Attached files

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

ý ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Fiscal Year Ended December 31, 2014

OR

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Transition Period from to

Commission File Number: [001-34949]

Tekmira Pharmaceuticals Corporation

(Exact Name of Registrant as Specified in Its Charter)

|

British Columbia, Canada

|

980597776

|

|

|

(State or Other Jurisdiction of

Incorporation or Organization)

|

(I.R.S. Employer

Identification No.)

|

|

|

100-8900 Glenlyon Parkway, Burnaby, BC V5J 5J8

(Address of Principal Executive Offices)

|

||

|

604-419-3200

(Registrant’s Telephone Number, Including Area Code):

|

||

|

Securities registered pursuant to Section 12(b) of the Act:

|

||

|

Title of Each Class

|

Name of Each Exchange on Which Registered

|

|

|

Common shares, without par value

|

The NASDAQ Stock Market LLC

|

|

|

Securities registered pursuant to Section 12(g) of the Act:

|

||

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No ý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer o

|

Accelerated filer ý

|

Non-accelerated filer o

|

Smaller reporting company o

|

|

(Do not check if a smaller reporting company)

|

|||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No ý

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive proxy statement for its 2015 annual meeting of stockholders, which the registrant intends to file pursuant to Regulation 14A with the Securities and Exchange Commission not later than 120 days after the registrant’s fiscal year end of December 31, 2014, are incorporated by reference into Part III of this Form 10-K.

2

TEKMIRA PHARMACEUTICALS CORPORATION

TABLE OF CONTENTS

|

Page

|

||

3

This annual report on Form 10-K contains forward-looking information and forward-looking statements (collectively, forward-looking statements) within the meaning of applicable securities laws. All statements other than statements relating to historical matters should be considered forward-looking statements. When used in this report, the words “believe,” “expect,” “plan,” “anticipate,” “estimate,” “predict,” “may,” “could,” “should,” “intend,” “will,” “target,” “goal” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these words.

Forward-looking statements in this annual report include statements about Tekmira’s strategy, future operations, clinical trials, prospects and the plans of management; RNAi (ribonucleic acid interference) and Hepatitis B virus product development programs; the effects of Tekmira’s products on the treatment of cancer, chronic Hepatitis B infection, infectious disease, alcohol use disorder, and other diseases; the potential of RNAi to generate a new class of therapies; Tekmira’s strategic focus on, and phased clinical plan of combination therapies for, curing HBV; the composition and roles of the management team; Tekmira’s continued listing on NASDAQ; the research benefits of the collaborating with The Baruch S. Blumberg Institute; clinical trial goals and milestones in product pipelines expected to be reached in the second half of 2015 and beyond, including the results of a TKM-HBV Phase I clinical trial, a multi-dosing TKM-HBV trial in the second half of 2015, filing an IND or equivalent for OCB-030 and initiating a study by year end 2015, the initiation of CYT-003 preclinical studies in 2015, filing an IND with the FDA or an equivalent filing with foreign regulatory authorities and initiating Phase 1 studies with one of the capsid assembly inhibitors in 2016, results from surface antigen secretion inhibitors and filing an IND or its equivalent in another territory for a lead compound in 2016, identifying orally active small molecule human STING agonists that possess the desired characteristics to progress into human clinical studies, filing an IND with the FDA or its equivalent in another territory for cccDNA formation inhibitors in 2017, and inhibiting the formation of new virus and subviral particles from cccDNA by controlling cccDNA transcription; the expected efficacy of Tekmira’s various HBV therapies; Tekmira’s continued commitment to its non-HBV assets, both clinical and preclinical, and timing of expected results; non-HBV clinical trial milestones, including final data from GI-NET and ACC studies in the second half of 2015, an HCC Phase I/II clinical trial, and results from a TKM-Ebola-Guinea study in the second half of 2015; non-HBV preclinical trial milestones, including filing an investigational new drug application for TKM-HTG in the second half of 2015, partnering or external funding for TKM-ALDH, and filing an investigational new drug application for TKM-HTG in the second half of 2015; the expected efficacy of Tekmira’s various non-HBV products; the continuation of LNP technology as an important cornerstone of Tekmira’s business development activities, and the expected yield from the latest generation of the platform; the expected return from strategic alliances, licensing agreements, and research collaborations, such as the potential value of a transaction with Monsanto Company, a grant from the U.S. National Institutes of Health, and transactions with Enantigen Therapeutics, Inc.; the potential quantum of value of the transactions contemplated in the Monsanto option agreement; funding and licensing of Blumberg’s HBV research; the sufficiency of space under Tekmira’s head office lease; Tekmira’s intent to retain earnings, if any, to finance the growth and development of their business and not to pay dividends or to make any other distributions in the near future; a rolling Phase II clinical program for HBV, using an iterative process of combination drug candidates, leading into Phase III clinical trials; the expansion of the HBV pipeline through internal development, acquisitions and in-licenses; the advancement of the RNAi product pipeline either internally or with partners, with a focus on realizing the long term value of these assets; arbitration proceedings with Alnylam Pharmaceuticals, Inc. in connection with ALN-VSP; arbitration proceedings with the University of British Columbia in connection with alleged unpaid royalties; anticipated royalty receipts; statements with respect to revenue and expense fluctuation and guidance; and the quantum and timing of potential funding.

With respect to the forward-looking statements contained in this annual report, Tekmira has made numerous assumptions. While Tekmira considers these assumptions to be reasonable, these assumptions are inherently subject to significant business, economic, competitive, market and social uncertainties and contingencies.

Our actual results could differ materially from those discussed in the forward-looking statements as a result of a number of important factors, including the factors discussed in this annual report on Form 10-K, including those discussed in Item 1A of this report under the heading “Risk Factors,” and the risks discussed in our other filings with the Securities and Exchange Commission and Canadian Securities Regulators. Readers are cautioned not to place undue reliance on these forward-looking statements, which reflect management’s analysis, judgment, belief or expectation only as of the date hereof. We explicitly disclaim any obligation to update these forward-looking statements to reflect events or circumstances that arise after the date hereof, except as required by law.

4

PART I

|

Item 1.

|

Business

|

Overview

Following our recent business combination with OnCore Biopharma, Inc., (“OnCore”) we intend to focus our efforts on discovering, developing and commercializing a cure for patients suffering from chronic HBV infection, a disease of the liver caused by the hepatitis B virus. Our strategy incorporates our heritage and expertise in RNAi combined with the newly acquired assets and expertise through the OnCore merger.

We believe that, as a result of the merger, Tekmira will be well positioned to capitalize on the HBV global market opportunity. Our current HBV pipeline consists of 9 drugs and drug candidates, with eight unique mechanisms of action. Our unique strategy is to target the three pillars we believe are necessary to deliver an HBV cure, including: (i) suppressing HBV viral replication, (ii) restoring host response by suppressing HBsAg or activating/stimulating the host immune system directed at HBV and (iii) eliminating covalently closed circular DNA (cccDNA), the reservoir of viral genomic material. We believe that our chances for success in HBV are increased, and risk is mitigated, by having a portfolio of assets targeting these three strategies. Most importantly, we believe combination therapies are the key to HBV treatment and a potential cure. We believe that clinical development can be accelerated when multiple components of a combination therapy regimen are controlled by the same company and therefore we have retained exclusive worldwide development and commercialization rights to all of our drug candidates and programs in HBV.

Recognized as a world leader in RNA interference (RNAi) delivery technology, Tekmira is a biopharmaceutical company that since inception has focused on advancing novel RNAi-based therapeutics. RNA interference is considered one of the most important discoveries in the field of biomedical science in the last decade. RNAi has the potential to generate a new class of therapies that take advantage of the body’s own natural processes to silence genes and, by extension, treat serious human diseases that often rely on the production of certain proteins at the genetic level. With this ability to eliminate disease-causing proteins from cells, RNAi therapies represent opportunities for therapeutic intervention that have not been achievable with conventional therapeutics.

Tekmira’s proprietary LNP Delivery Platform allows for the successful delivery and enablement of RNAi drugs. By encapsulating the RNAi trigger molecules in lipid nanoparticles (LNP); our LNP technology enables efficient delivery and uptake into target cells. Our LNP technology represents the most widely adopted delivery method in RNAi. To date, it has enabled eight clinical trials and has been administered to more than 250 patients. Recent results demonstrate that multi-dosing with LNP technology has been well-tolerated with treatments out to one year.

