Attached files

| file | filename |

|---|---|

| 8-K - 8-K - WINDSTREAM HOLDINGS, INC. | d839269d8k.htm |

| EX-99.1 - EX-99.1 - WINDSTREAM HOLDINGS, INC. | d839269dex991.htm |

REIT

Update Call December 18, 2014

Exhibit 99.2 |

Safe

Harbor / Participants in the Proxy Solicitation Windstream claims the protection

of the safe-harbor for forward-looking statements contained in the Private Securities Litigation

Reform

Act

of

1995.

Forward-looking

statements

are

subject

to

uncertainties

that

could

cause

actual

future

events

and

results

to

differ materially from those expressed in the forward-looking statements.

Forward-looking statements include, but are not limited to, statements

regarding the completion of the transaction, the expected benefits of the transaction, the expected financial

attributes of the new Windstream and the REIT including the initial rent amount, the

pro forma dividend and leverage ratio for each company, and the illustrative

trading multiples and values for each company. Such statements are based on estimates,

projections, beliefs, and assumptions that Windstream believes are reasonable but are

not guarantees of future events and results. Actual future events and results of

Windstream may differ materially from those expressed in these forward-looking

statements as a result of a number of important factors.

Factors that could cause actual results to differ materially from those contemplated in

Windstream’s forward-looking statements include, among others: (i)

risks related to the anticipated timing of the proposed separation, the expected tax treatment of the

proposed transaction, the ability of each of Windstream (post-spin) and the new

REIT to conduct and expand their respective businesses following the proposed

spin off, the ability of Windstream to reduce its debt by the currently-anticipated amounts, and

the diversion of management’s attention from regular business concerns; (ii) our

ability to receive, or delays in obtaining, the regulatory approvals required to

complete the spin off, and the risk that Windstream’s board of directors could abandon the

spinoff or modify or change the terms of the spinoff at any time

and for any reason until the spinoff is complete; and (iii) our

ability to obtain stockholder approval of an amendment to our subsidiary’s

certificate of incorporation that will facilitate the REIT spin off without

incurring a large tax liability; (iv) those additional factors under "Risk Factors" in Item 1A of Part I of

Windstream’s Annual Report on Form 10-K for the year ended December 31, 2013,

and in subsequent filings with the Securities and Exchange Commission at

www.sec.gov. Windstream and its directors and executive officers may be deemed

to be participants in the solicitation of proxies from Windstream’s

stockholders with respect to the proposals for which stockholder approval is being sought in advance of the REIT

spin off. Information about Windstream’s directors and executive officers

and their ownership of Windstream’s common stock is set forth in

Windstream’s proxy statement on Schedule 14A filed with the SEC on March 25, 2014 and Windstream’s Annual Report

on Form 10-K for the year ended December 31, 2013. Information regarding the

identity of the potential participants, and any direct or indirect interests

they have in the proposals, by security holdings or otherwise, will be set forth in the proxy statement

and other materials to be filed with the SEC in connection with the proposals.

Windstream’s stockholders are advised to read the proxy statement when it

becomes available because it will contain important information. The proxy statement will be mailed by

Windstream to its stockholders, and investors will also be able to access the proxy

statement and other relevant documents for free once filed with the SEC at

www.sec.gov. 2 |

Today’s Agenda

3

Agenda

Leadership

Review of REIT spinoff

Discussion of updates to the transaction

Progress and timeline

Tony Thomas

President & CEO, Windstream

Previously CFO of Windstream;

most recently REIT CEO

Over 20 years experience in the

communications industry

Bob Gunderman

CFO, Windstream

Previously Windstream Treasurer

–

Interim CFO since Oct. 2014 |

REIT

Spinoff from Windstream 4

Windstream

Today

CS&L

Windstream will spin off certain network assets

into an independent, publicly traded real estate

investment trust or REIT, named Communications

Sales & Leasing (“CS&L)

