Attached files

| file | filename |

|---|---|

| 8-K - 8-K - US FOODS, INC. | d893733d8k.htm |

Q4

& FY 2014 Performance Update

A Taste of What’s Cooking at US Foods

March 2015

Exhibit 99.1 |

1

FOOD. FOOD PEOPLE. EASY. While

the

information

provided

herein

is

believed

to

be

accurate

and

reliable,

US

Foods,

Inc.

(the

“Company”)

does

not

make

any

representations or warranties, express or implied, as to the accuracy or

completeness of such information or as to future results. No

representation or warranty is made that any of the projections presented herein

will be realized. This information should be read in conjunction with

the Company’s Annual Report on Form 10-K for the fiscal year ended December 27, 2014.

Forward-looking statements notice

This

presentation

and

related

comments

by

our

management

may

include

“forward-looking

statements”

made

under

the

safe

harbor

provisions

of

the

Private

Securities

Litigation

Reform

Act

of

1995,

as

amended.

Our

use

of

the

words

“expect,”

“anticipate,”

“possible,”

“potential,”

“target,”

“believe,”

“commit,”

“intend,”

“continue,”

“may,”

“would,”

“could,”

“should,”

“project,”

“projected,”

“positioned”

or similar expressions is intended to

identify forward-looking statements that represent our current judgment about

possible future events. We believe these judgments are reasonable, but these

statements are not guarantees of any events or financial results, and our actual results may differ materially due to a

variety of important factors. Among other items, such factors might include: our

ability to remain profitable during times of cost inflation, commodity

volatility, and other factors; competition in the industry and our ability to compete successfully; our reliance on third-party suppliers,

including the impact of any interruption of supplies or increases in product costs;

shortages of fuel and increases or volatility in fuel costs; any declines in

the consumption of food prepared away from home, including as a result of changes in the economy or other factors affecting

consumer confidence; costs and risks associated with labor relations and the

availability of qualified labor; any change in our relationships with

group

purchasing

organizations;

our

ability

to

increase

sales

to

independent

customers;

changes

in

industry

pricing

practices;

changes

in

the

cost

structure

of

competitors;

costs

and

risks

associated

with

government

laws

and

regulations,

including

environmental,

health,

safety,

food

safety, transportation, labor and employment laws and regulations, and changes in

existing laws or regulations; a cyber-security incident, technology

disruptions and our ability to implement new technologies; liability claims relating to products that we distribute; our ability to maintain

a good reputation; costs and risks associated with litigation or

governmental investigations; our ability to manage future expenses and liabilities

with respect to our retirement benefits; our ability to successfully

integrate future acquisitions; our ability to achieve the benefits that we expect to

achieve from our cost savings programs; risks relating to our indebtedness,

including our substantial amount of debt, our ability to incur substantially

more debt, restrictions and limitations placed on us by our debt agreements and increases in interest rates; and risks related to and

our ability to consummate our proposed acquisition by Sysco Corporation

(“Sysco”), including risks to our relationships with customers, vendors

and employees. Additional information regarding these factors is contained in

our filings with the Securities and Exchange Commission, including, without

limitation, our Annual Report on Form 10-K for the fiscal year ended December 27, 2014.

All forward-looking statements speak only as of the date they were made. We do

not undertake any obligation to update or publicly release any revisions to

any forward-looking statements to reflect events, circumstances or changes in expectations after the date of this presentation. |

2

FOOD. FOOD PEOPLE. EASY. Non-GAAP financial measures

This presentation contains unaudited financial measures which are not required by,

or presented in accordance with, accounting principals generally accepted in

the United States of America (“GAAP”), including Reported EBITDA, Adjusted EBITDA, Consolidated EBITDA, Debt

Coverage Ratio, Interest Coverage Ratio, Adjusted Operating Expenses and Adjusted

Gross Profit. Management believes these non-GAAP financial measures

provide meaningful supplemental information regarding our operating performance because they exclude amounts that our

management and our board of directors do not consider part of core operating

results when assessing our performance. Our management uses these

non-GAAP financial measures to evaluate our historical financial performance, establish future operating and capital budgets and

determine variable compensation for management and employees. Accordingly, we

believe these non-GAAP financial measures are useful in allowing for a

better understanding of our core operations. While

management

believes

that

these

non-GAAP

financial

measures

provide

useful

information,

they

are

not

operating

measures

under

GAAP,

and there are limitations associated with their use. The calculation of these

non-GAAP financial measures may not be completely comparable to

similarly

titled

measures

of

other

companies

due

to

potential

differences

between

companies

in

their

method

of

calculation.

