Attached files

| file | filename |

|---|---|

| 8-K - 8-K - SmartStop Self Storage, Inc. | d911561d8k.htm |

| Exhibit 99.1

|

SmartStop 2014 Year End Financial Results

Self Storage

...The Smarter way to Store!tm

Presented by H. Michael Schwartz Chairman & CEO

April 21, 2015

|

|

Disclaimer and Risk Factors Disclaimers

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS SmartStop

Self Storage

The Smarter Way to Storel

Certain statements contained in this material, other than historical facts, may be considered forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). We intend for all such forward-looking statements to be covered by the applicable safe harbor provisions for forward-looking statements contained in Section 27A of the Securities Act and Section 21E of the Exchange Act, as applicable. Such statements include, in particular, statements about our plans, strategies, and prospects and are subject to certain risks and uncertainties, including known and unknown risks, which could cause actual results to differ materially from those projected or anticipated. Therefore, such statements are not intended to be a guarantee of our performance in future periods. Such forward-looking statements can generally be identified by our use of forward-looking terminology such as “may,” “will,” “expect,” “intend,” “anticipate,” “estimate,” “believe,” “continue,” or other similar words. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date this report is filed with the Securities and Exchange Commission. We cannot guarantee the accuracy of any such forward-looking statements contained in this material, and we do not intend to publicly update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise.

Any such forward-looking statements are subject to risks, uncertainties, and other factors and are based on a number of assumptions involving judgments with respect to, among other things, future economic, competitive, and market conditions, all of which are difficult or impossible to predict accurately. To the extent that our assumptions differ from actual results, our ability to meet such forward-looking statements, including our ability to generate positive cash flow from operations and provide distributions to stockholders, and our ability to find suitable investment properties, may be significantly hindered. All forward- looking statements should be read in light of the risks identified in our 2014 Annual Report on Form 10-K. 2

|

|

Disclaimer and Risk Factors Risk_Factors SmartStop

Self Storage

The Smarter Way to Storel

• See our Form 10-K for specific risks associated with an investment in SmartStop® Self Storage, Inc. formerly known as Strategic Storage Trust, Inc.

• As of December 31, 2014, our accumulated deficit was approximately $65 million.

• No public market currently exists for shares of our common stock. It may be difficult to sell your shares. If you sell your shares, it will likely be at a substantial discount.

• We have paid distributions from sources other than our cash flows from operations. We are not prohibited from undertaking such activities by our charter, bylaws or investment policies, and we may use an unlimited amount from any source to pay our distributions. We also may be required to sell assets or issue new securities for cash in order to pay distributions. Any such actions could reduce the amount of capital we ultimately invest in assets and negatively impact the amount of income available for future distributions.

• Prior to September 1, 2014 we had no employees and depended on our advisor to select investments and conduct our operations, and there is no guarantee that our advisor devoted adequate time or resources to us.

• Our board of directors may change any of our investment objectives, including our focus on self storage facilities.

• Prior to September 1, 2014 we paid substantial fees and expenses to our advisor and its affiliates which reduced cash available for investment and distribution.

• Prior to September 1, 2014 there were substantial conflicts of interest among us and our sponsor, advisor and property manager.

• We may fail to remain qualified as a REIT, which could adversely affect our operations and our ability to make distributions.

• We may incur substantial debt, which could hinder our ability to pay distributions to our stockholders or could decrease the value of your investment.

• We encourage you to review our SEC filings at www.sec.gov.

|

|

SmartStop® Self Storage, Inc. Overview

SmartStop® Self Storage, Inc. (“SmartStop”) is a selfadministered and self-managed self storage REIT with approximately 400 employees as of March 31, 2015

SmartStop® owns and/or operates 164 self storage properties, ~103,000 units and ~12.9 million net rentable square feet in 20 states and Toronto, Canada. SmartStop is now the seventh largest self storage owner/operator in the U.S.

