Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - XPO Logistics, Inc. | d920232d8k.htm |

Exhibit 99.1 XPO Investor Presentation Second Quarter 2015 XPO to Acquire Norbert Dentressangle Announced April 28, 2015 XPO to Acquire Bridge Terminal Transport Announced May 4, 2015

Forward-Looking Statements This presentation includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, including the expected closing dates for the acquisitions by XPO Logistics of Norbert Dentressangle SA and Bridge Terminal Transport Services, Inc. (“BTT”), the expected impact of the transactions and the related financing, including the expected impact on XPO Logistics’ results of operations and EBITDA, the retention of the management teams of Norbert Dentressangle and BTT, the expected ability to integrate operations and technology platforms and to cross-sell services, and the expected ability to retain acquired companies’ businesses and to grow XPO’s and the acquired companies’ businesses. All statements other than statements of historical fact are, or may be deemed to be, forward-looking statements. In some cases, forward-looking statements can be identified by the use of forward-looking terms such as “anticipate,” “estimate,” “believe,” “continue,” “could,” “intend,” “may,” “plan,” “potential,” “predict,” “should,” “will,” “expect,” “objective,” “projection,” “forecast,” “goal,” “guidance,” “outlook,” “effort,” “target” or the negative of these terms or other comparable terms. However, the absence of these words does not mean that the statements are not forward-looking. These forward-looking statements are based on certain assumptions and analyses made by us in light of our experience and our perception of historical trends, current conditions and expected future developments, as well as other factors we believe are appropriate in the circumstances. These forward-looking statements are subject to known and unknown risks, uncertainties and assumptions that may cause actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by such forward-looking statements. Factors that might cause or contribute to a material difference include those discussed in XPO’s filings with the SEC and the following: economic conditions generally; competition; XPO’s ability to find suitable acquisition candidates and execute its acquisition strategy; the expected impact of the Norbert Dentressangle and BTT acquisitions, including the expected impact on XPO’s results of operations; the ability to obtain the requisite regulatory approvals and, in the case of the BTT acquisition, to satisfy other closing conditions; XPO’s ability to successfully complete the contemplated tender offer and the squeeze out of Norbert Dentressangle’s publicly held shares; the ability to successfully integrate and realize anticipated synergies and cost savings with respect to Norbert Dentressangle, BTT and other acquired companies; XPO’s ability to raise debt and equity capital; XPO’s ability to attract and retain key employees to execute its growth strategy, including retention of Norbert Dentressangle’s and BTT’s management teams; litigation, including litigation related to alleged misclassification of independent contractors; the ability to develop and implement a suitable information technology system; the ability to maintain positive relationships with XPO’s, Norbert Dentressangle’s and BTT’s networks of third-party transportation providers; the ability to retain XPO’s, Norbert Dentressangle’s, BTT’s and other acquired companies’ largest customers; rail and other network changes; weather and other service disruptions; and governmental regulation. All forward-looking statements set forth in this presentation are qualified by these cautionary statements and there can be no assurance that the actual results or developments anticipated will be realized or, even if substantially realized, that they will have the expected consequences to, or effects on, XPO, Norbert Dentressangle or their respective businesses or operations. Forward-looking statements set forth in this document speak only as of the date hereof, and neither XPO nor Norbert Dentressangle undertakes any obligation to update forward-looking statements to reflect subsequent events or circumstances, changes in expectations or the occurrence of unanticipated events except to the extent required by law. Information concerning Norbert Dentressangle contained in this presentation has been sourced from publicly available information. The public tender offer that will be filed by XPO on Norbert Dentressangle shares will be described in an information memorandum, which will be subject to the review and approval of the French Autorité des marchés financiers.

Non-GAAP Financial Measures This press release contains certain non-GAAP financial measures as defined under Securities and Exchange Commission (“SEC”) rules, such as adjusted net loss available to common shareholders and adjusted earnings (loss) before interest, taxes, depreciation and amortization (“adjusted EBITDA”), in each case for the quarters ended March 31, 2015 and 2014. As required by SEC rules, we provide reconciliations of these measures to the most directly comparable measure under United States generally accepted accounting principles (“GAAP”), which are set forth in the attachments to this release. We believe that adjusted net loss available to common shareholders improves comparability from period to period by removing the impact of nonrecurring expense items, including costs related to the conversion of the company’s convertible senior notes; acquisition-related transaction and integration costs; and accelerated amortization of trade names related to the rebranding to XPO Logistics. We believe that adjusted EBITDA improves comparability from period to period by removing the impact of our capital structure (interest expense from our outstanding debt), asset base (depreciation and amortization) and tax consequences, in addition to the nonrecurring expense items noted above. In addition to its use by management, we believe that adjusted EBITDA is a measure widely used by securities analysts, investors and others to evaluate the financial performance of companies in our industry. Other companies may calculate adjusted EBITDA differently, and therefore our measure may not be comparable to similarly titled measures of other companies. Adjusted EBITDA is not a measure of financial performance or liquidity under GAAP and should not be considered in isolation or as an alternative to net income, cash flows from operating activities and other measures determined in accordance with GAAP. Items excluded from adjusted EBITDA are significant and necessary components of the operations of our business, and, therefore, adjusted EBITDA should only be used as a supplemental measure of our operating performance. 2 | XPO Investor Presentation May 4, 2015

