Attached files

| file | filename |

|---|---|

| 8-K - 8-K - WEST PHARMACEUTICAL SERVICES INC | form8kinvconfsept9-102014.htm |

1 West Pharmaceutical Services, Inc. Investor Presentation September 2014

2 Safe Harbor Statement Cautionary Statement Under the Private Securities Litigation Reform Act of 1995 This presentation and any accompanying management commentary contain “forward-looking statements” as that term is defined in the Private Securities Litigation Reform Act of 1995. Such statements include, but are not limited to, statements about expected financial results for 2014 and future years. Each of these estimates is based on preliminary information, and actual results could differ from these preliminary estimates. We caution investors that the risk factors listed under “Cautionary Statement” in our press releases, as well as those set forth under the caption "Risk Factors" in our most recent Annual Report on Form 10-K as filed with the Securities and Exchange Commission and as revised or supplemented by our quarterly reports on Form 10-Q, could cause our actual results to differ materially from those estimated or predicted in the forward-looking statements. You should evaluate any statement in light of these important factors. Except as required by law or regulation, we undertake no obligation to publicly update any forward-looking statements, whether as a result of new information, future events, or otherwise. Non-GAAP Financial Measures Certain financial measures included in these presentation materials, or which may be referred to in management’s discussion of the Company’s results and outlook, have not been calculated in accordance with generally accepted accounting principles (“GAAP”), and therefore are referred to as non-GAAP financial measures. Non-GAAP financial measures should not be considered in isolation or as an alternative to such measures determined in accordance with GAAP.

3 Today’s Presentation West: Long-established, still advancing Growing Packaging Systems franchise • Market growth drivers • Competitive advantages • High-value component products Evolving Delivery Systems businesses • Manufacturer of complex devices • Developing proprietary portfolio • Leading Products Strong financial position Third-quarter 2014 earnings release and conference call: October 30, 2014

4 Partnering with our pharmaceutical, device and biotechnology customers from their beginnings, we’ve grown… …to become the preeminent supplier of products used in containing and administering small-volume parenteral drugs

