Attached files

| file | filename |

|---|---|

| 8-K - 8-K - ESSENDANT INC | ustr-8k_20150210.htm |

| EX-99.1 - EX-99.1 - ESSENDANT INC | ustr-ex991_201502106.htm |

United Stationers Inc. Earnings Presentation Fourth Quarter 2014 Exhibit 99.2

Forward Looking Statements and Non-GAAP Measures This presentation contains forward-looking statements, including references to goals, plans, strategies, objectives, projected costs or savings, anticipated future performance, results or events and other statements that are not strictly historical in nature. These statements are based on management’s current expectations, forecasts and assumptions. This means they involve a number of risks and uncertainties that could cause actual results to differ materially from those expressed or implied here. These risks and uncertainties include, but are not limited to the following: United’s reliance on key customers, and the risks inherent in continuing or increased customer concentration and consolidations; end-user demand for products in the office, technology, and furniture product categories may continue to decline; prevailing economic conditions and changes affecting the business products industry and the general economy; United’s ability to effectively manage its operations and to implement growth, cost-reduction and margin-enhancement initiatives; United’s reliance on supplier allowances and promotional incentives; United’s reliance on independent resellers for a significant percentage of its net sales and, therefore, the importance of the continued independence, viability and success of these resellers; continuing or increasing competitive activity and pricing pressures within existing or expanded product categories, including competition from product manufacturers who sell directly to United’s customers; the impact of supply chain disruptions or changes in key suppliers’ distribution strategies; United’s ability to maintain its existing information technology systems and the systems and e-commerce services that it provides to customers, and to successfully procure, develop and implement new systems and services without business disruption or other unanticipated difficulties or costs; the creditworthiness of United’s customers; United’s ability to manage inventory in order to maximize sales and supplier allowances while minimizing excess and obsolete inventory; United’s success in effectively identifying, consummating and integrating acquisitions; the risks and expense associated with United’s obligations to maintain the security of private information provided by United’s customers; the costs and risks related to compliance with laws, regulations and industry standards affecting United’s business; the availability of financing sources to meet United’s business needs; United’s reliance on key management personnel, both in day-to-day operations and in execution of new business initiatives; and the effects of hurricanes, acts of terrorism and other natural or man-made disruptions. Shareholders, potential investors and other readers are urged to consider these risks and uncertainties in evaluating forward-looking statements and are cautioned not to place undue reliance on the forward-looking statements. For additional information about risks and uncertainties that could materially affect United’s results, please see the company’s Securities and Exchange Commission filings. The forward-looking information in this news release is made as of this date only, and the company does not undertake to update any forward-looking statement. Investors are advised to consult any further disclosure by United regarding the matters discussed in this release in its filings with the Securities and Exchange Commission and in other written statements it makes from time to time. It is not possible to anticipate or foresee all risks and uncertainties, and investors should not consider any list of risks and uncertainties to be exhaustive or complete. Information marked with an asterisk (*) is non-GAAP information. A reconciliation of these items to the most comparable GAAP measures is presented on the company’s Website (www.unitedstationers.com) under the Investor Information section. Except as noted, all references within this presentation to financial results are presented in accordance with U.S. Generally Accepted Accounting Principles. Certain prior-period amounts have been reclassified to conform to the current presentation.

