Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Kraton Corp | kra043020158-k.htm |

Kraton Performance Polymers, Inc. First Quarter 2015 Earnings Conference Call April 30, 2015

Forward Looking Statement Disclaimer Kraton First Quarter 2015 Earnings Call 2 This presentation includes forward-looking statements that reflect our plans, beliefs, expectations and current views with respect to, among other things, future events and financial performance. Forward-looking statements are often characterized by the use of words such as “outlook,” “believes,” “estimates,” “expects,” “projects,” “may,” “intends,” “plans” or “anticipates,” or by discussions of strategy, plans or intentions, including the matters described under the caption “Selected 2015 Estimates.” All forward-looking statements in this presentation are made based on management's current expectations and estimates, which involve known and unknown risks, uncertainties and other important factors that could cause actual results to differ materially from those expressed in forward-looking statements. These risks and uncertainties are more fully described in our latest Annual Report on Form 10-K, including but not limited to “Part I, Item 1A. Risk Factors” and “Part II, Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations” therein, and in our other filings with the Securities and Exchange Commission, and include, but are not limited to, risks related to: conditions in the global economy and capital markets; declines in raw material costs; our reliance on LyondellBasell Industries for the provision of significant operating and other services; the failure of our raw materials suppliers to perform their obligations under long- term supply agreements, or our inability to replace or renew these agreements when they expire; limitations in the availability of raw materials we need to produce our products in the amounts or at the prices necessary for us to effectively and profitably operate our business; competition from other producers of SBCs and from producers of products that can be substituted for our products; our ability to produce and commercialize technological innovations; our ability to protect our intellectual property, on which our business is substantially dependent; hazards inherent to the chemical manufacturing business; other risks, factors and uncertainties described in this presentation and our other reports and documents; and other factors of which we are currently unaware or deem immaterial. Readers are cautioned not to place undue reliance on our forward-looking statements. Forward-looking statements speak only as of the date they are made, and we undertake no obligation to update such information in light of new information or future events.

GAAP Disclaimer 3 This presentation includes the use of both GAAP and non-GAAP financial measures. The non-GAAP financial measures are EBITDA, Adjusted EBITDA, Adjusted Gross Profit and Adjusted Net Income attributable to Kraton (or earnings per share). Tables included in this presentation and our earnings release reconcile each of these non-GAAP financial measures with the most directly comparable GAAP financial measure. For additional information on the impact of the spread between the FIFO basis of accounting and estimated current replacement cost (“ECRC”), see Management’s Discussion and Analysis of Financial Condition and Results of Operations in our Annual Report on Form 10-K for the fiscal year ended December 31, 2014. We consider these non-GAAP financial measures to be important supplemental measures of our performance and believe they are frequently used by investors, securities analysts and other interested parties in the evaluation of our performance including period- to-period comparisons and/or that of other companies in our industry. Further, management uses these measures to evaluate operating performance, and our incentive compensation plan bases incentive compensation payments on our Adjusted EBITDA performance, along with other factors. These non-GAAP financial measures have limitations as analytical tools and in some cases can vary substantially from other measures of our performance. You should not consider them in isolation, or as a substitute for analysis of our results under GAAP in the United States. For EBITDA, these limitations include: EBITDA does not reflect the significant interest expense on our debt; EBITDA does not reflect the significant depreciation and amortization expense associated with our long-lived assets; EBITDA included herein should not be used for purposes of assessing compliance or non-compliance with financial covenants under our debt agreements. The calculation of EBITDA in our debt agreements includes adjustments, such as extraordinary, non- recurring or one-time charges, proforma cost savings, certain non-cash items, turnaround costs, and other items included in the definition of EBITDA in our debt agreements; and other companies in our industry may calculate EBITDA differently than we do, limiting its usefulness as a comparative measure. As an analytical tool, Adjusted EBITDA is subject to all the limitations applicable to EBITDA. We prepare Adjusted EBITDA by eliminating from EBITDA the impact of a number of items we do not consider indicative of our on-going performance, including the spread between FIFO and ECRC, but you should be aware that in the future we may incur expenses similar to the adjustments in this presentation. Our presentation of Adjusted EBITDA should not be construed as an inference that our future results will be unaffected by unusual or non-recurring items. In addition, due to volatility in raw material prices, Adjusted EBITDA may, and often does, vary substantially from EBITDA and other performance measures, including net income calculated in accordance with U.S. GAAP; and Adjusted EBITDA may, and often will, vary significantly from EBITDA calculations under the terms of our debt agreements and should not be used for assessing compliance or non-compliance with financial covenants under our debt agreements. Because of these and other limitations, EBITDA and Adjusted EBITDA should not be considered as a measure of discretionary cash available to us to invest in the growth of our business. As a measure of our performance, Adjusted Gross Profit is limited because it often will vary substantially from gross profit calculated in accordance with U.S. GAAP due to volatility in raw material prices. Finally, we prepare Adjusted Net Income attributable to Kraton by eliminating from net income the impact of a number of items we do not consider indicative of our on-going performance, including the spread between FIFO and ECRC. Our presentation of non-GAAP financial measures and the adjustments made therein should not be construed as an inference that our future results will be unaffected by unusual or non-recurring items, and in the future we may incur expenses or charges similar to the adjustments made in the presentation of our non-GAAP financial measures.

