Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Santander Consumer USA Holdings Inc. | scusa8-k123114earningsfinal.htm |

| EX-99.1 - EXHIBIT 99.1 - Santander Consumer USA Holdings Inc. | exhibit991december312014.htm |

Santander Consumer USA Holdings Inc. 4Q14 Company Update

IMPORTANT INFORMATION 2 Forward-Looking Statements This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Any statements about our expectations, beliefs, plans, predictions, forecasts, objectives, assumptions, or future events or performance are not historical facts and may be forward-looking. These statements are often, but not always, made through the use of words or phrases such as “anticipates,” “believes,” “can,” “could,” “may,” “predicts,” “potential,” “should,” “will,” “estimates,” “plans,” “projects,” “continuing,” “ongoing,” “expects,” “intends,” and similar words or phrases. Although we believe that the expectations reflected in these forward-looking statements are reasonable, these statements are not guarantees of future performance and involve risks and uncertainties which are subject to change based on various important factors, some of which are beyond our control. For additional discussion of these risks, refer to the section entitled “Risk Factors” and elsewhere in our Annual Report on Form 10-K and our Quarterly Reports on Form 10-Q filed by us with the SEC. Among the factors that could cause our financial performance to differ materially from that suggested by the forward-looking statements are: (a) we operate in a highly regulated industry and continually changing federal, state, and local laws and regulations could materially adversely affect our business; (b) adverse economic conditions in the United States and worldwide may negatively impact our results; (c) our business could suffer if our access to funding is reduced; (d) we face significant risks implementing our growth strategy, some of which are outside our control; (e) our agreement with Chrysler may not result in currently anticipated levels of growth and is subject to certain performance conditions that could result in termination of the agreement; (f) our business could suffer if we are unsuccessful in developing and maintaining relationships with automobile dealerships; (g) our financial condition, liquidity, and results of operations depend on the credit performance of our loans; (h) loss of our key management or other personnel, or an inability to attract such management and personnel, could negatively impact our business; (i) we are subject to certain regulations, including oversight by the Office of the Comptroller of the Currency, the CFPB, the Bank of Spain, and the Federal Reserve, which oversight and regulation may limit certain of our activities, including the timing and amount of dividends and other limitations on our business; and (j) future changes in our relationship with Santander could adversely affect our operations. If one or more of the factors affecting our forward-looking information and statements proves incorrect, our actual results, performance or achievements could differ materially from those expressed in, or implied by, forward-looking information and statements. Therefore, we caution not to place undue reliance on any forward-looking information or statements. The effect of these factors is difficult to predict. Factors other than these also could adversely affect our results, and the reader should not consider these factors to be a complete set of all potential risks or uncertainties. New factors emerge from time to time, and management cannot assess the impact of any such factor on our business or the extent to which any factor, or combination of factors, may cause results to differ materially from those contained in any forward-looking statement. Any forward-looking statements only speak as of the date of this document, and we undertake no obligation to update any forward-looking information or statements, whether written or oral, to reflect any change, except as required by law. All forward-looking statements attributable to us are expressly qualified by these cautionary statements.

AGENDA Highlights Strategy and Business Appendix: Financial and Supplemental Information Results 3

4Q14: HIGHLIGHTS » Fourth quarter net income of $247.0 million1, or $0.69 per diluted common share, up 117% from prior year fourth quarter » Net income1 for fourth quarter 2013 of $113.9 million, or $0.33 per diluted common share » Fourth quarter ROE and ROA of 29.1% and 3.1%, respectively » Fourth quarter 2013 ROE and ROA of 17.3% and 1.8%, respectively » Strong capital base; TCE/TA2 of 10.7%, up 9.7% from prior year » Current portfolio performance consistent with retained mix and typical seasonal patterns of deterioration in the second half of the year » Net charge-off ratio of 8.6%, seasonally up from 8.4% in prior quarter and up from 8.1% in prior year fourth quarter » Allowance to loans ratio decreased to 11.5% from 12.1% quarter-over- quarter, primarily driven by positive model impacts and a decrease in months’ coverage versus prior quarter3 Robust Financial Performance Stable Credit Performance 1 GAAP Net income attributable to SCUSA shareholders 2 See reconciliation on slide 26 3Allowance to loan ratios exclude impairment on purchased receivables portfolio 4Net bonds sold of $941 million ($ in millions) » Platform more than doubled this year to $10.3 billion at December 31, 2014 from $4.5 billion at the end of 2013 » Fourth quarter servicing fee income of $20 million, up from $4 million in the prior year fourth quarter » Remain focused on this capital-light, higher ROE strategy in 2015 » Leverages servicing and compliance expertise » Total originations and sales of $6.1 billion and $1.1 billion, respectively » In Q4, $1 billion4 transaction from the core nonprime platform, SDART » $1.2 billion in new capacity in amortizing and warehouse facilities » Chrysler Capital penetration rate of 27% at the end of Q4; remain confident about ongoing success of Chrysler agreement » Net unsecured consumer loans of $1.8 billion, up from $1.3 billion in prior quarter and $954 million in prior year fourth quarter » Focused on balance sheet management and risk-adjusted returns, accretive to long-term earnings » Leveraging history of big bank ownership and compliance culture » Enhanced regulatory environment creating barrier to entry that benefits stronger industry players » Resources committed to CCAR infrastructure » Established formal regulatory liaison team Quality Originations & Capital Markets Expertise Sound Risk Management & Compliance Serviced for Others Platform » Scorecard implemented utilizing call monitoring system, Call Miner, to provide associate ratings via voice-to-text software for Right-Party Contact (RPC) and messages left » Grades associates on quality of the call or message left » Implemented lease end-of-term process Enhanced Technology & Operations 4

4Q14: PERFORMANCE 1 As defined in public filings Three Months Ended December 31, 2014 September 30, 2014 June 30, 2014 March 31, 2014 December 31, 2013 Yield on Earning Assets1 (%) 14.9% 15.7% 16.0% 16.6% 16.4% Cost of Debt (%) 2.1% 1.9% 2.0% 2.0% 2.1% Net Interest Margin1 (%) 13.1% 14.1% 14.3% 14.8% 14.6% Efficiency Ratio1 (%) 19.1% 16.0% 17.4% 16.9%2 19.2% Net Charge-off Ratio (%) 8.6% 8.4% 5.8% 6.4% 8.1% Return on Average Assets (%) 3.1% 2.5% 3.4% 2.3%2 1.8% Return on Average Equity (%) 29.1% 23.9% 33.0% 22.4%2 17.3% Diluted EPS ($) $0.69 $0.54 $0.69 $0.442 $0.33 Key Metrics & Ratios End of Period December 31, 2014 September 30, 2014 June 30, 2014 March 31, 2014 December 31, 2013 Delinquency Ratio (%) 4.5% 4.1% 3.8% 3.1% 4.5% Loan Loss Allowance to Loans (%)3 11.5% 12.1% 11.4% 11.0% 10.3% Tangible Common Equity to Tangible Assets4 (%) 10.7% 10.4% 10.0% 9.7% 9.7% 5 2 Q1 2014 adjusted for $75.8 million non-recurring stock compensation and other IPO-related expenses; reconciliation on slide 26 3 Excludes impairment on purchased receivables portfolios 4 Non-GAAP measure; see reconciliation on slide 26

