Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - ROI LAND INVESTMENTS LTD | roi_8k3m-052015.htm |

| EX-99.2 - AGENCY AGREEMENT - ROI LAND INVESTMENTS LTD | roi_8k3m-ex9902.htm |

| EX-99.3 - COLLATERAL ASSIGNMENT - ROI LAND INVESTMENTS LTD | roi_8k3m-ex9903.htm |

| EX-99.4 - LOAN AND SECURITY AGREEMENT - ROI LAND INVESTMENTS LTD | roi_8k3m-ex9904.htm |

Exhibit 99.1

ROI Land Investments LTD.

Kitimat Notes due May 8, 2018

Series A

_________________

Kitimat Note Purchase Agreement

_________________

Dated May 8, 2015

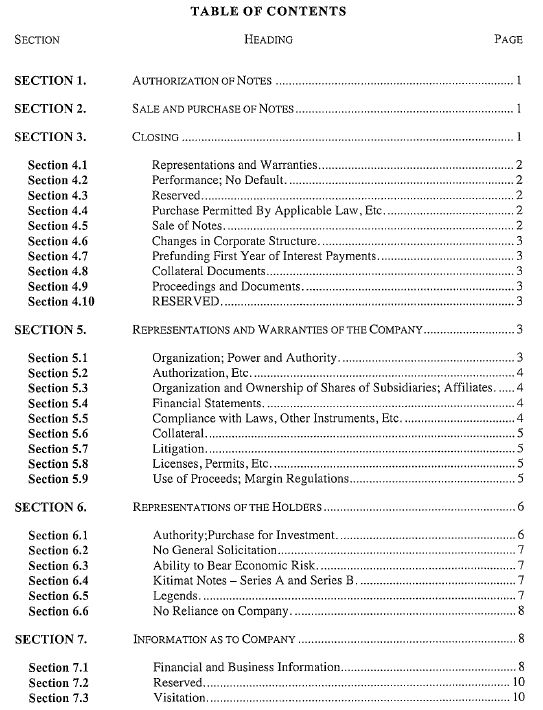

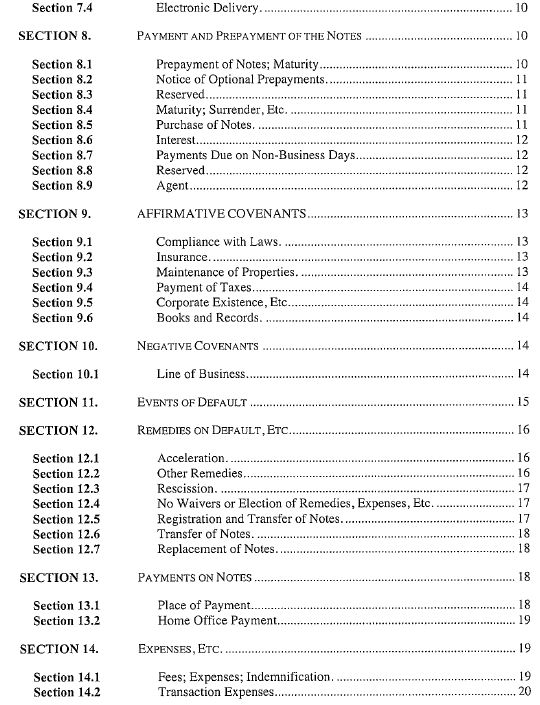

| 1 |

| i |

| ii |

| iii |

| SCHEDULE A: | DEFINED TERMS |

| SCHEDULE B: | FORM OF NOTE; INFORMATION RELATING TO HOLDERS |

| SCHEDULE C: | FORM OF INTERCOMPANY LOAN |

| SCHEDULED: | FORM OF COLLATERAL ASSIGNMENT |

| iv |

KITIMAT NOTE PURCHASE AGREEMENT

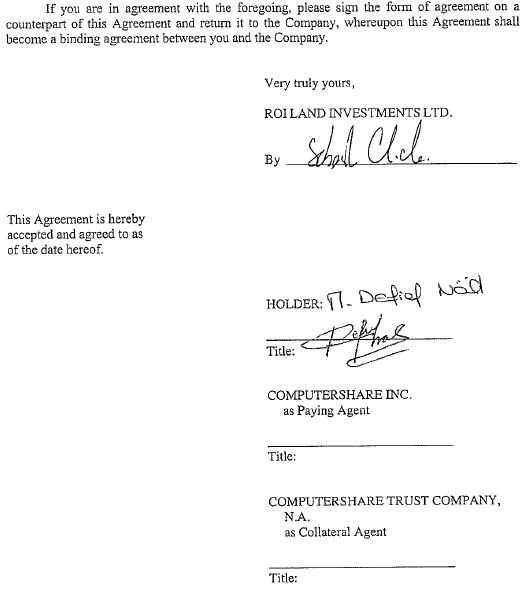

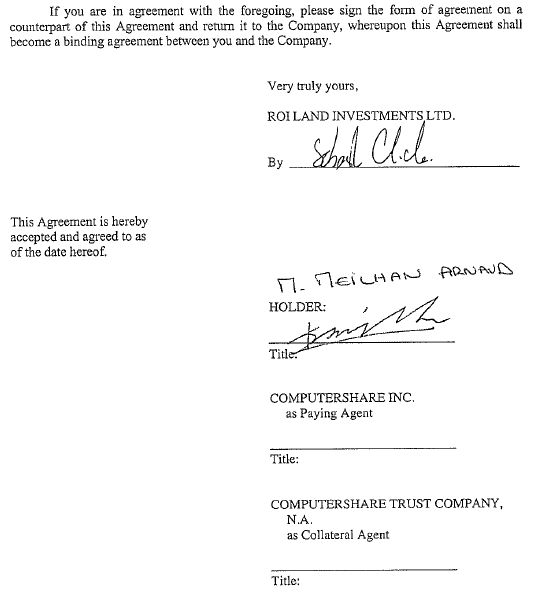

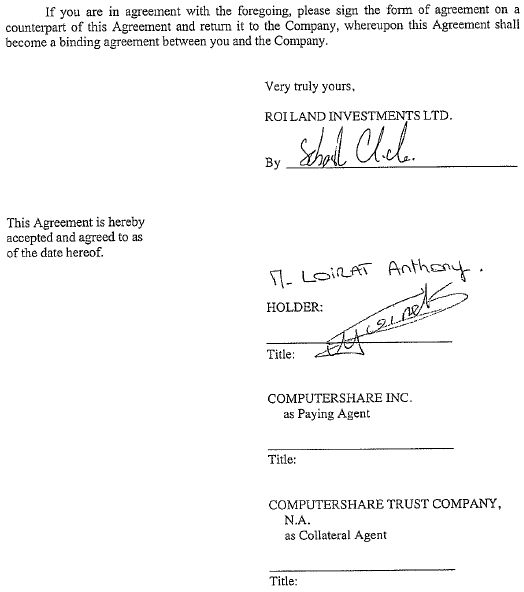

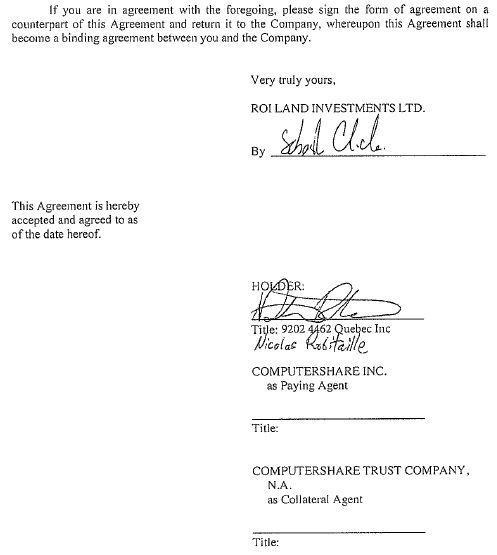

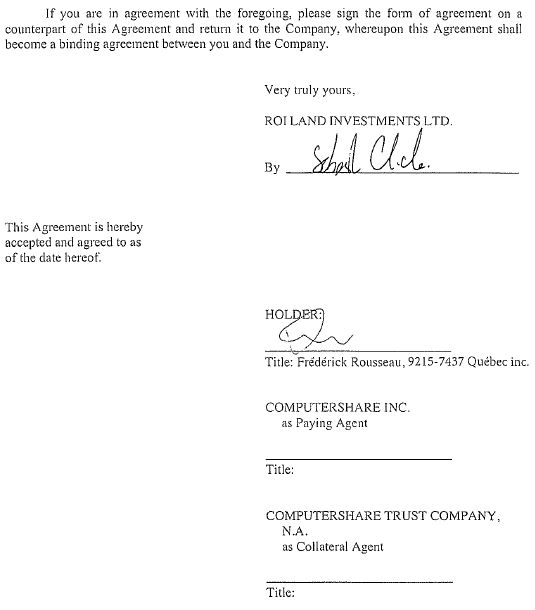

This KITIMAT NOTE PURCHASE AGREEMENT (this "Agreement") is dated as of May 8, 2015 among ROI Land Investments LTD., a Nevada corporation (the "Company"), each purchaser of Notes listed in Schedule C hereto (each, together with their respective successors and permitted assigns, a "Holder", and collectively "Holders"), Computershare Trust Company, N.A., a national banking association, solely in its capacity as collateral agent ("Collateral Agent") and Computershare Inc., a Delaware corporation, solely in its capacity as paying agent ("Paying Agent") for the Holders (the Collateral Agent and the Paying Agent, together with the applicable respective successors and permitted assigns in such capacities, the "Agent").

