Attached files

Exhibit 10.206

LIMITED LIABILITY COMPANY AGREEMENT

OF BR BELLAIRE BLVD, LLC

THIS LIMITED LIABILITY COMPANY AGREEMENT (as amended from time to time, this “Agreement” or this “Limited Liability Company Agreement”) is made and entered into this 9th day of January, 2015, by and between Blaire House, LLC, a Delaware limited liability company (the “TCR Member”), and BR Southside Member, LLC, a Delaware limited liability company (the “BR Member”).

RECITALS:

A. BR Bellaire Blvd, LLC (the “Company”) was formed effective as of December 18, 2014 by the filing of its Certificate of Formation with the Secretary of State of Delaware.

B. The TCR Member and the BR Member desire to enter into this Agreement to reflect the current business arrangement among the Members.

NOW THEREFORE, for good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the TCR Member and the BR Member hereby agree as follows:

ARTICLE 1.

DEFINITIONS

In addition to terms defined in the body of this Limited Liability Company Agreement, the following terms when used in this Limited Liability Company Agreement shall have the following meanings (unless otherwise expressly provided herein):

“1933 Act” has the meaning set forth in Section 16.19.

“Act” means the Delaware Limited Liability Company Act, as amended from time to time.

“Additional Capital Contributions” means with respect to each Member, all additional Capital Contributions made by such Member pursuant to Section 8.4.

“Additional Contribution Priority Return” means an amount accruing at the rate of ten percent (10%) per annum on a Member's unreturned Additional Capital Contributions (including all Dilution Contributions, but not Disproportionate Contributions) less all amounts actually distributed to the Member pursuant to Sections 9.1(b). The Additional Contribution Priority Return shall be compounded monthly and calculated on a cumulative basis.

“Adjusted Capital Account Balance” means the balance, if any, in the Member’s Capital Account as of the end of the relevant taxable year, after giving effect to the following adjustments: the Member’s Capital Account balance shall be increased by the amounts which the Member is deemed obligated to restore pursuant to Regulations Section 1.704-1(b)(2)(ii)(c); and (ii) the Member’s Capital Account balance shall be decreased by the items described in Regulations Section 1.704-1(b)(2)(ii)(d)(4), (5), and (6).

| 1 |

“Affiliate” means, as to any Person, (i) in the case of an individual, any relative of such Person (i.e. a sibling of such Person, a descendant of such Person or any of such Person’s siblings, or the spouse of any of them) and (ii) any Entity controlling, controlled by or under common control with such Person.

“Bankruptcy” means, as to any Person, any of (i) the filing by the Person of a voluntary petition or the Person otherwise initiating proceedings (A) to have the Person adjudicated insolvent, (B) seeking an order for relief of the Person as debtor under the United States Bankruptcy Code, (C) seeking any composition, reorganization, readjustment, liquidation, dissolution, or similar relief under the present or any future federal bankruptcy laws or any other present or future applicable federal, state, or other statute or law relative to bankruptcy, insolvency, or other relief for debtors with respect to the Person or (D) seeking the appointment of any trustee, receiver, conservator, assignee, sequestrator, custodian, liquidator or other similar official of the Person or of all or any substantial part of its property; or (ii) the Person making any general assignment for the benefit of creditors of the Person.

“Bluerock Transferee” has the meaning set forth in Section 12.2(a).

“BR Affiliate” has the meaning set forth in Section 5.16.1.

“BR Cost Overrun Loan” has the meaning set forth in Section 8.4.2.

“BR Member” has the meaning set forth in the preamble to this Agreement.

“BR REIT” means Bluerock Residential Growth REIT, Inc.

“Buy/Sell” has the meaning set forth in Section 12.6.1.

“Buy/Sell Closing Date” has the meaning set forth in Section 12.6.5.

“Capital Account” means a capital account maintained in accordance with the rules contained in Treasury Regulations Section 1-704-1(b)(2).

“Capital Call” has the meaning set forth in Section 8.1.2.

“Capital Contribution” means the total amount of cash and the Gross Asset Value of any property (other than cash) contributed to the Company by a Member pursuant to terms of this Agreement (minus any liabilities related to contributed property that the Company assumes or takes the property subject to).

“Capital Proceeds” means (i) the Company's share of the proceeds of a Capital Transaction after subtracting (A) payment of all expenses associated with the Capital Transaction, (B) repayment of all secured and unsecured debts of Company required to be paid in connection with such Capital Transaction or that the Managers determine should be paid in connection with such Capital Transaction, (C) all amounts retained as Reserves and (D) all proceeds of the Capital Transaction applied to repair, restoration or improvements of the Project and (ii) any amounts included in Reserves derived from Capital Contributions and/or Capital Transactions which the Managers determine to distribute, excluding any Construction Recoveries (to the extent actually set aside or used to repair any related defects or deficiencies from which the Construction Recoveries were derived or to reimburse the TCR Member or its Affiliates for costs that they actually incurred to repair any such related defects or deficiencies).

| 2 |

“Capital Transaction” means (i) a transaction pursuant to which the indebtedness of the Company (whether or not secured by the Project) is refinanced or any additional borrowing by the Company, including the Loan; (ii) a sale, condemnation, exchange or other disposition of the Project or any part thereof; (iii) an insurance recovery or receipt of condemnation proceeds related to the Project; or (iv) any other transaction with respect to the Company which, in accordance with generally accepted accounting principles, is considered capital in nature.

“Certificate of Formation” means the certificate of formation of the Company filed with the Delaware Secretary of State as required by the Act, as such certificate of formation may be amended or amended and restated from time to time.

“Code” means the Internal Revenue Code of 1986, as amended from time to time.

“Company” has the meaning set forth in the Recitals to this Agreement.

“Company Minimum Gain” has the meaning assigned to “partnership minimum gain” in Regulations Section 1.704-2(b)(2), as determined pursuant to Regulations Section 1.704-2(d).

“Completion Milestones” means, for each of the phases of the Project identified in the table below, the date for such phase set forth in the table below, as extended for delays resulting from Force Majeure Events of which the TCR Member or Developer promptly notifies Owner:

| Begin demolition of existing improvements | July 1, 2015 | |

| Begin framing residential units | July 18, 2016 | |

| Delivery of first residential unit | March 2, 2017 | |

| Delivery of final residential unit | December 4, 2017 |

“Construction Recoveries” means all recoveries from subcontractors, suppliers, insurers and similar persons in respect of construction warranty obligations, construction defects or similar claims.

“Debt Service” means, for any period, principal, interest and other required payments (including any required loan rebalancing or remargining payments, except to the extent that such loan rebalancing is required by the Lender as a result of a Hard Cost Overrun or Soft Cost Overrun) owing on the Loan or any other loan to the Company, but excluding any balloon payments due at maturity.

“Default Action(s)” has the meaning set forth in Section 6.6.

“Defaulting Member” has the meaning set forth in Section 8.4.4.

| 3 |

“Depreciation” means, for each taxable year, an amount equal to the depreciation, amortization and other cost recovery deductions allowable under the Code with respect to an asset for such taxable year, except that if the Gross Asset Value of an asset differs from its adjusted basis for federal income tax purposes at the beginning of such taxable year, Depreciation shall be an amount which bears the same ratio to such beginning Gross Asset Value as the federal income tax depreciation, amortization and other cost recovery deductions for such taxable year bears to such beginning adjusted tax basis; provided, however, if the adjusted basis for federal income tax purposes of an asset at the beginning of such taxable year is zero, Depreciation shall be determined with reference to such beginning Gross Asset Value using any reasonable method selected by the Managers.

“Developer” means Maple Multi-Family Operations, L.L.C., a Delaware limited liability company, an affiliate of the TCR Member.

“Development Agreement” means that certain Development Agreement between the Company and Developer with respect to the Project, as the same may be amended from time to time.

“Development Fee” has the meaning set forth in Section 5.12.3.

“Dilution Contributions” means any Additional Capital Contributions as to which a Member has obtained the benefit of the 3:1 multiplier under Section 8.4.6.

“Disproportionate Contribution” means, in the case of the TCR Member, the unreturned Additional Capital Contributions (other than Dilution Contributions) of the TCR Member in excess of one-ninth of the aggregate unreturned Additional Capital Contributions (other than Dilution Contributions) of the BR Member and, in the case of the BR Member, the unreturned Additional Capital Contributions (other than any Dilution Contributions) of the BR Member in excess of nine times the aggregate unreturned Additional Capital Contributions (other than Dilution Contributions) of the TCR Member.