Contents

Growth strategy and execution First quarter 2015 financial results Planned acquisition of Norbert Dentressangle Planned acquisition of Bridge Terminal Transport Summary 3 | XPO Investor Presentation May 4, 2015

One of the Largest 3PLs in North America Today

Leader in end-to-end supply chain solutions #1 provider of last mile logistics for heavy goods #1 manager of expedited shipments #2 freight brokerage firm and 12th largest logistics company #3 provider of intermodal services, and leader in cross-border Mexico intermodal Leading provider of technology-enabled contract logistics Growing presence in freight forwarding, LTL and managed transportation Over 39,000 deliveries a day facilitated by XPO businesses Over 2 billion inventory units are tracked by XPO’s contract logistics technology at any given moment Source: Industry publications and company filings 4 | XPO Investor Presentation May 4, 2015

Strong Value Proposition Drives Growth

Complete service portfolio – Freight brokerage, intermodal, last mile, expedite, highly-engineered contract logistics and global forwarding Positioned as a single-source provider with the scale and resources to optimize the supply chains of blue chip customers – Capitalizes on the trend toward outsourcing Serves 15,000 customers in the manufacturing, retail, e-commerce, industrial, technology, aerospace, commercial, life sciences and government sectors 5 | XPO Investor Presentation May 4, 2015

Precise Execution of Growth Plan

Began executing a new growth strategy under new management, following a significant investment in the company in September of 2011 Completed 14 strategic acquisitions and established 23 cold-starts in three years Created leading-edge recruiting and training programs Introduced scalable IT platform Added national operations centers for shared services, carrier procurement and last-mile operations Stratified customers, assigned a single point of contact to each Created a culture of passionate on-time performance Disciplined focus on operational excellence 6 | XPO Investor Presentation May 4, 2015

Major Resources Dedicated to Customer Satisfaction

201 locations in the U.S., Canada, Mexico, Asia and Europe More than 10,000 employees Approximately 4,900 owner operator trucks under contract for drayage, expedited and last mile subsidiaries – Will expand to 6,200 owner operator trucks after acquisition of BTT Relationships with an additional 32,000 vetted carriers representing approximately 700,000 trucks Highly integrated and customer-focused organization 7 | XPO Investor Presentation May 4, 2015

Significant Growth Embedded in XPO’s Model

Strategic accounts: market multiple services to large shippers Multi-modal: become the logistics partner of choice by offering the most compelling range of transportation solutions Scale and productivity: recruit sales reps and provide state-of-the-art training and information technology Cold-starts: expand footprint in markets with best access to sales talent Market demand: build leadership positions in the fastest-growing areas of logistics M&A program: pursue the most strategically compelling opportunities while maintaining price-for-value discipline 8 | XPO Investor Presentation May 4, 2015

Secular Trends Driving Industry Growth

Growth in e-commerce retailing Outsourcing of logistics services and capacity Conversion from over-the-road to intermodal rail Near-shoring of manufacturing in Mexico Just-in-time lean production Driver shortage Automation in transportation and logistics We have positioned XPO’s service offering to capitalize on each of these trends 9 | XPO Investor Presentation May 4, 2015

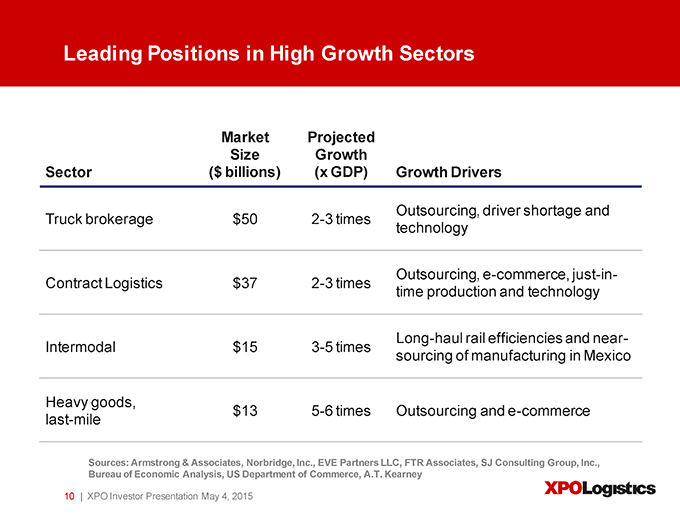

Leading Positions in High Growth Sectors

Market Projected Size Growth Sector ($ billions) (x GDP) Growth Drivers Outsourcing, driver shortage and Truck brokerage $50 2-3 times technology Outsourcing, e-commerce, just-in-Contract Logistics $37 2-3 times time production and technology Long-haul rail efficiencies and near-Intermodal $15 3-5 times sourcing of manufacturing in Mexico Heavy goods, $13 5-6 times Outsourcing and e-commerce last-mile Sources: Armstrong & Associates, Norbridge, Inc., EVE Partners LLC, FTR Associates, SJ Consulting Group, Inc., Bureau of Economic Analysis, US Department of Commerce, A.T. Kearney 10 | XPO Investor Presentation May 4, 2015

