Attached files

| file | filename |

|---|---|

| 8-K - 8-K - HOME BANCORP, INC. | d837153d8k.htm |

December 15, 2014

3

rd

Quarter 2014

Investor Presentation

Exhibit 99.1 |

Forward Looking Statements

Certain comments in this presentation contain certain forward looking statements

(as defined in the Securities Exchange Act of 1934 and the regulations

hereunder). Forward looking statements are not historical facts but instead represent only the

beliefs, expectations or opinions of Home Bancorp, Inc. and its management

regarding future events, many of which, by their nature, are inherently

uncertain. Forward looking statements may be identified by the use of such

words as: “believe”, “expect”, “anticipate”,

“intend”, “plan”, “estimate”, or words of similar meaning, or future or conditional terms such as “will”,

“would”, “should”, “could”, “may”,

“likely”, “probably”, or “possibly.” Forward

looking statements include, but are not limited to, financial projections

and estimates and their underlying assumptions; statements regarding plans, objectives and

expectations with respect to future operations, products and services; and

statements regarding future performance. Such statements are subject to

certain risks, uncertainties and assumption, many of which are difficult to predict and generally are

beyond the control of Home Bancorp, Inc. and its management, that could cause

actual results to differ materially from those expressed in, or implied or

projected by, forward looking statements. The following factors, among others, could cause actual

results to differ materially from the anticipated results or other expectations

expressed in the forward looking statements: (1) economic and competitive

conditions which could affect the volume of loan originations, deposit flows and real estate values;

(2) the levels of non-interest income and expense and the amount of loan

losses; (3) competitive pressure among depository institutions increasing

significantly; (4) changes in the interest rate environment causing reduced interest margins; (5) general

economic conditions, either nationally or in the markets in which Home Bancorp,

Inc. is or will be doing business, being less favorable than expected; (6)

political and social unrest, including acts of war or terrorism; or (7) legislation or changes in

regulatory requirements adversely affecting the business in which Home Bancorp,

Inc. is engaged. Home Bancorp, Inc. undertakes no obligation to update

these forward looking statements to reflect events or circumstances that occur after the

date on which such statements were made.

As used in this report, unless the context otherwise requires, the terms

“we,” “our,”

“us,”

or the “Company”

refer to Home

Bancorp, Inc. and the term the “Bank”

refers to Home Bank, a federally chartered savings bank and wholly owned

subsidiary of the Company. In addition, unless the context otherwise

requires, references to the operations of the Company include the

operations of the Bank.

For a more detailed description of the factors that may affect Home

Bancorp’s operating results or the outcomes described in these

forward-looking statements, we refer you to our filings with the Securities and Exchange Commission, including our

annual report on Form 10-K for the year ended December 31, 2013. Home Bancorp

assumes no obligation to update the forward-looking statements made

during this presentation. For more information, please visit our website

www.home24bank.com.

2 |

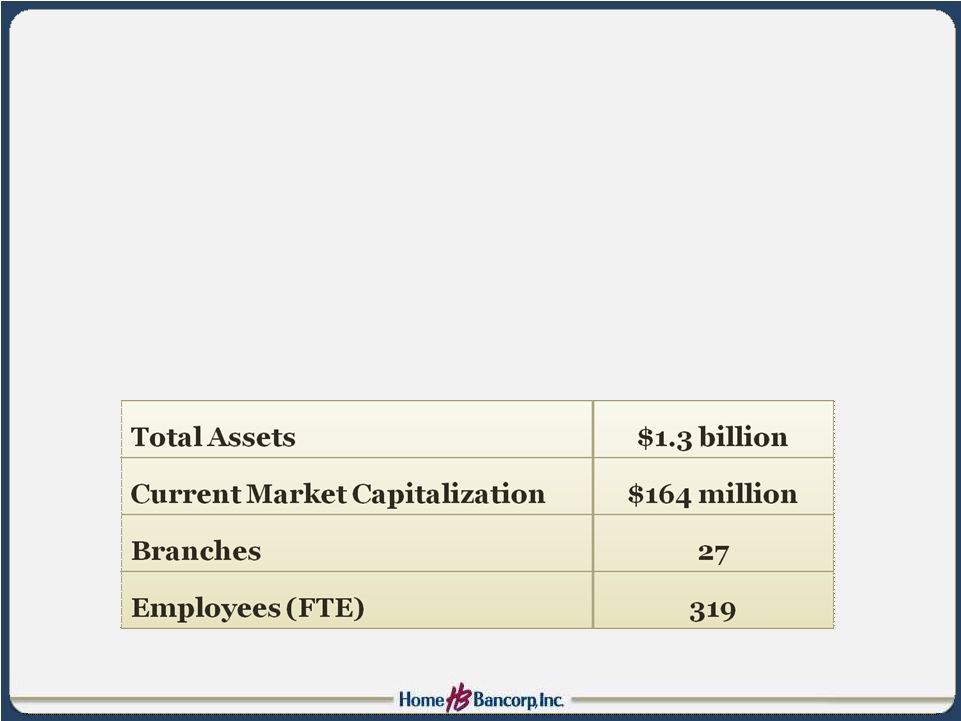

Our

Company •

Bank chartered in 1908 –

106 years strong

•

Headquartered in Lafayette, Louisiana

•

Federal Savings Bank Charter

•

IPO completed in October 2008

•

Ticker symbol: HBCP (Nasdaq Global)

