Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - Jishanye, Inc. | Financial_Report.xls |

| EX-31.2 - EXHIBIT 31.2 - Jishanye, Inc. | v407065_ex31-2.htm |

| EX-32.1 - EXHIBIT 32.1 - Jishanye, Inc. | v407065_ex32-1.htm |

| EX-32.2 - EXHIBIT 32.2 - Jishanye, Inc. | v407065_ex32-2.htm |

| EX-31.1 - EXHIBIT 31.1 - Jishanye, Inc. | v407065_ex31-1.htm |

| EX-10.10 - EXHIBIT 10.10 - Jishanye, Inc. | v407065_ex10-10.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

(Mark One)

| x |

ANNUAL REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934.

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2014 |

| ¨ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934.

For the transition period from _________ to __________ |

Commission File Number 000-55180

| JISHANYE, INC. | ||

| (Name of Registrant in its Charter) |

| Delaware | 46-1992903 | |

|

(State of Other Jurisdiction of incorporation or organization) |

(I.R.S.) Employer I.D. No.) |

|

7F., No.247, Minsheng 1st Rd. Xinxing Dist., Kaohsiung City 800 Taiwan Republic of China | ||

| (Address of Principal Executive Offices) |

Registrant's Telephone Number, including Area Code: +88672223733

Securities Registered Pursuant to Section 12(b) of the Exchange Act: None

Securities Registered Pursuant to Section 12(g) of the Exchange Act:

Common Stock, $0.0001 Par Value

(Title of Class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 406 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Sections 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files.) Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check One)

| Large accelerated filer ¨ | Accelerated filer ¨ |

| Non-accelerated filer ¨ | Smaller reporting company x |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

As of June 30, 2014, the last day of the registrant’s most recent fiscal second quarter, the aggregate market value of the common stock held by non-affiliates was $53,920 based upon the latest known sale price on June 30, 2013 of $0.008 per share.

As of December 31, 2014, there were 12,500,001 shares of common stock issued and outstanding.

Documents incorporated by reference: NONE

TABLE OF CONTENTS

| 2 |

PART I

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION

This report contains forward-looking statements. These statements involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements to be materially different from any future results, performance or achievement expressed or implied by the forward-looking statements. These risks and uncertainties include, but are not limited to, the factors described under “Business,” “Risk Factors,” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” In some cases, you can identify forward-looking statements by terms such as “anticipates,” “believes,” “could,” “estimates,” “expects,” “intends,” “may,” “plans,” “potential,” “predicts,” “projects,” “should,” “would” and similar expressions intended to identify forward-looking statements. Forward-looking statements reflect our current views with respect to future events and are based on assumptions and subject to risks and uncertainties. Given these uncertainties, you should not place undue reliance on these forward-looking statements, and there can be no assurance that the forward-looking statements contained in this report will in fact occur.

This report contains forward-looking statements, including statements regarding, among other things, (a) our projected sales and profitability, (b) our technology, (c) our manufacturing, (d) the regulation to which we are subject, (e) anticipated trends in our industry and (f) our needs for working capital.

Forward-looking statements represent our estimates and assumptions only as of the date of this report. You should read this report and the documents that we reference in this report, or that we filed as exhibits to this report completely and with the understanding that our actual future results may be materially different from what we expect.

Except as required by law, we assume no obligation to update any forward-looking statements publicly, or to update the reasons actual results could differ materially from those anticipated in any forward-looking statements, even if new information becomes available in the future.

OTHER PERTINENT INFORMATION

References in this report to “we,” “us,” “our” and the “Company” and words of like import refer to Jishanye, Inc. and its subsidiary.

References to Taiwan refer to Taiwan, Republic of China.

Our business is conducted in Taiwan using NT$, the currency of Taiwan, and our financial statements are presented in United States dollars (“USD” or “$”). In this report, we refer to assets, obligations, commitments and liabilities in our financial statements in USD. These dollar references are based on the exchange rate of NT$ to USD, determined as of a specific date. Changes in the exchange rate will affect the amount of our obligations and the value of our assets in terms of USD which may result in an increase or decrease in the amount of our obligations (expressed in USD) and the value of our assets, including accounts receivable (expressed in USD).

| 3 |

| ITEM 1. | BUSINESS |

Jishanye, Inc. (formerly Jishanye Bio-Tech, Inc.) (the “Company” or “Jishanye”) was incorporated in the State of Delaware on April 12, 2012. On October 25, 2013, the Company amended its Certificate of Incorporation to change the Company's name to "Jishanye, Inc." which was approved by the Board on October 24, 2013. Jishanye was incorporated as a holding company with no business other than holding an equity interest of our operating subsidiary in Taiwan, Jishanye Taiwan. The Company, through its subsidiary is engaged in selling enzymes products to public consumers in Taiwan.

In June 2014, the Company changed its business plan to provide funeral management services to customers in Taiwan and offer death care management consultancy services to small and medium-sized enterprises in Taiwan, Hong Kong and mainland China in the future. The Company’s goal is to establish an international brand on death care management consultancy services with high quality and name recognition.

The Company will provide a variety of death care management consultancy services which cover the purchase of cemetery property, funeral and cemetery merchandise and funeral services. In addition, the Company plans to provide consultancy services for pre-arranged funeral and pre-arranged death care contracts.

Our commitment to provide high quality products and our multiple marketing channels differentiate ourselves from our competitors and give us a competitive advantage to gradually grow into a well-recognized company.

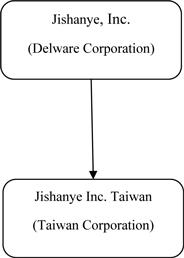

Company Structure

Jishanye, Inc. (“Jishanye” or the “Company”) is a Delaware corporation organized on April 12, 2012 as “Jishanye Bio-tech, Inc.” by Hsin-Lung Lin, a Taiwanese citizen, as a holding company for Jishanye Bio-Tech Co. Ltd. Taiwan (“Jishanye Taiwan”), a Taiwanese limited liability company. The Company changed its name to Jishanye, Inc. on October 25, 2013. Jishanye Taiwan, being the operating company of Jishanye in Taiwan, was established on August 17, 2012 and is a wholly owned subsidiary of Jishanye.

On July 16, 2012, the Company issued a total of 12,500,000 shares of our common stock, $0.0001 par value per share, to several non U.S. persons in consideration for their previous investment of $100,000 in the Company, among which $93,560 has been contributed into its wholly-owned subsidiary Jishanye Taiwan on July 19, 2012 as its capital contribution. The issuance was made pursuant to an exemption from registration contained in Regulation S under the Securities Act of 1933, as amended. Subsequent to the financing, lead investor Yen-Ling Wang transferred 5,700,000 of her 5,820,00 shares of the Company purchased in the financing to Jishanye Holding Limited, a British Virgin Island company controlled by Yen-Ling Wang.

The registered capital of Jishanye Taiwan, in the amount of $96,386 (NT$2.8 million) has been fully contributed.

| 4 |

The following chart illustrates our Company’s organizational structure:

Industry and Market Overview

Death care industry provides approximately $3 billion market annually. The average cost per death care contract is around $5,000. The better the economy, the more spending in death care. Taiwan death care products mainly comprise of the following services:

| - | Death care management and consultancy services which cover the purchase of cemetery property, funeral and cemetery merchandises and funeral services. |

| - | Funeral and cemetery merchandises. |

| - | Cremation service which is currently provided primarily by government-owned companies. |

The leading death care companies in Asia are Sino-Life Group Limited, Anxian Yuan China Holdings Limited, Nirvana Inc. and SAGE International group limited.

