Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Fifth Street Asset Management Inc. | v406300_8k.htm |

Exhibit 99.1

Commentary and Perspectives from Fifth Street Asset Management First Quarter 2015Capital Markets Outlook Taking a Pause Middle market issuance has been off to a slower start this year, partially due to softer M&A activity (See Figure 1). Prior to the broader market sell-off at year end, new money deals were on the rise and leverage was ticking up—helping sponsors justify purchase premiums. Now, a reversal of fortunes has taken hold. Last year’s reset ushered in a pullback in leverage as well as greater deal selectivity, widening the bid-ask spread and dampening the appetite for M&A. Although sponsored loan volume stands at just $9 billion year-to-date, we expect the middle market lending environment to improve over the year. However, for the near term, we are likely to see opportunistic refinancing and dividend recapitalizations dominating new money transactions. Figure 1Sponsored: Quarterly New Money vs. Refinancing 3025 Volume 2015 Sponsored 105 MM Source: BN) Thomson Reuters LPC; As of 3/31/15. 01Q 041Q 051Q 061Q 071Q 081Q 091Q 101Q 111Q 121Q 131Q 141Q 15 New Money Refinancing Larger Middle Market Deal Size $100MM to $500MM. Traditional Middle Market Deal Size is less than $100MM. The “Haves” and “Have Nots” While market bifurcation has persisted for some time—with high quality credits attracting a disproportionate share of interest from lenders— many have noted an intensification as of late. Credits that are perceived as having a “clean story” have typically been oversubscribed, leading spreads to flex down. On the other hand, so-called marginal credits have tended to flex wider or, in some cases, have been pulled from the market altogether. According to S&P Capital IQ LCD, as the March quarter unfolded, the percent of loans flexing down has been hovering in the 50-60% range, compared to 25-30% at year-end. Conversely, only about 10% of loans$ have been flexing up versus 25-40% just one quarter ago (See Figure 2). April 1, 2015Last year’s reset ushered in a pullback in leverage as well as greater deal selectivity, widening the bid-ask spread and dampening the appetite for M&A. Figure 260%Flex Activity(1)40%20%0%-20%-40%-60%-80%111212121213131313141414------------Nov Feb May Aug Nov Feb May Aug Nov Feb May Aug 11/30/20142/28/2015 Flex up Flex down Source: S&P Capital IQ LCD; ME period reflects 30 days ended such date. “Flex” refers to increase / decrease in the spread or margin on a syndicated loan when demand is more / less than expected.

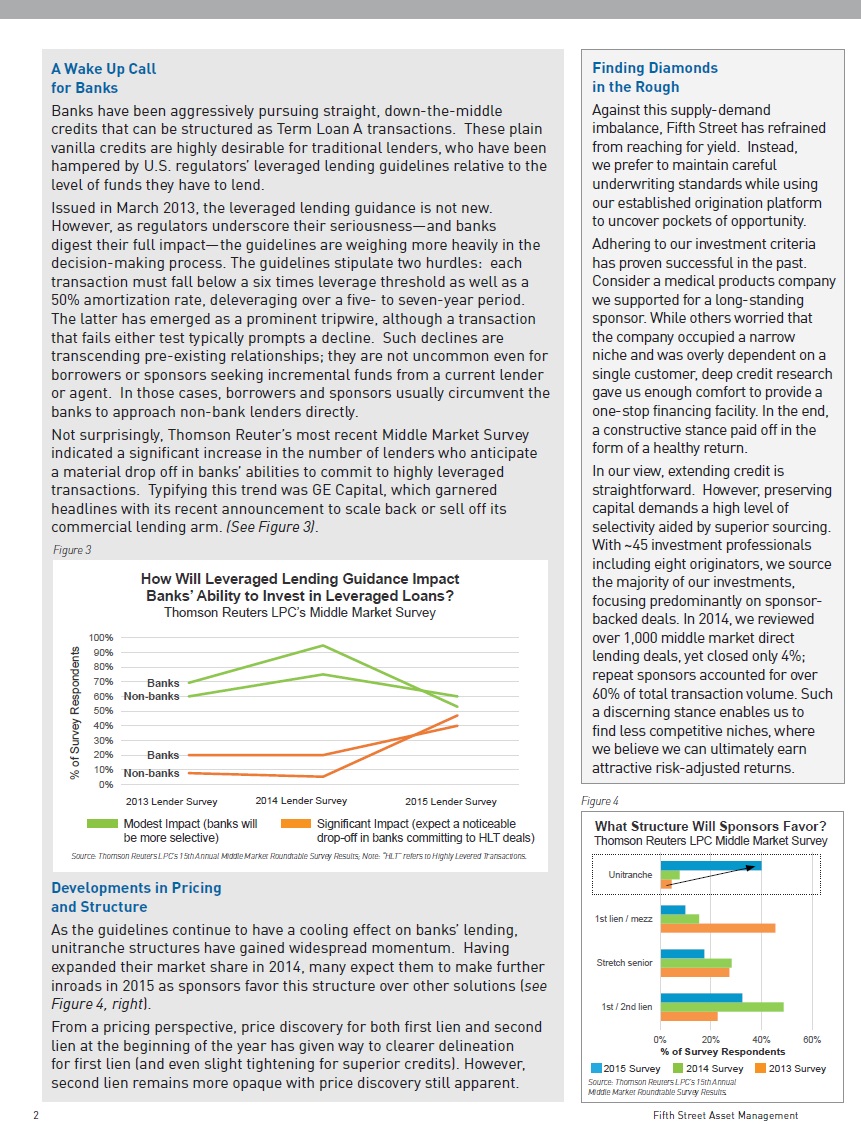

