Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - CHICAGO BRIDGE & IRON CO N V | v393917_8k.htm |

| EX-99.2 - EXHIBIT 99.2 - CHICAGO BRIDGE & IRON CO N V | v393917_ex99-2.htm |

Exhibit 99.1

A World of Solutions CB&I Investor/Analyst Day November 2014

A World of Solutions A World of Solutions This presentation contains forward - looking statements regarding CB&I and represents our expectations and beliefs concerning future events . These forward - looking statements are intended to be covered by the safe harbor for forward - looking statements provided by the Private Securities Litigation Reform Act of 1995 . Forward - looking statements involve known and unknown risks and uncertainties . When considering any statements that are predictive in nature, depend upon or refer to future events or conditions, or use or contain words, terms, phrases, or expressions such as “achieve”, “forecast”, “plan”, “propose”, “strategy”, “envision”, “hope”, “will”, “continue”, “potential”, “expect”, “believe”, “anticipate”, “project”, “estimate”, “predict”, “intend”, “should”, “could”, “may”, “might”, or similar forward - looking statements, we refer you to the cautionary statements concerning risk factors and “Forward - Looking Statements” described under “Risk Factors” in Item 1 A of our Annual Report filed on Form 10 - K filed with the SEC for the year ended December 31 , 2013 , and any updates to those risk factors or “Forward - Looking Statements” included in our subsequent Quarterly Reports on Form 10 - Q filed with the SEC, which cautionary statements are incorporated herein by reference . 2 Safe Harbor Statement

A World of Solutions 3 A World of Solutions Presenters Philip K. Asherman President & Chief Executive Officer Ronald A. Ballschmiede Chief Financial Officer Patrick K. Mullen Executive Vice President & Group President Engineering, Construction and Maintenance Luke V. Scorsone Executive Vice President & Group President Fabrication Services E. Chip Ray Executive Vice President & Group President Environmental Solutions Daniel M. McCarthy Executive Vice President & Group President Technology

A World of Solutions 4 A World of Solutions 125 Years of Excellence CB&I Values ▪ Safety ▪ Ethics ▪ Teamwork Customers ▪ Quality ▪ Reliability ▪ Delivery ▪ Scale Shareholders ▪ Earnings growth ▪ Sustainability ▪ Share value CB&I Values Customers Shareholders

A World of Solutions 5 A World of Solutions Commitment to Safety CB&I is the 2015 recipient of the National Safety Council’s Green Cross for Safety Award

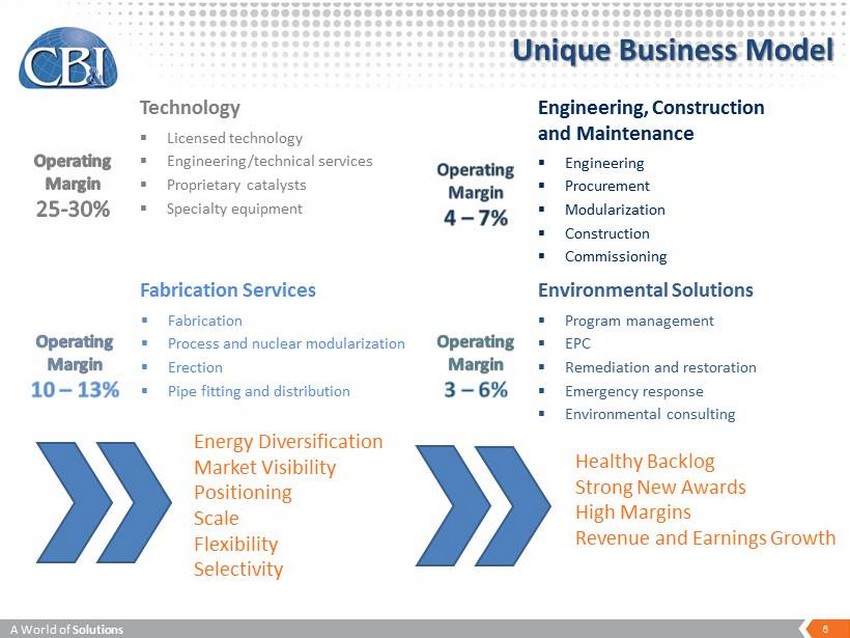

A World of Solutions 6 A World of Solutions Unique Business Model Fabrication Services ▪ Fabrication ▪ Process and nuclear m odularization ▪ Erection ▪ Pipe fitting and distribution ▪ Engineering ▪ Procurement ▪ Modularization ▪ Construction ▪ Commissioning Engineering, Construction and Maintenance Technology ▪ Licensed technology ▪ Engineering/technical services ▪ Proprietary catalysts ▪ Specialty equipment Environmental Solutions ▪ Program management ▪ EPC ▪ Remediation and restoration ▪ Emergency response ▪ Environmental consulting Energy Diversification Market Visibility Positioning Scale Flexibility Selectivity Healthy Backlog Strong New Awards High Margins Revenue and Earnings Growth

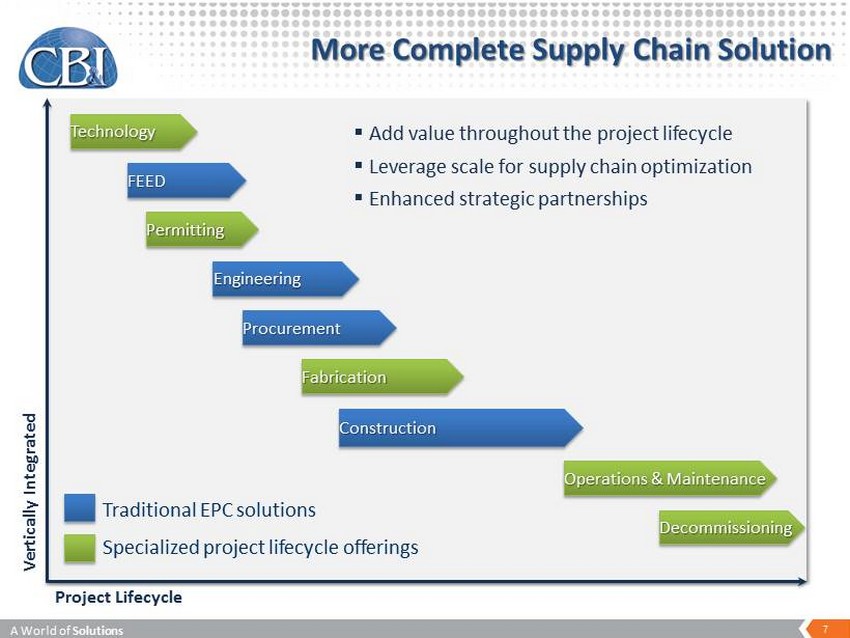

A World of Solutions 7 A World of Solutions More Complete Supply Chain Solution Engineering Procurement Construction Operations & Maintenance Decommissioning Fabrication Permitting Traditional EPC solutions Specialized project lifecycle offerings FEED Technology ▪ Add value throughout the project lifecycle ▪ Leverage scale for supply chain optimization ▪ Enhanced strategic partnerships Vertically Integrated Project Lifecycle

A World of Solutions 8 A World of Solutions Diversification Across Energy Infrastructure

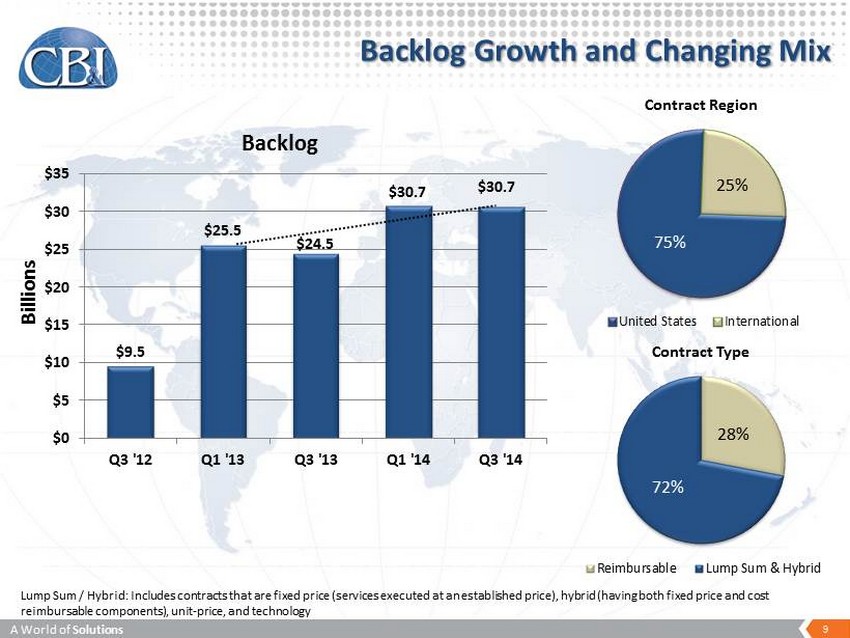

A World of Solutions 9 A World of Solutions Backlog Growth and Changing Mix 28% 72% Contract Type Reimbursable Lump Sum & Hybrid 75% 25% Contract Region United States International $9.5 $25.5 $24.5 $30.7 $30.7 $0 $5 $10 $15 $20 $25 $30 $35 Q3 '12 Q1 '13 Q3 '13 Q1 '14 Q3 '14 Billions Backlog Lump Sum / Hybrid: Includes contracts that are fixed price (services executed at an established price), hybrid (having both fixed price and cost reimbursable components), unit - price, and technology

Engineering, Construction and Maintenance

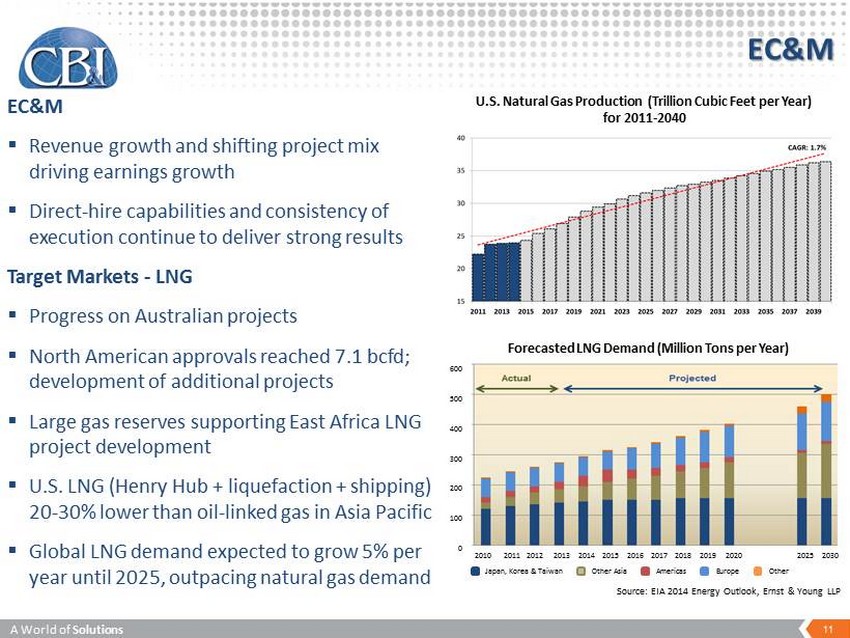

A World of Solutions A World of Solutions 11 EC&M ▪ Revenue growth and shifting project mix driving earnings growth ▪ D irect - hire capabilities and consistency of execution continue to deliver strong results Target Markets - LNG ▪ P rogress o n Australian projects ▪ North American approvals reached 7.1 bcfd ; development of additional projects ▪ Large gas reserves supporting East Africa LNG project development ▪ U.S. LNG (Henry Hub + liquefaction + shipping) 20 - 30% lower than oil - linked gas in Asia Pacific ▪ Global LNG demand expected to grow 5% per year until 2025, outpacing natural gas demand EC&M 600 500 400 300 200 100 0 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2025 2 03 0 Japan, Korea & Taiwan Other Asia Americas Europe Other Source: EIA 2014 Energy Outlook, Ernst & Young LLP Forecasted LNG Demand (Million Tons per Year) U.S. Natural Gas Production (Trillion Cubic Feet per Year) for 2011 - 2040

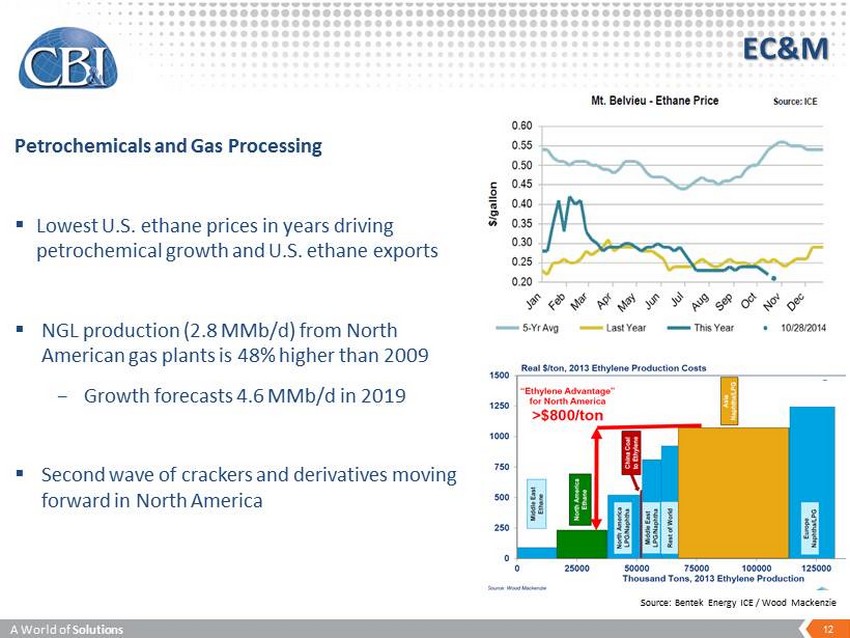

A World of Solutions A World of Solutions 12 Petrochemicals and Gas Processing ▪ Lowest U.S. ethane p rices in years driving petrochemical growth and U.S. ethane exports ▪ NGL production ( 2.8 MMb /d) from North American gas plants is 48% higher than 2009 − Growth f orecasts 4.6 MMb /d in 2019 ▪ Second wave of crackers and derivatives moving forward in North America EC&M S ource : Bentek Energy ICE / Wood Mackenzie

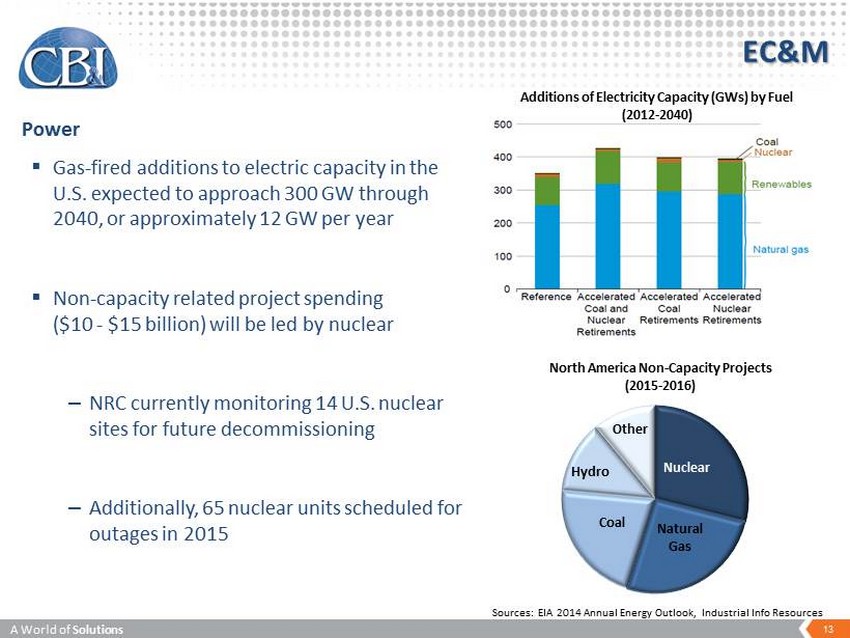

A World of Solutions 13 A World of Solutions Nuclear Natural Gas Coal Hydro Other North America Non - Capacity Projects (2015 - 2016) EC&M ▪ Gas - fired additions to electric capacity in the U.S. expected to approach 300 GW through 2040, or approximately 12 GW per year ▪ Non - capacity related project spending ($10 - $15 billion) will be led by nuclear – NRC currently monitoring 14 U.S. nuclear sites for future decommissioning – Additionally, 65 nuclear units scheduled for outages in 2015 Sources: EIA 2014 Annual Energy Outlook, Industrial Info Resources Power Additions of Electricity Capacity (GWs) by Fuel (2012 - 2040)

A World of Solutions 14 A World of Solutions U.S. Nuclear Progress

A World of Solutions 15 A World of Solutions Reficar and Refining ▪ 150,000 BPD refinery expansion project in Cartagena, Colombia to be completed in 2015 ▪ Project integrates offerings including: t echnology, storage, piping, and EPC ▪ Refining activity remains robust in the Middle East for new capacity and refinery upgrades

Fabrication Services

A World of Solutions 17 A World of Solutions Fabrication Services Fabrication Services ▪ Positioning for international growth in pipe spool fabrication ▪ Entering new geographic markets for plate structures ▪ Investing in technology and equipment to drive productivity and efficiency gains Target Markets ▪ Middle East / Africa: Investments driven by rising demand for oil and gas and refined products ▪ North America: Oil and gas production, p ower, industrial manufacturing, LNG pipe spool fabrication and bending

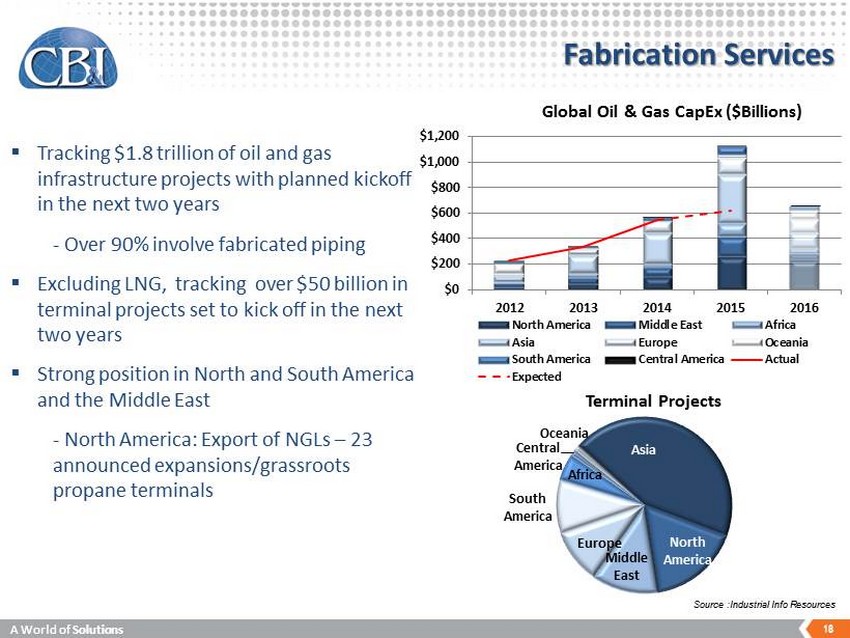

A World of Solutions 18 A World of Solutions 18 Fabrication Services Source :Industrial Info Resources ▪ Tracking $1.8 trillion of oil and gas infrastructure projects with planned kickoff in the next two years - Over 90% involve fabricated piping ▪ Excluding LNG, tracking over $50 billion in terminal projects set to kick off in the next two years ▪ Strong position in North and South America and the Middle East - North America: Export of NGLs – 23 announced expansions/grassroots propane terminals $0 $200 $400 $600 $800 $1,000 $1,200 2012 2013 2014 2015 2016 Global Oil & Gas CapEx ($Billions) North America Middle East Africa Asia Europe Oceania South America Central America Actual Expected Asia North America Middle East Europe South America Africa Central America Oceania Terminal Projects

Environmental Solutions

A World of Solutions 20 A World of Solutions 20 Environmental Solutions Environmental Solutions ▪ Strategic and growth initiatives enhancing market position ▪ Cost savings initiatives resulting in improved competitiveness Market Focus – US Federal Government ▪ DOD mission critical support being prioritized in an environment of flat funding (sequestration) − Base operations − Modernization of fuels systems ▪ DOE, DOD and EPA funding stable for site environmental remediation efforts

A World of Solutions 21 A World of Solutions 21 Environmental Solutions State and Local Governments ▪ Upgrading / expansion of aging infrastructure is enabling growth of PM and CM services ▪ Expanding emergency recovery pre - storm solutions Private Sector ▪ Shale energy capital projects (e.g., site prep for large projects) ▪ Power plant closures and asset retirement driving environmental clean - up

Technology

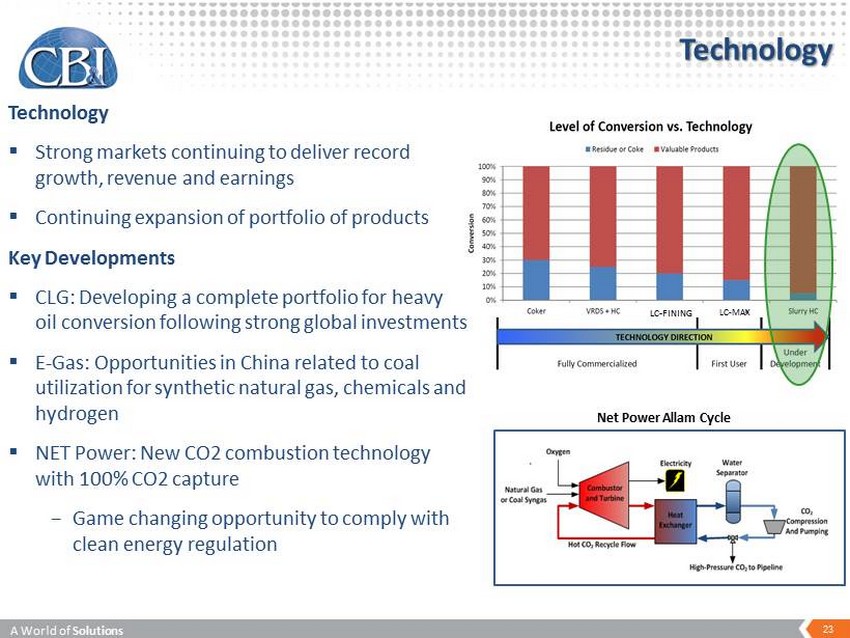

A World of Solutions A World of Solutions 23 Technology Technology ▪ Strong markets continuing to deliver record growth, revenue and earnings ▪ Continuing expansion of portfolio of products Key Developments ▪ CLG: Developing a complete portfolio for heavy oil conversion following strong global investments ▪ E - Gas: Opportunities in China related to coal utilization for synthetic natural gas, chemicals and hydrogen ▪ NET Power: New CO2 combustion technology with 100% CO2 capture − G ame changing opportunity to comply with clean energy regulation LC - FINING LC - MAX Net Power Allam Cycle

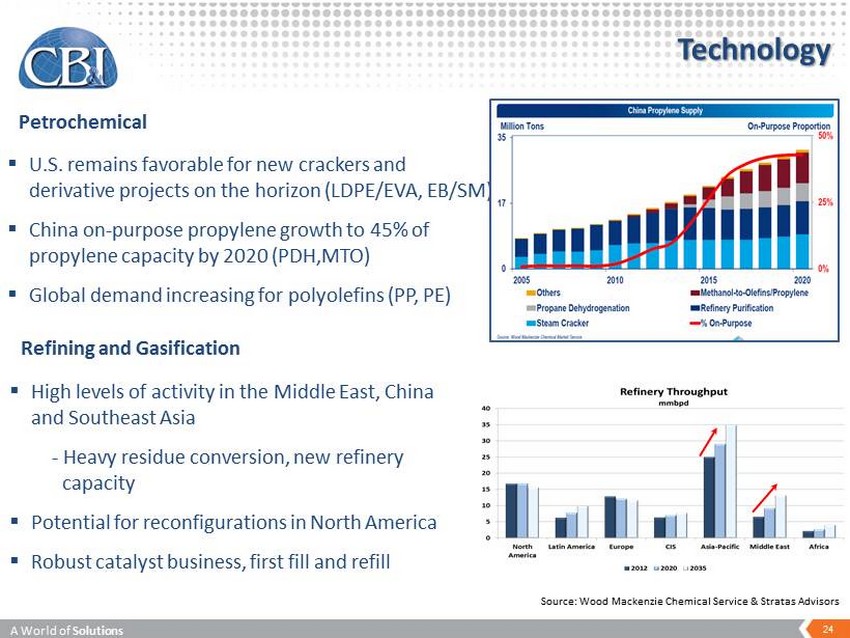

A World of Solutions A World of Solutions 24 Technology ▪ U.S. remains favorable for new crackers and derivative projects on the horizon (LDPE/EVA, EB/SM) ▪ China on - purpose propylene growth to 45% of propylene capacity by 2020 ( PDH,MTO) ▪ Global demand increasing for p olyolefins (PP, PE) Petrochemical Refining and Gasification ▪ High levels of activity in the Middle East, China and Southeast Asia - Heavy residue conversion, new refinery capacity ▪ Potential for reconfigurations in North America ▪ Robust catalyst business, first fill and refill Source: Wood Mackenzie Chemical Service & Stratas Advisors

Finance

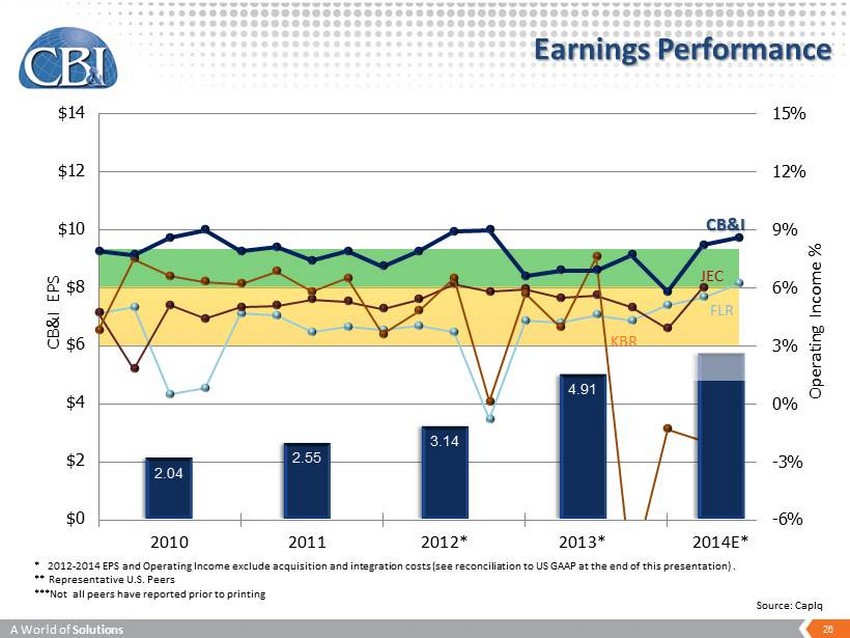

A World of Solutions 26 A World of Solutions -6% -3% 0% 3% 6% 9% 12% 15% 2.04 2.55 3.14 4.91 $0 $2 $4 $6 $8 $10 $12 $14 2010 2011 2012* 2013* 2014E* Earnings Performance CB&I * 2012 - 2014 EPS and Operating Income exclude acquisition and integration costs (see reconciliation to US GAAP at the end of this presentation) . ** Representative U.S. Peers ***Not all peers have reported prior to printing Operating Income % CB&I EPS FLR JEC KBR Source: CapIq

A World of Solutions 27 A World of Solutions Cash Flow Drivers Operating ▪ Greater rigor on billing process to reduce days outstanding ▪ Changing project mix provides increased control and predictability ▪ U.S. nuclear projects contract capital liability unwind decelerating Financing ▪ Over $4.5 billion in credit capacity with $2.7 billion available provides sufficient flexibility Investing ▪ Capital expenditures consistent with 2014 ▪ Investments in technology

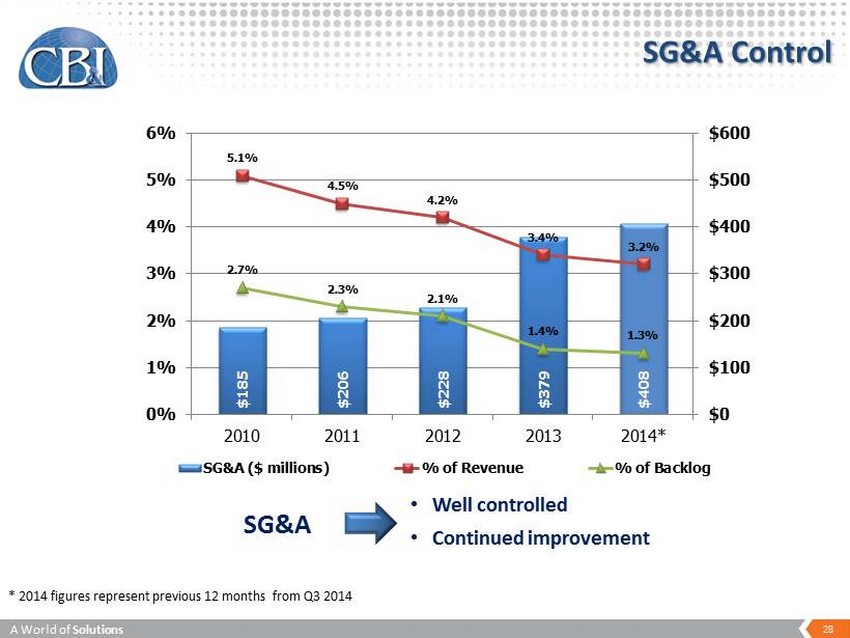

A World of Solutions 28 A World of Solutions SG&A • Well controlled • Continued improvement SG&A Control $185 $206 $228 $379 $408 5.1% 4.5% 4.2% 3.4% 3.2% 2.7% 2.3% 2.1% 1.4% 1.3% $0 $100 $200 $300 $400 $500 $600 0% 1% 2% 3% 4% 5% 6% 2010 2011 2012 2013 2014* SG&A ($ millions) % of Revenue % of Backlog * 2014 figures represent previous 12 months from Q3 2014

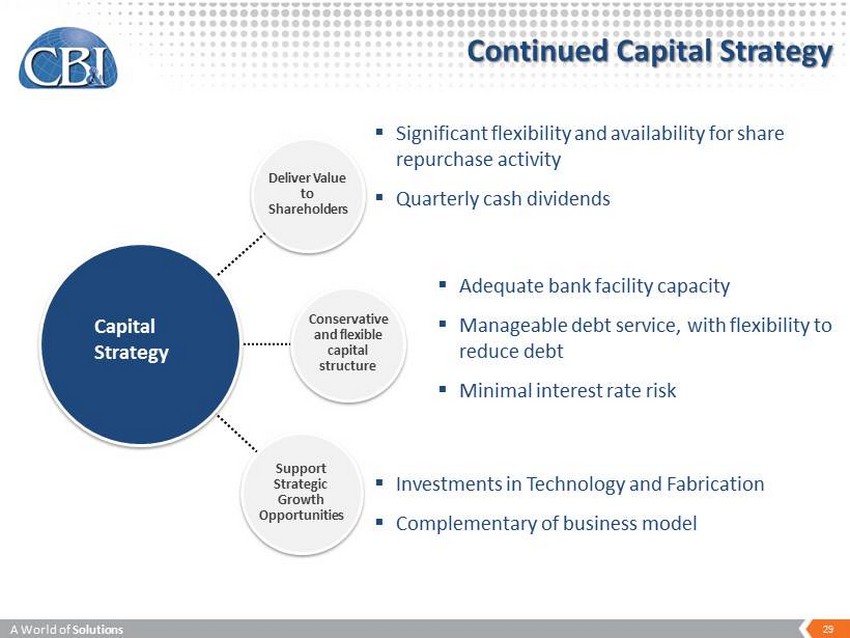

A World of Solutions 29 A World of Solutions Continued Capital Strategy ▪ Adequate bank facility capacity ▪ Manageable debt service, with flexibility to reduce debt ▪ Minimal interest rate risk ▪ Significant flexibility and availability for share repurchase activity ▪ Quarterly cash dividends Deliver Value to Shareholders Conservative and flexible capital structure Support Strategic Growth Opportunities Capital Strategy ▪ Investments in Technology and Fabrication ▪ Complementary of business model

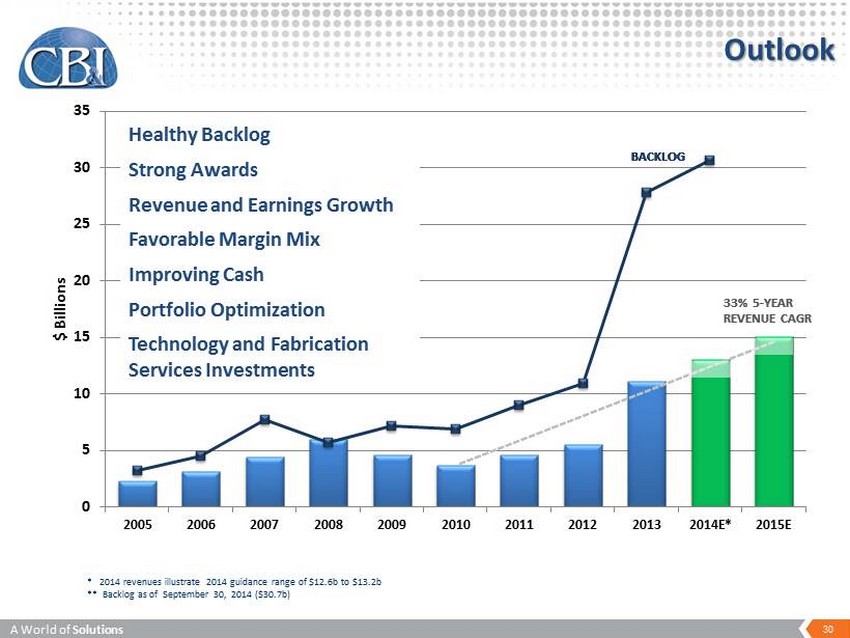

A World of Solutions 30 A World of Solutions 0 5 10 15 20 25 30 35 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014E* 2015E $ Billions BACKLOG 33% 5 - YEAR REVENUE CAGR BACKLOG 33% 5 - YEAR REVENUE CAGR BACKLOG BACKLOG Outlook * 2014 revenues illustrate 2014 guidance range of $12.6b to $13.2b ** Backlog as of September 30, 2014 ($30.7b) Healthy Backlog Strong Awards Revenue and Earnings Growth Favorable Margin Mix Improving Cash Portfolio Optimization Technology and Fabrication Services Investments

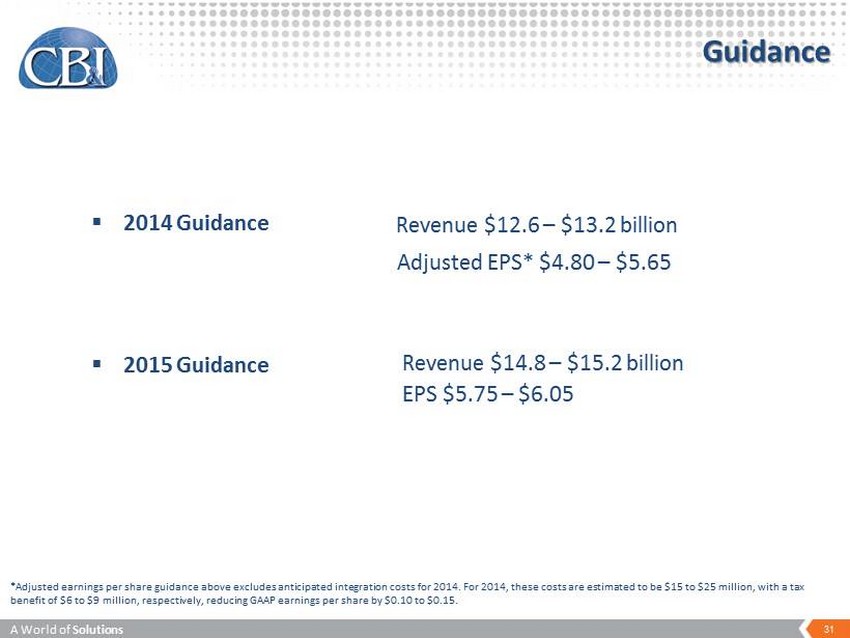

A World of Solutions 31 A World of Solutions Guidance ▪ 2014 Guidance Revenue $12.6 – $13.2 billion Adjusted EPS* $4.80 – $5.65 Revenue $14.8 – $15.2 billion EPS $5.75 – $6.05 ▪ 2015 Guidance *Adjusted earnings per share guidance above excludes anticipated integration costs for 2014. For 2014, these costs are estimated to be $15 to $25 million, with a tax benefit of $6 to $9 million, respectively, reducing GAAP earnings per share by $0.10 to $0.15 .

A World of Solutions Questions

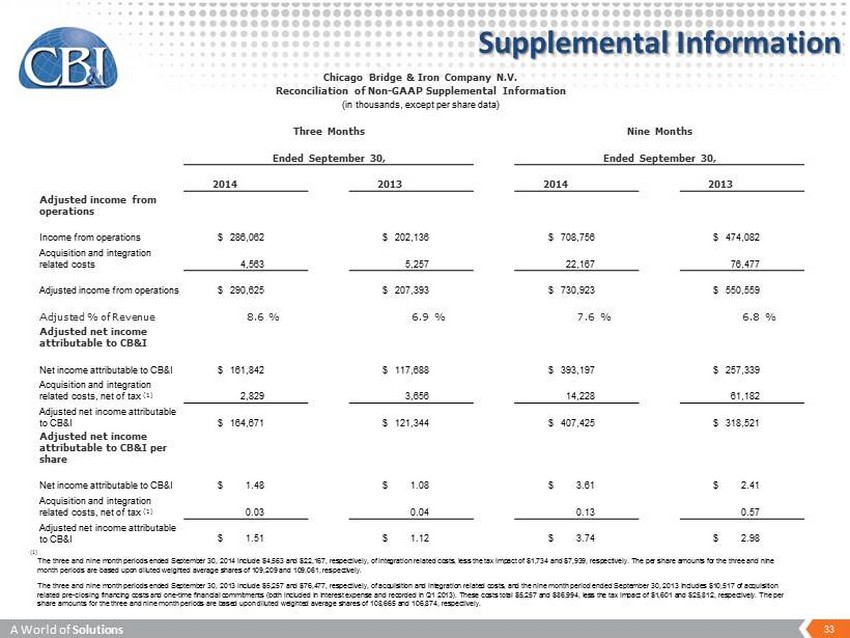

A World of Solutions 33 A World of Solutions Chicago Bridge & Iron Company N.V. Reconciliation of Non - GAAP Supplemental Information (in thousands, except per share data) Three Months Nine Months Ended September 30, Ended September 30, 2014 2013 2014 2013 Adjusted income from operations Income from operations $ 286,062 $ 202,136 $ 708,756 $ 474,082 Acquisition and integration related costs 4,563 5,257 22,167 76,477 Adjusted income from operations $ 290,625 $ 207,393 $ 730,923 $ 550,559 Adjusted % of Revenue 8.6 % 6.9 % 7.6 % 6.8 % Adjusted net income attributable to CB&I Net income attributable to CB&I $ 161,842 $ 117,688 $ 393,197 $ 257,339 Acquisition and integration related costs, net of tax (1 ) 2,829 3,656 14,228 61,182 Adjusted net income attributable to CB&I $ 164,671 $ 121,344 $ 407,425 $ 318,521 Adjusted net income attributable to CB&I per share Net income attributable to CB&I $ 1.48 $ 1.08 $ 3.61 $ 2.41 Acquisition and integration related costs, net of tax (1 ) 0.03 0.04 0.13 0.57 Adjusted net income attributable to CB&I $ 1.51 $ 1.12 $ 3.74 $ 2.98 (1) The three and nine month periods ended September 30, 2014 include $4,563 and $22,167, respectively, of integration related co sts , less the tax impact of $1,734 and $7,939, respectively. The per share amounts for the three and nine month periods are based upon diluted weighted average shares of 109,209 and 109,061, respectively. The three and nine month periods ended September 30, 2013 include $5,257 and $76,477, respectively, of acquisition and integr ati on related costs, and the nine month period ended September 30, 2013 includes $10,517 of acquisition related pre - closing financing costs and one - time financial commitments (both included in interest expense and recorded in Q1 201 3). These costs total $5,257 and $86,994, less the tax impact of $1,601 and $25,812, respectively. The per share amounts for the three and nine month periods are based upon diluted weighted average shares of 108,665 and 106,874, res pec tively. Supplemental Information

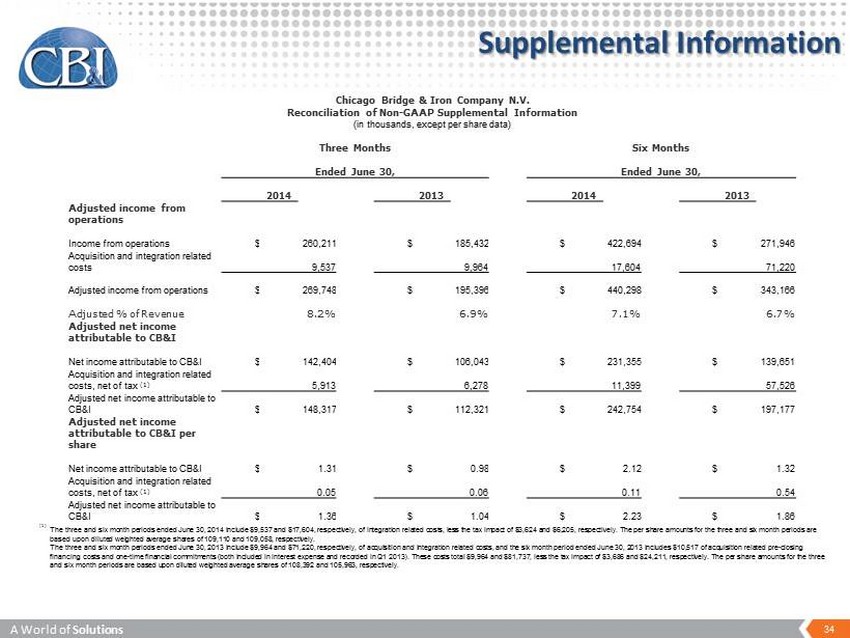

A World of Solutions 34 A World of Solutions Chicago Bridge & Iron Company N.V. Reconciliation of Non - GAAP Supplemental Information (in thousands, except per share data) Three Months Six Months Ended June 30, Ended June 30, 2014 2013 2014 2013 Adjusted income from operations Income from operations $ 260,211 $ 185,432 $ 422,694 $ 271,946 Acquisition and integration related costs 9,537 9,964 17,604 71,220 Adjusted income from operations $ 269,748 $ 195,396 $ 440,298 $ 343,166 Adjusted % of Revenue 8.2% 6.9% 7.1% 6.7% Adjusted net income attributable to CB&I Net income attributable to CB&I $ 142,404 $ 106,043 $ 231,355 $ 139,651 Acquisition and integration related costs, net of tax (1 ) 5,913 6,278 11,399 57,526 Adjusted net income attributable to CB&I $ 148,317 $ 112,321 $ 242,754 $ 197,177 Adjusted net income attributable to CB&I per share Net income attributable to CB&I $ 1.31 $ 0.98 $ 2.12 $ 1.32 Acquisition and integration related costs, net of tax (1 ) 0.05 0.06 0.11 0.54 Adjusted net income attributable to CB&I $ 1.36 $ 1.04 $ 2.23 $ 1.86 (1) The three and six month periods ended June 30, 2014 include $9,537 and $17,604, respectively, of integration related costs, l ess the tax impact of $3,624 and $6,205, respectively. The per share amounts for the three and six month periods are based upon diluted weighted average shares of 109,110 and 109,058, respectively. The three and six month periods ended June 30, 2013 include $9,964 and $71,220, respectively, of acquisition and integration rel ated costs, and the six month period ended June 30, 2013 includes $10,517 of acquisition related pre - closing financing costs and one - time financial commitments (both included in interest expense and recorded in Q1 2013). These costs tota l $9,964 and $81,737, less the tax impact of $3,686 and $24,211, respectively. The per share amounts for the three and six month periods are based upon diluted weighted average shares of 108,392 and 105,963, respectively. Supplemental Information

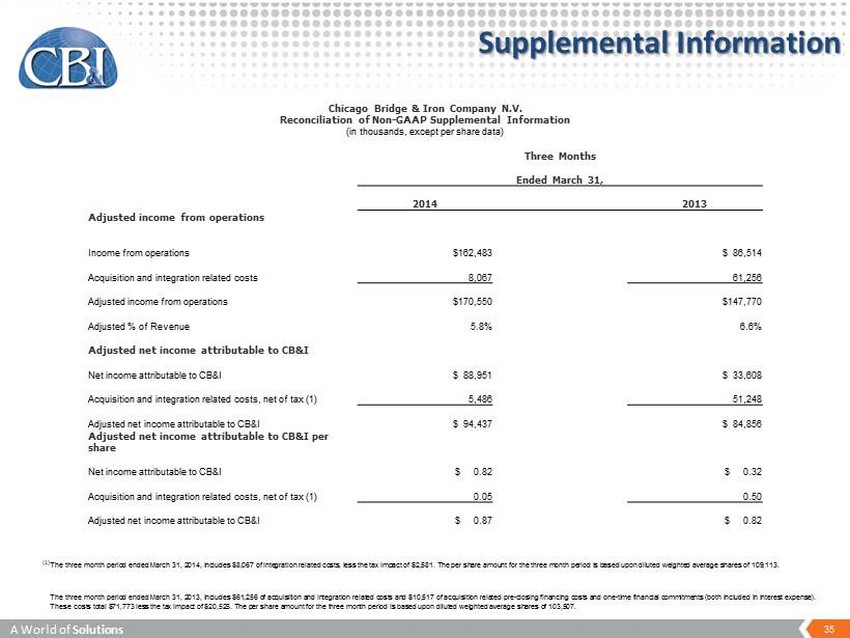

A World of Solutions 35 A World of Solutions Chicago Bridge & Iron Company N.V. Reconciliation of Non - GAAP Supplemental Information (in thousands, except per share data) Three Months Ended March 31, 2014 2013 Adjusted income from operations Income from operations $162,483 $ 86,514 Acquisition and integration related costs 8,067 61,256 Adjusted income from operations $170,550 $147,770 Adjusted % of Revenue 5.8% 6.6% Adjusted net income attributable to CB&I Net income attributable to CB&I $ 88,951 $ 33,608 Acquisition and integration related costs, net of tax (1 ) 5,486 51,248 Adjusted net income attributable to CB&I $ 94,437 $ 84,856 Adjusted net income attributable to CB&I per share Net income attributable to CB&I $ 0.82 $ 0.32 Acquisition and integration related costs, net of tax (1 ) 0.05 0.50 Adjusted net income attributable to CB&I $ 0.87 $ 0.82 (1) The three month period ended March 31, 2014, includes $8,067 of integration related costs, less the tax impact of $2,581. The pe r share amount for the three month period is based upon diluted weighted average shares of 109,113. The three month period ended March 31, 2013, includes $61,256 of acquisition and integration related costs and $10,517 of acq uis ition related pre - closing financing costs and one - time financial commitments (both included in interest expense). These costs total $71,773 less the tax impact of $20,525. The per share amount for the three month period is based upon dilut ed weighted average shares of 103,507. Supplemental Information

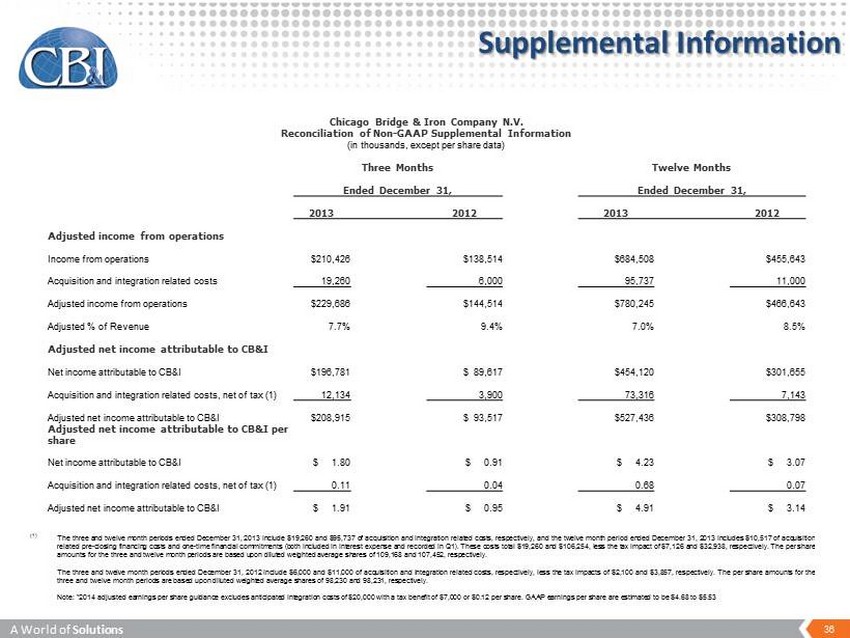

A World of Solutions 36 A World of Solutions Chicago Bridge & Iron Company N.V. Reconciliation of Non - GAAP Supplemental Information (in thousands, except per share data) Three Months Twelve Months Ended December 31, Ended December 31, 2013 2012 2013 2012 Adjusted income from operations Income from operations $210,426 $138,514 $684,508 $455,643 Acquisition and integration related costs 19,260 6,000 95,737 11,000 Adjusted income from operations $229,686 $144,514 $780,245 $466,643 Adjusted % of Revenue 7.7% 9.4% 7.0% 8.5% Adjusted net income attributable to CB&I Net income attributable to CB&I $196,781 $ 89,617 $454,120 $301,655 Acquisition and integration related costs, net of tax (1 ) 12,134 3,900 73,316 7,143 Adjusted net income attributable to CB&I $208,915 $ 93,517 $527,436 $308,798 Adjusted net income attributable to CB&I per share Net income attributable to CB&I $ 1.80 $ 0.91 $ 4.23 $ 3.07 Acquisition and integration related costs, net of tax (1 ) 0.11 0.04 0.68 0.07 Adjusted net income attributable to CB&I $ 1.91 $ 0.95 $ 4.91 $ 3.14 (1) The three and twelve month periods ended December 31 , 2013 include $ 19 , 260 and $ 95 , 737 of acquisition and integration related costs, respectively, and the twelve month period ended December 31 , 2013 includes $ 10 , 517 of acquisition related pre - closing financing costs and one - time financial commitments (both included in interest expense and recorded in Q 1 ) . These costs total $ 19 , 260 and $ 106 , 254 , less the tax impact of $ 7 , 126 and $ 32 , 938 , respectively . The per share amounts for the three and twelve month periods are based upon diluted weighted average shares of 109 , 168 and 107 , 452 , respectively . The three and twelve month periods ended December 31 , 2012 include $ 6 , 000 and $ 11 , 000 of acquisition and integration related costs, respectively, less the tax impacts of $ 2 , 100 and $ 3 , 857 , respectively . The per share amounts for the three and twelve month periods are based upon diluted weighted average shares of 98 , 230 and 98 , 231 , respectively . Note : " 2014 adjusted earnings per share guidance excludes anticipated integration costs of $ 20 , 000 with a tax benefit of $ 7 , 000 or $ 0 . 12 per share . GAAP earnings per share are estimated to be $ 4 . 68 to $ 5 . 53 Supplemental Information