Attached files

| file | filename |

|---|---|

| 8-K - 8-K - CST BRANDS, INC. | cst2015form8-kq1dividendsd.htm |

| EX-99.1 - EXHIBIT 99.1 - CST BRANDS, INC. | exhibit991q12015dividendsd.htm |

CST Brands, Inc Company Update March 2015 Exhibit 99.2

Safe Harbor Statements Forward-Looking Statements Statements contained in this presentation that state the Company’s or management’s expectations or predictions of the future are forward-looking statements are intended to be covered by the safe harbor provisions of the Securities Act of 1933, as amended, and the Securities Exchange Act of 1934, as amended. The words “believe,” “expect,” “should,” “intends,” “estimates,” and other similar expressions identify forward-looking statements. It is important to note that actual results could differ materially from those projected in such forward-looking statements. For more information concerning factors that could cause actual results to differ from those expressed or forecasted, see CST filings with the Securities and Exchange Commission (“SEC”), including the Risk Factors in our most recently filed Annual Reports on Form 10-K as filed with the SEC and available on CST Brand’s website at www.cstbrands.com and CrossAmerica’s website at www.crossamericapartners.com. If any of these risks or uncertainties materialize, or if our underlying assumptions prove to be incorrect, actual results may vary significantly from what we projected. Any forward-looking statement you see or hear during this presentation reflects our current views as of the date of this presentation with respect to future events. We assume no obligation to publicly update or revise these forward-looking statements for any reason, whether as a result of new information, future events, or otherwise. Non-GAAP Financial Measures To supplement our consolidated and combined financial statements prepared in accordance with accounting principles generally accepted in the United States (“GAAP”) and to better reflect period-over-period comparisons, we use non-GAAP financial measures that either exclude or include amounts that are not normally excluded or included in the most directly comparable measure, calculated and presented in accordance with GAAP. Non-GAAP financial measures do not replace and are not superior to the presentation of GAAP financial results, but are provided to improve overall understanding of our current financial performance and our prospects for the future. We believe the non-GAAP financial results provide useful information to both management and investors regarding certain additional financial and business trends relating to financial condition and operating results. In addition, management uses these measures, along with GAAP information, for reviewing financial results and evaluating our historical operating performance. The non-GAAP adjustments for all periods presented are based upon information and assumptions available as of the date of this presentation. The non-GAAP information is not prepared in accordance with GAAP and may not be comparable to non- GAAP information used by other companies. Information regarding the non-GAAP financial measure referenced in this presentation, including the reconciliation to the nearest GAAP measure can be found in our financial results press releases, available on our web sites: www.cstbrands.com and www.crossamericapartners.com. 1

CST Consolidated Overview • Spun from Valero Energy Corporation on May 1, 2013 • Ranks 266 in Fortune 500 for 2013 • One of the largest independent wholesaler and retailer of motor fuels and convenience merchandise in North America • Strong urban footprint, supplying and retailing motor fuel in nearly 3,000 locations in the U.S. and eastern Canada – 2014 consolidated revenue of $12.7 billion – Over 10.6 million gallons of fuel supplied/sold per day – Serve approximately 10 million retail customers per week • Acquired 100% membership interests in GP of CrossAmerica and all the incentive distribution rights on October 1, 2014 2

Our Footprint Site Locations • US Retail – 1,043 • Canadian Retail – 862 (1) • CrossAmerica – 744 (2) CO 79 AZ NM OK TX AR LA WY Site count as of March 1, 2015 (1) Canada Retail includes Convenience Stores, Commission Agents, and Cardlock (2) 23 NY locations and 22 TX locations are controlled by CrossAmerica and operated by US Retail (i.e., the count “overlaps”) CST Service Centers • San Antonio • Montreal Ontario Quebec Atlantic CA 62 38 138 3 634 22 2 27 28 140 537 185 NY 32 PA 131 NJ 107 VA 83 OH 76 MA 70 TN 50 FL 46 32 NH 21 WV 14 IL 8 ME 8 KY 7 IN 3 DE 1 MD 1 SD 8 MN 41 WI 12 MI 3 CrossAmerica Service Center • Allentown 3