AGENDA Highlights Strategy and Business Appendix: Financial and Supplemental Information Results 6

SCUSA OVERVIEW » Santander Consumer USA Holdings Inc. (NYSE: SC) (“SCUSA”) is approximately 60.5 percent owned by Santander Holdings USA, Inc., a wholly-owned subsidiary of Banco Santander, S.A. (NYSE: SAN)1 » SCUSA is a full-service, technology-driven consumer finance company focused on vehicle and unsecured consumer lending and third-party servicing » Historically focused on nonprime markets; established and continued presence in prime and lease » Approximately 4,400 employees and approximately 800 vendor-based employees across multiple locations in the U.S. and the Caribbean 1 As of December 31, 2014 2 Chrysler Capital is a dba of SCUSA » Our strategy is to continue to leverage our efficient, scalable infrastructure and data to underwrite, originate and service consumer assets while controlling balance sheet growth » Focus on optimizing the mix of retained assets vs. assets sold and serviced for others » Continued presence in prime markets through Chrysler Capital2 and in unsecured consumer lending » Efficient funding through third parties and Santander Strategy SCUSA’s fundamentals are strong, and the company is focused on maintaining disciplined underwriting standards to deliver strong returns, robust profitability and value to its shareholders 7

SCUSA TODAY » Originate and refinance loans via SCUSA’s branded tech-enabled platform, RoadLoans.com » Active relationships with more than 17,000 franchised automotive dealers throughout the United States » Originate loans through select independent dealers and OEMs, primarily Chrysler, and leases through Chrysler Direct Auto Finance Indirect Auto Finance and OEM Relationships Vehicle Finance » Finance third-party receivables for consumer installment products » Leverage relationship with a lending technology company that enables SCUSA to facilitate private-label credit cards to underserved markets, via retailers » Finance third-party receivables for revolving consumer products Installment Revolving Unsecured Consumer Lending » Proprietary systems leverage SCUSA’s knowledge of consumer behavior across the full credit spectrum, and enable the company to effectively price, manage and monitor risk » Scalability evidenced by acquisitions and/or conversions and originations of more than $104 billion of assets since 2008 » Capital-light, higher ROE serviced for others platform Origination & Servicing Platforms 8

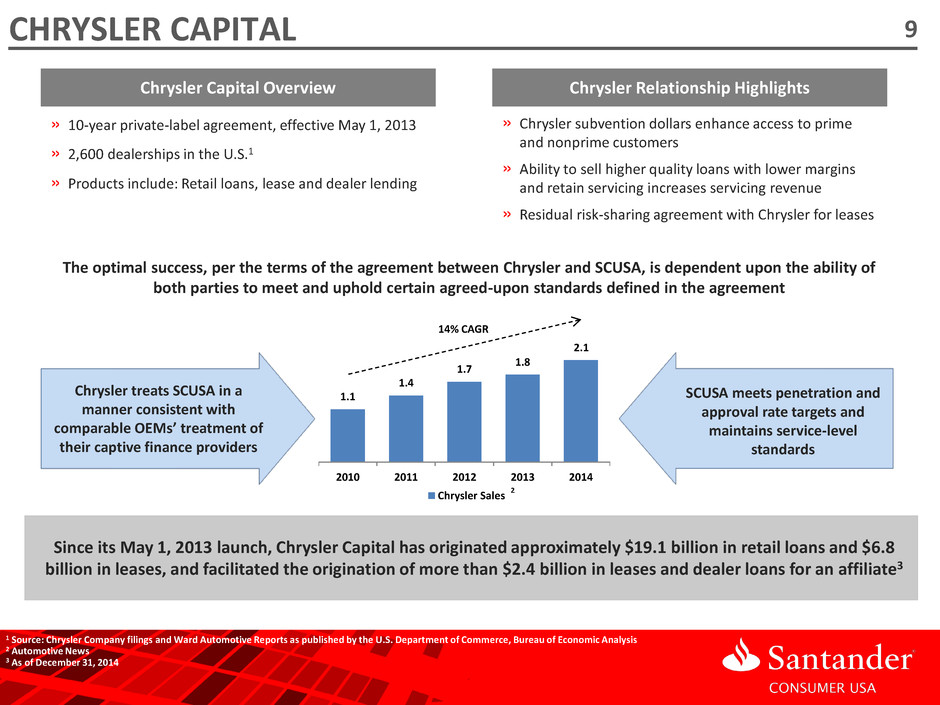

Chrysler Capital Overview Chrysler Relationship Highlights » 10-year private-label agreement, effective May 1, 2013 » 2,600 dealerships in the U.S.1 » Products include: Retail loans, lease and dealer lending » Chrysler subvention dollars enhance access to prime and nonprime customers » Ability to sell higher quality loans with lower margins and retain servicing increases servicing revenue » Residual risk-sharing agreement with Chrysler for leases 1 Source: Chrysler Company filings and Ward Automotive Reports as published by the U.S. Department of Commerce, Bureau of Economic Analysis 2 Automotive News 3 As of December 31, 2014 The optimal success, per the terms of the agreement between Chrysler and SCUSA, is dependent upon the ability of both parties to meet and uphold certain agreed-upon standards defined in the agreement Chrysler treats SCUSA in a manner consistent with comparable OEMs’ treatment of their captive finance providers SCUSA meets penetration and approval rate targets and maintains service-level standards Since its May 1, 2013 launch, Chrysler Capital has originated approximately $19.1 billion in retail loans and $6.8 billion in leases, and facilitated the origination of more than $2.4 billion in leases and dealer loans for an affiliate3 1.1 1.4 1.7 1.8 2010 2011 2012 2013 2014 Chrysler Sales 14% CAGR 2.1 CHRYSLER CAPITAL 9 2