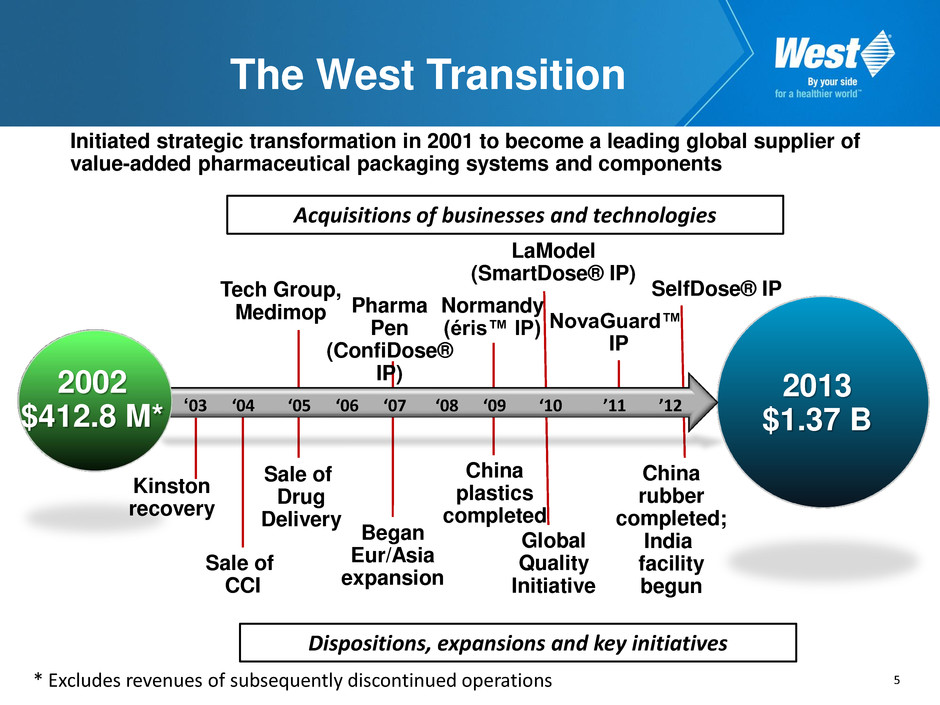

5 The West Transition Initiated strategic transformation in 2001 to become a leading global supplier of value-added pharmaceutical packaging systems and components ‘03 ‘04 ‘05 ‘06 ‘07 ‘08 ‘09 ‘10 ’11 ’12 2002 $412.8 M* 2013 $1.37 B Kinston recovery Sale of CCI Sale of Drug Delivery Tech Group, Medimop Began Eur/Asia expansion Pharma Pen (ConfiDose® IP) Normandy (éris™ IP) LaModel (SmartDose® IP) China plastics completed Global Quality Initiative SelfDose® IP China rubber completed; India facility begun * Excludes revenues of subsequently discontinued operations NovaGuard™ IP Acquisitions of businesses and technologies Dispositions, expansions and key initiatives

6 PHARMACEUTICAL / BIOTECHNOLOGY We are Proud to Serve Our Customers GENERIC MEDICAL DEVICE Industry-leading market shares in Europe and North America

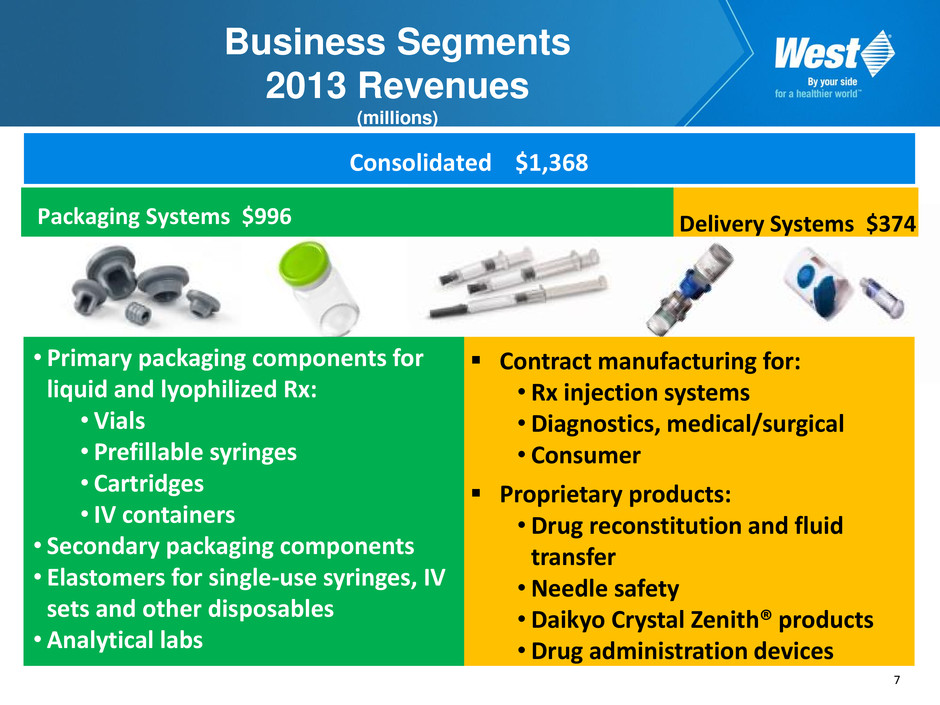

7 Business Segments 2013 Revenues (millions) Contract manufacturing for: • Rx injection systems • Diagnostics, medical/surgical • Consumer Proprietary products: • Drug reconstitution and fluid transfer • Needle safety •Daikyo Crystal Zenith® products • Drug administration devices • Primary packaging components for liquid and lyophilized Rx: • Vials • Prefillable syringes • Cartridges • IV containers • Secondary packaging components • Elastomers for single-use syringes, IV sets and other disposables • Analytical labs Packaging Systems $996 Delivery Systems $374 Consolidated $1,368