With anti-viral, oncology, and metabolic product platforms, our RNAi product pipeline is focused on areas where there is a significant medical need and commercial opportunity. Tekmira’s clinical and preclinical programs include RNAi therapeutics addressing chronic hepatitis B virus (HBV) infection, cancer indications such as gastrointestinal neuroendocrine tumors and adrenocortical carcinoma, and metabolic disorders such as hypertriglyceridemia.

Tekmira’s LNP technology also enables our partners’ development programs and pipelines, providing us with non-dilutive funding to support its internal therapeutic development programs. Because LNP can enable a wide variety of nucleic acid triggers, including messenger RNA (mRNA), we continue to seek new product development and partnering opportunities based on our industry-leading delivery expertise.

Corporate History

Tekmira was incorporated pursuant to the British Columbia Business Corporations Act (BCBCA), on October 6, 2005, and commenced active business on April 30, 2007, when Tekmira and its parent company, Inex Pharmaceuticals Corporation (“Inex”) were reorganized under a statutory plan of arrangement (the “Reorganization”) completed under the provisions of the BCBCA. The Reorganization saw Inex’s entire business transferred to and continued by Tekmira. In this discussion of corporate history the terms “we”, “us” and “our” refer to the business of Inex for the time prior to the Reorganization and the business of Tekmira for the time after the Reorganization.

Since 1992, we have focused on developing lipid delivery technologies for different classes of therapeutic agents, including chemotherapy drugs and nucleic acid drugs. Our technology was applied to the development of Marqibo®, a liposomal formulation of the chemotherapy drug vincristine, which was subsequently licensed to Hana Biosciences in 2006. Under this legacy agreement, our current licensee, Spectrum Pharmaceuticals, Inc., has a license to develop Marqibo, along with two other liposomal chemotherapy products.

Since 2005, Protiva Biotherapeutics, Inc. (“Protiva”) and Inex began separately developing lipid nanoparticle delivery technology for a class of nucleic acid drugs called RNAi trigger molecules that mediate RNA interference, or RNAi, and both Protiva and Inex initiated separate research collaborations with Alnylam Pharmaceuticals, Inc. (“Alnylam”) to combine Alnylam’s expertise in RNAi trigger molecules or “trigger” technologies with each of Protiva’s and Inex’s separate proprietary knowledge of RNAi delivery technology. In January 2007, Inex entered into a License and Collaboration Agreement with Alnylam where Inex obtained, among other things, a worldwide license to certain Alnylam intellectual property for the research, development, manufacturing and commercialization of RNAi products for the treatment of human diseases, and Alnylam obtained exclusive access to Inex’s delivery technology for siRNA and microRNA. In August 2007, Protiva entered into a Cross License Agreement with Alnylam where Protiva obtained, among other things, a worldwide license to certain Alnylam intellectual property for the research, development, manufacturing and commercialization of RNAi products for the treatment of human diseases and Alnylam obtained non-exclusive access to Protiva’s delivery technology for siRNA and microRNA.

In 2008, Inex and Protiva entered into a business combination. At the time of its acquisition, Protiva was a private, venture-backed company incorporated under the laws of Canada and since 2003 had focused its business on developing lipid nanoparticle (LNP) delivery technology for RNAi, a business similar to Inex’s. Since commencing work on the delivery of RNAi triggers, Protiva has filed several patent applications covering different LNP formulations, manufacturing processes, and RNAi trigger design to remove any immune stimulatory properties. At the time of its acquisition, Protiva had licensed its LNP technology on a non-exclusive basis to Alnylam and (“Merck”) and had access to Alnylam’s intellectual property for the research, development and commercialization of RNAi products.

5

The business combination with Protiva was completed through an acquisition, under a share purchase agreement, of all the then outstanding shares of Protiva in consideration for common shares of Tekmira. Protiva is now Tekmira’s wholly-owned subsidiary. Concurrent with the completion of the business combination with Protiva, we entered into initial research agreements with F. Hoffman-La Roche Ltd and Hoffman La-Roche Inc., which we refer to together as (“Roche”), and completed private placement investments of $5.0 million with Alnylam and $5.0 million with an affiliate of Roche. Since the completion of the business combination with Protiva, Tekmira has focused on advancing RNAi therapeutic products and providing LNP delivery technology to pharmaceutical partners and collaborators using Protiva’s lipid technology.

In March of 2015, Tekmira completed a merger whereby OnCore Biopharma, Inc. (“OnCore”) became a wholly owned subsidiary of Tekmira. As described in further detail below, Tekmira’s business strategy going forward intends to focus on discovering, developing and commercializing therapeutics targeting chronic hepatitis B infection, as well as continuing to advance our non-HBV programs as well.

Tekmira is headquartered in Vancouver, Canada, and it opened an office in Seattle, USA in May 2014. As a result of the merger with OnCore, we also have offices in Doylestown, Pennsylvania, USA.

Business Combination between Tekmira and OnCore

On March 4, 2015, Tekmira completed a business combination pursuant to which OnCore became a wholly-owned subsidiary of Tekmira. This combined company intends to focus on developing a curative regimen for hepatitis B virus (HBV) patients by combining multiple therapeutic approaches. The transaction was approved by 99.5% of votes cast by Tekmira shareholders voting at a Special Meeting held on Tuesday, March 3, 2015, and representing 51.2% of Tekmira’s common shareholders. In connection with the transaction, Tekmira issued 23,973,315 common shares to the shareholders of OnCore in exchange for their OnCore securities, and OnCore became a wholly-owned subsidiary of Tekmira.

The new company's management team includes Mark J. Murray, PhD, President and Chief Executive Officer; Patrick T. Higgins, Chief Operating Officer; Bruce Cousins, Chief Financial Officer; Michael J. Sofia, PhD, Chief Scientific Officer; and Michael J. Abrams, PhD, Chief Discovery Officer. William T. Symonds, PharmD, is the Chief Development Officer and will lead the clinical development of the portfolio.

Vivek Ramaswamy is the Chairman of the Board for Tekmira. The remaining Board members are Dr. Mark J. Murray, Mr. Herbert Conrad, Mr. Richard Henriques, Dr. Keith Manchester, Mr. Frank Karbe, and Dr. William Symonds.

The business combination involving Tekmira and OnCore brings together each of Tekmira’s and OnCore’s broad expertise in antiviral drug development, Tekmira’s clinic-ready HBV RNAi therapeutic and OnCore’s existing HBV programs to build a portfolio of compounds with a long term goal of eradicating HBV. We believe that, as a result of the merger, Tekmira will have a comprehensive HBV pipeline of drugs, and drug candidates, and be positioned to capitalise on the HBV global market opportunity. With eight unique mechanisms in development, our pipeline targets the three pillars we believe are necessary to deliver an HBV cure, including: (i) suppressing HBV viral replication, (ii) restoring host response by suppressing Hepatitis B surface antigen (HBsAg) or activating/stimulating the host immune system directed at HBV and (iii) eliminating covalently closed circular DNA (cccDNA). We believe that our chances for success in HBV are increased, and risk is mitigated, by having a portfolio of assets targeting these three strategies. Most importantly, we believe combination therapies are the key to HBV treatment and a potential cure. We believe that clinical development can be accelerated when multiple components of a combination therapy regimen are controlled by the same company, and therefore we have retained exclusive worldwide development and commercialization rights to all of our drug candidates and programs in HBV.

While we intend to focus our business strategy on HBV, we also believe that value resides in our other non-HBV programs and with our Lipid Nanoparticle (LNP) technology. We plan to determine what we believe are the best strategies for optimizing the value of the remaining assets. We also see significant value in the collaborations Tekmira has established to date, and plan to continue to work closely with and support our partners using Tekmira’s RNAi technology.

Voluntary Delisting from the Toronto Stock Exchange (TSX)

Our common shares were voluntarily delisted from the Toronto Stock Exchange ("TSX") as of Tuesday, March 3, 2015.

6

RNA Interference

In the last decade, RNAi has become one of the most important innovations in the field of drug discovery and development. In 2006 the scientists who discovered the mechanisms for RNAi were awarded the Nobel Prize in Physiology or Medicine.

