Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - ANCHOR BANCORP WISCONSIN INC | d874273d8k.htm |

NASDAQ: ABCW

Sterne Agee Financial Institutions Investor Conference

February 2015

Exhibit 99.1 |

2

This

presentation

does

not

constitute

an

offer

to

sell,

nor

a

solicitation

of

an

offer

to

buy,

any

securities

of

Anchor

BanCorp

Wisconsin,

Inc.

(“Anchor”

or

the

“Company”)

by

any

person

in

any

jurisdiction

in

which

it

is

unlawful

for

such

person

to

make

such

an

offering

or

solicitation.

Neither the Securities and Exchange Commission nor any other regulatory body has

approved or disapproved of the securities of Anchor or passed upon the accuracy or adequacy of this

presentation. Any representation to the contrary is a criminal offense.

Except as otherwise indicated, this presentation speaks as of the date hereof. The

delivery of this presentation shall not, under any circumstances, create any implication that there has been

no change in the affairs of the Company after the date hereof.

Market

and

other

statistical

data

used

in

this

presentation

has

been

obtained

from

independent

industry

sources

and

publications

as

well

as

from

research

reports

prepared

for

other

purposes. Industry publications and surveys and forecasts generally state that the

information contained therein has been obtained from sources believed to be reliable. Anchor has not

independently verified the data obtained from these sources. Forward-looking

information obtained from these sources is subject to the same qualifications and the additional uncertainties

regarding the other forward-looking statements in this presentation.

From time to time, Anchor may make forward-looking statements that reflect the

Company’s views with respect to, among other things, future events and financial performance. Words such

as “may,”

“should,”

“could,”

“predict,”

“potential,”

“believe,”

“will likely result,”

“expect,”

“continue,”

“will,”

“anticipate,”

“seek,”

“estimate,”

“intend,”

“plan,”

“projection,”

“would”

and “outlook,”

or

the negative version of those words or other comparable words are intended to

identify forward-looking statements, but are not the exclusive means of identifying such statements. These

forward-looking statements are not historical facts, and are based on current

expectations, estimates and projections about the Company’s industry, management’s beliefs and certain

assumptions made by management, many of which, by their nature, are inherently

uncertain and beyond the Company’s control. Accordingly, you are cautioned that any such forward-

looking

statements

are

not

guarantees

of

future

performance

and

are

subject

to

certain

risks,

uncertainties

and

assumptions

that

are

difficult

to

predict.

Although

the

Company

believes

that

the expectations reflected in such forward-looking statements are reasonable as

of the date made, actual results may prove to be materially different from the expected results expressed or

implied by such forward-looking statements. Any forward-looking statement

speaks only as of the date on which it was made, and unless otherwise required by law, the Company does not

undertake any obligation to update or review any forward-looking statements,

whether as a result of new information, future developments or otherwise.

This presentation includes certain non-GAAP financial measures. These

non-GAAP financial measures should be considered only as supplemental to, and not as superior to, financial

measures prepared in accordance with GAAP. Please refer to the Appendix of this

presentation for a reconciliation of the non-GAAP financial measures included in this presentation to the

most directly comparable financial measures prepared in accordance with GAAP.