8 Competitive Advantages Pharmaceutical Packaging Category leader in mature end-markets “Designed-in” primary packaging barrier to entry Strong IP base - materials/process/manufacturing technology (HVPs) Global capabilities for global customers Key partnerships – Daikyo Seiko, West Mexico Delivery Systems Manufactures complex systems: Healthcare focus Engineering and tooling Established proprietary product sales: Strong Position in Devices Drug Reconstitution and Administration Needle Safety 2008 2009 2010 2011 2012 2013 Segment revenue (constant $)

9 Injectable Drug Growth: More, better, different Persistent growth of injectable therapeutics Increasing industry and regulatory standards: • Quality • Safety Changing point-of-care: • Patient focused - Ease of use • Needle safety Higher value per Rx and course of therapy Competitive end-markets: Differentiation • Global demographic, economic and healthcare policy changes

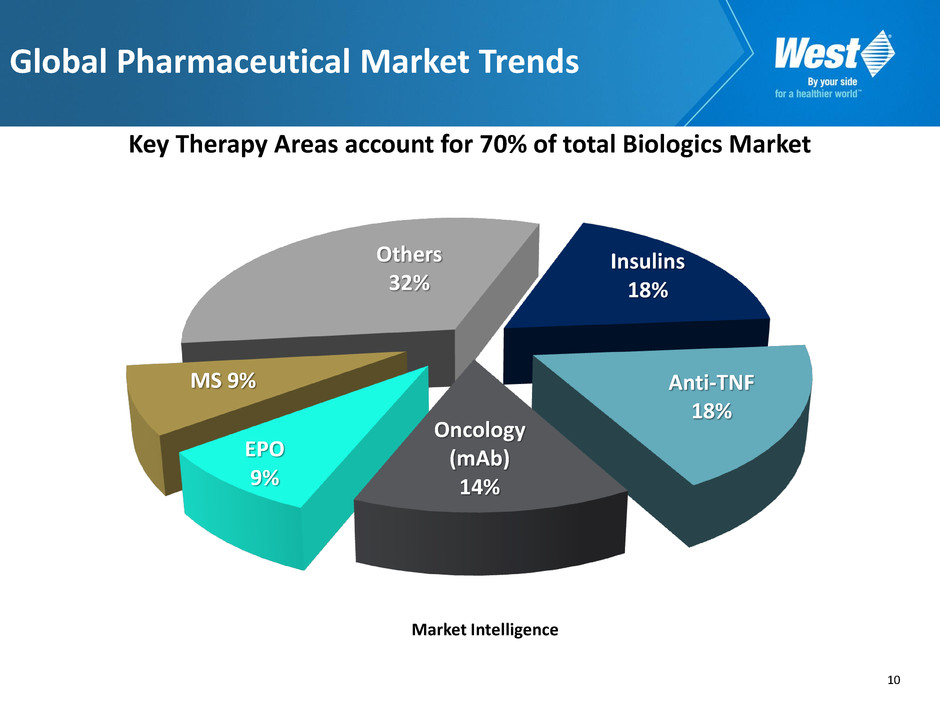

10 Key Therapy Areas account for 70% of total Biologics Market Global Pharmaceutical Market Trends Insulins 18% Anti-TNF 18% Oncology (mAb) 14% EPO 9% MS 9% Others 32% Market Intelligence

11 A Trusted Partner West and Daikyo Components The Top 50 Pharma and Biotech Companies rely on in the world • The top 35 injectable biologics rely on West and Daikyo components • > 130 million needle safety systems annually • > 100 million components and assemblies for pens and auto-injectors annually

