Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - W R GRACE & CO | a8-kx020615xseparationpres.htm |

| 8-K - 8-K - W R GRACE & CO | a8-kx020615xseparation8xk.htm |

1 © 2014 W. R. Grace & Co. Investor Presentation February 5, 2015 W. R. Grace & Co. Grace to Create Two New Industry-Leading Public Companies

2 © 2015 W. R. Grace & Co. Disclaimer Statement Regarding Safe Harbor For Forward-Looking Statements This presentation contains forward-looking statements, that is, information related to future, not past, events. Such statements generally include the words “believes,” “plans,” “intends,” “targets,” “will,” “expects,” “suggests,” “anticipates,” “outlook,” “continues” or similar expressions. Forward-looking statements include, without limitation, expected financial positions; results of operations; cash flows; financing plans; business strategy; operating plans; capital and other expenditures; competitive positions; growth opportunities for existing products; benefits from new technology and cost reduction initiatives, plans and objectives; and markets for securities. For these statements, Grace claims the protection of the safe harbor for forward-looking statements contained in Section 27A of the Securities Act and Section 21E of the Exchange Act. Like other businesses, Grace is subject to risks and uncertainties that could cause its actual results to differ materially from its projections or that could cause other forward-looking statements to prove incorrect. Factors that could cause actual results to materially differ from those contained in the forward- looking statements include, without limitation: risks related to foreign operations, especially in emerging regions; the cost and availability of raw materials and energy; the effectiveness of its research and development and growth investments; acquisitions and divestitures of assets and gains and losses from dispositions; developments affecting Grace’s outstanding indebtedness; developments affecting Grace's funded and unfunded pension obligations; its legal and environmental proceedings; uncertainties that may delay or negatively impact the spin-off or cause the spin-off to not occur at all; uncertainties related to the company’s ability to realize the anticipated benefits of the spin-off; the inability to establish or maintain certain business relationships and relationships with customers and suppliers or the inability to retain key personnel during the period leading up to and following the spin-off; costs of compliance with environmental regulation; and those additional factors set forth in Grace's most recent Annual Report on Form 10-K, quarterly report on Form 10-Q and current reports on Form 8-K, which have been filed with the Securities and Exchange Commission and are readily available on the Internet at www.sec.gov. Reported results should not be considered as an indication of future performance. Readers are cautioned not to place undue reliance on Grace's projections and forward- looking statements, which speak only as the date thereof. Grace undertakes no obligation to publicly release any revision to the projections and forward-looking statements contained in this announcement, or to update them to reflect events or circumstances occurring after the date of this announcement. Non-GAAP Financial Terms These slides contain certain “non-GAAP financial terms” which are defined in the Appendix. Reconciliations of non-GAAP terms to the closest GAAP term (i.e., net income) are provided in the Appendix.

3 © 2015 W. R. Grace & Co. Conference Call Details Call to Discuss Q4 Earnings and Creation of Two New Companies Time: February 5, 2015, 8:30 a.m. EST Dial-in: +1 877.415.3178 (U.S.) or +1 857.244.7321 (International) Passcode: 20461224 Webcast: http://investor.grace.com/ Grace Participants: Fred Festa, Chairman and Chief Executive Officer Hudson La Force, Senior Vice President and Chief Financial Officer Tania Almond, Investor Relations Officer