IN CONSIDERATION of the mutual covenants and undertakings herein contained, Company, Holders and Agent hereby agree as follows:

SECTION 1. AUTHORIZATION OF NOTES

The Company shall authorize the issue and sale of U.S. $2,442,830.00 (TWO MILLION FOUR HUNDRED AND FOURTY TWO THOUSAND, EIGHT HUNDRED AND THIRTY U.S. DOLLARS) aggregate principal amount of series A Kitimat Notes ("Series A Notes") and U.S. $473,117.00 (FOUR HUNDRED AND SEVENTY THREE THOUSAND, ONE HUNDRED AND SEVENTEEN U.S. DOLLARS) aggregate principal amount of series B Kitimat Notes ("Series B Notes") due May 8, 2018 (the Series A Notes and the Series B Notes, as amended, restated or otherwise modified from time to time pursuant to Section 16 and including any such notes issued in substitution therefor pursuant to Section 12, shall be collectively referred to as the "Notes" or the "Kitimat Notes"). The Notes shall be substantially in the form set out in Schedule B. Certain capitalized and other terms used in this Agreement are defined in Schedule A. References to a "Schedule" are references to a Schedule attached to this Agreement unless otherwise specified. References to a "Section" are references to a Section of this Agreement unless otherwise specified.

SECTION 2. SALE AND PURCHASE OF NOTES

Subject to the terms and conditions of this Agreement, the Company shall issue and sell to each Holder and each Holder shall purchase from the Company, at the Closing provided for in Section 3, Notes in the principal amount specified opposite such Holder's name in Schedule Bat the purchase price of I 00% of the principal amount thereof. The Holders' obligations hereunder are several and not joint obligations and no Holder shall have any liability to any Person for the performance or non-performance of any obligation by any other Holder hereunder.

SECTION 3. CLOSING

The sale and purchase of the Notes to be purchased by each Holder shall occur at the offices of Moses & Singer LLP, The Chrysler Building, 405 Lexington Avenue, New York, NY 10174-7800 at 2.00 p.m., EDT time, at a closing (the "Closing") on May 8, 2015. At the Closing the Company shall deliver to each Holder a single Note dated the date of the Closing and registered in such Holder's name (or in the name of its nominee), against delivery, on or before the Closing, by such Holder to the Company or its order of immediately available funds in the amount of the purchase price therefor by wire transfer for the account of the Company to or to the order of the Company, pursuant to bank details provided to the Holder by the Company.

| 1 |

If at the Closing the Company shall fail to tender such Notes to any purchasing Holder as provided above in this Section 3, or any of the conditions specified in Section 4 shall not have been fulfilled to such Holder's satisfaction, such Holder shall, at its election, be relieved of all further obligations under this Agreement, without thereby waiving any rights such Holder may have by reason of any of the conditions specified in Section 4 not having been fulfilled to such Holder's satisfaction or such failure by the Company to tender such Notes.

SECTION 4. CONDITIONS TO CLOSING

Each Holder's obligation to purchase and pay for the Notes to be sold to such Holder at the Closing is subject to the fulfillment to such Holder's satisfaction, prior to or at the Closing, of the following conditions:

Section 4.1 REPRESENTATIONS AND WARRANTIES.

The representations and warranties of the Company in this Agreement shall be correct when made and at the Closing.

Section 4.2 PERFORMANCE; No DEFAULT.

The Company shall have performed and complied with all agreements and conditions contained in this Agreement required to be performed or complied with by it prior to or at the Closing. Before and after giving effect to the issue and sale of the Notes (and the application of the proceeds thereof), no Default or Event of Default shall have occurred and be continuing.

Section 4.3 RESERVED.

Section 4.4 PURCHASE PERMITTED BY APPLICABLE LAW, ETC.

On the date of the Closing such Holder's purchase of Notes shall (a) be permitted by the laws and regulations of each jurisdiction to which such Holder is subject, without recourse to provisions (such as section 1405(a)(8) of the New York Insurance Law) permitting limited investments by insurance companies without restriction as to the character of the particular investment, (b) not violate any applicable law or regulation (including, without limitation, Regulation T, U or X of the Board of Governors of the Federal Reserve System) and (c) not subject such Holder to any tax, penalty or liability under or pursuant to any applicable law or regulation, which law or regulation was not in effect on the date hereof.

Section 4.5 SALE OF NOTES.

Contemporaneously with the Closing the Company shall sell to each Holder and each Holder shall purchase the Notes to be purchased by it at t

| 2 |

Section 4.6 CHANGES IN CORPORATE STRUCTURE.

The Company shall not have changed its jurisdiction of incorporation or organization, as applicable, or been a party to any merger or consolidation or succeeded to all or any substantial part of the liabilities of any other entity, at any time following the date of the most recent financial statements filed by it.

Section 4.7 PREFUNDING FIRST YEAR OF INTEREST PAYMENTS.

The Company will prefund the first year of interest payments in the total amount of U.S.$ 211,711.93 (TWO HUNDRED AND ELEVEN THOUSAND, SEVEN HUNDRED AND ELEVEN U.S. DOLLARS AND NINETY THREE CENTS in connection with the Series A Notes and in the total amount of U.S.$ 41,003.47 (FORTY ONE THOUSAND AND THREE U.S. DOLLARS AND FOURTY SEVEN CENTS) in connection with the Series B Notes, by placing with the Paying Agent an amount representing such sum on deposit, for the purpose of paying such interest payments, subject to the provisions of the Agency Agreement. The Bonus will be paid together with interest on the first Interest Payment Date, to each Holder of Notes pro rata to the applicable Holder's holding of Notes.

Section 4.8 COLLATERAL DOCUMENTS.

The Collateral Agent shall have received copies and /or fully executed originals of the Collateral Documents, executed by each of the parties thereto.

Section 4.9 PROCEEDINGS AND DOCUMENTS.

All corporate and other proceedings in connection with the transactions contemplated by this Agreement and all documents and instruments incident to such transactions shall be reasonably satisfactory to such Holder and its special counsel, if any, and such Holder and its special counsel, if any, shall have received all such counterpart originals or certified or other copies of such documents as such Holder or such special counsel, if any, may reasonably request.

Section 4.10 RESERVED.

SECTION 5. REPRESENTATIONS AND WARRANTIES OF THE COMPANY. The Company represents and warrants to each Holder and the Agent that:

Section 5.1 ORGANIZATION; POWER AND AUTHORITY.

The Company is a corporation duly organized, validly existing and in good standing under the laws of its jurisdiction of incorporation, and is duly qualified as a foreign corporation and is in good standing in each jurisdiction in which such qualification is required by law, other than those jurisdictions as to which the failure to be so qualified or in good standing would not, individually or in the aggregate, reasonably be expected to have a Material Adverse Effect. The Company has the corporate power and authority to own or hold under lease the properties it purports to own or hold under lease, to transact the business it transacts and proposes to transact, to execute and deliver this Agreement and the other Note Documents and to perform the provisions hereof and thereof.

| 3 |

Section 5.2 AUTHORIZATION, ETC.

This Agreement and the other Note Documents have been duly authorized by all necessary corporate action on the part of the Company, and each of this Agreement and the other Note Documents constitutes, and upon execution and delivery thereof each Note shall constitute, a legal, valid and binding obligation of the Company enforceable against the Company in accordance with its terms, except as such enforceability may be limited by (i) applicable bankruptcy, insolvency, reorganization, moratorium or other similar laws affecting the enforcement of creditors' rights generally and (ii) general principles of equity (regardless of whether such enforceability is considered in a proceeding in equity or at law).

Section 5.3 ORGANIZATION AND OWNERSHIP OF SHARES OF SUBSIDIARIES; AFFILIATES.

The Company's only subsidiary is ROI Canada, which is wholly-owned by the Company. It is duly organized, validly existing and in good standing under the laws of Canada. All of the outstanding shares of capital stock or similar equity interests of ROI Canada have been validly issued, are fully paid and non-assessable and are owned by the Company free and clear of any Lien that is prohibited by this Agreement or the other Note Documents.

Section 5.4 FINANCIAL STATEMENTS.

Subject to Section 7.1, the Company has delivered to each Holder copies of the financial statements of the Company and its Subsidiaries. All of such financial statements (including in each case the related schedules and notes) fairly present in all material respects the consolidated financial position of the Company and its Subsidiaries as of the respective dates specified in such statements and the consolidated results of their operations and cash flows for the respective periods so specified and have been prepared in accordance with GAAP consistently applied throughout the periods involved except as set forth in the notes thereto (subject, in the case of any interim financial statements, to normal year-end adjustments).

Section 5.5 COMPLIANCE WITH LAWS, OTHER INSTRUMENTS, ETC.