12 Our Growth Initiatives 2014-2018 Daikyo Crystal Zenith® is a registered trademark of Daikyo Seiko, Ltd. *Average Selling Price Packaging Systems Delivery Systems High-value products: modest unit growth, increasing ASP* and margin Geographic expansion: China, India sourcing and end-markets Optimize global operating efficiency Build on Delivery Systems capabilities and proprietary products: Daikyo Crystal Zenith® Safety and administration aids Self-dosing devices/combination products

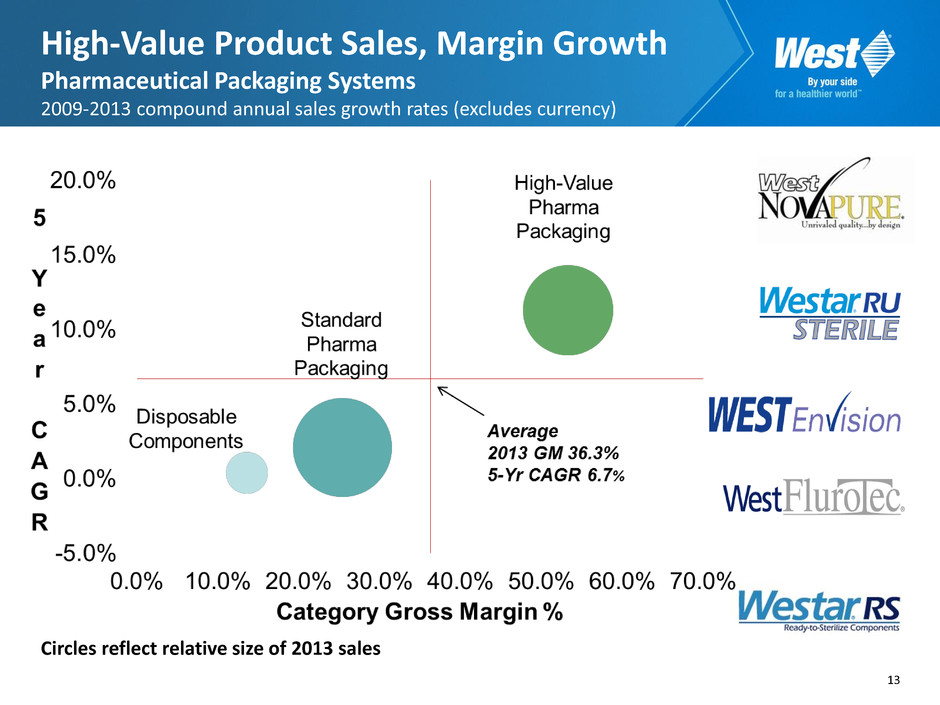

13 High-Value Product Sales, Margin Growth Pharmaceutical Packaging Systems 2009-2013 compound annual sales growth rates (excludes currency) Circles reflect relative size of 2013 sales

14 Our Growth Initiatives 2014-2018 Daikyo Crystal Zenith® is a registered trademark of Daikyo Seiko, Ltd. *Average Selling Price Packaging Systems Delivery Systems High-value products: modest unit growth, increasing ASP* and margin Geographic expansion: China, India sourcing and end-markets Optimize global operating efficiency Build on Delivery Systems capabilities and proprietary products: Daikyo Crystal Zenith® Safety and administration aids Self-dosing devices/combination products

