Attached files

| file | filename |

|---|---|

| 8-K - 8-K - FRANKLIN ELECTRIC CO INC | a20150527keybanc8-k.htm |

KeyBanc Investor Conference May 27, 2015

Safe Harbor Statement “Safe Harbor” Statement under the Private Securities Litigation Reform Act of 1995. Any forward-looking statements contained herein, including those relating to market conditions or the Company’s financial results, costs, expenses or expense reductions, profit margins, inventory levels, foreign currency translation rates, liquidity expectations, business goals and sales growth, involve risks and uncertainties, including but not limited to, risks and uncertainties with respect to general economic and currency conditions, various conditions specific to the Company’s business and industry, weather conditions, new housing starts, market demand, competitive factors, changes in distribution channels, supply constraints, effect of price increases, raw material costs, technology factors, integration of acquisitions, litigation, government and regulatory actions, the Company’s accounting policies, future trends, and other risks which are detailed in the Company’s Securities and Exchange Commission filings, included in Item 1A of Part I of the Company’s Annual Report on Form 10-K for the fiscal year ending January 3, 2015, Exhibit 99.1 attached thereto and in Item 1A of Part II of the Company’s Quarterly Reports on Form 10-Q. These risks and uncertainties may cause actual results to differ materially from those indicated by the forward-looking statements. All forward-looking statements made herein are based on information currently available, and the Company assumes no obligation to update any forward-looking statements. 2

Water Systems 2014 % +(-) Prior Year $825 M + 8% $124 M (9%) Fueling Systems 2014 % +(-) Prior Year $223 M + 12% $52 M 22% 3 Total Company 2014 % +(-) Prior Year Sales $1,048 M + 9% Operating Income(1) $124 M (2%) EPS(1) $1.76 + 2% (1) After non-GAAP adjustments – see 10-K for reconciliation to GAAP EPS 2014 Sales & Earnings Growth

Earnings Per Share 4 $0 $0.25 $0.50 $1.00 $1.50 $1.25 $0.75 $2.00 $1.75 2014 $1.76 2013 $1.68 $1.72 2012 $1.73 $1.57 2011 $1.33 $1.35 2010 $0.83 $0.95 Adjusted EPS $1.65 $1.41 EPS Before Restructuring EPS

Return on Invested Capital(1) 5 (1) Return on invested capital = operating income ÷ (average net debt plus equity) after non-GAAP adjustments (see 10-K for reconciliation to GAAP operating income) 0% 10% 5% 20% 15% Franklin Electric Peer E Peer C Peer B Peer A 11.1% Peer D 12.5% 18.1% 16.4% 14.4% 16.4% 2014: 16.4% 5 Year Average

Strong Balance Sheet 6 2014 2013 2012 Cash & Marketable Securities $59 M $135 M $103 M Net Debt/Capital 15% 7% 9%