“Disproportionate Contribution Priority Return” means (i) an amount accruing at the rate of nine percent (9%) per annum on a Member's unreturned Disproportionate Contributions for Remargining Payments or payment of indemnity claims under Section 15.1 and at a rate of twenty percent (20%) per annum on a Member's unreturned Disproportionate Contributions for purposes other than Remargining Payments or such indemnity payments less (ii) all amounts actually distributed to the Member pursuant to Section 9.1(a) on account of Disproportionate Contribution Priority Return. The Disproportionate Contribution Priority Return shall be compounded monthly and calculated on a cumulative basis.

“Discretionary Changes” means any modifications or changes that the Members agree to make to the Plans or the Project (and any applicable corresponding changes to the Total Project Budget) that (i) are not required to complete the construction of the Project as originally contemplated by the Plans and (ii) are not necessitated by deficiencies in the Plans or government- mandated revisions of the Plans or the Project (except government-mandated revisions resulting from changes in building codes or other applicable laws after the date of this Agreement). Discretionary Changes include, for example, upgrades/downgrades of interior or exterior finishes, additional/fewer Project amenities, and increases/decreases in square footage.

“Distributions” means the distributions payable (or deemed payable) to a Member.

| 4 |

“Due Date” has the meaning set forth in Section 8.1.2.

“Economic Interest” means a Member’s or Economic Interest Owner’s share of one or more of the Company’s Profits and Losses and distributions of the Company’s assets pursuant to this Limited Liability Company Agreement and the Act, but shall not include any right to vote on, consent to or otherwise participate in any decision of the Members or Managers.

“Economic Interest Owner” means the owner of an Economic Interest who is not a Member.

“Entity” means any general partnership, limited partnership, limited liability company, corporation, joint venture, trust, business trust, cooperative, association, foreign trust or foreign business organization or other type of entity, including any governmental unit.

“Feasibility Period” has the meaning set forth in the Ground Lease.

“Fiscal Year” means the Company’s fiscal year, which shall be the calendar year.

“Force Majeure Event” means acts of God, war, riots, civil insurrections, hurricanes, tornados, floods, earthquakes, epidemics or plagues, acts or campaigns of terrorism or sabotage, interruptions to domestic or international transportation, trade restrictions, delays caused by any governmental or quasi-governmental entity, shortages of materials, natural resources or labor, labor strikes, governmental prohibitions or regulations including administrative delays in obtaining building permits, inability to obtain materials or any other cause beyond the reasonable control of the Person seeking relief.

“Foreign Corrupt Practices Act” means the Foreign Corrupt Practices Act of the United States, 15 U.S.C. Sections 78a, 78m, 78dd-1, 78dd-2, 78dd-3, and 78ff, as amended.

“GC Contract” has the meaning set forth in Section 5.12.2.

“General Contractor” means Maple Multi-Family TX Contractor, L.L.C., a Texas limited liability company, an affiliate of the TCR Member.

“Gross Asset Value” means with respect to any asset, the asset’s adjusted basis for federal income tax purposes, except as follows:

(a) The initial Gross Asset Value of any asset contributed by a Member to the Company shall be the gross fair market value of such asset on the date of the contribution as determined by the Managers;

(b) The Gross Asset Values of all Company assets shall be adjusted to equal their respective gross fair market values in accordance with Regulations Section 1.704-1(b)(2)(iv)(g) (taking Code Section 7701(g) into account), as determined by agreement of the Managers, as of the following times: (i) the acquisition of an additional Membership Interest by any new or existing Member in exchange for more than a de minimis Capital Contribution; (ii) the distribution by the Company to a Member of more than a de minimis amount of property as consideration for a Membership Interest; (iii) the grant of a Membership Interest in the Company (other than a de minimis interest) as consideration for the provision of services to or for the benefit of the Company by a new or existing Member acting in a Member capacity or in anticipation of being a Member; (iv) the liquidation of the Company within the meaning of Regulations Section 1.704-1(b)(2)(ii)(g); and (v) the grant of a noncompensatory option to acquire a Membership Interest in the Company (other than an option for a de minimis interest); provided, however, that an adjustment pursuant to clauses (i), (ii), (iii) and (v) shall be made only if the Managers reasonably determine that such adjustment is necessary or appropriate to reflect the relative economic interests of the Members in the Company;

| 5 |

(c) The Gross Asset Value of any Company asset distributed to any Member (taking Code Section 7701(g) into account) shall be adjusted to equal the gross fair market value of such asset on the date of distribution as reasonably determined by the Managers; and

(d) The Gross Asset Values of Company assets shall be increased (or decreased) to reflect any adjustments to the adjusted basis of such assets pursuant to Code Section 732(d), 734(b) or 743(b), but only to the extent that the adjustment is taken into account in determining Capital Accounts pursuant to Regulations Section 1.704-1(b)(2)(iv)(m), provided that Gross Asset Values will not be adjusted under this paragraph (d) to the extent that the Managers determine that an adjustment under paragraph (b) above is necessary or appropriate in connection with a transaction that would otherwise result in an adjustment under this paragraph (d).

If the Gross Asset Value of an asset has been determined or adjusted pursuant to paragraph (a), (b) (c) or (d) hereof, such Gross Asset Value shall thereafter be adjusted by the Depreciation taken into account with respect to such asset for purposes of computing Profits and Losses.

“Ground Lease” means that certain Ground Lease with respect to the Property to be entered into substantially concurrently with this Agreement by and between the Company, as tenant, and PROKOP Industries BH, L.P., the owner of the fee interest in the Property, as landlord.

“Hard Costs” means all items under the category heading “Hard Cost” in the Total Project Budget.

“Hard Cost Overrun” means, from time to time, the amount by which (i) the aggregate Hard Costs incurred in connection with the development and construction of the Project as of the date of measurement, excluding Hard Costs relating to Force Majeure Events or Discretionary Changes, exceed (ii) the sum of (A) the portion of the Total Project Budget allocated to Hard Costs (after any reallocation among line items within the Total Project Budget allowed by this Agreement), including the available Hard Cost contingency in the Total Project Budget, (B) Construction Recoveries applied to payment of Hard Costs and (C) all insurance proceeds collected as a result of casualty losses occurring prior to the Substantial Completion to the extent applied to payment of Hard Costs. Hard Cost Overruns include, without duplication, loan rebalancing payments required by a Lender in connection with a Loan, but only to the extent that such loan rebalancing payments are required by the Lender as a result of an actual or projected Hard Cost Overrun not relating to Force Majeure Events or Discretionary Changes. Hard Cost Overruns also include overruns resulting from Non-Discretionary Changes but not overruns resulting from Discretionary Changes.

| 6 |

“Indemnitee” has the meaning set forth in Section 15.1.

“Initial Capital Contribution” means the initial contribution (which may be made in multiple installments in accordance with the terms hereof) to the capital of the Company made by a Member pursuant to this Limited Liability Company Agreement. The Initial Capital Contributions of the Initial Members are set forth on Exhibit A.

“Initial Members” means those persons identified on Exhibit A attached hereto and made a part hereof by this reference, who have executed this Agreement.

“Internal Rate of Return” and “IRR” means as of any date, the internal rate of return on the Total Investment of a Member to such date (including giving credit for the 3:1 multiplier on the Member’s Additional Capital Contributions as may occur under Section 8.4.6 below), calculated to be that discount rate (expressed on a percentage basis), compounded monthly, which when applied to such Total Investment and the corresponding Distributions with respect thereto, causes the net present value, as of such date, of such Distributions and Total Investment to equal zero. For this purpose, Capital Contributions and Distributions shall be assumed to have occurred as of the first of the month nearest the actual date such Capital Contribution or Distribution is made. The formula used to calculate IRR shall be: (1 + monthly IRR) ^ 12-1.

“Land Contract” has the meaning set forth in Section 5.12.5.

“Lender” means Bank of America, N.A.

“Limited Liability Company Agreement” or “Agreement” means this Limited Liability Company Agreement, as amended from time to time.

“Liquidators” has the meaning set forth in Section 14.3.1.

