Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Cullen Agricultural Holding Corp | v397972_8k.htm |

| EX-10.3 - EXHIBIT 10.3 - Cullen Agricultural Holding Corp | v397972_ex10-3.htm |

| EX-2.1 - EXHIBIT 2.1 - Cullen Agricultural Holding Corp | v397972_ex2-1.htm |

| EX-99.1 - EXHIBIT 99.1 - Cullen Agricultural Holding Corp | v397972_ex99-1.htm |

| EX-10.1 - EXHIBIT 10.1 - Cullen Agricultural Holding Corp | v397972_ex10-1.htm |

| EX-10.2 - EXHIBIT 10.2 - Cullen Agricultural Holding Corp | v397972_ex10-2.htm |

Exhibit 99.2

January 2015

Disclaimer THIS PRESENTATION HAS BEEN PREPARED FOR USE BY CULLEN AGRICULTURAL HOLDING CORP. (“CULLEN”) AND LONG ISLAND BRAND BEVERAGES, LLC (“LIBB”) IN CONNECTION WITH THEIR PROPOSED BUSINESS COMBINATION. CULLEN AND ITS DIRECTORS AND EXECUTIVE OFFICERS MAY BE DEEMED TO BE PARTICIPANTS IN THE SOLICITATION OF PROXIES FOR THE SPECI AL MEETING OF CULLEN STOCKHOLDERS TO BE HELD TO APPROVE THE BUSINESS COMBINATION (THE “SPECIAL MEETING”). STOCKHOLDERS OF CULLEN AND OTHER INTERESTED PERSONS ARE ADVISED TO READ, WHEN AVAILABLE, CULLEN’S PRELIMINARY AND DEFINITIVE PROXY STATEMENTS IN CONNECTION WITH CULLEN’S SOLICITATION OF PROXIES FOR THE SPECIAL MEETING AND THE REGISTRATION STATEMENT TO BE FILED BY CULLEN’S WHOLLY OWNED SUBSIDIARY, LONG ISLAND ICED TEA CORP. (“HOLDCO”), IN CONNECTION WITH THE ISSUANCE OF SHARES OF COMMON STOCK OF HOLDCO IN THE TRANSACTION, BECAUSE THESE DOCUMENTS WILL CONTAIN IMPORTANT INFORMATION. SUCH PERSONS CAN ALSO READ CULLEN’S ANNUAL REPORT ON FORM 10 - K FOR THE FISCAL YEAR ENDED DECEMBER 31, 2013, FOR A DESCRIPTION OF THE SECURITY HOLDINGS OF THE CULLEN OFFICERS AND DIRECTORS AND THEIR RESPECTIVE INTERESTS AS SECURITY HOLDERS IN THE SUCCESSF UL CONSUMMATION OF THE BUSINESS COMBINATION. THE DEFINITIVE PROXY STATEMENT AND FINAL PROSPECTUS INCLUDED IN HOLDCO’S REGISTRATION STATEMENT WILL BE MAILED TO CULLEN’S STOCKHOLDERS AS OF A RECORD DATE TO BE ESTABLISHED FOR VOTING ON THE TRANSACTION. STOCKHOLDERS WILL ALSO BE ABLE TO OBTAIN A COPY OF SUCH DOCUMENTS, WITHOUT CHARGE, BY DIRECTING A REQUEST TO CULLEN AGRICULTURAL HOLDING CORP., C/O PAUL VASSILAKOS, 180 MADISON AVENUE, SUITE 1702, NEW YORK, NEW YORK 10016. THESE DOCUMENTS, ONCE AVAILABLE, AND CULLEN’S ANNUAL REPORT ON FORM 10 - K CAN ALSO BE OBTAINED, WITHOUT CHARGE, AT THE SECURITIES AND EXCHANGE COMMISSION’S INTERNET SITE (HTTP://WWW.SEC.GOV). NEITHER CULLEN NOR LIBB UNDERTAKE ANY OBLIGATION TO UPDATE OR REVISE ANY FORWARD - LOOKING STATEMENTS, WHETHER AS A RESULT OF NEW INFORMATION, FUTURE EVENTS OR OTHERWISE. IMPORTANT FACTORS, AMONG OTHERS, THAT MAY AFFECT ACTUAL RESULTS INCLUDE: UNCERTAINTIES AS TO THE TIMING OF THE PROPOSED TRANSACTION; THE SATISFACTION OF CLOSING CONDITIONS TO THE PROPOSED TRANSACTION; COSTS RELATED TO THE PROPOSED TRANSACTION; CHANGES IN ECONOMIC CONDITIONS GENERALLY, CHANGES IN LIBB’S INDUSTRY; LEGISLATIVE AND REGULATORY CHANGES; AVAILABILITY OF DEBT AND EQUITY CAPITAL TO LIBB ON FAVORABLE TERMS, OR AT ALL; THE DEGREE AND NATURE OF LIBB’S COMPETITION; AND LIBB’S DEPENDENCE ON ITS KEY EMPLOYEES . NEITHER CULLEN NOR LIBB MAKES ANY REPRESENTATION OR WARRANTY AS TO THE ACCURACY OR COMPLETENESS OF THE INFORMATION CONTAINED IN THIS PRESENTATION. THIS PRESENTATION IS NOT INTENDED TO BE ALL - INCLUSIVE OR TO CONTAIN ALL THE INFORMATION THAT A PERSON MAY DESIRE IN CONSIDERING AN INVESTMENT IN CULLEN AND IS NOT INTENDED TO FORM THE BASIS OF ANY INVESTMENT DECISION IN CULLEN. THIS PRESENTATION SHALL NOT CONSTITUTE AN OFFER TO SELL OR THE SOLICITATION OF AN OFFER TO BUY ANY SECURITIES, NOR SHALL THER E BE ANY SALE OF SECURITIES IN ANY JURISDICTIONS IN WHICH SUCH OFFER, SOLICITATION OR SALE WOULD BE UNLAWFUL PRIOR TO REGISTRATION OR QUALIFICATION UNDER THE SECURITIES LAWS OF ANY SUCH JURISDICTION.

