Attached files

| file | filename |

|---|---|

| EX-32.1 - EXHIBIT 32.1 - Net Element, Inc. | tv489318_ex32-1.htm |

| EX-31.2 - EXHIBIT 31.2 - Net Element, Inc. | tv489318_ex31-2.htm |

| EX-31.1 - EXHIBIT 31.1 - Net Element, Inc. | tv489318_ex31-1.htm |

| EX-23.1 - EXHIBIT 23.1 - Net Element, Inc. | tv489318_ex23-1.htm |

| EX-21.1 - EXHIBIT 21.1 - Net Element, Inc. | tv489318_ex21-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2017

OR

¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from __________ to __________

Commission file number: 001-34887

Net Element, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 90-1025599 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

| 3363 NE 163rd Street, Suite 705 North Miami Beach, FL |

33160 | |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (305) 507-8808

Securities registered under Section 12(b) of the Exchange Act:

| Title of each class | Name of each exchange on which registered | |

| Common Stock, par value $0.0001 per share | NASDAQ Capital Market |

Securities registered under Section 12(g) of the Exchange Act:

| Warrants, each exercisable for one share of Common Stock |

| (Title of class) |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ¨ YES x NO

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ¨ YES x NO

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. x YES ¨ NO

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). x YES ¨ NO

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company," and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ¨ | Accelerated filer ¨ |

| Non-accelerated filer ¨ (Do not check if a smaller reporting company) | Smaller reporting company x |

| Emerging growth company ¨ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). ¨ YES x NO

The aggregate market value of the registrant’s common equity, other than shares held by persons who may be deemed affiliates of the registrant, as of June 30, 2017 was approximately $8,996,491.

The registrant had 3,862,352 shares of common stock outstanding as of March 29, 2018.

DOCUMENTS INCORPORATED BY REFERENCE

None.

Forward-Looking Statements

This Annual Report on Form 10-K (this “Report”), including the section entitled “Management’s Discussion and Analysis of Financial Conditions and Results of Operation” and “Risk Factors”, contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. You should not rely upon forward-looking statements as predictions of future events. The events and circumstances reflected in the forward-looking statements may not be achieved or occur. All statements other than statements of historical fact, including, statements regarding our future results of operations and financial position, our business strategy and plans, our objectives for future operations, and any statements of a general economic or industry specific nature, are forward-looking statements. You can identify forward-looking statements by the fact that they do not relate strictly to historical or current facts. Forward-looking statements generally are identified by the words “expects,” “anticipates,” “believes,” “intends,” “estimates,” “aims,” “plans,” “may,” “will,” “continue,” “seeks,” “should,” “believe,” “potential” or the negative of such terms and similar expressions. We have based these forward-looking statements largely on our current expectations and projections about future events and trends that we believe, based on information currently available to our management, may affect our financial condition, results of operations, business strategy, short-term and long-term business operations and objectives, and financial needs. These forward-looking statements are subject to a number of risks, uncertainties and assumptions, including those described in the "Risk Factors" section in Part I, Item 1A of this Report. Moreover, we operate in a very competitive and rapidly changing environment.

If these or other risks and uncertainties (including those described in Part I, Item 1A of this Report and the Company’s subsequent filings with the U.S. Securities and Exchange Commission (the “SEC” or the “Commission”)) materialize, or if the assumptions underlying any of these statements prove incorrect, the Company’s actual results may be materially different from those expressed or implied by such statements. We undertake no obligation to publicly revise any forward-looking statement to reflect circumstances or events after the date of this Report to reflect the occurrence of unanticipated events. You should, however, review the factors and risks described in the reports we file from time-to-time with the SEC after the date of this Report. These factors include, among other factors:

| ■ | the impact of any new or changes made to laws, regulations, card network rules or other industry standards affecting our business; | |

| ■ | the impact of any significant chargeback liability and liability for merchant or customer fraud, which we may not be able to accurately anticipate and/or collect; | |

| ■ | our ability to secure or successfully migrate merchant portfolios to new bank sponsors if current sponsorships are terminated; | |

| ■ | our and our bank sponsors’ ability to adhere to the standards of Visa and MasterCard payment card brand; | |

| ■ | our reliance on third-party processors and service providers; | |

| ■ | our dependence on independent sales groups (“ISGs”) that do not serve us exclusively to introduce us to new merchant accounts; | |

| ■ | our ability to pass along increases in interchange costs and other costs to our merchants; | |

| ■ | our ability to protect against unauthorized disclosure of merchant and cardholder data, whether through breach of our computer systems or otherwise; | |

| ■ | the effect of the loss of key personnel on our relationships with ISGs, card brands, bank sponsors and our other service providers; | |

| ■ | the effects of increased competition, which could adversely impact our financial performance; | |

| ■ | the impact of any increase in attrition due to an increase in closed merchant accounts and/or a decrease in merchant charge volume that we cannot anticipate or offset with new accounts; | |

| ■ | the effect of adverse business conditions on our merchants; | |

| ■ | our ability to adopt technology to meet changing industry and customer needs or trends; | |

| ■ | the impact of any decline in the use of credit cards as a payment mechanism for consumers or adverse developments with respect to the credit card industry in general; | |

| ■ | the impact of any adverse conditions in industries in which we obtain a substantial amount of our bankcard processing volume; | |

| ■ | the impact of seasonality on our operating results; | |

| ■ | the impact of any failure in our systems due to factors beyond our control; | |

| ■ | the impact of any material breaches in the security of third-party processing systems we use; | |

| ■ | the impact of any new and potential governmental regulations designed to protect or limit access to consumer information; | |

| ■ | the impact on our profitability if we are required to pay federal, state or local taxes on transaction processing; | |

| ■ | the impact on our growth and profitability if the markets for the services that we offer fail to expand or if such markets contract; | |

| ■ | significant losses we have incurred and may continue to experience in the future; | |

| ■ | foreign laws and regulations, which are subject to change and uncertain interpretation; | |

| ■ | geopolitical instability and other conditions that may adversely affect trends in consumer, business and government spending; | |

| ■ | the Company’s ability (or inability) to obtain additional financing in sufficient amounts or on acceptable terms when needed; | |

| ■ | the impact on our operating results as a result of impairment of our goodwill and intangible assets; | |

| ■ | our material weaknesses in internal control over financial reporting and our ability to maintain effective controls over financial reporting in the future; and | |

| ■ | the other factors identified in the section of this Report entitled “Risk Factors.” |

World Wide Web addresses contained in this Report are for explanatory purposes only and they (and the content contained therein) do not form a part of, and are not incorporated by reference into, this Report.

TABLE OF CONTENTS

| 3 |

Net Element, Inc., (“Net Element”) a Delaware corporation, is a holding company that conducts its operations through its subsidiaries. Net Element and its subsidiaries are referred to collectively as the “Company,” “Net Element,” “we,” “us,” or “our,” unless the context requires otherwise.

Company Overview

Net Element is a global technology and value-added solutions group that supports electronic payments acceptance in a multi-channel environment including point-of-sale (POS), ecommerce and mobile devices. The Company operates two business segments as a provider of North American Transaction Solutions and International Transaction Solutions. Additionally, we have corporate overhead broken out in our segment reporting.

We offer a broad range of payment acceptance and processing services that enable merchants of all sizes to accept and process over 100 different payment options in more than 120 currencies, including credit, debit, prepaid and alternative payments. We also provide merchants with value-added services and technologies including integrated payment technologies, POS solutions, security solutions, fraud management, information solutions and analytical tools.