First Quarter 2015 Highlights Kraton First Quarter 2015 Earnings Call 4 Record first quarter adjusted earnings (non-GAAP): Adjusted EBITDA of $49.2 million, up 31% from Q1 2014 Adjusted EPS of $0.76 per share, more than 2x the $0.33 per share in Q1 2014 Currency negatively impacted Adjusted EBITDA by $2.5 million and Adjusted EPS by $0.07 per share Sales volume of 74 kilotons, in line with Q1 2014 Revenue of $261.4 million, down $50.2 million compared to Q1 2014 primarily due to changes in foreign currency and lower raw material costs Adjusted gross profit (non-GAAP) of $1,075 per ton Since inception of the share repurchase program in Q4 2014 through March 31, 2015, 1.7 million shares repurchased, representing a decline in share count of 5% See the appendix for a reconciliation of GAAP to non-GAAP financial measures.

Asia 89% Europe 9% North America 2% Medical 93% Industrial 7% CariflexTM 5 Kraton Fourth Quarter 2014 Earnings Call Portfolio Composition Revenue by Geography 3/31/2015 TTM Revenue by Application 3/31/2015 TTM Sales volume increased 3.6% on higher sales into industrial and medical glove applications Excluding the effect of currency, revenue growth of 4.3% despite lower raw material costs Cariflex represents 12% of 3/31/2015 TTM revenue compared to 10% for the TTM period ended 3/31/2014 $35 $35 Q1'14 Q1'15 Revenue ($ millions) 100% 100% TTM March 2014 TTM March 2015 Innovation & Differentiated

Specialty Polymers 6 Kraton Fourth Quarter 2014 Earnings Call Sales volume decreased 4.8% with gains in protective film, medical and cable gel applications more than offset by lower volume into lubricant additive and personal care volume applications Revenue decrease reflects lower average selling prices associated with lower raw material costs Currency movements adversely impacted revenue by $5.5 million $108 $92 Q1'14 Q1'15 Revenue ($ millions) Other 25% Lube Additives 18%Polymod 14% Personal Care 11% Medical 8% Adhesives & Coatings 7% Cable Gels 7% Industrial 6% Consumer 4% Asia 31% Europe 27% North America 41% South America 1% 27% 27% 73% 73% TTM March 2014 TTM March 2015 Standard Innovation & Differentiated Portfolio Composition Revenue by Geography 3/31/2015 TTM Revenue by Application 3/31/2015 TTM

