Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - ORBCOMM Inc. | d811381d8k.htm |

| EX-99.2 - EX-99.2 - ORBCOMM Inc. | d811381dex992.htm |

| EX-23.1 - EX-23.1 - ORBCOMM Inc. | d811381dex231.htm |

| EX-99.1 - EX-99.1 - ORBCOMM Inc. | d811381dex991.htm |

| EX-99.4 - EX-99.4 - ORBCOMM Inc. | d811381dex994.htm |

| EX-99.5 - EX-99.5 - ORBCOMM Inc. | d811381dex995.htm |

| EX-10.1 - EX-10.1 - ORBCOMM Inc. | d811381dex101.htm |

| EX-99.6 - EX-99.6 - ORBCOMM Inc. | d811381dex996.htm |

Investor

Overview November 2014

Exhibit 99.3 |

2

Safe Harbor Statement

Certain statements discussed in this presentation constitute forward-looking statements

within the meaning of the Private Securities Litigation Reform Act of 1995. These

forward-looking statements generally relate to our plans, objectives and expectations for future events and include statements about our

expectations, beliefs, plans, estimates, objectives, intentions, assumptions and other

statements that are not historical facts. Such forward-looking statements,

including those concerning the Company’s expectations and estimates, are subject to known

and unknown risks and uncertainties, which could cause actual results to differ

materially from the results, projected, expected or implied by the forward-looking statements, some of which are beyond the Company’s

control, that may cause the Company’s actual results, performance or achievements, or

industry results, to be materially different from any future results, performance or

achievements expressed or implied by such forward-looking statements. These risks and uncertainties include but are not limited to: failure to

satisfy the conditions, including required regulatory approvals, of the pending acquisition of

SkyWave Mobile Communications Inc., any delay in consummating the acquisition of

SkyWave or the failure to consummate the acquisition of SkyWave; the costs and expenses associated with the acquisition of SkyWave;

failure to successfully integrate SkyWave with our existing operations or failure to realize

the expected benefits of the acquisition of SkyWave; dependence of SkyWave’s

business on its commercial relationship with Inmarsat and the services provided by Inmarsat, including the continued availability of Inmarsat’s

satellites; substantial losses we have incurred and may continue to incur; demand for and

market acceptance of our products and services and the applications developed by us and

our resellers; market acceptance and success of our Automatic Identification System business; dependence on a few significant

customers, including a concentration in Brazil for SkyWave, loss or decline or slowdown in the

growth in business from key customers, such as Caterpillar Inc., Komatsu Ltd., Hitachi

Construction Machinery Co., Ltd., Union Pacific Railroad and Maersk Lines, and other value-added resellers, or VARs, and international

value-added resellers, or IVARs for ORBCOMM and Onixsat, Satlink and Sascar, and other

value-added Solution Providers, or SPs, for SkyWave; dependence on a few

significant vendors or suppliers, loss or disruption or slowdown in the supply of products and services from key vendors, such as Inmarsat plc. and

Amplus Communication Pte Ltd.; loss or decline or slowdown in growth in business of any of the

specific industry sectors we serve, such as transportation, heavy equipment, fixed

assets and maritime; our potential future need for additional capital to execute on our growth strategy; additional debt service

acquired with or incurred in connection with existing or future business operations; our

acquisitions may expose us to additional risks, such as unexpected costs, contingent or

other liabilities, or weaknesses in internal controls, and expose us to issues related to non-compliance with domestic and foreign laws,

particularly regarding our acquisitions of businesses domiciled in foreign countries; the

terms of our credit agreement, under which we currently have borrowed $80 million and

may borrow an additional $80 million for use with acquisitions, could restrict our business activities or our ability to execute our

strategic objectives or adversely affect our financial performance; the inability to effect

suitable investments, alliances and acquisitions or the failure to integrate and

effectively operate the acquired businesses; fluctuations in foreign currency exchange rates; the inability of our subsidiaries, international

resellers and licensees to develop markets outside the United States; the inability to obtain

or maintain the necessary regulatory authorizations, approvals or licenses, including

those that must be obtained and maintained by third parties, for particular countries or to operate our satellites; technological changes,

pricing pressures and other competitive factors; satellite construction and launch failures,

delays and cost overruns of our next-generation satellites and launch vehicles;