Competitive Strengths

Experienced CEO

Chang, Chun-Hao, the new CEO of Jishanye Inc. has been working in the funeral service industry for years and is familiar with funeral services and management and funeral and cemetery merchandise business in Asia.

Professional Funeral Services

We plan to recruit more full-time employees and provide training to the new hires. Our CEO, Mr. Chang, Chu-Hao, will be the key leader and trainer. He will pass his experiences and knowledge to our new hires to ensure the high quality of our services.

| 5 |

Understanding of the Culture

Asia has a very different funeral culture from other areas in the world. Our management has been in the business in Asia for years. Their understanding of the industry, regulation, and market is the most valuable asset to the Company.

Our Growth Strategy

Our growth strategy is as follows:

Funeral home

We plan to build or purchase a funeral home in Taiwan in 2015.

Cemetery

We plan to acquire lands in Taiwan to build cemetery for sales and management in 2015.

Funeral services

We plan to expand our business in funeral consulting service and to sell funeral and cemetery merchandises in 2015.

Business Overview

We closed our enzyme sales and marketing business plan in 2014. Going forward we will focus on providing death care management consulting services,

Intellectual Property

Due to the Company’s change of business plan from the enzyme business to death care management consulting services, we currently do not own material intellectual property related to our current business.

Research and Development Expenditures

Due to the Company’s change of business plan from the enzyme business to death care management consulting services we do not anticipate material research and development expenditures going forward.

Employees

We currently have three full-time employees. We also have certain part-time employees, who are shareholders of the Company, who do not receive compensation. In addition, we intend to recruit some additional full-time employees in the future. All of the Company’s employees are employed by the Company’s subsidiary Jishanye Taiwan.

Subsidiaries

Jisnaye Taiwan is a wholly owned subsidiary of Jishanye. We are considering establishing branches or subsidiaries in mainland China, Hong Kong, Singapore and Malaysia with the expansion and development of our business in the future.

Regulation

The Company needs to comply with Regulations on Funeral and Interment Control of the People's Republic of China.

Any management consulting relating to construction of funeral homes, funeral service stations, cinerary halls and cemeteries shall be subject to examination and approval of related departments of the governments. Handling of mortal remains and conducting of funeral activities shall observe the provisions of the regulations.

| 6 |

General Regulations

Taiwan Regulation on Company Administration

The current primary regulation governing companies in Taiwan is the Company Law, latest amended on January 16, 2013 by Legislative Yuan, which provided the fundamental framework for regulating companies. The Ministry of Economic Affairs at various levels of the administration is responsible for the management and supervision on any companies related matters.

Under the Company Law, a company refers to any profit-driven juridical association, organized, registered and established in accordance with this Company Law. Under the Company Law, companies have been divided into four categories: unlimited liability company, limited liability company, joint liability company and company limited by shares.

Under the Company Law, a company cannot be established unless properly registered with Ministry of Economic Affairs, and prior to such registration, no business or other legal act can be conducted in the name of a company. In addition, the capital amount of a company must be fully contributed by its shareholders of their own fund at the time of its establishment, rather than paid by installment or through external financing. Furthermore, the capital contribution must be audited and certified by accountants.

A limited liability company is a company organized by more than one shareholder, where the shareholders are only liable to the extent of their contributed capital to the company. Director(s) of a limited liability company is responsible for the management and operation of the company and subject to duty of care and duty of loyalty while executing his business judgment with respect to the operation of the company.

Taiwan Regulation on Foreign Exchange

Foreign exchange regulation in Taiwan is primarily governed by the Ordinance of Foreign Exchange Administration, latest amended on April 29, 2009 (the “Foreign Exchange Ordinance”). Under the Foreign Exchange Ordinance, foreign exchange refers to foreign currency, bills and marketable securities. The authority managing the administration of foreign exchange is Ministry of Finance of Republic of China, while the authority managing the practical operation of foreign exchange business is Central Bank of Republic of China. The Foreign Exchange Ordinance also specifies the allocated power of Ministry of Finance and Central Bank, respectively. To the extent that any foreign exchange receipts, payments or transactions reaches the threshold of $17,212 (NT$500,000) or equivalent in foreign currency, it must be reported to the Central Bank or its designated authorities. Upon incurrence of any of the following events, the State Council of Republic of China may determine and announce that for a period of time, to close the foreign exchange market, suspend or restrict all or partial foreign exchange payment, order a mandatory sale or deposit of all or partial foreign exchange into a designed bank, or dispose in any other manner as it deems necessary:

| - | the disorder in domestic or international economy to the detriment of the stability of Taiwan’s economy; or |

| - | Taiwan suffers serious trade deficit. |

Taiwan Regulation on Foreign Investment

The current principal regulation governing foreign investment is Foreign Investment Regulation latest amended on November 19, 1997 (the “Investment Regulation”). Under the Investment Regulation, investment refers to any activities involving (1) holding share capital of a company incorporated in Taiwan; (2) establishing branches, wholly-owned or partnership enterprises in Taiwan; or (3) providing more than one-year term loan to the above-mentioned investee enterprises. The authority in charge of foreign investment is Ministry of Economic Affairs of Republic of China. The industries in Taiwan are categorized into permitted, restricted and prohibited foreign investment areas. Investors may apply for settlement of exchange in accordance with the annual yield of their investment or the allocation of surplus.

With respect to foreign investment in the food industry, unless such investment is made from the People’s Republic of China, there’s no restriction under Investment Regulation. Since the Company falls into the food industry, the Company and prospective investors in this offering will not be affected by Investment Regulation.

| 7 |

Eminent domain

When the investment made by an investor constitutes less than 45% of the total amount of capital of the investee enterprise, and the investee enterprise has been expropriated or acquired by the government for the purpose of national defense, reasonable government compensation shall be paid to the investors. However, if the capital contribution made by the investor constitutes equal to or more than 45% of the total amount of capital of the investee enterprise and continues remaining above 45% for two decades since its establishment, then the government may not exercise its eminent domain power over such investee enterprise.

Taiwan Regulations on Tax

The current principal regulations governing tax in Taiwan include the following:

| - | Income Tax Law, latest amended on August 8, 2012; |

| - | The Implementation Rules of Income Tax Law, latest amended on September 7, 2011; |

| - | Value-Added and Non-Value-Added Business Tax Law, latest amended on November 23, 2011; and |

| - | The Implementation Rules of Value-Added And Non-Value-Added Business Tax Law, latest amended on March 6, 2012. |

Under the Income Tax Law, there are two kinds of income tax, comprehensive income tax for individuals and income tax for enterprises operating for profit, respectively.

Individuals who have income with a source within Taiwan must pay comprehensive income tax on their income sourced within Taiwan; while non-resident individuals having income with a source within Taiwan, except otherwise provided in the Income Tax Law, shall pay tax based on the amount attributable to the sources of their income.