Our Family of Brands Licensed Brands Proprietary Brands 4

Organic Growth • Grow organically through the construction of New- To-Industry Stores (NTIs) Acquisitive Growth • Grow our business in existing and new geographic locations through acquisitions Wholesale Business Growth • Develop and expand our wholesale fuel distribution business Merchandise Profit Growth • Develop our convenience store brands and maximize merchandise gross profit margin Benefits from CrossAmerica: • Provides access to the master limited partnership (“MLP”) capital markets to provide efficient capital for our growth • Significantly increases our wholesale fuel supply business as this is the primary business of CrossAmerica • Provides additional business development expertise to assist us in implementing our acquisition strategy • Affords access to multiple fuel supply relationships with major integrated energy companies, helping diversify our available fuel supply • Creates a “sponsored MLP” relationship whereby certain CST assets, such as its U.S. Retail wholesale fuel supply business and NTI real property assets, can be dropped down (sold) to CrossAmerica for cash and/or limited partner equity consideration Our Business Strategy 5

Our Value Creation 6

2009 2010 2011 2012 2013 2014 2015* Totals Canada R&R 2 3 5 2 2 3 3 20 Canada NTI 3 2 3 5 7 10 11 41 U.S. R&R 0 1 1 2 4 3 3 14 U.S. NTI 4 7 6 11 15 28 38 109 Organic Growth • MLP providing capital to fund high-return growth • US NTIs constructed 2008-2013 – 48 stores – $229 million in invested capital, inclusive of land – $101 million in EBITDA, through 12/31/14 • NTIs are generating EBITDA ROI > 15% CST New-To-Industry (NTI) and Raze and Rebuild (R&R) Growth 7 * 2015 NTIs reflect the mid-point of current guidance, 35-40 stores in US and 10-12 stores in Canada

• Industry leader in food service and grocery sales • Opportunity to learn and leverage across networks • Successful franchise business Acquisitive Growth 32 Company Operated 45 Franchisees Central New York Nice N Easy (26) / Sunoco (6) Nov 1, 2014 close date CST/CAPL Asset Purchases Rationale • Immediate synergy recognition in home market • Supplied by our local Distribution Center • New fuel brand opportunity • Re-branded Corner Store 22 Company Operated San Antonio & Austin Shell Jan 8, 2015 close date CST/CAPL Asset Purchases Rationale (From Landmark Industries) • Over 90% owned locations • Located in growing market • Unbranded fuel • Large stores with inside sales growth opportunity • Loyalty/credit card program 64 Company Operated Upper Midwest (MN, WI, SD, MI) Freedom Valu / SuperAmerica Feb 16, 2015 close date CAPL Stock Purchase Rationale Operational & Food Expertise Centralized Accounting & Other Support Areas Buying Power and Vendor Support Private Label Products Grow Cash Flow at CrossAmerica And More… 8

Wholesale Business Growth Before the CrossAmerica transaction, CST wholesale distributed to 4 dealer locations Benefits of Wholesale Fuels Business • Predominantly “fixed” rate wholesale fuel margins • Limited exposure to commodity risk • Stable cash flow from real estate rental income • Consolidating industry is creating opportunity Competitive Strengths of CrossAmerica • Prime real estate locations • Long-term relationships with major oil companies and refiners • Financial flexibility to pursue acquisitions • Track record of acquiring and integrating • Extensive industry experience • Relationship with CST CrossAmerica Wholesale Dealers 782 812 1074 1160 2012 2013 2014 2015 YTD 9