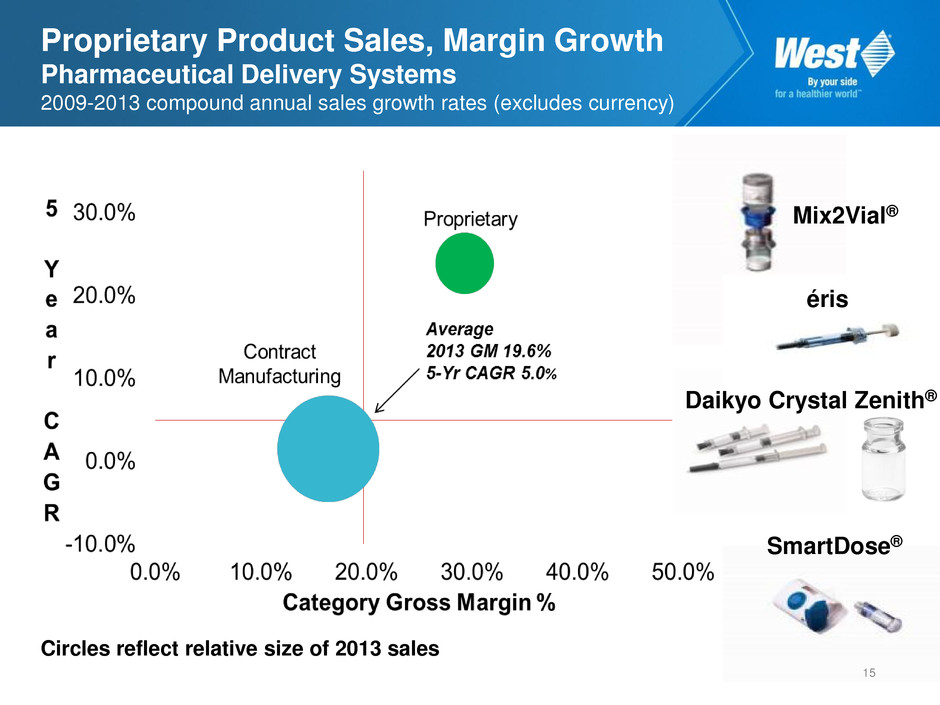

Proprietary Product Sales, Margin Growth Pharmaceutical Delivery Systems 2009-2013 compound annual sales growth rates (excludes currency) Circles reflect relative size of 2013 sales SmartDose® Mix2Vial® éris Daikyo Crystal Zenith® 15

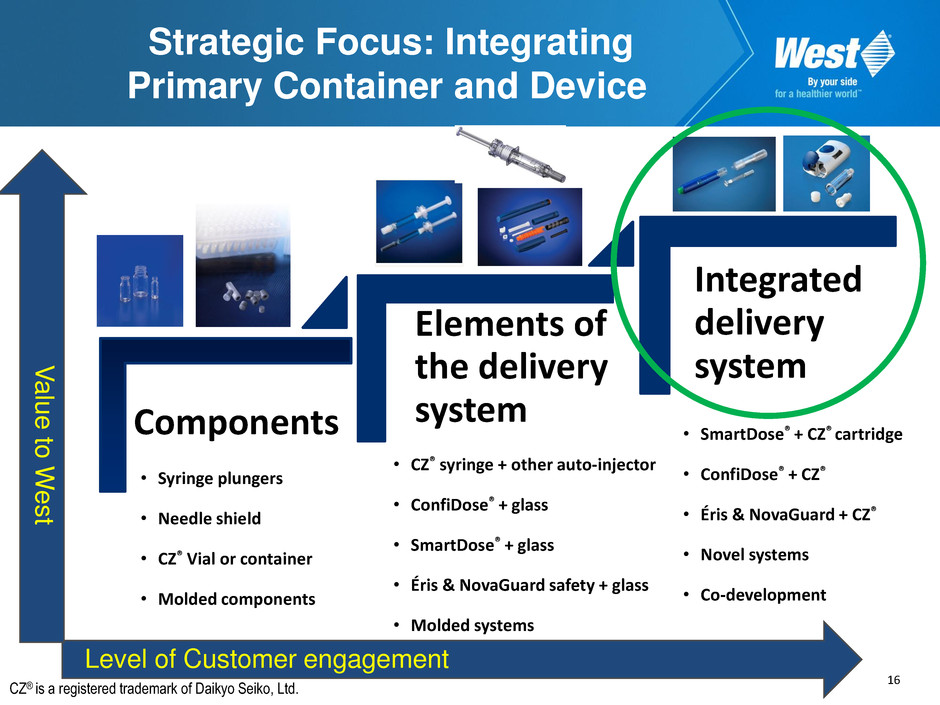

16 Strategic Focus: Integrating Primary Container and Device Components Elements of the delivery system Integrated delivery system • CZ® syringe + other auto-injector • ConfiDose® + glass • SmartDose® + glass • Éris & NovaGuard safety + glass • Molded systems • SmartDose® + CZ® cartridge • ConfiDose® + CZ® • Éris & NovaGuard + CZ® • Novel systems • Co-development Level of Customer engagement V alue to W e s t • Syringe plungers • Needle shield • CZ® Vial or container • Molded components CZ® is a registered trademark of Daikyo Seiko, Ltd.