“Loan” means the construction loan obtained by the Company for the development of the Project in the approximate amount of $31,557,483.

“Loan Contingency” has the meaning set forth in Section 8.1.4(a).

“Loan Guaranty” has the meaning set forth in Section 6.5.2.

“Major Decision(s)” has the meaning set forth in Section 7.7.

“Management Agreement” has the meaning set forth in Section 5.15.

“Management Committee” has the meaning set forth in Section 5.4.1.

“Management Company” has the meaning set forth in Section 5.15.

“Managers” means the BR Member and the TCR Member, or any other Person(s) that succeed such Persons in their capacities as Managers.

| 7 |

“Mandatory Developer Cost Overrun Loan” has the meaning set forth in Section 8.4.5.

“Member” means each of the Initial Members and each of the Persons who may hereafter become Members. To the extent a Manager has purchased a Membership Interest in the Company, the Manager will have all the rights of a Member with respect to such Membership Interest, and the term “Member” as used herein shall include a Manager to the extent it has purchased such Membership Interest in the Company. If a Person is a Member immediately prior to the purchase or other acquisition by such Person of an Economic Interest, such Person shall have all the rights of a Member with respect to both its existing Membership Interest and such purchased or otherwise acquired Economic Interest, as the case may be. The initial Ownership Percentages associated with the Membership Interests of the Members are set forth on Exhibit A attached hereto and incorporated herein by reference.

“Member Minimum Gain” has the meaning assigned to “partner nonrecourse debt minimum gain” in Regulations Section 1.704-2(i)(2).

“Member Nonrecourse Debt” has the meaning assigned to “partner nonrecourse debt” in Regulations Section 1.704-2(b)(4).

“Member Nonrecourse Deductions” has the meaning assigned to “partner nonrecourse deduction” in Regulations Section 1.704-2(i)(1).

“Membership Interest” means a Member’s entire interest in the Company including such Member’s Economic Interest and the right to participate in the management of the business and affairs of the Company, including the right to vote on, consent to, or otherwise participate in any decision or action of or by the Members granted pursuant to this Limited Liability Company Agreement or the Act.

“Net Cash Flow” means, for any period, the total annual cash gross receipts of the Company during such period derived from Company's direct or indirect interest in the Project and any and all sources, other than Capital Contributions or proceeds realized as a result of a Capital Transaction during such period, together with any amounts included in Reserves (other than Reserve amounts derived from Capital Contributions or Capital Transactions, unless such amounts are used to pay Debt Service, Operating Expenses or any balloon payments on loans at maturity) from prior periods which the Managers determine to release less (i) Debt Service for such period or any balloon payments on loans at maturity paid during such period (other than Debt Service or balloon payments paid from Capital Contributions or proceeds from a Capital Transaction), (ii) the Operating Expenses of the Company paid during such period (other than Operating Expenses paid from Capital Contributions or proceeds from a Capital Transaction), and (iii) any increases or replacements in Reserves (other than from Capital Contributions or proceeds from a Capital Transaction) during such period.

“Non-Defaulting Member” has the meaning set forth in Section 8.4.4.

“Non-Development Cost Overrun” means any cost overruns with respect to Hard Costs or Soft Costs which are attributable to Force Majeure Events, property taxes (unless attributable to failure to achieve the Completion Milestones), Debt Service (unless attributable to failure to achieve the Completion Milestones) other than any balloon payments due on loans at maturity, Discretionary Changes and/or operating deficits for the Project (unless attributable to failure to achieve the Completion Milestones).

| 8 |

“Non-Discretionary Changes” means any modifications or changes that the Members are required to make to the Plans or to the Project (other than Discretionary Changes), except a government-mandated modification or change resulting from changes in building codes or other applicable laws after the date of this Agreement. Non-Discretionary Changes include, for example, changes to the Plans or the constructed portions of the Project to correct design or construction deficiencies or to implement government-mandated revisions not resulting from changes in building codes or other applicable laws after the date of this Agreement, or general contractor claims under the GC Contract for increased compensation due to errors or inconsistencies in the Plans, concealed conditions, delays or other reasons, in any such case unless resulting from a Force Majeure Event.

“Nonrecourse Deductions” has the meaning assigned to it in Regulations Section 1.704-2(b)(1). The amount of Nonrecourse Deductions for a taxable year of the Company equals the net increase, if any, in the amount of Company Minimum Gain during that taxable year, determined according to the provisions of Regulations Section 1.704-2(c).

“Notices” has the meaning set forth in Section 16.13.

“Offeree” has the meaning set forth in Section 12.6.2.

“Offeror” has the meaning set forth in Section 12.6.2.

“Operating Budget” has the meaning set forth in Section 5.14.2.

“Operating Expenses” means all cash expenditures made by the Company in connection with ground leasing, owning and operating the Project or otherwise conducting its business (but excluding Hard Costs and Soft Costs).

“Ownership Percentage” means, subject to adjustment pursuant to other provisions of this Agreement, the Ownership Percentage of each Member as described on Exhibit A.

“Person” means any individual or Entity, and the heirs, executors, administrators, legal representatives, successors, and assigns of such “Person” where the context so permits.

“Plans” means the plans and specifications for the Project identified in Exhibit D, as they may be updated from time to time by (i) the mutual consent of all of the Members, (ii) changes made by the TCR Member in accordance with Section 7.7(s) or (iii) changes made by the Developer to the extent permitted under Section 3.2.3 of the Development Agreement.

“Postal Service” has the meaning set forth in Section 16.13.

“Principals” means Kenneth J. Valach, Sean Rae and Scot Davis.

| 9 |

“Profits” or “Losses” means, for each taxable year, an amount equal to the Company’s taxable loss or income, respectively, for such taxable year, determined in accordance with Section 703(a) of the Code (and for this purpose, all items of income, gain, loss, or reduction required to be stated separately pursuant to Section 703(a)(1) of the Code shall be included in taxable income or loss), with the following adjustments:

(a) Any income of the Company that is exempt from federal income tax and not otherwise taken into account in computing Profits or Losses shall be added to such taxable income or loss;

(b) Any expenditures of the Company described in Section 705(a)(2)(B) of the Code, or treated as Code Section 705(a)(2)(B) expenditures pursuant to Regulations Section 1.704-1(b)(2)(iv)(i), and not otherwise taken into account in computing Profits or Losses shall be subtracted from such taxable income or loss;

(c) In the event the Gross Asset Value of any Company asset is adjusted pursuant to paragraph (b) or (c) of the definition thereof, the amount of such adjustment shall be taken into account as gain or loss from the disposition of such asset for purposes of computing Profits or Losses;

(d) Gain or loss resulting from any disposition of Company property with respect to which gain or loss is recognized for federal income tax purposes shall be computed by reference to the Gross Asset Value of the property disposed of notwithstanding that the adjusted tax basis of such property differs from its Gross Asset Value;

(e) In lieu of the depreciation, amortization, and other cost recovery deductions taken into account in computing such taxable income or loss, there shall be taken into account Depreciation for the taxable year;

(f) To the extent an adjustment to the tax basis of any Company asset pursuant to Code Section 734(b) is required pursuant to Treasury Regulations Section 1.704 1(b)(2)(iv)(m)(4) to be taken into account in determining Capital Accounts as a result of a distribution other than a complete liquidation of Member’s interest in the Company (within the meaning of the Code), the amount of such adjustment shall be treated as an item of gain (if the adjustment increases the basis of the asset) or loss (if the adjustment decreases the basis of the asset) from the disposition of the asset and shall be taken into account for purposes of computing Profits or Losses; and

(g) Any items which are specially allocated pursuant to Article 10 hereof shall not be taken into account in computing Profits or Losses but shall be determined by applying rules analogous to those set forth in paragraphs (a) through (d) of this definition.

If the profit or loss for a taxable year, as adjusted in the manner provided herein, is a positive amount, such amount shall be the Profits for such taxable year; and if the profit or loss for a taxable year, as adjusted in the manner provided herein, is a negative amount, such amount shall be the Losses for such taxable year.

“Project” means a Class A rental apartment complex operating under the name “Alexan Southside” to be constructed upon the Property, such complex to encompass approximately 269 units and approximately 240,486 net rentable square feet.

| 10 |

“Property” means the ground leasehold estate in that certain real property located in Houston, Texas which is more particularly described in Exhibit B attached hereto and incorporated herein, upon which the Company intends to develop the Project.

