Attached files

| file | filename |

|---|---|

| 8-K - 8-K - ESSA Bancorp, Inc. | d884001d8k.htm |

| Exhibit 99.1

|

ESSA Bancorp, Inc.

2015 Annual Meeting

|

|

Forward Looking Statements

Certain statements contained herein are “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Such forward-looking statements may be identified by reference to a future period or periods, or by the use of forward-looking terminology, such as “may”, “will”, “believe”, “expect”, “estimate”, “anticipate”, “continue”, or similar terms or variations on those terms, or the negative of those terms. Forward-looking statements are subject to numerous risks and uncertainties, including, but not limited to, those related to the economic environment, particularly in the market areas in which ESSA Bancorp, Inc. (the “Company”) operates, competitive products and pricing, fiscal and monetary policies of the U.S. Government, changes in government regulations affecting financial institutions, including regulatory fees and capital requirements, changes in prevailing interest rates, acquisitions and the integration of acquired businesses, credit risk management, asset-liability management, the financial and securities markets and the availability of and costs associated with sources of liquidity. The Company wishes to caution readers not to place undue reliance on any such forward-looking statements, which speak only as of the date made. The Company wishes to advise readers that the factors listed above could affect the company’s financial performance and could cause the Company’s actual results for future periods to differ materially from any opinions or statements expressed with respect to future periods in any current statements. The Company does not undertake and specifically declines any obligation to publicly release the result of any revisions which may be made to any forward-looking statements to reflect events or circumstances after the date of such statements or to reflect the occurrence of anticipated or unanticipated event.

|

|

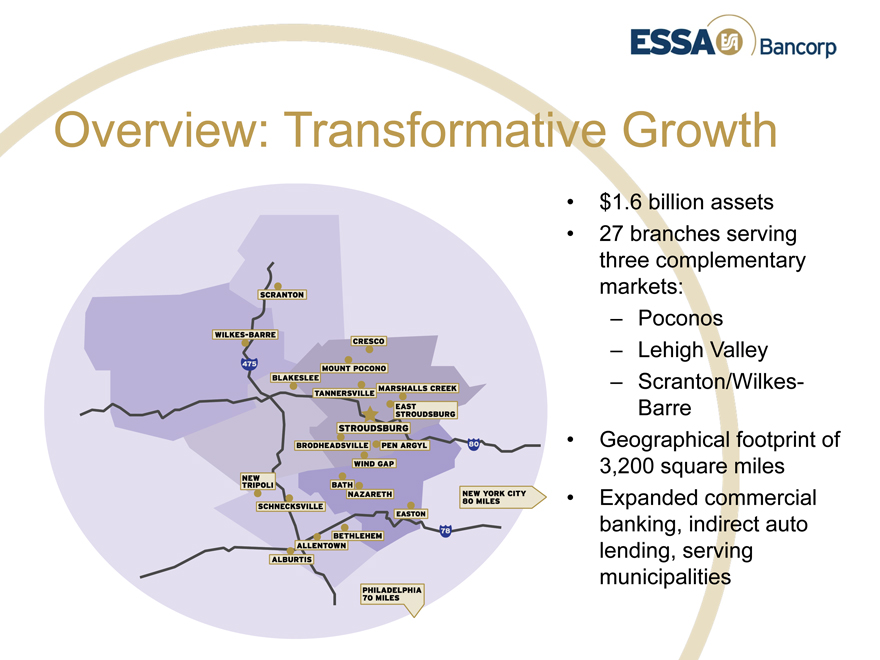

Overview: Transformative Growth

$1.6 billion assets

27 branches serving three complementary markets:

