Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Genpact LTD | d864834d8k.htm |

| EX-99.1 - EX-99.1 - Genpact LTD | d864834dex991.htm |

February 4, 2015

Ticker (NYSE: G)

Genpact

Q4 and FY 2014 Earnings Presentation

Exhibit 99.2 |

DESIGN

•

TRANSFORM

•

RUN

2

©

2015 Copyright Genpact. All Rights Reserved.

These

materials

contain

certain

statements

concerning

our

future

growth

prospects

and

forward-looking

statements,

as

defined

in

the

safe

harbor

provisions

of

the

U.S.

Private

Securities

Litigation

Reform

Act

of

1995.

These

statements

are

based

on

Genpact’s

current

expectations

and

beliefs,

as

well

as

a

number

of

assumptions

concerning

future

events.

These

statements

involve

a

number

of

risks,

uncertainties

and

other

factors

that

could

cause

actual

results

to

differ

materially

from

those

in

such

forward-looking

statements.

These

risks

and

uncertainties

include

but

are

not

limited

to

a

slowdown

in

the

economies

and

sectors

in

which

our

clients

operate,

a

slowdown

in

the

BPO

and

IT

Services

sectors,

the

risks

and

uncertainties

arising

from

our

past

and

future

acquisitions,

our

ability

to

convert

bookings

to

revenues,

our

ability

to

manage

growth,

factors

which

may

impact

our

cost

advantage,

wage

increases,

our

ability

to

attract

and

retain

skilled

professionals,

risks

and

uncertainties

regarding

fluctuations

in

our

earnings,

dependence

on

tax

legislation,

general

economic

conditions

affecting

our

industry

as

well

as

other

risks

detailed

in

our

reports

filed

with

the

U.S.

Securities

and

Exchange

Commission

(the

“SEC”),

including

the

Company’s

Annual

Report

on

Form

10-K.

These

filings

are

available

at

www.sec.gov

or

on

the

investor

relations

section

of

our

website,

www.genpact.com.

Genpact

may

from

time

to

time

make

additional

written

and

oral

forward-looking

statements,

including

statements

contained

in

our

filings

with

the

SEC.

The

Company

undertakes

no

obligation

to

update

any

forward-

looking

statements

that

may

be

made

from

time

to

time

by

or

on

behalf

of

the

Company.

These

materials

also

include

measures

defined

by

the

SEC

as

non-GAAP

financial

measures.

Genpact

believes

that

these

non-

GAAP

measures

can

provide

useful

supplemental

information

to

investors

regarding

financial

and

business

trends

relating

to

its

financial

condition

and

results

of

operations

when

read

in

conjunction

with

the

Company’s

reported

results.

Reconciliations

of

these

non-GAAP

measures

from

GAAP

are

available

in

this

presentation

and

in

our

earnings

release

dated

February

4,

2015.

Forward-Looking Statements

Non-GAAP Financial Measures |

DESIGN •

TRANSFORM •

RUN

3

©

2015 Copyright Genpact. All Rights Reserved.

FY 2014 –

Key Financial Highlights

Solid growth and strategy execution

FY ‘14 versus FY ‘13 performance:

Total Revenue:

+7%

Revenue from Global Clients

(1)

:

+10%

GE Revenue

(1)

:

-2%

FY 2014 Adjusted Income from Operations margin at 15.1%, reflecting planned

strategic investments

(2)

Solid progress in the execution of our strategy:

Realigning our resources and developing new solutions for our targeted

verticals, service lines and geographies

Making significant client-facing investments

Adding domain and subject-matter experts to drive differentiation

Notes:

1.

Data adjusted for dispositions by GE of businesses that Genpact continues to serve

as Global Clients. 2.

