Attached files

| file | filename |

|---|---|

| 8-K - 8-K - ANCHOR BANCORP WISCONSIN INC | d919136d8k.htm |

| EX-99.1 - EX-99.1 - ANCHOR BANCORP WISCONSIN INC | d919136dex991.htm |

First Quarter 2015 Earnings Presentation |

2

This

presentation

does

not

constitute

an

offer

to

sell,

nor

a

solicitation

of

an

offer

to

buy,

any

securities

of

Anchor

BanCorp

Wisconsin,

Inc.

(“Anchor”

or

the

“Company”)

by

any

person

in

any

jurisdiction

in

which

it

is

unlawful

for

such

person

to

make

such

an

offering

or

solicitation.

Neither the Securities and Exchange Commission nor any other regulatory body has

approved or disapproved of the securities of Anchor or passed upon the accuracy or adequacy of this

presentation. Any representation to the contrary is a criminal offense.

Except as otherwise indicated, this presentation speaks as of the date hereof. The

delivery of this presentation shall not, under any circumstances, create any implication that there has

been no change in the affairs of the Company after the date hereof.

Market

and

other

statistical

data

used

in

this

presentation

has

been

obtained

from

independent

industry

sources

and

publications

as

well

as

from

research

reports

prepared

for

other

purposes. Industry publications and surveys and forecasts generally state that the

information contained therein has been obtained from sources believed to be reliable. Anchor has not

independently verified the data obtained from these sources. Forward-looking

information obtained from these sources is subject to the same qualifications and the additional uncertainties

regarding the other forward-looking statements in this presentation.

From time to time, Anchor may make forward-looking statements that reflect the

Company’s views with respect to, among other things, future events and financial performance. Words such

as “may,”

“should,”

“could,”

“predict,”

“potential,”

“believe,”

“will likely result,”

“expect,”

“continue,”

“will,”

“anticipate,”

“seek,”

“estimate,”

“intend,”

“plan,”

“projection,”

“would”

and “outlook,”

or

the negative version of those words or other comparable words are intended to

identify forward-looking statements, but are not the exclusive means of identifying such statements. These

forward-looking statements are not historical facts, and are based on current

expectations, estimates and projections about the Company’s industry, management’s beliefs and certain

assumptions made by management, many of which, by their nature, are inherently

uncertain and beyond the Company’s control. Accordingly, you are cautioned that any such forward-

looking

statements

are

not

guarantees

of

future

performance

and

are

subject

to

certain

risks,

uncertainties

and

assumptions

that

are

difficult

to

predict.

Although

the

Company

believes

that

the expectations reflected in such forward-looking statements are reasonable as

of the date made, actual results may prove to be materially different from the expected results expressed or

implied by such forward-looking statements. Any forward-looking statement

speaks only as of the date on which it was made, and unless otherwise required by law, the Company does not

undertake any obligation to update or review any forward-looking statements,

whether as a result of new information, future developments or otherwise.

This presentation includes certain non-GAAP financial measures. These

non-GAAP financial measures should be considered only as supplemental to, and not as superior to, financial

measures prepared in accordance with GAAP. Please refer to the Appendix of this

presentation for a reconciliation of the non-GAAP financial measures included in this presentation to the

most directly comparable financial measures prepared in accordance with GAAP.

Cautionary Statement Regarding Forward-Looking

Information and Non-GAAP Financial Information |

3

Continuing the Recovery & Executing Our

Business Plan

Continue Credit Improvement

Execute Business Development

Strategies

Improve Efficiency

Potential Future Value of the DTA¹

Normalize Excess Capital

Building

Shareholder

Value

1)