SmartStop® serves as the sponsor of two public nontraded REITs: Strategic Storage Trust II, Inc., which focuses on current income-producing self storage investments, and Strategic Storage Growth Trust, Inc. that focuses on lease-up, redevelopment and growth investments in self storage

SmartStop® is one of the fastest-growing self storage REITs nationwide

|

|

SmartStop® Self Storage, Inc. Overview SmartStop has a Dedicated Group of Self Storage Experts… H. MICHAEL SCHWARTZ PAULA MATTHEWS MICHAEL S. MCCLURE WAYNE JOHNSON JAMES BERG KEN MORRISON Chairman, Executive Vice President Executive Vice President, Chief Investment Officer Secretary Senior Vice President, Chief Executive Officer & & Assistant Secretary Chief Financial Officer Property Management President & Treasurer Approximately 400 self storage professionals, in areas including: Investor Relations Operations Accounting Capital Due Diligence Revenue Human Marketing Projects Property Management Acquisitions Finance Resources Legal Management Team responsible for 12 consecutive year over year quarters of same store revenue and NOI growth: Q1 2012 Q2 2012 Q3 2012 Q4 2012 Q1 2013 Q2 2013 Q3 2013 Q4 2013 Q1 2014 Q2 2014 Q3 2014 Q4 2014 Revenue 3.6% 4.5% 5.5% 5.8% 9.0% 9.7% 9.4% 8.6% 7.6% 8.8% 7.8% 6.7% Growth NOI Growth 8.7% 5.7% 8.5% 10.4% 19.0% 21.2% 16.1% 13.9% 8.1% 15.7% 14.9% 14.3% Total 45 61 72 77 90 90 91 101 109 109 109 111 Properties 5

|

|

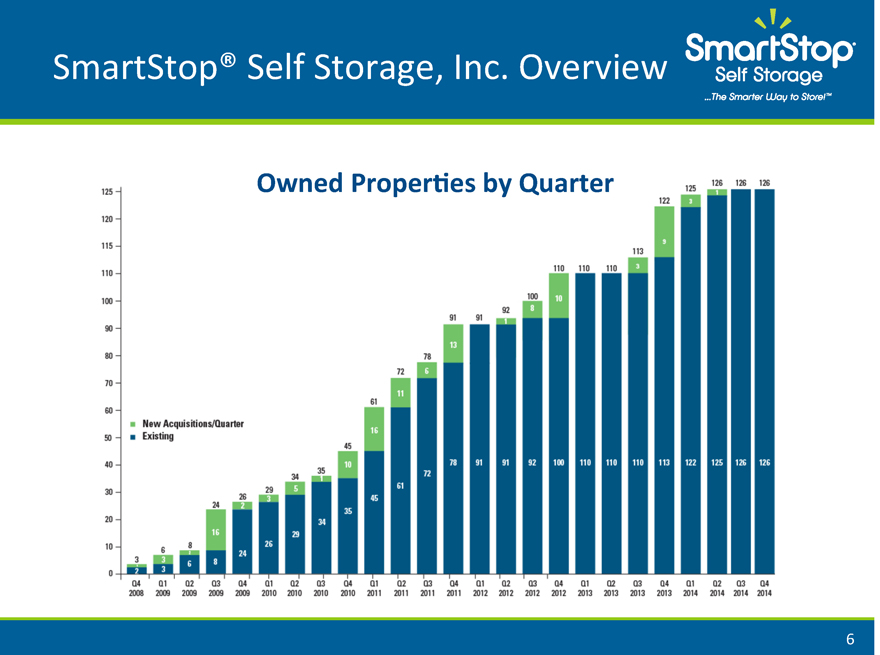

SmartStop® Self Storage, Inc. Overview Owned Properties by Quarter 6 Smartstop self storage the Smarter way to store new acquisitions/Quarter Existing

