Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - Black Creek Diversified Property Fund Inc. | dvcv-8k_051115.htm |

| EX-99.1 - PRESS RELEASE - Black Creek Diversified Property Fund Inc. | ex99-1.htm |

Table of Contents

CAUTIONARY NOTE REGARDING FORWARD LOOKING STATEMENTS

Statements included in this portfolio performance and review package that are not historical facts (including any statements concerning investment objectives, other plans and objectives of management for future operations or economic performance or assumptions or forecasts related thereto) are forward looking statements. These statements are only predictions. We caution that forward looking statements are not guarantees. Actual events or our investments and results of operations could differ materially from those expressed or implied in the forward looking statements. Forward looking statements are typically identified by the use of terms such as “may,” “will,” “should,” “expect,” “could,” “intend,” “plan,” “anticipate,” “estimate,” “believe,” “continue,” “predict,” “potential” or the negative of such terms and other comparable terminology.

The forward looking statements included herein are based upon our current expectations, plans, estimates, assumptions and beliefs that involve numerous risks and uncertainties. Assumptions relating to the foregoing involve judgments with respect to, among other things, future economic, competitive and market conditions and future business decisions, all of which are difficult or impossible to predict accurately and many of which are beyond our control. Although we believe that the expectations reflected in such forward looking statements are based on reasonable assumptions, our actual results and performance could differ materially from those set forth in the forward looking statements. Factors which could have a material adverse effect on our operations and future prospects include, but are not limited to: the continuing impact of high unemployment and the slow economic recovery, which is having and may continue to have a negative effect on the following, among other things, the fundamentals of our business, including overall market demand and occupancy, tenant space utilization, and rental rates; the value of our real estate assets, which may limit our ability to dispose of assets at attractive prices or obtain or maintain debt financing secured by our properties or on an unsecured basis; general risks affecting the real estate industry (including, without limitation, the inability to enter into or renew leases, dependence on tenants’ financial condition, and competition from other developers, owners and operators of real estate); our ability to effectively raise and deploy proceeds from our equity offerings; risks associated with the availability and terms of debt and equity financing and refinancing and the use of debt to fund acquisitions and developments, including the risk associated with interest rates impacting the cost and/or availability of financing and refinancing; the business opportunities that may be presented to and pursued by us, changes in laws or regulations (including changes to laws governing the taxation of real estate investment trusts; changes in accounting principles, policies and guidelines applicable to real estate investment trusts; environmental, regulatory and/or safety requirements; and the availability and cost of comprehensive insurance, including coverage for terrorist acts and earthquakes. Except as otherwise required by the federal securities laws, we undertake no obligation to publicly update or revise any forward looking statements after the date of this supplemental package, whether as a result of new information, future events, changed circumstances or any other reason. You should review the risk factors contained in Part I, Item 1A of our 2014 Annual Report on Form 10-K, filed with the Securities and Exchange Commission on March 3, 2015, and in our subsequent quarterly reports.

Please see the section titled “Definitions” at the end of this portfolio performance and review package for definitions of terms used herein.

| Page | 2 |

| PERFORMANCE |

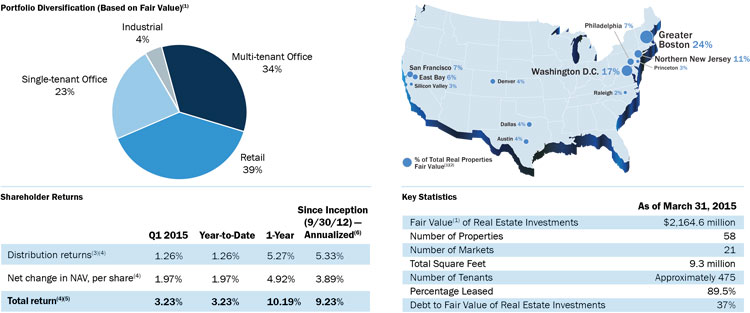

Dividend Capital Diversified Property Fund Inc. is a daily NAV-based REIT and has invested in a diverse portfolio of real property and real estate related investments. As used herein, “the Portfolio,” “we,” “our” and “us” refer to Dividend Capital Diversified Property Fund Inc. and its consolidated subsidiaries and partnerships except where the context otherwise requires.

Quarter Highlights

| ● | Total return of 3.23% for the quarter; 10.19% for the last 12 months |

| ● | Acquired (i) office property in Austin, TX for $37.3 million, and (ii) retail property in Mashpee, MA for $35.5 million |

| ● | Sold 2.7 million square foot office and industrial portfolio for $398.6 million |

| ● | Reported percentage leased of 89.5% as of March 31, 2015 |

| ● | Paid weighted-average distribution of $0.0897/share | |

| (1) | As determined in accordance with our Valuation Procedures, filed as Exhibit 99.1 to our 2014 Annual Report on Form 10-K. See a discussion of some of the differences between the definition of “fair value” of our real estate assets as used in our Valuation Procedures and in this document versus GAAP values in the section titled “Definitions” beginning on page 23. For a description of key assumptions used in calculating the value of our real properties as of March 31, 2015, please refer to “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in Part I, Item 2 of our Quarterly Report on Form 10-Q. |

| (2) | In addition to the markets shown, we had real property investments, each accounting for 1% or less of the total fair value of our real property portfolio, in the following markets: Central Kentucky, Chicago, IL, Fayetteville, AR, Jacksonville, FL, Los Angeles, CA, Louisville, KY, Minneapolis/St. Paul, MN, Pittsburgh, PA, and San Antonio, TX. |

| (3) | Represents the compounded return realized from reinvested distributions before class specific expenses. We pay our dealer manager (1) a dealer manager fee equal to 1/365th of 0.60% of our NAV per share for Class A shares and Class W shares for each day, (2) a dealer manager fee equal to 1/365th of 0.10% of our NAV per share for Class I shares for each day and (3) for Class A shares only, a distribution fee equal to 1/365th of 0.50% of our NAV per share for Class A shares for each day. |

| (4) | Excludes the impact of up-front commissions paid with respect to certain Class A shares. We pay selling commissions on Class A shares sold in the primary offering of up to 3.0% of the NAV per share, which may be higher or lower due to rounding. Selling commissions may be reduced or eliminated to or for the account of certain categories of purchasers. |

| (5) | Total return represents the compound annual rate of return assuming reinvestment of all dividend distributions. Past performance is not a guarantee of future results. |

| (6) | Q4 2012 represents the first full quarter for which we have complete NAV return data. As such, we use 9/30/12 as “inception” for the purpose of calculating cumulative returns since inception. |

| Page | 3 |

| NET ASSET VALUE |

The following table sets forth the components of NAV for the Portfolio as of the end of each of the five quarters ending March 31, 2015, as determined in accordance with our valuation procedures. As used below, “Fund Interests” means our Class E shares, Class A shares, Class W shares, and Class I shares, along with the OP Units held by third parties, and “Aggregate Fund NAV” means the NAV of all of the Fund Interests (amounts in thousands except per share information).

| As of | ||||||||||||||||||||

|

March 31, |

December 31, |

September 30, |

June 30, |

March 31, |

||||||||||||||||

| Real properties: | ||||||||||||||||||||

| Office | $ | 1,245,000 | $ | 1,446,850 | $ | 1,442,900 | $ | 1,354,250 | $ | 1,355,230 | ||||||||||

| Industrial | 85,800 | 248,300 | 263,150 | 261,700 | 261,900 | |||||||||||||||

| Retail | 833,770 | 786,705 | 745,155 | 743,465 | 715,225 | |||||||||||||||

| Total real properties | 2,164,570 | 2,481,855 | 2,451,205 | 2,359,415 | 2,332,355 | |||||||||||||||

| Debt related investments | 87,901 | 94,951 | 94,673 | 94,414 | 94,180 | |||||||||||||||

| Total investments | 2,252,471 | 2,576,806 | 2,545,878 | 2,453,829 | 2,426,535 | |||||||||||||||

| Cash and other assets, net of other liabilities | (22,269 | ) | (10,814 | ) | 663 | 7,036 | 77,452 | |||||||||||||

| Debt obligations | (827,304 | ) | (1,192,250 | ) | (1,182,819 | ) | (1,139,657 | ) | (1,182,210 | ) | ||||||||||

| Outside investors’ interests | (4,445 | ) | (8,652 | ) | (10,310 | ) | (10,570 | ) | (10,512 | ) | ||||||||||

| Aggregate Fund NAV | $ | 1,398,453 | $ | 1,365,090 | $ | 1,353,412 | $ | 1,310,638 | $ | 1,311,265 | ||||||||||

| Total Fund Interests outstanding | 191,434 | 190,547 | 190,967 | 187,310 | 188,318 | |||||||||||||||

| NAV per Fund Interest | $ | 7.31 | $ | 7.16 | $ | 7.09 | $ | 7.00 | $ | 6.96 | ||||||||||

| (1) | For information about the valuation procedures and key assumptions used in these calculations, please refer to “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in Part I, Item 2 of our Quarterly Report on Form 10-Q. |

| (2) | For information about the valuation procedures and key assumptions used in these calculations, please refer to “Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities” in Part II, Item 5 of our 2014 Annual Report on Form 10-K. |

| (3) | For information about the valuation procedures and key assumptions used in these calculations, please refer to “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in Part I, Item 2 of our Quarterly Report on Form 10-Q for the period ended September 30, 2014, filed with the Securities and Exchange Commission on November 12, 2014. |

| (4) | For information about the valuation procedures and key assumptions used in these calculations, please refer to “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in Part I, Item 2 of our Quarterly Report on Form 10-Q for the period ended June 30, 2014, filed with the Securities and Exchange Commission on August 12, 2014. |

| (5) | For information about the valuation procedures and key assumptions used in these calculations, please refer to “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in Part I, Item 2 of our Quarterly Report on Form 10-Q for the period ended March 31, 2014, filed with the Securities and Exchange Commission on May 13, 2014. |

When the fair value of our real estate assets is calculated for the purposes of determining our NAV per share, the calculation is done using the fair value methodologies detailed within the Financial Accounting Standards Board Accounting Standards Codification under Topic 820, Fair Value Measurements and Disclosures (“ASC Topic 820”). However, our valuation procedures and our NAV are not subject to GAAP and will not be subject to independent audit. In the determination of our NAV, the value of certain of our assets and liabilities are generally determined based on their carrying amounts under GAAP; however, those principles are generally based upon historic cost and therefore may not be determined in accordance with ASC Topic 820. Readers should refer to our audited financial statements for our net book value determined in accordance with accounting principles generally accepted in the United States (“GAAP”) from which one can derive our net book value per share by dividing our stockholders’ equity by shares of our common stock outstanding as of the date of measurement.

