Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - ROI LAND INVESTMENTS LTD | roi_8k3m-052015.htm |

| EX-99.2 - AGENCY AGREEMENT - ROI LAND INVESTMENTS LTD | roi_8k3m-ex9902.htm |

| EX-99.3 - COLLATERAL ASSIGNMENT - ROI LAND INVESTMENTS LTD | roi_8k3m-ex9903.htm |

| EX-99.1 - NOTES, SERIES A AND B - ROI LAND INVESTMENTS LTD | roi_8k3m-ex9901.htm |

Exhibit 99.4

LOAN AND SECURITY AGREEMENT

THIS LOAN AND SECURITY AGREEMENT (this "Agreement"), dated as of May 8, 2015, is made by and between ROI DEV Canada Inc., a Canadian corporation ("Borrower"), and ROI Land Investments LTD., a Nevada corporation (the "Lender").

WHEREAS, Borrower desires to borrow funds from the Lender for the acquisition of real property and for working capital and other general corporate purposes as more fully described herein; and

WHEREAS, on the date hereof, Borrower, is entering into that certain Beneficiary Authorization and Charge Agreement ("Mortgage"), together with 1016566 B.C. LTD., of 825 Blvd. Lebourgneuf, Bureau 315, Quebec City, Quebec G2J OB9, in its capacity as registered legal owner of the real property described in Schedule A of the Mortgage, in favor of the Lender.

NOW THEREFORE, for good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, and in consideration of the mutual promises herein made, the Lender and Borrower, intending to be legally bound, agree as follows:

1. Loan

A. The Lender hereby agrees to lend to Borrower, and Borrower hereby agrees to borrow from the Lender, upon the terms and conditions set forth in this Agreement, an aggregate amount of U.S. $2,915,947.00.00 (TWO MILLION NINE HUNDRED AND FIFTEEN THOUSAND AND NINE HUNDRED AND FORTY SEVEN U.S. DOLLARS) (the "Loan"). Borrower's obligation to repay the Loan and the interest thereon shall be evidenced by one or more secured notes each in the form attached hereto as Exhibit A and incorporated by reference herein (each, a "Note" and collectively, the "Notes").

B. Borrower agrees to pay interest on the Loan at the rate, on the dates and calculated by the method set forth in the Notes. Borrower shall deliver to the Lender such payments of principal and interest on the Loan as are required by the terms of each Note, in each case, in cash by wire transfer of immediately available funds to such account or accounts as shall be designated in writing by the Lender from time to time.

2. Use of Proceeds

The proceeds of the Loan shall be used for the purpose of completing an acquisition of and developing that certain land for residential use located at 1015-1050 Nalabila Blvd., Kitimat, BC, Canada, involving the construction and sale and/or lease of eighty-four (84) residential apartments and nine (9) townhouses, the payment of certain fees and expenses and for working capital and other general corporate purposes (which may, for the avoidance of any doubt, be denominated in a currency other than U.S. Dollars).

| 1 |

3. Representations and Warranties of Borrower

To induce the Lender to enter into this Agreement and the other transactions to be consummated contemporaneously herewith, Borrower hereby represents and warrants to the Lender that: (a) the execution, delivery and performance by Borrower of this Agreement and the Notes shall not cause a breach under any agreement or instrument binding on Borrower or its assets, or under any applicable law or under the organizational documents of Borrower; (b) Borrower has duly authorized by all action the execution, delivery and performance of this Agreement and the Notes; (c) this Agreement and the Notes are and shall be enforceable against Borrower; (d) no consent or approval is required for Borrower to execute, deliver or perform this Agreement or the Notes; and (e) the security interest in the Collateral (as defined below) granted to the Lender shall constitute, upon the completion of all necessary filings or notices in proper public offices or the taking of any necessary possessions or similar acts, a perfected first priority security interest in and to the Collateral held by the Lender as provided in this Agreement.

4. Security Interest

To secure the complete and timely payment, performance and discharge in full, as the case may be, of all of the obligations of Borrower under this Agreement and the Notes, Borrower hereby unconditionally and irrevocably pledges, grants and hypothecates to the Lender a continuing first priority security interest in and to, a lien upon and a right of set-off against all of Borrower's right, title and interest of whatsoever kind and nature in and to the Collateral. "Collateral" means

(a) that certain real property described in the Mortgage; and

(b) all proceeds and products in whatever form of all or any part of the Collateral, including, without limitation, all rents, profits, income and benefits, all proceeds of any sale, lease, disposition or other transfer of the Collateral, all proceeds of any tort claims in connection therewith, all proceeds of insurance and all condemnation awards and all other compensation for any event of loss with respect to all or any part of the Collateral (together with all rights to recover and proceed with respect to the same), and all additions and accessions to, substitutions for and replacements of all or any part of the Collateral.

