Attached files

| file | filename |

|---|---|

| EX-10.36 - EXHIBIT 10.36 - VWR Corp | a2014form10-kex1036c.htm |

| EX-10.53 - EXHIBIT 10.53 - VWR Corp | a2014form10-kex1053c.htm |

| EX-10.54 - EXHIBIT 10.54 - VWR Corp | a2014form10-kex1054c.htm |

| EXCEL - IDEA: XBRL DOCUMENT - VWR Corp | Financial_Report.xls |

| EX-23.1 - EXHIBIT 23.1 - VWR Corp | a2014form10-kex231c.htm |

| EX-31.1 - EXHIBIT 31.1 - VWR Corp | a2014form10-kex311c.htm |

| EX-32.1 - EXHIBIT 32.1 - VWR Corp | a2014form10-kex321c.htm |

| EX-31.2 - EXHIBIT 31.2 - VWR Corp | a2014form10-kex312c.htm |

| EX-32.2 - EXHIBIT 32.2 - VWR Corp | a2014form10-kex322c.htm |

| EX-21.1 - EXHIBIT 21.1 - VWR Corp | a2014form10-kex211c.htm |

| EX-10.56 - EXHIBIT 10.56 - VWR Corp | a2014form10-kex1056c.htm |

| EX-24 - EXHIBIT 24 - VWR Corp | a2014form10-kex24c.htm |

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

ý ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2014

¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from __________ to __________

Commission file number: 001-36673

VWR Corporation

(Exact name of registrant as specified in its charter)

Delaware | 26-0237871 |

(State of incorporation) | (I.R.S. Employer Identification No.) |

Radnor Corporate Center, Building One, Suite 200

100 Matsonford Road

Radnor, Pennsylvania 19087

(Address of principal executive offices)

(610) 386-1700

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

Common Stock, par value $0.01 per share | The NASDAQ Stock Market LLC |

(Title of class) | (Name of exchange on which registered) |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ¨ Yes ý No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ¨ Yes ý No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ý Yes ¨ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). ý Yes ¨ No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ý

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. ¨ Large accelerated filer ¨ Accelerated filer ý Non‑accelerated filer ¨ Smaller reporting company

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). ¨ Yes ý No

There were no shares of common stock held by non-affiliates of the registrant on June 30, 2014.

On February 27, 2015, 131,358,700 shares of the registrant’s common stock, $0.01 par value per share, were outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of our definitive proxy statement for our 2015 annual meeting of stockholders are incorporated by reference into Part III of this report.

VWR CORPORATION AND SUBSIDIARIES

FORM 10-K

For the fiscal year ended December 31, 2014

TABLE OF CONTENTS

Page | |

i

Glossary of Commonly Used Terms

Term | Description | |

the Company, we, us, our | VWR Corporation and its consolidated subsidiaries | |

Additional Sale | our sale of common stock via the underwriters’ over-allotment option in the IPO | |

Adjusted EBITDA* | our earnings or loss before interest, taxes, depreciation, amortization and certain other adjustments | |

Adjusted EPS* | our Adjusted Net Income divided by adjusted weighted average shares outstanding on a diluted basis | |

Adjusted Net Income* | our net income or loss adjusted for certain items | |

Americas | a geographically-defined reportable segment covering North, Central and South America | |

A/R Facility | an accounts receivable securitization facility due 2016 | |

Biopharma | the combination of the pharmaceutical and biotechnology sectors | |

Board | the board of directors of VWR Corporation | |

EMEA-APAC | a geographically-defined reportable segment covering Europe, Middle East, Africa and Asia-Pacific | |

FASB | the Financial Accounting Standards Board | |

GAAP | United States generally accepted accounting principles | |

IPO | our initial public offering, which occurred on October 1, 2014 and closed on October 7, 2014 | |

ITRA | the income tax receivable agreement with VWR Holdings | |

NASDAQ | the stock exchange on which our common stock is traded | |

Prospectus | the final prospectus for our IPO, filed pursuant to Rule 424(b)(4) with the SEC on October 3, 2014 | |

SEC | The United States Securities and Exchange Commission | |

Senior Credit Facility | a senior secured credit facility, consisting of term loans denominated in euros and U.S. dollars and a multi-currency revolving loan facility | |

Senior Notes | 7.25% unsecured senior notes due 2017 | |

SG&A expenses | selling, general and administrative expenses as defined by GAAP and SEC regulations | |

Sponsors | Madison Dearborn Partners, Avista Capital Partners and their affiliates | |

Subordinated Notes | 10.75% unsecured senior subordinated notes due 2017 | |

VWR Acquisition | the 2007 merger through which we became controlled by our Sponsors | |

VWR Funding | VWR Funding, Inc., our wholly-owned subsidiary | |

VWR Holdings | Varietal Distribution Holdings, LLC, our parent company | |

* | Denotes non-GAAP financial measurements. See Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Key Indicators of Performance and Financial Condition” for more information, including where to find reconciliations from the most directly comparable GAAP-based financial measurements. |

ii

Cautionary Factors Regarding Forward-Looking Statements

This report contains forward-looking statements. All statements other than statements of historical fact included in this report are forward-looking statements. Forward-looking statements discuss our current expectations and projections relating to our financial condition, results of operations, plans, objectives, future performance and business. These statements may be preceded by, followed by or include the words “aim,” “anticipate,” believe,” “estimate,” “expect,” “forecast,” “intend,” “likely,” “outlook,” “plan,” “potential,” “project,” “projection,” “seek,” “can,” “could,” “may,” “should,” “would,” “will,” the negatives thereof and other words and terms of similar meaning.

Forward-looking statements are inherently subject to risks, uncertainties and assumptions; they are not guarantees of performance. You should not place undue reliance on these statements. We have based these forward-looking statements on our current expectations and projections about future events. Although we believe that our assumptions made in connection with the forward-looking statements are reasonable, we cannot assure you that the assumptions and expectations will prove to be correct.