INTRODUCTION TO LONG ISLAND ICED TEA PRODUCT OVERVIEW MARKETING & BRANDING GROWTH OPPORTUNITY Competitive Analysis FINANCIAL HIGHLIGHTS

Introduction Market Opportunity: Ready - to - drink (“RTD”) tea market projected to grow at more than 10% annually during next five years, and market becoming increasingly fragmented as healthier upstarts encroach on dominant brands Global Brand Potential: Immediate recognition and consideration for brand name Mass Market Proposition: Value from a premium quality beverage at an accessible price Healthier - for - You: Brand uses only premium grade teas and cane sugar/sucralose, in addition to all - natural ingredients; vs. use of high fructose corn syrup or aspartame in other leading brands; gluten - free and non - GMO (genetically modified organisms) DISTRIBUTION : Q3 2014 YoY revenue growth of 192% (9/30/14 ), with the brand now available in a multitude of supermarket chains and AOM accounts (All - Other - Markets ); spring/summer 2014 in 30 Northeast Costco locations Increasing Brand Awareness: Investment in first ad campaign in the tri - state area June 2014 Growth Potential Outside U.S.: Strong brand name and value proposition expected to support 2015 plans to expand in key markets outside of the U.S . INTRODUCTION TO LONG ISLAND ICED TEA 4 Source: IBISWorld Industry Report OD4297 : RTD Tea Production in the US (January 2014)

Experienced Management Team PHILIP THOMAS (FOUNDER & CEO) • Over 20 years of beverage experience • Revitalized a 45 year old family owned food and beverage distribution business, Magnum Enterprises, in 2003 by creating strategic partnerships with Coca-Cola , Vitamin Water and Kellogg’s • Founded Capital Link in 2005, involved in a nationally recognized ATM processing network that funds over 13,000 ATMs in all 50 states PETER DYDENSBORG (COO) • Over 30 years of experience in the distribution and building of brands within large corporations, including Keebler, Kellogg's, Coca Cola and Thomas English Muffins • Previously the Director of Sales for Phoenix Beverages, a distributor of multi - platform beverages, from 2004 until joining Long Brand Beverages in 2014 • Senior Zone Manager at Kellogg’s Snacks from 1994 to 2004 James Meehan (CAO ) • Over ten years of public company accounting and auditing experience • Manager at nationally recognized public accounting firm prior to joining Long Island Brand Beverages in June 2014 INTRODUCTION TO LONG ISLAND ICED TEA 5

