Attached files

| file | filename |

|---|---|

| EX-23 - EX-23 - XPO Logistics, Inc. | xpo201410-kexx23.htm |

| EX-21 - EX-21 - XPO Logistics, Inc. | xpo201410-kexx21.htm |

| EX-31.1 - EX-31.1 - XPO Logistics, Inc. | xpo201410-kexx311.htm |

| EX-32.2 - EX-32.2 - XPO Logistics, Inc. | xpo201410-kexx322.htm |

| EX-32.1 - EX-32.1 - XPO Logistics, Inc. | xpo201410-kexx321.htm |

| EX-31.2 - EX-31.2 - XPO Logistics, Inc. | xpo201410-kexx312.htm |

| EXCEL - IDEA: XBRL DOCUMENT - XPO Logistics, Inc. | Financial_Report.xls |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

(Mark One)

ý | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Fiscal Year Ended December 31, 2014

OR

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number: 001-32172

XPO Logistics, Inc.

(Exact name of registrant as specified in its charter)

Delaware | 03-0450326 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

Five Greenwich Office Park

Greenwich, Connecticut 06831

(Address of principal executive offices)

(855) 976-4636

(Registrant’s telephone number, including area code)

Securities registered under Section 12(b) of the Act:

Title of Each Class: | Name of Each Exchange on Which Registered: | |

Common Stock, par value $.001 per share | New York Stock Exchange | |

Securities registered pursuant to Section 12(g) of the Act:

None

__________________________________

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ý No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ¨ No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ý

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer | ý | Accelerated filer | ¨ | |||

Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act): Yes ¨ No ý

The aggregate market value of the registrant’s common stock, par value $0.001 per share, held by non-affiliates of the registrant was $1,505,183,527 as of June 30, 2014, the last business day of the registrant’s most recently completed second fiscal quarter, based upon the closing price of $28.62 per share on the NYSE on that date.

As of February 20, 2015, there were 79,367,271 shares of the registrant’s common stock, par value $0.001 per share, outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Specified portions of the registrant’s proxy statement, which will be filed with the Securities and Exchange Commission pursuant to Regulation 14A in connection with the registrant’s 2015 Annual Meeting of Stockholders (the “Proxy Statement”), are incorporated by reference into Part III of this Annual Report on Form 10-K. Except with respect to information specifically incorporated by reference in this Annual Report, the Proxy Statement is not deemed to be filed as part hereof.

XPO LOGISTICS, INC.

FORM 10-K—FOR THE YEAR ENDED DECEMBER 31, 2014

TABLE OF CONTENTS

PART I | Page No. | |

Item 1 | ||

Item 1A | ||

Item 1B | ||

Item 2 | ||

Item 3 | ||

Item 4 | ||

PART II | ||

Item 5 | ||

Item 6 | ||

Item 7 | ||

Item 7A | ||

Item 8 | ||

Item 9 | ||

Item 9A | ||

Item 9B | ||

PART III | ||

Item 10 | ||

Item 11 | ||

Item 12 | ||

Item 13 | ||

Item 14 | ||

PART IV | ||

Item 15 | ||

Exhibit Index

This Annual Report on Form 10-K is for the year ended December 31, 2014. The Securities and Exchange Commission (the “SEC”) allows us to incorporate by reference information that we file with the SEC, which means that we can disclose important information to you by referring you directly to those documents. Information incorporated by reference is considered to be part of this Annual Report. In addition, information that we file with the SEC in the future will automatically update and supersede information contained in this Annual Report.

1

PART I

ITEM 1. BUSINESS

General

XPO Logistics, Inc., a Delaware corporation, together with its subsidiaries (“XPO” or the “Company”), is a leading asset-light provider of third-party logistics services. Shippers and carriers outsource their transportation logistics to us, and we facilitate supply chain solutions.

As a third-party, asset-light logistics provider, we utilize our relationships with subcontracted transportation providers—typically independent contract motor carriers, railroads and charter aircraft owners for domestic loads, and air and ocean carriers for international shipments. As of December 31, 2014, we had approximately 4,100 trucks under contract to our intermodal, expedited and last mile business units. We have access to additional transportation capacity through our relationships with over 30,000 other carriers.

In September 2011, following the equity investment in the Company led by Jacobs Private Equity, LLC, we began implementing our strategy to leverage our strengths, with the goals of significant growth and value creation. Through the disciplined execution of our strategy, we have built leading positions in some of the fastest-growing sectors of transportation logistics in North America. As of December 31, 2014, we were:

• | The third largest freight brokerage firm and a Top 50 logistics company; |

• | The largest provider of last mile logistics for heavy goods and a leading last mile provider to the e-commerce industry; |

• | The largest manager of expedited shipments through our expedited ground, air charter and web-based managed transportation services; |

• | The third largest provider of intermodal services; and |

• | A leading provider of highly engineered, technology-enabled contract logistics services for large manufacturers and service companies. |

We believe that our broad service offerings give us a competitive advantage, as many customers, particularly large shippers, increasingly seek to do business with fewer, larger third-party logistics providers that offer deep capacity across a wide range of services. Our services are provided by a well-trained employee base that understands the importance of providing world-class service. We currently have more than 10,000 employees, all non-union.