The enterprise with head office located in Taiwan shall pay profit-seeking income tax on its global income both within and outside Taiwan; while the enterprises with head office outside Taiwan shall only pay profit-seeking income tax on its business income sourced from within Taiwan.

| - | Rate of income tax. The individual comprehensive income tax exemption threshold is NT$60,000 ($2,065) per person per year. Any income beyond such exemption threshold is subject to a progressive tax rate ranging from 5% to 40%. |

| - | With respect to enterprise operating for profit, the exemption threshold is NT$120,000 ($4,131). Any income beyond such exemption threshold is subject to 17% tax rate on its taxable income. |

| - | Sale of goods or service, import of goods in Taiwan shall be subject to Value-Added or Non-Value-Added Business Tax. |

| - | Rate of business tax. The rate of business tax, except otherwise stipulated in the relevant tax law, ranges from 5% to 10% as determined by the State Council of Taiwan. |

Where You Can Find Us

We presently maintain our executive office at 7F., No.247, Minsheng 1st Rd., Xinxing Dist., Kaohsiung City 800, Taiwan, Republic of China. Our telephone number is +88672223733. Our Taiwan subsidiary Jishanye Taiwan maintains a website at http://www.taiwanzoe.com.tw/ .

| 8 |

| ITEM 1A | RISK FACTORS |

You should carefully consider the risks described below together with all of the other information included in this Form 10-K. The statements contained in or incorporated herein that are not historic facts are forward-looking statements that are subject to risks and uncertainties that could cause actual results to differ materially from those set forth in or implied by forward-looking statements. See “Cautionary Statement Regarding Forward-Looking Statements.” If any of the following risks actually occurs, our business, financial condition or results of operations could be harmed. In that case, you may lose all or part of your investment.

Risks Relating to Our Business

Our limited operating history may not serve as an adequate basis to judge our future prospects and results of operations.

We cannot guaranty that we will achieve profitability or that we will not continue to incur net losses in the future. We will continue to encounter risks and difficulties that companies at a similar stage of development frequently experience, including the potential failure to:

| · | obtain sufficient working capital to sustain and expansion our business; |

| · | attract additional customers and increase spending per customer; |

| · | manage our expanding operations; |

| · | maintain adequate control of our expenses allowing us to realize anticipated revenue growth; |

| · | implement our product development, marketing, and sales, and adapt and modify them as needed; |

If we are not successful in addressing any or all of the foregoing risks, our business may be materially and adversely affected.

We have incurred losses since inception and may continue to incur losses.

Since inception we have incurred a gross loss from operations of $358,691, and we may continue to incur losses in the future. We expect our costs and expenses to increase as we expand our operations. Our ability to achieve and maintain profitability depends on the growth of our market share, the acceptance of our product by our customers, the competitiveness of our enzyme products, our ability to provide new products to meet the demands of our customers and our ability to control our costs and expenses. We may not be able to achieve or sustain profitability on a quarterly or an annual basis.

Our business and prospects could be materially and adversely affected if we are not able to manage our growth successfully.

We are just beginning selling death care consulting services and sell death care products across Taiwan. We anticipate continued growth in the future through internal expansion as well as external strategic partnerships or alliances. Our expansion will place substantial demands on our managerial, operational, technological and other resources. To manage and support our continued growth, we must continue to improve our operational, administrative, financial and technological systems, procedures and controls, and expand, train and manage our growing employee base. We cannot assure you that our current and planned personnel, systems, procedures and controls will be adequate to support our future operations. Any failure to effectively and efficiently manage our expansion could materially and adversely affect our ability to capitalize on new business opportunities, which in turn could have a material adverse effect on our results of operations.

| 9 |

Because our auditors have issued a going concern opinion, there is substantial uncertainty that we will continue operations in which case you could lose your investment.

Our auditors have issued a going concern opinion. This means that there is substantial doubt that we can continue as an ongoing business for the next twelve months. The financial statements do not include any adjustments that might result from the uncertainty about our ability to continue in business. As such we may have to cease operations and you could lose your investment.

Our expenses exceeds our working capital available, if we are unable to secure additional sources of funding, our ability to continue is a going concern and you could lose your investment.

As of December 31, 2014, we have a working capital deficit of $358,691. We do not have sufficient working capital to cover our operational expenses. If we are not able to secure additional funding, we will exhaust substantially all of our assets and have no funds with which to continue, and as a result we may have to cease operations and you could lose your investment.

Competition in our industry is intense and, if we are unable to compete effectively, we may lose customers and our financial results may be negatively affected.

In Asia, the funeral home and cemetery industry is characterized by a large number of locally-owned, independent operations. To compete successfully, our funeral service locations and cemeteries must maintain good reputations and high professional standards, as well as offer attractive services at competitive prices. In addition, we must market the Company in such a manner as to distinguish us from our competitors. If we are unable to successfully compete, our financial condition, results of operations, and cash flows could be materially adversely affected.

Unfavorable publicity could affect our reputation and business.

Since our operations relate to life events involving emotional stress for our client families, our business is dependent on consumer trust and confidence. Unfavorable publicity about our business generally or in relation to any specific location could affect our reputation and consumers’ trust and confidence in our services, thereby having an adverse impact upon our sales and financial results as well as the price of our common stock.

We lack risk management methods, our business, reputation and financial results may be adversely affected.

We currently do not have methods to identify, monitor and manage risks with respect to our business. If any of such risks to which we are, or may be, exposed materialize, our business, reputation, financial condition and operating results could be materially and adversely affected. In addition, our insurance policies may not provide adequate coverage.

If we cannot explore various marketing channels for our products and services profitably, our planned future growth will be impeded,

which would adversely affect sales.

Our growth is dependent on increases in sales through our successful exploration of a variety of marketing channels. Our ability to timely expand our market share through a combination of marketing channels, including our consultancy services depends in part on the following factors: the availability of such channels; the ability to negotiate acceptable terms with third party service providers; the ability to identify customer demand in different geographic areas; the hiring, training and retention of competent sales personnel; the effective management of inventory to meet the needs of increased orders on a timely basis; general economic conditions; and the availability of sufficient funds for expansion. Many of these factors are beyond our control.

Delays or failures in utilizing these marketing channels, or achieving lower than expected sales through such marketing channels, could materially adversely affect our growth and profitability.

Our future success depends on the continuing efforts of our senior management team and other key personnel, and our business may be harmed if we lose their services.

Our future success depends heavily upon (i) the continuing services of our current senior management team and (ii) the recruitment of other key personnel, in particular the Chief Executive Officer. If we fail to recruit the key personnel, or one or more of our senior management team, are unable or unwilling to continue in their present positions, we may not be able to replace them easily, or at all. As such, our business may be disrupted and our financial condition and results of operations may be materially and adversely affected. Competition for senior management and key personnel is intense, the pool of qualified candidates is very limited, and we may not be able to retain the services of our senior executives or key personnel, or attract and retain high-quality senior executives or key personnel in the future. As is customary in the Taiwan, we do not have insurance coverage for the loss of our senior management team or other key personnel.

| 10 |

In addition, if any member of our senior management team or any of our other key personnel joins a competitor or forms a competing company, we may lose customers, sensitive trade information and key professionals and staff members. Each of our current employees has entered into an employment agreement as well as confidentiality agreement, with Jishanye Taiwan. See “Management—Employment Agreements” for a more detailed description of the key terms of these employment agreements. If any disputes arise between any of our senior executives or key personnel and us, we cannot assure you of the extent to which any of these agreements may be enforced.

Our directors and certain senior management have other business interests, which may limit the amount of time they can devote to our company and potentially create conflicts of interest.

Our directors and certain senior management have other business interests, which may lead to periodic interruptions of our business operations. Our director and Head of Sales Management of Jishanye Taiwan, Mr. Wen-Lang Chang, also serves as the Senior Customer Development Manager of Hawley & Hazel Taiwan. Mr. Wen-Lang Chang can dedicate approximately four to eight hours per week to the operation of our Company.

