Attached files

| file | filename |

|---|---|

| EX-99.6 - EX-99.6 - VIASYSTEMS GROUP INC | d787165dex996.htm |

| EX-99.9 - EX-99.9 - VIASYSTEMS GROUP INC | d787165dex999.htm |

| EX-99.7 - EX-99.7 - VIASYSTEMS GROUP INC | d787165dex997.htm |

| EX-99.2 - EX-99.2 - VIASYSTEMS GROUP INC | d787165dex992.htm |

| EX-99.1 - EX-99.1 - VIASYSTEMS GROUP INC | d787165dex991.htm |

| EX-99.10 - EX-99.10 - VIASYSTEMS GROUP INC | d787165dex9910.htm |

| EX-99.3 - EX-99.3 - VIASYSTEMS GROUP INC | d787165dex993.htm |

| EX-2.1 - EX-2.1 - VIASYSTEMS GROUP INC | d787165dex21.htm |

| EX-99.8 - EX-99.8 - VIASYSTEMS GROUP INC | d787165dex998.htm |

| 8-K - 8-K - VIASYSTEMS GROUP INC | d787165d8k.htm |

| EX-99.4 - EX-99.4 - VIASYSTEMS GROUP INC | d787165dex994.htm |

Merger with TTM

Employee Presentation

September 22, 2014

Proprietary and Confidential

Exhibit 99.5 |

Disclaimer

2

Forward-Looking Statements Certain

statements in this communication may constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements

relate to a variety of matters, including but not limited to: the operations of the businesses of TTM

and Viasystems separately and as a combined entity; the timing and consummation of the proposed

merger; the expected benefits of the integration of the two companies; the combined company’s plans, objectives, expectations and intentions;

and other statements that are not historical fact. These statements are made on the basis of the

current beliefs, expectations and assumptions of the management of TTM and Viasystems regarding

future events and are subject to significant risks and uncertainty. Statements regarding our expected performance in the future are forward-looking

statements. It is

uncertain whether any of the events anticipated by the forward-looking statements will transpire or occur, or if any of them do, what impact they will have on the results of

operations and financial condition of the combined company or the price of Viasystems’ or

TTM’s common stock. These forward-looking statements involve certain risks and

uncertainties that could cause actual results to differ materially from those indicated in such

forward-looking statements, including but not limited to: the ability of the parties to

consummate the proposed merger and the satisfaction of the conditions precedent to consummation of the

proposed merger, including the ability to secure regulatory approvals in a timely manner or at

all; the adoption of the Merger Agreement by Viasystems’ stockholders; the possibility of legal or regulatory proceedings (including related to

the transaction itself); the ability of TTM to successfully integrate Viasystems’ operations,

product lines, technology and employees and realize synergies and additional opportunities for

growth from the proposed merger in a timely manner or at all; unknown, underestimated or undisclosed commitments or liabilities; the potential impact of the

announcement or consummation of the proposed transactions on the parties’ relationships with

third parties, which may make it more difficult to maintain business and operational

relationships; the level of demand for the combined company’s products, which is subject to many factors, including uncertain global economic and industry

conditions, demand for electronic products and printed circuit boards, and customers’ new

technology and capacity requirements; TTM’s and Viasystems’ ability to (i) develop,

deliver and support a broad range of products, expand their markets and develop new markets, (ii)

timely align their cost structures with business conditions, and (iii) attract, motivate and

retain key employees; and developments beyond Viasystems’ or TTM’s control, including but not limited to, changes in domestic or global economic conditions,

competitive conditions and consumer preferences, adverse weather conditions or natural disasters,

health concerns, international, political or military developments, and technological

developments. Additional factors that may cause results to differ materially from those described in the forward-looking statements are set forth in the Annual

Report on Form 10-K of TTM Technologies, Inc. for the year ended December 30, 2013, which was

filed with the Securities and Exchange Commission (the “SEC”) on February 21, 2014,

under the heading “Item 1A. Risk Factors” and in the Annual Report on Form 10-K of Viasystems for the year ended December 31, 2013, which was filed

with the SEC on February 14, 2014, under the heading “Item 1A. Risk Factors,” and in each

company’s other filings made with the SEC available at the SEC’s website at

www.sec.gov.

Neither Viasystems nor TTM undertakes any obligation to update any such forward-looking statements

to reflect any new information, subsequent events or circumstances, or

otherwise, except as may be

required by law. |

3

Use of Non-GAAP Financial Measures

In addition to the financial statements presented in accordance with U.S. GAAP, TTM

and Viasystems use certain non-GAAP financial measures, including “adjusted EBITDA.”