Adjusted Income from Operations is a non-GAAP measure. FY ‘14 GAAP income

from operations margin was 12.9%. |

DESIGN •

TRANSFORM •

RUN

4

©

2015 Copyright Genpact. All Rights Reserved.

Q4 2014 –

Key Financial Highlights

Q4 ‘14 versus Q4 ‘13 performance:

Total Revenue:

+8%

Revenue from Global Clients

(1)

:

+11%

GE Revenue

(1)

:

-5%

Q4 2014 Adjusted Income from Operations margin at 13.6%, reflecting planned

investments

(2)

Global

Client

growth

was

broad-based

and

led

by

five

of

our

target

verticals

–

CPG,

Life

Sciences, Insurance, Manufacturing and Services, and Capital Markets

From a service line perspective, Finance & Accounting, Core Vertical

Operations, and Consulting led growth

Signed two large transformational deals, one each in the CPG and

Banking verticals

Notes:

1.

Data adjusted for dispositions by GE of businesses that Genpact continues to serve

as Global Clients 2.

Adjusted Income from Operations is a non-GAAP measure. Q4 ‘14 GAAP income

from operations margin was 11.8%. |

DESIGN •

TRANSFORM •

RUN

5

©

2015 Copyright Genpact. All Rights Reserved.

FY 2014 –

Solid Growth and Progress on Strategy Execution

Key events and accomplishments:

Continued

progress

on

converting

large

deal

pipeline;

signed

six

large

transformational

engagements, including two in the fourth quarter

Continued to add depth to our client-facing teams; invested 6.6% of our revenue

in sales and marketing and also made incremental investments in capability

builds Built industry leading solutions that integrate new technology and

data insights to solve for critical client and industry needs

Launched

Systems

of

Engagement

SM

(SOE)

technology;

combining

advanced

technologies

with our deep domain and process expertise to drive business impact for

clients Accelerated

the

integration

of

rapid

robotic

automation

solutions

with

our

SEP

SM

framework

to drive increased efficiency and effectiveness and operational intelligence for

our clients Made strong progress on the Know Your Customer (KYC) solution

with Markit; Integration of our Life Sciences regulatory affairs acquisition

on track Collaboration with Lombard Risk Management on collateral management

exemplifies use of strategic partnerships and alliances to create new client

solutions |

DESIGN •

TRANSFORM •

RUN

6

©

2015 Copyright Genpact. All Rights Reserved.

Bookings Up 50% Year-Over-Year

($ millions)

2014

YoY

Bookings*

2,156

+50%

Annual bookings up significantly over 2013 of $1,440m due to:

Realignment of our strategic focus to key target verticals, service lines and

geographies led to an increase in salesforce productivity

2013 bookings were broadly flat in comparison to 2012

Focus on large annuity opportunities led to six new large deal wins over the

course of 2014

Notes:

* New bookings means the total contract value of new contracts, and certain

renewals, extensions and changes to existing contracts. Regular renewals of contracts with