Performance Products 7 Kraton Fourth Quarter 2014 Earnings Call Sales volume increased 1.5% on higher sales into personal care applications in Europe and paving applications in North America, partially offset by lower sales into paving applications in South America Revenue decrease reflects lower average selling prices associated with lower raw material costs Currency movements adversely impacted revenue by $15.1 million $168 $135 Q1'14 Q1'15 Revenue ($ millions) Paving 26% Roofing 18%Personal Care 20% Packaging & Industrial Adhesives 19% Other 10% Industrial 7% Asia 8% Europe 47% North America 36% South America 9% 65% 62% 35% 38% TTM March 2014 TTM March 2015 Standard Innovation & Differentiated Portfolio Composition Revenue by Geography 3/31/2015 TTM Revenue by Application 3/31/2015 TTM

Kraton Portfolio Overview 8 Kraton Fourth Quarter 2014 Earnings Call Portfolio Composition Revenue by Geography 3/31/2015 TTM Revenue by Product Group 3/31/2015 TTM 54% 57% 46% 43% TTM March 2014 TTM March 2015 Standard Innovation & Differentiated Cariflex 12% Specialty Polymers 34% Performance Products 54% Innovation and differentiated product grades represent 57% of TTM revenue at March 31, 2015, up from 54% for the TTM period ended March 31, 2014 The increase in revenue contribution from innovation and differentiated grades reflects: Continued growth in Cariflex Growth in protective films, medical and cable gel applications in Specialty Polymers Growth in personal care and flexible printing plates applications within Performance Products Asia 25% Europe 36% North America 34% South America 5%

First Quarter Revenue and Adjusted Gross Profit Kraton First Quarter 2015 Earnings Call 9 $312 $261 Q1 2014 Q1 2015 Revenue 74.4 kilotons of sales volume in Q1 2015 and Q1 2014 Currency movements adversely impacted revenue by $22.6 million Revenue decrease also reflects the effect of lower raw material costs on average selling prices Record first quarter Adjusted Gross Profit and Adjusted Gross Profit per ton in 2015 Increase in unit margins resulted in Adjusted Gross Profit of $1,075 per ton in Q1 2015 Overcame currency headwind of $3.9 million, or $52/ton $66 $80 Q1 2014 Q1 2015 Adjusted Gross Profit See the appendix for a reconciliation of GAAP to non-GAAP financial measures. ($ in millions)

First Quarter Adjusted EBITDA and Adjusted EPS Kraton First Quarter 2015 Earnings Call 10 $37 $49 Q1 2014 Q1 2015 Adjusted EBITDA $0.33 $0.76 Q1 2014 Q1 2015 Adjusted EPS Record first quarter 2015 Adjusted EBITDA of $49.2 million Adjusted EBITDA margin of 18.8% in Q1’15 vs. 12.0% in Q1’14 Currency headwind of $2.5 million Variable compensation, consulting and turnaround costs up an aggregate of $4.7 million compared Q1’14 Weighted average share count down 1.1 million shares, reflecting impact of the share repurchase program Currency negatively impacted Adjusted EPS by $0.07 per share ($ in millions) See the appendix for a reconciliation of GAAP to non-GAAP financial measures.

On Track To Deliver $18 Million In 2015 Cost Reductions Kraton First Quarter 2015 Earnings Call 11 2015 Target Status Manufacturing cost reductions $12 million SAR cost reductions $6 million Total 2015 cost reduction target $18 million Approximately $2.5 million realized in Q1 2015

Cash Flow and Other Financial Highlights 12 Operating cash flow exceeded Q1 2014 by $47.2 million $12.9 million used to repurchase 662,543 additional shares in Q1 2015 KRA ABL availability at March 31, 2015 of $155.5 million and KRA total liquidity (defined as ABL availability plus KRA cash) of $184.3 million Consolidated net debt to TTM Adjusted EBITDA of 2.2x at March 31, 2015 KFPC debt is 50% guaranteed by Kraton Polymers, LLC and 50% guaranteed by Formosa Petrochemical Corporation 3 months ended March 31, 2015 ($ in millions) Kraton KFPC Consolidated Operating cash flow $(5) $(2) $(7) Investing activities (15) (16) $(31) Financing activities 7 20 27 Currency impact on cash (4) 1 (3) Beginning cash 46 8 54 Ending cash 29 11 40 Gross debt 373 20 393 Net debt $344 $9 $353