“DTA”

refers to Anchor’s deferred tax asset. |

4

2015 First Quarter Highlights

Asset Quality

Net Interest

Income

Non-Interest

Expense

Non-Interest

Income

Capital

•

Capital remains strong with Common Equity Tier 1 ratio of 15.84%

•

Successful public offering completed in October 2014

•

Market capitalization as of March 31, 2015 of $334 million

•

Non-interest expense lower Q-O-MRQ by $3.6 million or a reduction of 14.8%

•

Announced efficiency initiatives designed to lower non-interest expense

–

anticipating one-time charge in Q2 2015 associated with initiatives

•

Non-interest income exclusive of the Capitol Square building and Richland Center

branch sales higher Q-O-MRQ by $2.2 million or an increase of 33.2%

•

Gain on sale of loans and loan fees up Q-O-MRQ by $1.5 million or 177.9%

•

Deposit Service Fees higher Q-O-Q1 2014 by $0.1 million or an increase of 4.5%

•

Net interest income of $17.1 million during Q1 2015

•

Funded/renewed $111 million of loans during Q1 2015

•

Cost of funds low and stable at 0.23%

•

NPLs down $10.0 million during Q1 2015, or a decline of 28.7%

•

OREO down $4.9 million during Q1 2015, or a decline of 13.7%

•

De-provision of $1.4 million in Q1 2015 |

5