You should understand that the following important factors, in addition to those discussed in this report, could affect our future results and could cause those results or other outcomes to differ materially from those expressed or implied in our forward-looking statements:

• | unfavorable political, economic, capital and credit market conditions in the regions where we operate; |

• | changes in our customers’ research and development and other scientific endeavors; |

• | changes to the life science industry adversely affecting our business; |

• | increased competition from other companies in our industry and our ability to increase our market shares in the geographic regions where we operate; |

• | our ability to maintain relationships with our customers and suppliers; |

• | our ability to consummate and integrate recent and future acquisitions; |

• | the international scope of our operations; |

• | the need to record impairment charges against our goodwill, other intangible and/or other long-lived assets; |

• | existing and increased government regulations to which we and our suppliers are subject; |

• | our ability to comply with applicable antitrust or competition laws; |

• | increased costs to comply with environmental, health and safety laws and regulations; |

• | product liability and other claims in the ordinary course of business; |

• | our ability to hire, train and retain executive officers and other key personnel; |

• | significant interruptions in the operations of our distribution centers or the operations of our suppliers; |

• | failure of our information services and its connectivity to our customers, suppliers and/or certain service providers; |

• | our failure to register and in some cases own the existing applications and registrations for our material trademarks or service marks in certain countries where we do business; |

• | foreign currency exchange rate fluctuations; and |

• | unanticipated increases to our income tax liabilities. |

All forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by the foregoing cautionary statements. In addition, all forward-looking statements speak only as of the date of this report. We undertake no obligations to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise other than as required under the federal securities laws.

iii

PART I

Item 1. | Business |

We are a leading, independent provider of laboratory products, services and solutions to the global life science, general research and applied markets. We have significant market share positions in Europe and North America. We also have operations in Asia-Pacific and other key emerging markets to support our multinational customers across the globe. We serve a critical role in connecting customer sites with core laboratory product suppliers across multiple industries and geographies. We offer one of the broadest portfolios of branded and private label laboratory products. We also offer a full range of value-added services, including custom manufacturing, to meet our customers’ needs. These services represent a growing but currently small portion of our overall net sales. We offer a wide selection of unique products and have developed an extensive global infrastructure including thousands of sales and service-focused professionals. We deliver value to our customers by improving the costs, efficiency and effectiveness of their research laboratories and production operations. We deliver value to our suppliers by providing them with cost-effective channel access to a global and diverse customer base.

Our portfolio includes chemicals, reagents, consumables, durable products and scientific equipment and instruments with a range of complexity and sophistication. We offer most of the leading branded products to the customer segments we serve. Our private label products enhance our branded product offerings by providing additional choice at varying price points to our customers. We complement our branded and private label product portfolio with value-added service offerings marketed under the “VWRCATALYST” brand, including sourcing and procurement, logistics, chemical and equipment tracking and sample management. We have recently expanded our service offerings to include more complex scientific research support services, such as DNA extraction, bioreactor servicing and compound management. In addition, we offer custom manufacturing solutions, including buffers, reagents and other chemicals used in biopharmaceutical and industrial applications and production processes. We believe these growing value-added service offerings integrate us within our customers’ critical operational processes and further differentiate our value proposition from that of our competitors. We believe our range of offerings and capabilities enhances our ability to expand our addressable market and gain market share leading to incremental net sales and profits.

Business Segments

We report financial results on the basis of two reportable segments organized by geographic region: Americas and EMEA-APAC. Our Americas segment is comprised of operations located principally in the United States and Canada as well as in Puerto Rico, Mexico and select countries in Central and South America, including Costa Rica, Brazil, Argentina and Chile, and includes 59 facilities located in 8 countries. The EMEA-APAC segment is comprised of our operations located principally in Europe as well as in certain Asia-Pacific countries, and includes 105 facilities located in 26 countries.

The following table presents the percentage of net sales from each of our reportable segments:

Year Ended December 31, | ||||||||

2014 | 2013 | 2012 | ||||||

Americas | 56 | % | 56 | % | 58 | % | ||

EMEA-APAC | 44 | 44 | 42 | |||||

Total | 100 | % | 100 | % | 100 | % | ||

Both of our segments provide laboratory products, services and solutions to customers in the life science, general research and applied markets, including the Biopharma, agricultural, chemical, environmental, food and beverage, healthcare, microelectronic and petrochemical industries, as well as governmental agencies, universities, primary education and research institutes and environmental organizations. We also offer a similar portfolio of laboratory products and other supplies in both of our segments.

1

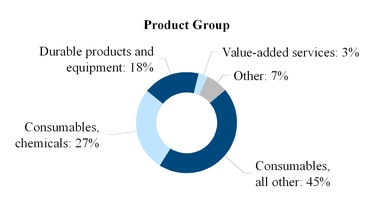

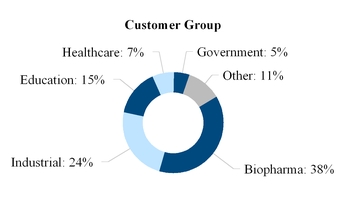

We use operational data and management assumptions to estimate our product and customer mix as a percentage of consolidated net sales. The following charts present estimated net sales by product and customer group as a percentage of total net sales for the year ended December 31, 2014:

For more information about our reportable segments, see Note 23 to our consolidated financial statements beginning on page F-1 of this report.

Products and Services

Branded and Private Label Laboratory Products

We provide value to our customers by offering one of the broadest portfolios of branded and private label laboratory products in our industry, including custom manufacturing. Our portfolio of branded products gives our customers access to some of the most recognized brands in the world. We enhance our customers’ choice by offering a lower cost, private label alternative to branded products. Private label laboratory products represented approximately 19% of our 2014 net sales. During 2014, we processed approximately 17,000 customer orders per day with an average order size of approximately $700. We distinguish between product types within our branded and private label laboratory products as consumable or durable.

Consumable Products

Many of our products, including chemicals, laboratory and production supplies and science education products, are consumable in nature. These products are basic and essential supplies required by research and quality control laboratories and are generally used on a recurring basis. In addition to our extensive selection of branded products, we offer a robust suite of private label offerings. Further, we offer custom manufactured chemicals, including buffers, reagents and other chemicals used in Biopharma and industrial applications and production process. Consumable products represented approximately 72% of our 2014 net sales.

Durable Products and Equipment

We also offer durable products and scientific instruments with varying levels of complexity and sophistication. These products represented approximately 18% of our 2014 net sales.

Value-Added Services

We complement our branded and private label product portfolio with a number of customized value-added services, which we collectively have branded “VWRCATALYST.” In addition to our traditional service offerings such as procurement, logistics, chemical and equipment tracking and glassware autoclaving, we have expanded our service offerings to include more complex scientific research support services, such as DNA extraction, bioreactor servicing and compound management. This enables us to support a higher level of science on behalf of our customers, enabling them to focus on core areas of research.

2

History

The origins of our business date to 1852 in Sacramento, California when we initially sold glassware and laboratory supplies for mining markets. We first became a publicly-owned company in 1986 after a spin-off from Univar Corporation, and later we were acquired by Merck KGaA in 1999. In 2001, we expanded internationally into Europe to become a leader in the global laboratory products market when Merck KGaA combined our operations with those of its European scientific supplies distribution business under the name “VWR International Corporation.” In 2004, we were divested by Merck KGaA and acquired by a newly formed entity controlled by Clayton, Dubilier & Rice, Inc., a private equity firm, in a leveraged transaction.

On June 29, 2007, we were acquired by VWR Holdings, which is owned by private equity funds managed by our Sponsors and certain members of our management team. Under the stewardship of Madison Dearborn Partners, we have undertaken several initiatives, including: (i) enhancing our technological infrastructure through the implementation of an integrated enterprise resource planning system in North America and a global web infrastructure; (ii) upgrading our distribution network with the construction of a new facility in central California; (iii) augmenting the effectiveness of our North American sales force by shifting our marketing strategy to a customer segment-specific approach consistent with that of our EMEA-APAC segment; and (iv) implementing a targeted acquisition strategy that has resulted in our purchase and integration of 37 businesses.