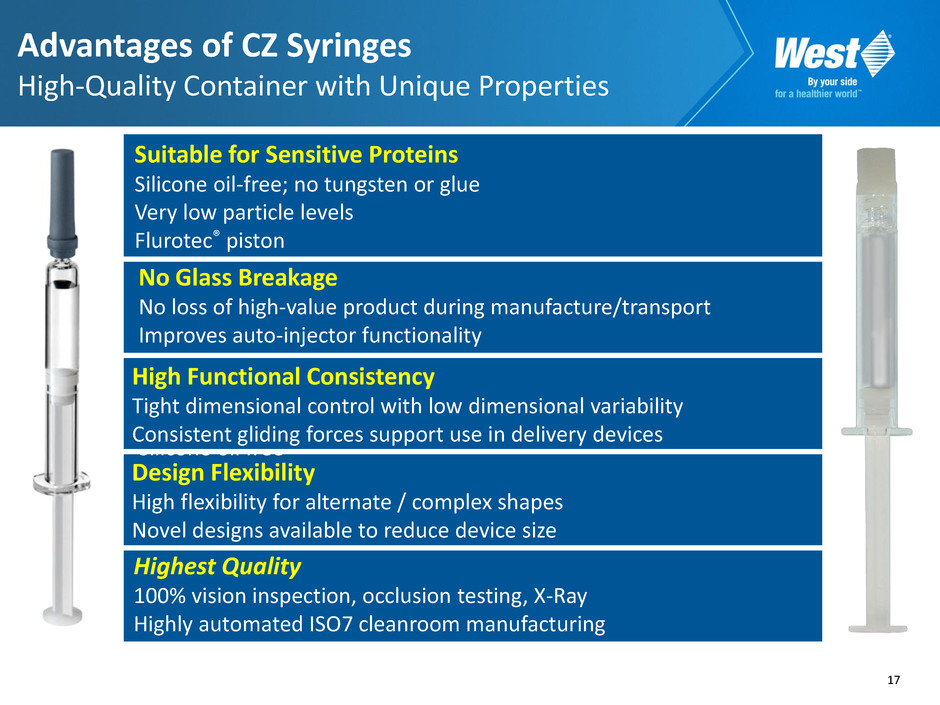

17 Design Flexibility High flexibility for alternate / complex shapes Novel designs available to reduce device size No Glass Breakage No loss of high-value product during manufacture/transport Improves auto-injector functionality — Minimized extractables and leachables Silicone oil free High Functional Consistency Tight dimensional control with low dimensional variability Consistent gliding forces support use in delivery devices Suitable for Sensitive Proteins Silicone oil-free; no tungsten or glue Very low particle levels Flurotec® piston Advantages of CZ Syringes High-Quality Container with Unique Properties Highest Quality 100% vision inspection, occlusion testing, X-Ray Highly automated ISO7 cleanroom manufacturing