Borrower hereby authorizes the Lender to take any action that the Lender deems necessary in its sole discretion to perfect the security interest granted herein, including, without limitation, the filing of one or more financing statements under the uniform commercial code (as in effect in any applicable jurisdiction) ("UCC") with the filing and recording agencies in any jurisdiction deemed necessary or desirable in the sole discretion of the Lender.

5. Events of Default

The occurrence of any of the following events (each an "Event of Default"), not cured in the applicable cure period, if any, shall constitute an Event of Default:

A. except as set forth in Sections (B) and (C) below, a breach of any representation, warranty, covenant or other provision of this Agreement, the Notes, the Mortgage or any other document or instrument delivered or executed in connection with or pursuant to this Agreement (collectively, the "Transaction Documents") which, if capable of being cured, is not cured within thirty (30) days following notice thereof to Borrower;

| 2 |

B. the failure to make when due any payment described in this Agreement, the Notes, the Mortgage, whether on a Payment Date or the Maturity Date (each as defined in the Notes), by acceleration or otherwise; and

C. (i) the application for the appointment of a receiver or custodian for Borrower or the property of Borrower, (ii) the entry of an order for relief or the filing of a petition by or against Borrower under the provisions of any bankruptcy or insolvency law, (iii) any assignment for the benefit of creditors by or against Borrower, or (iv) Borrower becomes insolvent.

6. Effect of Default

During the continuance of any Event of Default the Lender may elect, by written notice delivered to Borrower, to take any or all of the following actions: (a) declare the outstanding amounts under the Notes to be forthwith due and payable, whereupon the entire unpaid Loan, together with accrued and unpaid Interest thereon, and all other cash obligations hereunder and thereunder, shall become forthwith due and payable, without presentment, demand, protest or any other notice of any kind, all of which are hereby expressly waived by Borrower, anything contained herein or in any of the Notes to the contrary notwithstanding, (b) foreclose on the Collateral, and (c) exercise any and all other remedies provided hereunder, under the Notes or available at law or in equity. In addition, upon and during the occurrence of any Event of Default, Borrower shall not make any payment on any other outstanding indebtedness of Borrower (other than indebtedness of Borrower to which the Lender has agreed in writing to subordinate this Agreement and the Notes, if any).

7. Payment of Expenses

Borrower shall reimburse the Lender on demand for all costs and expenses, including, without limitation, reasonable legal expenses and reasonable attorneys' fees of outside counsel, incurred by the Lender in connection with (a) the documentation and consummation of the transactions contemplated hereunder and any other transactions between Borrower and the Lender, including, without limitation, UCC and other public record searches and filings, overnight courier or other express or messenger delivery, appraisal costs, surveys, title insurance and environmental audit or review (including due diligence review) costs; (b) the collection, protection or enforcement of any rights in or to the Collateral; (c) the collection of any obligations of Borrower to the Lender under this Agreement, the Notes or any other Transaction Document; (d) the administration and enforcement of the Lender's rights under this Agreement or any other Transaction Document (including, without limitation, any costs and expenses of any third party provider engaged by the Lender for such purposes); (e) costs associated with any refinancing or restructuring of the Notes whether in the nature of a "work out," in any insolvency or bankruptcy proceeding or otherwise, and whether or not consummated; (f) all out-of-pocket costs and expenses of the Lender and its assignees (including, without limitation, attorneys' fees) in connection with the assignment, transfer or syndication of the Notes; (g) all liability for any intangibles, documentary, stamp or other similar taxes, fees and excises, if any, including any interest and penalties; and (h) any finder's or brokerage fees, commissions and expenses, that may be payable in connection with this Agreement, the Notes and the other Transaction Documents. All such costs, expenses and charges shall constitute obligations hereunder, shall be payable by Borrower to the Lender on demand, and, until paid, shall bear Default Interest (as defined in the Notes). Without limiting the foregoing, if (i) any Note is placed in the hands of an attorney or agency for collection or enforcement or is collected or enforced through any legal proceeding or the Lender otherwise takes action to collect amounts due under such Note or to enforce the provisions of such Note or (ii) there occurs any bankruptcy, reorganization, receivership of Borrower or other proceedings affecting creditors' rights and involving a claim under such Note, then Borrower shall pay the costs incurred by the Lender for such collection, enforcement or action or in connection with such bankruptcy, reorganization, receivership or other proceeding, including, but not limited to, attorneys' fees and disbursements (including such fees and disbursements related to seeking relief from any stay, automatic or otherwise, in effect under any applicable bankruptcy law).