Customers

We maintain a diverse and stable customer base. We provided solutions to approximately 120,000 customers in 2014, including over 230 Fortune 500 companies, approximately 5,000 leading academic institutions and thousands of smaller businesses in multiple industries. We centrally manage and actively collaborate with our largest global customers and provide them with value-added services, optimize the efficiency of their research, production and procurement activities and support them with dedicated on-site professionals and technicians. In addition, we manage relationships with our regional customers on a local basis, with a focus on their particular customer segment-specific needs. We estimate that we shipped products to approximately 290,000 unique customer sites in 2014.

We seek to be an important provider of laboratory products and services to our customer base. The substantial majority of our 50 largest customer relationships are governed by three- to five-year contracts that typically include pricing and volume incentives intended to position us as the primary provider of laboratory products and services.

We are a significant provider of laboratory products, chemicals, safety equipment and life science supplies to a majority of the world’s 20 largest pharmaceutical companies. In 2014, our top 20 customers accounted for approximately 20% of our net sales, with no single customer representing more than 4% of our net sales. As of December 31, 2014, our top ten customers have had relationships with us averaging more than 12 years.

Suppliers

We distribute branded and private label products sourced from approximately 4,500 core laboratory product suppliers located across the globe. This includes a majority of the leading developers and manufacturers of laboratory chemicals and reagents, glassware, plastics, instruments and other laboratory equipment, protective clothing and laboratory furniture, who sell through distributors. We strive to maintain strong relationships with our largest suppliers, most of which have utilized our infrastructure for more than 20 years. Our top five suppliers in 2014 were Corning, Eppendorf, GE Healthcare, Merck KGaA and Thermo Fisher Scientific. In 2014, our largest supplier, Merck KGaA, supplied products to us that accounted for approximately 9% of our consolidated net sales, approximately 4% of our net sales in the Americas and approximately 17% of our net sales in EMEA-APAC. We benefit from our longstanding and strong relationship with Merck KGaA and its affiliates. Our business operated as a division of Merck KGaA from 1999 until we were acquired by Clayton, Dubilier & Rice, Inc. in 2004. In connection with the acquisition, Merck KGaA agreed to enter into a long-term, exclusive supply agreement with us primarily covering Western Europe, which had an initial five-year term that was subsequently extended for an additional five-year period. In April 2014, we began operating under new, non-exclusive supply agreements with Merck KGaA that extend through December 2018.

Our supplier relationships are based on contracts that vary in terms of geographic scope, duration, product and service type, with some relationships including exclusivity provisions. Depending on our relationships and agreements, our services to suppliers may include distribution, sales and marketing support as well as servicing of instruments and equipment.

We manufacture a portion of our private label products, primarily lab and production chemicals, including buffers, reagents and other chemicals used in biopharmaceutical and industrial applications, and source the remainder from third-parties, including our established branded suppliers. We utilize a disciplined process to ensure the high quality of our private label products. Private label products provide our customers with a value-focused alternative to branded products and generally provide us higher margins.

3

Sales and Marketing

We reach customers through a well-trained global sales force, comprehensive websites and targeted catalogs. Our sales force is comprised of approximately 3,100 sales and sales support professionals, including approximately 280 sales specialists in areas such as life science, chromatography, production, chemicals and furniture, selected for their in-depth industry and product knowledge. Our sales professionals include native speakers for each of the countries in which we operate, allowing them to have high impact interactions with our customers across the globe.

Our e-commerce platform plays a vital role in how we conduct business with our customers. Over half of the orders that we process originate from our e-commerce platform, including our websites which feature our full product offering on a multi-language platform. Our websites utilize Google® search analytics and feature personalized search tools, customer specific web solutions as well as enhanced data on over 2.1 million products, all of which allow us to optimize the online purchasing experience for our customers. Our customers make use of the rich functionality that our websites have to offer, many of which better integrate our customers’ processes with our own. The flexibility and scalability of our websites allow us to integrate acquisitions, drive geographical expansion and serve segmented market needs with relative ease.

We also provide printed literature including flyers, brochures, magazines and catalogs. Our general catalogs, which present the most comprehensive view of our product portfolio, are printed in over 20 languages and distributed worldwide. Our general catalogs are supplemented by specialty catalogs, as well as brochures, geared toward specific industries, applications and product lines. For example, we have developed “all you need” catalogs for industries such as brewing, dairy, life science and genomics. In addition, we produce several serial publications that engage our customers with informative articles and a focused product offering, timed to release during prime purchasing seasons.

Distribution Network, Facilities and Infrastructure

Our global infrastructure consists of over 160 facilities, which enables us to deliver a broad array of products to our customers generally within 24 to 48 hours. We have the broadest Pan-European platform, which enables us to reach customers throughout Europe with industry-leading efficiency and service levels. We operate a distribution network of over 4.5 million square feet of distribution space, consisting of strategically located distribution centers, various smaller regional service centers, and “just-in-time” facilities and customer contract centers for customer-specific requirements. Below is a summary of these facilities:

• | our distribution centers receive products from manufacturers, manage inventory and fill and ship customer orders; |

• | our regional service centers are located near selected customer locations and are designed to supply a limited number of products to those customers that require a high level of service; |

• | we also operate “just-in-time” facilities at or near customer sites to meet customer needs promptly; |

• | customer contact centers have the responsibility for order entry and customer service; and |

• | our two captive service centers employ more than 800 associates who provide commercial and administrative support services to us and our customers and suppliers. |

We also contract with third parties to ship products directly to our customers.

We maintain our corporate headquarters in Radnor, Pennsylvania for executive, financial, legal, information systems, marketing and other administrative activities. Our European executive, financial, legal, information systems, marketing and other administrative activities are in Darmstadt, Germany and Haasrode, Belgium.

Technology

We have a highly automated ERP system that promotes standardization and simplicity. Our global web infrastructure provides seamless integration with our customers. Furthermore, our technology platforms support rapid development and deployment of enhancements so that we may quickly adapt to meet the technology needs of our customers and seamlessly integrate new acquisitions. We have recently made significant investments in our IT platform to implement a common ERP and e-commerce platform to enhance the customer experience. In 2014, over half of our orders were derived from e-commerce. We have more than 175,000 integrated e-commerce connections with our customers using www.vwr.com as their purchasing platform.

Our IT operating strategy is to act globally when possible and locally where necessary to strategically facilitate our business objectives and to develop a stable, growth oriented infrastructure and global informational system platform. Our IT infrastructure has evolved into a cohesive group of core global computing platforms. This development has reduced costs while improving our overall quality and delivering more value.

4

Competition

We operate in a highly competitive environment with a diverse and fragmented base of competitors, many of whom focus on specific regions and market segments. Competitive factors in the customer segments we serve include service and delivery, breadth of product line, price, customer support, e-commerce capabilities and the ability to meet the special and local needs of our customers.

In our Americas segment within our laboratory products business, we compete primarily with Thermo Fisher Scientific and Sigma-Aldrich. The majority of our other competitors include laboratory equipment manufacturers, which sell direct to their customers, and smaller distributors that focus on specific geographies and product categories. With respect to our value-added services business, we compete with local service providers and life science companies, which offer laboratory management services to their clients, such as Thermo Fisher Scientific, PerkinElmer and Agilent Technologies and other service outsourcing companies.

In our EMEA-APAC segment within our laboratory products business, we have the broadest Pan-European platform, which provides us with an important competitive advantage. We principally compete with Thermo Fisher Scientific for certain global customers, Sigma-Aldrich in chemicals and reagents, and certain regional competitors, including Geyer and Omnilab in Germany and Dutscher in France and Switzerland in specific product categories. With respect to our valued-added services business, we predominantly compete with small businesses operating on a regional basis.

We believe our competitive strengths position us well in our customer segments and in the geographies we serve. We rely on our scale, market position, customer access, depth of product and value-added service offerings, marketing strategies and sales force, acquisition strategy, financial profile and management team to deliver superior solutions to our customers and provide extensive market channel access to our suppliers.

Employees

As of December 31, 2014, we had approximately 8,800 employees, including approximately 3,900 in North America, 3,600 in Europe, 1,100 in Asia-Pacific (including over 800 employees in our shared service centers) and 200 in Central and South America. Of these employees, approximately 3,100 employees (or approximately 35% of our global workforce) are in customer facing roles. As of December 31, 2014, approximately 5% of our employees in North America were represented by unions, and virtually all of our employees in Europe are represented by workers’ councils and/or unions. We believe our relations with our employees are good.

Trademarks and Tradenames

We believe the VWR tradename is well recognized in the global laboratory products market and by scientists and is therefore a valuable asset to us. We use a number of different registered and unregistered trademarks and service marks for our products and services, substantially all of which are owned by us. However, we have not registered all of our trademarks or service marks in each country in which we do business. Generally, registered trademarks have perpetual lives, provided that they are renewed on a timely basis and continue to be used properly as trademarks, subject only to the rights of third parties to seek cancellation of the marks.

Our business is not dependent to a material degree on patents, copyrights or trade secrets although we consider our catalogs, websites and proprietary software integral to our operations. Although we believe we have adequate policies and procedures in place to protect our intellectual property, we have not sought patent protection for our processes nor have we registered the copyrights in any of our catalogs, websites or proprietary software. Other than licenses to commercially available third-party software, we have no licenses to intellectual property that are significant to our business.

Government Regulation

Some of the products we offer and our operations are subject to a number of complex and stringent laws and regulations governing the production, storage, handling, transportation, import, export and distribution of chemicals, drugs and other similar products, including the operating and security standards of the United States Drug Enforcement Administration, the Alcohol and Tobacco Tax and Trade Bureau, the Food and Drug Administration, the Bureau of Industry and Security and various state boards of pharmacy as well as comparable state and foreign agencies. In addition, our operational activities must comply with the rules and regulations of the Department of Transportation, the Federal Aviation Administration and similar foreign agencies. We are also required to abide by the anti-corruption and anti-bribery laws of all countries in which we operate, including the United States Foreign Corrupt Practices Act of 1977, as amended (the “FCPA”). While we believe we are in compliance in all material respects with such laws and regulations, any non-compliance could result in substantial fines, penalties or assessments or otherwise restrict our ability to provide competitive distribution services and thereby have an adverse impact on our financial condition.

5

Environmental, Health and Safety Matters

We are subject to a broad range of foreign, federal, state and local environmental, health and safety laws and regulations, including those pertaining to air emissions, water discharges, the manufacturing, handling, disposal and transport of solid and hazardous materials and wastes, the investigation and remediation of contamination and otherwise relating to health and safety and the protection of the environment and natural resources. As our global operations have involved and continue to involve the manufacturing, handling, transport and distribution of materials that are, or could be, classified as toxic or hazardous, there is a risk of contamination and environmental damage inherent in our operations and the products we manufacture, handle, transport and distribute. Our environmental, health and safety liabilities and obligations may result in significant capital expenditures and other costs, which could negatively impact our business, financial condition and results of operations. We may be fined or penalized by regulators for failing to comply with environmental, health and safety laws and regulations. In addition, contamination resulting from our current or past operations may trigger investigation or remediation obligations, which may have a material adverse effect on our business, financial condition and results of operations.

Based on current information, we believe that any costs we may incur relating to environmental, health and safety matters will not be material. We cannot be certain, however, that identification of presently unidentified environmental, health and safety conditions, new regulations, more vigorous enforcement by regulatory authorities or other unanticipated events will not arise in the future and give rise to additional environmental liabilities, business interruptions, compliance costs or penalties which could have a material adverse effect on our business, financial condition and results of operations. In addition, environmental laws and regulations are constantly evolving and it is not possible to predict accurately the effect they, or any new regulations or legislation, may have in future periods.

Insurance

We maintain commercial insurance programs with third parties in the areas of executive risk, commercial property, business interruption and casualty (including product liability). We also self-insure certain risks inherent in our business which, taken together with the deductible levels and exclusions contained within our third-party programs, results in our recording of accruals for incurred claims. Our ultimate exposure may be mitigated by amounts we expect to recover from third parties associated with such claims.

Available Information

We file or furnish annual and quarterly reports and other information with or to the SEC. You may read and copy any documents we file at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 for further information on the Public Reference Room. Our SEC filings are also available to the public free of charge at the SEC’s website at www.sec.gov.

You may also access our press releases, financial information and reports filed with or furnished to the SEC (for example, our Annual Report on Form 10-K, our Quarterly Reports on Form 10-Q and our Current Reports on Form 8-K and any amendments to those forms) online at www.vwr.com. Copies of any documents on our website are available without charge, and reports filed with or furnished to the SEC will be available as soon as reasonably practicable after they are filed with or furnished to the SEC. The information found on our website is not part of this or any other report filed with or furnished to the SEC.

Corporate Information

Our principal executive offices are located at Radnor Corporate Center, Building One, Suite 200, 100 Matsonford Road, Radnor, PA 19087. Our telephone number is (610) 386-1700. Our Internet website is located at www.vwr.com.

6

Item 1A. | Risk Factors |

There are many factors that affect our business and the results of operations, some of which are beyond our control. The following is a description of some important factors that may cause our results of operations or financial condition in future periods to differ materially from those currently expected or desired.

Risks Related to Our Business

Our business is affected by general economic conditions in the United States, Europe and the other regions in which we operate, and unfavorable global economic conditions or instability in the capital and credit markets could adversely impact our business.

With operations in many parts of the world, the global economy has a significant impact on our business. Unfavorable economic conditions in the United States, Europe and other regions in which we operate, and volatility in the global capital and credit markets, could materially and adversely affect our business, financial condition and results of operations. In particular, a deterioration of global economic conditions, or a prolonged period of market instability, could present the following additional risks and uncertainties for our business:

• | a reduction in revenues from and/or less favorable pricing or terms with new and existing customers; |

• | the inability to expand our customer base in existing or new markets; |

• | difficulties in collecting trade accounts receivable; |

• | an increase in product prices from our suppliers that we are not able to pass through to our customers; |

• | an acceleration of payment terms with our suppliers and/or the imposition of more restrictive credit terms and other contractual requirements; |

• | an increased risk of excess and obsolete inventory; |

• | a reduction in research and development spending by our customers, especially those in the Biopharma industry; |

• | the inability to access additional capital or refinance existing indebtedness; |

• | a limited availability to enter into new derivative financial instruments; and |

• | the need to record impairment charges against our goodwill, other intangible and/or other long-lived assets. |

Our business, financial condition and results of operations may be harmed if our customers discontinue, outsource or spend less on research and development and other scientific endeavors or discontinue or lessen their relationship with us.

Our customers are engaged in research, development and production in the Biopharma, agricultural, chemical, environmental, food and beverage, healthcare, microelectronic and petrochemical industries as well as in the education and government sectors. The amount of customer spending on research, development and production has a large impact on our sales and profitability. Our customers determine the amounts that they will spend on the basis of, among other things, general economic conditions, their financial condition and liquidity, spending priorities and their need to develop new products, which, in turn, is dependent upon a number of factors, including their competitors’ research, development and production initiatives.

In addition, consolidation in the industries in which our customers operate may have an impact on such spending as customers integrate acquired operations, including research and development departments and their budgets. Our customers finance their research and development spending from private and public sources. Government funding of scientific research and education has varied for several reasons, including general economic conditions, growth in population, political priorities, changes in the number of students and other demographic changes.

A deterioration in general economic conditions or a return to a period of economic contraction could result in reductions, or further reductions as the case may be, in spending by our customers across all customer segments that we serve, including the Biopharma industry as our largest customer segment. In addition, certain of our customers who depend on U.S. federal funding to finance their scientific research may be adversely impacted by U.S. federal spending cuts required by the “sequestration” mechanism in the Budget Control Act of 2011 and the Bipartisan Budget Act of 2013. Sequestration, which went into effect in March 2013, mandates $1.2 trillion of spending reductions split between domestic and defense spending over a ten-year period. A reduction in spending by our customers could have a material adverse effect on our business, financial condition and results of operations.

7

The substantial majority of our 50 largest customer relationships are governed by three- to five-year contracts that typically include pricing and volume incentives intended to position us as the primary provider of laboratory products and services. These contracts typically do not contain minimum purchase requirements or provide us with an exclusive supplier relationship during the term of such contract. In many cases, our customers will undertake a competitive process at the expiration of these contracts and have on occasion not selected us to continue as their provider of laboratory products and services. The loss of one or more of our large customers, a material reduction in their purchase of products or services from us, extended disruptions or interruptions in their operations or material changes in the terms based on which we sell to them, could have a material adverse effect on our business, financial condition and results of operations.

The life science industry has and will continue to experience significant changes that could adversely affect our business.

Many of our customers in the life science industry have experienced significant changes in the last several years and are expected to continue to experience significant changes, including reductions in governmental payments for pharmaceutical products, expirations of significant patents, lower funding for research and development and adverse changes in legislation or regulations regarding the delivery or pricing of general healthcare services or mandated benefits. In response to these and other changes, some of our life science customers have implemented or may in the future implement actions in an effort to control and reduce costs, including:

• | development of large and sophisticated group purchasing organizations that reduces spending on laboratory products; |

• | consolidation of pharmaceutical companies resulting in a rationalization of research expenditures; |

• | purchasing the products that we supply directly from manufacturers; |

• | closing of domestic facilities and the establishment of facilities at low-cost offshore locations; and |

• | significant reductions in and/or outsourcing of research, development and production activities, including outsourcing to low-cost offshore locations. |

The ability of our life science customers to develop new products to replace revenue decreases attributable to expirations of significant patents, along with the impact of other past or potential future changes in the general healthcare industry may result in our customers significantly reducing their purchases of products and services from us or the prices they are willing to pay for those products or services. In addition, we will need to adapt our business to maintain existing customer relationships and develop new customer relationships as our customers consolidate or outsource certain activities domestically or to low-cost offshore locations.

We compete in a highly competitive market. Failure to compete successfully could have a material adverse effect on our business, financial condition and results of operations.

We compete in the global laboratory products market, primarily with Thermo Fisher Scientific, which has a portion of its business dedicated to the distribution of laboratory products and services. We also compete with many smaller regional, local and specialty distributors, as well as with manufacturers of all sizes selling directly to their customers. Competitive factors include price, service and delivery, breadth of product line, customer support, e-business capabilities, service offerings and the ability to meet the special requirements of customers.

A few of our competitors have greater financial and other resources than we do. Most of our products are available from several sources, and some of our customers have relationships with several distributors. Our agreements with customers generally provide that the customer can terminate the agreement or reduce the scope of products or services provided pursuant to the agreement with little or no notice. Lack of product availability, stemming from either our inability to acquire products or interruptions in the supply of products from manufacturers, could have a material adverse effect on our ability to compete. Our competitors could also obtain exclusive rights to distribute some products, thereby foreclosing our ability to distribute these products. Vertically integrated distributors may also have an advantage with respect to the total delivered product cost of certain of their captive products. Additionally, manufacturers could increase their efforts to sell directly to consumers and effectively bypass distributors like us. Consolidation in the global laboratory products market could result in existing competitors increasing their market share, which could have a material adverse effect on our business, financial condition and results of operations. The entry of new participants in the industry could also have a material adverse effect on our ability to compete.

8

We are subject to currency risks with respect to our international operations and certain outstanding foreign-denominated debt.

While we report our consolidated financial results in U.S. dollars, we derive a significant portion of our sales and incur costs in foreign currencies (principally the euro, the British pound sterling, the Canadian dollar and the Swiss franc) from our operations outside the United States. For example, in 2014 approximately one-half of our net sales came from our operations outside the United States. Fluctuations in the relative values of currencies occur from time to time and could adversely affect our operating results. Specifically, during times of a strengthening U.S. dollar, our reported international sales and earnings will be reduced because the local currency will translate into fewer U.S. dollars. This could also make it more difficult to pay amounts due on our debt, the majority of which is denominated in U.S. dollars.

Although the majority of our outstanding debt is denominated in U.S. dollars, as of December 31, 2014 we had €567.1 million ($686.7 million on a U.S. dollar equivalent basis) of euro-denominated debt recorded on our U.S. dollar-denominated balance sheet, which constitutes approximately 33% of our total outstanding debt. As a result, our operating results are exposed to foreign currency risk with respect to this indebtedness. Specifically, during times of a weakening U.S. dollar, the relative value of this debt would increase, which would require us to record foreign exchange losses. For example, during the years ended December 31, 2014, 2013 and 2012, we recognized a net foreign currency remeasurement gain (loss) of $90.9 million, $(38.8) million and $(14.4) million, respectively.

Our business, financial condition and results of operations depend upon maintaining our relationships with suppliers.

We offer products from a wide range of suppliers. While there is generally more than one source of supply for most of the categories of products that we sell, we currently do not manufacture the majority of our products and are dependent on these suppliers for access to those products. Our most significant supplier is Merck KGaA and its affiliates, which supplied products to us that accounted for approximately 9% of our net sales in 2014. In April 2014, we began operating under new, non-exclusive chemical distribution agreements with Merck KGaA that extend through December 2018. These new agreements cover a portion of our overall sales of products from Merck KGaA in Europe. The economics of these agreements include less favorable pricing terms than our previous agreement. The new agreements began negatively impacting our gross margin in April 2014.

Our ability to sustain our gross margins has been, and will continue to be, dependent in part upon our ability to obtain favorable terms from our suppliers. These terms may change from time to time, and such changes could adversely affect our gross margins over time. In addition, our results of operations and cash flows could be adversely impacted by the acceleration of payment terms to our suppliers and/or the imposition of more restrictive credit terms and other contractual requirements.

Some of our competitors are increasing their manufacturing operations both internally and through acquisitions of manufacturers, including manufacturers that supply products to us. In addition, we manufacture certain products that may compete directly with products we source from our suppliers. To date, we have not experienced an adverse impact on our ability to continue to source products from manufacturers that have been vertically integrated or otherwise compete with us, although there is no assurance that we will not experience such an impact in the future.

The loss of one or more of our large suppliers, a material reduction in their supply of products or provision of services to us, extended disruptions or interruptions in their operations or material changes in the terms we obtain from them, could have a material adverse effect on our business, financial condition and results of operations.

Our future operating results may fluctuate significantly and our current operating results may not be a good indication of our future performance. Fluctuations in our quarterly financial results could affect our stock price in the future.

Our net sales and operating results have historically varied from period-to-period, and we expect that they will continue to do so as a result of a number of factors, many of which are outside of our control. If our quarterly financial results or our predictions of future financial results fail to meet the expectations of securities analysts and investors, our stock price could be negatively affected. Any volatility in our quarterly financial results may make it more difficult for us to raise capital in the future or pursue acquisitions that involve issuances of our stock. Our operating results for prior periods may not be effective predictors of future performance.

9

A significant part of our growth strategy is to engage in acquisitions, which will subject us to a variety of risks that could harm our business.

As part of our business strategy, we intend to continue to review and complete selective acquisition opportunities focusing initially in North America and Europe and, over the longer term, in other select geographies. There can be no assurances that we will be able to complete suitable acquisitions for a variety of reasons, including the identification of and competition for acquisition targets, the need for regulatory approvals, the inability of the parties to agree to the structure or purchase price of the transaction and our inability to finance the transaction on commercially acceptable terms. In addition, any completed acquisition will subject us to a variety of other risks:

• | we may need to allocate substantial operational, financial and management resources in integrating new businesses, technologies and products, and management may encounter difficulties in integrating the operations, personnel or systems of the acquired businesses; |

• | acquisitions may have a material adverse effect on our business relationships with existing or future suppliers, in particular, to the extent we consummate acquisitions that vertically integrate portions of our business; |

• | we may assume substantial actual or contingent liabilities, known and unknown; |

• | acquisitions may not meet our expectations of future financial performance; |

• | we may experience delays or reductions in realizing expected synergies; |

• | we may incur substantial unanticipated costs or encounter other problems associated with acquired businesses or devote time and capital investigating a potential acquisition and not complete the transaction; |

• | we may be unable to achieve our intended objectives for the transaction; and |

• | we may not be able to retain the key personnel, customers and suppliers of the acquired business. |

In addition, we may be unable to maintain uniform standards, controls, procedures and policies as we attempt to integrate the acquired businesses, and this may lead to operational inefficiencies. These factors related to our acquisition strategy, among others, could have a material adverse effect on our business, financial condition and results of operations.

The international scope of our operations may adversely affect our business.

We are continuing to expand our sourcing, commercial operations and administrative activities internationally. In 2014, we derived approximately one-half of our net sales from operations outside the United States. Our ability to manage our business and conduct our operations internationally require considerable management attention and resources and is subject to the challenges of supporting a rapidly growing business in an environment of multiple languages, cultures, customs, legal and regulatory systems, alternative dispute systems and commercial markets. Expansion has required and will continue to require us to invest significant funds and other resources. Accordingly, we face certain risks, including:

• | restrictions on foreign ownership of subsidiaries; |

• | tariffs and other trade barriers and restrictions; |

• | operating in jurisdictions that do not protect intellectual property rights to the same extent as the United States; |

• | differing laws or administrative practices; |

• | recruiting and retaining talented and capable employees in foreign countries and maintaining our corporate culture across all geographies; |

• | business practices that are inconsistent with local or U.S. law, such as the United States Foreign Corrupt Practices Act of 1977, as amended (the “FCPA”), or other applicable anti-bribery regulations; |

• | violating sanctions established by the Office of Foreign Assets Control of the U.S. Department of the Treasury, with respect to threats to the national security, foreign policy or the economy of the United States; |

• | political risks; |

10

• | disruptions in the efficiency and effectiveness of, and difficulty in overseeing and managing, operations, supply chain and certain important administrative functions, including those that have been or in the future may be transferred to our shared services operations; |

• | restrictions imposed by foreign governments on international cash transfers; |

• | fluctuations in foreign currency exchange rates; and |

• | potentially adverse tax consequences of operating in multiple international jurisdictions. |

In addition, an adverse change in laws or administrative practices in countries within which we operate could have a material adverse effect on us. Our operations outside the United States also may present additional risk with respect to compliance with government regulations and licensing requirements. If we are unable to manage the complexity of our global operations successfully, our business, financial condition and operating results could be adversely affected.

In recent years, we incurred, and we may in the future incur, impairment charges related to our goodwill and other intangible assets, which could negatively impact our results of operations.

We carry significant amounts of goodwill and other intangible assets, including indefinite-lived intangible assets, on our balance sheet as a result of the VWR Acquisition and acquisitions subsequent to the VWR Acquisition. Our intangible assets with finite useful lives primarily relate to customer and supplier relationships and are amortized over their respective estimated useful lives on a straight-line basis. Our indefinite-lived intangible assets relate to our trademarks and tradenames.