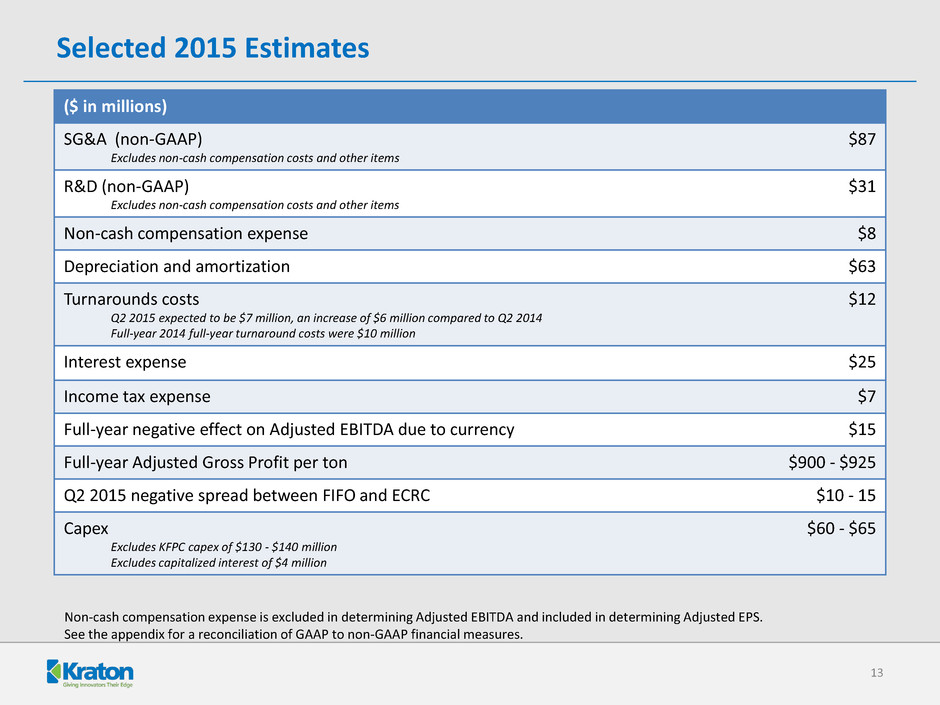

Selected 2015 Estimates 13 ($ in millions) SG&A (non-GAAP) Excludes non-cash compensation costs and other items $87 R&D (non-GAAP) Excludes non-cash compensation costs and other items $31 Non-cash compensation expense $8 Depreciation and amortization $63 Turnarounds costs Q2 2015 expected to be $7 million, an increase of $6 million compared to Q2 2014 Full-year 2014 full-year turnaround costs were $10 million $12 Interest expense $25 Income tax expense $7 Full-year negative effect on Adjusted EBITDA due to currency $15 Full-year Adjusted Gross Profit per ton $900 - $925 Q2 2015 negative spread between FIFO and ECRC $10 - 15 Capex Excludes KFPC capex of $130 - $140 million Excludes capitalized interest of $4 million $60 - $65 Non-cash compensation expense is excluded in determining Adjusted EBITDA and included in determining Adjusted EPS. See the appendix for a reconciliation of GAAP to non-GAAP financial measures.