The execution, delivery and performance by the Company of this Agreement and the other Note Documents shall not (i) contravene, result in any breach of, or constitute a default under, or result in the creation of any Lien in respect of any property of the Company or any Subsidiary under, any indenture, mortgage, deed of trust, loan, purchase or credit agreement, lease, corporate charter or by-laws, shareholders agreement or any other agreement or instrument to which the Company or any Subsidiary is bound or by which the Company or any Subsidiary or any of their respective properties may be bound or affected, (ii) result in a breach of any of the terms, conditions or provisions of any order, judgment, decree or ruling of any court, arbitrator or Governmental Authority applicable to the Company or any Subsidiary or (iii) violate any provision of any statute or other rule or regulation of any Governmental Authority applicable to the Company or any Subsidiary.

| 4 |

Section 5.6 COLLATERAL.

(a) No tax, stamp duty, or other similar payment is payable in connection with the execution and delivery of each of the Collateral Documents.

(b) No special requirement in terms of local presence, license or other qualification is stipulated by any applicable law for the Collateral Agent to validly receive and to enforce any of the security established by the Collateral Documents.

(c) Each of the Collateral Documents is sufficient to create in favor of the Collateral Agent on behalf of the Secured Parties a security interest in those items and types of Collateral described therein.

Section 5.7 LITIGATION.

There are no actions, suits, investigations or proceedings pending or, to the best knowledge of the Company, threatened in writing against or affecting the Company or any Subsidiary or any property of the Company or any Subsidiary in any court or before any arbitrator of any kind or before or by any Governmental Authority that would, individually or in the aggregate, reasonably be expected to have a Material Adverse Effect.

Section 5.8 LICENSES,PERMITS,ETC.

The Company and its Subsidiaries own or possess all licenses, permits, franchises, authorizations, patents, copyrights, proprietary software, service marks, trademarks and trade names, or rights thereto, that individually or in the aggregate are material (material in relation to the business, operations, affairs, financial condition, assets or properties of the Company and its Subsidiaries taken as a whole), without known conflict with the rights of others, except for those conflicts that, individually or in the aggregate, would not have a Material Adverse Effect.

Section 5.9 USE OF PROCEEDS; MARGIN REGULATIONS.

The Company shall apply the proceeds of the sale of the Notes hereunder to make a loan to ROI Canada, for the purpose of completing an acquisition of and developing that certain land ("Land") for residential use located at 1015-1050 Nalabila Blvd., Kitimat, BC, Canada, (the "Kitimat Land") involving the construction and sale and/or lease of eighty-four (84) residential apartments ("Apartments") and nine (9) townhouses ("Houses" and, together with the Apartments, the "Kitimat Property"), the payment of certain fees and expenses and for working capital and other general corporate purposes (which may, for the avoidance of any doubt, be denominated in a currency other than U.S. Dollars).

ROI Canada owns the entire beneficial interest in the Kitimat Land, pursuant to that certain Transfer of Beneficial Interest, made as of December 31, 2014, among Coast to Coast Holding Ltd. and ROI Canada, whereby ROI Canada acquired such beneficial interest for the amount of CAD$1,950,000.00 (ONE MILLION NINE HUNDRED AND FIFTY THOUSAND CANADIAN DOLLARS), paid in the amount of CAD$600,000.00 (SIX HUNDRED THOUSAND CANADIAN DOLLARS) on or about December 31, 2014 and the amount of CAD$1,350,000.00 (ONE MILLION THREE HUNDRED AND FIFTY THOUSAND

| 5 |

CANADIAN DOLLARS) on April 24, 2015. Accordingly, the proceeds of the issue of the Notes shall be used, in part, to fund the deferred payment of such purchase price. The registered (or "legal") owner of the Kitimat Land is a nominee company, 1016566 B.C. Ltd. ("Legal Owner"), shares of which are held by ROI Canada. Accordingly, the Collateral includes a mortgage (with attachments) dated as of May 8, 2015, over the Kitimat Land, granted by the Legal Owner and ROI Canada, collectively, in favour of the Company.

The Legal Owner obtained a valuation ("Valuation") of the Kitimat Land from A-Teck Appraisals, dated as of April 1, 2015. The Valuation concluded that the final value of the Kitimat and the Kitimat Property stood at CAD$15,400,000 (FIFTEEN MILLION, FOUR HUNDRED THOUSAND CANADIAN DOLLARS), as of February 24, 2015, subject to the terms and conditions of the Valuation. A copy of the Valuation is available at a Holder's written request and signature of any required confidentiality agreement.

No part of the proceeds from the sale of the Notes hereunder shall be used, directly or indirectly, for the purpose of buying or carrying any margin stock within the meaning of Regulation U of the Board of Governors of the Federal Reserve System (12 CFR 221), or for the purpose of buying or carrying or trading in any "securities" (as defined in section 2(1) of the Securities Act) under such circumstances as to involve the Company in a violation of Regulation X of said Board (12 CFR 224) or to involve any broker or dealer in a violation of Regulation T of said Board (12 CFR 220). As used in this Section, the terms "margin stock" and "purpose of buying or carrying" shall have the meanings assigned to them in said Regulation U.

SECTION 6. REPRESENTATIONS OF THE HOLDERS

Each Holder severally represents and warrants to the Company and the Agent that:

Section 6.1 AUTHORITY;PURCHASEFORlNVESTMENT.

Each Holder has the power and authority to execute and deliver this Agreement and to perform its obligations hereunder. The execution and delivery by each Holder of this Agreement and the consummation of the transaction contemplated hereby have been duly authorized by all necessary corporate or other action on the part of the Holder. If the Holder is an individual, the Holder has the legal capacity to enter into this Agreement. This Agreement constitutes a legal, valid and binding obligation of the Holder, enforceable against the Holder in accordance with its terms, subject to laws of general application relating to bankruptcy, insolvency and the relief of debtors and rules of law governing specific performance, injunctive relief or other equitable remedies, and to limitations of public policy. Each Holder is purchasing the Securities for its own account and not with a present view to, or for sale in connection with, any distribution thereof in violation of the registration requirements of the Securities Act. Each Holder understands that the Securities have not been registered under the Securities Act and may be resold only if registered pursuant to the provisions of the Securities Act or if an exemption from registration is available, except under circumstances where neither such registration nor such an exemption is required by law, and that the Company is not required to register the Securities.

Investor Status: Each Holder is not, and was not at the time the Holder was offered the Securities, a U.S. Person (as defined by Rule 902(k) of Regulation S promulgated under the Securities Act), and is not acquiring the Securities for the account or benefit of any U.S. Person. Each Holder as of the date hereof is either:

| 6 |

(a) an individual net worth, or joint net worth with such Holder's spouse, in excess of $1,000,000 (not including the value of any equity in such Holder's primary residence but subtracting any mortgage indebtedness in excess of the value of such Holder's primary residence); or

(b) (i) individual income in excess of $200,000 (or in excess of $300,000 joint income with such Holder's spouse) in each of the two most recent years and a reasonable expectation of reaching the same income level in the current year or (ii) otherwise qualifies as an "Accredited Investor" as that term is defined in Rule 50l(a) of Regulation D promulgated under the Securities Act; or

(c) not an Accredited Investor, but has such knowledge and experience in financial and business matters that he, she or it is capable of evaluating the merits and risks of the prospective investment.

Section 6.2 No GENERAL SOLICITATION.

No Holder is purchasing the Securities as a result of any advertisement, article, notice or other communication published in a newspaper or magazine or similar media or broadcast over television or radio, whether closed circuit, or generally available, or any seminar, meeting or other conference whose attendees were invited by any general solicitation or general advertising.

Section 6.3 ABILITY TO BEAR ECONOMIC RISK.

Each Holder acknowledges that investment in the Securities involves a high degree of risk, and represents that it is able, without materially impairing its financial condition, to hold the Securities for an indefinite period of time and suffer a complete loss of its investment. Each Holder has carefully considered the potential risks relating to the Company and the Securities. Each Holder fully understands that the Company is a development stage company and that the Company is subject to all of the risks inherent in any development stage company. Each Holder understands that the Company has not generated any revenues since inception and acknowledges that the Company has made no assurance that they will be able to generate future earnings.

Section 6.4 SERIES A AND SERIES B.

Each Holder and the Collateral Agent severally acknowledges that (i) the Company will issue Series A Notes and Series B Notes contemporaneously and that each such series shares pro rata in any proceeds of Collateral and (ii) the currency of transactions involving the Kitimat Land and/or the Kitimat Property, as applicable, is Canadian Dollars (CAD$).

Section 6.5 LEGENDS.

Each Holder understands that the Notes may bear the following legends:

| 7 |

(a) "THE SECURITIES REPRESENTED BY THIS INSTRUMENT HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE "SECURITIES ACT"), OR ANY STATE SECURITIES LAWS, AND MAY NOT BE SOLD OR TRANSFERRED OR OFFERED FOR SALE OR TRANSFER UNLESS A REGISTRATION STATEMENT UNDER THE SECURITIES ACT AND OTHER APPLICABLE SECURITIES LAWS WITH RESPECT TO SUCH SECURITIES IS THEN IN EFFECT, OR IN THE OPINION OF COUNSEL FOR THE HOLDER, SATISFACTORY TO THE COMPANY SUCH REGISTRATION UNDER THE SECURITIES ACT AND OTHER APPLICABLE SECURITIES LAWS IS NOT REQUIRED."