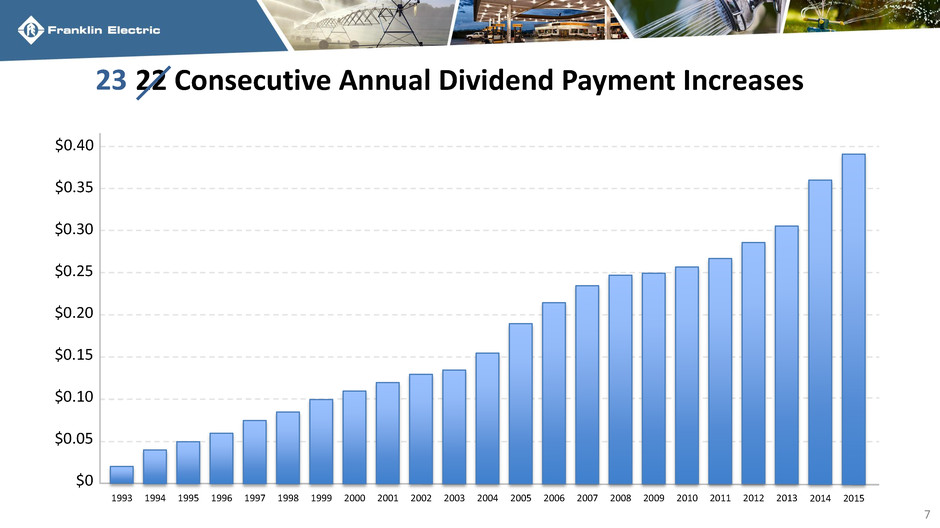

22 Consecutive Annual Dividend Payment Increases 7 23 $0 1993 $0.10 $0.15 $0.20 $0.25 $0.30 $0.05 1994 1995 1996 1997 1998 1999 2000 2002 2009 2003 2004 2005 2006 2007 2008 2010 2001 2011 2012 2013 $0.35 2014 2015 $0.40

8 Two Current Issues

Pioneer 9

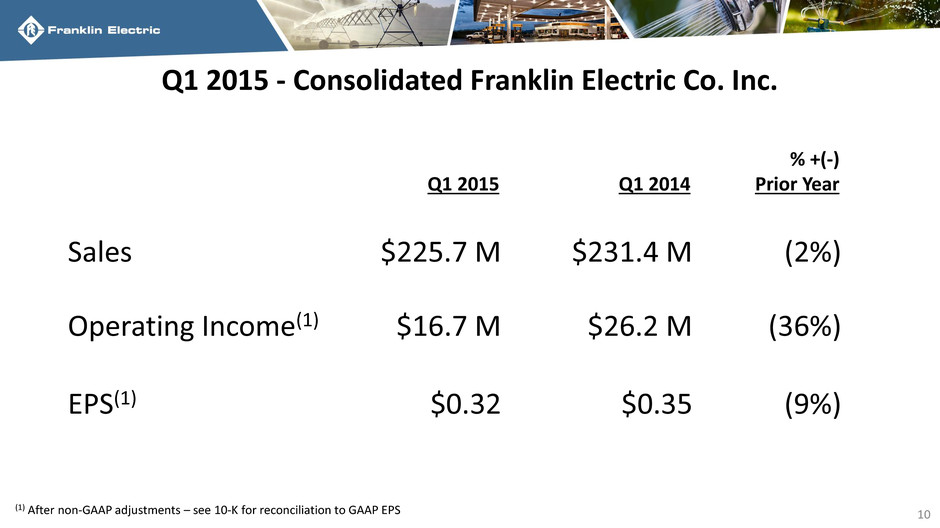

Q1 2015 - Consolidated Franklin Electric Co. Inc. 10 Q1 2015 Q1 2014 % +(-) Prior Year Sales $225.7 M $231.4 M (2%) Operating Income(1) $16.7 M $26.2 M (36%) EPS(1) $0.32 $0.35 (9%) (1) After non-GAAP adjustments – see 10-K for reconciliation to GAAP EPS

Restated Q1 2014 -Consolidated Franklin Electric Co. Inc. 11 Q1 2015 Q1 2014 % +(-) Prior Year Sales $225.7 M $217.4 M + 4% Operating Income(1) $16.7 M $23.8 M (30%) EPS(1) $0.32 $0.31 + 3% (1) After non-GAAP adjustments – see 10-K for reconciliation to GAAP EPS (at 2015 Exchange Rates)

US Groundwater 12 Weather Agriculture New Distribution (16% of Total Water Q1 Sales)

Strategy 13

Business Segments 14 Water Systems 79% Fueling Systems 21% *Based on 2014 revenue *

Water Systems Sales 15 Groundwater Pumping Systems 57% Surface Pumps 43% * *Based on 2014 revenue

Water Systems Sales 16 Irrigation & Industrial Groundwater Pumping Systems 24% Residential Groundwater Pumping Systems 33% Residential Surface Pumps 19% Irrigation & Industrial Surface Pumps 24% *Based on 2014 revenue *