Focused Sales and Marketing Effort

Differentiate XPO by providing a passionate commitment to customer satisfaction across a range of services Strategic accounts team markets to largest 2,000 companies, where XPO can provide services throughout the supply chain in both transportation and logistics National accounts team focuses on next largest 1,600 companies Sales force is in constant contact with hundreds of thousands of small and mid-sized prospects Two-thirds of top 50 customers use multiple XPO services Sources: SJ Consulting Group, Inc., company data 11 | XPO Investor Presentation May 4, 2015

High Productivity through Technology

One common IT platform for freight brokerage in all cold-starts and acquired companies Proprietary Freight Optimizer tools for pricing and load-covering – Highly scalable load execution and tendering via automated load-to-carrier matching – Algorithms that retrieve truck information from multiple sources, weighted by cost and performance, to optimize carrier sourcing Proprietary Rail Optimizer tools rolled out in Q1 2015 – EDI integration secures 53’ container, small box and drayage capacity, and facilitate constant communications with the railroads – Alerts customers to unforeseen delays such as weather disruptions 2015 IT budget of $125 million 12 | XPO Investor Presentation May 4, 2015

Cold-starts Contribute to Organic Growth

23 cold-starts to date: 12 freight brokerage, 10 global forwarding; one expedite Low capital investment can deliver outsized returns Hire strong industry veterans as branch presidents Position in prime recruitment areas and scale up Freight brokerage cold-starts have grown organically to an annual revenue run rate of approximately $270 million 13 | XPO Investor Presentation May 4, 2015

CEO Bradley S. Jacobs

Prior to XPO, founded and led four highly successful companies, including two world-class publicly-traded corporations United Rentals: Built world’s largest equipment rental company United Waste: Created 5th largest solid waste business in North America Hamilton Resources: Grew global oil trading company to ~$1 billion Amerex Oil Associates: Built one of world’s largest oil brokerage firms United Rentals stock outperformed S&P 500 by 2.2x from 1997 to 2007 United Waste stock outperformed S&P 500 by 5.6x from 1992 to 1997 14 | XPO Investor Presentation May 4, 2015

Highly Skilled Management Team

Troy Cooper United Rentals, United Waste Chief Operating Officer John Hardig Stifel Nicolaus, Alex. Brown Chief Financial Officer Scott Malat Goldman Sachs, UBS, JPMorgan Chase Chief Strategy Officer Gordon Devens AutoNation, Skadden Arps General Counsel Louis DeJoy New Breed Chief Executive Officer, Supply Chain Bill Fraine Chief Operating Officer, Supply Chain New Breed, FedEx Ashfaque Chowdhury New Breed Chief Information Officer, Supply Chain Karl Meyer 3PD, Home Depot Chief Executive Officer, Last Mile Paul Smith Pacer President, Intermodal Julie Luna Pacer, Union Pacific Chief Commercial Officer Mario Harik Oakleaf Waste Management Chief Information Officer Partial list, the full management team can be found on www.xpo.com 15 | XPO Investor Presentation May 4, 2015

Highly Skilled Management Team

Dave Rowe Echo Global Logistics Chief Technology Officer Bud Workmon 3PD, Cardinal Logistics President, Last Mile Will O’Shea 3PD, Ryder, Cardinal Logistics Chief Sales and Marketing Officer, Last Mile Dominick Muzi Priority Solutions, AIT Worldwide President, Global Forwarding Drew Wilkerson C.H. Robinson Regional Vice President Michael O’Donnell Landstar, Penske, TNT Executive VP, Expedite Managed Transportation Jenna Sargent OHL, Schneider Logistics Regional Sales and Operations Manager Jake Schnell C.H. Robinson Sr. Operational Process and Integration Manager Lou Amo Electrolux, Union Pacific, Odyssey Logistics Vice President, Operational Initiatives Greg Ritter Knight Transportation, C.H. Robinson Senior Vice President, Strategic Accounts Chris Duffell United Rentals Vice President, Strategic Initiatives Partial list, the full management team can be found on www.xpo.com 16 | XPO Investor Presentation May 4, 2015

