Attached files

| file | filename |

|---|---|

| EX-32.B - SECTION 906 CFO CERTIFICATIONS - WINDSTREAM HOLDINGS, INC. | a10qexhibit32b1q17.htm |

| EX-32.A - SECTION 906 CEO CERTIFICATIONS - WINDSTREAM HOLDINGS, INC. | a10qexhibit32a1q17.htm |

| EX-31.B - SECTION 302 CFO CERTIFICATIONS - WINDSTREAM HOLDINGS, INC. | a10qexhibit31b1q17.htm |

| EX-31.A - SECTION 302 CEO CERTIFICATIONS - WINDSTREAM HOLDINGS, INC. | a10qexhibit31a1q17.htm |

| EX-21 - LISTING OF SUBSIDIARIES - WINDSTREAM HOLDINGS, INC. | exhibit21listingofsubsidia.htm |

| EX-10.39 - WAIVER AND RELEASE AGREEMENT - WINDSTREAM HOLDINGS, INC. | exhibit103920170331.htm |

| EX-10.38 - THIRD TRANCHE B-6 INCREMENTAL AMENDMENT - WINDSTREAM HOLDINGS, INC. | exhibit1038thirdamendment.htm |

| EX-10.37 - TRANCHE B-7 REFINANCING AGREEMENT - WINDSTREAM HOLDINGS, INC. | exhibit1037trancheb-7.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D. C. 20549

FORM 10-Q

x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended March 31, 2017

or

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Exact name of registrant as specified in its charter | State or other jurisdiction of incorporation or organization | Commission File Number | I.R.S. Employer Identification No. | |||

Windstream Holdings, Inc. | Delaware | 001-32422 | 46-2847717 | |||

Windstream Services, LLC | Delaware | 001-36093 | 20-0792300 | |||

4001 Rodney Parham Road | ||||

Little Rock, Arkansas | 72212 | |||

(Address of principal executive offices) | (Zip Code) | |||

(501) 748-7000 | ||||

(Registrants’ telephone number, including area code) | ||||

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Windstream Holdings, Inc. | ý YES ¨ NO | |||

Windstream Services, LLC | ý YES ¨ NO | |||

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Windstream Holdings, Inc. | ý YES ¨ NO | |||

Windstream Services, LLC | ý YES ¨ NO | |||

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of large accelerated filer, accelerated filer, smaller reporting company, and emerging growth company in Rule 12b-2 of the Exchange Act:

Windstream Holdings, Inc. | Large accelerated filer ý | Accelerated filer ¨ | ||

Non-accelerated filer ¨ | (Do not check if a smaller reporting company) | |||

Smaller reporting company ¨ | ||||

Emerging growth company ¨ | ||||

Windstream Services, LLC | Large accelerated filer ¨ | Accelerated filer ¨ | ||

Non-accelerated filer ý | (Do not check if a smaller reporting company) | |||

Smaller reporting company ¨ | ||||

Emerging growth company ¨ | ||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Windstream Holdings, Inc. | ¨ YES ¨ NO | |||

Windstream Services, LLC | ¨ YES ¨ NO | |||

Indicate by check mark whether the registrant is a shell company (as defined by Rule 12b-2 of the Exchange Act).

Windstream Holdings, Inc. | ¨ YES ý NO | |||

Windstream Services, LLC | ¨ YES ý NO | |||

As of May 4, 2017, 190,494,304 shares of common stock of Windstream Holdings, Inc.were outstanding. Windstream Holdings, Inc. holds a 100 percent interest in Windstream Services, LLC.

This Form 10-Q is a combined quarterly report being filed separately by two registrants: Windstream Holdings, Inc. and Windstream Services, LLC. Windstream Services, LLC is a direct, wholly-owned subsidiary of Windstream Holdings, Inc. Accordingly, Windstream Services, LLC meets the conditions set forth in general instruction H(1)(a) and (b) of Form 10-Q and is therefore filing this form with the reduced disclosure format. Unless the context indicates otherwise, the use of the terms “Windstream,” “we,” “us” or “our” shall refer to Windstream Holdings, Inc. and its subsidiaries, including Windstream Services, LLC, and the term “Windstream Services” shall refer to Windstream Services, LLC and its subsidiaries.

The Exhibit Index is located on page 81. | ||

WINDSTREAM HOLDINGS, INC.

WINDSTREAM SERVICES, LLC

FORM 10-Q

TABLE OF CONTENTS

Page No. | ||

Item 1. | ||

Item 2. | ||

Item 3. | ||

Item 4. | ||

Item 1. | ||

Item 1A. | ||

Item 2. | Unregistered Sales of Equity Securities and Use of Proceeds | * |

Item 3. | Defaults Upon Senior Securities | * |

Item 4. | Mine Safety Disclosures | * |

Item 5. | ||

Item 6. | ||

_____________

* | No reportable information under this item. |

1

WINDSTREAM HOLDINGS, INC.

WINDSTREAM SERVICES, LLC

FORM 10-Q

PART I - FINANCIAL INFORMATION

Item 1. Financial Statements

WINDSTREAM HOLDINGS, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS (UNAUDITED)

Three Months Ended March 31, | |||||||||

(Millions, except per share amounts) | 2017 | 2016 | |||||||

Revenues and sales: | |||||||||

Service revenues | $ | 1,344.4 | $ | 1,340.6 | |||||

Product sales | 21.3 | 32.8 | |||||||

Total revenues and sales | 1,365.7 | 1,373.4 | |||||||

Costs and expenses: | |||||||||

Cost of services (exclusive of depreciation and amortization included below) | 682.4 | 668.8 | |||||||

Cost of products sold | 20.8 | 28.9 | |||||||

Selling, general and administrative | 213.3 | 203.8 | |||||||

Depreciation and amortization | 338.5 | 304.8 | |||||||

Merger, integration and other costs | 57.3 | 5.0 | |||||||

Restructuring charges | 7.4 | 4.4 | |||||||

Total costs and expenses | 1,319.7 | 1,215.7 | |||||||

Operating income | 46.0 | 157.7 | |||||||

Dividend income on Uniti common stock | — | 17.6 | |||||||

Other income (expense), net | 0.7 | (1.2 | ) | ||||||

Net loss on early extinguishment of debt | (3.2 | ) | (35.4 | ) | |||||

Other-than-temporary impairment loss on investment in Uniti common stock | — | (181.9 | ) | ||||||

Interest expense | (211.8 | ) | (219.7 | ) | |||||

Loss before income taxes | (168.3 | ) | (262.9 | ) | |||||

Income tax benefit | (57.0 | ) | (31.0 | ) | |||||

Net loss | $ | (111.3 | ) | $ | (231.9 | ) | |||

Basic and diluted loss per share: | |||||||||

Net loss | ($.89 | ) | ($2.52 | ) | |||||

See the accompanying notes to the unaudited interim consolidated financial statements.

2

WINDSTREAM HOLDINGS, INC.

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS) (UNAUDITED)

Three Months Ended March 31, | |||||||||

(Millions) | 2017 | 2016 | |||||||

Net loss | $ | (111.3 | ) | $ | (231.9 | ) | |||

Other comprehensive income (loss): | |||||||||

Available-for-sale securities: | |||||||||

Unrealized holding gain arising during the period | — | 104.6 | |||||||

Other-than-temporary impairment loss recognized in the period | — | 181.9 | |||||||

Change in available-for-sale securities | — | 286.5 | |||||||

Interest rate swaps: | |||||||||

Unrealized gain (loss) on designated interest rate swaps | 3.4 | (8.3 | ) | ||||||

Amortization of net unrealized losses on de-designated interest rate swaps | 1.5 | 1.2 | |||||||

Income tax (expense) benefit | (1.9 | ) | 2.7 | ||||||

Change in interest rate swaps | 3.0 | (4.4 | ) | ||||||

Postretirement and pension plans: | |||||||||

Plan curtailment | — | (5.5 | ) | ||||||

Amounts included in net periodic benefit cost: | |||||||||

Amortization of net actuarial loss | — | 0.1 | |||||||

Amortization of prior service credits | (0.2 | ) | (0.5 | ) | |||||

Income tax benefit | 0.1 | 2.3 | |||||||

Change in postretirement and pension plans | (0.1 | ) | (3.6 | ) | |||||

Other comprehensive income | 2.9 | 278.5 | |||||||

Comprehensive (loss) income | $ | (108.4 | ) | $ | 46.6 | ||||

See the accompanying notes to the unaudited interim consolidated financial statements.

3

WINDSTREAM HOLDINGS, INC.