(b) Any legend required by the securities laws of any state to the extent such laws are applicable to the Securities represented by the certificate so legended.

Section 6.6 No RELIANCE ON COMPANY.

IN MAKING AN INVESTMENT DECISION, EACH HOLDER SEVERALLY REPRESENTS THAT (A) IT HAS RELIED ON ITS OWN EXAMINATION OF THE COMPANY AND THE MERITS AND RISKS INVOLVED IN PURCHASING THE SECURITIES; (B) IT HAS CONSULTED ITS OWN ADVISORS AS TO FINANCIAL, LEGAL, BUSINESS, TAX, INVESTMENT AND RELATED MATTERS CONCERNING THE PURCHASE OF THE SECURITIES; (C) IT HAS NOT RELIED ON THE COMPANY'S PUBLIC FILINGS; AND (D) IT HAS BEEN AFFORDED THE OPPORTUNITY TO ASK QUESTIONS CONCERNING THIS INVESTMENT OF OFFICERS OF THE COMPANY AND HAS BEEN FURNISHED WITH SUCH INFORMATION WITH RESPECT TO THE COMPANY AS SUCH HOLDER HAS REQUESTED TO THE HOLDER'S SATISFACTION.

SECTION 7. INFORMATION AS TO COMPANY

Section 7.1 FINANCIAL AND BUSINESS INFORMATION.

The Company shall provide the information described in sub-sections (a) to (d) below to the Holders. The Company shall be deemed to have discharged its obligations under this Section 7.1 by filing such reports with the Securities and Exchange Commission via the EDGAR filing system.

(a) Quarterly Statements-within 60 days (or such shorter period as is the earlier of (x) 15 days greater than the period applicable to the filing of the Company's Quarterly Report on Form 10 Q (the "Form 10 Q") with the SEC regardless of whether the Company is subject to the filing requirements thereof and (y) the date by which such financial statements are required to be delivered under any material credit facility or the date on which such corresponding financial statements are delivered under any material credit facility if such delivery occurs earlier than such required delivery date) after the end of each quarterly fiscal period in each fiscal year of the Company (other than the last quarterly fiscal period of each such fiscal year), duplicate copies of,

(i) a consolidated balance sheet of the Company and its Subsidiaries as at the end of such quarter, and

| 8 |

(ii) consolidated statements of income, changes in shareholders' equity and cash flows of the Company and its Subsidiaries, for such quarter and (in the case of the second and third quarters) for the portion of the fiscal year ending with such quarter,

setting forth in each case in comparative from the figures for the corresponding periods in the previous fiscal year, all in reasonable detail, prepared in accordance with GAAP applicable to quarterly financial statements generally, and certified by a senior financial officer as fairly presenting, in all material respects, the financial position of the companies being reported on and their results of operations and cash flows, subject to changes resulting from year-end adjustments, provided that delivery within the time period specified above of copies of the Company's Form I 0 Q prepared in compliance with the requirements therefor and filed with the SEC shall be deemed to satisfy the requirements of this Section 7.l(a);

(b) Annual Statements -within 120 days (or such shorter period as is the earlier of (x) 15 days greater than the period applicable to the filing of the Company's Annual Report on Form 10 K (the "Form 10 K") with the SEC regardless of whether the Company is subject to the filing requirements thereof and (y) the date by which such financial statements are required to be delivered under any material credit facility or the date on which such corresponding financial statements are delivered under any material credit facility if such delivery occurs earlier than such required delivery date) after the end of each fiscal year of the Company, duplicate copies of

(i) a consolidated balance sheet of the Company and its Subsidiaries as at the end of such year, and

(ii) consolidated statements of income, changes m shareholders' equity and cash flows of the Company and its Subsidiaries for such year,

setting forth in each case in comparative form the figures for the previous fiscal year, all in reasonable detail, prepared in accordance with GAAP, and accompanied by an opinion thereon of independent public accountants of recognized national standing, which opinion shall state that such financial statements present fairly, in all material respects, the financial position of the companies being reported upon and their results of operations and cash flows and have been prepared in conformity with GAAP, and that the examination of such accountants in connection with such financial statements has been made in accordance with generally accepted auditing standards, and that such audit provides a reasonable basis for such opinion in the circumstances, provided that the delivery within the time period specified above of the Company's Form 10 K for such fiscal year (together with the Company's annual report to shareholders, if any, prepared pursuant to Rule 14a 3 under the Securities Exchange Act of 1934) prepared in accordance with the requirements therefor and filed with the SEC, shall be deemed to satisfy the requirements of this Section 7.1(b).

(c) SEC and Other Reports -promptly upon their becoming available, one copy of (i) each financial statement, report, notice or proxy statement sent by the Company or any Subsidiary to its principal lending banks as a whole (excluding information sent to such banks in the ordinary course of administration of a bank facility, such as information relating to pricing and borrowing availability) or to its public "securities" (as defined in section 2(1) of the Securities Act) holders generally, and (ii) each regular or periodic report, each registration statement that shall have become effective (without exhibits except as expressly requested by such Holder), and each final prospectus and all amendments thereto filed by the Company or any Subsidiary with the SEC;

| 9 |

(d) Notice of Default or Event of Default- promptly, and in any event within five days after a Responsible Officer becoming aware of the existence of any Default or Event of Default, a written notice specifying the nature and period of existence thereof and what action the Company is taking or proposes to take with respect thereto;

(e) Resignation or Replacement of Auditors- within ten days following the date on which the Company's auditors resign or the Company elects to change auditors, as the case may be, notification thereof, together with such supplying information as the Required Holders may request; and

(f) Requested Information - with reasonable promptness, such other data and information relating to the business, operations, affairs, financial condition, assets or properties of the Company or any of its Subsidiaries (including, but without limitation, actual copies of the Company's Form 10 Q and Form 10 K) or relating to the ability of the Company to perform its Obligations hereunder and under the Notes as from time to time may be reasonably requested by the Holders.

Section 7.2 RESERVED.

Section 7.3 VISITATION.

The Company shall permit the representatives of the Collateral Agent if a Default or Event of Default then exists, at the expense of the Company, to visit and inspect any of the offices or properties of the Company or any Subsidiary, to examine all their respective books of account, records, reports and other papers, to make copies and extracts therefrom, and to discuss their respective affairs, finances and accounts with their respective officers, all at such reasonable times and as often as may be reasonably requested.

Section 7.4 ELECTRONIC DELIVERY.

The Company shall timely file such Form 10-Q or Farm 10-K, satisfying the requirements of Section 7.1, as applicable, with the SEC on EDGAR and shall make such form available on its home page on the internet, which is located at http://roilandinvestments.com as of the date of this Agreement; provided however, that the Company shall give each Holder prior written notice, which may be by e-mail or in accordance with Section 17, of such posting or filing in connection with each delivery, provided further, that upon request of any Holder to receive paper copies of such forms and financial statements or to receive them by e-mail, the Company shall promptly e-mail them or deliver such paper copies, as the case may be, to such Holder.

SECTION 8. PAYMENT AND PREPAYMENT OF THE NOTES

Section 8.1 PREPAYMENT OF NOTES; MATURITY.

| 10 |

The Company may at any time prior to the six month anniversary of the Closing Date, at its option, upon notice of each optional prepayment in accordance with Section 8.2, prepay all, or any part of, the Notes. Each such notice shall specify the date for prepayment (which shall be a Business Day), the aggregate principal amount of the Notes to be prepaid on such date, the principal amount of each Note held by such Holder to be prepaid and the interest to be paid on the prepayment date with respect to such principal amount being prepaid. The Company will fund the prepayment of Notes by funds received from the sale of Kitimat Property, in the sole discretion of the Company, and will direct the Agent to make the distribution to each Holder specified in such direction. The Company will, reasonably promptly following receipt of such proceeds of sale by the Company, deliver to the Agent an amount representing, in the case of the Kitimat Series A Notes, 25% of the profit made on the corresponding disposition by of it the Kitimat Property or in the case of the Kitimat Series B Notes, 50% of the profit made by it on such disposition. The Agent shall distribute such amounts to the Holders, pro rata to their applicable holding of Notes. For the avoidance of any doubt, the total net profit shall be the sale price minus expenses, converted into U.S. Dollars.

The entire unpaid principal balance of each Note shall be due and payable on the Maturity Date thereof. Notwithstanding anything to the contrary contained herein, the Maturity Date may be extended by the Company for up to a period of 18 months provided that the Company gives the Holders (with a copy to the Agent) written notice of such extension not less than 30 days prior to the then existing Maturity Date.

Section 8.2 NOTICE OF OPTIONAL PREPAYMENTS.

The Company shall give each Holder (with a copy to the Agent) written notice of each optional prepayment under this Section 8 not less than thirty days and more than sixty days prior to the date fixed for such prepayment.

Section 8.3 RESERVED.

Section 8.4 MATURITY;SURRENDER,ETC.