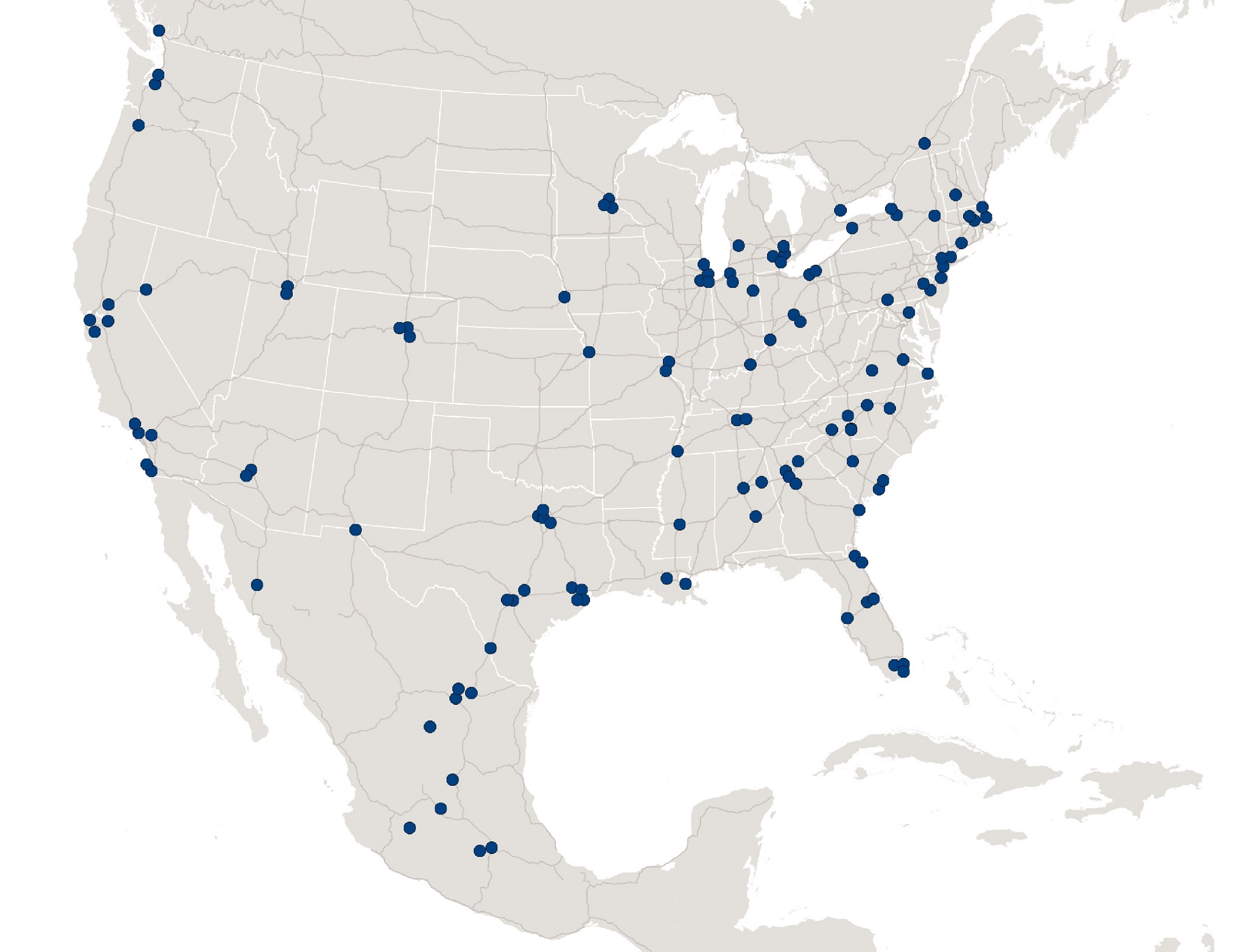

As of December 31, 2014, our Transportation and Logistics segments operated from 197 locations in North America, Europe and Asia including: 178 Company-owned branches and 19 independent agent offices. See below for a map of our locations over North America.

2

XPO Logistics Footprint in North America as of December 31, 2014

Our Business Units

As of December 31, 2014, our activities consisted of two business segments. Our Transportation segment consists of our truck brokerage, intermodal, last mile, expedited transportation and freight forwarding businesses. Our Logistics segment consists of our contract logistics business. We provide financial information for our segments in Note 16 to our Consolidated Financial Statements. The differences in our operating and reportable segments from our last annual report are related to an internal management reorganization and acquisitions during the year ended December 31, 2014. Our previous Freight Brokerage, Expedited Transportation and Freight Forwarding reportable segments have been consolidated into the Transportation operating and reportable segment while our acquisition of New Breed (previously the Contract Logistics reportable segment) represents the Logistics operating and reportable segment.

Transportation

Our Transportation segment provides transportation brokerage services to large multi-national, medium-sized and small business customers where the Company manages all aspects of the services offered including selecting qualified carriers/vessels, negotiating rates, tracking shipments, billing and resolving disputes. Transportation offers a comprehensive suite of services with the common goal of facilitating the movement of goods using proprietary transportation management technology and third-party carriers. Transportation includes our truck brokerage, intermodal, last mile, expedited transportation and freight forwarding operations as further described below.

Truck Brokerage

Our XPO Logistics truck brokerage business is a non-asset business that places shippers’ freight with qualified carriers, primarily trucking companies. This freight is typically classified as truckload (“TL”) or less than-truckload (“LTL”) shipments. Customers offer loads to us via telephone, fax, email, electronic data interchange and the Internet on a daily basis. The majority of these services are priced on a transactional or spot market basis for both customers and carriers. In some cases, we contractually agree to handle a significant portion of a customer’s freight at pre-determined rates for specific origin and destination parameters. We collect payments from our customers and pay the carriers for transporting customer loads.

From 2011 to 2014, we grew our truck brokerage business from a single location to the third largest truck brokerage firm based on net revenues in North America in 2014. We have continued to grow our truck brokerage operations, and during 2011

3

through 2014, we made six brokerage acquisitions and established 13 cold-start sales office locations. We believe that we have a substantial opportunity to continue to scale up the business given that, based on our revenue for the quarter ended December 31, 2014, we currently serve less than 1.5% of the estimated addressable truck brokerage market.

Intermodal

Our XPO Logistics intermodal business is asset-light; it provides container capacity, rail brokerage, local drayage (also called cartage), on-site operational services and door-to-door shipment management. We contract with railroads to provide the long-haul portion of the shipment of freight in containers, and we contract with trucking companies for the local pick-up and delivery legs of the intermodal freight movement. We also provide customized electronic tracking and analysis of market prices and negotiated rail, truck and intermodal rates, in order to determine the optimal transportation routes.

Since our March 2014 acquisition of Pacer International, Inc. and its subsidiaries (“Pacer”), we have offered door-to-door intermodal services to a wide range of customers in North America, including large industrial and retail shippers, transportation intermediaries such as intermodal marketing companies, and steamship lines. The Pacer acquisition made us the third largest provider of intermodal services in North America, and a leading provider of intermodal services in the fast-growing cross-border Mexico sector.

Last Mile

Our XPO Last Mile business is a leading non-asset provider of last mile logistics in North America and the largest facilitator of last mile deliveries for heavy goods. Last mile delivery comprises the final stage of the delivery from a local distribution center or retail store to the end-consumer’s home or business. This is a fast growing sector of transportation logistics that serves blue chip retailers, e-commerce companies and smaller retailers with limited in-house trucking capabilities.

Important aspects of last mile service are responsiveness to seasonal demand, economies of scale, and an ability to maintain a consistently high quality of customer experience. In addition, the last mile process often requires incremental services, including pre-scheduled delivery times, unpacking, assembly, utility connection, installation or removal of an old product. These additional services are commonly referred to as white-glove services. We use our proprietary technology platforms to collect customer feedback, monitor carrier performance, manage capacity and communicate during narrow windows of service to ensure an end-consumer experience that protects the brand equity of our customers.

In August 2013, we acquired 3PD Holding, Inc. (“3PD”), which made us a leader in the heavy goods sector of last mile logistics. In November 2013, we expanded our last mile capabilities with the acquisition of Optima Service Solutions, LLC (“Optima”), which uses a contractual network of independent carriers and technicians to facilitate last mile delivery and installation of large appliances and electronics. In June 2014, we rebranded our last mile delivery logistics business to XPO Last Mile. In July 2014, we further expanded our last mile operations with the acquisition of Simply Logistics Inc d/b/a Atlantic Central Logistics (“ACL”), which focuses on serving the e-commerce channel through 14 East Coast locations. In February 2015, we further expanded our last mile logistics operations through the acquisition of UX Specialized Logistics (“UX”), a North American provider of last mile logistics services for major retail chains and e-commerce companies.

Expedited Transportation

Our expedited transportation group is predominantly a non-asset based service provider—substantially all of the transportation equipment used in its operations is provided by independent owner-operators who own one piece of equipment, or by independent owners of multiple pieces of equipment who employ multiple drivers, commonly referred to as fleet owners. We are focused on developing strong, long-term relationships with these fleet owners and incentivizing them to furnish their capacity to us on an exclusive basis.

Our expedited transportation group operates as XPO Express, XPO NLM and XPO Air Charter, and is the largest manager of expedited shipments in North America. Expedited transportation services can be characterized as time-critical, time-sensitive or high priority freight shipments, many of which have special handling needs. These urgent needs typically arise due to tight supply chain tolerances, interruptions or changes in the supply chain or the failure of another mode of transportation within the supply chain.

Expedited shipments are predominantly direct transit movements offering door-to-door service within tightly prescribed time parameters. Customers request our services typically on a per-load transaction basis, with only a small percentage of loads being scheduled for future delivery dates. We operate an ISO 9001:2008 certified 24-hour, seven-day-a-week call center that gives our customers on-demand communications and status updates relating to their shipments.