Kraton First Quarter 2015 Earnings Call 14 Kraton Performance Polymers, Inc. 2015 Investor Day June 16, 2015 8:00 am to 12:30 pm Marriott East Side 525 Lexington Avenue at 49th Street New York, NY 10017 Additional details to follow 2015 Investor Day

Appendix April 30, 2015 15

$792 $820 $1,010 $743 $772 $804 $860 $890 $890 $867 $803 $817 $1,075 Q1'12 Q2'12 Q3'12 Q4'12 Q1'13 Q2'13 Q3'13 Q4'13 Q1'14 Q2'14 Q3'14 Q4'14 Q1'15 $3.4 $14.0 ($37.6) ($10.2) ($0.5) ($2.3) ($20.7) ($7.3) $4.0 $4.3 ($1.8) ($15.8) ($33.4) Q1'12 Q2'12 Q3'12 Q4'12 Q1'13 Q2'13 Q3'13 Q4'13 Q1'14 Q2'14 Q3'14 Q4'14 Q1'15 Monomer Volatility ($ in millions, except per ton information) 16 Quarterly Difference Between Inventory Valuation at FIFO and at ECRC Adjusted Gross Profit per Ton Annual Difference Between Inventory Valuation at FIFO and at ECRC $12.1 $66.3 ($30.5) ($30.7) ($9.3) 2010 2011 2012 2013 2014

Reconciliation of Gross Profit to Adjusted Gross Profit ($ in millions) 17 Q1'12 Q2'12 Q3'12 Q4’12 Q1’13 Q2’13 Q3’13 Q4’13 Q1'14 Q2'14 Q3'14 Q4’14 Q1’15 Gross Profit @ FIFO $75.5 $73.5 $42.8 $39.7 $59.9 $59.9 $47.5 $58.6 $57.1 $72.1 $63.8 $44.1 $46.6 FIFO to ECRC ($3.4) ($14.0) $37.6 $10.2 $0.5 $2.3 $20.7 $7.3 ($4.0) ($4.3) $1.8 $15.8 $33.4 Restructuring and other charges - $1.0 - - - - $0.1 $0.1 $0.5 $0.1 - $ 0.1 $ 0.0 Production downtime - - - - - - $3.5 - $12.4 - $(1.0) $(1.5) $(0.2) Impairment of spare parts inventory - - - - - - - - - - - $0.4 - Storm related charges - $2.8 ($0.3) - - - - - - - - - - Property tax dispute $5.6 - - - - - - - - - - - - Settlement gain (loss) ($6.8) - - - - - - - - - - - - Non-cash compensation expense $0.0 $0.0 $0.0 $0.0 $0.0 $0.1 $0.1 $0.1 $0.2 $0.2 $0.1 $0.1 $0.2 Adjusted Gross Profit $71.0 $63.3 $80.1 $49.9 $60.4 $62.3 $71.8 $66.1 $66.2 $68.0 $64.8 $59.0 $80.0 Sales Volume (Kilotons) 89.6 77.2 79.3 67.2 78.2 77.5 83.5 74.3 74.4 78.4 80.7 72.2 74.4 Adjusted Gross Profit per ton $792 $820 $1,010 $743 $772 $804 $860 $890 $890 $867 $803 $817 1,075 Columns may not foot due to rounding.

GAAP and Non-GAAP Statement of Operations – Q1 2015 ($ in thousands, except per share amounts) 18 Three months ended March 31, 2015 Other FIFO to ECRC As Reported Adjustments Adjustment Adjusted Revenue $ 261,429 $ - $ - $ 261,429 Cost of goods sold 214,868 128 (a) (33,408) 181,588 Gross profit 46,561 (128) 33,408 79,841 Operating expenses: Research and Development 7,947 - 7,947 Selling, general and administrative 26,949 (1,619) (b) - 25,330 Depreciation and amortization 15,296 - - 15,296 Total operating expenses 50,192 (1,619) - 48,573 Earnings of unconsolidated joint venture 76 - - 76 Interest expenses, net 6,120 - - 6,120 Income (loss) before income taxes (9,675) 1,491 33,408 25,224 Income tax expense 66 107 (c) 984 1,157 Consolidated net income (loss) (9,741) 1,384 32,424 24,067 Net income (loss) attributable to noncontrolling interest (285) 188 (d) - (97) Net income (loss) attributable to Kraton $ (9,456) $ 1,196 $ 32,424 $ 24,164 Earnings (loss) per common share: Basic $ (0.30) $ 0.04 $ 1.03 $ 0.76 Diluted $ (0.30) $ 0.04 $ 1.02 $ 0.76 Weighted average common shares outstanding: Basic 31,067 31,067 31,067 31,067 Diluted 31,067 31,371 31,371 31,371 a) $0.1 million reduction of production downtime costs related to an insurance recovery. b) $0.8 million of restructuring and other charges, $0.3 million of transaction related costs, and $0.5 million of KFPC startup costs. c) Tax effect of other adjustments. d) KFPC startup costs.