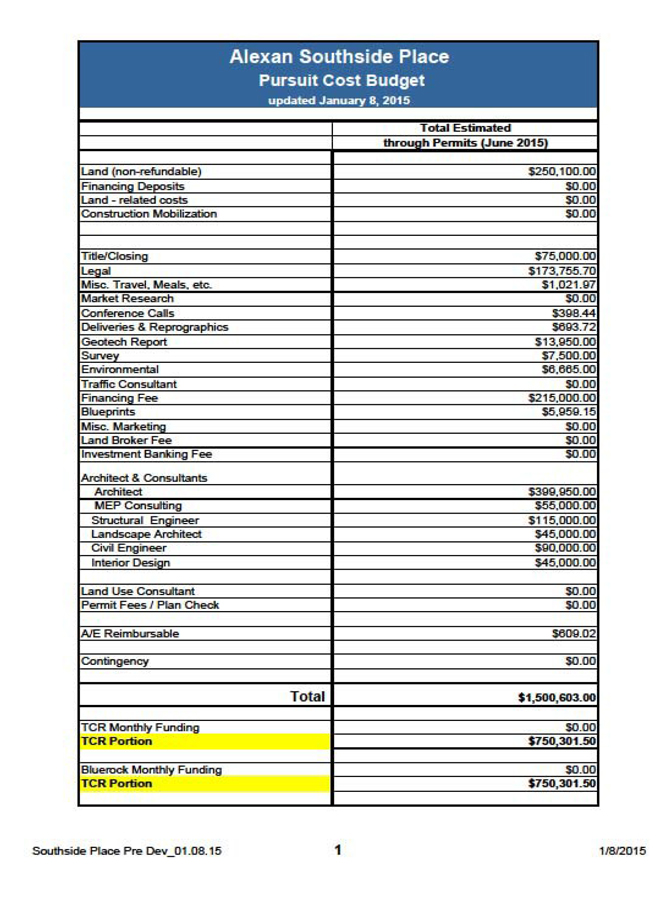

“Pursuit Costs” means pre-development costs with respect the Project, such as earnest money deposits, and other related pursuit costs detailed in the Pursuit Costs Budget and incurred in connection with the ground lease, acquisition and development of the Project.

“Pursuit Costs Budget” means that certain budget attached hereto as Exhibit E.

“Regulatory Allocations” has the meaning set forth in Section 10.3.1.

“Reimbursement Request” has the meaning set forth in Section 8.1.1.

“REIT” means a real estate investment trust as defined in Code Section 856.

“REIT Member” means any Member, if such Member is a REIT or a direct or indirect subsidiary of a REIT.

“REIT Prohibited Transaction” has the meaning set forth in Section 5.16.3.

“REIT Requirements” means the requirements for qualifying as a REIT under the Code and the Regulations.

“Remargining Payment” means any payment of principal on the Loan or another mortgage loan to the Company that is (i) to cover a gap between the outstanding balance of the Loan or such other mortgage loan and proceeds of any mortgage loan obtained to refinance the Loan or such other mortgage loan, (ii) to meet requirements for extension of the maturity of the Loan or such other mortgage loan or (iii) to satisfy a remargining requirement that is part of the Loan or such other mortgage loan.

“Removal Action” has the meaning set forth in Section 5.9.

“REOC” has the meaning set forth in Section 5.16.1.

“Representatives” means the meaning set forth in Section 5.4.1.

“Reserves” means with respect to any fiscal period, funds set aside or amounts allocated to reserves for the Company during such period, which shall be maintained in amounts deemed sufficient by the Managers for working capital, capital expenditures, repairs, replacements and anticipated expenditures for paying taxes, insurance, debt service, ground lease rent or other costs or expenses incident to the ownership of the Project or the operation of the Company’s business.

“Soft Cost(s)” means all items under the category heading “Soft Cost” in the Total Project Budget. Soft Costs include, without limitation, architectural and engineering fees and legal fees incurred by the Company.

| 11 |

“Soft Cost Overrun” means, from time to time, the amount by which (i) the aggregate Soft Costs incurred in connection with the development and construction of the Project as of the date of measurement, excluding Soft Costs relating to Force Majeure Events, property taxes (unless attributable to failure to achieve the Completion Milestones), Debt Service (unless attributable to failure to achieve the Completion Milestones) other than any balloon payments due on loans at maturity, Discretionary Changes and/or operating deficits for the Project (unless attributable to failure to achieve the Completion Milestones), exceed (ii) the sum of (A) the portion of the Total Project Budget allocated to Soft Costs (after any reallocation among line items within the Total Project Budget allowed by this Agreement), including the available Soft Cost contingency in the Total Project Budget, (B) Construction Recoveries applied to payment of Soft Costs and (C) all insurance proceeds collected as a result of casualty losses occurring prior to the Substantial Completion to the extent applied to payment of Soft Costs. Soft Cost Overruns include, without duplication, loan rebalancing payments required by a Lender in connection with a Loan, but only to the extent that such loan rebalancing payments are required by the Lender as a result of an actual or projected Soft Cost Overrun not relating to Force Majeure Events, property taxes (unless attributable to failure to achieve the Completion Milestones), Debt Service (unless attributable to failure to achieve the Completion Milestones) other than any balloon payments due on loans at maturity, Discretionary Changes and/or operating deficits for the Project (unless attributable to failure to achieve the Completion Milestones). Soft Cost Overruns include overruns resulting from Non-Discretionary Changes but excludes overruns resulting from Discretionary Changes.

“Substantial Completion” means (i) the architect for the Project has certified that the construction of the Project has been substantially completed in accordance with the Plans (subject to completion of punch list items estimated to cost not more than $200,000) and (ii) a certificate of occupancy or equivalent documentation has been issued with respect to the Project by appropriate governmental agencies.

“taxable year” means a Fiscal Year or other period for which the Code or the Regulations requires Profits and Losses to be determined and allocated to the Members for federal income tax purposes.

“TCR Change of Control” shall be deemed to have occurred if, at any time prior to Substantial Completion, none of the Principals or another Person reasonably acceptable to the BR Member continues to be actively involved in the Project and able to perform his or her responsibilities as a representative of the TCR Member.

“TCR Cost Overrun Loan” has the meaning set forth in Section 8.4.2.

“TCR Guarantors” means CFP Residential, L.P., a Texas limited partnership, CFH Maple Residential Investor, L.P., a Texas limited partnership, VF MultiFamily Holdings, Ltd., a Texas limited partnership, VF Residential, Ltd., a Texas limited partnership, and Maple Residential, L.P., a Delaware limited partnership.

“TCR Indemnified Party” has the meaning set forth in Section 5.9.

“TCR Member” has the meaning set forth in the preamble to this Agreement.

“TCR Transferee” has the meaning set forth in Section 12.2(b).

| 12 |

“Total Investment” means the sum of the aggregate Capital Contributions made by a Member.

“Total Project Budget” means the final budget annexed hereto as Exhibit C, as it may be updated from time to time by the mutual consent of all of the Members or to allow for reallocation of line items by the TCR Member or the Developer in accordance with Section 5.14.1 of this Agreement or Section 4.2 of the Development Agreement.

“Transfer” has the meaning set forth in Section 12.1.

“Treasury Regulations” or “Regulations” means the Income Tax Regulations promulgated under the Code, as amended from time to time (including corresponding provisions of succeeding regulations).

“Valuation Amount” has the meaning set forth in Section 12.6.2.

“UBTI” has the meaning set forth in Section 5.16.2.

ARTICLE 2.

FORMATION OF COMPANY

2.1 Formation. On December 18, 2014, the Company was formed as a Delaware limited liability company by executing and delivering the Certificate of Formation to the Secretary of State of Delaware in accordance with the provisions of the Act.

2.2 Name. The name of the Company is BR Bellaire Blvd, LLC. The Company may do business under that name and under any other name or names which the Members select. If the Company does business under a name other than that set forth in its Certificate of Formation, then the Company shall file a trade name certificate as required by law.

2.3 Principal Place of Business. The principal place of business of the Company is 820 Gessner Road, Suite 760, Houston, Texas 77024. The Company may locate its places of business at any other place or places as the Managers may from time to time deem advisable.