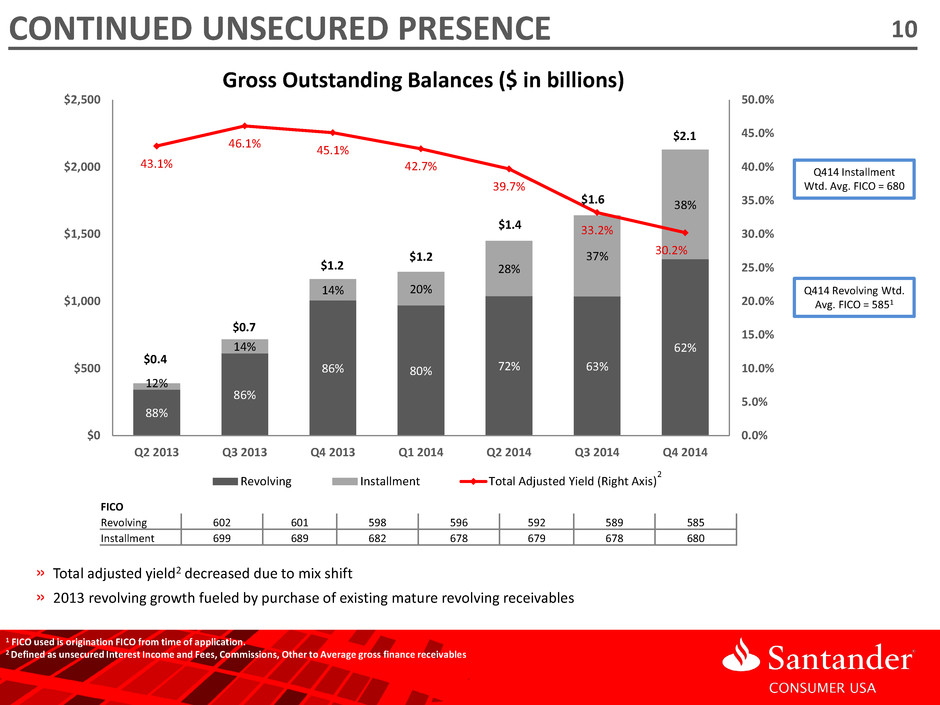

88% 86% 86% 80% 72% 63% 62% 12% 14% 14% 20% 28% 37% 38% 43.1% 46.1% 45.1% 42.7% 39.7% 33.2% 30.2% 0.0% 5.0% 10.0% 15.0% 20.0% 25.0% 30.0% 35.0% 40.0% 45.0% 50.0% $0 $500 $1,000 $1,500 $2,000 $2,500 Q2 2013 Q3 2013 Q4 2013 Q1 2014 Q2 2014 Q3 2014 Q4 2014 Gross Outstanding Balances ($ in billions) Revolving Installment Total Adjusted Yield (Right Axis) » Total adjusted yield2 decreased due to mix shift Q414 Revolving Wtd. Avg. FICO = 5851 1 FICO used is origination FICO from time of application. 2 Defined as unsecured Interest Income and Fees, Commissions, Other to Average gross finance receivables » 2013 revolving growth fueled by purchase of existing mature revolving receivables Q414 Installment Wtd. Avg. FICO = 680 2 FICO Revolving 602 601 598 596 592 589 585 Installment 699 689 682 678 679 678 680 10 CONTINUED UNSECURED PRESENCE $0.4 $0.7 $1.2 $1.2 $1.4 $1.6 $2.1

KEY COMPLIANCE PROGRAM ELEMENTS 11 Program leverages history of big bank ownership and compliance culture » CEO tone from the top » Bank-affiliated for 14 years » Three lines of defense » Compliance involved at all levels Compliance Culture » Committee structures in place » Integrated into Risk Framework Governance » Expanded Regulatory Liaison team Compliance Staffing » Updated annually and located in centralized intranet for ease of associate access Policies and Procedures » Compliance monitoring and testing based on Comprehensive Risk Assessments Monitoring and Testing » Escalated complaint process » Expansion of vendor oversight Complaints » Mandatory annual regulatory training delivered to all associates, management and the Board Training

AGENDA Highlights Strategy and Business Appendix: Financial and Supplemental Information Results 12

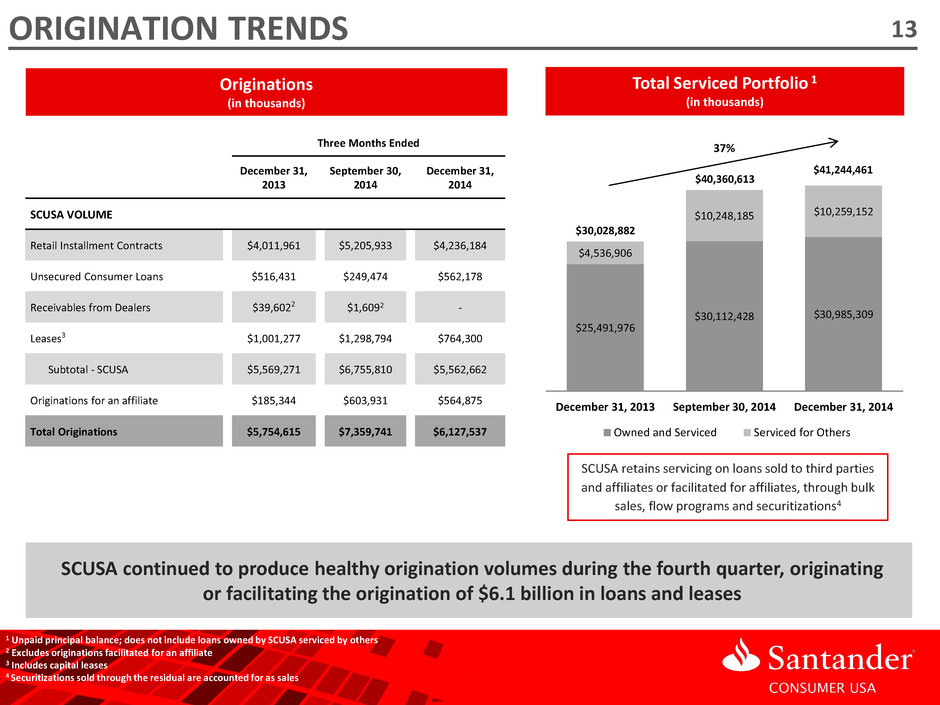

$25,491,976 $30,112,428 $30,985,309 $4,536,906 $10,248,185 $10,259,152 December 31, 2013 September 30, 2014 December 31, 2014 Owned and Serviced Serviced for Others Total Serviced Portfolio 1 (in thousands) ORIGINATION TRENDS SCUSA continued to produce healthy origination volumes during the fourth quarter, originating or facilitating the origination of $6.1 billion in loans and leases Originations (in thousands) SCUSA retains servicing on loans sold to third parties and affiliates or facilitated for affiliates, through bulk sales, flow programs and securitizations4 $40,360,613 1 Unpaid principal balance; does not include loans owned by SCUSA serviced by others 2 Excludes originations facilitated for an affiliate 3 Includes capital leases 4 Securitizations sold through the residual are accounted for as sales 37% $41,244,461 $30,028,882 13 Three Months Ended December 31, 2013 September 30, 2014 December 31, 2014 SCUSA VOLUME Retail Installment Contracts $4,011,961 $5,205,933 $4,236,184 Unsecured Consumer Loans $516,431 $249,474 $562,178 Receivables from Dealers $39,6022 $1,6092 - Leases3 $1,001,277 $1,298,794 $764,300 Subtotal - SCUSA $5,569,271 $6,755,810 $5,562,662 Originations for an affiliate $185,344 $603,931 $564,875 Total Originations $5,754,615 $7,359,741 $6,127,537