19 Three months ended March 31, 2014 Other FIFO to ECRC As Reported Adjustments Adjustment Adjusted Revenue $ 311,656 $ - $ - $ 311,656 Cost of goods sold 254,583 (12,904) (a) 4,024 245,703 Gross profit 57,073 12,904 (4,024) 65,953 Operating expenses: Research and Development 8,297 - - 8,297 Selling, general and administrative 34,218 (10,325) (b) - 23,893 Depreciation and amortization 16,409 - - 16,409 Total operating expenses 58,924 (10,325) - 48,599 Earnings of unconsolidated joint venture 117 - - 117 Interest expenses, net 6,338 - - 6,338 Income (loss) before income taxes (8,072) 23,229 (4,024) 11,133 Income tax expense (benefit) 122 178 (c) (33) 267 Consolidated net income (loss) (8,194) 23,051 (3,991) 10,866 Net income (loss) attributable to noncontrolling interest (285) 190 - (95) Net income (loss) attributable to Kraton $ (7,909) $ 22,861 $ (3,991) $ 10,961 Earnings (loss) per common share: Basic $ (0.24) $ 0.70 $ (0.12) $ 0.34 Diluted $ (0.24) $ 0.69 $ (0.12) $ 0.33 Weighted average common shares outstanding: Basic 32,162 32,162 32,162 32,162 Diluted 32,162 32,501 32,501 32,501 a) $12.4 million of production downtime and $0.5 million of restructuring and other charges. b) $9.2 million of transaction related costs, $0.6 million of production downtime, and $0.5 million of KFPC startup costs. c) Tax effect of other adjustments. d) KFPC startup costs. GAAP and Non-GAAP Statement of Operations – Q1 2014 ($ in thousands, except per share amounts)

Reconciliation of Net Income and EPS to Adjusted Net Income and EPS ($ in thousands, except per share amounts) 20 Three months ended March 31, 2015 Three months ended March 31, 2014 Income (Loss) Before Income Noncontrolling Diluted Income (Loss) Before Income Noncontrolling Diluted Income Tax Taxes Interest EPS Income Tax Taxes Interest EPS GAAP Earnings (Loss) $ (9,675) $ 66 $ (285) $ (0.30) $ (8,072) $ 122 $ (285) $ (0.24) Restructuring and other charges (a) 819 26 - 0.02 521 99 - 0.01 Transaction and acquisition related costs (b) 328 7 - 0.01 9,236 - - 0.28 Production downtime (c) (108) (2) - 0.00 13,013 - - 0.39 KFPC startup costs (d) 452 76 188 0.01 459 79 190 0.01 Spread between FIFO and ECRC 33,408 984 - 1.02 (4,024) (33) - (0.12) Adjusted Earnings (Loss) $ 25,224 $ 1,157 $ (97) $ 0.76 $ 11,133 $ 267 $ (95) $ 0.33 a) Severance expenses, professional fees and other restructuring related charges which are primarily recorded in selling, general and administrative expenses in 2015 and primarily in cost of goods sold in 2014. In 2014, primarily professional fees related to the terminated Combination Agreement with LCY, which are recorded in selling, general and administrative expenses. b) Primarily professional fees related to the terminated Combination Agreement with LCY, which are recorded in selling, general and administrative expenses. c) Weather-related production downtime at our Belpre, Ohio, facility and an operating disruption from a small fire at our Berre, France, facility. In 2014, $12.4 million is recorded in cost of goods sold and $0.6 million is recorded in selling, general and administrative expenses. In 2015, the reduction in costs is related to an additional insurance recovery related to the Belpre production downtime, which is recorded in cost of goods sold. d) Startup costs related to the joint venture company, KFPC, which are recorded in selling, general and administrative expenses.