|

|

SmartStop® Self Storage, Inc. Overview Owned/Operated Square Footage by State (as of 3/31/2015) • 164 properties • 20 states, 1 province • 103,000 units • 12.9 million SF 5 3.8% 1 0.4% 1 0.6% 4 2.2% 8 4.8% 6 3.5% 10 7.0% 1 0.4% 5 3.2% 6 3.2% 4 1.8% 4 3.2% 14.9% 6 2.8% 26 5 2.9% 15 9.3% 6 2.5% 3 1.7% 22 13.2% 15 11.1% 11 7.5% 7 Washington Nevada Colorado California Arizona Illinois Kentucky Tennessee Alabama Mississippi Texas Toronto new york Pennsylvania new jersey Maryland Virginia n. Carolina s. Carolina Georgia Florida Smartstop self storage …the smarter way to store!tm

|

|

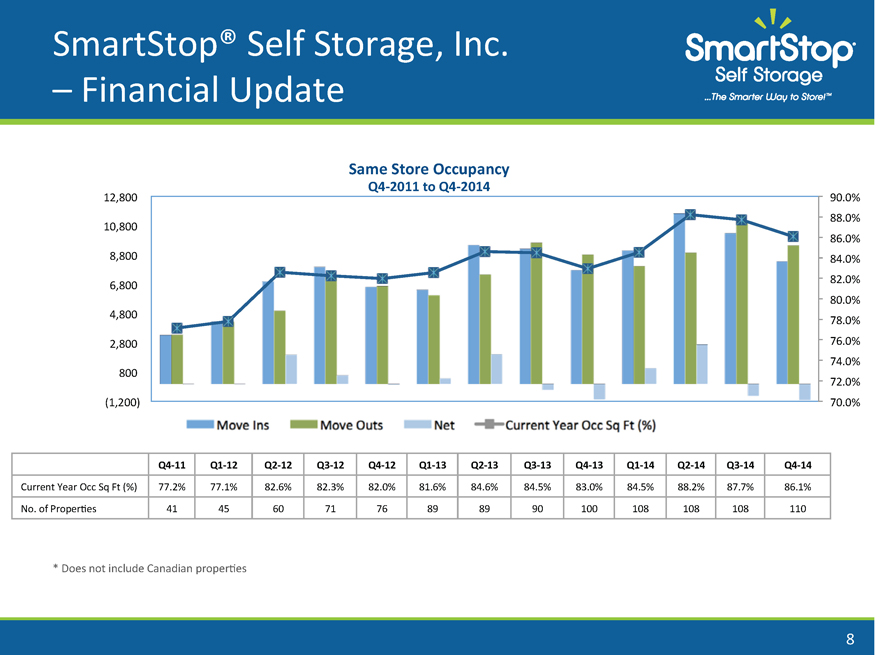

SmartStop® Self Storage, Inc. – Financial Update smartstop self storage the smarter way to store!tm 12,800 10,800 8,800 6,800 4,800 2,800 800 (1,200) 90.0% 88.0% 86.0% 84.0% 82.0% 80.0% 78.0% 76.0% 74.0% 72.0% 70.0% Same Store Occupancy Q4--2011 to Q4-2014 Q4-11 Q1--12 Q2--12 Q3--12 Q4--12 Q1-13 Q2--13 Q3--13 Q4--13 Q1--14 Q2--14 Q3--14 Q4--14 Current Year Occ Sq Ft (%) 77.2% 77.1% 82.6% 82.3% 82.0% 81.6% 84.6% 84.5% 83.0% 84.5% 88.2% 87.7% 86.1% No. of Properties 41 45 60 71 76 89 89 90 100 108 108 108 110 * Does not include Canadian properties

|

|

SmartStop® Self Storage, Inc. - Financial Update SmartStop

Self Storage

...The Smarter way to Store!”