Windstream retains operational control of the

network assets via a long-term “triple net”

exclusive master lease agreement and will retain

sole responsibility for meeting its existing

regulatory obligations post transaction

Windstream will retain the day-to-day role of

providing advanced network communications

services to businesses and consumers

CS&L will become a new publicly traded real-

estate investment trust that invests in telecom

distribution system assets

Windstream

is separating the business into two independent, publicly traded

companies through a tax-free spinoff of selected network assets

Long-Term

Exclusive

Lease

Agreement

Windstream |

Improving the Transaction Structure to Maximize Value

5

Benefits of New Structure

Updates to Structure

The revised structure improves Windstream’s credit profile, resulting in a

financially stronger anchor tenant for CS&L

Debt reduction and flexibility:

Significantly improves WIN leverage

with:

–

Addl. $150M in debt reduction and

–

Future debt pay down using CS&L stock

of an estimated $850M to $1B,

depending on CS&L valuation

(1)

CS&L retains flexibility to grow and

return capital to shareholders

~20% retention provides WIN the

opportunity to benefit from optimal

CS&L value and enable both

companies to retain financial

flexibility

Ownership:

–

Windstream will distribute ~80% of

CS&L shares to WIN shareholders

–

Remaining ~20% of CS&L shares

used to retire WIN debt

opportunistically within 12 months

of close

–

WIN will vote its REIT shares in

accordance with the vote of the

publicly held shares

Debt for Debt Exchange:

–

Incremental $150M debt issued at

CS&L used for additional debt pay

down at Windstream

(1) Assumes share price based on a OIBDA multiple of 12.5x– 13.9x at

CS&L |

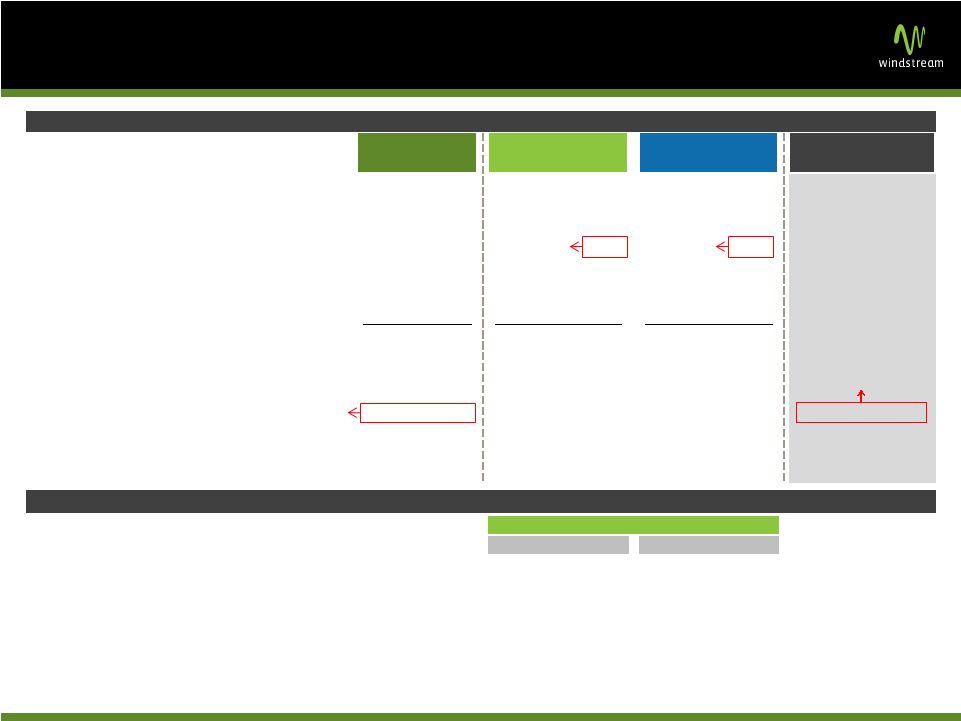

Revised

Transaction Structure Has Multiple Benefits 6

(1) Assumes a 1 for 1 exchange ratio

Strategic benefits remain unchanged: Transaction improves

Windstream’s

financial position and accelerates network investments, creates 2 focused

businesses

and

maximizes

value

for

shareholders

Unchanged

Unchanged

Unchanged

Unchanged

Unchanged

Unchanged

Slightly enhanced by ~$150M less leverage

Temporarily enhanced by benefit of REIT

dividends until disposition

Slightly lower AFFO due to ~$150M additional

leverage

Results in modest change to payout ratio

of less than 200 bps

Significantly enhanced due to future use of CS&L

equity stake to pay down debt

Depending on REIT valuation, could result in

lower net leverage of 0.6x -

0.7x compared

to previous structure

Slightly higher net leverage ratio of 0.2x

Unchanged at $.10 per share

Windstream benefits from temporarily

higher free cash flow from REIT dividends

until liquidation

Unchanged -

at $.60 per share

(1)