$26,402 $28,796 $29,732 $30,641 $32,250 $203 $199 $211 $202 $230 19.2% 16.9% 17.4% 16.0% 19.1% Q4 2013 Q1 2014 Q2 2014 Q3 2014 Q4 2014 Total Assets Operating Expenses Efficiency Ratio 1 $120 $319 1 INCOME & OPERATING EXPENSES Highlights » In an environment of continued competition and increased expenses, SCUSA continues to produce steady returns, with fourth quarter 2014 net income2 of $247.0 million, up 117 percent year-over-year » Fourth quarter net finance and other interest income increased $119.8 million, or 13 percent, from fourth quarter 2013, driven by the 25 percent year-over-year increase in the average portfolio » SCUSA continues to demonstrate industry-leading efficiency, evidencing continued ability to scale despite increases in regulatory and compliance costs 1 Q1 2014 core net income and operating expenses adjusted for $119.8 pre-tax ($75.8 after-tax) million non-recurring stock compensation and other IPO-related expenses; reconciliation on slide 26 2 GAAP net income attributable to SCUSA shareholders Income ($ in millions) $953 $1,043 $1,076 $1,114 $1,073 $114 $246 $191 $247 14.6% 14.8% 14.3% 14.1% 13.1% Q4 2013 Q1 2014 Q2 2014 Q3 2014 Q4 2014 Net Finance and Other Interest Income Net Income Net Interest Margin $76 $81 $157 1 14 Expenses and Efficiency Ratio ($ in millions)

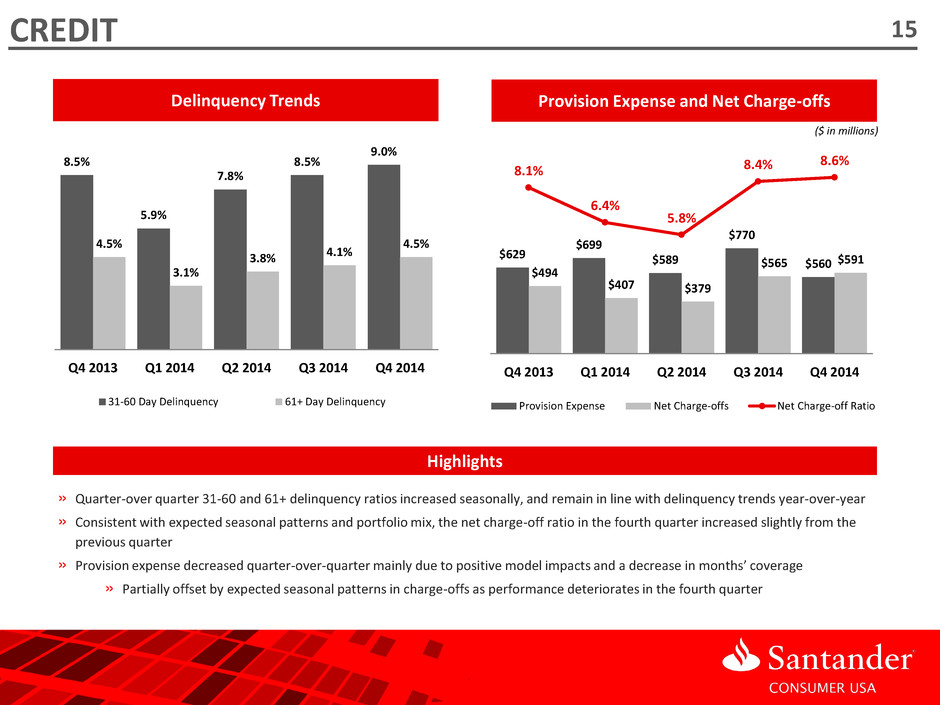

» Quarter-over quarter 31-60 and 61+ delinquency ratios increased seasonally, and remain in line with delinquency trends year-over-year » Consistent with expected seasonal patterns and portfolio mix, the net charge-off ratio in the fourth quarter increased slightly from the previous quarter » Provision expense decreased quarter-over-quarter mainly due to positive model impacts and a decrease in months’ coverage » Partially offset by expected seasonal patterns in charge-offs as performance deteriorates in the fourth quarter $629 $699 $589 $770 $560 $494 $407 $379 $565 $591 8.1% 6.4% 5.8% 8.4% 8.6% Q4 2013 Q1 2014 Q2 2014 Q3 2014 Q4 2014 Provision Expense Net Charge-offs Net Charge-off Ratio CREDIT ($ in millions) Highlights Delinquency Trends 8.5% 5.9% 7.8% 8.5% 9.0% 4.5% 3.1% 3.8% 4.1% 4.5% Q4 2013 Q1 2014 Q2 2014 Q3 2014 Q4 2014 31-60 Day Delinquency 61+ Day Delinquency Provision Expense and Net Charge-offs 15