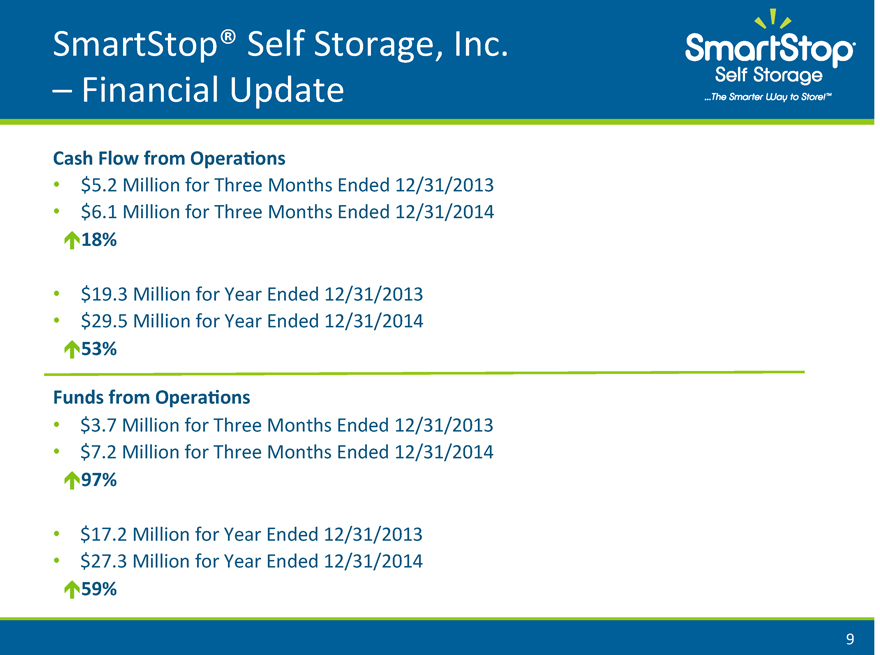

Cash Flow from Operations

$5.2 Million for Three Months Ended 12/31/2013

$6.1 Million for Three Months Ended 12/31/2014 *18%

$19.3 Million for Year Ended 12/31/2013

$29.5 Million for Year Ended 12/31/2014 *53%

Funds from Operations

$3.7 Million for Three Months Ended 12/31/2013

$7.2 Million for Three Months Ended 12/31/2014 *97%

$17.2 Million for Year Ended 12/31/2013

$27.3 Million for Year Ended 12/31/2014 *59%

9

|

|

SmartStop® Self Storage, Inc. - Financial Update SmartStop

Self Storage

...The Smarter way to Store!”

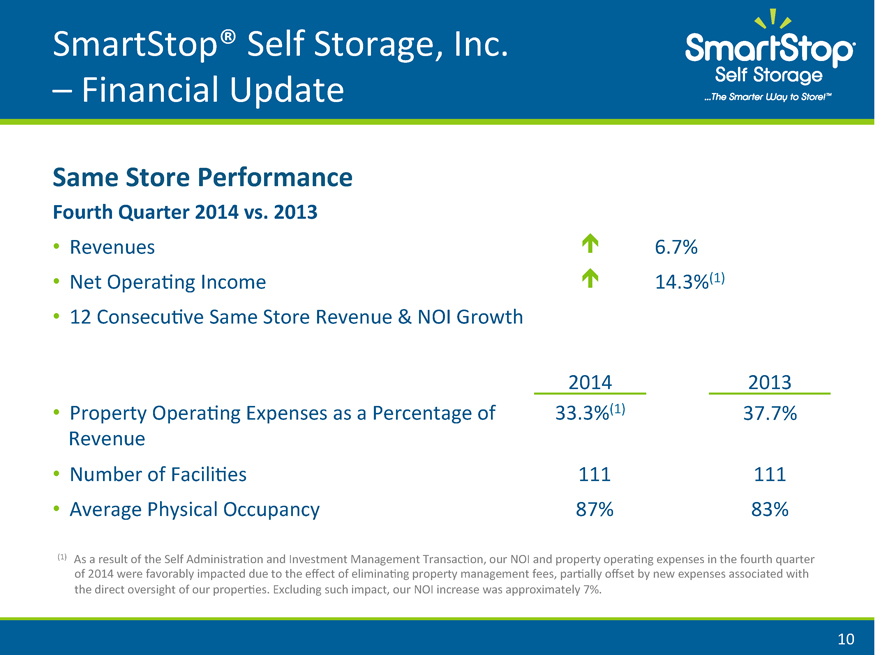

Same Store Performance

Fourth Quarter 2014 vs. 2013

Revenues

Net Operating Income

12 Consecutive Same Store Revenue & NOI Growth t

t 6.7%

14.3%(1)

