Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Net Element, Inc. | v388938_8k.htm |

SeeThruEquity Presentation 2014

1 Disclaimer This presentation is for discussion purposes only. All prices and rates referenced herein are indicative and subject to market conditions. The material is based upon information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied upon as such. The material available in this presentation may contain forward - looking statements, which are subject to risks, uncertainties and assumptions. In some cases, you can identify these statements by forward - looking words such as “may”, “might”, “will”, “should”, “expect”, “plan”, “anticipate”, “believe”, “estimate”, “predict”, “optimistic”, “potential” , “future” or “continue”, the negative of these terms and other comparable terminology. Such forward - looking statements are based on current plans, estimates and expectations and are made pursuant to the Private Securities Litigation Reform Act of 1995. Forward - looking statements are based on known and unknown risks, assumptions, uncertainties and other factors. The Company’s actual results, performance and achievements may differ materially from any future results, performance, or achievements expressed or implied by such forward - looking statements. We do not assume responsibility for the accuracy or completeness of any forward - looking statement and you should not rely on forward - looking statements as predictions of future events. We are under no duty to update any of these forward - looking statements to conform them to actual results or revised expectations.

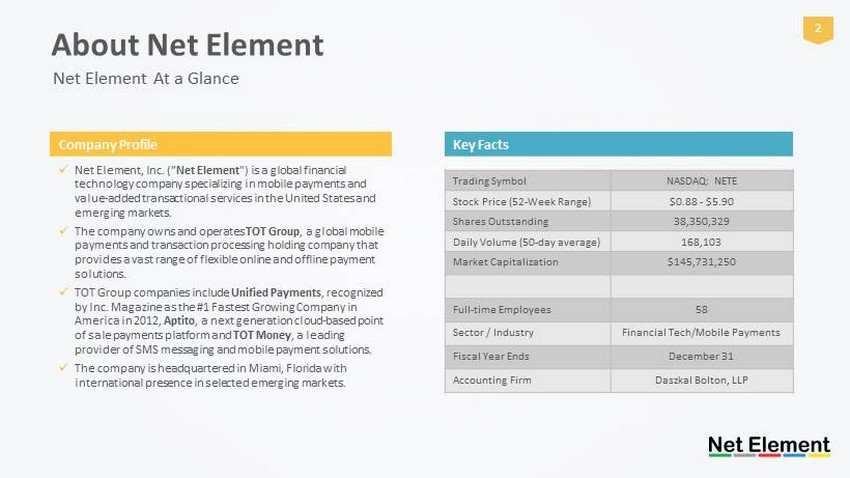

2 Company Profile x Net Element, Inc. (” Net Element " ) is a global financial technology company specializing in mobile payments and value - added transactional services in the United States and emerging markets. x The company owns and operates TOT Group , a global mobile payments and transaction processing holding company that provides a vast range of flexible online and offline payment solutions. x TOT Group companies include Unified Payments , recognized by Inc. Magazine as the #1 Fastest Growing Company in America in 2012, Aptito , a next generation cloud - based point of sale payments platform and TOT Money , a leading provider of SMS messaging and mobile payment solutions. x The company is headquartered in Miami, Florida with international presence in selected emerging markets. Key Facts About Net Element Net Element At a Glance Trading Symbol NASDAQ: NETE Stock Price (52 - Week Range) $0.88 - $5.90 Shares Outstanding 38,350,329 Daily Volume (50 - day average) 168,103 Market Capitalization $145,731,250 Full - time Employees 58 Sector / Industry Financial Tech/Mobile Payments Fiscal Year Ends December 31 Accounting Firm Daszkal Bolton , LLP