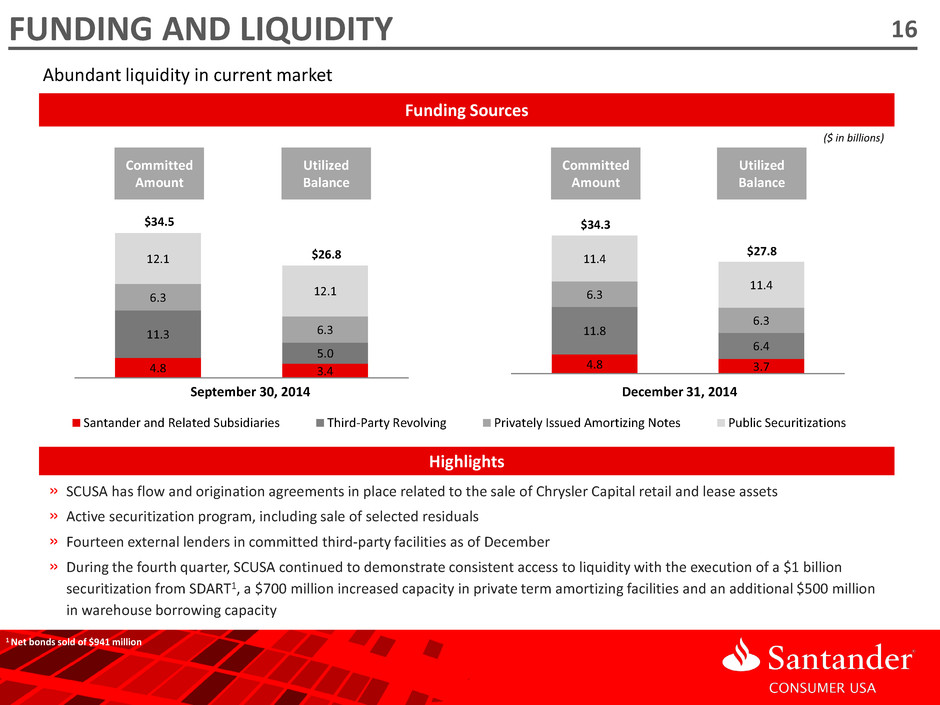

4.8 3.7 11.8 6.4 6.3 6.3 11.4 11.4 Santander and Related Subsidiaries Third-Party Revolving Privately Issued Amortizing Notes Public Securitizations FUNDING AND LIQUIDITY Funding Sources Highlights 16 4.8 3.4 11.3 5.0 6.3 6.3 12.1 12.1 Committed Amount Utilized Balance Committed Amount Utilized Balance September 30, 2014 December 31, 2014 $34.3 $27.8 Abundant liquidity in current market ($ in billions) $34.5 $26.8 » SCUSA has flow and origination agreements in place related to the sale of Chrysler Capital retail and lease assets » Active securitization program, including sale of selected residuals » Fourteen external lenders in committed third-party facilities as of December » During the fourth quarter, SCUSA continued to demonstrate consistent access to liquidity with the execution of a $1 billion securitization from SDART1, a $700 million increased capacity in private term amortizing facilities and an additional $500 million in warehouse borrowing capacity 1 Net bonds sold of $941 million

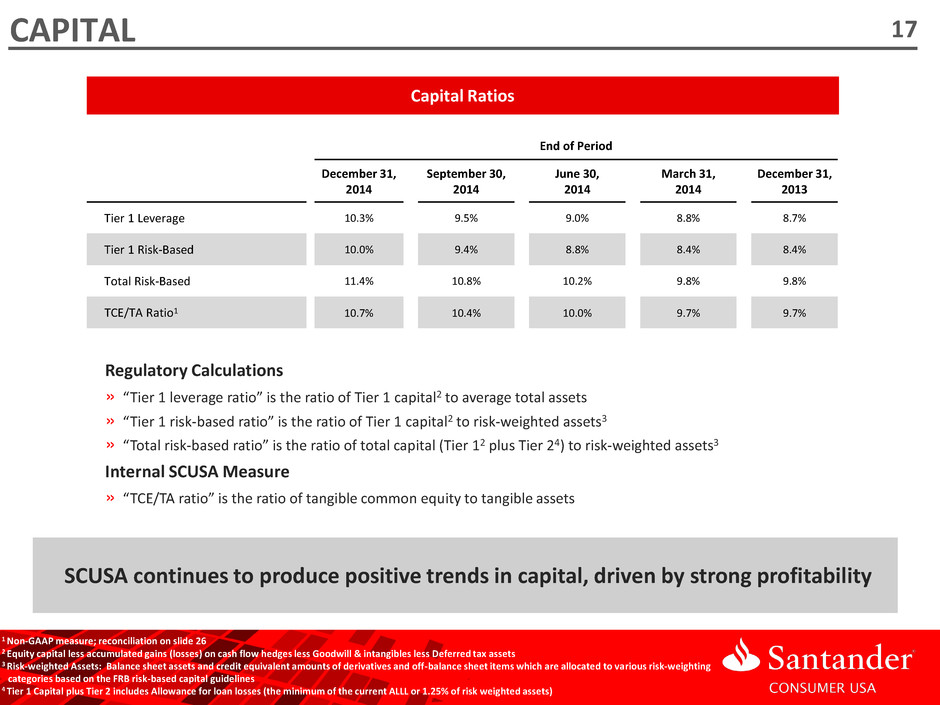

End of Period December 31, 2014 September 30, 2014 June 30, 2014 March 31, 2014 December 31, 2013 Tier 1 Leverage 10.3% 9.5% 9.0% 8.8% 8.7% Tier 1 Risk-Based 10.0% 9.4% 8.8% 8.4% 8.4% Total Risk-Based 11.4% 10.8% 10.2% 9.8% 9.8% TCE/TA Ratio1 10.7% 10.4% 10.0% 9.7% 9.7% SCUSA continues to produce positive trends in capital, driven by strong profitability Capital Ratios 1 Non-GAAP measure; reconciliation on slide 26 2 Equity capital less accumulated gains (losses) on cash flow hedges less Goodwill & intangibles less Deferred tax assets 3 Risk-weighted Assets: Balance sheet assets and credit equivalent amounts of derivatives and off-balance sheet items which are allocated to various risk-weighting categories based on the FRB risk-based capital guidelines 4 Tier 1 Capital plus Tier 2 includes Allowance for loan losses (the minimum of the current ALLL or 1.25% of risk weighted assets) Regulatory Calculations » “Tier 1 leverage ratio” is the ratio of Tier 1 capital2 to average total assets » “Tier 1 risk-based ratio” is the ratio of Tier 1 capital2 to risk-weighted assets3 » “Total risk-based ratio” is the ratio of total capital (Tier 12 plus Tier 24) to risk-weighted assets3 Internal SCUSA Measure » “TCE/TA ratio” is the ratio of tangible common equity to tangible assets 17 CAPITAL

AGENDA Highlights Strategy and Business Appendix: Financial and Supplemental Information Results 18