The companies present non-GAAP financial information to enable investors to see

each company through the eyes of management and to provide better insight into its ongoing

financial performance.

Adjusted EBITDA is defined as earnings before interest expense, income taxes,

depreciation, amortization of intangibles, stock-based compensation expense, gain on sale of

assets, asset impairments, restructuring, costs related to acquisitions, and other

charges. For a reconciliation of adjusted EBITDA to net income, please see Appendix A at the

end of this presentation. Adjusted EBITDA is not a recognized financial measure

under U.S. GAAP, and does not purport to be an alternative to operating income or an

indicator

of

operating

performance.

Adjusted

EBITDA

is

presented

to

enhance

an

understanding

of

operating

results

and

is

not

intended

to

represent

cash

flows

or

results

of

operations. The Boards of Directors, lenders and management of the companies use

adjusted EBITDA primarily as an additional measure of operating performance for matters

including

executive

compensation

and

competitor

comparisons.

The

use

of

this

non-GAAP

measure

provides

an

indication

of

each

company’s

ability

to

service

debt,

and

management

considers

it

an

appropriate

measure

to

use

because

of

the

companies’

leveraged

positions.

Adjusted EBITDA has certain material limitations, primarily due to the exclusion of

certain amounts that are material to each company’s consolidated results of operations, such

as interest expense, income tax expense, and depreciation and amortization. In

addition, adjusted EBITDA may differ from the adjusted EBITDA calculations reported by other

companies in the industry, limiting its usefulness as a comparative measure.

The companies use adjusted EBITDA to provide meaningful supplemental information

regarding operating performance and profitability by excluding from EBITDA certain items

that each company believes are not indicative of its ongoing operating results or

will not impact future operating cash flows, which include stock-based compensation expense,

gain on sale of assets, asset impairments, restructuring, costs related to

acquisitions, and other charges. Data Used in This Presentation

Due to rounding, numbers presented throughout this and other documents may not add

up precisely to the totals provided and percentages may not precisely reflect the

absolute figures.

Disclaimer |

Disclaimer

4

Participants in the Solicitation

Additional Information and Where to Find It

No Offer or Solicitation

TTM and Viasystems and their respective directors and executive officers will be participants in the

solicitation of proxies from Viasystems' stockholders in connection with the proposed merger

and may have direct or indirect interests in the proposed merger. Information about TTM’s directors and executive officers is set forth in TTM’s Proxy

Statement on Schedule 14A for its 2014 Annual Meeting of Stockholders, which was filed with the SEC on

March 14, 2014, and its Annual Report on Form 10-K for the fiscal year ended December 30,

2013, which was filed with the SEC on February 21, 2014. These documents are available free of charge at the SEC’s website at

www.sec.gov, and from TTM by contacting Investor Relations by mail at TTM Technologies, Inc., 1665

Scenic Avenue, Suite 250, Costa Mesa, CA 92626, Attn: Investor Relations Department, by

telephone at 714-327-3000, or by going to TTM’s Investor Relations page on its corporate website at www.ttmtech.com. Information about

Viasystems' directors and executive officers is set forth in Viasystems' Proxy Statement on Schedule

14A for its 2014 Annual Meeting of Stockholders, which was filed with the SEC on March 14,

2014, and its Annual Report on Form 10-K for the fiscal year ended December 31, 2013, which was filed with the SEC on February 14, 2014. These

documents are available free of charge at the SEC’s website at www.sec.gov, and from Viasystems

by contacting Investor Relations by mail at Viasystems Group, Inc., 101 South Hanley Road,

Suite 1800, St. Louis, MO 63105, Attn: Investor Relations Department, by telephone at 314-727-2087, or by going to Viasystems' Investor Info page on

its corporate website at www.viasystems.com. Additional information regarding the interests of

participants in the solicitation of proxies in connection with the proposed merger will be

included in the Proxy Statement/Prospectus that TTM will file with the SEC.

The information in this communication is for informational purposes only and is neither an offer to

purchase, nor a solicitation of an offer to sell, subscribe for or buy any securities or the

solicitation of any vote in any jurisdiction pursuant to the proposed transactions or otherwise, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in

contravention of applicable law. No offer of securities shall be made except by means of a prospectus

meeting the requirements of Section 10 of the Securities Act of 1933, as amended.