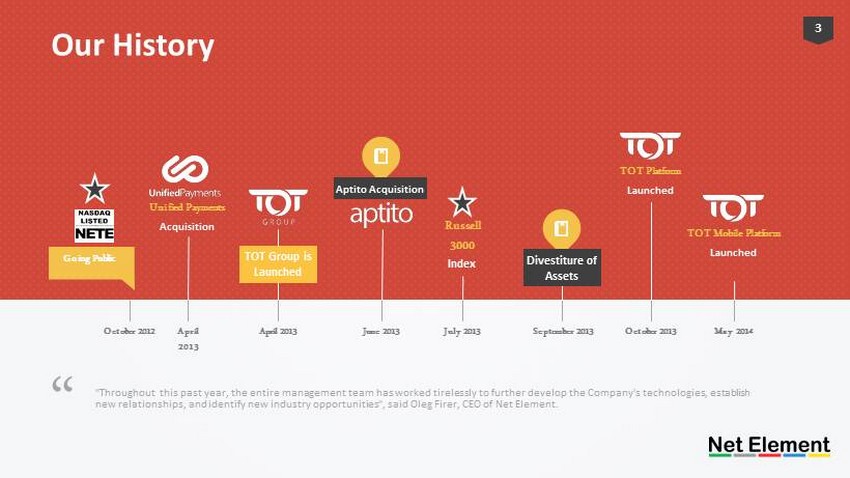

3 October 2012 Unified Payments A cquisition June 2013 Aptito Acquisition July 2013 May 2014 Russell 3000 Index April 2013 September 2013 Divestiture of Assets Going Public April 2013 TOT Group is Launched October 2013 TOT Platform Launched "Throughout this past year, the entire management team has worked tirelessly to further develop the Company's technologies, establish new relationships, and identify new industry opportunities", said Oleg Firer, CEO of Net Element. “ Our History TOT Mobile Platform Launched

4 We create and deliver innovative, end - to - end payment solutions to enable commerce around the world with focus on emerging markets. But, we don ’ t do it alone. Our family of companies are as passionate about driving innovations that enable commerce. Value - Added Transactional Services and Technologies TOT Group is a multinational technology group specializing in mobile payments and value - added transactional services. The Company is strategically positioned for growth in emerging markets. Payment Acceptance Solutions Unified Payments has been recognized by Inc. Magazine as the fastest growing company in America in 2012 and is a leading payment provider of payment processing to merchants across United States. Charge for Services by SMS, WAP or Phone TOT Money is a leading provider of carrier - integrated mobile payments solutions. R elationships with mobile operators give the Company unrivaled coverage, a strong platform for innovation in mobile payments and messaging . All - in - One Digital Solution for Digital Age Aptito is a next - generation, cloud - based payments platform, which creates an online consumer experience into offline commerce environments via tablet, mobile and all other cloud - connected devices. Family of Brands We Stand Apart F rom the Rest

5 • Large and growing market with favorable economic trends • The use of non - cash forms of payments including mobile payments has steadily increased over the past ten years and continues to climb Large & Growing Industry • Focused on fast growing and highly profitable market segments • Proved transactional business in the United States with recurring revenues • Diverse, low - risk, recession proved recurring revenue stream • Strong established customer & partner base Recurring Revenue Business Model • Resilient business with strong recurring revenue, diversified customer base and good visibility • Full front and back office operations including risk, underwriting, deployment, activation, client services, data entry and retention • Significant , untapped opportunities for expansion and growth Resilient Operating Leverage • Proven track record of scaling businesses and delivering shareholder value • Proven achievements in new product launch • Proven achievements in new market development and establishing market presence • Relentless focus on value creation and growth Proven Management Team Investment Highlight What Makes Net Element Special