First Quarter 2015 Financial Results

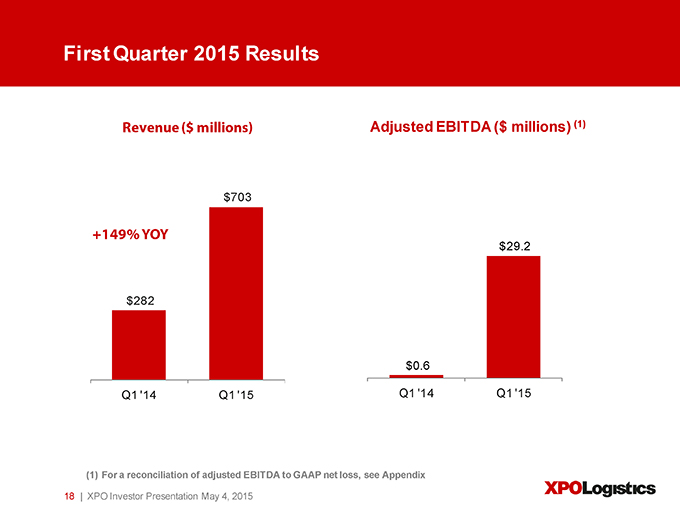

First Quarter 2015 Results Revenue ($ millions) Adjusted EBITDA ($ millions) (1) $703 +149% YOY $29.2 $282 $0.6 Q1 ‘14 Q1 ‘15 Q1 ‘14 Q1 ‘15 (1) For a reconciliation of adjusted EBITDA to GAAP net loss, see Appendix 18 | XPO Investor Presentation May 4, 2015

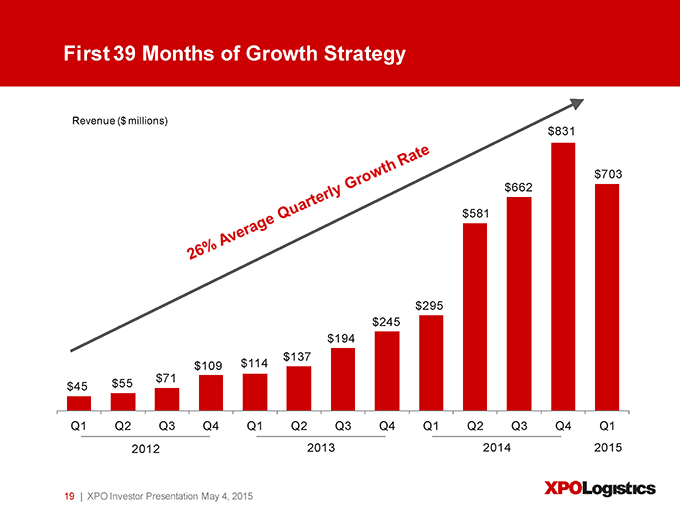

First 39 Months of Growth Strategy

Revenue ($ millions) $831 $703 $662 $581 $295 $245 $194 $137 $109 $114 $55 $71 $45 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 2012 2013 2014 2015 19 | XPO Investor Presentation May 4, 2015

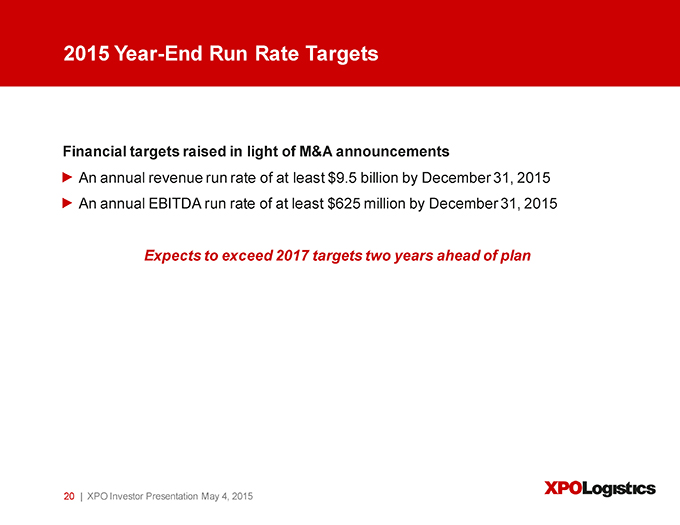

2015 Year-End Run Rate Targets

Financial targets raised in light of M&A announcements An annual revenue run rate of at least $9.5 billion by December 31, 2015 An annual EBITDA run rate of at least $625 million by December 31, 2015 Expects to exceed 2017 targets two years ahead of plan 20 | XPO Investor Presentation May 4, 2015