Cautionary Statement Regarding Forward-Looking

Information and Non-GAAP Financial Information |

3

Our Turnaround Story

October 2013

Oct. 2013

December 2014

August 013 –

The Recap

Aug. 2013

September 2013 –

Recap Execution

Sept. 2013

Apr. 2014 -

Jul. 2014

April 2014 –

July 2014

June 2009

Jun. 2009

June 2009 –

January 2011

Jun. 2009 -

Jan. 2011

Aug. 2010

August 2010

October 2014

Oct. 2014

Dec. 2014

January 2015

Jan. 2015

Additions to exec. mgmt team: CEO,

CFO, Chief Credit Officer, Retail

Banking Manager

Anchor effected a 1-for-200 reverse

stock split

Authorized shares were reduced

from 2 billion to 12 million,

consisting of 11.9 million of common

and 100,000 of preferred

Cease and Desist Order and

Prompt Corrective Action

Directive lifted by OCC in

April

Cease and Desist lifted by

FRB in July

Anchor announced

it entered into an

agreement to sell

its Viroqua branch

Prompt Corrective Action Directive

issued by the OCC

Anchor entered into stock

purchase agreements with

certain institutional investors,

private investors and directors

and officers of Anchor to sell

common stock for aggregate

gross proceeds of $175 million

Anchor exchanged TARP Preferred

Stock for 300,000 common shares and

cancelled the outstanding TARP warrant

Anchor satisfied all obligations under the

Amended and Restated Credit

Agreement with certain lenders and U.S.

Bank with a cash payment of $49 million

Anchor converted from a WI corporation

to a DE corporation

All issued and outstanding shares of

legacy common stock were cancelled

Anchor common

stock offering priced

at $26.00 per share,

and listed on

NASDAQ as ABCW

Anchor concluded FY 2014 with

consolidated net income of

$14.6 million or $1.60 EPS

(diluted)

Anchor closed on the sale of its

corporate headquarters

Anchor closed on the sale of its

Richland Center branch

Cease and

Desist Orders

issued by the

OCC and FRB |

4

Experienced Management Team

Name

Title

Years of

Experience

Selected Professional Biography

Chris M. Bauer

Director, President & CEO

45

Director, President and Chief Executive Officer of the Company since June 2009

Formerly independent consultant and immediate past chairman of the American

Automobile Association, Inc.

Founded First Business Bank Milwaukee in 2000, serving as its chairman until

2003 Retired as chairman and Chief Executive Officer of Firstar Bank

Milwaukee, N.A. and head of commercial banking for Firstar Corp. in

1999 Thomas G. Dolan

EVP, Chief Operating Officer

30

Joined the Company and the Bank in March 2011 as CFO, promoted to COO September

2014 More than 25 years of experience with LaSalle Bank and Bank of America

and was the owner and Managing Director of Northern Pointe Consulting, a

financial institution consulting firm from 2008 to 2012

Martha M. Hayes

EVP & Chief Risk Officer

30

Joined the Bank as its Chief Credit Risk Officer in July 2009

Former

President

and

Managing

Director

of

Merrill

Lynch

Business

Financial

Services

in Chicago

from 2004 to 2008

Previously worked at Wachovia as Senior Vice President and Director of Commercial

Loan Products and Chief Operating Officer for Wachovia’s Risk

Management Division, Business Credit Solutions William T. James

SVP, Chief Financial Officer

25

Joined the Company and the Bank in October 2013 as Treasurer, promoted to CFO

September 2014 Previously served as Treasurer and Senior Vice President of

Guaranty Bank in Milwaukee from 2006 to 2013

Currently oversees the Treasury Management, Finance, and Accounting areas

Scott M. McBrair

EVP (Retail Banking Group)

30

Prior to joining Anchor in 2011, Mr. McBrair served as the Executive Vice

President-Retail Banking at Webster Bank from 2005 to 2009

Served

in

a

variety

of

retail

banking

assignments

at

Bank

One,

now

JPMorgan

Chase,

over

a

21

year

span

from

1983

to

2005,

most

recently

as

EVP

–

Retail

Regional

Manager

Ronald R. Osterholz

SVP (Human Resources)

40

Joined the Bank in 1973 and previously served as Savings Officer, Branch Manager

and Branch Coordinator

Currently oversees the Bank’s Human Resources and Training departments

Mark D. Timmerman

EVP, Secretary & GC

20

Oversees the Bank’s legal and compliance areas

Has

been

a

member

of

the

State

Bar

of

Wisconsin

since

1994 |

5

Overview of the Anchor Franchise

1)

Financial data as of or for the year ended December 31, 2014. Returns and net

charge-offs shown annualized. Note: NPAs and NPLs excludes troubled debt

restructurings that are now accruing. Depository ranking information based on June 30, 2014 FDIC data.