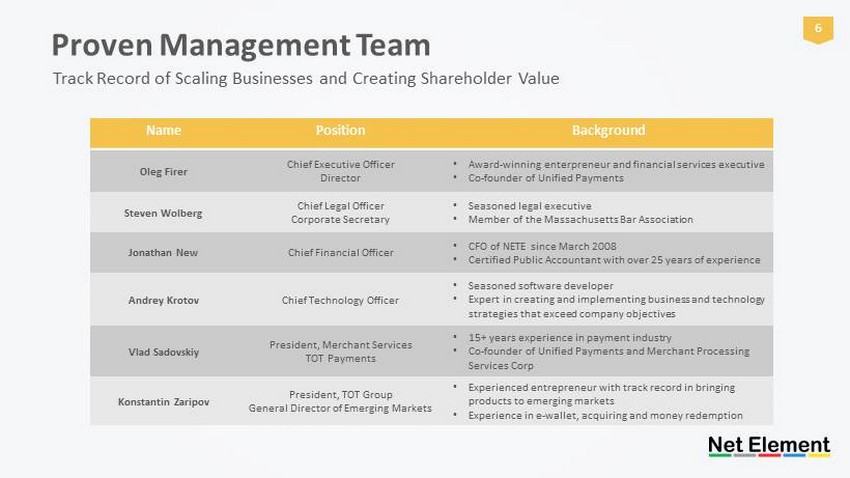

6 Name Position Background Oleg Firer Chief Executive Officer Director • Award - winning enterpreneur and financial services executive • Co - founder of Unified Payments Steven Wolberg Chief Legal Officer Corporate Secretary • Seasoned legal executive • Member of the Massachusetts Bar Association Jonathan New Chief Financial Officer • CFO of NETE since March 2008 • Certified Public Accountant with over 25 years of experience Andrey Krotov Chief Technology Officer • Seasoned software developer • Expert in creating and implementing business and technology strategies that exceed company objectives Vlad Sadovskiy President, Merchant Services TOT Payments • 15+ years experience in payment industry • Co - founder of Unified Payments and Merchant Processing Services Corp Konstantin Zaripov President, TOT Group General Director of Emerging Markets • Experienced entrepreneur with track record in bringing products to emerging markets • Experience in e - wallet, acquiring and money redemption Proven Management Team Track Record of Scaling Businesses and Creating Shareholder Value

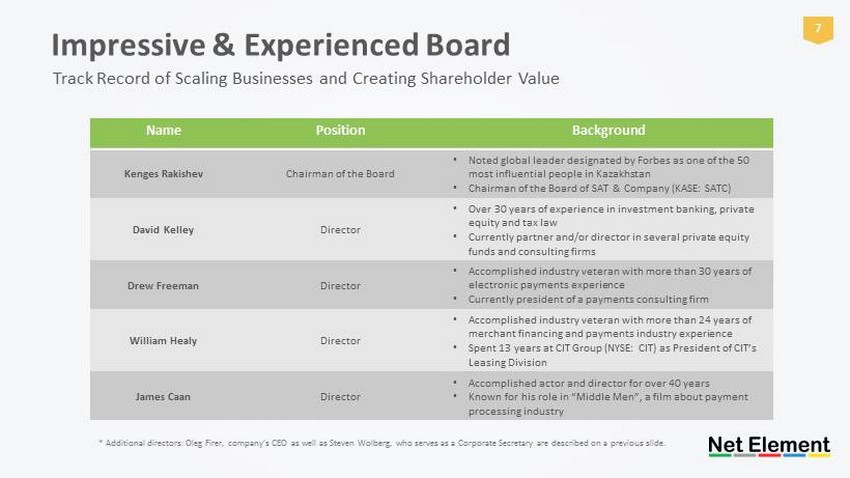

7 Name Position Background Kenges Rakishev Chairman of the Board • Noted global leader designated by Forbes as one of the 50 most influential people in Kazakhstan • Chairman of the Board of SAT & Company (KASE: SATC) David Kelley Director • Over 30 years of experience in investment banking, private equity and tax law • Currently partner and/or director in several private equity funds and consulting firms Drew Freeman Director • Accomplished industry veteran with more than 30 years of electronic payments experience • Currently president of a payments consulting firm William Healy Director • Accomplished industry veteran with more than 24 years of merchant financing and payments industry experience • Spent 13 years at CIT Group (NYSE: CIT) as President of CIT’s Leasing Division James Caan Director • Accomplished actor and director for over 40 years • Known for his role in “Middle Men”, a film about payment processing industry * Additional directors: Oleg Firer, company’s CEO as well as Steven Wolberg, who serves as a Corporate Secretary are describ ed on a previous slide. Impressive & Experienced Board Track Record of Scaling Businesses and Creating Shareholder Value

8 Business Segments Create new revenue opportunities, and strengthen loyalty by giving customers an ability to transact using their mobile devices. Mobile Payments Charge for services using mobile VAS include products and services that generate additional income for its partners and customers. Need a way to accept local payment methods: carrier billing, e - wallet, Visa®, MasterCard®, Amex®, and more.. Payment Processing All - in - one payment solutions OMNI - Channel Processing Mobile Payments Value - Added Services Payment Processing Value - Added Services All types of commerce

9 Sales & Marketing Channels & Geographies Emerging Segments Differentiated Offerings New Verticals Value Added Resellers Sales Agents Domestic & International Alternative Payments Data Analytics & Marketing Security & Fraud Services Prepaid Electronic Commerce Innovative Technologies Alternative Payments Focused on Fast Growing and Highly Profitable Market Segments Mobile Commerce

10 Net Element has amassed the building blocks to deliver sustainable organic growth complemented by strategic acquisitions. TECHNOLOGY More than 20 proven payment enabling technologies. GEOGRAPHY Focused on $195 Billion global emerging m arkets p ush, complimented by strong U.S. presence. SYNERGIES Robust pipeline of strategic acquisitions to complement differentiating technologies and organic growth. ORGANIC GROWTH ACQUISITION GROWTH Sales & Marketing Multiple Growth Levels