CONSOLIDATED BALANCE SHEETS (UNAUDITED)

(Millions, except par value) | March 31, 2017 | December 31, 2016 | ||||||

Assets | ||||||||

Current Assets: | ||||||||

Cash and cash equivalents | $ | 51.5 | $ | 59.1 | ||||

Accounts receivable (less allowance for doubtful | ||||||||

accounts of $23.7 and $27.1, respectively) | 654.8 | 618.6 | ||||||

Inventories | 87.0 | 77.5 | ||||||

Prepaid expenses and other | 169.8 | 111.7 | ||||||

Total current assets | 963.1 | 866.9 | ||||||

Goodwill | 4,690.2 | 4,213.6 | ||||||

Other intangibles, net | 1,577.7 | 1,320.5 | ||||||

Net property, plant and equipment | 5,575.6 | 5,283.5 | ||||||

Other assets | 97.6 | 85.5 | ||||||

Total Assets | $ | 12,904.2 | $ | 11,770.0 | ||||

Liabilities and Shareholders’ Equity | ||||||||

Current Liabilities: | ||||||||

Current maturities of long-term debt | $ | 19.3 | $ | 14.9 | ||||

Current portion of long-term lease obligations | 172.9 | 168.7 | ||||||

Accounts payable | 335.8 | 390.2 | ||||||

Advance payments and customer deposits | 215.1 | 178.1 | ||||||

Accrued taxes | 80.9 | 78.0 | ||||||

Accrued interest | 96.0 | 58.1 | ||||||

Other current liabilities | 381.0 | 366.6 | ||||||

Total current liabilities | 1,301.0 | 1,254.6 | ||||||

Long-term debt | 5,459.8 | 4,848.7 | ||||||

Long-term lease obligations | 4,787.1 | 4,831.9 | ||||||

Deferred income taxes | 98.2 | 151.5 | ||||||

Other liabilities | 535.7 | 513.3 | ||||||

Total liabilities | 12,181.8 | 11,600.0 | ||||||

Commitments and Contingencies (See Note 15) | ||||||||

Shareholders’ Equity: | ||||||||

Common stock, $.0001 par value, 375.0 shares authorized, | ||||||||

190.4 and 96.3 shares issued and outstanding, respectively | — | — | ||||||

Additional paid-in capital | 1,220.5 | 559.7 | ||||||

Accumulated other comprehensive income | 8.8 | 5.9 | ||||||

Accumulated deficit | (506.9 | ) | (395.6 | ) | ||||

Total shareholders’ equity | 722.4 | 170.0 | ||||||

Total Liabilities and Shareholders’ Equity | $ | 12,904.2 | $ | 11,770.0 | ||||

See the accompanying notes to the unaudited interim consolidated financial statements.

4

WINDSTREAM HOLDINGS, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS (UNAUDITED)

Three Months Ended March 31, | ||||||||

(Millions) | 2017 | 2016 | ||||||

Cash Flows from Operating Activities: | ||||||||

Net loss | $ | (111.3 | ) | $ | (231.9 | ) | ||

Adjustments to reconcile net loss to net cash provided from operations: | ||||||||

Depreciation and amortization | 338.5 | 304.8 | ||||||

Provision for doubtful accounts | 9.6 | 9.7 | ||||||

Share-based compensation expense | 16.8 | 13.7 | ||||||

Deferred income taxes | (55.2 | ) | (27.5 | ) | ||||

Noncash portion of net loss on early extinguishment of debt | (15.1 | ) | (7.4 | ) | ||||

Other-than-temporary impairment loss on investment in Uniti common stock | — | 181.9 | ||||||

Amortization of unrealized losses on de-designated interest rate swaps | 1.5 | 1.2 | ||||||

Plan curtailment | — | (5.5 | ) | |||||

Other, net | 0.7 | (15.3 | ) | |||||

Changes in operating assets and liabilities, net | ||||||||

Accounts receivable | 33.8 | (2.0 | ) | |||||

Prepaid income taxes | (5.6 | ) | (5.8 | ) | ||||

Prepaid expenses and other | (30.5 | ) | (6.0 | ) | ||||

Accounts payable | (61.5 | ) | (100.2 | ) | ||||

Accrued interest | 29.9 | 39.8 | ||||||

Accrued taxes | (2.3 | ) | (12.5 | ) | ||||

Other current liabilities | (5.3 | ) | 4.2 | |||||

Other liabilities | 2.4 | (10.0 | ) | |||||

Other, net | (13.9 | ) | (4.0 | ) | ||||

Net cash provided from operating activities | 132.5 | 127.2 | ||||||

Cash Flows from Investing Activities: | ||||||||

Additions to property, plant and equipment | (243.4 | ) | (263.8 | ) | ||||

Proceeds from the sale of property | — | 6.2 | ||||||

Cash acquired from EarthLink | 5.0 | — | ||||||

Other, net | (2.5 | ) | — | |||||

Net cash used in investing activities | (240.9 | ) | (257.6 | ) | ||||

Cash Flows from Financing Activities: | ||||||||

Dividends paid to shareholders | (23.7 | ) | (14.9 | ) | ||||

Proceeds from issuance of stock | 9.6 | — | ||||||

Repayments of debt and swaps | (1,133.4 | ) | (985.3 | ) | ||||

Proceeds of debt issuance | 1,315.6 | 1,278.0 | ||||||

Debt issuance costs | (7.0 | ) | (10.7 | ) | ||||

Stock repurchases | — | (28.9 | ) | |||||

Payments under long-term lease obligations | (40.6 | ) | (36.8 | ) | ||||

Payments under capital lease obligations | (8.7 | ) | (19.8 | ) | ||||

Other, net | (11.0 | ) | (7.9 | ) | ||||

Net cash provided from financing activities | 100.8 | 173.7 | ||||||

(Decrease) increase in cash and cash equivalents | (7.6 | ) | 43.3 | |||||

Cash and Cash Equivalents: | ||||||||

Beginning of period | 59.1 | 31.3 | ||||||

End of period | $ | 51.5 | $ | 74.6 | ||||

Supplemental Cash Flow Disclosures: | ||||||||

Interest paid, net of interest capitalized | $ | 168.9 | $ | 178.6 | ||||

Income taxes (refunded) paid, net | $ | (0.2 | ) | $ | 6.5 | |||

See the accompanying notes to the unaudited interim consolidated financial statements.

5

WINDSTREAM HOLDINGS, INC.

CONSOLIDATED STATEMENT OF SHAREHOLDERS’ EQUITY (UNAUDITED)

(Millions, except per share amounts) | Common Stock and Additional Paid-In Capital | Accumulated Other Comprehensive Income | Accumulated Deficit | Total | ||||||||||||

Balance at December 31, 2016 | $ | 559.7 | $ | 5.9 | $ | (395.6 | ) | $ | 170.0 | |||||||

Net loss | — | — | (111.3 | ) | (111.3 | ) | ||||||||||

Other comprehensive income (loss), net of tax: | ||||||||||||||||

Change in postretirement and pension plans | — | (0.1 | ) | — | (0.1 | ) | ||||||||||

Amortization of unrealized losses on de-designated interest rate swaps | — | 0.9 | — | 0.9 | ||||||||||||

Change in designated interest rate swaps | — | 2.1 | — | 2.1 | ||||||||||||

Comprehensive income (loss) | — | 2.9 | (111.3 | ) | (108.4 | ) | ||||||||||

Share-based compensation | 10.7 | — | — | 10.7 | ||||||||||||

Stock issued for pension contribution (See Note 7) | 9.6 | — | — | 9.6 | ||||||||||||

Stock issued to employee savings plan (See Note 7) | 22.7 | — | — | 22.7 | ||||||||||||

Stock issued in merger with EarthLink (See Note 2) | 646.9 | — | — | 646.9 | ||||||||||||

Taxes withheld on vested restricted stock and other | (8.8 | ) | — | — | (8.8 | ) | ||||||||||

Dividends of $.15 per share declared to shareholders | (20.3 | ) | — | — | (20.3 | ) | ||||||||||

Balance at March 31, 2017 | $ | 1,220.5 | $ | 8.8 | $ | (506.9 | ) | $ | 722.4 | |||||||

See the accompanying notes to the unaudited interim consolidated financial statements.

6

WINDSTREAM SERVICES, LLC

CONSOLIDATED STATEMENTS OF OPERATIONS (UNAUDITED)

Three Months Ended March 31, | |||||||||

(Millions) | 2017 | 2016 | |||||||

Revenues and sales: | |||||||||

Service revenues | $ | 1,344.4 | $ | 1,340.6 | |||||

Product sales | 21.3 | 32.8 | |||||||

Total revenues and sales | 1,365.7 | 1,373.4 | |||||||

Costs and expenses: | |||||||||

Cost of services (exclusive of depreciation and amortization included below) | 682.4 | 668.8 | |||||||

Cost of products sold | 20.8 | 28.9 | |||||||

Selling, general and administrative | 213.0 | 203.3 | |||||||

Depreciation and amortization | 338.5 | 304.8 | |||||||

Merger, integration and other costs | 57.3 | 5.0 | |||||||

Restructuring charges | 7.4 | 4.4 | |||||||

Total costs and expenses | 1,319.4 | 1,215.2 | |||||||

Operating income | 46.3 | 158.2 | |||||||

Dividend income on Uniti common stock | — | 17.6 | |||||||

Other income (expense), net | 0.7 | (1.2 | ) | ||||||

Net loss on early extinguishment of debt | (3.2 | ) | (35.4 | ) | |||||

Other-than-temporary impairment loss on investment in Uniti common stock | — | (181.9 | ) | ||||||

Interest expense | (211.8 | ) | (219.7 | ) | |||||

Loss before income taxes | (168.0 | ) | (262.4 | ) | |||||

Income tax benefit | (56.9 | ) | (30.8 | ) | |||||

Net loss | $ | (111.1 | ) | $ | (231.6 | ) | |||

See the accompanying notes to the unaudited interim consolidated financial statements.