3 |

Significant Asset Growth Since IPO

4

138% asset increase

CAGR = 16% |

Acquisitions

•

Britton & Koontz Bank –

February 2014

–

Baton Rouge, Natchez & Vicksburg, Mississippi

–

Cash Deal @ 88% of book value

•

$301 MM Assets, $170MM Loans, $216MM Deposits

•

Guaranty Savings Bank –

July 2011

–

Greater New Orleans

–

Cash Deal @ 95% of book value

•

$257 MM Assets, $184MM Loans, $193MM Deposits

•

Statewide Bank –

March 2010

–

Northshore of Lake Ponchartrain/New Orleans

–

FDIC assisted

•

$199MM Assets, $157MM Loss Share Loans, $206MM Deposits

5 |

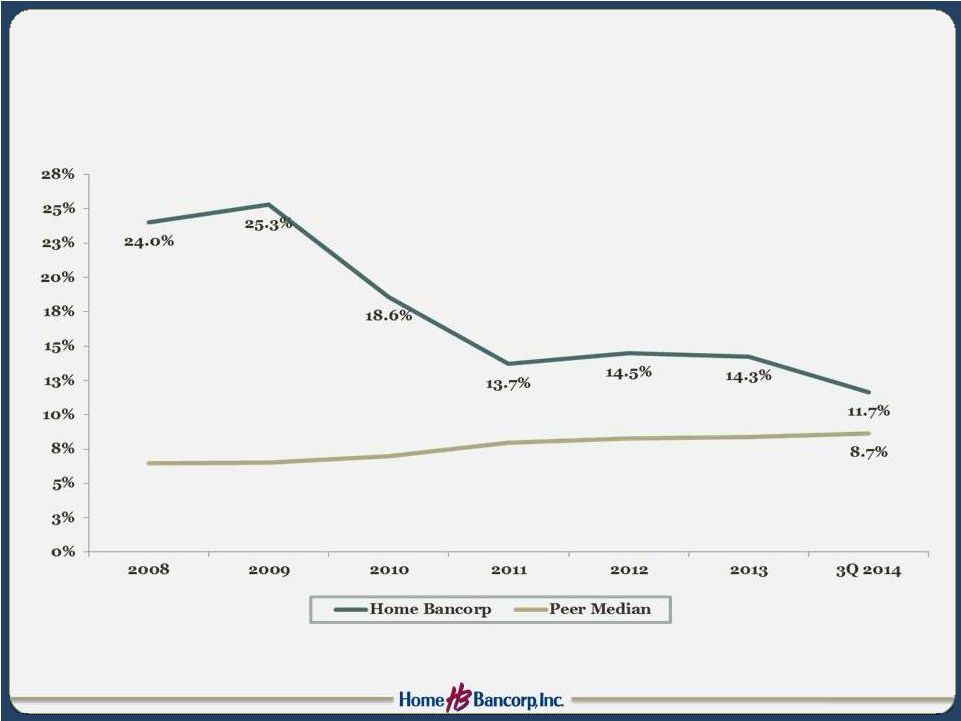

Tangible Common Equity Ratio

6

Peer = BHCs $1-$3 billion in assets. Peer data as of 6/30/2014.

Source: ffiec.gov |

Share

Repurchase Activity 7

21% of IPO shares

repurchased |

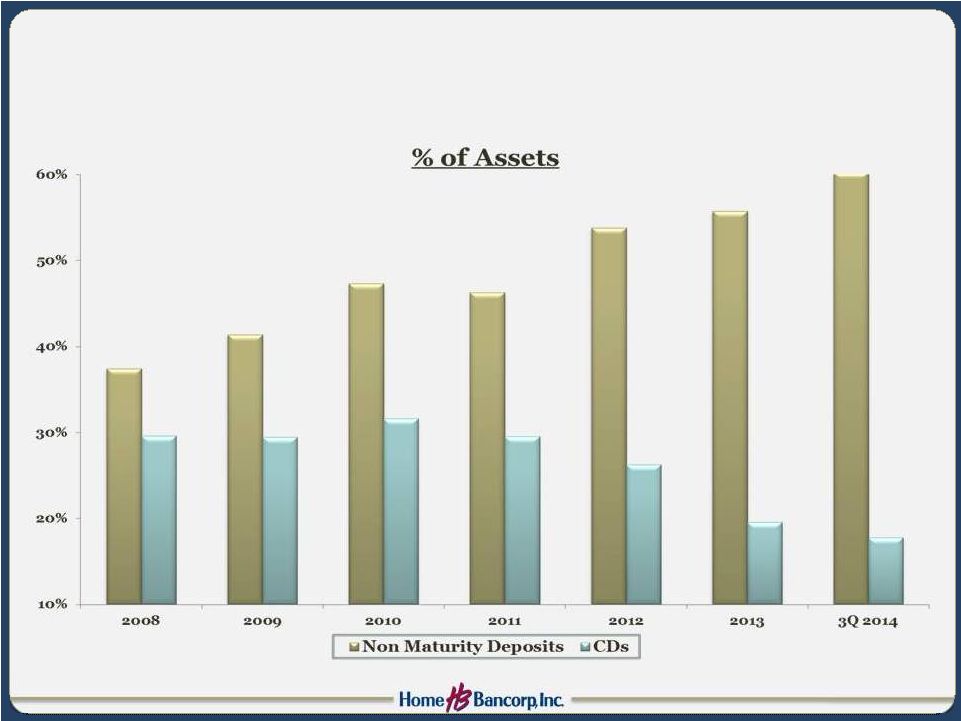

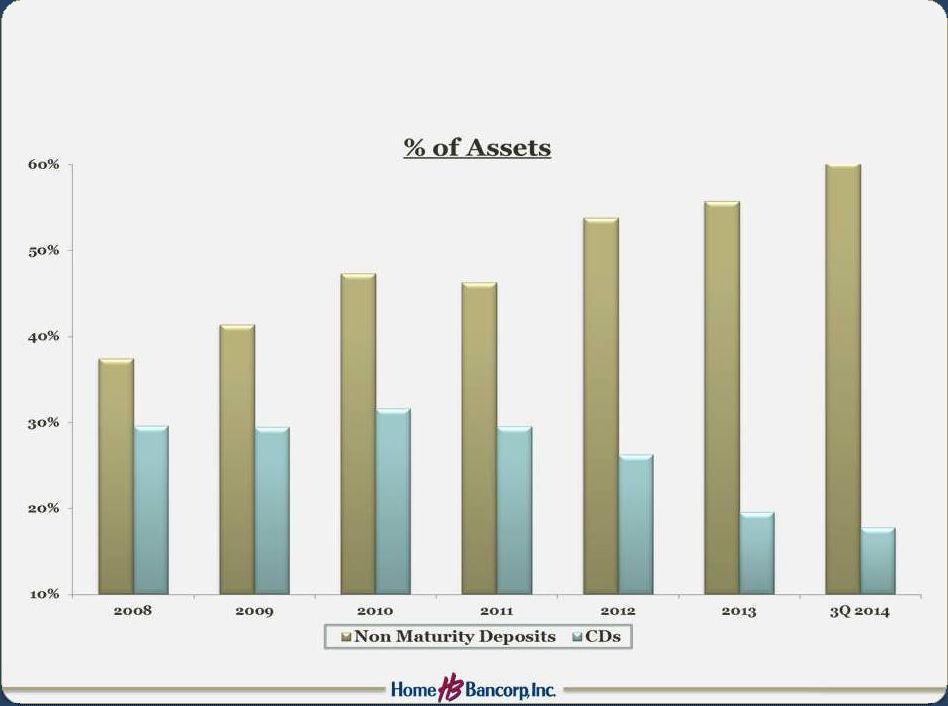

Favorable Balance Sheet Mix Change

(% of assets)