We believe that our technology-centered value-added service offerings and the payments ecosystem differentiate us from the competition. It enables us to efficiently provide a comprehensive suite of services to clients across the value chain of commerce-enabling services and technologies as well as to innovate, develop and deploy new services, while providing us with significant economies of scale. Our broad and varied distribution includes sales channels, such as our direct and indirect sales forces, referral partners and value-added resellers, which provide us with a growing and diverse client base of merchants. We believe this combination of attributes provides us with the competitive advantages that generate strong growth by enabling us to efficiently manage, update and maintain our technology, to utilize technology integration and value-added services to expand our new sales and distribution, and to realize significant operating leverage. We create our value-added solutions from a suite of proprietary technology products, software, cloud-based applications, processing services, security offerings, and customer support programs that we configure to meet our clients’ individual needs.

We provide additional services through our portfolio of brands including:

| · | Unified Payments – payment acceptance solutions, including POS solutions and value-added services throughout the United States; |

| · | Unified m-POS – easy-to-use mobile application that provides the functionalities that small to medium sized businesses (“SMB”) need to accept and manage transactions in a neat and easy to use interface, which is EMV-compliant, accepts traditional and contactless transactions such as Apple Pay®. Unified m-POS application is available for download in Apple’s App Store and Google Play; | |

| · | Aptito – proprietary cloud-based POS platform for the hospitality industry and SMB merchants; |

| · | Restoactive – seamless visual POS integration that modernizes experience in the restaurant POS environment and behind the scenes. Integration ready for over 500,000 restaurants in the United States; | |

| · | Zero Pay – zero-fee payment acceptance program for SMB merchants in the United States. Zero Pay program saves merchants costs involved in accepting credit and debit cards using mobile POS by passing the cost to the consumer; | |

| · | PayOnline – proprietary integrated, global e-commerce and mobile payments processing platform and fraud management system; |

| · | Pay-Travel – integrated payment processing solutions to the travel industry, which includes integrations with various Global Distribution Systems (“GDS”) such as Amadeus®, Galileo®, Sabre®, additional geo filters and passenger name record (PNR) through Pay-Travel service offered by PayOnline; |

| · | Sales Central – designed to enhance responsiveness of our indirect non-bank sales forces (“Sales Partners”) and improve sales efficiency. The cloud-based solution provides to both Sales Partners and merchants an integrated toolkit to more effectively manage a variety of sales, operations, reporting and accounting functions; | |

| · | Netevia – future-ready multi-channel payments platform developed by in-house Net Element Software team (software-as-a-service “SaaS” and White Label models) and available across all brands. Connecting and simplifying payments across sales channels through a single integration point, Netevia delivers end-to-end payment processing through easy-to-use APIs.; and |

| · | Digital Provider – integrated direct-carrier, mobile operator solution for smaller content providers and merchants throughout selected international markets. |

We have operations and offices located within the United States (“U.S.”) (domestic) and outside of the U.S. (international) where sales, customer service and/or administrative personnel are based. Through U.S. based subsidiaries, we generate revenues from transactional services, valued-added payment services and technologies for SMBs. Through wholly owned subsidiaries, we operate internationally with a focus on transactional services, mobile payment transactions, online payment transactions, value-added payment services and technologies in selected international markets.

Our business is characterized by transaction related fees, multi-year contracts, and a diverse client base, which allows us to grow alongside our clients. Our multi-year contracts allow us to achieve a high level of recurring revenues with the same clients. While the contracts typically do not specify fixed revenues to be realized thereunder, they do provide a framework for revenues to be generated based on volume of services provided during such contracts’ term.

Recent Developments

During 2017, we completed a number of transactions and other accomplishments in pursuit of our strategy of enhancing financial results, creating a strong operational foundation and competitive advantage. We believe the following transactions and actions have focused and strengthened our company and improved our capital structure and cash flow.

| 4 |

Our primary actions during 2017 were as follows:

| · | Received a $7.55 million institutional investment to support continued organic growth and blockchain focused developments |

| · | Ensured continued compliance with NASDAQ listing requirements |

| · | Ranked as one of the fastest growing companies in North America on Deloitte's 2017 Technology Fast 500™ |

| · | Supported Florida SMB merchants affected by Hurricane Irma with free mobile point of sale credit card readers |

Recent Partnerships:

| · | Joined the Enterprise Ethereum Alliance ("EEA"), the world's largest open-source blockchain initiative with over 250 member companies. Membership to the alliance is complementary to the Company's recently announced decentralized blockchain technology solution, Netevia, that will enable a vast number of value-added services ("VAS") and support the adoption of Ethereum in the enterprise |

| · | Partnered with Elo to provide a modern best-in-class point of sale solution. Combined Aptito POS software with Elo’s all-in-one touchscreen device delivering stylish and reliable POS solution |

| · | Partnered with Payvision in Europe, extended access to global currencies. Expanded payment acceptance to 120+ currencies globally |

| · | Partnered with Planet Payment for multi-currency pricing solution in the United States. Introduced multi-currency payment acceptance to online merchants in the United States |

Recent Product Launches:

| · | Launched multi-channel payments platform, Netevia, connecting and simplifying payments across sales channels through a single integration point, Netevia delivers end-to-end payment processing through easy-to-use APIs. This model complements Net Element's ability to perform in a multi-channel environment, including point-of-sale (POS), e-commerce, mobile devices and will enable the company to perform in blockchain technology solutions when fully-developed |

| · | Launched web-based, integrated same-day ACH and eCheck payment processing solution in the United States |

| · | Launched Zero-Fee processing program for SMB merchants in the United States |

| · | Launched loyalty program for international online merchants utilizing a PayOnline platform |

| · | Launched PayOnline's support for electronic commerce in the United States |

| · | Launched Apple Pay support in Russia |

| · | Launched payment acceptance module for Telegram, Viber, Facebook and VK instant messenger apps |

| · | Expanded payments module to include the Prominent InSales platform. InSales platform which provides access to over 4,000 merchants |

| · | Launched comprehensive point-of-sale program during Unified Payments' "2017 Launch Series" at Northeast Acquirers Association event |

| · | Launched ISO incubator to help certified resellers of Unified Payments grow their business, compete and achieve success in today's evolving marketplace |

| · | Launched fully-integrated payment acceptance for V-Tell, an international mobile network operator |

| · | Launched fully-integrated payment acceptance for Azimuth Airlines |

| · | Added support for iDEAL payment system, the most popular payment system in Netherlands |

Outlook

Our strategy is to ensure that our business remains successful in a rapidly changing market, creating sustainable value for all our stakeholders, including our clients, distribution partners and shareholders. We aim to achieve superior results for our clients by having a deep understanding of their payment acceptance needs, extensive market reach, strong product development and technology enablement.