If we fail to maintain an effective system of internal controls over financial reporting, we may not be able to accurately report our financial results or prevent fraud.

We are subject to reporting obligations under U.S. securities laws. Pursuant to Section 404 of the Sarbanes-Oxley Act of 2002 and the related rules adopted by the Securities and Exchange Commission, every public company is required to include a management report on the company’s internal controls over financial reporting in its annual report, which contains management’s assessment of the effectiveness of the company’s internal controls over financial reporting. These requirements will first apply to our annual report on Form 10-K for this fiscal year ending on December 31, 2014.

There is no assurance that we will be able to maintain effective internal controls over financial reporting in the future. If we fail to do so, we may not be able to produce reliable financial reports and prevent fraud. Moreover, if we were not able to conclude that we have effective internal controls over financial reporting, investors may lose confidence in the reliability of our financial statements, which would negatively impact the trading price of our shares. Our reporting obligations as a public company, including our efforts to comply with Section 404 of the Sarbanes-Oxley Act, will continue to place a significant strain on our management, operational and financial resources and systems for the foreseeable future.

We may require additional funds to continue our business plan.

As of December 31, 2014, we had cash on hand of $12,387, and we have accumulated a deficit of $358,691. At this rate, we anticipate that additional funding will be needed for general administrative expenses and marketing costs within the next three months. Currently our negative cash flow per month is approximately $3,000.

In order to expand our business operations, we anticipate that we will have to raise additional funding. If we are not able to raise the capital necessary to fund our business expansion objectives, we may have to delay the implementation of our business plan.

The estimated budget of our operation expenses for 2015 is as follows:

| Salaries and benefits | $ | 50,000 | ||

| Management overhead | 10,000 | |||

| Professional fees | 100,000 | |||

| General overhead | 20,000 | |||

| $ | 180,000 |

| 11 |

We do not currently have any arrangements for financing. Obtaining additional funding will be subject to a number of factors, including general market conditions, investor acceptance of our business plan and initial results from our business operations. These factors may impact the timing, amount, terms or conditions of additional financing available to us. The most likely source of future funds available to us is through the sale of additional shares of common stock or advances from our major shareholders or directors and, if we are able to obtain equity financing, it will likely result in significant additional dilution to the interests of our current stockholders and may include liquidation or other preferences that adversely affect your rights as a stockholder. The Company may obtain financing by issuing debt which may involve agreements that include covenants limiting or restricting our ability to take specific actions, such as incurring additional debt, making capital expenditures or declaring dividends. There can be no assurance that we will be able to obtain such additional financing and if we cannot receive such financing we may be forced to suspend or cease operations.

We do not expect to pay dividends in the foreseeable future.

We have never paid any dividends on our common stock. We do not expect to pay cash dividends on our common stock at any time in the foreseeable future. The future payment of dividends directly depends upon our future earnings, capital requirements, financial requirements and other factors that our board of directors will consider. Since we do not anticipate paying cash dividends on our common stock, return on your investment, if any, will depend solely on an increase, if any, in the market value of our common stock.

We are an Emerging Growth Company as defined under the Jumpstart Our Business Startups Act.

An “emerging growth company” is an issuer whose initial public offering was or will be completed after Dec. 8, 2011, and had total annual gross revenues of less than $1 billion during its most recently completed fiscal year. An issuer’s EGC status terminates on the earliest of:

| · | The last day of the first fiscal year of the issuer during which it had total annual gross revenues of $1 billion or more; |

| · | The last day of the fiscal year of the issuer following the fifth anniversary of the date of the issuer’s initial public offering; |

| · | The date on which such issuer has issued more than $1 billion in non-convertible debt securities during the prior three-year period determined on a rolling basis; or |

| · | The date on which the issuer is deemed to be a “large accelerated filer” under the Exchange Act, which means, among other things, that it has a public float in excess of $700 million. |

Pursuant to the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”), as an emerging growth company the Company can elect to opt out of the extended transition period for any new or revised accounting standards that may be issued by the PCAOB or the SEC. The Company has elected not to opt out of such extended transition period which means that when a standard is issued or revised and it has different application dates for public or private companies, the Company, as an emerging growth company, can adopt the standard for the private company. This may make comparison of the Company's financial statements with any other public company which is not either an emerging growth company nor an emerging growth company which has opted out of using the extended transition period difficult or impossible as possible different or revised standards may be used.

The Company has elected to use the extended transition period for complying with new or revised financial accounting standards available under Section 102(b)(2)(B) of the JOBS Act. Among other things, this means that the Company's independent registered public accounting firm will not be required, as with smaller reporting companies, to provide an attestation report on the effectiveness of the Company's internal control over financial reporting so long as it qualifies as an emerging growth company, which may increase the risk that weaknesses or deficiencies in the internal control over financial reporting go undetected. Likewise, so long as it qualifies as an emerging growth company, the Company may elect not to provide certain information, including certain financial information and certain information regarding compensation of executive officers that would otherwise have been required to provide in filings with the SEC, which may make it more difficult for investors and securities analysts to evaluate the Company. As a result, investor confidence in the Company and the market price of its common stock may be adversely affected.

| 12 |

In addition to qualifying as an emerging growth company, we also currently qualify as a Smaller Reporting Company under Rule 12b-2 of the Securities Exchange Act of 1934, as amended. Rule 12b-2 defines a Smaller Reporting Company as an issuer that is not an investment company, an asset-backed issuer, or a majority-owned subsidiary of a parent that is not a smaller reporting company and that:

| · | Had a public float of less than $75 million as of the last business day of its most recently completed second fiscal quarter, computed by multiplying the aggregate worldwide number of shares of its voting and non-voting common equity held by non-affiliates by the price at which the common equity was last sold, or the average of the bid and asked prices of common equity, in the principal market for the common equity; or |

| · | In the case of an initial registration statement under the Securities Act or Exchange Act for shares of its common equity, had a public float of less than $75 million as of a date within 30 days of the date of the filing of the registration statement, computed by multiplying the aggregate worldwide number of such shares held by non-affiliates before the registration plus, in the case of a Securities Act registration statement, the number of such shares included in the registration statement by the estimated public offering price of the shares; or |

| · | In the case of an issuer whose public float as calculated under paragraph (1) or (2) of this definition was zero, had annual revenues of less than $50 million during the most recently completed fiscal year for which audited financial statements are available. |

As long as we remain a Smaller Reporting Company, we may take advantage of certain scaled or reduced disclosure requirements, some of which are the same as the reduced disclosure requirements applicable to an Emerging Growth Company. In the event that we cease to be an Emerging Growth Company as a result of a lapse of the five year period, but continue to be a Smaller Reporting Company, we would continue to take advantage of the scaled disclosure requirements applicable to a Smaller Reporting Company.

| 13 |

Risks Related to Doing Business in Taiwan

Fluctuation in the value of the NT$ may have a material adverse effect on your investment.

The value of the NT$ against the US dollar (“USD”) and other currencies may fluctuate and is affected by, among other things, changes in political and economic conditions. As of December 31, 2014, the exchange rate of NT$ to the USD was 31.78 NT$ = 1 USD.

