Attached files

Exhibit 10.204

Bell Hendersonville (fka Grove at Waterford Crossing)

SECOND AMENDMENT TO MULTIFAMILY LOAN AND SECURITY AGREEMENT

(Multipurpose)

This Second Amendment To Multifamily Loan And Security Agreement (this "Amendment") dated as of December 3, 2014, is executed by and between BELL BR WATERFORD CROSSING JV. LLC, a Delaware limited liability company and BELL HNW WATERFORD, LLC, a Delaware limited liability company, as tenants in common (individually and together, "Borrower") and FANNIE MAE, a corporation duly organized under the Federal National Mortgage Association Charter Act, as amended, 12 U.S.C. §1716 et seq. and duly organized and existing wider the laws of the United States ("Fannie Mae").

RECITALS:

A. Pursuant to that certain Multifamily Loan and Security Agreement dated as of April 4 2012 (the “Effective Date”), executed by and between Bell BR Waterford Crossing JV, LLC, a Delaware limited liability company ("Prior Borrower") and CWCapital LLC a Massachusetts limited Liability company now known as Walker & Dunlop, LLC, a Delaware limited liability company ("Prior Lender") (as amended, restated, replaced, supplemented, or otherwise modified from time to time, the "Loan Agreement"), Prior Lender made a loan to Prior Borrower in the original principal amount of Twenty Million One Hundred Thousand and 00/100 Dollars ($20,100,000.00) (the “Mortgage Loan"), as evidenced by that certain Multifamily Note dated as of the Effective Date, executed by Prior Borrower and made payable to Prior Lender in the amount of the Mortgage Loan (as amended, restated, replaced, supplemented, or otherwise modified from time to time, the "Note").

B. In addition to the Loan Agreement, the Mortgage Loan and the Note are also secured by, among other things, a certain Multifamily Mortgage, Deed of Trust, or Deed to Secure Debt dated as of the Effective Date (as amended, restated, replaced, supplemented or otherwise modified from time to time, the "Security Instrument").

C. Fannie Mae is the successor-in-interest to the Prior Lender under the Loan Agreement, the holder of the Note and the mortgagee or beneficiary under the Security Instrument.

D. Prior Lender services the Mortgage Loan on behalf of Fannie Mae.

E. The parties are executing this. Amendment pursuant to the Loan Agreement to add Bell HNW Waterford, LLC, a Delaware limited liability as a tenancy-in-common Borrower, and to modify the Loan Agreement to include Co-Tenants modifications.

NOW, THEREFORE, in consideration of the mutual promises contained in this Amendment and of other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, Borrower and Fannie Mae agree as follows:

| Fannie Mae | 08-13 | © 2013 Fannie Mae |

AGREEMENTS:

| Section 1. | Recitals. |

The recitals set forth above are incorporated herein by reference as if fully set forth in the body of this Amendment.

| Section 2. | Defined Terms. |

Capitalized terms used and not specifically defined herein shall have the meanings given to such terms in the Loan Agreement.

| Section 3. | Modification of Loan Agreement. |

The Loan Agreement is hereby amended to add Bell HNW Waterford, LLC, a Delaware limited liability as a co-tenant Borrower, and to modify the Loan Agreement to include the Co- Tenants modifications described in Sections 5 and 6 below.

| Section 4. | Modification of Summary of Loan Terms. |

Part I of the Summary of Loan Terms is hereby deleted in its entirety and replaced with the Part I set forth on Exhibit A attached hereto and made a part hereof.

| Section 5. | Addition of Exhibit/Schedule 2 Addenda (Co-Tenants). |

Exhibit/Schedule 2 Addenda to Multifamily Loan and Security Agreement (Co-Tenants) attached hereto is hereby added to the Loan Agreement and made a part thereof.

| Section 6. | Addition of Exhibit 3 Modifications to Multifamily Loan and Security Agreement (Co-Tenants). |

Exhibit 3 to Multifamily Loan and Security Agreement (Co-Tenants) attached hereto is hereby added to the Loan Agreement and made a part thereof.

| Section 7. | Authorization. |

Borrower represents and warrants that Borrower is duly authorized to execute and deliver this Amendment and is and will continue to be duly authorized to perform its obligations under the Loan Agreement, as amended hereby.

