Attached files

| file | filename |

|---|---|

| EX-31.1 - EXHIBIT 31.1 - PRA GROUP INC | exhibit311-20150331.htm |

| EX-31.2 - EXHIBIT 31.2 - PRA GROUP INC | exhibit312-20150331.htm |

| EXCEL - IDEA: XBRL DOCUMENT - PRA GROUP INC | Financial_Report.xls |

| EX-32.1 - EXHIBIT 32.1 - PRA GROUP INC | exhibit321-20150331.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

ý | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended March 31, 2015.

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number: 000-50058

(Exact name of registrant as specified in its charter)

Delaware | 75-3078675 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

120 Corporate Boulevard, Norfolk, Virginia | 23502 | |

(Address of principal executive offices) | (zip code) | |

(888) 772-7326

(Registrant’s telephone number, including area code)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES ý NO ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). YES ý NO ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” “non-accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ý | Accelerated filer | ¨ | |||

Non-accelerated filer | ¨ | Smaller reporting company | ¨ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). YES ¨ NO ý

The number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date.

Class | Outstanding as of May 5, 2015 | |

Common Stock, $0.01 par value | 48,320,549 | |

PRA GROUP, INC.

INDEX

Page(s) | ||

2

Part I. FINANCIAL INFORMATION

Item 1. Financial Statements

PRA GROUP, INC.

CONSOLIDATED BALANCE SHEETS

March 31, 2015 and December 31, 2014

(unaudited)

(Amounts in thousands, except per share amounts)

March 31, 2015 | December 31, 2014 | ||||||

Assets | |||||||

Cash and cash equivalents | $ | 40,542 | $ | 39,661 | |||

Investments | 91,470 | 89,703 | |||||

Finance receivables, net | 1,954,772 | 2,001,790 | |||||

Other receivables, net | 16,834 | 12,959 | |||||

Net deferred tax asset | 5,771 | 6,126 | |||||

Property and equipment, net | 46,855 | 48,258 | |||||

Goodwill | 496,653 | 527,445 | |||||

Intangible assets, net | 10,042 | 10,933 | |||||

Other assets | 37,674 | 41,876 | |||||

Total assets | $ | 2,700,613 | $ | 2,778,751 | |||

Liabilities and Equity | |||||||

Liabilities: | |||||||

Accounts payable | $ | 7,838 | $ | 4,446 | |||

Accrued expenses | 69,250 | 89,361 | |||||

Income taxes payable | 22,120 | 11,020 | |||||

Other liabilities | 6,725 | 5,962 | |||||

Net deferred tax liability | 265,661 | 255,587 | |||||

Interest bearing deposits | 32,439 | 27,704 | |||||

Borrowings | 1,479,262 | 1,482,456 | |||||

Total liabilities | 1,883,295 | 1,876,536 | |||||

Commitments and contingencies (Note 10) | |||||||

Stockholders’ equity: | |||||||

Preferred stock, par value $0.01, authorized shares, 2,000, issued and outstanding shares - 0 | — | — | |||||

Common stock, par value $0.01, 100,000 authorized shares, 48,320 issued and outstanding shares at March 31, 2015, and 49,577 issued and outstanding shares at December 31, 2014 | 483 | 496 | |||||

Additional paid-in capital | 31,339 | 111,659 | |||||

Retained earnings | 964,145 | 906,010 | |||||

Accumulated other comprehensive (loss) | (178,649 | ) | (115,950 | ) | |||

Total stockholders’ equity | 817,318 | 902,215 | |||||

Total liabilities and equity | $ | 2,700,613 | $ | 2,778,751 | |||

The accompanying notes are an integral part of these consolidated financial statements.

3

PRA GROUP, INC.

CONSOLIDATED INCOME STATEMENTS

For the three months ended March 31, 2015 and 2014

(unaudited)

(Amounts in thousands, except per share amounts)

Three Months Ended March 31, | |||||||

2015 | 2014 | ||||||

Revenues: | |||||||

Income recognized on finance receivables, net | $ | 228,403 | $ | 177,970 | |||

Fee income | 13,053 | 15,608 | |||||

Other revenue | 3,750 | 344 | |||||

Total revenues | 245,206 | 193,922 | |||||

Operating expenses: | |||||||

Compensation and employee services | 65,271 | 51,385 | |||||

Legal collection fees | 13,691 | 10,833 | |||||

Legal collection costs | 20,854 | 26,533 | |||||

Agent fees | 8,261 | 1,450 | |||||

Outside fees and services | 12,797 | 10,791 | |||||

Communications | 10,418 | 8,963 | |||||

Rent and occupancy | 3,560 | 2,338 | |||||

Depreciation and amortization | 4,610 | 3,947 | |||||

Other operating expenses | 9,578 | 6,100 | |||||

Total operating expenses | 149,040 | 122,340 | |||||

Income from operations | 96,166 | 71,582 | |||||

Other income and (expense): | |||||||

Interest income | 147 | 1 | |||||

Interest expense | (14,923 | ) | (4,860 | ) | |||

Net foreign currency transaction gain | 6,789 | 8 | |||||

Income before income taxes | 88,179 | 66,731 | |||||

Provision for income taxes | 30,044 | 25,891 | |||||

Net income | $ | 58,135 | $ | 40,840 | |||

Net income per common share: | |||||||

Basic | $ | 1.19 | $ | 0.82 | |||

Diluted | $ | 1.19 | $ | 0.81 | |||

Weighted average number of shares outstanding: | |||||||

Basic | 48,724 | 49,929 | |||||

Diluted | 49,052 | 50,363 | |||||

The accompanying notes are an integral part of these consolidated financial statements.

4

PRA GROUP, INC.

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME/(LOSS)

For the three months ended March 31, 2015 and 2014

(unaudited)

(Amounts in thousands)

Three Months Ended March 31, | |||||||

2015 | 2014 | ||||||

Net income | $ | 58,135 | $ | 40,840 | |||

Other comprehensive (loss)/income: | |||||||

Change in foreign currency translation, net of tax | (62,699 | ) | 448 | ||||

Total other comprehensive (loss)/income | (62,699 | ) | 448 | ||||

Comprehensive (loss)/income | $ | (4,564 | ) | $ | 41,288 | ||

The accompanying notes are an integral part of these consolidated financial statements.

5

PRA GROUP, INC.

CONSOLIDATED STATEMENT OF CHANGES IN STOCKHOLDERS’ EQUITY

For the three months ended March 31, 2015

(unaudited)

(Amounts in thousands)

Accumulated | ||||||||||||||||||||||

Additional | Other | Total | ||||||||||||||||||||

Common Stock | Paid-in | Retained | Comprehensive | Stockholders’ | ||||||||||||||||||

Shares | Amount | Capital | Earnings | Loss | Equity | |||||||||||||||||

Balance at December 31, 2014 | 49,577 | $ | 496 | $ | 111,659 | $ | 906,010 | $ | (115,950 | ) | $ | 902,215 | ||||||||||

Components of comprehensive income: | ||||||||||||||||||||||

Net income | — | — | — | 58,135 | — | 58,135 | ||||||||||||||||

Foreign currency translation adjustment | — | — | — | — | (62,699 | ) | (62,699 | ) | ||||||||||||||

Vesting of nonvested shares | 221 | 2 | (2 | ) | — | — | — | |||||||||||||||

Repurchase and cancellation of common stock | (1,478 | ) | (15 | ) | (77,787 | ) | — | — | (77,802 | ) | ||||||||||||

Amortization of share-based compensation | — | — | 3,636 | — | — | 3,636 | ||||||||||||||||

Income tax benefit from share-based compensation | — | — | 4,127 | — | — | 4,127 | ||||||||||||||||

Employee stock relinquished for payment of taxes | — | — | (10,294 | ) | — | — | (10,294 | ) | ||||||||||||||

Balance at March 31, 2015 | 48,320 | $ | 483 | $ | 31,339 | $ | 964,145 | $ | (178,649 | ) | $ | 817,318 | ||||||||||

The accompanying notes are an integral part of these consolidated financial statements.