no change in scope are not counted as new bookings. |

DESIGN •

TRANSFORM •

RUN

7

©

2015 Copyright Genpact. All Rights Reserved.

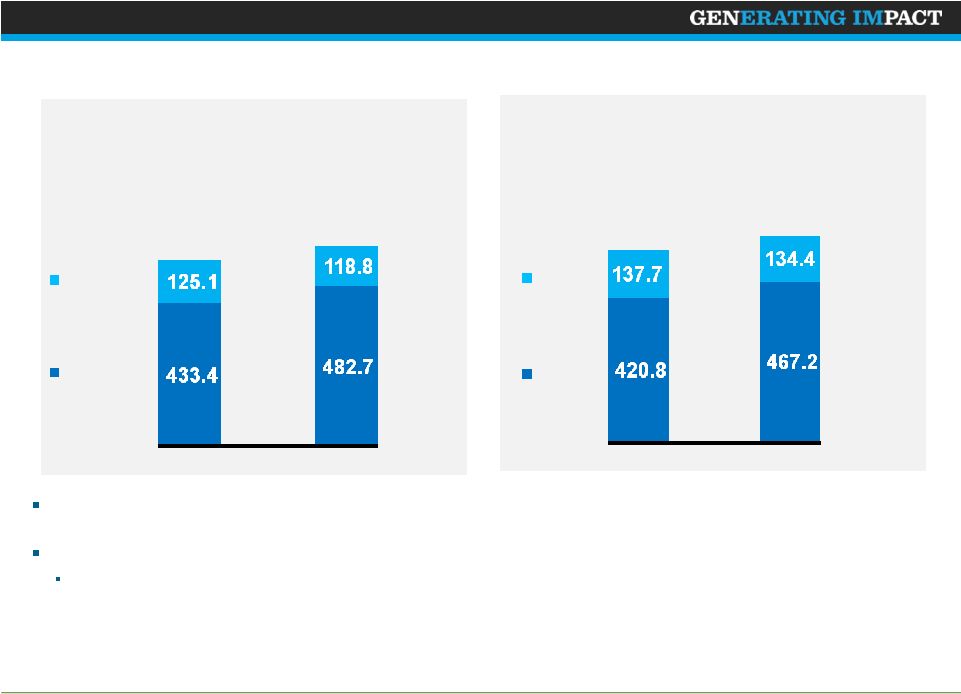

Q4 2014 Revenue Summary

Total growth at constant currency was 9.2%; excluding Pharmalink, total revenue

growth was 5.6%, or 7.1% on a constant currency basis

Q4 2014 Global Clients

BPO revenues increased 16% and ITO revenues declined 3%

Notes:

1.

Data adjusted for dispositions by GE of businesses that Genpact continues to serve

as Global Clients Global

Clients

(1)

GE

(1)

BPO

ITO

7.7%

YoY

Growth%

11.4%

(5.0%)

7.7%

(2.4%)

11.0%

YoY

Growth%

Q4 ‘13

Q4 ‘14

Q4 ‘13

Q4 ‘14

($ in millions)

($ in millions)

$558.5

$601.5

$601.5

$558.5 |

DESIGN •

TRANSFORM •

RUN

8

©

2015 Copyright Genpact. All Rights Reserved.

Q4 Results Reflect Investments in Client-Facing Teams

and Capabilities

Q4‘13

Q4‘14

YoY

Revenue

558.5

601.5

7.7%

Cost of Revenue

345.8

359.2

3.9%

Gross Profit

212.6

242.3

14.0%

Gross Profit % of Revenue

38.1%

40.3%

220 bps

SG&A

136.2

167.3

22.8%

SG&A % of Revenue

24.4%

27.8%

340bps

Adjusted

Income

from

Operations

(1)

85.7

81.8

-4.5%

Adjusted Income from Operations Margin

15.3%

13.6%

-170 bps

($ millions)

Notes:

1.

Adjusted Income from Operations is a non-GAAP measure. Income from Operations

was $71.6 million in Q4 ‘13 and $70.9 million in Q4’14. Gross

profit margins increase was driven by productivity and favorable foreign exchange |

DESIGN •

TRANSFORM •

RUN

9

©

2015 Copyright Genpact. All Rights Reserved.

FY 2014 Revenue Summary

Notes:

1.

Data adjusted for dispositions by GE of businesses that Genpact continues to serve

as Global Clients Global

Clients

(1)

GE

(1)

BPO

ITO

6.9%

YoY

Growth%

9.6%

(2.4%)

6.9%

3.6%

8.0%

YoY

Growth%

2,132

2,279

FY ‘13

FY ‘14

FY ‘13

FY ‘14

($ in millions)

($ in millions)