| Section 8. | Compliance with Loan Documents. |

The representations and warranties set forth in the Loan Documents, as amended hereby, are true and correct with the same effect as if such representations and warranties had been made on the date hereof, except for such changes as are specifically permitted under the Loan Documents. In addition, Borrower has complied with and is in compliance with all of the covenants set forth in the Loan Documents, as amended hereby.

| Fannie Mae | 08-13 | © 2013 Fannie Mae |

| Section 9. | No Event of Default. |

Borrower represents and warrants that, as of the date hereof, no Event of Default under the Loan Documents, as amended hereby, or event or condition which with the giving of notice or the passage of time, or both, would constitute an Event of Default, has occurred and is continuing.

| Section 10. | Costs. |

Borrower agrees to pay all fees and costs (including attorneys' fees) incurred by Fannie Mae and any Loan Servicer in connection with this Amendment.

| Section 11. | Continuing Force and Effect of Loan Documents. |

Except as specifically modified or amended by the terms of this Amendment, all other terms and provisions of the Loan Agreement and the other Loan Documents are incorporated by reference herein and in all respects shall continue in full force and effect. Borrower, by execution of this Amendment, hereby reaffirms, assumes and binds itself to all of the obligations, duties, rights, covenants, terms and conditions that are contained in the Loan Agreement and the other Loan Documents, including Section 15.01 (Governing Law; Consent to Jurisdiction and Venue), Section 15.04 (Counterparts), Section 15.07 (Severability; Entire Agreement; Amendments) and Section 15.08 (Construction) of the Loan Agreement.

| Section 12. | Counterparts. |

This Amendment may be executed in any number of counterparts with the same effect as if the parties hereto had signed the same document and all such counterparts shall be construed together and shall constitute one instrument.

[Remainder of Page Intentionally Blank]

| Fannie Mae | 08-13 | © 2013 Fannie Mae |

IN WITNESS WHEREOF, Borrower and Fannie Mae have signed and delivered this Amendment under seal (where applicable) or have caused this Amendment to be signed and delivered under seal (where applicable) by their duly authorized representatives. Where applicable law so provides, Borrower and Fannie Mae intend that this Amendment shall be deemed to be signed and delivered as a sealed instrument.

| BORROWER | |||

| BELL BR WATERFORD CROSSING JV, LLC, | |||

| a Delaware limited liability company | |||

| By: BR Waterford JV Member, LLC, a Delaware | |||

| limited liability company, its manager | |||

| By: | /s/ Jordan Ruddy | ||

| Jordan Ruddy | |||

| Authorized Signatory | |||

| Fannie Mae | 08-13 | © 2013 Fannie Mae |

| BORROWER: | |||||

| BELL HNW WATERFORD, LLC, a | |||||

| Delaware limited liability company | |||||

| By: | Bell HNW Nashville Portfolio, LLC, a North | ||||

| Carolina limited liability company, its sole | |||||

| member and manager | |||||

| By: | Bell HNW Partners Inc, a North Carolina | ||||

| corporation, its manager | |||||

| By: | /s/ Jonathan D. Bell | ||||

| Name: Jonathan D. Bell | |||||

| Title: President | |||||

| Fannie Mae | 08-13 | © 2013 Fannie Mae |

| FANNIE MAE | ||||

| By: | Walker & Dunlop, LLC, a Delaware limited liability company, its Servicer | |||