XPO Express facilitates the over-the-road movement of urgent freight and is the largest component of our expedited transportation group. XPO Air Charter arranges point-to-point air charter services and combines them with ground transportation to achieve the most expedient delivery time. In the year ended December 31, 2014, XPO NLM’s proprietary

4

online bid technology managed more than $750 million of gross transportation expenditures. Our expedited services are supported by our freight forwarding business, which can arrange shipments on demand as part of multi-modal freight movements.

Freight Forwarding

Our XPO Global Logistics freight forwarding business operates as a non-asset based logistics provider for domestic and international shipments. We provide time-critical, time-sensitive and cost-sensitive services for global freight movements, domestic U.S. and cross-border North America movements, as well as value-added and customized services such as asset retrieval.

XPO Global Logistics provides its services through a network of relationships with ground, air and ocean carriers and a network of Company-owned and agent-owned locations. Our freight forwarding capabilities are not restricted by size, weight, mode or location, and therefore are potentially attractive to a wide market base.

Our subsidiary, Ocean World Lines, Inc. (“OWL”), operates as a non-vessel operating common carrier (“NVOCC”) and transports our customers’ freight by contracting with the actual vessel operator. We consolidate the freight bound for a particular destination from a common shipping point, prepare required shipping documents, arrange for any inland transportation, deliver the freight to the vessel operator and arrange transportation to the final destination. At the destination port, acting directly or through our agent, we deliver the freight to the receivers of the goods, which may include customs clearance and inland freight transportation to the final destination.

As a customs broker, we are licensed by the U.S. Customs and Border Protection Service to act on behalf of importers in handling customs formalities and other details critical to the importation of goods. We prepare and file formal documentation required for clearance through customs agencies, obtain customs bonds, facilitate the payment of import duties on behalf of the importer, arrange for the payment of collect freight charges, assist with determining and obtaining the best commodity classifications for shipments and assist with qualifying for duty drawback refunds. We provide customs brokerage services to direct domestic importers in connection with many of the shipments that we handle as an NVOCC, as well as shipments arranged by other freight forwarders, NVOCCs or vessel operating common carriers.

Logistics

On September 2, 2014, the Company acquired New Breed Holding Company (“New Breed”), a preeminent U.S. provider of asset-light based, complex, technology-enabled contract logistics for large multi-national and medium-sized corporations and government agencies.

New Breed’s customers primarily operate in industries with high-growth outsourcing opportunities, such as technology, telecom, e-commerce, aerospace and defense, medical equipment and select areas of manufacturing. These customers have demanding requirements for quality standards, real-time data visibility, customer service, handling of high-value products, high transaction volumes with large numbers of SKUs, and/or time-assured deliveries.

With our acquisition of New Breed, we design, implement, operate and optimize mission-critical outsourced supply chains for leading corporations. Through New Breed’s supply chain technology and operational expertise, we offer services solving complex supply chain challenges and create and implement transformative solutions for customers, while reducing their operating costs and inventory levels and improving their customer service. We believe that the combination of New Breed’s information technology (“IT”) workforce with our own—resulting in over 600 dedicated IT professionals focused on customer-facing innovations—advances our competitive advantage across all our lines of business.

Our Strategy

Our strategy has three main components:

• | Acquisitions. We take a disciplined approach to acquisitions: we look for companies that are highly scalable and are a good strategic fit with our core competencies. When we acquire a company, we seek to integrate it with our operations by moving the acquired operations onto our technology platform that connects our broader organization. We gain more carriers, customers, lane histories and pricing histories with each acquisition, and some acquisitions add complementary services. We use these resources company-wide to buy transportation more efficiently and to cross-sell a more complete supply chain solution to customers. In 2012, we completed the acquisition of four non-asset, third-party logistics companies. We acquired another six companies in 2013, including 3PD, the largest non-asset, third-party provider of last mile logistics for heavy goods in North America, and National Logistics Management (“NLM”), the largest provider of web-based expedited transportation management in North America. On March 31, 2014, we acquired Pacer, the third largest provider of intermodal transportation services in North America. On July 28, 2014, we acquired last mile logistics company ACL. We |

5

completed our acquisition of contract logistics company New Breed on September 2, 2014. On February 9, 2015, we acquired substantially all of the assets of last mile logistics company UX Specialized Logistics (“UX”). We have an active pipeline of key targets, and we plan to continue acquiring quality companies that fit our strategy for growth.

• | Cold-starts. We believe that cold-starts can generate high returns on invested capital because of the relatively low amount of start-up capital—generally one million dollars or less for a brokerage coldstart—and the large component of variable-based incentive compensation. Given this model, cold-starts of any size can generate high returns on invested capital. We plan to continue to open cold-start locations where we see the potential for strong returns. |

• | Optimization of operations. We are continuing to optimize our existing operations by growing our sales force, implementing advanced information technology, cross-selling our services and leveraging our shared capacity. We have a disciplined framework of processes in place for the recruiting, training and mentoring of newly hired employees, and for marketing to the hundreds of thousands of prospective customers who can use our services. Our network is supported by our proprietary information technology that includes robust sales, service, carrier procurement and customer experience management capabilities, as well as benchmarking and analysis. Most important to our growth, we are developing a culture of passionate, world-class service for customers. |

Information Systems and Intellectual Property

One of the ways we empower our employees to deliver world-class service is through our information technology. We believe that technology is a big differentiator in our industry. We have an IT team of over 600 talented professionals that focuses solely on driving innovation and the effectiveness of our systems.

In our Transportation segment, we have been making a significant investment in information technology. In our truck brokerage business, we have developed a proprietary software solution that provides actionable pricing information as well as cost effective, timely and reliable access to carrier capacity, which we believe gives us an advantage versus our competitors. In our last mile business, our proprietary software provides real-time workflow visibility and customer experience management for superior satisfaction ratings. Our XPO NLM business manages more than $750 million of gross transportation spend using our proprietary online bidding software where carriers bid on loads that are awarded electronically. In our expedited transportation business, we utilize satellite tracking and communication units on our independently-contracted vehicles, which provides our customers with real-time electronic updates.

We have over 200 IT projects currently planned for launch in 2015, including the planned release of our proprietary Rail Optimizer system for our intermodal business, currently in beta test. This software is designed to optimize all aspects of the intermodal network, including shipment management, capacity flow and asset management, market-based pricing and shipment execution with our rail providers.

In 2014, our acquisition of New Breed included proprietary technology that enables sophisticated contract logistics solutions for large multi-national and medium-sized corporations and government agencies with complex supply chain requirements. This software supports services such as omni-channel distribution, reverse logistics, transportation management, freight bill audit and payment, lean manufacturing support, aftermarket support and supply chain optimization.

Technology represents one of our Company’s largest categories of investment within our annual capital expenditure budget, reflecting our belief that the continual enhancement of our technology platforms is critical to our success. By continuing to develop our technology solutions, we plan to improve our productivity through automation and process optimization, and to be in position to effectively integrate our anticipated acquisitions and leverage our scale across XPO.

We rely on a combination of trademarks, copyrights, trade secrets, and nondisclosure and non-competition agreements to establish and protect our intellectual property and proprietary technology. Additionally, we have numerous registered trademarks, trade names, and logos in the United States and international locations.