Planned for 2018:

We will continue to focus on understanding our clients and addressing their payment acceptance needs in core market segments.

| ● | Continue growth in all key segments |

| ● | Drive client retention |

| ● | Expand our client base in selected markets |

| ● | Deliver value-added products to our clients to increase efficiencies and payment acceptance |

| ● | Launch new tools to reach our clients, such as digital channels, and deepening partner relations |

The global payments industry continued to deliver healthy growth during 2017, with underlying transaction volumes demonstrating even greater strength. We believe that new and disruptive technologies will provide us the opportunity to differentiate ourselves from our competition, continue developing and delivering innovative payment solutions in 2018 and beyond.

| ● | Continue to develop Netevia, our next-generation payments platform, enabling intelligent routing of payments for the application development community |

| ● | Continue to scale and enhance new product launches that will add value to our clients |

| ● | Extend our capabilities in next-generation POS hardware and software, and deepening our partner proposition |

| 5 |

| ● | Commence trials of advanced technologies around business intelligence and mobile based payments acceptance |

| ● | Target further developments in blockchain technologies, payments enablement for Internet of Things and biometrics payment acceptance |

| ● | Continue investment in future emerging payment technologies |

Realize the full potential of our business model.

| ● | Deliver stronger organic growth |

| ● | Develop additional payment network relationships to integrate with our technologies |

| ● | Seek acquisition or investment opportunities to deepen our technological and distribution capabilities |

We believe that blockchain technologies will play key roles in future commerce to facilitate transactions and serve as a secure payment platform. We also believe that these technologies will encourage innovation through development of value-added services and cater to both merchants and their customers.

We are developing a decentralized crypto-based ecosystem to act as a framework for a number of value-added services that can connect merchants and consumers directly utilizing blockchain technology while increasing the economic efficiency of all transactions being made within the ecosystem. Specifically, we launched a platform called Netevia that delivers end-to-end payment processing through easy-to-use APIs and complements the Company’s ability to perform in a multi-channel environment, including point-of-sale (POS), e-commerce and mobile devices and will enable the Company to perform in decentralized blockchain technology solutions. We are working to implement additional features on the platform, which will include default value-added modules, such as a payment platform technology solution, peer-to-peer interface solution and blockchain rewards system solution. We expect that the users of our blockchain based payments solution, when such solution is fully implemented, will be able to make payments by using payment options of their preference: fiat money, mainstream and alternative cryptocurrencies. The main function of the blockchain based payments solution is to provide the “one-click” payment technology solution with minimum transaction costs and maximum comfort for the users. We expect that such function will be complementary to our current platform which supports multiple payment methods internationally. We also expect that the peer-to-peer module will allow participants to transact directly using blockchain technology and support conversion and transmittal of multiple payment methods including traditional payment methods, mainstream and alternative cryptocurrencies, and the rewards system that will reward users for active use of the ecosystem and contributions into its development.

In providing such blockchain technology solutions, we will not be holding any deposits, nor trade in, digital assets. We are committed to comply with the government regulations applicable to our blockchain technology solutions.

Our Mission and Vision

Our mission is to power global commerce and allow our clients to conduct business globally. We believe that by understanding the consumer behavior and the needs of our merchants is the most effective and, ultimately, the most profitable means to accomplish our mission and create long-term value for all stakeholders.

We drive client growth through our in-depth knowledge of global transactional services and related value-added service offerings which separate us from the competition.

Our vision is to set the standard for multi-channel payments acceptance and value-added service offerings with focus on creation of unified global transaction acceptance ecosystem. We believe in emerging technologies and as such we are developing a decentralized blockchain ecosystem to support a vast number of value-added decentralized applications (“dApps”), which will provide value to our clients.

In order to achieve this vision, we seek to further develop single on-boarding, global transaction acceptance ecosystem. Manifesting this vision requires scaling our direct and indirect connectivity to multiple payment and mobile networks internationally. By implementing this vision, we believe that we will be able to provide centralized, global multi-channel transactional platform to our clients internationally.

Our Strategy

Our strategy is to power global commerce through a world-wide, multi-channel solutions offering. To continue to grow our business, our strategy is to focus on providing merchants with the ability to process a variety of electronic transactions across multiple channels. We seek to leverage the adoption of and transition to card, electronic and digital-based payments by expanding our market share through our distribution channels and services innovations. We also seek growth through strategic acquisitions to improve our offerings, scale and geography. We intend to continue to invest in and leverage our technology infrastructure and our people to increase our penetration in existing markets.

Key elements of our business strategy include:

| · | Continued investment in our core technology and new technology offerings including blockchain; | |

| · | Allocation of resources and expertise to grow in commerce and payments segments; | |

| · | Grow and control distribution by adding new merchants and partners; | |

| · | Leverage technology and operational advantages throughout our global footprint; |

| 6 |

| · | Expansion of our cardholder and subscriber customer base; | |

| · | Continue to develop seamless multinational solutions for our clients; | |

| · | Increase monetization while creating value for our clients; | |

| · | Focus on continued improvement and operation excellence; and | |

| · | Pursue potential domestic and international acquisitions of, investments in, and alliances with companies that have high growth potential, significant market presence or key technological capabilities. |

With our existing infrastructure and supplier relationships, we believe that we can accommodate expected portfolio growth. We believe that our available capacity and infrastructure will allow us to take advantage of operational efficiencies as we grow our processing volume and expand to other geographical territories.

Market Overview

The financial technology and transaction processing industry is an integral part of today’s worldwide financial structure. The industry is continually evolving, driven in large part by technological advances. The benefits of card-based payments allow merchants to access a broader universe of consumers, enjoy faster settlement times and reduce transaction errors. By using credit or debit cards, consumers are able to make purchases more conveniently, whether in person, over the Internet, or by mail, fax or telephone, while gaining the benefit of loyalty programs, such as frequent flyer miles or cash back, which are increasingly being offered by credit or debit card issuers.

In addition, consumers are also beginning to use card-based and other electronic payment methods for purchases at an earlier age in life, and increasingly for small dollar amount purchases. Given these advantages of card-based payment systems to merchants and consumers, favorable demographic trends, and the resulting proliferation of credit and debit card usage, we believe businesses will increasingly seek to accept card-based payment systems in order to remain competitive.

We believe that cash transactions are becoming progressively obsolete. The proliferation of bankcards has made the acceptance of bankcard payments a virtual necessity for many businesses, regardless of size, in order to remain competitive. In addition, the advent and growth of e-commerce and crypto-currencies have marked a significant new trend in the way business is being conducted. E-commerce is dependent upon credit and debit cards, as well as other cashless payment processing methods.

The payment processing industry continues to evolve rapidly, based on the application of new technology and changing customer needs. We intend to continue to evolve with the market to provide the necessary technological advances to meet the ever-changing needs of our market place. Traditional players in the industry must quickly adapt to the changing environment or be left behind in the competitive landscape.

Business Segments

| North American Transaction Solutions |

International Transaction Solutions | |||

| Clients: | Businesses of all types and sizes. Current focus on SMB merchants | Online businesses, merchants requiring cross-border payment acceptance, content providers and mobile applications of all types and sizes | ||

| Goals: | To help business grow commerce at the retail, online and m-POS. Enable multi-channel commerce | To help businesses transact online with ease and security and help digital merchants monetize their content in a mobile environment | ||

|

Key Solutions: |

· Merchant Acquiring · Value-added services · Aptito POS technology · m-POS technology · Smart payment POS terminal · Business performance analytics · Marketing / loyalty |

· Integrated online and mobile billing solutions · Complete cross-border toolkit for online business · Integrated GDS transaction processing · Mobile content monetization and management · Security / risk management · Marketing / loyalty | ||

| 2017 Segment Revenue: | $51M, up 21% from 2016 | $9M, down 27% from 2016 |

We operate two reportable business operating segments: (i) North American Transaction Solutions and (ii) International Transaction Solutions. Our segments are designed to establish lines of businesses that support our client base and further globalize our solutions. Management determines the reportable segments based on the internal reporting used by our Chief Operating Decision Maker to evaluate performance and to assess where to allocate resources. The principal revenue stream for all segments came from service and transaction related fees during 2017.

