Attached files

| file | filename |

|---|---|

| EX-2.1 - EXHIBIT 2.1 - ZAIS Group Holdings, Inc. | v403259_ex2-1.htm |

| EX-99.1 - EXHIBIT 99.1 - ZAIS Group Holdings, Inc. | v403259_ex99-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) March 4, 2015

HF2 FINANCIAL MANAGEMENT INC.

(Exact Name of Registrant as Specified in its Charter)

|

Delaware (State or other Jurisdiction of Incorporation) |

001-35848 (Commission File Number) |

46-1314400 (IRS Employer Identification No.) |

|

999 18th Street, Suite 3000, Denver, Colorado (Address of Principal Executive Offices) |

80202 (Zip Code) |

Registrant’s telephone number, including area code (303) 498-9737

Not Applicable

(Former name, former address and former fiscal year, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 1.01 Entry Into A Material Definitive Agreement.

Amendment to Investment Agreement

As previously reported by HF2 Financial Management Inc. (the “Company”) on a Current Report on Form 8-K filed with the Securities and Exchange Commission (“SEC”) on September 17, 2014, the Company entered into an Investment Agreement (the “Investment Agreement”), dated as of September 16, 2014, as amended on October 31, 2014, by and among the Company, ZAIS Group Parent, LLC (“ZGP”) and the members of ZGP (the “ZGP Founder Members”). Pursuant to the terms of the Investment Agreement, the Company will contribute cash to ZGP in exchange for newly issued Class A units of ZGP (“Class A Units”), which are referred to herein as the “Acquired Units” and the transaction is referred to as the “Business Combination.” ZGP is the sole member of ZAIS Group, LLC (“ZAIS”). Pursuant to the Investment Agreement, the contribution amount for the Acquired Units is an amount in cash equal to the assets in the trust account maintained for the benefit of the Company’s public stockholders (the “Trust Account”), after giving effect to redemptions and less the Company’s aggregate costs, fees and expenses incurred in connection with or pursuant to the consummation of the Business Combination (including deferred commissions) (the “Expense Payments” and the consideration to be paid to ZGP, the “Closing Acquisition Consideration”).

On March 4, 2015, the Company, ZGP and the Founder Members entered into a Second Amendment to Investment Agreement (the “Second Amendment”) pursuant to which the parties amended one of the conditions to the closing of the transactions contemplated by the Investment Agreement (the “Closing”). Prior to the Second Amendment, the Investment Agreement stated that after giving effect to redemptions of Class A common stock, par value $0.0001 per share, of the Company (“Class A Common Stock”) in connection with the Business Combination and subtracting the Expense Payments, the sum of (1) the amount of cash in the Company’s Trust Account, (2) any other available cash of the Company and (3) any other proceeds from issuances of equity of ZGP made available to the Company shall equal at least $100,000,000. As amended by the Second Amendment, the Investment Agreement provides that after giving effect to the redemptions of Class A Common Stock in connection with the Business Combination and the Expense Payments (other than certain notes issued to the Company’s financial advisers), the amount of cash in the Trust Account shall equal at least $65,000,000.

In addition, prior to the Second Amendment, the Investment Agreement stated that if the Expense Payments exceeded $10,000,000, then additional Class A Units would be issued to the ZGP Founder Members, which would decrease the Company’s ownership of ZGP. As amended by the Second Amendment, if Expense Payments exceed $5,600,000, then additional Class A Units will be issued to the ZGP Founder Members. As discussed below under Item 8.01 under the caption “Amendments to Agreements with Financial Advisers,” certain anticipated Expense Payments payable to the financial advisers originally in the amount of $7.0 million have been reduced, giving effect to the amendments to the agreements with the financial advisers described below, to $2.6 million (taking into account Expense Payments payable in cash and in the form of certain notes, as described below, but excluding Expense Payments payable in Adviser Shares). Expense Payments payable in cash have been reduced by $5.65 million, resulting in additional cash available for contribution by the Company to ZGP.

This description of the Second Amendment is qualified in its entirety by the terms and conditions of the Second Amendment, a copy of which is filed with this Current Report on Form 8-K as Exhibit 2.1 and is incorporated herein by reference, and the foregoing description of the Second Amendment is qualified in its entirety by reference thereto.

Item 3.01. Notice of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing.

As previously disclosed by the Company, on January 2, 2015, the Company received notice from NASDAQ that NASDAQ has concluded that it has not complied with NASDAQ Listing Rules 5620(a) and 5620(b) for the fiscal year ended December 31, 2014 and has determined to initiate procedures to delist our Class A Common Stock from NASDAQ. NASDAQ Listing Rule 5620(a) requires each company to hold an annual meeting of shareholders no later than one year after the end of the company’s fiscal year-end. A subsequent notice from NASDAQ received by the Company on January 5, 2015 stated that the Company’s failure to comply with NASDAQ Listing Rule 5550(a)(3) serves as an additional basis for delisting. NASDAQ Listing Rule 5550(a)(3) requires listed companies to maintain at least 300 “public holders” which includes beneficial holders and holders of record, but does not include any holder who is, either directly or indirectly, an executive officer, director, or the beneficial holder of more than 10% of the total shares outstanding. The Company submitted a request for a hearing with the NASDAQ Hearings Panel on January 9, 2015, and a hearing was held on February 19, 2015.

On March 3, 2015, the Company received a letter from the Hearings Panel which states that the Hearings Panel has determined to extend the listing of the Company’s Class A Common Stock provided that: (i) the Company completes the Business Combination on or before March 21, 2015, (ii) the Company receives, on or before the closing of the Business Combination, a determination from the NASDAQ Staff that the Business Combination meets all initial listing criteria for listing on the NASDAQ Stock Market and (iii) on the earlier of April 17, 2015 or 20 business days after the completion of the Business Combination, the Company demonstrates that it had the requisite number of shareholders and round lot shareholders as of the closing of the Business Combination to meet the initial listing standards of NASDAQ. There can be no assurance the Company will be able to meet these conditions or be able to maintain its listing on the NASDAQ Capital Market.

Item 8.01 Other Events.

The Company is scheduled to hold its special meeting of stockholders to approve the Business Combination on March 9, 2015 at 9:00 a.m. eastern time at the offices of Morgan, Lewis & Bockius LLP, 399 Park Avenue, New York, NY 10022. In connection with its special meeting, the Company filed with the SEC on January 26, 2015, and delivered to its stockholders, a definitive proxy statement on Schedule 14A (the “Proxy Statement”). The following information supplements and updates certain information set forth in the Proxy Statement, and should be read in conjunction with the Proxy Statement, which should be read carefully and in its entirety. The Company also issued a press release on March 4, 2015 announcing the Second Amendment and other matters disclosed in this Form 8-K. A copy of the press release is attached as Exhibit 99.1 and is incorporated herein by reference.

Redemptions; Change in Redemption Request Deadline

In the Proxy Statement, the Company disclosed that the deadline for holders of shares of the Company’s Class A Common Stock that were sold in its initial public offering (“public shares” and the holders thereof, “public stockholders”) to submit a request to have their shares of Class A Common Stock redeemed for cash was 5:00 p.m. Eastern time on February 13, 2015. In order to give stockholders an opportunity to consider the amended and new agreements described in this Current Report on Form 8-K, the Company has extended the deadline for public stockholders to request redemption of their shares of Class A Common Stock to 5:00 p.m. Eastern time on March 6, 2015.

In order to exercise redemption rights, a public stockholder must:

| · | submit shares for redemption that have been affirmatively voted for or against the Business Combination; |

| · | check the box on the proxy card that accompanied the Proxy Statement to elect redemption; |

| · | check the box on the proxy card that accompanied the Proxy Statement marked “Shareholder Certification;” |

| · | submit a request in writing prior to 5:00 p.m., Eastern time on March 6, 2015 that the Company redeem your public shares for cash to Continental Stock Transfer & Trust Company, the Company’s transfer agent, at the following address: |

Continental Stock Transfer & Trust Company

17 Battery Place

New York, New York 10004

Attn: Mark Zimkind

E-mail: mzimkind@continentalstock.com

| · | and deliver such shares either physically or electronically through DTC’s DWAC (Deposit/Withdrawal At Custodian) System to the Company’s transfer agent prior to 5:00 p.m., Eastern time, on March 6, 2015. |

ZGP Agreements with Neil Ramsey

As disclosed in a Schedule 13D filed on February 17, 2015, a private investment fund named dQuant Special Opportunities Fund, LP (“Spec Ops”), a Delaware limited partnership, purchased in the open market earlier this month 2,378,883 shares of our Class A Common Stock through open market and privately negotiated purchases. The general partner of Spec Ops is Neil Ramsey. Mr. Ramsey is also the managing member of NAR Special Global, LLC, one of the sponsors of the Company that holds 1,135,973 of the shares of Class A Common Stock that were purchased prior to and contemporaneously with the Company’s initial public offering.