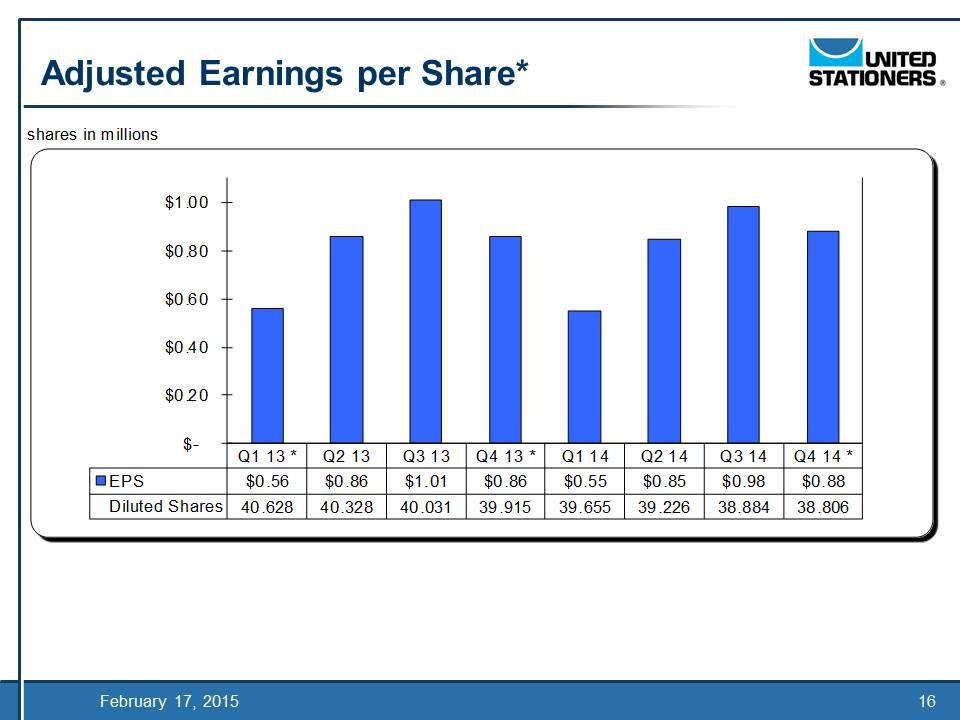

Results Recap 4th quarter 2014 results reflect progress on strategic plan Sales Sales increased 8.9%, 3.5% organic growth Industrial grew over 58.0%, approximately 5.0% organic growth, positively impacted by acquisitions Janitorial and breakroom grew 11.4% Online business grew 15% Gross Margin was 16% Adjusted EPS was $0.88*

Strategy 3 Elements of Our Strategy Strengthen our Core business Win online Expand and diversify our offering to higher growth and higher margin channels and categories