Our valuation procedures, which address specifically each category of our assets and liabilities and are applied separately from the preparation of our financial statements in accordance with GAAP, involve adjustments from historical cost. There are certain factors which cause NAV to be different from net book value on a GAAP basis. Most significantly, the valuation of our real estate assets, which is the largest component of our NAV calculation, will be provided to us by the Independent Valuation Firm on a daily basis. For GAAP purposes, these assets are generally recorded at depreciated or amortized cost. Other examples that will cause our NAV to differ from our GAAP net book value include the straight-lining of rent, which results in a receivable for GAAP purposes that is not included in the determination of our NAV, and, for purposes of determining our NAV, the assumption of a value of zero in certain instances where the balance of a loan exceeds the value of the underlying real estate properties, where GAAP net book value would reflect a negative equity value for such real estate properties, even if such loans are non-recourse. Third party appraisers may value our individual real estate assets using appraisal standards that deviate from market value standards under GAAP. The use of such appraisal standards may cause our NAV to deviate from GAAP fair value principles. We did not develop our valuation procedures with the intention of complying with fair value concepts under GAAP and, therefore, there could be differences between our fair values and the fair values derived from the principal market or most advantageous market concepts of establishing fair value under GAAP.

| Page | 4 |

| NET ASSET VALUE (continued) |

The following table sets forth the quarterly changes to the components of NAV for the Portfolio, for each of the most recent four quarters, and for the twelve month period ended March 31, 2015 (amounts in thousands, except per share information):

| Three Months Ended | Previous Four | |||||||||||||||||||

| March 31, 2015 | December 31, 2014 | September 30, 2014 | June 30, 2014 | Quarters | ||||||||||||||||

| NAV as of beginning of period | $ | 1,365,090 | $ | 1,353,412 | $ | 1,310,638 | $ | 1,311,265 | $ | 1,311,265 | ||||||||||

| Fund level changes to NAV | ||||||||||||||||||||

| Realized/unrealized gains (losses) on net assets | 22,540 | 11,515 | 14,391 | 3,745 | 52,191 | |||||||||||||||

| Income accrual | 26,217 | 24,269 | 23,733 | 23,266 | 97,485 | |||||||||||||||

| Dividend accrual | (17,197 | ) | (16,751 | ) | (16,698 | ) | (16,620 | ) | (67,266 | ) | ||||||||||

| Advisory fee | (3,931 | ) | (3,967 | ) | (3,901 | ) | (3,802 | ) | (15,601 | ) | ||||||||||

| Performance based fee | (352 | ) | (204 | ) | (189 | ) | (1 | ) | (746 | ) | ||||||||||

| Class specific changes to NAV | ||||||||||||||||||||

| Dealer Manager fee | (49 | ) | (46 | ) | (37 | ) | (23 | ) | (155 | ) | ||||||||||

| Distribution fee | (11 | ) | (10 | ) | (8 | ) | (7 | ) | (36 | ) | ||||||||||

| NAV as of end of period | ||||||||||||||||||||

| before share sale/redemption activity | $ | 1,392,307 | $ | 1,368,218 | $ | 1,327,929 | $ | 1,317,823 | $ | 1,377,137 | ||||||||||

| Share sale/redemption activity | ||||||||||||||||||||

| Shares sold | 18,665 | 14,097 | 44,429 | 30,715 | 107,906 | |||||||||||||||

| Shares redeemed | (12,519 | ) | (17,225 | ) | (18,946 | ) | (37,900 | ) | (86,590 | ) | ||||||||||

| NAV as of end of period | $ | 1,398,453 | $ | 1,365,090 | $ | 1,353,412 | $ | 1,310,638 | $ | 1,398,453 | ||||||||||

| Shares outstanding beginning of period | 190,547 | 190,967 | 187,310 | 188,318 | 188,318 | |||||||||||||||

| Shares sold | 2,603 | 1,986 | 6,332 | 4,409 | 15,330 | |||||||||||||||

| Shares redeemed | (1,716 | ) | (2,406 | ) | (2,675 | ) | (5,417 | ) | (12,214 | ) | ||||||||||

| Shares outstanding end of period | 191,434 | 190,547 | 190,967 | 187,310 | 191,434 | |||||||||||||||

| NAV per share as of beginning of period | $ | 7.16 | $ | 7.09 | $ | 7.00 | $ | 6.96 | $ | 6.96 | ||||||||||

| Change in NAV per share | 0.15 | 0.07 | 0.09 | 0.04 | 0.35 | |||||||||||||||

| NAV per share as of end of period | $ | 7.31 | $ | 7.16 | $ | 7.09 | $ | 7.00 | $ | 7.31 | ||||||||||

We include no discounts to our NAV for the illiquid nature of our shares, including the limitations on your ability to redeem shares under our share redemption programs and our ability to suspend or terminate our share redemption programs at any time. Our NAV generally does not consider exit costs (e.g. selling costs and commissions related to the sale of a property) that would likely be incurred if our assets and liabilities were liquidated or sold. While we may use market pricing concepts to value individual components of our NAV, our per share NAV is not derived from the market pricing information of open-end real estate funds listed on stock exchanges.

Please note that our NAV is not a representation, warranty or guarantee that: (1) we would fully realize our NAV upon a sale of our assets; (2) shares of our common stock would trade at our per share NAV on a national securities exchange; or (3) a stockholder would be able to realize the per share NAV if such stockholder attempted to sell his or her shares to a third party.

| Page | 5 |

| |

| FINANCIAL HIGHLIGHTS |

Amounts in thousands, except per share information and percentages.

| As of or For the Three Months Ended | ||||||||||||||||||||

| Selected Operating Data (as adjusted) (1) |

March 31, 2015 |

December 31, 2014 |

September 30, 2014 |

June 30, 2014 |

March 31, 2014 |

|||||||||||||||

| Total revenues | $ | 62,582 | $ | 59,093 | $ | 58,591 | $ | 56,814 | $ | 58,068 | ||||||||||

| Net income (loss) | 132,201 | 5,700 | (7,514 | ) | 3,816 | 31,988 | ||||||||||||||

| Portfolio Statistics | ||||||||||||||||||||

| Operating properties | 58 | 68 | 69 | 68 | 68 | |||||||||||||||

| Square feet | 9,327 | 11,871 | 12,000 | 11,732 | 11,652 | |||||||||||||||

| Percentage leased at end of period | 89.5 | % | 93.7 | % | 92.8 | % | 92.6 | % | 92.2 | % | ||||||||||

| Earnings Per Share | ||||||||||||||||||||

| Net (loss) income per share | $ | 0.69 | $ | 0.03 | $ | (0.04 | ) | $ | 0.02 | $ | 0.15 | |||||||||

| Funds from Operations (“FFO”) per share (2) | $ | 0.13 | $ | 0.12 | $ | 0.12 | $ | 0.12 | $ | 0.11 | ||||||||||

| Company-defined FFO per share (2) | $ | 0.14 | $ | 0.12 | $ | 0.13 | $ | 0.12 | $ | 0.11 | ||||||||||

| Weighted average number of common shares outstanding - basic | 179,317 | 179,926 | 178,729 | 177,529 | 176,873 | |||||||||||||||

| Weighted average number of common shares outstanding - diluted | 191,766 | 192,137 | 191,422 | 190,386 | 189,993 | |||||||||||||||

| Net Asset Value (“NAV”) (3) | ||||||||||||||||||||

| NAV per share at the end of period | $ | 7.31 | $ | 7.16 | $ | 7.09 | $ | 7.00 | $ | 6.96 | ||||||||||

| High NAV per share during period | $ | 7.31 | $ | 7.19 | $ | 7.09 | $ | 7.00 | $ | 6.96 | ||||||||||

| Low NAV per share during period | $ | 7.13 | $ | 7.08 | $ | 7.00 | $ | 6.96 | $ | 6.93 | ||||||||||

| Weighted average distributions per share | $ | 0.0897 | $ | 0.0872 | $ | 0.0872 | $ | 0.0873 | $ | 0.0874 | ||||||||||

| Weighted average closing dividend yield - annualized | 4.91 | % | 4.87 | % | 4.92 | % | 4.99 | % | 5.02 | % | ||||||||||

| Weighted average total return for the period | 3.23 | % | 2.31 | % | 2.53 | % | 1.75 | % | 1.72 | % | ||||||||||

| Aggregate fund NAV at end of period | $ | 1,398,462 | $ | 1,365,090 | $ | 1,353,412 | $ | 1,310,638 | $ | 1,311,265 | ||||||||||

| Consolidated Debt | ||||||||||||||||||||

| Leverage (4) | 37 | % | 47 | % | 47 | % | 47 | % | 49 | % | ||||||||||

| Secured borrowings | $ | 652,127 | $ | 853,267 | $ | 871,230 | $ | 875,968 | $ | 918,716 | ||||||||||

| Secured borrowings as % of total borrowings | 78 | % | 71 | % | 73 | % | 76 | % | 77 | % | ||||||||||

| Unsecured borrowings | $ | 181,000 | $ | 345,000 | $ | 317,500 | $ | 270,000 | $ | 270,000 | ||||||||||

| Unsecured borrowings as % of total borrowings | 22 | % | 29 | % | 27 | % | 24 | % | 23 | % | ||||||||||

| Fixed rate borrowings (5) | $ | 824,967 | $ | 1,145,017 | $ | 1,062,890 | $ | 1,067,538 | $ | 1,110,196 | ||||||||||

| Fixed rate borrowings as % of total borrowings | 99 | % | 96 | % | 89 | % | 93 | % | 93 | % | ||||||||||

| Floating rate borrowings | $ | 8,160 | $ | 53,250 | $ | 125,840 | $ | 78,430 | $ | 78,520 | ||||||||||

| Floating rate borrowings as % of total borrowings | 1 | % | 4 | % | 11 | % | 7 | % | 7 | % | ||||||||||

| Total borrowings | $ | 833,127 | $ | 1,198,267 | $ | 1,188,730 | $ | 1,145,968 | $ | 1,188,716 | ||||||||||

| (1) | Operating data in this table and throughout this document are presented inclusive of amounts relating to real properties that have been disposed of or classified as held for sale at the end of the period, and in certain cases, reclassified as discontinued operations in our GAAP financial statements. Certain asset and liability amounts in this table and throughout this document are presented inclusive of amounts relating to real properties that have been classified as held for sale in our GAAP financial statements. |

| (2) | For a reconciliation of FFO and Company-Defined FFO to GAAP net income, see the section titled “Funds from Operations” beginning on page 10. |

| (3) | As determined in accordance with our Valuation Procedures, filed as Exhibit 99.1 to our 2014 Annual Report on Form 10-K. See a discussion of some of the differences between the definition of “fair value” of our real estate assets as used in our Valuation Procedures and in this document versus GAAP values in the section titled “Definitions” beginning on page 23. For a description of key assumptions used in calculating the value of our real properties as of March 31, 2015, please refer to “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in Part I, Item 2 of our Quarterly Report on Form 10-Q. |

| (4) | Leverage presented represents our total borrowings, calculated on a GAAP basis, divided by the fair value of our real property and debt investments. |

| (5) | Fixed rate borrowings presented includes floating rate borrowings that are effectively fixed by a derivative instrument such as a swap through maturity or substantially through maturity. |

| Page | 6 |

| |

| PORTFOLIO PROFILE |

The following table presents information about the operating results and fair value of our real property and debt investment portfolios as of or for the three months ended March 31, 2015 (dollar and square footage amount in thousands).