Customers, Sales and Marketing

Our Company provides services to a variety of customers ranging in size from small, entrepreneurial organizations to Fortune 500 companies. During 2014, our business units served more than 15,000 different customers. Approximately 16.1% of revenue for the year ended December 31, 2014 was attributable to our top five clients for such period, with our largest customer accounting for approximately 5.1% of our revenue during such period.

Our customers are engaged in a wide range of industries, including manufacturing, industrial, retail, technology, aerospace, commercial, life sciences and government sectors. In addition, we serve third-party logistics providers, who themselves serve a multitude of customers and industries. Our third-party logistics provider customers vary in size from small, independent, single-facility organizations to global logistics companies. Our truck brokerage, last mile, intermodal, and expedited services are marketed to the United States, Canada and Mexico while our freight forwarding business serves these

6

same North American markets, as well as global markets. Our contract logistics services are marketed primarily in the United States.

To serve our customers, we maintain a significant staff of sales representatives and related support personnel. In addition to our own sales staff and locations, our network of independent agents manages sales relationships within their exclusive markets in our freight forwarding business.

Our sales strategy is twofold: we seek to establish long-term relationships with new accounts and to increase the amount of business generated from our existing customer base. These objectives are served by our position as one of the largest third-party logistics providers in North America and by our ability to cross-sell a range of services. We believe that these attributes are competitive advantages in the transportation logistics industry. We are focused on raising our profile in front of every prospective customer in this sector by deploying a highly experienced, dedicated team that sells to the 2,000 largest shippers, which we have identified as strategic accounts, and the next largest 1,600 shippers, identified as national accounts. Additionally, our branch sales teams pursue the hundreds of thousands of small to medium-sized shippers operating in North America. See Note 16 to the Consolidated Financial Statements for further geographic information.

Competition

The transportation logistics industry is intensely competitive with thousands of transportation companies competing in the domestic and international markets. Our competitors include local, regional, national and international companies with the same services that our business units provide. Due in part to the fragmented nature of the industry, our business units do not operate from a position of dominance, and therefore must strive daily to retain existing business relationships and forge new relationships.

We compete on service, reliability, scope of operations, information technology capabilities and price. Some competitors have larger customer bases, significantly more resources and more experience than we do. The health of the transportation logistics industry will continue to be a function of domestic and global economic growth. However, we believe we will benefit from a long-term outsourcing trend that should continue to enable certain sectors of transportation logistics, particularly the freight brokerage sector, to grow at rates that outpace growth in the macro-environment.

Regulation

Our operations are regulated and licensed by various governmental agencies in the United States and in the other countries where we operate. Such regulations impact us directly and indirectly by regulating third-party transportation providers we use to transport freight for our customers.

Regulation affecting Motor Carriers, Owner Operators and Transportation Brokers. Our subsidiaries that operate as motor carriers have licenses to operate as motor carriers from the Federal Motor Carrier Safety Administration (“FMCSA”) of the U.S. Department of Transportation (“DOT”). Our subsidiaries acting as property brokers have property broker licenses from the FMCSA. Our motor carrier subsidiaries and the third-party motor carriers we engage in the United States must comply with the safety and fitness regulations of the DOT, including those relating to drug- and alcohol-testing, hours-of-service, records retention, vehicle inspection, driver qualification and minimum insurance requirements. Weight and equipment dimensions also are subject to government regulations. We also may become subject to new or more restrictive regulations relating to emissions, drivers’ hours-of-service, independent contractor eligibility requirements, onboard reporting of operations, air cargo security and other matters affecting safety or operating methods. Other agencies, such as the U.S. Environmental Protection Agency (“EPA”), the Food and Drug Administration, the California Air Resources Board, and U.S. Department of Homeland Security (“DHS”), also regulate our equipment, operations and independent contractor drivers. We and the third-party carriers we use are also subject to a variety of state vehicle registration and licensing requirements.

The FMCSA has introduced the Compliance Safety Accountability program (“CSA”), which uses a Safety Management System (“SMS”) to rank motor carriers on seven categories of safety-related data, known as Behavioral Analysis and Safety Improvement Categories, or “BASICs,” which data, it is anticipated, will eventually be used for determining a carrier’s DOT safety rating under revisions to existing Safety Fitness Determination (“SFD”) regulations. As a result, our fleet could be ranked poorly as compared to our competitors, and the safety ratings of our motor carrier operations could be adversely impacted. Our network of third-party transportation providers may experience a similar result. A reduction in safety and fitness ratings may result in difficulty attracting and retaining qualified independent contractors and could cause our customers to direct their business away from us and to carriers with more favorable CSA scores, which would adversely affect our results of operations.

In the past, the subsidiaries through which we operate our expedited and intermodal drayage operations have exceeded the established intervention threshold in certain of the BASICs, and we may exceed those thresholds in the future. Depending on our ratings, we may be prioritized for an intervention action or roadside inspection, either of which could adversely affect our results of operations, or customers may be less likely to assign loads to us. We cannot predict the extent to which CSA

7

requirements or safety and fitness ratings under SMS or SFD could adversely affect our business, operations or ability to retain compliant drivers, or those of our subsidiaries, independent contractors or third-party transportation providers.

The FMCSA has proposed new rules that would require nearly all carriers, including us, to install and use electronic logging devices (“ELD”). The proposed regulations provide for the installation and use of ELDs to be required two years after publication of the final regulations. ELD installation will increase costs for, and may not be well-received by, independent contractors.

Our operations serving ports and rail yards are subject to various regulatory initiatives such as the Ports of Los Angeles and Long Beach clean truck program effective in 2009, California Air Resources Board (“CARB”) drayage truck regulation effective in 2010 and the Port of Oakland truck ban effective in 2010, each of which banned trucks that did not meet certain emissions standards. To comply with these requirements, our motor carrier subsidiaries providing intermodal drayage services in California have implemented programs to source truck capacity from independent owner operators that meet these emissions requirements. The State of California also has required diesel tractors as well as 53-foot long and other trailers operated in the state to satisfy certain fuel efficiency and other performance requirements by compliance target dates occurring between 2011 and 2023. Compliance with California’s and ports’ regulations has increased rates payable to owner operators operating in California and new tractor costs, might increase the costs of new trailers operated in California, might require the retrofitting of pre-2011 model year trailers operated in California, and could diminish equipment productivity and increase operating expenses.

Regulations affecting our Subsidiaries Providing Ocean and Air Transportation. RF International, Ltd., a Pacer subsidiary (“RFI”), is licensed as a customs broker by U.S. Customs and Border Protection (“CBP”) of DHS in each United States customs district in which it does business. All United States customs brokers are required to maintain prescribed records and are subject to periodic audits by CBP. In other jurisdictions in which we perform customs brokerage services, our operations are licensed, where necessary, by the appropriate governmental authority.

Our subsidiaries offering expedited air charter transportation are subject to regulation by the Transportation Security Administration (“TSA”) of DHS regarding air cargo security for all loads, regardless of origin and destination. XPO Global Logistics (“XGL”), RFI and XPO Air Charter also are regulated as “indirect air carriers” by the DHS and TSA. These agencies provide requirements, guidance and, in some cases, administer licensing requirements and processes applicable to the freight forwarding industry. We must actively monitor our compliance with such agency requirements to ensure that we have satisfactorily completed the security requirements and qualifications and implemented the required policies and procedures. These agencies generally require companies to fulfill these qualifications prior to transacting various types of business. Failure to do so could result in penalties and fines. The air cargo industry is also subject to regulatory and legislative actions that could affect the economic conditions within the industry by requiring changes in operating practices or influencing the demand for and the costs of providing services to clients. We cannot predict the extent to which any such regulatory or legislative actions could adversely affect our business and operations, but we strive to comply with and satisfy agency requirements.

