Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - CYPRESS SEMICONDUCTOR CORP /DE/ | Financial_Report.xls |

| EX-10.5 - DIRECTOR OPTION GRANTS UNDER SPANSION PLAN - CYPRESS SEMICONDUCTOR CORP /DE/ | nqoptiondirectorgrants.htm |

| EX-31.1 - EXHIBIT 31.1 - CYPRESS SEMICONDUCTOR CORP /DE/ | exhibit311-2015032910q.htm |

| EX-32.1 - EXHIBIT 32.1 - CYPRESS SEMICONDUCTOR CORP /DE/ | exhibit321-2015032910q.htm |

| EX-31.2 - EXHIBIT 31.2 - CYPRESS SEMICONDUCTOR CORP /DE/ | exhibit312-2015032910q.htm |

| EX-10.2 - J. DANIEL MCCRANIE SEPARATION AGREEMENT - CYPRESS SEMICONDUCTOR CORP /DE/ | jdanielmccranieseveranceag.htm |

| 10-Q - 10-Q - CYPRESS SEMICONDUCTOR CORP /DE/ | cy-20150329x10q.htm |

| EX-32.2 - EXHIBIT 32.2 - CYPRESS SEMICONDUCTOR CORP /DE/ | exhibit322-201532910q.htm |

CYPRESS SEMICONDUCTOR CORPORATION

PERFORMANCE ACCELERATED RESTRICTED STOCK

PROGRAM (PARS) GRANT AGREEMENT

Congratulations! You have been selected as a key person that is responsible for driving the long-term success of Cypress Semiconductor Corporation (the “Company” or “Cypress”). This is a very confidential and selective program and each participant has been approved by the Executive Staff. We are counting on your strong performance in 2015 and beyond to achieve the vision of the Company and deliver strong total shareholder return to our fellow stockholders.

Unless otherwise defined herein, the terms in the 2013 Stock Plan (the “Plan”) shall have the same defined meanings in this notice and grant agreement (collectively, the “Grant Agreement”).

(LAST NAME) | |

(FIRST NAME) | |

(MIDDLE NAME) | |

(EMPLOYEE NUMBER) | |

(GRANT DATE) | |

You have been granted performance-based restricted stock units (“PSUs”) and service-based restricted stock units (“RSUs”) under the Plan as part of the Company’s Performance Accelerated Restricted Stock Program (“PARS Program”), and your grant is subject to the terms and conditions of the Plan and this Grant Agreement. PSUs are granted with specific performance targets identified by the Compensation Committee of the Board of Directors (the “Committee”) and RSUs are service-based grants.

This grant fully vests over a three year period. Your total number of targeted shares under this Grant Agreement for the three year vesting period is _________, of which _____ are RSUs and _____ are PSUs (at target). You may earn up to _______ PSUs (200% of target) depending on the level of performance achieved. In addition to this grant, you may receive additional grants in the future that contain additional performance goals for 2016 and 2017.

1

GRANT SUMMARY

Description | Grant Type | 2015 | 2016 | 2017 | Total (at target) |

Service Based | RSU | ||||

Milestone 1 - TSR 2015 | PSU | ||||

Milestone 2 - TSR 2015-2016 | PSU | ||||

Milestone 3 - TSR 2016 | PSU | ||||

Milestone 4 - TSR 2015-2017 | PSU | ||||

Milestone 5 - TSR 2016-2017 | PSU | ||||

Milestone 6 - TSR 2017 | PSU | ||||

Milestone 7 - 2015 Synergies | PSU | ||||

Milestone 8 - 2016 Synergies | PSU | ||||

Milestone 9 - 2017 Synergies | PSU | ||||

Milestone 10 - Q415 EPS | PSU | ||||

Milestone 11 - Q416 EPS | PSU | ||||

Milestone 12 - 2017 EPS | PSU | ||||

Total | |||||

Service- Based Award (RSU) Vesting Terms

You are eligible to earn 100% of your targeted service-based RSUs if you remain an employee in good standing of Cypress through the vesting dates specified below and are in a similar role, same or higher pay grade and same or increased scope of responsibilities as your current role on the date of grant. The Administrator, in its sole discretion, shall determine the amount of the reduction in vesting to be applied to your RSU as of or following any reduction in role, pay grade or scope of responsibility, which may include a determination that no Shares shall vest as of or following such change.

Service Based RSU Vesting Dates:

2015- January 29, 2016

2016- January 27, 2017

2017- February 2, 2018

2

Performance-Based (PSU) Vesting Terms

Performance-based PSU shares will be eligible to vest subject to satisfaction of the vesting and performance criteria below.