Goodwill and other intangible assets with indefinite useful lives are not amortized and are tested annually for impairment, and they must also be tested for impairment between the annual tests if an event or change in circumstance occurs that would more likely than not reduce the fair value of the asset below its carrying amount. Other amortizable intangible assets are reviewed for impairment whenever an indication of potential impairment exists.

Future changes in our estimates or judgments could reduce our fair value measurements, which could in turn result in an impairment charge:

• | During 2014, we recognized an $11.3 million impairment of goodwill related to a recent acquisition, which was associated with acquisition-specific factors. |

• | Our expected net sales, cash flow performance or market conditions could be adversely affected due to, among other things, negative macroeconomic or industry-specific factors. For example, in 2011 and 2010, we recognized impairment charges of $3.3 million and $48.1 million, respectively, resulting primarily from factors specific to the science education industry, while in 2008, we recognized impairment charges of $392.1 million related primarily to macroeconomic factors. We could also experience adverse changes in market factors such as discount rates, valuation multiples derived from comparable publicly-traded companies, a decline in the trading price of our common stock or control premiums derived from market transactions. |

See Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Critical Accounting Policies—Testing Goodwill and Other Intangible Assets for Impairment” for more information.

As of December 31, 2014, goodwill and other intangible assets represented approximately $3.4 billion or 69% of our total assets. We may recognize additional impairment charges in the future should our operating results, market conditions or fair value assumptions decline due to, among other things, ongoing or worsening economic instability and volatility or other macroeconomic or industry-specific pressures, including but not limited to rising interest rates.

We are subject to laws and regulations governing government contracts, and failure to address these laws and regulations or comply with government contracts could harm our business by leading to a reduction in sales to these customers.

We sell products to government entities and, as a result, we are subject to various statutes and regulations that apply to companies doing business with the government. The laws governing government contracts differ from the laws governing private contracts and government contracts may contain pricing terms and conditions that are not applicable to private contracts. We are also subject to investigation for compliance with the regulations governing government contracts. A failure to comply with these regulations could result in suspension of these contracts, criminal, civil and administrative penalties or debarment.

11

If we do not comply with existing government regulations or if we or our suppliers become subject to more onerous government regulations, we could be adversely affected.

Some of the products we offer and our operations are subject to a number of complex and stringent laws and regulations governing the production, handling, transportation, storage, import, export and distribution of chemicals, drugs and other similar products, including the operating and security standards of the United States Drug Enforcement Administration, the Alcohol and Tobacco Tax and Trade Bureau, the Food and Drug Administration, the Bureau of Industry and Security and various state boards of pharmacy as well as comparable state and foreign agencies. In addition, our operational activities must comply with the rules and regulations of the Department of Transportation, the Federal Aviation Administration and similar foreign agencies. We are also required to abide by the anti-corruption and anti-bribery laws of all countries in which we operate, including the FCPA. While we believe we are in compliance in all material respects with such laws and regulations, any non-compliance could result in substantial fines, penalties or assessments or otherwise restrict our ability to provide competitive products and solutions and thereby have an adverse impact on our financial condition. We cannot assure you that existing laws and regulations will not be revised or that new, more restrictive laws will not be adopted or become applicable to us or the products that we manufacture and distribute.

If our suppliers become subject to more stringent laws, they may seek to recover any or all increased costs of compliance from us by increasing prices, and we may not be able to recover all such increased prices from our customers. Accordingly, we cannot assure you that our business and financial condition will not be materially and adversely affected by future changes in applicable laws and regulations applicable to our suppliers.

If any of our operations are found not to comply with applicable antitrust or competition laws, our business may suffer.

Our operations are subject to applicable antitrust and competition laws in the countries in which we conduct our business, in particular in the United States and in the European Union. These laws prohibit, among other things, anticompetitive agreements and practices. If any of our commercial agreements are found to violate or infringe upon such laws, we may be subject to civil and other penalties and/or third-party claims for damages. Further, agreements that infringe upon these laws may be void and unenforceable, in whole or in part, or require modification in order to be lawful and enforceable. If we are unable to enforce any of our commercial agreements, whether at all or in material part, our business could be adversely affected.

We are subject to environmental, health and safety laws and regulations, and costs to comply with such laws and regulations, or any liability or obligation imposed under such laws or regulations, could negatively impact our business, financial condition and results of operations.

We are subject to a broad range of foreign, federal, state and local environmental, health and safety laws and regulations, including those pertaining to air emissions, water discharges, the manufacturing, handling, disposal and transport of solid and hazardous materials and wastes, the investigation and remediation of contamination and otherwise relating to health and safety and the protection of the environment and natural resources. As our global operations have involved and continue to involve the manufacturing, handling, transport and distribution of materials that are, or could be classified as toxic or hazardous, there is a risk of contamination and environmental damage inherent in our operations and the products we manufacture, handle, transport and distribute. Our environmental, health and safety liabilities and obligations may result in significant capital expenditures and other costs, which could negatively impact our business, financial condition and results of operations. We may be fined or penalized by regulators for failing to comply with environmental, health and safety laws and regulations. In addition, contamination resulting from our current or past operations may trigger investigation or remediation obligations, which may have a material adverse effect on our business, financial condition and results of operations.

Based on current information, we believe that any costs we may incur relating to environmental, health and safety matters will not be material. We cannot be certain, however, that identification of presently unidentified environmental, health and safety conditions, new regulations, more vigorous enforcement by regulatory authorities or other unanticipated events will not arise in the future and give rise to additional environmental liabilities, business interruptions, compliance costs or penalties which could have a material adverse effect on our business, financial condition and results of operations. In addition, environmental, health and safety laws and regulations are constantly evolving and it is not possible to predict accurately the effect they, or any new regulations or legislation may have in future periods.

12

We are subject to product liability and other claims in the ordinary course of business.

Our business involves risk of product liability, patent infringement and other claims in the ordinary course of business arising from the products that we source from various manufacturers or produce ourselves, as well as from the services we provide. Our exposure to such claims may increase as we seek to increase the geographic scope of our sourcing activities and sales of private label products and to the extent that we expand our manufacturing operations. We maintain insurance policies, including product liability insurance, and in many cases the manufacturers of the products we distribute have indemnified us against such claims. We cannot assure you that our insurance coverage or indemnification agreements with manufacturers will be available in all pending or any future cases brought against us. Furthermore, our ability to recover under any insurance or indemnification arrangements is subject to the financial viability of our insurers, our manufacturers and our manufacturers’ insurers, as well as legal enforcement under the local laws governing the arrangements. In particular, as we seek to expand our sourcing from manufacturers in Asia-Pacific and other developing locations, we expect that we will increase our exposure to potential defaults under the related indemnification arrangements. Insurance coverage in general or coverage for certain types of liabilities, such as product liability or patent infringement in these developing markets may not be readily available for purchase or cost-effective for us to purchase. Furthermore, insurance for liability relating to asbestos, lead and silica exposure is not available, and we do not maintain insurance for product recalls. Accordingly, we could be subject to uninsured and unindemnified future liabilities, and an unfavorable result in a case for which adequate insurance or indemnification is not available could result in a material adverse effect on our business, financial condition and results of operations.

We are also involved in various disputes, litigation and regulatory matters incidental to our business, including employment matters, commercial disputes, government contract compliance matters, disputes regarding environmental clean-up costs, and other matters arising out of the normal conduct of our business. We intend to vigorously defend ourselves in such matters. From time to time, we are named as a defendant in cases as a result of our distribution of laboratory supplies, including litigation resulting from the alleged prior distribution of products containing asbestos by certain of our predecessors or acquired companies. While the impact of this litigation has historically been immaterial, there can be no assurance that the impact of the pending and any future claims will not be material to our business, financial condition or results of operations in the future.

If we are unable to hire, train and retain key personnel, our business, financial condition and results of operations could be adversely affected.

Our success depends in large part upon our continuing ability to identify, hire, retain and motivate skilled professionals. We face intense competition for these professionals from our competitors, customers, suppliers and other companies within the industries in which we compete and the geographical regions in which we operate. Any failure on our part to hire, train and retain a sufficient number of qualified professionals could have a significant adverse impact on our business.

We depend heavily on the services of our senior management. We believe that our future success will depend upon the continued services of our senior management. Our business may be harmed by the loss of one or more members of our senior management. We currently do not maintain key-man life insurance with respect to our executive officers.

We rely upon our distribution centers and third parties to ship products to our customers, and significant interruptions in the operations of our distribution centers or the operations of such third parties could harm our business, financial condition and results of operations.

Our infrastructure primarily consists of strategically located distribution centers and various smaller regional service centers where we receive products from manufacturers, manage inventory and fill and ship customer orders. We also ship a significant amount of our orders through various independent package delivery providers. Prompt shipment of our products is important to our business. Any significant disruptions to the operations of our distribution centers or such third parties for any reason, including labor relations issues, power interruptions, severe weather, fire or other circumstances beyond the control of us or such third parties, could cause our operating expenses to increase or seriously harm our ability to fulfill our customers’ orders or deliver products on a timely basis, or both. In addition, an increase in prices by our third-party carriers, due to increases in fuel prices or otherwise, could adversely impact our financial condition and results of operations if we are unable to find alternative providers or make adjustments to our selling prices.

13

Problems with or failure of our information services and their connectivity to our customers, suppliers and/or certain service providers could significantly disrupt our operations, which could reduce our customer or supplier base and could harm our business, financial condition and results of operations.

Our businesses rely on sophisticated information systems to obtain, rapidly process, analyze and manage data to facilitate the purchase and distribution of millions of inventory items from numerous distribution centers; to receive, process and ship orders on a timely basis; to account for other product and service transactions with customers; to manage the accurate billing and collections for thousands of customers; and to process payments to suppliers. Our business and results of operations may be adversely affected if these systems are interrupted or damaged by unforeseen events or if they fail for any extended period of time, including due to the actions of third parties. To reduce our risks against unforeseen events, we continually deploy, test and refine disaster recovery and business continuity preparedness plans.

Information security risks have generally increased in recent years because of the proliferation of new technologies and the increased sophistication and activities of perpetrators of cyber-attacks. A failure in or breach of our operational or information security systems, or those of our third-party service providers, as a result of cyber-attacks or information security breaches could disrupt our business and/or our supply chain, result in the improper disclosure or misuse of confidential or proprietary information, damage our reputation and/or increase our costs. As a result, cyber security and the continued development and enhancement of the controls and processes designed to protect our systems, computers, software, data and networks from attack, damage or unauthorized access remain a high priority for us. Although we believe that we have robust information security procedures and other safeguards in place, as cyber threats continue to evolve, we may be required to expend additional resources to continue to enhance our information security measures and/or to investigate and remediate any information security vulnerabilities.

In addition, we accept payment by credit card and similar payment instruments for a material portion of our sales, and our ability to accept, process and settle credit card transactions is subject to rules and regulations issued and/or amended from time to time by payment card companies, such as American Express, VISA, MasterCard and Discover. These rules and regulations, which vary based on annual transaction volume and transaction experience, require us to safeguard customer information, including applying the minimum security standards for the manner in which we capture, store, process and transmit such information. Our failure to comply with such changing rules and standards can subject us to fines, restrictions or expulsion from these card acceptance programs, which could have a material adverse effect on our business, financial condition and results of operations.

We have recently completed the implementation of an enterprise resource planning system in our U.S. laboratory products business and we plan to continue to make technology and infrastructure investments, including with respect to our enterprise resource planning and e-commerce capabilities. Our technology initiatives are designed to enhance the security, confidentiality, integrity and availability of data and systems, to ensure our operations continue to provide a high quality service to our customers and to provide important information to our management. We are continually assessing the risks and costs associated with potential problems and interruptions that could reduce the efficiency and effectiveness of our operations in the near term, looking for opportunities to transfer or share these risks with specialized information systems security providers and insuring against these risks where appropriate. Despite these efforts, the cost and potential problems and interruptions associated with the implementation of our technology initiatives could disrupt or reduce our productivity, including our ability to process orders, ship products, provide services and customer support, send invoices and track payments, fulfill contractual obligations or otherwise operate our business, as well as disrupt or impair our ability to provide important information to our management and investors.

We have not registered and in some cases do not own the existing applications and registrations for our material trademarks or service marks in every country in which we do business.

We serve our customers globally through our operations in 34 countries and use a number of registered and unregistered trademarks and service marks for our products and services, substantially all of which are owned by us. Although we have registered our material trademarks in the United States and the primary European countries in which we conduct business, we have not registered and in some cases do not own the existing applications and registrations for our material trademarks or service marks in all countries in which we conduct business. Our efforts to protect our intellectual property rights in certain countries, especially those in Asia-Pacific, may only provide us with limited protection. In addition, in some countries, we may be blocked from registering or otherwise protecting certain of our marks by others who have already registered identical or similar marks for similar goods or services, and in those cases, we run the risk of being sued for infringement or being unable to effectively establish brand identity.

The failure to own and have enforceable rights in the trademarks and service marks used in our business could have a material adverse effect on our business, financial condition and results of operations.

14

Unanticipated increases to our income tax liabilities could adversely impact our results of operations.

As a global corporation, our business is subject to a wide variety of U.S. federal, state and non-U.S. laws, regulations and policies. There can be no assurance that laws, regulations and policies will not be changed in ways that will impact our income tax provision or our income tax assets and liabilities. We are also subject to income tax audits in the United States and numerous foreign jurisdictions. Judgment is required in determining our global provision for income taxes and other tax liabilities. Although we believe that our tax estimates are reasonable, we cannot assure you that the final determination of tax audits or tax disputes will not be different from what is reflected in our historical income tax provisions and accruals. Tax authorities in the various jurisdictions in which we have a presence and conduct business may disagree with our tax positions and assess additional taxes.