For our international operations, XGL and RFI are members of the International Air Transportation Association (“IATA”), a voluntary association of airlines and forwarders that outlines operating procedures for freight forwarders acting as agents or third-party intermediaries for its members. A substantial portion of our international air freight business is completed with other IATA members.

For our international oceanic freight forwarding business, XGL, RFI and OWL, are registered as an Ocean Transportation Intermediary (“OTI”) by the U.S. Federal Maritime Commission (“FMC”), which establishes the qualifications, regulations and bonding requirements to operate as an OTI for businesses originating and terminating in the United States. XGL and OWL are also licensed NVOCCs and ocean freight forwarders.

Our international freight forwarder operations subject us to regulations of the U.S. Department of State, U.S. Department of Commerce and the U.S. Department of Treasury and to various laws and regulations of the other countries where we operate. Regulations cover matters such as what commodities may be shipped to what destination and to what end-user, unfair international trade practices, and limitations on entities with which we may conduct business.

Classification of Independent Contractors. Tax and other federal and state regulatory authorities as well as private litigants continue to assert that independent contractor drivers in the trucking industry are employees rather than independent contractors. Federal legislators have introduced legislation in the past to make it easier for tax and other authorities to reclassify independent contractors as employees, including legislation to increase the recordkeeping requirements for employers of independent contractors and to heighten the penalties of employers who misclassify their employees and are found to have violated employees’ overtime and/or wage requirements. Additionally, federal legislators have sought to abolish the current safe harbor allowing taxpayers meeting certain criteria to treat individuals as independent contractors if they are following a long-standing, recognized practice. Federal legislators also sought to expand the Fair Labor Standards Act to cover “non-employees” who perform labor or services for businesses, even if the “non-employees” are properly classified as independent contractors;

8

require taxpayers to provide written notice to workers based upon their classification as either an “employee” or a “non-employee”; and impose penalties and fines for violations of the notice requirements or “employee” or “non-employee” misclassifications. Some states have put initiatives in place to increase their revenues from items such as unemployment, workers’ compensation and income taxes, and a reclassification of independent contractors as employees would help states with this initiative. Taxing and other regulatory authorities and courts apply a variety of standards in their determination of independent contractor status. If our independent contractor drivers are determined to be our employees, we would incur additional exposure under some or all of the following: federal and state tax, workers’ compensation, unemployment benefits, labor, employment and tort laws, including for prior periods, as well as potential liability for employee benefits and tax withholdings.

Environmental Regulations. Our facilities and operations and our independent contractors are subject to various environmental laws and regulations dealing with the hauling, handling and disposal of hazardous materials, emissions from vehicles, engine-idling, fuel spillage and seepage, discharge and retention of storm water, and other environmental matters that involve inherent environmental risks. We have instituted programs to monitor and control environmental risks and maintain compliance with applicable environmental laws and regulations. We may be responsible for the cleanup of any spill or other release involving hazardous materials caused by our operations or business. In the past, we have been responsible for the costs of cleanup of diesel fuel spills caused by traffic accidents or other events, and none of these incidents materially affected our business or operations. We generally transport only hazardous materials rated as low-to-medium-risk, and a small percentage of our total shipments contain hazardous materials. We believe that our operations are in substantial compliance with current laws and regulations and do not know of any existing environmental condition that would reasonably be expected to have a material adverse effect on our business or operating results. We also do not expect to incur material capital expenditures for environmental controls in 2015. Future changes in environmental regulations or liabilities from newly discovered environmental conditions or violations (and any associated fines and penalties) could have a material adverse effect on our business, competitive position, results of operations, financial condition or cash flows. Federal and state governments have also proposed environmental legislation that could, among other things, potentially limit carbon, exhaust and greenhouse gas emissions. If enacted, such legislation could also result in higher new tractor and trailer costs, reduced productivity and efficiency, and increased operating expenses, all of which could adversely affect our results of operations.

Risk Management and Insurance

We generally require carriers that we engage to have at least $1 million of automobile liability insurance and $100,000 of cargo insurance, or up to $250,000 in the case of our last-mile and intermodal contract carriers. We require motor carriers we engage to enter into a written agreement with us and to meet safety and performance qualification standards. We also require motor carriers to have workers compensation and other insurance as required by law in connection with the specific tasks they are undertaking. Railroads, which are largely self-insured, provide limited common carrier cargo liability protection, generally up to $250,000 per container.

In our truck and intermodal brokerage operations, we generally are not liable for damage to our customers’ cargo or in connection with damage arising from the provision of transportation services. However, in some instances, we agree to assume cargo and other liability. While we endeavor to limit this exposure to matters arising due to our negligence or misconduct, or to cap our exposure at a stated maximum dollar amount, we are not always able to do so.

With respect to our expedited transportation and intermodal drayage operations where we perform services as a licensed motor carrier and in our freight forwarding and last-mile delivery logistics businesses, we have primary liability to our customer for cargo loss and damage and for certain liabilities caused by our independent contractors and contracted carriers. Accordingly, liability claims may be asserted against us for the actions of transportation providers we engage and their employees or independent contractor drivers, or for our actions in retaining them. Claims against us may exceed the amount of our insurance coverage or may not be covered by insurance at all.

We maintain liability insurance policies to protect us against losses that may not be recovered from the responsible contracted carrier. Our last-mile delivery logistics operations may involve installation of appliances in customers’ homes involving water, gas or electric connections. We maintain commercial general liability insurance coverage to protect us from claims related to these services. Our warehouse operations maintain legal liability insurance to protect us against claims arising from damage or loss to goods stored in our warehouses. We also maintain property damage insurance to protect us against damage to our property. Our terms of carriage on international and ocean shipments limit our liability consistent with industry standards. We offer our NVOCC and freight forwarding customers the option to purchase all risk cargo insurance for their shipments. We also maintain insurance for commercial automobile liability, truckers’ commercial automobile liability, commercial general liability, employers’ liability and umbrella and excess umbrella liability, with coverage limits and subject to self-insured retention levels that we believe are reasonable given the varying historical frequency, severity and timing of claims. However, we cannot provide assurance that our insurance coverage will effectively protect us in the event of claims made against us.

9

Seasonality

Our revenues and profitability are typically lower for the first quarter of the calendar year relative to our other quarters. We believe this is due in part to the post- holiday reduction in demand experienced by many of our customers, which leads to more capacity in the non- expedited and service-critical markets and, in turn, less demand for expedited and premium shipping services. In addition, the productivity of our independent contractors and transportation providers generally decreases during the winter season because inclement weather impedes operations. It is not possible to predict whether the historical revenue and profitability trends will occur in future periods.

Employees

As of December 31, 2014, we had approximately 10,000 full-time and part-time employees, none of whom were covered by a collective bargaining agreement. We recognize our trained staff of employees as one of our most critical resources and acknowledge the recruitment, training and retention of qualified employees as essential to our ongoing success. We believe that we have good relations with our employees.

Executive Officers of the Registrant

We provide below information regarding each of our executive officers.