7

WINDSTREAM SERVICES, LLC

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS) (UNAUDITED)

Three Months Ended March 31, | |||||||||

(Millions) | 2017 | 2016 | |||||||

Net loss | $ | (111.1 | ) | $ | (231.6 | ) | |||

Other comprehensive income (loss): | |||||||||

Available-for-sale securities: | |||||||||

Unrealized holding gain arising during the period | — | 104.6 | |||||||

Other-than-temporary impairment loss recognized in the period | — | 181.9 | |||||||

Change in available-for-sale securities | — | 286.5 | |||||||

Interest rate swaps: | |||||||||

Unrealized gain (loss) on designated interest rate swaps | 3.4 | (8.3 | ) | ||||||

Amortization of net unrealized losses on de-designated interest rate swaps | 1.5 | 1.2 | |||||||

Income tax (expense) benefit | (1.9 | ) | 2.7 | ||||||

Change in interest rate swaps | 3.0 | (4.4 | ) | ||||||

Postretirement and pension plans: | |||||||||

Plan curtailment | — | (5.5 | ) | ||||||

Amounts included in net periodic benefit cost: | |||||||||

Amortization of net actuarial loss | — | 0.1 | |||||||

Amortization of prior service credits | (0.2 | ) | (0.5 | ) | |||||

Income tax benefit | 0.1 | 2.3 | |||||||

Change in postretirement and pension plans | (0.1 | ) | (3.6 | ) | |||||

Other comprehensive income | 2.9 | 278.5 | |||||||

Comprehensive (loss) income | $ | (108.2 | ) | $ | 46.9 | ||||

See the accompanying notes to the unaudited interim consolidated financial statements.

8

WINDSTREAM SERVICES, LLC

CONSOLIDATED BALANCE SHEETS (UNAUDITED)

(Millions) | March 31, 2017 | December 31, 2016 | ||||||

Assets | ||||||||

Current Assets: | ||||||||

Cash and cash equivalents | $ | 51.5 | $ | 59.1 | ||||

Accounts receivable (less allowance for doubtful | ||||||||

accounts of $23.7 and $27.1, respectively) | 654.8 | 618.6 | ||||||

Inventories | 87.0 | 77.5 | ||||||

Prepaid expenses and other | 169.8 | 111.7 | ||||||

Total current assets | 963.1 | 866.9 | ||||||

Goodwill | 4,690.2 | 4,213.6 | ||||||

Other intangibles, net | 1,577.7 | 1,320.5 | ||||||

Net property, plant and equipment | 5,575.6 | 5,283.5 | ||||||

Other assets | 97.6 | 85.5 | ||||||

Total Assets | $ | 12,904.2 | $ | 11,770.0 | ||||

Liabilities and Member Equity | ||||||||

Current Liabilities: | ||||||||

Current maturities of long-term debt | $ | 19.3 | $ | 14.9 | ||||

Current portion of long-term lease obligations | 172.9 | 168.7 | ||||||

Accounts payable | 335.8 | 390.2 | ||||||

Advance payments and customer deposits | 215.1 | 178.1 | ||||||

Payable to Windstream Holdings, Inc. | 11.3 | 15.0 | ||||||

Accrued taxes | 80.9 | 78.0 | ||||||

Accrued interest | 96.0 | 58.1 | ||||||

Other current liabilities | 369.7 | 351.6 | ||||||

Total current liabilities | 1,301.0 | 1,254.6 | ||||||

Long-term debt | 5,459.8 | 4,848.7 | ||||||

Long-term lease obligations | 4,787.1 | 4,831.9 | ||||||

Deferred income taxes | 98.2 | 151.5 | ||||||

Other liabilities | 535.7 | 513.3 | ||||||

Total liabilities | 12,181.8 | 11,600.0 | ||||||

Commitments and Contingencies (See Note 15) | ||||||||

Member Equity: | ||||||||

Additional paid-in capital | 1,216.7 | 556.1 | ||||||

Accumulated other comprehensive income | 8.8 | 5.9 | ||||||

Accumulated deficit | (503.1 | ) | (392.0 | ) | ||||

Total member equity | 722.4 | 170.0 | ||||||

Total Liabilities and Member Equity | $ | 12,904.2 | $ | 11,770.0 | ||||

See the accompanying notes to the unaudited interim consolidated financial statements.

9

WINDSTREAM SERVICES, LLC

CONSOLIDATED STATEMENTS OF CASH FLOWS (UNAUDITED)

Three Months Ended March 31, | ||||||||

(Millions) | 2017 | 2016 | ||||||

Cash Flows from Operating Activities: | ||||||||

Net loss | $ | (111.1 | ) | $ | (231.6 | ) | ||

Adjustments to reconcile net loss to net cash provided from operations: | ||||||||

Depreciation and amortization | 338.5 | 304.8 | ||||||

Provision for doubtful accounts | 9.6 | 9.7 | ||||||

Share-based compensation expense | 16.8 | 13.7 | ||||||

Deferred income taxes | (55.2 | ) | (27.5 | ) | ||||

Noncash portion of net loss on early extinguishment of debt | (15.1 | ) | (7.4 | ) | ||||

Other-than-temporary impairment loss on investment in Uniti common stock | — | 181.9 | ||||||

Amortization of unrealized losses on de-designated interest rate swaps | 1.5 | 1.2 | ||||||

Plan curtailment | — | (5.5 | ) | |||||

Other, net | 0.7 | (15.3 | ) | |||||

Changes in operating assets and liabilities, net | ||||||||

Accounts receivable | 33.8 | (2.0 | ) | |||||

Prepaid income taxes | (5.6 | ) | (5.8 | ) | ||||

Prepaid expenses and other | (30.5 | ) | (6.0 | ) | ||||

Accounts payable | (61.5 | ) | (100.2 | ) | ||||

Accrued interest | 29.9 | 39.8 | ||||||

Accrued taxes | (2.3 | ) | (12.5 | ) | ||||

Other current liabilities | (6.1 | ) | 4.2 | |||||

Other liabilities | 2.4 | (10.0 | ) | |||||

Other, net | (13.9 | ) | (4.0 | ) | ||||

Net cash provided from operating activities | 131.9 | 127.5 | ||||||

Cash Flows from Investing Activities: | ||||||||

Additions to property, plant and equipment | (243.4 | ) | (263.8 | ) | ||||

Proceeds from the sale of property | — | 6.2 | ||||||

Cash acquired from EarthLink | 5.0 | — | ||||||

Other, net | (2.5 | ) | — | |||||

Net cash used in investing activities | (240.9 | ) | (257.6 | ) | ||||

Cash Flows from Financing Activities: | ||||||||

Distributions to Windstream Holdings, Inc. | (24.3 | ) | (44.1 | ) | ||||

Contribution from Windstream Holdings, Inc. | 9.6 | — | ||||||

Repayments of debt and swaps | (1,133.4 | ) | (985.3 | ) | ||||

Proceeds of debt issuance | 1,315.6 | 1,278.0 | ||||||

Debt issuance costs | (7.0 | ) | (10.7 | ) | ||||

Payments under long-term lease obligations | (40.6 | ) | (36.8 | ) | ||||

Payments under capital lease obligations | (8.7 | ) | (19.8 | ) | ||||

Other, net | (9.8 | ) | (7.9 | ) | ||||

Net cash provided from financing activities | 101.4 | 173.4 | ||||||

(Decrease) increase in cash and cash equivalents | (7.6 | ) | 43.3 | |||||

Cash and Cash Equivalents: | ||||||||

Beginning of period | 59.1 | 31.3 | ||||||

End of period | $ | 51.5 | $ | 74.6 | ||||

Supplemental Cash Flow Disclosures: | ||||||||

Interest paid, net of interest capitalized | $ | 168.9 | $ | 178.6 | ||||

Income taxes (refunded) paid, net | $ | (0.2 | ) | $ | 6.5 | |||

See the accompanying notes to the unaudited interim consolidated financial statements.

10

WINDSTREAM SERVICES, LLC

CONSOLIDATED STATEMENT OF MEMBER EQUITY (UNAUDITED)

(Millions) | Additional Paid-In Capital | Accumulated Other Comprehensive Income | Accumulated Deficit | Total | ||||||||||||

Balance at December 31, 2016 | $ | 556.1 | $ | 5.9 | $ | (392.0 | ) | $ | 170.0 | |||||||

Net loss | — | — | (111.1 | ) | (111.1 | ) | ||||||||||

Other comprehensive income (loss), net of tax: | ||||||||||||||||

Change in postretirement and pension plans | — | (0.1 | ) | — | (0.1 | ) | ||||||||||

Amortization of unrealized losses on de-designated interest rate swaps | — | 0.9 | — | 0.9 | ||||||||||||

Change in designated interest rate swaps | — | 2.1 | — | 2.1 | ||||||||||||

Comprehensive income (loss) | — | 2.9 | (111.1 | ) | (108.2 | ) | ||||||||||

Share-based compensation | 10.7 | — | — | 10.7 | ||||||||||||

Contributions from Windstream Holdings, Inc.: | ||||||||||||||||

Cash contribution to pension plan (See Note 7) | 9.6 | — | — | 9.6 | ||||||||||||

Stock contribution to employee savings plan (See Note 7) | 22.7 | — | — | 22.7 | ||||||||||||

Stock contribution for merger with EarthLink (See Note 2) | 646.9 | — | — | 646.9 | ||||||||||||

Taxes withheld on vested restricted stock and other | (8.8 | ) | — | — | (8.8 | ) | ||||||||||

Distributions payable to Windstream Holdings, Inc. | (20.5 | ) | — | — | (20.5 | ) | ||||||||||

Balance at March 31, 2017 | $ | 1,216.7 | $ | 8.8 | $ | (503.1 | ) | $ | 722.4 | |||||||

See the accompanying notes to the unaudited interim consolidated financial statements.