6

PRA GROUP, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

For the three months ended March 31, 2015 and 2014

(unaudited)

(Amounts in thousands)

Three Months Ended March 31, | |||||||

2015 | 2014 | ||||||

Cash flows from operating activities: | |||||||

Net income | $ | 58,135 | $ | 40,840 | |||

Adjustments to reconcile net income to net cash provided by operating activities: | |||||||

Amortization of share-based compensation | 3,636 | 2,836 | |||||

Depreciation and amortization | 4,610 | 3,947 | |||||

Amortization of debt discount | 1,048 | 998 | |||||

Deferred tax expense | 7,617 | 10,812 | |||||

Net foreign currency transaction gain | (6,789 | ) | (8 | ) | |||

Changes in operating assets and liabilities: | |||||||

Other assets | 4,201 | (5,496 | ) | ||||

Other receivables | (3,876 | ) | 821 | ||||

Accounts payable | 5,290 | 3,123 | |||||

Income taxes receivable/payable, net | 11,100 | 10,695 | |||||

Accrued expenses | (21,752 | ) | (25,248 | ) | |||

Other liabilities | 763 | 5,927 | |||||

Net cash provided by operating activities | 63,983 | 49,247 | |||||

Cash flows from investing activities: | |||||||

Purchases of property and equipment | (3,212 | ) | (6,416 | ) | |||

Acquisition of finance receivables, net of buybacks | (183,828 | ) | (150,087 | ) | |||

Collections applied to principal on finance receivables | 171,344 | 135,397 | |||||

Purchase of investments | (42,705 | ) | — | ||||

Proceeds from sales and maturities of investments | 41,189 | — | |||||

Net cash used in investing activities | (17,212 | ) | (21,106 | ) | |||

Cash flows from financing activities: | |||||||

Income tax benefit from share-based compensation | 4,127 | 4,115 | |||||

Proceeds from lines of credit | 140,976 | — | |||||

Principal payments on lines of credit | (94,044 | ) | — | ||||

Repurchases of common stock | (77,802 | ) | — | ||||

Principal payments on long-term debt | (33,750 | ) | (2,500 | ) | |||

Net increase in interest-bearing deposits | 7,539 | — | |||||

Net cash (used in)/provided by financing activities | (52,954 | ) | 1,615 | ||||

Effect of exchange rate on cash and cash equivalents | 7,064 | 59 | |||||

Net increase in cash and cash equivalents | 881 | 29,815 | |||||

Cash and cash equivalents, beginning of period | 39,661 | 162,004 | |||||

Cash and cash equivalents, end of period | $ | 40,542 | $ | 191,819 | |||

Supplemental disclosure of cash flow information: | |||||||

Cash paid for interest | $ | 14,376 | $ | 5,731 | |||

Cash paid for income taxes | 7,082 | 1,868 | |||||

Supplemental disclosure of non-cash information: | |||||||

Employee stock relinquished for payment of taxes | $ | (10,294 | ) | $ | (7,497 | ) | |

The accompanying notes are an integral part of these consolidated financial statements.

7

1. | Organization and Business: |

Throughout this report, the terms "PRA Group," "our," "we," "us," the "Company" or similar terms refer to PRA Group, Inc. and its subsidiaries.

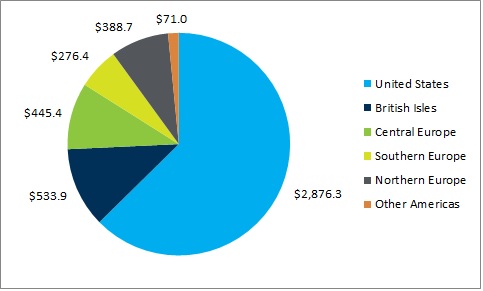

PRA Group, Inc., a Delaware corporation, and its subsidiaries, is a financial and business service company operating in the Americas and Europe. The Company’s primary business is the purchase, collection and management of portfolios of defaulted consumer receivables. The Company also services receivables on behalf of clients, provides business tax revenue administration, audit, discovery and recovery services for state and local governments in the U.S., provides class action claims settlement recovery services and related payment processing to corporate clients, and provides vehicle location, skip tracing and collateral recovery services for auto lenders, governments and law enforcement.

The consolidated financial statements of the Company are prepared in accordance with U.S. generally accepted accounting principles ("GAAP") and include the accounts of all of its subsidiaries. All significant intercompany accounts and transactions have been eliminated. Under the guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 280 “Segment Reporting” (“ASC 280”), the Company has determined that it has several operating segments that meet the aggregation criteria of ASC 280, and, therefore, it has one reportable segment, accounts receivable management, based on similarities among the operating units including the nature of the products and services, the nature of the production processes, the types or class of customer for their products and services, the methods used to distribute their products, and services and the nature of the regulatory environment.

The following table shows the amount of revenue generated for the three months ended March 31, 2015 and 2014 and long-lived assets held at March 31, 2015 and 2014 for the United States, the Company's country of domicile, and outside of the United States (amounts in thousands):

As Of And For The | As Of And For The | ||||||||||||||

Three Months Ended March 31, 2015 | Three Months Ended March 31, 2014 | ||||||||||||||

Revenues | Long-Lived Assets | Revenues | Long-Lived Assets | ||||||||||||

United States | $ | 184,671 | $ | 37,141 | $ | 191,188 | $ | 32,669 | |||||||

Outside the United States | 60,535 | 9,714 | 2,734 | 2,461 | |||||||||||

Total | $ | 245,206 | $ | 46,855 | $ | 193,922 | $ | 35,130 | |||||||

Revenues are attributed to countries based on the location of the related operations. Long-lived assets consist of net property and equipment.

The accompanying unaudited consolidated financial statements of the Company have been prepared in accordance with Rule 10-01 of Regulation S-X promulgated by the Securities and Exchange Commission (“SEC”) and, therefore, do not include all information and disclosures required by U.S. GAAP for complete financial statements. In the opinion of the Company, however, the accompanying unaudited consolidated financial statements contain all adjustments, consisting only of normal recurring adjustments, necessary for a fair presentation of the Company’s consolidated balance sheet as of March 31, 2015, its consolidated income statements and statements of comprehensive income/(loss) for the three months ended March 31, 2015 and 2014, its consolidated statement of changes in stockholders’ equity for the three months ended March 31, 2015, and its consolidated statements of cash flows for the three months ended March 31, 2015 and 2014. The consolidated income statements of the Company for the three months ended March 31, 2015 may not be indicative of future results. Certain reclassifications have been made to prior year amounts to conform to the current year presentation. These unaudited consolidated financial statements should be read in conjunction with the audited consolidated financial statements and notes thereto included in the Company’s 2014 Annual Report on Form 10-K, filed on March 2, 2015.

8

2. | Finance Receivables, net: |

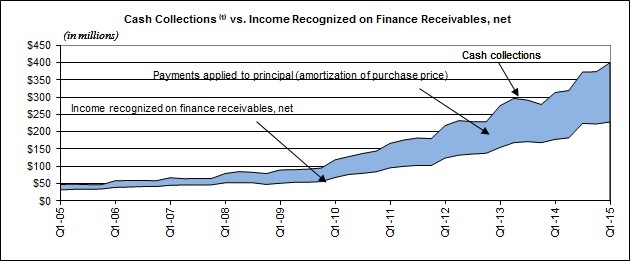

Changes in finance receivables, net for the three months ended March 31, 2015 and 2014 were as follows (amounts in thousands):

Three Months Ended March 31, | |||||||

2015 | 2014 | ||||||

Balance at beginning of period | $ | 2,001,790 | $ | 1,239,191 | |||

Acquisitions of finance receivables (1) | 183,828 | 150,087 | |||||

Foreign currency translation adjustment | (59,502 | ) | 80 | ||||

Cash collections | (399,747 | ) | (313,367 | ) | |||

Income recognized on finance receivables, net | 228,403 | 177,970 | |||||

Cash collections applied to principal | (171,344 | ) | (135,397 | ) | |||

Balance at end of period | $ | 1,954,772 | $ | 1,253,961 | |||

(1) Acquisitions of finance receivables are net of buybacks and include certain capitalized acquisition related costs.

At the time of acquisition, the life of each pool is generally estimated to be between 80 and 120 months based on projected amounts and timing of future cash collections using the proprietary models of the Company. At March 31, 2015, the weighted average remaining life of the Company's pools is estimated to be approximately 99 months. Based upon current projections, cash collections applied to principal on finance receivables as of March 31, 2015 are estimated to be as follows for the twelve months in the periods ending (amounts in thousands):

March 31, 2016 | $ | 549,385 | |

March 31, 2017 | 435,274 | ||

March 31, 2018 | 348,119 | ||

March 31, 2019 | 271,240 | ||

March 31, 2020 | 165,051 | ||

March 31, 2021 | 101,106 | ||

March 31, 2022 | 80,591 | ||

March 31, 2023 | 4,006 | ||

$ | 1,954,772 | ||

At March 31, 2015, the Company had unamortized purchased principal (purchase price) in pools accounted for under the cost recovery method of $18.1 million; at December 31, 2014, the amount was $17.1 million.