| Real Properties (1) | ||||||||||||||||||||||||

| As of or for the three months ended March 31, 2015 | Total | Office | Industrial | Retail | Debt Related Investments, Net | Grand Total | ||||||||||||||||||

| Number of investments | 58 | 19 | 6 | 33 | 10 | 68 | ||||||||||||||||||

| Square footage | 9,327 | 3,986 | 1,909 | 3,432 | N/A | 9,327 | ||||||||||||||||||

| Percentage leased at period end | 89.5 | % | 94.0 | % | 72.9 | % | 93.4% | N/A | 89.5 | % | ||||||||||||||

| Net operating income (“NOI”)(2) | $ | 44,250 | $ | 26,574 | $ | 3,752 | $ | 13,924 | $ | 3,203 | $ | 47,453 | ||||||||||||

| Segment as % of total NOI | 93.3 | % | 56.0 | % | 7.9 | % | 29.3% | 6.7 | % | 100.0 | % | |||||||||||||

| NOI - cash basis (3) | $ | 44,201 | $ | 27,396 | $ | 3,589 | $ | 13,216 | $ | 3,203 | $ | 47,404 | ||||||||||||

| Fair Value (4) | $ | 2,164,570 | $ | 1,245,000 | $ | 85,800 | $ | 833,770 | $ | 87,901 | $ | 2,252,471 | ||||||||||||

| Segment as % of total Fair Value | 96.1 | % | 55.3 | % | 3.8 | % | 37.0% | 3.9 | % | 100.0 | % | |||||||||||||

| (1) | “As of” information includes all real properties that we owned as of March 31, 2015. Operations information provided here and throughout this document is presented inclusive of amounts related to properties that have been disposed of as of March 31, 2015, including amounts that are classified within discontinued operations in our 2014 Annual Report on Form 10-K and Quarterly Reports on Form 10-Q. |

| (2) | For a reconciliation of NOI to GAAP net income, see the section titled “Results of Operations” beginning on page 12. |

| (3) | For a reconciliation of NOI – Cash Basis to NOI and to GAAP net income, see the section titled “Results of Operations” beginning on page 12. |

| (4) | As determined in accordance with our Valuation Procedures, filed as Exhibit 99.1 to our 2014 Annual Report on Form 10-K. See a discussion of some of the differences between the definition of “fair value” of our real estate assets as used in our Valuation Procedures and in this document versus GAAP values in the section titled “Definitions” beginning on page 23. For a description of key assumptions used in calculating the value of our real properties as of March 31, 2015, please refer to “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in Part I, Item 2 of our Quarterly Report on Form 10-Q. |

As of March 31, 2015, our real property investments were geographically diversified across 21 markets throughout the United States. Our debt related investments are located in five additional markets resulting in a combined portfolio allocation across 26 markets.

| Page | 7 |

| |

| BALANCE SHEETS |

The following table presents our consolidated balance sheets, as adjusted, as of the end of each of the five quarters ended March 31, 2015. Certain asset and liability amounts in this table are presented inclusive of amounts relating to real properties that have been classified as held for sale in our GAAP financial statements (dollar amounts in thousands):

| As of | ||||||||||||||||||||

|

March 31, 2015 |

December 31, 2014 |

September 30, 2014 |

June 30, 2014 |

March 31, 2014 |

||||||||||||||||

| ASSETS | ||||||||||||||||||||

| Investments in real property | $ | 2,139,022 | $ | 2,472,926 | $ | 2,450,058 | $ | 2,376,245 | $ | 2,352,401 | ||||||||||

| Accumulated depreciation and amortization | (455,064 | ) | (523,246 | ) | (512,427 | ) | (489,273 | ) | (469,466 | ) | ||||||||||

| Total net investments in real property | 1,683,958 | 1,949,680 | 1,937,631 | 1,886,972 | 1,882,935 | |||||||||||||||

| Debt related investments, net | 87,901 | 94,951 | 94,673 | 94,414 | 94,180 | |||||||||||||||

| Total net investments | 1,771,859 | 2,044,631 | 2,032,304 | 1,981,386 | 1,977,115 | |||||||||||||||

| Cash and cash equivalents | 10,226 | 14,461 | 27,814 | 52,880 | 81,292 | |||||||||||||||

| Restricted cash | 18,564 | 27,454 | 25,784 | 25,212 | 35,209 | |||||||||||||||

| Other assets, net | 49,877 | 61,587 | 62,271 | 60,345 | 67,856 | |||||||||||||||

| Total Assets | $ | 1,850,526 | $ | 2,148,133 | $ | 2,148,173 | $ | 2,119,823 | $ | 2,161,472 | ||||||||||

| LIABILITIES AND EQUITY | ||||||||||||||||||||

| Liabilities: | ||||||||||||||||||||

| Mortgage notes and other secured borrowings | $ | 652,127 | $ | 853,267 | $ | 871,230 | $ | 875,968 | $ | 918,716 | ||||||||||

| Unsecured borrowings | 181,000 | 345,000 | 317,500 | 270,000 | 270,000 | |||||||||||||||

| Intangible lease liabilities, net | 54,937 | 86,243 | 78,545 | 74,393 | 72,389 | |||||||||||||||

| Other liabilities | 70,744 | 99,643 | 101,657 | 117,322 | 93,724 | |||||||||||||||

| Total Liabilities | 958,808 | 1,384,153 | 1,368,932 | 1,337,683 | 1,354,829 | |||||||||||||||

| Equity: | ||||||||||||||||||||

| Stockholders’ equity: | ||||||||||||||||||||

| Common stock | 1,783 | 1,784 | 1,787 | 1,746 | 1,755 | |||||||||||||||

| Additional paid-in capital | 1,584,780 | 1,586,444 | 1,589,520 | 1,566,332 | 1,576,970 | |||||||||||||||

| Distributions in excess of earnings | (786,286 | ) | (893,791 | ) | (883,418 | ) | (860,790 | ) | (848,768 | ) | ||||||||||

| Accumulated other comprehensive loss | (11,808 | ) | (10,120 | ) | (9,515 | ) | (10,672 | ) | (10,586 | ) | ||||||||||

| Total stockholders’ equity | 788,469 | 684,317 | 698,374 | 696,616 | 719,371 | |||||||||||||||

| Noncontrolling interests | 103,249 | 79,663 | 80,867 | 85,524 | 87,272 | |||||||||||||||

| Total Equity | 891,718 | 763,980 | 779,241 | 782,140 | 806,643 | |||||||||||||||

| Total Liabilities and Equity | $ | 1,850,526 | $ | 2,148,133 | $ | 2,148,173 | $ | 2,119,823 | $ | 2,161,472 | ||||||||||

| Page | 8 |

| |

| STATEMENTS OF OPERATIONS |

The following table presents our condensed consolidated statements of operations, as adjusted, for each of the five quarters ended March 31, 2015. Operating data in this table are presented inclusive of amounts relating to real properties that have been reclassified as discontinued operations in our GAAP financial statements (amounts in thousands, except per share data):

| Three Months Ended | ||||||||||||||||||||

March 31, 2015 |

December 31, 2014 |

September 30, 2014 |

June 30, 2014 |

March 31, 2014 |

||||||||||||||||

| REVENUE: | ||||||||||||||||||||

| Rental revenue | $ | 59,379 | $ | 57,268 | $ | 56,793 | $ | 55,054 | $ | 56,055 | ||||||||||

| Debt related income | 3,203 | 1,825 | 1,798 | 1,760 | 2,013 | |||||||||||||||

| Total Revenue | 62,582 | 59,093 | 58,591 | 56,814 | 58,068 | |||||||||||||||

| EXPENSES: | ||||||||||||||||||||

| Rental expense | 15,129 | 13,050 | 12,804 | 11,770 | 13,714 | |||||||||||||||

| Real estate depreciation and amortization expense | 20,815 | 22,514 | 21,918 | 22,213 | 22,350 | |||||||||||||||

| General and administrative expenses | 2,737 | 2,928 | 2,739 | 3,125 | 2,819 | |||||||||||||||

| Advisory fees, related party | 4,299 | 4,242 | 4,083 | 3,853 | 3,743 | |||||||||||||||

| Acquisition-related expenses | 423 | 237 | 214 | 252 | — | |||||||||||||||

| Impairment of real estate property | 1,400 | — | 9,500 | — | — | |||||||||||||||

| Total Operating Expenses | 44,803 | 42,971 | 51,258 | 41,213 | 42,626 | |||||||||||||||

| Other Income (Expenses): | ||||||||||||||||||||

| Interest and other income (expense) | 632 | 480 | 429 | 334 | (81 | ) | ||||||||||||||

| Interest expense | (13,981 | ) | (15,354 | ) | (15,276 | ) | (15,105 | ) | (16,465 | ) | ||||||||||

| Loss on extinguishment of debt and financing commitments | (896 | ) | — | — | — | (63 | ) | |||||||||||||

| Gain on sale of real property | 128,667 | 4,452 | — | 2,986 | 33,155 | |||||||||||||||

| Net (Loss) Income | 132,201 | 5,700 | (7,514 | ) | 3,816 | 31,988 | ||||||||||||||

| Net loss (income) attributable to noncontrolling interests | (8,618 | ) | (397 | ) | 475 | (330 | ) | (4,550 | ) | |||||||||||

| NET (LOSS) INCOME ATTRIBUTABLE TO COMMON STOCKHOLDERS | $ | 123,583 | $ | 5,303 | $ | (7,039 | ) | $ | 3,486 | $ | 27,438 | |||||||||

| NET (LOSS) INCOME PER BASIC AND DILUTED COMMON SHARE | $ | 0.69 | $ | 0.03 | $ | (0.04 | ) | $ | 0.02 | $ | 0.15 | |||||||||