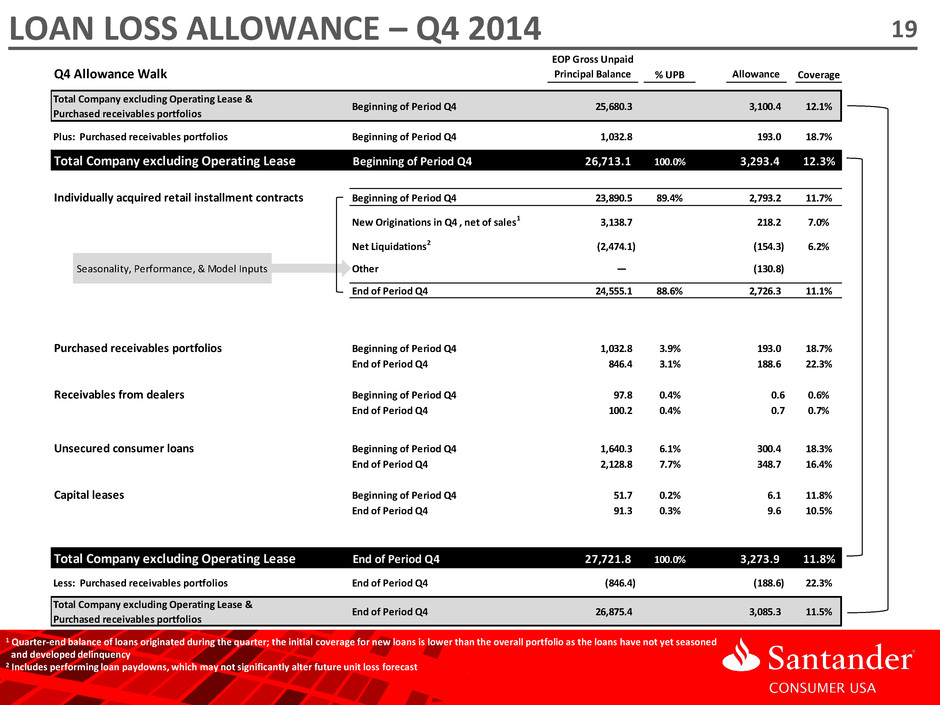

LOAN LOSS ALLOWANCE – Q4 2014 19 1 Quarter-end balance of loans originated during the quarter; the initial coverage for new loans is lower than the overall portfolio as the loans have not yet seasoned and developed delinquency 2 Includes performing loan paydowns, which may not significantly alter future unit loss forecast Q4 Allowance Walk EOP Gross Unpaid Principal Balance % UPB Allowance Coverage Beginning of Period Q4 25,680.3 3,100.4 12.1% Plus: Purchased receivables portfolios Beginning of Period Q4 1,032.8 193.0 18.7% Total Company excluding Operating Lease Beginning of Period Q4 26,713.1 100.0% 3,293.4 12.3% Individually acquired retail installment contracts Beginning of Period Q4 23,890.5 89.4% 2,793.2 11.7% New Originations in Q4 , net of sales1 3,138.7 218.2 7.0% Net Liquidations2 (2,474.1) (154.3) 6.2% Seasonality, Performance, & Model Inputs Other — (130.8) End of Period Q4 24,555.1 88.6% 2,726.3 11.1% Purchased receivables portfolios Beginning of Period Q4 1,032.8 3.9% 193.0 18.7% End of Period Q4 846.4 3.1% 188.6 22.3% Receivables from dealers Beginning of Period Q4 97.8 0.4% 0.6 0.6% End of Period Q4 100.2 0.4% 0.7 0.7% Unsecured consumer loans Beginning of Period Q4 1,640.3 6.1% 300.4 18.3% End of Period Q4 2,128.8 7.7% 348.7 16.4% Capital leases Beginning of Period Q4 51.7 0.2% 6.1 11.8% End of Period Q4 91.3 0.3% 9.6 10.5% Total Company excluding Operating Lease End of Period Q4 27,721.8 100.0% 3,273.9 11.8% Less: Purchased receivables portfolios End of Period Q4 (846.4) (188.6) 22.3% End of Period Q4 26,875.4 3,085.3 11.5% Total Company excluding Operating Lease & Purchased receivables portfolios Total Company excluding Operating Lease & Purchased receivables portfolios

COMPANY ORGANIZATION 20 Banco Santander, S.A. Spain dba Chrysler Capital Other Subsidiaries Centerbridge Other Subsidiaries Santander Holdings USA, Inc. (f/k/a Sovereign Bancorp Inc.) Santander Bank N.A. (f/k/a Sovereign Bank) Sponsor Auto Finance Holdings Series LP DDFS LLC (Tom Dundon) Santander Consumer USA Holdings Inc. (“SCUSA”) Public Shareholders Other Management 100% Ownership 60.5% Ownership **Ownership percentages are approximates as of December 31, 2014 1 Beneficial Ownership includes options currently exercisable or exercisable within 60 days of December 31, 2014 0.3% Ownership 29.1% Ownership 10.0% Ownership (13.3% Beneficial Ownership) 1 0.1% Ownership (0.6% Beneficial Ownership) 1

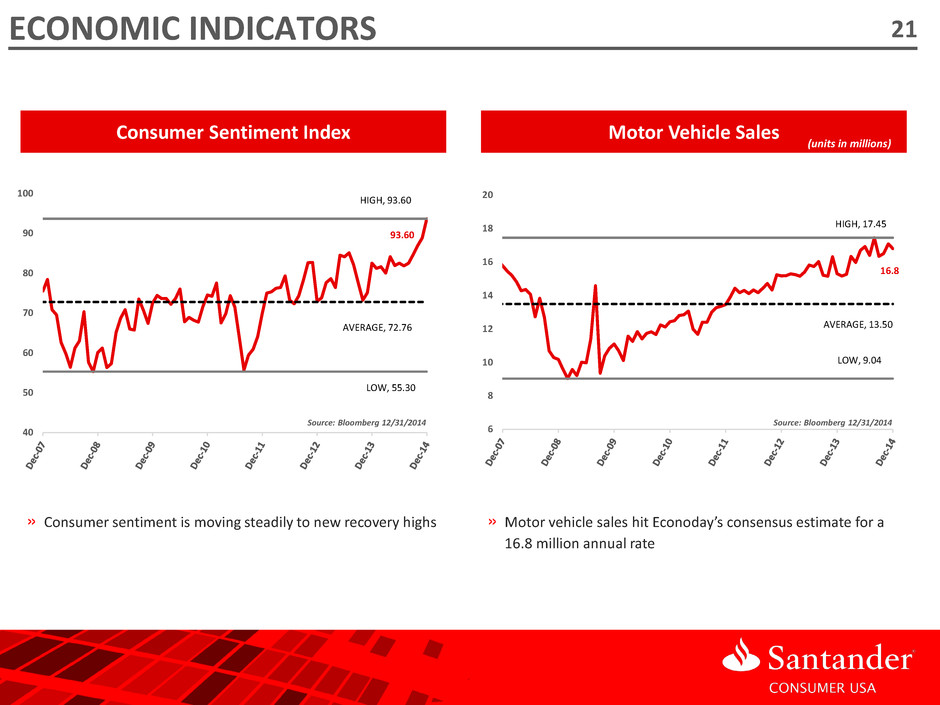

16.8 AVERAGE, 13.50 HIGH, 17.45 LOW, 9.04 6 8 10 12 14 16 18 20 AVERAGE, 72.76 HIGH, 93.60 93.60 LOW, 55.30 40 50 60 70 80 90 100 ECONOMIC INDICATORS Consumer Sentiment Index Motor Vehicle Sales » Motor vehicle sales hit Econoday’s consensus estimate for a 16.8 million annual rate » Consumer sentiment is moving steadily to new recovery highs (units in millions) 21 Source: Bloomberg 12/31/2014 Source: Bloomberg 12/31/2014

