Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Avanos Medical, Inc. | d807372d8k.htm |

| EX-4.2 - EX-4.2 - Avanos Medical, Inc. | d807372dex42.htm |

| EX-4.1 - EX-4.1 - Avanos Medical, Inc. | d807372dex41.htm |

| EX-99.2 - EX-99.2 - Avanos Medical, Inc. | d807372dex992.htm |

Halyard Health

Halyard Health

Investor Presentation

Exhibit 99.1 |

2

Legal Disclaimer

Legal Disclaimer

PRELIMINARY FINANCIAL RESULTS

This presentation contains Halyard Health’s preliminary financial results for the

quarter ended September 30, 2014. This financial information is preliminary and subject

to completion of quarter-end financial reporting processes and review.

FORWARD-LOOKING

INFORMATION Certain

matters in this presentation and in today’s discussion constitute “forward-looking statements” regarding business strategies, market potential, future

financial performance and other matters. Forward-looking statements include all statements that do

not relate solely to historical or current facts, and can generally be identified by the use of

words such as “may,” “believe,” “will,” “expect,” “project,” “estimate,” “anticipate,” “plan,” or “continue” and similar expressions, among

others. These forward-looking statements address, among other things, the anticipated effects of

Halyard Health’s separation from Kimberly-Clark and the distribution of Halyard

Health’s common stock to the shareholders of Kimberly-Clark which is expected to occur on October 31, 2014 (the “spin-off”). The matters

discussed in these forward-looking statements are based on the current plans and expectations of

management and are subject to certain risks and uncertainties that could cause actual results

to differ materially from those projected, anticipated or implied in the forward-looking statements. These risks include but are not

limited to actions by governmental and regulatory authorities; delays, costs and difficulties related

to the spin-off; and general economic and political conditions globally and in the markets

in which Halyard Health does business. There can be no assurance that these future events will occur as anticipated or that Halyard

Health’s results will be as estimated. For a description of additional factors that could cause

Halyard Health’s future results to differ materially from those expressed in any such

forward-looking statements, see “Risk Factors” under Item 1A of Halyard Health’s Registration Statement on Form 10 (as amended) filed

with the Securities and Exchange Commission. The

forward-looking statements contained in this presentation are made only as of October 21, 2014. We do not undertake, and specifically decline any obligation,

to update any forward-looking statements or to publicly announce the results of any revisions to

any of such statements to reflect future events or developments except as required by law,

including the securities laws of the United States and the rules and regulations of the Securities and Exchange Commission.

NOT AN OFFER

Nothing contained in this presentation shall be deemed an offer to sell or the solicitation of an

offer to buy any securities of Halyard Health, Inc. or Kimberly-Clark Corporation. |

3

Legal Disclaimer (Continued)

Legal Disclaimer (Continued)

BASIS OF PRESENTATION

The information included in this presentation about Halyard Health assumes the

completion of the transfer by Kimberly-Clark of its health care business to the Company and

the spin-off of Halyard Health. Halyard Health’s historical financial data presented herein is derived from the consolidated financial statements and

accounting records of Kimberly-Clark using the historical results of operations and historical

costs basis of the assets and liabilities that comprised its health care business and give

effect to allocations of expenses from Kimberly-Clark. This historical financial data is not indicative of our future performance and does not reflect

what Halyard Health’s financial position, results of operations and cash flows would have been

had it been a separate stand-alone entity. In addition, pro forma financial data is

presented herein that is derived by the application of pro forma adjustments to Halyard Health’s historical financial data to effect the spin-off and

related transactions as if they had occurred on January 1, 2013. The pro forma adjustments are based

on currently available information and certain assumptions that Halyard Health believes are

reasonable, but actual results may differ from the pro forma adjustments. A reconciliation of pro forma net sales and pro forma net income

to Halyard Health’s historical net sales and net income can be found in the Appendix to this

presentation. STATEMENT REGARDING NON-GAAP FINANCIAL MEASURES This presentation contains

“non-GAAP financial measures,” that are financial measures that either exclude or include amounts that are not excluded or included in the

most directly comparable measures calculated and presented in accordance with generally accepted

accounting principles. Specifically, we make use of the non- GAAP financial measures

“EBITDA” and “Adjusted EBITDA” and “Pro Forma Adjusted EBITDA.” Management believes that EBITDA and Adjusted EBITDA are useful

tools for investors and other users of our financial statements in assessing our ability to service or

incur indebtedness, maintain current operating levels of capital assets and acquire additional

operations and businesses. Management believes that the most directly comparable GAAP measure is net income (loss). These

measures should be considered in addition to results prepared in accordance with GAAP, but are not a

substitute for GAAP results. Certain adjustments used in calculating Adjusted EBITDA and Pro

Forma Adjusted EBITDA are based on estimates and assumptions of management and do not purport to reflect actual historical

results. In addition, you should be aware when evaluating Adjusted EBITDA and Pro Forma Adjusted

EBITDA that in the future we may incur expenses similar to those excluded when calculating

these measures. Our computation of Adjusted EBITDA may not be comparable to other similarly titled measures computed by other

companies, because all companies do not calculate Adjusted EBITDA in the same fashion. A reconciliation of EBITDA and Adjusted EBITDA to our net income (loss)

under GAAP for each of the periods presented can be found in the Appendix to this presentation.

We also present financial data for the twelve months ended September 30, 2014 that is derived by

subtracting the data for the nine months ended September 30, 2013 from our historical financial

data for the year ended December 31, 2013 and then adding corresponding financial data for the nine months ended September 30,

2014. This financial data is for informational purposes only and the reconciliation can be found

in the Appendix to this presentation. |

4

Transaction Overview

Transaction Overview

Company

Halyard Health, Inc.