Prior to May 20, 2015, we had a single reportable business segment: payment processing for electronic commerce. On May 20, 2015, we obtained financial and operational control of PayOnline, a provider of online payment processing of online transactions in emerging markets. Additionally, we rebranded our mobile payments business to Digital Provider and began reporting gross revenues for mobile payments where we provide access to branded content. Given the size of assets and revenues from PayOnline and Digital Provider, we began reporting segment information for three operating segments during the third quarter of 2015. During the fourth quarter of 2017, we re-organized our segment data along geographic lines with two operating segments; North American and International. We also continue to break-out corporate overhead so that we can better see the stand-alone potential of each region.

| 7 |

Comparative segment revenues and related financial information pertaining to our segments for the years ended December 31, 2017 and 2016 are presented in the tables in Note 16, Segment Information, to our consolidated financial statements (the “Consolidated Financial Statements”), which are included elsewhere in this Report.

| · | North American Transaction Solutions – This segment provides technology and services that businesses require to accept cashless transaction for retail card-present (or “swipe”), e-commerce or card-not-present mail order / telephone order (“MOTO”) transactions (referred to as “Merchant Acquiring”) as well as next-generation offerings such as mobile payment services, merchant performance analytical tools, merchant back office reporting, and our cloud-based Aptito POS platform, which includes hospitality, mobile POS (“m-POS”) and SMB retail point-of-sale applications (referred to as “Value-added Services”). |

| · | International Transaction Solutions – This segment provides online and mobile commerce solutions for merchants including social networks, game developers, online magazines, mobile applications and digital media operators. We provide mobile users with a simple, secure and fast way to pay for purchases via mobile device, interactive device or web without a credit card or a bank account. Our fully-integrated, processor agnostic electronic commerce platform that simplifies complex enterprise online transaction processing challenges from payment acceptance and processing through risk prevention and payment security via point-to-point encryption and tokenization solutions. Our proprietary software-as-a-service (“SaaS”) suite of solutions for electronic and mobile commerce gateway and payment processing platform is compliant at Level 1 of Payment Card Industry (“PCI”) Data Security Standards (“DSS”) streamlines the order-to-cash process, improves electronic payment acceptance and reduces the scope of burden of PCI DSS compliance. |

North American Transaction Solutions Segment

The following table presents North American Transaction Solutions segment information as a percentage of total revenue:

| 2017 | 2016 | |||||||

| Segment revenue | 85 | % | 78 | % | ||||

North American Transaction Solutions Operations. Our largest segment, North American Transaction Solutions, where through our subsidiary TOT Payments, LLC, doing business as Unified Payments, we provide businesses of all sizes and types with a wide range of solutions at the point of sale, including Merchant Acquiring, e-commerce, mobile commerce, POS and other business solutions. Our largest service in this segment is Merchant Acquiring, which facilitates the acceptance of cashless transactions at the POS, whether a retail transaction at a physical business location, a mobile commerce transaction through a mobile or tablet device, which includes m-POS acceptance, Android Pay™, Apple Pay™ and Samsung Pay or an electronic commerce transaction over the web. Geographical presence for this segment is North America.

Our North American Transaction Solutions segment revenues are primarily derived from processing payment acceptance transactions in a multi-channel environment for SMB merchants and includes fees for providing processing, loyalty and software services, and sales and support of POS devices. Revenues are generated from a variety of sources, including:

| · | Discount fees charged to a merchant for processing of a transaction. The discount fee is typically either a percentage of the purchase amount or an interchange fee plus a fixed dollar amount or percentage; | |

| · | Processing fees charged to merchants for processing of a transaction; | |

| · | Processing fees charged to our Sales Partners who have outsourced their transaction processing to us; | |

| · | Sales and support of POS devices; | |

| · | Fees from providing reporting and other services; | |

| · | Software license fees for Aptito POS platform, which includes hospitality and SMB retail point-of-sale application; | |

| · | PCI compliance fees charged to a merchant for providing PCI compliance on annual basis; and | |

| · | Business software license fees for merchant analytics and back office reporting. |

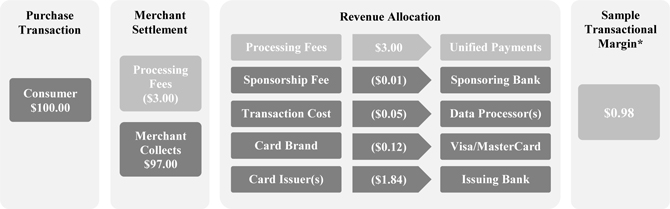

For example, in a transaction using a Visa or MasterCard card, the allocation of funds resulting from a $100 transaction follows.

* Does not include agent commission payments.

| 8 |

We typically provide our services as part of a broader payment acceptance solution to our business clients across multiple channels, including:

| · | Retail Merchants – physical businesses or storefront locations, such as retailers, supermarkets, restaurants, hotels and other brink and mortar facilities, which we refer to as Retail. We supply our Retail merchants with POS terminals from leading manufacturers, which are Europay®, MasterCard®, and Visa® (commonly referred to as “EMV” or “Chip”) compliant and Near Field Communication (“NFC”) capable, accepting all card brands and products, as well as alternative payment forms, such as Android Pay™, Apple Pay™ and Samsung Pay. | |

| · | Mobile Merchants – physical businesses with remote or wireless storefront locations, such as small retail and service providers that use mobile devices with POS capabilities to accept electronic payments, which we refer to as Mobile; and | |

| · | Online – online businesses or website locations, such as retailers, digital content providers, and mobile application developers with Internet-based storefronts that can be accessed through a personal computer or a mobile device, where we refer to as e-commerce. |

North American Transaction Solutions Marketing. We employ a variety of go-to-market strategies in our North American Transaction Solutions segment. We mostly partner with indirect non-bank Sales Partners, such as independent sales agents, independent sales groups and referral partners that user our brand to market services (“ISG”), independent sales groups that we sponsor to Card Brands as registered Independent Sales Organizations (“ISO”) – these groups market services under their own brands, independent software vendors (“ISV”), value added resellers (“VAR”), and payment services providers (“PSP”) to sell our payment solutions to SMB merchants. We believe that this sales approach provides us with access to an experienced sales force to market our services with limited investment in sales infrastructure and management time. We believe our focus on the unique needs of SMB allows us to develop compelling offerings for our sales channels to bring to prospective merchants and provides us with a competitive advantage in our target market.

Sales & Marketing Support – Among the services and capabilities we provide are rapid application response time, merchant application acceptance by a proprietary and secure on-line sales portal, superior customer service, merchant reporting and robust analytics. In addition, by controlling the underwriting process we believe we offer the ISGs more rapid and consistent review of merchant applications than may be available from other service providers. Additionally, in certain circumstances, we offer our sales organizations tailored compensation programs and unique technology applications to assist them in the sales process. We keep an open dialogue with our Sales Partners to address their concerns as quickly as possible and work with them in investigating chargebacks or potentially suspicious activity with the aim of ensuring our merchants do not unduly suffer downtime or the unnecessary withholding of funds.