2.4 Registered Office and Registered Agent. The Company’s initial registered office and the name of its initial registered agent shall be as set forth in the Certificate of Formation. The registered office and registered agent may be changed from time to time by filing the address of the new registered office and/or the name of the new registered agent with the Secretary of State of Delaware pursuant to the Act.

2.5 Term. The term of the Company commenced on the date the Certificate of Formation was filed with the Secretary of State of Delaware and shall continue thereafter in perpetuity unless earlier dissolved in accordance with the provisions of this Limited Liability Company Agreement or the Act.

| 13 |

ARTICLE 3.

BUSINESS OF COMPANY

3.1 Permitted Businesses. The business of the Company shall be:

(a) To acquire, ground lease, develop, sell, exchange, construct, improve, subdivide, mortgage, lease, maintain, transfer, operate, own as an investment and/or otherwise engage in all general business activities related or incidental to the ownership and development of the Property and the Project; and

(b) To engage in all activities necessary, customary, convenient, or incident to any of the foregoing.

The Members and the Managers acknowledge that the Project is to be developed and held for investment with the intent of maximizing the return to the Members, but such investment intent shall not preclude a disposition of the Project consistent with the terms of this Agreement. The Members acknowledge that the current business plan for the Company does not contemplate a sale of the Project at a specific date.

ARTICLE 4.

NAMES AND ADDRESSES OF INITIAL MEMBERS

The names and addresses of the Initial Members are set forth on Exhibit A attached hereto and by this reference made a part hereof.

ARTICLE 5.

RIGHTS AND DUTIES OF MANAGERS

5.1 Management. The business and affairs of the Company shall be managed by its Managers, subject to the participation of the Management Committee as provided in other provisions of this Agreement. Except for situations in which the approval of the Members is expressly required by this Agreement or by nonwaivable provisions of applicable law or as otherwise set forth in this Agreement, the Managers shall have full and complete authority, power and discretion to manage and control the business, affairs and properties of the Company, to make all decisions regarding those matters and to perform any and all other acts or activities customary or incident to the management of the Company’s business. Unless authorized to do so by this Agreement or by the Managers or the Management Committee, no attorney-in-fact, employee or other agent of the Company shall have any power or authority to bind the Company in any way, to pledge the Company’s credit or to render the Company pecuniarily liable for any purpose. No Member shall have any power or authority to bind the Company unless the Member has been authorized by the Managers or the Management Committee to act as an agent of the Company in accordance with the previous sentence. The day-to-day administration and management of the development and construction of the Project will be delegated to the Developer pursuant to the terms, conditions and obligations of the Development Agreement. In addition, the Managers hereby delegate to the TCR Member the authority (without further approval by the Managers or the Management Committee) to implement any Operating Budget approved in accordance with the terms of this Limited Liability Company Agreement.

| 14 |

5.2 Number and Tenure. The Company shall have two (2) Managers, and BR Member and the TCR Member shall serve as the initial Managers. Each Manager shall hold office until its successor shall have been elected and qualified or until its earlier resignation or removal.

5.3 Certain Powers of Managers. Subject to receipt of the applicable approvals under Sections 5.4 and 7.7 below, the Managers shall have power and authority, on behalf of the Company:

(a) To cause Company to acquire the Property, to enter into and perform its obligations under the Ground Lease, to close on the Loan and to construct and develop the Project.

(b) To invest any Company funds (by way of example but not limitation) in time deposits, short-term governmental obligations, or other investments, provided the funds in any such investment vehicle (other than governmental obligations or an investment vehicle that holds only governmental obligations) are insured by the Federal Deposit Insurance Corporation (or its successor or replacement).

(c) To execute all instruments and documents, including, without limitation, checks, drafts, notes and other negotiable instruments; purchase and sale agreements; mortgages or deeds of trust; security agreements; financing statements; deeds, ground leases, contracts, settlement statements, agreements, affidavits and any other documents providing for the acquisition, mortgage or disposition of the Company’s property; assignments; bills of sale; leases; and any other instruments or documents necessary, in the opinion of the Managers, to the business of the Company.

(d) To purchase liability and other insurance to protect employees, officers, property and business.

(e) Subject to Section 5.14, to employ accountants, engineers, architects, surveyors, attorneys, managing agents, leasing agents, and other experts to perform services for the Company and to compensate them from Company funds.

(f) To enter into any and all other agreements on behalf of the Company, with any other Person for any purpose, in such forms as the Managers may approve.

(g) To create offices and designate officers, who need not be Members. Any such persons appointed to be officers of the Company may or may not be employees of the Company, any Member, or any Affiliate thereof. Any officers so appointed shall have such authority and perform such duties as the Managers may, from time to time, expressly delegate to them in writing and the officers so appointed shall serve at the pleasure of the Managers.

(h) To borrow money for the Company from banks, other lending institutions, Managers, Members, or Affiliates of the Managers or Members on such terms as the Managers deem appropriate and, in connection therewith, to hypothecate, encumber and grant security interests in the assets of the Company to secure repayment of the borrowed sums.

| 15 |

(i) To do and perform all other acts as may be necessary or appropriate to the conduct of the Company’s business, to the extent such acts are not reserved unto the Members pursuant to another provision of this Agreement, including Section 7.7.

5.4 Management Committee.

5.4.1 The Managers and Members hereby establish a management committee (the “Management Committee”) for the Company for the purpose of the Managers considering and approving actions pursuant to Section 5.3. The Management Committee shall consist of four (4) individuals, each appointed to act as a representative of the Manager that appointed him or her (the “Representatives”) as follows: (i) BR Member, or its successor as Manager, shall be entitled to designate two (2) Representatives to represent it as Manager and (ii) TCR Member, or its successor as Manager, shall be entitled to designate two (2) Representatives to represent it as Manager. The initial members of the Management Committee are set forth on Exhibit A.

5.4.2 Each Representative as a member of the Management Committee, subject to this Section 5.4.2, shall hold office until death, resignation or removal at the pleasure of the Manager that appointed him or her. Any Representative may resign at any time by giving written notice to the Manager that appointed such Representative. The resignation of any Representative shall take effect upon receipt of notice thereof by such Manager or at such later time as shall be specified in such notice; and, unless otherwise specified therein, the acceptance of such resignation shall not be necessary to make it effective. A Representative shall also cease to be a member of the Management Committee upon the resignation or removal as a Manager of the Company of the Manager that appointed such Representatives. If a vacancy occurs on the Management Committee, the Manager with the right to appoint and remove such vacating Representative shall appoint his or her successor. A Manager shall lose its right to have its Representatives vote on any item as of the date on which such Manager ceases to be a Manager, including by means of removal under Section 5.9 or as otherwise provided in this Agreement. If the BR Member transfers all or a portion of its Membership Interest to a transferee permitted by Section 12.2(a), such transferee shall automatically, and without any further action or authorization by any Manager or Member, succeed to the rights and powers of the BR Member under this Section 5.4 as may be agreed to between the BR Member which is transferring the Membership Interest, on the one hand, and the permitted transferee to which the Membership Interest is being transferred, on the other hand, including the shared or unilateral right to appoint the Representatives that the BR Member was theretofore entitled to appoint pursuant to this Section 5.4. If the TCR Member transfers all or a portion of its Membership Interest to a transferee permitted pursuant to Section 12.2(b), such permitted transferee shall automatically, and without any further action or authorization by any Manager or Member, succeed to the rights and powers of the TCR Member under this Section 5.4 as may be agreed to between the TCR Member which is transferring the Membership Interest, on the one hand, and the permitted transferee to which the Membership Interest is being transferred, on the other hand, including the shared or unilateral right to appoint the Representatives that the TCR Member was theretofore entitled to appoint pursuant to this Section 5.4.

| 16 |

5.4.3 The Management Committee shall meet at least once every quarter (unless waived by mutual agreement of the Managers) and as otherwise required. The only Representatives required to constitute a quorum for a meeting of the Management Committee shall be one (1) Representative appointed by BR Member and one (1) Representative appointed by TCR Member; provided, however, if any Representative fails to attend any meeting and as a result thereof the Management Committee is unable to obtain a quorum, and thereafter such Representative fails to agree to reschedule and attend any such meeting within 15 days after receipt of written notice that the Management Committee was unable to obtain a quorum, then a quorum can be obtained without the attendance of a Representative of the Manager who selected the absent Representative.