Total Shareholder Return (TSR)

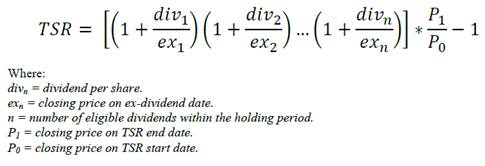

You are eligible to earn your targeted PSU shares based on the Company’s achievement of certain levels of TSR as compared to Cypress’s peer group of companies. Total Shareholder Return (TSR) is used to represent the cumulative return of an investment and includes both the change in the stock price as well as the value of dividends paid from a specified start and ending period. TSR is defined as:

In the event that a peer company no longer trades on the NYSE or NASDAQ on the last day of the performance measurement period, the performance of the SOXX will replace that peer company. In the event that more than one peer company no longer trade on the NYSE or NASDAQ on the last day of the performance measurement period, the performance of the SOXX will only replace one peer company and any other peer company that no longer trades on the NYSE or NASDAQ will be excluded from the calculation. The calculation of the SOXX TSR will be consistent with the TSR calculations of the Peer Companies as outlined earlier.

The payout for the TSR milestones is as follows:

Cypress TSR Rank Relative to Peer Group | Performance Multiplier (of Target)* |

At or above the 90th Percentile | 200% |

Between the 65th Percentile TSR and 90th Percentile | Determined by linear interpolation between 65th and 90th percentile |

At the 65th Percentile | 100% |

Between the 25th Percentile TSR and 65th Percentile | Determined by linear interpolation between 25th and 65th percentile |

At or below the 25th Percentile TSR | 0% |

*If the TSR is negative, the payout will be 50% of the earned Shares.

3

Milestone #1 – 2015 TSR

You are eligible to earn your targeted PSU shares for Milestone #1 based on the Company’s achievement of certain levels of Total Shareholder Return (TSR) as compared to the 2015 Cypress Peer Group of Companies (Appendix #1). The Milestone #1 measurement period of TSR will be from December 26, 2014 through December 31, 2015 and shares are eligible to vest on January 29, 2016, subject to satisfaction of the vesting and performance criteria.

Milestone #2 – 2015-2016 TSR

You are eligible to earn your targeted PSU shares for Milestone #2 based on the Company’s achievement of certain levels of TSR as compared to the 2015 Cypress Peer Group of Companies (Appendix #1). The Milestone #2 measurement period of TSR will be from December 26, 2014 through December 30, 2016 and shares are eligible to vest on January 27, 2017, subject to satisfaction of the vesting and performance criteria.

Milestone #3 – 2016 TSR

You are eligible to earn your targeted PSU shares for Milestone #3 based on the Company’s achievement of certain levels of TSR as compared to the 2016 Cypress Peer Group of Companies (to be provided after approval by the Committee in 2016). The Milestone #3 measurement period of TSR will be from January 4, 2016 through December 30, 2016 and shares are eligible to vest on January 27, 2017, subject to satisfaction of the vesting and performance criteria.

Milestone #4 – 2015-2017 TSR

You are eligible to earn your targeted PSU shares for Milestone #4 based on the Company’s achievement of certain levels of TSR as compared to the 2015 Cypress Peer Group of Companies (Appendix #1). The Milestone #4 measurement period of TSR will be from December 26, 2014 through December 29, 2017 and shares are eligible to vest on February 2, 2018, subject to satisfaction of the vesting and performance criteria.

Milestone #5– 2016-2017 TSR

You are eligible to earn your targeted PSU shares for Milestone #5 based on the Company’s achievement of certain levels of TSR as compared to the 2016 Cypress Peer Group of Companies (as determined by the Committee in 2016). The Milestone #5 measurement period of TSR will be from December 31, 2015 through December 29, 2017 and shares are eligible to vest on February 2, 2018, subject to satisfaction of the vesting and performance criteria.

Milestone #6–2017 TSR

You are eligible to earn your targeted PSU shares for Milestone #6 based on the Company’s achievement of certain levels of TSR as compared to the 2017 Cypress Peer Group of Companies (As determined by the Committee in 2017). The Milestone #6 measurement period of TSR will be from December 30, 2016 through December 29, 2017 and shares are eligible to vest on February 2, 2018, subject to satisfaction of the vesting and performance criteria.

4

Merger Synergies

You are eligible to earn your targeted PSU shares if the cost synergies associated with the merger of Cypress and Spansion achieves the stated goal for each of the years as defined below. All payouts adjust on a linear scale between the 0% payout and the 100% payout and then between the 100% payout to 200% maximum payout.

Milestone #7 – 2015 Synergies

The payout for Milestone #7 is as follows:

0% Payout = Annualized Q4, 2015 synergy savings of $______ or lower

100% Payout = Annualized Q4, 2015 synergy savings of $________ or higher

200% Payout = Annualized Q4, 2015 synergy savings of $________ or higher

Shares for Milestone #7 are eligible to vest on January 29, 2016, subject to satisfaction of the vesting and performance criteria.