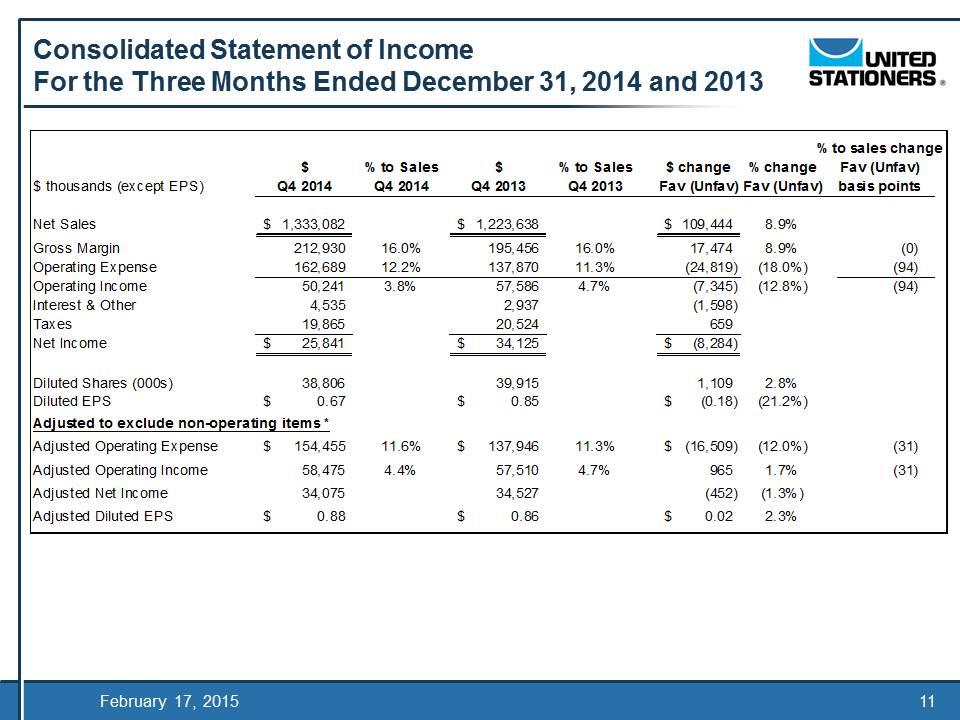

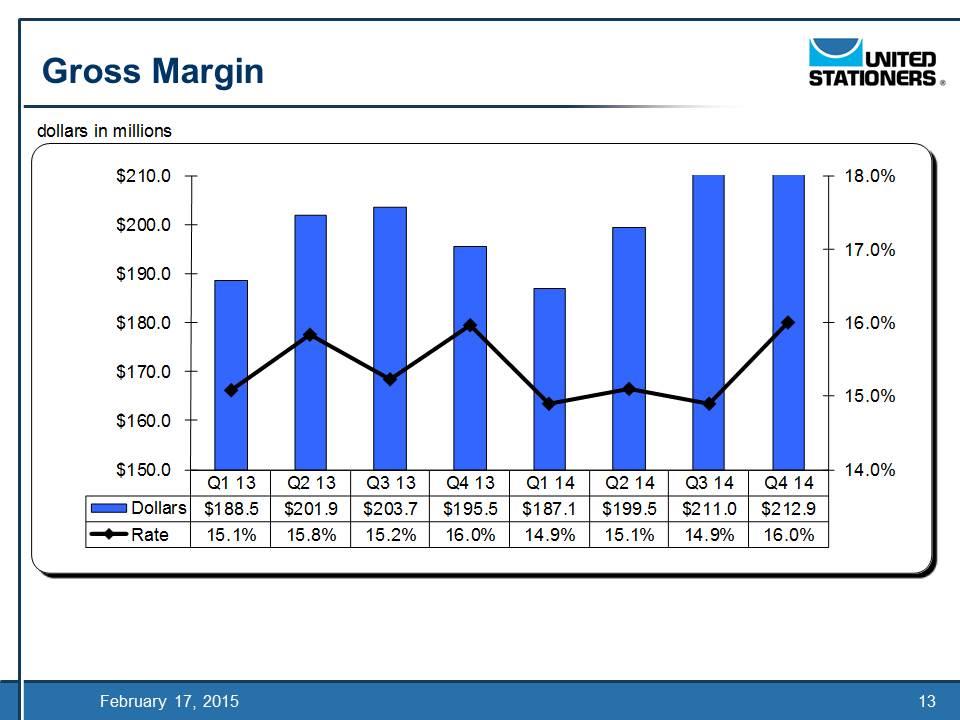

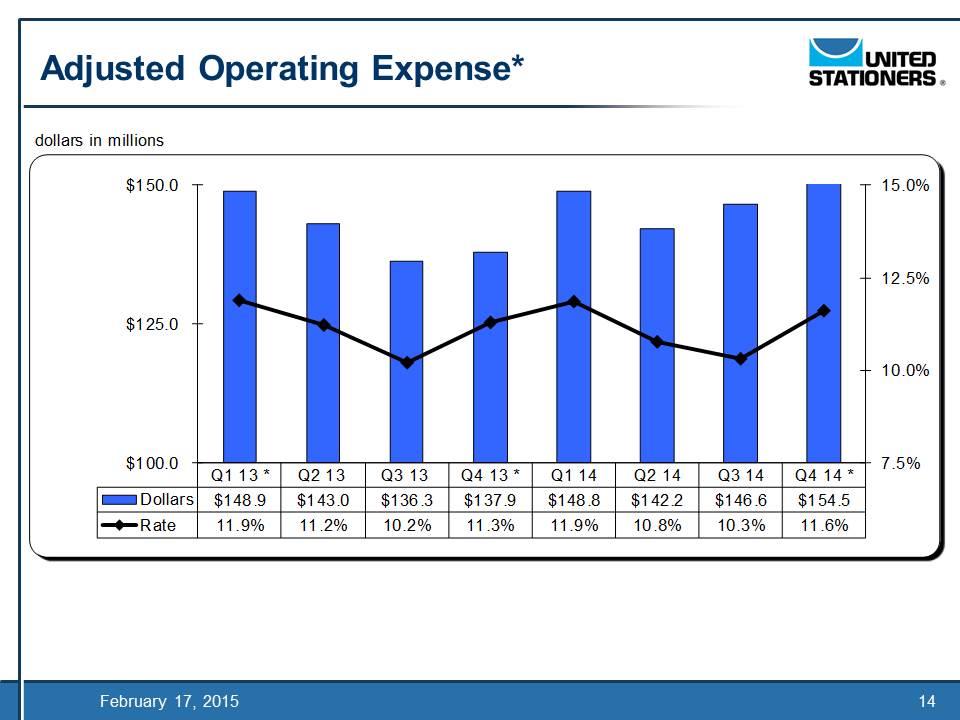

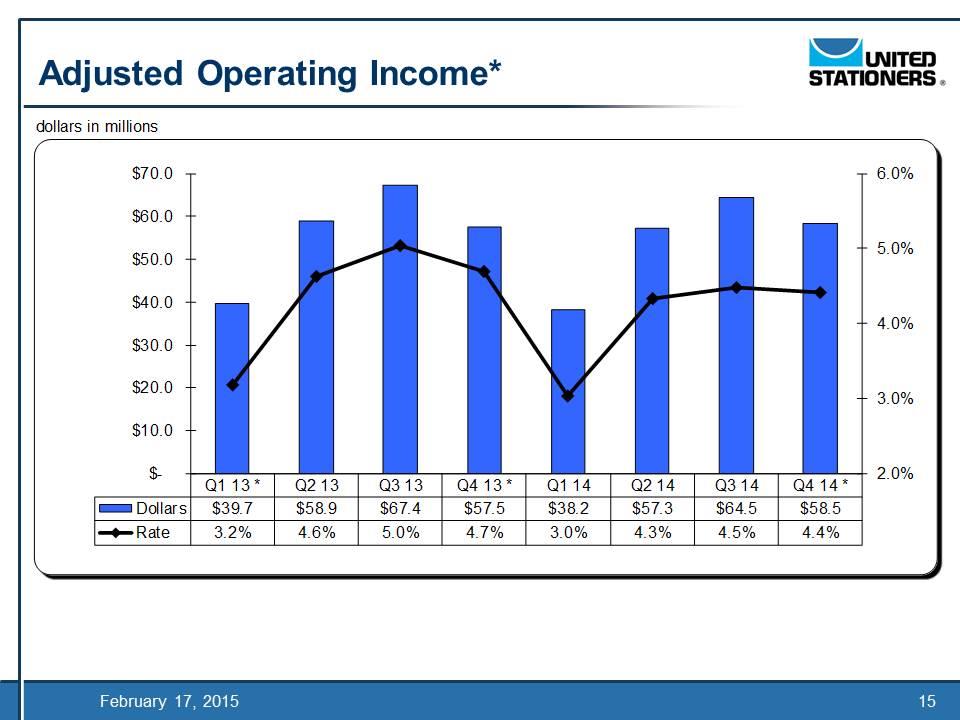

Fourth Quarter 2014 Results Sales were $1.3 billion, up 8.9%. Adjusted earnings per diluted share were $0.88*. Gross margin was $212.9 million, or 16.0% of sales. Adjusted operating expenses in Q4 2014 were $154.5 million*, or 11.6%* of sales. Adjusted operating income was $58.5 million*, or 4.4%* of sales. Adjusted net income was $34.1 million*.

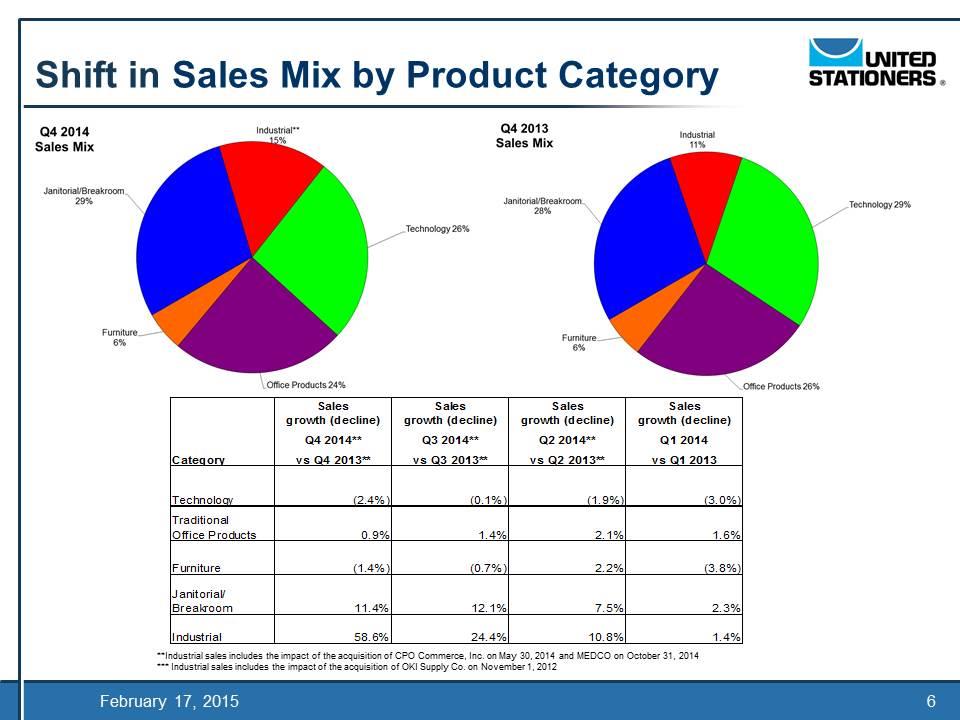

Shift in Sales Mix by Product Category **Industrial sales includes the impact of the acquisition of CPO Commerce, Inc. on May 30, 2014 and MEDCO on October 31, 2014 *** Industrial sales includes the impact of the acquisition of OKI Supply Co. on November 1, 2012

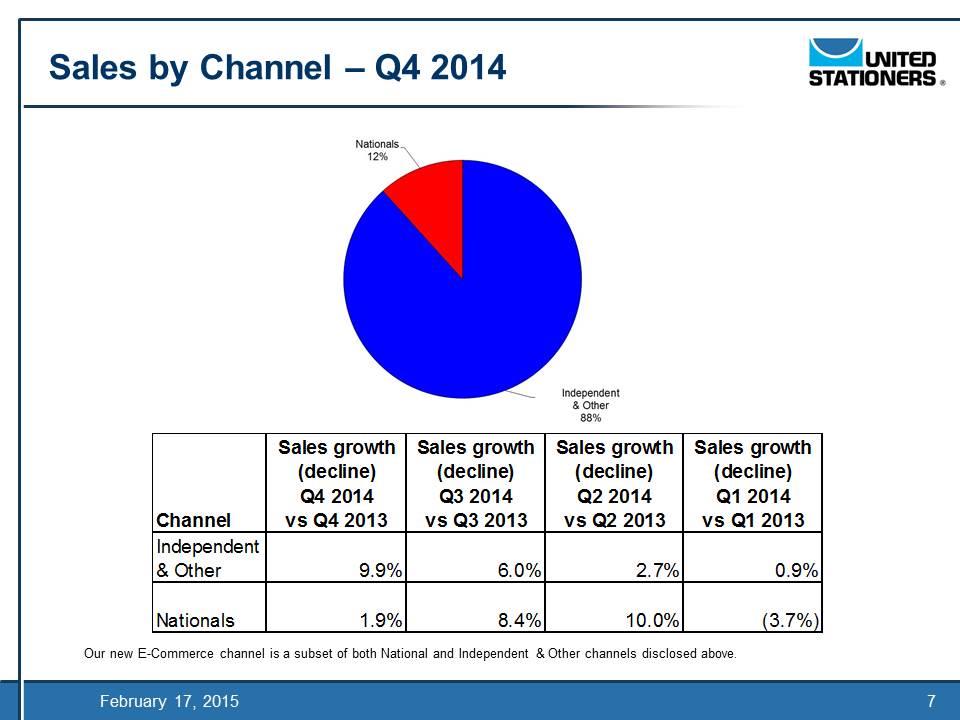

Sales by Channel – Q4 2014 Our new E-Commerce channel is a subset of both National and Independent & Other channels disclosed above.

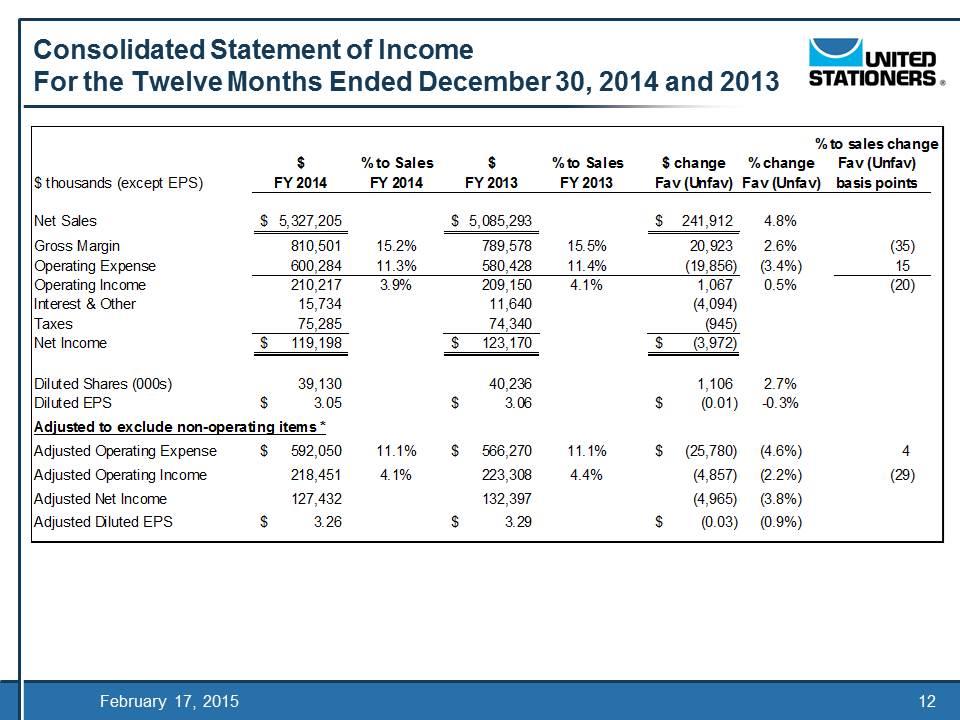

2014 Results Sales were $5.3 billion, up 4.8%, 2.9% organic growth. Adjusted earnings per diluted share were $3.26*. Gross margin was $810.5 million, or 15.2% of sales. Adjusted operating expenses were $592.1 million*, or 11.1%* of sales. Adjusted operating income was $218.5 million*, or 4.1%* of sales. Adjusted net income was $127.4 million. The Company repurchased 1.2 million shares for $50.0 million and paid cash dividends of $21.8 million to common shareholders.

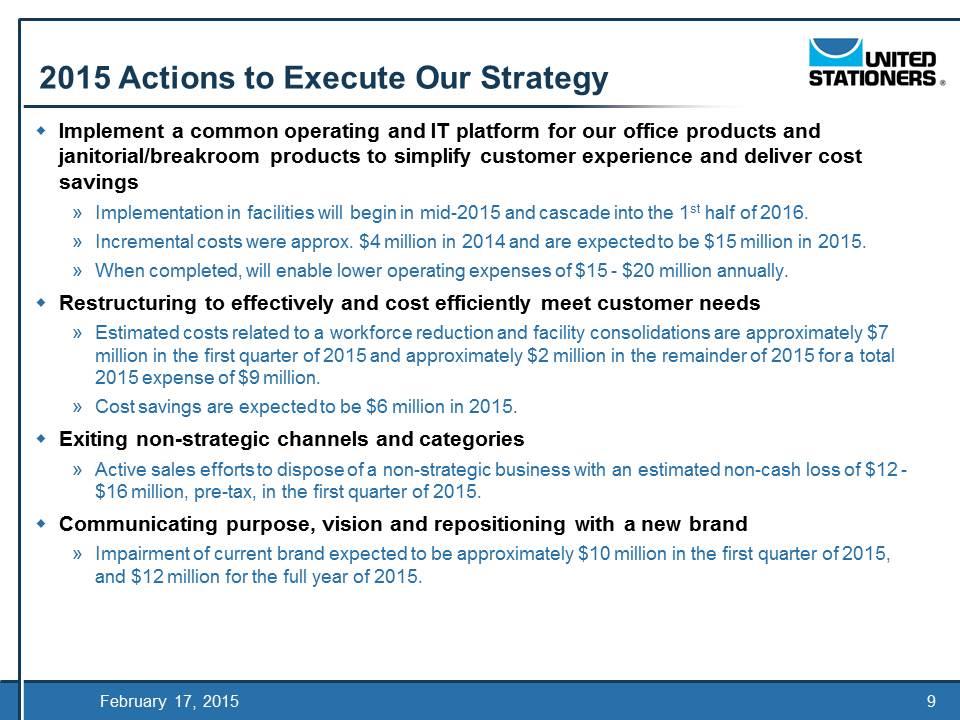

2015 Actions to Execute Our Strategy Implement a common operating and IT platform for our office products and janitorial/breakroom products to simplify customer experience and deliver cost savings Implementation in facilities will begin in mid-2015 and cascade into the 1st half of 2016. Incremental costs were approx. $4 million in 2014 and are expected to be $15 million in 2015. When completed, will enable lower operating expenses of $15 - $20 million annually. Restructuring to effectively and cost efficiently meet customer needs Estimated costs related to a workforce reduction and facility consolidations are approximately $7 million in the first quarter of 2015 and approximately $2 million in the remainder of 2015 for a total 2015 expense of $9 million. Cost savings are expected to be $6 million in 2015. Exiting non-strategic channels and categories Active sales efforts to dispose of a non-strategic business with an estimated non-cash loss of $12 - $16 million, pre-tax, in the first quarter of 2015. Communicating purpose, vision and repositioning with a new brand Impairment of current brand expected to be approximately $10 million in the first quarter of 2015, and $12 million for the full year of 2015.

Appendix

Consolidated Statement of Income For the Three Months Ended December 31, 2014 and 2013

Consolidated Statement of Income For the Twelve Months Ended December 30, 2014 and 2013

Gross Margin

Adjusted Operating Expense*

Adjusted Operating Income*

Adjusted Earnings per Share*

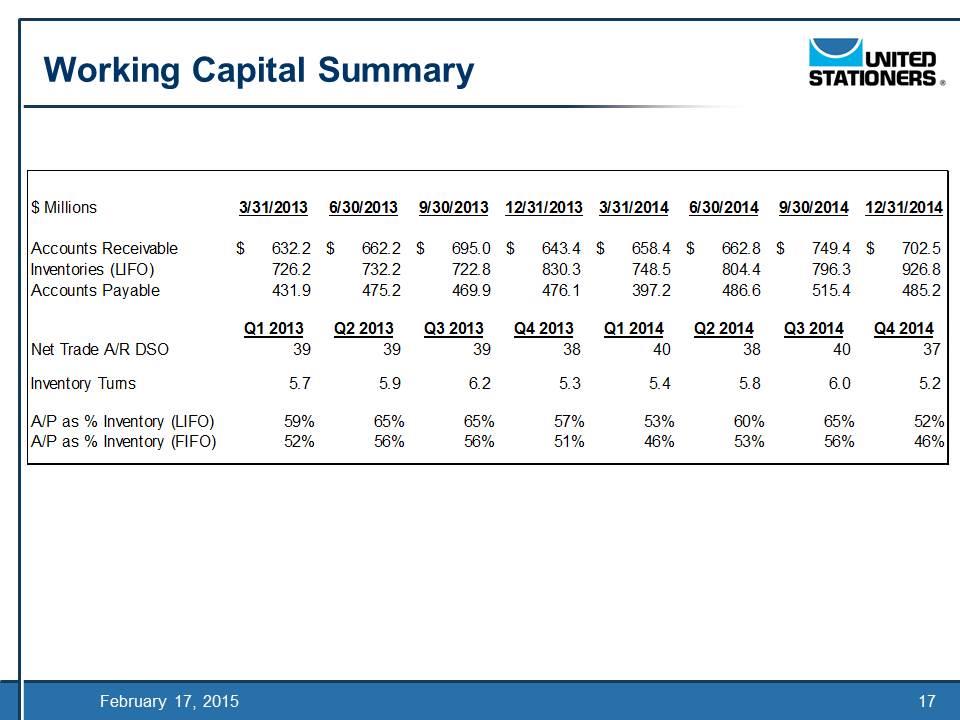

Working Capital Summary

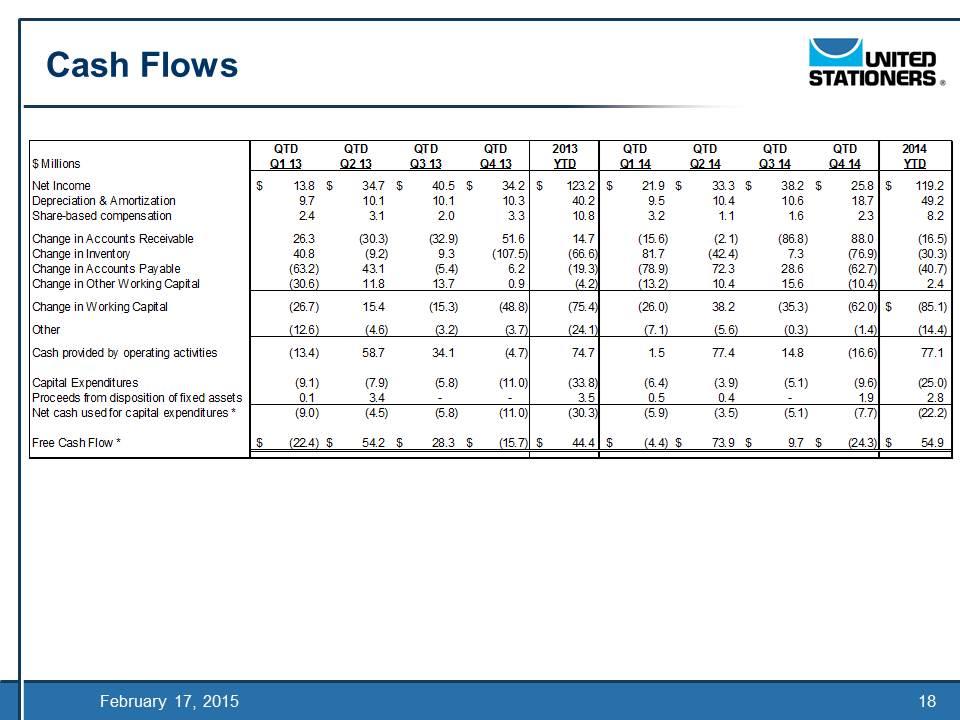

Cash Flows

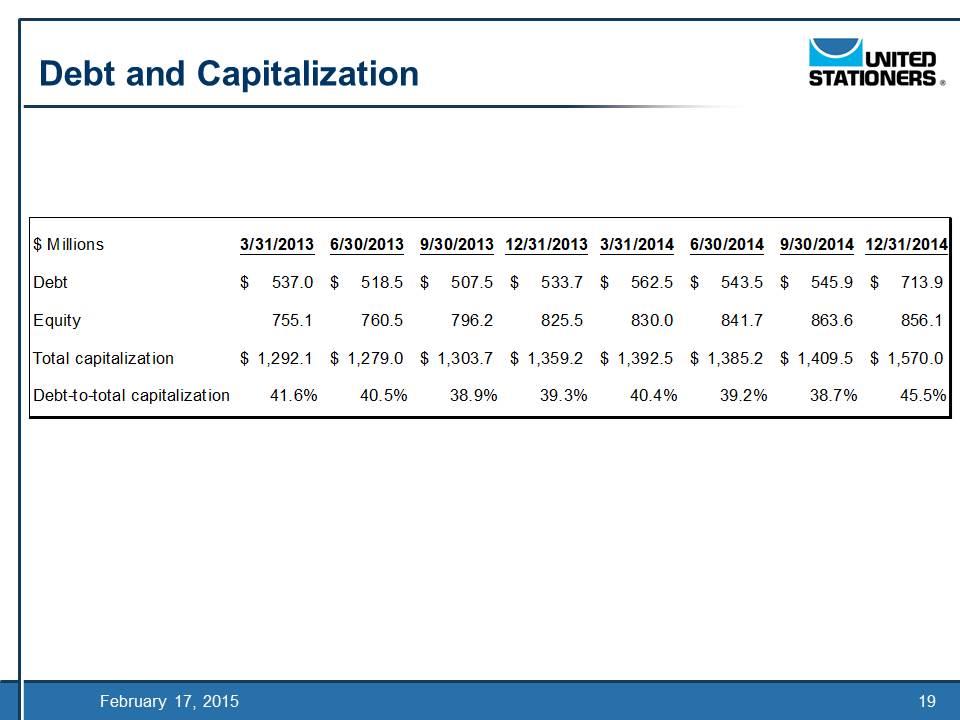

Debt and Capitalization