8

2008

2009

2010

2011

2012

2013

3Q 2014

Cash & Equivalents

9%

5%

6%

4%

4%

4%

5%

Investments

22%

23%

18%

16%

17%

16%

15%

Total Loans net

63%

64%

63%

69%

70%

71%

72%

Other Assets

6%

8%

13%

11%

9%

9%

8%

Non Maturity Deposits

38%

41%

47%

46%

54%

56%

60%

CDs

29%

30%

32%

30%

26%

19%

18%

Borrowings & Other

9%

4%

2%

10%

5%

10%

10%

Equity

24%

25%

19%

14%

15%

14%

12%

•

Strong organic loan growth

•

Shrinking investment portfolio (as % of assets)

•

Deposit growth has offset capital deployment |

Our

Locations 9

Source: snl.com |

Unemployment Rate by Market

September 2014

10

Sources: bls.gov, mdes.ms.gov |

•

Low unemployment (4.4%)

•

1

st

overall mid-size city (8

th

overall) for manufacturing jobs

(New Geography 2013)

•

5

th

best mid-size city (17

th

overall)

in Leading Locations for

Economic & Job Growth (Area

Development 2014)

•

5

th

best mid-size city (27

th

overall)

Best Cities for Jobs, Forbes 2014

•

Home to most affordable

university in Louisiana (U.S.

Department of Education 2013)

11

2013

Rank

Institution

Deposits

in Market

($000)

Parish

Market

Share %

1

Iberiabank

1,634,275

29.08

2

JP Morgan

1,053,938

18.75

3

Home Bank

489,351

8.71

4

Hancock

487,052

8.67

5

Capital One

469,405

8.35

Lafayette Market

Source: snl.com |

•

1

st

overall metro area for

Economic Growth Potential

(Business Facilities 2013)

•

1

st

overall most rapidly recovering

housing market (National

Association of Home Builders)

•

Top 5 emerging entrepreneurial

cities (Entrepreneur Magazine

2013)

•

7

th

overall best city for

information jobs (Forbes 2013)

•

Top 25 best places to retire

(Forbes 2013)

12

2013

Rank

Institution

Deposits

in Market

($000)

Parish

Market

Share %

1

JP Morgan

6,770,803

47.3

2

Capital One

2,660,497

18.6

3

Regions

1,444,723

10.1

4

Hancock

1,365,528

9.5

5

Iberiabank

555,857

3.9

12

Home Bank

73,660

0.5

Baton Rouge Market

Source: snl.com |

•

1

st

overall in US for working age

In-migration of Prime Workers

(Forbes 2014)

•

1

st

Most Economical mid-size city

for business (KPMG 2014)

•

1

st

overall for the decade for Major

Economical Development Wins in

the South (Southern Business &

Development)

•

1

st

in US for Exports per capita

(New Geography 2013)

•

2

nd

overall in US Post Recession

Performance (Brookings Institute

2013)

13

2013

Rank

Institution

Deposits in

Market

($000)

Fed

Market

Share %

1

Capital One

10,390,696

32.4

2

Hancock

4,927,007

15.4

3

JP Morgan

4,707,911

14.7

4

Regions

2,380,213

7.4

5

First NBC

2,289,444

7.1

16

Home Bank

228,476

0.7

New Orleans/Northshore Market

Source: snl.com |

•

Strong, stable deposit base

•

25% non-interest-bearing deposits

•

Limited large bank competition

•

Tuscaloosa Shale opportunity

14

2013

Rank

Institution

Deposits in

Market

($000)

County

Market

Share %

1

BancorpSouth

240,245

32.1

2

Trustmark

215,151

28.7

3

RiverHills

133,296

17.8

4

Regions

124,974

16.7

5

Guaranty B&T

20,639

2.8

6

Home Bank

14,353

1.9

2013

Rank

Institution

Deposits in

Market

($000)

County

Market

Share %

1

Home Bank

171,768

27.8

2

United Miss.