2,132

2,279

Total growth at constant currency was 7.9%; excluding Pharmalink, total revenue

growth was 5.7%, or 6.7% on a constant currency basis

FY 2014 Global Clients

Business Process Outsourcing revenues increased 12% and ITO revenues increased

3% |

DESIGN •

TRANSFORM •

RUN

10

©

2015 Copyright Genpact. All Rights Reserved.

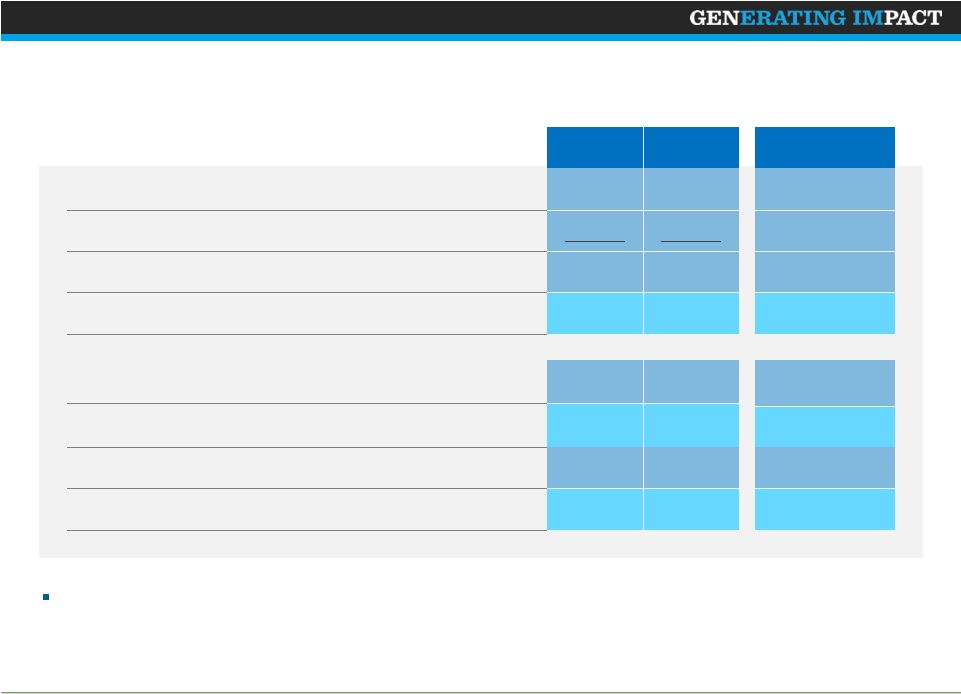

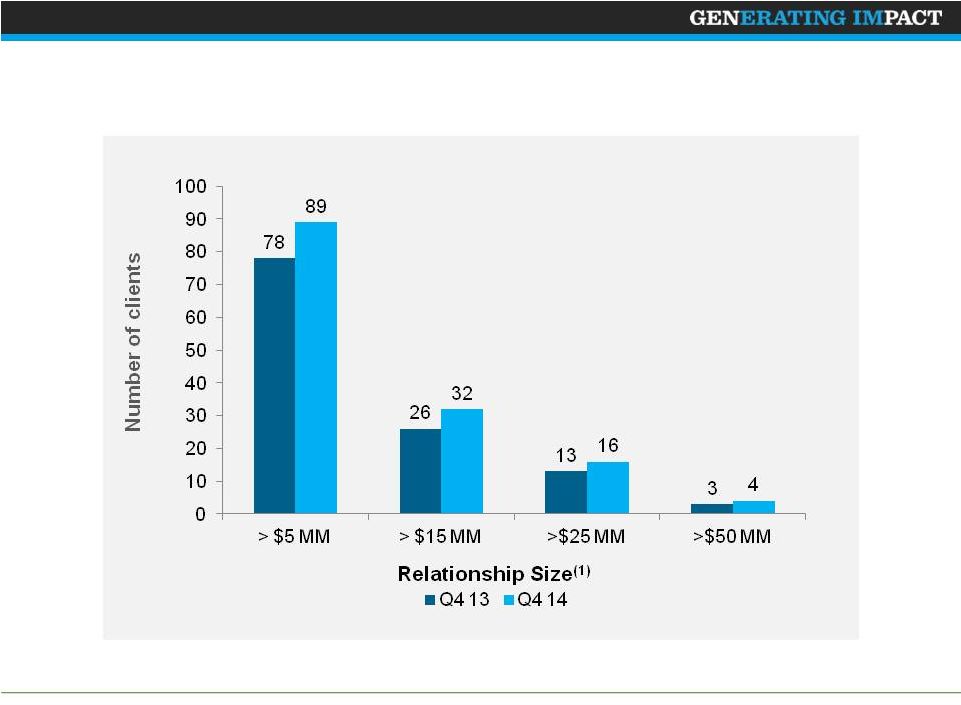

Continue to Expand Client Relationships

Notes:

1.