Water Systems Sales 17 Irrigation & Industrial Groundwater Pumping Systems 24% Residential Groundwater Pumping Systems 33% Residential Surface Pumps 19% Irrigation & Industrial Surface Pumps 24% #2 Global Supplier to residential water pumping systems distribution channel #1 Global supplier to agricultural irrigation pumping systems distribution channel Non Discretionary Replacement Purchases Represent +80% of Sales *Based on 2014 revenue *

Sales in Developing Regions 18 2010 $0 $50 $75 $100 $125 $150 $175 $200 $225 2004 2005 2006 2007 2008 2009 $25 2011 $250 $300 $350 2012 $325 $275 2013 $65 M 2014 $400 $375 $401 M $361 M $340 M $306 M $258 M $217 M $232 M $161 M $104 M $85 M

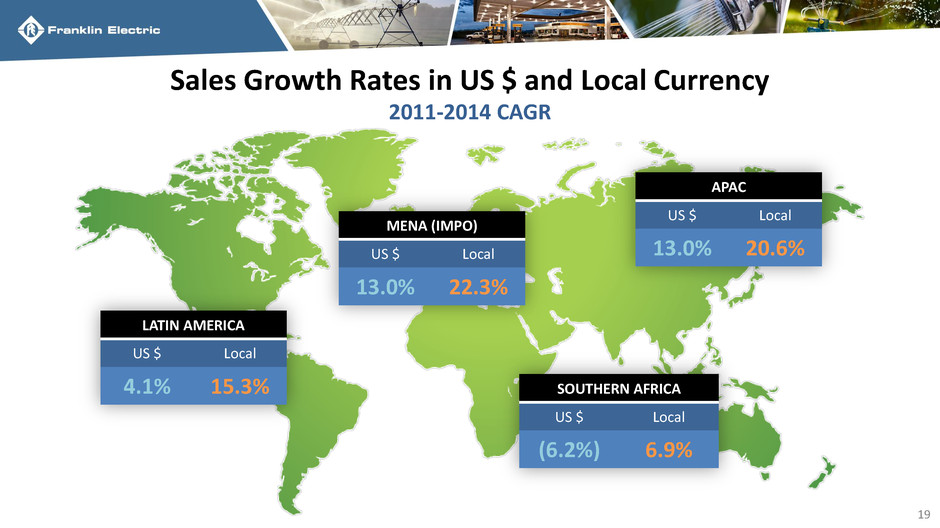

MENA (IMPO) US $ Local 13.0% 22.3% Sales Growth Rates in US $ and Local Currency 19 LATIN AMERICA US $ Local 4.1% SOUTHERN AFRICA US $ Local (6.2%) APAC US $ Local 13.0% 2011-2014 CAGR 15.3% 6.9% 20.6%