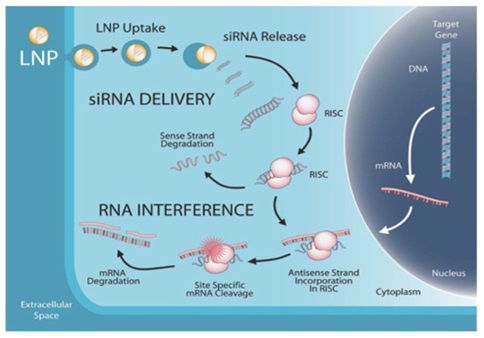

We believe that RNAi has the potential to generate a new class of safer therapeutics. RNAi therapeutics take advantage of the body’s own natural processes to eliminate specific gene-products or proteins in the cell. Synthetic RNAi trigger molecules are developed as drugs that specifically suppress the production of disease-associated proteins through the RNAi mechanism. RNAi trigger molecules are designed using the gene sequence coding for the target protein. RNAi -based drugs are typically small synthetic nucleic acid molecules. When RNAi triggers are introduced into the cell they are incorporated into an RNA-induced silencing complex (RISC), which interacts specifically with messenger RNA (mRNA) coding for the target protein. mRNA are cleaved in a sequence specific manner and then destroyed, preventing production of the target protein. Importantly, this process is catalytic and RISC associated RNAi triggers can remain stable inside the cell for weeks, destroying many more copies of the target mRNA and maintaining target protein suppression for extended periods of time.

Potential of RNAi Therapeutics

The development of RNAi drugs allows for a completely novel approach to treating disease, which is why RNAi is considered one of the most promising and rapidly advancing frontiers in drug discovery. While there are no RNAi therapeutics approved for commercial use, there are a number of RNAi products currently in human clinical trials. RNAi products are broadly applicable as they can eliminate the production of disease-causing proteins from cells, creating opportunities for therapeutic intervention that have not been achievable with conventional drugs. Development of RNAi therapeutic products is currently limited by the instability of the RNAi trigger molecules in the bloodstream and the inability of these molecules to access target cells or tissues following administration. Delivery technology is necessary to protect these drugs in the bloodstream to allow efficient delivery and cellular uptake by the target cells.

Tekmira’s Lipid Nanoparticle (LNP) Delivery Technology

Tekmira has developed a proprietary delivery platform called Lipid Nanoparticle or LNP. This platform has become the gold-standard in RNAi development, establishing Tekmira as a leader in this new area of innovative medicine.

Our proprietary LNP delivery technology allows for the successful encapsulation of RNAi trigger molecules in lipid nanoparticles (LNP) administered intravenously, which travel through the bloodstream to target tissues or disease sites. LNPs are designed to protect the triggers, and stay in the circulation long enough to accumulate at disease sites, such as the liver or cancerous tumors. LNPs are then taken up into the target cells by a process called endocytosis. Subsequent activation by the changing environment inside the cell causes the LNP to release the trigger molecules, which can then successfully mediate RNAi.

In preclinical studies, Tekmira’s LNP technology has demonstrated how it can overcome the limitations of RNAi drug delivery, enabling efficient and selective “gene silencing” or reduction of certain target proteins. We believe that Tekmira is well positioned to benefit from the need for effective delivery technology for RNAi therapeutics to reach specific disease sites. Using our LNP technology we, along with our partners, are advancing several RNAi therapeutics across a range of indications for serious conditions with limited treatment options.

7

Lipid Nanoparticle (LNP)-Enabled Delivery and Mechanism of RNA Interference

* RISC is an RNA-induced silencing complex that incorporates one strand of siRNA or microRNA

Today, our LNP technology represents the most widely adopted delivery technology in RNAi, which has enabled eight clinical trials and has been administered to more than 250 human subjects. Because LNP can enable a wide variety of nucleic acid triggers, including mRNA, we continue to see new product development and partnering opportunities based on our industry-leading delivery expertise.

In October 2013, we presented new preclinical data at the International mRNA Health Conference in Tubingen, Germany, demonstrating that mRNA when encapsulated and delivered using Tekmira’s LNP technology can be effectively delivered and expressed in the liver in tumors and other specific tissues of therapeutic interest.

Our Product Pipeline

HBV-Focused Pipeline

Hepatitis B virus (HBV) causes the most common serious liver infection in the world. The World Health Organization (WHO) estimates that 350 million people worldwide are chronically infected, and other estimates suggest this could include up to 1.4 million people in the United States. Individuals chronically infected with HBV are at an increased risk of developing significant liver disease, including cirrhosis, or permanent scarring of the liver, as well as liver failure and hepatocellular carcinoma (HCC) or liver cancer. According to the Hepatitis B Foundation, HBV is the cause of up to 80% of liver cancers. Individuals with liver cancer typically have a five-year survival rate of only 15%. The WHO estimates that more than 780,000 people die every year due to the consequences of hepatitis B virus disease.

Our extensive experience in antiviral drug development has been applied to our TKM-HBV program to develop an RNAi therapeutic for chronic hepatitis B infection. Small molecule nucleotide therapy has been the standard of care for chronic HBV infected patients. However, many of these patients continue to express a viral protein called HBV surface antigen (HBsAg). This protein causes inflammation in the liver leading to cirrhosis and, in some cases, HCC and death.

As a result of our merger whereby OnCore became a wholly owned subsidiary of Tekmira, our pipeline of assets has expanded beyond therapeutics being developed with RNAi technology, particularly with respect to HBV. In HBV, we now have what we believe is an industry-leading pipeline focused on finding a cure for chronic HBV infection. Our belief is that to achieve an HBV cure, a combination of products that affect the three main drivers of HBV persistence need to be utilized. Specifically, this means that to be successful, we believe we need to have products that address antiviral replication, immune reactivation and reduce the pool of cccDNA.

Once multiple compounds within the portfolio with sufficient anti-HBV activity have been identified, we intend, subject to discussions with regulatory authorities, to conduct a rolling Phase II clinical program. These studies will likely evaluate combinations of two or more drug candidates in small cohorts of patients with chronic HBV infection to identify active combinations and those that do not have sufficient antiviral activity. We expect to use these results to adaptively design additional treatment regimens for the next cohorts. We also plan to evaluate different treatment durations to determine the optimal duration for a finite duration therapy. We plan to continue this iterative process until we select combination therapy regimens and treatment durations to conduct Phase III clinical trials intended to ultimately support regulatory filings for marketing approval. A graphic summary of our HBV products is set forth below.

8

Note: The solid circles represent the mechanism that "directly" impacts the given persistence factor. The shaded circle shows "indirect" effects of a given mechanism.

We intend to continue to expand our HBV pipeline through internal development, acquisitions and in-licenses. We believe that a major engine for internal innovation is the collaboration entered into by OnCore, which is now a wholly owned subsidiary on Tekmira, with The Baruch S. Blumberg Institute, (“Blumberg”) one of the leading non-profit research institutes in the world focused on HBV. We believe that this collaboration will provide us with access to cutting-edge research in new target identification, assay development, mechanism of action studies and lead-finding efforts focused on hepatitis B virus. This relationship also provides us with access to research that we believe is equal to, or surpasses that of other biotechnology or pharmaceutical companies, and can add value to our current and future research and development efforts in HBV.

TKM-HBV is designed to address an unmet medical need and eliminate HBsAg expression in patients chronically infected with HBV. Reducing HBsAg is thought to be a key prerequisite to enable a patient’s immune system to raise an adequate antibody response against the virus. The ability of TKM-HBV to inhibit numerous viral elements in addition to HBsAg increases the likelihood of successfully controlling the viral infection.

TKM-HBV is being developed as a multi-component RNAi therapeutic that simultaneously targets three sites on the HBV genome. Targeting three distinct and highly conserved sites on the HBV genome is intended to facilitate potent knockdown of all viral mRNA transcripts and viral antigens across a broad range of HBV genotypes and reduce the risk of developing antiviral resistance. The goal is for TKM-HBV to be administered without prophylactic steroid treatment.

