Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - MoneyOnMobile, Inc. | c628-20141029ex991b604dd.htm |

| 8-K - 8-K - MoneyOnMobile, Inc. | c628-20141029x8k.htm |

Calpian, Inc. Announces Financial Results for

Second Quarter Fiscal Year 2015

Key Highlights

|

· |

Second consecutive quarter of more than 30% growth in revenue |

|

· |

Consolidated revenues of $59.2 million for the quarter ending September 30, 2014; Up $13.5 million |

|

· |

34% quarter-to-quarter growth by Money-On-Mobile |

|

· |

2% quarter-to-quarter revenue growth by domestic businesses |

|

· |

Senior Debt Reduced by $4 million and extended maturity 12 months |

|

· |

Operating Expenses down $325,000 quarter-to-quarter |

DALLAS – October 29, 2014 – Calpian, Inc. (OTCQB: CLPI), a global mobile payments technology and processing company, today reported the company’s second quarter 2015 financial results for the quarter ending September 30, 2014, with significant increases in international revenues for the second consecutive quarter.

"Our second consecutive quarter with more than 30 percent growth in revenue is an exciting development," said Harold Montgomery, Calpian founder and CEO. "We have established solid momentum in both the U.S. and Indian businesses, and we’re committed to maintaining it going forward. In pursuing various growth initiatives, the Company continuously evaluates different capital raising options, both equity and debt.”

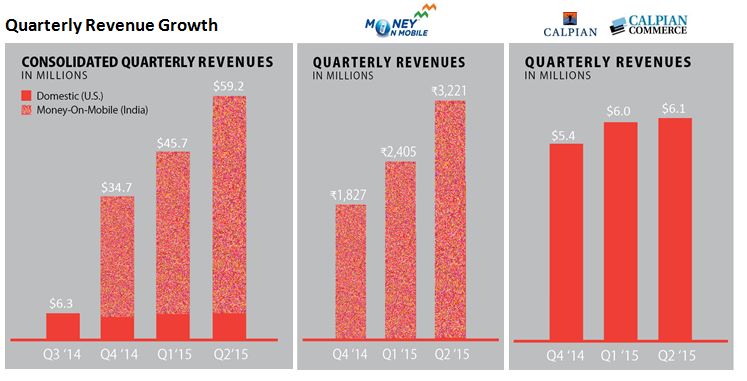

Revenues – Calpian, Inc. consolidated revenues were $59.2 million for the quarter ending September 30, 2014, up $13.2 million, a 30 percent increase compared to $45.7 million for the quarter ending June 30, 2014, which was up $11 million, a 32 percent increase over the quarter ending March 31, 2014. Revenues included Money-On-Mobile which contributed $52.2 million to the total, an increase of 34 percent over the prior quarter. Calpian Commerce and the residual acquisition business contributed $6.1 million of the total revenue, a 2 percent increase over the prior quarter.

Revenue In India – Money-On-Mobile revenues were ₹3.2 billion Indian rupees for the quarter ending June 30, 2014, up 34 percent from the prior quarter’s mark of ₹2.4 billion Indian rupees. (Note: the Indian Rupee to U.S. Dollar exchange rate on September 30, 2014 was USD$1: INR 61.7284).

Domestic Revenue in the U.S. – Domestic revenues were $6.1 million for the quarter ending September 30, 2014, up 2 percent from the prior quarter revenue of $6 million. Revenues included those from Calpian Commerce which contributed $5.2 million of the total.

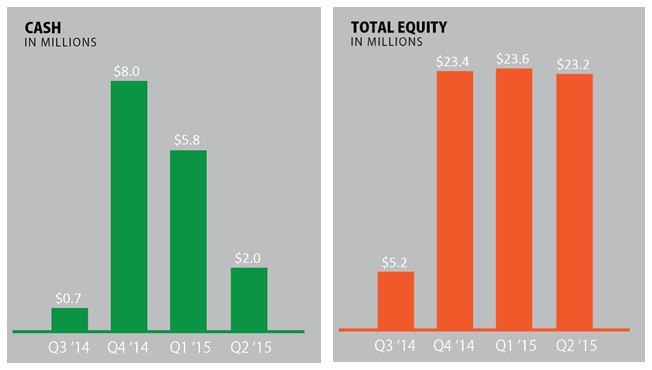

Cash – Calpian ended the second quarter with $2 million in cash. Cash balances decreased $3.8 million from the prior quarter primarily reflecting the Company’s continued investment in its Indian Subsidiary Money-On-Mobile. During the quarter, the company also sold a portion of its domestic assets, the proceeds of which were used to reduce senior debt by almost $4 million to $9.3 million. Senior debt was also rescheduled to begin amortization four quarters hence, on October 1, 2015.

Equity – Total equity (subject to final audit adjustments) is expected to be $23.2 million for the quarter ending September 30, 2014, a decrease of $400,000, which primarily reflects quarterly operating losses at Money-On-Mobile being offset by the one-time gain on sale of domestic assets.

Webcast and Conference Call Information

Calpian will host a conference call to discuss the results at 10 a.m. CDT / 11 a.m. EDT today. Participants can register for the call and webcast via the following link: https://prismdigitalmedia.cwebcast.com/permalink/#/reg/nGr6e3pY0vWB-JV4zzNWBg~~. Once registered for the call, interested parties will receive the conference call dial-in information. An archived version of the webcast will remain on the Calpian, Inc. website’s “Investors Relations” page at www.calpian.com following the live webcast.

About Calpian, Inc.

Calpian, Inc. (CLPI) is a global mobile payments technology and processing company offering mobile payment services through Indian subsidiary Money-On-Mobile and domestic transaction services through Calpian Commerce. Money-On-Mobile is a mobile payments service provider that enables Indian consumers to use their mobile phones to pay for goods and services, or transfer funds from one cell phone to another using simple SMS text functionality. Calpian

Commerce provides the U.S. merchant community with an integrated suite of payment processing services and related software products. For more information, visit www.calpian.com.

# # #

Note to Investors:

This press release contains certain forward-looking statements based on our current expectations, forecasts and assumptions that involve risks and uncertainties. This release does not constitute an offer to sell or a solicitation of offers to buy any securities of any entity. Forward-looking statements in this release are based on information available to us as of the date hereof. Our actual results may differ materially from those stated or implied in such forward-looking statements, due to risks and uncertainties associated with our business, which include the risk factors disclosed in our Form 10-K filed on August 11, 2014. Forward-looking statements include statements regarding our expectations, beliefs, intentions or strategies regarding the future and can be identified by forward-looking words such as "anticipate," "believe," "could," "estimate," "expect," "intend," "may," "should," and "would" or similar words. We assume no obligation to update the information included in this press release, whether as a result of new information, future events or otherwise. Any forecasts that are provided by management in this presentation and are based on information available to us at this time and management expects that internal projections and expectations may change over time. In addition, the forecasts are entirely on management’s best estimate of our future financial performance given our current contracts, current backlog of opportunities and conversations with new and existing customers about our products.

Investor ContactMedia Contact

Adam Holdsworth Matt Averitt

ProActive Capital Group AverittPR

646.862.4607214.823.2244

adamh@proactivecapital.commatt@averittpr.com