| WEIGHTED AVERAGE NUMBER OF COMMON SHARES OUTSTANDING | ||||||||||||||||||||

| Basic | 179,317 | 179,926 | 178,729 | 177,529 | 176,873 | |||||||||||||||

| Diluted | 191,766 | 192,137 | 191,422 | 190,386 | 189,993 | |||||||||||||||

| Weighted average distributions declared per common share | $ | 0.0897 | $ | 0.0872 | $ | 0.0872 | $ | 0.0873 | $ | 0.0874 | ||||||||||

| Page | 9 |

| |

| FUNDS FROM OPERATIONS |

The following tables present NAREIT-Defined Funds From Operations (“FFO”) and Company-defined FFO for each of the five quarters ended March 31, 2015. Operating data in these tables are presented inclusive of amounts relating to real properties that have been reclassified as discontinued operations in our GAAP financial statements (amounts in thousands except for per share amounts and percentages):

| Three Months Ended | ||||||||||||||||||||

March 31, 2015 |

December 31, 2014 |

September 30, 2014 |

June 30, 2014 |

March 31, 2014 |

||||||||||||||||

| Reconciliation of net earnings to FFO: | ||||||||||||||||||||

| Net (loss) income attributable to common stockholders | $ | 123,583 | $ | 5,303 | $ | (7,039 | ) | $ | 3,486 | $ | 27,438 | |||||||||

| Add (deduct) NAREIT-defined adjustments: | ||||||||||||||||||||

| Depreciation and amortization expense | 20,815 | 22,514 | 21,918 | 22,213 | 22,350 | |||||||||||||||

| Gain on disposition of real property | (128,667 | ) | (4,452 | ) | — | (2,986 | ) | (33,155 | ) | |||||||||||

| Impairment of real property | 1,400 | — | 9,500 | — | — | |||||||||||||||

| Noncontrolling interests’ share of adjustments | 6,810 | (1,251 | ) | (2,187 | ) | (1,399 | ) | 2,989 | ||||||||||||

| FFO attributable to common shares-basic | 23,941 | 22,114 | 22,192 | 21,314 | 19,622 | |||||||||||||||

| FFO attributable to dilutive OP units | 1,662 | 1,501 | 1,576 | 1,544 | 1,456 | |||||||||||||||

| FFO attributable to common shares-diluted | $ | 25,603 | $ | 23,615 | $ | 23,768 | $ | 22,858 | $ | 21,078 | ||||||||||

| FFO per share-basic and diluted | $ | 0.13 | $ | 0.12 | $ | 0.12 | $ | 0.12 | $ | 0.11 | ||||||||||

| FFO payout ratio | 67 | % | 71 | % | 70 | % | 73 | % | 79 | % | ||||||||||

| Reconciliation of FFO to Company-Defined FFO: | ||||||||||||||||||||

| FFO attributable to common shares-basic | $ | 23,941 | $ | 22,114 | $ | 22,192 | $ | 21,314 | $ | 19,622 | ||||||||||

| Add (deduct) our adjustments: | ||||||||||||||||||||

| Acquisition-related expenses | 423 | 237 | 214 | 252 | — | |||||||||||||||

| Loss on extinguishment of debt and financing commitments | 896 | — | — | — | 63 | |||||||||||||||

| Unrealized loss on derivatives | 11 | — | — | — | — | |||||||||||||||

| Noncontrolling interests’ share of our adjustments | (86 | ) | (15 | ) | (14 | ) | (17 | ) | (4 | ) | ||||||||||

| Company-Defined FFO attributable to common shares-basic | 25,185 | 22,336 | 22,392 | 21,549 | 19,681 | |||||||||||||||

| Company-Defined FFO attributable to dilutive OP units | 1,748 | 1,516 | 1,590 | 1,561 | 1,460 | |||||||||||||||

| Company-Defined FFO attributable to common shares-diluted | $ | 26,933 | $ | 23,852 | $ | 23,982 | $ | 23,110 | $ | 21,141 | ||||||||||

| Company-Defined FFO per share-basic and diluted | $ | 0.14 | $ | 0.12 | $ | 0.13 | $ | 0.12 | $ | 0.11 | ||||||||||

| Weighted average number of shares outstanding | ||||||||||||||||||||

| Basic | 179,317 | 179,926 | 178,729 | 177,529 | 176,873 | |||||||||||||||

| Diluted | 191,766 | 192,137 | 191,422 | 190,386 | 189,993 | |||||||||||||||

| Page | 10 |

| FUNDS FROM OPERATIONS (continued) |  |

The following table presents certain other supplemental information for each of the five quarters ended March 31, 2015 (amounts in thousands):

| Three Months Ended | ||||||||||||||||||||

March 31, 2015 |

December 31, 2014 |

September 30, 2014 |

June 30, 2014 |

March 31, 2014 |

||||||||||||||||

| Other Supplemental Information | ||||||||||||||||||||

| Capital Expenditures Summary | ||||||||||||||||||||

| Recurring capital expenditures | $ | 2,795 | $ | 4,084 | $ | 2,501 | $ | 1,597 | $ | 3,789 | ||||||||||

| Non-recurring capital improvements | 261 | 818 | 284 | 1,401 | 210 | |||||||||||||||

| Total Capital Expenditures | 3,056 | 4,902 | 2,785 | 2,998 | 3,999 | |||||||||||||||

| Other non-cash adjustments | ||||||||||||||||||||

| Straight-line rent decrease (increase) to rental revenue | 356 | (98 | ) | (1,150 | ) | (485 | ) | (1,305 | ) | |||||||||||

| Amortization of above- and below- market rent (increase) decrease to rental revenue | (353 | ) | (537 | ) | (124 | ) | 152 | (108 | ) | |||||||||||

| Amortization of loan costs and hedges - increase to interest expense | 1,101 | 1,240 | 1,205 | 1,192 | 1,208 | |||||||||||||||

| Amortization of mark-to-market adjustments on borrowings - (decrease) increase to interest expense | (265 | ) | (262 | ) | (276 | ) | (283 | ) | 100 | |||||||||||

| Total other non-cash adjustments | $ | 839 | $ | 343 | $ | (345 | ) | $ | 576 | $ | (105 | ) | ||||||||

| Page | 11 |

| RESULTS OF OPERATIONS |  |

The following tables present revenue and net operating income (“NOI”) of our four operating segments, as adjusted, for each of the five quarters ending March 31, 2015. Our same store portfolio includes all operating properties owned for the entirety of all periods presented, and includes 53 properties acquired prior to January 1, 2014, and owned through March 31, 2015, comprising approximately 8.4 million square feet. (amounts in thousands):

| Three Months Ended | ||||||||||||||||||||

| Revenue: | March 31, 2015 |

December 31, 2014 |

September 30, 2014 |

June 30, 2014 |

March 31, 2014 |

|||||||||||||||

| Same store real property: | ||||||||||||||||||||

| Office | $ | 28,633 | $ | 27,880 | $ | 28,522 | $ | 27,999 | $ | 28,114 | ||||||||||

| Industrial | 1,628 | 1,614 | 1,576 | 1,687 | 1,752 | |||||||||||||||

| Retail | 17,565 | 14,718 | 14,836 | 14,863 | 15,006 | |||||||||||||||

| Total same store real property revenue | 47,826 | 44,212 | 44,934 | 44,549 | 44,872 | |||||||||||||||

| 2014/2015 Acquisitions/Dispositions | 11,553 | 13,056 | 11,859 | 10,505 | 11,183 | |||||||||||||||

| Debt related investments | 3,203 | 1,825 | 1,798 | 1,760 | 2,013 | |||||||||||||||

| Total | $ | 62,582 | $ | 59,093 | $ | 58,591 | $ | 56,814 | $ | 58,068 | ||||||||||

| NOI: | ||||||||||||||||||||

| Same store real property: | ||||||||||||||||||||

| Office | $ | 21,011 | $ | 20,412 | $ | 20,678 | $ | 20,637 | $ | 19,985 | ||||||||||

| Industrial | 1,111 | 1,242 | 1,182 | 1,283 | 1,162 | |||||||||||||||

| Retail | 12,546 | 11,439 | 11,631 | 11,745 | 11,429 | |||||||||||||||

| Total same store real property NOI | 34,668 | 33,093 | 33,491 | 33,665 | 32,576 | |||||||||||||||

| 2014/2015 Acquisitions/Dispositions | 9,582 | 11,125 | 10,498 | 9,619 | 9,765 | |||||||||||||||

| Debt related investments | 3,203 | 1,825 | 1,798 | 1,760 | 2,013 | |||||||||||||||

| Total | $ | 47,453 | $ | 46,043 | $ | 45,787 | $ | 45,044 | $ | 44,354 | ||||||||||

| NOI - cash basis: | ||||||||||||||||||||

| Same store real property: | ||||||||||||||||||||

| Office | $ | 22,322 | $ | 21,411 | $ | 21,168 | $ | 21,434 | $ | 20,153 | ||||||||||

| Industrial | 1,041 | 1,172 | 847 | 1,345 | 1,018 | |||||||||||||||

| Retail | 12,050 | 10,882 | 11,056 | 11,108 | 10,805 | |||||||||||||||

| Total same store real property NOI - cash basis | 35,413 | 33,465 | 33,071 | 33,887 | 31,976 | |||||||||||||||

| 2014/2015 Acquisitions/Dispositions | 8,788 | 10,057 | 9,577 | 9,000 | 8,865 | |||||||||||||||

| Debt related investments | 3,203 | 1,825 | 1,798 | 1,760 | 2,013 | |||||||||||||||

| Total | $ | 47,404 | $ | 45,347 | $ | 44,446 | $ | 44,647 | $ | 42,854 | ||||||||||

| Page | 12 |

| RESULTS OF OPERATIONS (continued) |  |

The following tables present a reconciliation of NOI – Cash Basis and NOI of our four operating segments, as adjusted, to GAAP net income attributable to common stockholders for each of the five quarters ending March 31, 2015 (amounts in thousands):

| Three Months Ended | ||||||||||||||||||||

March 31, 2015 |

December 31, 2014 |

September 30, 2014 |

June 30, 2014 |

March 31, 2014 |

||||||||||||||||

| NOI - cash basis | $ | 47,404 | $ | 45,347 | $ | 44,446 | $ | 44,647 | $ | 42,854 | ||||||||||

| Straight line rent | (356 | ) | 98 | 1,150 | 485 | 1,305 | ||||||||||||||

| Net amortization of above- and below-market lease assets and liabilities, and other non-cash adjustments to rental revenue | 405 | 598 | 191 | (88 | ) | 195 | ||||||||||||||

| NOI | $ | 47,453 | $ | 46,043 | $ | 45,787 | $ | 45,044 | $ | 44,354 | ||||||||||

| Real estate depreciation and amortization expense | (20,815 | ) | (22,514 | ) | (21,918 | ) | (22,213 | ) | (22,350 | ) | ||||||||||