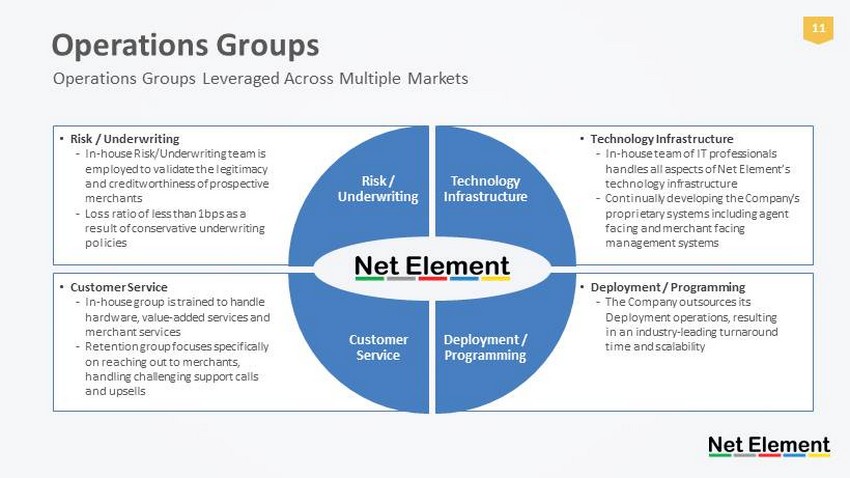

11 Risk / Underwriting Technology Infrastructure Deployment / Programming Customer Service • Risk / Underwriting - In - house Risk/Underwriting team is employed to validate the legitimacy and creditworthiness of prospective merchants - Loss ratio of less than 1bps as a result of conservative underwriting policies • Customer Service - In - house group is trained to handle hardware, value - added services and merchant services - Retention group focuses specifically on reaching out to merchants, handling challenging support calls and upsells • Technology Infrastructure - In - house team of IT professionals handles all aspects of Net Element’s technology infrastructure - Continually developing the Company’s proprietary systems including agent facing and merchant facing management systems • Deployment / Programming - The Company outsources its Deployment operations, resulting in an industry - leading turnaround time and scalability Operations Groups Operations Groups Leveraged Across Multiple Markets

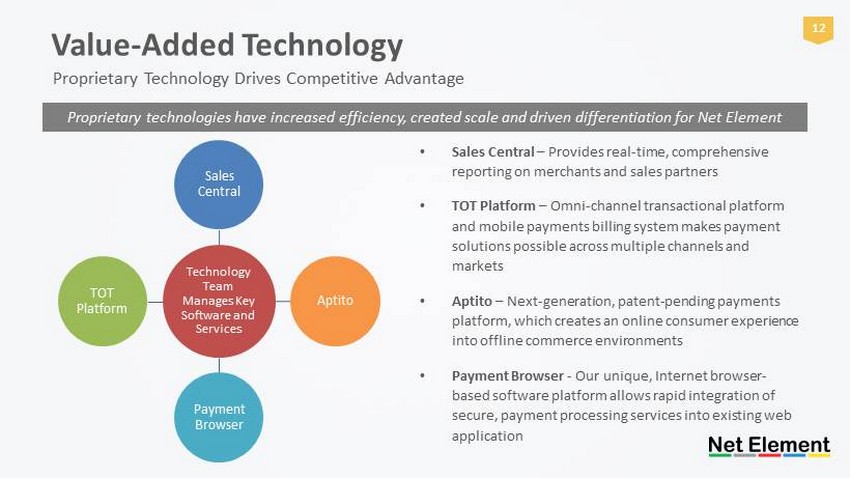

12 Value - Added Technology Proprietary Technology Drives Competitive Advantage Technology Team Manages Key Software and Services Sales Central Aptito Payment Browser TOT Platform • Sales Central – Provides real - time, comprehensive reporting on merchants and sales partners • TOT Platform – Omni - channel transactional platform and mobile payments billing system makes payment solutions possible across multiple channels and markets • Aptito – Next - generation, patent - pending payments platform, which creates an online consumer experience into offline commerce environments • Payment Browser - Our unique, Internet browser - based software platform allows rapid integration of secure, payment processing services into existing web application Proprietary technologies have increased efficiency, created scale and driven differentiation for Net Element