2014 2013

Property Operating Expenses as a Percentage of Revenue

Number of Facilities

Average Physical Occupancy 33.3%(1)

111

87% 37.7%

111

83%

(1) As a result of the Self Administration and Investment Management Transaction, our NOI and property operating expenses in the fourth quarter of 2014 were favorably impacted due to the effect of eliminating property management fees, partially offset by new expenses associated with the direct oversight of our properties. Excluding such impact, our NOI increase was approximately 7%.

10

|

|

SmartStop® Self Storage, Inc. - Financial Update SmartStop

Self Storage

...The Smarter way to Store!”

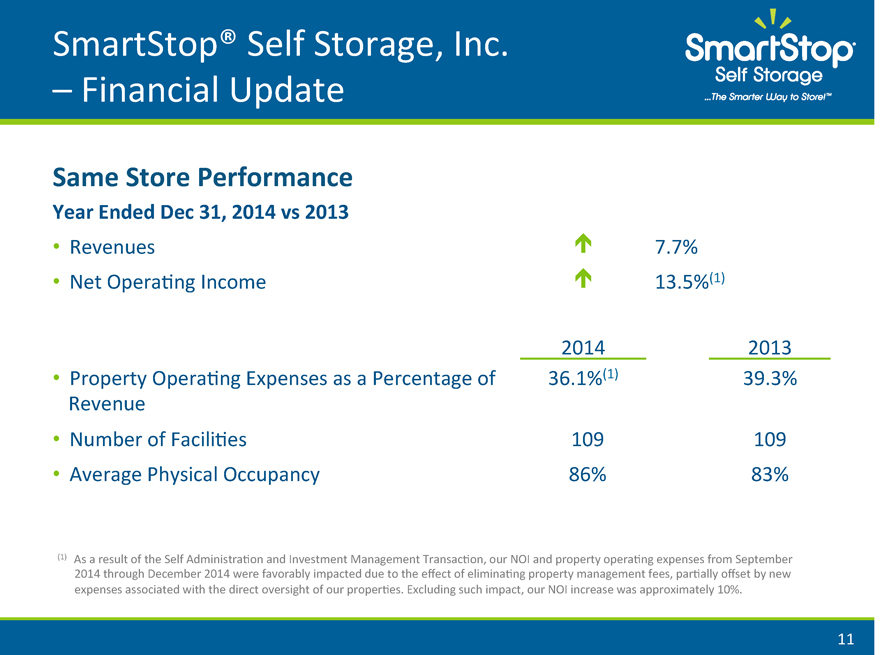

Same Store Performance

Year Ended Dec 31, 2014 vs 2013

• Revenues t 7.7%

• Net Operating Income t 13.5%(1)

2014 2013

• Property Operating Expenses as a Percentage of Revenue 36.1%(1) 39.3%

• Number of Facilities 109 109

• Average Physical Occupancy 86% 83%

(1) As a result of the Self Administration and Investment Management Transaction, our NOI and property operating expenses from September 2014 through December 2014 were favorably impacted due to the effect of eliminating property management fees, partially offset by new expenses associated with the direct oversight of our properties. Excluding such impact, our NOI increase was approximately 10%.

11

|

|

Self Administration and Investment SmartStop

Management Transaction: Self Storage

...The Smarter way to Store!”