| 3 |

8. No Waiver.

No delay or failure on the part of the Lender in the exercise of any right, power or privilege granted under this Agreement or the Notes, or available at law or in equity, shall impair any such right, power or privilege or be construed as a waiver of any Event of Default or any acquiescence therein. No single or partial exercise of any such right, power or privilege shall preclude the further exercise of such right, power or privilege. No waiver shall be valid against the Lender unless made in writing and signed by the Lender, and then only to the extent expressly specified therein.

9. Notices.

All notices, requests, demands and other communications to be given or delivered under or by reason of the provisions of this Agreement or the Notes shall be in writing and shall be deemed to have been duly given: (i) on the date of service if served personally on the party to whom notice is to be given, (ii) on the day after delivery to FedEx or similar overnight courier or the Express Mail service maintained by the United States Postal Service, or (iii) on the fifth day after mailing, if mailed to the party to whom notice is to be given, by first class mail, registered or certified, postage prepaid and properly addressed, to the party as follows:

| If to the Lender: | ROI Land Investments LTD. |

| Sebastian Cliche | |

| ROI LAND INVESTMENTS LTD. | |

| 825 Lebourgneuf Blvd, Suite 315 | |

| Quebec, QUEBEC G2J OB9 | |

| Tel: 1-418-781-2954 | |

| If to Borrower: | ROI DEV Canada Inc. |

| Sebastian Cliche, | |

| ROI LAND INVESTMENTS LTD. | |

| 825 Lebourgneuf Blvd, Suite 315 | |

| Quebec, QUEBEC G2J OB9 | |

Tel: l-418-781-2954 |

| 4 |

Either Borrower or the Lender, or both, may change its address for notice purposes by notice to the other party in the matter provided herein.

10. Governing Law and Jurisdiction.

This Agreement shall be governed and construed, in accordance with, and governed by, the laws of the State of New York (without giving effect to the principles of conflicts of laws thereof). Any legal action or proceeding with respect to this Agreement shall be brought in the courts of the State of New York or of the United States sitting in New York, New York, and by execution and delivery of this Agreement, each of the parties consents to the exclusive jurisdiction of those courts. Each of the parties irrevocably waives any objection, including any objection to the laying of venue or based on the grounds of forum non conveniens, which it may now or hereafter have to the bringing of any action or proceeding in such jurisdiction in respect of this Agreement.

11. Miscellaneous.

A. Benefit: This Agreement shall bind and inure to the benefit of Borrower and the Lender, and their respective successors and permitted assigns; provided, however, Borrower shall have no right to assign its rights or obligations hereunder to any person or entity without the prior written consent of the Lender.

B. Amendments: This Agreement may be amended or modified only in writing signed by Borrower and the Lender. No course of dealing between Borrower or the Lender shall operate as a waiver of any right, power or privilege granted under this Agreement or the Notes, or available at law or in equity.

C. Entire Agreement: This Agreement, the exhibits hereto, the Notes and the other Transaction Documents contain the entire agreement between Borrower and the Lender regarding the Loan and supersede all prior written and oral agreements or statements by and among the parties or any of them.

D. Rights Cumulative: Subject to the terms and conditions hereof, all rights, powers and privileges granted hereunder are cumulative, and are not exclusive of any other rights, powers and privileges granted by this Agreement, the Notes or any other Transaction Document, or available at law or in equity.

E. Pronouns: All pronouns and all variations thereof are deemed to refer to the masculine, feminine, or neuter, singular or plural, as the context in which they are used may require.