Our revenues and costs are denominated in the NT$, and our financial assets are also denominated in NT$. We completely rely on dividends payable to us by our operating company in Taiwan, Jishanye Taiwan. Any significant appreciation or depreciation of the NT$ against the USD may affect our cash flows, revenues, earnings and financial position, and the value of, and any dividends payable on, our shares in USD. For example, a further appreciation of the NT$ against the USD would make any new NT$-denominated investments or expenditures more costly to us, to the extent that we need to convert USD into the NT$ for such purposes. An appreciation of the NT$ against the USD would also result in foreign currency translation losses for financial reporting purposes when we translate our USD denominated financial assets into the NT$, as the NT$ is our reporting currency in Taiwan. Conversely, a significant depreciation of the NT$ against the USD may significantly reduce the USD equivalent of our reported earnings, and may adversely affect the price of our shares.

Our controlling shareholders may take actions that are not in, or may conflict with, our public shareholders’ best interest.

As of December 31, 2014, Jishanye Holding Limited owned, directly or indirectly, a controlling interest of approximately 45% of our outstanding common shares. Accordingly, this shareholder will continue to have the ability to exercise a controlling influence over our business and may take actions that you may not agree with or that are not in our or our public shareholders’ best interest.

Our primary operation is located in Taiwan, and because the rights of shareholders under Taiwan law differ from those under U.S. law, you may have difficulty protecting your shareholder rights.

We conduct all of our business operations through our operating entity in Taiwan, whose corporate affairs are governed by its Articles of Incorporation and by the laws governing corporations incorporated in Taiwan. The rights of shareholders and the responsibilities of management and the members of the board of directors under Taiwan law are different from those applicable to a corporation incorporated in the United States. For example, directors and controlling shareholders of Taiwan companies do not owe fiduciary duties to minority shareholders. With respect to a limited liability company or a company limited by shares, directors, rather than management, are responsible to manage the company and subject to the duty of loyalty and duty of care. However, in case of personal gains resulted from violation by the directors of their duties under the preceding sentence, the shareholders may, within a year of such gains and through their resolutions, treat such gains as company’s gains, and the directors shall not be held liable any more under such circumstances. The management shall conduct business of the company in strict compliance with its rights and authorization as set forth in the related corporate charter documents as well as employment contracts. Therefore, public shareholders of Taiwan companies may have more difficulty in protecting their interest in connection with actions taken by management or members of the board of directors than they would as public shareholders of a U.S. corporation.

U.S. investors may experience difficulties in attempting to effect service of process and to enforce judgments based upon U.S. federal securities laws against the company and its non-U.S. resident directors and senior officers.

All of our directors and senior officers are non-residents of the United States. Consequently, it may be difficult for investors to effect service of process on any of them in the United States and to enforce judgments obtained in United States courts against them based on the civil liability provisions of the United States securities laws. Since all our assets are located in Taiwan it may be difficult or impossible for U.S. investors to collect a judgment against us. As well, any judgment obtained in the United States against us may not be enforceable in the United States.

| ITEM 1B | UNRESOLVED STAFF COMMENTS |

Not applicable.

| 14 |

| ITEM 2. | PROPERTIES |

Our business office is located at 7F., No.247, Minsheng 1st Rd., Xinxing Dist., Kaohsiung City 800, Taiwan, Republic of China. Our telephone number is +88672223733. Our offices occupy approximately 2,260 square feet and we possess the premises under a rent free lease with Taiwan Life Inc. until November 2015.

| ITEM 3. | LEGAL PROCEEDINGS |

From time to time, we may become involved in various lawsuits and legal proceedings, which arise, in the ordinary course of business. However, litigation is subject to inherent uncertainties, and an adverse result in these or other matters may arise from time to time that may harm our business. We are currently not aware of any such legal proceedings or claims that we believe will have a material adverse effect on our business, financial condition or operating results.

| ITEM 4. | MINE SAFETY DISCLOSURES |

N/A

| 15 |

PART II

| ITEM 5. | MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES. |

Market Information

Our common stock has been quoted on the OTC Market-Pink (“OTCPK”) under the symbol “JSHY” since May 12, 2014. The latest available closing price of our common stock prior to March 15, 2015 was $6.64.

The following table sets forth for the respective periods indicated the high and low closing prices for the common stock, as reported by the OTCPK. Such prices are based on inter-dealer bid and asked prices, without markup, markdown, commissions, or adjustments and may not represent actual transactions. The first sale of our stock on the OTCPK was in 2014.

| Fiscal Year Ended December 31, 2014 | ||||||||

| Low | High | |||||||

| First Quarter ended March 31, 2014 | $ | N/A | $ | N/A | ||||

| Second Quarter ended June 30, 2014 | $ | N/A | $ | N/A | ||||

| Third Quarter ended September 30, 2014 | $ | N/A | $ | N/A | ||||

| Fourth Quarter ended December 31, 2014 | $ | 6.65 | $ | 13.75 | ||||

Shareholders

On March 15, 2015, there were 31 holders of record of our common stock.

Dividends

The holders of our common stock are entitled to receive dividends when, as and if declared by the board of directors out of funds legally available therefore. To date, we have not declared nor paid any cash dividends. The board of directors does not intend to declare any dividends in the foreseeable future, but instead intends to retain all earnings, if any, for use in our business operations.

Securities Authorized for Issuance Under Equity Compensation Plans

No securities are authorized for issuance by the Company under equity compensation plans.

Sale of Unregistered Securities

None.

Repurchase of Equity Securities

We did not repurchase any of our equity securities that were registered under Section 12 of the Securities Act during the quarter ended December 31, 2014.

| ITEM 6. | SELECTED FINANCIAL DATA |

Not applicable.

| 16 |

| ITEM 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

You should read this Management’s Discussion and Analysis in conjunction with the Consolidated Financial Statements and Related Notes. This discussion contains forward-looking statements that reflect our plans, estimates and beliefs. Our actual results may differ materially from those anticipated in these forward-looking statements.

Overview

We were incorporated in the State of Delaware on April 12, 2012 under the name “Jishanye Bio-Tech, Inc.” On October 24, 2013, we changed our corporate name to “Jishanye, Inc.” Through our subsidiary we were engaged in selling enzymes products to public consumers in Taiwan. The Company began providing death care management consultancy services to consumers across Taiwan in June 2014.

The Company currently provides death care consultancy services to consumers across Taiwan. Our goal is to offer death care management consultancy services to small and medium-sized enterprises of Taiwan, Hong Kong and mainland China and establish an international brand with high quality and name recognition.

The Company will provide a variety of death care management consultancy services which cover the purchase of cemetery property, funeral and cemetery merchandises and funeral services. In addition, the Company is capable of offering consultancy services for pre-arranged funeral and pre-arranged death care contracts.

On September 15, 2014, the Board appointed Chung-Hao Chang as new Chief Executive Officer and Mei-Chun Lin to serve as new Chief Financial Officer of the Company. Hsin-Lung Lin will continue to serve as a member of the Company’s Board of Directors. Chung-Hao Chang is also the owner of Taiwan Life Inc. Taiwan Life Inc. is engaged in death care and funeral service businesses in Taiwan.

Going Concern

The consolidated financial statements included in this Form 10-K have been prepared in conformity with accounting principles generally accepted in the United States of America, which contemplate continuation as a going concern. We had an accumulated deficit of $358,691 and a working capital deficit of $258,716 as of December 31, 2014. These conditions raise substantial doubt as to our ability to continue as a going concern. The consolidated financial statements do not include any adjustments that might result from the outcome of this uncertainty. The consolidated financial statements do not include any adjustments relating to the recoverability and classification of recorded asset amounts, or amounts and classification of liabilities that might be necessary should the Company be unable to continue as a going concern. The major shareholders of the Company will continue to fund the Company until it is able to sustain positive cash flows from operations.