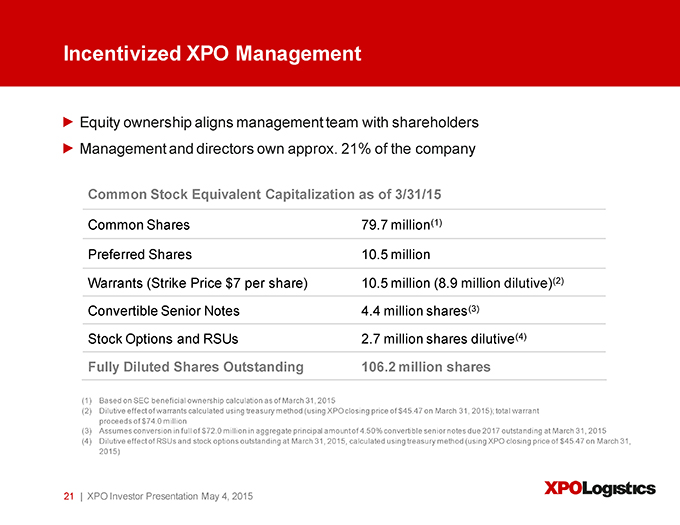

Incentivized XPO Management

Equity ownership aligns management team with shareholders Management and directors own approx. 21% of the company Common Stock Equivalent Capitalization as of 3/31/15 Common Shares 79.7 million(1) Preferred Shares 10.5 million Warrants (Strike Price $7 per share) 10.5 million (8.9 million dilutive)(2) Convertible Senior Notes 4.4 million shares(3) Stock Options and RSUs 2.7 million shares dilutive(4) Fully Diluted Shares Outstanding 106.2 million shares (1) Based on SEC beneficial ownership calculation as of March 31, 2015 (2) Dilutive effect of warrants calculated using treasury method (using XPO closing price of $45.47 on March 31, 2015); total warrant proceeds of $74.0 million (3) Assumes conversion in full of $72.0 million in aggregate principal amount of 4.50% convertible senior notes due 2017 outstanding at March 31, 2015 (4) Dilutive effect of RSUs and stock options outstanding at March 31, 2015, calculated using treasury method (using XPO closing price of $45.47 on March 31, 2015) 21 | XPO Investor Presentation May 4, 2015

Planned Acquisition of Norbert Dentressangle

XPO Will Attain Global Platform for Growth

Top ten worldwide logistics company 863 locations in 27 countries and more than 52,000 employees Europe’s largest ground transportation network, including more than €250 million of dedicated carriage – Mix of 7,700 owned trucks, 3,200 trucks contracted through owner-operators and access to an additional 12,000 independent carriers Leading outsourced European e-fulfillment platform Second largest freight brokerage firm worldwide by net revenue Information above reflects the pro-forma combination of XPO Logistics and Norbert Dentressangle Sources: Industry publications and company filings 23 | XPO Investor Presentation May 4, 2015

Strategic Rationale

ND’s capabilities closely mirror XPO’s North American offering – XPO will gain global scale in three of its core services: contract logistics, freight brokerage and global freight forwarding Companies share an asset-light model with low capital intensity: net capex of approximately 2.0%—2.5% of revenue Combines blue chip customer bases, including many of the world’s largest multinational companies Capitalizes on start of eurozone economic rebound and strong US dollar Significant future acquisition opportunities in highly fragmented eurozone Creates single source transportation and logistics provider with global footprint 24 | XPO Investor Presentation May 4, 2015

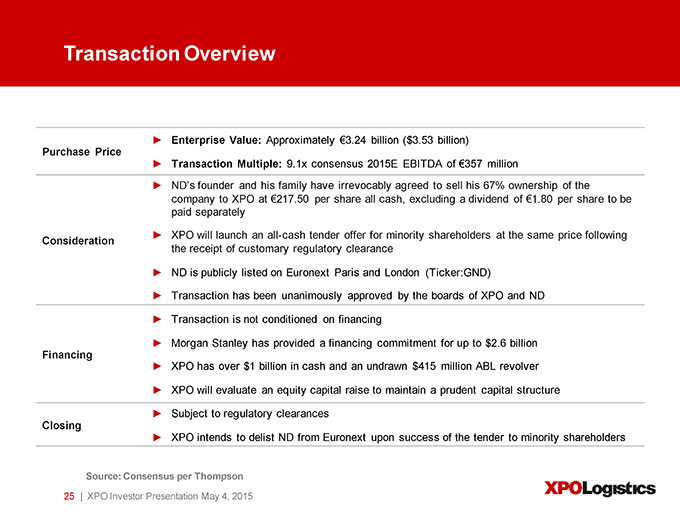

Transaction Overview

Enterprise Value: Approximately €3.24 billion ($3.53 billion) Purchase Price Transaction Multiple: 9.1x consensus 2015E EBITDA of €357 million ND’s founder and his family have irrevocably agreed to sell his 67% ownership of the company to XPO at €217.50 per share all cash, excluding a dividend of €1.80 per share to be paid separately XPO will launch an all-cash tender offer for minority shareholders at the same price following Consideration the receipt of customary regulatory clearance ND is publicly listed on Euronext Paris and London (Ticker:GND) Transaction has been unanimously approved by the boards of XPO and ND Transaction is not conditioned on financing Morgan Stanley has provided a financing commitment for up to $2.6 billion Financing XPO has over $1 billion in cash and an undrawn $415 million ABL revolver XPO will evaluate an equity capital raise to maintain a prudent capital structure Subject to regulatory clearances Closing XPO intends to delist ND from Euronext upon success of the tender to minority shareholders Source: Consensus per Thompson 25 | XPO Investor Presentation May 4, 2015