Sales & Marketing Compensation – As compensation for their referral of merchant accounts, we pay our Sales Partners an agreed-upon recurring commission, or percentage of the income we derive from the transactions we process from the merchants they refer to us. The amount of the recurring commissions we pay to our Sales Partners varies on a case-by-case basis and depends on several factors, including but not limited to the number and type of merchants each group refers to us. We provide additional incentives to our Sales Partners, including, from time to time, advances and merchant acquisition bonuses that are secured by income earned from the referred merchant and repayable from future compensation that may be earned by the groups in respect to the merchants they have referred to us. For the year ended December 31, 2017 and 2016, we had provided merchant acquisition incentives to Sales Partners in an aggregate amount of $1.8 million and $1.3 million, respectively. Our organic growth plan calls for future incentives to be funded to our Sales Partners for referred merchants.

North American Transaction Solutions. Our solutions are designed to help SMB merchants accept cashless payments in an multi-channel payment environment, which spans across POS, e-commerce and mobile devices.

Mobile POS Platform – An integrated POS platform developed on Apple’s® iOS and Android® mobile operating systems for the hospitality, retail, service and on the go industries. Our goal with Aptito is to create an easy to use POS and business management solution, which incorporates everything a small business needs to help streamline every-day management, operations and payment acceptance.

| § | Aptito Hospitality POS – proprietary, fully integrated cloud-based POS and restaurant management system developed on Apple’s® iOS mobile operating system is designed to be used as a stand-alone all digital POS or be extended to include: m-POS, self-ordering kiosk, digital menus, pay at the table EMV and NFC ready card readers, cash drawers, receipt and kitchen printers. The need for uptime in a hospitality environment is paramount and as such our Aptito Hospitality POS local server allows our merchants to remain online, even if the Internet connection to the cloud is lost. Our local server solution is automatically synchronized with the cloud, providing 99.99% uptime. |

| · | Aptito Retail POS – cloud-based POS solution is available on Apple® iOS and Android® mobile operating platforms and allows retailers to focus on their business and improve the in-store experience. Retailers are able to customize Aptito Retail POS based on their environment. Peripherals for Aptito Retail POS include a fully integrated cash drawer, thermal receipt printer, barcode scanner, barcode printer and EMV-compliant point of sale acceptance terminal. This allows retailers the ability to customize their POS solution based on their unique needs. The need for uptime in a retail environment is paramount and as such our Aptito Retail POS local server allows our merchants to remain online, even if the Internet connection to the cloud is lost. Our local server solution is automatically synchronized with the cloud, providing 99.99% uptime. |

| · | Restoactive – utilizing Aptito POS Platform architecture, we have developed and launched Restoactive, which seamlessly plugs into a current restaurant environment through integrations with some of the biggest POS and restaurant management platforms such as: MICROS®, POSitouch®, Aloha® and Symphony®. By integrating into the leading POS and restaurant management platforms, Restoactive is now accessible by over 500,000 restaurants in the United States. We believe Restoactive to be the first of its kind integrated platform, which introduces all-in-one digital menu, kiosk and m-POS application into an existing POS environment without the need to displace existing restaurant management platforms. |

| 9 |

| · | Unified m-POS – Unified m-POS solution is available on Apple® iOS and Android® mobile operating platforms and makes it easier and safer to take business on the go. Whether at the local farmer’s market or at a customer’s site, Unified m-POS accept payments with ease and security. Mobile application is EMV-compliant, accepts traditional and contactless transactions such as Apple Pay®. Unified m-POS application is available for download in Apple’s App Store and Google Play |

In addition to enhancing our ability to drive core merchant acquiring sales, Mobile POS Platform allows us to earn incremental revenue from business clients. Currently, revenue model is based on a SaaS fee, which we bill on a per station basis and additional services fee, which we bill for additional applications we offer.

We also believe that our Mobile POS Platform can help enhance client retention because we believe it will become core to our clients’ businesses and position us as a value-added partner. For example, business owners may use our business management tools to manage their employees’ work schedules, payroll, patron reservations, operate customer loyalty programs, manage inventory, and/or provide analytics on their business.

Other POS Platforms – We act as an authorized dealer for various POS manufacturers and POS software providers and deploy these systems where our proprietary products are not the best fit. Systems we offer are fully integrated with our payment acceptance capabilities.

Merchant Management Platform – We have developed Sales Central, a proprietary cloud-based merchant management platform. Sales Central is designed to enhance responsiveness of our Sales Partners and improve sales efficiency. The cloud-based solution provides to both Sales Partners and merchants an integrated toolkit to more effectively manage a variety of sales, operations, reporting and accounting functions. The system is designed to improve conversion rates, technology advisory functions and to reduce deployment time for merchants. It also allows troubleshooting of merchant issues in real-time. Sales Central is currently one of the few cloud-based systems nationwide that allows Sales Partners to onboard and monitor merchants on multiple processing platforms through a single interface.

| · | Sales Central for Sales Partners – allows Sales Partners to onboard merchants on multiple processing platforms available in the U.S. Its merchant underwriting and boarding process is seamless and paperless. Merchant Library allows Sales Partners to safely store and retrieve any agreement, form or contract related to merchants. Sales Partners that utilize the system are equipped with merchant pricing, residual calculations and risk management modules, which allow easier management of most of their day-to-day operations. Sales Partners compensation and merchant profitability can be managed using multi-level, single-click, drill-down navigation to pricing, detail, summary and statement information. |

| · | Sales Central On the Go – fully integrated, digital onboarding interface designed for Sales Partners and merchants, streamlines and automates merchant account sign-up process, delivers real-time decisions and paperless boarding approval from online and mobile devices. Mobile boarding capability facilitates API-driven, instant boarding to multiple payment processing platforms and provides new merchants with a modular approach for providing their personal and business information. The platform manages underwriting, risk assessment, merchant ID assignments and is compliant with banking standards such as Know Your Customer regulations. |

| · | Sales Central for Merchants – integrated reporting, accounting and analytics back office solution for SMB merchants. A variety of reporting tools along with easy to understand charts enables merchants to analyze sales and improve performance. The ticket system allows merchants direct communication with Company’s service and technical support designed to improve the customer service experience. |

| · | Unified Insights – the integrated Unified Insights module is a business dashboard focused on “Big Data” that gives merchants a 360-degree view of their business in a more usable formats. With Unified Insights, merchants can compare current revenue, online reputation, and social media activity to their past performance and to similar business in their area. |

North American Transaction Solutions Competition. Many large and small companies compete with us in providing payment processing services and related services to a wide range of merchants. Many of our current and prospective competitors have substantially greater financial, technical and marketing resources, larger customer bases, longer operating histories, more developed infrastructures, greater name recognition and/or more established relationships in the industry than we have. Because of this our competitors may be able to adopt more aggressive pricing policies than we can, develop and expand their service offerings more rapidly, adapt to new or emerging technologies and changes in customer requirements more quickly, take advantage of acquisitions and other opportunities more readily, achieve greater economies of scale, and devote greater resources to the marketing and sale of their services. There are also many smaller transaction processors that provide various services to small and medium sized merchants.