Business History Spring 2011 July 4, 2011 2012 – 2013 Q1 2014 April 2014 May 2014 June 2014 September 2014 Test pilot in New York Metro area O fficial launch Partnerships with major distributors such as: Phoenix (NY), High Grade and JD Beverages ( NJ), Canada Dry (NJ), Full Circle (PA) and Metro Beverages (PA) Brand investment: Revitalization of logo and packaging; expansion of workforce to over 30 full and part - time employees Available in 30 Costco stores Sam’s Club Showcase Events Northeast marketing campaign and PR Blitz Rollout of 60 calorie bottle to schools INTRODUCTION TO LONG ISLAND ICED TEA 6

INTRODUCTION TO LONG ISLAND ICED TEA PRODUCT OVERVIEW MARKETING & BRANDING GROWTH OPPORTUNITY Competitive Analysis FINANCIAL HIGHLIGHTS

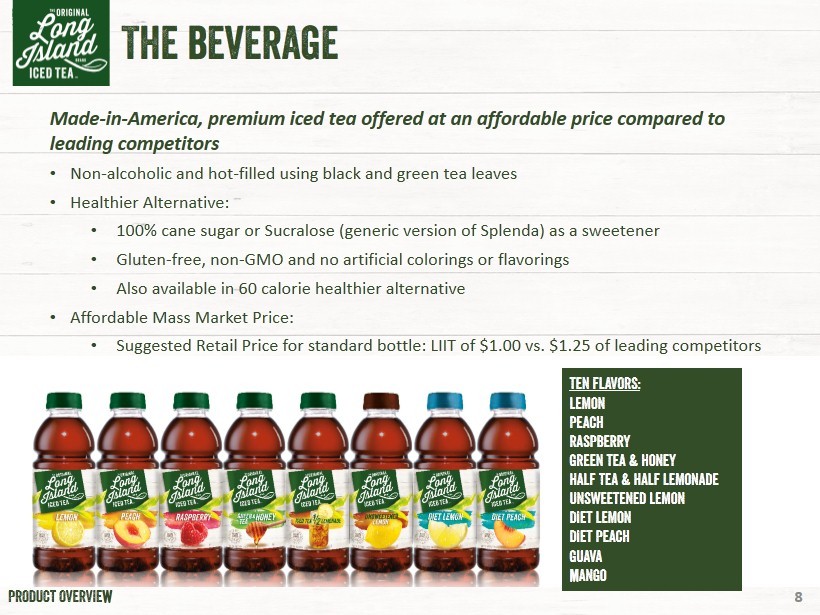

The Beverage Made - in - America, premium iced tea offered at an affordable price compared to leading competitors • Non - alcoholic and hot - filled using black and green tea leaves • Healthier Alternative: • 100 % cane sugar or Sucralose (generic version of Splenda) as a sweetener • Gluten - free, non - GMO and n o artificial colorings or flavorings • Also available in 60 calorie healthier alternative • Affordable M ass Market Price: • Suggested Retail Price for standard bottle: LIIT of $1.00 vs. $1.25 of leading competitors Ten FLAVORS: Lemon Peach Raspberry Green Tea & Honey Half Tea & Half Lemonade Unsweetened Lemon Diet Lemon Diet Peach Guava Mango PRODUCT OVERVIEW 8

Logo & Packaging New branding and packaging completed for spring 2014 CAP COLOR: Green - Regular Blue - Diet Brown - Unsweetened Logo and background evoke summer at the beach (faded signs, white washed houses) Easy to identify flavor name and fruit image Brand’s quality seal noting non - GMO & cane sugar differentiation PRODUCT OVERVIEW LONG ISLAND ICED TEA’S PACKAGING IS A STAND OUT AT RETAIL: • Strong brand logo • Cleaner, simpler packaging vs. competitors • Immediate Iced Tea association • Easy to select flavors 9

INTRODUCTION TO LONG ISLAND ICED TEA PRODUCT OVERVIEW MARKETING & BRANDING GROWTH OPPORTUNITY Competitive Analysis FINANCIAL HIGHLIGHTS

The Brand CREATING A GLOBAL BRAND Name - I mmediate global recognition of phrase “Long Island Iced Tea” Legacy & Wit - Drawing upon the equity of a legendary cocktail and geographic region Quality Ingredients - Premium ingredients, natural cane sugar, non - GMO and gluten - free Locally Brewed - NY - based local brand distributed nationally BRAND GOALS Capitalize on the association with “Long Island Iced Tea” and redefine/expand the globally recognized name Create a well - known slogan related to Long Island Iced Tea MARKETING & BRANDING 11

Mood & Target Consumers LIIT's brand image inspires refreshment, sunny days and the relaxation associated with summer and the beach Key consumer communications include : Original Americana Quirky Fresh Simple Surprising Classic MARKETING & BRANDING 12