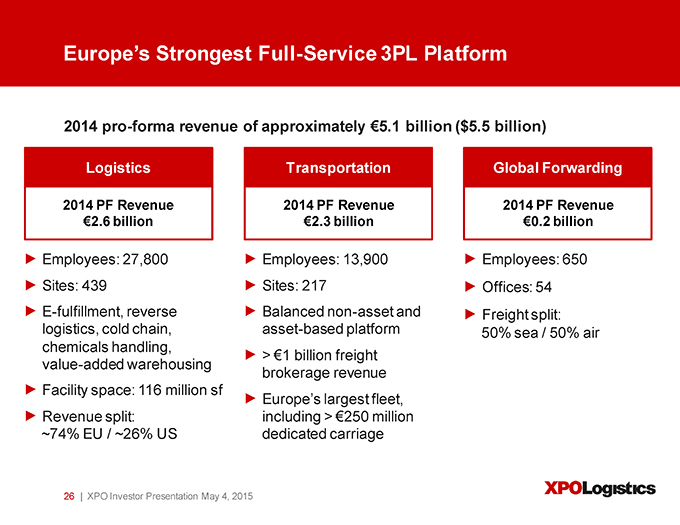

Europe’s Strongest Full-Service 3PL Platform

2014 pro-forma revenue of approximately €5.1 billion ($5.5 billion) Logistics Transportation Global Forwarding 2014 PF Revenue 2014 PF Revenue 2014 PF Revenue €2.6 billion €2.3 billion €0.2 billion Employees: 27,800 Employees: 13,900 Employees: 650 Sites: 439 Sites: 217 Offices: 54 E-fulfillment, reverse Balanced non-asset and Freight split: logistics, cold chain, asset-based platform 50% sea / 50% air chemicals handling, > €1 billion freight value-added warehousing brokerage revenue Facility space: 116 million sf Europe’s largest fleet, Revenue split: including > €250 million ~74% EU / ~26% US dedicated carriage 26 | XPO Investor Presentation May 4, 2015

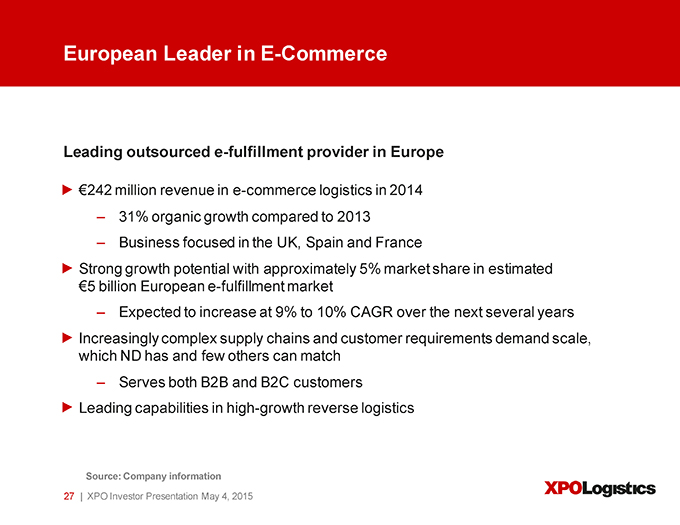

European Leader in E-Commerce

Leading outsourced e-fulfillment provider in Europe €242 million revenue in e-commerce logistics in 2014 – 31% organic growth compared to 2013 – Business focused in the UK, Spain and France Strong growth potential with approximately 5% market share in estimated €5 billion European e-fulfillment market – Expected to increase at 9% to 10% CAGR over the next several years Increasingly complex supply chains and customer requirements demand scale, which ND has and few others can match – Serves both B2B and B2C customers Leading capabilities in high-growth reverse logistics Source: Company information 27 | XPO Investor Presentation May 4, 2015