A Wake Up Call for BanksBanks have been aggressively pursuing straight, down-the-middle credits that can be structured as Term Loan A transactions. These plain vanilla credits are highly desirable for traditional lenders, who have been hampered by U.S. regulators’ leveraged lending guidelines relative to the level of funds they have to lend.Issued in March 2013, the leveraged lending guidance is not new. However, as regulators underscore their seriousness—and banks digest their full impact—the guidelines are weighing more heavily in the decision-making process. The guidelines stipulate two hurdles: each transaction must fall below a six times leverage threshold as well as a 50% amortization rate, deleveraging over a five- to seven-year period. The latter has emerged as a prominent tripwire, although a transaction that fails either test typically prompts a decline. Such declines aretranscending pre-existing relationships; they are not uncommon even for borrowers or sponsors seeking incremental funds from a current lender or agent. In those cases, borrowers and sponsors usually circumvent the banks to approach non-bank lenders directly.Not surprisingly, Thomson Reuter’s most recent Middle Market Survey indicated a significant increase in the number of lenders who anticipate a material drop off in banks’ abilities to commit to highly leveraged transactions. Typifying this trend was GE Capital, which garnered headlines with its recent announcement to scale back or sell off its commercial lending arm. (See Figure 3).Figure 3How Will Leveraged Lending Guidance ImpactBanks’ Ability to Invest in Leveraged Loans?Thomson Reuters LPC’s Middle Market SurveyRespondents100%90%80%70%Banks60%Non-banks50%Survey40%30%20%ofBanks10%Non-banks%0%2013 Lender Survey2014 Lender Survey2015 Lender SurveyModest Impact (banks willSignificant Impact (expect a noticeablebe more selective)drop-off in banks committing to HLT deals)Source: Thomson Reuters LPC’s 15th Annual Middle Market Roundtable Survey Results; Note: “HLT” refers to Highly Levered Transactions.Developments in Pricing and StructureAs the guidelines continue to have a cooling effect on banks’ lending, unitranche structures have gained widespread momentum. Having expanded their market share in 2014, many expect them to make further inroads in 2015 as sponsors favor this structure over other solutions (see Figure 4, right).From a pricing perspective, price discovery for both first lien and second lien at the beginning of the year has given way to clearer delineationfor first lien (and even slight tightening for superior credits). However, second lien remains more opaque with price discovery still apparent. Finding Diamonds in the RoughAgainst this supply-demand imbalance, Fifth Street has refrained from reaching for yield. Instead,we prefer to maintain careful underwriting standards while using our established origination platform to uncover pockets of opportunity.Adhering to our investment criteria has proven successful in the past. Consider a medical products company we supported for a long-standing sponsor. While others worried that the company occupied a narrow niche and was overly dependent on a single customer, deep credit research gave us enough comfort to provide a one-stop financing facility. In the end, a constructive stance paid off in the form of a healthy return.In our view, extending credit is