Results of Operations

Comparison of the fiscal years ended December 31, 2014 and 2013

Revenues. For the fiscal years ended December 31, 2014 and 2013, we had total revenues of $18,056 (Death care: $16,500; Enzyme $1,556) and $24,741 (Death case: $0; Enzyme $24,741), respectively. We changed our business plan in June 2014 and generated limited revenues from our new business.

Cost of revenues. For the fiscal years ended December 31, 2014 and 2013, we had cost of revenues of $652 and $10,142, respectively. The decrease was mainly because our revenues from sales of enzyme products decreased in 2014.

General and administrative expenses. For the fiscal years ended December 31, 2014 and 2013, we had general and administrative expenses of $161,813 and $184,738, respectively. We closed our office in Pingtung in November 2013 and leased an office in Kaohsiung in Nov 2014. Accordingly, the related offices expenses decreased. In addition, because of the change of our business plan, we incurred less expense in marketing and selling enzyme products.

Net loss. For the fiscal years ended December 31, 2014 and 2013, our net loss was $145,835 and $170,873, respectively. The decrease mainly resulted from the decrease in operating expenses due to close of our Pingtung office in 2014.

| 17 |

Liquidity and Capital Resources

On July 16, 2012, we raised $100,000 from the sale of 12,500,001 shares of our common stock and we received $149,500 from the issuance of a loan payable that were used to fund our operations in 2013. As of December 31, 2014, we had cash on hand of $12,387.

We used $29,729 and $111,567 of cash in our operations for the fiscal years ended December 31, 2014 and 2013, respectively, the decrease mainly resulted from the decrease in operating expenses due to closing our office in 2014.

We received $29,584 and used $48,994 of cash in investing activities for the fiscal years ended December 31, 2014 and 2013, respectively. In 2013, we spent $48,994 to purchase property and equipment. In 2014, as the result of closing our office in Pingtung, we sold the asset and received cash of $29,584.

We received $9,438 and $149,500 of cash in financing activities for the fiscal years ended December 31, 2014 and 2013, respectively. The Company borrowed these loans from related parties in 2014 and 2013.

We plan to fund our operations from loans from our major shareholders and plan to raise equity capital by offering shares of our common stock to investors.

On January 15, 2013, our former Chief Executive Officer, Chief Financial Officer and Chairman of the Board, Mr. Lin Hsin-Lung, extended a loan in the amount of $149,500 to the Company. The loan is due on demand and has no interest obligations. On September 15, 2014, the Board appointed Chung-Hao Chang as new Chief Executive Officer and Mei-Chun Lin to serve as new Chief Financial Officer of the Company. Hsin-Lung Lin will continue to serve as a member of the Company’s Board of Directors.

On December 31, 2014, Taiwan life Inc., extended a loan in the amount of approximately $10,000 to the Company. The loan has-no a maturity date and has no interest obligations.

The estimated budget for 2015 is as follows:

| Salaries and benefits | $ | 50,000 | ||

| Management overhead | 10,000 | |||

| Professional fees | 100,000 | |||

| General overhead | 20,000 | |||

| Total | $ | 180,000 |

We believe we will be able to raise the necessary capital to carry out our business plan, but there is no guarantee that we will be able to do so.

Stock Acquisition by Chief Executive Officer

On October 23, 2014, Chun-Hao Chang, the Company’s Chairman of the Board of Directors, Chief Executive Officer and President, completed the purchase of 1,200,000 shares of the Company’s common stock for a purchase price of $5,000 from Jishanye Holding Limited in a private transaction. As a result of the stock purchase Chun-Hao Chang holds approximately 9.6% of the Company’s common stock.

Critical Accounting Policies

Our financial statements and related public financial information are based on the application of accounting principles generally accepted in the United States ("US GAAP"). US GAAP requires the use of estimates; assumptions, judgments and subjective interpretations of accounting principles that have an impact on the assets, liabilities, revenues and expenses amounts reported. These estimates can also affect supplemental information contained in our external disclosures including information regarding contingencies, risk and financial condition. We believe our use of estimates and underlying accounting assumptions adhere to GAAP and are consistently and conservatively applied. We base our estimates on historical experience and on various other assumptions that we believe to be reasonable under the circumstances. Actual results may differ materially from these estimates under different assumptions or conditions. We continue to monitor significant estimates made during the preparation of our financial statements.

| 18 |

We believe the following is among the most critical accounting policies that impact our consolidated financial statements. We suggest that our significant accounting policies, as described in our financial statements in the Summary of Significant Accounting Policies, be read in conjunction with this Management's Discussion and Analysis of Financial Condition and Results of Operations.

Foreign Currency

Assets and liabilities recorded in foreign currencies are translated at the exchange rate on the balance sheet date. Revenue and expenses are translated at average rates of exchange prevailing during the year. Translation adjustments resulting from this process are charged or credited to Other Comprehensive Income.

Use of Estimates

The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the consolidated financial statements and the reported amounts of revenues and expenses during the reporting period. Specific estimates include the collectability of accounts receivable and the valuation of inventory, Actual results could differ from those estimates.

Inventory

Inventory is stated at the lower of cost or market, using the average cost method. Management compares the cost of inventory with its market value and an allowance is made to write down inventory to market value, if lower. As of December 31, 2014, the Company had finished goods of $870 and no allowance for obsolete inventory.

Revenue Recognition

Product revenue is recognized at the date of shipment to customers when a formal arrangement exists, the price is fixed or determinable, the delivery is completed, no other significant obligations of the Company exist and collectability is reasonably assured. Service revenue is recognized when persuasive evidence of an arrangement exists, service has provided, the fee is fixed or determinable, and collectability is probable. Payments received before all of the relevant criteria for revenue recognition are satisfied are recorded as advances from customers.

Sales represent the invoiced value of products, net of value-added tax (“VAT”). All of the Company’s products sold in Taiwan are subject to a value-added tax of 5% of the gross sales price. This VAT may be offset by VAT paid by the Company on raw materials and other materials included in the cost of producing the finished product. The Company records VAT payable and VAT receivable net of payments in the financial statements. The VAT tax return is filed offsetting the payables against the receivables. Sales and purchases are recorded net of VAT collected and paid as the Company acts as an agent for the government.

Recent Accounting Pronouncements

The Company does not expect adoption of the new accounting pronouncements will have a material effect on the Company’s financial statements.

Off-Balance Sheet Arrangements

None.

| 19 |

| ITEM 7A | QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK. |

Not Applicable.

| ITEM 8. | FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA. |

Financial Statements

| 20 |

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors and Stockholders

of

Jishanye, Inc.

Kaohsiung City, Taiwan

We have audited the accompanying consolidated balance sheet of Jishanye, Inc. as of December 31, 2014 and the related consolidated statements of operations and comprehensive loss, stockholders’ deficit and cash flows for the year then ended. Jishanye, Inc.’s management is responsible for these financial statements. Our responsibility is to express an opinion on these financial statements based on our audits. The financial statements of Jishanye, Inc. as of December 31, 2013 and for the year then ended were audited by other auditors whose report, which included an explanatory paragraph as to the Company’s ability to continue as a going concern expressed an unqualified opinion.

We conducted our audit in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audit included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audit provides a reasonable basis for our opinion.