| By: | /s/ Loretta Webb | |||

| Loretta Webb | ||||

| Vice President | ||||

| Fannie Mae | 08-13 | © 2013 Fannie Mae |

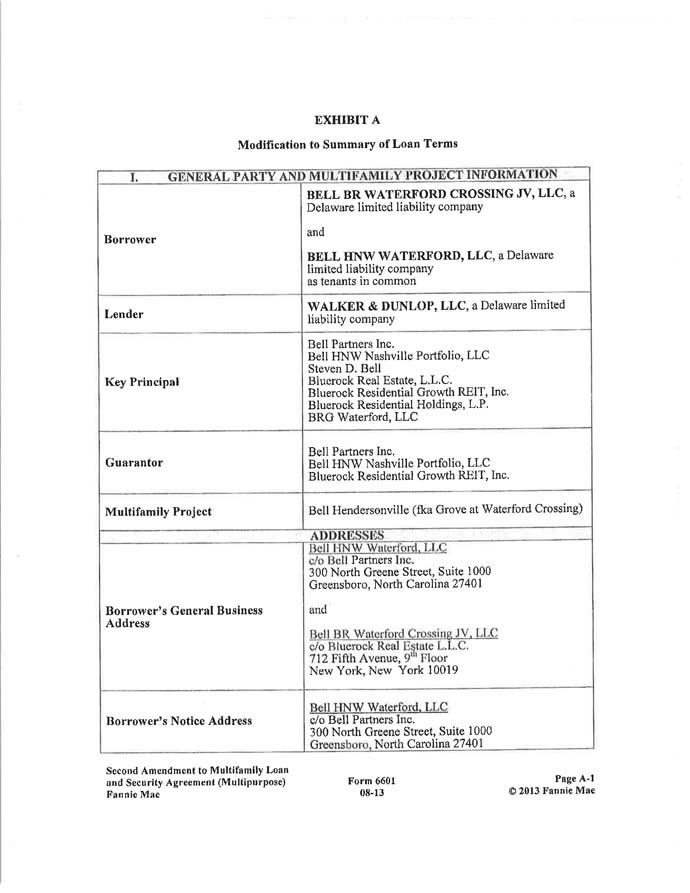

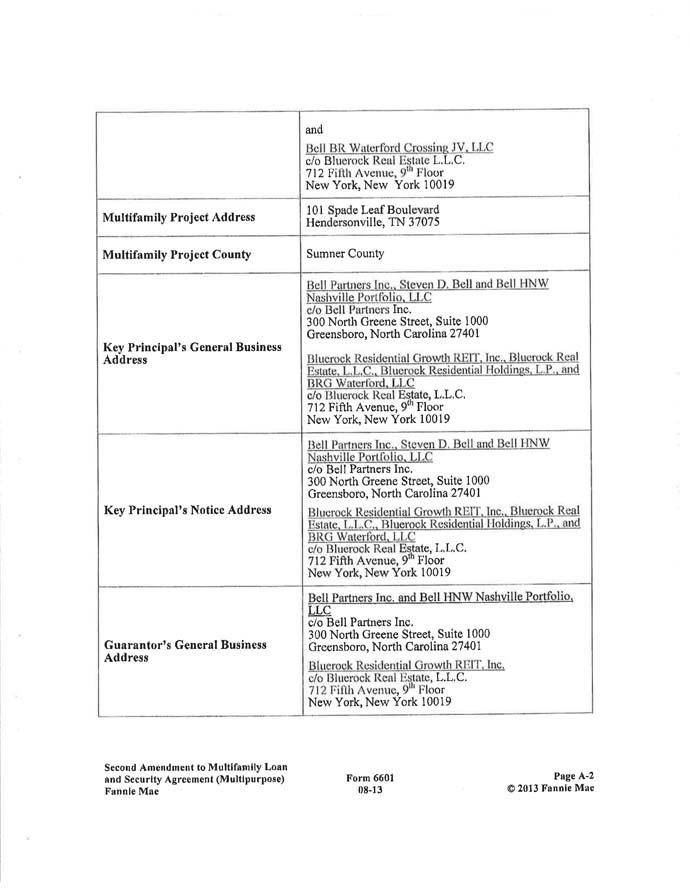

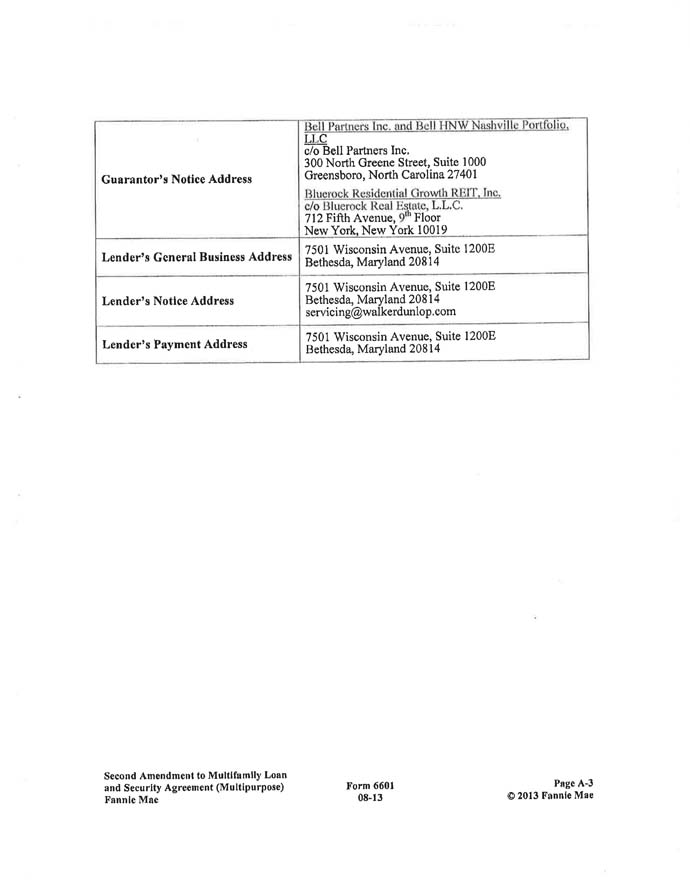

EXHIBIT A

Modification to Summary of Loan Terms

| Fannie Mae | 08-13 | © 2013 Fannie Mae |

| Fannie Mae | 08-13 | © 2013 Fannie Mae |

| Fannie Mae | 08-13 | © 2013 Fannie Mae |

| /s/ JR | ||

| Borrower Initials (Bell BR) | ||

| Fannie Mae | 08-13 | © 2013 Fannie Mae |

| /s/ JB | ||

| Borrower’s Initials (Bell HNW) | ||

| Fannie Mae | 08-13 | © 2013 Fannie Mae |

MODIFICATIONS TO MULTIFAMILY LOAN AND SECURITY AGREEMENT

ADDENDA TO SCHEDULE 2 - SUMMARY OF LOAN TERMS

(Co-Tenants)

| VI. Co-Tenants | |

| Co-Tenant Representative | Bell BR Waterford Crossing JV, LLC |

| Tenancy-in-Common Agreement | Tenants in Common Agreement by and between Bell BR Waterford Crossing JV, LLC and Bell HNW Waterford, LLC |

| Fannie Mae | 08-13 | © 2013 Fannie Mae |

| /s/ JR | ||

| Borrower Initials (Bell BR) | ||

| Fannie Mae | 08-13 | © 2013 Fannie Mae |

| s/ JB | ||

| Borrower Initials (Bell HNW) | ||

| Fannie Mae | 08-13 | © 2013 Fannie Mae |

EXHIBIT 3

MODIFICATIONS TO MULTIFAMILY LOAN AND SECURITY AGREEMENT

(Co-Tenants)

The foregoing Loan Agreement is hereby modified as follows:

1. Capitalized terms used and not specifically defined herein have the meanings given to such terms in the Loan Agreement.