straightforward. However, preserving capital demands a high level of selectivity aided by superior sourcing. With ~45 investment professionals including eight originators, we source the majority of our investments, focusing predominantly on sponsor-backed deals. In 2014, we reviewed over 1,000 middle market direct lending deals, yet closed only 4%; repeat sponsors accounted for over 60% of total transaction volume. Such a discerning stance enables us to find less competitive niches, where we believe we can ultimately earn attractive risk-adjusted returns.Figure 4What Structure Will Sponsors Favor?Thomson Reuters LPC Middle Market SurveyUnitranche1st lien / mezzStretch senior1st / 2nd lien0%20%40%60%% of Survey Respondents 2015 Survey 2014 Survey 2013 SurveySource: Thomson Reuters LPC’s 15th AnnualMiddle Market Roundtable Survey Results. 2Fifth Street Asset Management

Eyes on the FedCautious optimism with respect to the economy has brought the interest rate hike question to the forefront. How will a potential rise in interest rates impact the middle market? Some investors assume that portfolio companies may come under greater financial stress as interest payments on floating-rate debt increases. Prudent credit managers, however, have often factored in those risks when originating deals. In fact, portfolio companies’ cash flows could potentially improve if rising interest rates signal some sort of fundamental improvement in the economy.In addition, credit managers invested in floating rate investments stand to reap the benefits of additional income when interest rates eventually rise. With 84% of FSAM’s credit-focused AUM in floating rate investments, we believe that the Fifth Street platform is well-positioned.Figure 5 % of Fifth Street DebtPortfolios in FloatingRate Investments:• FSFR: ~100%• SLF I and II: 100% Fixed & Floating Rate Debt Investments as a % of FSAM’s Credit-Focused AUMFixed RateDebt, 16%Floating RateDebt, 84% Generally speaking, interest rates will need to rise at least 75-100 bps for lenders to reap the benefits of additional income, factoring in interest rate floors. The market average Libor floor is approximately 100 bps; however, we believe the market will anticipate the benefit ahead of time. • Hedge Fund: ~100%• FSC: 75%As of 12/31/14. To quantify the impact more broadly, considerFifth Street Senior Floating Rate Corp. (FSFR), a pure play with a portfolio of ~100% senior, floating rate loans. Figure 6 below reflects the benefit to FSFR’s net spread income at various rate levels. Yet, with a current yield of over 11%(2), FSFR represents more than just an interest rate play—it offers compelling income independent of the direction of interest rates.Figure 6FSFR’s Estimated Annual Change in Net SpreadIncome from Interest Rate Changes$14.9MM$10.8MM$6.7MM$2.6MM($1.3MM)100 bps 200 bps300 bps 400 bps 500 bpsBasis Point Increase in Base RateAs of 12/31/14. Net spread income calculated as the difference between the change in interest income and interest expense.