PR & Marketing Initiatives IN THE FIELD PR & OTHER June 2014 marketing launch included significant investment in regional advertisement: Out of home billboards website launch “Craft Brewed” “No ID Required” “Just Add Rocks” “There’s No Such Thing As One Too Many” “Buy Your Family A Round” “Put It On Your (Grocery) Tab” TAGLINES: MARKETING & BRANDING celebrity endorsements In - Store demonstrations Facebook twitter Print digital Billboards & Print 13

INTRODUCTION TO LONG ISLAND ICED TEA PRODUCT OVERVIEW MARKETING & BRANDING GROWTH OPPORTUNITY Competitive Analysis FINANCIAL HIGHLIGHTS

Geographic Expansion AGGRESSIVE GROWTH PLAN OVER THE NEXT 12 MONTHS • Market saturation across the entire Northeast • Other top 10 markets planned for 2015 and nationwide by 2016 • Future potential partnerships in Australia, New Zealand and Philippines 2014 2015 2016 GROWTH OPPORTUNITY 15

Growing Sales Channels A multitude of distribution points in the Northeast, covering leading supermarkets, grocery and convenience stores as well as wholesalers GROWTH OPPORTUNITY Regional Chains (Under 150 Stores) National chains (Over 150 Stores) • Costco spring/summer 2014 • Sam’s Club showcase events in spring/summer 2014 • Expanded Shop Rite locations in 2014 • Participating in co - op advertising program • Strong penetration of independent chain markets in NY metro area 16 7 - 11 A&P Associated Supermarkets Best Yet Compare Foods C - Town Fairway Fine Fare Food Bazaar Food Dynasty Food Emporium Foodtown Grace’s Marketplace Gristedes H Mart Handy Pantry Key Food King Kullen North shore Farms Pathmark Pioneer Supermarket ShopRite Stop & Shop SuperFresh Trade Fair Waldbaums Western Beef Wild by Nature Select Distribution Points

INTRODUCTION TO LONG ISLAND ICED TEA PRODUCT OVERVIEW MARKETING & BRANDING GROWTH OPPORTUNITY Competitive Analysis FINANCIAL HIGHLIGHTS

Iced Tea Brand Sales – Summer 2014 Competitive Analysis Source: 1010data (Based on A&P Data) Note: Sales through August 2, 2014 18

Market Share¹ Sugars / Sweeteners Calories per 16oz Bottle² Sugar per 16oz Bottle² N/A Natural Cane Sugar / Sucralose 160 42g Dr Pepper Snapple Group 16.6% Cane or Beet Sugar / Aspartame / Sucralose 150 36g Ferolito, Vultaggio & Sons (Arizona) 30.9% High Fructose Corn Syrup / Sucralose 180 48g Pepsi Lipton Tea Partnership 36.1% Sugar / Sucralose 140 36g Competitor Comparison Competitive Analysis (1) Data for 52 - weeks ending April 21, 2013. Mintel . “Tea and RTD Teas - US, July 2013”. ( 2 ) Nutritional information for regular lemon flavor 19

INTRODUCTION TO LONG ISLAND ICED TEA PRODUCT OVERVIEW MARKETING & BRANDING GROWTH OPPORTUNITY Competitive Analysis FINANCIAL HIGHLIGHTS

21 FINANCIAL HIGHLIGHTS Financial Performance 2012 2013 2014 • LIIT Launched using independent distributors and competitive margins • Major regional distributors secured ( Phoenix & Peerless) • Sam’s Club showcases, Costco rollout and 1,200 retail doors • Northeast ad campaign $376 $158 $210 $307 $200 $170 $175 $753 $583 $0 $300 $600 $900 $1,200 Q3 '12 Q4 '12 Q1 '13 Q2 '13 Q3 '13 Q4 '13 Q1 '14 Q2 '14 Q3 '14 12 - Pack Cases (000) Revenue ($000) 56.8 23.8 31.7 46.2 30.1 25.5 26.3 115.1 88.6 0 40 80 120 160 Q3 '12 Q4 '12 Q1 '13 Q2 '13 Q3 '13 Q4 '13 Q1 '14 Q2 '14 Q3 '14 2015 • Develop Top 10 Markets • Expand in Southeast and Midwest markets 2016/2017 • Nationwide expansion • National ad campaign • Global expansion Note: Effective sales price per 12 pack of $6.65 for distributors and $6.45 for club stores