In the case of an optional prepayment of Notes pursuant to this Section 8, the principal amount of each Note to be prepaid shall mature to the extent of such prepayment amount and become due and payable on the date fixed for such prepayment, together with interest on such principal amount accrued to (but not including) such date and the applicable premium, if any. From and after such date, interest shall only accrue on the remaining principal amount if such Note. Any Note paid or prepaid in full shall be surrendered to the Company and cancelled.

Section 8.5 PURCHASE OF NOTES.

The Company shall not and shall not permit any Affiliate to purchase, redeem, prepay or otherwise acquire, directly or indirectly, any of the outstanding Notes except (a) upon the payment or prepayment of the Notes in accordance with this Agreement and the Notes or (b) pursuant to an offer to purchase made by the Company or an Affiliate to the Holders of all Notes at the time outstanding upon the same terms and conditions. Any such offer shall provide each Holder with sufficient information to enable it to make an informed decision with respect to such offer, and shall remain open for at least twenty Business Days. If the Holders of more than 50% of the principal amount of the Notes then outstanding accept such offer, the Company shall promptly notify the remaining Holders (with a copy to the Agent) of such fact and the expiration date for the acceptance by Holders of such offer shall be extended by the number of days necessary to give each such remaining Holder at least ten Business Days from its receipt of such notice to accept such offer. The Company shall promptly cancel all Notes acquired by it or any Affiliate pursuant to any payment, prepayment or purchase of Notes pursuant to this Agreement and no Notes may be issued in substitution or exchange for any such Notes.

| 11 |

Section 8.6 INTEREST.

The Notes shall bear interest from the date of issuance at the rate of 8 percent (8%) per annum (the "Interest Rate"), payable in arrears on each Interest Payment Date and at the Maturity Date. Interest shall also be paid in cash on the date of any payment, prepayment or redemption of Notes in full or in part on the principal amount so paid, prepaid or redeemed. Upon and after the occurrence of an Event of Default, and during the continuation thereof, the Company's Obligations hereunder shall bear interest at the Interest Rate plus two (2%) percent per annum which is payable in cash on demand by the Holders (the "Default Rate").

Section 8.7 PAYMENTS DUE ON NON-BUSINESS DAYS.

Anything in this Agreement or the Notes to the contrary notwithstanding, (x) subject to clause (y), any payment of interest on any Note that is due on a date that is not a Business Day shall be made on the next succeeding Business Day without including the additional days elapsed in the computation of the interest payable on such next succeeding Business Day; and (y) any payment of principal of or the applicable premium on any Note (including principal due on the Maturity Date of such Note) that is due on a date that is not a Business Day shall be made on the next succeeding Business Day and shall include the additional days elapsed in the computation of interest payable on such next succeeding Business Day.

Section 8.8 RESERVED.

Section 8.9 AGENT

The Agent shall have no duty, liability, responsibility or obligation with respect to the following, all of which shall be the sole responsibility of the Company:

(a) any sale or disposal of all or any part of the Kitimat Property (including without limitation whether any prepayment is required in connection therewith or the amount of any such prepayment);

(b) any currency exchange relating to any payment or prepayment (and, for the avoidance of doubt, all payments made to the Paying Agent shall be made in U.S. Dollars);

(c) any allocation of payments or prepayments among the Notes;

(d) the amount or timing of any payment or prepayment, or whether any payment or prepayment is due;

| 12 |

(e) the establishment or maintenance of the register of Holders delivered by the Company to the Paying Agent;

(f) the use of any funds borrowed hereunder

The Company shall be solely responsible for all calculations and determinations of when and in what amounts payments and prepayments shall be made. The Agent shall be entitled to fully rely upon such calculations and determinations made by the Company and the Company shall provide written notice of such amounts to the Agent at least 5 Business Days before any payment or prepayment made hereunder.

The Company shall notify the Agent of any prepayment, purchase, or redemption of any

Notes.

The Company shall notify the Agent of any prepayment, purchase, or redemption of any

The Agent shall be entitled to fully rely upon the register delivered by the Company to the Paying Agent for all purposes, including with respect to the Holders entitled to receive any payment or prepayment and the Holders entitled to provide the Agent with direction hereunder.

SECTION 9. AFFIRMATIVE COVENANTS

The Company covenants that so long as any of the Notes are outstanding:

Section 9.1 COMPLIANCE WITH LAWS.

The Company shall, and shall cause each of its Subsidiaries to, comply with all laws, ordinances or governmental rules or regulations to which each of them is subject, including, without limitation, Environmental Laws, the USA PATRIOT Act, and shall obtain and maintain in effect all licenses, certificates, permits, franchises and other governmental authorizations necessary to the ownership of their respective properties or to the conduct of their respective businesses, in each case to the extent necessary to ensure that non-compliance with such laws, ordinances or governmental rules or regulations or failures to obtain or maintain in effect such licenses, certificates, permits, franchises and other governmental authorizations would not, individually or in the aggregate, reasonably be expected to have a Material Adverse Effect.

Section 9.2 INSURANCE.

The Company shall, and shall cause each of its Subsidiaries to, maintain, with financially sound and reputable insurers, insurance with respect to their respective properties and businesses against such casualties and contingencies, of such types, on such terms and in such amounts (including deductibles, co-insurance and self-insurance, if adequate reserves are maintained with respect thereto) as is customary in the case of entities of established reputations engaged in the same or a similar business and similarly situated.

Section 9.3 MAINTENANCE OF PROPERTIES.

The Company shall, and shall cause each of its Subsidiaries to, maintain and keep, or cause to be maintained and kept, their respective properties in good repair, working order and condition (other than ordinary wear and tear), so that the business carried on in connection

| 13 |

therewith may be properly conducted at all times, provided that this Section shall not prevent the Company or any Subsidiary from discontinuing the operation and the maintenance of any of its properties if such discontinuance is desirable in the conduct of its business and the Company has concluded that such discontinuance would not, individually or in the aggregate, reasonably be expected to have a Material Adverse Effect.

Section 9.4 PAYMENT OF TAXES.

The Company shall, and shall cause each of its Subsidiaries to, file all income tax or similar tax returns required to be filed in any jurisdiction and to pay and discharge all taxes shown to be due and payable on such returns and all other taxes, assessments, governmental charges, or levies payable by any of them, to the extent the same have become due and payable and before they have become delinquent, provided that neither the Company nor any Subsidiary need pay any such tax, assessment, charge or levy if (i) the amount, applicability or validity thereof is contested by the Company or such Subsidiary on a timely basis in good faith and in appropriate proceedings, and the Company or a Subsidiary has established adequate reserves therefor in accordance with GAAP on the books of the Company or such Subsidiary or (ii) the nonpayment of all such taxes, assessments, charges and levies would not, individually or in the aggregate, reasonably be expected to have a Material Adverse Effect.

Section 9.5 CORPORATE EXISTENCE, ETC.

The Company shall at all times preserve and keep its corporate existence in full force and effect. The Company shall at all times preserve and keep in full force and effect the corporate existence of each of its Subsidiaries (unless merged into the Company or a wholly-owned Subsidiary) and all rights and franchises of the Company and its Subsidiaries unless, in the good faith judgment of the Company, the termination of or failure to preserve and keep in full force and effect such corporate existence, right or franchise would not, individually or in the aggregate, have a Material Adverse Effect.

Section 9.6 BOOKS AND RECORDS.

The Company shall, and shall cause each of its Subsidiaries to, maintain proper books of record and account in conformity with GAAP and all applicable requirements of any Governmental Authority having legal or regulatory jurisdiction over the Company or such Subsidiary, as the case may be. The Company shall, and shall cause each of its Subsidiaries to, keep books, records and accounts which, in reasonable detail, accurately reflect all transactions and dispositions of assets. The Company and its Subsidiaries have devised a system of internal accounting controls sufficient to provide reasonable assurances that their respective books, records, and accounts accurately reflect all transactions and dispositions of assets and the Company shall, and shall cause each of its Subsidiaries to, continue to maintain such system.

SECTION 10. NEGATIVE COVENANTS

The Company covenants that so long as any of the Notes are outstanding:

Section 10.1 LINE OF BUSINESS.

| 14 |

The Company shall not and shall not permit any Subsidiary to engage in any business if, as a result, the general nature of the business in which the Company and its Subsidiaries, taken as a whole, would then be engaged would be substantially changed from the general nature of the business in which the Company and its Subsidiaries, taken as a whole, are engaged on the date of this Agreement.