170,737

27.6

3

Regions

147,509

23.9

4

Concordia

127,968

20.7

Vicksburg

Natchez

Western Mississippi Market

Source: snl.com |

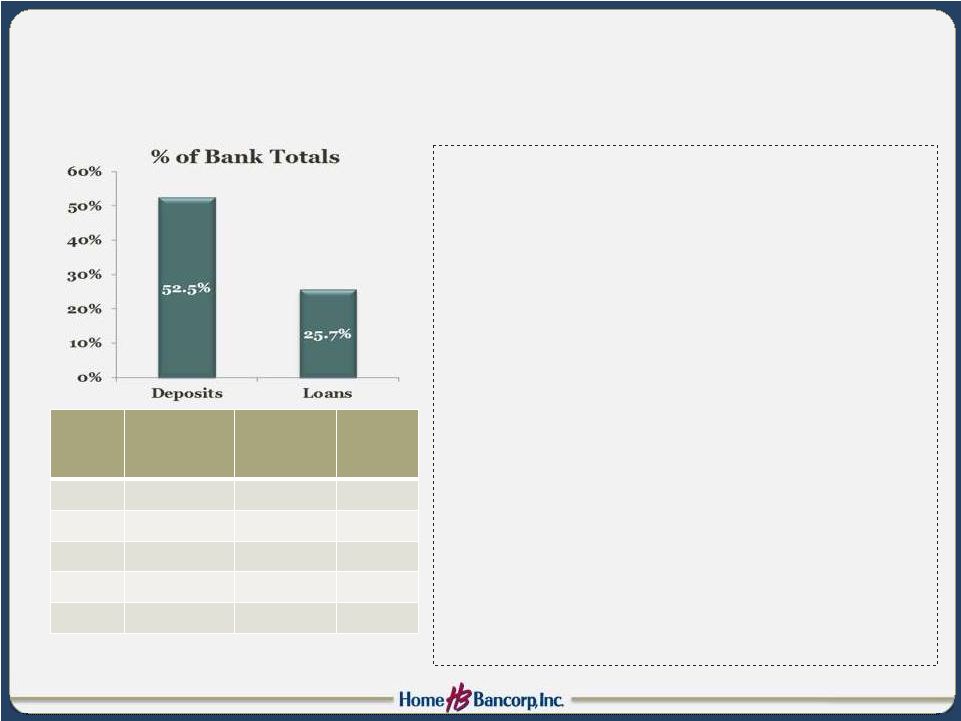

15

Market Diversification

September 30, 2014

Loans

Deposits

In 2008, virtually 100% of loans and deposits were located in Lafayette

Market |

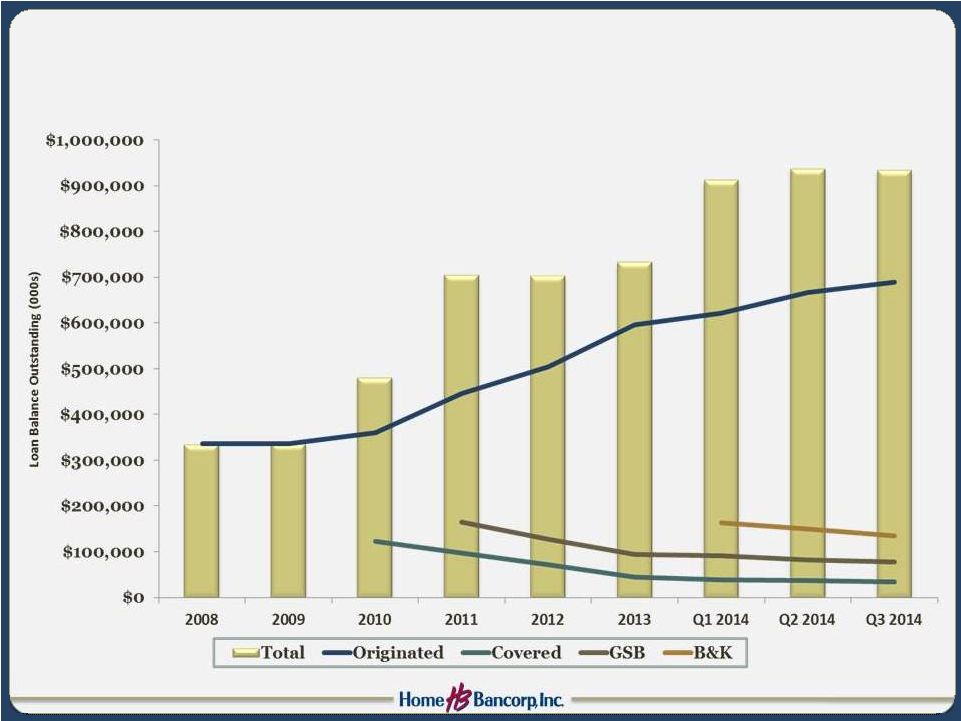

Strong Organic Loan Growth

(excludes acquisition accounting discounts)

16 |

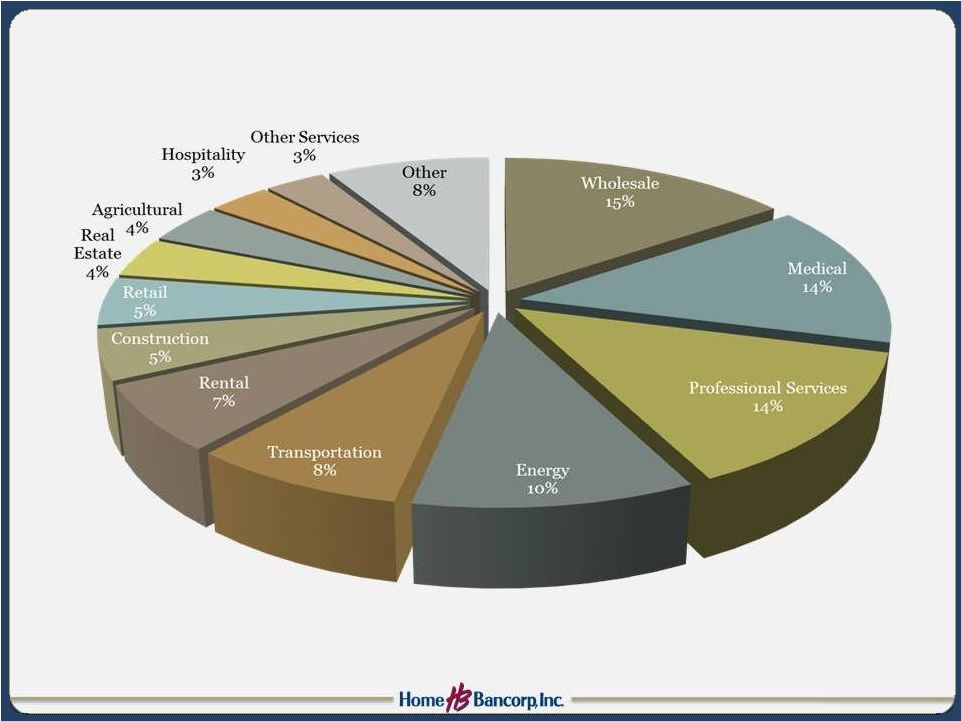

Loan

Portfolio Composition 17

12/31/08 balance:

$336 million

9/30/14 balance:

$907 million

Direct Energy Exposure = 3% of

Total Loans |

Commercial Real Estate Portfolio

18

9/30/14 balance:

$330 million |

Construction and Land Portfolio

19

9/30/14 balance:

$123 million |

C&I Portfolio

20

9/30/14 balance:

$96 million |

1-4 Family First Mortgage Portfolio

21

9/30/14 balance:

$234 million

Original Term

Mortgage Portion |

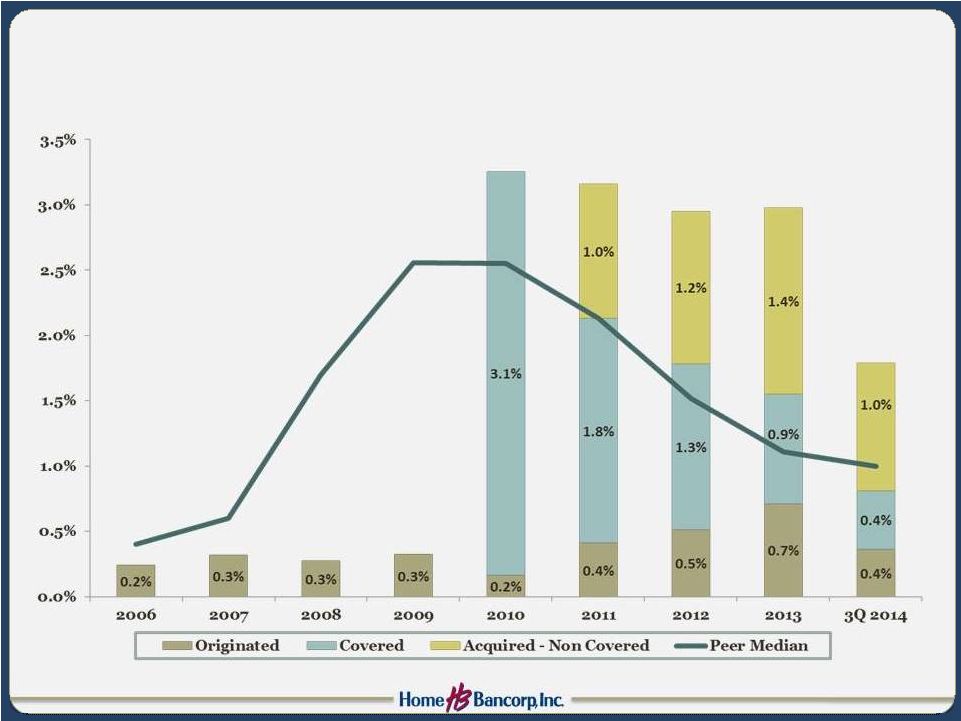

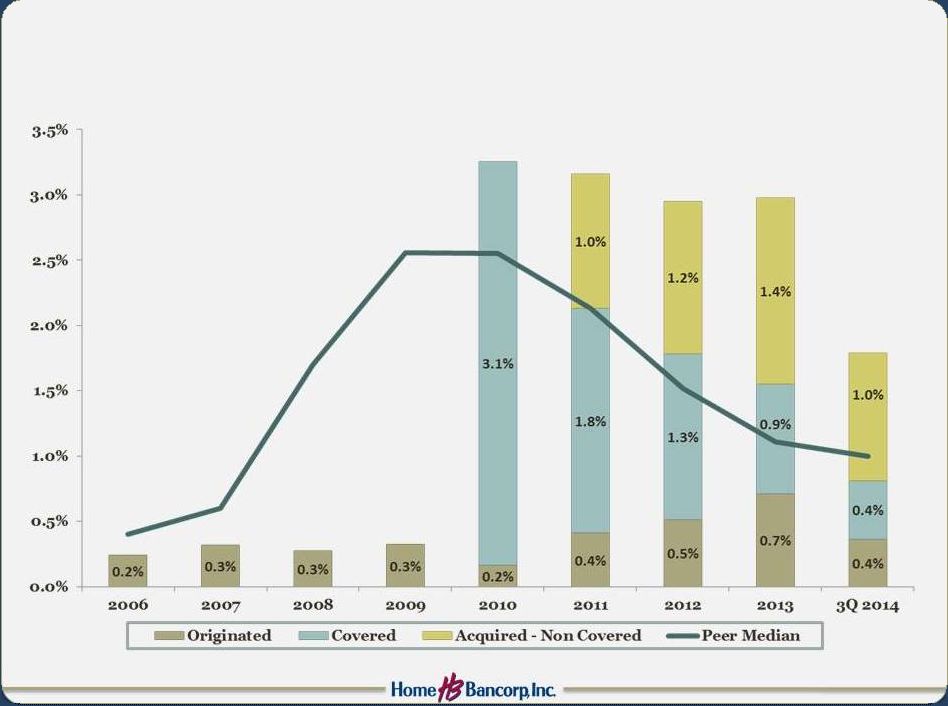

Non

Performing Assets / Assets 22 |

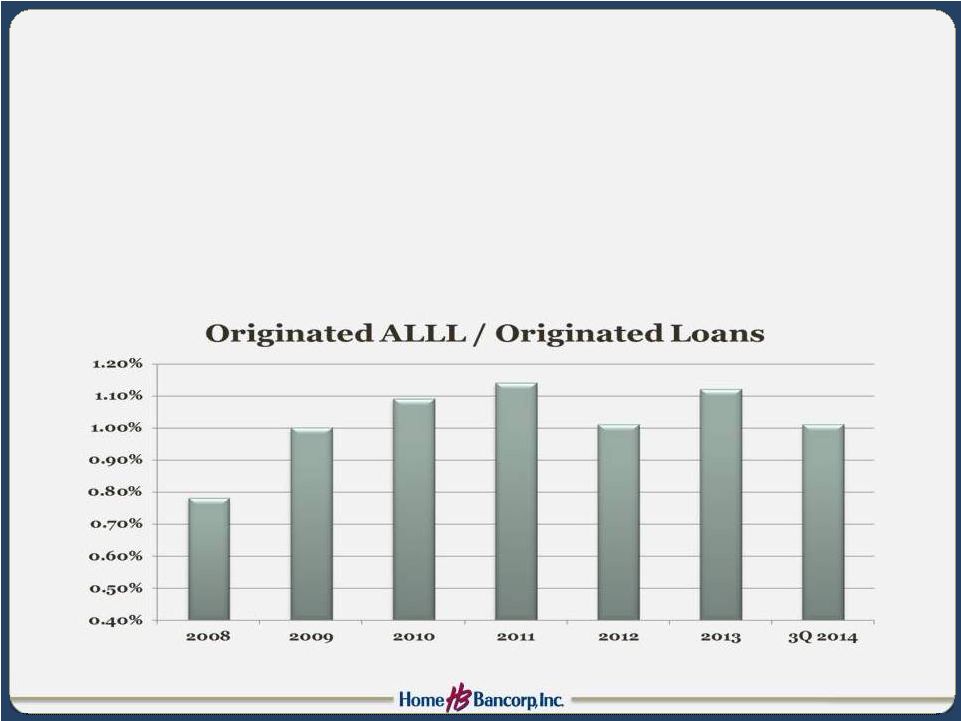

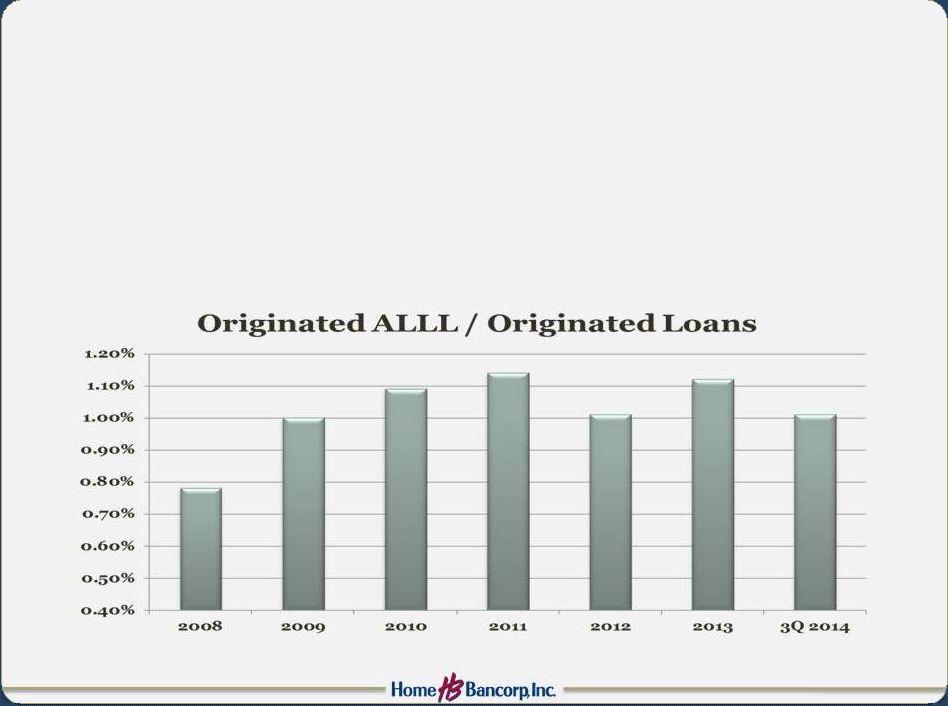

•

Reported ALLL / Gross Loans = 0.82%

–

Peer Median = 1.34%

23

ALLL and Loan Discounts |

Deposit Growth and Composition

24

Non-Interest Deposits / Assets

Home Bank = 20%

Peer Median = 15% |

Strong Non-Maturity Deposit Growth

25 |

Quarterly Performance Metrics

26

3Q 2013

4Q 2013

1Q 2014

2Q 2014

3Q 2014

Reported Net Income

$2,482,747

$1,705,649

$1,433,456

$2,752,625

$2,876,517

Merger Adjusted Net Income

(1)

$2,482,747

$1,905,406

$2,790,488

$2,889,045

$2,888,065

EPS -

Diluted

(1)

$0.37

$0.28

$0.40

$0.42

$0.41

ROA

(1)

1.04%

0.79%

1.00%

0.93%

0.93%

ROE

(1)

7.14%

5.39%

7.90%

7.87%

7.70%

Efficiency Ratio

(1)

65.4%

71.6%

69.1%

66.2%

64.0%

NIM (TE)

4.79%

4.60%

4.72%

4.64%

4.63%

TCE Ratio

14.4%

14.2%

11.3%

11.4%

11.7%

Tangible Book Value/Share

$19.47

$19.72

$19.65

$20.20

$20.58

Ending Share Price

$18.06

$18.85

$20.99

$22.02

$22.71

NPAs/Assets

2.9%

3.0%

2.3%

2.1%

1.8%

Originated NPAs

(2)

/Originated Assets

0.7%

0.8%

0.5%

0.5%

0.4%

(1)

Excludes merger-related costs (see Table 2 in appendix)

(2)