5.4.4 Each of the two (2) Representatives appointed by BR Member shall be entitled to cast one (1) vote on any matter that comes before the Management Committee and each of the two (2) Representatives appointed by TCR Member shall be entitled to cast one (1) vote on any matter that comes before the Management Committee; provided, however, that from and after the admission of BR REIT as a direct or indirect owner of the BR Member and the BR Member delivering notice to the TCR Member that such admission has been complete, each of the two (2) representatives appointed by the BR Member shall be entitled to cast two (2) votes on any matter that comes before the Management Committee. Approval by the Management Committee of any matter (other than matters which are Major Decisions under Section 7.7 or which may be made unilaterally by a Member, but only as expressly set forth in this Agreement) shall require the affirmative vote of at least a majority of the votes of the Representatives then in office voting at a duly held meeting of the Management Committee.

5.4.5 Any meeting of the Management Committee may be held by telephone conference call, video conference or through similar communications equipment by means of which all persons participating in the meeting can communicate with each other. Participation in a telephonic and/or video conference meeting held pursuant to this Section 5.4.5 shall constitute presence in person at such meeting.

5.4.6 Any action required or permitted to be taken at a meeting of the Management Committee may be taken without a meeting, without prior notice and without a vote if a consent or consents in writing, setting forth the action so taken, shall be signed by Representatives having not less than the minimum number of votes that would be necessary to authorize or take such action at a meeting at which all Representatives entitled to vote thereon were present and voted. All consents shall be filed with the minutes of the proceedings of the Management Committee.

5.4.7 A member of the Management Committee may act solely in the self interest of the Manager that appointed such member. A member of the Management Committee will have no obligation to consider the interests of the Company or any Member or Manager other than the Manager that appointed such member, nor will a member of the Management Committee have any fiduciary duty, duty of loyalty, duty of good faith, duty to disclose or other duty or obligation whatsoever to the Company or any Member or Manager other than the Manager that appointed such member. In considering the interest of the Manager that appointed such member, a member of the Management Committee may take into account the Manager’s interest as a Member or a Manager or both. To the maximum extent permitted under applicable law, each of the Company, the Members and the Managers hereby waives all duties and obligations, including any fiduciary duty, duty of loyalty, duty of good faith, duty to disclose or other duty or obligation, that a member of the Management Committee otherwise would have to it to the extent such duties and obligations are inconsistent with this Section 5.4.7.

| 17 |

5.5 Limitation of Liability. No Member, Manager or Representative has guaranteed, nor shall any of them have any obligation with respect to, the return of a Member’s Capital Contributions or profits from the operation of the Company. Each Member, Manager or Representative shall be entitled to rely on information, opinions, reports or statements, including but not limited to financial statements or other financial data prepared or presented in accordance with the provisions of the Act. No Member, Manager or Representative shall be liable to the Company or to any of the others of them for negligence or for mistakes of judgment or losses or liabilities due to such negligence or for mistakes of judgment or to the negligence, dishonesty, unlawful acts or bad faith of any employee, broker or other agent, accountant, attorney, other professional or person employed by the Company provided that such person was selected, engaged, retained and supervised by such Member, Manager or Representative, as applicable, without gross negligence. No Member, Manager or Representative shall have any liability to the Company or to any of the other of them for any loss suffered by the Company which arises out of any action or inaction of such Member, Manager or Representative if, prior thereto, such Member, Manager or Representative, in good faith, determined that such course of conduct was within the authority allowed to it by this Agreement and such course of conduct did not constitute fraud, willful misconduct, a material breach of this Agreement or gross negligence.

5.6 Managers and Representatives Have No Exclusive Duty to Company. A Manager or Representative shall not be required to manage the Company as his, her or its sole and exclusive function and he, she or it may have other business interests and may engage in other activities in addition to those relating to the Company. Neither the Company nor any Member shall have any right, by virtue of this Limited Liability Company Agreement, to share or participate in such other investments or activities of a Manager or Representative or to the income or proceeds derived therefrom. A Manager or Representative shall incur no liability to the Company or to any of the Members as a result of engaging in any other business or venture. Nothing in this Section 5.6 limits the responsibility of a Representative to the Manager that appointed such Representative.

5.7 Bank Accounts. The Managers may from time to time open bank accounts, brokerage accounts and other accounts in the name of the Company, and the Managers shall be the sole signatory thereon, unless the Managers determine otherwise.

5.8 Resignation. Any Manager of the Company may resign at any time by giving written notice to the Members of the Company. The resignation of any Manager shall take effect upon receipt of notice thereof or at such later time as shall be specified in such notice; and, unless otherwise specified therein, the acceptance of such resignation shall not be necessary to make it effective. The resignation of a Manager shall also constitute the resignation of such Manager’s Representatives on the Management Committee. The resignation of a Manager who is also a Member shall not affect the Manager’s rights as a Member and shall not constitute a withdrawal of a Member.

| 18 |

5.9 Removal of Managers. At a meeting called expressly for that purpose, a Manager may be removed, by the affirmative vote of all Members (excluding the Membership Interest of BR Member or its permitted transferee in the event BR Member or its permitted transferee, or an Affiliate of any of them, is the subject of such removal vote and excluding the Membership Interest of TCR Member or its permitted transferee in the event TCR Member or its permitted transferee, or an Affiliate of any of them, is the subject of such removal vote), but only in the event of any of the following (each a “Removal Action”): (i) a material breach of this Agreement (but expressly excluding failure to make an Additional Capital Contribution) on the part of such Manager (either as a Manager or as a Member), which breach shall continue uncured for thirty (30) calendar days after the giving of written notice thereof to such Manager by a Member specifying the nature of such breach or, if more than thirty (30) days is reasonably required to cure such breach and if the defaulting Manager commences to cure within the original thirty (30) day cure period and diligently continues to cure such breach, such additional time as is reasonably necessary to cure the breach not to exceed an additional thirty (30) days; (ii) fraud, gross negligence or willful misconduct on the part of such Manager in management of the business or affairs of the Company; (iii) Bankruptcy of such Manager; (iv) willful misappropriation of Company funds by the Manager; (v) the transfer of a Membership Interest or a direct or indirect ownership interest in the Manager in violation of this Agreement or, in the case of the TCR Member, the occurrence of a TCR Change of Control in violation of this Agreement; (vi) the Manager’s withdrawal as a Member in violation of this Agreement; (vii) failure of such Manager (as a Member) to fund any Initial Capital Contribution required of it under Section 8.1 or any Mandatory Developer Cost Overrun Loan, TCR Cost Overrun Loan or BR Cost Overrun Loan required of it and, in any such case, continuation of such failure for thirty (30) days; or (viii) in the case of a Manager designated by the TCR Member, the termination of the Development Agreement or the GC Contract as a result of an event of default by the Developer or the General Contractor thereunder. The removal of a Manager shall also constitute the removal of Representatives on the Management Committee appointed by such Manager. The removal of a Manager who is also a Member shall not affect the Manager’s rights as a Member and shall not constitute a withdrawal of the Manager as a Member. If the TCR Member is removed as a Manager as a result of any Removal Action, (x) the Developer may be terminated as the developer under the Development Agreement, (y) the General Contractor may be terminated as the general contractor under the GC Contract and (z) if the removal occurs before Substantial Completion, the TCR Member will no longer be entitled to receive any portion of the promote otherwise payable under Section 9.1 (i.e. the 20% share payable under subsection (g) thereof, the 30% share payable under Section (h) thereof and the 50% share payable under subsection (i) thereof) but rather, from and after such removal, shall only share in distributions as a Member based on its Ownership Percentage in the amount distributed (including the amount that otherwise would have constituted the promote). In any instance where the TCR Member is removed as Manager and/or the Developer is removed as developer under the Development Agreement and/or the General Contractor is terminated as the general contractor under the GC Contract, regardless of the cause of such removal or termination, the BR Member shall cause the TCR Member, the TCR Guarantors and/or any Affiliate of the TCR Member that executed a Loan Guaranty or any other guaranty or indemnity agreement for a loan to the Company to be released in full from such Loan Guaranty or other guaranty or indemnity agreement; provided, that, if the BR Member is unable to obtain such release despite its commercially reasonable efforts to do so, the BR Member and Affiliates of the BR Member reasonably acceptable to the TCR Member shall be obligated to indemnify and hold harmless the TCR Member, the TCR Guarantors and/or any such Affiliate (each, a “TCR Indemnified Party”), pursuant to an indemnification agreement in form and substance reasonably satisfactory to the TCR Indemnified Parties, without prejudice to any other indemnification right under Sections 15.1 and 15.2, for any amount paid by the TCR Indemnified Parties under such Loan Guaranty or other guaranty or indemnity agreement and actual losses and expenses (including reasonable attorney’s fees and costs) incurred by the TCR Indemnified Parties in defending against a claim for performance under such Loan Guaranty or other guaranty or other guaranty or indemnity agreement, except to the extent (i) the TCR Indemnified Parties are separately obligated to the Company or the BR Member, without right of reimbursement, under a written agreement for the amount sought to be recovered under such Loan Guaranty or indemnity agreement or (ii) the amount sought to be recovered would never be collectible from, or claimed against, the Company but for the fraud, willful misconduct or gross negligence by the TCR Indemnified Parties; provided, however, that the BR Member and its Affiliates shall not be obligated to indemnify the TCR Indemnified Parties if (x) the Developer, the General Contractor or the TCR Member was removed as a result of a Removal Action described in any of clauses (ii), (iii), (iv), (v), (vi), (vii) or (viii) above or (y) with respect to any action taken by the BR Member after the date of removal, the TCR Member has expressly approved of or consented to the action taken by BR Member in writing within two (2) business days following the receipt of written notice from BR Member that BR Member intends to take such action (and if the TCR Member has not affirmatively responded to BR Member by the end of such two (2) business day period, the TCR Member shall be deemed to have expressly disagreed with the action).