Merchandise Profit Growth • US merchandise sales per store are up 5% from 2012 • Sales per store are up despite lower fuel volume as we drive for fuel margin gross profit improvement • Testing grocery concepts in San Antonio Grow inside sales by expanding offerings and driving traffic • US merchandise gross profit is up 10% from 2012, despite lower store count • Food sales growing at a faster rate than overall merchandise • Expanding branded food programs • Nice N Easy acquisition Focus on higher margin food category to expand merchandise gross profit •Opened 3x larger new Corner Store Distribution Center in 1Q15 • Servicing 22 stores acquired from Landmark Industries Improve distribution capabilities to support organic and acquisitive growth 10

CST Key Metrics 2014 Gross Profit (mm) 2014 2013 Motor Fuel $383 $262 Merchandise $405 $382 Other $56 $55 Metrics 2014 2013 Core Stores (EOP) 989 1,036 Motor Fuel Gallons (PSPD) 4,901 4,997 Motor Fuel CPG (net of CC) 20.1¢ 14.0¢ Merchandise Sales (PSPD) $3,508 $3,382 Merchandise Margin* (net of CC) 30.3% 29.8% Metrics 2014 2013 Total Retail Stores (EOP) 861 846 Motor Fuel Gallons (PSPD) 3,230 3,298 Motor Fuel CPG (net of CC) 26.5¢ 24.5¢ Company Operated Stores (EOP) 293 272 Merchandise Sales (PSPD) $2,733 $2,741 Merchandise Margin* (net of CC) 27.3% 27.9% Gross Profit (mm) 2014 2013 Motor Fuel $266 $250 Merchandise* $76 $74 Other $92 $87 U.S. Retail Key Metrics (USD) Canadian Retail Key Metrics (CAD) * Merchandise margin excludes other revenue margin 11

CST Key Metrics 2014 Gross Profit (mm)* 2014 2013 Motor Fuel $645 $504 Merchandise $481 $454 Other $150 $139 Metrics 2014 2013 Total Revenues from fuel sales (mm) $2.6 $1.9 Site Count 1,074 812 Wholesale gallons distributed (mm) 888 638 Wholesale margin cents per gallon 6.8¢ 6.9¢ Wholesale fuel gross profit (mm) $60.6 $43.9 Distributions per unit (4Q rate) $0.5425 $0.5125 Gross Profit (mm) 2014 2013 Motor Fuel $69 $44 Merchandise $18 - Other (rental income) $45 $43 CST Consolidated Key Metrics (USD) CrossAmerica Key Metrics (USD) * Only includes CrossAmerica since October 1, 2014 CST Brands CrossAmerica Partners CST/CAPL Combined 2014 Annual Revenues (b) $12.1 $0.6 $12.7 Annual Fuel Gallons (b) 2.9 0.2 3.1 Total Co-op/Dealer Sites 1,882 1,074 2,956 Network Footprint (U.S. states and Canadian provinces) 16 16 32 12