We believe that our specific focus on smaller merchants, in addition to our understanding of the needs and risks associated with providing payment processing services to small merchants and indirect non-bank sales forces, gives us a competitive advantage over larger competitors, which have a broader market perspective and priorities. We also believe that we have a competitive advantage over competitors of a similar or smaller size that may lack our extensive experience, value-added product offering and resources.

| 10 |

North American Transaction Solutions Industry Mix and Geography. In the United States, we have developed significant expertise in industries that we believe present relatively low risks as the customers are generally present and the products or services are generally delivered at the time the transaction is processed. These include:

| · | Restaurants | |

| · | Schools and educational services | |

| · | Brick and mortar retailers | |

| · | Convenience and liquor stores | |

| · | Professional service providers | |

| · | Hotel and lodging establishments |

Merchants we served during 2017 processed an average of $12,257 each month in credit card transactions and had an average transaction value of $41.55 per transaction. Larger payment processors have traditionally underserved these merchants. As a result, these merchants have historically paid higher transaction fees than larger merchants and have not been provided with tailored solutions and on-going services that larger merchants typically receive from larger payment processing providers.

Our total North American Transaction Solutions processing volume for the year ended December 31, 2017 was $2.3 billion, a 18% increase over processing during the year ended December 31, 2016. Transactions processed for the year ended December 31, 2017 were 89.0 million compared to 87.5 million for the year ended December 31, 2016.

Our card-present processing volume for the year ended December 31, 2017 represented 73% of the total North American Transaction Solution volume, and card-not-present processing volume represented 27%.

As of December 31, 2017, approximately 39.6% of our SMB merchants were restaurants and 22% were health and beauty services, and 16% were general merchandise. The high concentration in restaurants reflects the efforts of our sales team actively targeting our Aptito POS product line. The following table reflects the percentage concentration of our merchant base by category:

| 2017 | 2016 | |||||||

| Restaurants | 39.6 | % | 36.6 | % | ||||

| Health / Beauty | 22.0 | % | 19.9 | % | ||||

| General Merchandise | 16.0 | % | 15.2 | % | ||||

| Professional Services | 8.1 | % | 8.4 | % | ||||

| Automotive | 6.8 | % | 7.1 | % | ||||

| Food Stores | 2.4 | % | 5.8 | % | ||||

| Educational Services | 2.7 | % | 4.4 | % | ||||

| Hotels / Motels | 1.1 | % | 1.6 | % | ||||

| Other | 1.3 | % | 1.0 | % | ||||

In December 2017, SMB merchants located in the following states represented the following percentage of our SMB card processing volume: New York represented 24.31%, Florida represented 11.9% California represented 10.97%, New Jersey represented 5.69% and North Carolina represented 5.28%. No other state represented more than 5% of our total SMB card processing volume. Our geographic concentration tends to reflect states where we maintain stronger sales force. We believe that the loss of any single SMB merchant would not have a material adverse effect on our financial condition or results of operations.

North American Transaction Solutions Risk Management. In the United States, we focus our sales efforts on low-risk bankcard merchants and have developed systems and procedures designed to minimize our exposure to potential merchant losses.

Effective risk management helps us minimize merchant losses for the mutual benefit of our merchants, Independent Sales Groups and ourselves. Our Underwriting and Risk Management Policy and procedures help to protect us from fraud perpetrated by our merchants. We believe our knowledge and experience in dealing with attempted fraud has resulted in our development and implementation of effective risk management and fraud prevention systems and procedures. In 2017, we experienced losses of .0002 (or 0.02%) of our SMB card processing volume.

We employ the following systems and procedures to minimize our exposure to merchant and transaction fraud:

| · | Merchant Application Underwriting – there are varying degrees of risk associated with different merchant types based on their industry, the nature of the merchant’s business, processing volumes and average transaction size. As such, varying levels of scrutiny are needed to evaluate a merchant application and to underwrite a prospective merchant account. These range from basic due diligence for merchants with low risk profiles to more comprehensive review for higher risk merchants. The results of this assessment serves as the basis for decisions regarding acceptance of the merchant account, criteria for establishing reserve requirements, processing limits, average transaction amounts and pricing. Once aggregated, these factors also assist the Company in monitoring transactions for those accounts when pre-determined criteria have been exceeded. |

| 11 |

| · | Merchant Monitoring – we employ several levels of merchant account monitoring to help us identify suspicious transactions and trends. Daily merchant activity is sorted into a number of customized reports by our systems. Our risk management team reviews any unusual activity highlighted by these reports, such as larger than normal transactions or credits, and monitors other parameters that are helpful in identifying suspicious activity. We have daily windows to decide if any transactions should be held for further review and this provides us time to interview a merchant or issuing bank to determine the validity of suspicious transactions. We also place merchants who require special monitoring on alert status and have engaged a third-party web crawling solution that scans all merchant websites for content and integrity. |

| · | Investigation and Loss Prevention – if a merchant exceeds any parameters established by our underwriting and/or risk management staff or violates regulations established by the applicable bankcard network or the terms of our merchant agreement, one of our investigators will identify the incident and take appropriate action to reduce our exposure to loss and the exposure of our merchant. This action may include requesting additional transaction information, withholding or diverting funds, verifying delivery of merchandise or even deactivating the merchant account. Additionally, Relationship Managers may be instructed to retrieve equipment owned by us. In addition, to protect ourselves from unexpected losses, we maintain a reserve account with our sponsoring bank, which can be used to offset any losses incurred at a given time. As of December 31, 2017, our reserve balance was $447,602. The reserve is replenished as required by funding 0.03% of bankcard processing volume. In the case of our self-designated bin, this is triggered when it falls below $25,000. This reserve is accounted for on our balance sheet under the caption “other assets”. |

| · | Reserves – some of our merchants are required to post reserves (cash deposits) that are used to offset chargebacks incurred. Our sponsoring banks hold such reserves related to our merchant accounts as long as we are exposed to loss resulting from a merchant’s processing activity. In the event that a small company finds it difficult to post a cash reserve upon opening an account with us, we may build the reserve by retaining a percentage of each transaction the merchant performs until the reserve is established. This solution permits the merchant to fund our reserve requirements gradually as its business develops. As of December 31, 2017, our total reserve deposits were approximately $5,715,466. We have no legal title to the cash accounts maintained at the sponsor bank in order to cover potential chargeback and related losses under the applicable merchant agreements. We also have no legal obligation to these merchants with respect to these reserve accounts. Accordingly, we do not include these accounts and the corresponding obligation to the merchants in our consolidated financial statements. |

North American Transaction Solutions Sponsoring Banks and Data Processors. Because we are not a “member bank” as defined by Visa, MasterCard, American Express and Discover (“Card Brands”), in order to authorize and settle payment transactions for merchants, we must be sponsored by a financial institution that holds member bank status with the Card Brands (“Sponsorship Bank” in the case of Visa and MasterCard) and various third-party vendors (“Data Processors”) to assist us with these functions. Card Brand rules restrict us from performing funds settlement or accessing merchant settlement funds and require that these funds be in the possession of a Sponsorship Bank until the merchant is funded.

Sponsoring Bank. We have agreements with several banks that sponsor us for membership in the Visa, MasterCard, American Express and Discover card brands and settle card transactions for our merchants. These agreements allow us to use the banks’ identification numbers, referred to as Bank Identification Number (“BIN”) for Visa transactions and Interbank Card Association (“ICA”) number for MasterCard transactions. The principal Sponsoring Bank through which we processed the majority of our transaction in the United States during 2017 was Merrick Bank, N.A. On March 1, 2018, we moved all of our processing from Merrick Bank, N.A. to Citizens Bank, N.A as part of our relationship with Priority Payments Inc. In addition, we process transactions through BIN sponsorship agreements with Esquire Bank, N.A. and Wells Fargo Bank, N.A. From time to time, we may enter into agreements with additional banks.