Milestone #8 -2016 Synergies

The payout for Milestone #8 is as follows:

0% Payout = Annualized Q4, 2016 synergy savings of $______ or lower

100% Payout = Annualized Q4, 2016 synergy savings of $________ or higher

200% Payout = Annualized Q4, 2016 synergy savings of $________ or higher

Shares for Milestone #8 are eligible to vest on January 27, 2017, subject to satisfaction of the vesting and performance criteria.

Milestone #9 – 2017 Synergies

The payout for Milestone #9 is as follows:

0% Payout = Annualized Q4, 2017 synergy savings of $______ or lower

100% Payout = Annualized Q4, 2017 synergy savings of $________ or higher

200% Payout = Annualized Q4, 2017 synergy savings of $________ or higher

Shares for Milestone #9 are eligible to vest on February 2, 2018, subject to satisfaction of the vesting and performance criteria.

5

Earnings Per Share (EPS)

You are eligible to earn your targeted PSU shares if Cypress’s non-GAAP EPS meets or exceeds the amounts specified below. All payouts adjust on a linear scale between the 0% payout and the 100% payout and between 100% payout and a maximum payout of 200%. The measurement period of EPS will be for Cypress’s reported earnings in the fourth quarter of each year except for in 2017.

Non-GAAP financial measures generally exclude charges related to stock-based compensation, restructuring charges, acquisition-related expenses and other discrete adjustments and the related tax effects. Non-GAAP EPS for purposes of the Milestones #10-12 below shall be calculated in a manner consistent with any non-GAAP EPS numbers publicly disclosed to the Company’s investors.

Milestone #10- Q415 EPS

The payout for Milestone #10 is based on Cypress’s Q4, 2015 non-GAAP EPS as follows:

0% Payout = Q4, 2015 EPS is $_________

100% Payout = Q4, 2015 EPS is $_________

200% Payout = Q4, 2015 EPS is $_________

Shares for Milestone #10 are eligible to vest on January 29, 2016, subject to satisfaction of the vesting and performance criteria.

Milestone #11- Q416 EPS

The payout for Milestone #11 is based on Cypress’s Q4, 2016 non-GAAP Earnings Per Share (EPS) as follows:

0% Payout = Q4, 2016 EPS is $_________

100% Payout = Q4, 2016 EPS is $_________

200% Payout = Q4, 2016 EPS is $_________

Shares for Milestone #11 are eligible to vest on January 27, 2017, subject to satisfaction of the vesting and performance criteria.

6

Milestone #12- 2017 EPS

The payout for Milestone #12 is based on Cypress’s 2017 non-GAAP Earnings Per Share (EPS) as follows:

0% Payout = 2017 EPS is $_________

100% Payout = 2017 EPS is $_________

200% Payout = 2017 EPS is $_________

Shares for Milestone #12 are eligible to vest on February 2, 2018, subject to satisfaction of the vesting and performance criteria.

7

ADDITIONAL VESTING CONDITIONS AND SCHEDULE

RSUs and PSUs have no exercise price and therefore always have value. Once vested, the value of each Share that vested pursuant to an RSU or PSU is equal to the value of one share of Cypress’s stock as reported on the NASDAQ market. Upon vest, any applicable taxes will be withheld in the form of shares, or you will be required to sell enough shares to pay the taxes required to be withheld, or you will need to use cash from external sources to satisfy the tax requirements. Vested shares remain yours for as long as you hold the shares, even if the Company no longer employs you. Upon vest, you may hold onto them for however long you like, earning each dividend declared by our Board of Directors, if applicable. However, you bear the risk of the stock declining in price and your shares losing value.

Assuming the satisfaction of any applicable vesting and performance criteria, Shares shall vest on the vesting dates specified in this Grant Agreement. The Company shall settle and issue the vested Shares as soon as practicable after such Shares have vested; provided, however, that the Company shall have no obligation to settle and issue PSU shares unless and until the Committee has certified achievement of the performance milestones (the “Certification”). Upon Certification, you will be notified to what extent you met the performance milestones.

Except to the extent required by law or provided under this Agreement or the Plan, this Award may not be modified adversely to your interest except by means of a writing signed by the Company and you. Nothing in the preceding sentence shall preclude the Committee from exercising administrative discretion with respect to the Plan or this Grant Agreement, and the exercise of such discretion shall be final, conclusive and binding on all interested parties and shall be given maximum deference permitted by law. This discretion includes, but is not limited to, determining the total percentage of PSUs that become payable to you including the use of negative discretion to reduce (including to zero), but not to increase the total number of Shares that would otherwise vest under any performance milestone under the terms of this Grant Agreement.

You must remain as an employee, consultant or director through the date of Certification and the vesting date to receive your PSUs.