11

NOTES TO UNAUDITED INTERIM CONSOLIDATED FINANCIAL STATEMENTS

1. Preparation of Interim Financial Statements:

In these consolidated financial statements, unless the context requires otherwise, the use of the terms “Windstream,” “we,” “us” or “our” shall refer to Windstream Holdings, Inc. and its subsidiaries, including Windstream Services, LLC, and the term “Windstream Services” shall refer to Windstream Services, LLC and its subsidiaries.

Organizational Structure – Windstream Holdings, Inc. (“Windstream Holdings”) is a publicly traded holding company incorporated in the state of Delaware on May 23, 2013, and the parent of Windstream Services, LLC (“Windstream Services”), a Delaware limited liability company organized on March 1, 2004. Windstream Holdings common stock trades on the NASDAQ Global Select Market (“NASDAQ”) under the ticker symbol “WIN”. Windstream Holdings owns a 100 percent interest in Windstream Services. Windstream Services and its guarantor subsidiaries are the sole obligors of all outstanding debt obligations and, as a result also file periodic reports with the Securities and Exchange Commission (“SEC”). Windstream Holdings is not a guarantor of nor subject to the restrictive covenants included in any of Windstream Services’ debt agreements. The Windstream Holdings board of directors and officers oversee both companies.

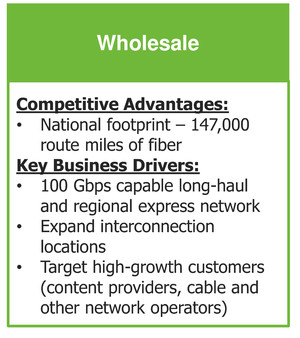

Description of Business – We are a leading provider of advanced network communications and technology solutions for consumers, businesses, enterprise organizations and wholesale customers across the United States. We provide data, cloud solutions, unified communications and managed services to small business and enterprise clients. We also offer bundled services, including broadband, security solutions, voice and digital television to consumers. We supply core transport solutions on a local and long-haul fiber network spanning approximately 147,000 miles.

Consumer service revenues are generated from the provisioning of high-speed Internet, voice and video services to consumers. Business service revenues include revenues from integrated voice and data services, advanced data and traditional voice and long-distance services provided to enterprise and small business customers. Wholesale revenues include revenues from other communications services providers for special access circuits and fiber connections, voice and data transport services, and revenues from the reselling of our services. Regulatory revenues include switched access revenues, federal and state Universal Service Fund (“USF”) revenues and amounts received from Connect America Fund - Phase II. Other service revenues include revenues from USF surcharges and other miscellaneous services.

Basis of Presentation – The accompanying unaudited consolidated financial statements have been prepared based upon SEC rules that permit reduced disclosure for interim periods. Certain information and footnote disclosures have been condensed or omitted in accordance with those rules and regulations. The accompanying consolidated balance sheet as of December 31, 2016, was derived from audited financial statements, but does not include all disclosures required by accounting principles generally accepted in the United States. In our opinion, these financial statements reflect all adjustments that are necessary for a fair statement of results of operations and financial condition for the interim periods presented including normal recurring accruals and other items. The results for the interim periods are not necessarily indicative of results for the full year. For a more complete discussion of significant accounting policies and certain other information, this report should be read in conjunction with the consolidated financial statements and accompanying notes included in our Annual Report on Form 10-K for the year ended December 31, 2016, which was filed with the SEC on March 1, 2017.

Windstream Holdings and its domestic subsidiaries, including Windstream Services, file a consolidated federal income tax return. As such, Windstream Services and its subsidiaries are not separate taxable entities for federal and certain state income tax purposes. In instances when Windstream Services does not file a separate return, income taxes as presented within the accompanying consolidated financial statements attribute current and deferred income taxes of Windstream Holdings to Windstream Services and its subsidiaries in a manner that is systematic, rational and consistent with the asset and liability method. Income tax provisions presented for Windstream Services and its subsidiaries are prepared under the “separate return method.” The separate return method represents a hypothetical computation assuming that the reported revenue and expenses of Windstream Services and its subsidiaries were incurred by separate taxable entities.

12

NOTES TO UNAUDITED INTERIM CONSOLIDATED FINANCIAL STATEMENTS

____

1. Preparation of Interim Financial Statements, Continued:

The preparation of financial statements, in accordance with accounting principles generally accepted in the United States (“U.S. GAAP”), requires management to make estimates and assumptions that affect the reported amounts of assets, liabilities, revenues and expenses and disclosure of contingent assets and liabilities. The estimates and assumptions used in the accompanying consolidated financial statements are based upon management’s evaluation of the relevant facts and circumstances as of the date of the consolidated financial statements. Actual results may differ from the estimates and assumptions used in preparing the accompanying consolidated financial statements, and such differences could be material.

There are no significant differences between the consolidated results of operations, financial condition, and cash flows of Windstream Holdings and those of Windstream Services other than for certain expenses incurred directly by Windstream Holdings principally consisting of audit, legal and board of director fees, NASDAQ listing fees, other shareholder-related costs, income taxes, common stock activity, and payables from Windstream Services to Windstream Holdings. Earnings per share data has not been presented for Windstream Services, because that entity has not issued publicly held common stock as defined in accordance with U.S. GAAP. Unless otherwise indicated, the note disclosures included herein pertain to both Windstream Holdings and Windstream Services.

Change in Accounting Estimate – The calculation of depreciation and amortization expense is based on the estimated economic useful lives of the underlying property, plant and equipment and finite-lived intangible assets. We periodically obtain updated depreciation studies to evaluate whether certain useful lives remain appropriate in accordance with authoritative guidance. With the assistance of a third-party valuation advisor, we completed analyses of the depreciable lives of assets held for use of certain subsidiaries during 2016. Based on the results of the analyses, we implemented new depreciation rates in the fourth quarter of 2016, the effects of which resulted in an increase to depreciation expense. Additionally, in the fourth quarter of 2016, we reassessed the estimated useful lives of certain fiber assets, extending the useful life of such assets from 20 to 25 years. The net impact of these changes resulted in an increase to depreciation expense of $8.8 million and an increase in our reported net loss of $5.8 million or $.05 per share for the three month period ended March 31, 2017. We anticipate the net impact of these changes to increase depreciation expense by $26.5 million during the remainder of 2017.

Recently Adopted Accounting Standards

Valuation of Inventory – In July 2015, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”) No. 2015-11, Inventory (Topic 330): Simplifying the Measurement of Inventory (“ASU 2015-11”). The updated guidance requires that an entity should measure inventory valued using a first-in, first-out or average cost method at the lower of cost and net realizable value. Net realizable value is defined as the estimated selling price in the ordinary course of business, less reasonably predictable costs of completion, disposal, and transportation. ASU 2015-11 should be applied on a prospective basis and is effective for fiscal years, and interim periods within those years, beginning after December 15, 2016. As required, we adopted ASU 2015-11 in the first quarter of 2017. The adoption of ASU 2015-11 did not have a material impact to our consolidated results of operations, financial position or cash flows.

Derivatives and Hedging – In March 2016, the FASB issued ASU No. 2016-05, Derivatives and Hedging (Topic 815): Effect of Derivative Contract Novations on Existing Hedge Accounting Relationships (a consensus of the Emerging Issues Task Force) (“ASU 2016-05”). ASU 2016-05 clarifies that a change in the counterparty to a derivative instrument that has been designated as the hedging instrument does not, in and of itself, require de-designation of that hedging relationship provided that all other hedge accounting criteria continue to be met. ASU 2016-05 is effective for fiscal years beginning after December 15, 2016. As required, we adopted ASU 2016-05 in the first quarter of 2017. The adoption of ASU 2016-05 did not have a material impact to our consolidated results of operations, financial position or cash flows.