| General and administrative expenses | (2,737 | ) | (2,928 | ) | (2,739 | ) | (3,125 | ) | (2,819 | ) | ||||||||||

| Advisory fees, related party | (4,299 | ) | (4,242 | ) | (4,083 | ) | (3,853 | ) | (3,743 | ) | ||||||||||

| Acquisition-related expenses | (423 | ) | (237 | ) | (214 | ) | (252 | ) | - | |||||||||||

| Impairment of real estate property | (1,400 | ) | - | (9,500 | ) | - | - | |||||||||||||

| Interest and other income | 632 | 480 | 429 | 334 | (81 | ) | ||||||||||||||

| Interest expense | (13,981 | ) | (15,354 | ) | (15,276 | ) | (15,105 | ) | (16,465 | ) | ||||||||||

| Loss on extinguishment of debt and financing commitments | (896 | ) | - | - | - | (63 | ) | |||||||||||||

| Gain on sale of real property | 128,667 | 4,452 | - | 2,986 | 33,155 | |||||||||||||||

| Net (income) loss attributable to noncontrolling interests | (8,618 | ) | (397 | ) | 475 | (330 | ) | (4,550 | ) | |||||||||||

| Net (loss) income attributable to common stockholders |

$ | 123,583 | $ | 5,303 | $ | (7,039 | ) | $ | 3,486 | $ | 27,438 | |||||||||

The following tables present details regarding our capital expenditures for each of the five quarters ending March 31, 2015 (amounts in thousands):

| Three Months Ended | ||||||||||||||||||||

| Recurring Capital Expenditures: | March 31, 2015 |

December 31, 2014 |

September 30, 2014 |

June 30, 2014 |

March 31, 2014 |

|||||||||||||||

| Land and building improvements | $ | 848 | $ | 1,626 | $ | 311 | $ | 546 | $ | 1,056 | ||||||||||

| Tenant improvements | 1,500 | 1,250 | 1,045 | 406 | 1,770 | |||||||||||||||

| Leasing costs | 447 | 1,208 | 1,145 | 645 | 963 | |||||||||||||||

| Total recurring capital expenditures | $ | 2,795 | $ | 4,084 | $ | 2,501 | $ | 1,597 | $ | 3,789 | ||||||||||

| Non-recurring Capital Expenditures: | ||||||||||||||||||||

| Land and building improvements | $ | 15 | $ | 93 | $ | 94 | $ | 19 | $ | 22 | ||||||||||

| Tenant improvements | 205 | 618 | 149 | 1,113 | 9 | |||||||||||||||

| Leasing costs | 41 | 107 | 41 | 269 | 179 | |||||||||||||||

| Total non-recurring capital expenditures | $ | 261 | $ | 818 | $ | 284 | $ | 1,401 | $ | 210 | ||||||||||

| Page | 13 |

| FINANCE & CAPITAL |  |

The following table describes certain information about our capital structure. Amounts reported as financing capital and our joint venture partners’ interests are presented on a GAAP basis. Amounts reported as equity capital other than our joint venture partners’ interests are presented based on the NAV as of March 31, 2015 (shares and dollar amounts other than price per share / unit in thousands).

| FINANCING: | As of March 31, 2015 | |||

| Mortgage notes and other secured borrowings | $ | 652,127 | ||

| Unsecured borrowings | 181,000 | |||

| Total Financing | $ | 833,127 | ||

| EQUITY: | Shares / Units | Percentage of aggregate Shares and Units outstanding |

NAV Per Share / Unit | Value | ||||||||||||

| Class E Common Stock | 162,188 | 84.7 | % | $ | 7.31 | $ | 1,184,822 | |||||||||

| Class A Common Stock | 1,219 | 0.6 | % | 7.31 | 8,901 | |||||||||||

| Class W Common Stock | 1,161 | 0.6 | % | 7.31 | 8,478 | |||||||||||

| Class I Common Stock | 13,742 | 7.2 | % | 7.31 | 100,389 | |||||||||||

| Class E OP Units | 13,124 | 6.9 | % | 7.31 | 95,863 | |||||||||||

| Total/Weighted Average | 191,434 | 100.0 | % | $ | 7.31 | $ | 1,398,453 | |||||||||

| Joint venture partners’ noncontrolling interests | 2,915 | |||||||||||||||

| Total Equity | 1,401,368 | |||||||||||||||

| TOTAL CAPITALIZATION | $ | 2,234,495 | ||||||||||||||

| Page | 14 |

| FINANCE & CAPITAL (continued) |

The following table presents a summary of our borrowings as of March 31, 2015 (dollar amounts in thousands):

Weighted Average Stated Interest Rate |

Outstanding Balance |

Gross Investment Amount Securing Borrowings (1) |

||||||||||

| Fixed rate mortgages | 5.9 | % | $ | 610,581 | $ | 1,198,881 | ||||||

| Floating rate mortgages | 3.2 | % | 8,160 | 16,125 | ||||||||

| Total mortgage notes | 5.8 | % | 618,741 | 1,215,006 | ||||||||

| Repurchase facility (2) | 2.8 | % | 33,386 | 43,365 | ||||||||

| Total secured borrowings | 5.7 | % | 652,127 | 1,258,371 | ||||||||

| Line of credit (2) | 2.2 | % | 81,000 | N/A | ||||||||

| Term loan (2) | 1.9 | % | 100,000 | N/A | ||||||||

| Total unsecured borrowings | 2.0 | % | 181,000 | N/A | ||||||||

| Total borrowings | 4.9 | % | $ | 833,127 | $ | 1,258,371 | ||||||

| (1) | “Gross Investment Amount” as used here and throughout this document represents the allocated gross basis of real property, calculated in accordance with GAAP, inclusive of the effect of gross intangible lease liabilities totaling approximately $80.9 million and before accumulated depreciation and amortization of approximately $455.1 million as of March 31, 2015. |

| (2) | Our repurchase facility and unsecured floating rate borrowings are effectively fixed by the use of fixed-for-floating rate swap instruments as of March 31, 2015. The stated interest rates disclosed above include the impact of these swaps. |

The following table presents a summary of our covenants and our actual results for each of the five quarterly periods ended March 31, 2015. Results for March 31, 2015, December 31, 2014 and September 30, 2014 were calculated in accordance with the terms of our amended and restated $550 million senior unsecured term loan and revolving line of credit, which we closed on January 13, 2015. Results for June 30, 2014, and March 31, 2014 were calculated in accordance with the terms of our previous senior unsecured term loan and revolving credit agreement, which we closed in December 2012.

| Actual as of: | |||||||||||||||||

| Portfolio-Level Covenants: | Covenant | March 31, 2015 |

December 31, 2014 |

September 30, 2014 |

June 30, 2014 |

March 31, 2014 |

|||||||||||

| Leverage | < 60% | 36.2 | % | 43.9 | % | 42.8 | % | 45.4 | % | 47.6 | % | ||||||

| Fixed Charge Coverage | > 1.50 | 2.3 | 2.1 | 2.2 | 2.0 | 1.9 | |||||||||||

| Secured Indebtedness | < 55% | 28.3 | % | 31.2% | 31.3 | % | 34.2 | % | 36.3 | % | |||||||

| Unencumbered Pool Covenants: | |||||||||||||||||

| Unsecured Interest Coverage | >2.0 | 8.4 | 9.4 | 9.9 | N/A | N/A | |||||||||||

| Leverage | < 60% | 17.8 | % | 38.8% | 35.9 | % | 33.5 | % | 38.7 | % | |||||||

| Page | 15 |

| FINANCE & CAPITAL (continued) |

The following table presents a detailed analysis of our borrowings outstanding as of March 31, 2015 (dollar amounts in thousands).

| As of March 31, 2015 | ||||||||||||||||||

| Borrowings | Principal Balance | Secured / Unsecured | Maturity Date | Extension Options | % of Total Borrowings |

Fixed or Floating Interest Rate |

Current Interest Rate |

|||||||||||

| Repurchase Facility | $ | 33,386 | Secured | 5/30/2015 | 2 - 1 Year | 4.0 | % | Floating (1) | 2.84 | % | ||||||||

| Campus Road Office Center (2) | 33,501 | Secured | 7/10/2015 | None | 4.0 | % | Fixed | 4.75 | % | |||||||||

| Preston Sherry Plaza | 22,381 | Secured | 9/1/2015 | None | 2.7 | % | Fixed | 5.85 | % | |||||||||

| Mansfield (2) | 8,307 | Secured | 10/1/2015 | None | 1.0 | % | Fixed | 6.03 | % | |||||||||

| Total 2015 | 97,575 | 11.7 | % | 4.46 | % | |||||||||||||

| Abington | 4,721 | Secured | 1/1/2016 | None | 0.6 | % | Fixed | 6.75 | % | |||||||||

| Hyannis | 4,675 | Secured | 1/1/2016 | None | 0.6 | % | Fixed | 6.75 | % | |||||||||

| Austin-Mueller Health Center (Seton) | 17,591 | Secured | 1/1/2016 | None | 2.1 | % | Fixed | 7.50 | % | |||||||||

| 40 Boulevard | 8,160 | Secured | 1/24/2016 | None | 1.0 | % | Floating | 3.18 | % | |||||||||

| DeGuigne | 7,057 | Secured | 2/1/2016 | None | 0.8 | % | Fixed | 7.78 | % | |||||||||

| Washington Commons | 21,300 | Secured | 2/1/2016 | None | 2.5 | % | Fixed | 5.94 | % | |||||||||

| 1300 Connecticut | 33,985 | Secured | 4/10/2016 | None | 4.1 | % | Fixed | 7.25 | % | |||||||||

| 1300 Connecticut B Note | 11,596 | Secured | 4/10/2016 | None | 1.4 | % | Fixed | 5.53 | % | |||||||||

| Riverport Industrial Portfolio | 8,126 | Secured | 4/1/2016 | None | 1.0 | % | Fixed | 7.38 | % | |||||||||

| 655 Montgomery | 56,782 | Secured | 6/11/2016 | None | 6.8 | % | Fixed | 6.01 | % | |||||||||

| Jay Street | 23,500 | Secured | 7/11/2016 | None | 2.8 | % | Fixed | 6.05 | % | |||||||||

| Bala Pointe | 24,000 | Secured | 9/1/2016 | None | 2.9 | % | Fixed | 5.89 | % | |||||||||

| Harborside | 110,032 | Secured | 12/10/2016 | 2 - 1 Year | 13.2 | % | Fixed | 5.50 | % | |||||||||