SECTION 11. EVENTS OF DEFAULT

An "Event of Default" shall exist if any of the following conditions or events shall occur and be continuing:

(a) the Company defaults in the payment of any principal and/or any applicable premium, if any, on any Kitimat Note, when the same becomes due and payable, whether at maturity or at a date fixed for prepayment or by declaration or otherwise; or

(b) the Company defaults in the payment of any interest on any Kitimat Note on two consecutive Interest Payment Dates; or

(c) the Company defaults in the performance of or compliance with any term contained in Section 7.1 or Section l 0; or

(d) the Company defaults in the performance of or compliance with any term contained herein (other than those referred to in Sections ll(a), (b) and (c)) and such default is not remedied within 30 days after the earlier of (i) a Responsible Officer obtaining actual knowledge of such default and (ii) the Company receiving written notice of such default from any Holder (any such written notice to be identified as a "notice of default" and to refer specifically to this Section ll(d)); or

(e) any representation or warranty made in writing by or on behalf of the Company or by any officer of the Company in this Agreement or any writing furnished in connection with the transactions contemplated hereby proves to have been false or incorrect in any material respect on the date as of which made; or

(f) the Company or any Subsidiary (i) files, or consents by answer or otherwise to the filing against it of, a petition for relief or reorganization or arrangement or any other petition in bankruptcy, for liquidation or to take advantage of any bankruptcy, insolvency, reorganization, moratorium or other similar law of any jurisdiction, (ii) makes an assignment for the benefit of its creditors, (iii) consents to the appointment of a custodian, receiver, trustee or other officer with similar powers with respect to it or with respect to any substantial part of its property, (iv) is adjudicated as insolvent or to be liquidated, or (v) takes corporate action for the purpose of any of the foregoing; or

(g) a court or other Governmental Authority of competent jurisdiction enters an order appointing, without consent by the Company or any of its Subsidiaries, a custodian, receiver, trustee or other officer with similar powers with respect to it or with respect to any substantial part of its property, or constituting an order for relief or approving a petition for relief or reorganization or any other petition in bankruptcy or for liquidation or to take advantage of any bankruptcy or insolvency law of any jurisdiction, or ordering the dissolution, winding-up or liquidation of the Company or any of its Subsidiaries, or any such petition shall be filed against the Company or any of its Subsidiaries and such petition shall not be dismissed within 60 days; or,

| 15 |

(h) unless such liability is covered fully by insurance proceeds, one or more final judgments or orders for the payment of money aggregating in excess of $5,000,000, including, without limitation, any such final order enforcing a binding arbitration decision, are rendered against one or more of the Company and its Subsidiaries and which judgments are not, within 60 days after entry thereof, bonded, discharged or stayed pending appeal, or are not discharged within 60 days after the expiration of such stay.

SECTION 12. REMEDIES ON DEFAULT, ETC.

Section 12.1 ACCELERATION.

(a) If an Event of Default with respect to the Company described in Section II (f) or (g) has occurred, all the Notes then outstanding shall automatically become immediately due and payable.

(b) If any other Event of Default has occurred and is continuing, the Required Holders may at any time at its or their option, notify the Company (copied to the Agent) that all the Notes then outstanding are immediately due and payable.

(c) If any Event of Default described in Section ll(a) or (b) has occurred and is continuing, any Holder(s) of Notes at the time outstanding affected by such Event of Default may at any time, at its or their option, notify the Company (copied to the Agent), that all the Notes are immediately due and payable.

Upon any Notes becoming due and payable under this Section 12.1, whether automatically or by declaration, such Notes shall forthwith mature and the entire unpaid principal amount of such Notes, plus (x) all accrued and unpaid interest thereon (including, but not limited to, interest accrued thereon at the Default Rate) and (y) the applicable premium, if any, determined in respect of such principal amount (to the full extent permitted by applicable law), shall all be immediately due and payable, in each and every case without presentment, demand, protest or further notice, all of which are hereby waived. The Company acknowledges, and the Holders agree, that each Holder has the right to maintain its investment in the Notes free from repayment by the Company (except as herein specifically provided for) and that the provision for payment of a premium by the Company in the event that the Notes are prepaid or are accelerated as a result of an Event of Default, is intended to provide compensation for the deprivation of such right under such circumstances.

Section 12.2 OTHER REMEDIES.

If any Default or Event of Default has occurred and is continuing, and irrespective of whether any Notes have become or have been declared immediately due and payable under Section 12.1, the Collateral Agent (at the written direction of the Required Holders) may proceed to protect and enforce the rights of the Holders by an action at law, suit in equity or other appropriate proceeding, whether for the specific performance of any agreement contained herein or in any Note, or for an injunction against a violation of any of the terms hereof or thereof, or in aid of the exercise of any power granted hereby or thereby or by law or otherwise.

Section 12.3 RESCISSION.

At any time after any Notes have been declared due and payable pursuant to Section 12.1 (b) or (c), the Required Holders, by written notice to the Company (with a copy to the Agent), may rescind and annul any such declaration and its consequences if (a) the Company has paid all overdue interest on the Notes, all principal of and applicable premium, if any, on any Notes that are due and payable and are unpaid other than by reason of such declaration, and all interest on such overdue principal and applicable premium, if any, and (to the extent permitted by applicable law) any overdue interest in respect of the Notes, at the Default Rate, and any amounts due and owing to the Agent, (b) neither the Company nor any other Person shall have paid any amounts which have become due solely by reason of such declaration, (c) all Events of Default and Defaults, other than non-payment of amounts that have become due solely by reason of such declaration, have been cured or have been waived pursuant to Section 16, and (d) no judgment or decree has been entered for the payment of any monies due pursuant hereto or to the Notes. No rescission and annulment under this Section 12.3 shall extend to or affect any subsequent Event of Default or Default or impair any right consequent thereon.

| 16 |

Section 12.4 NO WAIVERS OR ELECTION OF REMEDIES, EXPENSES, ETC.

No course of dealing and no delay on the part of the Collateral Agent (acting at the written direction of the Required Holders) in exercising any right, power or remedy shall operate as a waiver thereof or otherwise prejudice such Holder's rights, powers or remedies. No right, power or remedy conferred by this Agreement or any other Note Document upon the Collateral Agent shall be exclusive of any other right, power or remedy referred to herein or therein or now or hereafter available at law, in equity, by statute or otherwise. Without limiting the Obligations of the Company under Section 15, the Company shall pay to the Collateral Agent on demand such further amount as shall be sufficient to cover all fees, costs and expenses of the Collateral Agent incurred in any enforcement or collection under this Section 12, including, without limitation, reasonable attorneys' fees, expenses and disbursements.

Section 12.5 REGISTRATION AND TRANSFER OF NOTES.

The Company shall keep at its principal executive office a register of Holders, which shall include the name and address of each Holder, details of such Holder's holdings, each transfer thereof and the name and address of each transferee of one or more Notes shall be registered in such register. If any Holder is a nominee, then (a) the name and address of the beneficial owner of such Note or Notes shall also be registered in such register as an owner and Holder thereof and (b) at any such beneficial owner's option, either such beneficial owner or its nominee may execute any amendment, waiver or consent pursuant to this Agreement. Prior to due presentment for registration of transfer, the Person(s) in whose name any Note(s) shall be registered shall be deemed and treated as the owner and Holder thereof for all purposes hereof, and the Company and the Agent shall not be affected by any notice or knowledge to the contrary. The Company shall give to any Holder promptly upon request therefor, a complete and correct copy of the names and addresses of all registered Holders. The Company shall either deliver to the Agent, at least five Business Days prior to each Interest Payment Date (or any prepayment and/or repayment date), a copy of the current register, or confirmation that details previously provided to the Paying Agent remain valid and should serve as the basis for payment and the Holders listed on such register (or the previously provided information, in the case of confirmation) shall be entitled to receive payment accordingly.

| 17 |

Section 12.6 TRANSFER OF NOTES.

Upon surrender of any Note to the Company at the address and to the attention of the designated officer (all as specified in Section 17), for registration of transfer (and in the case of a surrender for registration of transfer accompanied by a written instrument of transfer duly executed by the registered Holder or such Holder's attorney duly authorized in writing and accompanied by the relevant name, address and other information for notices of each transferee of such Note or part thereof), within ten Business Days thereafter, the Company shall execute and deliver, at the Company's expense (except as provided below), one or more new Notes (as requested by the Holder thereof) in exchange therefor, in an aggregate principal amount equal to the unpaid principal amount of the surrendered Note. Each such new Note shall be payable to such Person as such Holder may request and shall be substantially in the form of Schedule B. Each such new Note shall be dated and bear interest from the date to which interest shall have been paid on the surrendered Note or dated the date of the surrendered Note if no interest shall have been paid thereon. The Company may require payment from the relevant Holder of a sum sufficient to cover any stamp tax or governmental charge imposed in respect of any such transfer of Notes. Notes shall not be transferred in denominations of less than $100,000, provided that if necessary to enable the registration of transfer by a Holder of its entire holding of Notes, one Note may be in a denomination of less than $100,000. Any transferee, by its acceptance of a Note registered in its name (or the name of its nominee), shall be deemed to have made the representation set forth in Section 6.2.

Section 12.7 REPLACEMENT OF NOTES.

Upon receipt by the Company at the address and to the attention of the designated officer (all as specified in Section 17) of evidence reasonably satisfactory to it of the ownership of and the loss, theft, destruction or mutilation of any Note, and the loss, theft, destruction or mutilitation of any Note, and

(a) in the case of loss, theft or destruction, of an indemnity reasonably satisfactory to

(b) in the case of mutilation, upon surrender and cancellation thereof,

within ten Business Days thereafter, the Company at its own expense shall execute and deliver, in lieu thereof, a new Note, dated and bearing interest from the date to which interest shall have been paid on such lost, stolen, destroyed or mutilated Note or dated the date of such lost, stolen, destroyed or mutilated Note if no interest shall have been paid thereon.

SECTION 13. PAYMENTS ON NOTES PLACE OF PAYMENT.