Delight More Customers Everyday 13

Appendix 14

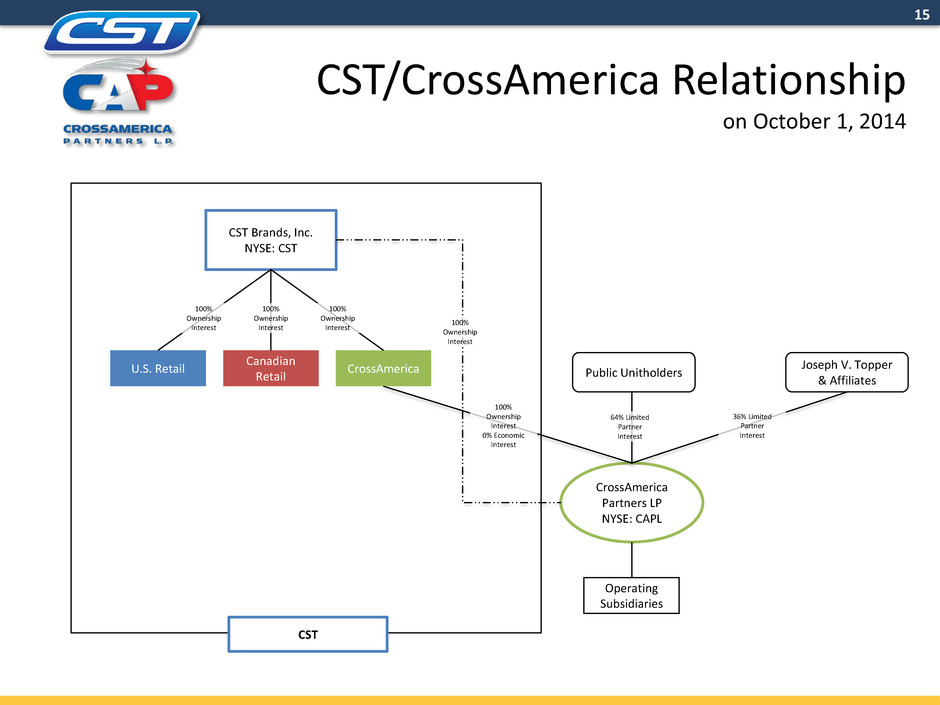

CST/CrossAmerica Relationship on October 1, 2014 15 CST Brands, Inc. NYSE: CST CrossAmerica Canadian Retail U.S. Retail CrossAmerica Partners LP NYSE: CAPL Public Unitholders Joseph V. Topper & Affiliates Operating Subsidiaries CST 100% Ownership Interest 100% Ownership Interest 100% Ownership Interest 100% Ownership Interest 100% Ownership Interest 0% Economic Interest 64% Limited Partner Interest 36% Limited Partner Interest

U.S. Retail On January 1, 2015, we closed on our first drop down of fuel supply equity interests to CrossAmerica. CrossAmerica purchased a 5% limited partner interest in CST Fuel in exchange for consideration of approximately $60 million (valued at the closing unit price on December 31, 2014), paid in 1.5 million common units representing limited partner interests in CrossAmerica. 16 Fuel Suppliers Merchandise Suppliers Company Operated Convenience Stores Wholesale fuel Business Effective January 1, 2015, CrossAmerica owns 5% of this business. U.S. Retail

Canadian Retail 17 Merchandise Suppliers Company Operated Convenience Stores Wholesale fuel Business Canadian Retail Fuel Suppliers Commission/Agent Sites Cardlock Sites Heating Oil Operations

CrossAmerica 18 Fuel Suppliers Independent Grocery Suppliers Independent Dealers Affiliated Dealers Real Estate Business Lessee Dealers Commission Agents CrossAmerica Non-Core Company Operated Convenience Stores U.S. Retail Segment Sub- Wholesalers Wholesale Fuel Business CrossAmerica