As

a

result

the

use of

these non-GAAP financial measures has limitations and should not be considered

in isolation from, or as a substitute for, other measures such as

net

income

or

net

income

attributable

to

stockholders.

Due

to

these limitations, these non-GAAP financial measures are used as a

supplement to GAAP measures and should not be considered as a substitute for net

income (loss) from continuing operations, operating profit or any other

performance measures derived in accordance with GAAP, nor are they a substitute for cash flow from operating activities as a

measure of our liquidity.

Management uses Adjusted EBITDA Margin and Consolidated EBITDA Margin to focus on

year-over-year changes in our business and believes this information

is also helpful to investors. We use Adjusted EBITDA in these EBITDA-related margin measures because we believe our

investors

are

familiar

with

Adjusted

EBITDA

and

that

consistency

in

presentation

of

EBITDA-related

measures

is

helpful

to

investors.

Management also uses Debt Coverage Ratios and Interest Coverage Ratios to focus on

year-over-year changes in our leverage and believes this information

is also helpful to investors. We caution investors that these non-GAAP financial measures presented also are intended to

supplement our GAAP results and are not a substitute for such results and may

differ from the non-GAAP measures used by other companies. Please

see the Appendix for a reconciliation of the differences between the non-GAAP financial measures to the most directly comparable

GAAP financial measures. |

3

FOOD. FOOD PEOPLE. EASY. Agenda

•

Business Highlights

•

Financial Update

•

Closing Comments

•

Appendix |

4

FOOD. FOOD PEOPLE. EASY. Agenda

•

Business Highlights

•

Financial Update

•

Closing Comments

•

Appendix |

5

FOOD. FOOD PEOPLE. EASY. Business Highlights

Note:

(1) Reconciliation of this non-GAAP measure is provided in the

Appendix. •

Q4 results

•

Sales increased 3.7%, and cases decreased 1.8%

•

Net income was $48 million

•

Adjusted

EBITDA

was

$240

million,

a

2.4%

decrease

from

last

year

1

•

FY 2014 results

•

Sales increased 3.2%, and cases decreased 1.2%

•

Net loss was $73 million

•

Adjusted

EBITDA

was

$866

million,

a

2.5%

increase

from

last

year

1

•

Business transformation focused on differentiation and innovation

•

Category Management and Merchandising

•

Sales Force Effectiveness

•

Acquisition by Sysco (the “Acquisition”)

•

Entered into an asset purchase agreement with Performance Food Group for the

divestiture of 11 US Foods distribution centers upon completion of the

Acquisition. •

The

FTC

voted

by

a

margin

of

3-2

to

seek

a

preliminary

injunction

to

prevent

the

closing

of

the

Acquisition.

Sysco

and US Foods are contesting. |

6

FOOD. FOOD PEOPLE. EASY. Agenda

•

Business Highlights

•

Financial Update

•

Closing Comments

•

Appendix |

7

FOOD. FOOD PEOPLE. EASY. Q4 Financial Performance

Notes:

(1) Reconciliations of these non-GAAP measures are provided in the

Appendix. (2) Represents Adjusted EBITDA as a percentage of Net Sales.

Individual components may not add to total presented due to rounding.

NET SALES

$5,754

$5,547

3.7%

GROSS PROFIT

$978

$972

$6

ADJUSTED GROSS PROFIT

1

$969

$977

($8)

% OF NET SALES

16.8%

17.6%

(77) bps

OPERATING EXPENSES

$865

$864

($1)

ADJUSTED OPERATING EXPENSES

1

$729

$731

$2

% OF NET SALES

12.7%

13.2%

51

bps

NET INCOME/(LOSS)

$48

($1)

$49

ADJUSTED

EBITDA

1

$240

$246

($6)

ADJUSTED

EBITDA

MARGIN

2

4.2%

4.4%

(26) bps

$ IN MILLIONS

Q4 2014

Q4 2013

B/(W) Y-O-Y CHANGE |

8

FOOD. FOOD PEOPLE. EASY. FY 2014 Financial Performance

Notes:

(1) Reconciliations of these non-GAAP measures are provided in the

Appendix. (2) Represents Adjusted EBITDA or Consolidated EBITDA as a

percentage of Net Sales. (3) Consolidated EBITDA includes Adjusted EBITDA

plus $50 million for cost saving actions taken by the Company as specified under the Company’s debt agreements.