| 19 |

5.10 Vacancies. Any vacancy occurring for any reason in the number of Managers of the Company may be filled by the affirmative vote of all Members (excluding the Membership Interest of BR Member or its permitted transferee to the extent the vacancy results from BR Member or its permitted transferee, or an Affiliate of any of them, being removed as Manager and excluding the Membership Interest of TCR Member or its permitted transferee to the extent the vacancy results from TCR Member or its permitted transferee, or an Affiliate of any of them, being removed as Manager). A Manager elected to fill a vacancy shall hold office until its successor shall be elected and shall qualify or until its earlier resignation or removal.

5.11 Salaries. The salaries and other compensation, if any, of the Managers shall be fixed from time to time by an affirmative vote of all the Members, and no Manager shall be prevented from receiving a salary or other compensation by reason of the fact that it is also a Member of the Company. The salaries and other compensation, if any, of a Representative or any officer of the Company shall be fixed from time to time by an affirmative vote of all the Members.

5.12 Development and Development Fee.

5.12.1 Development Agreement. The Company and Developer have entered into a mutually agreed form of Development Agreement to govern the rights and responsibilities of the Company and Developer with respect to the development and construction of the Project, including a Development Fee payable to Developer as described below. Developer will cause the Project to be constructed in accordance with the terms of the Development Agreement.

| 20 |

5.12.2 General Contractor. The Company has engaged the General Contractor pursuant to a “cost plus fee” contract for construction of the Project (the “GC Contract”). The fee payable to the General Contractor thereunder is five percent (5%) of the Hard Costs in the Total Project Budget.

5.12.3 Development Fee. Under and subject to the Development Agreement, Developer will be entitled to earn a fee (the “Development Fee”) equal to three percent (3%) of the Total Project Budget (exclusive of the Development Fee). The Development Fee shall compensate Developer for all development management and project management services (including project accounting and financial reporting) required to achieve Substantial Completion. The Development Fee shall be paid on a proportional basis (based on the percentage of the construction completed) from draws against Capital Contributions (until the Initial Capital Contributions are funded) and the Loan or, to the extent not funded from those sources, other existing available funds of the Company or, upon Final Completion, Additional Capital Contributions; provided, however, that no portion of the Development Fee shall be paid with respect to the acquisition of the Property and payment of Pursuit Costs.

5.12.4 Development Information. During the construction process, the TCR Member will provide or cause the Developer to provide to the Company and BR Member copies of all draw-related information for the Loan, including but not limited to monthly copies of the construction draws and construction draws top sheets with budget-versus-actual information, plus full physical access to the Property and all documentation of the Company in connection with the development and construction of the Project.

5.12.5 Developer Contribution. For no additional charge or credit to the TCR Member’s Capital Account, TCR Member shall convey or cause Developer or its Affiliates to convey to the Company all of (i) ownership and contract rights in and to the Property and/or lease agreements and related options related to the Property held by TCR Member or Developer or their Affiliates, including but not limited to rights to acquire the Property in accordance with the various existing lease agreements and options related to the acquisition of the Property, including the Ground Lease (together, the “Land Contract”), (ii) all design and construction plans for the Project (at Developer’s actual cost, free and clear of all liabilities), (iii) all other tangible and intangible rights associated with the Project held by TCR Member or Developer or their Affiliates and (iv) all other items appurtenant to the Project held by TCR Member or Developer or their Affiliates.

5.12.6 BR Member’s Owner Representative. The BR Member will be entitled to staff the Project, at the expense of the Company, with an owner’s representative throughout the construction period to oversee, supervise and assist the Developer in the administration of the Project as needed by the Developer. The reasonable cost of the owner’s representative, which shall not exceed $50,000, will be capitalized into the Total Project Budget and paid from the construction draws to the extent approved by Lender (or, to the extent not so paid, added to the Capital Account of the BR Member and set off on a dollar for dollar basis amounts owed for the owner’s representative).

| 21 |

5.12.7 Warranties. TCR Member shall cause the General Contractor to warrant to the Company the construction of the Project for twelve (12) months after the Certificate of Occupancy is received for the Project such that the General Contractor must promptly correct and repair, at its sole cost and expense to the extent not allowed as a reimbursable cost under the GC Contract, all defects discovered during such twelve (12) month period. The Company may not assign such warranty by TCR Member or the General Contractor, but any subcontractor warranties may be assigned by the Company to any third party who purchases the Project from the Company during such period as the subcontractor warranties continue.

5.13 Limit on Construction Warranties. While Developer and, to an extent, the TCR Member will act as the representative of the Company in dealings with and supervision of the architect, engineer and other design professionals for the Project and the contractors, subcontractors, suppliers, materialman and artisans engaged in connection with the Project, except as provided in Section 5.12.7, the TCR Member will not be obligated to provide any warranty of construction nor will the TCR Member be liable for errors in design, any departure from the plans and specifications or any other construction defect in the Project. Neither the TCR Member nor any of its Affiliates (except as provided in the GC Contract in respect of the General Contractor and the Development Agreement in respect of the Developer) is a guarantor of the work of any architect, engineer or other design professional or the work of any contractor, subcontractor, supplier, materialman or artisan engaged in connection with the Project. NEITHER THE TCR MEMBER NOR ANY OF ITS AFFILIATES (EXCEPT AS PROVIDED IN THE GC CONTRACT IN RESPECT OF THE GENERAL CONTRACTOR AND THE DEVELOPMENT AGREEMENT IN RESPECT OF THE DEVELOPER) WILL BE RESPONSIBLE FOR ERRORS IN DESIGN OF THE PROJECT OR FOR CONSTRUCTION DEFECTS. UNDER NO CIRCUMSTANCE WILL THE TCR MEMBER OR ANY OF ITS AFFILIATES BE RESPONSIBLE FOR INCIDENTAL OR CONSEQUENTIAL DAMAGES SUFFERED BY THE COMPANY OR ANOTHER MEMBER OR MANAGER AS A RESULT OF DEFECTS IN DESIGN OR CONSTRUCTION OF THE PROJECT, INCLUDING ANY LOSS IN REVENUES, EXCESS CARRYING COSTS, ANY LOSS OF OPPORTUNITIES, ANY LIABILITY TO OTHER PERSONS FOR LOSS, INJURY OR DAMAGE TO PERSONS OR PROPERTY OR DEATH, OR ANY DAMAGE TO THE PROJECT. The Company retains the risk of (a) adequacy of all plans and specifications and compliance of plans and specifications with applicable laws and (b) subject to the Company’s rights under the GC Contract and the Development Agreement, conformance of construction with the applicable plans and specifications, applicable laws and sound building practices. THE TCR MEMBER SPECIFICALLY DISCLAIMS ALL WARRANTIES, INCLUDING ANY WARRANTY OF MERCHANTABILITY, HABITABILITY OR GOOD AND WORKMANLIKE CONSTRUCTION AND WARRANTIES OF FITNESS FOR USE OR ACCEPTABILITY FOR THE PURPOSE INTENDED, AND THE COMPANY AND THE OTHER MEMBERS AND MANAGERS WAIVE ALL BASIS FOR RECOVERY OR REIMBURSEMENT (INCLUDING ANY GROUND FOR RECOVERY BASED ON NEGLIGENCE OR STRICT LIABILITY), TO THE EXTENT THE SAME WOULD ALLOW GREATER RECOURSE THAN PROVIDED IN THIS SECTION 5.13 AGAINST THE TCR MEMBER OR ANY AFFILIATE OF THE TCR MEMBER WITH RESPECT TO THE DESIGN AND CONSTRUCTION OF THE PROJECT (EXCEPT AS PROVIDED IN THE GC CONTRACT IN RESPECT OF THE GENERAL CONTRACTOR OR THE DEVELOPMENT AGREEMENT IN RESPECT OF THE DEVELOPER). Nothing in this Section 5.13 limits (i) the responsibility of the General Contractor under its GC Contract with the Company, (ii) the responsibility of the Developer under the Development Agreement, (iii) the TCR Member’s obligation to make Mandatory Cost Overrun Loans and/or TCR Cost Overrun Loans or (iv) the responsibility of the TCR Guarantors under the Guaranty Agreement from the TCR Guarantors to the Company and the BR Member.