On March 4, 2015, ZGP entered into an agreement with Mr. Ramsey, an affiliate of NAR Special Global, LLC and of dQuant Special Opportunities Fund, L.P. (together, the “Ramsey Investors”), each of which are significant stockholders of the Company, under which ZGP has agreed to pay Mr. Ramsey, within five business days from, and conditioned on, the closing of the Business Combination, an incentive fee of $3.4 million if Mr. Ramsey causes the Ramsey Investors to purchase from stockholders who have tendered their shares of Class A common stock for redemption such number of shares of Class A Common Stock as is necessary to meet the closing conditions that there be at least $65 million in the Trust Account after giving effect to redemptions and Expense Payments (other than certain notes to the Company’s financial advisers). ZGP also has agreed to enter into a two-year Consulting Agreement with Mr. Ramsey through RQSI Ltd, an entity controlled by Mr. Ramsey (the “Consulting Agreement”), under the terms of which, among other things, Mr. Ramsey will provide consulting services to ZGP, its senior management team and ZAIS, as requested by ZGP’s managing member, from time to time during the 24-month period beginning on, and subject to, the closing of the Business Combination. Mr. Ramsey may not compete against ZGP during the term of the Consulting Agreement, and for two years following its termination. In consideration for his undertakings under the Consulting Agreement, ZGP will pay Mr. Ramsey a consulting fee of $500,000 per annum payable in monthly installments. ZGP may terminate the Consulting Agreement for cause, as defined in the Consulting Agreement. If the purchases of shares necessary to earn the incentive fee are made by the Ramsey Investors, the Ramsey Investors will have invested an aggregate of $60,000,000 through open market purchases in February and March 2015. The payment by ZGP to Mr. Ramsey of the incentive fee described above and of the amounts due under the Consulting Agreement could be viewed as effectively reducing the per share cost to the Ramsey Investors for the Class A Common Stock by $0.77 per share relative to the per share cost of the other Purchaser Parties.

Amendments to Agreements with Financial Advisers

Pursuant to an agreement that the Company entered into with EarlyBirdCapital, Inc. (“EBC”) and Sandler O’Neill & Partners, L.P. (“Sandler”) at the time of its initial public offering, the Company agreed to pay to EBC and Sandler an aggregate advisory fee of $7.0 million upon the consummation of the Business Combination. The Company also entered into an agreement with Sidoti & Company LLC (“Sidoti” and together with EBC and Sandler, the “Adviser Firms”) pursuant to which the Company receives advisory services from Sidoti in exchange for a cash fee of $400,000, to be paid out of the $7.0 million fee owed to EBC and Sandler. The Company has amended its agreements with the Adviser Firms to provide that the Company will: (i) pay to the Adviser Firms an aggregate of $1,350,000 in cash (the “Cash Fee”), (ii) issue to the Adviser Firms promissory notes in an aggregate principal amount of $1,250,000, which have an interest rate equal to the applicable federal rate and a two-year term (the “Notes”), and (iii) issue to the Adviser Firms an aggregate of 150,000 shares of Class A Common Stock (the “Adviser Shares”). The Cash Fee, Notes and Adviser Shares would be delivered to the Adviser Firms upon the Closing. The Notes will be excluded from the definition of “Expense Payments” for purposes of calculating whether the minimum cash closing condition of $65 million in the Trust Account is satisfied, but not for purposes of determining whether additional Class A Units will be issued to the ZGP Founder Members. The Adviser Shares will be excluded from the definition of “Expense Payments” for all purposes to the extent an equivalent number of shares of Class A Common Stock are transferred to the Company from the sponsors. The effect of the amended agreements with the Adviser Firms is to increase the cash contributed to ZGP in the Business Combination by $5.65 million. ZGP will in turn make payments aggregating $4.4 million to Neil A. Ramsey pursuant to the Ramsey Agreements described above.

Impact of the Business Combination on HF2’s Public Float

In the Proxy Statement, the Company included certain disclosure that assumed maximum redemptions of 7,142,857 shares of Class A Common Stock which, after the deduction of Expense Payments, would have resulted in approximately $100,000,000 in the Trust Account at the Closing. Set forth below is disclosure regarding the anticipated ownership of the Company after the Business Combination assuming maximum redemptions of 10,990,238 shares of Class A Common Stock which, after the deduction of Expense Payments, would result in approximately $65,000,000 in the Trust Account at the Closing.

| HF2 public stockholders | 1.8 | % | ||

| HF2 Sponsors, Officers and Directors* | 98.2 | % |

| * | Includes 4,398,750 shares purchased by the Company’s sponsors prior to the Company’s initial public offering (“Founders’ Shares”), 1,598,400 shares purchased by the Company’s sponsors in private placements at the time of the Company’s initial public offering (“Sponsors’ Shares”) and assumes an aggregate of 6,380,762 shares acquired in the open market by the Company’s sponsors, officers and directors and ZGP Founder Members, including as described below under “Purchases of Shares of Class A Common Stock by Sponsors and Others.” |

The Company will receive a number of Class A Units equal to the aggregate number of shares of Class A Common Stock outstanding at the Closing and after giving effect to any redemptions of Class A Common Stock by the Company’s public stockholders.

Immediately after the Closing, the ZGP Founder Members will hold 7,000,000 Class A Units, subject to adjustment in accordance with the Investment Agreement. It is also contemplated that, after the Closing, ZGP will issue up to 1,600,000 Class B Units (“Class B Units”) to key ZAIS employees which will vest on the later of the date of grant and the second anniversary of the Closing.

During the first five years after the Closing, ZGP will release up to an additional 2,800,000 Class A Units (the “Additional Founder Units”) to the ZGP Founder Members if the sum of the average per share closing price over any 20 trading-day period of the Class A Common Stock plus cumulative dividends paid on the Class A Common Stock between the Closing and the day prior to such 20 trading-day period (the “Total Per Share Value”) meets or exceeds specified thresholds, ranging from $12.50 to $21.50. After the Closing, ZGP may grant up to 5,200,000 Class B-1, Class B-2, Class B-3 and Class B-4 Units (together the “Additional Employee Units”) to ZAIS employees. The Additional Employee Units vest in three equal installments: one-third upon achieving the applicable Total Per Share Value threshold (which are the same as for the Additional Founder Units), one-third upon the first anniversary of such achievement and one-third upon the second anniversary of such achievement. The applicable Total Per Share Value threshold must be achieved within the first five years after the Closing. Although the Class B Units are outstanding when issued, the Class B Units are not entitled to any distributions from ZGP (and thus will not participate in the Company’s income or loss) or other material rights until the Class B Units vest and may not be exchanged for shares of Class A Common Stock until they vest.

Assuming the redemption of 10,990,238 public shares and that all or none of the Additional Founder Units are released or Additional Employee Units are issued, the ownership percentage of the Company in ZGP will be as shown below:

| With Additional Founder Units and Additional Employee Units (1) | Without Additional Founder Units and Additional Employee Units | |||||||

| HF2 (2) | 43.2 | % | 59.5 | % | ||||

| ZGP Founder Members | 33.6 | % | 33.0 | % | ||||

| ZAIS Employees (3) | 23.2 | % | 7.5 | % | ||||

| (1) | Includes release of 2,800,000 Additional Founder Units and issuance of 5,200,000 Additional Employee Units. |

| (2) | Assumes 12,601,912 shares of Class A Common Stock outstanding after the redemption of 10,990,238 shares of Class A Common Stock, including all Founders’ Shares and Sponsors’ Shares and all public shares held by the Company’s public stockholders, sponsors, officers and directors. |

| (3) | Includes up to 1,600,000 Class B Units contemplated to be issued to key ZAIS employees following the Closing and assumes that these Class B Units have vested. Class B Units that have not vested are not entitled to any economic participation in ZGP or other material rights. These Class B Units vest on the later of the date of grant and the second anniversary of the Closing. |

The ownership percentages in the above two tables do not take into account Closing related adjustments to the number of Class A Units to be retained by the ZGP Founder Members and assume no equity awards have been granted under the Company’s proposed 2015 Stock Incentive Plan. If the actual facts are different than these assumptions (which they are likely to be), the percentage ownerships in the Company and ZGP will be different.

Unaudited Pro Forma Condensed Combined Financial Information

In the section of the Proxy Statement entitled “Unaudited Pro Forma Condensed Combined Financial Information,” the Company disclosed certain unaudited pro forma financial information assuming no redemptions of Class A Common Stock and the redemption of 7,142,857 shares of Class A Common Stock, which, after the deduction of Expense Payments, would have resulted in approximately $100,000,000 in the Trust Account at the Closing.

In connection with the Second Amendment, the Company is providing the following unaudited pro forma condensed combined balance sheet as of September 30, 2014 and the unaudited pro forma condensed combined statements of operations for the nine months ended September 30, 2014 and for the year ended December 31, 2013 based on the historical financial statements of the Company and ZGP after giving effect to the Business Combination and assuming that (i) 10,990,238 shares of Class A Common Stock are redeemed (the maximum number of shares that may be redeemed in order for the Company to satisfy the closing condition that it have $65,000,000 of cash in the Trust Account after giving effect to redemptions and Expense Payments (other than certain notes issued to the Company’s financial advisers) and (ii) the amount of Expense Payments is $5,600,000, including cash expenses of $4,350,000 and notes issued of $1,250,000.

The unaudited pro forma condensed combined statements of operations information for the nine months ended September 30, 2014 and the year ended December 31, 2013 give pro forma effect to the Business Combination as if it had occurred on January 1, 2013. The unaudited pro forma condensed combined statement of operations information for the nine months ended September 30, 2014 and the year ended December 31, 2013 was derived from ZGP’s unaudited consolidated statement of operations for the nine months ended September 30, 2014, ZGP’s audited consolidated statement of operations for the year ended December 31, 2013, the Company’s unaudited statement of income for the nine months ended September 30, 2014 and the Company’s audited statement of income for the year ended December 31, 2013.