Individual components may not add to total presented due to rounding.

NET SALES

$23,020

$22,297

3.2%

GROSS PROFIT

$3,798

$3,823

($25)

ADJUSTED

GROSS

PROFIT

1

$3,858

$3,835

$23

% OF NET SALES

16.8%

17.2%

(44) bps

OPERATING EXPENSES

$3,546

$3,502

($44)

ADJUSTED

OPERATING

EXPENSES

1

$2,992

$2,990

($2)

% OF NET SALES

13.0%

13.4%

41 bps

NET INCOME/(LOSS)

($73)

($57)

($16)

ADJUSTED

EBITDA

1

$866

$845

$21

ADJUSTED

EBITDA

MARGIN

2

3.8%

3.8%

(3) bps

CONSOLIDATED

EBITDA

3

$916

CONSOLIDATED

EBITDA

MARGIN

2

4.0%

$ IN MILLIONS

FY 2014

FY 2013

B/(W) Y-O-Y CHANGE |

9

FOOD. FOOD PEOPLE. EASY. Cash Flow

Individual components may not add to total presented due to rounding.

$ IN MILLIONS

Q1 2014

Q2 2014

Q3 2014

Q4 2014

FY 2014

Cash from Operating Activities

$31

$216

$56

$99

$402

Capital Expenditures, net of Proceeds

($40)

($25)

($16)

($36)

($118)

Cash provided by Financing Activities

$1

($45)

($12)

($64)

($120)

Net Cash Change

($8)

$146

$27

($1)