| Total 2016 | 331,525 | 39.8 | % | 6.04 | % | |||||||||||||

| Shiloh Road | 22,700 | Secured | 1/8/2017 | None | 2.7 | % | Fixed | 5.57 | % | |||||||||

| Bandera Road | 21,500 | Secured | 2/8/2017 | None | 2.6 | % | Fixed | 5.46 | % | |||||||||

| Eastern Retail Portfolio | 110,000 | Secured | 6/11/2017 | None | 13.2 | % | Fixed | 5.51 | % | |||||||||

| Wareham | 24,400 | Secured | 8/8/2017 | None | 2.9 | % | Fixed | 6.13 | % | |||||||||

| Kingston | 10,574 | Secured | 11/1/2017 | None | 1.3 | % | Fixed | 6.33 | % | |||||||||

| Sandwich | 15,825 | Secured | 11/1/2017 | None | 1.9 | % | Fixed | 6.33 | % | |||||||||

| Total 2017 | 204,999 | 24.6 | % | 5.69 | % | |||||||||||||

| Term Loan | 100,000 | Unsecured | 1/31/2018 | 2 - 1 Year | 12.0 | % | Floating (1) | 1.86 | % | |||||||||

| Line of Credit | 81,000 | Unsecured | 1/31/2019 | 1 - 1 Year | 9.7 | % | Floating (1) | 2.16 | % | |||||||||

| Norwell | 5,406 | Secured | 10/1/2022 | None | 0.6 | % | Fixed | 6.76 | % | |||||||||

| Harwich | 5,553 | Secured | 9/1/2028 | None | 0.7 | % | Fixed | 5.24 | % | |||||||||

| New Bedford | 7,836 | Secured | 12/1/2029 | None | 0.9 | % | Fixed | 5.91 | % | |||||||||

| Total 2018 - 2029 | 199,795 | 23.9 | % | 2.37 | % | |||||||||||||

| Total borrowings | 833,894 | 100.0 | % | 4.89 | % | |||||||||||||

| Add: mark-to-market adjustment on assumed debt | 1,710 | |||||||||||||||||

| Less: GAAP principal amortization on restructured debt | (2,477) | |||||||||||||||||

| Total Borrowings (GAAP basis) | $ | 833,127 | ||||||||||||||||

| (1) | Our repurchase facility borrowings, term loan borrowings, and line of credit borrowings are effectively fixed by the use of fixed-for-floating rate swap instruments as of March 31, 2015. The stated interest rates disclosed above include the impact of these swaps. |

| (2) | Subsequent to March 31, 2015, we repaid amounts due on our Campus Road Office Center and Mansfield mortgage notes using proceeds from our line of credit. |

| Page | 16 |

| REAL PROPERTIES |

The following table describes our operating property portfolio as of March 31, 2015 (dollar and square feet amounts in thousands):

| Market | Number of Properties |

Gross Investment Amount |

Net Rentable Square Feet |

Secured Indebtedness (1) | % of Gross Investment Amount | % of Total Net Rentable Square Feet |

% Leased (2) | |||||||||||||

| Office Properties: | ||||||||||||||||||||

| Washington, DC | 3 | $ | 282,695 | 878 | $ | 45,581 | 13.2 | % | 9.4 | % | 99.3 | % | ||||||||

| Northern New Jersey | 1 | 212,194 | 594 | 110,032 | 9.9 | % | 6.4 | % | 100.0 | % | ||||||||||

| East Bay, CA | 1 | 145,242 | 405 | — | 6.8 | % | 4.3 | % | 100.0 | % | ||||||||||

| San Francisco, CA | 1 | 118,913 | 270 | 56,781 | 5.6 | % | 2.9 | % | 91.4 | % | ||||||||||

| Denver, CO | 1 | 86,394 | 257 | — | 4.0 | % | 2.8 | % | 95.0 | % | ||||||||||

| Austin, TX | 2 | 82,563 | 311 | 17,591 | 3.9 | % | 3.3 | % | 96.1 | % | ||||||||||

| Silicon Valley, CA | 2 | 62,276 | 196 | 30,557 | 2.9 | % | 2.1 | % | 94.0 | % | ||||||||||

| Princeton, NJ | 1 | 51,247 | 167 | 33,501 | 2.4 | % | 1.8 | % | 100.0 | % | ||||||||||

| Chicago, IL | 2 | 48,791 | 305 | 29,460 | 2.3 | % | 3.3 | % | 90.2 | % | ||||||||||

| Philadelphia, PA | 1 | 42,283 | 173 | 24,000 | 2.0 | % | 1.9 | % | 92.5 | % | ||||||||||

| Dallas, TX | 1 | 35,165 | 149 | 22,381 | 1.6 | % | 1.6 | % | 87.1 | % | ||||||||||

| Minneapolis/St Paul, MN | 1 | 29,504 | 107 | — | 1.4 | % | 1.1 | % | 100.0 | % | ||||||||||

| Los Angeles, CA | 1 | 15,031 | 111 | — | 0.7 | % | 1.2 | % | 0.0 | % | ||||||||||

| Fayetteville, AR | 1 | 11,695 | 63 | — | 0.5 | % | 0.7 | % | 100.0 | % | ||||||||||

| Total/Weighted Average Office: 19 properties, 14 markets with average annual rent of $29.46 per sq. ft. | 19 | 1,223,993 | 3,986 | 369,884 | 57.2 | % | 42.8 | % | 94.0 | % | ||||||||||

| Industrial Properties: | ||||||||||||||||||||

| Dallas, TX | 1 | 35,738 | 446 | 22,700 | 1.7 | % | 4.8 | % | 35.1 | % | ||||||||||

| Central Kentucky | 1 | 27,053 | 727 | — | 1.3 | % | 7.8 | % | 100.0 | % | ||||||||||

| Louisville, KY | 4 | 26,955 | 736 | 8,126 | 1.3 | % | 7.9 | % | 69.2 | % | ||||||||||

| Total/Weighted Average Industrial: 6 properties, three markets with average annual rent of $3.49 per sq. ft. | 6 | 89,746 | 1,909 | 30,826 | 4.3 | % | 20.5 | % | 72.9 | % | ||||||||||

| Retail Properties: | ||||||||||||||||||||

| Greater Boston | 27 | 547,346 | 2,294 | 87,298 | 25.6 | % | 24.5 | % | 94.1 | % | ||||||||||

| Philadelphia, PA | 1 | 104,894 | 426 | 67,800 | 4.9 | % | 4.6 | % | 98.8 | % | ||||||||||

| Washington, DC | 1 | 62,516 | 233 | — | 2.9 | % | 2.5 | % | 98.4 | % | ||||||||||

| Raleigh, NC | 1 | 45,300 | 142 | 26,200 | 2.1 | % | 1.5 | % | 100.0 | % | ||||||||||

| San Antonio, TX | 1 | 32,065 | 161 | 21,500 | 1.5 | % | 1.7 | % | 89.6 | % | ||||||||||

| Jacksonville, FL | 1 | 19,494 | 73 | — | 0.9 | % | 0.8 | % | 20.3 | % | ||||||||||

| Pittsburgh, PA | 1 | 13,668 | 103 | 16,000 | 0.6 | % | 1.1 | % | 94.1 | % | ||||||||||

| Total/Weighted Average Retail: 33 properties, seven markets with average annual rent of $16.49 per sq. ft. | 33 | 825,283 | 3,432 | 218,798 | 38.5 | % | 36.7 | % | 93.4 | % | ||||||||||

| Grand Total/Weighted Average | 58 | $ | 2,139,022 | 9,327 | $ | 619,508 | 100.0 | % | 100.0 | % | 89.5 | % | ||||||||

| (1) | Secured indebtedness represents the principal balance outstanding and does not include our mark-to-market adjustment on debt or GAAP principal amortization on our troubled debt restructuring. |

| (2) | Based on executed leases as of March 31, 2015. |

| Page | 17 |

| LEASING ACTIVITY |

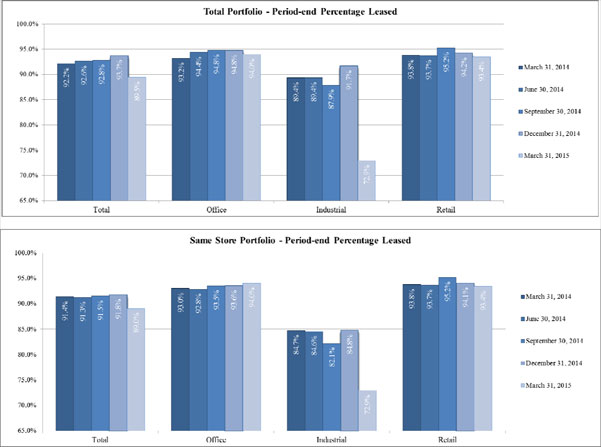

The following graphs highlight our total portfolio and same store portfolio percentage leased at the end of each of the five quarters ended March 31, 2015, by segment and in total:

| Page | 18 |

| |

| LEASING ACTIVITY (continued) |

The following table presents our lease expirations, by segment and in total, as of March 31, 2015 (dollars and square feet in thousands):

| Total | Office | Industrial | Retail | ||||||||||||||||||||||||||||

| Year | Number of Leases Expiring |

Annualized Base Rent | % of Total Annualized Base Rent | Square Feet | Number of Leases Expiring |

Annualized Base Rent | Square Feet | Number of Leases Expiring |

Annualized Base Rent | Square Feet | Number of Leases Expiring |

Annualized Base Rent | Square Feet | ||||||||||||||||||

| 2015 (1) | 124 | $ | 10,689 | 6.4% | 664 | 70 | $ | 6,661 | 358 | 1 | $ | 182 | 52 | 53 | $ | 3,846 | 254 | ||||||||||||||

| 2016 | 77 | 21,258 | 12.6% | 884 | 49 | 18,635 | 702 | — | — | — | 28 | 2,623 | 182 | ||||||||||||||||||

| 2017 | 73 | 41,667 | 24.8% | 1,358 | 37 | 37,466 | 988 | 2 | 183 | 53 | 34 | 4,018 | 317 | ||||||||||||||||||

| 2018 | 90 | 10,007 | 6.0% | 442 | 59 | 7,636 | 315 | 1 | 39 | 3 | 30 | 2,332 | 124 | ||||||||||||||||||

| 2019 | 96 | 22,970 | 13.7% | 1,127 | 52 | 13,084 | 418 | 2 | 1,226 | 212 | 42 | 8,660 | 497 | ||||||||||||||||||

| 2020 | 70 | 15,888 | 9.4% | 760 | 31 | 5,283 | 228 | — | — | — | 39 | 10,605 | 532 | ||||||||||||||||||

| 2021 | 30 | 12,353 | 7.3% | 1,386 | 13 | 5,623 | 180 | 3 | 3,051 | 1,021 | 14 | 3,679 | 185 | ||||||||||||||||||

| 2022 | 23 | 7,813 | 4.6% | 424 | 13 | 3,286 | 102 | — | — | — | 10 | 4,527 | 322 | ||||||||||||||||||

| 2023 | 19 | 14,069 | 8.4% | 622 | 10 | 9,977 | 340 | — | — | — | 9 | 4,092 | 282 | ||||||||||||||||||

| 2024 | 17 | 3,457 | 2.1% | 238 | 4 | 838 | 31 | — | — | — | 13 | 2,619 | 207 | ||||||||||||||||||

| Thereafter | 22 | 7,947 | 4.7% | 441 | 3 | 1,894 | 85 | 1 | 178 | 51 | 18 | 5,875 | 305 | ||||||||||||||||||

| Total | 641 | $ | 168,118 | 100.0% | 8,346 | 341 | $ | 110,383 | 3,747 | 10 | $ | 4,859 | 1,392 | 290 | $ | 52,876 | 3,207 | ||||||||||||||

| (1) | Includes leases that are on a month-to-month basis. |

The following table presents our top 10 tenants by annualized base rent and their related industry sector, as of March 31, 2015 (dollars and square feet in thousands):

| Tenant | Locations | Industry Sector | Annualized

Base Rent (1) |

% of Total Annualized Base Rent |

Square Feet |

% of Occupied Square Feet | |||||||

| 1 | Charles Schwab & Co, Inc | 1 | Securities, Commodities, Fin. Inv./Rel. Activities | $ | 22,992 | 13.7% | 594 | 7.1% | |||||

| 2 | Sybase | 1 | Publishing Information (except Internet) | 17,971 | 10.7% | 405 | 4.9% | ||||||

| 3 | Northrop Grumman | 1 | Professional, Scientific and Technical Services | 15,585 | 9.3% | 575 | 6.9% | ||||||

| 4 | Stop & Shop | 15 | Food and Beverage Stores | 14,187 | 8.4% | 882 | 10.6% | ||||||

| 5 | Novo Nordisk | 1 | Chemical Manufacturing | 4,444 | 2.6% | 167 | 2.0% | ||||||

| 6 | Seton Health Care | 1 | Hospitals | 4,339 | 2.6% | 156 | 1.9% | ||||||

| 7 | Shaw’s Supermarket | 4 | Food and Beverage Stores | 3,944 | 2.3% | 240 | 2.9% | ||||||

| 8 | I.A.M. National Pension Fund | 1 | Funds, Trusts and Other Financial Vehicles | 3,066 | 1.8% | 63 | 0.8% | ||||||

| 9 | TJ Maxx (Marshalls,TJ Maxx, HomeGoods) | 7 | Clothing and Clothing Accessories Stores | 2,592 | 1.5% | 272 | 3.3% | ||||||

| 10 | Home Depot | 1 | Building Material and Garden Equipment and Supplies Dealers | 2,469 | 1.5% | 102 | 1.2% | ||||||

| Total | 33 | $ | 91,589 | 54.4% | 3,456 | 41.6% | |||||||

| (1) | Annualized base rent represents the annualized monthly base rent of executed leases as of March 31, 2015. |

| Page | 19 |

| |

| LEASING ACTIVITY (continued) |

The following series of tables details leasing activity during the four quarters ended March 31, 2015:

| Quarter | Number of Leases Signed |

Gross Leasable Area (“GLA”) Signed |

Average Rent Per Sq. Ft. |

Average Growth / Straight Line Rent |

Weighted Average Lease term (mos) |

Tenant Improvements & Incentives Per Sq. Ft. |

Average Free Rent (mos) |

|||||||||||||||||||||

| Office Comparable (1) | ||||||||||||||||||||||||||||

| Q1 2015 | 12 | 36,394 | $ | 28.59 | 28.9 | % | 48 | $ | 11.16 | 1.6 | ||||||||||||||||||

| Q4 2014 | 9 | 34,887 | 29.69 | 12.6 | % | 55 | 8.32 | 2.8 | ||||||||||||||||||||

| Q3 2014 | 10 | 87,176 | 25.26 | 10.8 | % | 94 | 18.62 | 2.0 | ||||||||||||||||||||

| Q2 2014 | 11 | 32,049 | 18.64 | 44.4 | % | 53 | 14.81 | 1.3 | ||||||||||||||||||||

| Total - twelve months | 42 | 190,506 | $ | 25.49 | 17.6 | % | 71 | $ | 14.67 | 1.9 | ||||||||||||||||||

| Industrial Comparable (1) | ||||||||||||||||||||||||||||

| Q1 2015 | 1 | 1,200 | $ | 3.75 | 7.0 | % | 36 | $ | 0.34 | — | ||||||||||||||||||

| Q4 2014 | 1 | 50,500 | 3.82 | 155.2 | % | 124 | 7.30 | 4.0 | ||||||||||||||||||||

| Q3 2014 | 3 | 852,000 | 3.25 | -4.2 | % | 74 | 3.65 | 1.7 | ||||||||||||||||||||

| Q2 2014 | 0 | — | 0.00 | 0.0 | % | 0 | 0.00 | — | ||||||||||||||||||||

| Total - twelve months | 5 | 903,700 | $ | 3.30 | -0.8 | % | 77 | $ | 3.85 | 1.8 | ||||||||||||||||||

| Retail Comparable (1) | ||||||||||||||||||||||||||||

| Q1 2015 | 12 | 140,021 | $ | 18.49 | 9.6 | % | 53 | $ | 3.46 | 0.1 | ||||||||||||||||||

| Q4 2014 | 14 | 49,789 | 24.67 | 7.0 | % | 42 | 0.75 | — | ||||||||||||||||||||

| Q3 2014 | 9 | 32,770 | 23.54 | 7.7 | % | 44 | 0.65 | — | ||||||||||||||||||||

| Q2 2014 | 15 | 69,035 | 21.17 | 14.0 | % | 62 | 2.51 | — | ||||||||||||||||||||

| Total - twelve months | 50 | 291,615 | $ | 20.57 | 9.9 | % | 52 | $ | 2.46 | — | ||||||||||||||||||

| Total Comparable Leasing (1) | ||||||||||||||||||||||||||||

| Q1 2015 | 25 | 177,615 | $ | 20.33 | 14.7 | % | 52 | $ | 5.01 | 0.4 | ||||||||||||||||||

| Q4 2014 | 24 | 135,176 | 12.93 | 14.9 | % | 76 | 5.15 | 2.2 | ||||||||||||||||||||

| Q3 2014 | 22 | 971,946 | 6.13 | 2.1 | % | 75 | 4.90 | 1.7 | ||||||||||||||||||||

| Q2 2014 | 26 | 101,084 | 20.45 | 21.5 | % | 59 | 6.41 | 0.4 | ||||||||||||||||||||

| Total - twelve months | 97 | 1,385,821 | $ | 9.03 | 9.4 | % | 71 | $ | 5.05 | 1.5 | ||||||||||||||||||

| Total Leasing | ||||||||||||||||||||||||||||

| Q1 2015 | 42 | 297,686 | $ | 17.64 | 57 | $ | 9.01 | 0.6 | ||||||||||||||||||||

| Q4 2014 | 35 | 214,761 | 13.83 | 53 | 5.32 | 1.6 | ||||||||||||||||||||||

| Q3 2014 | 31 | 1,055,135 | 6.76 | 74 | 6.32 | 1.7 | ||||||||||||||||||||||

| Q2 2014 | 32 | 113,278 | 20.49 | 58 | 7.68 | 0.6 | ||||||||||||||||||||||

| Total - twelve months | 140 | 1,680,860 | $ | 9.91 | 67 | $ | 6.76 | 1.4 | ||||||||||||||||||||

| (1) | Comparable leases comprise leases for which prior leases were in place for the same suite within 12 months of executing a new lease. Comparable leases must have terms of at least six months and the square footage of the suite occupied by the new tenant cannot deviate by more than 50% from the size of the old lease’s suite. |

| Page | 20 |

| |

| INVESTMENT ACTIVITY |

The following tables describe changes in our portfolio from December 31, 2013 through March 31, 2015 (dollars and square feet in thousands):

| Square Feet | ||||||||||||||||||||

| Properties and Square Feet Activity | Number of Properties | Total | Office | Industrial | Retail | |||||||||||||||

| Properties owned as of | ||||||||||||||||||||

| December 31, 2013 | 82 | 15,250 | 5,132 | 7,046 | 3,072 | |||||||||||||||

| 2014 Acquisitions | 3 | 585 | 262 | — | 323 | |||||||||||||||

| 2014 Dispositions | (17 | ) | (3,973 | ) | (300 | ) | (3,563 | ) | (110 | ) | ||||||||||

| Building remeasurement and other (1) | — | 9 | — | 9 | — | |||||||||||||||

| December 31, 2014 | 68 | 11,871 | 5,094 | 3,492 | 3,285 | |||||||||||||||

| Q1 2015 Acquisitions | 2 | 298 | 155 | — | 143 | |||||||||||||||

| Q1 2015 Dispositions | (13 | ) | (2,846 | ) | (1,263 | ) | (1,583 | ) | — | |||||||||||

| Building remeasurement and other (1) | 1 | 4 | — | — | 4 | |||||||||||||||

| March 31, 2015 | 58 | 9,327 | 3,986 | 1,909 | 3,432 | |||||||||||||||

| (1) | Building remeasurements reflect changes in gross leasable area due to renovations or expansions of existing properties. In the first quarter of 2015 we retained one building of a two-building campus while disposing of the other building, resulting in an additional property that we did not previously consider a distinct property. |

| Property acquisitions | Location | Acquisition Date | Number of Properties | Purchase Price | Square Feet | ||||||

| 2014: | |||||||||||

| Durgin Square | Portsmouth, NH | 5/28/2014 | 1 | $ | 24,700 | 138 | |||||

| 1st Avenue Plaza | Denver, CO | 8/22/2014 | 1 | 75,000 | 262 | ||||||

| Salt Pond | Narragansett, RI | 11/4/2014 | 1 | 39,160 | 185 | ||||||

| Total 2014 | 3 | $ | 138,860 | 585 | |||||||

| 2015: | |||||||||||

| Rialto | Austin, TX | 1/15/2015 | 1 | $ | 37,300 | 155 | |||||

| South Cape | Mashpee, MA | 3/18/2015 | 1 | 35,450 | 143 | ||||||

| Total 2015 | 2 | $ | 72,750 | 298 | |||||||

| Page | 21 |

| |

| INVESTMENT ACTIVITY (continued) |

| Property dispositions | Segment | Location | Disposition Date | Number of Properties | Contract Sales Price | Square Feet | ||||||||||||

| (dollars and square feet in thousands) | ||||||||||||||||||

| During 2014 | ||||||||||||||||||

| Industrial Portfolio | Industrial | Various (1) | 1/22/2014 | 12 | $ | 175,000 | 3,386 | |||||||||||

| Cranston | Retail | Cranston, RI | 2/18/2014 | 1 | 6,750 | 110 | ||||||||||||

| Shackleford | Office | Little Rock, AR | 2/25/2014 | 1 | 19,550 | 102 | ||||||||||||

| Shadelands | Office | East Bay, CA | 6/13/2014 | 1 | 5,700 | 60 | ||||||||||||

| Lundy (2) | Industrial | Silicon Valley, CA | 10/15/2014 | 1 | 13,579 | 177 | ||||||||||||

| South Havana | Office | Denver, CO | 11/7/2014 | 1 | 9,100 | 138 | ||||||||||||

| Total for the year ended December 31, 2014 | 17 | $ | 229,679 | 3,973 | ||||||||||||||

| During 2015 | ||||||||||||||||||

| Park Place | Office | Dallas, TX | 1/16/2015 | 1 | $ | 46,600 | 177 | |||||||||||

| Office and Industrial Portfolio | Office and Industrial | Various (3) | 3/11/2015 | 12 | 398,635 | 2,669 | ||||||||||||

| Total for the three months ended March 31, 2015 | 13 | $ | 445,235 | 2,846 | ||||||||||||||

| (1) | The Industrial Portfolio comprised 12 industrial buildings located in the Atlanta, GA, Cincinnati, OH, Central Pennsylvania, Columbus, OH, Dallas, TX, Indianapolis, IN, and Minneapolis, MN markets. |

| (2) | Sales price for the Lundy property represents the principal balance outstanding of the mortgage note on the property as of the date of the foreclosure sale. Due to the contractual balance of the mortgage note, we did not receive any proceeds from the sale of Lundy. |

| (3) | The Office and Industrial Portfolio comprised (i) six office properties comprising 1.1 million net rentable square feet located in Los Angeles, CA (three properties), Northern New Jersey, Miami, FL, and Dallas, TX, and (ii) six industrial properties comprising 1.6 million net rentable square feet located in Los Angeles, CA, Dallas, TX, Cleveland, OH, Chicago, IL, Houston, TX, and Denver, CO. |

| Page | 22 |

| |

| DEFINITIONS |

This section contains an explanation of certain non-GAAP financial measures we provide in other sections of this document, as well as the reasons why management believes these measures provide useful information to investors about the Company’s financial condition or results of operations. Additional detail can be found in the Portfolio’s most recent annual report on Form 10-K and quarterly report on Form 10-Q, as well as other documents filed with or furnished to the Securities and Exchange Commission from time to time.

2014 Annual Report on Form 10-K

We refer to our Annual Report on Form 10-K for the period ended December 31, 2014, filed with the Securities and Exchange Commission on March 3, 2015, as our “2014 Annual Report on Form 10-K.”

Annualized Base Rent

Annualized base rent represents the annualized monthly base rent of leases executed as of March 31, 2015.

Comparable leases

Comparable leases comprise leases for which prior leases were in place for the same suite within 12 months of executing a new lease. Comparable leases must have terms of at least six months and the square footage of the suite occupied by the new tenant cannot deviate by more than 50% from the size of the old lease’s suite.

Fair Value as determined by our NAV Valuation Procedures

When the fair value of our real estate assets is calculated for the purposes of determining our NAV per share, the calculation is done using the fair value methodologies detailed within the Financial Accounting Standards Board Accounting Standards Codification under Topic 820, Fair Value Measurements and Disclosures (“ASC Topic 820”). However, our valuation procedures and our NAV are not subject to GAAP and will not be subject to independent audit. In the determination of our NAV, the value of certain of our assets and liabilities are generally determined based on their carrying amounts under GAAP; however, those principles are generally based upon historic cost and therefore may not be determined in accordance with ASC Topic 820. Readers should refer to our audited financial statements for our net book value determined in accordance with GAAP from which one can derive our net book value per share by dividing our stockholders’ equity by shares of our common stock outstanding as of the date of measurement.

Our valuation procedures, which address specifically each category of our assets and liabilities and are applied separately from the preparation of our financial statements in accordance with GAAP, involve adjustments from historical cost. There are certain factors which cause NAV to be different from net book value on a GAAP basis. Most significantly, the valuation of our real estate assets, which is the largest component of our NAV calculation, will be provided to us by the Independent Valuation Firm on a daily basis. For GAAP purposes, these assets are generally recorded at depreciated or amortized cost. Other examples that will cause our NAV to differ from our GAAP net book value include the straight-lining of rent, which results in a receivable for GAAP purposes that is not included in the determination of our NAV, and, for purposes of determining our NAV, the assumption of a value of zero in certain instances where the balance of a loan exceeds the value of the underlying real estate properties, where GAAP net book value would reflect a negative equity value for such real estate properties, even if such loans are non-recourse. Third party appraisers may value our individual real estate assets using appraisal standards that deviate from market value standards under GAAP. The use of such appraisal standards may cause our NAV to deviate from GAAP fair value principles. We did not develop our valuation procedures with the intention of complying with fair value concepts under GAAP and, therefore, there could be differences between our fair values and the fair values derived from the principal market or most advantageous market concepts of establishing fair value under GAAP.

We include no discounts to our NAV for the illiquid nature of our shares, including the limitations on your ability to redeem shares under our share redemption programs and our ability to suspend or terminate our share redemption programs at any time. Our NAV generally does not consider exit costs (e.g. selling costs and commissions related to the sale of a property) that would likely be incurred if our assets and liabilities were liquidated or sold. While we may use market pricing concepts to value individual components of our NAV, our per share NAV is not derived from the market pricing information of open-end real estate funds listed on stock exchanges.

Please note that our NAV is not a representation, warranty or guarantee that: (1) we would fully realize our NAV upon a sale of our assets; (2) shares of our common stock would trade at our per share NAV on a national securities exchange; or (3) a stockholder would be able to realize the per share NAV if such stockholder attempted to sell his or her shares to a third party.

| Page | 23 |

| |

| DEFINITIONS (continued) |

Funds From Operations (“FFO”)

We believe that FFO, as defined by the National Association of Real Estate Investment Trusts (“NAREIT”), is a meaningful supplemental measure of our operating performance because historical cost accounting for real estate assets in accordance with U.S. Generally Accepted Accounting Principles (“GAAP”) implicitly assumes that the value of real estate assets diminishes predictably over time, as reflected through depreciation and amortization expense. However, since real estate values have historically risen or fallen with market and other conditions, many industry investors and analysts have considered presentation of operating results for real estate companies that use historical cost accounting to be insufficient. Thus, NAREIT created FFO as a supplemental measure of operating performance for real estate investment trusts that consists of net income (loss), calculated in accordance with GAAP, plus real estate-related depreciation and amortization and impairment of depreciable real estate, less gains (or losses) from dispositions of real estate held for investment purposes.

Company-Defined FFO

As part of its guidance concerning FFO, NAREIT has stated that the “management of each of its member companies has the responsibility and authority to publish financial information that it regards as useful to the financial community.” As a result, modifications to FFO are common among REITs as companies seek to provide financial measures that meaningfully reflect the specific characteristics of their businesses. In addition to the NAREIT definition of FFO and other GAAP measures, we provide a Company-Defined FFO measure that we believe is helpful in assisting management and investors assess the sustainability of our operating performance. As described further below, our Company-Defined FFO presents a performance metric that adjusts for items that we do not believe to be related to our ongoing operations. In addition, these adjustments are made in connection with calculating certain of the Company’s financial covenants including its interest coverage ratio and fixed charge coverage ratio and therefore we believe this metric will help our investors better understand how certain of our lenders view and measure the financial performance of the Company and ultimately its compliance with these financial covenants. However, no single measure can provide users of financial information with sufficient information and only our disclosures read as a whole can be relied upon to adequately portray our financial position, liquidity and results of operations.

Our Company-Defined FFO is derived by adjusting FFO for the following items: acquisition-related expenses and gains and losses associated with extinguishment of debt and financing commitments. Historically, Management has also adjusted FFO for certain other adjustments that did not occur in any of the periods presented, and are further described in Item 7 of Part II of our 2014 Annual Report on Form 10-K, “Management’s Discussion and Analysis of Financial Condition and Results of Operations—How We Measure Our Performance.” Management’s evaluation of our future operating performance excludes these items based on the following economic considerations:

Acquisition-related expenses — For GAAP purposes, expenses associated with the acquisition of real property, including acquisition fees paid to our Advisor and gains or losses related to the change in fair value of contingent consideration related to the acquisition of real property, are recorded to earnings. We believe by excluding acquisition-related expenses, Company-Defined FFO provides useful supplemental information for management and investors when evaluating the sustainability of our operating performance, because these types of expenses are directly correlated to our investment activity rather than our ongoing operating activity.

Gains and losses on derivatives and on the extinguishment of debt and financing commitments —— Gains and losses on derivatives represent the gains or losses on the fair value of derivative instruments that are not accounted for as hedges of the underlying financing transactions. Such gains and losses may be due to the nonoccurrence of forecasted financings or ineffectiveness due to changes in the expected terms of financing transactions. As these gains or losses relate to underlying long-term assets and liabilities, where we are not speculating or trading assets, our management believes that any such gains or losses are not reflective of our ongoing operations. Losses on extinguishment of debt and financing commitments represent losses incurred as a result of the early retirement of debt obligations and breakage costs and fees incurred related to certain of our derivatives and other financing commitments. Such losses may be due to dispositions of assets, the repayment of debt prior to its contractual maturity or the nonoccurrence of forecasted financings. Our management believes that any such losses are not related to our ongoing operations. Accordingly, we believe by excluding anticipated gains or losses on derivatives and losses on extinguishment of debt and financing commitments, Company-Defined FFO provides useful supplemental information for management and investors when evaluating the sustainability of our operating performance.

We also believe that Company-Defined FFO allows investors and analysts to compare the performance of our portfolio with other REITs that are not currently affected by the adjusted items. In addition, as many other REITs adjust FFO to exclude the items described above, we believe that our calculation and reporting of Company-Defined FFO may assist investors and analysts in comparing our performance with that of other REITs. However, because Company-Defined FFO excludes items that are an important component in an analysis of our historical performance, such supplemental measure should not be construed as a complete historical performance measure and may exclude items that have a material effect on the value of our common stock.

| Page | 24 |

| |

| DEFINITIONS (continued) |

Limitations of FFO and Company-Defined FFO