Name | Age | Position | |||

Bradley S. Jacobs | 58 | Chairman of the Board and Chief Executive Officer | |||

Troy A. Cooper | 45 | Chief Operating Officer | |||

John J. Hardig | 50 | Chief Financial Officer | |||

Gordon E. Devens | 46 | Senior Vice President and General Counsel | |||

Scott B. Malat | 38 | Chief Strategy Officer | |||

Mario A. Harik | 34 | Chief Information Officer | |||

Bradley Jacobs has served as our Chief Executive Officer and Chairman of the board of directors since September 2011. Mr. Jacobs is also the managing director of Jacobs Private Equity, LLC, which is our largest stockholder. He has led two public companies: United Rentals, Inc. (NYSE: URI), which he co-founded in 1997, and United Waste Systems, Inc., founded in 1989. Mr. Jacobs served as chairman and chief executive officer of United Rentals for its first six years and as executive chairman for an additional four years. He served eight years as chairman and chief executive officer of United Waste Systems. Previously, Mr. Jacobs founded Hamilton Resources (UK) Ltd. and served as its chairman and chief operating officer. This followed the co-founding of his first venture, Amerex Oil Associates, Inc., where he was chief executive officer.

Troy Cooper has served as our Chief Operating Officer since May 2014. Mr. Cooper joined our company in September 2011 as Vice President—Finance, and has held positions of increasing responsibility since then. Mr. Cooper is responsible for the day-to-day operations and profit and loss performance of the Company. Mr. Cooper was most recently with United Rentals, Inc., where he served as vice president—group controller responsible for field finance functions. Previously, he held controller positions with United Waste Systems, Inc. and OSI Specialties, Inc. (formerly a division of Union Carbide, Inc.). Mr. Cooper began his career in public accounting with Arthur Andersen and Co. and has a degree in accounting from Marietta College.

John Hardig has served as our Chief Financial Officer since February 2012. Mr. Hardig most recently served as managing director for the Transportation & Logistics investment banking group of Stifel Nicolaus Weisel from 2003 until joining our company. Prior to that, Mr. Hardig was an investment banker in the Transportation and Telecom groups at Alex. Brown & Sons (now Deutsche Bank). Mr. Hardig holds a master of business administration degree from the University of Michigan Business School and a bachelor’s degree from the U.S. Naval Academy.

Gordon Devens has served as our Senior Vice President and General Counsel since November 2011. Mr. Devens was most recently vice president—corporate development with AutoNation, Inc., where he was previously vice president—associate general counsel. Earlier, he was an associate at the law firm of Skadden, Arps, Slate, Meagher & Flom LLP, where he specialized in mergers and acquisitions and securities law. Mr. Devens holds a doctorate of jurisprudence and a bachelor’s degree in business administration from the University of Michigan.

Scott Malat has served as our Chief Strategy Officer since July 2012. Mr. Malat served as our Senior Vice President—Strategic Planning from the time he joined us in October 2011 until July 2012. Prior to joining XPO Logistics, Mr. Malat was with Goldman Sachs Group, Inc., where he served as senior equity research analyst covering the air, rail, trucking and shipping sectors. Earlier, Mr. Malat was an equity research analyst with UBS, and a strategy manager with JPMorgan Chase & Co. He serves on the board of directors of the non-profit PSC Partners Seeking a Cure. He is a CFA® charterholder and has a degree in statistics with a concentration in business management from Cornell University.

10

Mario Harik has served as our Chief Information Officer since November 2011. Mr. Harik has built comprehensive IT organizations and overseen the implementation of proprietary platforms for a variety of firms and has consulted to members of the Fortune 100. His prior positions include chief information officer and senior vice president—research and development with Oakleaf Waste Management; chief technology officer with Tallan, Inc.; co-founder of G3 Analyst, where he served as chief architect of web and voice applications; and architect and consultant with Adea Solutions. Mr. Harik holds a master of engineering degree in information technology from Massachusetts Institute of Technology, and a degree in engineering, computer and communications from the American University of Beirut, Lebanon.

Corporate Information and Availability of Reports

XPO Logistics, Inc. was incorporated in Delaware on May 8, 2000. Our executive office is located at Five Greenwich Office Park, Greenwich, Connecticut 06831. Our telephone number is (855) 976-4636. Our stock is listed on the New York Stock Exchange (“NYSE”) under the symbol “XPO”.

Our corporate website is www.xpo.com. We make available on this website, free of charge, access to our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, Proxy Statements on Schedule 14A and amendments to those materials filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), as soon as reasonably practicable after we electronically submit such material to the SEC. We also make available on our website copies of materials regarding our corporate governance policies and practices, including the XPO Logistics, Inc. Corporate Governance Guidelines, our Senior Officer Code of Business Conduct and Ethics and the charters relating to the committees of our board of directors. You also may obtain a printed copy of the foregoing materials by sending a written request to: Investor Relations, XPO Logistics, Inc., Five Greenwich Office Park, Greenwich, Connecticut 06831. The public may read and copy any materials that we file with the SEC at the SEC’s Public Reference Room at 100 F Street, NE, Washington, DC 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. In addition, the SEC’s website is www.sec.gov. The SEC makes available on this website, free of charge, reports, proxy and information statements and other information regarding issuers, such as us, that file electronically with the SEC. Information on our website or the SEC’s website is not part of this document. We are currently classified as a “large accelerated filer” for purposes of filings with the SEC.

Item 1A. Risk Factors

Cautionary Statement Regarding Forward-Looking Statements

This Annual Report on Form 10-K and other written reports and oral statements we make from time to time contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Exchange Act. All statements other than statements of historical fact are, or may be deemed to be, forward-looking statements. In some cases, forward-looking statements can be identified by the use of forward-looking terms such as “anticipate,” “estimate,” “believe,” “continue,” “could,” “intend,” “may,” “plan,” “potential,” “predict,” “should,” “will,” “expect,” “objective,” “projection,” “forecast,” “goal,” “guidance,” “outlook,” “effort,” “target” or the negative of these terms or other comparable terms. However, the absence of these words does not mean that the statements are not forward-looking. These forward-looking statements are based on certain assumptions and analyses made by the Company in light of its experience and its perception of historical trends, current conditions and expected future developments, as well as other factors it believes are appropriate in the circumstances. These forward-looking statements are subject to known and unknown risks, uncertainties and assumptions that may cause actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by such forward-looking statements. Factors that might cause or contribute to a material difference include, but are not limited to, those discussed below and the risks discussed in the Company’s other filings with the SEC. All forward-looking statements set forth in this Annual Report are qualified by these cautionary statements and there can be no assurance that the actual results or developments anticipated by the Company will be realized or, even if substantially realized, that they will have the expected consequence to or effects on the Company or its business or operations. The following discussion should be read in conjunction with the Company’s audited Consolidated Financial Statements and related Notes thereto included elsewhere in this Annual Report. Forward-looking statements set forth in this Annual Report speak only as of the date hereof, and we do not undertake any obligation to update forward-looking statements to reflect subsequent events or circumstances, changes in expectations or the occurrence of unanticipated events, except as required by law.

Economic recessions and other factors that reduce freight volumes could have a material adverse impact on our business.