F: Headings; References: All headings used herein are used for convenience only and shall not be used to construe or interpret this Agreement. Except where otherwise indicated, all references herein to Sections refer to Sections hereof.

| 5 |

G. Severability: Any term or provision of this Agreement that is invalid or unenforceable in any situation in any jurisdiction shall not affect the validity or enforceability of the remaining terms and provisions hereof or the validity or enforceability of the offending term or provision in any other situation or in any other jurisdiction. In the event that any provision hereof would, under applicable law, be invalid or unenforceable in any respect, each party hereto intends that such provision shall be construed by modifying or limiting it so as to be enforceable to the maximum extent compatible with, and possible under, applicable law.

H. Register: The Borrower shall maintain at its principal executive office (or such other office or agency of the Borrower as it may designate by notice to each holder of Notes), a register for the Loan and the Notes in which the Borrower shall record the name and address of the Person in whose name the Loan and the Notes have been issued (including the name and address of each transferee) and the principal amount (and stated interest) of any portion of the Loan or Notes held by such Person (the "Register"). The Borrower shall keep the Register open and available at all times during business hours for inspection of the Lender or its representatives. The Register may be maintained in electronic format. Notwithstanding anything to the contrary contained herein, the Notes, the Loan and this Agreement are registered obligations and the right, title, and interest of the Lender and its assignees in and to such Notes (or any rights under this Agreement) shall be transferable only upon notation of such transfer in the Register. The Notes shall only evidence the Lender's or its assignee's right, title and interest in and to the related Notes, and in no event is any such Note to be considered a bearer instrument or obligation. This Section 9(k) shall be construed so that the Notes and the Loan are at all times maintained in "registered form" within the meaning of Sections 163(f), 87l(h)(2) and 88l(c)(2) of the Code and any related Treasury regulations promulgated thereunder.

I. Further Assurances: Each party agrees to cooperate fully with the other parties, to take such actions, to execute such further instruments, documents and agreements, and to give such further written assurances, as may be reasonably requested by any other party to evidence and reflect the transactions described herein and contemplated hereby, and to carry into effect the intents and purposes of this Agreement.

J. Counterparts; Facsimile Signature: This Agreement may be executed in any number of counterparts, each of which shall be deemed an original, but all of which together shall constitute but one and the same instrument. This Agreement shall become effective when duly executed and delivered by each party hereto. Counterpart signature pages to this Agreement may be delivered by facsimile or electronic delivery (i.e., by email of a PDF signature page) and each such counterpart signature page shall constitute an original for all purposes.

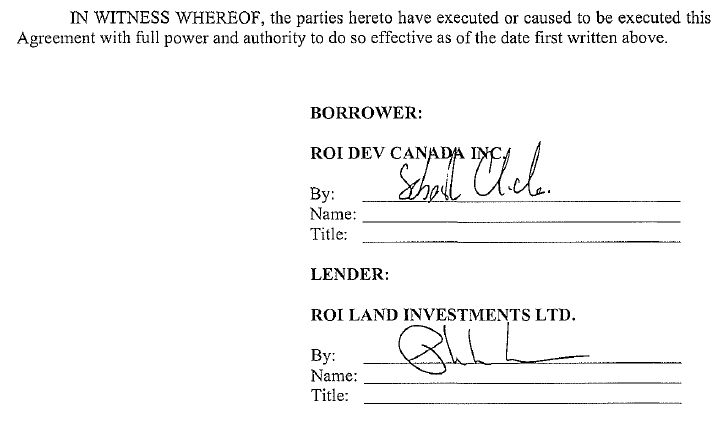

[Signature Page Follows]

| 6 |

| 7 |

EXHIBIT A

FORM OF SECURED NOTE

SECURED NOTE

| Issuance Date: May 8, 2015 | Principal: U.S. $2,915,947.00.00 (TWO MILLION NINE HUNDRED AND FIFTEEN THOUSAND AND NINE HUNDRED AND FORTY SEVEN U.S. DOLLARS) |

FOR VALUE RECEIVED, ROI DEV Canada, Inc., a Canadian corporation (the "Company") hereby promises to pay to ROI Land Investments LTD., a Nevada corporation, or its successors or assigns (the "Holder") (a) the amount set out above as the Principal plus (b) Interest (as defined below), in each case in accordance with the terms hereof.

This Secured Note (this "Note") is one of the Notes issued pursuant to that certain Loan and Security Agreement, dated as of even date herewith, by and between the Company and the Holder (as may be amended, restated, supplemented or otherwise modified from time to time, the "Loan and Security Agreement"). All capitalized terms used but not defined herein shall have the meanings assigned to such terms in the Loan and Security Agreement. This Note is secured by the Collateral described in and pursuant to the Loan and Security Agreement.

