward - looking terminology such as the words “believe,” “expect,” “anticipate,” “intend,” “plan,” “estimate” or similar expressions. Actual results may differ materially from those set forth in the forward - looking statements due to a variety of factors. More information about these risks, uncertainties and factors may be found in Net Element’s Annual Report on Form 10 - K, Quarterly Reports on Form 10 - Q and Current Reports on Form 8 - K. Net Element does not assume any obligation to update any forward - looking statements as a result of new information, future developments or otherwise. 2 Disclaimer Forward - looking Statements. Use of Non - GAAP financial measures

www.netelement.com NASDAQ: NETE 3 Net Element At a Glance Emerging as a leader in mobile payments and transactional services Introduction • Industry: Computer and Data Processing Services • Headquarters: Miami, Florida • Differentiators: - Omni - channel payments platform - Wrapping broad suite of services - International expansion • Strategy: - U.S .: mature market, compete on services - International : more fragmented market, exclusive banking and mobile operator relationships NASDAQ NETE Stock Price $0.67 52 - Week Range $0.60 - $5.75 Shares Outstanding 46,186,962 Daily Volume (90 - day average) 454,931 Market Capitalization $30.9 million 2014 Revenue $21.2 million Full - time Employees 65 Data as of May 21, 2015 • Global payments and transactions provider for small to medium size enterprises (“SMEs”)

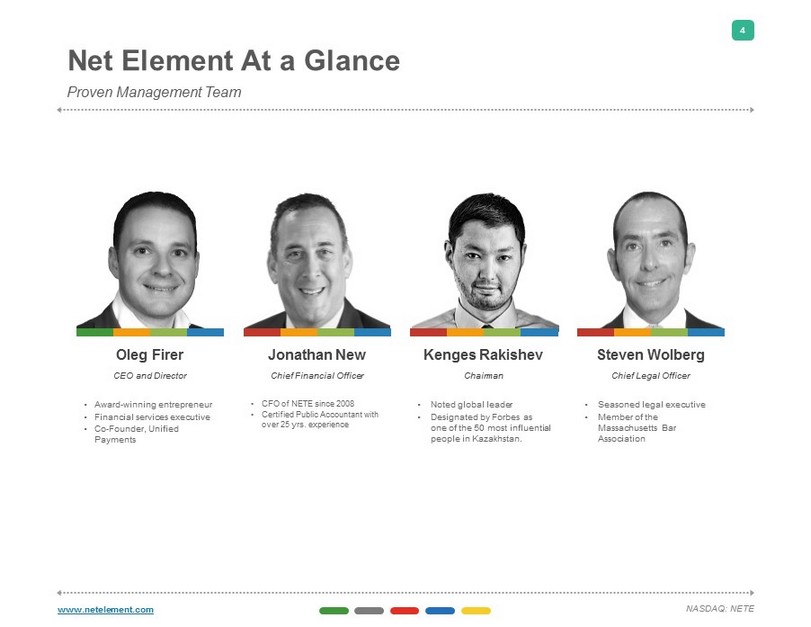

www.netelement.com NASDAQ: NETE 4 Net Element At a Glance Proven Management Team Oleg Firer CEO and Director • Award - winning entrepreneur • Financial services executive • Co - Founder, Unified Payments Jonathan New Chief Financial Officer • CFO of NETE since 2008 • Certified Public Accountant with over 25 yrs. experience Kenges Rakishev Chairman • Noted global leader • D esignated by Forbes as one of the 50 most influential people in Kazakhstan . Steven Wolberg Chief Legal Officer • Seasoned legal executive • Member of the Massachusetts Bar Association

www.netelement.com NASDAQ: NETE 5 Omni Channel Processing Omni - Channel Payments Acceptance Ecosystem $597 Million in total transactions processed in 2014 O ver 79.1 Million transactions worldwide Payment Acceptance and Value Added Transactional Services Mobile Payments and Direct Carrier Billing United States: 91 % of 2014 Revenue International: 9 % of 2014 Revenue

www.netelement.com NASDAQ: NETE 6 Expanding O ur O fferings Payments innovator in Russian Federation, Europe and Asia All - in - One Digital m - POS Solution Planned acquisition in 2Q 2015 expected to be profitable Next generation cloud - based payments and POS platform for hospitality

www.netelement.com NASDAQ: NETE 7 Unified Payments Quick, secure payments. Anytime, anywhere Value add services: shopping cart, rewards and loyalty programs; back office tools; inventory management fulfillment; credit scoring; analytical dashboard Features: Apple Pay & Near Field Communication (NFC) enabled Mobile Card Readers Secure & Reliable 24/7 Service

www.netelement.com NASDAQ: NETE 8 United States Merchant Strategy 35.4 million bankcard transactions in 2014 Partners Include Top Brands • Approximately 10,000 SME merchants • Average annual revenue $1,800 per merchant • Average upfront Cost Per Acquisition $184 • Increased revenue per merchant for value added services $20 per annum

www.netelement.com NASDAQ: NETE » Number of Transactions » Number of Merchants Key Drivers » % of the sale amount – Merchant Discount Rate (“MDR”) » Fees: per transaction, monthly statements and services Revenue Sample $100 transaction $ 0.98 0.98% Pays 3.00% MDR ($3.00) $3.00 ($0.12) ($0.01) ($1.84) Collects $3.00 Fee From merchant Merchant Acquirer Collects $0.12 Fee From Unified Card Association Collects $0.01 Fee From Unified Sponsoring Bank Collects 1.84% From Unified Card Issuer(s) Merchant ($ 0.05) Various $ 0.05 Fees From Unified Transactional Cost 9 Sample U.S. Credit Card Transaction How We Make Money (Payments Processing) Amount Transaction Participant Revenue Costs Net