The transportation industry historically has experienced cyclical fluctuations in financial results due to economic recession, downturns in business cycles of our customers, increases in prices charged by third-party carriers, interest rate fluctuations and other U.S. and global economic factors beyond our control. The recession beginning in 2008 and continuing throughout 2009 impacted the availability of services from our rail, truck, ocean and air transportation providers and our customers’ demands for our services. Although conditions have improved since 2009, the future pace of recovery and even the

11

continuation thereof cannot be predicted. During economic downturns, reduced overall demand for transportation services will likely reduce demand for our services and exert downward pressures on rates and margins. In periods of strong economic growth, demand for limited transportation resources can result in increased network congestion and resulting operating inefficiencies. In addition, deterioration in the economic environment subjects our business to various risks that may have a material impact on our operating results and cause us to not reach our long-term growth goals. These risks may include the following:

• | A reduction in overall freight volumes in the marketplace reduces our opportunities for growth. In addition, if a downturn in our customers’ business cycles causes a reduction in the volume of freight shipped by those customers, our operating results could be adversely affected. |

• | Some of our customers may face economic difficulties and may not be able to pay us, and some may go out of business. In addition, some customers may not pay us as quickly as they have in the past, causing our working capital needs to increase. |

• | A significant number of our transportation providers may go out of business and we may be unable to secure sufficient equipment or other transportation services to meet our commitments to our customers. |

• | We may not be able to appropriately adjust our expenses to changing market demands. In order to maintain high variability in our business model, it is necessary to adjust staffing levels to changing market demands. In periods of rapid change, it is more difficult to match our staffing level to our business needs. In addition, we have other primarily variable expenses that are fixed for a period of time, and we may not be able to adequately adjust them in a period of rapid change in market demand. |

We operate in a highly competitive industry and, if we are unable to adequately address factors that may adversely affect our revenue and costs, our business could suffer.

Competition in the transportation services industry is intense. Increased competition may lead to revenue reductions, reduced profit margins, or a loss of market share, any one of which could harm our business. There are many factors that could impair our profitability, including the following:

• | competition with other transportation services companies, some of which have a broader coverage network, a wider range of services, more fully developed information technology systems and greater capital resources than we do; |

• | reduction by our competitors of their rates to gain business, especially during times of declining growth rates in the economy, which reductions may limit our ability to maintain or increase rates, maintain our operating margins or maintain significant growth in our business; |

• | a shift in the business of shippers to asset-based trucking companies that also offer brokerage services in order to secure access to those companies’ trucking capacity, particularly in times of tight industry wide capacity; |

• | solicitation by shippers of bids from multiple transportation providers for their shipping needs and the resulting depression of freight rates or loss of business to competitors; |

• | establishment by our competitors of cooperative relationships to increase their ability to address shipper needs; and |

• | competition, particularly in our intermodal business, with companies affiliated with our key rail transportation providers, which may receive preferential terms and conditions as compared to those available to us. |

We may not be able to successfully execute our acquisition strategy.

We intend to expand substantially through acquisitions to take advantage of market opportunities we perceive in our current markets (transportation and logistics) as well as new markets that we may enter. However, we can provide no assurance that future acquisitions will be completed in the time frame we anticipate, if at all. In addition, we may experience delays in making acquisitions or be unable to make the acquisitions we desire for a number of reasons. Suitable acquisition candidates may not be available at purchase prices that are attractive to us or on terms that are acceptable to us. In pursuing acquisition opportunities, we will compete with other companies, some of which have greater financial and other resources than we do.

We are unable to predict the size, timing and number of acquisitions we may complete. In addition, we may incur expenses associated with sourcing, evaluating and negotiating acquisitions (including those that are not completed), and we also may pay fees and expenses associated with obtaining financing for acquisitions and with investment banks and others finding acquisitions for us. Any of these amounts may be substantial, and together with the size, timing and number of acquisitions we pursue, may negatively impact us and cause significant volatility in our financial results.

Any acquisitions that we undertake could be difficult to integrate, disrupt our business, dilute stockholder value and adversely affect our results of operations.

Acquisitions involve numerous risks, including the following:

• | failure of the acquired company to achieve anticipated revenues, earnings or cash flows; |

• | assumption of liabilities that were not disclosed to us or that exceed our estimates; |

12

• | inability to negotiate effective indemnification protection from the seller, or inability to collect in the event of an indemnity claim; |

• | problems integrating the purchased operations with our own, which could result in substantial costs and delays or other operational, technical or financial problems; |

• | potential compliance issues with regard to acquired companies that did not have adequate internal controls; |

• | diversion of management’s attention or other resources from our existing business; |

• | risks associated with entering markets, such as rail intermodal, air freight forwarding, ocean cargo, and last-mile logistics and contract logistics, in which we have limited prior experience; |

• | increases in working capital and capital expenditure investment to fund the growth of acquired operations; |

• | potential loss of key employees and customers of the acquired companies; and |

• | future write-offs of intangible and other assets if the acquired operations fail to generate sufficient cash flows. |

We may not successfully manage our growth.

We intend to grow rapidly and substantially, including by expanding our internal resources, making acquisitions and entering into new markets. We may experience difficulties and higher-than-expected expenses in executing this strategy as a result of unfamiliarity with new markets, change in revenue and business models and entering into new geographic areas.

Our growth will place a significant strain on our management, operational and financial resources. We will need to continually improve existing procedures and controls as well as implement new transaction processing, operational and financial systems, and procedures and controls to expand, train and manage our employee base. Our working capital needs will increase substantially as our operations grow. Failure to manage growth effectively, or obtain necessary working capital, could have a material adverse effect on our business, results of operations, cash flows, stock price and financial condition.

The execution of our strategy depends on our ability to raise capital in the future, and our inability to do so could prevent us from achieving our growth objectives.

We may in the future be required to raise capital through public or private financing or other arrangements in order to pursue our growth strategy or operate our businesses. Such financing may not be available on acceptable terms, or at all, and our failure to raise capital when needed could harm our business or ability to execute our strategy. Further debt financing may involve restrictive covenants and could reduce our profitability. If we cannot raise funds on acceptable terms, we may not be able to grow our business or respond to competitive pressures.

Sales or issuances of a substantial number of shares of our common stock may adversely affect the market price of our common stock.

We anticipate that we will fund future acquisitions or our capital requirements from time to time, in whole or part, through sales or issuances of our common stock or equity-based securities, subject to prevailing market conditions and our financing needs. Future equity financing will dilute the interests of our then-existing stockholders, and future sales or issuances of a substantial number of shares of our common stock or other equity-related securities may adversely affect the market price of our common stock.

Our success is dependent on our Chief Executive Officer and other key personnel.

Our success depends on the continuing services of our Chief Executive Officer, Mr. Bradley S. Jacobs. We believe that Mr. Jacobs possesses valuable knowledge and skills that are crucial to our success and would be very difficult to replicate.

Over time, our success will depend on attracting and retaining qualified personnel, including our senior management team. Competition for senior management is intense, and we may not be able to retain our management team or attract additional qualified personnel. The loss of a member of senior management would require our remaining senior officers to divert immediate and substantial attention to fulfilling the duties of the departing executive and to seeking a replacement. The inability to adequately fill vacancies in our senior executive positions on a timely basis could negatively affect our ability to implement our business strategy, which could adversely impact our results of operations and prospects.

Our business will be seriously harmed if we fail to develop, implement, maintain, upgrade, enhance, protect and integrate information technology systems.