We presented results from our preclinical studies at the 10th Annual Meeting of the Oligonucleotide Therapeutics Society Meeting held in San Diego, California, on October 15, 2014. Among the results reported is the potent and rapid reduction in HBsAg demonstrated by TKM-HBV in several well-validated models. In these models, TKM-HBV treatment resulted in reductions in both intrahepatic and serum HBsAg, as well as reductions in HBV DNA, covalently closed circular DNA (cccDNA), Hepatitis B e antigen and Hepatitis B c antigen. A rapid 1 log reduction in serum HBsAg was achieved with a single 1 mg/kg dose of TKM-HBV in the humanized mouse model, which closely mimics chronic human hepatitis B infection. 1-2 log viral reductions from similar single-dose LNP treatments in two other true-infection animal models were also demonstrated.

Preclinical studies conducted on infected primary human hepatocytes showed that TKM-HBV had robust and consistent activity against different viral strains representing the major clinical genotypes A, B, C and D. Our data shows that inclusion of three RNAi triggers results in a more broadly effective knockdown of hepatitis B viral elements than a single trigger alone. The mode of action of TKM-HBV complements standard of care nucleoside/nucleotide (NUC) therapy, and lack of drug antagonism has been demonstrated with entecavir, lamivudine and tenofovir on infected primary human hepatocytes, making combination therapy a viable option.

Our data supports the utility of TKM-HBV as a potential new therapeutic option for treating patients with chronic HBV infection. In early 2015, we advanced two TKM-HBV product candidates into a Phase I trial. Both product candidates employ the same unique combination of three RNAi trigger molecules. However, they differ in their LNP composition. One formulation employs a third generation LNP, and the other employs a new, fourth generation LNP, which incorporates novel lipid chemistry and demonstrates improved potency. The multi-component RNAi therapeutic is expected to result in broad and effective inhibition of HBV.

9

The TKM-HBV Phase I clinical trial is a randomized, single-blind, placebo-controlled study, involving single ascending doses of TKM-HBV. The study will assess the safety, tolerability and pharmacokinetics of intravenous administration of two formulations of TKM-HBV in healthy adult subjects. For each formulation, there are five planned cohorts for a total of 20 subjects (40 in total for both formulations). Four subjects will be enrolled per cohort with three subjects receiving TKM-HBV, and one receiving placebo. We expect the results from the Phase I clinical trial in healthy human volunteers to determine which product formulation we will advance into chronically infected patients in a multi-dosing trial in the second half of 2015.

Following our recent merger with OnCore, our product development pipeline will now focus on discovery, acquisition or in-licensing and developing drug candidates that attack multiple targets of the HBV lifecycle, including the aggressive suppression of HBV replication, restoration of an adequate immune response and reducing the pool of cccDNA. Although the ultimate curative regimens for HBV are currently unknown, we have assembled a robust portfolio of drug development programs targeting multiple targets within the HBV life cycle, which we plan to evaluate to determine the best potential combination approaches for patients. These assets include the following:

Cyclophilin Inhibitor — OCB-030

Cyclophilins are proteins that have been shown to play a role in several biological processes, including viral infection. By inhibiting cyclophilin, we believe the ability of HBV to replicate can be impaired and the host immune response toward HBV may be enhanced. Through our OnCore subsidiary, we have licensed from NeuroVive Pharmaceutical AB, or “NeuroVive”, the exclusive rights to develop and commercialize cyclophilin inhibitor drug candidates, including OCB-030, for the treatment of hepatitis B. We are engaged in studies which we expect to be completed in order to file an IND, or equivalent, and initiate a study by year end 2015.

TLR9 Agonist (CYT-003)

Pharmaceutical activation of toll-like receptors (TLRs) is a novel and attractive approach for the treatment of chronic HBV because agonism of these receptors triggers innate immune responses and also stimulates adaptive immunity. It is hoped that immune stimulation by TLR agonists can overcome the multiple immunologic blocks that allows chronic HBV infection, including direct activation of the host’s innate antiviral response, hence overcoming the functional weakness in HBV-specific immune cell responses.

Licensed from Cytos Bioetchnology Ltd. (“Cytos”), CYT-003 is a biological carrier which is filled with the immunostimulatory oligonucleotide called G10. G10 is a toll-like receptor-9 (TLR-9) agonist. CYT-003 has been shown to directly activate B cells and stimulates human pDC to secrete Interferon alpha. CYT-003 also activates other antigen presenting cells indirectly and promotes the development of TH1 type cytokine response. This is thought to be potentially beneficial in promoting anti-HBV T cell immunity. CYT-003 has previously been utilised in human trials in other indications and therefore could move quickly into the clinic in HBV infected patients. Preclinical studies to demonstrate proof of concept are anticipated to be initiated in 2015.

Capsid Assembly Inhibitors

We are developing two capsid assembly inhibitors as oral therapeutics for the treatment of chronic HBV infection. By inhibiting assembly of the viral capsid, the ability of hepatitis B virus to replicate is impaired, which subsequently reduces the amount of new virus produced, and may have an effect on cccDNA. Through our OnCore subsidiary, we have acquired exclusive, worldwide rights to these drug candidates through an in-license from Blumberg and Drexel University, or (“Drexel”), and through OnCore’s recent acquisition of Enantigen Therapeutics, Inc., or Enantigen.

Surface Antigen Secretion Inhibitors

We are developing multiple small molecule orally bioavailable HBV surface antigen secretion inhibitors. By inhibiting the secretion of HBV surface antigen from infected cells, we expect that the immune response of patients treated with this therapy can reengage and thereby mount a more credible response to a hepatitis B virus infection. We acquired these drug candidates through OnCore’s recent acquisition of Enantigen.

STING Agonists

We are developing STING (stimulator of interferon genes) agonists. By activating interferon genes, we anticipate that the body can produce additional interferon alpha and beta, which have antiviral properties. Our development program, which is currently in the discovery research stage, is based on proof of concept data in mice generated by Blumberg which showed that STING agonists can elicit an antiviral response and inhibit HBV replication in mouse liver cells. In collaboration with Blumberg, our plan is to identify potent, orally active small molecule human STING agonists that possess the desired characteristics to progress into human clinical studies.

10

cccDNA Formation Inhibitors

We are developing multiple series of cccDNA formation inhibitors. The inhibition of cccDNA formation would reduce the amount of cccDNA in the infected liver cell and could ultimately eliminate the reservoir of HBV genomic material required for continued viral replication. Through our OnCore subsidiary, we acquired the exclusive, worldwide rights to this program through an in-license from Blumberg. This program is currently in lead optimization.

cccDNA Epigenetic Modifiers

In addition to cccDNA formation inhibitors, we are developing cccDNA epigenetic modifiers. By controlling cccDNA transcription, we anticipate that we may be able to inhibit the formation of new virus and subviral particles from cccDNA. This development program, which is currently in the discovery research stage, is based on proof of concept data generated by Blumberg using known inhibitors of enzymes involved in DNA information processing.

Non-HBV Assets – Clinical Programs and Pre-Clinical Programs (LNP enabled)

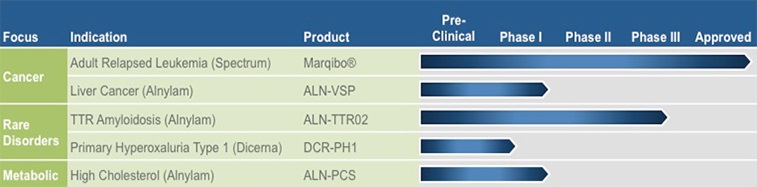

We believe there is significant value in our non-HBV assets and remain committed to maximizing this value. We intend to continue our clinical programs to the appropriate point in support of this objective. We also remain interested in advancing our ongoing metabolic and rare disease preclinical programs in an appropriate way toward this value maximization objective and in continuing to leverage our knowledge and expertise in LNP technology. A graphic summary of our non-HBV products is set forth below.

Our RNAi product pipeline is focused on anti-virals, oncology and metabolic product platforms, where there is a significant medical need and commercial opportunity. Our intention is to advance our RNAi product pipeline either ourselves or with partners, with a focus on realizing the value of these assets.

We believe that our LNP technology is a leading technology for formulating novel RNAi and mRNA products. The use of the technology in these fields has the potential to enable a broad new class of therapeutics. Our LNP technology currently represents the most widely adopted and advanced delivery technology in RNAi, having enabled eight clinical trials and with administration to over 250 patients to date. LNP and RNAi technology has the potential to generate a broad new class of therapeutics that take advantage of the body’s own natural processes to silence genes — or more specifically to eliminate specific gene-products, from the cell.