Relationship size = Clients representing annual revenues based on last four rolling

quarters |

DESIGN •

TRANSFORM •

RUN

11

©

2015 Copyright Genpact. All Rights Reserved.

FY‘13

FY’14

YoY

Revenue

2,132.0

2,279.4

6.9%

Cost of Revenue

1,319.6

1,378.1

4.4%

Gross Profit

812.4

901.4

10.9%

Gross Profit % of Revenue

38.1%

39.5%

140 bps

SG&A

484.8

585.6

20.8%

SG&A % of Revenue

22.7%

25.7%

300bps

Adjusted

Income

from

Operations

(1)

352.6

344.2

-2.4%

Adjusted Income from Operations Margin

16.5%

15.1%

-140 bps

($ millions)

Notes:

1.

Adjusted Income from Operations is a non-GAAP measure. Income from Operations

was $309.5 million in FY ‘13 and $294.0 million in FY’14. FY Results

Reflect Investments in Client-Facing Teams and Capabilities

Gross profit margins increase driven by incremental revenue as well as operating

efficiencies and favorable foreign exchange |

DESIGN •

TRANSFORM •

RUN

12

©

2015 Copyright Genpact. All Rights Reserved.

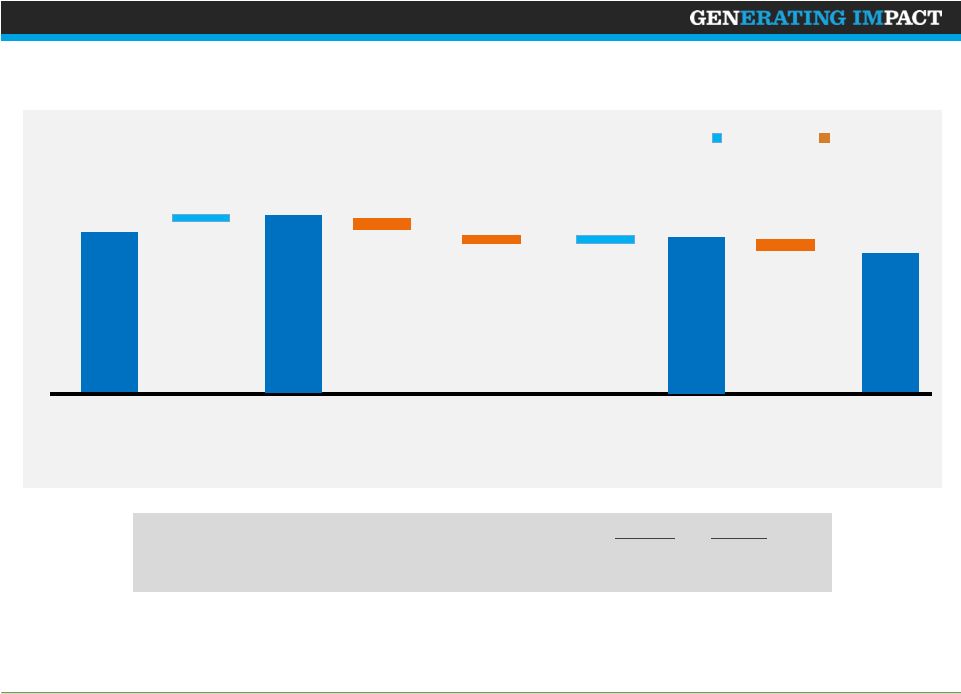

EPS Year-Over-Year Bridge

FY ‘13

FY ‘14

Adjusted Net Income ($ millions)