Subject to Section 13.2, payments of principal, applicable premium, if any, and interest becoming due and payable on the Notes shall be made by wire transfer. The Company may at any time, by notice to each Holder, change the place of payment of the Notes so long as such place of payment shall be either the principal office of the Company in such jurisdiction or the office of the Paying Agent.

| 18 |

Section 13.2 HOME OFFICE PAYMENT.

Notwithstanding anything contained in Section 13.1 or in such Note to the contrary, the Company shall pay or cause (by depositing the corresponding amount with the Agent, with an applicable direction) the payment of all sums becoming due on such Note for principal, applicable premium, if any, interest and all other amounts becoming due hereunder by wire delivered to the applicable Holder, without the presentation or surrender of such Note or the making of any notation thereon, except that upon written request of the Company made concurrently with or reasonably promptly after payment or prepayment in full of any Note, such Holder shall surrender such Note for cancellation, reasonably promptly after any such request, to the Company at its principal executive office or at the place of payment most recently designated by the Company pursuant to Section 13.1. Prior to any sale or other disposition of any Note held by a Holder or its nominee, such Holder shall, at its election, either endorse thereon the amount of principal paid thereon and the last date to which interest has been paid thereon or surrender such Note to the Company in exchange for a new Note or Notes pursuant to Section 12.

SECTION 14. EXPENSES,ETC.

Section 14.1 FEES; EXPENSES; INDEMNIFICATION.

(a) The Company shall pay to each of the Paying Agent and the Collateral Agent from time to time such compensation for its acceptance of its services under the Note Documents, respectively, as the parties shall agree in writing from time to time.

(b) The Company shall reimburse each of the Paying Agent and the Collateral Agent promptly upon request for all out-of-pocket disbursements, advances and expenses incurred or made by it in addition to the compensation for its services. Such expenses shall include the reasonable compensation, disbursements and expenses of the Paying Agent's and the Collateral Agent's agents and counsel.

(c) The Company shall indemnify each of the Paying Agent and the Collateral Agent and its officers, directors, employees, agents and any predecessor paying agent or collateral agent for, and hold each of the Paying Agent and the Collateral Agent harmless against, any and all loss, damage, claims, liability or expense (including attorneys' fees) incurred by it, arising out of or in connection with the acceptance or administration of the Note Documents to which it is a party and the performance of its duties hereunder and thereunder (including the costs and expenses of enforcement against the Company) or defending itself against any claim (whether asserted by any Holder, the Company or any other Person), or liability in connection with the acceptance, exercise or performance of any of its powers or duties hereunder or thereunder. The Company need not indemnify against any loss, liability or expense incurred through the Paying Agent's or the Collateral Agent's, as the case may be, own willful misconduct or gross negligence, as finally determined by a court of competent jurisdiction.

| 19 |

Section 14.2 TRANSACTION EXPENSES.

Without limiting the generality of Section 14.1, whether or not the transactions contemplated hereby are consummated, the Company shall pay all fees, costs and expenses (including reasonable attorneys' fees of counsel and local or other counsel) incurred by the Agent in connection with such transactions and in connection with any amendments, waivers or consents under or in respect of this Agreement or the other Note Documents (whether or not such amendment, waiver or consent becomes effective), including, without limitation: (a) the fees, costs and expenses incurred in enforcing or defending (or determining whether or how to enforce or defend) any rights under this Agreement or the other Note Documents or in responding to any subpoena or other legal process or informal investigative demand issued in connection with this Agreement or the other Note Documents, and (b) the fees, costs and expenses, including financial advisors' fees, incurred in connection with the insolvency or bankruptcy of the Company or any Subsidiary or in connection with any work-out or restructuring of the transactions contemplated hereby and by the Notes. The Company shall pay, and shall save each Holder harmless from, (i) all claims in respect of any fees, costs or expenses, if any, of brokers and finders (other than those, if any, retained by a Holder in connection with its purchase of the Notes) and (ii) any and all wire transfer fees that any bank deducts from any payment under such Note to such Holder or otherwise charges to a Holder with respect to a payment under such Note.

Section 14.3 SURVIVAL.

The Obligations of the Company to the Agent under this Section 14, in addition to Section 10 of the Collateral Assignment of Intercompany Loan Documents, shall survive the payment or transfer of any Note, the enforcement, amendment or waiver of any provision of this Agreement or the other Note Documents, the resignation or removal of the Agent and the termination of this Agreement and the other Note Documents.

SECTION 15. SURVIVAL OF REPRESENTATIONS AND WARRANTIES; ENTIRE AGREEMENT.

All representations and warranties contained herein shall survive the execution and delivery of this Agreement and the Notes, the purchase or transfer by any Holder of any portion of or interest in any Note and the payment of any Note, and may be relied upon by any subsequent Holder, regardless of any investigation made at any time by or on behalf of such Holder. All statements contained in any certificate or other instrument delivered by or on behalf of the Company pursuant to this Agreement shall be deemed representations and warranties of the Company under this Agreement. Subject to the preceding sentence, each Holder acknowledges that this Agreement and the Notes embody the entire agreement and understanding between each Holder and the Company and supersede all prior agreements and understandings relating to the subject matter hereof. Each Holder acknowledges that no documentation provided prior to this Agreement and the Notes, including any private placement memorandum, was relied upon in making its decision to invest in the Notes, and that subsequent to receiving such documentation and prior to signing this Agreement, each Holder had an opportunity to rescind its agreement to purchase the Notes and have all monies previously placed in escrow returned to it.

SECTION 16. AMENDMENT AND WAIVER REQUIREMENTS.

| 20 |

This Agreement and the other Note Documents may be amended, and the observance of any term hereof or of the Notes may be waived (either retroactively or prospectively), only with the written consent of the Company and the Required Holders, except that:

(a) no amendment or waiver of any of Sections 1, 2, 3, 4, 5, 6 or 21 hereof, or any defined term (as it is used therein), shall be effective as to any Holder unless consented to by such Holder in writing;

(b) no amendment or waiver may, without the written consent of the each Holder at the time outstanding, (i) subject to Section 12 relating to acceleration or rescission, change the amount or time of any prepayment or payment of principal of, or reduce the rate or change the time of payment or method of computation of (x) interest on the Notes or (y) the applicable premium, (ii) change the percentage of the principal amount of the Notes the Holders of which are required to consent to any amendment or waiver, or (iii) amend any of Section 8 and Section

!!(a), !!(b), 12 or 20; and

(c) no amendment or waiver may, without the written consent of the Agent, affect any rights, duties, powers, immunities or obligations of the Agent (including without limitation the Agency Agreement and Section 20 of this Agreement).

Section 16.2 DECISION OF HOLDERS.

(a) Solicitation. The Company shall provide each Holder with sufficient information, sufficiently far in advance of the date a decision is required, to enable such Holder to make an informed and considered decision with respect to any proposed amendment, waiver or consent in respect of any of the provisions hereof or of the Notes. The Company shall deliver executed or true and correct copies of each amendment, waiver or consent effected pursuant to this Section 16 to each Holder and the Agent promptly following the date on which it is executed and delivered by, or receives the consent or approval of, the Required Holders.

(b) Payment. The Company shall not directly or indirectly pay or cause to be paid any remuneration, whether by way of supplemental or additional interest, fee or otherwise, or grant any security or provide other credit support, to any Holder as consideration for or as an inducement to the entering into by such Holder of any waiver or amendment of any of the terms and provisions hereof or any Note unless such remuneration is concurrently paid, or security is concurrently granted or other credit support concurrently provided, on the same terms, ratably to each Holder even if such Holder did not consent to such waiver or amendment.

(c) Consent in Contemplation of Transfer. Any consent given pursuant to this Section 16 by a Holder that has transferred or has agreed to transfer its Note to the Company, any Subsidiary or any Affiliate of the Company in connection with such consent shall be void and of no force or effect except solely as to such Holder, and any amendments effected or waivers granted or to be effected or granted that would not have been or would not be so effected or granted but for such consent (and the consents of all other Holders that were acquired under the same or similar conditions) shall be void and of no force or effect except solely as to such Holder.

| 21 |

Section 16.3 BINDING EFFECT, ETC.

Any amendment or waiver consented to as provided in this Section I 6 applies equally to all Holders and is binding upon them and upon each future Holder and upon the Company without regard to whether such Note has been marked to indicate such amendment or waiver. No such amendment or waiver shall extend to or affect any obligation, covenant, agreement, Default or Event of Default not expressly amended or waived or impair any right consequent thereon. No course of dealing between the Company and any Holder and no delay in exercising any rights hereunder or under any Note shall operate as a waiver of any rights of any Holder.

Section 16.4 NOTES HELD BY COMPANY, ETC.

Solely for the purpose of determining whether the Holders of the requisite percentage of the aggregate principal amount of Notes then outstanding approved or consented to any amendment, waiver or consent to be given under this Agreement, or the Notes, or have directed the taking of any action provided herein or the Notes to be taken upon the direction of the Holders of a specified percentage of the aggregate principal amount of Notes then outstanding, Notes directly or indirectly owned by the Company or any of its Affiliates shall be deemed not to be outstanding. Upon the request of the Collateral Agent, the Company shall promptly certify whether any Notes are directly or indirectly owned by the Company or any of its Affiliates, and if so, the amount of such holdings.