The unaudited pro forma condensed combined balance sheet as of September 30, 2014 assumes that the Business Combination had occurred on September 30, 2014. The unaudited pro forma condensed combined balance sheet information as of September 30, 2014 was derived from ZGP’s unaudited consolidated balance sheet as of September 30, 2014 and the Company’s unaudited balance sheet as of September 30, 2014.

The pro forma adjustments are based on the information currently available, as described in the accompanying footnotes. The unaudited pro forma condensed combined statement of operations is not necessarily indicative of what the actual results of operations would have been had the Business Combination taken place on the dates indicated, nor is it indicative of the future consolidated results of operations or financial condition of the post-combination company. In addition, the allocation of the consideration delivered to ZGP at Closing shown in the pro forma adjustments is preliminary and will be subject to a final determination upon the Closing, which may result in materially different allocations that may have a material effect on the actual results of operations and financial condition of the combined company. The selected unaudited pro forma condensed combined financial information below should be read in conjunction with the sections of the Proxy Statement entitled “HF2 Management’s Discussion and Analysis of Financial Condition and Results of Operations,” “ZGP Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the historical consolidated financial statements and notes thereto of the Company and ZGP included in the Proxy Statement.

| UNAUDITED PRO FORMA CONDENSED COMBINED BALANCE SHEET | ||||||||||||||||||

| ASSUMES MAXIMUM CONVERSION | ||||||||||||||||||

| SEPTEMBER 30, 2014 (in thousands) |

| ZAIS Group Parent LLC and Subsidiaries | HF2 Financial Management Inc. | Pro Forma Adjustments | Footnote Reference | Pro Forma Combined | ||||||||||||||

| Assets | ||||||||||||||||||

| Cash and cash equivalents | $ | 22,675 | $ | 127 | (101 | ) | 1 | $ | 75,959 | |||||||||

| 184,747 | 2 | |||||||||||||||||

| (4,249 | ) | 4 | ||||||||||||||||

| (8,400 | ) | 6 | ||||||||||||||||

| (115,397 | ) | 7 | ||||||||||||||||

| (3,443 | ) | 8 | ||||||||||||||||

| Cash and cash equivalents, held in trust | 184,747 | (184,747 | ) | 2 | - | |||||||||||||

| Income and fees receivable | 6,219 | 6,219 | ||||||||||||||||

| Investments in affiliated funds, at fair value | 105 | 105 | ||||||||||||||||

| Due from related parties | 574 | 574 | ||||||||||||||||

| Prepaid expenses and other current assets | 1,683 | 12 | 1,695 | |||||||||||||||

| Fixed assets, net | 1,154 | 1,154 | ||||||||||||||||

| Other assets | 3,404 | 3,404 | ||||||||||||||||

| Assets of Consolidated Funds | ||||||||||||||||||

| Cash and cash equivalents | 202,420 | 202,420 | ||||||||||||||||

| Restricted cash | 80,174 | 80,174 | ||||||||||||||||

| Investments, at fair value | 1,118,201 | 1,118,201 | ||||||||||||||||

| Investments in affiliated securities, at fair value | 29,472 | 29,472 | ||||||||||||||||

| Derivative assets, at fair value | 2,930 | 2,930 | ||||||||||||||||

| Due from affiliates | 162 | 162 | ||||||||||||||||

| Other Assets | 11,588 | 11,588 | ||||||||||||||||

| Total Assets | $ | 1,480,761 | $ | 184,886 | $ | (131,590 | ) | $ | 1,534,057 | |||||||||

| Liabilities, Redeemable Non-Controlling Interests of Consolidated Funds and Equity | ||||||||||||||||||

| Accrued compensation and benefits | 15,702 | 15,702 | ||||||||||||||||

| Due to Related Parties | 32 | 32 | ||||||||||||||||

| Other liabilities | 2,569 | 1,250 | 5 | 3,819 | ||||||||||||||

| Deferred commissions | 101 | (101 | ) | 1 | - | |||||||||||||

| Other accrued liabilities | 396 | 396 | ||||||||||||||||

| Liabilities of Consolidated Funds | ||||||||||||||||||

| Notes payable of Consolidated CDOs, at fair value | 784,940 | 784,940 | ||||||||||||||||

| Derivative liabilities, at fair value | 7,354 | 7,354 | ||||||||||||||||

| Securities sold, not yet purchased | 57,118 | 57,118 | ||||||||||||||||

| Redemptions payable | 2,000 | 2,000 | ||||||||||||||||

| Due to Broker | - | - | ||||||||||||||||

| Other liabilities | 128,755 | 128,755 | ||||||||||||||||

| Total Liabilities | 998,470 | 497 | 1,149 | 1,000,116 | ||||||||||||||

| Commitments and Contingencies | ||||||||||||||||||

| Redeemable Non-Controlling Interests of Consolidated Funds | 450,615 | 450,615 | ||||||||||||||||

| Common stock subject to conversion | 172,351 | (172,351 | ) | 9 | - | |||||||||||||

| Equity | ||||||||||||||||||

| Preferred stock | ||||||||||||||||||

| Class A common stock | 1 | 2 | 9 | 2 | ||||||||||||||

| (1 | ) | 7 | ||||||||||||||||

| Class B common stock | 0.020 | 0.0200 | ||||||||||||||||

| Additional paid-in capital | - | 13,434 | 172,349 | 9 | 45,695 | |||||||||||||

| (17,795 | ) | 11 | ||||||||||||||||

| (115,396 | ) | 7 | ||||||||||||||||

| (1,397 | ) | 3 | ||||||||||||||||

| (4,249 | ) | 4 | ||||||||||||||||

| (1,250 | ) | 5 | ||||||||||||||||

| Retained Earnings / (Deficit) | (1,397 | ) | 1,397 | 3 | - | |||||||||||||

| Total Equity of HF2 Financial Management Inc. | 12,038 | 33,659 | 45,697 | |||||||||||||||

| Members' Interest in ZGP held by non-controlling members | 7,588 | 10 | 25,383 | |||||||||||||||

| 17,795 | 11 | |||||||||||||||||

| Members' equity | 19,431 | (7,588 | ) | 10 | - | |||||||||||||

| (8,400 | ) | 6 | ||||||||||||||||

| (3,443 | ) | 8 | ||||||||||||||||

| Equity attributable to non-controlling | ||||||||||||||||||

| interests of Consolidated Funds | 12,245 | 12,245 | ||||||||||||||||

| Total Equity | 31,676 | 12,038 | 83,326 | |||||||||||||||

| Total Liabilities, Redeemable Non-Controlling Interests of Consolidated Funds and Equity | $ | 1,480,761 | $ | 184,886 | $ | (131,590 | ) | $ | 1,534,057 | |||||||||

See notes to unaudited pro forma condensed combined financial statements

NOTES TO UNAUDITED PRO FORMA CONDENSED COMBINED BALANCE SHEET

ASSUMES MAXIMUM CONVERSION

SEPTEMBER 30, 2014 (in thousands)

| 1 | Record payment of deferred commissions payable to an investment banker relating to the sale of Sponsor shares at the time of consummation of our IPO. | |

| 2 | Reclassify Cash held in Trust to Cash and Cash Equivalents. | |

| 3 | Reclassify the Company’s Retained Earnings to Additional Paid In Capital. | |

| 4 | Record $4,350 of Company cash transaction expenses, including, but not limited to legal fees and expenses, accounting fees, proxy solicitation costs and printing fees, less $101 of deferred commissions. | |

| 5 | Record $1,250 note issued to the Company’s investment bankers in connection with completion of the transaction. | |

| 6 | Record $8,400 of estimated Transaction Expenses to be incurred by ZGP in completing the transaction. | |

| 7 | Record reduction of cash and equity due to maximum amount of Redemptions of 10,990,238 shares of Class A Common Stock. If holders of more than 10,990,238 shares redeem their shares for cash, the transaction will not close. After expenses, the company estimates it will have $175 million in its trust account, and must deliver $65 million to close. $115.3975 million divided by $10.50 per share equals 10,990,238 shares. The Company may use the difference, or $115.3975 million, to fund conversions in connection with the consummation of the business combination. With $115.3975 million available for conversions, the Company may convert up to 10,990,238 shares for $10.50 per share. | |

| 8 | Distribution to Founder Members based on working capital adjustment in accordance with Investment Agreement. | |

| 9 | Reclassify common stock subject to possible conversion to equity. After the transaction, no common stock will be subject to conversion. | |

| 10 | Reclassify ZGP Member's Equity to Member's Interest in ZGP held by non-controlling members. | |

| 11 | Adjust Member's Interest in ZGP held by non-controlling members to reflect their 35.71% ownership of the combined entity's total equity of $71,081. The net total equity of $71,081 consists of total gross equity of $83,326 minus the portion of equity attributable to non-controlling interests in Consolidated Funds of $12,245. The ownership percentage of 35.71% does not include the 1,600,000 Class B Units expected to be issued to ZAIS employees shortly after Closing, or the Additional Founder Units and Additional Employee Units that may be issued during the first five years after Closing as such Class B Units are not eligible to participate in the economics of the Company until after certain vesting hurdles (as explained further in Notes 11 and 12 to the Unaudited Pro Forma Condensed Combined Statement of Operations) are achieved. |