265.9

231.4

Diluted

Shares

Outstanding

(millions)

(2)

236

225

97

-11

FX Re-

measurement

Loss

FY ‘13

GAAP

EPS

(Cents per share)

Net

Adjustments

(1)

113

16

Net

Adjustments

(1)

FY ‘13

Adjusted

EPS

FY ‘14

Adjusted

EPS

FY ‘14

GAAP

EPS

-3

Lower Adjusted

Income from

Operations

-18

Increase Decrease

Notes:

1.

Adjustments primarily include amortization of acquired intangible assets,

stock-based compensation expenses and acquisition-related expenses.

2.

Weighted average number of diluted shares outstanding

-

The above bridge reflects only significant variance items year over year and is

illustrative and subject to rounding. -

EPS = Diluted earnings per share

Share buyback

net of dilution/

Others

4

85

103 |

DESIGN •

TRANSFORM •

RUN

13

©

2015 Copyright Genpact. All Rights Reserved.

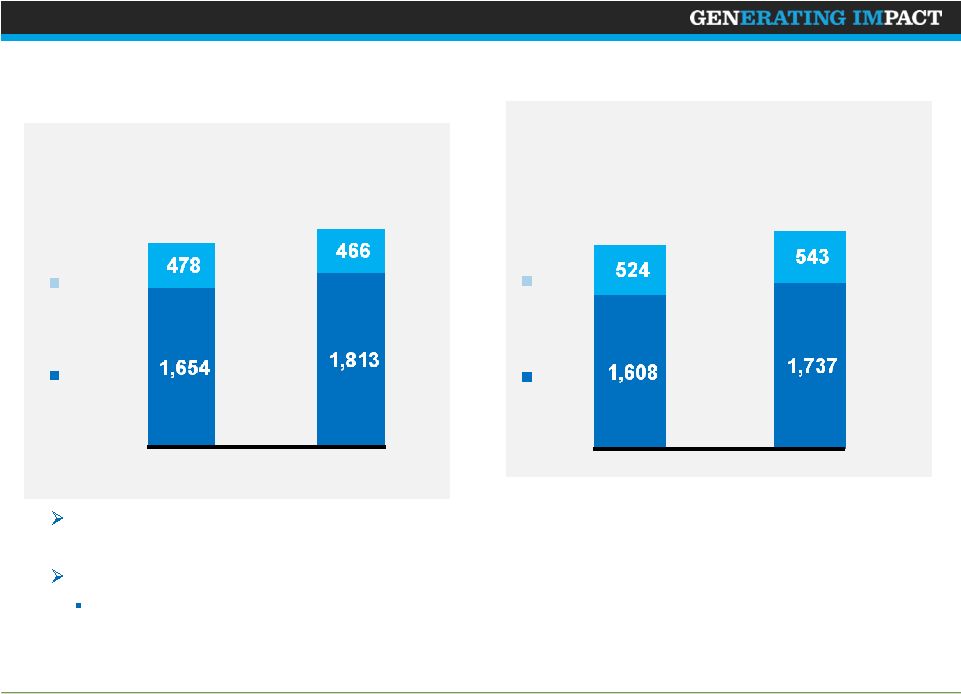

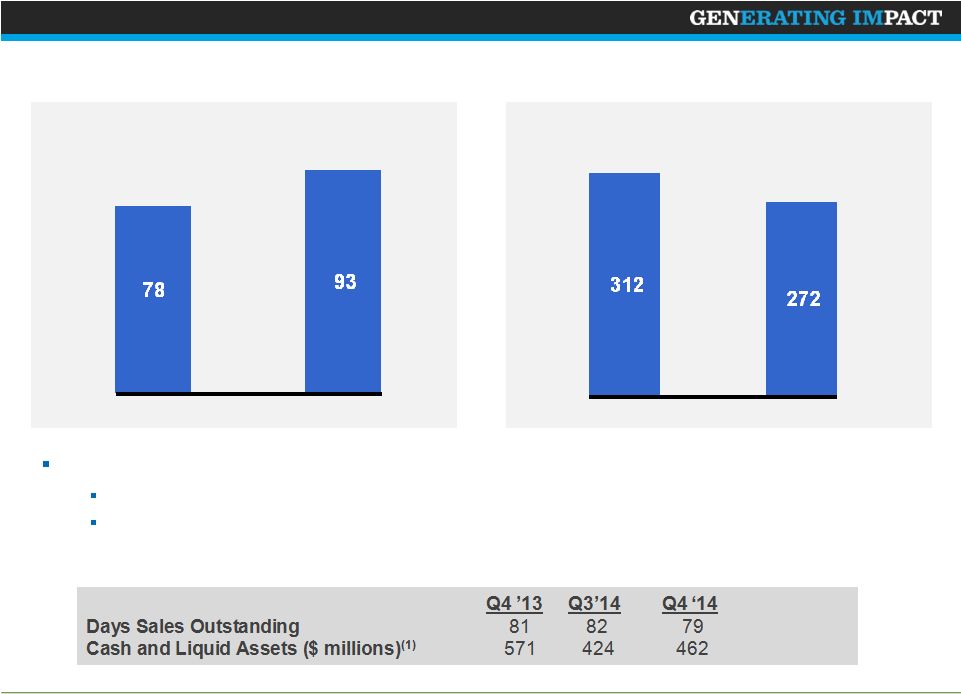

Cash From Operations

FY 2014 cash from operations down $40 MM

Cash from operations down 13% YoY; better than our earlier outlook mainly due to

the improvement in DSOs. The year over year decline was primarily driven by

the impact of foreign exchange re-measurement. Lower

operating income also contributed to the decline.

Q4 ‘13

Q4 ‘14

19%

Notes:

1) Cash and Liquid Assets = Cash and cash equivalents and short-term

deposits (13%)

FY ‘13

FY ‘14

YoY

Change%

YoY

Change%

($ in millions)