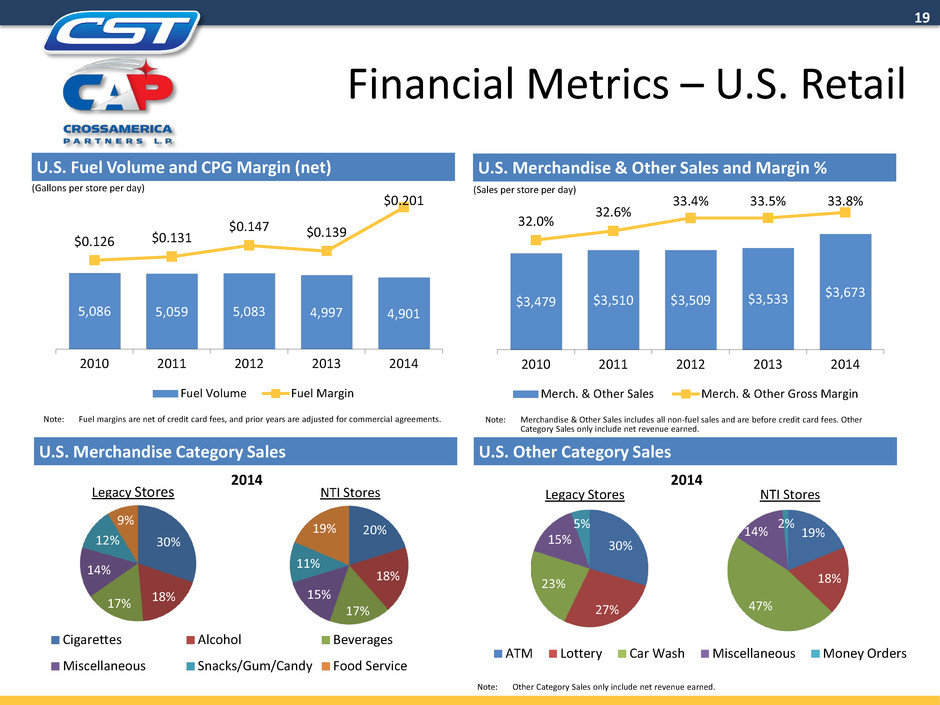

Financial Metrics – U.S. Retail 30% 27% 23% 15% 5% ATM Lottery Car Wash Miscellaneous Money Orders U.S. Merchandise & Other Sales and Margin % Note: Merchandise & Other Sales includes all non-fuel sales and are before credit card fees. Other Category Sales only include net revenue earned. (Sales per store per day) 5,086 5,059 5,083 4,997 4,901 $0.126 $0.131 $0.147 $0.139 $0.201 2010 2011 2012 2013 2014 Fuel Volume Fuel Margin U.S. Fuel Volume and CPG Margin (net) Note: Fuel margins are net of credit card fees, and prior years are adjusted for commercial agreements. (Gallons per store per day) U.S. Other Category Sales 30% 18% 17% 14% 12% 9% Cigarettes Alcohol Beverages Miscellaneous Snacks/Gum/Candy Food Service 2014 Legacy Stores Legacy Stores Note: Other Category Sales only include net revenue earned. U.S. Merchandise Category Sales 20% 18% 17% 15% 11% 19% 2014 NTI Stores NTI Stores 19% 18% 47% 14% 2% $3,479 $3,510 $3,509 $3,533 $3,673 32.0% 32.6% 33.4% 33.5% 33.8% 2010 2011 2012 2013 2014 Merch. & Other Sales Merch. & Other Gross Margin 19