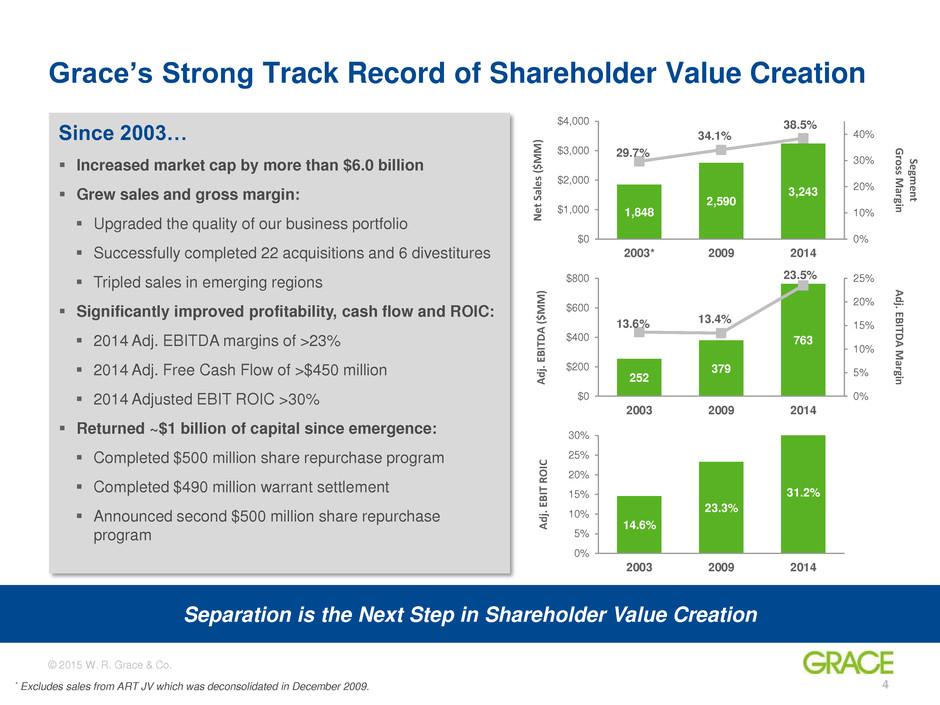

4 © 2015 W. R. Grace & Co. Grace’s Strong Track Record of Shareholder Value Creation Separation is the Next Step in Shareholder Value Creation Since 2003… Increased market cap by more than $6.0 billion Grew sales and gross margin: Upgraded the quality of our business portfolio Successfully completed 22 acquisitions and 6 divestitures Tripled sales in emerging regions Significantly improved profitability, cash flow and ROIC: 2014 Adj. EBITDA margins of >23% 2014 Adj. Free Cash Flow of >$450 million 2014 Adjusted EBIT ROIC >30% Returned ~$1 billion of capital since emergence: Completed $500 million share repurchase program Completed $490 million warrant settlement Announced second $500 million share repurchase program 1,848 2,590 3,243 29.7% 34.1% 38.5% 0% 10% 20% 30% 40% $0 $1,000 $2,000 $3,000 $4,000 2003* 2009 2014 Se gm e n t G ro ss M argin N e t Sa le s ($ M M ) 252 379 763 13.6% 13.4% 23.5% 0% 5% 10% 15% 20% 25% $0 $200 $400 $600 $800 2003 2009 2014 A d j. EBI TD A M argin A d j. E BI TD A ( $ M M ) 14.6% 23.3% 31.2% 0% 5% 10% 15% 20% 25% 30% 2003 2009 2014 A d j. E BI T ROI C TSO @ 12/31/2003 = 65.6M shares Closing Share price 12/31/2003 = $2.57 Market Cap = $169M TSO @ 12/31/2014 = 73.8M shares Closing Share price 12/31/2014 = $95.39 Market Cap = $7.04B TSO @ 1/28/2015 = 73.8M shares Closing Share price 12/31/2014 = $86.54 Market Cap = $6.39B * Excludes sales from ART JV which was deconsolidated in December 2009.

5 © 2015 W. R. Grace & Co. Construction Products and Darex Packaging Global leader in specialty construction chemicals, specialty building materials, and packaging technologies Leverage independent company platform and strong cash flow to accelerate growth in global markets Sales and marketing focus with strong technical sales and service component Less capital intensive, simpler manufacturing operations Catalysts Technologies and Materials Technologies Global leader in process catalysts and specialty silicas High margin, technologically advanced business focused on growth, margin expansion and strong cash flow Manufacturing and technology focus with strong technical sales and service component More capital intensive, complex manufacturing operations Grace to Create Two Industry-Leading Public Companies “New Grace” “New GCP” Improved Strategic Focus, Simplified Operating Structures, and More Efficient Capital Allocation and Capital Structures

6 © 2015 W. R. Grace & Co. Compelling Rationale for Spin-Off Enhanced Strategic Focus Two strong, focused operating companies: Industry-leading market and technology positions Strong free cash flow High returns on invested capital Positioned to capture distinct growth opportunities More efficient capital allocation: Investment decisions optimized at each company Simplified Operating Structure Compelling growth and margin profiles Simplified operating structures: Improved management focus Cost productivity and optimized functional support Strong leadership teams focused on value creation Strong Financial Profiles Optimized capital structures Financial flexibility to pursue growth and M&A opportunities Two unique and compelling investment opportunities: Simpler investor thesis Distinct investment identity Separation Expected to Increase Shareholder Value

7 © 2015 W. R. Grace & Co. 2014 Financials Metrics(1) ~$1.8 billion sales ~$2.2 billion with sales from ART JV ~$500 million Adjusted EBITDA ~28% Adjusted EBITDA margin Key Metrics Expected leverage at time of spin-off: Net Debt / Adj. EBITDA: 2.0x – 2.5x Expected cash tax rate: 10% – 15% until 2021 “New Grace” Overview Global Leader in Process Catalysts and Specialty Silicas Agile, focused competitor in catalysts and specialty silicas Best in-class financial profile with high margins and cash flow Attractive growth drivers in catalysts end markets Technology leadership position with footprint to support growth Materials science and complex manufacturing expertise Blue chip customer base Key Business Highlights Financial Highlights Leadership Fred Festa to remain Chairman and CEO Hudson La Force to remain CFO Sales by Product Line 71% 29% ~$1.8 billion Materials Technologies Catalysts Technologies 1 Year ended December 31, 2014, reflecting business segment separation with corporate costs allocated proportionate to sales.