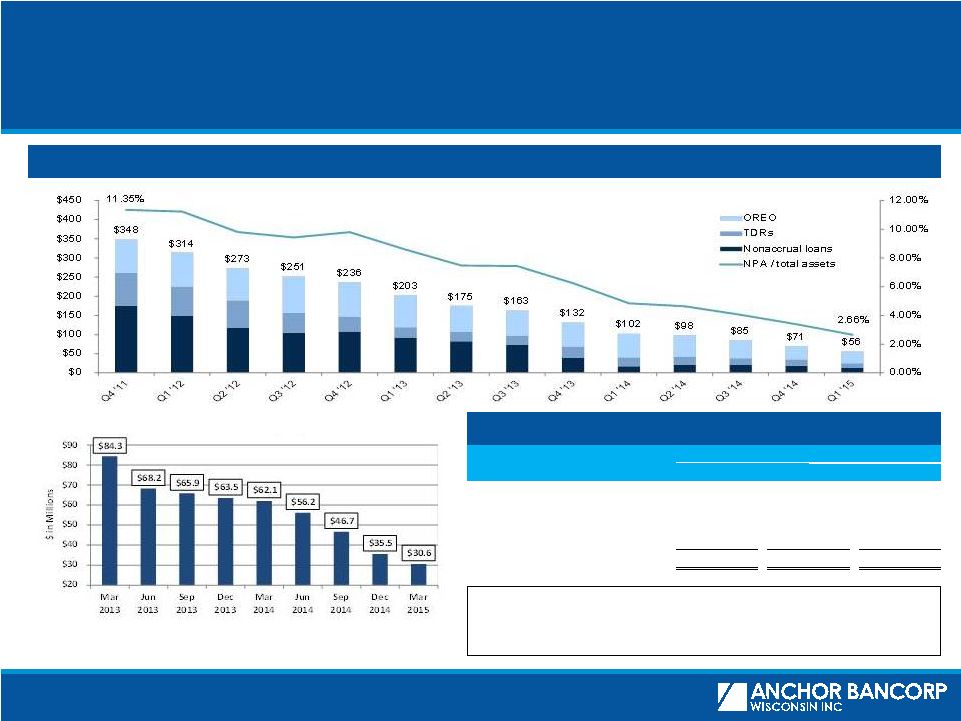

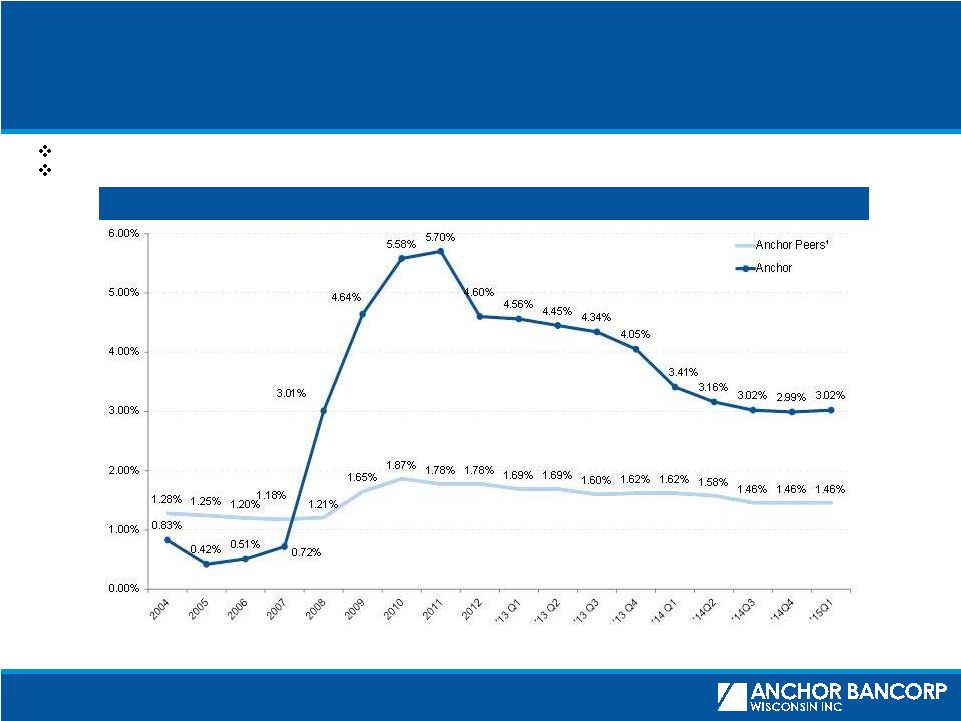

Continued Improving Asset Quality

Proactively managing asset quality

Non-performing Asset Levels ($mm)

1)

Non-performing

loans

and

assets

exclude

troubled

debt

restructurings

that

are

now

accruing.

Source: Anchor SEC filings.

Credit Quality Overview

($000s)

As of

12/31/2013

12/31/2014

3/31/2015

Nonaccrual loans

$39,151

$18,632

$13,248

Troubled debt restructurings¹

29,346

16,483

11,806

OREO

63,460

35,491

30,632

Total nonperforming assets

$131,957

$70,606

$55,686

NPLs / Gross Loans

4.22%

2.22%

1.60%

NPAs / Total Assets

6.25

3.39

2.66

ALLL / Gross Loans

4.02

2.97

3.00

ALLL / NPLs

95.16

133.95

187.74

REO Net Balance by Quarter |

6

Maintaining Appropriate Loan Loss Reserves

Allowance to Total Loans Held-for-Investment

Anchor has built an allowance sufficient to cover potential credit losses

The ALLL to total NPLs was 187.74% at March 31, 2015, an increase from 95.16% at

December 31, 2013

1)

Anchor peer group represents all Wisconsin banks and thrifts with total assets

greater than $500 million as of March 31, 2015. Note: Anchor data reflects the

consolidated entity. Source: SNL Financial and Anchor SEC filings.