$164

Beginning Cash

$180

$172

$317

$345

$180

Ending Cash

$172

$317

$345

$344

$344 |

10

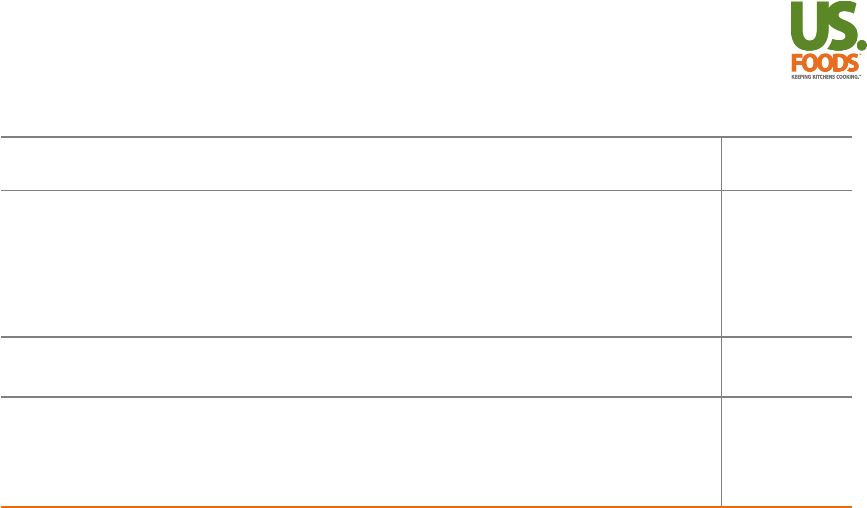

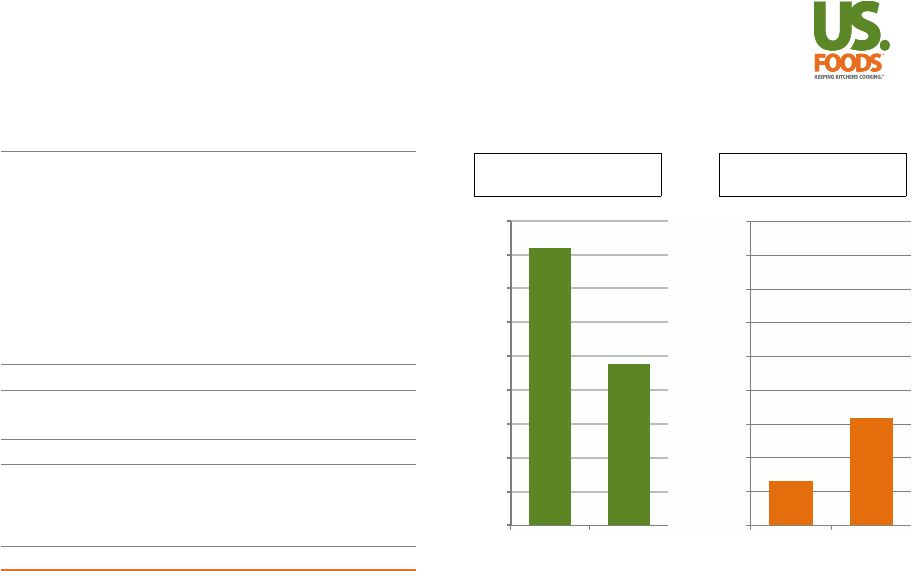

FOOD. FOOD PEOPLE. EASY. 1.3x

Capital Structure & Credit Statistics

1.3x

Notes:

(1) Total debt as of December 27, 2014 of $4,733 million excludes $15 million of

unamortized premium on senior notes. (2) Debt coverage ratio equals net debt

divided by Consolidated EBITDA over last 12 months. Debt /LTM

As of

Consolidated

$ IN MILLIONS

12/27/2014

EBITDA

ABL Revolver (2016)

$0

ABS Facility (2016)

$636

CMBS Facility (2017)

$472

Term Loan (2019)

$2,074

Capital Leases (2018 -

2025)

$189

Other Debt (2018 -

2031)

$12

Total Senior Secured Debt

$3,383

3.7x

Senior Notes (2019)

$1,350

Total

Debt

1

$4,733

5.2x

Less: Restricted Cash

($6)

Less: Cash and Cash Equivalents

($344)

Net Debt

$4,383

4.8x

Credit Statistics

Debt Coverage

Interest Coverage

Ratio

2

Ratio

3

1.3x

3.2x

1.0x

2.0x

3.0x

4.0x

5.0x

6.0x

7.0x

8.0x

9.0x

At Close

7/2/2007

12/27/2014

1.0x

2.0x

3.0x

4.0x

5.0x

6.0x

7.0x

8.0x

9.0x

At Close

7/2/2007

12/27/2014

8.2x

4.8x

(3) Interest coverage ratio equals Consolidated EBITDA over last 12 months divided by net

interest expense over last 12 months. |

11

FOOD. FOOD PEOPLE. EASY. We have $1,173 million of available liquidity.

Liquidity

As of

$ IN MILLIONS

12/27/2014

Borrowing Availability:

ABL Facility (2016)

$765

ABS Facility (2016)

$64

Total Cash & Equivalents

$344

Total Cash and Borrowing Availability

$1,173 |

12

FOOD. FOOD PEOPLE. EASY. Agenda

•

Business Highlights

•

Financial Update

•

Closing Comments

•

Appendix |

13

FOOD. FOOD PEOPLE. EASY. Agenda

•

Business Highlights

•

Financial Update

•

Closing Comments

•

Appendix |

14

FOOD. FOOD PEOPLE. EASY. Non-GAAP Reconciliations

Management believes these non-GAAP financial measures provide meaningful

supplemental information regarding the Company’s operating

performance

because

they

exclude

amounts

that

the

Company’s

management

and

board

of

directors

do

not

consider

part

of

core

operating

results when assessing the performance of the Company. Management uses these

non-GAAP financial measures to evaluate the Company’s historical

financial performance, establish future operating and capital budgets and

determine variable compensation for management and employees.

Accordingly, the Company believes these non-GAAP financial measures are useful in allowing for a better understanding of the

Company's core operations.

While

management

believes

that

these

non-GAAP

financial

measures

provide

useful

information,

they

are

not

operating

measures

under

GAAP,

and there are limitations associated with their use. The Company's calculation of

these non-GAAP financial measures may not be comparable to

similarly

titled

measures

of

other

companies

due

to

potential

differences

between

companies

in

their

method

of

calculation.

As

a

result,

the

use

of

these non-GAAP financial measures has limitations and should not be considered

in isolation from or as a substitute for measures such as Net income or Net

income attributable to stockholders. Due to these limitations, these non-GAAP financial measures are used as a supplement to

GAAP measures. |

15

FOOD. FOOD PEOPLE. EASY. Non-GAAP Reconciliation -

Adjusted EBITDA.