Franchise Summary

Third largest bank headquartered in Wisconsin

Strong funding base

Focused on expanding commercial lending business and

building a service-driven, relationship-based franchise

Serves nearly 108,000 households and businesses

95 year history

Franchise Footprint

Financial Highlights¹

Balance Sheet ($mm)

Total assets

$2,082

Total net loans

1,524

Total deposits

1,814

Tangible common equity

228

Tangible common equity / Tangible assets

10.93%

Asset Quality

NPAs / Total Assets

3.39%

NPLs / Gross Loans

2.22

Reserves / NPLs

133.95

Reserves / Gross Loans

2.97

NCOs / Avg. Loans

0.86 YTD

LTM Profitability - YTD

ROAA

0.69%

Net interest margin

3.48

Efficiency ratio

90.12 |

6

Attractive Demographic Footprint

“The Triangle”

accounts for nearly half of the Wisconsin population

Headquartered in Madison—Wisconsin’s fastest growing market and home to

the State Government and the University of Wisconsin

Median household income in 2013 of $56,889, compares favorably to the national

average of $51,314 Madison has a highly educated population contributing to

a dynamic business environment and diversified local economy

As reported in the September 2014 issue of In Business, Madison was rated the most

livable city in the nation, according to Livability.com’s second

annual top 100 Places to live survey Strong presence in the Fox

Valley—one of Wisconsin’s fastest growing markets While

historically strong in the paper industry (e.g. Kimberly Clark), the Fox Valley has broadened its manufacturing

base to include electronics and government vehicles

Significant opportunity in the Milwaukee market

138 business establishments in the Milwaukee area employ 500 or more employees

Seven Fortune 500 companies are headquartered in the metro area

More than 40 Fortune 500 companies have significant operations in the Milwaukee

area. Total personal income for the metro Milwaukee area was $73.6 billion

in 2012 Equates to a per capita personal income of $46,943, 7.3% higher

than the per capita figure for the United States as a whole

Source: US Census; SNL Financial; Metropolitan Milwaukee Association of Commerce

|

7

Competitive Market Positioning

Deposit

Market

Share

–

Fox

Valley

#4 deposit rank in the Madison metropolitan

statistical area (“MSA”)

Madison, Fox Valley and suburban Milwaukee

regions account for nearly half of Wisconsin’s

total population

18 branches in prosperous Dane County

53 locations spanning 10 MSAs in the state

Note: Deposit data as of June 30, 2014.

Source: FDIC.

Deposit

Market

Share

–

Madison

MSA

Observations and Key Facts

Deposit

Market

Share

–

Milwaukee

MSA

Total

Number of

Deposits

Market

Rank

Institution

Branches

($mm)

Share

1

U.S. Bank National Association

52

$25,353

41.0%

2

BMO Harris Bank National Association

75

9,341

15.1

3

JPMorgan Chase Bank, National Association

30

5,454

8.8

4

Associated Bank, National Association

41

5,190

8.4

5

Wells Fargo Bank, National Association

13

1,730

2.8

6

PNC Bank, National Association

32

1,134

1.8

7

WaterStone Bank, SSB

11

985

1.6

8

North Shore Bank, FSB

26

941

1.5

9

Tri City National Bank

33

850

1.4

10

Park Bank

5

732

1.2

30

Anchor BanCorp Wisconsin Inc.

7

165

0.3

Total in Market

554

$61,913

Total

Number of

Deposits

Market

Rank

Institution

Branches

($mm)

Share

1

BMO Harris Bank National Association

29

$2,575

15.9%

2

U.S. Bank National Association

14

1,538

9.5

3

Associated Bank, National Association

26

1,294

8.0

4

Anchor BanCorp Wisconsin Inc.

22

1,016

6.3

5

First Business Bank

1

975

6.0

6

John Deere Financial, f.s.b.