($ in

millions) |

DESIGN •

TRANSFORM •

RUN

14

©

2015 Copyright Genpact. All Rights Reserved.

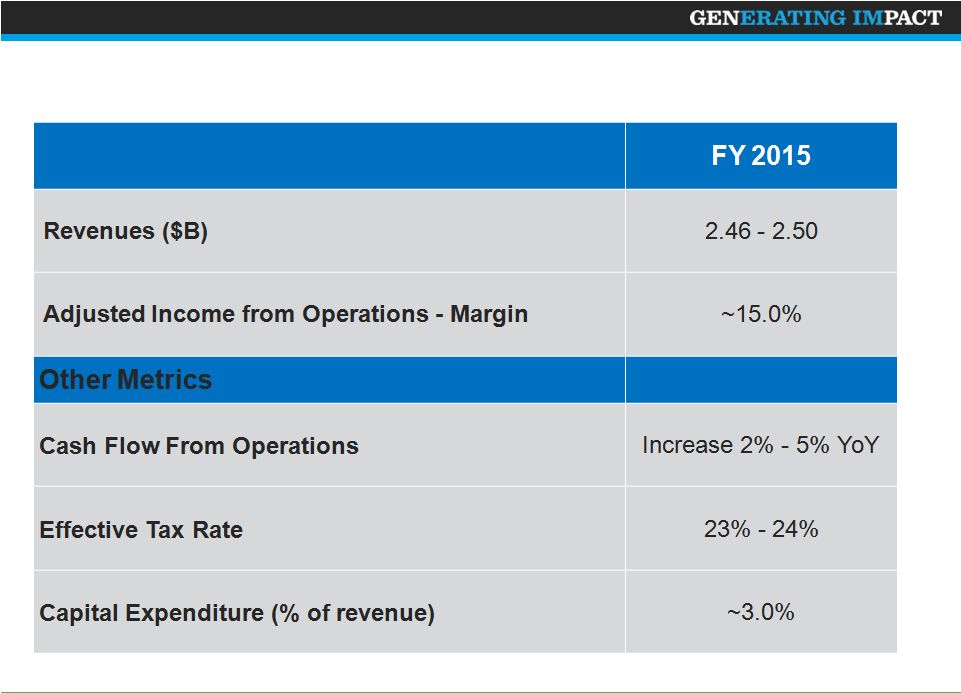

Full Year 2015 Outlook |

DESIGN •

TRANSFORM •

RUN

15

©

2015 Copyright Genpact. All Rights Reserved.

Annexure 1: Reconciliation of Adjusted Income from

Operations –

Full Year 2014

(USD, in thousands)

Year ended December 31

2013

2014

Income from operations per GAAP

$

309,527

$

294,031

Add: Stock-based compensation

31,129

28,065

Add: Amortization of acquired intangible assets

18,321

22,233

Add: Acquisition related expenses

-

2,772

Add/Less: Other Income (Expense), net excluding net interest

(1,168)

2,112

Add/Less: Gain (Loss) on Equity-method investment activity, net

169

(4,795)

Less: Net income attributable to noncontrolling interest

(5,334)

(169)

Adjusted income from operations

$

352,644

$

344,249 |

DESIGN •

TRANSFORM •

RUN

16

©

2015 Copyright Genpact. All Rights Reserved.

Annexure 2: Reconciliation of Adjusted Income From

Operations –

Q4 2014

(USD, in thousands)

Quarter ended December 31

2013

2014

Income from operations per GAAP

$

71,633

$

70,866

Add: Stock-based compensation

9,198

7,912

Add: Amortization of acquired intangible assets

4,685

6,347

Add: Acquisition related expenses

-

795

Add/Less: Other Income (Expense), net excluding net interest

1,190

776

Add/Less: Gain (Loss) on Equity-method investment activity, net

30

(4,882)

Less: Net income attributable to noncontrolling interest

(1,064)

-

Adjusted income from operations

$

85,672

$

81,814 |

DESIGN •

TRANSFORM •

RUN

17

©

2015 Copyright Genpact. All Rights Reserved.

Annexure 3: Reconciliation of Adjusted Net Income –

Full

Year 2014

(USD, in thousands, except per share data)

Year ended December 31

2013

2014

Net income attributable to Genpact Limited shareholders per GAAP

$

229,717

$

192,002

Add: Stock-based compensation

31,129

28,065

Add: Amortization of acquired intangible assets

18,321

22,233

Add: Acquisition related expenses

-

2,772

Less: Tax impact on stock-based compensation

(6,913)

(6,366)

Less: Tax impact on amortization of acquired intangibles

(6,373)

(7,154)

Less: Tax impact on acquisition related expenses

-

(184)

Adjusted net income

$

265,881

$

231,368

Adjusted diluted earnings per share

$

1.13

$

1.03 |

DESIGN •

TRANSFORM •

RUN

18

©

2015 Copyright Genpact. All Rights Reserved.

Annexure 4: Reconciliation of Adjusted Net Income –

Q4

2014

(USD, in thousands, except per share data)

Quarter ended December 31

2013

2014

Net income attributable to Genpact Limited shareholders per GAAP

$

48,842

$

45,752

Add: Stock-based compensation

9,198

7,912

Add: Amortization of acquired intangible assets

4,685

6,347

Add: Acquisition related expenses

-

795

Less: Tax impact on stock-based compensation

(1,160)

(1,160)

Less: Tax impact on amortization of acquired intangibles

(2,085)

(1,997)

Less: Tax impact on acquisition related expenses

-

(131)

Adjusted net income

$

59,480

$

57,518

Adjusted diluted earnings per share

$

0.25

$

0.26 |

Thank You |