13

NOTES TO UNAUDITED INTERIM CONSOLIDATED FINANCIAL STATEMENTS

____

1. Preparation of Interim Financial Statements, Continued:

Employee Share-Based Payment Accounting – In March 2016, the FASB issued ASU No. 2016-09, Compensation - Stock Compensation (Topic 718): Improvements to Employee Share-Based Payment Accounting (“ASU 2016-09”), which simplifies several aspects of the accounting for employee share-based payment transactions, including the accounting for income taxes, forfeitures, and statutory tax withholding requirements, as well as classification in the statement of cash flows. Under the new guidance all excess tax benefits and tax deficiencies, including tax benefits of dividends on share-based payment awards, should be recognized as income tax expense or benefit in the income statement, eliminating the notion of the APIC pool. The excess tax benefits will be classified as operating activities along with other income tax cash flows rather than financing activities in the statement of cash flows. The tax effects of exercised or vested awards should be treated as discrete items in the reporting period in which they occur. ASU 2016-09 also allows entities to elect to either estimate the total number of awards that are expected to vest or account for forfeitures when they occur. Additionally, ASU 2016-09 clarifies that cash payments to tax authorities in connection with shares withheld to meet statutory tax withholding requirements should be presented as a financing activity in the statement of cash flows. ASU 2016-09 is effective for annual reporting periods beginning after December 15, 2016. We adopted this standard effective January 1, 2017 and maintained our past practice of estimating the total number of awards expected to vest. The adoption of ASU 2016-09 did not have a material impact to our consolidated results of operations, financial position or cash flows.

Goodwill Impairment – In January 2017, the FASB issued ASU No. 2017-04, Intangibles-Goodwill and Other (Topic 350): Simplifying the Test for Goodwill Impairment (“ASU 2017-04”) simplifying the subsequent measurement of goodwill by eliminating the second step from the goodwill impairment test. The second step requires the measurement of a goodwill impairment by comparing the implied value of a reporting unit’s goodwill and the goodwill’s carrying amount. Under the amendments, the goodwill impairment will be measured as the excess of the reporting unit’s carrying amount over its fair value. An impairment charge should be recognized for the amount by which the carrying amount exceeds the reporting unit’s fair value; however, the loss recognized should not exceed the total amount of goodwill allocated to that reporting unit. ASU 2017-04 also eliminates the requirement for any reporting unit with a zero or negative carrying amount to perform a qualitative assessment and, if it fails that qualitative test, to perform the second step of the goodwill impairment test. Therefore, the same impairment assessment applies to all reporting units. An entity still has the option to perform the qualitative assessment for a reporting unit to determine if the quantitative impairment test is necessary. As permitted, we early adopted this standard effective January 1, 2017.

Recently Issued Authoritative Guidance

Revenue Recognition – In May 2014, the FASB issued ASU No. 2014-09, Revenue from Contracts with Customers (Topic 606) (“ASU 2014-09”). The standard outlines a single comprehensive revenue recognition model for entities to follow in accounting for revenue from contracts with customers and supersedes most current revenue recognition guidance, including industry-specific guidance. The core principle of the revenue model is that an entity should recognize revenue for the transfer of promised goods or services to customers in an amount that reflects the consideration to which the entity expects to be entitled to receive for those goods or services. ASU 2014-09 also includes new accounting principles related to the deferral and amortization of contract acquisition and fulfillment costs. ASU 2014-09 may be adopted by applying the provisions of the new standard on a retrospective basis to all periods presented in the financial statements or on a modified retrospective basis which would result in the recognition of a cumulative effect adjustment in the year of adoption. When issued, ASU 2014-09 was to be effective for annual periods beginning after December 15, 2016 and interim periods within those annual periods. Early adoption was not permitted.

In July 2015, the FASB deferred the effective date of ASU 2014-09 by one year to December 15, 2017 for annual reporting periods beginning after that date, or January 1, 2018, for calendar companies like Windstream. Entities are permitted to early adopt the standard, but not before the original effective date of December 15, 2016.

In 2016, the FASB issued the following updates to the revenue recognition guidance:

• | ASU No. 2016-08, Revenue from Contracts with Customers (Topic 606): Principal versus Agent Considerations (Reporting Revenue Gross versus Net) to improve the operability and understandability of the implementation guidance on principal versus agent considerations. |

• | ASU No. 2016-10, Revenue from Contracts with Customers (Topic 606): Identifying Performance Obligations and Licensing to provide more detailed guidance with respect to identifying performance obligations and accounting for licensing arrangements, including intellectual property licenses, royalties, license restrictions and renewals. |

14

NOTES TO UNAUDITED INTERIM CONSOLIDATED FINANCIAL STATEMENTS

____

1. Preparation of Interim Financial Statements, Continued:

• | ASU No. 2016-11, Revenue Recognition (Topic 605) and Derivatives and Hedging (Topic 815): Rescission of SEC Guidance Because of Accounting Standards Updates 2014-09 and 2014-16 Pursuant to Staff Announcements at the March 3, 2016 EITF Meeting to rescind several SEC Staff announcements that are codified in Topic 605: Revenue Recognition, including, among other items, guidance relating to accounting for consideration given by a vendor to a customer, as well as accounting for shipping and handling fees and freight services. |

• | ASU No. 2016-12, Revenue from Contracts with Customers (Topic 606): Narrow-Scope Improvements and Practical Expedients to provide clarification to Topic 606 on how to assess collectability, present sales tax, treat noncash consideration, and account for completed and modified contracts at the time of transition. This guidance also clarifies that an entity retrospectively applying the guidance in Topic 606 is not required to disclose the effect of the accounting change in the period of adoption. |

• | ASU No. 2016-20, Technical Corrections and Improvements to Topic 606: Revenue from Contracts with Customers to provide additional clarification and guidance with respect to a number of issues including impairment testing for capitalized contract costs, losses on construction and production-type contracts, and disclosures of prior-period and remaining performance obligations. |

The effective date and transition requirements for each of these amendments are the same as the effective date and transition requirements of ASU 2014-09.

We will adopt this standard effective January 1, 2018 utilizing the modified retrospective basis. We have established a cross-functional team to implement the standard and have identified and are in the process of implementing changes to our systems, processes and internal controls to meet the standard’s reporting and disclosure requirements. While we have not fully quantified the effects of the standard on our consolidated financial statements, we have determined that due to changes in the timing of recognition of certain installation services and discounts, promotional credits and price guarantees given to customers, we will recognize contract assets and liabilities in our consolidated balance sheets. In addition, the requirement to defer incremental contract acquisition costs, including sales commissions, and recognize such costs over the contract period or expected customer life will result in the recognition of a deferred charge within our consolidated balance sheets.

Leases – In February 2016, the FASB issued ASU 2016-02, Leases (Topic 842), which will require that virtually all lease arrangements that do not meet the criteria of a short-term lease be presented on the lessee’s balance sheet by recording a right-of-use asset and a lease liability equal to the present value of the related future lease payments. The income statement impacts of the leases will depend on the nature of the leasing arrangement and will be similar to existing accounting for operating and capital leases. The new standard does not substantially change the accounting for lessors. The new standard will also require additional disclosures regarding an entity’s leasing arrangements and will be effective for the first interim reporting period within annual periods beginning after December 15, 2018, although early adoption is permitted. Lessees and lessors will be required to apply the new standard at the beginning of the earliest period presented in the financial statements in which they first apply the new guidance, using a modified retrospective transition method. We are currently assessing the timing of adoption and the impact the new standard will have on our consolidated financial statements.

Financial Instruments - Credit Losses – In June 2016, the FASB issued ASU No. 2016-13, Financial Instruments - Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments (“ASU 2016-13”). This standard introduces a new forward-looking approach, based on expected losses, to estimate credit losses on certain types of financial instruments, including trade receivables. The estimate of expected credit losses will require entities to incorporate considerations of historical information, current information and reasonable and supportable forecasts. This new standard also expands the disclosure requirements to enable users of financial statements to understand the entity’s assumptions, models and methods for estimating expected credit losses. ASU 2016-13 is effective for annual and interim reporting periods beginning after December 15, 2019, and the guidance is to be applied using a modified retrospective transition approach. Early adoption is permitted for annual and interim reporting periods beginning after December 15, 2018. We are currently assessing the timing of adoption and the impact the new standard will have on our consolidated financial statements.

15

NOTES TO UNAUDITED INTERIM CONSOLIDATED FINANCIAL STATEMENTS

____

1. Preparation of Interim Financial Statements, Continued:

Statement of Cash Flows –In August 2016, the FASB issued ASU No. 2016-15, Statement of Cash Flows (Topic 230): Classification of Certain Cash Receipts and Cash Payments (“ASU 2016-15”). This standard provides guidance on how certain cash receipts and cash payments should be presented and classified in the statement of cash flows, including among others, debt prepayment and extinguishment costs, contingent consideration payments made after a business combination, proceeds from the settlement of insurance claims and distributions received from equity method investees. The standard also clarifies that when cash receipts and cash payments have aspects of more than one class of cash flows and cannot be separated, classification will depend on the predominant source or use of the underlying cash flows. ASU 2016-15 is effective for annual and interim reporting periods beginning after December 15, 2017, with early adoption permitted. We will adopt this standard effective January 1, 2018. We are currently assessing the impact the new standard will have on our consolidated statement of cash flows.