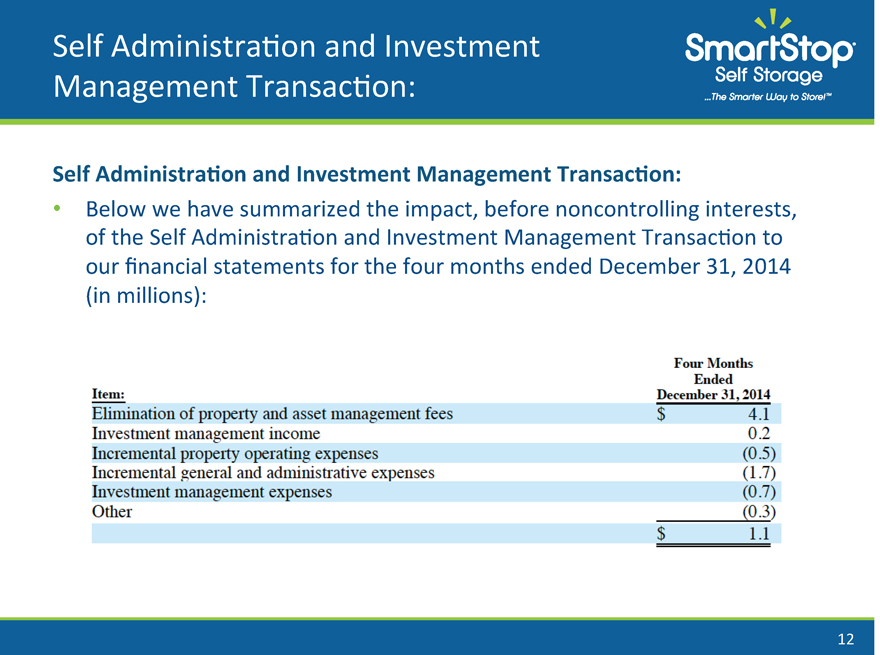

Self Administration and Investment Management Transaction:

• Below we have summarized the impact, before non controlling interests, of the Self Administration and Investment Management Transaction to our financial statements for the four months ended December 31, 2014 (in millions):

Item: December 31, 2014

Elimination of property and asset management fees $ 4.1

Investment management income 0.2

Incremental property operating expenses (0.5)

Incremental general and administrative expenses (1.7)

Investment management expenses (0.7)

Other (0.3)

$ 1.1

|

|

Subsequent Events

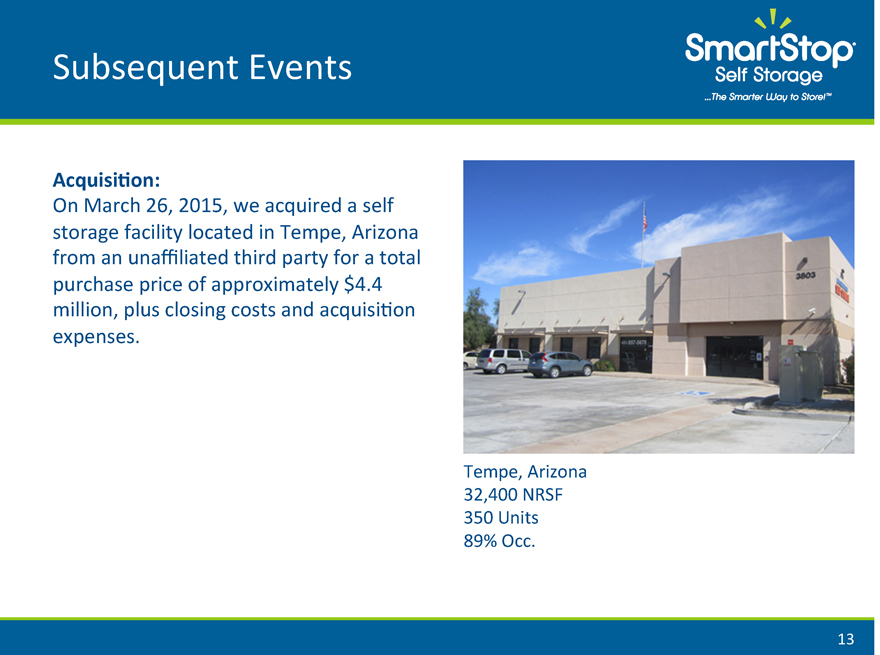

Acquisition:

On March 26, 2015, we acquired a self storage facility located in Tempe, Arizona from an unaffiliated third party for a total purchase price of approximately $4.4 million, plus closing costs and acquisition expenses.