We are also committed to continuing to support the work of our product development partners and intellectual property licensees with the goal of realizing the short-term and long term financial potential of these partnerships.

Clinical Programs (LNP enabled)

TKM-PLK1

Our oncology product platform, TKM-PLK1, targets polo-like kinase 1 (PLK1), a protein involved in tumor cell proliferation and a validated oncology target. Inhibition of PLK1 expression prevents the tumor cell from completing cell division, resulting in cell cycle arrest and death of the cancer cell. Evidence that patients with elevated levels of PLK1 in their tumors exhibit poorer prognosis and survival rates has been documented in the medical literature. TKM-PLK1 is being evaluated in oncology indications in which there are limited or ineffective therapies available: Gastrointestinal Neuroendocrine Tumors (GI-NET), Adrenocortical Carcinoma (ACC) and Hepatocellular Carcinoma (HCC).

11

GI-NET and ACC

GI-NET is the gastrointestinal subset of neuroendocrine tumors. According to a paper by Yao et al. (2008), a historical analysis of the US SEER database reveals the incidence of neuroendocrine tumors has increased faster in the last few decades than any other neoplasm, with a growth rate of greater than 3% expected to continue in the near term. The prevalence of GI-NET in the US is estimated to be approximately 55,000 individuals. Prognosis for advanced or metastatic GI-NET, the target population for TKM-PLK1, is poor with 25-54% of patients surviving less than one year.

ACC is an ultra-rare form of cancer that develops in the adrenal gland, with data from the US National Cancer Institute estimating 500 patients in the US. Survival prognosis for these patients is poor. A large percentage of patients are not good surgical candidates and there is a lack of effective systemic therapies.

We presented updated Phase I TKM-PLK1 data at the 6th Annual NET Conference hosted by the North American Neuroendocrine Tumor Society (NA-NETS) in Charleston, South Carolina on October 4, 2013. This data set included a total of 36 patients in a population of advanced cancer patients with solid tumors. Doses ranged from 0.15 mg/kg to 0.90 mg/kg during the dose escalation portion of the trial, with the maximum tolerated dose (MTD) of 0.75 mg/kg. Serious adverse events (SAEs) were experienced by four subjects in this heavily pre-treated, advanced cancer patient population, with three of four subjects continuing on study. Forty percent (6 out of 15) of patients evaluable for response, treated at a dose equal to or greater than 0.6 mg/kg, showed clinical benefit. Three out of the four ACC patients (75%) treated with TKM-PLK1 achieved stable disease, including one patient who saw a 19.3% reduction in target tumor size after two cycles of treatment and is still on study receiving TKM-PLK1. Of the two GI-NET patients enrolled, both experienced clinical benefit: one patient had a partial response based on Response Evaluation Criteria in Solid Tumors (RECIST) criteria, and the other GI-NET patient achieved stable disease and showed a greater than 50% reduction in Chromogranin-A (CgA) levels, a key biomarker used to predict clinical outcome and tumor response.

Based on encouraging results from the dose escalation portion and expansion cohort from our Phase I TKM-PLK1 clinical trial, we expanded into a Phase I/II clinical trial with TKM-PLK1, which is specifically enrolling patients within two therapeutic indications: advanced GI-NET or ACC. This multi-center, single arm, open label study is designed to measure efficacy using RECIST criteria for GI-NET patients and ACC patients as well as evaluate the safety, tolerability and pharmacokinetics of TKM-PLK1. TKM-PLK1 is administered weekly with each four-week cycle consisting of three once-weekly doses followed by a rest week. In the Fall of 2014, we achieved our enrolment target of patients with advanced GI-NET or ACC tumors. These patients will continue treatment and be followed to determine if TKM-PLK1 produces a meaningful clinical benefit.

We provided an update on this Phase I/II clinical study in December 2014. To date, 55 patients, in both the Phase I and Phase I/II studies have been treated at doses of ≥ 0.6 mg/kg, which is considered to be in the efficacious dose range based on preclinical studies. Of these, 31 patients comprise the target population of GI-NET or ACC patients. Currently, nine patients (GI-NET and ACC) remain actively on treatment and data collection is ongoing.

While we are still awaiting maturation of data, we continue to see evidence of anti-tumor activity in some treated subjects, including one ACC patient with an almost complete resolution of their disease. We expect to report final data from these studies in the second half of 2015.

HCC

HCC is one of the most common cancers and one of the most deadly, with over 650,000 deaths each year worldwide according to the Globocan 2012 database. US incidence is estimated at 27,000 individuals with annual growth rates greater than 2%. HCC is an aggressive, hard-to-treat disease with one-year survival rates of less than 50% and five-year rates as low as 4% (National Cancer Institute). To date, Nexavar® (sorafenib) is the only agent approved to treat HCC with an improvement in overall survival of just two to three months.

In May 2014, we initiated another Phase I/II clinical trial with TKM-PLK1, enrolling patients with advanced HCC. Patient dosing has commenced and we have completed the first treatment in all of our subjects for the first HCC cohort. This Phase I/II clinical trial is a multi-center, single arm, open label dose escalation study designed to evaluate the safety, tolerability and pharmacokinetics of TKM-PLK1 as well as determine the maximum tolerated dose in patients with advanced HCC. It will also include a preliminary assessment of the anti-tumor activity of TKM-PLK1 in this patient population. It is expected that approximately 38 patients with advanced HCC tumors will be enrolled in this Phase I/II clinical trial.

TKM-Ebola

TKM-Ebola, an anti-Ebola RNAi therapeutic, is being developed under a $140 million contract, signed in July 2010, with the U.S. Department of Defense (DoD) Joint Project Manager Medical Countermeasure Systems BioDefense Therapeutics (JPM-MCS-BDTX). Preclinical studies published in the medical journal The Lancet in 2010 demonstrated that when RNAi triggers targeting the Ebola virus and delivered by our LNP technology were used to treat previously infected non-human primates, the result was 100 percent protection from an otherwise lethal dose of Zaire Ebola virus (Geisbert et al., The Lancet, Vol. 375, May 29, 2010).

12

In May 2013, our collaboration with the JPM-MCS-BDTX was modified and expanded to include advances in LNP formulation technology. The contract modification increased the first stage of funding from $34.7 million to $41.7 million. In April 2014, we signed a second contract modification to increase this funding by $2.1 million to a total of $43.8 million to compensate Tekmira for unrecovered costs that occurred in 2012 and to provide additional funding should it be required.

TKM-Ebola is being developed under specific U.S. Food and Drug Administration (FDA) regulatory guidelines called the “Animal Rule”. This allows, in circumstances where it is unethical or not feasible to conduct human efficacy studies, marketing approval to be granted based on adequate and well-controlled animal studies when the results of those studies establish that the drug is reasonably likely to produce clinical benefit in humans. Demonstration of the product’s safety in humans is still required.

We were granted Fast Track designation from the FDA for the development of TKM-Ebola in March 2014. The FDA’s Fast Track is a process designed to facilitate the development and expedite the review of drugs in order to get important new therapies to the patient earlier.

In May 2014, we successfully completed the single ascending dose portion of the TKM-Ebola Phase I clinical trial in healthy human volunteers. Results demonstrated that administration of the TKM-Ebola therapeutic, in the absence of any steroid containing pre-medication, was well-tolerated at a dose level of 0.3 mg/kg, determined to be the maximum tolerated dose.

In July 2014, we received notice from the FDA placing the TKM-Ebola Investigational New Drug application (IND) on clinical hold until additional information is supplied, and the multiple ascending dose portion of the trial protocol is modified to ensure the safety of healthy volunteers. The clinical hold was subsequently modified to a partial clinical hold to permit the administration of TKM-Ebola to patients with a suspected or confirmed Ebola virus infection. Under the FDA’s expanded access program, several patients with a confirmed or suspected Ebola virus infection were treated with TKM-Ebola. Data is being collected and will be provided to the FDA under our IND. Health Canada also established a similar framework for the potential use of TKM-Ebola in the same group of patients.

With the emergency use of our TKM-Ebola product under expanded access protocols and recent developments, such as the production of a new product candidate for clinical trials in West Africa, the clinical development pathways for our Ebola products are evolving. We may not be able to resolve the partial clinical hold of the healthy volunteer, multiple ascending dose portion of our Phase 1 trial of TKM-Ebola.