Ticker (When-Issued)

HYH-WI

Ticker (Regular Way)

HYH

When-Issued Trading Begins

Tuesday, October 21

st

Record Date

Thursday, October 23

rd

Spin Effective / Distribution Date

Friday, October 31

st

Distribution Ratio

8 to 1 (KMB to HYH)

Ex-Dividend Date /

First Regular Way Day of Trading

Monday, November 3

rd

Expected Shares Outstanding

Approximately 46.5 MM

Spin-off Overview and Timing Considerations |

Today’s Presenters and Halyard Representatives

Today’s Presenters and Halyard Representatives

5

Robert Abernathy

Chairman &

Chief Executive Officer

Christopher Lowery

SVP & Chief Operating Officer

20+ years of healthcare

industry experience in

Sales & Marketing, most

recently at Covidien

Former VP of Global

Health Care Sales &

Marketing at Kimberly-

Clark

Steven Voskuil

SVP & Chief Financial Officer

20+ years of experience

with Kimberly-Clark

Former VP of Finance at

Kimberly-Clark

International

Former Treasurer of

Kimberly-Clark

20+ years in

Kimberly-Clark senior

management across all

business units and

geographies

Former President of

Global Health Care at

Kimberly-Clark,

1997 -

2004

8+ years of experience

with Kimberly-Clark

Former Senior Finance

Director of Health Care at

Kimberly-Clark

Former Assistant

Treasurer of Kimberly-

Clark

David Crawford

VP Treasurer, FP&A and

Investor Relations |

Compelling Investment Opportunity

Compelling Investment Opportunity

6

Diverse Business with Leading Positions

1

Global Manufacturing and Sales Organization

2

Strategic Focus Shifts to Medical Devices

3

Proven and Experienced Management Team

5

Significant Cash Flow Generation to Fund Opportunistic

Acquisitions and to Drive Total Shareholder Return

4 |

7

Over 30 Years of Innovation in Medical Products

Over 30 Years of Innovation in Medical Products

Founded health care business in the late 1970s with a focus on products

leveraging Kimberly-Clark’s patented, innovative nonwovens technology

providing protection from liquids, while remaining breathable

Introduced Kimguard Sterilization Wrap

Launched international expansion strategy, leveraging existing regional

headquarters in Belgium, Japan and Australia

Expanded S&IP product portfolio with the acquisition of Tecnol Medical

Products, a leading provider of facial protection and other disposable

medical products

Increased presence in medical devices with the acquisition of Ballard Medical

Products, a disposable medical devices company focused on respiratory care

and digestive

health

Acquired Safeskin Corporation, a market-leading exam glove provider, to

deliver head-to-toe customer protection

Kimberly-Clark

Global

Business

Plan

designates

S&IP

“run

for

cash”

and

emphasizes increased medical device focus

Acquired Baylis Medical’s pain management device business and I-Flow

Corporation, a provider of elastomeric infusion pumps used in surgical pain

management

and

other

infusion

therapies

Led change in exam glove market from latex to nitrile

1970

1976

1990

1997

1999

2000

2005

2009

2014

2007 |

Spin-off Benefits and Rationale

Spin-off Benefits and Rationale

8

Capital

Flexibility

Eliminates competition for capital with a larger consumer business

Creates

greater

flexibility

to

invest

in

innovation

and

business

development

Strategic

Health Care

Focus

Employee

Incentives

Enables Halyard to pursue its own distinct strategies and operating priorities,

which have diverged over time from those of Kimberly-Clark

Allows management to concentrate on Halyard’s specific product markets,

customers and long-term strategies for value creation

Improves ability to attract and retain key employees focused on healthcare

Aligns executive incentive programs more directly to financial performance

Spin-off Creates a Diversified, Global Med Tech Company

with a Growing Medical Device Platform |

Halyard’s Strategic Vision

Halyard’s Strategic Vision

9

Traditional S&IP Focus Has

Created a Stable and Reliable

Platform with Significant

Cash Flow...

...Which We Expect to Enable

Halyard to Grow Medical Devices

and Transform the Portfolio

Over Time |

10

Halyard Health Overview –

Diverse Business with Leading Positions

Halyard Health Overview –

Diverse Business with Leading Positions

Halyard is a global, market-leading company that addresses some of today’s

most important health and

healthcare

needs,

offering

products

and

solutions

to

prevent

infection,

eliminate

pain

and

speed

recovery across the healthcare continuum

$1.7Bn of 2013 net sales

16,500 employees globally

(1)

Two

segments:

Surgical

&

Infection

Prevention

(S&IP)

and

Medical

Devices

North

America

Europe,

Middle East

& Africa

Asia Pacific &

Latin America

Other

(3)

S&IP

Medical

Devices

1.

As part of the previously announced closing of Halyard’s Exam Glove facility

in Thailand, Halyard will reduce employee headcount by approximately 3,000 employees.

2.

Excludes Corporate and other.

3.

Includes related party sales to Kimberly-Clark.

4.

Estimated global addressable market size based on industry data and internal

marketing estimates. S&IP

Medical

Devices

($Bn)

~

~

1

Net Sales by Segment

(2)

Net Sales by Region

2013A

2013A

Global Addressable

Market Potential

(4)

70%

30%

68%

14%

12%

6%

$7.0

$5.0 |

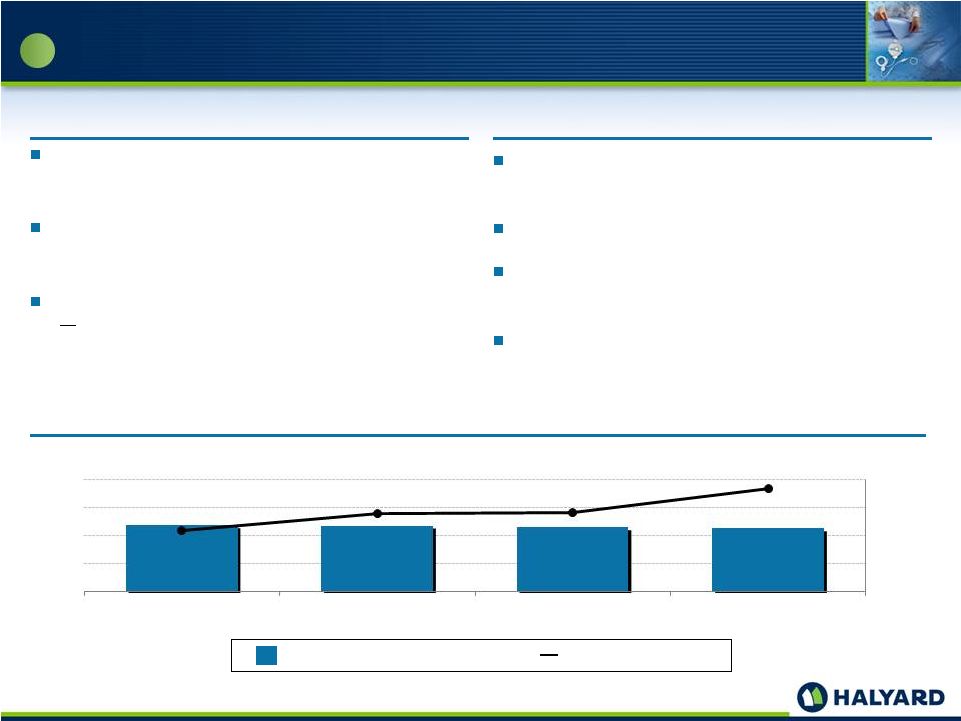

11

Surgical & Infection Prevention Overview

Surgical & Infection Prevention Overview

The S&IP segment offers products to help prevent health

care-acquired infections (HAIs)