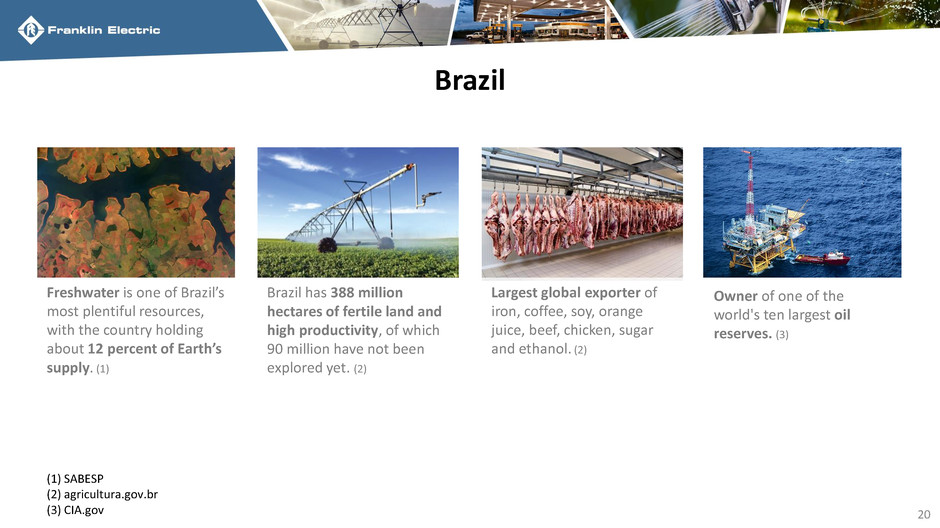

Brazil 20 Brazil has 388 million hectares of fertile land and high productivity, of which 90 million have not been explored yet. (2) Freshwater is one of Brazil’s most plentiful resources, with the country holding about 12 percent of Earth’s supply. (1) Largest global exporter of iron, coffee, soy, orange juice, beef, chicken, sugar and ethanol. (2) Owner of one of the world's ten largest oil reserves. (3) (1) SABESP (2) agricultura.gov.br (3) CIA.gov

AM AC RR PA MA PI AP RO MT TO CE RN PB PE AL SE BA MG SP PR SC RS MS GO DF ES RJ January 2008 Main offices and factory: Joinville, Santa Catarina Distribution Centers: Ananindeua – Para Recife – Pernambuco Contagem – Minas Gerais Cotia – Sao Paulo Aparecida de Goiânia – Goias June 2014 Offices and factory: Monte Azul Paulista – Sao Paulo Distribution Center: Recife – Pernambuco Teresina – Piaui DISTRIBUTION CENTER Ap. de Goiania, Goias Ananindeua, Para Contagem, Minas Gerais Cotia, Sao Paulo Recife, Pernambuco Joinville, Santa Catarina Brazil Distribution 21

Demand for water increasing. Production of water-intensive crops is expected to grow by 80% between 2000 and 2050. (1) India 22 India is 17.5% of the world’s population and rapidly growing. Groundwater irrigation has been expanding at a very rapid pace in India since the 1970s and now accounts for over 60 % of the area irrigated in the country (1) Solar specific opportunity. 27 million agriculture pumps, unreliable electrical grid, and 300+ days of sunshine (1) International Water Management Institute (IWMI)

23 India Distribution August 2014 – Acquired Pluga Main Office: Savli, Gujarat, Vadadora 2012 – Subsidiary Established Office: New Dehli

Solar Water Systems 24

Projected Energy Demand 25 * Source: EIA – International Energy Outlook (http://commons.wikimedia.org/wiki/File:World_energy_consumption_outlook.png)

Artificial Lift Systems 26

New Passenger Vehicle Sales 27 * Source: Scotiabank Group Global Auto Report 2000 2014 2000 2014 North America China, India, & South America + 8.1 X 20 M 3 M 19.4 M 24.4 M

Fuel Management Systems #2 Global Supplier Vapor Recovery Systems #1 Global Supplier Piping & Containment Systems #1 Global Supplier Pumping Systems #1 Global Supplier Fueling Systems 28

Fueling Systems Developing Regions 29 United States 49% Developed Non-US 19% Developing Regions 32% *2014 Developed Regions 5 YEAR CAGR 9.0% Developing Regions 5 YEAR CAGR 24.0%

Fueling Systems India JV Stage I Vapor Recovery 30

Fueling Systems Stage II Vapor Recovery 31

New Products 32 HVAC/INDUSTRIAL COMMERCIAL BOOSTING SOLAR PUMPING CONSTANT PRESSURE WASTEWATER OVERFILL PREVENTION

Uses of Cash - 2005 to 2014 33 Dividends/Stock Repurchase Capital Expenditures & R&D Acquisitions $220 M $381 M $433 M

Acquisition Timeline 34 2015 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2004 JBD FUE LI N G FUE LI N G W A TE R

Acquisitions • Fragmented Global Markets – Bolt-on Acquisition Opportunities • Franklin Acquisition Profile (Past 10 Years) – Acquisitions per Year ≈ 2 – Purchase Price $1-125 M (avg. $25 M) – Average EBITDA Multiple ≈ 7.5 X 35

KeyBanc Investor Conference May 27, 2015