|

7

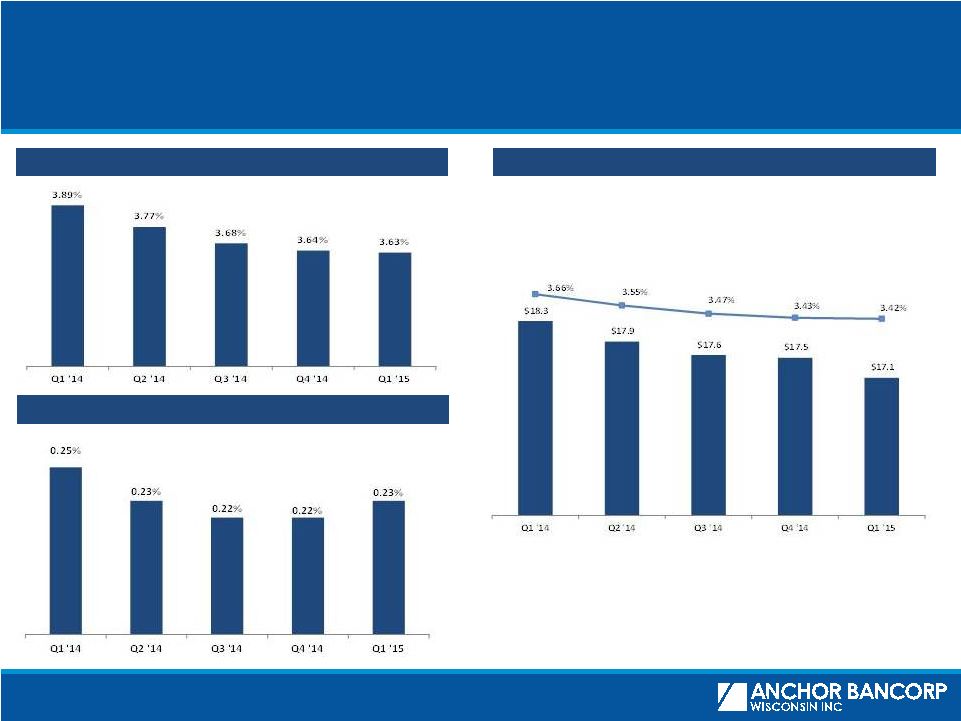

Net Interest Income

Yield on Interest-earning Assets

Cost of Interest-bearing Liabilities

Net Interest Income & Net Interest Margin

$ in Millions |

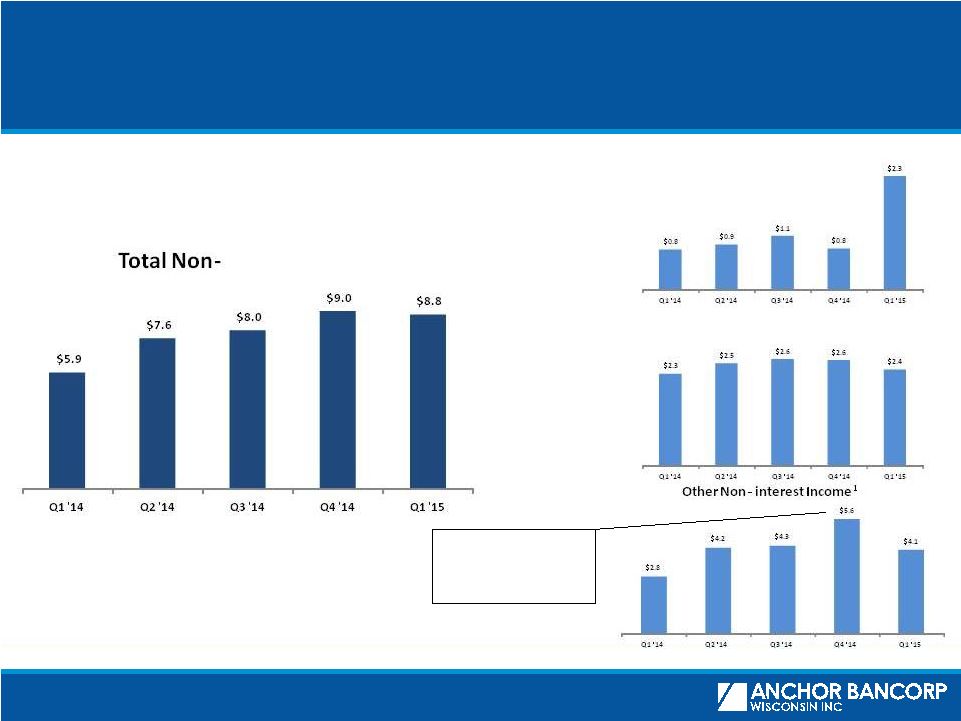

8

Non-Interest Income

1

Other Non-interest Income

includes investment and insurance commissions, gains/losses

on sale of investment securities, other than temporary impairment of investment

securities, gains/losses on sale of OREO, and other miscellaneous items

$ in Millions

interest Income

Gain on Sale of Loans and Loan Fees

Q4 2014 includes gains on

sales of the Capitol Square

building and Richland

Center branch

Deposit Service Fees |

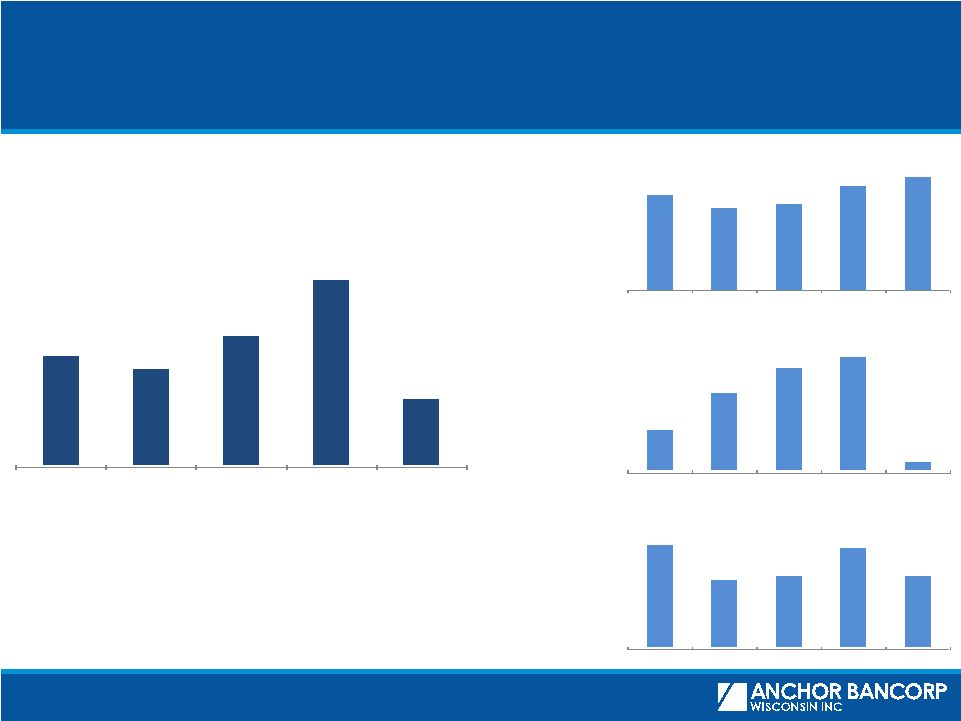

9

Non-Interest Expense

$1.2

$2.3

$3.0

$3.3

$0.2

Q1 '14

Q2 '14

Q3 '14

Q4 '14

Q1 '15

OREO Expense, net

$ in Millions

1

Other Non-interest Expense

includes occupancy, FDIC insurance, furniture and

equipment, data processing, marketing, MSR impairment/recovery, provision for unfunded

commitments, and other miscellaneous items

$22.3

$21.9

$22.9

$24.6

$21.0

Q1 '14

Q2 '14

Q3 '14

Q4 '14

Q1 '15

Total Non-interest Expense

$11.2

$10.7

$10.9

$11.5

$11.8

Q1 '14

Q2 '14

Q3 '14

Q4 '14

Q1 '15

Compensation and Benefits

$9.9

$8.9

$9.0

$9.8

$9.0

Q1 '14

Q2 '14

Q3 '14

Q4 '14

Q1 '15

Other Non-interest Expense

1 |

10

Summary of Recent Initiatives

Branch Sales

Branch

Consolidations

Compensation &

Benefits

Occupancy

Universal

Banker Branch

Staffing Model

•

2015 Q1 –

announced sale of the Viroqua branch to Royal Bank of Elroy,

anticipated to settle in May 2015

•

2015 Q2 –

announced sale of the Winneconne branch to Premier Community

Bank, anticipated to settle in August 2015

•

2015 Q2 –

announced consolidation of 6 branches in the Wisconsin communities

of Appleton, Menasha, Oshkosh, Janesville, Franklin, and Madison, all with other

branches within 5 miles.