TTM will file with the SEC a registration statement on Form S-4, which will include a prospectus

with respect to TTM’s shares of common stock to be issued in the proposed merger and a

proxy statement of Viasystems in connection with the proposed merger between TTM and Viasystems (the “Proxy Statement/Prospectus”). The Proxy

Statement/Prospectus will be sent or given to Viasystems’ stockholders and will contain important

information about the proposed merger and related matters. VIASYSTEMS’ SECURITY

HOLDERS ARE ADVISED TO READ THE PROXY STATEMENT/PROSPECTUS CAREFULLY WHEN IT BECOMES AVAILABLE

BECAUSE IT WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED MERGER. The Proxy

Statement/Prospectus and other relevant materials (when they become available) and any other

documents filed by TTM or Viasystems with the SEC may be obtained free of charge at the SEC’s website at www.sec.gov. In

addition, security holders will be able to obtain free copies of the Proxy Statement/Prospectus from

TTM or Viasystems by contacting either (1) Investor Relations by mail at TTM Technologies,

Inc., 1665 Scenic Avenue, Suite 250, Costa Mesa, CA 92626, Attn: Investor Relations Department, by telephone at 714-327-3000, or by going to TTM’s

Investor Relations page on its corporate website at www.ttmtech.com or (2) Investor Relations by mail

at Viasystems Group, Inc., 101 South Hanley Road, Suite 1800, St. Louis, MO 63105, Attn:

Investor Relations Department, by telephone at 314-727-2087, or by going to Viasystems' Investor Info page on its corporate website at

www.viasystems.com.

|

Agenda

Transaction Overview

Sales Force Actions and Expectations

5 |

Transaction Overview

TTM to acquire 100% of Viasystems in a cash/stock transaction

Viasystems stockholders will receive $11.33 per share in cash and 0.706 shares of TTM

stock for each Viasystems share

At

current

market

values

(as

of

09/19/14),

this

implies

an

offer

price

of

$16.46

per

Viasystems

share (41% premium to current)

TTM shareholders will own approximately 84% of the common stock of the combined

company

Viasystems’

implied enterprise valuation of ~$927mm, equivalent to ~6.8 x 6/30/14 adjusted

LTM EBITDA of $137mm

Expected closing in the first half of 2015, subject to regulatory reviews and other

customary conditions to closing

TTM has fully committed financing for the transaction

Viasystems’

two largest shareholders (combined 67% ownership) have signed agreements to

vote in favor of the transaction

6 |

Transaction Rationale

Combination

of

two

industry

leaders,

creating

enhanced

scale

and

new

growth

opportunities

End

market

diversification

into

Automotive

and

expanded

presence

in

Medical,

Industrial

&

Instrumentation

Complementary global footprint, commitment to operational excellence and expertise in

key technologies

Outstanding combined customer list spanning North America, Asia and Europe

Strong talent pool, with extensive experience in the PCB industry

Value creation opportunity

Enhance scale to compete with Asian Industry Leaders ($2.5bn combined pro forma

2013 revenue)

Potential to achieve industry-leading financial performance

7 |

Overview of TTM Technologies, Inc.

8 |

Leading position

in growing market segments Market Leader

Top 10 world PCB makers 2013 ($mm)

Global PCB manufacturer with combined pro forma FY 2013 revenue of $2.5

billion Core supplier to automotive segment

Complementary positions in medical; industrial & instrumentation; networking

& communications; and aerospace & defense segments

Advanced technology supplier to rapidly growing smartphone and tablet

segments 9

Source: Prismark Partners,February 2014

Top 10 represent ~34% of 2013 total world PCB output

2013 Global PCB output of ~$55bn

Viasystems

TTM

$2,556

$2,539

$2,205

$2,163

$2,136

$1,700

$1,567

$1,372

$1,315

$1,180

0

500

1,000

1,500

2,000

2,500

3,000

3,500

4,000

Nippon

Mektron

TTM +

Viasystems

Young

Poong

Zhen Ding

Unimicron

SEMCO

Ibiden

Tripod

Sumitomo

Daeduck

Pro forma TTM + Viasystems: 5% |

End

Market Diversification Viasystems

TTM

2013 sales = $1,171mm

2013 sales = $1,368mm

2013 revenue by end market

Pro forma combined revenue by end market

10

Aerospace/

Defense

15%

Cellular

Phone

20%

Computing/

Storage/Peripherals

20%

Medical/

Industrial/

Instrumentation/

Other

8%

Networking/

Communications

32%

Other

5%

Automotive

30%

Telecom

17%

Industrial &

Instrumentation

25%

Computer &

Datacom

17%

Military and

Aerospace

11%

Introduces attractive new Automotive segment – 14% of total sales

Cellular Phone end market reduced from 20% of total sales to 11%

Telecom and Computing end market reduced from 51% of total sales to 43%

Aerospace & Defense reduced from 15% of total sales to 13%

Medical, Industrial and Instrumentation end market increased to 16% of total sales from 8% |