1

877

5.4

7

JPMorgan Chase Bank, National Association

5

733

4.5

8

State Bank of Cross Plains

9

648

4.0

9

The Park Bank

13

575

3.6

10

Wells Fargo Bank, National Association

7

419

2.6

Total in Market

248

$16,200

Total

Number of

Deposits

Market

Rank

Institution

Branches

($mm)

Share

1

BMO Harris Bank National Association

16

$1,170

15.2%

2

Associated Bank, National Association

12

888

11.5

3

JPMorgan Chase Bank, National Association

13

693

9.0

4

National Exchange Bank and Trust

7

627

8.1

5

U.S. Bank National Association

10

464

6.0

6

Wells Fargo Bank, National Association

5

354

4.6

7

The First National Bank - Fox Valley

4

305

4.0

8

American National Bank - Fox Cities

1

220

2.9

9

Anchor BanCorp Wisconsin Inc.

9

217

2.8

10

West Pointe Bank

1

214

2.8

Total in Market

155

$7,721 |

8

Continuing the Recovery & Executing Our

Business Plan

Continue Credit Improvement

Execute Business Development

Strategies

Improve Efficiency

Potential Future Value of the DTA¹

Normalize Excess Capital

Building

Shareholder

Value

1)

“DTA”

refers to Anchor’s deferred tax asset. |

9

Q4 & Year-End 2014 Financial Highlights

Delivered improved operating results

Net Income of $14.6 million or $1.60 diluted EPS

5 consecutive quarters of profitability

Maintaining low cost of funds

Rationalizing cost structure (mortgage/branch system)

Credit quality improved

NPLs decreased $33.4 million or 48.7%

OREO decreased $28.0 million or 44.1%

NPA/Total Assets improved YOY from 6.25% to 3.39%

De—provisioned reserves of $4.6 million in 2014

Organic growth in loans and deposits

Emphasis on growing C&I business –

hired strong, experienced talent

Transformed mortgage business, hired experienced market and business leader

Net of discontinued business, classified loan reductions and exclusions of sold

branch loans, loans grew $68 million or 4.2% in 2014

|

Loan

Portfolio 10

While total loans decreased $38.4

MM in 2014, originations offset

$106 million of loan runoff from

discontinued business:

($000s)

2013

2014

YoY Change

Adj. Change*

Adj. % Change

1-4 Family Mortgage

$529,777

$541,211

$11,434

27,585

5.2%

Home Equity

$226,225

$220,182

($6,043)

(171)

-0.1%

Commercial Real Estate

$702,355

$683,509

($18,846)

40,754

5.8%

Commercial Business

$21,591

$16,514

($5,077)

(1,677)

-7.8%

Consumer & Education

$141,606

$121,689

($19,917)

1,361

1.0%

Gross Loans

$1,621,554

$1,583,105

($38,449)

67,852

4.2%

*Adjustments include discontinued business, classified loan reductions and exclusion of sold branch

loans •

$21M of student loan runoff

•

$83M of classified loan decline

•

$2M in sold branch loans |

Deposit Mix

11

($000s)

2013

2014

YoY Change

Adj. Change*

Adj. % Change

Non-interest bearing

$259,926

$291,248

$31,322

$33,439

12.9%

Demand

$301,956

$305,004

$3,048

$4,822

1.6%

Money market

$468,461

$455,594

($12,867)

($9,795)

-2.1%

Savings

$293,159

$312,544

$19,385

$21,446

7.3%

Other

$822

$2,568

$1,746

$1,746

212.4%

Jumbo CDs

$88,700

$69,226

($19,474)

($19,474)

-22.0%

Retail CDs

$462,269

$377,987

($84,282)

($76,695)

-16.6%

Total CDs

$550,969

$447,213

($103,756)

-$96,169

-17.5%

Total Deposits

$1,875,293

$1,814,171

($61,122)

($44,511)

-2.4%

*Adjustments excluding impact of sold branch deposits |

12

Deposit Costs Reduced Significantly

Cost of Interest-Bearing Deposits

Anchor has significantly reduced its cost of deposits since 2010

1)

Anchor peer group represents all Wisconsin banks and thrifts with total assets

greater than $500 million as of December 31, 2014. Source: SNL Financial and

Anchor SEC filings. Note:

Represents

financial

data

for

the

three

months

ended

December

31

of

each

respective

year

and

quarterly

data

after

that.