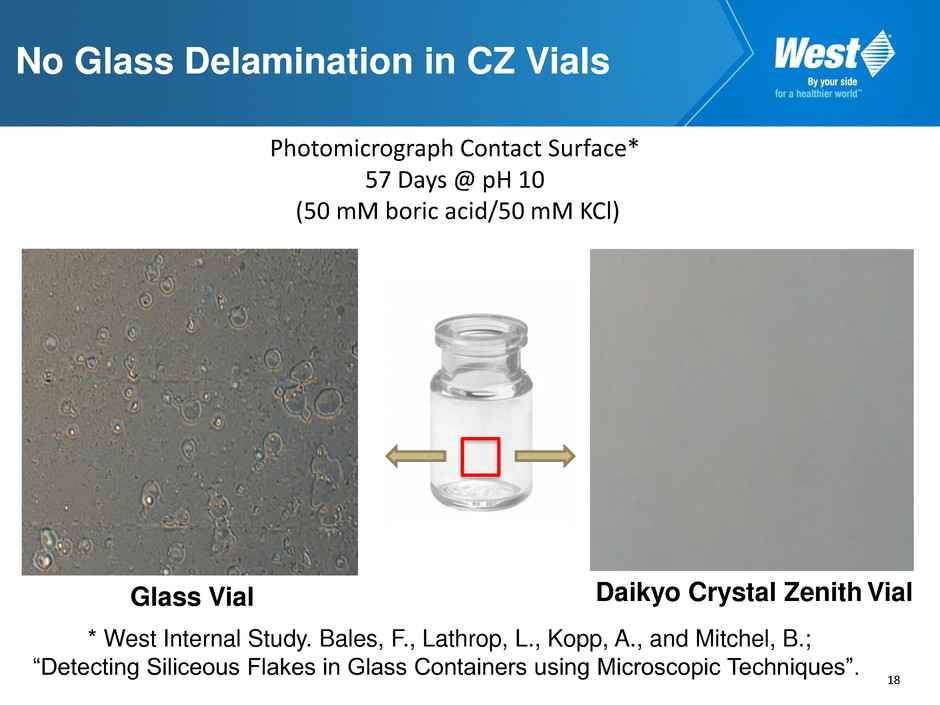

18 * West Internal Study. Bales, F., Lathrop, L., Kopp, A., and Mitchel, B.; “Detecting Siliceous Flakes in Glass Containers using Microscopic Techniques”. Photomicrograph Contact Surface* 57 Days @ pH 10 (50 mM boric acid/50 mM KCl) Daikyo Crystal Zenith Vial Glass Vial No Glass Delamination in CZ Vials

19 Daikyo Crystal Zenith Product Approvals Hyaluronic acid MRI contrast media Bone cement 6 Contrast Media 5 MRI 2 Hyaluronic Acid 1 Calcitonin 1 Proton pump inhibitor Oncology Anticoagulant Oncology Bisphosphonate Hyaluronic acid Oncology Bisphosphonate Bulk Container Japan MHLW Europe EMEA US FDA Calcitonin Bone cement Hyaluronic acid Over 100 drugs being evaluated with CZ at various stages Prefilled Polymer Syringes >80% market share in Japan* *2013 IMS Japan

20 Advanced large-volume injector for biologics • Tested on humans in a clinical study • Validated production line for clinical and commercial use Current capabilities • Up to 3.5 mL delivered volume • Delivery time from minutes to hours • Subcutaneous injection • Proven in numerous user studies • Single push-button operation • Fully programmable delivery time Crystal Zenith cartridge system Daikyo Flurotec piston and lined seal SmartDose Electronic Wearable Injector

21 2013 sales growth in key product/geographic categories (ex-Fx): • High-value products grew 9.9% ($38 million) • Proprietary devices grew 19.5% ($15 million) • Asia-Pacific sales grew 14.8% ($13 million) First-in-human trials of SmartDose • Development and supply agreement Geographic expansion • Completed China elastomers facility Commercial production initiated • Completed India metals facility Operating license issued We are Delivering on our Strategies

22 Take-away Messages Key partner to pharmaceutical, biotech, and med device customers “Sticky” core business – significant barriers to entry Strong competitive position • Diversified customer base • Maturing proprietary technology pipeline • Global footprint with strong position in fast growing Asia markets Financial strength to invest • Strong balance sheet and operating cash flow Performance-based incentive plans linked to growth capital efficiency

23 West Pharmaceutical Services, Inc.