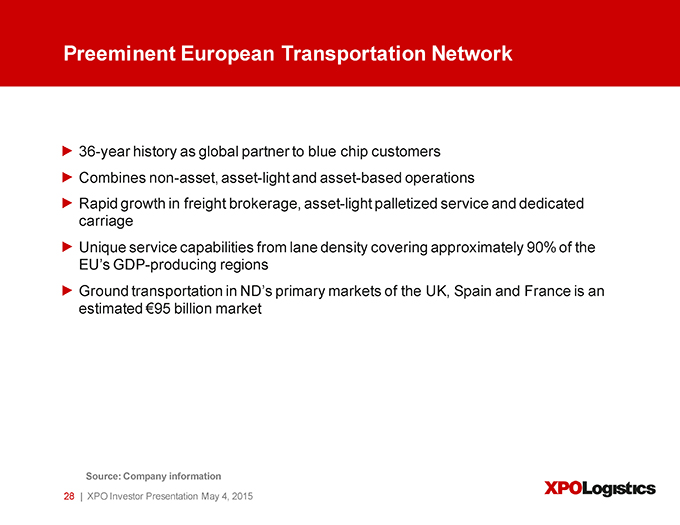

Preeminent European Transportation Network

36-year history as global partner to blue chip customers Combines non-asset, asset-light and asset-based operations Rapid growth in freight brokerage, asset-light palletized service and dedicated carriage Unique service capabilities from lane density covering approximately 90% of the EU’s GDP-producing regions Ground transportation in ND’s primary markets of the UK, Spain and France is an estimated €95 billion market Source: Company information 28 | XPO Investor Presentation May 4, 2015

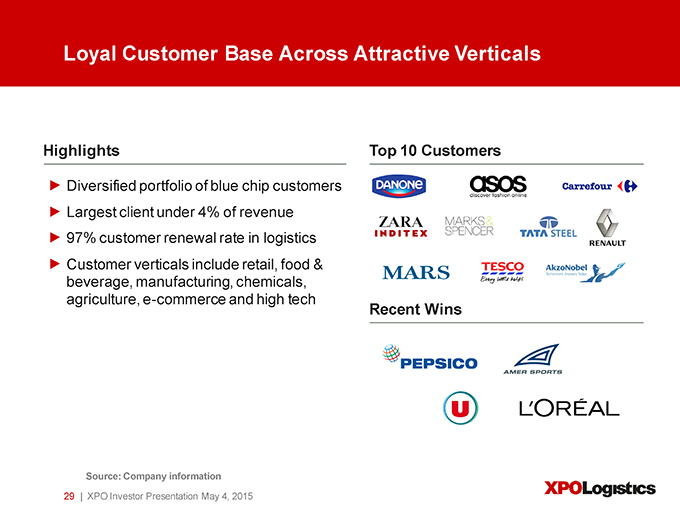

Loyal Customer Base Across Attractive Verticals

Highlights Top 10 Customers Diversified portfolio of blue chip customers Largest client under 4% of revenue 97% customer renewal rate in logistics Customer verticals include retail, food & beverage, manufacturing, chemicals, agriculture, e-commerce and high tech Recent Wins Source: Company information 29 | XPO Investor Presentation May 4, 2015

Synergies to Drive Growth

Substantial opportunities to cross-sell services and cross-fertilize best practices between North American and European platforms XPO expects to invest in growing the European business through – Expansion of e-fulfillment services to build on leadership position – Deployment of proprietary Freight Optimizer platform to grow best-in-class brokerage capabilities – A combined annual technology spend of approximately $225 million, which will be among the highest in the industry Global scale in contract logistics supports operational excellence 30 | XPO Investor Presentation May 4, 2015

Intense Focus on Operational Execution

Current ND CEO Hervé Montjotin will become CEO of XPO Europe and President of XPO Logistics worldwide Substantially all of the ND executive team will join XPO ND’s headquarters in Lyon, France will become XPO’s European headquarters Global career advancement and rotation opportunities make XPO the destination of choice for top talent Similar entrepreneurial company cultures focused on world-class service Ongoing benefits from sharing of best practices worldwide Disciplined integration processes in place 31 | XPO Investor Presentation May 4, 2015

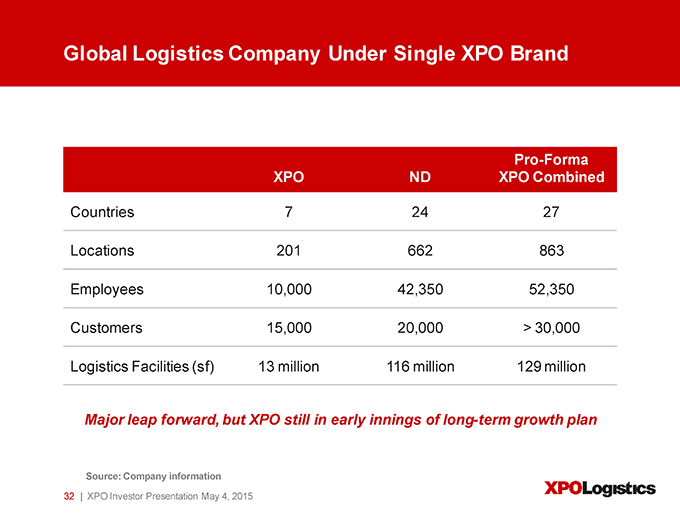

Global Logistics Company Under Single XPO Brand

Pro-Forma XPO ND XPO Combined

Countries 7 24 27 Locations 201 662 863 Employees 10,000 42,350 52,350 Customers 15,000 20,000 > 30,000 Logistics Facilities (sf) 13 million 116 million 129 million Major leap forward, but XPO still in early innings of long-term growth plan Source: Company information 32 | XPO Investor Presentation May 4, 2015