13 $1.792 trillion, global e - commerce market by 2014 18.1% annual growth of e - commerce market 58.5% annual growth of m - payments market $796 billion, global m - payments market by 2014 Mobile Commerce Revolution: Internet commerce changed how we do business, and now the rapid expansion of mobile is morphing the retail environment again. TOT Group’s next generation, cloud - based payments platform creates an online consumer experience in offline commerce environments via tablet, mobile and all other cloud - connected devices. The solution is a tablet - based POS that combines traditional POS functionality with mobile ordering, payments, social media, intelligent offers, mobile applications, loyalty, and transactional data all in one solutions with TOT Platform at the center of it all. Data Source: Capgemini World Payments Report 2013 Opportunity in Numbers Large and Growing Market with Favorable Economic Trends

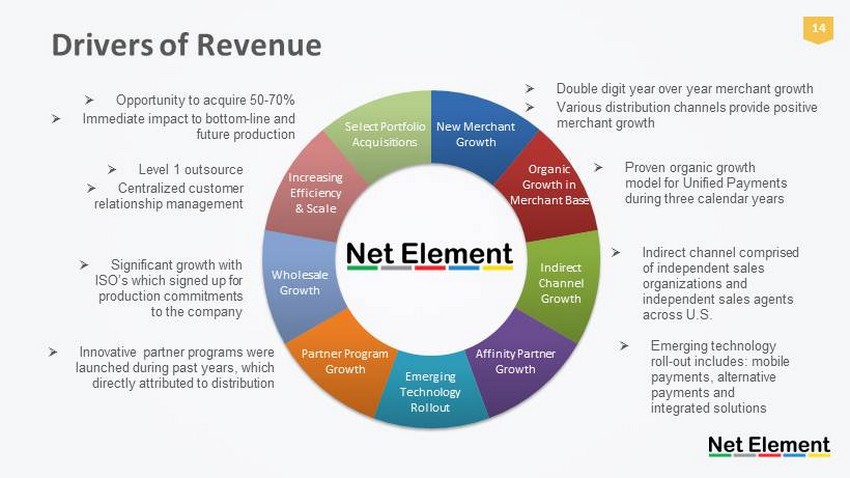

14 New Merchant Growth Organic Growth in Merchant Base Indirect Channel Growth Affinity Partner Growth Emerging Technology Rollout Partner Program Growth Wholesale Growth Increasing Efficiency & Scale Select Portfolio Acquisitions Drivers of Revenue » Opportunity to acquire 50 - 70% » Immediate impact to bottom - line and future production » Indirect channel comprised of independent sales organizations and independent sales agents across U.S. » S ignificant growth with ISO’s which signed up for production commitments to the company » Proven organic growth model for Unified Payments during three calendar years » Double digit year over year merchant growth » Various distribution channels provide positive merchant growth » Level 1 outsource » Centralized customer relationship management » Innovative partner programs were launched during past years, which directly attributed to distribution » Emerging technology roll - out includes: mobile payments, alternative payments and integrated solutions

15 Competitive Advantages Innovative solutions Differentiating product offerings Aggressive sales strategy Strategic position in the fastest - growing markets