– Poconos

– Lehigh Valley

– Scranton/Wilkes-Barre

Geographical footprint of 3,200 square miles

Expanded commercial banking, indirect auto lending, serving municipalities

|

|

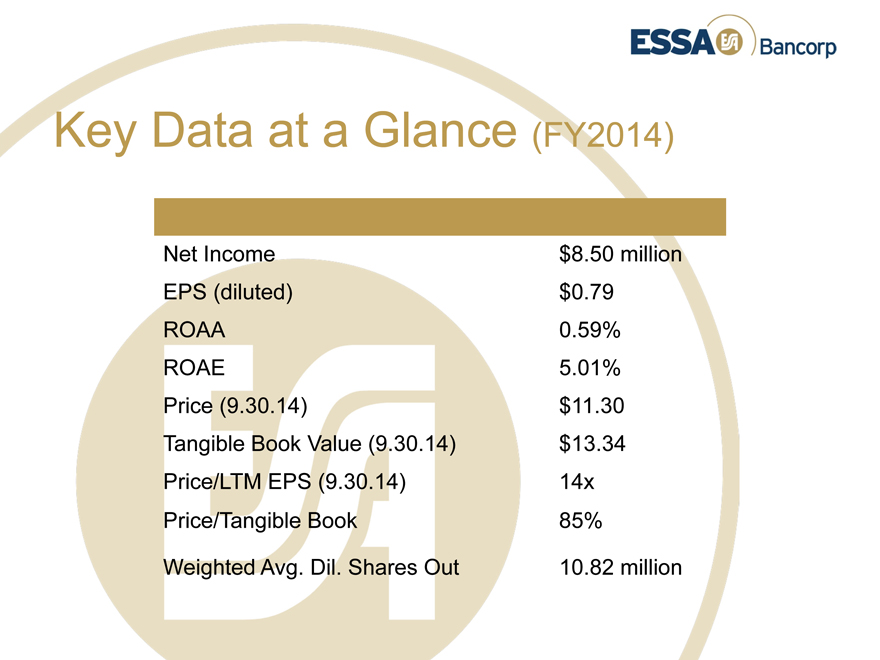

Key Data at a Glance (FY2014)

Net Income $8.50 million EPS (diluted) $0.79 ROAA 0.59% ROAE 5.01% Price (9.30.14) $11.30 Tangible Book Value (9.30.14) $13.34 Price/LTM EPS (9.30.14) 14x Price/Tangible Book 85%

Weighted Avg. Dil. Shares Out 10.82 million

|

|

FY2014: Growth Drives Financials

Net income of $8.5 million, second-highest in ESSA history

Company record EPS of $0.79

Net interest income up year-over-year, and up 13% in fourth quarter 2014 compared with Q4 2013

Added $100.5 million of indirect auto loans and $62.5 million of commercial loans year-over-year

Total deposits increased 8.92% to $1.13 billion, including non-interest bearing checking accounts increasing 19.1%, reflecting new accounts added as a result of the Franklin acquisition

|

|

FY2014: Building Franchise Value

Closed, integrated acquisition of Franklin Security Bancorp

– Established a presence in the Wilkes-Barre & Scranton market

– Added $217.5 million in total assets, $152.2 million in loans, and $162.2 million in deposits

Acquired from another bank the loans and deposits of two branches, and retained one physical facility in Monroe County

Consolidated two ESSA branches into new facility for improved efficiency

Tangible Book value rose to $13.34 per share, up from $12.99 a year ago

Stockholders’ equity of $167.3 million

|

|

Growing ESSA Bancorp

|

|

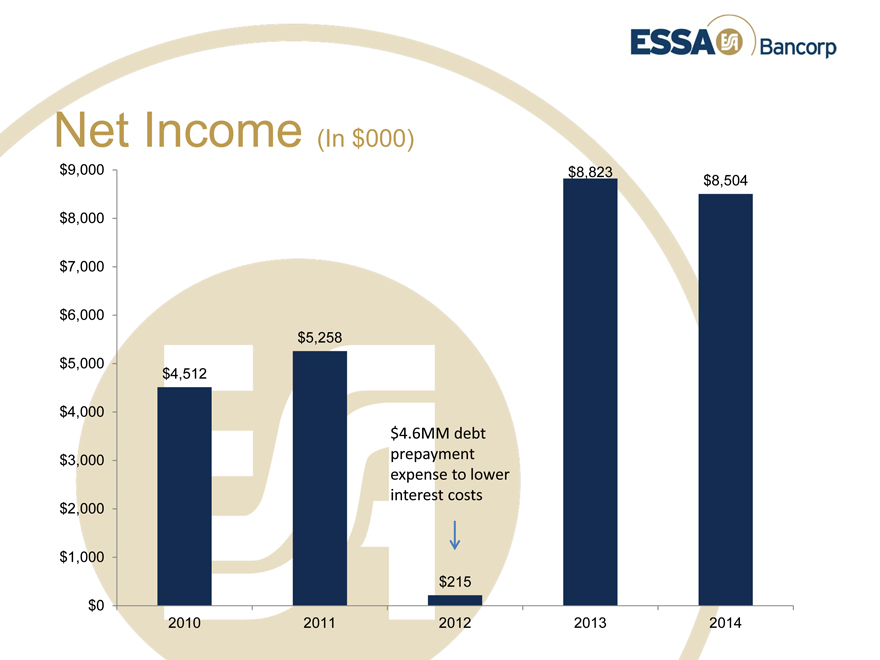

Net Income (In $000)