| 22 |

5.14 Total Project Budget and Operating Budget.

5.14.1 Total Project Budget. The Members have attached the Total Project Budget to this Agreement as Exhibit C. The Total Project Budget may be modified only (i) as may be agreed to by the Members pursuant to Section 7.7, (ii) by the TCR Member to reallocate savings in a line item within the Total Project Budget to another line item within the Total Project Budget or (iii) as allowed by Section 4.2 of the Development Agreement.

5.14.2 Operating Budget. Other than with respect to the development and construction of the Project, the Company shall operate the Project under a business plan and an annual operating budget (each, an “Operating Budget”) commencing for the period beginning as of the date of issuance of a certificate of occupancy for any of the residential units in the Project. The TCR Member shall deliver to the Members for approval the initial proposed Operating Budget for the remainder of the Fiscal Year beginning as of the date of issuance of a certificate of occupancy for any of the residential units in the Project not later than forty-five (45) days before the beginning of that period. The Operating Budget for each Fiscal Year thereafter shall be proposed by the Management Company, after which the TCR Member shall review the Operating Budget as proposed by the Management Company and deliver it to the Management Committee with its recommendations by not later than November 1st of the preceding Fiscal Year or 10 days after receipt of the proposed Operating Budget from the Management Company, whichever is later. After the Operating Budget has been approved by the Management Committee, the TCR Member shall or shall cause Management Company to implement it on behalf of Company and TCR Member and the Management Company may incur and may cause the Company to incur the expenditures and obligations therein provided. No material changes or departures from any item in an approved Operating Budget shall be made by the TCR Member without the prior approval of the BR Member. If an Operating Budget has not been approved by January 1st of any Fiscal Year, the Company, until such approval can be achieved, shall continue to operate the Project under the Operating Budget for the previous Fiscal Year with such adjustments as may be necessary to reflect deletion of non- recurring expense items set forth in the previous Operating Budget and positive or negative adjustments in insurance costs, taxes, utility costs and Debt Service payments. The TCR Member shall promptly advise and inform the BR Member of any transaction, notice, event or proposal directly relating to the management and operation of the Project, other assets of the Company or the Company which is expected to cause a material deviation from the Operating Budget.

5.15 Management Company. The Managers shall agree upon and cause the Company to enter into a management agreement (the “Management Agreement”) with a management company mutually agreed upon by the Members (including any successors, the “Management Company”) to manage, lease-up and operate the Property pursuant to the Management Agreement. The Management Agreement shall require that Management Company operate the Project in a first class manner and in accordance with the standards and conditions for the type, style, class, use and location of the Property. The Management Agreement shall also require that the Management Company undertake all such duties and obligations with respect to the Operating Budget as will be set forth in the Management Agreement, including requiring the Management Company to propose an Operating Budget for each Fiscal Year by not later than October 15th of the preceding Fiscal Year. The Company shall pay the Management Company a management fee in the amount of no more than two and one-half percent (2.5%) of annual gross cash revenues generated from the Project (except during the lease up phase, when the management fee may be a fixed amount or subject to a floor amount), payable monthly.

| 23 |

5.16 Operation in Accordance with REOC/REIT Requirements.

5.16.1 The Members acknowledge that BR Member or one or more of its Affiliates (a “BR Affiliate”) intends to qualify as a “real estate operating company” or “venture capital operating company” within the meaning of U.S. Department of Labor Regulation 29 C.F.R. Section 2510.3-101 (a “REOC”), and the Members agree that the Company shall be operated in a manner that will enable BR Member and/or such BR Affiliate, as applicable, to so qualify; provided, however, that in no event shall the foregoing require any loss of voting or decision rights to the TCR Member, or result in any adverse consequence to the TCR Member, or subject the TCR Member to liability for any inadvertent failure to comply with the standards applicable to a REOC. Except as disclosed to BR Member, TCR Member (i) shall not fund any Capital Contribution with the “plan assets” of any “employee benefit plan” within the meaning of Section 3(3) of the Employee Retirement Income Security Act of 1974, as amended, or any “plan” as defined by Section 4975 of the Code.

5.16.2 Except for the Property and the Project, a Member or Manager shall not knowingly cause the Company to hold any investment, incur any indebtedness or otherwise take any action that would cause any Member of the Company (or any Person holding an indirect interest in the Company through an entity or series of entities treated as partnerships for U.S. federal income tax purposes) to realize any “unrelated business taxable income” as such term is defined in Code Sections 511 through 514 (“UBTI”), unless specifically agreed to by the Members in writing. No Manager or Member shall be liable for any income or other taxes, damages, costs or expenses incurred by the Company or any Member by reason of the recognition by the Company of UBTI unless caused by its own fraud, willful misconduct or gross negligence.

5.16.3 The Company may not engage in any activities or hold any assets that would constitute or result in the occurrence of a REIT Prohibited Transaction as defined herein. Notwithstanding anything to the contrary contained in this Agreement, during the time a REIT Member is a Member of the Company, no Member or Manager shall knowingly take any action which, or the effect of which, would constitute or result in the occurrence of a REIT Prohibited Transaction by the Company. “REIT Prohibited Transaction” means any of the actions specifically set forth in the following Sections 5.16.3.1 through 5.16.3.7:

5.16.3.1 Entering into any lease, license, concession or other agreement, or permitting any sublease, license, concession or other agreement, that provides for rent or other payment based in whole or in part on the income or profits of any person, excluding for this purpose a lease that provides for rent based in whole or in part on a fixed percentage or percentages of gross receipts or gross sales of any person without reduction for any costs of the lessee (and, in the case of a sublease, without reduction for any sublessor costs);

| 24 |

5.16.3.2 Leasing, as a lessor, personal property, excluding for this purpose a lease of personal property that is entered into in connection with a lease of real property where the rent attributable to the personal property is less than 15% of the total rent provided for under the lease;

5.16.3.3 Acquiring or holding any debt investments (except for temporary investments of cash balances not exceeding in the aggregate 25% of the Company’s assets) unless (i) the amount of interest income received or accrued by the Company under such debt investment does not, directly or indirectly, depend in whole or in part on the income or profits of any person and (ii) the debt is fully secured by mortgages on real property or on interests in real property;

5.16.3.4 Acquiring or holding, directly or indirectly, more than 10% of the outstanding securities of any one issuer (by vote or value) other than an entity which either (i) is taxable as a partnership or a disregarded entity for United States federal income tax purposes, (ii) has properly elected to be a taxable REIT subsidiary of the REIT Member or its parent company which is a REIT, by jointly filing with REIT Member or its parent company which is a REIT IRS Form 8875, or (iii) has properly elected to be a REIT for U.S. federal income tax purposes;