In December 2014, the US Congress amended the Rare and Tropical Disease list to include Ebola as a candidate for a potential Accelerated Review Voucher.

TKM-Ebola-Guinea, an Anti-Ebola RNAi Therapeutic Targeting Ebola-Guinea Strain of Ebola Virus

In September 2014, we joined an international consortium led by the International Severe Acute Respiratory and Emerging Infection Consortium (ISARIC) at the University of Oxford, UK, to potentially provide an RNAi based investigational therapeutic for expedited clinical studies in West Africa.

In October 2014, the genomic sequence of the Ebola-Guinea strain, which is the virus responsible for the recent outbreak in West Africa, was determined from several viral isolates and published in the New England Journal of Medicine (Baize S., et al. Emergence of Zaire Ebola Virus Disease in Guinea; New England Journal of Medicine, October 9, 2014 Vol. 371 No. 15). We rapidly developed a modified RNAi therapeutic to specifically target Ebola-Guinea. The new product, TKM-Ebola-Guinea, is designed to match the genomic sequence exactly, with two RNAi molecule triggers. Results of preclinical studies with TKM-Ebola-Guinea demonstrated efficacy comparable to those obtained with TKM-Ebola, which demonstrated up to 100% protection from an otherwise lethal dose of the virus.

In December 2014, we entered into a Manufacturing and Clinical Trial Agreement with the University of Oxford to provide the new TKM-Ebola-Guinea therapeutic product for clinical studies in West Africa. ISARIC can conduct clinical studies of TKM-Ebola-Guinea in Ebola virus infected patients, with funding provided by the Wellcome Trust. GMP manufacture of TKM-Ebola-Guinea is now complete and 100 treatment courses are available for the study. A Phase II single arm trial called RAPIDE (Rapid Assessment of Potential Interventions & Drugs for Ebola), was initiated in March 2015 in Sierra Leone. The study is open-label with a concurrent observational study in Ebola virus disease, and results are expected in the second half of 2015.

The U.S. Department of Defense JPM-MCS-BDTX has also exercised an option, valued at $7.0 million, in our current contract to manufacture TKM-Ebola-Guinea. We have been awarded the option for scale-up and GMP manufacture of the product for approximately 500 treatment courses.

Non-HBV Preclinical Programs (LNP enabled)

We are currently evaluating several additional preclinical candidates with potential in diverse therapeutic areas. Given the extremely high efficiency of delivery for third and fourth generation liver-centric LNP formulations, we are focused on rare diseases where the molecular target is found in the liver, early clinical proof-of-concept can be achieved and development opportunities may be accelerated. Our research team intends to continue to generate preclinical data to support the advancement of the most promising of these targets.

13

TKM-Marburg

Like Ebola, Marburg is a member of the filovirus family of hemorrhagic fever viruses. Natural outbreaks with the Marburg-Angola strain have resulted in mortality in approximately 90% of infected individuals. There are currently no approved therapeutics available for the treatment of Marburg infection.

In 2010, along with the University of Texas Medical Branch (UTMB), we were awarded a National Institutes of Health (NIH) grant to support research to develop RNAi therapeutics to treat Ebola and Marburg hemorrhagic fever viral infections. In November 2013, we announced data showing 100% survival in non-human primates infected with the Angola strain of the Marburg virus in two separate studies. These results build upon a study published earlier in the Journal of Infectious Disease showing 100% protection in guinea pig models of infection with Angola, Ci67 and Ravn strains of the Marburg virus using a broad spectrum RNAi therapeutic enabled by Tekmira’s LNP.

In February 2014, along with UTMB, and other collaborators, we were awarded additional funding from the NIH in support of this research. Data was published demonstrating complete protection of non-human primates against lethal Marburg-Angola strain, (Science Translational Medicine. Thi EP., et al. Marburg virus infection in nonhuman primates: Therapeutic treatment by lipid-encapsulated siRNA. 2014 Aug 20;6 (250))

Non-HBV Preclinical Programs (LNP enabled)

We are currently evaluating several additional preclinical candidates with potential in diverse therapeutic areas. Given the extremely high efficiency of delivery for third and fourth generation liver-centric LNP formulations, we are focused on rare diseases where the molecular target is found in the liver, early clinical proof-of-concept can be achieved and development opportunities may be accelerated. Our research team intends to continue to generate preclinical data to support the advancement of the most promising of these targets.

TKM-HTG

Our metabolic product platform, TKM-HTG, aims to achieve rapid and sustained reductions of triglycerides to address the limitations of existing Hypertriglyceridemia (HTG) treatments. Hypertriglyceridemia is a type of dyslipidemia where there are high blood levels of triglycerides. Patients with severe HTG, (classified as triglyceride levels greater than 1000 mg/dL) are at risk of acute pancreatitis as well as the risk of cardiovascular disease. Approximately one million adults in the US and 18 million worldwide suffer from severe HTG. (NHANES 2003-2004 data).

Another patient group affected by HTG are those with Familial Chylomicronemia Syndrome (FCS), which is a very rare hereditary condition affecting an estimated 1:1,000,000 people (www.fcs.raredr.com). Additionally, 35% of patients with Type 2 Diabetes (T2D) suffer from mixed hyperlipidemia which is a combination of elevated cholesterol and high triglycerides. With underlying T2D, these patients are at considerable risk from cardiovascular disease.

TKM-HTG is being developed as a multi-component RNAi therapeutic that simultaneously targets a combination of genes expressed in the liver, which are known to play a significant role in triglyceride metabolism. High triglyceride levels are medically linked to increased risk of cardiovascular disease, fatty liver disease, insulin resistance and pancreatitis.

We anticipate filing an investigational new drug application, or equivalent document, in the second half of 2015.

TKM-ALDH

TKM-ALDH is designed to knockdown or silence aldehyde dehydrogenase (ALDH) to induce long term acute sensitivity to ethanol, for use in severe alcohol use disorder. Aldehyde dehydrogenase is a key enzyme in ethanol metabolism. Inhibition of ALDH activity, through the silencing of ALDH, results in the build-up of acetaldehyde leading to adverse physiological effects. Human proof of concept for ALDH inhibition already exists in the form of the approved drug disulfiram. However, disulfiram’s efficacy is compromised by poor compliance because it has to be taken daily. We believe TKM-ALDH will induce prolonged ethanol sensitivity that will enable it to overcome the compliance limitations associated with daily dosing. We are exploring partnering or external funding opportunities to maximize the value of this asset.

Ongoing Advancements in LNP Technology

We plan to continue to develop our proprietary LNP delivery technology and receive clinical validation from LNP-based products currently in clinical trials. The most advanced LNP-enabled therapeutic, which is being developed by Alnylam, has entered a Phase III clinical trial. We believe our LNP technology can remain an important cornerstone of our business development activities moving forward. We recently announced the latest (fourth) generation of the platform which comprises a rational re-design of the lipid architecture, as well as formulation and process advances. These attributes can be utilized in programs entering the clinic in 2015 and are expected to yield significant increases in potency and therapeutic index.

14

Because LNP can enable a wide variety of nucleic acid triggers, including mRNA, we continue to see new product development and partnering opportunities based on what we believe is our industry-leading delivery expertise. In February 2014, we presented new preclinical data at the AsiaTIDES scientific symposium in Tokyo, Japan demonstrating that mRNA can be effectively delivered to target proteins expressed.

Partner-Based Programs

Patisiran (ALN-TTR02)

Patisiran, or ALN-TTR02, which is being developed by Alnylam, represents the most clinically advanced application of our proprietary LNP delivery technology. In November 2013, Alnylam presented positive results from its Phase II clinical trial with patisiran (ALN-TTR02), an RNAi therapeutic targeting transthyretin (TTR) for the treatment of TTR-mediated amyloidosis (ATTR). In December 2013, Alnylam announced the initiation of the APOLLO Phase III trial of patisiran to evaluate efficacy and safety of patisiran in ATTR patients with Familial Amyloidotic Polyneuropathy (FAP). In April 2014, Alnylam presented positive new data from its Phase II clinical trial with patisiran. These results provide additional support for Alnylam's Phase III APOLLO trial. In October 2014, Alnylam reported positive clinical data for the ongoing patisiran Phase II Open Label Extension (OLE) study in patients with FAP. The results demonstrated sustained knockdown of serum TTR of up to 90% and a favorable tolerability profile out to one year of treatment.