$9,000 $8,823 $8,504

$8,000

$7,000

$6,000 $5,258 $5,000 $4,512

$4,000

$4.6MM debt $3,000 prepayment expense to lower $2,000 interest costs

$1,000 $215 $0

2010 2011 2012 2013 2014

|

|

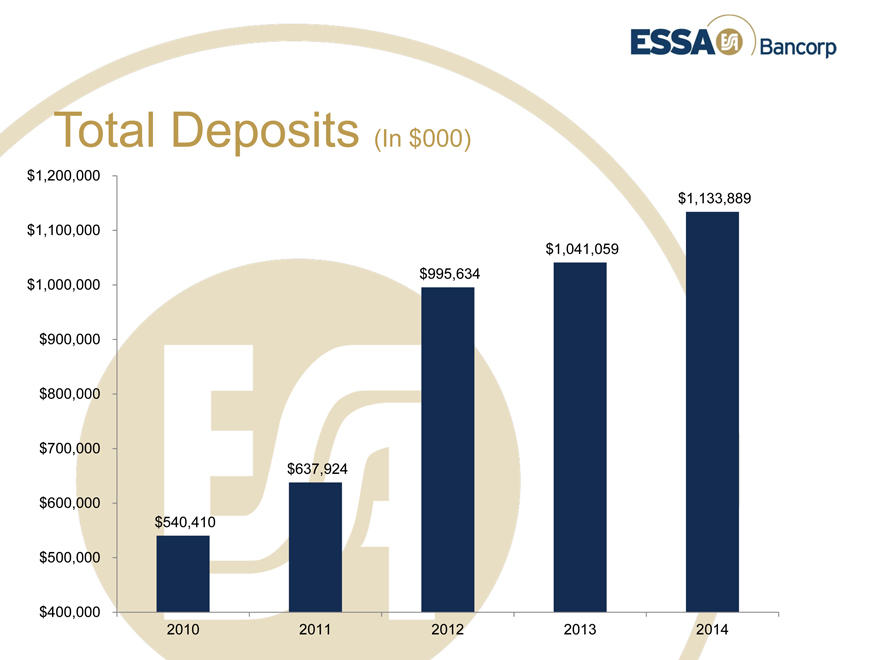

Total Deposits (In $000)