and provide protection

for both healthcare workers and patients

Infection prevention is an important issue that affects both

caregivers and patients and creates a significant burden /

cost on the healthcare system

Halyard seeks to reduce infections in healthcare settings

Key Highlights and Strategy

1

Overview

30-year track record —

market leadership positions

across product portfolio

Strong cash flow generation

Build on history of differentiated innovation to maintain

market leadership

Ongoing focus on operational efficiencies and margin

expansion

Historical Financial Performance

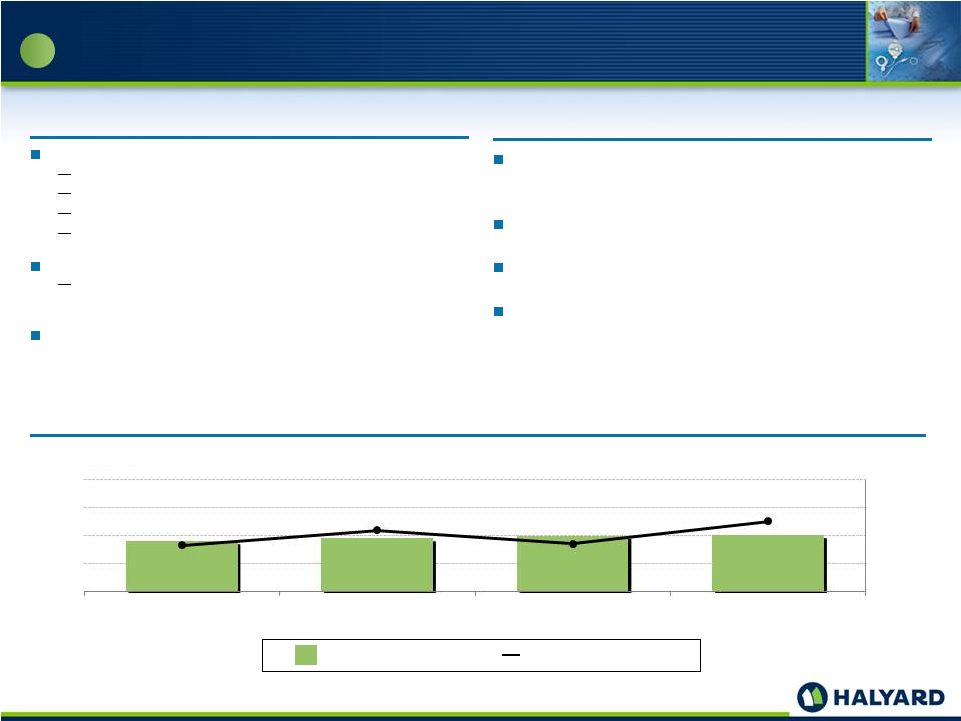

FYE 12/31 ($MM)

Surgical & Infection Prevention Net Sales

Operating Profit Margin

One in 25 hospitalized patients, or approximately

700,000 incidents, acquires an infection in the U.S.

per year

1,188

1,185

1,153

1,133

12.6%

13.1%

13.1%

13.8%

11.0%

12.0%

13.0%

14.0%

0

500

1,000

1,500

2,000

2011A

2012A

2013A

LTM 9/30/14A |

12

Diversified S&IP Product Portfolio with Leading Brands

Diversified S&IP Product Portfolio with Leading Brands

Sterilization Wraps

KIMGUARD

QUICK CHECK

SMART-FOLD

Surgical Drapes & Gowns

AERO BLUE

MICROCOOL

Facial Protection

TECNOL

FLUIDSHIELD

Protective Apparel

CONTROL

SPUNCARE

Medical Exam Gloves

SAFESKIN

LAVENDER

STERLING

PURPLE NITRILE

1 |

13

Medical Device Overview

Medical Device Overview

Medical Device segment focused on four therapeutic areas:

Surgical Pain Management

Interventional Pain Management

Respiratory Health

Digestive Health

Large market opportunity to reduce narcotic-based pain control

Currently less than 10% penetration in applicable

surgical procedures

Market driven by physician education and awareness,

reimbursement, clinical evidence supporting outcomes and

relative cost effectiveness

Key Highlights and Strategy

1

Overview

Leading market positions in pain, respiratory and digestive

health

Invest

for

growth

–

both

organic

and

inorganic

opportunities

Leverage global sales and marketing infrastructure

Aggressively move into category adjacencies to expand

product portfolio

Historical Financial Performance

FYE 12/31 ($MM)