Windstream shareholders receiving ~80%

of CSL shares

Lease Payment

Revenue

OIBDA

Free Cash

Flow / AFFO

Leverage

Dividend

Windstream

CS&L |

Value

creation excludes 19.9% of CS&L’s

equity

value retained by New

Windstream

$ 14.23 / 59.9%

Revised Transaction Structure Has Multiple Benefits

(cont’d)

7

Note: For illustrative purposes only and not intended to predict future

share prices of New Windstream or CS&L. Assumes 12/31/14 transaction date for illustrative and pro forma purposes.

CS&L’s indicative share price and dividend per share assumes a 1:1 exchange

ratio. Assumes $650M lease payment from Windstream to CS&L and pay down of ~$3.4B of debt at

Windstream via the debt for debt exchange and cash payment. Assumes New WIN retains

19.9% interest in CS&L (~$1B in value). Excludes transfer of consumer CLEC business.

Current

Current

Triple-Net

REIT Comp

Average

(Dollars in Millions, Except per Share)

Current ILEC

Comp Average

FY15E Revenue

(1)

5,763

$

5,763

$

650

$

FY15E Adjusted OIBDA

(1)

2,064

1,414

630

Assumed Adjusted OIBDA Multiple

6.8x

6.1x

13.9x

Indicative Enterprise Value

13,967

$

8,625

$

8,757

$

(-) Net Debt (as of 12/31/14E)

(2)

(8,600)

(5,250)

(3,550)

(+) Temporary Retained Ownership in CS&L

(3)

---

1,036

---

Indicative Equity Value

5,367

$

4,412

$

5,207

$

Shares Outstanding

603

603

603

Indicative Share Price

8.90

$

7.32

$

8.64

$

Net Leverage

4.2x

3.7x

5.6x

Net Leverage Incl. Temporary Retained Ownership in CS&L

---

3.0x

---

Assuming a CS&L OIBDA Multiple of:

12.5x

13.9x

Windstream Retained Ownership in CS&L

861

$

1,036

$

Net Leverage Including CS&L Stake

3.1x

3.0x

Improvement from Base Case Net Leverage of 3.7x

(0.6x)

(0.7x)

New Structure Improves WIN Leverage and Provides Increased Financial Flexibility

12/31/14

Windstream

Windstream

CS&L

Illustrative Combined

Value / % Change

CS&L Valuation Sensitivity and Resulting New Windstream Net Leverage

(1) FY15E Revenue and adjusted OIBDA equal to Wall St. consensus estimates.

(2) Excludes debt premium. FY14E debt estimated based on FCF and payout ratio guidance.

Assumes Windstream incurs $200M in transaction expenses and financing fees at transaction closing.

(3) Assumes Windstream retains a 19.9% interest in CS&L. The retained

ownership amount excludes transaction fees for the future liquidation of the equity interest and any prepayment

penalties associated with the debt pay down.

|

Growth-focused enterprise

telecom services provider

Separation Creates Two Focused Businesses

8

Enterprise service provider with

advanced capabilities

Differentiated business model focusing

on mid-size business market

Roadmap to sustainable growth with

73% of revenue in growth segments

Financial flexibility to invest in growth

initiatives

REIT

Geographically diverse, high-quality

assets

Ability to grow and diversify both

organically and through acquisition

Capital structure supports shareholder

dividends and financial flexibility to

grow

Sustainable and predictable free cash

flow

Windstream

Yield-oriented REIT focused on

growth and diversification

Strong and improving

balance sheet |

Windstream Strategic Priorities

9

Strengthen

the core business

Invest

for profitable growth

Expand

capabilities

Upgrade and expand

network to provide best in

class user experience

Simplify systems

environment and improve

operational processes to

gain efficiency and scale

Deliver exceptional

customer service

Success based fiber

expansion to enhance

revenue and expenses

Enhance broadband

capabilities and speeds

Transition to IP network

Offer new services

Partner with REIT to

expand opportunities

Strategic M&A

Driving revenue and OIBDA growth |

Communications Sales & Leasing Strategy and Overview

10

Strategy

Invest

in

telecom

distribution

systems

infrastructure,

including

fiber,

copper,

real

estate, and other related fixed assets

Grow FFO per share by partnering with tenants on success-based network expansion

opportunities, strategic acquisitions of telecom infrastructure and growing

lease revenue via rate escalations

Return income to investors through regular dividend distributions

Operations

Anchor tenant:

Windstream

Future customers:

Other carriers and telecommunications services providers

Growth strategy:

Success-based capital investments, M&A and lease escalations

Employees:

~25

Ticker:

CSAL CEO &

Chairman

Skip Frantz, Chairman

CEO: Search underway

Financial

Considerations

Initial lease revenue:

~$650M

(1)

Expected pro forma net leverage:

Expected dividend:

$.60

per

share,

assuming

a

1

for

1

basis

(2)

The REIT will distribute at least 90% of its annual taxable income as dividends

(1)

The REIT will also receive Windstream’s residential CLEC business.

(2)

The exchange ratio is expected to be .2 shares of CS&L for each share of WIN owned,

subject to finalization. With a .2 exchange ratio, the CS&L dividend is expected to be $2.40 /

share annually.

Well-positioned to grow funds from operations (FFO) per share

~.65x |

Transaction Timeline

11

Received

Private

Letter

Ruling

from IRS

Already completed

Received

regulatory

approvals

from 8 out

of 9 states

Filed

preliminary

Form 10

with the SEC

Shareholder

vote for WIN

Corp charter

amendment to

facilitate the

REIT spin off

without large

tax liability

Confirm

management,

file definitive

Form 10, and

execute

financing

transactions

Finalize all

regulatory

approvals

Expect to close the REIT spinoff in the first half of 2015

Future events |

12

Deleveraging:

Additional

cash

flow

generated

from

this

structure

will

accelerate WIN debt pay down, strengthening the balance sheet

Positioning both WIN and CS&L for growth:

Transaction better positions both

companies to focus on growth through attractive expansion projects

Attractive

dividend:

CS&L’s

strong

and

stable

cash

flow

will

support

an

attractive dividend

Strategic flexibility:

New capital structures provide increased strategic

flexibility, allowing each company to optimize priorities and opportunities

Transaction unlocks meaningful value for shareholders

Transaction Benefits

Summary |

Appendix

13 |

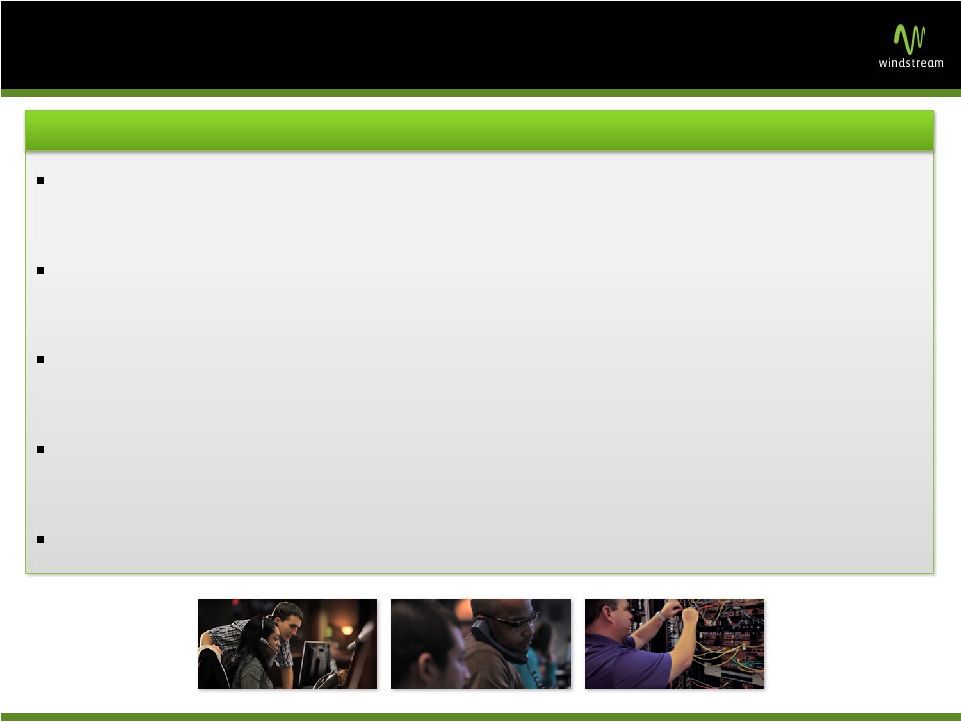

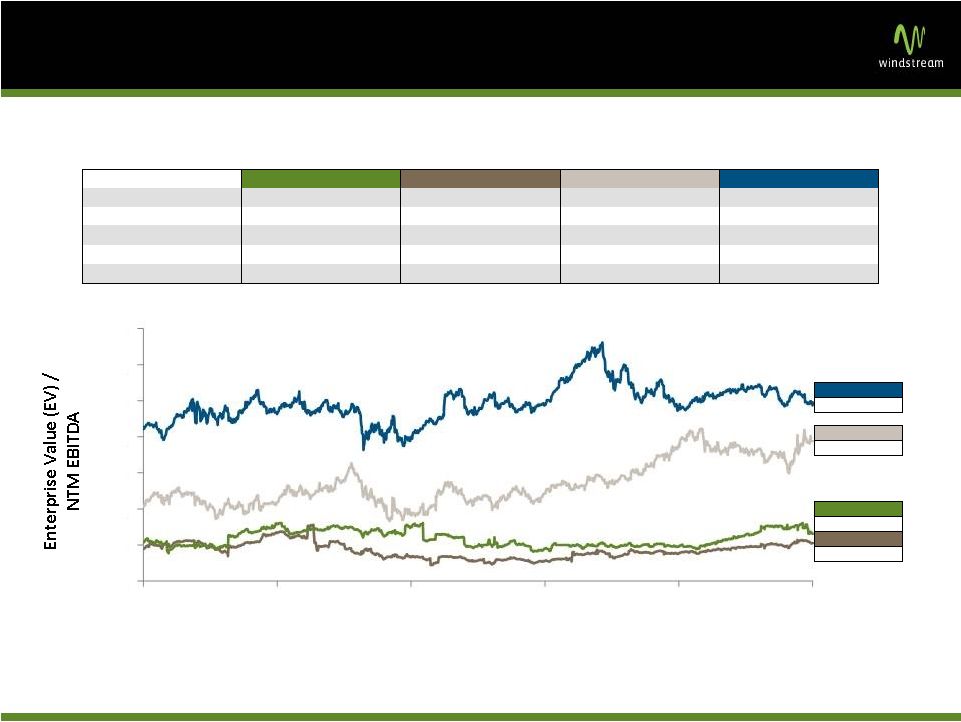

Historical Valuation of REITs versus WIN Peers

14

Source: Factset.

Note: Triple Net REITs average EV / NTM EBITDA includes O, OHI, NNN, GLPI, EPR, LXP,

MPW, NHI, SBRA, LTC and GTY. Note: ILECs average EV / NTM EBITDA includes ALSK,

HCOM, FRP, CNSL, CBB, WIN, FTR and CTL. Note: Fiber average EV / NTM EBITDA

includes CCOI, ZAYO and LVLT. Triple Net REITs have historically traded at

significant premiums to WIN and its peers Average During

Windstream

ILECs

Fiber

Triple Net REITs

Current Multiple:

6.8x

6.1x

11.8x

13.9x

Last 1

Year: 6.5x

5.9x

11.4x

14.3x

Last 2

Years: 6.2x

5.7x

10.6x

14.7x

Last 3

Years: 6.2x

5.5x

10.0x

14.3x

Last 5

Years: 6.4x

5.7x

9.4x

13.9x

ILECs

6.1x

Windstream

6.8x

Triple Net REITs

13.9x

Fiber

11.8x

4x

6x

8x

10x

12x

14x

16x

18x

12/17/09

12/17/10

12/17/11

12/17/12

12/17/13

12/17/14 |