Accretable yield represents the amount of income recognized on finance receivables the Company can expect to generate over the remaining life of its existing portfolios based on estimated future cash flows as of the balance sheet date. Additions represent the original expected accretable yield, on portfolios purchased during the period, to be earned by the Company based on its proprietary buying models. Net reclassifications from nonaccretable difference to accretable yield primarily result from the Company’s increase in its estimate of future cash flows. When applicable, net reclassifications to nonaccretable difference from accretable yield result from the Company’s decrease in its estimates of future cash flows and allowance charges that exceed the Company’s increase in its estimate of future cash flows. Changes in accretable yield for the three months ended March 31, 2015 and 2014 were as follows (amounts in thousands):

Three Months Ended March 31, | |||||||

2015 | 2014 | ||||||

Balance at beginning of period | $ | 2,513,185 | $ | 1,430,067 | |||

Income recognized on finance receivables, net | (228,403 | ) | (177,970 | ) | |||

Additions | 172,382 | 106,197 | |||||

Net reclassifications from nonaccretable difference | 119,252 | 91,636 | |||||

Foreign currency translation adjustment | (72,260 | ) | 1,071 | ||||

Balance at end of period | $ | 2,504,156 | $ | 1,451,001 | |||

9

The following is a summary of activity within the Company’s valuation allowance account, all of which relates to loans acquired with deteriorated credit quality, for the three months ended March 31, 2015 and 2014 (amounts in thousands):

Three Months Ended March 31, | |||||||

2015 | 2014 | ||||||

Beginning balance | $ | 86,166 | $ | 91,101 | |||

Allowance charges | 2,685 | 1,387 | |||||

Reversal of previous recorded allowance charges | (1,055 | ) | (3,340 | ) | |||

Net allowance charges/(reversals) | 1,630 | (1,953 | ) | ||||

Ending balance | $ | 87,796 | $ | 89,148 | |||

3. Investments:

Investments consist of the following at March 31, 2015 and December 31, 2014 (amounts in thousands):

March 31, 2015 | December 31, 2014 | |||||||

Trading | ||||||||

Short-term investments | $ | 13,160 | $ | 37,405 | ||||

Available-for-sale | ||||||||

Securitized assets | 5,938 | 3,721 | ||||||

Held-to-maturity | ||||||||

Securitized assets | 53,716 | 31,017 | ||||||

Other investments | ||||||||

Private equity funds | 18,656 | 17,560 | ||||||

$ | 91,470 | $ | 89,703 | |||||

Trading

Short-term investments: The Company’s investments in money market mutual funds are stated at fair value. Fair value is estimated using the net asset value of the investment. Unrealized gains and losses are recorded in earnings.

Available-for-Sale

Investments in securitized assets: The Company holds a majority interest in a closed-end Polish investment fund. The fund was formed in December 2014 to acquire portfolios of nonperforming consumer loans in Poland. The Company’s investment consists of a 100% interest in the Series B certificates and a 20% interest in the Series C certificates. Each certificate comes with one vote and is governed by a co-investment agreement. Series C certificates, which share equally in the residual profit of the fund, are accounted for as debt securities classified as available-for-sale and are stated at fair value. Income is recognized using the effective yield method.

Held-to-Maturity

Investments in securitized assets: The Company holds Series B certificates in a closed-end Polish investment fund. The certificates, which provide a preferred return based on the expected net income of the portfolios, are accounted for as a beneficial interest in securitized financial assets and stated at amortized cost. The Company has determined it has the ability and intent to hold these certificates until maturity, which require repayment in fixed amounts on specific dates. The preferred return is not a guaranteed return. Income is recognized under ASC Topic 325-40, "Beneficial Interests in Securitized Financial Assets" ("ASC 325-40"). Income is recognized using the effective yield method. The Company adjusts the yield for changes in estimated cash flows prospectively through earnings. If the fair value of the investment falls below its carrying amount and the decline is deemed to be other than temporary, the investment is written down, with a corresponding charge to earnings. The underlying securities

10

have both known principal repayment terms as well as unknown principal repayments due to potential borrower pre-payments. Accordingly, it is difficult to accurately predict the final maturity date of these investments. Revenues recognized on these investments were $1.2 million during the three months ended March 31, 2015, and is recorded in the Other Revenue line item in the income statement.

Other Investments

Investments in private equity funds: Investments in private equity funds represent limited partnerships in which the Company has less than a 3% interest and are carried at cost. Distributions received from the partnerships are included in other revenue. Distributions received in excess of the Company's proportionate share of accumulated earnings are applied as a reduction of the cost of the investment.

The amortized cost and estimated fair value of available-for sale and held-to-maturity investments at March 31, 2015 and December 31, 2014 were as follows (amounts in thousands):

March 31, 2015 | |||||||||||||

Amortized Cost | Gross Unrealized Gains | Gross Unrealized Losses | Aggregate Fair Value | ||||||||||

Available-for-sale | |||||||||||||

Securitized assets | $ | 5,938 | — | — | $ | 5,938 | |||||||

Held-to-maturity | |||||||||||||

Securitized assets | 53,716 | — | — | 53,716 | |||||||||

December 31, 2014 | |||||||||||||

Amortized Cost | Gross Unrealized Gains | Gross Unrealized Losses | Aggregate Fair Value | ||||||||||

Available-for-sale | |||||||||||||

Securitized assets | $ | 3,721 | — | — | $ | 3,721 | |||||||

Held-to-maturity | |||||||||||||

Securitized assets | 31,017 | — | — | 31,017 | |||||||||

4. | Borrowings: |

The Company's borrowings consisted of the following as of the dates indicated (amounts in thousands):

March 31, 2015 | December 31, 2014 | ||||||

Domestic revolving credit | $ | 467,750 | $ | 409,000 | |||

Domestic term loan | 181,250 | 185,000 | |||||

Seller note payable | 169,938 | 169,938 | |||||

Multicurrency revolving credit | 398,438 | 427,680 | |||||

Aktiv subordinated loan | — | 30,000 | |||||

Convertible senior notes | 287,500 | 287,500 | |||||

Less: debt discount | (25,614 | ) | (26,662 | ) | |||

Total | $ | 1,479,262 | $ | 1,482,456 | |||

Domestic Revolving Credit and Term Loan

The Company has a credit facility with Bank of America, N.A., as administrative agent, and a syndicate of lenders named therein (the “Credit Agreement”). The total credit facility under the Credit Agreement includes an aggregate principal amount of $831.3 million (subject to compliance with a borrowing base and applicable debt covenants), which consists of (i) a fully-funded $181.3 million term loan, (ii) a $630 million domestic revolving credit facility, of which $162.3 million is available to be drawn, and (iii) a $20 million multi-currency revolving credit facility, of which $20 million is available to be drawn. The facilities all

11

mature on December 19, 2017. The term and revolving loans accrue interest, at the option of the Company, at either the base rate or the Eurodollar rate (as defined in the Credit Agreement) for the applicable term plus 2.50% per annum in the case of the Eurodollar rate loans and 1.50% in the case of the base rate loans. The base rate is the highest of (a) the Federal Funds Rate (as defined in the Credit Agreement) plus 0.50%, (b) Bank of America’s prime rate, and (c) the Eurodollar rate plus 1.00%. The Company’s revolving credit facility includes a $20 million swingline loan sublimit, a $20 million letter of credit sublimit and a $20 million alternative currency equivalent sublimit.