Reconciliation of Net Income to EBITDA and Adjusted EBITDA ($ in thousands) 21 a) Severance expenses, professional fees and other restructuring related charges which are primarily recorded in selling, general and administrative expenses in 2015 and primarily in cost of goods sold in 2014. b) Primarily professional fees related to the terminated Combination Agreement with LCY, which are recorded in selling, general and administrative expenses. c) Weather-related production downtime at our Belpre, Ohio, facility and an operating disruption from a small fire at our Berre, France, facility. In 2014, $12.4 million is recorded in cost of goods sold and $0.6 million is recorded in selling, general and administrative expenses. In 2015, the reduction in costs is related to an additional insurance recovery related to the Belpre production downtime, which is recorded in cost of goods sold. d) Startup costs related to the joint venture company, KFPC, which are recorded in selling, general and administrative expenses. e) In 2015, $2.2 million, $0.2 million, and $0.2 million and in 2014, $3.1 million, $0.3 million, and $0.2 million is recorded in selling, general and administrative expenses, research and development expenses, and cost of goods sold, respectively. Three months ended Three months ended 3/31/2015 3/31/2014 Net loss attributable to Kraton $ (9,456) $ (7,909) Net loss attributable to noncontrolling interest (285) (285) Consolidated net loss (9,741) (8,194) Add: Interest expense, net 6,120 6,338 Income tax expense 66 122 Depreciation and amortization expenses 15,296 16,409 EBITDA 11,741 14,675 Add (deduct): Restructuring and other charges (a) 819 521 Transaction and acquisition related costs(b) 328 9,236 Production downtime(c) (108) 13,013 KFPC startup costs(d) 452 459 Non-cash compensation expense (e) 2,609 3,614 Spread between FIFO and ECRC 33,408 (4,024) Adjusted EBITDA $ 49,249 $ 37,494

Historical Revenue by Product Group ($ in thousands) 22 Q1 2015 Performance Products 134,768$ Specialty Polymers 91,674 Cariflex 34,837 Other 150 Total 261,429$ Q1 2014 Q2 2014 Q3 2014 Q4 2014 FY 2014 Performance Products 167,852$ 183,974$ 180,122$ 146,982$ 678,930$ Specialty Polymers 108,346 110,463 98,742 94,884 412,435 Cariflex 35,363 29,242 39,959 34,032 138,596 Other 95 88 148 141 472 Total 311,656$ 323,767$ 318,971$ 276,039$ 1,230,433$ Q1 2013 Q2 2013 Q3 2013 Q4 2013 FY 2013 Performance Products 199,484$ 194,951$ 195,533$ 172,971$ 762,939$ Specialty Polymers 113,287 110,073 102,940 85,709 412,009 Cariflex 27,029 29,244 28,231 31,499 116,003 Other 307 275 405 183 1,170 Total 340,107$ 334,543$ 327,109$ 290,362$ 1,292,121$ Q1 2012 Q2 2012 Q3 2012 Q4 2012 FY 2012 Performance Products 245,636$ 221,131$ 210,624$ 173,371$ 850,762$ Specialty Polymers 138,380 124,588 107,580 93,712 464,260 Cariflex 22,645 29,805 24,193 29,255 105,898 Other 1,652 232 238 80 2,202 Total 408,313$ 375,756$ 342,635$ 296,418$ 1,423,122$

Kraton Performance Polymers, Inc. First Quarter 2015 Earnings Conference Call April 30, 2015