Planned Acquisition of Bridge Terminal Transport

Bridge Terminal Transport Services Company Profile BTT is one of the largest asset-light drayage providers in the United States Network of 1,300 independent owner operators and 28 terminals, primarily on the East Coast – Approximately 250 employees 33-year-old company with loyal blue chip customer relationships – Approximately 1,800 customers – Top ten customers have an average tenure of 19 years with BTT Revenue of $232 million and EBITDA of $12.4 million for the trailing 12 months ended March 31, 2015 34 | XPO Investor Presentation May 4, 2015

Strategic Rationale and Synergies

Acquisition will increase XPO’s total capacity under contract to its drayage, last mile and expedite businesses to more than 6,200 independent owner operators – Can take on more freight in tight markets, when drayage capacity is scarce – More cost effective and more reliable to use contracted owner operators, rather than unaffiliated third-party carriers Strengthens XPO’s drayage footprint on the East Coast Well-run operations can be seamlessly integrated into XPO’s network 35 | XPO Investor Presentation May 4, 2015

Details of the BTT Transaction

Purchase price is $100 million, excluding any working capital adjustments, with no assumption of debt Represents a consideration of 8.1 times EBITDA of $12.4 million Expected to be immediately accretive to earnings before the benefits of cross-selling and other synergies Expected to close in the second quarter of 2015 Will be rebranded and integrated with XPO Logistics Closing is subject to customary conditions, including antitrust clearance 36 | XPO Investor Presentation May 4, 2015

Clear Path for Significant Value Creation

XPO’s growth plan is still in early innings Significant future growth embedded in XPO’s business model Leading positions in fastest-growing areas of transportation and logistics Compelling value proposition as a multi-modal, single-source provider Passionate culture of on-time performance and efficiency Top management talent with requisite skills to execute XPO’s growth strategy As large as we are, we have captured less than 1% of the opportunity represented by customer spend For a reconciliation of adjusted EBITDA to GAAP net loss, see Appendix 37 | XPO Investor Presentation May 4, 2015

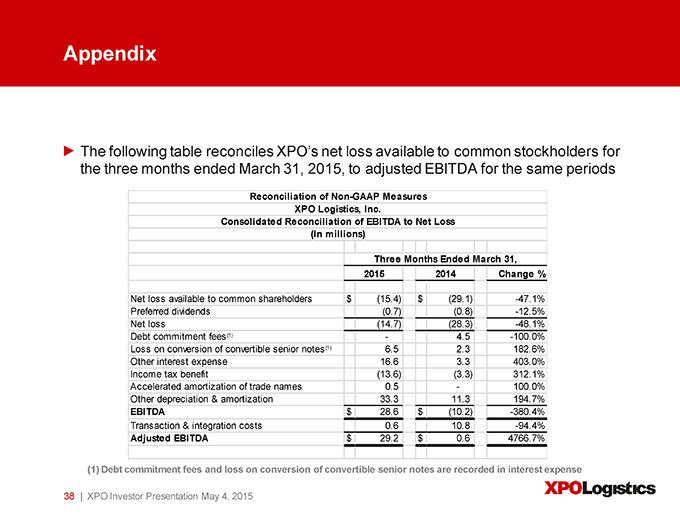

Appendix

The following table reconciles XPO’s net loss available to common stockholders for the three months ended March 31, 2015, to adjusted EBITDA for the same periods Reconciliation of Non-GAAP Measures XPO Logistics, Inc. Consolidated Reconciliation of EBITDA to Net Loss (In millions) Three Months Ended March 31, 2015 2014 Change % Net loss available to common shareholders $ (15.4) $ (29.1) -47.1% Preferred dividends (0.7) (0.8) -12.5% Net loss (14.7) (28.3) -48.1% Debt commitment fees(1) - 4.5 -100.0% Loss on conversion of convertible senior notes(1) 6.5 2.3 182.6% Other interest expense 16.6 3.3 403.0% Income tax benefit (13.6) (3.3) 312.1% Accelerated amortization of trade names 0.5 -100.0% Other depreciation & amortization 33.3 11.3 194.7% EBITDA $ 28.6 $ (10.2) -380.4% Transaction & integration costs 0.6 10.8 -94.4% Adjusted EBITDA $ 29.2 $ 0.6 4766.7% (1) Debt commitment fees and loss on conversion of convertible senior notes are recorded in interest expense 38 | XPO Investor Presentation May 4, 2015