Fifth Street ActivityAs a management team, we are confident about our business and the range of growth opportunities we are seeing. While our business development companies, Fifth Street Finance Corp. (FSC) and Fifth Street Senior Floating Rate Corp. (FSFR), have historically driven our strong growth, we remain committedto diversifying the asset management platform through other growth initiatives. Two initiatives that we are actively pursuing are the expansion of our CLO business and our hedge fund.Debut CLODuring the quarter, FSAM announced the closing of its first collateralized loan obligation (CLO), Fifth Street Senior Loan Fund I, LLC (“CLO I”). At $309.5 million, the CLO invests primarily in middle market senior secured loans sourced and originated through the Fifth Street platform. As a first-time issuer, FSAM was pleased with the institutional interestdisplayed—a validation of the strength of our direct origination platform. CLO I represents an important milestone in the continued growth of this product line. We are also continuing to evaluate the securitization of Fifth Street Senior Loan Fund II, LLC (SLF II) and are in active conversations with prospective investors as we look to raise our third senior loan fund, Senior Loan Fund III.Strong Hedge Fund ResultsElsewhere, we are pleased to announce that our hedge fund marked its second anniversary in February(3). Primarily focused on yield-oriented, uncorrelated, and liquid corporate credit assets and equities, the hedge fund has generated consistent results, with 25 out of 26 months of positive net returns(3).The hedge fund has approximately $80 million of AUM(4) and continues to grow as a result of its unique alpha strategy.Direct Lending MomentumBeyond our existing products, we continue to explore other strategies in the direct lending space, which appear to be gathering momentum as a distinct asset class. According to Preqin, direct lending fundraising has already climbed fourfold since 2012 ($7.1 billion versus $29.1 billion of inflows in 2014), with room for further expansion. Over 60% of investors cited it as the most attractive investment opportunity in the current market(5). Such robust interest comes as no surprise given that many global investors seek incremental returns without undue risk. Direct lending can also provide protection from rising interest rates and premium yields relative to traditional fixed income along with stronger asset protection. With an award-winning direct origination platform and a core focuson middle market credit strategies, we believe Fifth Street is well-equipped to capitalize on future momentum in the direct lending space. Our highly selective, sponsor-focused platform emphasizes scale, discipline and a focus on capital preservation. (1) Copyright © 2015, S&P Capital IQ (and its affiliates, as applicable). Reproduction of this chart in any form is prohibited except with the prior written permission of S&P Capital IQ (“S&P”). None of S&P, its affiliates or their suppliers guarantee the accuracy, adequacy, completeness or availability of any information and is not responsible for any errors oromissions, regardless of the cause or for the results obtained from the use of such information. In no event shall S&P, its affiliates or any of their suppliers be liable for any damages, costs, expenses, legal fees, or losses (including lost income or lost profit and opportunity costs) in connection with any use of S&P information. I (2) As of 3/17/15. I (3) The hedge fund began as a partners’ fund (the “Partners Fund”), which was formed in February 2013 and commenced operations in March 2013. Returns prior to February 2014 represent returns for the Partners Fund. The Partners Fund operated with a substantially similar investment objective and strategy as the hedge fund and investment decisions for the Partners Fund were made by the same investment team as for the hedge fund. I (4) As of 3/30/15. I (5) Preqin’s 2015 Global Private Debt Report.DISCLAIMER: Statements included herein may constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, which relate to future events and/or Fifth Street Asset Management Inc.’s (“Fifth Street”) future performance or financial condition. These statements are based on certain assumptions about future events or conditions and involve a number of risks and uncertainties. These statements are not guarantees of future performance, condition or results. Actual results may differ materially from those in the forward-looking statements as a result of a number of factors, including those described from time to time in our filings with the SEC.The information contained in this article is summary information that is intended to be considered in the context of Fifth Street’s SEC filings and other public announcements that Fifth Street may make, by press release or otherwise, from time to time. Fifth Street undertakes no duty or obligation to publicly update or revise the forward-looking statements or other information contained in this article. These materials contain information about Fifth Street, its affiliated funds (including FSC and FSFR) and general information about the market. You should not view information related to the past performance of Fifth Street and its affiliated funds or information about the market as indicative of future results, the achievement of which cannot be assured.Nothing in these materials should be construed as a recommendation to invest in any securities that may be issued by Fifth Street or its affiliates or as legal, accounting or tax advice. None of Fifth Street, its affiliated funds or any affiliate of Fifth Street or its affiliated funds makes any representation or warranty, express or implied, as to the accuracy or completeness of the information contained herein and nothing contained herein shall be relied upon as a promise or representation whether as to the past or future performance. Certain information set forth herein includes estimates, projections and targets and involves significant elements of subjective judgment and analysis. No representations are made as to the accuracy of such estimates, projections or targets or that all assumptions relating to such estimates, projections or targets have been considered or stated or that such estimates, projections or targets will be realized.This article is not intended to be an offer to sell, or the solicitation of an offer to purchase, any security (including FSAM or its affiliates, FSC or FSFR), the offer and/or sale of which can only be made by definitive offering documentation. Any other or solicitation with respect to any securities that may be issued by Fifth Street or its affiliates will be made only by means of definitive offering memoranda or prospectus (as applicable), which will be provided to prospective investors and will contain material information that is not set forth herein, including risk factors relating to any such investment. 4Copyright © Fifth Street Management LLC. All Rights Reserved.