In our opinion, the consolidated financial statements referred to above present fairly, in all material respects, the financial position of Jishanye, Inc. as of December 31, 2014 and the results of its operations and its cash flows for the year then ended in conformity with accounting principles generally accepted in the United States of America.

The accompanying consolidated financial statements have been prepared assuming that Jishanye, Inc. will continue as a going concern. As discussed in Note 2 to the consolidated financial statements, Jishanye, Inc. has suffered recurring losses from its operations and has a working capital deficit at December 31, 2014 that raise substantial doubt about its ability to continue as a going concern. Management’s plans in regard to these matters are also described in Note 2. The consolidated financial statements do not include any adjustments that might result from the outcome of this uncertainty.

/s/ GBH CPAs, PC

GBH CPAs,PC

www.gbhcpas.com

Houston, Texas

April 15, 2015

| F-1 |

Report of Independent Registered Public Accounting Firm

Board of Directors and Stockholders of

Jishanye, Inc.

We have audited the accompanying consolidated balance sheet of Jishanye, Inc. and subsidiary as of December 31, 2013, and the related consolidated statements of operations and other comprehensive loss, stockholders' (deficit), and cash flows for the year ended December 31, 2013. These financial statements are the responsibility of the Company's management. Our responsibility is to express an opinion on consolidated financial statements based on our audits.

We conducted our audit in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the consolidated financial statements are free of material misstatement. The Company is not required to have, nor were we engaged to perform, an audit of internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall consolidated financial statement presentation. We believe that our audit provides a reasonable basis for our opinion.

In our opinion, the consolidated financial statements referred to above present fairly, in all material respects, the consolidated financial position of Jishanye, Inc. and subsidiary as of December 31, 2013, and the consolidated results of their operations and their consolidated cash flows for the year ended December 31, 2013, in conformity with U.S. generally accepted accounting principles.

The accompanying financial statements have been prepared assuming the Company will continue as a going concern. The Company has an accumulated deficit of $212,855, as of December 31, 2013 and has used cash in operations of $111,567 for year 2013. These matters, among others, raise substantial doubt about the Company’s ability to continue as a going concern. Management’s plans concerning these matters are described in Note 2. These accompanying consolidated financial statements do not include any adjustments that might result from the outcome of this uncertainty.

Goldman Kurland and Mohidin LLP

Encino, California

April 8, 2014

| F-2 |

Consolidated Balance Sheets

As of December 31, 2014 and 2013

| 2014 | 2013 | |||||||

| Assets | ||||||||

| Current assets: | ||||||||

| Cash and cash equivalents | $ | 12,387 | $ | 4,184 | ||||

| Inventory | 870 | - | ||||||

| Prepaid expenses | 1,664 | - | ||||||

| Other receivables | - | 7,611 | ||||||

| Total current assets | 14,921 | 11,795 | ||||||

| Property and equipment, net of accumulated depreciation of $0 and $4,845, respectively | - | 27,456 | ||||||

| Total assets | $ | 14,921 | $ | 39,251 | ||||

| Liabilities and Stockholders' Deficit | ||||||||

| Current liabilities: | ||||||||

| Accounts payable and accrued expense | $ | 113,598 | $ | 2,522 | ||||

| Accrued expense - related party | 1,101 | - | ||||||

| Short-term debt - related party | 158,938 | 149,500 | ||||||

| Total current liabilities | 273,637 | 152,022 | ||||||

| Total liabilities | 273,637 | 152,022 | ||||||

| Stockholders' deficit: | ||||||||

| Common stock, $0.0001 par value; 100,000,000 shares authorized, 12,500,001 shares issued and outstanding | 1,250 | 1,250 | ||||||

| Additional paid-in capital | 98,750 | 98,750 | ||||||

| Accumulated other comprehensive income (loss) | (25 | ) | 84 | |||||

| Accumulated deficit | (358,691 | ) | (212,855 | ) | ||||

| Total stockholders' deficit | (258,716 | ) | (112,771 | ) | ||||

| Total liabilities and stockholders' deficit | $ | 14,921 | $ | 39,251 | ||||

The accompanying notes are an integral part of these consolidated financial statements.

| F-3 |

Consolidated Statements of Operations and Comprehensive Loss

For the Years Ended December 31, 2014 and 2013

| 2014 | 2013 | |||||||

| Revenues | $ | 18,056 | $ | 24,741 | ||||

| Cost of revenues | 652 | 10,142 | ||||||

| Gross profit | 17,404 | 14,599 | ||||||

| Operating expense: | ||||||||

| General and administrative | 161,813 | 184,738 | ||||||

| Total operating expense | 161,813 | 184,738 | ||||||

| Loss from operations | (144,409 | ) | (170,139 | ) | ||||

| Other income (expenses): | ||||||||

| Other income (expenses) | 119 | (734 | ) | |||||

| Loss from sale of property and equipment | (1,546 | ) | - | |||||

| Total other expenses | (1,427 | ) | (734 | ) | ||||

| Net loss | (145,836 | ) | (170,873 | ) | ||||

| Other comprehensive loss: | ||||||||

| Foreign currency translation loss | (109 | ) | (2,346 | ) | ||||

| Total comprehensive loss | $ | (145,945 | ) | $ | (173,219 | ) | ||

| Weighted average common shares outstanding: | ||||||||

| Basic and diluted | 12,500,001 | 12,500,001 | ||||||

| Loss per common share: | ||||||||

| Basic and diluted | $ | (0.01 | ) | $ | (0.01 | ) | ||

The accompanying notes are an integral part of these consolidated financial statements.

| F-4 |

Consolidated Statements of Stockholders’ Deficit

For the Years Ended December 31, 2014 and 2013

| Accumulated | Total | |||||||||||||||||||||||

| Additional | Other | Stockholders' | ||||||||||||||||||||||

| Common Stock | Paid | Comprehensive | Accumulated | Equity | ||||||||||||||||||||

| Shares | Amount | in Capital | Income (Loss) | Deficit | (Deficit) | |||||||||||||||||||

| Balance, December 31, 2012 (as restated) | 12,500,001 | $ | 1,250 | $ | 98,750 | $ | 2,430 | $ | (41,982 | ) | $ | 60,448 | ||||||||||||

| Foreign currency translation loss | - | - | - | (2,346 | ) | - | (2,346 | ) | ||||||||||||||||

| Net loss | - | - | - | - | (170,873 | ) | (170,873 | ) | ||||||||||||||||

| Balance, December 31, 2013 | 12,500,001 | $ | 1,250 | $ | 98,750 | $ | 84 | $ | (212,855 | ) | $ | (112,771 | ) | |||||||||||

| Foreign currency translation loss | - | - | - | (109 | ) | - | (109 | ) | ||||||||||||||||

| Net loss | - | - | - | - | (145,836 | ) | (145,836 | ) | ||||||||||||||||

| Balance, December 31, 2014 | 12,500,001 | $ | 1,250 | $ | 98,750 | $ | (25 | ) | $ | (358,691 | ) | $ | (258,716 | ) | ||||||||||

The accompanying notes are an integral part of these consolidated financial statements.