We rely heavily on our information technology systems to efficiently run our business, and they are a key component of our growth strategy. To keep pace with changing technologies and customer demands, we must correctly interpret and address market trends and enhance the features and functionality of our proprietary technology platform in response to these trends, which may lead to significant ongoing software development costs. We may be unable to accurately determine the needs of our

13

customers and the trends in the transportation services industry or to design and implement the appropriate features and functionality of our technology platform in a timely and cost-effective manner, which could result in decreased demand for our services and a corresponding decrease in our revenues. Despite testing, external and internal risks, such as malware, insecure coding, “Acts of God,” data leakage and human error pose a direct threat to our information technology systems and operations. We may also be subject to cybersecurity attacks and other intentional hacking. Any failure to identify and address such defects or errors or prevent a cyber-attack could result in service interruptions, operational difficulties, loss of revenues or market share, liability to customers or others, diversion of resources, injury to our reputation and increased service and maintenance costs. Addressing such issues could prove to be impossible or very costly and responding to resulting claims or liability could similarly involve substantial cost. We must maintain and enhance the reliability and speed of our information technology systems to remain competitive and effectively handle higher volumes of freight through our network and the various service modes we offer. If our information technology systems are unable to manage additional volume for our operations as our business grows, or if such systems are not suited to manage the various service modes we offer, our service levels and operating efficiency could decline. We expect customers to continue to demand more sophisticated, fully integrated information systems from their transportation providers. If we fail to hire and retain qualified personnel to implement, protect and maintain our information technology systems or if we fail to upgrade our systems to meet our customers’ demands, our business and results of operations could be seriously harmed. This could result in a loss of customers or a decline in the volume of freight we receive from customers.

We license an operating system that we are developing into an integrated information technology system for all of our business segments. This new system may not be successful or may not achieve the desired results. We may require additional training or different personnel to successfully implement this system, all of which may result in additional expense, delays in obtaining results or disruptions to our operations. In addition, acquired companies will need to be on-boarded onto this new integrated information technology system, which may cause additional training or licensing cost and disruption. In such event, our revenue, financial results and ability to operate profitably could be negatively impacted. The challenges associated with integration of our acquisitions may increase these risks.

We depend on third-parties in the operation of our business.

In our freight forwarding and freight brokerage operations, we do not own or control the transportation assets that deliver our customers’ freight, and we do not employ the people directly involved in delivering the freight. In our expedited transportation and freight brokerage businesses (particularly our last mile delivery logistics operations, our over-the-road expedite operations and our intermodal drayage operations), we engage independent contractors who own and operate their own equipment. Accordingly, we are dependent on third-parties to provide truck, rail, ocean, air and other transportation services and to report certain events to us, including delivery information and cargo claims. This reliance could cause delays in reporting certain events, including recognizing revenue and claims. Our inability to maintain positive relationships with independent transportation providers could significantly limit our ability to serve our customers on competitive terms. If we are unable to secure sufficient equipment or other transportation services to meet our commitments to our customers or provide our services on competitive terms, our operating results could be materially and adversely affected and our customers could switch to our competitors temporarily or permanently. Many of these risks are beyond our control, including the following:

• | equipment shortages in the transportation industry, particularly among contracted truckload carriers and railroads; |

• | interruptions in service or stoppages in transportation as a result of labor disputes, seaport strikes, network congestion, weather-related issues, Acts of God, or acts of terrorism; |

• | changes in regulations impacting transportation; |

• | increases in operating expenses for carriers, such as fuel costs, insurance premiums and licensing expenses, that result in a reduction in available carriers; and |

• | changes in transportation rates. |

Increases in independent contractor driver compensation or other difficulties attracting and retaining qualified independent contractor drivers could adversely affect our profitability and ability to maintain or grow our independent contractor driver fleet.

Our expedited transportation and intermodal drayage businesses operate through fleets of vehicles that are owned and operated by independent contractors. Our last mile delivery logistics business also operates through a fleet of independent contract carriers that supply their own vehicles, drivers and helpers. These independent contractors are responsible for maintaining and operating their own equipment and paying their own fuel, insurance, licenses and other operating costs. Turnover and bankruptcy among independent contractor drivers often limit the pool of qualified independent contractor drivers and increase competition for their services. In addition, regulations such as the FMCSA Compliance Safety Accountability program may further reduce the pool of qualified independent contractor drivers. Thus, our continued reliance on independent contractor drivers could limit our ability to grow our ground transportation fleet.

14

We are currently experiencing, and expect to continue to experience from time to time in the future, difficulty in attracting and retaining sufficient numbers of qualified independent contractor drivers. Additionally, our agreements with independent contractor drivers are terminable by either party upon short notice and without penalty. Consequently, we regularly need to recruit qualified independent contractor drivers to replace those who have left our fleet. If we are unable to retain our existing independent contractor drivers or recruit new independent contractor drivers, our business and results of operations could be adversely affected.

The compensation we offer our independent contractor drivers is subject to market conditions and we may find it necessary to continue to increase independent contractor drivers’ compensation in future periods, which may be more likely to the extent economic conditions continue to improve. If we are unable to continue to attract and retain a sufficient number of independent contractor drivers, we could be required to increase our mileage rates and accessorial pay or operate with fewer trucks and face difficulty meeting shipper demands, all of which would adversely affect our profitability and ability to maintain our size or to pursue our growth strategy.

Certain of our businesses rely on owner-operators and contract carriers to conduct their operations, and the status of these parties as independent contractors, rather than employees, is being challenged.

We are involved in numerous lawsuits, including purported class action and multi-plaintiff litigations, and state tax and other administrative proceedings that claim that the Company’s contract carriers or owner-operators or their drivers should be treated as our employees, rather than independent contractors. We incur certain costs, including legal fees, in defending the status of these parties as independent contractors. While we believe that our contract carriers and owner-operators and their drivers are properly classified as independent contractors rather than as employees, adverse decisions have been rendered recently in certain cases pending against us, including with respect to class certification of certain contract carriers and determinations that certain of our contract carriers and owner-operators are improperly classified. Certain of these decisions are subject to appeal, but we cannot provide assurance that we will determine to pursue any appeal or that any such appeal will be successful. Adverse final outcomes in these matters could, among other things, entitle certain of our contract carriers and owner-operators and their drivers to reimbursement with respect to certain expenses and to the benefit of wage-and-hour laws and result in employment and withholding tax and benefit liability for us, and could result in changes to the independent contractor status of our contract carriers and owner-operators. Changes to state laws governing the definition of independent contractors could also impact the status of our contract carriers and owner-operators. Adverse final outcomes in these matters or changes to state laws could cause us to change our business model, which could have a material adverse effect on our business strategies, financial condition, results of operations or cash flows. These claims involve potentially significant classes that could involve thousands of claimants and, accordingly, significant potential damages and litigation costs, and could lead others to bring similar claims.

The independent contractor misclassification matters in which we are currently engaged involve companies that we acquired, including XPO Last Mile and Pacer. Pursuant to the purchase agreements by which we acquired certain private companies, the former owners have agreed to indemnify us for costs and liabilities related to such class action and individual lawsuits, subject to certain limits, and we have retained purchase price holdbacks as security for such indemnification. Other than with respect to acquisitions for which our acquisition accounting process remains open (including, as discussed below, the Pacer acquisition), we believe that we have adequate purchase price holdbacks with respect to the potential impact of loss contingencies involving classification matters that are probable and reasonably estimable. However, such holdbacks may be insufficient to protect us against the full amount of the indemnified liability, in which case we would need to fund any losses from our available liquidity sources. To the extent that we do not have indemnification rights with respect to any such liabilities, or we are unable to collect under any such indemnification agreements, any payments will require utilization of our funds and establishment of reserves.

We do not currently expect any of these matters or these matters in the aggregate to have a material adverse effect on our results of operations, financial condition or cash flows. However, the results of these matters cannot be predicted with certainty and an unfavorable resolution of one or more of these matters, or our failure to recover, in full or in part, under the indemnity provisions noted above, could have a material adverse effect on our financial condition, results of operations or cash flows.

Pacer Classification Claims