Alnylam has also pursued two other LNP-based products through clinical development: ALN-VSP (liver cancer), and ALN-PCS02 (hypercholesterolemia). Alnylam will pay Tekmira low single digit royalties based on commercial sales of Alnylam’s LNP-enabled products. More information about our licensing agreement with Alnylam can be found under the “Strategic Alliances, Licensing Agreements, and Research Collaborations” section of this report.

Marqibo®

Marqibo®, originally developed by Tekmira, is a novel, sphingomyelin/cholesterol liposome-encapsulated formulation of the FDA-approved anticancer drug vincristine. Marqibo’s approved indication is for the treatment of adult patients with Philadelphia chromosome-negative acute lymphoblastic leukemia (Ph-ALL) in second or greater relapse or whose disease has progressed following two or more lines of anti-leukemia therapy. Our licensee, Spectrum Pharmaceuticals, Inc. (“Spectrum”), launched Marqibo through its existing hematology sales force in the United States. We are entitled to mid-single digit royalty payments based on Marqibo’s commercial sales. Spectrum has ongoing trials evaluating Marqibo in three additional indications, which are: first line use in patients with Philadelphia Negative Acute Lymphoblastic Leukemia (Ph-ALL), Pediatric ALL and Non-Hodgkin’s lymphoma. More information about our licensing agreement with Spectrum can be found under the “Strategic Alliances, Licensing Agreements, and Research Collaborations” section of this report.

DCR-PH1

In November 2014, we signed a licensing and collaboration agreement with Dicerna Pharmaceuticals, Inc. to utilize our LNP delivery technology exclusively in Dicerna's primary hyperoxaluria type 1 (PH1) development program. Dicerna will use our third generation LNP technology for delivery of DCR-PH1, Dicerna's product incorporating its Dicer substrate RNA (DsiRNA) molecule, for the treatment of PH1, a rare, inherited liver disorder that often results in kidney failure and for which there are no approved therapies. More information about our licensing agreement with Dicerna can be found under the “Strategic Alliances, Licensing Agreements, and Research Collaborations” section of this report.

Strategic Alliances, Licensing Agreements, and Research Collaborations

Since inception, we have fostered collaborations and technology licensing relationships with leading companies in the RNAi field, including Alnylam Pharmaceuticals, Inc., Bristol-Myers Squibb Company, Merck & Co. Inc., the U.S. Department of Defense’s BioDefense Therapeutics’ Office, Monsanto, Dicerna Pharmaceuticals Inc., and other undisclosed pharmaceutical and biotechnology companies.

15

We have certain rights under the RNAi intellectual property of Alnylam Pharmaceuticals, Inc. to develop 13 RNAi therapeutic products. In addition, we have a broad non-exclusive license to use Unlocked Nucleobase Analogs (UNAs) from Arcturus Therapeutics, Inc. (“Arcturus”) for the development of RNAi therapeutic products directed to any target in any therapeutic indication.

Alnylam Pharmaceuticals, Inc. (“Alnylam”) and Acuitas Therapeutics Inc. (“Acuitas”)

In November 2012, we, Alnylam, and AlCana Technologies, Inc. (now Acuitas Therapeutics Inc.) entered into an agreement to settle all litigation and to restructure the existing contractual relationship, replacing all earlier licensing, cross-licensing, collaboration, and manufacturing agreements. Consistent with the terms outlined in the 2012 settlement agreement, in December 2013, we finalized and entered a cross-license agreement with Acuitas. The terms provide Acuitas with access to certain of our earlier Intellectual Property (IP) generated prior to April 2010, and provide us with certain access to their technology and licenses in the RNAi field, along with a percentage of each milestone, and royalty payment with respect to certain products. In addition, Acuitas has agreed that it will not compete in the RNAi field for a period of five years.

As a result of the settlement and 2012 cross-license agreement, we received a total of $65 million in cash payments from Alnylam in November 2012. This included $30 million associated with the termination of the manufacturing agreement and $35 million associated with the termination of the previous Alnylam-Inex and Alnylam-Protiva license agreements, as well as a reduction of the milestone and royalty schedules associated with Alnylam’s ALN-VSP, ALN-PCS, and ALN-TTR programs. Of the $65 million received from Alnylam, $18.7 million was subsequently paid by us to our lead legal counsel, in satisfaction of the contingent obligation owed to that counsel. In addition, Alnylam transferred all agreed upon patents and patent applications related to LNP technology for the systemic delivery of RNAi therapeutic products, including the MC3 lipid family, which is used in Alnylam’s TTR-mediated amyloidosis treatment ALN-TTR02, to Tekmira. As a result, we own and control prosecution of this IP portfolio. We are the only company able to sublicense LNP intellectual property in future platform-type relationships. Alnylam has a license to use our IP to develop and commercialize products and may only grant access to our LNP technology to its partners if the partner is part of a product sublicense. Alnylam’s license rights are limited to patents that we filed, or that claim priority to a patent that was filed, before April 15, 2010. Alnylam does not have rights to our patents filed on or after April 15, 2010 unless they claim priority to a patent filed before that date. Alnylam will pay us low single digit royalties based on commercial sales of Alnylam’s LNP-enabled products using our technology, including ALN-TTR02 (patisiran), ALN-VSP, and ALN-PCS02.

The 2012 cross-license agreement with Alnylam also grants us IP rights to develop our own proprietary RNAi therapeutics. Alnylam has granted us a worldwide license for the discovery, development and commercialization of RNAi products directed to 13 gene targets – three exclusive and ten non-exclusive licenses – provided that they have not been committed by Alnylam to a third party, or are otherwise unavailable as a result of the exercise of a right of first refusal held by a third party, or are part of an ongoing or planned development program of Alnylam. Licenses for five of the 10 non-exclusive targets – ApoB, PLK1, Ebola, WEE1, and CSN5 – have already been granted, along with an additional license for ALDH2, which has been granted on an exclusive basis. In consideration for this license, we have agreed to pay single-digit royalties to Alnylam on product sales and have milestone obligations of up to $8.5 million on the non-exclusive licenses (with the exception of TKM-Ebola, which has no milestone obligations). Alnylam no longer has “opt-in” rights to our lead oncology product, TKM-PLK1, so we now hold all development and commercialization rights related TKM-PLK1. We will have no milestone obligations on the three exclusive licenses.

In December 2013, we received a $5.0 million milestone from Alnylam, triggered by the initiation of the APOLLO Phase III trial of patisiran. We have entered an arbitration proceeding with Alnylam, as provided for under our licensing agreement, to resolve a matter related to a disputed $5.0 million milestone payment payable to us by Alnylam for its ALN-VSP product. We have not recorded any revenue in respect of this milestone.

Merck & Co., Inc. ("Merck") and Alnylam license agreement

As a result of the business collaboration with Protiva in 2008, we acquired a non-exclusive royalty-bearing worldwide license agreement with Merck. Under the license, Merck will pay up to $17.0 million in milestones for each product they develop covered by Protiva’s IP, except for the first product for which Merck will pay up to $15.0 million in milestones, and will pay royalties on product sales. Merck’s license rights are limited to patents that we filed, or that claim priority to a patent that was filed, before October 9, 2008. Merck does not have rights to our patents filed after October 9, 2008 unless they claim priority to a patent filed before that date. Merck has also granted a license to us to certain of its patents. On March 6, 2014, Alnylam announced that they acquired all assets and licenses from Merck, which included our license agreement.

Dicerna Pharmaceuticals, Inc. (“Dicerna”)

In November 2014, Tekmira signed a licensing agreement and a development and supply agreement with Dicerna to license Tekmira's LNP delivery technology for exclusive use in Dicerna's primary hyperoxaluria type 1 (PH1) development program. Dicerna will use Tekmira's third generation LNP technology for delivery of DCR-PH1, Dicerna's product incorporating its Dicer substrate RNA (DsiRNA) molecule, for the treatment of PH1, a rare, inherited liver disorder that often results in kidney failure and for which there are no approved therapies. Under the agreements, Dicerna paid Tekmira $2.5 million upfront and will potentially make payments of $22 million in aggregate development milestones, plus a mid-single-digit royalty on future PH1 sales. This partnership also includes a supply agreement under which we will provide clinical drug supply and regulatory support for the rapid advancement of this product candidate.