2. The Definitions Schedule is hereby amended by adding the following new definitions in the appropriate alphabetical order:

"Co-Tenant" means, individually and collectively, all persons, trusts or entities comprising Borrower.

"Co-Tenant Representative" means the Co-Tenant Representative identified on the Summary of Loan Terms.

"Initial Bankruptcy Case(s)" means one or more bankruptcy cases resulting from one or more Co-Tenants filing for relief under the Insolvency Laws.

"Initial Debtor" means the debtor of an Initial Bankruptcy Case.

"Subsequent Bankruptcy Case" means any bankruptcy case filed by one or more Co-Tenants after an Initial Bankruptcy Case.

"Tenancy-in-Common Agreement" means that certain Tenancy-in-Common Agreement identified on the Summary of Loan Terms.

3. Section 3.02(a) (Personal Liability of Borrower - Personal Liability Based on Lender's Loss) of the Loan Agreement is hereby amended by adding the following provisions to the end thereof:

(8) the modification, termination or waiver of any provisions under the Tenancy-in-Common Agreement, or the entering into a new agreement related to the management of the Mortgaged Property, without the prior written consent of Lender; or

(9) the filing of any action, complaint, petition or other claim to divide the Mortgaged Property, cause the appointment of a receiver for the Mortgaged Property or compel the sale of the Mortgaged Property.