Definition of a Business – In January 2017, the FASB issued ASU No. 2017-01, Business Combinations (Topic 805), Clarifying the Definition of a Business (“ASU 2017-01”). Under the new guidance an integrated set of activities must include, at a minimum, an input and a substantive process that together significantly contribute to the ability to create output to be considered a business. ASU 2017-01 provides a framework to assist entities in evaluating whether both an input and a substantive process are present and removes the evaluation of whether a market participant could replace missing elements. Although outputs are not required for an integrated sets of activities to be a business, outputs generally are a key element of a business; therefore, the new guidance provides more stringent criteria for an integrated sets of activities without outputs. Furthermore, ASU 2017-01 narrows the definition of the term output so that it is consistent with how outputs are described in Topic 606. ASU 2017-01 is effective for annual periods beginning after December 15, 2017, including interim periods within those annual reporting periods. Early adoption is permitted. We are currently assessing the timing of adoption and the impact the new standard will have on our consolidated financial statements.

Presentation of Defined Benefit Retirement Costs – In March 2017, the FASB issued ASU 2017-07, Compensation-Retirement Benefits (Topic 715) Improving the Presentation of Net Periodic Pension Cost and Net Periodic Postretirement Benefit Cost (“ASU 2017-07”). This standard changes the income statement presentation of defined benefit plan expense by requiring separation between operating expense (service cost component) and non-operating expense (all other components, including interest cost, amortization of prior service cost, actuarial gains and losses, curtailments and settlements). The operating expense component will be reported in the same income statement line item(s) as other employee compensation costs arising from services rendered during the period while the non-operating components will be reported in other income and expense. In addition, only the service cost component will be eligible for capitalization as part of an asset such as inventory or property, plant and equipment. Retrospective application of the change in income statement presentation is required, while the change in capitalized benefit cost is to be applied prospectively. The ASU is effective for fiscal years beginning after December 15, 2017. We are currently assessing the impact that adopting this new accounting standard will have on our consolidated financial statements.

2. Completion of Merger:

On February 27, 2017, Windstream Holdings completed its merger with EarthLink Holdings Corp. (“EarthLink”), pursuant to the terms of the Agreement and Plan of Merger (the “Merger Agreement”) dated November 5, 2016, whereby EarthLink merged into Europa Merger Sub, Inc., an wholly-owned subsidiary of Windstream Services, LLC, and survived, and immediately following, merged with Europa Merger Sub, LLC, a wholly-owned subsidiary of Windstream Services, LLC, with Merger Sub surviving and changing its name to EarthLink Holdings, LLC (the “Merger”). EarthLink Holdings, LLC is a direct, wholly-owned subsidiary of Windstream Services and provides data, voice and managed network services to retail and wholesale business customers and nationwide Internet access and related value-added services to residential customers. In the Merger, we added approximately 700,000 customers and approximately 16,000 incremental route fiber miles, which expanded our national footprint to approximately 147,000 fiber route miles and enhanced our ability to offer customers expanded products, services and enhanced enterprise solutions. We also expect to achieve operating expense and capital expenditure synergies in integrating the acquired operations. Pursuant to the terms of the Merger Agreement, each share of EarthLink common stock was exchanged for .818 of Windstream Holdings common stock. No fractional shares were issued in the Merger, with a cash payment being made in lieu of fractional shares. Employee restricted stock units issued by EarthLink that were outstanding as of the merger date were exchanged for an equivalent number of Windstream Holdings restricted stock units based on the same exchange ratio of EarthLink common stock to Windstream Holdings common stock of .818 per share. The replacement restricted stock units remain subject to the vesting and other terms and conditions prescribed by the EarthLink equity plans that were assumed by us in the Merger. In the aggregate, Windstream Holdings issued 87.8 million shares of its common stock and 5.2 million of replacement equity awards. Windstream also assumed $435.3 million aggregate principal amount of EarthLink’s long-term debt, which we refinanced, as further discussed in Note 4. The Merger qualifies as a tax-free reorganization for U.S. federal income tax purposes and is valued at approximately $1.1 billion.

16

NOTES TO UNAUDITED INTERIM CONSOLIDATED FINANCIAL STATEMENTS

____

2. Completion of Merger, Continued:

We accounted for the Merger using the acquisition method of accounting and accordingly, the cost of the acquisition was allocated to the assets acquired and liabilities assumed based on their estimated fair values as of the merger date. The allocation of the purchase price is preliminary and subject to change based on the finalization of the third-party appraisals and obtaining information currently not available to us, primarily related to the tax basis of assets acquired. Any changes to the initial estimates of the fair value of the acquired assets and liabilities assumed will be recorded as adjustments to those asset and liabilities with the offset charged to goodwill. Goodwill associated with the Merger was primarily attributable to the EarthLink workforce and expected synergies. Approximately $54.8 million of goodwill associated with the acquisition of EarthLink is expected to be deductible for income tax purposes.

The following table summarizes the preliminary fair values of the assets acquired and liabilities assumed for EarthLink.

(Millions) | Preliminary Allocation | |||

Fair value of assets acquired: | ||||

Cash and other current assets | $ | 37.7 | ||

Accounts receivable | 75.3 | |||

Property, plant and equipment | 344.0 | |||

Goodwill | 476.6 | |||

Customer lists (a) | 275.0 | |||

Trade name, developed technology and software (b) | 31.0 | |||

Other assets | 0.3 | |||

Total assets acquired | 1,239.9 | |||

Fair value of liabilities assumed: | ||||

Current liabilities | 119.5 | |||

Long-term debt | 449.1 | |||

Other liabilities | 24.4 | |||

Total liabilities assumed | 593.0 | |||

Common stock and replacement equity awards issued to EarthLink shareholders (c) | $ | 646.9 | ||

(a) | Customer lists are amortized using the sum-of-years digit methodology over a weighted average life of 5.5 years. |

(b) | Trade name is amortized on a straight-line basis over an estimated useful life of 7 years. Internally developed technology and software are amortized on a straight-line basis over an estimated useful life of 3 years. |

(c) | Total merger consideration of $646.9 million consisted of $631.4 million related to shares issued to EarthLink shareholders and $15.5 million related to replacement equity awards. |

The preliminary fair values of the assets acquired and liabilities assumed were determined with the assistance of a third-party valuation firm using income, cost, and market approaches. The customer lists were valued based on the present value of future cash flows and the trade name was valued using the relief-from-royalty method, both of which are income approaches. Significant assumptions utilized in the income approach were based on our specific information and projections, which are not observable in the market and are thus considered Level 3 measurements as defined by authoritative guidance. The cost approach, which estimates value by determining the current cost of replacing an asset with another of equivalent economic utility, was used as appropriate for valuing internally developed technology and software and property, plant and equipment. The cost to replace a given asset reflects the estimated reproduction or replacement cost for the asset, less an allowance for loss in value due to depreciation. The fair value of the EarthLink credit facility was based on its redemption cost, while the remaining bonds were valued based on quoted market prices. Equity consideration was based on the opening price of our common stock on February 27, 2017. Consideration related to replacement restricted stock units was calculated based on the opening price of our common stock on February 27, 2017, net of the portion of the fair value attributable to future vesting requirements. The amount allocated to unearned compensation cost for awards subject to future service requirements was calculated based on the fair value of such awards at the acquisition date and will be recognized as compensation cost over the remaining future service period. The preliminary allocation of the purchase price, including the allocation of purchase price to acquired net operating losses, resulted in an estimated net deferred tax asset which was fully offset by a valuation allowance. We expect to adjust this preliminary net deferred tax asset and valuation allowance upon finalization of the third party-appraisal and upon receipt of additional information not currently available to us.

17

NOTES TO UNAUDITED INTERIM CONSOLIDATED FINANCIAL STATEMENTS

____

2. Completion of Merger, Continued:

The results of EarthLink’s operations are included in our consolidated results of operations beginning on February 27, 2017. For the three months ended March 31, 2017, our consolidated results of operations include revenues and sales of $82.1 million and an operating loss of $2.8 million attributable to EarthLink. We incurred $53.1 million of merger and integration expenses during the first quarter of 2017 related to the completion of the Merger (see Note 9).

The following unaudited pro forma consolidated results of operations of Windstream for the three months ended March 31, 2017 and 2016 assume that the Merger occurred as of January 1, 2016:

Three Months Ended March 31, | |||||||||

(Millions) | 2017 | 2016 | |||||||

Revenues and sales | $ | 1,515.2 | $ | 1,631.5 | |||||

Operating income | $ | 96.8 | $ | 92.5 | |||||

Net loss | $ | (82.3 | ) | $ | (270.6 | ) | |||

Loss per share | ($.45 | ) | ($1.53 | ) | |||||

The pro forma information presents our historical results of operations adjusted to include EarthLink, with the results prior to the merger closing date adjusted to include the pro forma effect of the elimination of transactions between Windstream and EarthLink, the adjustment to revenues and sales to change EarthLink’s reporting of USF fees billed to customers and the related payments from a net basis to a gross basis to conform to Windstream’s reporting of such customer billings, the adjustment to depreciation and amortization expense associated with the estimated acquired fair value of property, plant and equipment and intangible assets, the adjustment to interest expense to reflect the refinancing of EarthLink’s long-term debt obligations, the impact of merger and integration expenses related to the acquisition and the related income tax effects of the pro forma adjustments. The pro forma amounts for the three months ended March 31, 2017 and 2016 also include the effects of non-acquisition-related items, as more fully discussed in Notes 9 and 10.