$1,200,000 $1,133,889

$1,100,000 $1,041,059 $995,634 $1,000,000

$900,000

$800,000

$700,000 $637,924

$600,000 $540,410

$500,000

$400,000

2010 2011 2012 2013 2014

|

|

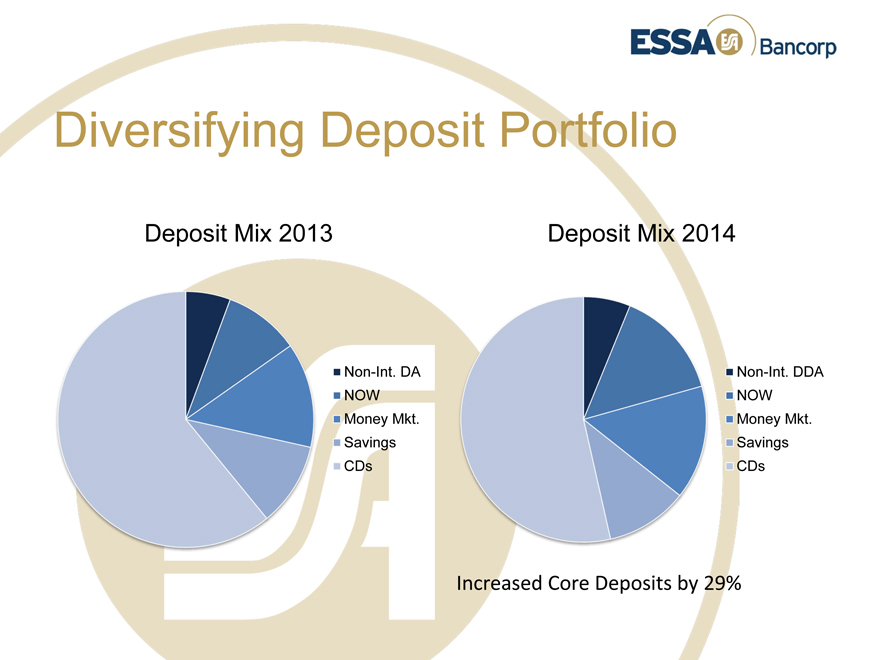

Diversifying Deposit Portfolio

Deposit Mix 2013 Deposit Mix 2014

Non-Int. DA Non-Int. DDA NOW NOW Money Mkt. Money Mkt. Savings Savings CDs CDs

Increased Core Deposits by 29%

|

|

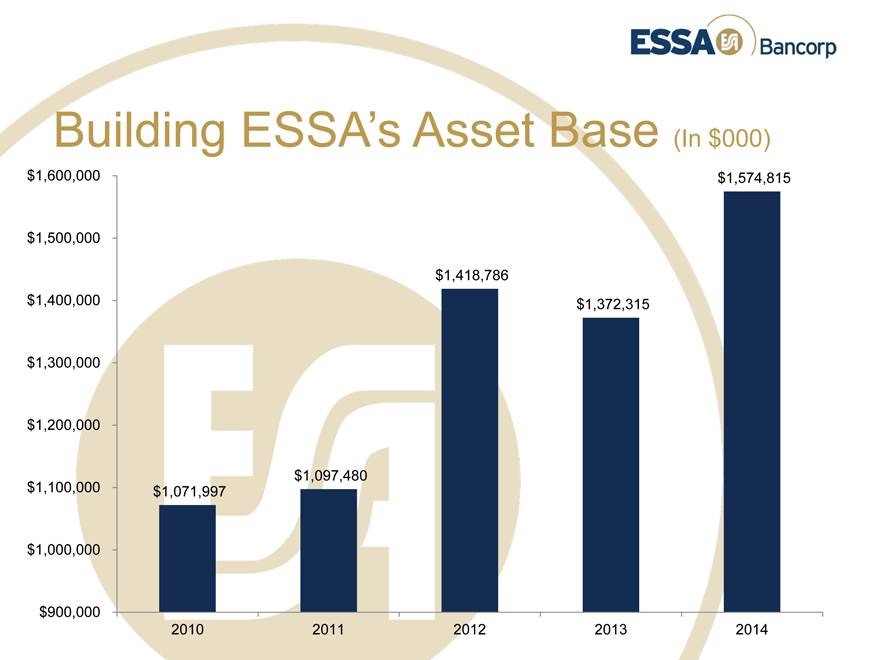

Building ESSA’s Asset Base (In $000)

$1,600,000 $1,574,815

$1,500,000

$1,418,786 $1,400,000 $1,372,315

$1,300,000

$1,200,000

$1,097,480 $1,100,000 $1,071,997

$1,000,000

$900,000

2010 2011 2012 2013 2014

|

|

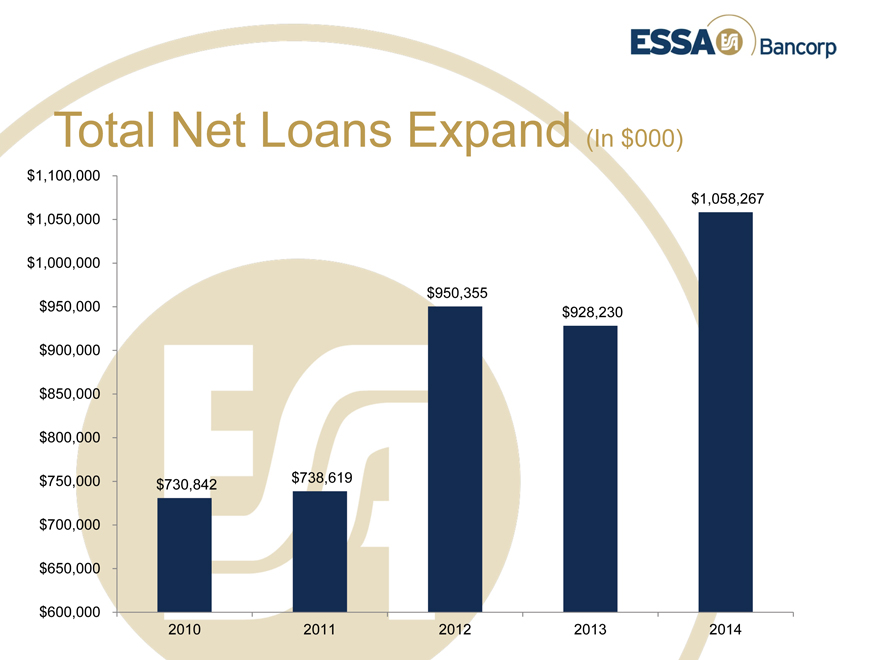

Total Net Loans Expand (In $000)