Medical Device Net Sales

Operating Profit Margin

452

478

499

506

17.0%

18.6%

17.2%

19.5%

12.0%

15.0%

18.0%

21.0%

24.0%

0

250

500

750

1,000

2011A

2012A

2013A

LTM 9/30/14A |

14

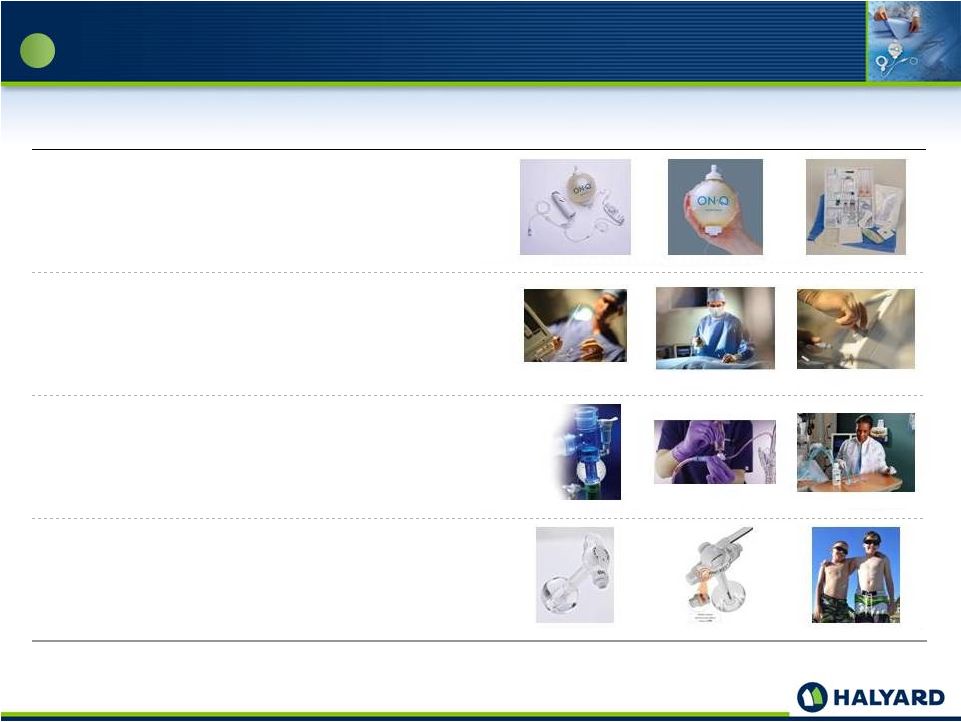

Portfolio of Innovative Medical Devices

Portfolio of Innovative Medical Devices

Surgical Pain

Management

ON-Q

HOMEPUMP

ECHOBRIGHT

Interventional Pain

Management

COOLIEF

TRANSDISCAL

SINERGY

Respiratory Health

BALLARD

MICROCUFF

TRACH CARE

Digestive Health

MIC-KEY

MIC

MIC-KEY SF

1 |

Global commercial infrastructure drives cost efficiencies, enables innovation and

strategically positions Halyard for growth in new markets

Products sold in 100+ countries

Well-recognized sales force of approximately 600 representatives in 11

countries Sales force supports customers with robust product training and

customer education programs Diversified manufacturing base and vertical

integration in nonwovens manufacturing a significant differentiator from

our key competitors Global Commercial Infrastructure with Efficient Footprint

and Effective Direct Sales Force

Global Commercial Infrastructure with Efficient Footprint

and Effective Direct Sales Force

2

Other

Direct Sales

Geography

North America

Europe,

Middle East

and Africa

Asia Pacific and

Latin America

Other

Global Commercial Infrastructure

68%

14%

12%

6%

15 |

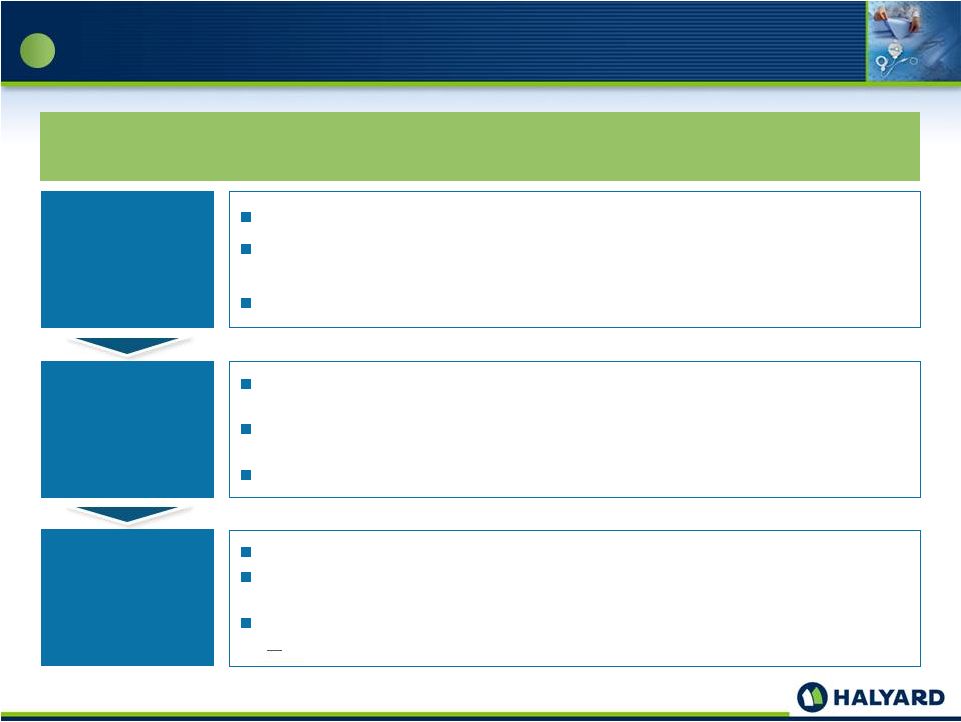

16

Position For

Success

(spin through

2015)

Successful spin execution and retirement of spin-related costs

Focus on efficiency / effectiveness of stand-alone operations, including

commercial footprint optimization

Accelerate innovation engine

Fuel Growth

Pipeline

(2016 -

2017)

Invest in growth programs and aggressively move into category adjacencies to

expand product portfolio

Round out portfolio, employing a disciplined approach to opportunistic

acquisitions and portfolio optimization

Continue to drive margins

Long-Term

Device Focus

(2018 and

beyond)

Strategic Focus –

Shift Towards Medical Devices Portfolio

Strategic Focus –

Shift Towards Medical Devices Portfolio

3

Positioned as medical devices company with revenue growth and higher margins

Natural portfolio evolution as the fastest growing part of the portfolio also has

the highest margins

Adjacency and / or Geographic Expansions for:

Surgical Pain, Interventional Pain, Digestive Health and Respiratory Health

Focused Execution to Accelerate Portfolio

Growth of Medical Devices |

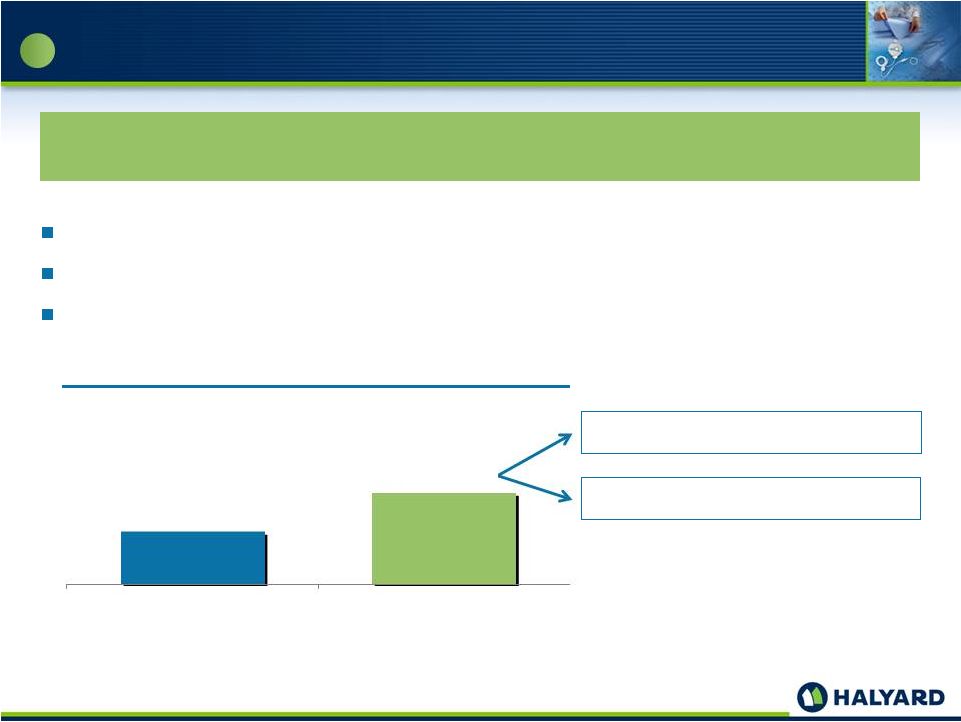

17

Increased R&D Investment

Increased R&D Investment

Incremental S&IP R&D to maintain current leadership

Accelerated spending on R&D within our Medical Devices segment, particularly

pain management Increased spending on new adjacent medical device

products R&D as % of Net Sales

<

~ 1% of Net Sales into S&IP

~ 5-6% of Net Sales into Medical Devices

3

~

3 –

4%

Doubling R&D Investment over Time to Drive

Profitable Growth and Margins

2%

Today

Long-Term Goal |

18

Disciplined Approach to Complementary Medical

Devices M&A

Disciplined Approach to Complementary Medical

Devices M&A

Focus on complementary acquisitions within adjacent therapeutic areas to our

existing Medical Devices segment

Viewed through disciplined lens with delineated growth, margin and return on

invested capital targets

As part of Kimberly-Clark, external growth opportunities were not a consistent

focus Halyard expects to actively pursue acquisition opportunities that fit

its strategic criteria (Pain Mgmt Segment)

Tecnol

Medical

1997

1999

2000

2009

2014

3 |

19

Capex

FYE 12/31 ($MM)

Free Cash Flow

(1)

FYE 12/31 ($MM)

Strong cash flow expected following retirement of spin-related costs and as

Halyard efficiencies increase Capital spending post-spin expected to be

less than 3% of net sales Cash available to fund opportunistic

acquisitions Ability to utilize cash flow to drive Total Shareholder

Return % Margin

(2)

2.4

2.9

2.4

1.

Defined as Cash Flow from Operations less Capex.

2.

Calculated as a percentage of Net Sales.

Significant Cash Flow Generation to Fund Opportunistic

Acquisitions and Drive Total Shareholder Return

Significant Cash Flow Generation to Fund Opportunistic

Acquisitions and Drive Total Shareholder Return

4

100

162

175

0

50

100

150

200

2011A

2012A

2013A

40

41

49

0

25

50

75

100

2011A

2012A

2013A |

20

Proven

ability

to

drive

value

through

growing

global

businesses,

expanding

into

ancillary

markets

and

integrating

complementary platform acquisitions

Years of leadership and operational experience from prior roles at Kimberly-Clark

Supported by years of diverse healthcare experience across Research and Development, Sales and

Marketing, Product Supply, Product Quality and Clinical Affairs

Experienced healthcare-oriented Board with Ronald Dollens, former President and CEO of Guidant, as

Lead Director Robert Abernathy

Chairman & CEO

Rhonda Gibby

SVP & Chief Human

Resources Officer

Christopher Isenberg

SVP, Global Supply Chain

& Procurement

Warren Machan

SVP, Business Strategy

John Wesley

SVP, General Counsel and

Chief Ethics & Compliance Officer

Christopher Lowery

SVP & COO

Steven Voskuil

SVP & CFO

20+ years in Kimberly-Clark senior

management across all business units

and geographies

Former President of Global Health

Care

at

Kimberly-Clark,

1997

-

2004

20+ years of healthcare industry

experience in Sales & Marketing, most

recently at Covidien

Former VP of Global Health Care

Sales & Marketing at Kimberly-Clark

20+ years of experience with

Kimberly-Clark

Former VP of Finance at Kimberly-

Clark International

Former Treasurer of Kimberly-Clark

VP of Human Resources for

Kimberly Clark’s global

business-to-business units

since 2010

Previous leadership roles at

Covidien

VP of Manufacturing and

Supply Chain at Kimberly-

Clark Global Health Care

since 2012

Former Senior

Manufacturing Director for

K-C Professional

Senior Director of Strategy

at Kimberly-Clark Global

Health Care since 2012

Former Senior Director of

Finance at Kimberly-Clark

Global Health Care

VP, Deputy General Counsel

and Corporate Secretary at

Kimberly-Clark since 2009

Former Partner at Dallas-based

Carrington, Coleman, Sloman &

Blumenthal

Proven and Experienced Management Team

Proven and Experienced Management Team

5 |

Compelling Investment Opportunity

Compelling Investment Opportunity

21

Diverse Business with Leading Positions

1

Global Manufacturing and Sales Organization

2

Strategic Focus Shifts to Medical Devices

3

Proven and Experienced Management Team

5

Significant Cash Flow Generation to Fund Opportunistic

Acquisitions and to Drive Total Shareholder Return

4 |

FINANCIAL REVIEW |

Financial Overview

Financial Overview

23

Strong, Diversified Cash Flow

Well-capitalized with Financial Flexibility

Limited Need for Capital Expenditures

Near-term Focus on Elimination of TSAs and

Other Transactional Costs

Disciplined Approach to Cash Deployment with a Focus on

Total Shareholder Return

Leverage Heritage of Cost Savings and Operational Efficiencies

|

Halyard expects $640MM of aggregate principal amount of debt at spin-off

$390MM

senior

secured

term

loan

facility

due

2021

(L+325

floating

rate,

0.75%

LIBOR

floor)

$250MM

senior

unsecured

notes

due

2022

(6.250%

coupon)

closed

on

October

17,

2014

Halyard also expects to have a $250MM revolving credit facility (L+225 floating

rate, no LIBOR floor) Net proceeds will be used to partially fund a cash

distribution to Kimberly-Clark Long-term

leverage

target

range

of

2.0

–

2.5x;

provides

flexibility

to

increase

leverage

for

opportunistic

M&A

24

Halyard Capitalization

Halyard Capitalization

($MM)

Tranche

Amount

Multiple of LTM (9/30/2014)

Pro Forma Adjusted EBITDA (x)

$250MM Revolver due 2019

-

-

Term Loan due 2021

390

1.6

Senior Notes due 2022

250

1.0

Total Debt

640

2.6

Cash

(40)

Net Debt

600

2.5

Pro Forma Capitalization

Capital Structure Assures Flexibility to Fund Growth |

25

Halyard Stand-Alone and Transitional Costs

Halyard Stand-Alone and Transitional Costs

1.

During the twelve months ended September 30, 2014, Halyard incurred approximately $95.0 million in

corporate cost allocation from Kimberly-Clark for these services. Halyard estimates that its aggregate annual

incremental

cash

expense

for

these

services

will

be

approximately

$40.0

million

per

year

(for

a

combined

total

of

$135.0

million

of

cash

expense)

2.

In

addition

to

the

$40.0

million

incremental

cash

costs,

Halyard

estimates

an

incremental

$11.0

million

per

year

of

additional

depreciation

and

amortization

expense.

3.

As a result of the separation and distribution, Halyard expects to incur additional ongoing net

expenses that it estimates will be approximately $29.2 million on an annual basis related primarily to (1) a decline of

purchasing scale, (2) stranded facility costs as a result of excess manufacturing capacity in certain

facilities, underutilization of certain of Halyard’s distribution facilities and inefficiencies in shipping costs and (3) a

reduction in related party sales.

4.

Halyard expects to incur a total of $60.0 million to $75.0 million of transitional costs after the

distribution through 2016 to establish its own capabilities as a stand-alone entity. These costs are related primarily to the

transition services Halyard expects to receive from Kimberly-Clark, as well as Halyard’s

branding and other supply chain costs. 5.

Additional

adjustments

are

also

made

to

Kimberly-Clark

operating

profit

to

account

for

transition

costs,

Thailand

glove

facility

restructuring,

corporate

adjustments,

pension

allocations and other items.

•

Information Technology

•

Finance

•

Human Resources

•

Decreased Purchasing

Scale

•

Stranded Facility Costs

•

Reduced Related Party

Sales

K-C Segment

Operating Profit

Incremental

Corporate Costs

IT Depreciation

Transaction

Dis-Synergies

Total Transitional

Costs

Incurred

2014–2016

Only

80% Expected 2015

•

Transition Service

Agreements

•

Branding

•

Royalties

•

Start Up

Ongoing Incremental Expenses

As A Stand-Alone Company

Stand-Alone Halyard

Operating Profit

•

Incremental D&A

Expense

(1)

(2)

(3)

(4)

Excludes $100-$125MM of pre-spin costs

(5)

40

11

29

60–75 |

Historical Segment Performance

Historical Segment Performance

26

Net Sales

FYE 12/31 ($MM)

(1)

1.

Excludes Corporate & Other.

2.

2011

–

2013

actuals

do

not

reflect

the

ongoing

costs

of

separation.

3.

Adjusted

EBITDA

for

the

twelve-months

ended

September

30,

2014

is

$313.4

million;

however,

when

presented

on

a

pro

forma

basis

to

give

effect

to

the

spin-off

and

related

transactions as if they had occurred on January 1, 2013, is approximately $244

million. Our pro forma Adjusted EBITDA includes approximately $69.2 million in cash expenses expected

to be incurred on an annual basis as a result of the spin-off in order to

operate as a stand-alone company. These expenses are not included in our actual Adjusted EBITDA for the same

period.

See

the

Appendix

for

more

information

regarding

the

calculation

of

Adjusted

EBITDA

for

the

actual

and

pro

forma

periods

presented

above.

Adj. EBITDA

FYE 12/31 ($MM)

(3)

(2)

(2)

(2)

1,188

1,185

1,153

1,133

452

478

499

506

1,640

1,663

1,652

1,639

0

500

1,000

1,500

2,000

2011A

2012A

2013A

LTM 9/30/14A

Surgical & Infection Prevention

Medical Devices

262

286

295

244

140

190

240

290

340

2011A

2012A

2013A

LTM 9/30/14

313 |

27

September 30, 2014 YTD Pro Forma Financial Performance

September 30, 2014 YTD Pro Forma Financial Performance

Pro Forma

(1)

($MM)

Nine Months Ended

9/30/2013

9/30/2014

S&IP

860.1

840.2

Medical Devices

366.8

373.5

Net Sales

1,226.9

1,213.7

September 30, 2014 YTD Pro Forma Financial Performance and Commentary

Pro Forma Adjusted EBITDA up 13% driven by:

Reduced SG&A (on a normalized basis):

Patent infringement settlement and lower

litigation costs

Benefit from strategic sales and

marketing headcount reductions taken in

Q4 2013

Lower sales incentive payments

Implementation of manufacturing costs

saving programs and productivity gains (on

a normalized basis)

Offsets from lower selling price in S&IP and

unfavorable mix shift and flat overall volume

growth in surgical pain

Currency losses from translational exposure

EBITDA

(2)

210.6

175.0

Adjusted EBITDA

(2)

166.6

188.0

Net

Income 91.7

46.2

1.

Pro forma financial data gives effect to the spin-off and related transactions as if they had

occurred on January 1, 2013. A reconciliation of pro forma net sales and pro forma net income

to Halyard Health’s historical net sales and net income can be found in the Appendix to this

presentation. 2.