Anchor

data

reflects

the

consolidated

entity.

Deposit

cost

represents

interest

expense

for

the

respective

quarter,

annualized,

as

a

percentage

of

average

total

deposits. |

13

Continued Improving Asset Quality

Proactively managing asset quality

Non-performing Asset Levels ($mm)

1)

Non-performing

loans

and

assets

exclude

troubled

debt

restructurings

that

are

now

accruing.

Source: Anchor SEC filings.

Credit Quality Overview

($000s)

As of

12/31/2013

12/31/2014

Nonaccrual loans

$39,151

$18,632

Troubled debt restructurings¹

29,346

16,483

OREO

63,460

35,491

Total nonperforming assets

$131,957

$70,606

NPLs / Gross Loans

4.22%

2.22%

NPAs / Total Assets

6.25

3.39

ALLL / Gross Loans

4.02

2.97

ALLL / NPLs

95.16

133.95 |

14

Maintaining Appropriate Loan Loss Reserves

Allowance to Total Loans Held-for-Investment

Anchor has built an allowance sufficient to cover potential credit losses

The ALLL to total NPLs was 133.95% at December 31, 2014, an increase from 95.16% at

December 31, 2013 1)

Anchor peer group represents all Wisconsin banks and thrifts with total assets

greater than $500 million as of December 31, 2014. Note: Anchor data reflects

the consolidated entity. Source: SNL Financial and Anchor SEC filings.

|

15

Key Investment Highlights

Well known banking executives with considerable financial services and acquisition

experience in their Wisconsin markets Business oriented and experienced Board

of Directors with large ownership stake Experienced commercial banking

management team Experienced and Qualified Management Team

Anchor’s growth is funded by its large core deposit base

At December 31, 2014, Anchor had total deposits of $1.8 billion

Anchor’s relationship banking model cross-sells deposit products at the

time of loan origination to clients in order to provide a stable source of

funding Strong Core Funding Base

Recap provided Anchor with stronger capital position and sophisticated investor

base As of December 31, 2014, Anchor had a 10.43% Tier 1 leverage ratio,

16.97% Tier 1 ratio and a 18.25% Total RBC ratio Total assets of $2.1 billion

and total gross loans of $1.6 billion at quarter end Non-performing

assets have declined 84.5% from March 31, 2010 to $70.6 million at December 31, 2014

Stable Balance Sheet and Strong Capital Position

Headquartered in Madison, Anchor is the third largest Wisconsin-based

depository 53 locations spanning 10 MSAs in the state

Anchor’s core markets, Fox Valley, Madison and Milwaukee, account for nearly

half of Wisconsin’s total population Madison was also named

America’s 14th Most Recession-Proof City by CNNMoney.com in September of 2010

Desirable Markets |

APPENDIX |

17

Board of Directors

Name

Selected Professional Biography

Chris M. Bauer

Director, President and Chief Executive Officer of the Company since June 2009

Formerly an independent consultant and immediate past chairman of the American Automobile

Association, Inc. Founded First Business Bank Milwaukee in 2000, serving as its

chairman until 2003 Retired as chairman and Chief Executive Officer of Firstar Bank

Milwaukee, N.A. and head of commercial banking for Firstar Corp. in 1999

Richard A. Bergstrom

Current Vice Chairman and former President of Bergstrom Corporation, Wisconsin’s largest

automotive retailer, with 25 dealerships across the state

Substantial senior management expertise and financial expertise as president of Bergstrom

Corporation Holly Cremer Berkenstadt

Director of the Company since 1994

Former Chairman of the Board and Director of Wisconsin Cheeseman, Inc., a direct food and

gift company located in Sun Prairie, Wisconsin

Director of the Cremer Foundation and serves as a Director of several not-for-profit

boards Bradley E. Cooper

Founding partner of Capital Z Partners, a private equity fund focused on investing in the

financial services sector Former investment banker in the Financial Institutions Group

of Salomon Brothers Martin S. Friedman

Co-founder of FJ Capital Management, an investment fund firm based in McLean, Virginia,

and has served as its CEO since 2008 Previously Director of Research for Friedman,

Billings, Ramsey Group, a research and securities trading firm, from 1998 to 2007 David L.

Omachinski Currently a CPA and serving as an independent business consultant

Chairman of the Board since June 2009 and Lead Director of the Board from February 2009 to

June 2009 Former President, COO and CFO of Oshkosh B’Gosh, a clothing

manufacturer Former President and CEO of Magnum Products, LLC, an equipment supplier

for a variety of industries Pat Richter

Director of Athletics-Emeritus at the University of Wisconsin-Madison and Emeritus

Director of the Board of the Green Bay Packers, Green Bay, Wisconsin

Member of the Board of Directors at Meriter Health Services, Madison, Wisconsin

|

18

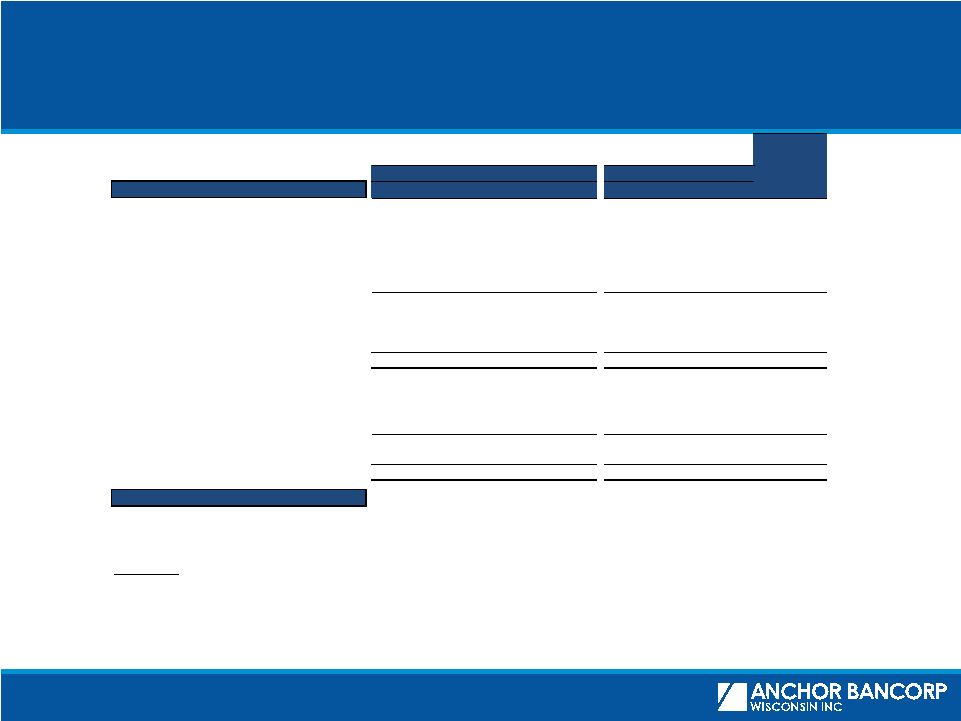

Reconciliation of Non-GAAP Measures

Non-GAAP Financial Measures¹

1)

Tangible common equity to tangible assets (the “tangible common equity

ratio”) is a non-GAAP financial measure. The Company calculates the tangible common equity ratio by excluding the balance of preferred

equity,

goodwill

and

other

intangible

assets

from

common

shareholders’

equity

and

assets.

The

Company

considers

this

information

important

to

shareholders

as

tangible

equity

is

a

measure

that

is

consistent

with

the calculation of capital for bank regulatory purposes, which excludes intangible

assets from the calculation of risk-based ratios. This disclosure should not be viewed as a substitute for results determined to be in

accordance with GAAP, nor is it necessarily comparable to non-GAAP performance

measures presented by other companies. ($000s)