TTM

Viasystems

Total

TTM

Viasystems

Total

# of facilities

7

10

17

6

5

11

Size (~ 1000 sq.ft)

860

1,100

1,960

3,400

4,610

8,010

North America

China

Automotive

Conventional PCB

HDI & QTA

Aerospace & Defense

Specialty Assy

1

Anaheim, CA

San Jose, CA

2

Milpitas, CA

Cleveland, OH

6

North Jackson, OH

5

Denver, CO

8

Zhongshan, China

9

Guangzhou, China

10

Huiyang, China

7

Sterling, VA

11

Forest Grove, OR

12

Toronto, Canada

13

Juarez, Chihuahua

15

Shenzhen, China

14

Shanghai, China

4

5

3

4

6

1

3

2

9

8

10

11

7

12

13

14

15

11

1

9

2

5

3

4

7

10

11

12

13

8

6

1

2

3

Santa Clara, CA

Stafford, CT

San Diego, CA

9

Stafford Springs, CT

8

Shanghai, China

Substrate

13

Shanghai -

SMST

High Tech/Quick-Turn/High Mix

4

Chippewa Falls, WI

6

Logan, UT

5

Santa Ana, CA

7

Hong Kong -

OPCM

Volume Production

10

Dongguan -

DMC

Shanghai -

SME

11

Guangzhou -

GME

12

Complementary Global Footprint and

Capabilities |

Outstanding Combined Customer List

Top 5 Customers

Apple

Cisco

Ericsson

Huawei

Juniper

Viasystems

TTM

Top 5 Customers

Autoliv

Alcatel-Lucent

Bosch

Continental

GE

Top 5 Customers

Alcatel-Lucent

Apple

Bosch

Cisco

Huawei

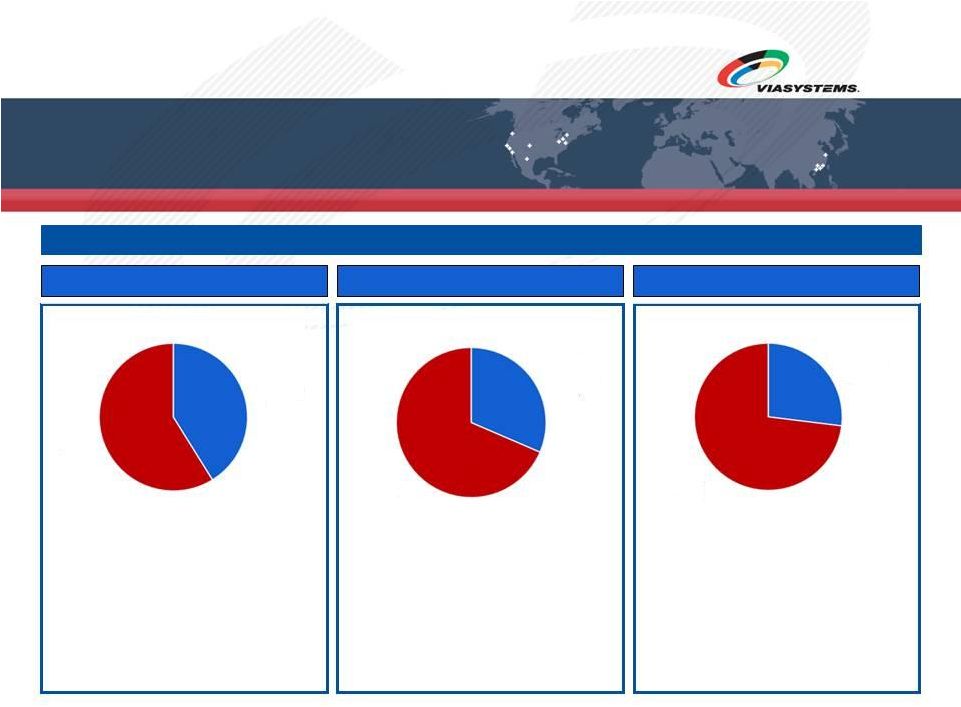

2013 revenue contribution by customer

Note: Customer names ordered alphabetically

12

TTM + Viasystems

Top 5

Customers

41%

Other

59%

Top 5

Customers

31%

Other

69%

Top 5

Customers

27%

Other

73% |

Summary Financial Impact

/ 12.0%

/ 11.3%

/ 12.6%

13

06/30/14 LTM Revenue and Adjusted EBITDA ($mm) |

Sales Force Actions

and Expectations |

Sales

Force Actions and Expectations Initiate Professionally Coordinated Customer

Communication Process Based Upon: Press Release

Customer Letter

Customer and Supplier Talking Points

Customer Q&A

15 |

Communication Timeline Review

Monday,

September

22,

2014

6:30 am CDT

Press Release

6:40 am CDT

Initiation of Customer/Vendor Communications

7:30 am CDT

Joint Investor Webcast and Call

8:30 am CDT

Employee Call

Tuesday,

September

23,

2014

8:30 am CDT

Joint Customer/Vendor Call

16 |

Communication Tool Review

Communication Packages Will Be Distributed to Sales Teams by Sales VPs and Directors

and to Inside Sales Team Leaders by Kelly Wetzler/Rich Kampf

Inside Sales Team Leader meeting

Sales Force Team meetings with VPs and Directors

Tool Review

For Customer Distribution

Press Release

Customer Letter

For Reference Only. NOT FOR DISTRIBUTION!

Customer and Supplier Talking Points

Customer Q&A

17 |

Customer Communication Process

Inside Sales Leader Meeting

Rich Kampf

Distribute communication tool package

Review proper usage

Inside Sales Leaders