$1,100,000 $1,058,267 $1,050,000

$1,000,000

$950,000 $950,355 $928,230

$900,000 $850,000 $800,000

$750,000 $738,619 $730,842

$700,000

$650,000

$600,000

2010 2011 2012 2013 2014

|

|

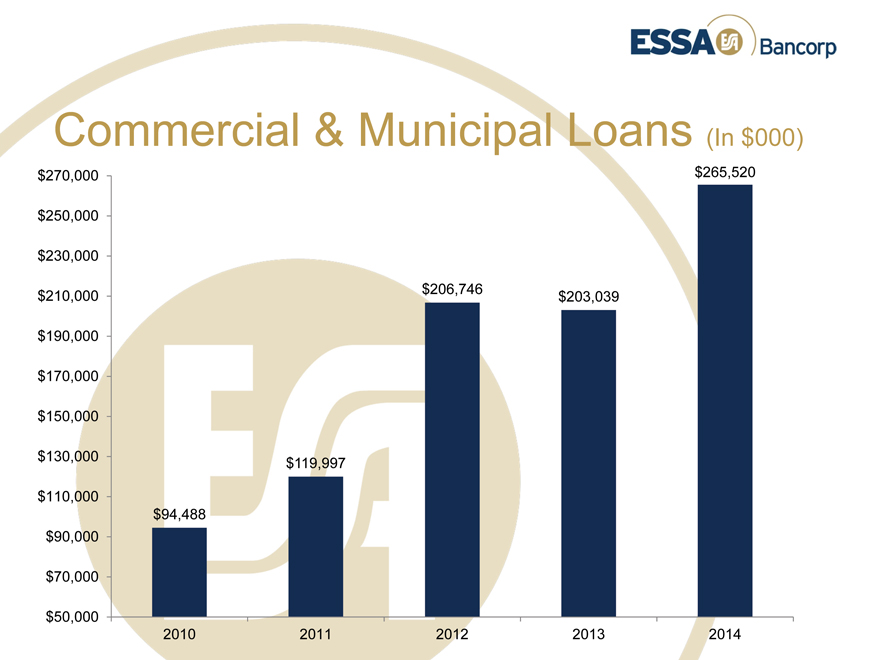

Commercial & Municipal Loans (In $000)