Tempe, Arizona 32,400 NRSF 350 Units 89% Occ.

SmartStop

Self Storage

...The Smarter way to Store!”

|

|

Subsequent Events SmartStop

Self Storage

...The Smarter way to Store!”

Suspension of DRIP:

At the recommendation of the Nominating and Corporate Governance Committee constituting a special committee of our board of directors, on April 2, 2015, our board of directors approved the suspension of our DRIP. Accordingly, beginning with the distributions declared by the board for the month of March 2015, which were payable in April 2015, and continuing until such time as the board may approve the resumption of the DRIP, if ever, all distributions declared by the board will be paid to our stockholders in cash.

|

|

Subsequent Events SmartStop

Self Storage

...The Smarter way to Store!”

Quarterly Dividend:

• On March 18, 2015, our board of directors declared a distribution rate for the second quarter of 2015 of $0.001917808 per day per share on the outstanding shares of common stock payable to stockholders of record of such shares as shown on our books at the close of business on each day during the period, commencing on April 1, 2015 and continuing on each day thereafter through and including June 30, 2015.

|

|

NOI and FFO Definition SmartStop

Self Storage

...The Smarter way to Store!”

Net Operating Income (“NOI”)

• NOI is a non-GAAP measure that we define as net income (loss), computed in accordance with GAAP, generated from properties before corporate general and administrative expenses, asset management fees, interest expense, depreciation, amortization, acquisition expenses, self administration and investment management transaction expenses and other nonproperty related expenses. We believe that net operating income is useful for investors as it provides a measure of the operating performance of our operating assets because net operating income excludes certain items that are not associated with the operation of the properties. Additionally, we believe that NOI is a widely accepted measure of comparative operating performance in the real estate community. However, our use of the term NOI may not be comparable to that of other real estate companies as they may have different methodologies for computing this amount.

Funds from Operations (“FFO”)

• Due to certain unique operating characteristics of real estate companies, the National Association of Real Estate Investment Trusts, or NAREIT, an industry trade group, has promulgated a measure known as funds from operations, or FFO, which we believe to be an appropriate supplemental measure to reflect the operating performance of a REIT. The use of FFO is recommended by the REIT industry as a supplemental performance measure.

• We define FFO, a non-GAAP measure, consistent with the standards established by the White Paper on FFO approved by the Board of Governors of NAREIT, as revised in February 2004, or the White Paper. The White Paper defines FFO as net income (loss) computed in accordance with GAAP, excluding gains or losses from sales of property and asset impairment write downs, plus depreciation and amortization, and after adjustments for unconsolidated partnerships and joint ventures. Adjustments for unconsolidated partnerships and joint ventures are calculated to reflect FFO on the same basis. Our FFO calculation complies with NAREIT’s policy described above.

|

|

NOI and FFO Definition SmartStop

Self Storage

...The Smarter way to Store!”

Presentation of FFO is intended to provide useful information to investors as they review our operating performance and as they compare our operating performance to different REITs, although it should be noted that not all REITs calculate FFO the same way, so comparisons with other REITs may not be meaningful. Furthermore, FFO is not necessarily indicative of cash flow available to fund cash needs and should not be considered as an alternative to net income (loss) or income (loss) from operations as an indication of our performance, as an alternative to cash flows from operations, which is an indication of our liquidity, or indicative of funds available to fund our cash needs including our ability to make distributions to our stockholders. FFO should be reviewed in conjunction with other measurements as an indication of our performance.

|

|

Questions?