Review communication package with their teams

Initiate

email

distribution

of

customer

letter

and

press

release

to

general

customer

population

Coordinate with field sales regarding notable customer feedback

18 |

Customer Communication Process –

Sales Force

Stick to the Script

Base

individual

customer

conversations

on

the

communication

tool

package

and

its

major

themes and messages

Communicate promptly and thoroughly

Be excited and positive

19 |

Customer Communication Process

Mission:

By

End

of

Tomorrow,

All

Viasystems’

Major

Customers

Will

Hear

the

News

from

Viasystems

Press Release

Investor Call

Sales Force General Communication Process

Inside Sales Emailing and Customer Calls

Common Customers Will also Learn from TTM

All media inquiries should be referred to Kelly Wetzler

20 |

Transition Period Guidelines

Transaction is targeted to close in the first half of 2015

Until Closing, TTM and Viasystems must operate independently!

To do otherwise violates anti-trust law

Do Not:

Collaborate with any TTM personnel

Engage in TTM business activities with customers

Speculate with customers about post-closing responsibilities

21 |

Closing Comments

This is very exciting news for Viasystems and our customers

The Merger is right for both companies

Viasystems will further diversify TTM through new end markets and new

customers Viasystems will complement TTM’s existing key market

positions and capabilities Viasystems shares similar operating

philosophies The combined company will become #2 in the world for printed

circuit boards Expanded and improved total solution offering to

customers Supports goal to expand global business model with improved

financial performance 22 |

Appendix A |

TTM

Non-GAAP ADJUSTED EBITDA Reconciliation

$mm

LTM 6/30/14

Net income

($3.3)

Income tax provision

4.4

Interest expense

24.0

Amortization of definite-lived intangibles

9.1

Depreciation expense

93.0

EBITDA

$127.2

Stock-based compensation

8.2

Gain on sale of assets

-

Restructuring and other changes

14.7

Impairments

12.6

Adjusted EBITDA

$162.7

24 |

Viasystems Non-GAAP ADJUSTED EBITDA

Reconciliation

$mm

2012

2013

LTM 6/30/14

Net income

($62.2)

($27.6)

($17.0)

Income tax provision

12.8

11.1

12.3

Interest expense

42.2

44.8

45.4

Depreciation and amortization

84.6

94.8

94.7

EBITDA

$77.3

$123.1

$135.4

Stock-based compensation

10.6

9.4

7.3

Restructuring

18.2

1.1

1.4

Impairment

1.7

-

-

Costs related to acquisition and equity registrations

13.6

0.6

0.6

Other, net

(0.4)

(6.0)

(6.0)

Loss on early extinguishment of debt

24.2

-

(4.3)

Amortization of deferred financing costs

2.7

2.9

2.8

Adjusted EBITDA

$148.0

$131.1

$137.3

25 |