16

Monsanto Company (“Monsanto”)

In January 2014, we signed an Option Agreement and a Service Agreement with Monsanto, pursuant to which Monsanto may obtain a license to use our proprietary delivery technology. The transaction supports the application of our proprietary delivery technology and related IP for use in agriculture. The potential value of the transaction could reach $86.2 million following the successful completion of milestones. In January 2014, we received $14.5 million of the $17.5 million in anticipated near term payments. We received additional payments of $1.5 M each in June 2014 and October 2014 following achievement of specific program objectives.

Spectrum Pharmaceuticals, Inc. (“Spectrum”)

In July 2013, Talon Therapeutics Inc. (formerly Hana Biosciences, Inc.) was acquired by Spectrum. Under a legacy license agreement, Spectrum has an exclusive license to three targeted chemotherapy products originally developed by us. Marqibo® (optisomal vincristine), Alocrest® (optisomal vinorelbine) and Brakiva® (optisomal topotecan). Spectrum will pay us milestones and single-digit royalties and is responsible for all future development and expenses.

We are eligible to receive milestone payments from Spectrum up to $18.0 million upon achievement of further development and regulatory milestones, as well as single-digit royalties based on product sales. If Spectrum sublicenses any of the product candidates, we are eligible to receive a percentage of any upfront fees or milestone payments received by Spectrum. On September 18, 2014, Spectrum announced that they have sublicensed rights to sell Marqibo in the Greater China region to CASI Pharmaceuticals, Inc. (“CASI”). CASI issued a promissory note for $1.5 million as up-front consideration for the sublicense. The promissory note is payable on March 17, 2016 at which time Spectrum will pay a portion to us. Depending on the royalty rates Spectrum receives from its sub-licensees, our royalty rate may be lower on product sales by the sub-licensees. The royalty rate will be reduced to low single digits if there is generic competition.

Marqibo is a novel, sphingomyelin/cholesterol liposome-encapsulated formulation of the FDA-approved anticancer drug vincristine originally developed by Tekmira. In September 2013, we announced that our licensee, Spectrum had launched Marqibo through its existing hematology sales force in the United States. Since then commercial sales have occurred. We are entitled to mid-single digit royalty payments based on Marqibo’s commercial sales.

Marina Biotech, Inc. (“Marina”) /Arcturus Therapeutics, Inc. (“Arcturus”)

In November 2012, we disclosed that we had obtained a worldwide, non-exclusive license to a novel RNAi trigger technology called Unlocked Nucleobase Analog (UNA) from Marina for the development of RNAi therapeutics. UNAs can be incorporated into RNAi drugs and have the potential to improve them by increasing their stability and reducing off-target effects. In August 2013, Marina assigned its UNA technology to Arcturus and the UNA license agreement between Tekmira and Marina was assigned to Arcturus. The terms of the license are otherwise unchanged.

To date, we have paid Marina $0.5 million in license fees and there are milestones of up to $3.2 million plus royalties for each product that we develop using UNA technology licensed from Marina. We announced on January 21, 2015, that we had initiated a Phase I clinical trial with TKM-HBV. As TKM-HBV utilizes UNA technology in-licensed from Arcturus, the initiation of the trial triggered a single milestone payment of $250,000 payable by us to Arcturus.

U.S. National Institutes of Health (“NIH”)

In October 2010, we announced that together with collaborators at The University of Texas Medical Branch (UTMB), we were awarded a new NIH grant to support research to develop RNAi therapeutics to treat Ebola and Marburg hemorrhagic fever viral infections using our LNP delivery technology. The grant, worth $2.4 million, is supporting work at Tekmira and at UTMB. In February 2014, we along with UTMB, and other collaborators, were awarded additional funding from the NIH in support of this research. Under this grant, we will receive $3.4 million over a period of five years.

Bristol-Myers Squibb Company (“BMS”)

In May 2010, we announced a research collaboration with BMS. Under this agreement, BMS conducted preclinical work to validate the function of certain genes and shared the data with us to potentially develop RNAi therapeutic drugs against therapeutic targets of interest. We formulated the required RNAi trigger molecules enabled by our LNP technology to silence target genes of interest. BMS paid us $3.0 million concurrent with the signing of the agreement. We provided a predetermined number of LNP batches over the four-year agreement. In May 2011, we announced a further expansion of the collaboration to include broader applications of our LNP technology and additional target validation work. In May 2014, the collaboration expired and both parties’ obligations ended. Recognition of revenue from agreements with BMS is covered in the Revenue section of this MD&A.

17

Halo-Bio RNAi Therapeutics, Inc. (“Halo-Bio”)

In August 2011, we entered into a license and collaboration agreement with Halo-Bio. Under the agreement, Halo-Bio granted to us an exclusive license to its multivalent ribonucleic acid MV-RNA technology. The agreement was amended on August 8, 2012, to adjust future license fees and other contingent payments. To date, we have recorded $0.5 million in fees under our license from Halo-Bio. We terminated the agreement with Halo-Bio on July 31, 2013. There are no further payments due or contingently payable to Halo-Bio.

Aradigm Corporation (“Aradigm”)

In December 2004, we entered into a licensing agreement with Aradigm under which Aradigm exclusively licensed certain of our liposomal intellectual property for the pulmonary delivery of Ciprofloxacin. As amended, this agreement calls for milestone payments totalling $4.5 and $4.75 million, respectively, for the first two disease indications pursued by Aradigm using our technology, and for low- to mid-single-digit royalties on sales revenue from products using our technology. We terminated the Aradigm license agreement in May 2013.

University of British Columbia (“UBC”)

Certain early work on lipid nanoparticle delivery systems and related inventions was undertaken at the University of British Columbia (UBC). These inventions are licensed to us by UBC under a license agreement, initially entered in 1998 and as amended in 2001, 2006 and 2007. We have granted sublicenses under the UBC license to Alnylam as well as to Talon. Alnylam has in turn sublicensed back to us under the licensed UBC patents for discovery, development and commercialization of RNAi products. In mid-2009, we and our subsidiary Protiva entered into a supplemental agreement with UBC, Alnylam and Acuitas, in relation to a separate research collaboration to be conducted among UBC, Alnylam and Acuitas to which we have license rights. The settlement agreement signed in late 2012 to resolve the litigation among Alnylam, Acuitas, Tekmira and Protiva provided for the effective termination of all obligations under such supplemental agreement as between and among all litigants.

On November 10, 2014, the University of British Columbia filed a demand for arbitration against Tekmira Pharmaceuticals Corp., BCICAC File No.: DCA-1623. We received UBC’s Statement of Claims on January 16, 2015. In its Statement of Claims, UBC alleges that it is entitled to $3.5 million in allegedly unpaid royalties based on publicly available information, and an unspecified amount based on non-public information. UBC also seeks interest and costs, including legal fees. Tekmira disputes UBC’s allegation. No dates have been scheduled for this arbitration.

Newly acquired assets as a result of our merger with OnCore

In addition to the newly acquired product candidates discussed above, our merger with OnCore resulted in the acquisition of the following:

Cytos Biotechnology Ltd (“Cytos”)

On December 30, 2014, OnCore entered into an exclusive, worldwide, sub-licensable (subject to certain restrictions with respect to licensed viral infections other than hepatitis) license to six different series of compounds. The licensed compounds are Qbeta-derived virus-like particles that encapsulate TLR9, TLR7 or RIG-I agonists and may or may not be conjugated with antigens from hepatitis virus or other licensed viruses. We have an option to expand this license to include additional viral infections other than influenza and Cytos will retain all rights for influenza, all non-viral infections, and all viral infections (other than hepatitis) for which we have not exercised an option.

In partial consideration for this license, upon closing of the Cytos Agreement we will be obligated to pay Cytos up to a total of $67 million for each of the six licensed compound series upon the achievement of specified development and regulatory milestones for hepatitis; and each additional licensed viral infection, up to a total of $110 million upon the achievement of specified sales performance milestones; and tiered royalty payments in the high-single to low-double digits, based upon the proportionate net sales of licensed products in any commercialized combination.

The Baruch S. Blumberg Institute (“Blumberg”) and Drexel University (“Drexel”)