4. Section 14.0l (a) (Events of Default - Automatic Events of Default) of the Loan Agreement is hereby amended by adding the following provisions to the end thereof:

(12) the filing of any action, complaint, petition or other claim to divide the Mortgaged Property, cause the appointment of a receiver for the Mortgaged Property or compel the sale of the Mortgaged Property, without Lender's prior written consent.

| Fannie Mae | 08-13 | © 2013 Fannie Mae |

5. Section 15.02(a) (Process of Serving Notice) of the Loan Agreement is hereby amended by adding the following provision to the end thereof:

(4) any notice to be provided to Borrower under this Loan Agreement shall be provided in accordance with and in the manner set forth in this Section 15.02 and directed to Co-Tenant Representative. Borrower agrees that any notice so sent shall constitute notice to Borrower.

6. The following article is hereby added to the Loan Agreement as Article 16 (Co-Tenants):

ARTICLE 16 CO-TENANTS

16.01 Representations and Warranties.

The representations and warranties made by Borrower to Lender in this Section 16.01 are made as of the Effective Date, and are true and correct.

(a) No partition action has been filed, or is currently being threatened, with respect to the Mortgaged Property.

(b) Each Co-Tenant has executed and delivered the Tenancy-in-Common Agreement and is currently a party thereto.

(c) The Tenancy-in-Common Agreement is in full force and effect and there are no defaults thereunder, nor has any event occurred that with the passage of time, the giving of notice or both would result in such a default.

16.02 Covenants.

(a) No Partition, Sale or Ouster.

Neither Borrower nor any Co-Tenant shall file any action, complaint, petition or claim to seek partition or to otherwise divide the Mortgaged Property, to compel any sale of the Mortgaged Property or to seek ouster of any Co-Tenant. Borrower and each Co-Tenant expressly waives any and all rights to partition the Mortgaged Property or seek ouster of any Co-Tenant.

(b) Notification of Default under Tenancy-in-Common Agreement.

Borrower hereby agrees that it will cause Co-Tenant Representative to notify Lender in writing within ten (10) days of a default by one or more of the parties under the Tenancy-in-Common Agreement.

| Fannie Mae | 08-13 | © 2013 Fannie Mae |

16.03 Subordination of the Tenancy-in-Common Agreement.

It is specifically agreed by Borrower and each Co-Tenant that the Tenancy-in-Common Agreement and all rights, remedies and indemnities benefiting Borrower or each Co-Tenant thereunder, the Mortgaged Property or the ownership or operation thereof are hereby expressly made fully junior, secondary, subject and subordinate to the rights and remedies of Lender under the Loan Documents, including any future advances made by Lender. Each Co-Tenant further subordinates and hereby makes junior, secondary and subject any and all purchase options, rights of first refusal and rights to purchase the Mortgaged Property or any right or interest therein, whether now owned or hereafter acquired (including, without limitation, any rights arising under the Insolvency Laws) to the terms and provisions of the Loan Documents. To the extent that any one or more Co-Tenant has or in the future obtains any lien or similar interest whatsoever in or to the Mortgaged Property, or any right or interest therein, whether now owned or hereafter acquired, such lien or other similar interest shall be and hereby is waived in its entirety until the Indebtedness is paid in full. Each Co-Tenant further agrees and covenants that prior to the full and final payment of the Indebtedness and the written final release and discharge of the Indebtedness by Lender, each Co-Tenant will not pursue any remedies against one another to which it may be entitled pursuant to the Tenancy-in-Common Agreement or to which it may be entitled at law or in equity without Lender's prior written consent, other than the right expressly set forth in the Tenancy-in-Common Agreement to purchase the interest of another Co-Tenant, to reduce the interest of another Co-Tenant, or (subject to the provisions in Section 16.04 (Bankruptcy) below) the right to seek contribution from another Co-Tenant.

16.04 Bankruptcy.

(a) After the occurrence of a Bankruptcy Event involving any one or more Co-Tenant(s), each Co-Tenant:

(1) agrees not to seek the sale of its tenancy-in-common interest separate and apart from any sale of the undivided fee simple interest in the Mortgaged Property. Each Co-Tenant acknowledges and agrees that the detriment to the interest of each other Co-Tenant outweighs the benefit to such Co-Tenant.