The Credit Agreement is secured by a first priority lien on substantially all of the Company’s assets. The Credit Agreement, as amended and modified, contains restrictive covenants and events of default including the following:

• | borrowings may not exceed 33% of the ERC of all eligible asset pools plus 75% of eligible accounts receivable; |

• | the consolidated leverage ratio (as defined in the Credit Agreement) cannot exceed 2.0 to 1.0 as of the end of any fiscal quarter; |

• | consolidated tangible net worth (as defined in the Credit Agreement) must equal or exceed $455.1 million plus 50% of positive cumulative consolidated net income for each fiscal quarter beginning with the quarter ended December 31, 2012, plus 50% of the cumulative net proceeds of any equity offering; |

• | capital expenditures during any fiscal year cannot exceed $40 million; |

• | cash dividends and distributions during any fiscal year cannot exceed $20 million; |

• | stock repurchases during the term of the agreement cannot exceed $250 million and cannot exceed $100 million in a single fiscal year; |

• | investments in loans and/or capital contributions cannot exceed $950 million to consummate the acquisition of the equity of Aktiv Kapital AS ("Aktiv"); |

• | permitted acquisitions (as defined in the Credit Agreement) during any fiscal year cannot exceed $250 million; |

• | indebtedness in the form of senior, unsecured convertible notes or other unsecured financings cannot exceed $500 million in the aggregate (without respect to the Company’s 3.00% Convertible Senior Notes due 2020); |

• | the Company must maintain positive consolidated income from operations (as defined in the Credit Agreement) during any fiscal quarter; and |

• | restrictions on changes in control. |

The revolving credit facility also bears an unused line fee of 0.375% per annum, payable quarterly in arrears.

The Company's borrowings on this credit facility at March 31, 2015 consisted of $181.3 million outstanding on the term loan with an annual interest rate as of March 31, 2015 of 2.68% and $467.8 million outstanding in 30-day Eurodollar rate loans on the revolving facility with a weighted average interest rate of 2.68%. At December 31, 2014, the Company's borrowings on this credit facility consisted of $185.0 million outstanding on the term loan with an annual interest rate as of December 31, 2014 of 2.67% and $409.0 million outstanding in 30-day Eurodollar rate loans on the revolving facility with a weighted average interest rate of 2.68%.

Seller Note Payable

In conjunction with the closing of the Aktiv business acquisition on July 16, 2014, the Company entered into a $169.9 million promissory note (the "Seller Note") with an affiliate of the seller. The Seller Note bears interest at the three-month London Interbank Offered Rate (“LIBOR”) plus 3.75% and matures on July 16, 2015. The quarterly interest due can be paid or added into the Seller Note balance at the Company's option. During the quarter ending March 31, 2015, the Company paid the quarterly interest payment of $1.7 million. At March 31, 2015, the balance due on the Seller Note was $169.9 million with an annual interest rate of 4.02%.

Multicurrency Revolving Credit Facility

On October 23, 2014, the Company entered into a credit agreement with DNB Bank ASA for a Multicurrency Revolving Credit Facility (“the Multicurrency Revolving Credit Agreement”). Subsequently, two other lenders joined the credit facility. Under the terms of the Multicurrency Revolving Credit Agreement, the credit facility includes an aggregate amount of $500 million, of which $128.3 million is available to be drawn, accrues interest at the Interbank Offered Rate ("IBOR") plus 2.50-3.00% (as determined by the ERC Ratio as defined in the Multicurrency Revolving Credit Agreement), bears an unused line fee of 0.35% per annum, payable monthly in arrears, and matures on October 23, 2019. The Multicurrency Revolving Credit Agreement also includes an Overdraft Facility aggregate amount of $40 million, of which $13.3 million is available to be drawn, accrues interest at the IBOR plus 2.50-3.00% (as determined by the ERC Ratio as defined in the Multicurrency Revolving Credit Agreement), bears a facility line fee of 0.50% per annum, payable quarterly in arrears, and also matures October 23, 2019.

12

The Multicurrency Revolving Credit Agreement is secured by i) the shares of most of the subsidiaries of Aktiv ii) all intercompany loans to Aktiv's subsidiaries. The Multicurrency Revolving Credit Agreement also contains restrictive covenants and events of default including the following:

• | the ERC Ratio (as defined in the Multicurrency Revolving Credit Agreement) may not exceed 28%; |

• | the GIBD Ratio (as defined in the Multicurrency Revolving Credit Agreement) cannot exceed 2.5 to 1.0 as of the end of any fiscal quarter; |

• | interest bearing deposits in AK Nordic AB cannot exceed SEK 500,000,000; |

• | cash collections must exceed 95% of Aktiv's IFRS forecast. |

At March 31, 2015, the balance on the Multicurrency Revolving Credit Agreement was $398.4 million, with an annual interest rate of 3.12%.

Aktiv Subordinated Loan

On December 16, 2011, Aktiv entered into a subordinated loan agreement with Metrogas Holding Inc., an affiliate with Geveran Trading Co. Ltd. During the first quarter of 2015, the Company elected to prepay (as allowed for in the agreement) the outstanding balance on the Aktiv subordinated loan of $30.0 million and terminate the agreement. The Aktiv subordinated loan accrued interest at LIBOR plus 3.75%, originally matured on January 16, 2016.

Convertible Senior Notes

On August 13, 2013, the Company completed the private offering of $287.5 million in aggregate principal amount of the Company’s 3.00% Convertible Senior Notes due 2020 (the “Notes”). The Notes were issued pursuant to an Indenture, dated August 13, 2013 (the "Indenture") between the Company and Wells Fargo Bank, National Association, as trustee. The Indenture contains customary terms and covenants, including certain events of default after which the Notes may be due and payable immediately. The Notes are senior unsecured obligations of the Company. Interest on the Notes is payable semi-annually, in arrears, on February 1 and August 1 of each year. Prior to February 1, 2020, the Notes will be convertible only upon the occurrence of specified events. On or after February 1, 2020, the Notes will be convertible at any time. Upon conversion, the Notes may be settled, at the Company’s option, in cash, shares of the Company’s common stock, or any combination thereof. Holders of the Notes have the right to require the Company to repurchase all or some of their Notes at 100% of their principal amount, plus any accrued and unpaid interest, upon the occurrence of a fundamental change (as defined in the Indenture). In addition, upon the occurrence of a make-whole fundamental change (as defined in the Indenture), the Company may, under certain circumstances, be required to increase the conversion rate for the Notes converted in connection with such a make-whole fundamental change. The conversion rate for the Notes is initially 15.2172 shares per $1,000 principal amount of Notes, which is equivalent to an initial conversion price of approximately $65.72 per share of the Company’s common stock, and is subject to adjustment in certain circumstances pursuant to the Indenture. The Company does not have the right to redeem the Notes prior to maturity. As of March 31, 2015, none of the conditions allowing holders of the Notes to convert their Notes had occurred.

As noted above, upon conversion, holders of the Notes will receive cash, shares of the Company’s common stock or a combination of cash and shares of the Company’s common stock, at the Company’s election. However, the Company’s current intent is to settle conversions through combination settlement (i.e., the Notes will be converted into cash up to the aggregate principal amount, and shares of the Company’s common stock or a combination of cash and shares of the Company’s common stock, at the Company’s election, for the remainder). As a result, and in accordance with authoritative guidance related to derivatives and hedging and earnings per share, only the conversion spread is included in the diluted earnings per share calculation, if dilutive. Under such method, the settlement of the conversion spread has a dilutive effect when the average share price of the Company’s common stock during any quarter exceeds $65.72.

The Company determined that the fair value of the Notes at the date of issuance was approximately $255.3 million, and designated the residual value of approximately $32.2 million as the equity component. Additionally, the Company allocated approximately $7.3 million of the $8.2 million original Notes issuance cost as debt issuance cost and the remaining $0.9 million as equity issuance cost.

ASC 470-20, "Debt with Conversion and Other Options" (“ASC 470-20”), requires that, for convertible debt instruments that may be settled fully or partially in cash upon conversion, issuers must separately account for the liability and equity components in a manner that will reflect the entity’s nonconvertible debt borrowing rate when interest cost is recognized in subsequent periods. Additionally, debt issuance costs are required to be allocated in proportion to the allocation of the liability and equity components and accounted for as debt issuance costs and equity issuance costs, respectively.

13

The balances of the liability and equity components of the Notes outstanding were as follows as of the dates indicated (amounts in thousands):

March 31, 2015 | December 31, 2014 | |||||||

Liability component - principal amount | $ | 287,500 | $ | 287,500 | ||||

Unamortized debt discount | (25,614 | ) | (26,662 | ) | ||||

Liability component - net carrying amount | 261,886 | 260,838 | ||||||

Equity component | $ | 31,306 | $ | 31,306 | ||||

The debt discount is being amortized into interest expense over the remaining life of the Notes using the effective interest rate, which is 4.92%.

Interest expense related to the Notes was as follows for the periods indicated (amounts in thousands):

Three Months Ended March 31, | |||||||

2015 | 2014 | ||||||

Interest expense - stated coupon rate | $ | 2,156 | $ | 2,156 | |||

Interest expense - amortization of debt discount | 1,048 | 998 | |||||

Total interest expense - convertible notes | $ | 3,204 | $ | 3,154 | |||

The Company was in compliance with all covenants under its financing arrangements as of March 31, 2015 and December 31, 2014.