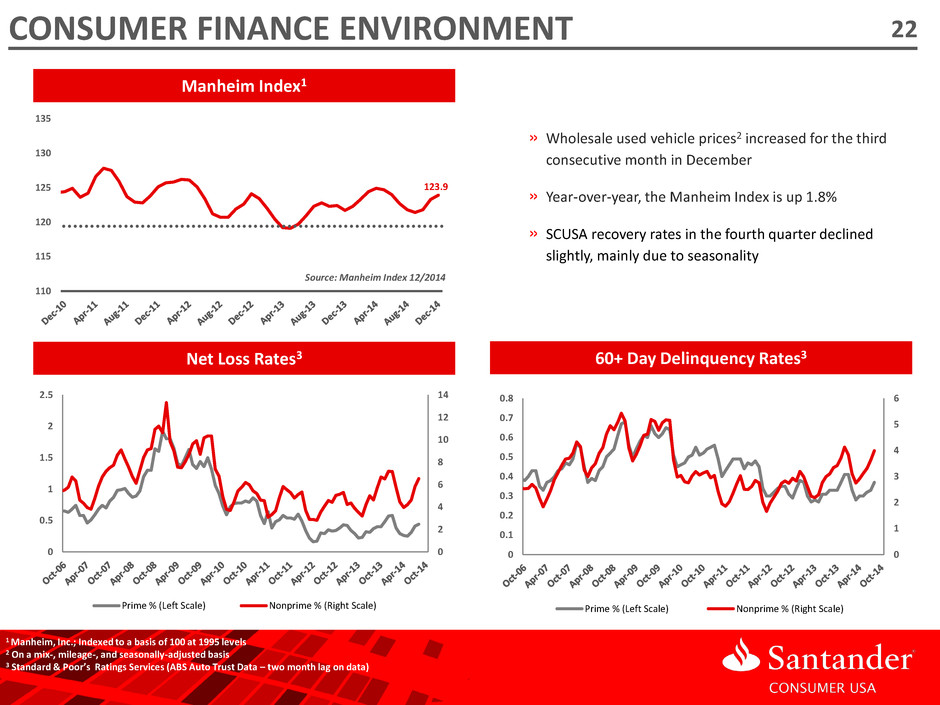

CONSUMER FINANCE ENVIRONMENT 22 1 Manheim, Inc.; Indexed to a basis of 100 at 1995 levels 2 On a mix-, mileage-, and seasonally-adjusted basis 3 Standard & Poor’s Ratings Services (ABS Auto Trust Data – two month lag on data) » Wholesale used vehicle prices2 increased for the third consecutive month in December » Year-over-year, the Manheim Index is up 1.8% » SCUSA recovery rates in the fourth quarter declined slightly, mainly due to seasonality 60+ Day Delinquency Rates3 Net Loss Rates3 Manheim Index1 123.9 110 115 120 125 130 135 Source: Manheim Index 12/2014 0 2 4 6 8 10 12 14 0 0.5 1 1.5 2 2.5 Prime % (Left Scale) Nonprime % (Right Scale) 0 1 2 3 4 5 6 0 0.1 0.2 0.3 0.4 0.5 0.6 0.7 0.8 Prime % (Left Scale) Nonprime % (Right Scale)

CREDIT PROFILES 26.8% 31.8% 26.3% 15.1% 27.0% 32.2% 26.1% 14.6% 26.7% 32.3% 26.5% 14.5% 26.9% 33.2% 26.5% 13.4% 26.4% 32.6% 26.4% 14.6% 0% 10% 20% 30% 40% <540 540-599 600-659 >660 Q4 2013 Q1 2014 Q2 2014 Q3 2014 Q4 2014 Retail Installment Contracts1 FICO Bands Unsecured Consumer Loans 6.3% 24.2% 39.4% 30.1% 3.5% 27.6% 43.9% 25.0% 10.0% 21.3% 40.9% 27.8% 3.2% 20.7% 35.6% 40.5% 3.3% 20.1% 34.3% 42.4% 0% 10% 20% 30% 40% 50% <540 540-599 600-659 >660 Q4 2013 Q1 2014 Q2 2014 Q3 2014 Q4 2014 FICO Bands 1 Held for investment; excludes prime assets held for sale ($45.4 million retail installment contracts held for sale as of December 31, 2014) 23

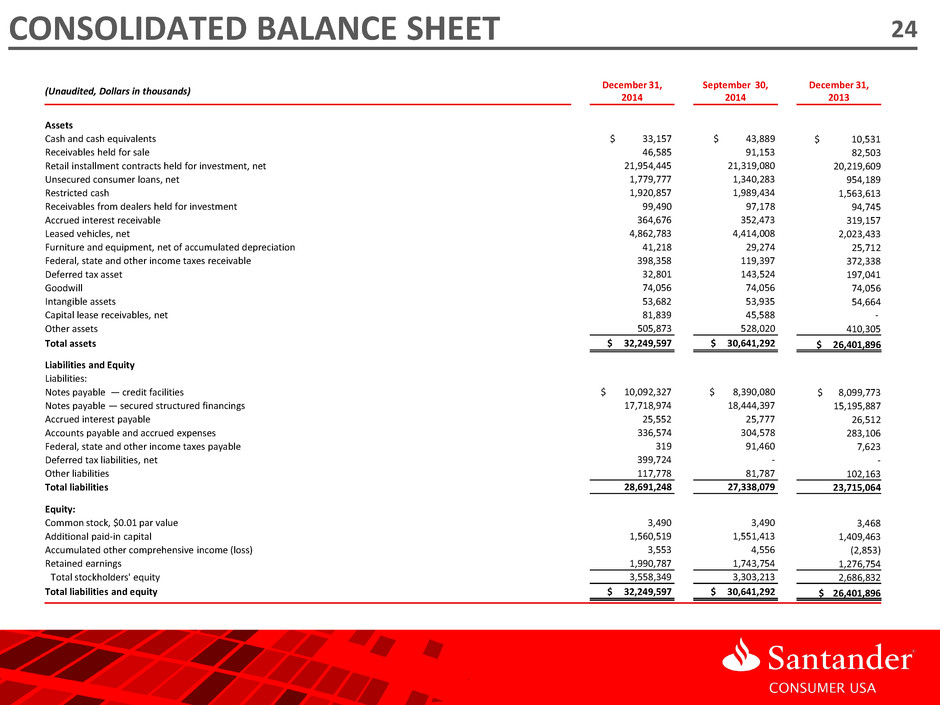

CONSOLIDATED BALANCE SHEET (Unaudited, Dollars in thousands) December 31, 2014 September 30, 2014 December 31, 2013 Assets Cash and cash equivalents $ 33,157 $ 43,889 $ 10,531 Receivables held for sale 46,585 91,153 82,503 Retail installment contracts held for investment, net 21,954,445 21,319,080 20,219,609 Unsecured consumer loans, net 1,779,777 1,340,283 954,189 Restricted cash 1,920,857 1,989,434 1,563,613 Receivables from dealers held for investment 99,490 97,178 94,745 Accrued interest receivable 364,676 352,473 319,157 Leased vehicles, net 4,862,783 4,414,008 2,023,433 Furniture and equipment, net of accumulated depreciation 41,218 29,274 25,712 Federal, state and other income taxes receivable 398,358 119,397 372,338 Deferred tax asset 32,801 143,524 197,041 Goodwill 74,056 74,056 74,056 Intangible assets 53,682 53,935 54,664 Capital lease receivables, net 81,839 45,588 - Other assets 505,873 528,020 410,305 Total assets $ 32,249,597 $ 30,641,292 $ 26,401,896 Liabilities and Equity Liabilities: Notes payable — credit facilities $ 10,092,327 $ 8,390,080 $ 8,099,773 Notes payable — secured structured financings 17,718,974 18,444,397 15,195,887 Accrued interest payable 25,552 25,777 26,512 Accounts payable and accrued expenses 336,574 304,578 283,106 Federal, state and other income taxes payable 319 91,460 7,623 Deferred tax liabilities, net 399,724 - - Other liabilities 117,778 81,787 102,163 Total liabilities 28,691,248 27,338,079 23,715,064 Equity: Common stock, $0.01 par value 3,490 3,490 3,468 Additional paid-in capital 1,560,519 1,551,413 1,409,463 Accumulated other comprehensive income (loss) 3,553 4,556 (2,853) Retained earnings 1,990,787 1,743,754 1,276,754 Total stockholders' equity 3,558,349 3,303,213 2,686,832 Total liabilities and equity $ 32,249,597 $ 30,641,292 $ 26,401,896 24