Excludes acquired NPAs |

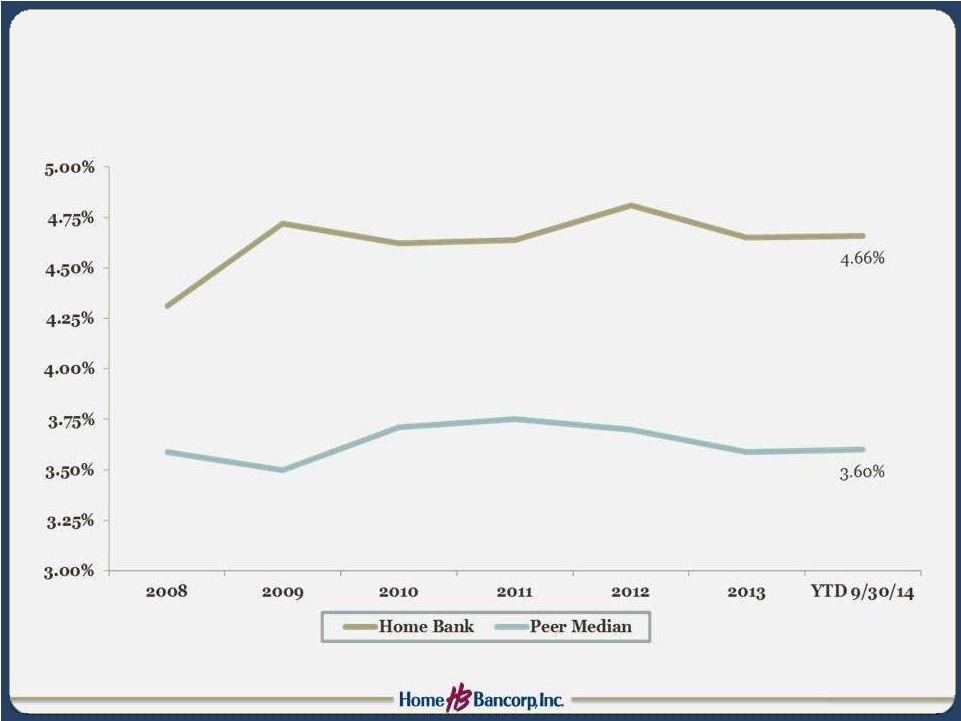

Net

Interest Margin (TE) 27 |

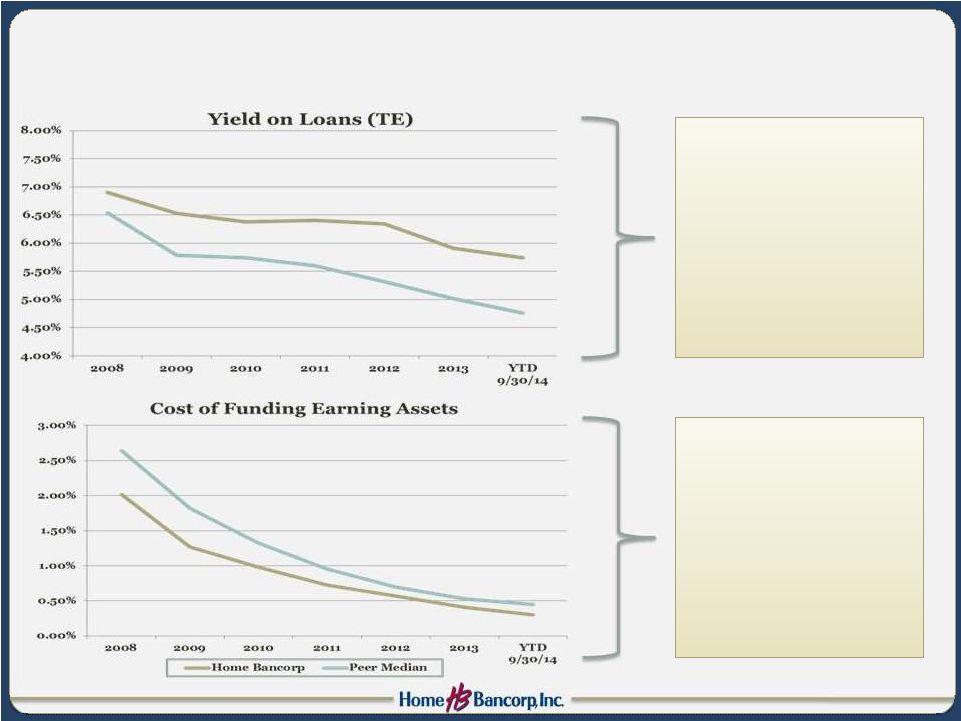

Net

Interest Margin Drivers 28

•

Strong loan/asset ratio

(71

st

percentile)

•

Loan discount balance

and accretion

•

C&D loans

•

Maintained lower costs

than peers even after

capital was deployed

•

Increased balances of

Non-interest deposits

•

Lower reliance on CDs |

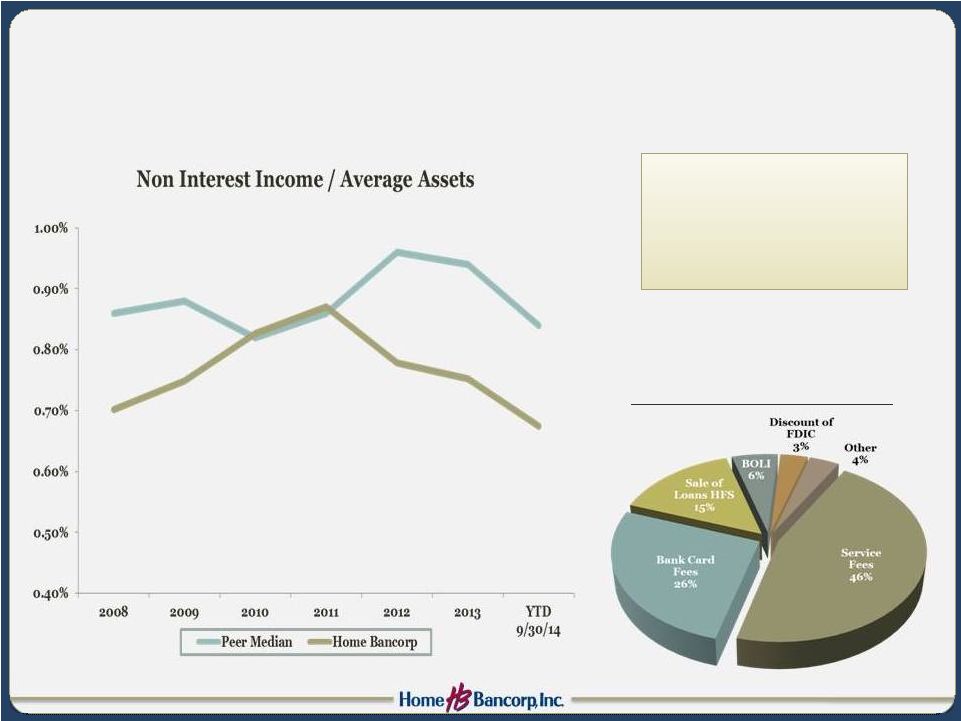

Non-Interest Income

29

2014 YTD Non-Interest Income

•

New retail leadership

•

Mortgage

•

Brokerage |

Non-Interest Expense

(excluding merger-related costs)

(1)

30

2014 YTD Non-Interest Expense

(1)

•

Investments in

commercial and

retail bankers

•

Infrastructure to

support continued

growth

•

Focus on efficiency

(1)

Excludes merger-related costs (see Table 2 in appendix)

|

Interest Rate Risk

Change in Interest Rates

(1)

% Change in NII at 9/30/14

(2)

+100

-0.2%

+200

-0.7%

+300

-1.3%

31

1)

Assumes instantaneous and parallel shift in interest rates.

2)

The actual impact of changes in interest rates will depend on many factors

including but not limited to: the Company’s ability to maintain

desired mix of interest-earning assets and interest-bearing

liabilities, actual timing of asset and liability repricing, and

competitor reaction to deposit and loan pricing.