SECTION 17. NOTICES

Except to the extent otherwise provided in Section 7.4, all notices and communications provided for hereunder shall be in writing and sent (a) by facsimile if the sender on the same day sends a confirming copy of such notice by an internationally recognized overnight delivery service (charges prepaid), or (b) by registered or certified mail with return receipt requested (postage prepaid), or (c) by an internationally recognized overnight delivery service (with charges prepaid). Any such notice must be sent:

(i) if to any Holder or its nominee, to such Holder or nominee at the address specified for such communications in Schedule B, or at such other address as such Holder or nominee shall have specified to the Company and the Agent in writing,

(ii) if to the Collateral Agent and/or to the Paying Agent, as follows:

Computershare Trust Company, N.A.

8742 Lucent Boulevard, Suite 225

Highlands Ranch, CO 80 I 29

Facsimile: (303) 262-0608

Attention: John M. Wahl

with a copy (in the case of the Paying Agent) to:

Computershare Inc.

480 Washington Boulevard

Jersey City, NJ 07310

| 22 |

Facsimile: (201) 680-4610

Attn: General Counsel

(iii) if to the Company, as follows:

ROI LAND INVESTMENTS LTD.

825 LebourgneufBlvd, Suite 315

Quebec, QUEBEC G2J OB9

Tel: 1-418-781-2954

Facsimile: 1-418-780-2079

Attention: Sebastian Cliche

or at such other address as the Company shall have specified to the

Holders and Agent in writing.

Written confirmation of receipt (A) given by the recipient of such notice, consent, waiver or other communication, (B) mechanically or electronically generated by the sender's facsimile machine containing the time, date and recipient facsimile number or (C) provided by an overnight courier service shall be rebuttable evidence of personal service, receipt by facsimile or receipt from an overnight courier service in accordance with clauses (a), (b) or (c) above, respectively.

SECTION 18. REPRODUCTION OF DOCUMENTS

This Agreement and all documents relating thereto, including, without limitation, (a) consents, waivers and modifications that may hereafter be executed, (b) documents received by any Holder (except the Notes themselves), and (c) financial statements, certificates and other information previously or hereafter furnished to any Holder, may be reproduced by such Holder by any photographic, photostatic, electronic, digital, or other similar process and such Holder may destroy any original document so reproduced. The Company agrees and stipulates that, to the extent permitted by applicable law, any such reproduction shall be admissible in evidence as the original itself in any judicial or administrative proceeding (whether or not the original is in existence and whether or not such reproduction was made by such Holder in the regular course of business) and any enlargement, facsimile or further reproduction of such reproduction shall likewise be admissible in evidence. This Section 18 shall not prohibit the Company or any other Holder from contesting any such reproduction to the same extent that it could contest the original, or from introducing evidence to demonstrate the inaccuracy of any such reproduction.

SECTION 19. CONFIDENTIAL INFORMATION

For the purposes of this Section 19, "Confidential Information" means information delivered to any Holder by or on behalf of the Company or any Subsidiary in connection with the transactions contemplated by or otherwise pursuant to this Agreement that is proprietary in nature and that was clearly marked or labeled or otherwise adequately identified when received by such Holder as being confidential information of the Company or such Subsidiary, provided that such term does not include information that (a) was publicly known or otherwise known to such Holder prior to the time of such disclosure, (b) subsequently becomes publicly known through no act or omission by such Holder or any Person acting on such Holder's behalf, (c) otherwise becomes known to such Holder other than through disclosure by the Company or any Subsidiary or (d) constitutes financial statements delivered to such Holder under Section 7.1 that are otherwise publicly available. Each Holder shall maintain the confidentiality of such Confidential Information in accordance with procedures adopted by such Holder in good faith to protect confidential information of third parties delivered to such Holder, provided that such Holder may deliver or disclose Confidential Information to (i) its directors, officers, employees, agents, attorneys, trustees and affiliates (to the extent such disclosure reasonably relates to the administration of the investment represented by its Notes), (ii) its auditors, financial advisors and other professional advisors who agree to hold confidential the Confidential Information substantially in accordance with this Section 19, (iii) any other Holder, (iv) any Person from which it offers to purchase any Security of the Company (if such Person has agreed in writing prior to its receipt of such Confidential Information to be bound by this Section 19), (v) any federal or state regulatory authority having jurisdiction over such Holder, or (vi) any other Person to which such delivery or disclosure may be necessary or appropriate (w) to effect compliance with any law, rule, regulation or order applicable to such Holder, (x) in response to any subpoena or other legal process, (y) in connection with any litigation to which such Holder is a party or (z) if an Event of Default has occurred and is continuing, to the extent such Holder may reasonably determine such delivery and disclosure to be necessary or appropriate in the enforcement or for the protection of the rights and remedies under such Holder's Notes or this Agreement. Each Holder, as applicable, by its acceptance of a Note, shall be deemed to have agreed to be bound by and to be entitled to the benefits of this Section 19 as though it were a party to this Agreement. If applicable, on reasonable request by the Company in connection with the delivery to any Holder of information required to be delivered to such Holder under this Agreement or requested by such Holder (other than a Holder that is a party to this Agreement or its nominee), such Holder shall enter into an agreement with the Company embodying this Section 19.

| 23 |

In the event that as a condition to receiving access to information relating to the Company or its Subsidiaries in connection with the transactions contemplated by or otherwise pursuant to this Agreement, any Holder is required to agree to a confidentiality undertaking which is different from this Section 19, this Section 19 shall not be amended thereby and, as between such Holder and the Company, this Section 19 shall supersede any such other confidentiality undertaking.

SECTION 20. REGARDING AGENT

(a) The Company hereby appoints Computershare Inc. as the Paying Agent hereunder and under and for purposes of each other Note Document to which the Paying Agent is a party, and hereby authorizes the Paying Agent to act on behalf of the Company in accordance with the terms thereof. Notwithstanding any provision to the contrary elsewhere in the Note Documents, the Paying Agent shall not have any duties or responsibilities, except those expressly set forth herein, or in any other Note Document to which the Paying Agent is a party, and shall not have any fiduciary relationship with any Person, and no implied covenants, functions, responsibilities, duties, obligations or liabilities shall be read into this Agreement or any other Note Document or otherwise exist against the Paying Agent. The duties of the Paying Agent shall be ministerial and administrative in nature.

| 24 |

(b) Each Holder hereby appoints and authorizes the Collateral Agent to be the agent for and representative of such Holder with respect to the Collateral Documents. Each Holder hereby consents to and approves each and all of the provisions of the Note Documents, and irrevocably authorizes and directs the Collateral Agent to execute and deliver the Note Documents to which the Collateral Agent is a party. Notwithstanding any provision to the contrary elsewhere in the Note Documents, the Collateral Agent shall not have any duties or responsibilities, except those expressly set forth herein, or in any other Note Document to which the Collateral Agent is a party, and shall not have any fiduciary relationship with any Person, and no implied covenants, functions, responsibilities, duties, obligations or liabilities shall be read into this Agreement or any other Note Document or otherwise exist against the Collateral Agent. The duties of the Collateral Agent shall be ministerial and administrative in nature.

(c) Notwithstanding anything to the contrary contained in any of the Note Documents, each Holder, by its acceptance of a Note, agrees that (a) no Holder shall have any right individually to realize upon any of the Collateral or to enforce the Collateral Documents, it being understood and agreed that all such powers, rights and remedies may be exercised solely by the Collateral Agent, on behalf of the Secured Parties in accordance with the terms of this Agreement and the other Note Documents, and all powers, rights and remedies under the Collateral Documents may be exercised solely by the Collateral Agent, in each case at the written direction of the Required Holders; (b) in the event of a foreclosure by the Collateral Agent (pursuant to the written direction of the Required Holders) on any of the Collateral pursuant to a public or private sale, the Collateral Agent or any Holder may be the purchaser or licensor of any or all of such Collateral at any such sale or other disposition and the Collateral Agent, as agent for and representative of the Holders (but not any Holder or Holders in its or their respective individual capacities) shall be entitled (at the written direction of the Required Holders) for the purpose of bidding and making settlement or payment of the purchase price for all or any portion of the Collateral sold at any such public sale, to use and apply any of the Company's Obligations hereunder as a credit on account of the purchase price for any Collateral payable by the Collateral Agent at such sale; (c) it has read and agrees to the terms of all of the Note Documents, including without limitation the Agency Agreement; and (d) the Agent shall be under no obligation to take any action under any Note Document at the request or direction of any of the Holders unless the Holders have offered to the Agent indemnity or security satisfactory to the Agent against any actual or potential loss, liability or expense.

(d) The Agent is entering into this Agreement not in its individual capacity but strictly in its capacity as Collateral Agent and Paying Agent under the Agency Agreement and in entering into this Agreement and acting hereunder, the Agent shall be entitled to the rights, powers, benefits, protections, immunities and indemnities set forth in the Agency Agreement as if fully set forth herein.

SECTION 21. COLLATERAL MATTERS; SECURITY INTEREST IN THE COLLATERAL.