in-orbit satellite failures or reduced performance of our existing satellites; our inability to replenish or expand our satellite constellation; the failure of

our system or reductions in levels of service due to technological malfunctions or

deficiencies or other events; our estimated ranges of financial results for the third

quarter of 2014 are preliminary, unaudited, subject to completion and additional financial closing procedures and may be revised as a result of

management’s and our auditor’s review of our results; significant liabilities

created by products we sell; litigation proceedings; inability to operate due to

changes or restrictions in the political, legal, regulatory, government, administrative and

economic conditions and developments in the United States and other countries and

territories in which we provide our services; ongoing global economic instability and uncertainty; changes in our business strategy; and the other

risks described in our filings with the SEC. Unless required by law, we undertake no

obligation to update or revise any forward-looking statements, whether as a result

of new information, future events or otherwise. For more detail on these and other risks, please see our “Risk Factors” section in our annual report on

Form 10-K for the year ended December 31, 2013. |

3

(1) Offering is not contingent on the completion of the SkyWave acquisition

(1) Offering is not contingent on the completion of the SkyWave acquisition

Offering Summary

Listing:

NASDAQ: ORBC

Offering Amount:

Approximately $72 Million (All primary)

Use of Proceeds:

For the acquisition of SkyWave

(1)

and general corporate purposes

Underwriter’s Option:

15%

Lock-up:

75 Days

Expected Pricing:

Late in the Week of 11/3

Bookrunners:

Raymond James (Active); Canaccord, Macquarie

Co-managers:

Craig-Hallum,

Chardan |

4

ORBCOMM: We Are the M2M Solutions Leader

Energy

Maritime

Heavy Equipment

Transportation

Government

Security

•

Asset Tracking & Geolocation

•

Command & Control

•

Reports & Analytics

•

Preventative Maintenance Alerts

•

Supply Chain Visibility

•

Maritime Intelligence

Applications and Benefits

Satellite, Cellular, Dual-Mode & AIS

Network Services

Device Management

Broad Portfolio of Devices

Applications

(Analytics, Reports, etc.) |

5

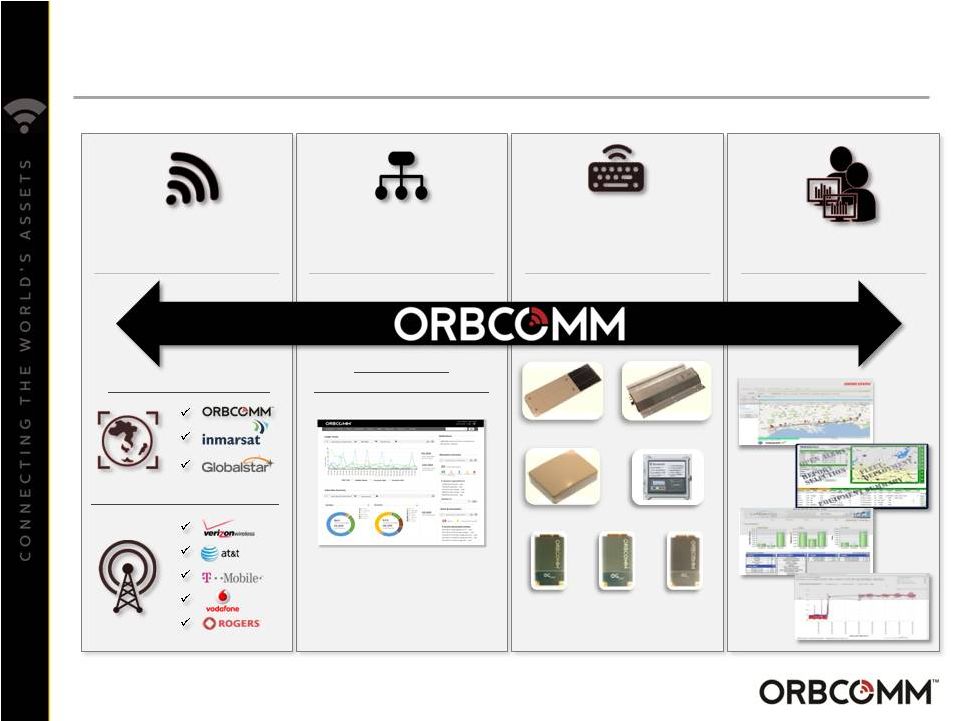

ORBCOMM’s End-to-End M2M Solutions

CONNECTIVITY

DEVICE

MANAGEMENT

HARDWARE

APPLICATIONS

Satellite Offerings

GT 1100 & GT 2300

RT 6000

+

& X1

ORBCOMM, Inmarsat &

Globalstar Modems

Subscriber

Management Portal

AssetView

FleetEdge

ReeferTrak

®

CargoWatch

®

Cellular Partnerships |

World Class

Customer Base Marquee Customers

Customer Success Stories

End-to-end telematics solution to track

and monitor Doosan’s global fleet of

construction equipment

Container tracking solution to

identify loading and unloading

events to reduce idle time, improve

utilization and information flow

Dry van trailer tracking and cold

chain management solution for

trucks

Cold chain monitoring and control

solutions for SWIFT’s refrigerated

intermodal fleet

6 |

7

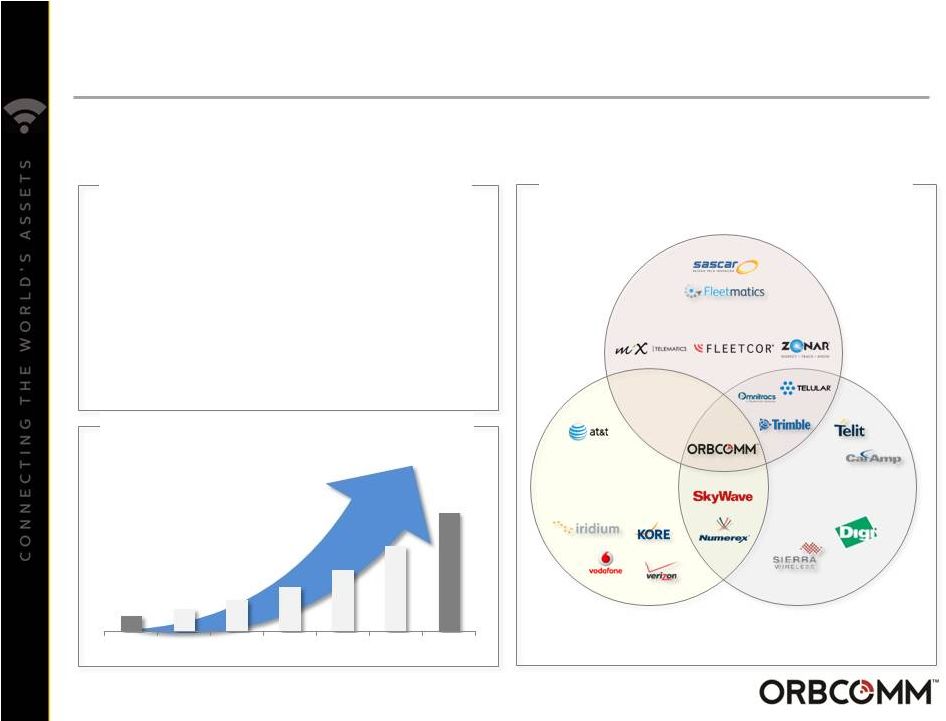

Large, Growing M2M Market Opportunity

Increasingly,

businesses

and

governments

face

the

need

to

track,

control,

monitor

and

communicate with fixed and mobile assets located throughout the world

M2M Ecosystem

Demand for M2M

Global M2M Subscribers by Year

•

Estimated

more

than

270M

M2M

units

globally

(1)

•

Companies are seeking to improve their visibility

and

management

of

fixed

and

mobile

assets

•

Requires access to an asset’s location, condition,

operation and environment and ability to command

and control the asset

•

M2M applications

enhance operational efficiencies,

increase safety and security, help end-users comply

with new regulations, and improve profitability

Subscribers

by

Year

in

Millions

(1)

(1) Global M2M subscribers including satellite and cellular; Source: Machina Research,

2013 Applications

Network

Enablement

Equipment

270

1,960

2013

2020 |

8

~

1,200k

(1)

ORBCOMM’S Path to Becoming the M2M Leader

ORBC Listed on . 16,000

Subscriber .

Opportunity .

Acquisition

of .

Acquisition

of .

Adjusted EBITDA

. Breakeven . Phase I Agreement

Wins Global

Account Launch Six OG2 . .

Satellites

. ~

500k

~

100k

Acquisition

of .

(1) Over 250k subscribers added post SkyWave

Large

National

Retailer |

9

ORBCOMM at an Inflection Point

NEW CAPABILITIES

STRATEGIC GROWTH

NEW OPPORTUNITIES

BROADENING REACH

Automated

Identification

System

(AIS)

New Products

& Services

New Satellite

Constellation

New

Vertical

Markets

Growth Drivers

M&A

Regulation

Driven

Demand

New

Geographies

Growing

Distribution

Network |

OG2 Expands Our

Network Capabilities Automatic Identification Systems (AIS)

•

Shipboard broadcast system transmits vessel

identification and position

•

Used by government and commercial customers

globally on more than 130,000 vessels daily

•

AIS equipped on all OG2 satellites

First six OG2 satellites launched in July; Remaining eleven to launch in 2015

CapEx holiday following completion of the OG2 program

Provides near real-time reporting

Increases unique ship detections

Improved modems

Smaller antennas

Better coverage

Larger message sizes

Faster messaging

•

Increased

M2M

data

capabilities

driving

new

sales

opportunities

•

Higher

capacity

–

up

to

12x

OG1

•

Higher gain, reduced power requirements

10

Upgrades Satellite-based M2M Technology |

11

Strategic Acquisitions Driving Opportunity Expansion

(1)

Shipments begin in 4Q14

(2)

5-year agreement

YEAR

INVESTMENTS

KEY

VERTICALS

SELECT CUSTOMER WINS

POST-ACQUISITION

2011

Transportation

(Cold Chain Management)

16,000

Subscriber Opportunity

(1)

with a

2012

Transportation

(Cold Chain Management)

28,000

Subscriber Opportunity

2013

Heavy Equipment & Rail

50,000

Subscriber Opportunity

(2)

Government & Security

$4.8M

Opportunity with DLA

2014

Transportation

In Progress

Government,

Maritime, Mining,

Energy,

Transportation

To Come

Large National

Retailer |

12

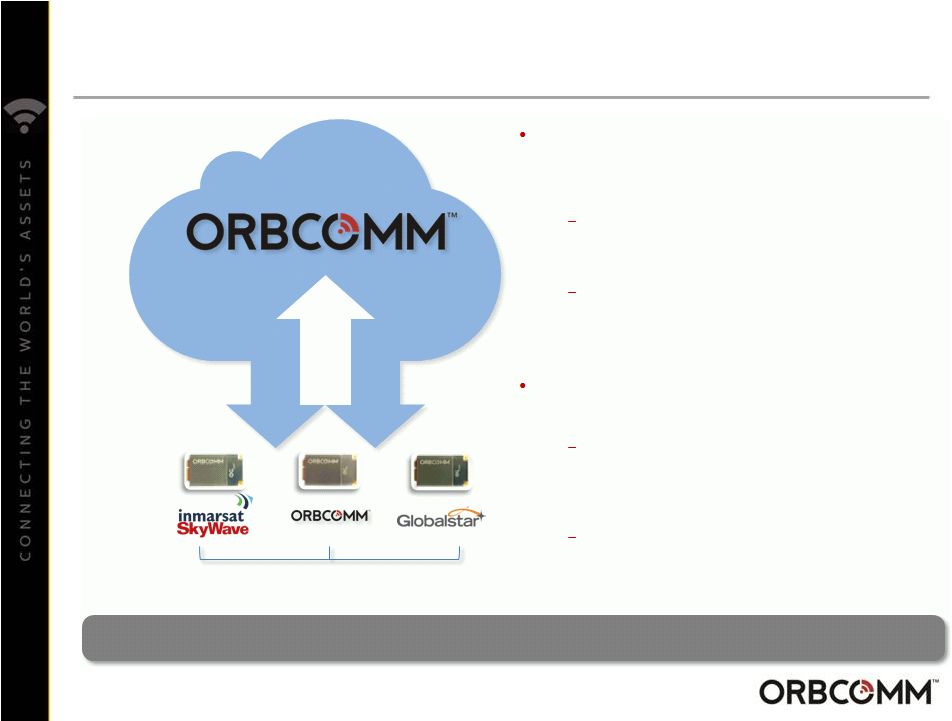

Creating the Satellite M2M Industry Standard

ORBCOMM’s standardized

platform unifies three of the

top four satellite M2M networks

MAPP

TM

(Multi-Network

Access

Point Platform)

Performance, global coverage, flexibility and ease of use

OG1, OG2

Identical Modem Form Factor

MAPP

ORBCOMM has the deepest experience in

the industry with satellite M2M

interoperability solutions

Identical device footprints, connectors,

programming environment, provisioning

and billing and sells for similar price

points

Seamlessly integrates information &

commands, provisioning, billing and

multi-mode communications for M2M

applications

Allows resellers to choose different

networks per regional deployment or a

combination of networks on a single

device

TM |

13

Acquisition of SkyWave

SkyWave is the largest provider of M2M services over Inmarsat’s network and is

the developer of IDP, the next-generation M2M service

SkyWave Statistics

Headquarters:

Ottawa,

Canada

Subscribers

(1)

:

Over 250,000

Network Partner:

SPs/Distributors:

400+

2014E Revenue

(2)(3)

:

$62-63M

2014E Adj. EBITDA

(2)(4)

:

$12-13M

Technical Resources:

90+

(1)

As of 6/30/2014; Over 250k subscribers added post-transaction

(2)

(3)

Adjusted to eliminate intercompany revenues

(4)

See Appendix –

“Adjusted EBITDA”

COMBINED

TECHNOLOGY

Large Messages

Dual Mode

Terrestrial Partners

Security

GEOGRAPHIC STRENGTHS

North America

South America

Europe

Australasia

MEA

Note: Full circles represent more favorable characteristics

Management estimate in USD based on available data, and adjusted to reflect Management’s

reconciliation from IFRS to U.S. GAAP |

14

SkyWave Provides Geographic Expansion

Expanding Addressable Market Through SkyWave Acquisition

•

SkyWave has access to valuable incremental markets

•

SkyWave

has

a

strong

Asian

presence

-

Asian

share

of

satellite

M2M

market

poised

to

increase

from

12.5%

in

2014

to

17.4%

in

2022

(1)

•

Substantial

ORBCOMM

OEM

sales

opportunity

for

SkyWave

services

in

new

territories

(1)

Source: Northern Sky Research

Incremental SkyWave/Inmarsat Authorized

ORBCOMM Authorized |

Rail

Expanding Our TAM: Increased Opportunity

Trailers

In-Cab, Trucks

Small Machines

Large Machines

Service Vehicles

Pipelines

Tanks

Commercial Utility Metering

Military Vehicles

Containers

Police/Fire/First Responders

Commercial Buoys

Commercial Ships

Recreational Ships

Transportation

OG1

OG2

Dual Mode

SkyWave

Combined

Heavy Equipment

Energy

Maritime

Government & Security

15 |

16

Transaction Opportunities and Benefits

SkyWave

creates

numerous

post-deal

opportunities

for

ORBCOMM

(1)

:

•

A leader

in satellite-based M2M

•

Over

$150M

combined

revenue

(2)

;

over

1.2M

combined subs

•

Nearly

200

combined

technical

resources

•

Global geographic

coverage •

Broadest product

distribution

.

•

Widest product

assortment

.

•

Cost

synergies

from

efficiencies

•

Product cost

reductions

•

Reduced technology

redundancies

•

Enlarge addressable

market •

Cross-selling

into the channel

•

Enhanced

technical

capabilities

•

Creates

standard

platform

for

the satellite M2M market

•

New

joint

sales

and

development

opportunities

•

Scale

across

two

leading

satellites

networks

.

•

Potential opportunities around

future constellations

Adds

Significant

Scale

Substantial

Synergy

Opportunities

Deepens Existing

Inmarsat

Relationship

(1)

The pro forma financial information is not intended to represent or be indicative of the

consolidated results of operations or financial position of ORBCOMM and SkyWave on a

combined basis and should not be taken as a representation of ORBCOMM’s future consolidated results of

operations or financial position. See “Safe Harbor Statement”

(2)

Pro forma for SkyWave acquisition; See page 22 |

17

FINANCIAL OVERVIEW |

18

Transaction Summary

Net Transaction Value:

$122.5 million

(1)

Financing Sources:

•

Macquarie debt facility expansion

•

Equity offering proceeds

(2)

Estimated Synergies:

Approximately $2-$4 million of annualized cost synergies

Estimated Transaction

Multiple:

9x Pre-synergy SkyWave 2015E EBITDA Contribution

(3)

7x Post-synergy SkyWave 2015E EBITDA Contribution

(3)

Closing Conditions:

•

FCC and Industry Canada approval

•

SkyWave shareholder approval

(4)

Anticipated Closing:

January 2015

(1)

$130 million payable to SkyWave shareholders less $7.5 million paid to ORBCOMM by Inmarsat

under the Inmarsat Agreement

(2)

Offering is not contingent on the completion of the SkyWave acquisition (3) Multiple based on midpoint of expected pre- and

post-synergy 2015E SkyWave EBITDA contribution

(4)

Holders of more than 90% of SkyWave’s outstanding shares have entered into a voting

agreement, pursuant to which they have agreed to vote their shares in favor of the

acquisition |

19

SkyWave Financial Overview

Revenue

(1)(2)

Adjusted EBITDA

(2)(3)

(in $Ms)

(in $Ms)

(1) Adjusted to eliminate intercompany revenues

(2) Management estimate in USD based on available data, and adjusted to reflect

Management’s reconciliation from IFRS to U.S. GAAP (3) See Appendix –

“Adjusted EBITDA”

•

Long-term track record of consistent revenue growth

•

Historically over 50% of total revenue has been recurring in nature

•

Opportunity for EBTIDA margin expansion and strong synergy realization

$62-63

$12-13

$56

$9

2013A

2014E

2013A

2014E |

20

ORBC Highlights and Developments: Q3 & Q4

Execution of growth strategy and strong customer

wins drive attractive growth prospects

•

Phase I Launch

of second generation constellation OG2 completed

•

Approximately

20,000

subscriber

additions

expected

over

the

next

75

days

from

the

following

three

customers:

,

&

–

20,000 compares to 600 subscriber additions in 3Q14 for the same customers

–

Of the 20,000 expected additions, 17,500 are OG2 enabled

•

Acquisition

of

:

–

Over

250k

subscribers

to

be

added

–

$12-13

million

of

2014E

Adjusted

EBITDA

(1)(2)

based

on

available

results

–

Over 400

complementary distribution and solution providers

Large National

Retailer

(1) Management estimate in USD based on available data, and adjusted to reflect

Management’s reconciliation from IFRS to U.S. GAAP (2) See Appendix – “Adjusted EBITDA”

|

21

ORBCOMM 3Q14 Preliminary Results

(1)

•

3Q14 Total Revenues increased 17% YoY to

$23.1M

•

3Q14 Adjusted EBITDA of $3.7M

•

3Q14 Adjusted EBITDA includes non-recurring

one-time costs associated with:

–

refinancing long-term debt;

–

satellite launch-related costs; and,

–

activities to win significant deals

•

4Q14 expected to exceed prior highs for

quarterly customer shipments

•

Expecting 4Q14 revenues in the range of

$28-30M

3Q14

Preliminary

Results

Service Revenues

$ 15.2

Product Sales

7.9

Total Revenues

23.1

Adjusted EBITDA

$ 3.7

(in $Ms)

Productive 3Q14 culminating in 4Q14 product shipments

that will drive higher recurring service revenues

(1)

See Appendix – “Preliminary Results” and “Adjusted EBITDA” |

22

Forward Outlook

(1)

•

2015E

Pro

Forma

Revenue

is

expected

to

be

$170-190

million

(2)(3)

•

2015E

Pro

Forma

Adjusted

EBITDA

is

expected

to

be

$40-45

million

(2)(3)(5)

(1)

(2)

Including SkyWave assuming transaction closed on January 1, 2013. Management estimate in USD

based on available data, and adjusted to reflect Management’s reconciliation from

IFRS to U.S. GAAP (3)

Based on Management’s planning and other factors. Actual results may differ materially

from forward outlook as a result of risks and uncertainties. See “Safe Harbor

Statement” (4)

Adjusted to eliminate intercompany revenues

(5)

See Appendix –

“Adjusted EBITDA”

(6)

Historical Pro Forma Adjusted EBITDA amounts do not reflect the elimination of Canadian

investment tax credits that were available to SkyWave (2013: $1.2M; 2014E:

$0.6M) Pro Forma ORBCOMM

(2)

2013A

2014E

2015E

Total Revenues

(4)

$ 131

$ 157-160

$ 170-190

Adjusted EBITDA

(5)

$ 26

$ 29-31

$ 40-45

(in $Ms)

(6)

(6)

(3)

(3)

The pro forma financial information is not intended to represent or be indicative of the

consolidated results of operations or financial position of ORBCOMM and SkyWave on a

combined basis and should not be taken as a representation of ORBCOMM’s future

consolidated results of operations or financial position

|

23

Our Target Model Post-Acquisition

Historical Pro Forma

1H 2014

(1)

Five Year Goal

(2)

Annual Service Revenue Growth Rate

10%

~20%

Service % of Total Revenue

63%

65 –

70%

Service Revenue Margin

68%

70 –

75%

Total Gross Margin

51%

60 –

65%

Adjusted EBITDA

(3)

19%

(4)

32.5 –

37.5%

Our business model is characterized by high operating leverage and we

are investing to accelerate growth

$350 -

400M Total Revenue

~$210 -

260M Gross Profit

~$114 -

150M Adj. EBITDA

(1)

The pro forma financial information is not intended to represent or be indicative of the

consolidated results of operations or financial position of ORBCOMM and SkyWave on a

combined basis and should not be taken as a representation of ORBCOMM’s future consolidated results of

operations or financial position (2) The foregoing do not represent projections for any period but

rather represent long-term objectives that management utilizes as goals in

managing the Company’s business. Achievement of these long-term objectives is (i)

subject to significant economic, competitive, business, and other risks and

uncertainties, and (ii) dependent upon successful execution on the Company’s business plan including successful integration of any

significant acquisitions. The Company undertakes no duty to update these goals. (3) See Appendix – “Adjusted EBITDA” (4) Historical Pro Forma Adjusted EBITDA amounts do not reflect the

elimination of Canadian investment tax credits that were available to SkyWave

(1H2014: $0.3M)

|

24

•

Leader in M2M communications and solutions

•

Growing world class customer base includes large recent wins

•

Deepening Inmarsat relationship creates a satellite M2M standard

•

Productive 3Q14 expected to drive all time high customer shipments in 4Q14

•

Accretive SkyWave acquisition provides access to new opportunities

•

Full deployment of OG2 in 2015 sets stage for extended CapEx holiday

|

25

APPENDIX |

26

Pro Forma Capitalization

(1)

(in $Ms)

June 30, 2014

Adjusted

Actual

6/30/14

As Adjusted for

Refinancing

As Further

Adjusted for this

Offering

Pro Forma as

Further Adjusted

for the Acquisition

Cash

(2)

$ 48.7

$ 81.8

$ 149.6

$ 85.6

Debt:

Term & Revolving Loan

(3)

80.0

80.0

150.0

Note payable

45.0

Note payable, related party

1.6

1.6

1.6

1.6

Total debt

46.6

81.6

81.6

151.6

Total equity

(4)

$ 234.8

$ 234.8

$ 302.6

$ 298.6

(5)

(5)

(1)

The pro forma financial information is not intended to represent or be indicative of the

consolidated results of operations or financial position of ORBCOMM and SkyWave on a

combined basis and should not be taken as a representation of ORBCOMM’s future consolidated results of operations

or financial position (2) Adjustments are based on Net Proceeds from Financings less

Management's estimates for discounts, fees and expenses, and assumes debt refinancing

of $80M; equity offering gross proceeds of approximately $72M and, acquisition loan of $70M

(3)

Term loan for $70 million and Revolving loan for $10 million; Acquisition term loan accordion

of $70 million

(4)

Increases in common stock and additional paid in capital less transaction fees (5) Adjusted based on SkyWave’s Purchase Price of $130 million

plus $4.0 million in acquisition- and integration- related fees and costs. Fees charged

to equity

|

27

Preliminary Results

Management has prepared the estimates for the quarter ended September 30, 2014 presented in

this Investor Overview in good faith based upon the most recent information available

to management from our internal reporting procedures as of the date of this Investor

Overview. These estimated results are preliminary, unaudited, subject to further

completion, reflect our current good faith estimates, are subject to additional

financial

closing

procedures

and

may

be

revised

as

a

result

of

management’s

further

review

of

our results, and

any adjustments that may result from the completion of the review of our condensed

consolidated financial statements.

We

and

our

auditors

have

not

completed

our

normal

quarterly

review

as

of

and

for

the

third

quarter

ended

September

30,

2014,

and

there

can

be

no

assurance

that

our

final

results for this quarterly

period will not differ from these estimates. Any such changes could be material. During the

course of the preparation of our condensed consolidated financial statements and

related notes as of and for the quarter ended September 30, 2014, we may identify items

that would require us to make material adjustments to the preliminary financial

information presented above. We assume no duty to update these preliminary estimates

except as required by law.

Our condensed consolidated financial statements and related notes as of and for the quarter

ended September 30, 2014 are not expected to be filed with the SEC until after this

offering is completed. Our actual

results

may

differ

materially

from

the

third

quarter

2014

estimates

presented

in

this

Investor Overview.

Accordingly, you should not place undue reliance on these preliminary estimates. These

estimates should not be viewed as a substitute for full interim financial statements

prepared in accordance with accounting principles generally accepted in the United

States, or U.S. GAAP. In addition, these preliminary estimates as of and

for

the

quarter

ended

September

30,

2014

are

not

necessarily

indicative

of

the

results

to

be

achieved

for

any future period. |

28

Adjusted EBITDA

EBITDA

is

defined

as

earnings

attributable

to

us

before

interest

income

(expense),

provision

for

income

taxes

and depreciation and amortization. We believe EBITDA is useful to our management and

investors in evaluating operating performance because it is one of the primary

measures used by us to evaluate the economic productivity of our operations, including

our ability to obtain and maintain our customers, our ability to operate our business

effectively, the efficiency of our employees and the profitability associated with

their performance. It also helps our management and investors to meaningfully evaluate and compare

the results of our operations from period to period on a consistent basis by removing the

impact of our financing transactions and the depreciation and amortization impact of

capital investments from our operating results. In addition, our management uses

EBITDA in presentations to our board of directors to enable it to have the same

measurement of operating performance used by management and for planning purposes,

including the preparation of our annual operating budget. We also believe that EBITDA, adjusted

for stock-based compensation expense, non-controlling interests, impairment loss,

non-capitalized satellite launch

and

in-orbit

insurance,

insurance

recovery,

and

acquisition-

and

integration-related

costs

(“Adjusted

EBITDA”) is useful to investors to evaluate our core operating results and financial

performance and our capacity

to

fund

capital

expenditures,

because

it

excludes

items

that

are

significant

non-cash

or

non-

recurring expenses reflected in the condensed consolidated statements of operations. EBITDA

and Adjusted EBITDA are not performance measures calculated in accordance with U.S.

GAAP. While we consider EBITDA and Adjusted EBITDA to be important measures of

operating performance, they should be considered in addition to, and not as a

substitute for, or superior to, net income (loss) or other measures of financial

performance prepared in accordance with U.S. GAAP and may be different than EBITDA and

Adjusted EBITDA measures presented by other companies. |

29

Adjusted EBITDA

The following is a reconciliation of Adjusted EBITDA to net income (loss) attributable to

ORBCOMM Inc. for the year

ended

December

31,

2013

and

the

preliminary

results

for

the

quarter

ended

September

30,

2014.

(In $Ms)

Fiscal Year

2013

3Q14

Preliminary

Estimated

Net Income (Loss) attributable

to ORBCOMM Inc.

$ 4.6

$ (0.1)

Net interest (income) expense

0.0

(0.0)

Provision for income taxes

1.3

0.1

Depreciation and amortization

6.0

2.5

EBITDA

$ 11.9

$ 2.5

Stock based compensation

3.0

0.9

Non-controlling interest

0.2

0.0

Acquisition-related costs

1.7

0.2

In-orbit insurance

0.0

0.1

Adjusted EBITDA

$ 16.7

$ 3.7

Note: In May 2014, ORBCOMM modified its definition of Adjusted EBITDA to adjust for

acquisition-related costs and non-capitalized satellite launch and

in-orbit insurance when incurred, to better reflect the on-going business.

(1)Differences in sums due to rounding

(1) |