Data Processor. We have agreements with several Data Processors to provide us with, on a non-exclusive basis, transaction processing and transmittal, transaction authorization and data capture, and access to various reporting tools. Our primary processing vendor in the United States is Priority Payment Systems, LLC (“Priority”), which provides us with the processing conduit to the Total System Services, Inc. (“TSYS”) and First Data Corporation (“FDC”) authorization and settlement network. We have entered into several service agreements with Priority. Each of the Priority service agreements may be terminated by Priority if, among other things, (i) certain insolvency events occur with respect to us or (ii) we fail to maintain our good standing with Card Brands. We may terminate each of the agreements if, among other things, (i) certain insolvency events occur with respect to Priority, (ii) Priority materially breaches any of the terms, covenants or conditions of the agreements and fails to cure such breach within 30 days following receipt of written notice thereof, or (iii) under certain circumstances, Priority is unable to perform services described in the agreement. In addition, we maintain direct processing agreements with TSYS and FDC.

As an example of processing an electronic payment, the below diagram illustrates the participants involved in a payment transaction. There are four main participants, the Merchant, the Service Provider (Unified Payments), the Sponsoring Bank and the Data Processor. Merchants are primarily business owners that accept credit card payment in exchange for their merchandise and services.

| 12 |

International Transaction Solutions.

The following table presents International Transaction Solutions Segment information as a percentage of total revenue:

| 2017 | 2016 | |||||||

| Segment revenue | 15 | % | 22 | % | ||||

During 2017, we have consolidated our Online Payment Solutions and Mobile Payment Solutions segments into a single International Transaction Solutions segment. Our online payment solutions company, PayOnline, now provides all operational support for our mobile payments business. Our mobile payments business is transitioning to a joint venture business model and we are in discussions with several potential partners regarding joint business development.

Through our subsidiary, PayOnline, we provide a wide range of value-added online solutions utilizing our fully-integrated, platform agnostic electronic commerce offering that simplifies complex enterprise online transaction processing challenges from payment acceptance and processing through risk prevention and payment security via point-to-point encryption and tokenization solutions. Our proprietary SaaS suite of solutions for electronic and mobile commerce gateway and payment processing platform is compliant at Level 1 of PCI DSS, streamlines the order-to-cash process, improves electronic payment acceptance and reduces the scope of burden of PCI DSS compliance. PayOnline holds a leadership position in the Russian Federation as one of the largest independent Internet Payment Services Provider (“IPSP”).

Our International Transaction Solutions segment revenues are primarily derived from processing credit and debit card transactions for online merchants and includes fees for providing processing, loyalty and software services. Revenues are generated from a variety of sources, including:

| · | Discount fees charged to a merchant for processing of a transaction. The discount fee is typically a percentage of the purchase amount; |

| · | Processing fees charged to merchants for processing of a transaction; |

| · | Processing fees charged to our sales partners who have outsourced their transaction processing to us; |

| · | Fees from providing reporting and other services; |

| · | Software license fees for PayOnline White-label platform; |

| · | Business software license fees for merchant analytics, back office reporting; and monetarization |

| · | Big Data monetization through upsell on payment confirmation page to the end consumer. |

Through our subsidiary Digital Provider, we enable mobile payment acceptance utilizing agreements with marketing companies owned by the top 3 MNOs including Mobile TeleSystem (MTS), MegaFon and VimpelCom.

There are several possible configurations of transactions that result in us receiving multiple fees for a transaction, depending on the role we play.

In a transaction using a Visa or MasterCard card, the allocation of funds resulting from a $100 transaction is as follows:

*Excludes commissions

Approximately 20% of leading e-commerce merchants in Russia use the PayOnline platform to accept payment transactions in Russia, Europe and Asia.

Online Transaction Solutions Marketing. The vast majority of PayOnline sales are direct sales, through our marketing efforts and fully automated leads management system. The marketing department of PayOnline consists of 5 specialists, responsible for product pricing, company branding and positioning, monitoring of competitors and technological developments, public relations and web marketing activities. Our marketing mix includes, but not limited to:

| · | Search Engine Optimization – PayOnline is in the top 10 results with most frequently used keywords in Google.ru and Yandex search engines. | |

| · | Social Media – PayOnline social media channels include Facebook, Vkontakte, Twitter, YouTube. | |

| · | Corporate Blog – Our corporate blog featured on popular developer communities like HabraHabr and GeekTimes is consistently in the Top 10. |

| · | Industry Research – Every year PayOnline specialists prepare and publish over 120+ research papers on popular e-commerce and IT development forums. | |

| · | RUNET – PayOnline is a payment processing provider for RUNET-ID (Russia’s largest Internet professionals’ social platform), Russian Internet Forum and Russian Interactive Week. | |

| · | Conferences – Every year our experts participate in 30+ trade shows and professional conferences. | |

| · | Education – Our senior managers are frequently invited by top Russian Federation universities and business schools as lecturers. |

| 13 |

During 2016, we attracted 320 new clients, of which 92% were in Russian Federation / CIS and 8% in Europe and Asia. Merchants we served during 2016 processed an average of $54,325 each month in credit card transactions and had an average transaction value of $21.30 per transaction. During 2016, our sales department consists of 25 specialists who are responsible for managing the leads, execution of the client agreements, client boarding, customization of the solutions, implementation of the payment acceptance solutions and post-sale client relationship.

Online Solutions. Our solutions combine payment processing, online shopping cart tools, web site design, web hosting and web related services which enable businesses to establish a presence and commercial capability on the Internet in a quick and simple fashion.

PayOnline Platform – We have developed the PayOnline Platform, a proprietary technology platform serving large and fast growing internet-led multinationals with complex payment needs, supported by our vertical expertise. Our reliable and secure proprietary technology platform enables merchants to accept a vast array of payment types, across multiple channels, anywhere in the world. Utilizing PayOnline Platform, we have built universal flexible payment solution adapted for websites and mobile applications. The solution includes:

| · | Personal Client Area: web-interface for clients to control and manage payments. |

| · | Adaptive payment form with the possibility of customization. |

| · | Simple payment process: binding card to account, moment payments, recurrent payments, temporary blocking of payment, reserving of payments, invoicing by e-mail. |

| · | Customization of protocol 3-D Secure for client's business needs. |

| · | Ability to customize the default settings of anti-fraud system. |

| · | Integrations with various Global Distribution Systems (“GDS”) such as Amadeus®, Galileo®, Sabre®, additional geo filters and passenger name record (PNR). |

| · | Integrations with Apple iOS, Android and Microsoft mobile platforms for mobile application. |

Payments from Start to Finish. PayOnline Platform reduces the payment integration time for merchants, banks and SaaS providers to just a few minutes with its PayOnline Application Program Interface (“API”) service. Easy, easier, easiest: PayOnline integration service simplifies complex payment integration when using APIs and makes the laborious task of adapting payment processes obsolete.

Complete Toolkit for Online Business. More than 20 integration modules for the world's most popular CMS (Content Management System) are available for clients with sites created on basis of CMS. A complete, modular system of web-based services gives our merchants the flexibility to add more options as and when required - without costly or lengthy IT projects.