Quarter Ended

FY Ended

(In millions)

Dec 27, 2014

Dec 28, 2013

Dec 27, 2014

Dec 28, 2013

Net income (loss)

48

$

(1)

$

(73)

$

(57)

$

Interest expense, net

71

73

289

306

Income tax provision (benefit)

(5)

36

36

30

Depreciation and amortization expense

102

101

412

388

EBITDA

215

209

664

667

Adjustments:

Sponsor

fees

1

2

2

10

10

Restructuring

and

tangible

asset

impairment

charges

2

-

3

-

8

Share-based

compensation

expense

3

3

(1)

12

8

Net LIFO reserve change

4

(9)

5

60

12

Loss

on

extinguishment

of

debt

5

-

-

-

42

Pension

settlement

6

2

2

2

2

Business

transformation

costs

7

14

17

54

61

Acquisition

related

costs

8

11

4

38

4

Other

9

2

5

26

31

Adjusted EBITDA

240

$

246

$

866

$

845

$

Notes:

(1)

Consists

of

management

fees

paid

to

Clayton,

Dubilier

&

Rice,

Inc.

and

Kohlberg

Kravis

Roberts

&

Co.

(collectively

the

“Sponsors”).

(2)

Primarily consists of facility closing, severance and related costs, and tangible

asset impairment charges. (3)

Share-based

compensation

expense

represents

costs

recorded

for

vesting

of

USF

Holding

Corp.

stock

option

awards,

restricted

stock,

and

restricted

stock

units.

(4)

Consists of net changes in the LIFO reserve.

(5)

Includes fees paid to debt holders, third party costs, early redemption premiums,

and the write-off of old debt facility unamortized debt issuance costs.

(6)

Consists of charges resulting from lump-sum payment settlements to retirees and

former employees participating in several Company sponsored pension plans.

(7)

Consists primarily of costs related to functionalization and significant process

and systems redesign. (8) Consists of direct and incremental costs

related to the Acquisition. (9)

Other

includes

gains,

losses

or

charges,

as

specified

under

the

Company’s

debt

agreements,

including

$16

million

of

costs

subject

to

coverage

under

the

Company’s

insurance policies.

Individual components may not add to total presented due to rounding.

|

16

FOOD. FOOD PEOPLE. EASY. Non-GAAP Reconciliation -

Adjusted Gross Profit

and Adjusted Operating Expenses.

Quarter Ended

FY Ended

(In millions)

Dec 27, 2014

Dec 28, 2013

Dec 27, 2014

Dec 28, 2013

Gross Profit

978

972

3,798

$

3,823

$

Net LIFO reserve change

1

(9)

5

60

12

Adjusted Gross Profit

969

$

977

$

3,858

$

3,835

$

Net sales

5,754

$

5,547

$

23,020

$

22,297

$

Operating Expenses

865

$

864

$

3,546

$

3,502

$

Adjustments:

Depreciation and amortization expense

(102)

(101)

(412)

(388)

Sponsor

fees

2

(2)

(2)

(10)

(10)

Restructuring

and

tangible

asset

impairment

charges

3

-

(3)

-

(8)

Share-based

compensation

expense

4

(3)

1

(12)

(8)

Pension settlement

5

(2)

(2)

(2)

(2)

Business

transformation

costs

6

(14)

(17)

(54)

(61)

Acquisition

related

costs

7

(11)

(4)

(38)

(4)

Other

8

(2)

(5)

(26)

(31)

Adjusted Operating Expenses

729

$

731

$

2,992

$

2,990

$

Notes:

(1)

Consists of net changes in the LIFO reserve.

(2)

Consists of management fees paid to the Sponsors.

(3)

Primarily consists of facility closing, severance and related costs, and tangible

asset impairment charges. (4)

Share-based

compensation

expense

represents

costs

recorded

for

vesting

of

USF

Holding

Corp.

stock

option

awards,

restricted

stock,

and

restricted

stock

units.

(5)

Consists of charges resulting from lump-sum payment settlements to retirees and

former employees participating in several Company sponsored pension plans.

(6)

Consists primarily of costs related to functionalization and significant process

and systems redesign. (7)

Consists of direct and incremental costs related to the Acquisition.

(8)

Other includes gains, losses or charges, as specified under the Company’s debt

agreements, including $16 million of costs subject to coverage under the

Company’s insurance policies.

Individual components may not add to total presented due to rounding.

|

|