The pro forma results are presented for illustrative purposes only and do not reflect either the realization of potential cost savings or any related integration costs. These pro forma results do not purport to be indicative of the results that would have been obtained if the Merger had occurred as of the date indicated, nor do the pro forma results intend to be a projection of results that may be obtained in the future.

3. Goodwill and Other Intangible Assets:

Goodwill represents the excess of cost over the fair value of net identifiable tangible and intangible assets acquired through various business combinations. The cost of acquired entities at the date of the acquisition is allocated to identifiable assets, and the excess of the total purchase price over the amounts assigned to identifiable assets has been recorded as goodwill.

Changes in the carrying amount of goodwill were as follows:

(Millions) | |||

Balance at December 31, 2016 | $ | 4,213.6 | |

Acquisition completed during the period - merger with EarthLink | 476.6 | ||

Balance at March 31, 2017 | $ | 4,690.2 | |

Goodwill assigned to our four operating segments was as follows:

(Millions) | ILEC Consumer and Small Business | Wholesale | Enterprise | CLEC Consumer and Small Business | Total | |||||||||||||||

Balance at December 31, 2016 | $ | 2,321.2 | $ | 1,176.4 | $ | 598.0 | $ | 118.0 | $ | 4,213.6 | ||||||||||

Acquisition completed during the period - merger with EarthLink | — | 127.0 | 227.8 | 121.8 | 476.6 | |||||||||||||||

Balance at March 31, 2017 | $ | 2,321.2 | $ | 1,303.4 | $ | 825.8 | $ | 239.8 | $ | 4,690.2 | ||||||||||

18

NOTES TO UNAUDITED INTERIM CONSOLIDATED FINANCIAL STATEMENTS

____

3. Goodwill and Other Intangible Assets, Continued:

Intangible assets were as follows at:

March 31, 2017 | December 31, 2016 | |||||||||||||||||||||||

(Millions) | Gross Cost | Accumulated Amortization | Net Carrying Value | Gross Cost | Accumulated Amortization | Net Carrying Value | ||||||||||||||||||

Franchise rights | $ | 1,285.1 | $ | (339.6 | ) | $ | 945.5 | $ | 1,285.1 | $ | (328.9 | ) | $ | 956.2 | ||||||||||

Customer lists | 2,066.7 | (1,479.0 | ) | 587.7 | 1,791.7 | (1,442.4 | ) | 349.3 | ||||||||||||||||

Cable franchise rights | 17.3 | (8.3 | ) | 9.0 | 17.3 | (8.0 | ) | 9.3 | ||||||||||||||||

Trade name | 8.0 | (0.1 | ) | 7.9 | — | — | — | |||||||||||||||||

Developed technology and software | 23.0 | (0.4 | ) | 22.6 | — | — | — | |||||||||||||||||

Patents | 10.6 | (5.6 | ) | 5.0 | 10.6 | (4.9 | ) | 5.7 | ||||||||||||||||

Balance | $ | 3,410.7 | $ | (1,833.0 | ) | $ | 1,577.7 | $ | 3,104.7 | $ | (1,784.2 | ) | $ | 1,320.5 | ||||||||||

Intangible asset amortization methodology and useful lives were as follows as of March 31, 2017:

Intangible Assets | Amortization Methodology | Estimated Useful Life | ||

Franchise rights | straight-line | 30 years | ||

Customer lists | sum of years digits | 5.5 - 15 years | ||

Cable franchise rights | straight-line | 15 years | ||

Trade name | straight-line | 7 years | ||

Developed technology and software | straight-line | 3 years | ||

Patents | straight-line | 3 years | ||

Amortization expense for intangible assets subject to amortization was $48.8 million and $47.5 million for the three month periods ended March 31, 2017 and 2016, respectively. Amortization expense for intangible assets subject to amortization was estimated to be as follows for each of the years ended March 31:

Year | (Millions) | ||

2018 | $ | 238.3 | |

2019 | 198.5 | ||

2020 | 158.1 | ||

2021 | 124.4 | ||

2022 | 90.9 | ||

Thereafter | 767.5 | ||

Total | $ | 1,577.7 | |

19

NOTES TO UNAUDITED INTERIM CONSOLIDATED FINANCIAL STATEMENTS

____

4. Long-term Debt:

Windstream Holdings has no debt obligations. All debt, including the senior secured credit facility described below, have been incurred by Windstream Services and its subsidiaries. Windstream Holdings is neither a guarantor of nor subject to the restrictive covenants imposed by such debt.

Long-term debt was as follows at:

(Millions) | March 31, 2017 | December 31, 2016 | ||||||

Issued by Windstream Services: | ||||||||

Senior secured credit facility, Tranche B5 – variable rates, due August 8, 2019 | $ | — | $ | 572.3 | ||||

Senior secured credit facility, Tranche B6 – variable rates, due March 29, 2021 (a) | 1,341.4 | 894.8 | ||||||

Senior secured credit facility, Tranche B7 – variable rates, due February 17, 2024 | 578.5 | — | ||||||

Senior secured credit facility, Revolving line of credit – variable rates, due April 24, 2020 | 648.0 | 475.0 | ||||||

Debentures and notes, without collateral: | ||||||||

2020 Notes – 7.750%, due October 15, 2020 | 700.0 | 700.0 | ||||||

2021 Notes – 7.750%, due October 1, 2021 | 809.3 | 809.3 | ||||||

2022 Notes – 7.500%, due June 1, 2022 | 441.2 | 441.2 | ||||||

2023 Notes – 7.500%, due April 1, 2023 | 343.5 | 343.5 | ||||||

2023 Notes – 6.375%, due August 1, 2023 | 585.7 | 585.7 | ||||||

Issued by subsidiaries of Windstream Services: | ||||||||

Windstream Holdings of the Midwest, Inc. – 6.75%, due April 1, 2028 (b) | 100.0 | 100.0 | ||||||

Net discount on long-term debt (c) | (13.9 | ) | (7.2 | ) | ||||

Unamortized debt issuance costs (c) | (54.6 | ) | (51.0 | ) | ||||

5,479.1 | 4,863.6 | |||||||

Less current maturities | (19.3 | ) | (14.9 | ) | ||||

Total long-term debt | $ | 5,459.8 | $ | 4,848.7 | ||||

(a) | If the maturity of the revolving line of credit is not extended prior to April 24, 2020, the maturity date of the Tranche B6 term loan will be April 24, 2020; provided further, if the 2020 Notes have not been repaid or refinanced prior to July 15, 2020 with indebtedness having a maturity date no earlier than March 29, 2021, the maturity date of the Tranche B6 term loan will be July 15, 2020. |

(b) | These bonds are secured equally with the senior secured credit facility with respect to the assets of Windstream Holdings of the Midwest, Inc. |

(c) | The net discount balance and unamortized debt issuance costs are amortized using the interest method over the life of the related debt instrument. |

Senior Secured Credit Facility - The amended credit facility provides that Windstream Services may seek to obtain incremental revolving or term loans in an unlimited amount subject to maintaining a maximum secured leverage ratio and other customary conditions, including obtaining commitments and pro forma compliance with financial maintenance covenants consisting of a maximum debt to consolidated earnings before interest, taxes, depreciation and amortization (“EBITDA”) ratio and a minimum interest coverage ratio. In addition, Windstream Services may request extensions of the maturity date under any of its existing revolving or term loan facilities.

On February 17, 2017, Windstream Services issued an aggregate principal amount of $580.0 million in borrowings under Tranche B7 of its senior secured credit facility, the proceeds of which were used to pay down amounts outstanding under Tranche B5, including accrued interest, and to pay related fees and expenses. The incremental Tranche B7 term loan matures on February 17, 2024 and was issued at a price of 99.5 percent of the principal amount of the loan.

20

NOTES TO UNAUDITED INTERIM CONSOLIDATED FINANCIAL STATEMENTS

____

4. Long-term Debt, Continued :

Interest rates applicable to the Tranche B7 term loan are, at Windstream Services’ option, equal to either a base rate plus a margin of 2.25 percent per annum or LIBOR plus a margin of 3.25 percent per annum. LIBOR for the Tranche B7 term loan shall at no time be less than 0.75 percent. The Tranche B7 term loan is subject to quarterly amortization payments in an aggregate amount equal to 0.25 percent of the initial principal amount of such term loans, with the remaining balance payable at maturity. At the time of repayment, unamortized debt issuance and discount related to Tranche B5 totaled $6.3 million, of which $1.2 million were included in the loss on debt extinguishment, while the remaining $5.1 million continue to be deferred and amortized to interest expense over the remaining life of Tranche B7 in accordance with debt modification accounting.

On the date of closing of the merger with EarthLink, Windstream Services amended its existing senior secured credit agreement to provide for the issuance of an aggregate principal amount of $450.0 million in incremental borrowings under Tranche B6, the proceeds of which were used to repay amounts outstanding under EarthLink’s credit facility and to redeem EarthLink’s outstanding 8.875 percent Senior Notes due 2019 and 7.375 percent Senior Secured Notes due 2020. The incremental loans were issued at a price of 99.0 percent of the principal amount of the loan. The incremental loans will be repayable at any time, subject to soft call protection for the first six months following incurrence.