The following principal payments are due on the Company's borrowings as of March 31, 2015 for the twelve month periods ending (amounts in thousands):

March 31, 2016 | $ | 186,188 | |

March 31, 2017 | 25,000 | ||

March 31, 2018 | 607,750 | ||

March 31, 2019 | — | ||

March 31, 2020 | 398,438 | ||

Thereafter | 287,500 | ||

Total | $ | 1,504,876 | |

5. | Property and Equipment, net: |

Property and equipment, at cost, consisted of the following as of the dates indicated (amounts in thousands):

March 31, 2015 | December 31, 2014 | ||||||

Software | $ | 52,990 | $ | 53,076 | |||

Computer equipment | 20,090 | 20,488 | |||||

Furniture and fixtures | 12,860 | 11,502 | |||||

Equipment | 12,512 | 12,880 | |||||

Leasehold improvements | 12,957 | 14,429 | |||||

Building and improvements | 7,141 | 7,049 | |||||

Land | 1,269 | 1,269 | |||||

Accumulated depreciation and amortization | (72,964 | ) | (72,435 | ) | |||

Property and equipment, net | $ | 46,855 | $ | 48,258 | |||

14

Depreciation and amortization expense relating to property and equipment for the three months ended March 31, 2015 and 2014, was $3.8 million and $2.8 million, respectively.

6. | Goodwill and Intangible Assets, net: |

In connection with the Company’s previous business acquisitions, the Company acquired certain tangible and intangible assets. Purchased intangible assets include client and customer relationships, non-compete agreements, trademarks and goodwill. Pursuant to ASC 350, the Company performs an annual review of goodwill on October 1 or more frequently if indicators of impairment exist. The Company performed an annual review of goodwill as of October 1, 2014, and concluded that it was more likely than not that the carrying value of goodwill did not exceed its fair value. The Company believes that nothing has occurred since the review was performed through March 31, 2015 that would indicate a triggering event and thereby necessitate further evaluation of goodwill or other intangible assets. The Company expects to perform its next annual goodwill review during the fourth quarter of 2015.

At March 31, 2015 and 2014, the carrying value of goodwill was $496.7 million and $104.1 million, respectively. The following table represents the changes in goodwill for the three months ended March 31, 2015 and 2014 (amounts in thousands):

Three Months Ended March 31, | ||||||||

2015 | 2014 | |||||||

Balance at beginning of period: | ||||||||

Goodwill | $ | 533,842 | $ | 110,240 | ||||

Accumulated impairment loss | (6,397 | ) | (6,397 | ) | ||||

527,445 | 103,843 | |||||||

Changes: | ||||||||

Foreign currency translation adjustment | (30,792 | ) | 243 | |||||

Net change in goodwill | (30,792 | ) | 243 | |||||

Balance at end of the period: | ||||||||

Goodwill | 503,050 | 110,483 | ||||||

Accumulated impairment loss | (6,397 | ) | (6,397 | ) | ||||

Balance at end of period: | $ | 496,653 | $ | 104,086 | ||||

7. | Share-Based Compensation: |

The Company has an Omnibus Incentive Plan (the "Plan") to assist the Company in attracting and retaining selected individuals to serve as employees and directors, who are expected to contribute to the Company's success and to achieve long-term objectives that will benefit stockholders of the Company. The Plan enables the Company to award shares of the Company's common stock to select employees and directors, as described in the Plan, not to exceed 5,400,000 shares, as authorized by the Plan.

As of March 31, 2015, total future compensation costs related to nonvested awards of nonvested shares (not including nonvested shares granted under the Long-Term Incentive ("LTI") Program) is estimated to be $15.3 million with a weighted average remaining life for all nonvested shares of 2.1 years (not including nonvested shares granted under the LTI program).

Total share-based compensation expense was $3.6 million and $2.8 million for the three months ended March 31, 2015 and 2014, respectively. Tax benefits resulting from tax deductions in excess of share-based compensation expense (windfall tax benefits) recognized under the provisions of ASC Topic 718 "Compensation-Stock Compensation" ("ASC 718") are credited to additional paid-in capital in the Company's Consolidated Balance Sheets. Realized tax shortfalls, if any, are first offset against the cumulative balance of windfall tax benefits, if any, and then charged directly to income tax expense. The total tax benefit realized from share-based compensation was approximately $7.5 million and $7.5 million for the three months ended March 31, 2015 and 2014, respectively.

Nonvested Shares

With the exception of the awards made pursuant to the LTI program and a few employee and director grants, the nonvested shares vest ratably over three to five years and are expensed over their vesting period.

15

The following summarizes all nonvested share transactions, excluding those related to the LTI program, from December 31, 2013 through March 31, 2015 (share amounts in thousands):

Nonvested Shares Outstanding | Weighted-Average Price at Grant Date | |||||

December 31, 2013 | 226 | $ | 29.58 | |||

Granted | 272 | 56.69 | ||||

Vested | (155 | ) | 37.34 | |||

Cancelled | (4 | ) | 50.41 | |||

December 31, 2014 | 339 | 47.34 | ||||

Granted | 84 | 52.49 | ||||

Vested | (88 | ) | 32.25 | |||

March 31, 2015 | 335 | $ | 52.60 | |||

The total grant date fair value of shares vested during the three months ended March 31, 2015 and 2014, was $2.8 million and $2.4 million, respectively.

Pursuant to the Plan, the Compensation Committee may grant time-vested and performance based nonvested shares. All shares granted under the LTI program were granted to key employees of the Company. The following summarizes all LTI program share transactions from December 31, 2013 through March 31, 2015 (share amounts in thousands):

Nonvested LTI Shares Outstanding | Weighted-Average Price at Grant Date | |||||

December 31, 2013 | 434 | $ | 25.79 | |||

Granted at target level | 111 | 49.60 | ||||

Adjustments for actual performance | 222 | 22.32 | ||||

Vested | (279 | ) | 24.21 | |||

December 31, 2014 | 488 | 30.52 | ||||

Granted at target level | 132 | 52.47 | ||||

Vested | (252 | ) | 20.21 | |||

Cancelled | (3 | ) | 30.36 | |||

March 31, 2015 | 365 | $ | 45.60 | |||

The total grant date fair value of shares vested during the three months ended March 31, 2015 and 2014, was $5.1 million and $5.7 million, respectively.

At March 31, 2015, total future compensation costs, assuming the current estimated performance levels are achieved, related to nonvested share awards granted under the LTI program are estimated to be approximately $12.4 million. The Company assumed a 7.5% forfeiture rate for these grants and the remaining shares have a weighted average life of 1.4 years at March 31, 2015.

8. | Income Taxes: |

The Company follows the guidance of FASB ASC Topic 740 "Income Taxes" ("ASC 740") as it relates to the provision for income taxes and uncertainty in income taxes. The guidance prescribes a recognition threshold and measurement attribute for the financial statement recognition and measurement of a tax position taken or expected to be taken in a tax return.

For tax purposes, the Company utilizes the cost recovery method of accounting. Under the cost recovery method, collections on finance receivables are applied first to principal to reduce the finance receivables to zero before taxable income is recognized. The Internal Revenue Service ("IRS") examined the Company's 2005 through 2012 tax returns and has asserted that tax revenue recognition using the cost recovery method does not clearly reflect taxable income. The Company believes it has sufficient support for the technical merits of its position, and believes cost recovery to be an acceptable tax revenue recognition method for companies in the bad debt purchasing industry. The IRS has issued Notices of Deficiency to the Company for tax years ended December 31, 2005 through 2012. The proposed deficiencies relate to the cost recovery method of tax accounting. In response to the notices, the Company filed petitions in the United States Tax Court. On April 30, 2015, a Joint Motion for Continuance was filed by the

16

Company and the IRS. The Tax Court granted the Motion on May 4, 2015. If the Company is unsuccessful in Tax Court, it can appeal to the federal Circuit Court of Appeals. See Note 10 “Commitments and Contingencies” for more information.

At March 31, 2015, the tax years subject to examination by the major federal, state or international taxing jurisdictions are 2003, 2005 and subsequent years. The 2003 tax year remains open to examination because of a net operating loss that originated in that year but was not fully utilized until the 2005 tax year. The examination periods for the 2005 through 2012 tax years are suspended until a decision of the Tax Court becomes final.