All PSUs are subject to the Company’s clawback policy (Appendix #2).

Notwithstanding any contrary provision of this Grant Agreement, if, at any time on or after September 28 of each year through 2017, the Committee determines that it is likely some or all of the shares potentially may be earned under the PSUs will in fact not be earned, the Committee (in its sole discretion) may determine that such PSU shares will never vest, will be permanently forfeited immediately and returned to the pool of shares available under the Plan. In making any

8

such determination, the Committee shall consider actual performance to date versus the pre established goals and any other factors that the Committee (in its discretion) determines to be relevant.

For all Milestones for which the measurement period is one year, if you are on any approved leave of absence (“LOA”) at any time - for a period of less than 91 calendar days, earned PSUs and RSUs, will be prorated for the period of your leave. If you are on any LOA (approved or not approved) - for 91 calendar days or greater you will not be eligible to earn any RSU or PSUs during the term of the LOA. For all Milestones having a measurement period greater than one year, if you are on any approved LOA at any time - for a period of less than 181 calendar days, earned RSUs and PSUs, will be prorated for the period of your leave. If you are on any LOA (approved or not approved) - for 181 calendar days or greater you will not be eligible to earn any RSUs or PSUs during the term of the LOA.

Each earned RSU or PSU is equivalent to one Share of common stock of the Company for purposes of determining the number of shares subject to this notice. Any RSU or PSU shares that do not vest will be forfeited.

CONFIDENTIALITY

As part of this Grant Agreement, you agree that your grant and all the terms and conditions of the grant are confidential. Therefore, except as necessary for compliance with a government regulation or filing or in connection with seeking personal legal, tax or other professional advice, you will not disclose the grant, or its terms and conditions to any third party except with approval of the Board of Directors, the Chief Executive Officer or the Chief Financial Officer. You may also discuss your grant with the Company’s Stock Administrator, the legal department, your EVP, the SVP or EVP of HR, or your HR Business Partner to the extent it relates to your employment at Cypress, or with your spouse. A violation of this confidentiality requirement may result in severe consequences, including a forfeiture of all grants, and/or termination of employment.

ACCEPTANCE OF GRANT

After reading the Plan and this Grant Agreement, please confirm your acceptance of the terms set forth in this Grant Agreement by accepting the terms through execution of this Grant Agreement below and returning a copy to the Company’s Stock Administrator by electronic copy to: stockadmin@cypress.com. The Plan and this Grant Agreement constitute your entire agreement with respect to this Award. You hereby agree to accept as binding, conclusive and final all decisions or interpretations of the Administrator upon any questions relating to the Plan and this Award.

If you are a U.S. resident, you must accept and return this Grant Agreement, executed, within 30 days after the date of notification to you. If you don’t accept the grant within 30 days, then it will

9

be accepted automatically on your behalf and you agree to be bound by the terms and conditions herein, the Plan and all conditions established by the Company in connection with Awards issued under the Plan unless you notify human resources or the legal department of your intention to reject the Award.

IN WITNESS WHEREOF, the undersigned have executed this Grant Agreement as of the date below.

CYPRESS SEMICONDUCTOR CORPORATION | GRANTEE | |

By: | By: | |

Thad Trent | Name | |

Chief Financial Officer

10

APPENDIX #1

CYPRESS 2015 PEER GROUP

11

APPENDIX #2

CYPRESS “CLAWBACK” POLICY

Under this Clawback Policy, and consistent with the Company’s core values, the Board has determined that it is appropriate to recover any incentive-based compensation that was paid out based on erroneous financial information reported under securities laws. Specifically, the Company may recoup incentive compensation from any employee if: (i) he or she engages in intentional misconduct pertaining to any financial reporting policy; (ii) there is a material negative revision of a financial or operating measure on the basis of which incentive compensation was awarded or paid to the employee; or (iii) he or she engages in any fraud, theft, misappropriation, embezzlement or dishonesty. Any recoupment will be made irrespective of whether the employee’s conduct contributed to the need for the restatement and/or revision.

If triggered, then to the fullest extent permitted by law, the Company may require the employee to reimburse the Company for all or a portion of any incentive compensation received within the last 36 months from the date that the company was required to prepare the accounting restatement that was based on the erroneous data. The employee may also be required to remit to the Company any profits realized from the sale of the Company’s common stock within the last 36 months from the date that the company is required to prepare the accounting restatement that was based on the erroneous data. The clawback will be calculated as the excess amount paid on the basis of the restated results.

In all circumstances the Compensation Committee will have the ability to exercise discretion with respect to all reimbursements under the Clawback Policy.

Additionally, it is the intent of this policy to comply with the clawback requirements of the Dodd-Frank Wall Street Reform and Consumer Protection Act. This policy may be modified to the degree that it does not comply with the final requirements issued by the Securities Exchange Commission.

12