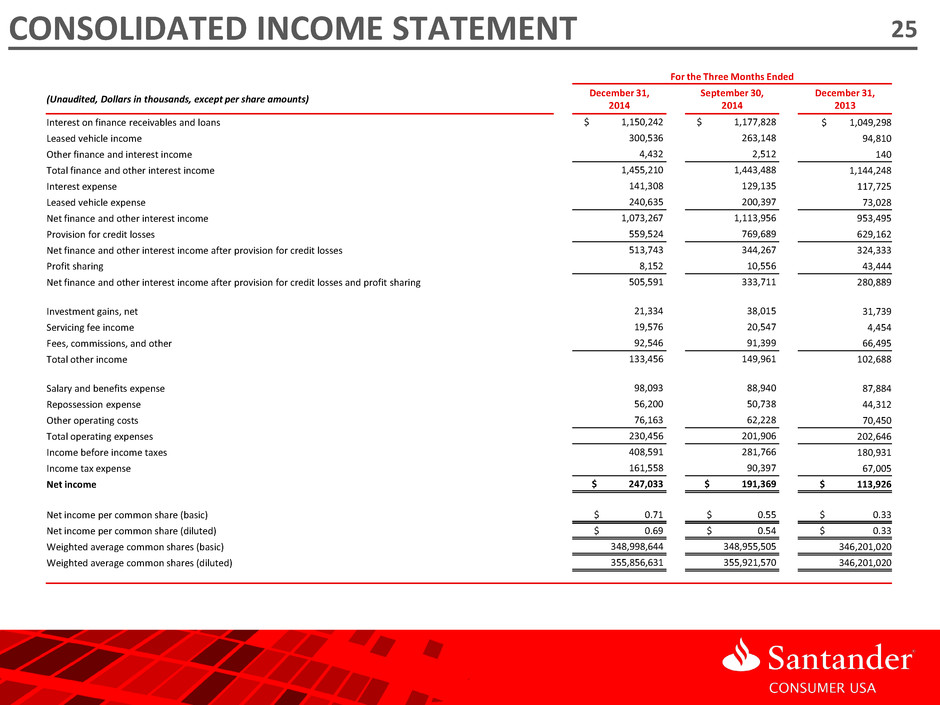

CONSOLIDATED INCOME STATEMENT For the Three Months Ended (Unaudited, Dollars in thousands, except per share amounts) December 31, 2014 September 30, 2014 December 31, 2013 Interest on finance receivables and loans $ 1,150,242 $ 1,177,828 $ 1,049,298 Leased vehicle income 300,536 263,148 94,810 Other finance and interest income 4,432 2,512 140 Total finance and other interest income 1,455,210 1,443,488 1,144,248 Interest expense 141,308 129,135 117,725 Leased vehicle expense 240,635 200,397 73,028 Net finance and other interest income 1,073,267 1,113,956 953,495 Provision for credit losses 559,524 769,689 629,162 Net finance and other interest income after provision for credit losses 513,743 344,267 324,333 Profit sharing 8,152 10,556 43,444 Net finance and other interest income after provision for credit losses and profit sharing 505,591 333,711 280,889 Investment gains, net 21,334 38,015 31,739 Servicing fee income 19,576 20,547 4,454 Fees, commissions, and other 92,546 91,399 66,495 Total other income 133,456 149,961 102,688 Salary and benefits expense 98,093 88,940 87,884 Repossession expense 56,200 50,738 44,312 Other operating costs 76,163 62,228 70,450 Total operating expenses 230,456 201,906 202,646 Income before income taxes 408,591 281,766 180,931 Income tax expense 161,558 90,397 67,005 Net income $ 247,033 $ 191,369 $ 113,926 Net income per common share (basic) $ 0.71 $ 0.55 $ 0.33 Net income per common share (diluted) $ 0.69 $ 0.54 $ 0.33 Weighted average common shares (basic) 348,998,644 348,955,505 346,201,020 Weighted average common shares (diluted) 355,856,631 355,921,570 346,201,020 25

RECONCILIATION OF NON-GAAP MEASURES » Core performance 26 (Dollars in thousands, except per share data) December 31, 2014 September 30, 2014 June 30, 2014 March 31, 2014 December 31, 2013 Total equity $3,558,349 $3,303,213 $3,102,258 $2,908,018 $2,686,832 Deduct: Goodwill and intangibles (127,738) (127,991) (127,693) (128,447) (128,720) Tangible common equity $3,430,611 $3,175,222 $2,974,565 $2,779,571 $2,558,112 Total assets $32,249,597 $30,641,292 $29,732,396 $28,796,233 $26,401,896 Deduct: Goodwill and intangibles (127,738) (127,991) (127,693) (128,447) (128,720) Tangible assets $32,121,859 $30,513,301 $29,604,703 $28,667,786 $26,273,176 Equity to assets ratio 11.0% 10.8% 10.4% 10.1% 10.2% Tangible common equity to tangible assets 10.7% 10.4% 10.0% 9.7% 9.7% For the Year Ended December 31, 2014 Three Months Ended March 31, 2014 Net income $766,349 $81,466 Add back: Stock compensation recognized upon IPO, net of tax 74,428 74,428 Other IPO-related expenses, net of tax 1,409 1,409 Core net income $842,186 $157,303 Weighted average common shares (diluted) 355,722,363 356,325,036 Net income per common share (diluted) $2.15 $0.23 Core net income per common share (diluted) $2.37 $0.44 Average total assets $29,173,189 $27,812,499 Return on average assets 2.40% 1.2% Core return on average assets 2.70% 2.3% Average total equity $2,997,634 $2,809,838 Return on average equity 23.10% 11.6% Core return on average equity 26.50% 22.4% Operating expenses $731,580 $318,448 Deduct: Stock compensation recognized upon IPO -117,654 (117,654) Other IPO-related expenses -2,175 (2,175) Core operating expenses $611,750 $198,619 Sum of net finance and other interest income and other income $3,657,169 $1,178,710 Efficiency ratio 20.00% 27.0% Core efficiency ratio 16.70% 16.9%

Strictly Private & Confidential