•

Slightly liability sensitive

•

Effective duration of investment portfolio = 2.8 years

|

Total Return Since 2008

32

Source: SNL. Data as of 12/09/2014 |

Share Information

33

4Q 2013

1Q 2014

2Q 2014

3Q 2014

12 Months

EPS –

GAAP

$0.25

$0.21

$0.40

$0.41

$1.27

EPS –

Merger Adjusted

(1)

$0.28

$0.40

$0.42

$0.41

$1.51

Ending Share Price

$18.85

$20.99

$22.02

$22.71

Dividend Yield

0.0%

0.0%

0.0%

0.0%

P/BV

94%

103%

106%

107%

P/TBV

96%

107%

109%

110%

Price / Earnings (12 months prior)

P/EPS –

GAAP

17.86x

P/EPS –

Merger Adjusted

(1)

14.96x

(1)

Excludes merger-related costs (see Table 1 in appendix)

$0.07 Dividend declared in

4

th

quarter (1.2% Yield) |

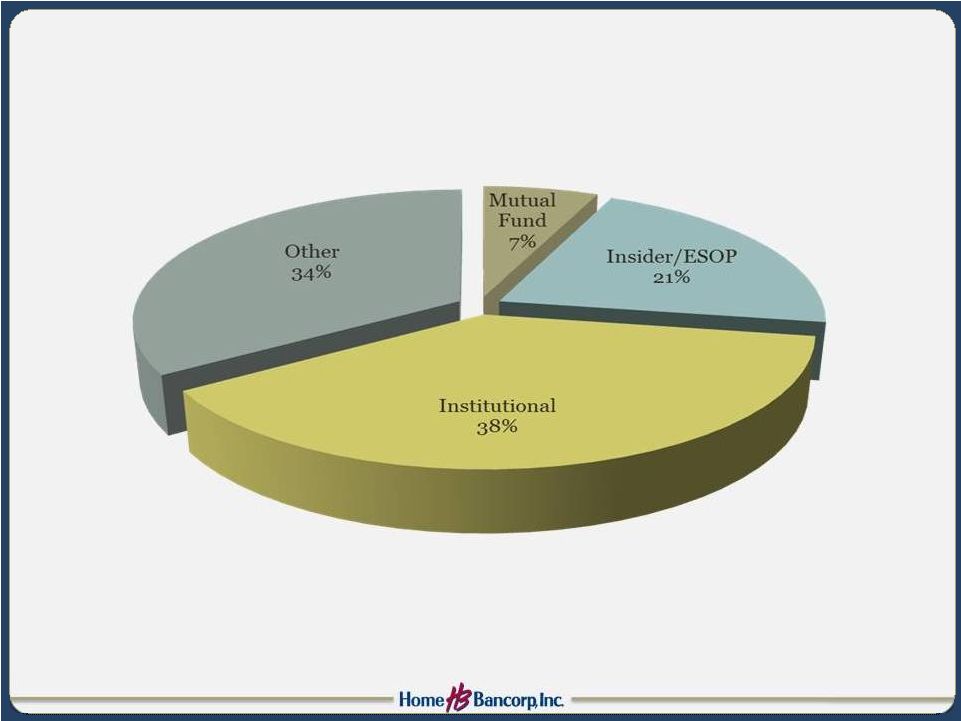

HBCP

Ownership 34

Source: SNL (data as of 12/09/2014)

Fully Diluted Insider Ownership = 26% |

Investment Perspective

•

Consistently superior organic asset quality

•

Deep customer relationships –

106 years

•

Successful acquirer; experienced deal team

•

Strong capital base

–

Disciplined deployment

–

Well positioned for further acquisitions

•

Vibrant economies

•

Trading at 110% of tangible book value

35 |

Executive Leadership

36

Scott Sutton, Chief Operations Officer

Joined Home Bank in 2008. Previously

served as Senior Vice President of

Operations of Teche Federal Bank and

as Senior Vice President of Iberiabank.

Darren Guidry, Chief Credit Officer

Joined Home Bank in 1993.

Previously served as Chief Lending

Officer.

Scott Ridley, Chief Banking Officer

Joined Home Bank in 2013.

Previously served as Group

Executive for Louisiana Business

Banking for Capital One Bank.

Joseph Zanco, Chief Financial Officer

Joined Home Bank in 2008. Previously

served as Corporate Controller and

Principal Accounting Officer for

Iberiabank.

John Bordelon, President and Chief Executive Officer

Has led Home Bank since 1993. Previously served in various management and other

positions since joining the Bank in 1981. Former Chairman of the

following organizations:

Greater

Lafayette

Chamber

of

Commerce,

University

of

Louisiana

Alumni Association, Community Bankers of Louisiana, and Ragin Cajun Athletic

Foundation |

Appendix

Non-GAAP Reconciliation

37

(dollars in thousands)

3Q 2013

4Q 2013

1Q 2014

2Q 2014

3Q 2014

Reported non-interest expense

7,890

$

8,774

$

11,257

$

10,370

$

9,968

$

Less: Merger-related expenses

-

(307)

(1,955)

(207)

(128)

Non-GAAP non-interest expense

7,890

$

8,467

$

9,302

$

10,163

$

9,840

$

Reported Net Income

2,483

1,706

1,433

2,753

2,877

Add: Merger-related expenses (after tax)

-

200

1,357

136

12

Non-GAAP Net Income

2,483

1,906

2,790

2,889

2,889

Diluted EPS

0.37

$

0.25

$

0.21

$

0.40

$

0.41

$

Add: Merger-related expenses

-

0.03

0.19

0.02

-

Non-GAAP EPS

0.37

$

0.28

$

0.40

$

0.42

$

0.41

$

TABLE 1

Reported non-interest expense

24,373

$

31,002

$

32,763

$

33,205

$

31,595

$

Less: Merger-related expenses

(1,000)

(2,053)

-

(307)

(2,290)

Non-GAAP noninterest expense

23,373

$

28,949

$

32,763

$

32,898

$

29,305

$

TABLE 2

Nine months

ended

9/30/14

2013

2011

2012

2010

(dollars in thousands) |

|