ASC 740 requires the recognition of interest if the tax law would require interest to be paid on the underpayment of taxes, and recognition of penalties if a tax position does not meet the minimum statutory threshold to avoid payment of penalties. The Company believes it has sufficient support for the technical merits of its position and that it is more likely than not this position will be sustained. Accordingly, the Company has not accrued for interest or penalties on any of its tax positions, including the cost recovery matter.

9. | Earnings per Share: |

Basic earnings per share (“EPS”) are computed by dividing net income available to common stockholders of PRA Group, Inc. by weighted average common shares outstanding. Diluted EPS are computed using the same components as basic EPS with the denominator adjusted for the dilutive effect of the Notes and nonvested share awards, if dilutive. For the Notes, only the conversion spread is included in the diluted earnings per share calculation, if dilutive. Under such method, the settlement of the conversion spread has a dilutive effect when the average share price of the Company’s common stock during any quarter exceeds $65.72, which did not occur during the period from which the Notes were issued on August 13, 2013 through March 31, 2015. Share-based awards that are contingent upon the attainment of performance goals are not included in the computation of diluted EPS until the performance goals have been attained. The dilutive effect of nonvested shares is computed using the treasury stock method, which assumes any proceeds that could be obtained upon the vesting of nonvested shares would be used to purchase common shares at the average market price for the period. The assumed proceeds include the windfall tax benefit that would be realized upon assumed exercise.

The following tables reconcile the computation of basic EPS and diluted EPS for the three months ended March 31, 2015 and 2014 (amounts in thousands, except per share amounts):

For the Three Months Ended March 31, | |||||||||||||||||||||

2015 | 2014 | ||||||||||||||||||||

Net Income | Weighted Average Common Shares | EPS | Net Income | Weighted Average Common Shares | EPS | ||||||||||||||||

Basic EPS | $ | 58,135 | 48,724 | $ | 1.19 | $ | 40,840 | 49,929 | $ | 0.82 | |||||||||||

Dilutive effect of nonvested share awards | 328 | — | 434 | (0.01 | ) | ||||||||||||||||

Diluted EPS | $ | 58,135 | 49,052 | $ | 1.19 | $ | 40,840 | 50,363 | $ | 0.81 | |||||||||||

There were no antidilutive options outstanding for the three months ended March 31, 2015 and 2014.

10. | Commitments and Contingencies: |

Employment Agreements:

The Company has employment agreements, most of which expire on December 31, 2017, with all of its U.S. executive officers and with several members of its U.S. senior management group. Such agreements provide for base salary payments as well as bonuses that are based on the attainment of specific management goals. At March 31, 2015, the estimated future compensation under these agreements is approximately $22.5 million. The agreements also contain confidentiality and non-compete provisions. Outside the U.S., employment agreements are in place with employees pursuant to local country regulations. Generally, these agreements do not have expiration dates and therefore it is impractical to estimate the amount of future compensation under these agreements. Accordingly, the future compensation under these agreements is not included in the $22.5 million total above.

17

Leases:

The Company is party to various operating leases with respect to its facilities and equipment. The future minimum lease payments at March 31, 2015 total approximately $36.8 million.

Forward Flow Agreements:

The Company is party to several forward flow agreements that allow for the purchase of defaulted consumer receivables at pre-established prices. The maximum remaining amount to be purchased under forward flow agreements at March 31, 2015 is approximately $564.4 million.

Contingent Purchase Price:

The asset purchase agreement entered into in connection with the acquisition of certain finance receivables and certain operating assets of National Capital Management, LLC ("NCM") in 2012, includes an earn-out provision whereby the sellers are able to earn additional cash consideration for achieving certain cash collection thresholds over a five year period. The maximum amount of earn-out during the period is $15.0 million. During 2014 and 2013, the Company paid the first two earn-out payments in the amount of $2.8 million and $6.2 million, respectively. As of March 31, 2015, the Company has recorded a present value amount for the expected remaining liability of $2.4 million.

Finance Receivables:

Certain agreements for the purchase of finance receivables portfolios contain provisions that may, in limited circumstances, require the Company to refund a portion or all of the collections subsequently received by the Company on particular accounts. The potential refunds as of the balance sheet date are not considered to be significant.

Litigation and Regulatory Matters:

The Company is from time to time subject to routine legal claims and proceedings, most of which are incidental to the ordinary course of its business. The Company initiates lawsuits against customers and is occasionally countersued by them in such actions. Also, customers, either individually, as members of a class action, or through a governmental entity on behalf of customers, may initiate litigation against the Company in which they allege that the Company has violated a state or federal law in the process of collecting on an account. From time to time, other types of lawsuits are brought against the Company. Additionally, the Company receives subpoenas and other requests or demands for information from regulators or governmental authorities who are investigating the Company's debt collection activities. The Company evaluates and responds appropriately to such requests.

The Company accrues for potential liability arising from legal proceedings when it is probable that such liability has been incurred and the amount of the loss can be reasonably estimated. This determination is based upon currently available information for those proceedings in which the Company is involved, taking into account the Company's best estimate of such losses for those cases for which such estimates can be made. The Company's estimate involves significant judgment, given the varying stages of the proceedings (including the fact that many of them are currently in preliminary stages), the number of unresolved issues in many of the proceedings (including issues regarding class certification and the scope of many of the claims), and the related uncertainty of the potential outcomes of these proceedings. In making determinations of the likely outcome of pending litigation, the Company considers many factors, including, but not limited to, the nature of the claims, the Company's experience with similar types of claims, the jurisdiction in which the matter is filed, input from outside legal counsel, the likelihood of resolving the matter through alternative mechanisms, the matter's current status and the damages sought or demands made. Accordingly, the Company's estimate will change from time to time, and actual losses could be more than the current estimate.

Subject to the inherent uncertainties involved in such proceedings, the Company believes, based upon its current knowledge and after consultation with counsel, that the legal proceedings currently pending against it, including those that fall outside of the Company's routine legal proceedings, should not, either individually or in the aggregate, have a material adverse impact on the Company's financial condition. However, it is possible, in light of the uncertainties involved in such proceedings or due to unexpected future developments, that an unfavorable resolution of a legal or regulatory proceeding or claim could occur which may be material to the Company's financial condition, results of operations, or cash flows for a particular period.

In certain legal proceedings, the Company may have recourse to insurance or third party contractual indemnities to cover all or portions of its litigation expenses, judgments, or settlements. Loss estimates and accruals for potential liability related to

18

legal proceedings are exclusive of potential recoveries, if any, under the Company's insurance policies or third party indemnities. The Company has not recorded any potential recoveries under the Company's insurance policies or third party indemnities.

The matters described below fall outside of the normal parameters of the Company’s routine legal proceedings.

Telephone Consumer Protection Act Litigation

The Company has been named as defendant in a number of putative class action cases, each alleging that the Company violated the Telephone Consumer Protection Act ("TCPA") by calling consumers' cellular telephones without their prior express consent. On December 21, 2011, the United States Judicial Panel on Multi-District Litigation entered an order transferring these matters into one consolidated proceeding in the United States District Court for the Southern District of California (the "Court"). On November 14, 2012, the putative class plaintiffs filed their amended consolidated complaint in the matter, now styled as In re Portfolio Recovery Associates, LLC Telephone Consumer Protection Act Litigation, case No. 11-md-02295 (the “MDL action”). On May 20, 2014, the Court stayed this litigation until such time as the United States Federal Communications Commission has ruled on various petitions concerning the TCPA. The range of loss, if any, on these matters cannot be estimated at this time.

Internal Revenue Service Audit

The Internal Revenue Service ("IRS") examined the Company's 2005 through 2012 tax returns and has asserted that tax revenue recognition using the cost recovery method does not clearly reflect taxable income. The Company believes it has sufficient support for the technical merits of its position, and believes cost recovery to be an acceptable tax revenue recognition method for companies in the bad debt purchasing industry. The Company has received Notices of Deficiency for tax years ended December 31, 2005 through 2012. The proposed deficiencies relate to the cost recovery method of tax accounting. In response to the notices, the Company filed petitions in the United States Tax Court challenging the deficiency. On April 30, 2015, a Joint Motion for Continuance was filed by the Company and the IRS. The Tax Court granted the Motion on May 4, 2015. If the Company is unsuccessful in Tax Court and any potential appeals to the federal Circuit Court of Appeals, it may ultimately be required to pay the related deferred taxes, and possibly interest and penalties. Deferred tax liabilities related to this item were $244.9 million at March 31, 2015. Any adverse determination on this matter could result in the Company amending state tax returns for prior years, increasing its taxable income in those states. The Company files tax returns in multiple state jurisdictions; therefore, any underpayment of state tax will accrue interest in accordance with the respective state statute. The Company’s estimate of the potential federal and state interest is $82.6 million as of March 31, 2015.

