Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - INDEPENDENCE REALTY TRUST, INC. | d829370d8k.htm |

Independence

Realty Trust, Inc. December 2014

Exhibit 99.1 |

Forward Looking

Statements, Non-GAAP Financial Measures and Disclaimers 2

This document and the related presentation may contain forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of 1995. These

forward-looking statements include, but are not limited to, statements about

Independence

Realty

Trust,

Inc.’s

(“IRT”)

plans,

objectives,

expectations

and

intentions

with

respect

to

future

operations,

projected acquisitions of properties under contract or in IRT’s pipeline and other

statements that are not historical facts. Forward-looking statements are sometimes

identified by the words “may”, “will”, “should”, “potential”, “predict”, “continue”,

“project”, “guide”, or other similar words or expressions. These

forward-looking statements are based upon the current beliefs and expectations of

IRT's management and are inherently subject to significant business, economic and competitive

uncertainties and contingencies, many of which are difficult to predict and generally not

within IRT’s control. In addition, these forward-looking statements are

subject to assumptions with respect to future business strategies and decisions that are

subject to change. IRT does not guarantee that the assumptions underlying such forward looking

statements are free from errors. Actual results may differ materially from the

anticipated results discussed in these forward-looking statements. The following

factors, among others, could cause actual results to differ materially from the anticipated results or other

expectations expressed in the forward-looking statements: the risk factors and other

disclosure contained in filings by IRT with the Securities and Exchange Commission

(“SEC”), including, without limitation, IRT’s most recent annual and quarterly reports

filed with SEC. IRT’s SEC filings are available on IRT’s website at www.irtreit.com. You are cautioned not to place undue reliance on

these forward-looking statements, which speak only as of the date of this

presentation. All subsequent written and oral forward-looking statements attributable to

IRT or any person acting on its behalf are expressly qualified in their entirety by the

cautionary statements contained or referred to in this document and the related

presentation.

Except

to

the

extent

required

by

applicable

law

or

regulation,

IRT

undertakes

no

obligation

to

update

these

forward-looking statements to reflect events or circumstances after the date of this

presentation or to reflect the occurrence of unanticipated events.

This document and the related presentation may contain non-U.S. generally accepted

accounting principles (“GAAP”) financial measures. A reconciliation of

these non-GAAP financial measures to the most directly comparable GAAP financial measure is

included in this document and/or IRT’s most recent annual and quarterly reports.

This presentation is for informational purposes only and does not constitute an offer

to sell or a solicitation of an offer to buy any securities of IRT.

|

–

Listed on the NYSE MKT in August 2013 –

“IRT”

–

Targets markets with strong demographic and employment trends with minimal new supply

–

22

properties

in

13

states

representing

6,470

units

at

September

30,

2014

–

Focused on delivering strong risk-adjusted returns

–

Monthly common dividend of $0.06 or $0.72 annually representing a 7.6% yield with a $9.44

stock price at November 28, 2014

–

IRT

is

externally

managed

by

a

subsidiary

of

RAIT

Financial

Trust

(NYSE:

RAS)

–

a

multi-strategy

commercial real estate company with a vertically integrated platform and significant

experience owning and lending against apartment properties

–

Seasoned external manager with significant resources for IRT’s benefit

Who are we?

3

•

IRT is an apartment REIT focused on building a portfolio of well-located apartment properties

in supply constrained secondary and tertiary markets which generate

attractive current returns with

the potential for rent increases and improved operating efficiency.

|

Attractive

Apartment Industry Dynamics Support Strong Demand 4

Positive Trends

Data Source: U.S. Census Bureau, National Multifamily Housing Council (NMHC), Economy.com,

RAIT Financial Trust IRT expects conditions will remain favorable for apartment

fundamentals for the foreseeable future in secondary markets. •

Positive Demographic Factors.

The Echo boom generation (born early 80’s –

’00’s), which is significantly larger than Gen X (born early

60’s –

80’s), is entering the rental market. Harvard research suggests that renters could

make up half of all new households by 2020. This equates to up to 7 million new

renter households this decade. •

Supply Shortage.

Supply has been constrained since the recession; U.S. needs 300,000 new apartments every year

to meet demand. Supply is still playing catch-up from the impacts of the

recession. In 2010, there were only 100,804 new apartments built. In 2013,

133,388 new apartments were built. Through the first three quarters of 2014,

114,262 new apartments were built. The majority of new developments since the downturn

have been focused on primary markets. •

Low

homeownership.

Changing

demographic

factors

and

lifestyles

plus

stringent

mortgage

lending

standards

and

competition

from

own-

to-rent

investors

have

resulted

in

the

homeownership

rate

at

levels

last

seen

in

the

mid-1990s |

Key Statistics

- Strong Momentum in the Business

5

•

Since September 30, 2013, IRT has more than doubled its portfolio by number of units and

properties As of or For the Three-Month Periods Ended

September 30,

2014

June 30,

2014 March 31,

2014 December 31,

2013

September 30,

2013

Financial Statistics:

Total revenue

$

13,057

$

11,649

$

8,135

$

5,768

$

4,787

Earnings (loss) per share-diluted

$

(0.00)

$

(0.01)

$

0.19

$

0.03

$

0.03

Funds from Operations (“FFO”) per

share

$

0.14

$

0.18

$

0.33

$

0.17

$

0.17

Core funds from operations

(“CFFO”) per share

$

0.17

$

0.19

$

0.17

$

0.20

$

0.17

Dividends declared per common

share

$

0.18

$

0.18

$

0.18

$

0.16

$

0.16

Total Shares Outstanding

25,801,540

17,751,540

17,742,540

9,652,540

9,643,540

Apartment Property Portfolio:

Reported investments in real

estate at cost

$

444,050

$

362,323

$

320,437

$

190,096

$

166,665

Net operating income

$

6,905

$

6,064

$

4,147

$

3,159

$

2,373

Number of properties owned

22

19

17

10

9

Multifamily units owned

6,470

5,342

4,970

2,790

2,358

Portfolio weighted average

occupancy

92.6%

93.1%

93.9%

94.6%

94.4%

Weighted average monthly

effective rent per unit

$

791

$

764

$

730

$

765

$

784

(1)

Weighted

average

monthly

effective

rent

per

occupied

unit

represents

the

average

monthly

rent

collected

for

all

occupied

units

after

giving

effect

to

tenant

concessions.

We

do

not

report

average

effective

rent

per

unit

in

the

month

of

acquisition

as

it

is

not

representative

of

a

full

month

of

operations.

Same

Store

weighted

average

effective

rent

per

unit

was

$814,

$798,

$795,

$792,

and

$784

for

the

periods

presented

above,

respectively.

Same

Store

is

defined

as

properties

in

the

portfolio

as

of

June

30,

2013

through

September

30,

2014.

(1) |

•

IRT seeks to acquire well-located, stable apartment properties in secondary and tertiary

markets Where we are?

6

(1)

Figures are as of September 30, 2014.

Geographic Diversity (by units)

(1)

National Footprint

(1)

–

IRT owned 22 apartment properties totaling 6,470 units in 13 states at September 30,

2014 –

IRT

corporate

office

–

Philadelphia,

PA |

IRT Portfolio

- Sampling

7

Raindance Apts

Oklahoma City,

Oklahoma

Tresa at Arrowhead

Phoenix, Arizona

Augusta Apts

Oklahoma City,

Oklahoma

Belle Creek

Henderson, Colorado

Invitational Apts

Oklahoma City,

Oklahoma

Centrepoint

Tucson, Arizona

Heritage Park Apts

Oklahoma City,

Oklahoma

Cumberland Glen

Smyrna, Georgia

Windrush

Edmund,

Oklahoma

Crestmont

Marietta, Georgia

The Reserve at Eagle Ridge

Waukegan, Illinois

At September 30, 2014

Runaway Bay

Indianapolis, Indiana

Heritage Trace

Newport News, Virginia

Copper Mill

Austin, Texas

The Crossings

Jackson, Mississippi

Berkshire Square

Indianapolis, Indiana

King’s Landing

Creve Coeur, Missouri

Arbors at the

Reservoir

Ridgeland, Mississippi

Carrington Park

Little Rock, Arkansas |

Stable,

Geographically Diversified Portfolio 8

Property Name

Location

Acquisition Date

Purchase

Price

Debt

Year Built or

Renovated(1)

Units(2)

Physical

Occupancy(3)

Average Monthly

Effective Rent per

Occupied Unit(4)

Belle Creek

Henderson, Colorado

4/29/2011

14,100

$

10,575

$

2011

162

(5)

96.3%

1,024

$

Copper Mill

Austin, Texas

4/29/2011

14,715

7,223

2010

320

94.7%

812

Crestmont

Marietta, Georgia

4/29/2011

13,500

6,633

2010

228

96.5%

737

Cumberland

Smyrna, Georgia

4/29/2011

13,800

6,781

2010

222

95.5%

711

Heritage Trace

Newport News, Virginia

4/29/2011

11,000

5,405

2010

200

87.5%

695

Tresa

Phoenix, Arizona

4/29/2011

36,675

27,500

2006

360

96.1%

828

Centrepoint

Tucson, Arizona

12/16/2011

29,500

17,600

2006

320

91.6%

833

Runaway Bay

Indianapolis, Indiana

10/11/2012

15,750

10,081

2002

192

95.8%

916

Berkshire Square

Indianapolis, Indiana

9/19/2013

13,250

8,612

2012

354

91.2%

572

The Crossings

Jackson, Mississippi

11/22/2013

23,000

15,313

2012

432

83.8%

778

Reserve at Eagle Ridge

Waukegan, Illinois

1/31/2014

29,000

18,850

2008

370

91.6%

942

Augusta

Oklahoma City, Oklahoma

2/28/2014

65,000

(6)

45,189

(7)

2011

197

90.9%

683

Heritage Park

Oklahoma City, Oklahoma

2/28/2014

-

(6)

-

(7)

2011

453

92.5%

636

Invitational

Oklahoma City, Oklahoma

2/28/2014

-

(6)

-

(7)

2011

344

89.5%

686

Raindance

Oklahoma City, Oklahoma

2/28/2014

-

(6)

-

(7)

2011

504

92.1%

527

Windrush

Edmond, Oklahoma

2/28/2014

-

(6)

-

(7)

2011

160

95.0%

783

King's Landing

Creve Coeur, Missouri

3/31/2014

32,700

21,200

2005

152

89.7%

1,493

Carrington Park

Little Rock, Arkansas

5/07/2014

21,500

14,235

1999

202

90.1%

1,000

Arbors at the Reservoir

Ridgeland, Mississippi

6/4/2014

20,250

13,150

2000

170

95.3%

1,062

Walnut Hill

Cordova, Tennessee

8/28/2014

27,900

18,650

2001

360

95.8%

919

Lenoxplace

Raleigh, North Carolina

9/5/2014

24,250

15,991

(9)

2012

268

95.9%

-

(8)

Stonebridge

Cordova, Tennessee

9/15/2014

29,800

-

1994

500

94.8%

-

(8)

Sub-total/Weighted Average

435,690

$

262,988

$

6,470

92.6%

791

$

Recent acquisitions

Columbus Property

Groveport, Ohio

11/24/2014

17,500

11,375

2008

240

99.2%

804

Properties under contract

South East Portfolio

Louisville, Kentucky

TBD

162,500

105,300

(9)

Various

1,549

91.4%

770

Little Rock Property

Little Rock, Arkansas

TBD

32,000

-

(9)

2005

260

95.8%

847

Sub-total/Weighted Average

194,500

$

105,300

$

1,809

92.0%

781

$

Total/Weighted Average

647,690

$

379,663

$

8,519

92.7%

789

$

At September 30,

2014 ($ in thousands, except per unit data) (1)

All

dates

are

for

the

year

in

which

a

significant

renovation

program

was

completed,

except

for

Runaway

Bay,

King's

Landing,

Carrington

Park,

Walnut

Hill,

Stonebridge

and

Arbors

at

the

Reservoir,

which

is

the

year

construction

was

completed.

(2)

Units represents the total number of apartment units available for rent at September

30, 2014 (3)

Physical occupancy for each of our properties is calculated as (i) total units

rented as of September 30, 2014 divided by (ii) total units available as of September 30, 2014, expressed as a percentage.

(4)

Average monthly effective rent per occupied unit represents the average monthly rent

for all occupied units for the three-month period ended September 30, 2014.

(5)

Does not include 6,256 square feet of retail space in six units,

of which 1,010 square feet of space is occupied by RAIT Residential for use as the

leasing office. The remaining 5,246 square feet of space is 86% occupied by four tenants

with an average monthly base rent of $1,623, or $16 per square foot per year. These

five tenants engaged in the following businesses: grocery, retail and various retail services.

(6)

Acquired as part of the Oklahoma City Portfolio for an aggregate

purchase price of $65,000.

(7)

Assumed as part of the Oklahoma City Portfolio and currently has

an aggregate carrying amount of $47,025.

(8)

We do not report average effective rent per unit in the month of

acquisition as it is not representative of a full month of operations.

(9)

The Southeast Portfolio purchase price is expected to be funded with $57.2 million

of cash and mortgage debt of $105.3 million. The Little Rock Property purchase price is expected to be funded

with $17.0 million of cash and revolver

draw of $15.0 million. No assurances can be given that these acquisitions will be

completed. Financing for Lenoxplace secured on October 24, 2014.

|

Disciplined

Approach to Acquisitions 9

•

Focus on acquiring assets in

supply constrained submarkets

–

Secondary and tertiary markets

–

Sub-markets with no substantial

new apartment construction

–

Stable resident bases and

occupancy rates

–

Positive net migration trends

–

Markets with strong employment

drivers

•

Source acquisitions through

existing relationships and

established channels

–

Existing RAIT relationships

–

Existing property manager

relationships

–

Brokerage community

–

Off-market transactions

–

TIC Syndicates

•

Target Profile for Acquisitions

Markets

Sourcing

Assets

1

2

3

–

Mid-rise/garden style (150-500

units) with good amenities

–

Acquire at less than replacement

cost in the $10 -

$35M price range;

with 5 to 15 year operating track

record

–

In-place cash flow with room to

grow rents

–

Operating efficiencies through

professional property management

–

Well-located property with good

access and favorable local work

force conditions |

•

In addition to the properties under contract and recent acquisitions described below, IRT has an

acquisition pipeline of approximately 754 units with an estimated aggregate purchase

price of $80.3 million as of November 17, 2014

(1)

•

On November 24, 2014, IRT completed the acquisition of a 240 unit property in Groveport, Ohio,

described below, for $17,500,000

•

IRT has entered into agreements to acquire the Southeast Portfolio and the Little Rock Property

described below Pipeline, Properties Under Contract & Recent Acquisitions

10

(1)

No assurances can be given that these acquisitions will be completed.

(2)

Each acquisition is subject to customary terms and closing conditions. No assurances can be

given that these acquisitions will be completed. (3)

Consists of five properties.

Purchase Date

TBD (In Contract)

MSA

Louisville, KY

Year Built /

Renovated

Various

Number of Units

1,549

Acquisition Price

$162.5 million

Average Monthly

Effective Rent/Unit

$770

Occupancy

91.4%

Purchase Date

TBD (In Contract)

MSA

Little Rock, AR

Year Built /

Renovated

2005

Number of Units

260

Acquisition Price

$32.0 million

Average Monthly

Effective Rent/Unit

$847

Occupancy

95.8%

Purchase Date

November 24, 2014

MSA

Columbus, OH

Year Built /

Renovated

2008

Number of Units

240

Acquisition Price

$17.5 million

Average Monthly

Effective Rent/Unit

$804

Occupancy

99.2%

Southeast Portfolio

(2) (3)

Columbus Property

Little Rock Property

(2) |

Sponsor: RAIT

Financial Trust (NYSE: RAS) 11

•

RAIT is a multi-strategy commercial real estate company organized as an

internally-managed REIT with $5.4 billion of assets under management as of September

30, 2014 •

Scalable “in-house”

commercial real estate platform with more than 700 employees, including

property management personnel

•

Seasoned executive team with extensive real estate equity and debt experience

•

Substantial expertise lending to, owning and managing multifamily assets

•

Extensive networks of contacts in the apartment industry

•

RAIT Residential, a property management company that is majority-owned by RAIT, manages

over 13,500 apartments in 17 states

–

RAIT’s IPO –

January 1998

–

Offices in Philadelphia, New York, Chicago, and Charlotte

–

Since its inception, RAIT has originated in excess of $1.8 billion of multifamily loans and

has owned more than $1.1 billion of apartment properties

–

Allows RAIT to source attractive, off-market acquisition opportunities

–

Provides significant competitive advantage in targeting geographically diversified

portfolios |

•

RAIT is the largest stockholder in IRT with 7.3 million shares or approximately 23.0% of

IRT’s outstanding common stock as of November 25, 2014

•

RAIT controls entities that advise and manage IRT and its properties

•

Management agreement structured to incentivize performance

Strong Alignment of Interests Between Sponsor and Stockholders

12

–

Externally managed by Independence Realty Advisors, a wholly-owned subsidiary of

RAIT –

Properties

managed

by

RAIT

Residential,

a

full-service

apartment

property

manager

that

is

majority-owned

by

RAIT

with

approximately

350

employees

–

No

acquisition,

disposition,

or

financing

fees

and

no

management

fees

on

shareholder

equity

–

No

management

fee

on

8

properties

acquired

prior

to

August

2013;

approximately

$156

million

of

real

estate

–

Low management fee (75 bps of gross real estate assets) on properties acquired after August

2013 –

Incentive fee (20% over a Core FFO yield of 7% (annualized)) |

Scott F.

Schaeffer Management Team

13

Chairman and CEO –

Independence Realty Trust, Inc. and Chairman and CEO –

RAIT Financial

Trust

CEO and Manager –

Independent Realty Advisors, LLC

Over 28 year career in real estate

James J. Sebra

CFO and Treasurer –

Independence Realty Trust, Inc. and CFO and Treasurer –

RAIT Financial

Trust

Treasurer –

Independent Realty Advisors, LLC

17 years of real estate experience

Farrell M. Ender

President –

Independence Realty Trust, Inc. and Senior Vice President –

RAIT Financial Trust

President –

Independent Realty Advisors, LLC

Over 10 years experience in the acquisition/disposition, property management, construction

management of apartment properties

Raphael Licht

Manager –

Independent Realty Advisors, LLC and General Counsel–

RAIT Financial Trust

17 years of real estate experience |

Attractive

Dividend 14

(1)

Dividend yields based on share price as of 11/28/2014 and most recently declared quarterly

dividend annualized, except for IRT, which is based on most recently declared monthly

dividend annualized. Dividend Yield

(1)

(%) |

Core FFO per

Share IRT Financial Highlights

15

Revenue

NOI

Dividends per Share

($ in millions, except per share data)

Note:

Refer

to

slide

22

for

reconciliation

of

Core

FFO

and

NOI

to

GAAP

net

income

(loss). |

Highlights

16

Strong Momentum in the Business

1

Disciplined Acquisition Strategy with Robust Pipeline

2

Strong Sponsorship and Alignment of Interest with IRT Stockholders

3

Attractive Dividend

4

5

Stable Portfolio in Supply-Constrained Markets |

Appendix

|

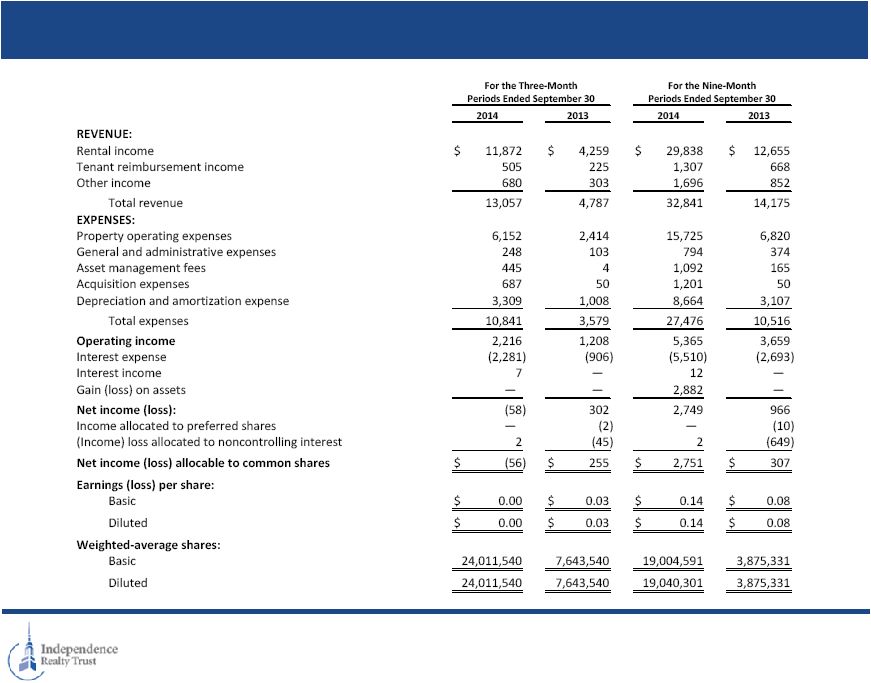

Income

Statement 18

At September 30, 2014 ($ in millions, except per unit data) |

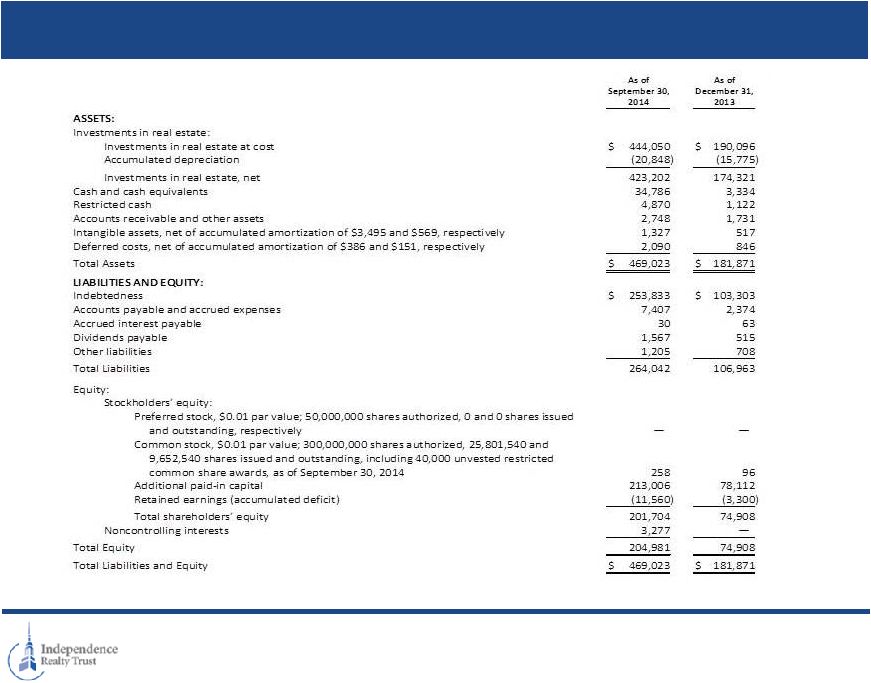

Balance

Sheet 19

At September 30, 2014 ($ in millions, except per unit data) |

Mortgage

Indebtedness 20

At September 30, 2014 ($ in millions, except per unit data)

Outstanding Principal

Carrying Amount

Effective Interest Rate

Maturity Date

Belle Creek Apartments

$

10,575

$

10,575

2.4%(1)

April 28, 2021

Berkshire Square Apartments

8,612

8,612

4.4%(3)

January 1, 2021

Centrepoint Apartments

17,600

17,600

3.7%(2)

January 1, 2019

Copper Mill Apartments

7,223

7,223

5.7%

May 1, 2021

Crestmont Apartments

6,633

6,633

5.7%

May 1, 2021

Cumberland Glen Apartments

6,781

6,781

5.7%

May 1, 2021

Heritage Trace Apartments

5,405

5,405

5.7%

May 1, 2021

Runaway Bay Apartments

10,081

10,081

3.6%

November 1, 2022

Tresa at Arrowhead

27,500

27,500

2.4%(1)

April 28, 2021

Reserve at Eagle Ridge

18,850

18,850

4.7%

March 1, 2024

OKC Portfolio

45,189

47,025

2.8%(5)

April 1, 2016

Kings’ Landing

21,200

21,200

4.0%(6)

June 1, 2021

Crossings

15,313

15,313

3.9%

June 1, 2024

Carrington Park

14,235

14,235

4.0%

August 1, 2024

Arbors at the Reservoir

13,150

13,150

4.0%

August 1, 2024

Walnut Hill

18,650

18,650

3.4%

October 1, 2021

Total mortgage debt/Weighted-

Average

$

246,997

$

248,833

3.7%

Secured Credit Facility

5,000

5,000

2.7%(4)

October 25, 2016

Total indebtedness /Weighted-

Average

$

251,997

$

253,833

3.7%

(1) Floating

rate

at

225

basis

points

over

30-day

LIBOR.

As

of

September

30,

2014,

30-day

LIBOR

was

0.15%.

Interest

only

payments

are

due

monthly.

These

mortgages

are

held

by

RAIT.

(2) Fixed

rate.

Interest

only

payments

are

due

monthly.

Beginning

February

1,

2015,

principal

and

interest

payments

are

required

based

on

a

30-year

amortization

schedule.

(3) Fixed

Rate.

Interest

only

payments

are

due

monthly.

Beginning

February

1,

2016,

principal

and

interest

payments

are

required

based

on

a

30-year

amortization

schedule.

(4) Floating

rate

at

250

basis

points

over

30-day

LIBOR.

As

of

September

30,

2014,

30-day

LIBOR

was

0.15%.

Interest

only

payments

are

due

monthly.

As

of

September

30,

2014,

we

were

in compliance with all

financial covenants contained in the credit facility.

(5) Contractual interest rate is 5.6%. The debt was assumed

and recorded at a premium that will be amortized to interest expense over the remaining term.

Principal and interest payments are required based on a 30-year amortization

schedule. (6) Fixed

Rate.

Interest

only

payments

are

due

monthly.

Beginning

June

1,

2017,

principal

and

interest

payments

are

required

based

on

a

30-year

amortization

schedule. |

Non-GAAP

Financial Measures: FFO and CFFO (1)

21

At September 30, 2014 ($ in millions, except per unit data) |