As of

09/30/2013

12/31/2013

03/31/2014

06/30/2014

09/30/2014

12/31/2014

Total GAAP Equity

$201,037

$202,198

$206,708

$211,507

$214,709

$227,663

Less: Preferred Equity

0

0

0

0

0

0

Less: Goodwill and Other Intangibles

0

0

0

0

0

0

Tangible Common Equity

$201,037

$202,198

$206,708

$211,507

$214,709

$227,663

Total GAAP Assets

$2,191,001

$2,112,474

$2,109,824

$2,121,249

$2,106,520

$2,082,379

Less: Goodwill and Other Intangibles

0

0

0

0

0

0

Tangible Assets

$2,191,001

$2,112,474

$2,109,824

$2,121,249

$2,106,520

$2,082,379

Tang. Common Equity / Tang. Assets

9.18%

9.57%

9.80%

9.97%

10.19%

10.93% |

19

ABCW Stock Price Performance

Current value

sustained by

confidence in ABCW,

Russell Index inclusion

and low float

Offering

Price:

$26.00

Recap

Px

$20.00

Per Share Data

TBV: $23.85

DTA: $11.85

Adj. TBV: $35.70

As of 12/31/2014

P/DTA

adj.TBV:

94%

(full DTA value)

P/TBV: 140%

Price as of

02/09/2015

TBV and DTA

values as of

12/31/14

Public Offering

Russell Inclusion

As of

02/09/2015

:

Price:

$33.50

Market Cap:

$319.8M

NASDA

Q |

20

Consolidated Financial Summary |

21

Consolidated Financial Summary

(cont.)

Ending

balances

(in 000's)

12/14-12/13

BALANCE SHEET

12/31/14

9/30/14

12/31/13

12/31/14

12/31/13

Incr(Decr)

Assets:

Investment securities

293,577

$

294,105

$

287,797

$

294,599

$

277,872

$

6%

Loans held for sale

5,608

5,145

4,137

6,594

3,085

114%

Loans: Mortgage

1,197,365

1,185,377

1,242,172

1,224,720

1,232,132

(1%)

Consumer

345,477

346,236

371,332

341,871

367,831

(7%)

Commercial

16,579

16,252

21,863

16,514

21,591

(24%)

Total loans

1,559,421

$

1,547,865

$

1,635,367

$

1,583,105

$

1,621,554

$

(2%)

Allowance for loan losses

(48,260)

(49,377)

(69,854)

(47,037)

(65,182)

(28%)

Interest earning deposits in banks

167,787

162,329

144,748

100,873

99,257

2%

Other assets

148,898

160,877

177,792

144,245

175,888

(18%)

Total assets

2,127,031

$

2,120,944

$

2,179,987

$

2,082,379

$

2,112,474

$

(1%)

Liabilities and Stockholders' Equity:

Total deposits

1,868,104

$

1,872,362

$

1,932,837

$

1,814,171

$

1,875,293

$

(3%)

Other borrowed funds

14,982

14,520

19,167

13,752

12,877

7%

Other liabilities

21,500

22,186

24,724

26,793

22,106

21%

Total liabilities

1,904,586

$

1,909,068

$

1,976,728

$

1,854,716

$

1,910,276

$

(3%)

Total stockholders' equity

222,445

211,876

203,259

227,663

202,198

13%

Total liabilities & stockholders' equity

2,127,031

$

2,120,944

$

2,179,987

$

2,082,379

$

2,112,474

$

(1%)

CREDIT QUALITY

12/31/14

9/30/14

12/31/13

12/31/2014

12/31/2013

Incr(Decr)

Provision for loan losses

(3,281)

$

(1,304)

$

-

$

(4,585)

$

950

$

N/M

Net charge-offs

(3,281)

834

6,671

13,560

19,529

(149%)

Ending allowance for loan losses

47,037

47,037

65,182

(28%)

Key Metrics

Loans 30 to 89 days past due

8,892

$

9,979

$

16,165

$

(45%)

Non-performing loans (NPL)

35,115

38,352

68,497

(49%)

Other real estate owned

35,491

46,725

63,460

(44%)

Non-performing assets

70,606

85,077

131,957

(46%)

Allowance for loan losses to NPL

133.95%

122.65%

95.16%

38.79

N/M = not meaningful

Quarter ended Averages

Ending balances |