| F-5 |

Consolidated Statements of Cash Flows

For the Years Ended December 31, 2014 and 2013

| 2014 | 2013 | |||||||

| Cash flows from operating activities: | ||||||||

| Net loss | $ | (145,836 | ) | $ | (170,873 | ) | ||

| Adjustments to reconcile net loss to net cash used in operating activities: | ||||||||

| Depreciation expense | 491 | 6,297 | ||||||

| Loss from sale of property and equipment | 1,546 | 15,652 | ||||||

| Changes in operating assets and liabilities: | ||||||||

| Accounts receivable | - | 3,291 | ||||||

| Other receivables | 7,611 | (6,069 | ) | |||||

| Inventory | (870 | ) | 39,471 | |||||

| Prepaid expenses and other current assets | (1,664 | ) | 9,112 | |||||

| Accounts payable and accrued expense | 107,893 | (6,810 | ) | |||||

| Accrued expense – related party | 1,101 | - | ||||||

| Advances from customers | - | (1,638 | ) | |||||

| Net cash used in operating activities | (29,728 | ) | (111,567 | ) | ||||

| Cash flows from investing activities | ||||||||

| Purchase of property and equipment | - | (48,994 | ) | |||||

| Proceeds from sale of property and equipment | 29,584 | - | ||||||

| Net cash provided by (used in) investing activities | 29,584 | (48,994 | ) | |||||

| Cash flows from financing activities | ||||||||

| Proceeds from long-term debt - related party | 9,438 | 149,500 | ||||||

| Net cash provided by financing activities | 9,438 | 149,500 | ||||||

| Effect of exchange rate changes on cash and cash equivalents | (1,091 | ) | (1,057 | ) | ||||

| Net increase (decrease) in cash | 8,203 | (12,118 | ) | |||||

| Cash and cash equivalents, beginning of the year | 4,184 | 16,302 | ||||||

| Cash and cash equivalents, end of the year | $ | 12,387 | $ | 4,184 | ||||

| Supplemental disclosure of cash flows information: | ||||||||

| Interest paid | $ | - | $ | - | ||||

| Income taxes paid | $ | - | $ | - | ||||

The accompanying notes are an integral part of these consolidated financial statements.

| F-6 |

Notes to Consolidated Financial Statements

Note 1 - Organization and Basis of Presentation

Jishanye, Inc. (“Jishanye” or the “Company”) is a Delaware Corporation organized on April 12, 2012 as “Jishanye Bio-tech, Inc.” by Hsin-Lung Lin, a Taiwanese citizen, as a holding company for Jishanye Bio-Tech Co. Ltd. Taiwan (“Jishanye Taiwan”), a Taiwanese limited liability company. The Company changed its name to Jishanye, Inc. on October 25, 2013. Jishanye Taiwan, being the operating company of Jishanye in Taiwan, was established on August 17, 2012 and is a wholly owned subsidiary of Jishanye.

The Company, through its subsidiary, was engaged in selling enzymes products to public consumers in Taiwan. In June 2014, the Company changed its business plan to provide funeral management services to customers in Taiwan and offer death care management consultancy services to small and medium-sized enterprises in Taiwan, Hong Kong and mainland China in the future. The Company’s goal is to establish an international brand on death care management consultancy services with high quality and name recognition.

Note 2 - Going Concern

The accompanying consolidated financial statements were prepared in conformity with accounting principles generally accepted in the United States of America (“US GAAP”), which contemplate continuation of the Company as a going concern. As of December 31, 2014, the Company has accumulated deficit of $358,691 and had working capital deficit of $258,716. These conditions raise substantial doubt as to the Company’s ability to continue as a going concern. These consolidated financial statements do not include any adjustments that might result from the outcome of this uncertainty. These consolidated financial statements do not include any adjustments relating to the recoverability and classification of recorded asset amounts, or amounts and classification of liabilities that might be necessary should the Company be unable to continue as a going concern. The major shareholders will continue to fund the Company until it is able to sustain positive cash flows from its operations.

Note 3 - Summary of Significant Accounting Policies

Basis of Presentation

The accompanying consolidated financial statements were prepared in conformity with US GAAP. The Company’s functional currency is the New Taiwanese Dollar (“NTD”); however, the accompanying consolidated financial statements were translated and presented in United States Dollars (“$” or “USD”).

Principles of Consolidation

The accompanying consolidated financial statements include the accounts of Jishanye and its wholly-owned subsidiary, Jishanye (Taiwan), Inc. All significant intercompany transactions and balances were eliminated in consolidation.

Foreign Currency

Assets and liabilities recorded in foreign currencies are translated at the exchange rate on the balance sheet date. Revenue and expenses are translated at average rates of exchange prevailing during the year. Translation adjustments resulting from this process are charged or credited to Other Comprehensive Income.

Use of Estimates

The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the consolidated financial statements and the reported amounts of revenues and expenses during the reporting period. Specific estimates include the collectability of accounts receivable and the valuation of inventory, Actual results could differ from those estimates.

| F-7 |

Cash and Cash Equivalents

Cash and cash equivalents include cash in hand and in time deposits, certificates of deposit and all highly liquid debt instruments with original maturities of three months or less.

Inventory

Inventory is stated at the lower of cost or market, using the average cost method. Management compares the cost of inventory with its market value and an allowance is made to write down inventory to market value, if lower. As of December 31, 2014, the Company had finished goods of $870 and no allowance for obsolete inventory.

Property and Equipment

Property and equipment are stated at cost and depreciated using the straight-line method over the estimated life of the asset.

Income Taxes

An asset and liability approach is used for financial accounting and reporting for income taxes. Deferred income taxes arise from temporary differences between income tax and financial reporting and principally relate to recognition of revenue and expenses in different periods for financial and tax accounting purposes and are measured using currently enacted tax rates and laws. In addition, a deferred tax asset can be generated by net operating loss carryforwards. If it is more likely than not that some portion or all of a deferred tax asset will not be realized, a valuation allowance is recognized.

Revenue Recognition

Product revenue is recognized at the date of shipment to customers when a formal arrangement exists, the price is fixed or determinable, the delivery is completed, no other significant obligations of the Company exist and collectability is reasonably assured. Service revenue is recognized when persuasive evidence of an arrangement exists, service has provided, the fee is fixed or determinable, and collectability is probable. Payments received before all of the relevant criteria for revenue recognition are satisfied are recorded as advances from customers.

Sales represent the invoiced value of products, net of value-added tax (“VAT”). All of the Company’s products sold in Taiwan are subject to a value-added tax of 5% of the gross sales price. This VAT may be offset by VAT paid by the Company on raw materials and other materials included in the cost of producing the finished product. The Company records VAT payable and VAT receivable net of payments in the financial statements. The VAT tax return is filed offsetting the payables against the receivables. Sales and purchases are recorded net of VAT collected and paid as the Company acts as an agent for the government.

Basic and Diluted Earnings (Loss) Per Common Share

Basic earnings (loss) per common share is computed by dividing net income (loss) available to common shareholders (numerator) by the weighted average number of shares outstanding (denominator) during the period. Diluted earnings per share gives effect to all dilutive potential common shares outstanding during the period using the treasury stock method and convertible preferred stock using the if-converted method. In computing Diluted EPS, the average stock price for the period is used in determining the number of shares assumed to be purchased from the exercise of stock options or warrants. Diluted EPS excludes all dilutive potential shares if their effect is anti-dilutive. There were no options, warrants or other instruments convertible into common stock outstanding for the years ended December 31, 2014 and 2013; therefore, basic and diluted loss per common share are the same.

Subsequent Events

The Company’s management reviewed all material events from December 31, 2014 through the issuance date of these financial statements for disclosure consideration.

| F-8 |

Note 4 - Related Party Transactions

Employment Agreement