(2) assigns to Lender, as additional security for the Indebtedness, its right to reject or ratify the Tenancy-in-Common Agreement under the Insolvency Laws.

(b) Neither Borrower nor any Co-Tenant shall have any right of, and each hereby waives any claim for, subrogation or reimbursement against any Co- Tenant or any general partner, member or manager of a Co-Tenant by reason of any payment by Borrower or by any Co-Tenant of the Indebtedness, whether such right or claim arises at law or in equity or under any contract or statute, until the Indebtedness has been paid in full and there has expired the maximum possible period thereafter during which any payment made by Borrower or such Co-Tenant to Lender with respect to the Indebtedness could be deemed a preference under the Insolvency Laws.

| Fannie Mae | 08-13 | © 2013 Fannie Mae |

(c) If any payment by a Co-Tenant is held to constitute a preference under the Insolvency Laws, or if for any other reason Lender is required to refund any sums to a Co-Tenant, such refund shall not constitute a release of any liability of Borrower under the Note, the Security Instrument or any other Loan Documents. It is the intention of Lender and Borrower that Borrower's obligations under the Note, the Security Instrument and any other Loan Documents shall not be discharged except by Borrower's performance of such obligations and then only to the extent of such performance.

(d) If, as the result of one or more Initial Bankruptcy Cases, an Initial Debtor achieves confirmation of a plan that impairs the liens granted Lender under the Security Instrument, then each Co-Tenant shall agree as follows:

(1) each Co-Tenant would be a party-in-interest in the Initial Bankruptcy Case(s);

(2) each Co-Tenant will be bound by the terms of the plan confirmed in the Initial Bankruptcy Case(s);

(3) each Co-Tenant will receive a benefit by reason of any impairment of Lender's lien that is authorized by the court in the Initial Bankruptcy Case;

(4) the interest of each Co-Tenant in the Mortgaged Property and the terms of the lien impairment will have been adequately represented by Initial Debtor(s);

(5) the impairment of the liens was a critical and necessary part of the plan and order confirming the plan issued in the Initial Bankruptcy Case(s);

(6) Lender and each Co-Tenant constitute all of the material necessary parties to the Initial Bankruptcy Case(s) and any Subsequent Bankruptcy Case(s) filed with respect to the Mortgaged Property;

(7) the confirmation order issued by a United States bankruptcy (or district) court will have been issued by a court of competent jurisdiction;

(8) the confirmation order in the Initial Bankruptcy Case(s) constitutes a final judgment on the merits;

| Fannie Mae | 08-13 | © 2013 Fannie Mae |

(9) any lien impairment request in the Subsequent Bankruptcy Case will be identical in all material respects to the lien impairment claims made in the Initial Bankruptcy Case(s); and

(10) that in view of the foregoing agreements, EACH CO-TENANT SHALL CONFIRM IT HAS WAIVED THE RIGHT TO REQUEST BANKRUPTCY RELIEF AFTER THE CONFIRMATION OF A PLAN IN THE INITIAL BANKRUPTCY CASE(S), AND SHALL FURTHER AGREE IT WILL CONSENT TO ENTRY OF AN ORDER DISMISSING ANY SUBSEQUENT BANKRUPTCY CASE CONCERNING THE MORTGAGED PROPERTY, AND THAT THE FAILURE OF ONE OR MORE CO-TENANTS TO CONSENT TO AN ORDER OF DISMISSAL AS REQUESTED BY LENDER IN THE SUBSEQUENT BANKRUPTCY CASE SHALL EVIDENCE "BAD FAITH" ON THE PART OF THE CO-TENANTS, AND SUCH FAILURE TO CONSENT SHALL CONSTITUTE ADEQUATE CAUSE FOR DISMISSAL OF THE SUBSEQUENT BANKRUPTCY CASE.

| Fannie Mae | 08-13 | © 2013 Fannie Mae |

| /s/ JR | ||

| Borrower Initials (Bell BR) | ||

| Fannie Mae | 08-13 | © 2013 Fannie Mae |

| /s/ JB | ||

| Borrower Initials (Bell HNW) | ||

| Fannie Mae | 08-13 | © 2013 Fannie Mae |