The "Maturity Date" means the earlier of (a) May 8, 2018, or (b) such earlier date as this Note becomes due and payable pursuant to the terms of the Loan and Security Agreement.

Commencing on the date hereof and ending on (and including) the Maturity Date, the outstanding Principal of this Note shall bear interest at the rate of (a) eight percent (8%) per annum (the "Interest Rate") computed on the basis of a 360-day year and the actual number of days elapsed. Until this Note is paid in full, interest shall be due and payable in cash in arrears on the last day of each calendar quarter following the Issuance Date (each such date, a "Payment Date").

Notwithstanding anything herein to the contrary, payment of interest due and owing on this Note shall be made by cash only by wire transfer of immediately available funds to the Holder on the applicable Payment Date at such place as the Holder shall have designated by written notice to the Company.

Upon the occurrence of any Event of Default, this Note shall bear interest (including post-petition interest in any proceeding under any Bankruptcy Law) on the unpaid principal amount thereof at a rate equal to the Interest Rate, plus two percent (2.0%) per annum (the "Default Rate") from the date of such Event of Default through and including the date such Event of Default is cured or waived in accordance with the terms of the Loan and Security Agreement. In the event that such Event of Default is subsequently waived, the adjustment referred to in the preceding sentence shall cease to be effective as of the date of such waiver; provided, that interest as calculated and unpaid at the Default Rate during the continuance of such Event of Default shall continue to be due to the extent relating to the days after the occurrence of such Event of Default through and including the date on which such Event of Default is waived. Interest at the Default Rate shall be due and payable, in cash, upon demand.

| 8 |

The Company may prepay this Note (in whole or in part) at any time without premium or penalty.

After all Principal, accrued interest and other amounts at any time owed on this Note have been paid in full in cash, this Note shall automatically be deemed canceled, shall be surrendered to the Company for cancellation and shall not be reissued.

The Holder may offer, sell, assign or transfer this Note to any party without notice to, or the consent of, the Company.

This Note is registered as to both principal and any stated interest with the Company, and transfer of this Note may be effected only by surrender of the old instrument and either the reissuance by the Company of the old instrument to the new holder or the issuance by the Company of a new instrument to the new holder. The foregoing requirements are intended to result in this Note being in "registered form" within the meaning of U.S. Treasury Regulations Section 1.871-14(c) and Sections 163(f), 87l(h) and 88l(c) of the U.S. Internal Revenue Code of 1986, as amended, and shall be interpreted and applied in a manner consistent therewith. This Note is a registered Note and, upon surrender of this Note for registration of transfer, duly endorsed, or accompanied by a written instrument of transfer duly executed, by the registered Holder hereof or such Holder's attorney duly authorized in writing, a new Note for a like Principal amount shall be issued to, and registered in the name of, the transferee. Prior to due presentment for registration of transfer, the Holder and the Company may treat the person in whose name this Note is registered as the owner hereof for the purpose of receiving payment and for all other purposes, and neither the Holder nor the Company shall be affected by any notice to the contrary.

This Note shall be construed and enforced in accordance with, and all questions concerning the construction, validity, interpretation and performance of this Note and all disputes arising hereunder shall be governed by, the laws of the State of New York, without giving effect to any choice of law or conflict of law provision or rule (whether of the State of New York or any other jurisdictions) that would cause the application of the laws of any jurisdictions other than the State of New York. The Company (a) agrees that any legal action or proceeding with respect to this Note or any other agreement, document, or other instrument executed in connection herewith, shall be brought in any state or federal court located within New York, New York, (b) irrevocably waives any objections which it may now or hereafter have to the venue of any suit, action or proceeding arising out of or relating to this Note, or any other agreement, document, or other instrument executed in connection herewith, brought in the aforementioned courts, and (c) further irrevocably waives any claim that any such suit, action, or proceeding brought in any such court has been brought in an inconvenient forum. THE COMPANY HEREBY IRREVOCABLY WAIVES ANY RIGHT IT MAY HAVE, AND AGREES NOT TO REQUEST, A JURY TRIAL FOR THE ADJUDICATION OF ANY DISPUTE HEREUNDER OR IN CONNECTION WITH OR ARISING OUT OF THIS NOTE OR ANY TRANSACTION CONTEMPLATED HEREBY.

| 9 |

| 10 |

| 11 |