A

reconciliation

of

EBITDA

and

Adjusted

EBITDA

to

our

net

income

(loss)

under

GAAP

for

each

of

the

periods

presented

can

be

found

in

the

Appendix

to

this

presentation. |

28

Q3 2014 Pro Forma Financial Performance

Q3 2014 Pro Forma Financial Performance

Pro Forma

(1)

($MM)

Three Months Ended

9/30/2013

9/30/2014

S&IP

287.0

279.2

Medical Devices

126.2

122.5

Net Sales

413.2

401.7

Q3 2014 Pro Forma Financial Performance and Commentary

Difficult comparison to prior year; second highest

quarter ever

Q3 2013 Pro Forma Adjusted EBITDA was

$14 million above the quarterly average for

the year

Decline in Pro Forma Adjusted EBITDA

approximately equal weightings between:

Expected price loss in exam gloves and

sterilization

Device sales lower due to surgical pain

volume related to competition in our category

Negative currency impact

EBITDA

(2)

83.9

63.8

Adjusted EBITDA

(2)

69.2

57.1

Net Income

40.2

7.9

1.

Pro forma financial data gives effect to the spin-off and related transactions

as if they had occurred on January 1, 2013. A reconciliation of pro forma net sales and pro forma net income

to Halyard Health’s historical net sales and net income can be found in the

Appendix to this presentation. 2.

A

reconciliation

of

EBITDA

and

Adjusted

EBITDA

to

our

net

income

(loss)

under

GAAP

for

each

of

the

periods

presented

can

be

found

in

the

Appendix

to

this

presentation. |

29

Halyard’s Long-Term Financial Objectives

Halyard’s Long-Term Financial Objectives

Organic Revenue

Growth

<1%

Portfolio optimized for higher growth

Improving growth rate especially in higher margin

categories

Organic Adjusted

Earnings Growth

<3%

Earnings growth driven by margin expansion

Growth in higher margin categories

R&D Expense

<2%

Increased investment; ~3-4% of net sales

Focused on organic innovation and new products for

adjacency expansion

Capital Expenditures

<3%

~3% of net sales

Funding growth and innovation initiatives

Total Shareholder

Return

N/A

Focus metric for Management

1.

Organic Revenue and Earnings Growth based on 2013 2-year CAGR.

2.

These goals are forward-looking, are subject to significant business, economic,

regulatory and competitive uncertainties and contingencies, many of which are beyond the control of

the Company and its management, and are based upon assumptions with respect to

future decisions, which are subject to change. Actual results will vary and those variations may

be

material.

For

discussion

of

some

of

the

important

factors

that

could

cause

these

variations,

please

consult

“Risk

Factors”

under

Item

1A

of

Halyard

Health’s

Registration

Statement

on Form 10 (as amended) filed with the Securities and Exchange Commission. Nothing

in this presentation should be regarded as a representation by any person that these goals will

be achieved. Halyard Health undertakes no obligation to update these goals and

forward-looking statements to reflect events or circumstances occurring after the date of this

presentation,

except

as

required

by

law,

including

the

securities

laws

of

the

United

States

and

the

rules

and

regulations

of

the

SEC.

You

should

not

place

undue

reliance

on

these

goals and forward-looking statements, which speak only as of October 21,

2014. Today

Longer Term Goals

(2)

(1) |

Focus

on Total Shareholder Return 30

Maintain balance sheet flexibility and focus on working capital efficiency

Disciplined growth funding

Capital spending

Research and development

Mergers and acquisitions

Infrastructure efficiency

Continued focus on margin accretion

Gross margin improvement from shift to increased medical device focus

Operating margin efficiency by eliminating spin-related transaction

costs Return excess cash to shareholders through potential share repurchases

and dividends

Focus on Key Long-Term Drivers of

Total Shareholder Return |

APPENDIX

APPENDIX |

32

Halyard Health Net Income to Pro Forma Adjusted

EBITDA Reconciliation

Halyard Health Net Income to Pro Forma Adjusted

EBITDA Reconciliation

Unaudited

($MM)

Three Months Ended

Nine Months Ended

9/30/2013

9/30/2014

9/30/2013

9/30/2014

Net Sales

419.5

408.5

1,246.2

1,232.7

Related

Party

Sales

(1)

(6.3)

(6.8)

(19.3)

(19.0)

Pro Forma Net Sales

413.2

401.7

1,226.9

1,213.7

Net Income (GAAP)

47.9

(7.4)

114.8

29.5

Related

Party Sales

(1)

(0.6)

(0.6)

(1.8)

(1.8)

Transaction Costs

(2)

-

35.4

-

61.2

Royalties

(3)

(2.6)

(2.6)

(7.9)

(7.9)

Interest Expense (Income)

(4)

(8.6)

(8.6)

(25.8)

(25.8)

Provision for Income Taxes

(5)

4.1

(8.3)

12.4

(9.0)

Pro Forma Net Income

40.2

7.9

91.7

46.2

Provision for Income Taxes (Benefit)

19.0

29.8

42.1

52.7

Interest Expense (Income)

7.9

7.8

24.2

23.0

Depreciation and Amortization

16.8

18.3

52.6

53.1

Pro Forma EBITDA

83.9

63.8

210.6

175.0

Thailand Restructuring

(6)

-

5.7

-

54.7

Royalties

(7)

2.6

2.6

7.9

7.9

Ongoing Separation and Distribution Impact

(8)

(17.3)

(17.3)

(51.9)

(51.9)

Unusual Items in the Period

(9)

-

2.3

-

2.3

Pro Forma Adjusted EBITDA

69.2

57.1

166.6

188.0

Note: Reference footnote disclosures on p. 34.

Operating Profit

70.3

13.1

167.7

70.3 |

33

Halyard Health Net Income to Pro Forma Adjusted

EBITDA Reconciliation (Continued)

Halyard Health Net Income to Pro Forma Adjusted

EBITDA Reconciliation (Continued)

Unaudited

($MM)

FY 2011

FY 2012

FY 2013

Less 9

Months

(2013)

Add 9

Months

(2014)

Combined

LTM

Sept. 30,

2014

Pro Forma

LTM

Sept. 30,

2014

(11)

Net Income

142.4

152.6

154.6

114.8

29.5

69.3

78.3

Provision for Income Taxes (Benefit)

72.2

77.2

73.2

54.5

43.6

62.3

67.2

Interest Expense (Income)

(3.9)

(1.8)

(2.5)

(1.6)

(2.9)

(3.8)

30.7

Depreciation and Amortization

51.1

57.6

69.2

52.6

53.1

69.7

69.7

EBITDA

261.8

285.6

294.5

220.3

123.3

197.5

245.9

Thailand Restructuring

(6)

54.7

54.7

54.7

Transaction Costs

(10)

61.2

61.2

-

Ongoing Stand-Alone Charges

(8)

(69.2)

Royalties

(7)

10.6

Unusual Items in the Quarter

(9)

2.3

Adjusted EBITDA

261.8

285.6

294.5

220.3

239.2

313.4

244.3

Note: Reference footnote disclosures on p. 34. |

34

Halyard Health Net Income to Pro Forma Adjusted

EBITDA Reconciliation (Supporting Footnotes)

Halyard Health Net Income to Pro Forma Adjusted

EBITDA Reconciliation (Supporting Footnotes)

Reflects an adjustment to eliminate related party sales associated with certain feminine care products

manufactured by Halyard for Kimberly-Clark that will not continue after the distribution. This

adjustment applies only to Corporate & Other and does not affect our S&IP or Medical Devices

segments. The net effect of the adjustment was a decrease in net sales of $6.8 million and $6.3

million and cost of products sold of $0.6 million and $0.6 million for the three months ended September

30, 2014 and 2013; a decrease in net sales of $19.0 million and $19.3 million and cost of

products sold of $1.8 million and $1.8 million for the nine months ended September 30, 2014 and 2013.

Transaction costs expected to be incurred in 2014 in connection with the distribution are estimated to

be between $100.0 million and $125.0 million, which include costs related to legal, accounting,

information technology services and consulting services. We expect all these costs to be expensed.

Reflects an adjustment to remove $35.4 million and $61.2 million, respectively, of transaction

costs directly related to the distribution that were incurred during the three and nine months ended

September 30, 2014. We expect to enter into certain intellectual property agreements with Kimberly-Clark pursuant to

which Halyard will pay Kimberly-Clark royalties for the use of certain Kimberly-Clark intellectual

property for a transition period ending on the second anniversary of the distribution. The net effect

of the agreements was an increase in selling and general expenses of $2.6 million for the three

months ended September 30, 2014 and 2013; and $7.9 million for the nine months ended September 30, 2014

and 2013. On October 17, 2014 we issued $250.0 aggregate principal amount of 6.25% Senior Notes due 2022.

Reflects an adjustment for the estimated interest expense and the amortization of deferred

financing costs on our new borrowings of $250.0 million under our senior notes, anticipated borrowings

under the secured term loan facility we expect to enter into at the time of the spin-off and the

revolving credit facility of up to $250.0 million that we expect to enter into at the time of the

spin-off. Pro forma interest expense reflects an assumed annual interest rate of 4.0% on indebtedness to

be incurred in conjunction with the borrowings under the secured term loan facility. We expect

borrowings under the secured term loan facility to bear interest at an adjusted LIBOR rate plus 3.25%

or a base rate plus 2.25%, at our option, and the secured term loan facility is expected to mature in

October 2021. Each one-eighth point change in our assumed interest rate on the borrowings

under the secured term loan facility would result in a $0.5 million change in our aggregate annual

interest expense. Reflects an income tax expense adjustment for the items noted above, calculated at the U.S. federal

statutory rate of 35%. Consists of certain restructuring costs related to our plan to exit one of our disposable glove

facilities in Thailand and outsource the related production. Adjusted to exclude transitional royalties expected to be paid to Kimberly-Clark for the use of

certain Kimberly-Clark intellectual property for a transition period ending on the second anniversary of

the distribution. See note (3) above.

Upon the distribution, we will assume responsibility for all of our stand-alone public company

costs, including the costs of corporate services currently provided by Kimberly-Clark. The corporate

services currently provided to us include executive management, supply chain, information technology,

legal, finance and accounting, investor relations, human resources, risk management, tax,

treasury and other services. During three and nine months ended September 30, 2014 and 2013, and the

twelve months ended September 30, 2014, and we incurred approximately $23.8 million, $47.5

million, and $95.0 million in corporate cost allocation from Kimberly-Clark for these services. We estimate that our aggregate annual incremental cash expense for these services will be

approximately $40.0 million per year (for a combined total of $135.0 million of cash expense) and an

incremental $11.0 million per year of additional depreciation and amortization expense (which is

not reflected in the table above). In addition, as a result of the separation and distribution, we expect to incur additional ongoing net expenses that we estimate will be approximately $29.2 million

on an annual basis related primarily to (1) a decline of purchasing scale, (2) stranded facility costs

as a result of excess manufacturing capacity in certain facilities, underutilization of certain of our

distribution facilities and inefficiencies in shipping costs and (3) a reduction in related party

sales. In addition, as a result of the separation and distribution, we expect to incur

$60.0 million to $75.0 million of transitional costs after the distribution through 2016 to establish our own capabilities as a

stand-alone entity. These costs are related primarily to the transition services we expect to

receive from Kimberly-Clark, as well as our branding and other supply chain transition costs. Our pro

forma Adjusted EBITDA has not been adjusted to account for these transitional costs. These costs are

estimates only and we may have to pay higher costs as a result of these transition services than

currently expected. See “Risk Factors—Risks Related to the Distribution and Our Separation from Kimberly-Clark” contained in our Registration Statement on Form 10 (as amended) filed with

the Securities and Exchange Commission.

Adjusted to exclude the following one-time costs incurred during the three months ended September

30, 2014: (1) approximately $1.3 million associated with the collapse of the roof and a wall at

our Southaven distribution facility due to severe weather and (2) approximately $1 million of Medical

Devices inventory was written off in connection with an inventory review in preparation for the

spin-off.

During the nine and twelve months ended September 30, 2014, we incurred transaction costs directly

relating to the separation and distribution in the amount of $61.2 million. Transaction costs

associated with the separation and distribution are estimated to be between $100.0 million and $125.0

million for the full year 2014. See note (2) above. Reflects adjustments to give effect to the spin-off and related transactions as if they had

occurred on January 1, 2013. Please see our Unaudited Pro Forma Condensed Combined Financial

Statements included in our Registration Statement on Form 10 (as amended) filed with the Securities and

Exchange Commission for a description of the adjustments to the items below for the year ended

December 31, 2013. See page 32 of this presentation for adjustments for the nine months ended September 30, 2013 and 2014.

1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

11. |