$270,000 $265,520

$250,000

$230,000

$206,746 $210,000 $203,039

$190,000 $170,000 $150,000

$130,000 $119,997

$110,000 $94,488 $90,000

$70,000

$50,000

2010 2011 2012 2013 2014

|

|

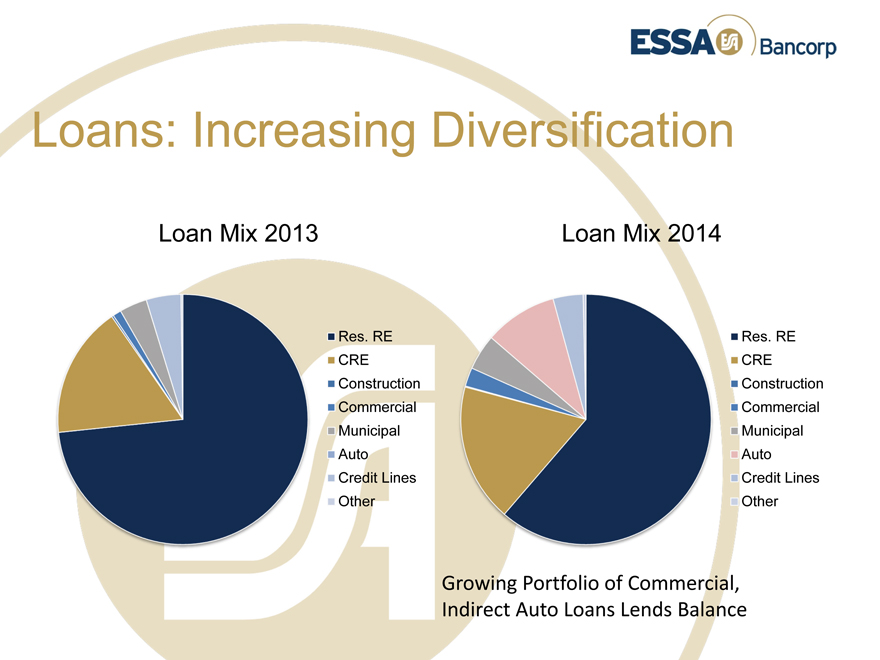

Loans: Increasing Diversification

Loan Mix 2013

Loan Mix 2014

Res. RE Res. RE CRE CRE Construction Construction Commercial Commercial Municipal Municipal Auto Auto Credit Lines Credit Lines Other Other