During 2016, Windstream Services had executed incremental amendments to its existing senior secured credit facility to provide for the issuance of an aggregate principal amount $900.0 million term loan under Tranche B6 due March 29, 2021, the proceeds of which were used to repurchase $441.1 million of outstanding 7.875 percent notes due November 1, 2017 (the “2017 Notes”) pursuant to a tender offer and to repay other debt obligations of Windstream Services along with related fees and expenses. Interest on all incremental loans under Tranche B6 accrue at LIBOR plus a margin of 4.00 percent per annum, with LIBOR subject to a 0.75 percent floor. The incremental loans are subject to quarterly amortization in an aggregate amount of approximately 0.25 percent of the initial principal amount of the loans, with the remaining balance payable on March 29, 2021.

Revolving line of credit - Under the amended senior secured credit facility, Windstream Services may obtain revolving loans and may issue up to $30.0 million of letters of credit, which upon issuance reduce the amount available for other extensions of credit. Accordingly, the total amount outstanding under the letters of credit and the indebtedness incurred under the revolving line of credit may not exceed $1,250.0 million. Borrowings under the revolving line of credit may be used for permitted acquisitions, working capital and other general corporate purposes of Windstream Services and its subsidiaries. Windstream Services will pay a commitment fee on the unused portion of the commitments under the revolving credit facility that will range from 0.40 percent to 0.50 percent per annum, depending on the debt to consolidated EBITDA ratio of Windstream Services and its subsidiaries. Revolving loans made under the credit facility are not subject to interim amortization and such loans are not required to be repaid prior to April 24, 2020, other than to the extent the outstanding borrowings exceed the aggregate commitments under the revolving credit facility. Interest rates applicable to loans under the revolving line of credit are, at Windstream Services’ option, equal to either a base rate plus a margin ranging from 0.25 percent to 1.00 percent per annum or LIBOR plus a margin ranging from 1.25 percent to 2.00 percent per annum, based on the debt to consolidated EBITDA ratio of Windstream Services and its subsidiaries. The maturity date of the revolving line of credit is April 24, 2020.

During the first three months of 2017, Windstream Services borrowed $293.0 million under the revolving line of credit in its senior secured credit facility and retired $120.0 million of these borrowings through March 31, 2017. Considering letters of credit of $25.7 million, the amount available for borrowing under the revolving line of credit was $576.3 million at March 31, 2017.

During the first three months of 2017, the variable interest rate on the revolving line of credit ranged from 2.65 percent to 5.00 percent, and the weighted average rate on amounts outstanding was 2.83 percent during the period. Comparatively, the variable interest rate ranged from 2.25 percent to 4.50 percent during the first three months of 2016, with a weighted average rate on amounts outstanding during the period of 2.52 percent.

Debentures and Notes Repaid in 2016

Tender Offer for 2017 Notes - On March 29, 2016, Windstream Services repurchased $441.1 million aggregate principal amount of the 2017 Notes for total consideration of $477.5 million, plus accrued interest, pursuant to a cash tender offer. Under the tender offer, Windstream Services paid total consideration of $1,082.50 per $1,000 principal amount of the 2017 Notes, which included a $30 early tender payment, plus accrued and unpaid interest. At the time of the repurchases, there was $4.6 million in unamortized net discount and debt issuance costs related to the repurchased notes. Proceeds from the issuance of the Tranche B6 term loan were used to fund the repurchase of the 2017 Notes under the tender offer.

21

NOTES TO UNAUDITED INTERIM CONSOLIDATED FINANCIAL STATEMENTS

____

4. Long-term Debt, Continued:

Partial Repurchase of Senior Notes - Pursuant to the debt repurchase program authorized by Windstream Services’ board of directors, during the first three months of 2016, Windstream Services repurchased in the open market $154.2 million aggregate principal amount of its senior unsecured notes consisting of the following:

• | $93.5 million aggregate principal amount of 2017 Notes, at a repurchase price of $97.8 million, including accrued and unpaid interest; |

• | $33.1 million aggregate principal amount of 7.750 percent senior unsecured notes due October 1, 2021, (the “2021 Notes”), at a repurchase price of $26.0 million, including accrued and unpaid interest; |

• | $17.0 million aggregate principal amount of 7.500 percent senior unsecured notes due June 1, 2022, (the “2022 Notes”), at a repurchase price of $13.1 million, including accrued and unpaid interest; and |

• | $10.6 million aggregate principal amount of 7.500 percent senior unsecured notes due April 1, 2023, (the “2023 Notes”), at a repurchase price of $8.0 million, including accrued and unpaid interest, respectively. |

At the time of repurchase, there was $1.6 million in unamortized premium and debt issuance costs related to the repurchased notes. The repurchases were funded utilizing available borrowings under the amended revolving line of credit.

The repurchases under the tender offer and the debt repurchase program were accounted for under the extinguishment method of accounting. Windstream Services recognized a net loss on the early extinguishment of these debt obligations, as presented in the table below.

Net Loss on Early Extinguishment of Debt

The net loss on early extinguishment of debt was as follows:

Three Months Ended March 31, | |||||||||

(Millions) | 2017 | 2016 | |||||||

EarthLink 2019 and 2020 Notes: | |||||||||

Premium on early redemption | $ | (18.3 | ) | $ | — | ||||

Unamortized premium recorded in the Merger | 16.3 | — | |||||||

Loss on early extinguishment of EarthLink 2019 and 2020 Notes | (2.0 | ) | — | ||||||

Senior secured credit facility: | |||||||||

Unamortized discount on original issuance | (0.3 | ) | — | ||||||

Unamortized debt issuance costs on original issuance | (0.9 | ) | — | ||||||

Loss on early extinguishment of senior secured credit facility | (1.2 | ) | — | ||||||

2017 Notes: | |||||||||

Premium on repurchases | — | (40.6 | ) | ||||||

Third-party fees for repurchases | — | (2.2 | ) | ||||||

Unamortized discount on original issuance | — | (2.0 | ) | ||||||

Unamortized debt issuance costs on original issuance | — | (3.7 | ) | ||||||

Loss on early extinguishment of 2017 Notes | — | (48.5 | ) | ||||||

Partial repurchases of 2021, 2022 and 2023 Notes: | |||||||||

Discount on repurchases | — | 13.6 | |||||||

Unamortized premium on original issuance | — | 0.3 | |||||||

Unamortized debt issuance costs on original issuance | — | (0.8 | ) | ||||||

Gain on early extinguishment from partial repurchases of 2021, 2022 and 2023 Notes | — | 13.1 | |||||||

Net loss on early extinguishment of debt | $ | (3.2 | ) | $ | (35.4 | ) | |||

22

NOTES TO UNAUDITED INTERIM CONSOLIDATED FINANCIAL STATEMENTS

____

4. Long-term Debt, Continued:

Maturities for long-term debt outstanding as of March 31, 2017, excluding $13.9 million of unamortized net discount and $54.6 million of unamortized debt issuance costs, were as follows:

Twelve month period ended: | (Millions) | ||

March 31, 2018 | $ | 19.3 | |

March 31, 2019 | 19.3 | ||

March 31, 2020 | 19.3 | ||

March 31, 2021 | 2,654.7 | ||

March 31, 2022 | 815.1 | ||

Thereafter | 2,019.9 | ||

Total | $ | 5,547.6 | |

Interest Expense

Interest expense was as follows:

Three Months Ended March 31, | ||||||||||

(Millions) | 2017 | 2016 | ||||||||

Interest expense - long-term debt | $ | 85.9 | $ | 91.5 | ||||||

Interest expense - long-term lease obligations: | ||||||||||

Telecommunications network assets | 122.8 | 126.9 | ||||||||

Real estate contributed to pension plan | 1.5 | 1.5 | ||||||||

Impact of interest rate swaps | 2.8 | 2.8 | ||||||||

Interest on capital leases and other | 1.1 | 0.6 | ||||||||

Less capitalized interest expense | (2.3 | ) | (3.6 | ) | ||||||

Total interest expense | $ | 211.8 | $ | 219.7 | ||||||

Debt Compliance

The terms of Windstream Services’ credit facility and indentures include customary covenants that, among other things, require maintenance of certain financial ratios and restrict Windstream Services’ ability to incur additional indebtedness. These financial ratios include a maximum leverage ratio of 4.5 to 1.0 and a minimum interest coverage ratio of 2.75 to 1.0. In addition, the covenants include restrictions on dividend and certain other types of payments. As of March 31, 2017, Windstream Services was in compliance with all of these covenants.

In addition, certain of Windstream Services’ debt agreements contain various covenants and restrictions specific to the subsidiary that is the legal counterparty to the agreement. Under Windstream Services’ long-term debt agreements, acceleration of principal payments would occur upon payment default, violation of debt covenants not cured within 30 days, a change in control including a person or group obtaining 50 percent or more ownership interest in Windstream Services, or breach of certain other conditions set forth in the borrowing agreements. Windstream Services and its subsidiaries were in compliance with these covenants as of March 31, 2017.

5. Derivatives: