Attached files

| file | filename |

|---|---|

| 8-K - 8-K - NANOSPHERE INC | d807395d8k.htm |

| EX-99.1 - EX-99.1 - NANOSPHERE INC | d807395dex991.htm |

COMPANY

OVERVIEW OCTOBER 2014

Exhibit 99.2 |

NANOSPHERE

This

presentation

contains

forward-looking

statements

about

us

and

our

industry

that

involve

substantial

risks

and

uncertainties.

We

intend

such

forward-looking

statements

to

be

covered

by

the

safe

harbor

provisions

for

forward-looking

statements

contained

in

Section

21E

of

the

Securities

Exchange

Act

of

1934,

as

amended,

and

Section

27A

of

the

Securities

Act

of

1933,

as

amended.

All

statements,

other

than

statements

of

historical

facts,

included

in

this

presentation

regarding

our

strategy,

future

operations,

future

financial

position,

future

net

sales,

projected

expenses,

products’

placements,

performance

and

acceptance,

prospects

and

plans

and

management’s

objectives,

as

well

as

the

growth

of

the

overall

market

for

our

products

in

general

and

certain

products

in

particular

and

the

relative

performance

of

other

market

participants

are

forward-looking

statements.

These

statements

involve

known

and

unknown

risks,

uncertainties

and

other

factors

that

may

cause

our

actual

results,

levels

of

activity,

performance

or

achievement

to

be

materially

different

from

those

expressed

or

implied

by

the

forward-looking

statements.

In

some

cases,

you

can

identify

forward-looking

statements

by

terms

such

as

“anticipate,”

“believe,”

“estimate,”

“expect,”

“intend,”

“may,”

“might,”

“plan,”

“project,”

“will,”

“would,”

“should,”

“could,”

“can,”

“predict,”

“potential,”

“continue,”

“objective,”

or

the

negative

of

these

terms,

and

similar

expressions

intended

to

identify

forward-looking

statements.

However,

not

all

forward-looking

statements

contain

these

identifying

words.

These

forward-looking

statements

reflect

our

current

views

about

future

events

and

are

based

on

assumptions

and

subject

to

risks

and

uncertainties.

Given

these

uncertainties,

you

should

not

place

undue

reliance

on

these

forward-looking

statements.

Actual

events

or

results

could

differ

materially

from

those

expressed

or

implied

by

these

forward-looking

statements

as

a

result

of

various

factors.

These

forward-looking

statements

represent

our

estimates

and

assumptions

only

as

of

the

date

hereof.

Unless

required

by

U.S.

federal

securities

laws,

we

do

not

intend

to

update

any

of

these

forward-looking

statements

to

reflect

circumstances

or

events

that

occur

after

the

statement

is

made

or

to

conform

these

statements

to

actual

results.

The

following

presentation

should

be

viewed

in

conjunction

with

the

consolidated

financial

statements

and

notes

thereto

appearing

in

our

Annual

Report

on

Form

10-K

and

subsequent

quarterly

reports

on

Form

10-Q.

Our

actual

results

may

differ

materially

from

those

anticipated

in

these

forward-looking

statements

as

a

result

of

various

factors,

including

but

not

limited

to:

•

if we do not achieve significant product revenue, we may not be able to meet our cash

requirements without obtaining additional capital from external sources, and if we are

unable to do so, we may have to curtail or cease operations;

•

estimates of the potential market size for

our products (including the hospital lab market in general and the blood stream infection (BSI)

market in particular) or failure of the market for these products to grow as

anticipated, •

the past performance of other companies which we believe to have

been in a market position analogous to where we believe we are now may not be predictive of our

future results in the manner we believe them to be,

•

our analysis of who our competitors have been, who they are now and who they will be in the

future (particularly in the BSI, enteric, extended tuberculosis and meningitis MDx

product markets) and our predictions of relevant future performance may be inaccurate,

•

comparisons of actual financial results for another company to what we predict will be our

future financial results may be inapposite, •

predictions of when “breakeven customer base”

is achieved and its relationship to our cash flow position, needs and “burn”

may prove to be inaccurate,

•

entrance of other competitors or other factors causing us to lose competitive advantage in the

sample-to-result MDx market, •

a lack of commercial acceptance of the Verigene System, its array of tests, and the development

of additional tests, which could negatively affect our financial results,

•

failure of third-party payors to reimburse our customers for the use of our clinical

diagnostic products or reduction of reimbursement levels, which could harm our ability to sell

our products,

•

failure of our products to perform as expected or to obtain certain approvals or the questioning

of the reliability of the technology on which our products are based, which could cause

lost revenue, delayed or reduced market acceptance of our products, increased costs and damage to our reputation,

•

our inability to manage our anticipated growth, constraints or inefficiencies caused by

unanticipated acceleration and deceleration of customer demand, and

•

those set forth under “Risk Factors”

in our Annual Report on Form 10-K, as amended from time to time under “Risk

Factors” in our Quarterly Reports on Form 10-Q.

FORWARD-LOOKING STATEMENTS |

NANOSPHERE

INVESTMENT THESIS

3

Nanosphere

•

Proprietary high value tests that enable clinicians to rapidly identify some of the most

complex, costly and deadly infectious diseases

•

Installed and growing customer base with leading hospital-based laboratories and academic

research institutions in the U.S.

•

Over 250 U.S. cumulative placements to date

•

3-year revenue CAGR 85.7%

•

Backlog poised to convert to accelerated revenue ramp

•

Menu and platform strategy defined with compelling data

•

Demonstrated proprietary IP advantage in protein capabilities

•

Positioned to be low cost provider |

NANOSPHERE

COMPANY BACKGROUND

State of the Art Molecular Diagnostic Testing

4

•

Rapid viral and bacteria disease detection

•

Expanding menu of tests

•

Proprietary Verigene®

System platform installed in over 250 U.S. hospitals and labs

•

Licensing relationship with the International Institute for Nanotechnology at

Northwestern •

Over 180+ issued patents, 6 pending applications and over 30+ non-exclusive licensed

patents •

Founded 1999

•

Headquartered in Northbrook, IL

•

165 full-time employees, as of December 31, 2013

o

56 in R&D

o

42 in manufacturing

o

50 in sales and marketing

o

17 in general and administrative |

NANOSPHERE

OUR MISSION

5

•

Improve Patient Care

•

Lower Costs to the Healthcare System

•

Deliver Exceptional Customer Service

o

Save lives

o

Decrease morbidity

o

Reduce spread of antibiotic resistance

o

Shorter length of stay

o

Antibiotic savings

o

Demonstrated economic outcomes

o

Value to lab / clinician / administration

o

Customer-based development

Enhance Medicine Through Targeted Diagnostics |

NANOSPHERE

MANAGEMENT TEAM

Officer / Title

Background

Michael McGarrity

President and

Chief Executive Officer

Joined Nanosphere in 2005

13 years with Stryker Corporation

Most recently Vice President, Stryker Instruments, a $700 million division of Stryker

Corporation

Graduate of the University of Notre Dame

Roger Moody

Vice President of Finance,

Treasurer and Chief

Financial Officer

Joined Nanosphere in 2007

Chief Financial Officer and Chief Operating Officer of Medsn

Strategic advisory services to technology and healthcare companies for Volpe Brown

Whelan & Company

B.S. from Syracuse University and M.B.A. from the University of Chicago, Graduate School

of Business

Ken Bahk, Ph.D.

Chief Strategy Officer

Joined Nanosphere in 2013

Director of Investments at Lurie Investments

Served in leadership positions for the premier MDx professional organizations (most

recently Chair of Strategic Opportunities, Association for Molecular Pathology)

Ph.D. in biochemistry and molecular biology, M.S. in neurobiology and physiology from

Northwestern University, and M.B.A. from the Kellogg School of Management

6 |

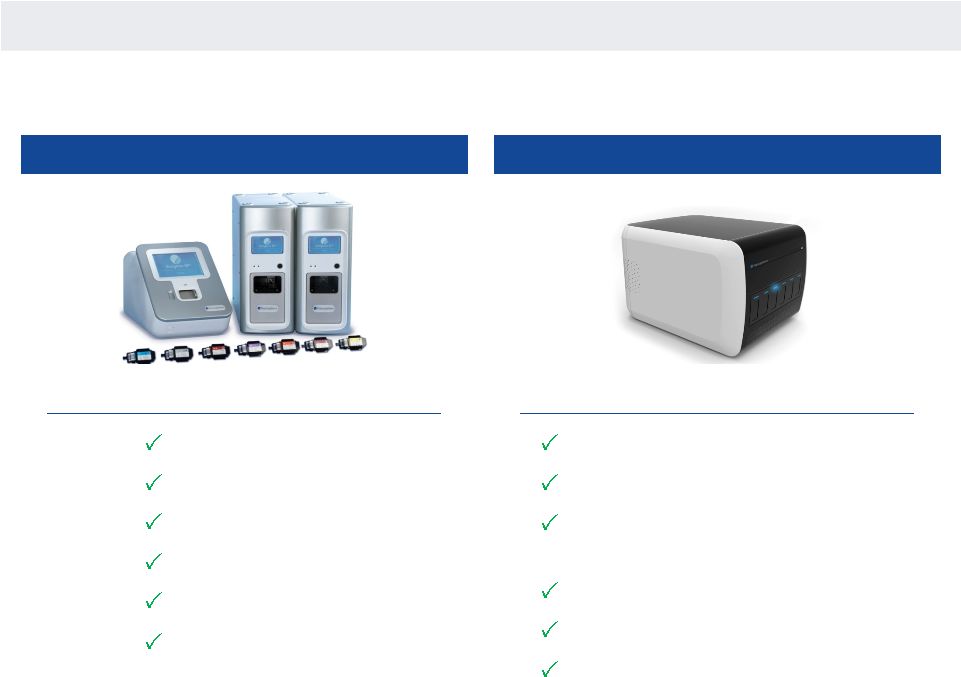

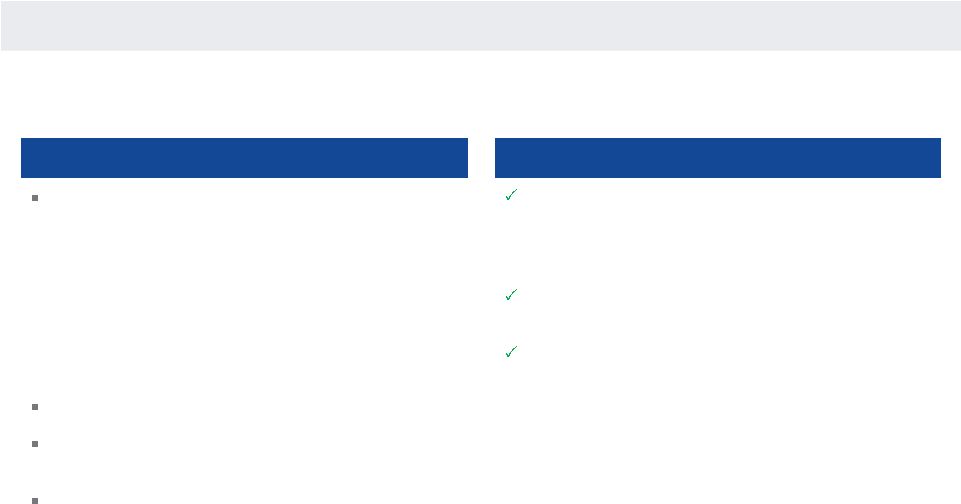

NANOSPHERE

OUR STATE-OF-THE-ART SOLUTION

The Verigene System utilizes advanced automation, microfluidics and proprietary chemistry to

enable rapid direct detection of nucleic acids and high-sensitivity protein detection

on the same platform High multiplexed

Accurate

Flexible

Easy to use

On demand

Moderate complexity

Current Verigene Platform

Next Generation Verigene System

(1)

One step sample-to-result

Lowest cost per test

Consolidates consumables into

one

Room temperature stability

Optimal footprint

Engineering system to be best-in-

class interface

Competitive

Engineering to be Best-in-Class

(1) Commercial release planned for 2016

7 |

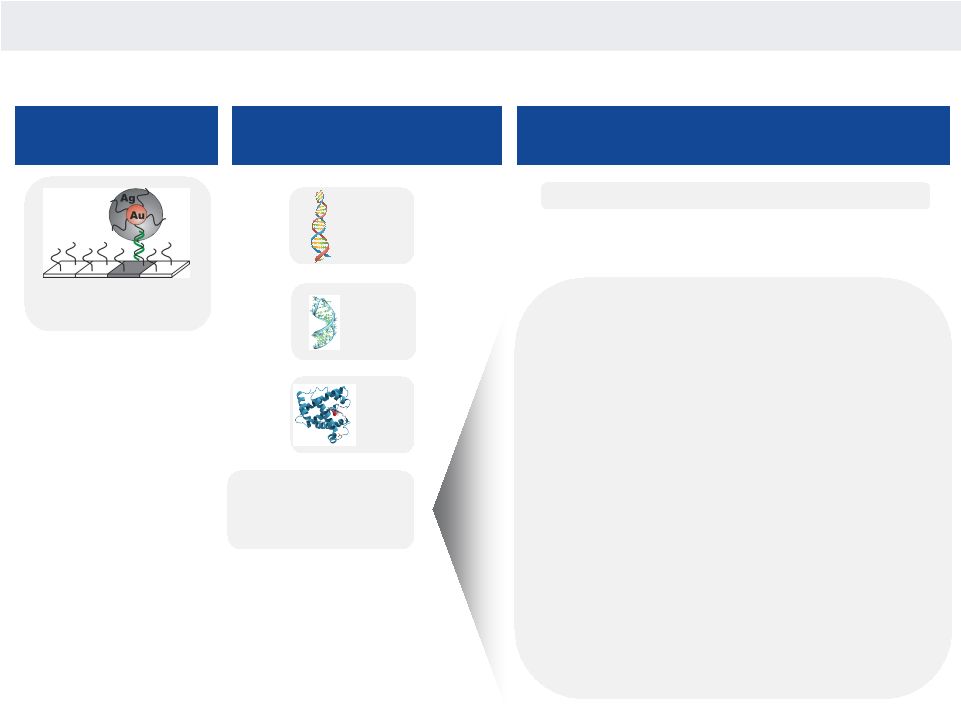

NANOSPHERE

STRONG PATENT PROTECTION

Patents

Proprietary Technology

Our proprietary technology is based on and

was exclusively licensed from the

International Institute for Nanotechnology

at Northwestern in May 2000

Technology generally covers core

technology, including nanotechnology-

based biodiagnostics and biobarcode

technology

As of September 2014, our patent portfolio

is comprised, on a worldwide basis, of over

180+ issued patents and 6 pending patent

applications

The issued patents cover approximately 11

different technological claims and the

pending patent applications cover

approximately three additional

technological claims

In addition, as of September 2014, we hold

non-exclusive licenses for over 30+ U.S.

patents that cover 11 different

technological claims from various

third parties

8 |

NANOSPHERE

HIGHLY VERSATILE TECHNOLOGY

Diagnostics | Drug Development | Life Sciences

1)

Multiplexed nucleic acid panels

—

Infectious diseases

—

Human genetics, personalized medicine

—

Security/defense

2)

High sensitivity and/or multiplexed protein

—

cTnI, PSA

—

Rheumatoid arthritis

—

Allergies

3)

Next gen diagnostics (combined NA+protein):

—

Infectious diseases (NxGen sepsis, C. diff)

—

Cancer (inflammation and immunity play

critical roles in pathogenesis)

Gold nanoparticle

DNA

RNA

Proteins

One

Technology

To Detect

Multiple Analytes

For Multiple Applications

and Markets

Significant

Potential

9 |

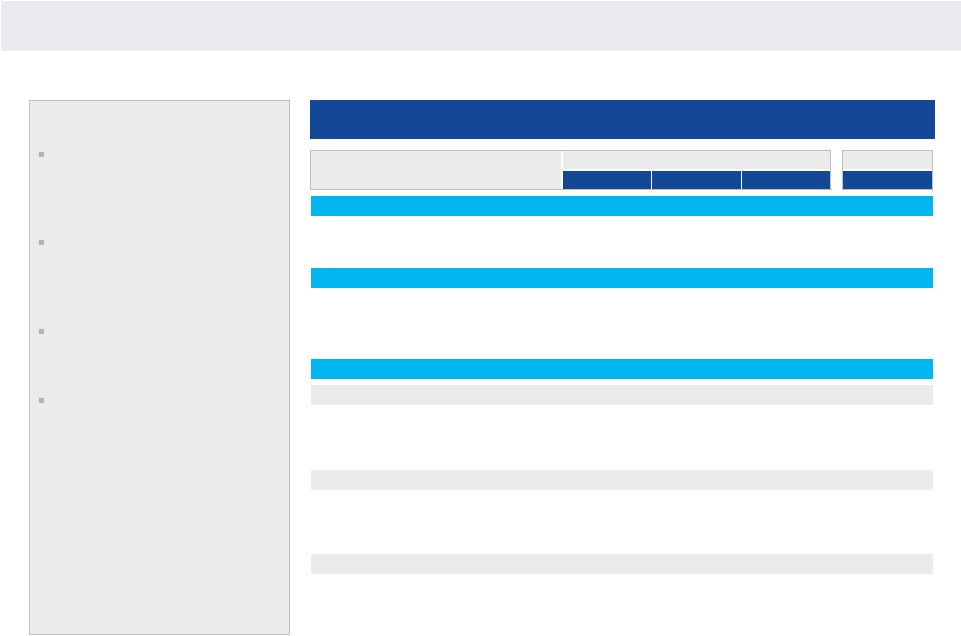

NANOSPHERE

MULTIPLEX MDX MARKET

Total Addressable Market

Key Points

Total global addressable market

for multiplex MDx applications is in

excess of approximately $1.1

billion

Core multiplex menu items include

respiratory, sepsis and

gastrointestinal, with others in

development (within microbiology)

According to Street estimates,

multiplex MDx market is only

7% penetrated

Availability of core tests on

sample-to-result platform is key

to broader penetration

Source: Wall Street research.

(1)

Includes

respiratory,

sepsis

and

GI

panels;

all

assumed

at

$100

U.S.

ASP

and

$80

OUS

ASP.

(2)

Includes

gram

positive,

negative

and

fungal.

(3)

US:

20

million

blood

culture

per

year,

of

which

10%

are

positive.

(4)

US:

20

million

stool

culture

per

year;

C.

difficile

alone

represents

about

5

million

tests.

Total Addressable Market

x

Penetrated

($Millions)

US

OUS

WW

x

YE 2013

Installed Base

Hospital, Reference Labs

5,500

5,000

10,500

600

Current Multiplex Penetration

6%

Total Multiplex Menu

(1)

Samples

7.2

5.3

12.5

0.9

Revenue

$720

$421

$1,141

$89

Current Multiplex Penetration

7%

7%

Multiplex Menu

Respiratory Panel

Samples

2.2

1.6

3.8

0.8

Revenue

$220

$124

$344

$80

Current Multiplex Penetration

23%

Sepsis Panel

(2)

Samples

(3)

2.0

1.7

3.7

0.1

Revenue

$200

$134

$334

$6

Current Multiplex Penetration

2%

GI Panel

Samples

(4)

3.0

2.0

5.0

0.0

Revenue

$300

$163

$463

$3

Current Multiplex Penetration

1%

10 |

NANOSPHERE

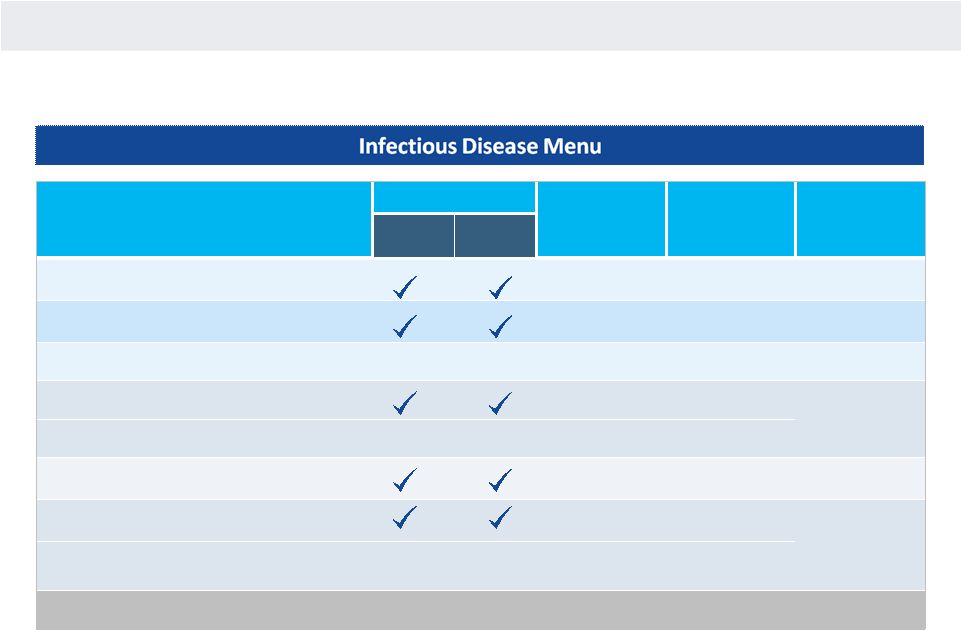

EXPANDING MENU OF HIGH VALUE MICROBIOLOGY TESTS

Menu

Regulatory Status

FDA

Approval

Date

Est. Annual

Revenue Per

Customer

Addressable

Market

($mm)

(2)

FDA

CE IVD

BSI —

Gram Positive (BC-GP)

June 2012

$50,000

$220

BSI —

Gram Negative (BC-GN)

January 2014

$30,000

80

Blood Culture Yeast (BC-Y)

In Development

TBD

TBD

30

Enteric Pathogens (EP)

October 2014

$60,000

350

Expanded Enteric Flex (Expanded EP Flex)

(1)

In Development

TBD

TBD

C. difficile

(C. diff)

December 2012

$30,000

120

Respiratory Virus with Sub-Typing (RV+)

January 2011

$70,000

340

Expanded Respiratory Pathogens Flex (Expanded

RP Flex)

In Development

Q1 2015

(3)

TBD

Total Menu

$1,140

(1)

Includes parasites

(2)

Sourced from Wall Street research

(3)

Management expectations.

11 |

NANOSPHERE

MAIN DRIVERS OF MDX ADOPTION

Sample-

To-Result

Need for more timely

and cost-effective

results

High Count

Multi-

Plexing

Need to address

costly and complex

disease states

Need

Product

Feature

Quicker

Response

Increased

Capability

12

We believe that conversion of traditional culture-based methods to molecular will

be driven by the need for rapid and clinically actionable results that will either

improve outcomes or improve economics

ACCOUNTABLE CARE |

NANOSPHERE

VERIGENE CHANGES THE GAME IN SEPSIS

Sepsis is a life-threatening response to bacteria in the

bloodstream:

—

Responsible for 1.6 million hospitalizations and nearly

200,000 deaths per year (one person every two minutes) in

the U.S.

(1)(2)

—

Risk of death increases by 7.6% every hour appropriate

treatment is delayed

(3)

—

Commonly complicated by antimicrobial resistance

Costs U.S. hospitals more than $20 billion annually

(4)

Conventional diagnostic methods require 48 to 96 hours to

deliver bacterial identification and resistance determination

Patients

are

treated

with

broad-based

antibiotics

that

are

often

unnecessary

or

inappropriate

and

frequently

toxic

Large Market With Unmet Need

The Verigene Value Proposition

Rapid and accurate identification of infection-causing bacteria and resistance to commonly

used antibiotics that enable clinicians to prescribe the right therapy at the right

time (1)

Healthcare

Cost

and

Utilization

Project.

Statistical

Brief

#122.

(2)

Angus,

D.C.,

Linde-Zwirble,

W.T.,

Lidicker,

J.,

Clermont,

G.,

Carcillo,

J.,

Pinsky,

M.R.

Epidemiology

of

severe

sepsis

in

the

United

States:

analysis

of

incidence,

outcome,

and

associated

costs

of

care.

Crit

Care

Med.

2001

Jul;29(7):1303-10.

(3)

Kumar

A,

et

al.

Duration

of

hypotension

before

initiation

of

effective

antimicrobial

therapy

is

the

critical

determinant

of

survival

in

human

septic

shock.

Crit

Care

Med

2006,

34:1589-

1596.

(4)

Healthcare

Cost

and

Utilization

Project.

Statistical

Brief

#160.

(5)

Buchan

BW,

Ginocchio

CC,

Manii

R,

Cavagnolo

R,

Pancholi

P,

et

al.

(2013)

Multiplex

Identification

of

Gram-Positive

Bacteria

and

Resistance

Determinants

Directly

from

Positive

Blood

Culture

Broths:

Evaluation

of

an

Automated

Microarray-Based

Nucleic

Acid

Test.

PLoS

Med

10(7):

e1001478.

doi:10.1371/journal.pmed.1001478.

(6)

Performance

of

the

Verigene

gram-positive

blood

culture

assay

for

direct

detection

of

gram-positive

organisms

and

resistance

markers

in

a

pediatric

hospital.

J

Clin

Microbiol.

2014

Jan;52(1):283-7.

doi:

10.1128/JCM.02322-13.

Epub

2013

Oct

16.

Reduces length of stay and enables significant cost

savings via identification and antibiotic resistance

determination directly from positive blood culture

bottles up to 2 days faster than conventional methods

(5)

Enables shift from empiric to targeted antibiotic

treatment

(6)

Identifies contaminants which enables rapid rule out and

avoidance of unnecessary treatment and cost associated

with empiric treatment

13 |

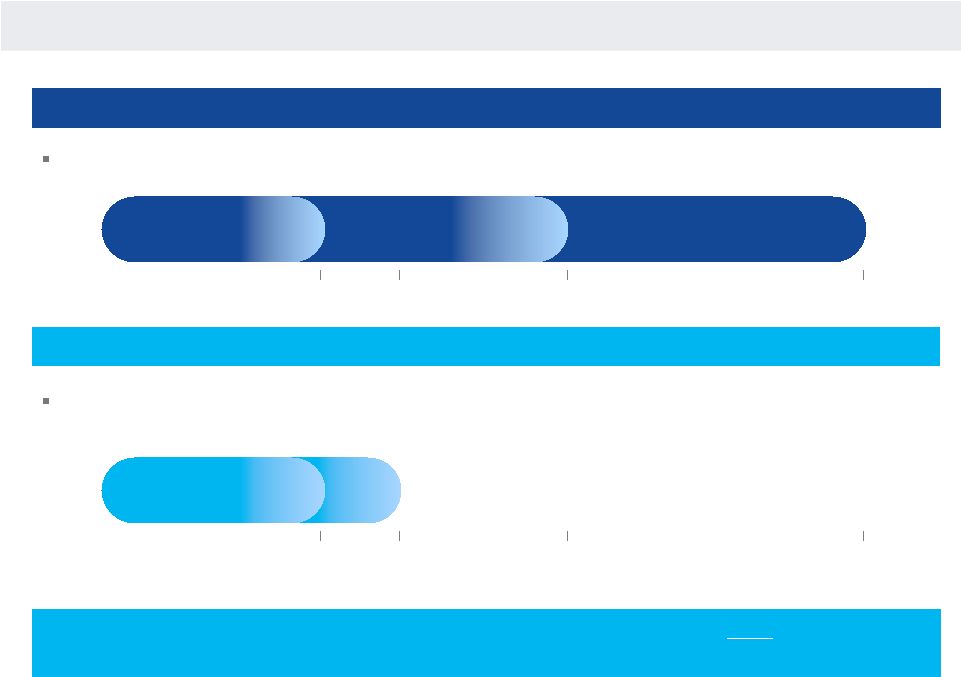

NANOSPHERE

The traditional blood culture workflow provides identification and resistance information at

>48 hours VERIGENE IMPACT

Blood Culture

and Gram Stain

BC-GP &

BC-GN

Results

Hours

12

15

24

48

Samples Plated for Sub-Culture

Blood Culture

and Gram Stain

Resistance Testing

Culture

Results

Hours

12

15

24

48

Verigene enables patients to be placed on appropriate antibiotics days

faster which

leads to decreased length of stay and significant financial savings

Traditional Blood Culture Workflow

Verigene Workflow

The Verigene Workflow provides identification and resistance information 2-2.5 hours after

the gram stain, or at ~ hour 15

14 |

NANOSPHERE

Sources:

Sango,

et

al.

A

stewardship

approach

to

optimize

antimicrobial

therapy

through

use

of

a

rapid

microarray

assay

on

blood

cultures

positive

with

Enterococcus

species.

J.

Clinical

Microbiology,

2013

September

23,

01951-13.

Koeneman

et

al.

Rapid

Identification

of

Methicillin-Sensitive

Staphylococcus

aureus

from

Positive

Blood

Cultures

using

the

Verigene

System:

A

System-Wide

Impact

on

Patient

Treatment

and

Physician

Compliance.

Poster

session

presented

at:

American

Society

for

Microbiology:

113

General

Meeting;

2013

May

18-21;

Denver,

CO.

Saves Money

Recent study by UF Shands:

21.7 day reduction in

Length of stay/patient

$61,000 reduction in

cost/patient

Saves Last Line

Therapies

Banner Healthcare:

Appropriate antibiotic

treatment reduced by

40.3 hours and moved

from prophylactic

treatment in 90% vs.

35% of patients

Saves Lives

80% reduction in

I.C.U. mortality

from 47.8%

to 9.5%

Economic

Antibiotic

Stewardship

Treatment

Outcomes

Benefit of Solution:

15

VERIGENE BENEFITS

th |

NANOSPHERE

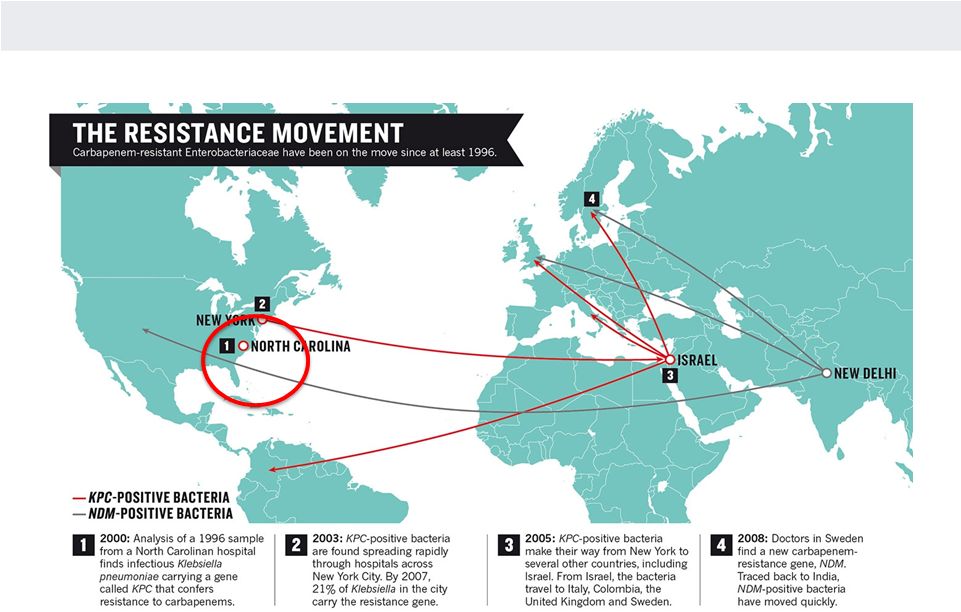

MIGRATION OF ANTIBACTERIAL RESISTANCE

Source: M. McKenna. Nature. Vol 499. 25 July 2013.

16 |

NANOSPHERE

17

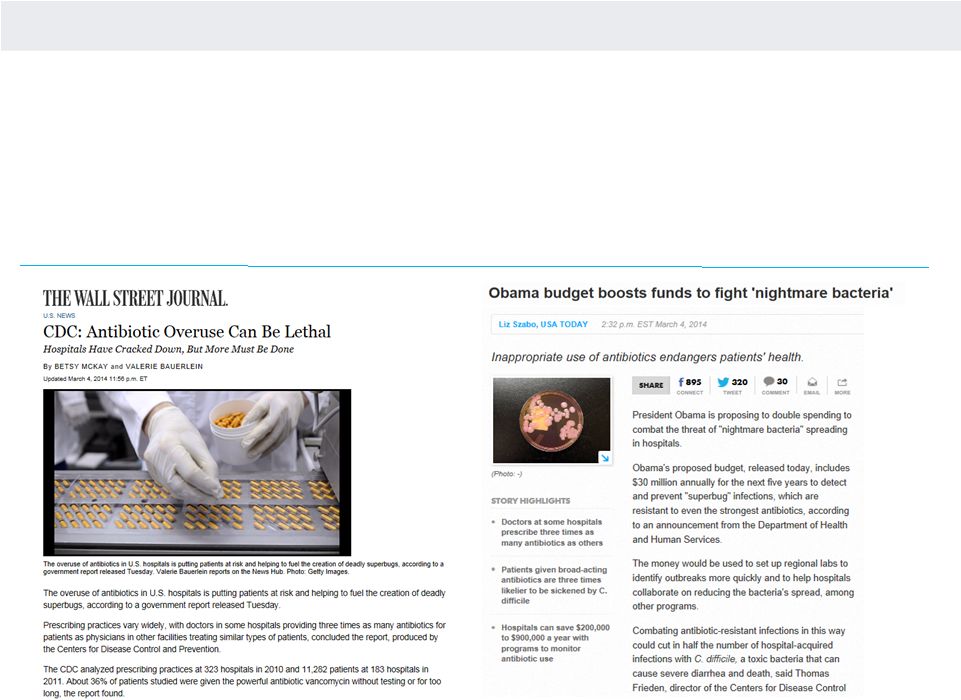

CDC LANDMARK RECOMMENDATIONS

Source: Centers for Disease Control. September 16, 2013

•

Burden and Threat Posed by Antibiotic-Resistant

Infections

o

Drug resistant infections are a threat to human and

economic health

o

Overuse of antibiotics is the single most important factor

o

Urgent action is needed NOW by everyone who uses

antibiotics

•

Four Core Actions Must Be Taken

o

Avoid infections

o

Track infections

o

Improve antibiotic stewardship and use

o

Development and implementation of drugs

and DIAGNOSTIC TESTS |

NANOSPHERE

COMPETITIVE ADVANTAGES

Reduce Mortality:

Each hour that appropriate antimicrobial

treatment is delayed, a sepsis patient’s mortality rate

increases by 7.6%

(1)

Reduce Hospitalization Costs:

Implementing rapid results

reporting for S. aureus

blood cultures can lead to an

average 6.2-day reduction in length of stay and a $21,387

reduction in costs per S. aureus-infected patient

(2)

Antimicrobial Stewardship:

Rapid mecA

reporting for

patients with S. aureus

bacteremia results in a 25.4-hour

reduction in the time to optimal antimicrobial therapy

(3)

Reduce the Impact of Contaminants:

Patients with false-

positive blood culture results triggered by contaminants

such as S. epidermidis

have hospitalization costs $8,750

higher than true negative blood culture patients

(4)

(1)

Kumar et al. 2006. Crit Care Med, 34:1589-96.

(2)

Bauer et al. 2010. Clin Infect Dis, 51:1074-80.

(3)

Carver et al. 2008. J Clin Microbiol, 46:2381-83.

(4)

Zwang and Albert 2006. J Hosp Med, 1:272-76.

Rapid Blood Culture Testing Benefits

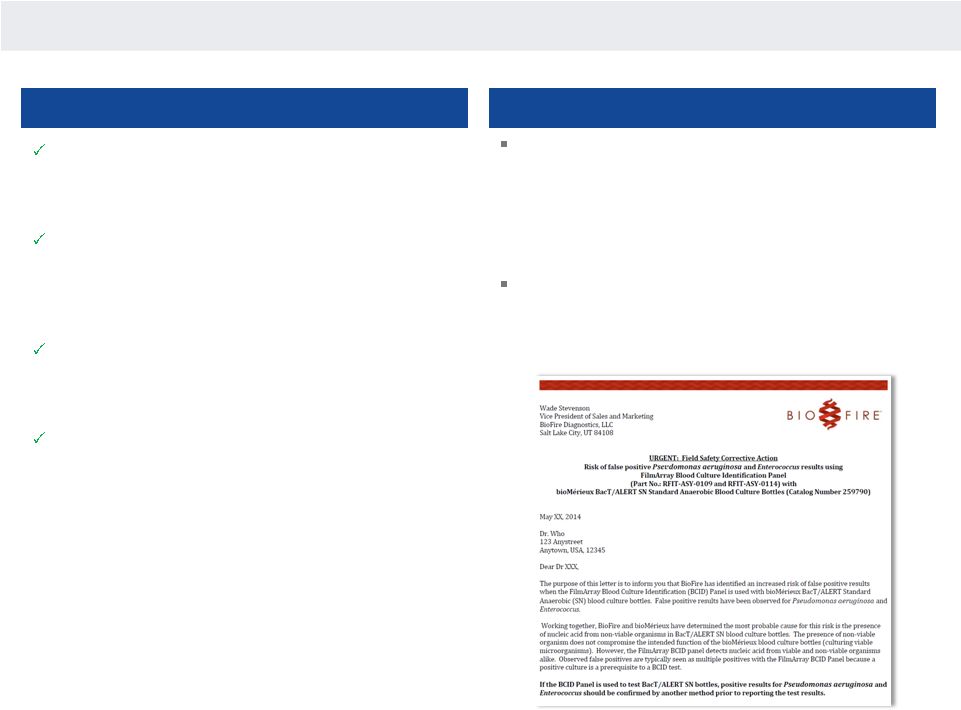

Versus BioFire

Nanosphere direct detection (no PCR) provides for

accuracy in both sensitivity and specificity required for

critical therapeutic change

—

BioFire’s PCR-based approach results in higher risk of

false positives as advised to their customers in the

below Field Safety Corrective Action

Clinically relevant design: assay designed to be based on

gold standard gram-stain

—

BioFire charges for results not indicated by gold

standard results in an additional cost of ~ $47K/year

18 |

NANOSPHERE

GASTROINTESTINAL INFECTIONS

The Verigene Value Proposition

More sensitive than culture (detects ~3X as many

infections in the same set of samples as stool

culture)

(3)

Replaces a highly labor intensive, slow (3-5 days) process

with a simple 2 hour test

Reduces time on stool bench by ~90% (90% stool

cultures are negative) which frees up tech time

Fast results reduce time to optimal therapy, improve

antimicrobial stewardship, reduce isolation days, and

avoid unnecessary admissions

Community-Acquired Diarrhea (Enteric)

Clinical, economic and workflow benefits to hospitals and laboratories

(1)

Healthcare Cost and Utilization Project. Statistical Brief #150.

(2)

Centers for Disease Control.

(3)

JCM, Khare et al. 2014, 52(10): 3667.

Caused by consumption of contaminated food or water

containing bacterial, viral or parasitic gastrointestinal

pathogens

—

Rotavirus is the most common cause of gastroenteritis in children

—

Norovirus is the leading cause of gastroenteritis among adults in the

U.S., causing greater than 90% of outbreaks

—

Campylobacter is the primary cause of bacterial gastroenteritis,

with

half of these cases associated with exposure to poultry

—

C. difficile

is a common cause of diarrhea in those who are hospitalized

and is frequently associated with antibiotic use

Generally, young children, babies, people with disabilities

and elderly individuals are most at risk for enteric

diseases due to weakened immune systems; travelers to

foreign countries may also be sensitive to bacteria in

food and water abroad

Associated with 3.7 million emergency department visits,

1.3 million inpatient hospitalizations and more than $6

billion in healthcare costs per year

(1)(2)

Most cases are self-resolving and not life-threatening,

yet some can have serious implications

19 |

NANOSPHERE

CONVERSION OF RESPIRATORY MARKET

Short / Targeted Panel

Expanded / General Panel

Expanded RP Flex

Expanded RP Flex

panel allows customers to select and de-select targets within a

broad panel (sub-panels) as our current respiratory panel already allows, but with

the option of a newly-introduced flexible pricing vehicle

—

Laboratory can now adopt one platform and respond to clinician ordering

patterns for a variety of patient populations and treatment algorithms which will

accelerate adoption beyond current hospital base

Afforded by the low COGS on the Verigene System

Estimated market opportunity of $340 million

(2)

The respiratory market has historically been characterized as crowded and price

sensitive Only a portion of hospitals have adopted molecular respiratory testing

methodologies Many of the molecular-using hospitals have two platforms because of

the way clinicians order tests

based on population and clinical demand

20

(1)

Sourced from Wall Street research |

NANOSPHERE

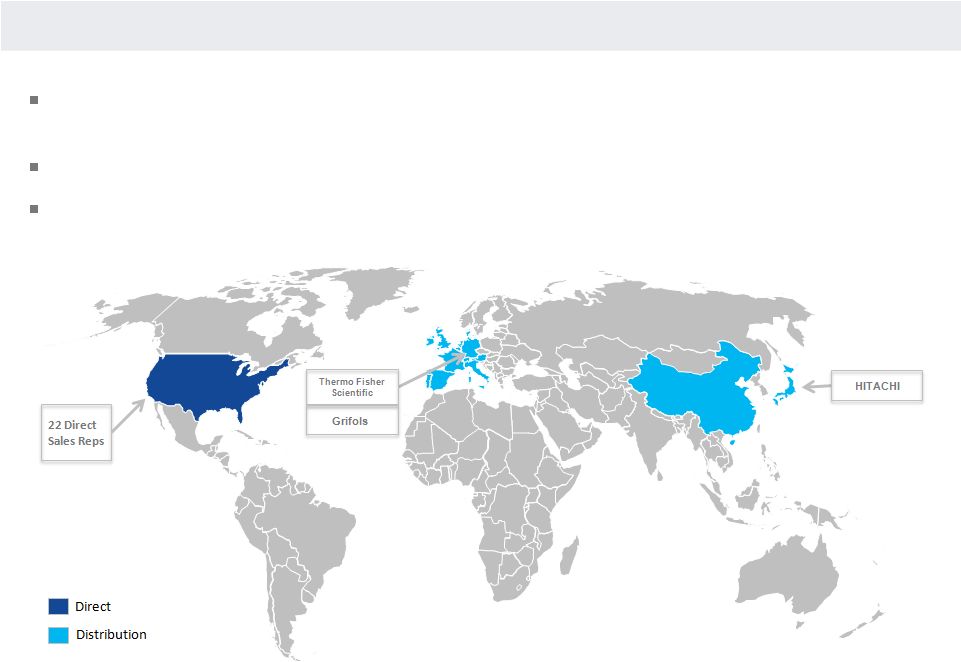

OVERVIEW OF COMMERCIAL PRESENCE

Sales and marketing organization comprises geographically dispersed sales representatives and

clinical support specialists as well as a centralized staff of market and product

managers Direct in the United States

Distribution in Western Europe, Japan and China

21 |

NANOSPHERE

REVENUE AND GROSS PROFIT

Key Points

Consistent revenue growth

driven by test sales

We believed expanded menu

will drive revenue growth

acceleration

Backlog of placements

pending instrument sales is

$7.8 million

Gross margin expansion

primarily driven by recent

consumable manufacturing

investments that lack

scientific risk

—

Increased cavitation

—

New line efficiency

—

Reagent reductions

—

Volume reductions

As consumable margins

expand, consumable

revenue contribution vs.

instruments increases

Cash flow improvements

driven by revenue growth,

margin expansion, expense

and working capital

management

Revenue

Revenue

22

Gross Profit

Gross Profit |

NANOSPHERE

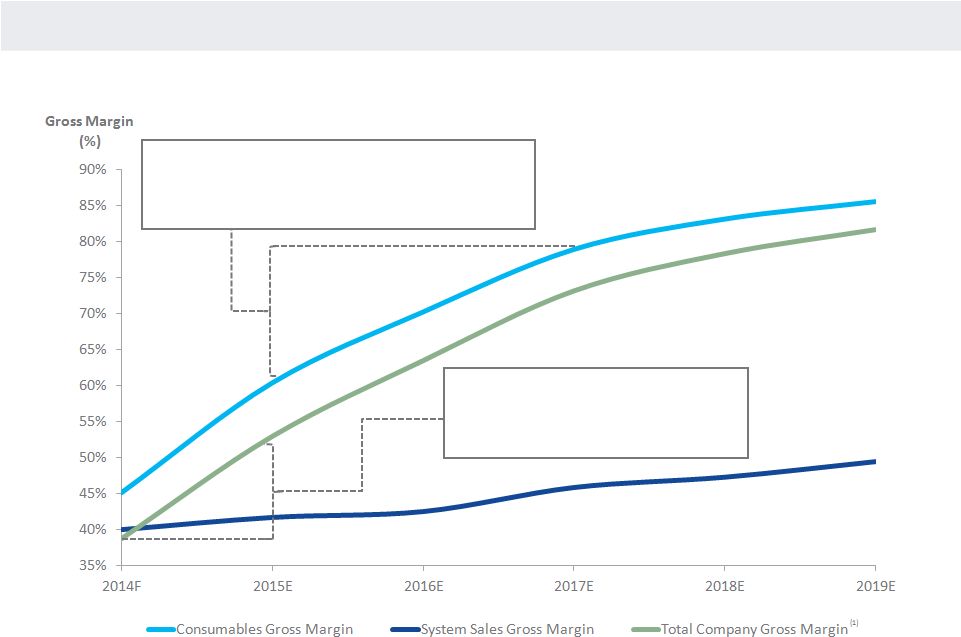

LOW RISK MARGIN EXPANSION

23

2015 Projected Margin Drivers:

Consumable cavitation,

labor and reagents

2016 / 2017 Projected Margin Drivers:

Royalties (patent expiration)

Primarily volume (materials & overhead absorption)

(1)

Includes royalties and license amortization.

(1) |

NANOSPHERE

SUMMARY INVESTMENT HIGHLIGHTS

Large Addressable Markets With Unmet Needs

Differentiated, High Value Tests in Sepsis and GI Infections

Momentum With Leading Hospitals

Attractive Placement and Assay Pull-Through Trends

Diversified, Customer Base

High Growth and Operating Leverage

Proprietary Multiplexed Molecular Platform

24 |