UNAUDITED PRO FORMA CONDENSED COMBINED STATEMENT OF OPERATIONS

ASSUMES MAXIMUM CONVERSION

NINE MONTHS ENDED SEPTEMBER 30, 2014 (in thousands, except per share amounts)

| ZAIS Group Parent LLC and Subsidiaries | HF2 Financial Management Inc. | Pro Forma Adjustments | Footnote Reference | Pro Forma Combined | ||||||||||||||

| Revenues | ||||||||||||||||||

| Management fee income | $ | 14,739 | $ | $ | $ | 14,739 | ||||||||||||

| Incentive income | 41,743 | 41,743 | ||||||||||||||||

| Other revenues | 454 | 454 | ||||||||||||||||

| Income of Consolidated Funds | 88,110 | 88,110 | ||||||||||||||||

| Total Revenues | 145,046 | - | - | 145,046 | ||||||||||||||

| Expenses | ||||||||||||||||||

| Employee compensation and benefits | 37,600 | - | 12 | 37,600 | ||||||||||||||

| - | 13 | |||||||||||||||||

| General, administrative and other | 13,086 | 929 | 375 | 20 | 14,390 | |||||||||||||

| Depreciation and amortization | 358 | 358 | ||||||||||||||||

| Expenses of Consolidated Funds | 99,864 | 99,864 | ||||||||||||||||

| Total Expenses | 150,908 | 929 | 375 | 152,212 | ||||||||||||||

| Other Income (Loss) | ||||||||||||||||||

| Interest income | 51 | (33 | ) | 14 | 18 | |||||||||||||

| Net (loss) on investments | (41 | ) | (41 | ) | ||||||||||||||

| Other income | 164 | 164 | ||||||||||||||||

| Net Gains of Consolidated Funds' investments | 72,177 | 72,177 | ||||||||||||||||

| Total Other Income | 72,300 | 51 | (33 | ) | 72,318 | |||||||||||||

| Income from continuing operations before income taxes | 66,438 | (878 | ) | (408 | ) | 65,152 | ||||||||||||

| Income tax expense | 19 | - | 5,771 | 15 | 5,790 | |||||||||||||

| Income from continuing operations | 66,419 | (878 | ) | (6,179 | ) | 59,362 | ||||||||||||

| Consolidated Net Income | $ | 66,419 | $ | (878 | ) | $ | (6,179 | ) | $ | 59,639 | ||||||||

| Other Comprehensive Income, Net of Tax | ||||||||||||||||||

| Foreign currency translation adjustment | 630 | - | 630 | |||||||||||||||

| Total Comprehensive Income | 67,049 | (878 | ) | (6,179 | ) | 59,992 | ||||||||||||

| Allocation of Consolidated Net Income (Loss) | ||||||||||||||||||

| Redeemable Non-controlling interests of Consolidated Funds | 41,434 | 41,434 | ||||||||||||||||

| Non-controlling interests of Consolidated Funds | 1,726 | 1,726 | ||||||||||||||||

| ZAIS Group Parent, LLC Members | 23,259 | (23,259 | ) | 16 | 7,847 | |||||||||||||

| 7,847 | 17 | |||||||||||||||||

| HF2 Financial Management | - | (878 | ) | 878 | 16 | 8,355 | ||||||||||||

| 14,126 | 17 | |||||||||||||||||

| (5,771 | ) | 18 | ||||||||||||||||

| 66,419 | (878 | ) | (6,179 | ) | 59,362 | |||||||||||||

| Allocation of Total Comprehensive Income (Loss) | ||||||||||||||||||

| Redeemable Non-controlling interests of Consolidated Funds | 41,408 | 41,408 | ||||||||||||||||

| Non-controlling interests of Consolidated Funds | 1,726 | 1,726 | ||||||||||||||||

| ZAIS Group Parent, LLC Members | 23,915 | (23,915 | ) | 16 | 8,081 | |||||||||||||

| 7,847 | 17 | |||||||||||||||||

| 234 | 19 | |||||||||||||||||

| HF2 Financial Management | - | (878 | ) | 878 | 16 | 8,777 | ||||||||||||

| 14,126 | 17 | |||||||||||||||||

| (5,771 | ) | 18 | ||||||||||||||||

| 422 | 19 | |||||||||||||||||

| $ | 67,049 | $ | (878 | ) | $ | (6,179 | ) | $ | 59,992 | |||||||||

| Weighted Average Number of Shares Outstanding | 23,592,150 | 12,601,912 | ||||||||||||||||

| Net Income / (Loss) per Share, basic and diluted | $ | (0.04 | ) | $ | 0.66 | |||||||||||||

See notes to unaudited pro forma condensed combined financial statements

NOTES TO UNAUDITED PRO FORMA CONDENSED COMBINED STATEMENT OF OPERATIONS

ASSUMES MAXIMUM CONVERSION

NINE MONTHS ENDED SEPTEMBER 30, 2014 (in thousands, except per share amounts)

| 12 | Under the terms of the Investment Agreement, the Company anticipates that it will issue 1,600,000 Class B Units to Key Employees of ZAIS immediately following the closing. These Class B Units will not have any rights or economic participation in the Company until they have vested. These units will be subject to cliff vesting on the later of two years after closing and the grant date, if the recipient remains employed by ZAIS on the vesting date. However, as the issuance of the units is not contractually required, the expense relating to those units has not been recorded in this unaudited pro forma condensed combined statement of operations. Under GAAP, the value of these Class B Units, if issued, would be expensed over the vesting period, using the best estimate of the value of a unit when granted. The Company estimates that had this expense been recorded in this unaudited pro forma condensed combined statement of operations, the amount for this period would have been $6,300, with an offsetting increase to Additional Paid in Capital. | |

| 13 | Under the terms of the Investment Agreement, the Company may issue up to an additional 5,200,000 Class B Units (the Additional Employee Units) in four separate tranches to key employees of ZAIS for a period of up to five years after the Closing. These Additional Employee Units will not have any material rights or economic participation in the Company until they have vested. These units vest one-third when the Company has achieved certain Total Per Share Value hurdles, and one-third on each of the first and second anniversaries of achieving the hurdle. The Additional Employee Units are more fully described in “Proposal No. 1 – Approval of the Business Combination – Related Agreements – Second Amended and Restated Limited Liability Company Agreement – Units”. However, as the issuance of the Additional Employee Units is not contractually required, the expense relating to those units has not been recorded in this unaudited pro forma condensed combined statement of operations. The Company estimates (using a statistical model that considers a variety of factors) that had this expense been recorded in this unaudited pro forma condensed combined statement of operations, the amount for this period would have been $7,656, with offsetting increases to Members’ Interest in ZGP held by non-controlling members of $2,734 and Additional Paid in Capital of $4,922. | |

| 14 | Record reduction in Investment income due to the payment of transaction expenses of $4,350 and Redemptions of $115,398. Since the Company has less cash to invest, its investment income is reduced. | |

| 15 | Record combined Federal and state income tax expense / (benefit) of $5,790 on Income from continuing operations before income tax of $65,152, at an effective tax rate of 8.89% as follows: |

| Statutory U.S. Federal Income Tax Rate | 35.00 | % | ||

| Income Allocated to Non-Controlling Interests | (27.40 | %) | ||

| State Income Taxes | 1.29 | % | ||

| Effective Income Tax Rate | 8.89 | % |

| 16 | Reverse the Company’s and ZGP’s separate Company historical Net Income. | |

| 17 | Apply percentage ownership of the ZGP Founder Members (35.71%) and the Company (64.29%) to the Adjusted consolidated pre-tax income of $21,973 to derive the ZGP and the Company adjustments of $7,847 and $14,126 respectively. Adjusted consolidated pre-tax income of $21,973 consists of the pre-tax historical incomes for ZGP and the Company of $23,259 and $(878) respectively, and the pre-tax pro-forma adjustments of $(408). These ownership percentages do not reflect the anticipated dilution resulting from the 1,600,000 Class B units (5% ownership) expected to be granted to Key Employees of ZAIS after the closing of the transaction because the Class B units will not participate in the income or loss of the Company until they are vested, which will not happen for at least two years after the closing. | |

| 18 | Allocate the Company’s combined Federal and state income tax expense / (benefit) of $5,771 as calculated on entry # 15, to the Company’s portion of Consolidated Net Income and Total Comprehensive Income | |

| 19 | Reclassify miscellaneous adjustments between the Company and ZGP in their percentage ownership. | |

| 20 | Record payment of consulting fee. |

UNAUDITED PRO FORMA CONDENSED COMBINED STATEMENT OF OPERATIONS

ASSUMES MAXIMUM CONVERSION

FOR THE YEAR ENDED DECEMBER 31, 2013 (in thousands, except per share amounts)

| ZAIS Group Parent LLC and Subsidiaries | HF2 Financial Management Inc. | Pro Forma Adjustments | Footnote Reference | Pro Forma Combined | ||||||||||||||

| Revenues | ||||||||||||||||||

| Management fee income | $ | 26,579 | $ | $ | $ | 26,579 | ||||||||||||

| Incentive income | 18,835 | 18,835 | ||||||||||||||||

| Other revenues | 1,265 | 1,265 | ||||||||||||||||

| Income of Consolidated Funds | 108,678 | 108,678 | ||||||||||||||||

| Total Revenues | 155,357 | - | - | 155,357 | ||||||||||||||

| Expenses | ||||||||||||||||||

| Employee compensation and benefits | 53,139 | - | - | 12 | 53,139 | |||||||||||||

| - | 13 | |||||||||||||||||

| General, administrative and other | 20,135 | 618 | 500 | 20 | 21,253 | |||||||||||||