Consumer Financial Protection Bureau ("CFPB") Investigation

In response to an investigative demand from the CFPB, the Company has provided certain documents and data regarding its debt collection practices. Subsequently, the Company has provided comments and engaged in discussions, which have included a number of face-to-face meetings between the Company and the CFPB staff. The Company has also discussed a proposed resolution of matters related to the CFPB's investigation, involving possible penalties, restitution and the adoption of new practices and controls in the conduct of our business. The Company is not able to estimate the amount of such penalties or restitution at this time. In these discussions, the CFPB staff has taken certain positions with respect to legal requirements applicable to our debt collection practices with which the Company disagrees. If the Company is unable to resolve its differences with the CFPB through its ongoing discussions, it could become involved in litigation.

11. | Fair Value Measurements and Disclosures: |

As defined by FASB ASC Topic 820, “Fair Value Measurements and Disclosures” (“ASC 820”), fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. ASC 820 also requires the consideration of differing levels of inputs in the determination of fair values. Those levels of input are summarized as follows:

•Level 1 - Quoted prices in active markets for identical assets and liabilities.

• | Level 2 - Observable inputs other than Level 1 quoted prices, such as quoted prices for similar instruments in active markets, quoted prices for identical or similar instruments in markets that are not active, and model-based valuation techniques for which all significant assumptions are observable in the market. |

19

• | Level 3 - Unobservable inputs that are supported by little or no market activity. Level 3 assets and liabilities include financial instruments whose value is determined using pricing models, discounted cash flow methodologies, or similar techniques as well as instruments for which the determination of fair value requires significant management judgment or estimation. |

The level in the fair value hierarchy within which a fair value measurement in its entirety falls is based on the lowest level input that is significant to the fair value measurement in its entirety.

Financial Instruments Not Required To Be Carried at Fair Value

In accordance with the disclosure requirements of ASC Topic 825, “Financial Instruments” (“ASC 825”), the table below summarizes fair value estimates for the Company’s financial instruments not required to be carried at fair value. The total of the fair value calculations presented does not represent, and should not be construed to represent, the underlying value of the Company. The carrying amounts of the financial instruments in the following table are recorded in the consolidated balance sheets at March 31, 2015 and December 31, 2014 (amounts in thousands):

March 31, 2015 | December 31, 2014 | ||||||||||||||

Carrying Amount | Estimated Fair Value | Carrying Amount | Estimated Fair Value | ||||||||||||

Financial assets: | |||||||||||||||

Cash and cash equivalents | $ | 40,542 | $ | 40,542 | $ | 39,661 | $ | 39,661 | |||||||

Held-to-maturity investments | 53,716 | 53,716 | 31,017 | 31,017 | |||||||||||

Other investments | 18,656 | 19,601 | 17,560 | 19,776 | |||||||||||

Finance receivables, net | 1,954,772 | 2,501,671 | 2,001,790 | 2,460,787 | |||||||||||

Financial liabilities: | |||||||||||||||

Interest-bearing deposits | 32,439 | 32,439 | 27,704 | 27,704 | |||||||||||

Revolving lines of credit | 866,188 | 866,188 | 836,680 | 836,680 | |||||||||||

Term loans | 181,250 | 181,250 | 185,000 | 185,000 | |||||||||||

Notes and loans payable | 169,938 | 169,938 | 199,938 | 199,938 | |||||||||||

Convertible notes | 261,886 | 310,230 | 260,838 | 324,757 | |||||||||||

Disclosure of the estimated fair values of financial instruments often requires the use of estimates. The Company uses the following methods and assumptions to estimate the fair value of the financial instruments in the above table:

Cash and cash equivalents: The carrying amount approximates fair value and quoted prices for identical assets can be found in active markets. Accordingly, the Company estimates the fair value of cash and cash equivalents using Level 1 inputs.

Held-to-maturity investments: Fair value of the Company’s investment in Series B certificates of a closed-end Polish investment fund is estimated using proprietary pricing models that the Company utilizes to make portfolio purchase decisions. Accordingly, the Company estimates the fair value of its held-to-maturity investments using Level 3 inputs as there is little observable market data available and management is required to use significant judgment in its estimates.

Other investments: This class of investments consists of private equity funds that invest primarily in loans and securities including single-family residential debt; corporate debt products; and financially-oriented, real-estate-rich and other operating companies in the Americas, Western Europe, and Japan. These investments are subject to certain restrictions regarding transfers and withdrawals. The investments can never be redeemed with the funds. Instead, the nature of the investments in this class is that distributions are received through the liquidation of the underlying assets of the fund. The fair value of the Company’s interest is valued by the fund managers; accordingly, the Company estimates the fair value of these investments using Level 3 inputs. The investments are expected to be returned through distributions as a result of liquidations of the funds’ underlying assets over 1 to 4 years.

Finance receivables, net: The Company records purchased receivables at cost, which represents a significant discount from the contractual receivable balances due. The Company computed the estimated fair value of these receivables using proprietary pricing models that the Company utilizes to make portfolio purchase decisions. Accordingly, the Company's fair value estimates use Level 3 inputs as there is little observable market data available and management is required to use significant judgment in its estimates.

20

Interest-bearing deposits: The carrying amount approximates fair value due to the short-term nature of the deposits and the observable quoted prices for similar instruments in active markets. Accordingly, the Company uses Level 2 inputs for its fair value estimates.

Revolving lines of credit: The carrying amount approximates fair value due to the short-term nature of the interest rate periods and the observable quoted prices for similar instruments in active markets. Accordingly, the Company uses Level 2 inputs for its fair value estimates.

Term loans: The carrying amount approximates fair value due to the short-term nature of the interest rate periods and the observable quoted prices for similar instruments in active markets. Accordingly, the Company uses Level 2 inputs for its fair value estimates.

Notes and loans payable: The carrying amount approximates fair value due to the short-term nature of the loan terms and the observable quoted prices for similar instruments in active markets. Accordingly, the Company uses Level 2 inputs for its fair value estimates.

Convertible notes: The Notes are carried at historical cost, adjusted for the debt discount. The fair value estimates for these Notes incorporates quoted market prices which were obtained from secondary market broker quotes which were derived from a variety of inputs including client orders, information from their pricing vendors, modeling software, and actual trading prices when they occur. Accordingly, the Company uses Level 2 inputs for its fair value estimates.

Financial Instruments Required To Be Carried At Fair Value

The carrying amounts in the following table are measured at fair value on a recurring basis in the accompanying consolidated balance sheets at March 31, 2015 and December 31, 2014 (amounts in thousands):

Fair Value Measurements as of March 31, 2015 | |||||||||||||||

Level 1 | Level 2 | Level 3 | Total | ||||||||||||

Assets: | |||||||||||||||

Trading investments | $ | 13,160 | $ | — | $ | — | $ | 13,160 | |||||||

Available-for-sale investments | — | — | 5,938 | 5,938 | |||||||||||

Liabilities: | |||||||||||||||

Interest rate swap contracts (recorded in accrued expenses) | — | 1,619 | — | 1,619 | |||||||||||

Fair Value Measurements as of December 31, 2014 | |||||||||||||||

Level 1 | Level 2 | Level 3 | Total | ||||||||||||

Assets: | |||||||||||||||

Trading investments | $ | 37,405 | $ | — | $ | — | $ | 37,405 | |||||||

Available-for-sale investments | — | — | 3,721 | 3,721 | |||||||||||

Liabilities: | |||||||||||||||

Interest rate swap contracts (recorded in accrued expenses) | — | 3,387 | — | 3,387 | |||||||||||

Trading investments: Fair value of the Company’s investments in money market mutual funds is reported using the closing price of the fund’s net asset value in an active market. Accordingly, the Company uses Level 1 inputs.

Available-for-sale investments: Fair value of the Company’s investment in Series C certificates of a closed-end Polish investment fund is estimated using proprietary pricing models that the Company utilizes to make portfolio purchase decisions. Accordingly, the Company estimates the fair value of its available-for-sale investments using Level 3 inputs as there is little observable market data available and management is required to use significant judgment in its estimates.

Interest rate swap contracts: The interest rate swap contracts are carried at fair value which is determined by using industry standard valuation models. These models project future cash flows and discount the future amounts to a present value using market-based observable inputs, including interest rate curves and other factors. Accordingly, the Company uses Level 2 inputs for its fair value estimates.

21

12. | Recent Accounting Pronouncements: |

In April 2014, FASB issued ASU 2014-08, "Reporting Discontinued Operations and Disclosures of Disposals of Components of an Entity" (“ASU 2014-08”) that amends the requirements for reporting discontinued operations. ASU 2014-08 requires the disposal of a component of an entity or a group of components of an entity to be reported in discontinued operations if the disposal represents a strategic shift that will have a major effect on the entity’s operations and financial results. ASU 2014-08 also requires additional disclosures about discontinued operations and disclosures about the disposal of a significant component of an entity that does not qualify as a discontinued operation. ASU 2014-08 is effective prospectively for reporting periods beginning after December 15, 2014, with early adoption permitted. The Company adopted ASU 2014-08 in the first quarter of 2015 which had no material impact on the Company's Consolidated Financial Statements.

In May 2014, FASB issued ASU 2014-09, "Revenue from Contracts with Customers" (“ASU 2014-09”) that updates the principles for recognizing revenue. The core principle of the guidance is that an entity should recognize revenue to depict the transfer of promised goods or services to customers in an amount that reflects the consideration to which the entity expects to be entitled in exchange for those goods or services. ASU 2014-09 also amends the required disclosures of the nature, amount, timing and uncertainty of revenue and cash flows arising from contracts with customers. ASU 2014-09 is effective for fiscal years, and interim periods within those years, beginning after December 15, 2016, and can be adopted either retrospectively to each prior reporting period presented or as a cumulative-effect adjustment as of the date of adoption, with early application not permitted. The Company is evaluating its implementation approach and the potential impacts of the new standard on its existing revenue recognition policies and procedures.

In June 2014, FASB issued ASU 2014-12, "Accounting for Share-Based Payments When the Terms of an Award Provide That a Performance Target Could Be Achieved after the Requisite Service Period" (“ASU 2014-12”). ASU 2014-12 requires that a performance target that affects vesting and that could be achieved after the requisite service period be treated as a performance condition. As such, the performance target should not be reflected in estimating the grant-date fair value of the award. ASU 2014-12 is effective for annual reporting periods beginning after December 15, 2015, with early adoption permitted. The Company is evaluating the potential impacts of the new standard on its existing stock-based compensation awards.

In February 2015, FASB issued ASU 2015-02, "Consolidation (Topic 810), Amendments to the Consolidation Analysis" ("ASU 2015-02"). The amendments under the new guidance modify the evaluation of whether limited partnerships and similar legal entities are variable interest entities ("VIEs") or voting interest entities and eliminate the presumption that a general partner should consolidate a limited partnership. ASU 2015-02 is effective for public business entities for fiscal years, and for interim periods within those fiscal years, beginning after December 15, 2015. Early adoption is permitted, including adoption in an interim period. A reporting entity also may apply the amendments retrospectively. The Company is currently evaluating the impact of adopting this guidance on its financial position and results of operations.

In April 2015, FASB issued ASU 2015-03, “Imputation of Interest (Subtopic 835-30): Simplifying the Presentation of Debt Issuance Costs” ("ASU 2015-03"). ASU 2015-03 requires an entity to present debt issuance costs related to a recognized debt liability in the balance sheet as a direct deduction from the carrying amount of the debt liability, consistent with debt discounts. The recognition and measurement guidance for debt issuance costs are not affected by the amendments in this update. For public business entities, this update is effective for financial statements issued for fiscal years beginning after December 15, 2015, and interim periods within those fiscal years. An entity should apply the new guidance on a retrospective basis. The Company is currently evaluating the impact of adopting this guidance on its financial position and results of operations.

22

Item 2. | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

Forward-Looking Statements:

This report contains forward-looking statements within the meaning of the federal securities laws. These forward-looking statements involve risks, uncertainties and assumptions that, if they never materialize or prove incorrect, could cause our results to differ materially from those expressed or implied by such forward-looking statements. All statements, other than statements of historical fact, are forward-looking statements, including statements regarding overall trends, gross margin trends, operating cost trends, liquidity and capital needs and other statements of expectations, beliefs, future plans and strategies, anticipated events or trends, and similar expressions concerning matters that are not historical facts. The risks, uncertainties and assumptions referred to above may include the following:

• | a prolonged economic recovery or a deterioration in the economic or inflationary environment in North America or Europe, including the interest rate environment; |

• | changes in the credit or capital markets, which affect our ability to borrow money or raise capital; |

• | our ability to purchase defaulted consumer receivables at appropriate prices; |

• | our ability to replace our defaulted consumer receivables with additional receivables portfolios; |

• | our ability to obtain accurate and authentic account documents relating to accounts that we acquire and the possibility that documents that we provide could contain errors; |

• | our ability to collect sufficient amounts on our defaulted consumer receivables; |

• | our ability to successfully acquire receivables of new asset types; |

• | changes in, or interpretations of, bankruptcy or collection laws that could negatively affect our business, including by causing an increase in certain types of bankruptcy filings involving liquidations, which may cause our collections to decrease; |

• | changes in, or interpretations of, state or federal laws or the administrative practices of various bankruptcy courts, which may impact our ability to collect on our defaulted receivables; |

• | our ability to collect and enforce our finance receivables may be limited under federal and state laws; |

• | our ability to employ and retain qualified employees, especially collection personnel, and our senior management team; |

• | our ability to comply with existing and new regulations of the collection industry, the failure of which could result in penalties, fines, litigation, damage to our reputation, or the suspension or termination of or required modification to our ability to conduct our business; |

• | our ability to adjust to debt collection and debt-buying regulations that may be promulgated by the Consumer Financial Protection Bureau ("CFPB") and the regulatory and enforcement activities of the CFPB, including an ongoing CFPB inquiry; |

• | our ability to satisfy the restrictive covenants in our debt agreements; |

• | changes in governmental laws and regulations or the manner in which they are interpreted or applied which could increase our costs and liabilities or impact our operations; |

• | investigations or enforcement actions by governmental authorities, which could result in changes to our business practices; negatively impact our portfolio purchasing volume; make collection of account balances more difficult or expose us to the risk of fines, penalties, restitution payments, and litigation; |

• | changes in interest or exchange rates, which could reduce our net income, and the possibility that future hedging strategies may not be successful, which could adversely affect our results of operations and financial condition, as could our failure to comply with hedge accounting principles and interpretations; |

• | our ability to obtain adequate insurance coverage at reasonable prices; |

• | our ability to manage growth successfully or to integrate our growth strategy; |

• | the possibility that we could incur business to technology disruptions or cyber incidents or not adapt to technological advances; |

• | our ability to manage risks associated with our international operations, which risks have increased as a result of the Aktiv Kapital AS ("Aktiv") acquisition; |

• | our ability to integrate the Aktiv business; |

• | our ability to recognize the anticipated synergies and benefits of the Aktiv acquisition; |

• | changes in tax laws regarding earnings of our subsidiaries located outside of the United States; |

• | the possibility that compliance with foreign and U.S. laws and regulations that apply to our international operations could increase our cost of doing business in international jurisdictions; |

• | net capital requirements pursuant to the European Union Capital Requirements Directive, which could impede the business operations of our subsidiaries; |

• | the incurrence of significant transaction, integration, and restructuring costs in connection with the Aktiv acquisition; |

• | our exposure to additional tax liabilities as a result of the Aktiv acquisition; |

• | the possibility that we could incur goodwill or other intangible asset impairment charges; |

• | our ability to retain existing clients and obtain new clients for our fee-for-service businesses; |

23

• | our work force could become unionized in the future, which could adversely affect the stability of our production and increase our costs; |

• | our ability to maintain, renegotiate or replace our credit facility; |

• | the possibility that the accounting for convertible debt securities could have an adverse effect on our financial results; |

• | the possibility that conversion of the convertible senior notes could affect the price of our common stock; |

• | our ability to raise the funds necessary to repurchase the convertible senior notes or to settle conversions in cash; |

• | the imposition of additional taxes on us; |

• | the possibility that we could incur significant allowance charges on our finance receivables; |

• | our loss contingency accruals may not be adequate to cover actual losses; |