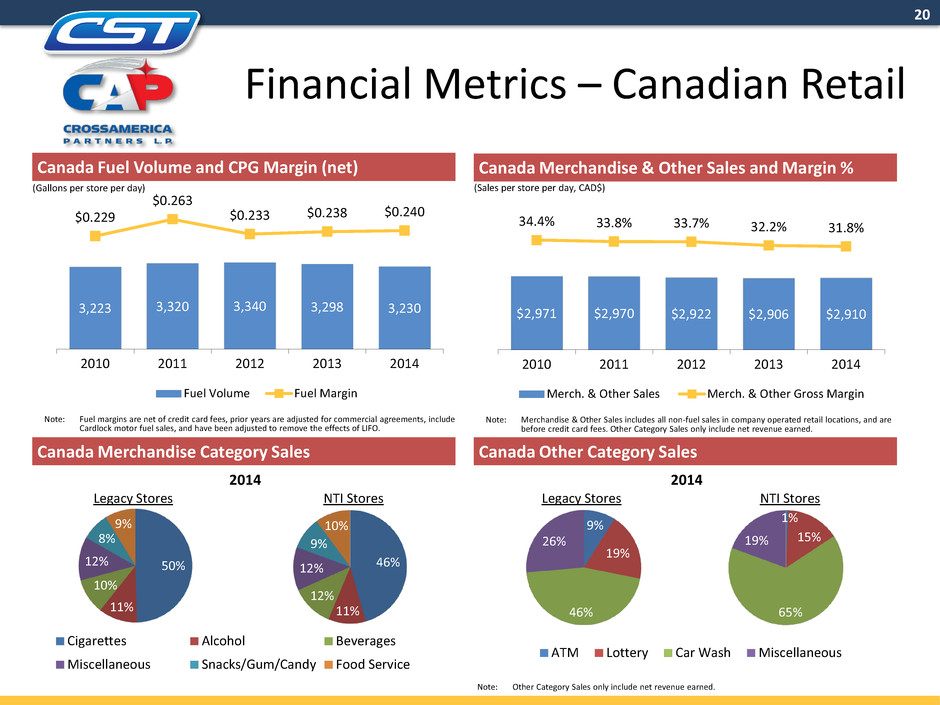

Financial Metrics – Canadian Retail 50% 11% 10% 12% 8% 9% Cigarettes Alcohol Beverages Miscellaneous Snacks/Gum/Candy Food Service 9% 19% 46% 26% ATM Lottery Car Wash Miscellaneous 1% 15% 65% 19% $2,971 $2,970 $2,922 $2,906 $2,910 34.4% 33.8% 33.7% 32.2% 31.8% 2010 2011 2012 2013 2014 Merch. & Other Sales Merch. & Other Gross Margin Canada Merchandise & Other Sales and Margin % Note: Merchandise & Other Sales includes all non-fuel sales in company operated retail locations, and are before credit card fees. Other Category Sales only include net revenue earned. (Sales per store per day, CAD$) 3,223 3,320 3,340 3,298 3,230 $0.229 $0.263 $0.233 $0.238 $0.240 2010 2011 2012 2013 2014 Fuel Volume Fuel Margin Canada Fuel Volume and CPG Margin (net) Note: Fuel margins are net of credit card fees, prior years are adjusted for commercial agreements, include Cardlock motor fuel sales, and have been adjusted to remove the effects of LIFO. (Gallons per store per day) Canada Other Category Sales 46% 11% 12% 12% 9% 10% 2014 NTI Stores NTI Stores Note: Other Category Sales only include net revenue earned. Canada Merchandise Category Sales 2014 Legacy Stores Legacy Stores 20

Financial Metrics – CrossAmerica 37% 28% 22% 13% ExxonMobil BP Motiva (Shell) Other $0.07 $0.07 $0.08 2012 Pro-Forma 2013 2014 Wholesale Margin per Gallon (in cents) 606 638 906 2012 2013 2014 Wholesale Gallons Distributed (in millions) Dollar Value of 3rd Party Acquisitions (in millions) $74 $58 $157 2012 2013 2014 Fuel Supplied by Brand 21

Incentive Distribution Rights Total Quarterly Distribution per Common and Subordinated Unit Marginal Percentage Interest in Distribution Target Amount Unitholders IDRs above $0.5031 up to $0.5469 85% 15% above $0.5469 up to $0.6563 75% 25% above $0.6563 50% 50% 22 Additional Information: • $0.5031 on an annual basis = $2.01 • $0.5469 on an annual basis = $2.19 • $0.6563 on an annual basis = $2.63 • Q4 2014 Dividend = $0.5325, on an annual basis = $2.13 If cash distributions to our unitholders exceed $0.5031 per unit in any quarter, CrossAmerica unitholders and the incentive distribution rights will receive distributions according to the following percentage allocations:

Successful New Store (NTI) Growth • Developed a new store format to meet the growing needs of the growing convenience store consumer and emphasize higher margin offerings • Goals of the new format: – Develop an open, attractive, modern store that appeals to wide demographics – Significantly expand food offering – Provide large refreshment presentation – Highlight private label offerings – Expand parking – Attractive exterior, allowing us to meet aesthetic requirements of any community – Quality built for sustainability and growth – 3 year ramp up with average > 15% returns U.S. NTIs Canada NTIs • 4,650 or 5,650 sq ft design • Land investments have averaged $1 - $1.5 million • Construction Investments have averaged $3 - $5 million • 3,000 sq ft design • Land investments have averaged $1 - $1.3 million • Construction Investments have averaged $3 - $4 million 23