| Depreciation and amortization | 499 | - | 499 | |||||||||||||||

| Expenses of Consolidated Funds | 39,982 | 39,982 | ||||||||||||||||

| Total Expenses | 113,755 | 618 | 500 | 114,873 | ||||||||||||||

| Other Income (Loss) | ||||||||||||||||||

| Interest income | 99 | (64 | ) | 14 | 35 | |||||||||||||

| Net (loss) on investments | (418 | ) | (418 | ) | ||||||||||||||

| Other income | 13 | 13 | ||||||||||||||||

| Net gains of Consolidated Funds' investments | 7,821 | 7,821 | ||||||||||||||||

| Total Other Income | 7,416 | 99 | (64 | ) | 7,451 | |||||||||||||

| Income from continuing operations before income taxes | 49,018 | (519 | ) | (564 | ) | 47,935 | ||||||||||||

| Income tax expense | 329 | 402 | 15 | 731 | ||||||||||||||

| Income from continuing operations | 48,689 | (519 | ) | (966 | ) | 47,204 | ||||||||||||

| Consolidated Net Income | $ | 48,689 | $ | (519 | ) | $ | (966 | ) | $ | 47,204 | ||||||||

| Other Comprehensive Income, Net of Tax | - | |||||||||||||||||

| Foreign currency translation adjustment | (131 | ) | (131 | ) | ||||||||||||||

| Total Comprehensive Income | 48,558 | (519 | ) | (966 | ) | 47,073 | ||||||||||||

| Allocation of Consolidated Net Income (Loss) | ||||||||||||||||||

| Redeemable Non-controlling interests of Consolidated Funds | 44,323 | 44,323 | ||||||||||||||||

| Non-controlling interests of Consolidated Funds | 1,751 | 1,751 | ||||||||||||||||

| ZAIS Group Parent, LLC Members | 2,615 | (2,615 | ) | 16 | 547 | |||||||||||||

| 547 | 17 | |||||||||||||||||

| HF2 Financial Management | - | (519 | ) | 519 | 16 | 583 | ||||||||||||

| 985 | 17 | |||||||||||||||||

| (402 | ) | 18 | ||||||||||||||||

| $ | 48,689 | $ | (519 | ) | $ | (966 | ) | $ | 47,204 | |||||||||

| Allocation of Total Comprehensive Income (Loss) | ||||||||||||||||||

| Redeemable Non-controlling interests of Consolidated Funds | 44,289 | 44,289 | ||||||||||||||||

| Non-controlling interests of Consolidated Funds | 1,751 | 1,751 | ||||||||||||||||

| ZAIS Group Parent, LLC Members | 2,518 | (2,518 | ) | 16 | 512 | |||||||||||||

| 547 | 17 | |||||||||||||||||

| (35 | ) | 19 | ||||||||||||||||

| HF2 Financial Management | - | (519 | ) | 519 | 16 | 512 | ||||||||||||

| 985 | 17 | |||||||||||||||||

| (402 | ) | 18 | ||||||||||||||||

| (62 | ) | 19 | ||||||||||||||||

| $ | 48,558 | $ | (519 | ) | $ | (966 | ) | $ | 47,073 | |||||||||

| Weighted Average Number of Shares Outstanding | 23,592,150 | 12,601,912 | ||||||||||||||||

| Net Income / (Loss) per Share, basic and diluted | $ | (0.02 | ) | $ | 0.05 | |||||||||||||

See notes to unaudited pro forma condensed combined financial statements

NOTES TO UNAUDITED PRO FORMA CONDENSED COMBINED STATEMENT OF OPERATIONS

ASSUMES MAXIMUM CONVERSION

FOR THE YEAR ENDED DECEMBER 31, 2013 (in thousands, except per share amounts)

| 12 | Under the terms of the Investment Agreement, the Company anticipates that it will issue 1,600,000 Class B Units to Key Employees of ZAIS immediately following the closing. These Class B Units will not have any rights or economic participation in the Company until they have vested. These units will be subject to cliff vesting on the later of two years after closing and the grant date, if the recipient remains employed by ZAIS on the vesting date. However, as the issuance of the units is not contractually required, the expense relating to those units has not been recorded in this unaudited pro forma condensed combined statement of operations. Under GAAP, the value of these Class B Units, if issued, would be expensed over the vesting period, using the best estimate of the value of a unit when granted. The Company estimates that had this expense been recorded in this unaudited pro forma condensed combined statement of operations, the amount for this period would have been $8,400, with an offsetting increase to Additional Paid in Capital. | |

| 13 | Under the terms of the Investment Agreement, the Company may issue up to an additional 5,200,000 Class B Units (the Additional Employee Units) in four separate tranches to key employees of ZAIS for a period of up to five years after the Closing. These Additional Employee Units will not have any material rights or economic participation in the Company until they have vested. These units vest one-third when the Company has achieved certain Total Per Share Value hurdles, and one-third on each of the first and second anniversaries of achieving the hurdle. The Additional Employee Units are more fully described in “Proposal No. 1 – Approval of the Business Combination – Related Agreements – Second Amended and Restated Limited Liability Company Agreement – Units”. However, as the issuance of the Additional Employee Units is not contractually required, the expense relating to those units has not been recorded in this unaudited pro forma condensed combined statement of operations. The Company estimates (using a statistical model that considers a variety of factors) that had this expense been recorded in this unaudited pro forma condensed combined statement of operations, the amount for this period would have been $10,209, with offsetting increases to Members’ Interest in ZGP held by non-controlling members of $3,646 and Additional Paid in Capital of $6,563. | |

| 14 | Record reduction in Investment income due to the payment of transaction expenses of $4,350 and Redemptions of $115,398. Since the Company has less cash to invest, its investment income is reduced. | |

| 15 | Record combined Federal and state income tax expense / (benefit) of $731 on Income from continuing operations before income tax of $47,395, at an effective tax rate of 1.53% as follows: |

| Statutory U.S. Federal Income Tax Rate | 35.00 | % | ||

| Income Allocated to Non-Controlling Interests | (34.04 | %) | ||

| State Income Taxes | 0.57 | % | ||

| Effective Income Tax Rate | 1.53 | % |

| 16 | Reverse the Company’s and ZGP’s separate Company historical Net Income. | |

| 17 | Apply percentage ownership of the ZGP Founder Members (35.71%) and the Company (64.29%) to the Adjusted consolidated pre-tax income of $1,532 to derive the ZGP and the Company adjustments of $547 and $985 respectively. Adjusted consolidated pre-tax income of $1,532 consists of the pre-tax historical incomes for ZGP and the Company of $2,615 and $(519) respectively, and the pre-tax pro-forma adjustments of $(564). These ownership percentages do not reflect the anticipated dilution resulting from the 1,600,000 Class B units (5% ownership) expected to be granted to Key Employees of ZAIS after the closing of the transaction because the Class B units will not participate in the income or loss of the Company until they are vested, which will not happen for at least two years after the closing. | |

| 18 | Allocate the Company’s combined Federal and state income tax expense / (benefit) of $402 as calculated on entry #15, to the Company’s portion of Consolidated Net Income and Total Comprehensive Income. | |

| 19 | Reclassify miscellaneous adjustments between the Company and ZGP in their percentage ownership. | |

| 20 | Record payment of consulting fee. |

Purchases of Shares of Class A Common Stock by Sponsors and Others

As of February 13, 2015, the Company had received 13,321,528 shares, out of 23,592,150 shares of Class A Common Stock Outstanding (or 56.5%), of Class A Common Stock validly submitted for redemption. Certain of the Company’s sponsors, directors and officers or their affiliates and certain of the ZGP Founder Members (the “Purchaser Parties”) have indicated to the Company that they intend to purchase shares of Class A Common Stock with an aggregate value of approximately $42 million in open market or in privately negotiated transactions, as described below.

The shares purchased by the Purchaser Parties would be purchased through EBC, Sandler or Sidoti from public stockholders that have made a request to redeem their shares of Class A Common Stock. The purchase of these shares will increase the likelihood of satisfaction of the requirement that the Company have available at least $65 million – the revised minimum requirement for closing the Business Combination – in the Trust Account at the Closing, after giving effect to redemptions and the Expense Payments (other than certain notes issued to the Company’s financial advisers).

All Founders’ Shares, Sponsors’ Shares and public shares held by our sponsors, officers and directors or their affiliates and the ZGP Founder Members, to the extent they have a proxy for such shares, have been or will be voted in favor of the Business Combination and will not be redeemed in connection with the consummation of the Business Combination. Assuming that the Purchaser Parties purchase the full amount of shares indicated above, it is anticipated that immediately before the closing (i) the Company’s sponsors, officers and directors and their affiliates will collectively hold 55.5% of the Company’s shares of Class A Common Stock and (ii) the Company’s sponsors, officers and directors and their affiliates and the ZGP Founder Members will collectively hold 57.5% of the Company’s shares of Class A Common Stock.

In connection with the purchases described above by the Purchaser Parties, the Company’s other sponsors will transfer to the Purchaser Parties a substantial majority of the Founders’ Shares held by them at the price at which they purchased the Founders’ Shares from the Company, which was $0.005875 per share. The transfer of the Founders Shares will occur immediately following the consummation of the Business Combination.

Compensation Committee Charter

The Company previously disclosed in the section of the Proxy Statement entitled “Management After the Business Combination—Committees of the Board of Directors—Compensation Committee” that the compensation committee charter of the Company after the closing of the Business Combination will provide that the Company’s GAAP compensation expense, from all cash and non-cash sources (which would include awards under the 2015 Stock Plan but exclude the issuance of the Class B-0, B-1, B-2, B-3 and B-4 Units) will not exceed 50% of ZAIS’s GAAP revenue (excluding revenue from any investment vehicles required to be consolidated in accordance with GAAP, but including revenue from ZAIS’s co-investments in any such investment vehicle) in any fiscal year period during the first five years after the Business Combination.

The Company and ZGP have agreed to modify the compensation committee charter of the Company that will apply after the closing of the Business Combination to provide for the following maximum amounts of GAAP compensation expense in lieu of the 50% of consolidated GAAP revenue maximum described above:

| 2015 | 65% of the Company’s consolidated GAAP revenue |

| 2016 | 60% of the Company’s consolidated GAAP revenue |

| 2017 | 55% of the Company’s consolidated GAAP revenue |

| 2018 | 50% of the Company’s consolidated GAAP revenue |

| 2019 | 50% of the Company’s consolidated GAAP revenue |

Certain Updated Information About ZGP and ZAIS as of December 31, 2014

The following information updates certain information included on pages 178 to 189 of the Proxy Statement with respect to ZGP and ZAIS as of December 31, 2014. The following updated information should be read in conjunction with the Proxy Statement, which should be read carefully and in its entirety.

Assets Under Management Update

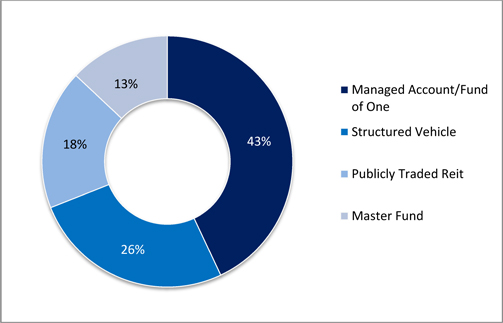

ZAIS’s assets under management (“AUM”) as of December 31, 2014 are approximately $4.1 billion. The decline in AUM since September 30, 2014 from $4.7 billion is primarily attributable to redemptions by one institutional investor. Of the approximately $4.1 billion of AUM as of December 31, 2014, approximately $476 million was invested in ZAIS’s Opportunity Fund, approximately $1.76 billion was invested in managed accounts, approximately $44 million was invested in private equity vehicles and approximately $1.85 billion was invested in structured and other investment vehicles.

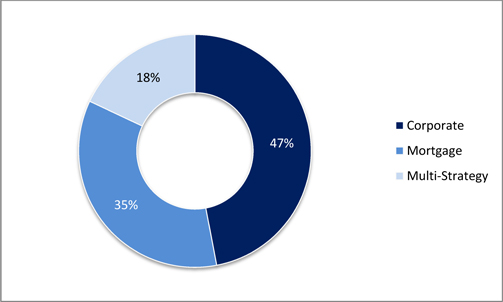

As of December 31, 2014, ZAIS managed over $1.7 billion in 17 managed accounts/funds of one and has approximately, (i) $1.43 billion deployed in mortgage strategies, (ii) $1.93 billion deployed in corporate debt strategies and (iii) $770 million deployed in multi-strategy funds.

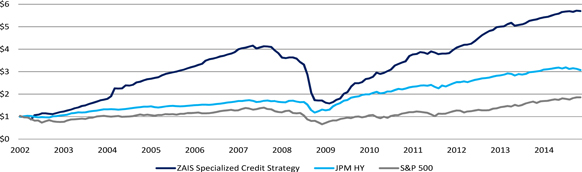

ZAIS Specialized Credit Composite Update (1)

The ZAIS Specialized Credit Composite (“ZAIS Composite” or “Composite”), presented below, includes 31 separately managed accounts, funds of one and commingled funds that vary in size and are managed for a broad range of specialized credit mandates. The ZAIS Composite is not a stock performance chart. Rather, it shows how one dollar invested in 2002 would have performed if it had been invested in the vehicles described below, which include accounts that are managed similarly to, and that hold similar targeted assets as, the mix of assets envisioned for recent broad structured credit mandates, including a current mandate managed for an institutional client.

| ANNUALIZED TOTAL RETURNS | ANNUAL TOTAL RETURNS | |||||||||||||||||||||||||||

| ZAIS Specialized | JP Morgan | ZAIS Specialized | JP Morgan | |||||||||||||||||||||||||

| Credit | Domestic High | Credit | Domestic High | |||||||||||||||||||||||||

| Composite | Yield Index | +/- | Composite | Yield Index | +/- | |||||||||||||||||||||||

| 1 - Year | 6.96 | % | 2.17 | % | 4.79 | % | 2014 | (3) | 6.96 | % | 2.17 | % | 4.79 | % | ||||||||||||||

| 3 - Year | 14.15 | % | 8.46 | % | 5.69 | % | 2013 | 9.79 | % | 8.24 | % | 1.55 | % | |||||||||||||||

| 5 - Year | 17.58 | % | 9.38 | % | 8.20 | % | 2012 | 26.72 | % | 15.39 | % | 11.33 | % | |||||||||||||||

| 7 - Year | 5.36 | % | 8.92 | % | -3.56 | % | 2011 | 10.50 | % | 6.96 | % | 3.54 | % | |||||||||||||||

| Since Inception(2) | 14.32 | % | 9.08 | % | 5.24 | % | 2010 | 36.70 | % | 14.73 | % | 21.97 | % | |||||||||||||||

| (1) | The ZAIS Composite includes 31 separately managed accounts, funds of one and commingled funds that are managed for a broad range of specialized credit mandates, varying in size. The ZAIS Composite includes accounts that are managed similarly to, and have similar targeted assets as, the mix of assets envisioned for recent broad structured credit mandates, including an active mandate managed for an institutional client. The ZAIS Composite excludes funds during their “ramp-up” periods. For potential broad structured credit mandates, ZAIS would opportunistically invest in non-agency residential mortgage backed securities (“RMBS”), collateralized loan obligation (“CLO”) mezzanine tranches, CLO equity tranches and, selectively, commercial mortgage backed securities (“CMBS”). As such, ZAIS excluded from the Composite those ZAIS managed funds and accounts that currently invest in other assets (e.g., senior CLO tranches, residential whole loans, agency interest only securities), structured product vehicles managed by ZAIS, ZFC REIT, and funds and managed accounts where ZAIS assumed management of the vehicles from prior managers. Since monthly performance information was not required for Matrix I and Matrix II funds, ZAIS did not include these funds in the ZAIS Composite (Matrix I net IRR was 11.87%; Matrix II-A net IRR was 17.64%; Matrix II-B net IRR was 6.13%). The ZAIS Composite is calculated by asset weighting the individual monthly returns of each component using the aggregated beginning-of-period capital balances and external cash flows as if the composite were one portfolio. The Composite’s Year-to-Date net returns are considered time-weighted since they are the cumulative result of compounding all monthly net return results. The ZAIS Composite return results: (i) are not a guarantee, prediction, or indicator of future returns; future investors could make a lesser profit or could incur substantial losses; (ii) are net of accrued management fees, incentive fees/allocations, if any, and foreign currency translation gains and losses; (iii) are based on capital activity for both fee paying and non-fee paying investors; (iv) reflect a mix of active and liquidated vehicles; (v) reflect the reinvestment of dividends, interest and earnings; (vi) treat client directed intra-month cash flows, if any, in separately managed accounts as if inflows occurred at the start of the month and outflows at the end of the month for purposes of calculating monthly returns; (vii) treat redemption or withdrawal charges of redeeming or withdrawing investors that were retained in the fund for the benefit of remaining investors as profit to the remaining investors (this increase in capital for remaining investors are not treated as profits under GAAP); and (viii) treat capital activity during July 2006 to November 2006 in one vehicle as if all the activity occurred in the month of November 2006 because the vehicle was ramping up during that time period. A structured product industry standard performance benchmark does not exist. As a result, there is no exact data point against which ZAIS can compare its performance. ZAIS does, however, closely monitor several sources of data to assess its performance relative to indices composed of relevant, if not identical, assets, including the J.P. Morgan Domestic High Yield Index (the “JPM HY”), ABX, PrimeX, CMBX and various proprietary dealer constructed indices. These indices each contain strengths and weaknesses. ZAIS has benchmarked the ZAIS Composite against the JPM HY mainly because of the relevance of the asset class and the fact that the index has been in existence for a period predating the inception of the Composite. Over shorter holding periods, tracking error relative to the proposed benchmark could be quite significant. |

(2) From February 2002 to December 2014.

(3) As of December 31, 2014.

ZAIS Opportunity Fund Performance Update

As of December 31, 2014, the 2014 year-to-date return for the ZAIS Opportunity Domestic Feeder Fund, LP (“Domestic Feeder”) Series A Interests that are subject to advisory fees and incentive allocations was 8.37% and the life-to-date return was 403.65%. Returns would differ for an investment in Domestic Feeder Series B and ZAIS Opportunity Fund, Ltd. Series A and Series B shares. An individual’s return may vary based on timing of capital transactions.

Corporate Credit Funds Performance Update(1)(2)(15)

| Inception | End Date | Fund | Strategy | Description | Total

Capital Drawn (mm) (3) | Total

Capital Returned (mm) (3,4) | NAV (mm) (5) | Net IRR (6) | JPM HY (7) | |||||||||||||||||||

| Aug-10 | Open | Empiricus B-B (8) | CLO Mezz / Equity | Fund of One | $ | 40.0 | $ | 0.2 | $ | 53.4 | 11.57 | % | 8.93 | % | ||||||||||||||

| Jul-09 | Open | Zephyr Recovery Mezz 2005-1 Unit Trust (9) | CLO Senior/Mezz | Commingled Fund | $ | 41.4 | $ | 22.4 | $ | 151.5 | 32.93 | % | 12.59 | % | ||||||||||||||

| Nov-11 | Open | Corporate Loan Master Fund | Leverage Loans | Fund of One | € | 99.5 | € | 1.8 | € | 111.7 | 4.30 | % | 8.39 | % | ||||||||||||||

| Dec-07 | Open | Insurance Company #1a | CLO Mezz | Managed Account | $ | 166.6 | $ | 148.1 | $ | 74.6 | 5.64 | % | 8.92 | % | ||||||||||||||

| Nov-11 | Open | Insurance Company #1b | Structured Settlements | Managed Account | $ | 108.0 | $ | 8.6 | $ | 110.6 | 6.37 | % | 8.40 | % | ||||||||||||||

| Mar-14 | Open | Insurance Company #1c | CLO Mezz | Managed Account | $ | 150.0 | $ | - | $ | 147.7 | -2.27 | % | -0.81 | % | ||||||||||||||

| Jul-10 | Open | German Insurance Company #1 | CLO Mezz | Managed Account | € | 132.9 | € | 60.5 | € | 89.0 | 4.09 | % | 9.03 | % | ||||||||||||||

| Dec-14 | Open | Insurance Company #2b | CLO/RMBS | Managed Account | $ | 25.0 | $ | - | $ | 25.0 | -0.26 | % | -7.15 | % | ||||||||||||||

| Oct-14 | Open | Managed Account #6 (10) | Leverage Loans | Managed Account | $ | 2.7 | $ | - | $ | 2.7 | -0.26 | % | -5.93 | % | ||||||||||||||

| Jun-05 | Open | Co-Epics I Ltd | CLO Equity | Passthrough Vehicle | $ | 9.5 | $ | 18.2 | $ | 0.1 | 12.56 | % | 8.19 | % | ||||||||||||||

| Jun-05 | Open | Epics I Ltd | CLO Equity | Passthrough Vehicle | $ | 173.4 | $ | 315.4 | $ | 2.6 | 9.70 | % | 8.19 | % | ||||||||||||||

| Mar-07 | Open | ZAIS Investment Grade Limited IX(11) | CLO/RMBS | Structured Vehicle | $ | 29.0 | $ | 6.1 | $ | - | -87.70 | % | 7.97 | % | ||||||||||||||

| Mar-14 | Open | ZAIS CLO 1, Limited(12) | Leverage Loans | Structured Vehicle | $ | 25.7 | $ | 3.6 | $ | 24.6 | 14.41 | % | -1.21 | % | ||||||||||||||

| Sep-14 | Open | ZAIS CLO 2, Limited(13) | Leverage Loans | Structured Vehicle | $ | 33.5 | $ | - | $ | 31.8 | -17.69 | % | -4.42 | % | ||||||||||||||

| Aug-14 | Open | ZAIS CLO 3 Warehouse (14) | Leverage Loans | Structured Vehicle | $ | 30.0 | $ | - | $ | 31.4 | NA | NA | ||||||||||||||||

| (1) | All amounts are as of December 31, 2014. The funds, managed accounts and structured vehicles included represent vehicles managed by ZAIS that have been predominantly focused on investing in CLOs and corporate credit. Excludes a European structured vehicle with approximately $50.2 million of AUM as of December 10, 2014 for which ZAIS acts as a servicer. |

| (2) | Past performance is not a guarantee, prediction or indicator of future returns and no representation is made that any investor will or is likely to achieve results comparable to those shown or will make any profit or will be able to avoid incurring substantial losses. |

| (3) | Amounts reflected herein are from inception through December 31, 2014 for all investors (including those investors that have fully redeemed or withdrawn). The total capital drawn for the Zephyr Recovery Mezz 2005-1 Unit Trust (“Zephyr Recovery Trust”) represents the net asset value as of the date ZAIS assumed asset management responsibilities from a prior manager on July 10, 2009. For structured vehicles this amount represents the capital contributions and distributions for the equity tranches of each vehicle from inception through December 31, 2014. |

| (4) | Includes operating distributions, redemptions or withdrawals. Redemptions and withdrawals are net of incentive fees/allocations, if any, and penalties (if applicable) paid by the investor. The total capital returned for the Zephyr Recovery Trust represent amounts returned to investors since ZAIS assumed asset management responsibilities from a prior manager. For structured vehicles this amount represents the distributions for the equity tranches of each vehicle through December 31, 2014. |

| (5) | Reflects the net asset values (after the deduction of accrued management fees and incentive fees/allocations, if any) as of December 31, 2014. For structured vehicles this amount reflects the fair value of the equity tranches of each vehicle as of December 31, 2014. |

| (6) | IRRs are computed on a net basis and are unaudited. IRRs have been calculated for the period from inception through December 31, 2014 for investors remaining in the funds or managed accounts as of December 31, 2014 which are subject to management fees and incentive fees/allocations, if any. For structured vehicles the IRR was computed for the equity tranches of each vehicle. |

| (7) | The JP Morgan Domestic High Yield Index (the “JPM HY”) is referred to only because it represents an index typically used to gauge the general performance of U.S. high yield bond market performance. The JPM HY returns have been provided for the period from inception of the respective fund through December 31, 2014, or the termination of the respective fund where applicable. |

| (8) | Represents Strategy B of the Empiricus B Fund. |

| (9) | This Fund was launched by Lehman Brothers Holdings Inc. (“Lehman”) on August 30, 2005. Following Lehman’s bankruptcy, ZAIS Group, LLC assumed the asset management responsibilities for this fund on July 10, 2009. The inception date for this Fund is deemed to be July 10, 2009. |

| (10) | IRR is calculated based on the date the account commenced trading which was in October 2014. |

| (11) | The amount listed represents the equity investment in ZAIS Investment Grade Limited IX. The total initial notional of all classes of securities issued in the related transaction was approximately $406 million. |

| (12) | The amount listed represents the equity investment in ZAIS CLO 1, Limited. The total initial notional of all classes of securities issued in the related transaction was approximately $309.9 million. The structured vehicle closed on March 27, 2014 at which time the vehicle moved out of the warehouse. Additionally, the entity made its first payment to the equity holders in the amount of approximately $3.6 million on October 15, 2014. This resulted in a significate increase in the IRR compared to September 30, 2014. |

| (13) | The amount listed represents the equity investment in ZAIS CLO 2, Limited. The total initial notional of all classes of securities issued in the related transaction was approximately $333.75 million. The structured vehicle closed on September 29, 2014 at which time the vehicle moved out of the warehouse. The entity has not yet made any payments to the noteholders. As a result, the net IRR was calculated using the amounts drawn on the notes and the fair value of the notes at December 31, 2014. The result is a negative IRR. |

| (14) | Entity is in the warehouse stage. |

| (15) | The following funds were included in the performance table as of September 30, 2014, however were excluded from the current performance table as of December 31, 2014 because these funds have either (i) been liquidated during the period from October 31, 2014 – December 31, 2014 or (ii) are in the process of being liquidated during the period from October 31, 2014 – December 31, 2014 and the only remaining asset is cash: |

| · | ZAIS Zephyr A-2, LTD |

| · | ZAIS Zephyr A-4, LLC |

| · | Zephyr Recovery 2004-1 LP |

| · | Zephyr Recovery 2004-2 LP |

| · | Zephyr Recovery 2004-3 LP |

| · | Zephyr 2004-4 LLC |

| · | Zephyr Recovery II-A LP |

| · | Zephyr Recovery II-B LP |

| · | Zephyr Recovery II-C LP |

| · | ZAIS Leda Fund |

| · | ZAIS Tydeus Fund |

Mortgage Related Strategies Performance Update (1)(2)(11)

| Total Capital | Total Capital | ABX. HE (8) | ||||||||||||||||||||||||||||||

| Inception End DateFund | Strategy | Description | Drawn (mm)(3) | Returned (mm) (3,4) | NAV (mm)(5) | Net IRR (6) | 06-1 AAA | 07-1 AAA | ||||||||||||||||||||||||

| DISTRESSED NON - AGENCY RMBS FOCUSED FUNDS & RELATED ACCOUNTS | ||||||||||||||||||||||||||||||||

| Aug-02 | Open | Galleria CDO V, Ltd(10) | RMBS | Structured Vehicle | $ | 12.0 | $ | 1.8 | $ | - | -87.11 | % | NA | NA | ||||||||||||||||||

| Jun-09 | Open | Managed Account #3 | RMBS | Managed Account | $ | 40.0 | $ | 15.0 | $ | 46.8 | 15.98 | % | 6.56 | % | 21.04 | % | ||||||||||||||||

| Apr-12 | Open | 2012 Managed Account(9) | RMBS With Overlay | Managed Account | $ | 71.3 | $ | 88.0 | $ | 0.3 | 11.82 | % | 3.75 | % | 29.38 | % | ||||||||||||||||

| Jul-12 | Open | INARI Fund | RMBS With Overlay | Fund of One | $ | 300.0 | $ | - | $ | 360.6 | 8.74 | % | 2.77 | % | 25.23 | % | ||||||||||||||||

| May-13 | Open | Managed Account #5 | RMBS With Overlay | Managed Account | $ | 125.0 | $ | - | $ | 135.0 | 4.77 | % | -0.08 | % | 16.66 | % | ||||||||||||||||

| COMMERCIAL REAL ESTATE | ||||||||||||||||||||||||||||||||

| Jan-09 | Open | ZAIS Value Added Real Estate Fund I, LP (7) | Commercial Real Estate | Non-fee Paying Investor | $ | 21.7 | $ | 6.1 | $ | 10.3 | -5.47 | % | NA | NA | ||||||||||||||||||