Online Solutions Competition. PayOnline primarily competes with other companies operating in the online payment processing market in emerging markets. In our key geographical market – Russian Federation, we compete primarily with the acquiring banks and payment processors (including payment aggregators). PayOnline cannot compete with acquiring banks or payment processors on pricing. Our major advantages relate to our robust, payment processor agnostic solution that simplifies complex enterprise online payment processing challenges from payment acceptance and processing through to risk prevention and payment security via tokenization solutions. Our competitive advantages include:

| · | Suite of individually tailored e-commerce solutions | |

| · | Payment conversion management | |

| · | Seamless client payment acceptance implementation | |

| · | Quick development and implementation of custom payment acceptance solutions | |

| · | Multiple integrated payment acceptance methods | |

| · | Wide geography of payment acceptance with a single integration | |

| · | More than 120 currencies accepted worldwide | |

| · | Proprietary Anti-Fraud System |

Online Solutions Industry Mix and Geography. We have developed significant expertise in industries that we believe present opportunities for growth. These include:

| · | Internet stores | |

| · | Professional service providers | |

| · | Travel services | |

| · | Telecommunications | |

| · | Social media networks | |

| · | Financial services | |

| · | Utilities and government services | |

| · | Digital content providers |

| 14 |

Merchants we served during 2017 processed an average of $71,515 each month in credit card transactions and had an average transaction value of $27 per transaction.

The following table reflects the percentage concentration of our merchant base by class:

| 2017 | 2016 | |||||||

| Internet Stores | 36.8 | % | 40.5 | % | ||||

| Professional Service | 23.0 | % | 19.5 | % | ||||

| Travel Services | 17.2 | % | 13.6 | % | ||||

| Telecommunications | 12.0 | % | 12.5 | % | ||||

| Social Media Networks | 3.3 | % | 3.8 | % | ||||

| Financial Services | 1.1 | % | 3.8 | % | ||||

| Utilities and Government Services | 0.4 | % | 4.8 | % | ||||

| Digital content providers | 3.4 | % | 4.4 | % | ||||

| Other | 2.8 | % | 1.6 | % | ||||

Online Solutions Risk Management. In the emerging markets, we focus our sales efforts on electronic commerce merchants and have developed systems and procedures designed to minimize our exposure to potential merchant losses and provide our merchants with cross-border payment acceptance.

Effective risk management helps us minimize merchant losses for the mutual benefit of our merchants and ourselves. Our Anti-Fraud System allows us to identify and prevent up to 99.9% of potential fraud related to bankcard processing in the electronic commerce environment. Our Underwriting and Risk Management Policy and procedures help to protect us from fraud perpetrated by our merchants. 150 different fraud filters allow our clients to maintain high level or payment conversion, averaging at 99.2%, while maintaining chargeback related losses as low as .0002 (or 0.023%). Our risk management is conducted in both manual and automatic modes.

Manual Risk Management involves specialists of our Underwriting and Risk Management Department, who are responsible for the following:

| · | Analysis of risks and underwriting of our partners, i.e. acquiring banks, financial companies and payment processors | |

| · | Analysis of potential risks and underwriting of our potential clients, i.e. merchants accepting payments over internet | |

| · | Manual validation of disputed payments | |

| · | Advising of our potential and current clients on how to correctly setup up fraud monitoring methods and tools | |

| · | Future development of our fraud monitoring and prevention systems, based on the client needs and recent trends in e-commerce and m-commerce marketplace and regulations |

PayOnline Anti-Fraud System is our proprietary Fully Automated Risk Management system. The system is based on the latest know-how of the informational and financial security aspects of the payment processing industry, as well as rules and recommendations of Visa and MasterCard on fraud prevention in electronic commerce.

Major components of PayOnline Anti-Fraud System include but are not limited to:

| · | Advance monitoring of the bank card transaction in automated mode, using 150 filters, individually tuned for each client, where each transaction is evaluated by key parameters, such as country where bank card is issued, country from where the payment is requested, amount of payment, amount of all payments by this card in the past 24 hours/month, IP address, etc. | |

| · | Additional validation of the bankcard by using 3-D Secure protocol or validation by charging random amount on the card. | |

| · | Monitoring of the transactions by specialists of the Underwriting and Risk Management Department. |

Online Solutions Licensing and Certifications. In order to perform services at the highest level of safety and quality of service, PayOnline holds various industry certifications and licenses.

| · | PCI DSS Level 1 – PayOnline is certified to Payment Card Industry Data Security Standard (“PCI DSS”) Level 1 standard version 3.2 PCI DSS. Certificate received by PayOnline March 2, 2018, allows the company to process online payment transactions. During 2017, PayOnline was certified to PCI DSS Level 1 version 3.1, as of February 22, 2017. | |

| · | SDP / CISP – PayOnline has passed international certification by Visa and MasterCard and is involved in MasterCard Site Data Protection (“SDP”) program and the Visa Cardholder Information Security Program (“CISP”). | |

| · | MasterCard – Since 2009, PayOnline is accredited as the official international Service Provider of MasterCard Worldwide, participates in the MasterCard SDP program and, in addition, has the status of MasterCard DataStorage Entity. | |

| · | Visa –Since 2009, PayOnline is accredited as the official Service Provider of Visa International payment system, participates in the Visa CISP program and holds the status of Visa Third Party Processor (“TPP”). |

| 15 |

| · | Cryptographic Transport Layer Security (“TLS”) Protocol – Data exchange between the enterprise e-commerce and PayOnline is made via secure channels, using the HTTPS protocol. TLS cryptographic protocol uses asymmetric cryptography for authentication, symmetric encryption for confidentiality and authenticity of the message codes to preserve the integrity of messages. |

| · | Qualys – PayOnline regularly passes ASV-scan procedure (automated external security audit) provided by Qualys in accordance with the requirements of international payment systems to companies with certified PCI DSS. Approximately 50 companies from the Forbes Global 100 list use Qualys to secure their business. |

Online Solutions Sponsoring Banks and Data Processors. Because we are not a “member bank” or a licensed financial services institution as defined by Visa, MasterCard, American Express and Discover (“Card Brands”), in order to authorize and settle payment transactions for merchants, we must be partner with a financial institution that holds member bank status with the Card Brands (“Partner Bank”) and various third-party vendors (“Data Processors”) to assist us with these functions. Card Brand rules restrict us from performing funds settlement or accessing merchant settlement funds and require that these funds be in the possession of a Partner Bank until the merchant is funded.

Partner Bank. Since 2008, PayOnline has been working to increase the number of partnership agreements and platform integrations with different banks, financial institutions and payment processors. Our worldwide expansion requires a broader range of regions and currencies covered by such partnership agreements, enabling us to provide international payment processing.

Our key partnerships and integrations in Russian Federation include:

| · | Bank of Moscow | · | QIWI Bank |

| · | VTB Bank | · | WebMoney |

| · | Round Bank | · | Absolutbank |

| · | Raiffesenbank | · | Yandex.Money |

| · | SDM Bank |

Our key partnerships and integrations in Europe, Asia and the United States include:

| · | Latvijas Pasta Banka | · | Kyrgyzkommertsbank |

| · | Rietumu Bank | · | Paysafe |

| · | Wirecard Bank | · | Authorize.net |

| · | Kazkommertsbank | · | Skrill |

| · | Kazkommertsbank Tajikistan | · | PayPal |

As an example of processing an electronic payment, the below diagram illustrates the participants involved in a payment transaction. There are four main participants, the Merchant, the Service Provider (PayOnline), the Partner Bank and the Data Processor (PayOnline). Merchants are primarily business owners that accept credit card payment in exchange for their merchandise and services.

Research and Development