Growing Portfolio of Commercial,

Indirect Auto Loans Lends Balance

|

|

Value, Quality, Strength

|

|

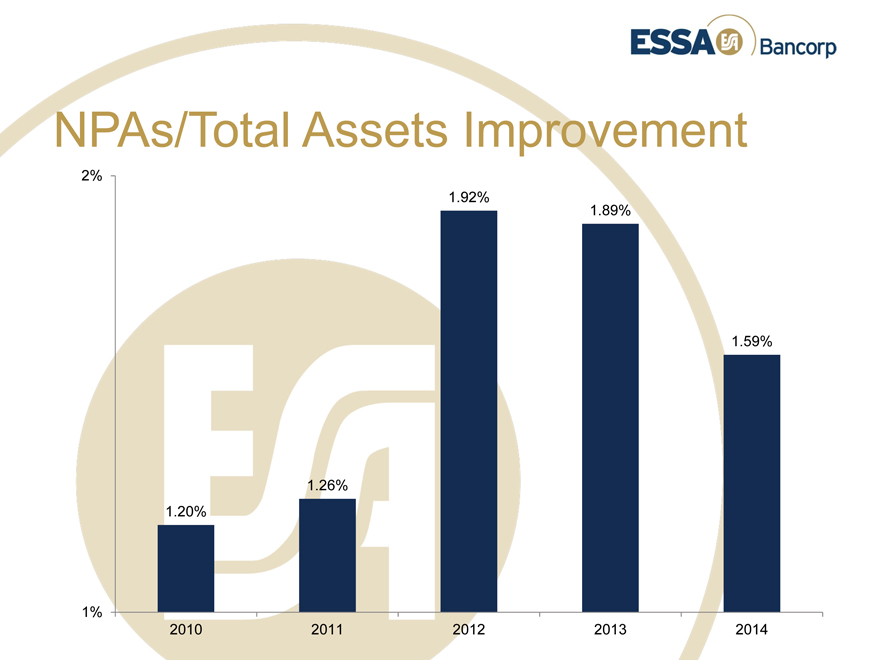

NPAs/Total Assets Improvement

2%

1.92% 1.89%

1.59%

1.26%

1.20%

1%

2010 2011 2012 2013 2014

|

|

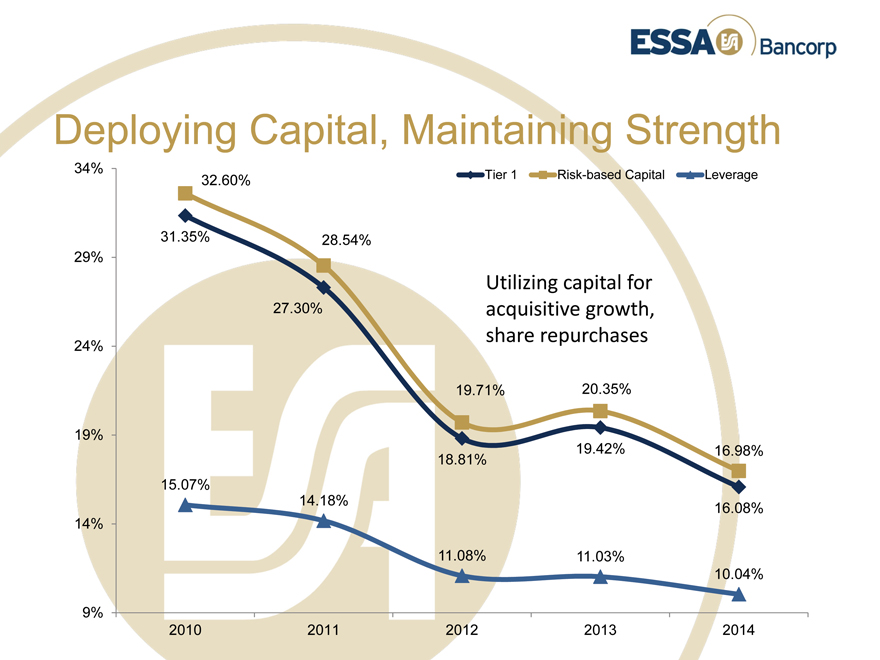

Deploying Capital, Maintaining Strength

34%

32.60% Tier 1 Risk-based Capital Leverage

31.35% 28.54% 29%

Utilizing capital for

27.30% acquisitive growth, share repurchases

24%

19.71% 20.35%

19% 19.42%

16.98%

18.81%

15.07%

14.18%

16.08% 14%

11.08% 11.03%

10.04%

9%

2010 2011 2012 2013 2014

|

|

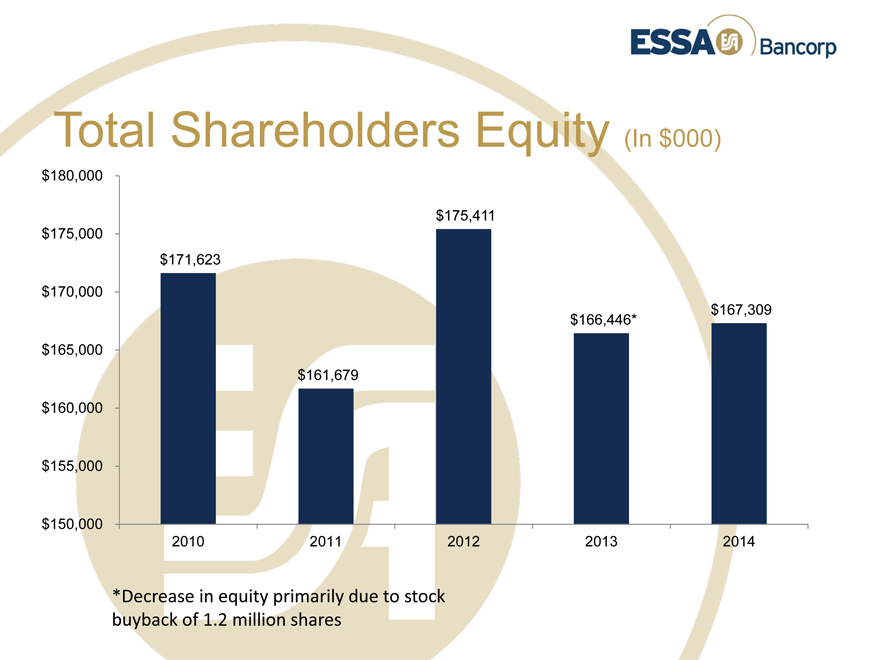

Total Shareholders Equity (In $000)