| (1) | All amounts are as of December 31, 2014. These entities represent private equity style funds, managed accounts and structured vehicles, that are or have been primarily focused on investing in residential mortgage related assets. The performance table also includes one vehicle which invested in commercial real estate properties. |

| (2) | Past performance is not a guarantee, prediction or indicator of future returns and no representation is made that any investor will or is likely to achieve results comparable to those shown or will make any profit or will be able to avoid incurring substantial losses. |

| (3) | Amounts reflected herein are from inception through December 31, 2014 for all investors (including those investors which have fully redeemed or withdrawn). For structured vehicles this amount represents the capital contributions and distributions for the equity tranches of each vehicle from inception through December 31, 2014. |

| (4) | Includes operating distributions, redemptions or withdrawals. Redemptions and withdrawals are net of incentive fees/allocations, if any, and redemption or withdrawal penalties (if applicable) paid by the investor. For structured vehicles this amount represents the distributions for the equity tranches of each vehicle through December 31, 2014. |

| (5) | Reflects the net asset values (after the deduction of accrued management fees and incentive fees/allocations, if any) as of December 31, 2014. For structured vehicles this amount reflects the fair value of the equity tranches of each vehicle as of December 31, 2014. |

| (6) | IRRs are computed on a net basis and are unaudited. IRRs have been calculated for the period from inception through December 31, 2014 for investors remaining in the fund or account as of December 31, 2014 which are subject to management fees and incentive fees/allocations, if any. For structured vehicles the IRR was computed for the equity tranches of each vehicle. |

| (7) | The investors in ZAIS Value Added Real Estate Fund I, L.P. (“ZVAREF”) consist of ZAIS and certain current and former ZAIS employees and owners that received their equity interests through a distribution-in-kind. Prior to the aforementioned distribution-in-kind, ZAIS was both the GP and the sole member. ZAIS does not receive any fees from the investors of ZVAREF. The capital drawn, capital returned and net IRR reflect the activity from the date of the distribution-in-kind through December 31, 2014. Capital drawn includes the value of the distribution-in-kind. Additionally, since ZVAREF does not have any fee paying investors, the net IRR reflects the return for all investors in ZVAREF. |

| (8) | The ABX.HE.06-1 AAA Index and ABX.HE. 07-1 AAA (the “ABX index”) is referred to only because it represents an index typically used to gauge the general performance of US subprime residential mortgage backed securities. The use of this index is not meant to be indicative of the asset composition or volatility of the portfolio of securities held by the funds, which may or may not have included securities which comprise the ABX Index, and which may hold considerably fewer than the number of different securities that make up the ABX Index. As such, an investment in the fund should be considered riskier than an investment in the ABX Index. The ABX Index returns have been calculated for the period from inception of the respective fund through December 31, 2014 or the termination of the respective fund where applicable. The ABX Index returns exclude the coupon payment and any applicable principal losses payable. |

| (9) | This managed account is currently in the process of being liquidated. Substantially all of the assets have been liquidated as of February 27, 2015. |

| (10) | The amount listed represents the equity investment in Galleria CDO V, Ltd. The total initial notional of all classes of securities issued in the related transaction was approximately $300 million. |

| (11) | SerVertis Master Fund I LP was included in the performance tables as of September 30, 2014, however was excluded from the current performance table as of December 31, 2014 because the fund is in the process of being liquidated during the period from October 31, 2014 – December 31, 2014 and the only remaining asset in the fund is cash. |

Multi-Strategy Funds and Accounts Performance Update(1)(2)

| Inception | End Date | Fund | Strategy | Description | Total

Capital Drawn (mm) (3) | Total

Capital Returned (mm) (3,4) |

NAV (mm) (5) | Net IRR (6) | JPM HY (7) | |||||||||||||||||||

| 0ct-03 | Open | ZAIS Opportunity Domestic Feeder Fund, LP | CLO/RMBS/CMBS | Commingled Fund | NA | NA | NA | 15.44 | %(8) | 8.50 | % | |||||||||||||||||

| Oct-13 | Open | ZAIS Atlas Fund, LP | RMBS / CLO / CMBS | Commingled Fund | NA | NA | NA | 2.58 | %(9) | 4.78 | % | |||||||||||||||||

| Mar-12 | Open | Pension Fund | CLO / RMBS / CMBS | Managed Account | $ | 169.5 | $ | - | $ | 183.7 | 6.70 | %(10) | 7.24 | % | ||||||||||||||

| Apr-14 | Open | Insurance Company #2 | RMBS / CLO | Managed Account | $ | 72.9 | $ | - | $ | 73.8 | 2.11 | % | -2.53 | % | ||||||||||||||

| (1) | All amounts are as of December 31, 2014. These funds and managed accounts represent hedge funds and managed accounts that invest in a combination of corporate debt instruments, such as CLOs, leveraged loans and high yield bonds, as well as residential and commercial mortgage related strategies. In addition, some funds invest in various derivative based instruments including, but not limited to swaps, interest only securities, inverse interest only securities and swaptions. |

| (2) | Past performance is not a guarantee, prediction or indicator of future returns and no representation is made that any investor will or is likely to achieve results comparable to those shown or will make any profit or will be able to avoid incurring substantial losses. |

| (3) | Amounts reflected herein are from inception through December 31, 2014 for all investors (including those investors which have fully redeemed or withdrawn, if any). |

| (4) | Includes operating distributions, redemptions or withdrawals. Redemptions and withdrawals are net of incentive fees/allocations, if any, and redemption or withdrawal penalties (if applicable) paid by the investor. |

| (5) | Reflects the net asset values (after the deduction of accrued management fees and incentive fees/allocations, if any) as of December 31, 2014. |

| (6) | IRRs are computed on a net basis and are unaudited. IRRs have been calculated for the period from inception through December 31, 2014 for investors remaining in the fund or managed account as of December 31, 2014 which are subject to management fees and incentive fees/allocations, if any. |

| (7) | The JP Morgan Domestic High Yield Index (the “JPM HY”) is referred to only because it represents an index typically used to gauge the general performance of U.S. high yield bond market performance. The JPM HY returns have been provided for the period from inception of the respective fund or managed account through December 31, 2014. |

| (8) | Net IRR assumes a $1 investment at inception and assumes no contributions or withdrawals during the investment period for a single investor in ZAIS Opportunity Domestic Feeder Fund, LP ("Opportunity Fund Domestic Feeder") Series A Interests that is subject to advisory fees and incentive allocation. Net IRR would differ for an investment in Opportunity Fund Domestic Feeder Series B, ZAIS Opportunity Fund, Ltd. Series A and Series B, as a result of timing of capital transactions, differences in fund expenses and lower or no management fees and incentive fees/allocations, if any. Effective April 1, 2012, management fee rates were reduced from 1.50% to 1.25% for Series A and from 1.00% to 0.75% for Series B. Effective January 1, 2013, incentive fee or allocation rates were reduced from 25% to 20% for Series A and from 20% to 15% for Series B. The Opportunity Fund Domestic Feeder's returns for January 2009 and February 2011 have been adjusted to account for an increase of capital resulting from redemption penalties retained in the fund for the benefit of the remaining investors. |

| (9) | Net IRR assumes a $1 investment at inception and assumes no contributions or withdrawals during the investment period for a single investor in ZAIS Atlas Fund, LP (“Atlas Domestic Feeder”) Sub-Class A-1 Interests that is subject to full advisory fees and incentive allocation. This net IRR result is based on pro forma returns based on what the highest fee paying Sub-Class A-1 of Atlas Domestic Feeder would have returned if actual investments had been made in that Sub-Class. These pro forma results do not reflect an actual investment in the full fee paying Sub-Class for the period October 2013 to November 2014 which was not offered to investors until April 1, 2014 because the Master Feeder fund structure was in its start-up phase and Sub-Class A-3, a reduced fee paying Sub-Class for the Founder’s shares, of the Atlas Domestic Feeder and ZAIS Atlas Offshore Ltd. was offered to investors. The monthly returns beginning December 1, 2014 reflect an actual investment in the full fee paying sub-class. Net IRR would differ for an investment in Atlas Domestic Feeder Sub-Class A-2 and A-3, as well as ZAIS Atlas Fund, Ltd. Sub-Class A-1 and A-3, as a result of timing of capital transactions, differences in fund expenses and lower or no management fees and incentive fees/allocations, if any. |

| (10) | The returns for this vehicle do not take into account a fee rebate for the investor’s separate interest in a ZAIS-managed fund. If the IRR had included the effect of the rebate, the stated returns would have been higher. |

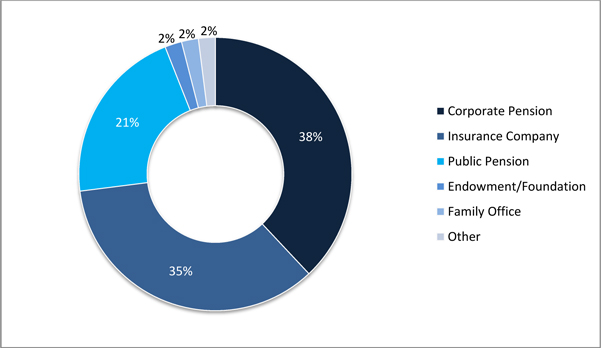

AUM By Investor Type(1)(2)

| (1) | As of December 31, 2014. Percentages are approximate and subject to change. |