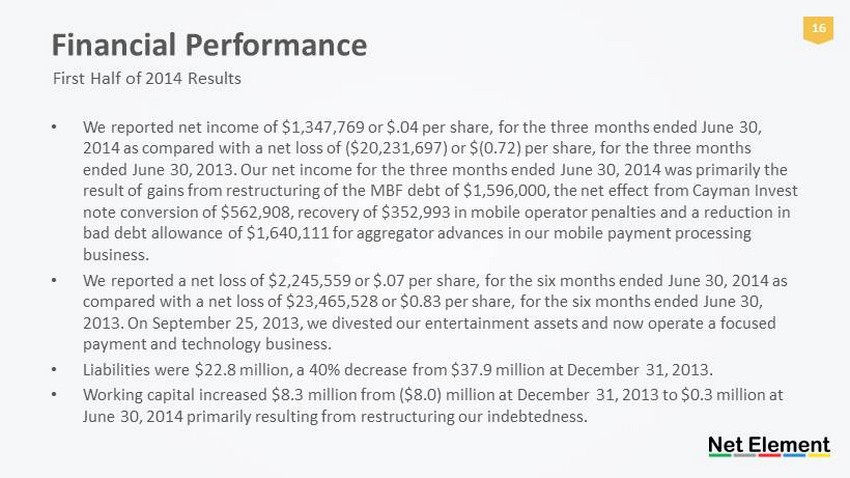

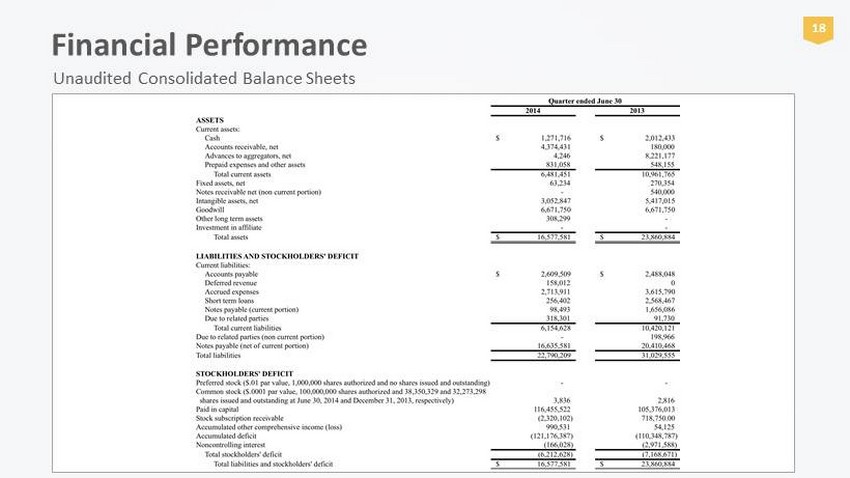

16 Financial Performance • We reported net income of $1,347,769 or $.04 per share, for the three months ended June 30, 2014 as compared with a net loss of ($20,231,697) or $(0.72) per share, for the three months ended June 30, 2013. Our net income for the three months ended June 30, 2014 was primarily the result of gains from restructuring of the MBF debt of $1,596,000, the net effect from Cayman Invest note conversion of $562,908, recovery of $352,993 in mobile operator penalties and a reduction in bad debt allowance of $1,640,111 for aggregator advances in our mobile payment processing business. • We reported a net loss of $2,245,559 or $.07 per share, for the six months ended June 30, 2014 as compared with a net loss of $23,465,528 or $0.83 per share, for the six months ended June 30, 2013. On September 25, 2013, we divested our entertainment assets and now operate a focused payment and technology business. • Liabilities were $22.8 million, a 40% decrease from $37.9 million at December 31, 2013. • Working capital increased $8.3 million from ($8.0) million at December 31, 2013 to $0.3 million at June 30, 2014 primarily resulting from restructuring our indebtedness. First Half of 2014 Results

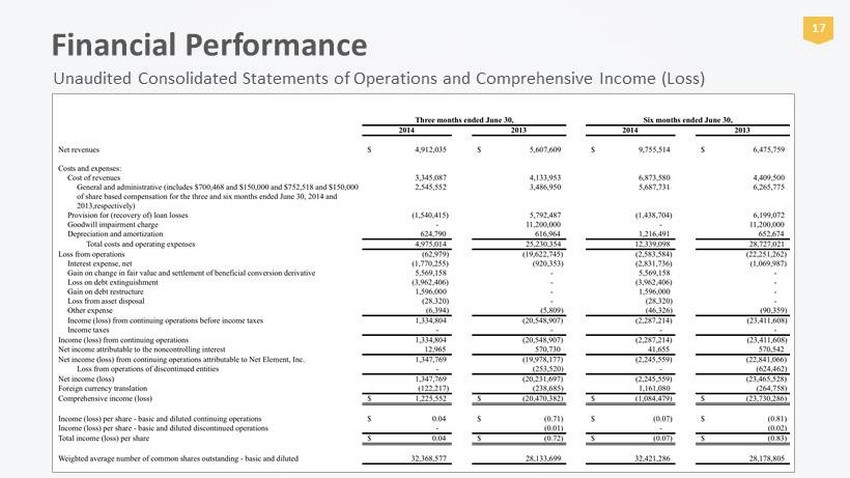

17 Financial Performance Unaudited Consolidated Statements of Operations and Comprehensive Income (Loss)

18 Financial Performance Unaudited Consolidated Balance Sheets

19 +1.305.507.8797 jn@netelement.com Jonathan New, CFO At Net Element we are committed to earning and keeping our clients and partners trust in everything we do, to that extent we promote transparency and open door policy. Have questions, do not hesitate to ask! twitter.com/netelement facebook.com/neteinternational www.netelement.com You can also find us at: Questions?