www.netelement.com NASDAQ: NETE 10 Mobile Payments Metrics Over 1 million mobile payment subscribers in Russia as of January 2014 • Billing via P - SMS, Direct Operator Billing, WAP automated phone, and online via credit card • Annual billings per subscriber: ~$12 • 49% increase in mobile payment subscribers in April 2015 over January 2015 Partners Include Top Brands

www.netelement.com NASDAQ: NETE » Number of Mobile subscribers » Number of Merchants Key Drivers » % of the sale amount – less » Revenue split % with mobile operator » Monthly fees Revenue Sample $10 transaction Initiates $10 payment to Merchant ( $10.00 ) $10.00 ($4.25) ( $5.00) $0.75 Collects $10 Fee from subscriber Mobile Operator Settles $4.25 Fee t o Merchant Merchant Revenue Split 50% of billed amount Mobile Operator Collects 15% Fee From Merchant Card Issuer(s) Subscriber ( $5.00) Receives 50% from Operator TOT Money 11 Sample Russian Carrier Billing Transaction How We Make Money (Mobile Processing) Amount Transaction Participant Revenue

www.netelement.com NASDAQ: NETE 12 Mobile Payments Metrics Data Source: 2014 MasterCard Mobile Payments Readiness Index and 2014 J’’son & Partners Russian Market of Mobile Operators Payments, Mobil e a nd SMS - banking Market Watch Replacing cash based payments with electronic payments for utilities, transit tickets, entertainment, and other services. • Market is expected to grow at compound annual growth (CAGR) rate of 31% in the period from 2013 - 2018 • Our market share is growing in 2015 - Targeting 2 million total subscribers - 100% growth over 2014 subscribers

www.netelement.com NASDAQ: NETE 13 Market Position 35.4 million transactions processed by Unified 82.4 billion , U.S. bankcard transactions in 2012 1.8 billion RUB processed by TOT Money 18 billion RUB, Russian carrier billing market in 2014 Data Source: 2013 Federal Reserve Payments Study and 2014 J’’son & Partners Russian Market of Mobile Operators Payments, Mobile and SMS - banki ng Market Watch ~0.04% market share ~10% market share

www.netelement.com NASDAQ: NETE 14 Geographic Expansion - UAE, India & Kazakhstan Data source: Study released in July 2014 by ResearchMoz. The United Arab Emirates (UAE) Cards and Payments Industry reported growth of UAE card payments from 10.3 million transactions in 2009 to 18.2 million in 2013. UAE ,Gulf States, & India Partnership • UAE cards & payments: 15.3% CAGR from 2008 - 13 Targeted Emerging Market Entry Strategy • Use high quality in - country partners • Leverage our centralized payment technology infrastructure • Acquire merchants through direct sales initiatives, value - added resellers, system integrators, strategic and affinity partners • Optimize sales force to drive customer retention and growth Other Partnerships Kazakhstan TAS Group Latin America

www.netelement.com NASDAQ: NETE 15 Financial Snapshot

www.netelement.com NASDAQ: NETE 16 2014 Milestones • Eliminated debt • Reorganized TOT Money business • Reduced general & administrative expenses GOALS • Migrated to proprietary billing system for mobile business operations • TOT Money passed 1 Million recurring mobile subscribers • Announced Apple Pay™ availability in U.S. • Developed Aptito go to market strategy • Enhanced board with financial services executives - Financial services veteran William Healy - P ayments technology industry veteran Drew Freeman ACTIONS Financial Operational Governance

www.netelement.com NASDAQ: NETE 17 2015 Initiatives • Close PayOnline transaction • Cash and Stock deal valued at up to $8.4 million GOALS • Expand Russia mobile payment market share • 10% and growing • Geographic expansion into additional markets - Launch Kazakhstan – 2Q 2015 - Launch UAE & India – 2Q 2015 ACTIONS Close Acquisition Expand Market Share Geographic Expansion • Organic growth of U.S. transactional processing business - Cash incentives to top producers and sales partners - Merchant portfolios acquisitions - Leverage Aptito to win hospitality customers Organic Growth U.S.

PayOnline Acquisition Appendix

www.netelement.com NASDAQ: NETE • Leading payment service provider to e - Commerce SMEs in Russia • Certified and accredited by Visa and MasterCard, international certificate of PCI DSS Level 1 • Founded in 2009 and is one of the fastest growing payment service providers – Top 3 Internet Payment Service Provider (“IPSP”) companies in the Russian market • Direct agreements with 7 acquiring banks in Europe and 5 banks in Commonwealth Independent States (CIS) • 2013 Processing volume $537MM (+68% over 2012), with an effective rate of commission in the amount of 0.57% (0.51% in 2012), revenues increased by 88% • Approximately 40% of revenue is in EUR/USD denomination and is originated in Europe and Asia PayOnline Market Share 30% of IPSP Market 6% of the market for Internet Payments with bankcards 2% of Internet Payments market PayOnline Reliable Payment Solution for e - Commerce 19 Data Source : The 2014 McKinsey Global Payments Map & Management Estimates

www.netelement.com NASDAQ: NETE Net Element a leader in mobile payments and value - added transactional services 20 Net Element, Inc. 3363 NE 163 rd Street, Suite 705 North Miami Beach, FL 33160 +1 305 - 507 - 8808 +1 786 - 272 - 0696 info@netelement.com www.netelement.com