$180,000

$175,411 $175,000 $171,623

$170,000 $167,309 $166,446*

$165,000 $161,679

$160,000 $155,000 $150,000

2010

2011

2012

2013

2014

*Decrease in equity primarily due to stock

buyback of 1.2 million shares

|

|

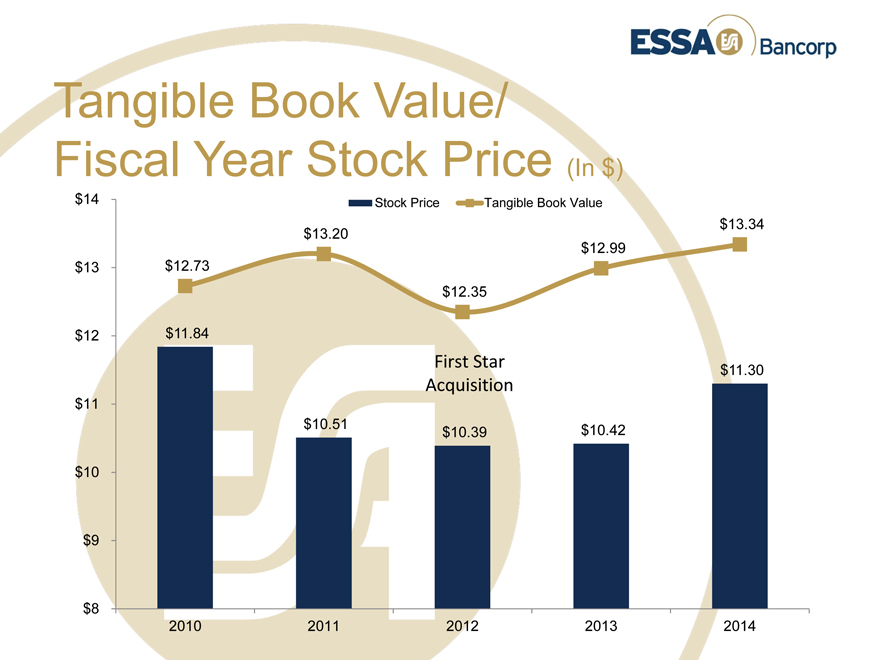

Tangible Book Value/ Fiscal Year Stock Price (In $)

$14 Stock Price Tangible Book Value

$13.34

$13.20

$12.99

$13 $12.73

$12.35

$12 $11.84

First Star

$11.30

Acquisition

$11

$10.51 $10.42

$10.39 $10

$9

$8

2010 2011 2012 2013 2014

|

|

Steady ESSA Stock Performance

ESSA SNL Micro Cap U.S. Bank & Thrift

SNL U.S. Bank $1B-$5B

20% 15% 10% 5% 0%

-5%

|

|

FY2015 1Q: A Strong Start

Net income of $2.6 million up 30% vs. 1Q 2014, reflecting positive run rate trend

Net Interest income up 16.4%, primarily reflecting loan growth

Scranton branch relocated to larger, upgraded facility

ROAA rises to 0.66% from 0.59%

ROAE increases to 6.06% from 4.77%

Total stockholders’ equity increases by $2 million

Share price 52-week high of $12.55 at 2-6-2015

|

|

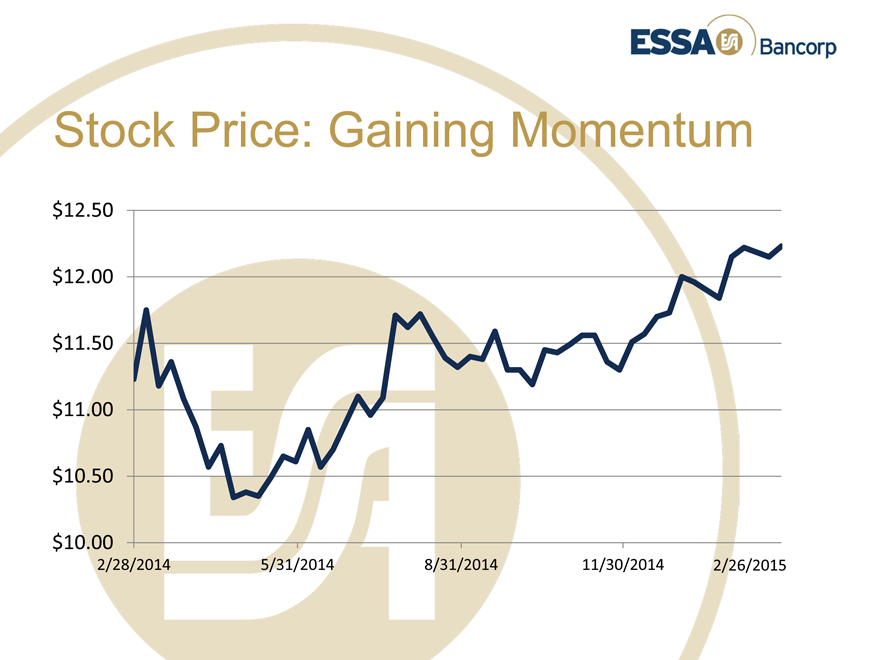

Stock Price: Gaining Momentum

$12.50

$12.00

$11.50

$11.00

$10.50

$10.00

2/28/2014 5/31/2014 8/31/2014 11/30/2014 2/26/2015

|

|

Looking Ahead: FY2015

Drive revenue growth through larger, diversified franchise

Leverage new commercial, municipal, indirect auto lending capabilities across the ESSA network

Expand retail banking, wealth management services to Scranton, Wilkes-Barre markets

Assess strategic branch and whole-bank acquisition opportunities

Increased quarterly dividend from $0.07 to $0.09 per share

Deliver balanced value through operational growth, earnings, opportunistic stock repurchases, and dividends

|

|

ESSA Bancorp, Inc.

2015 Annual Meeting