•

Expanding Appleton Commercial facility for Retail Bank business

•

2015

Q2

–

Creating

a

new

Universal

Banker

Branch

staffing

model

–

the

majority

of

staff will be able to open new accounts and perform most branch transactions for

customers improving branch efficiency and providing customers with strong

customer service

•

2015 Q2 –

Offering Voluntary Separation Plan packages to approximately 140

eligible employees providing a variety of benefits including additional

compensation,

subsidized

COBRA

health

benefits,

and

optional

job

placement

services

•

2014 Q4 –

completed sale of Capitol Square Madison Headquarters facility

•

2015 Q1 -

completed purchase of new City View Madison Support Center which

will consolidate various operational teams |

11

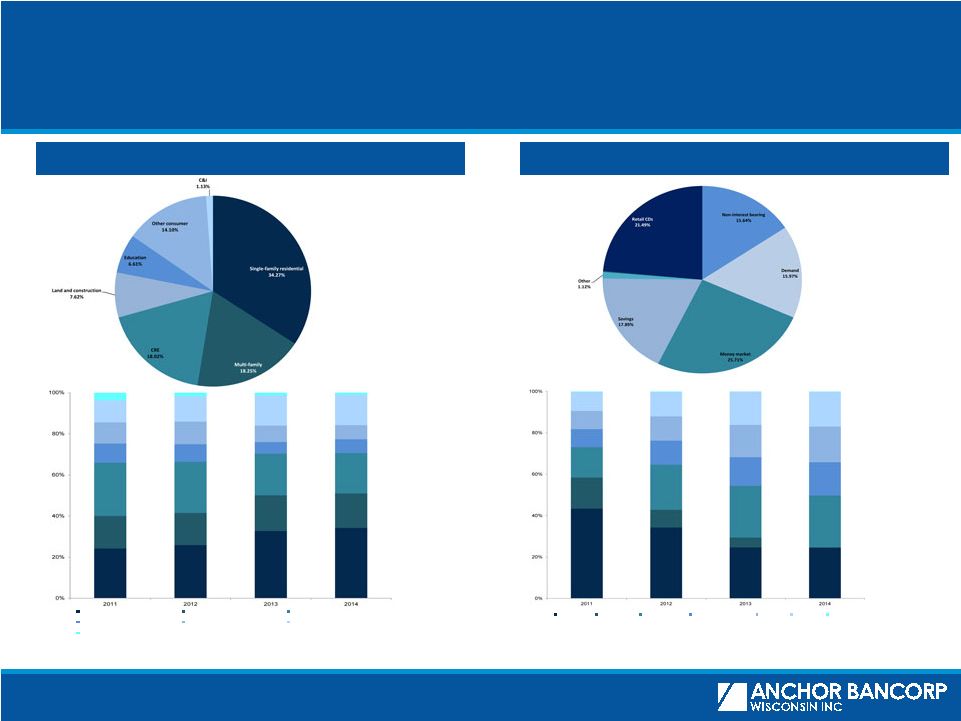

Loan and Deposit Overview

Loan Composition

Deposit Composition

1)

For the three months ended March 31, 2015. Cost represents the cost of

interest-bearing deposits only. Gross Loans

at 3/31/15 = $1.6bn

Yield¹

= 4.25%

Deposits

at 3/31/15 = $1.8bn

Cost¹

= 0.22%

Single-family residential

Multi-family

CRE

Land and construction

Education

Other consumer

C&I

Jumbo CDs

Retail CDs

Jumbo CDs

Money market

Non-interest bearing

Savings

Demand

Other

Note:

Loan

and

deposit

data

as

of

March

31

for

years

2011

–

2012

and

as

of

December

31

for

2013

-

2014. |

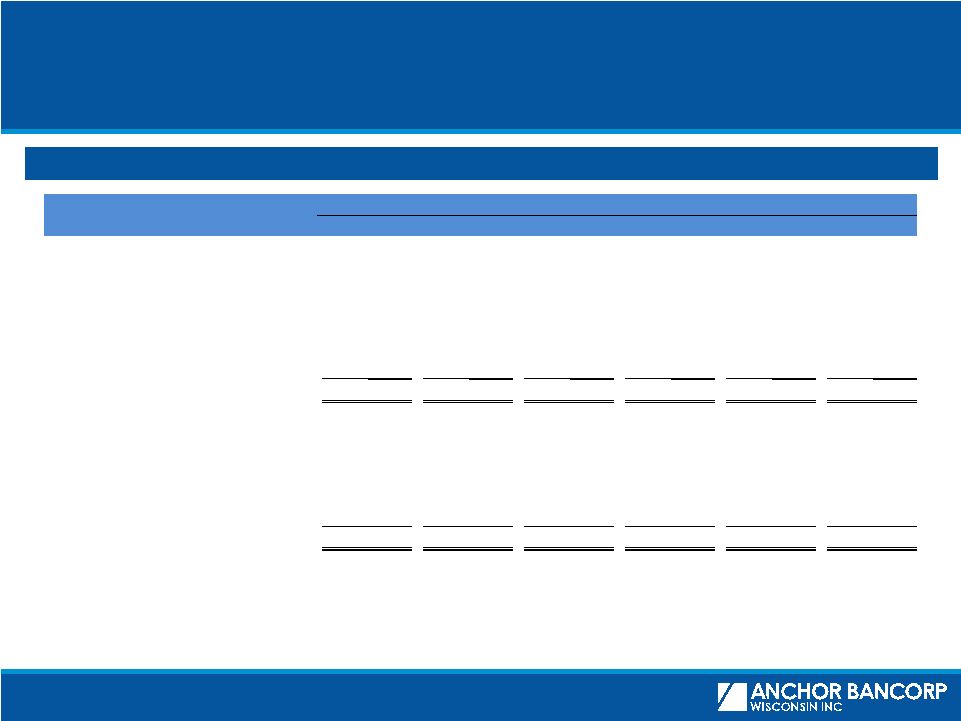

12

Reconciliation of Non-GAAP Measures

Non-GAAP Financial Measures¹

1)

Tangible common equity to tangible assets (the “tangible common equity

ratio”) is a non-GAAP financial measure. The Company calculates the tangible common equity ratio by excluding the balance of preferred

equity,

goodwill

and

other

intangible

assets

from

common

shareholders’

equity

and

assets.

The

Company

considers

this

information

important

to

shareholders

as

tangible

equity

is

a

measure

that

is

consistent

with

the calculation of capital for bank regulatory purposes, which excludes intangible

assets from the calculation of risk-based ratios. This disclosure should not be viewed as a substitute for results determined to be in

accordance with GAAP, nor is it necessarily comparable to non-GAAP performance

measures presented by other companies. ($000s)

12/31/2013

03/31/2014

06/30/2014

09/30/2014

12/31/2014

03/31/2015

Total GAAP Equity

202,198

$

206,708

$

211,507

$

214,709

$

227,663

$

236,856

$

Less: Preferred Equity

-

-

-

-

-

-

Less: Goodwill and Other Intangibles

-

-

-

-

-

-

Tangible Common Equity

202,198

$

206,708

$

211,507

$

214,709

$

227,663

$

236,856

$

Total GAAP Assets

2,112,474

$

2,109,824

$

2,121,249

$

2,106,521

$

2,082,379

$

2,094,161

$

Less: Goodwill and Other Intangibles

-

-

-

-

-

-

Tangible Assets

2,112,474

$

2,109,824

$

2,121,249

$

2,106,521

$

2,082,379

$

2,094,161

$

Tang. Common Equity / Tang. Assets

9.57%

9.80%

9.97%

10.19%

10.93%

11.31%

As of |