8 © 2015 W. R. Grace & Co. $0.8B $0.4B $0.4B $0.5B Refining Technologies ART (JV) Specialty Catalysts Engineered Materials $6.7B $5.5B $3.8B $4.7B $1.2B Refining Catalysts Petrochemical Catalysts Polymer Catalysts Engineered Materials Discovery Sciences “New Grace” Overview – Business Segment Detail Market Size Business Overview 1 HPC applications served through the Company’s Advanced Refining Technologies (ART) joint venture with Chevron. Refining Technologies FCC catalysts and additives for petroleum refiners #1 in FCC catalysts Advanced Refining Technologies(1) Hydroprocessing catalysts #1 in resid hydroprocessing catalysts Specialty Catalysts Catalysts, supports, and technology licensing for polyolefins Chemical catalysts and supports for specialty chemicals #1 in independent polyethylene catalysts #2 in polypropylene catalysts and process technology licensing Engineered Materials Specialized silica-based materials used as process aids, additives, and adsorbents #1 in specialty silica gel Discovery Sciences Pharmaceutical and life science products including silica-based separation media and excipients ~$20B market opportunity Sales by Product Line C atal y sts T e c h n o lo g ie s Mater ia ls T e c h n o lo g ie s ~$1.8B in sales in 2014

9 © 2015 W. R. Grace & Co. 2014 Financials Metrics(1) ~$1.5 billion sales ~$260 million Adjusted EBITDA ~17% Adjusted EBITDA margin Key Metrics Expected leverage at time of spin-off: Net Debt / Adj. EBITDA: 3.0x – 3.5x Expected cash tax rate: 25% – 30% “New GCP” Overview Global leader in specialty construction products and packaging technologies Agile, focused construction player supported by packaging business with high cash flow Poised to accelerate organic growth and bolt-on acquisitions as standalone company Global leader in construction chemicals and packaging technologies Reputation as an industry innovator Global footprint to support emerging regions growth Low capital intensity ~2% of sales Key Business Highlights Financial Highlights Leadership Greg Poling, currently President and COO of Grace, to become CEO Sales by Product Line 75% 25% ~$1.5 billion Darex Packaging Construction Products 1 Year ended December 31, 2014, reflecting business segment separation with corporate costs allocated proportionate to sales.

10 © 2015 W. R. Grace & Co. “New GCP” Overview – Business Segment Detail Market Size Business Overview 1 HPC applications served through the Company’s Advanced Refining Technologies (ART) joint venture with Chevron. Specialty Construction Chemicals Dispersants that improve concrete flow, placement and strength Quality improvers and grinding aids that enhance cement producer efficiencies #1 in cement additives #2 in concrete admixtures Specialty Building Materials Waterproofing for below grade and horizontal deck applications Residential roofing underlayment's and flashing Fire protection materials Darex Packaging Formulated coatings and sealants for metal cans and closures used in consumer and industrial applications #1 in can sealants ~$18B market opportunity Sales by Product Line C o n stru c ti o n P ro d u ct s D ar e x P a c k a g in g ~$1.5B in sales in 2014 $7.1B $1.1B $6.4B $3.8B Concrete Chemicals Cement Additives Specialty Building Materials Packaging Technologies $0.7B $0.4B $0.4B Specialty Construction Chemicals Specialty Building Materials Darex Packaging

11 © 2015 W. R. Grace & Co. Spin-Off Transaction Details Transaction Structure Distribution of 100% of New GCP shares to Grace shareholders Expected tax-free distribution to shareholders for U.S. federal income tax purposes Timing Transaction targeted to be completed in approximately 12 months Financial Policy Both companies expected to be well capitalized and positioned for growth Disciplined, returns-based approaches to capital allocation Combined leverage of the two new companies about the same as existing Grace Principal Closing Conditions Separation is subject to customary closing conditions, including final approval of Grace Board of Directors Separation Will Create Two Companies Better Positioned for Growth and Value Creation

12 © 2015 W. R. Grace & Co. Key Summary Points Creating two strong, independent companies with: Improved strategic focus Simplified operating structures More efficient capital allocation and capital structures Experienced and proven management teams and highly skilled employees dedicated to driving growth and creating value for customers Separation strategy is consistent with Grace’s strong track record of driving growth and creating value for shareholders Targeting completion in approximately 12 months

13 © 2015 W. R. Grace & Co. For additional information, please visit grace.com or contact: Tania Almond Investor Relations Officer +1 410.531.4590 Tania.Almond@grace.com David Joseph Finance Manager, Investor Relations +1 410.531.8209 David.Joseph@grace.com

14 © 2015 W. R. Grace & Co. Appendix: Definitions and Reconciliations of Non-GAAP Measures

15 © 2015 W. R. Grace & Co. Appendix: Reconciliations of Non-GAAP Financial Measures (continued)

16 © 2015 W. R. Grace & Co. Appendix: Reconciliations of Non-GAAP Financial Measures (continued)

17 © 2015 W. R. Grace & Co. Appendix: Reconciliations of Non-GAAP Financial Measures (continued)