Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - Vertex Energy Inc. | Financial_Report.xls |

| EX-31.1 - EXHIBIT 31.1 - Vertex Energy Inc. | a6302014-ex311.htm |

| EX-10.25 - EXHIBIT 10.25 - Vertex Energy Inc. | ex1025tsa-omegaxmtb.htm |

| EX-32.1 - EXHIBIT 32.1 - Vertex Energy Inc. | a6302014-ex321.htm |

| EX-10.23 - EXHIBIT 10.23 - Vertex Energy Inc. | ex1023myrtlegroveleasewexh.htm |

| EX-99.2 - EXHIBIT 99.2 - Vertex Energy Inc. | a6302014-ex992.htm |

| EX-32.2 - EXHIBIT 32.2 - Vertex Energy Inc. | a6302014-ex322.htm |

| EX-31.2 - EXHIBIT 31.2 - Vertex Energy Inc. | a6302014-ex312.htm |

| EX-10.24 - EXHIBIT 10.24 - Vertex Energy Inc. | ex1024omega-operationmanag.htm |

| 10-Q - 10-Q - Vertex Energy Inc. | a6302014-document.htm |

| EX-10.26 - EXHIBIT 10.26 - Vertex Energy Inc. | ex1026omegabangopurchasean.htm |

Exhibit 10.22

LAND LEASE

between

MARRERO TERMINAL LLC,

as Landlord

and

OMEGA REFINING, LLC,

as Tenant

Relating to the Used Motor Oil Re-Refinery

Located at 5000 River Road,

Marrero, Louisiana 70094

Dated as of April 30, 2008

TABLE OF CONTENTS

Page No.

1.1Lease. 2

1.2Condition of the Leased Premises. 2

1.3Joint Use Areas. 2

1.4Office/Warehouse and Parking Lot. 3

1.5Option Tract. 3

2.1Term. 3

2.2Renewal Options. 3

2.3Coterminous with Terminaling Agreement. 4

3.1Base Rent. 4

3.2Operating Expense Subsidy. 4

3.3Option to Pay Base Rent and the Operating Expense Subsidy in Arrears. 4

3.4Joint Use Area Costs. 5

3.5Rent. 6

3.6Late Charge. 6

3.7Net Lease. 6

3.8Prepayment of Base Rent and Operating Expense Subsidy. 6

3.9Independent Obligations. 6

4.1Quiet Possession. 6

Land Lease Page i

H-

10.22

5.1Use. 7

5.2Alterations. 7

5.3Maintenance and Repair of Plant and Leased Premises. 7

5.4Maintenance and Repair of Joint Use Areas. 7

6.1Personal Property Taxes. 7

6.2Impositions. 8

6.3Rent and Use Taxes. 8

6.4Other Taxes. 8

6.5Delinquency of Payment. 8

7.1Tenant’s Insurance. 9

7.2Landlord’s Insurance 9

7.3Subrogation. 9

8.1Utilities and Services. 9

9.1Compliance with Laws and Permits. 9

9.2Permits. 10

9.3Survival. 10

10.1Hazardous Materials. 10

10.2Notice to Landlord. 11

10.3Indemnification. 11

Land Lease Page ii

H-

10.22

10.4Disclaimer Regarding Pre-Existing Conditions. 12

10.5Survival. 12

11.1Tenant’s Indemnification, Waiver and Release. 12

11.2Landlord’s Indemnification. 13

12.1Liability of Landlord. 14

13.1Expropriation of Entire Leased Premises or Portions of the Storage Facility. 14

13.2Partial Expropriation/Continuation of Lease. 14

13.3Continuance of Obligations. 15

13.4Fire and Casualty Damage. 15

14.1Assignment and Subletting. 15

14.2Release of Tenant upon Assignment. 16

14.3Assignment by Landlord. 16

15.1Subordination. 16

15.2Waiver of Landlord’s Lien; Tenant’s Right to Encumber Leasehold Interest and Personal Property. 17

16.1Default. 17

16.2Landlord Remedies. 18

16.3Waiver. 18

16.4Bankruptcy or Insolvency. 19

Land Lease Page iii

H-

10.22

16.5Waiver by Tenant. 19

17.1Notices. 19

18.1Surrender of Leased Premises. 20

18.2No Surrender During Lease Term. 21

19.1Successors. 21

19.2Headings. 21

19.3Time of Essence. 21

19.4Invalidity. 21

19.5Attorney’s Fees. 21

19.6Governing Law. 21

19.7Entire Agreement. 21

19.8Authority. 21

19.9Servitudes. 22

19.10Landlord’s Liability. 22

19.11Recording of Lease. 22

19.12Estoppel Certificates. 22

19.13Force Majeure. 23

Land Lease Page iv

H-

10.22

EXHIBITS

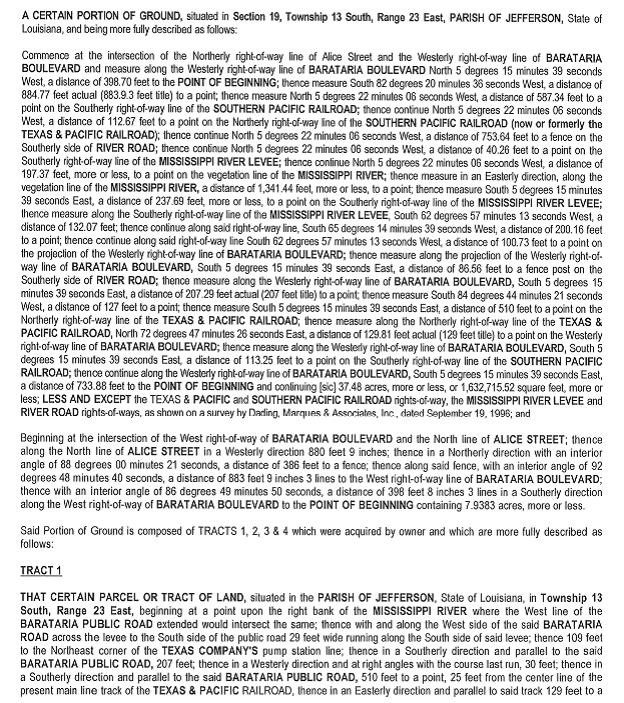

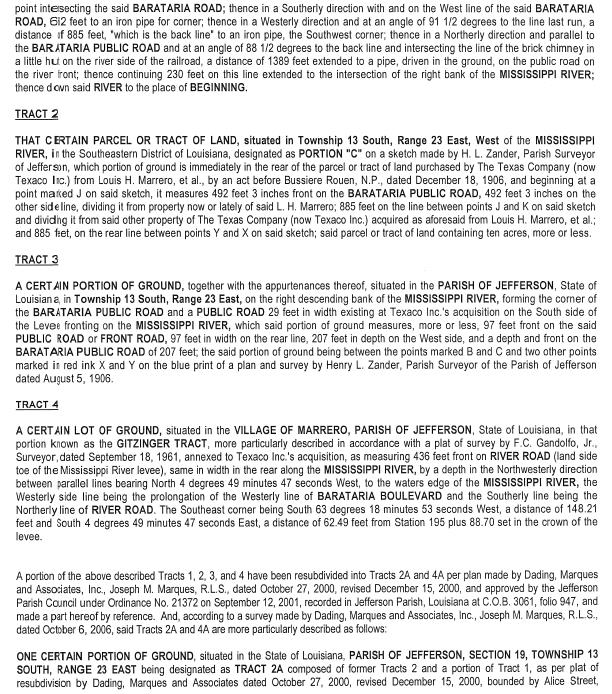

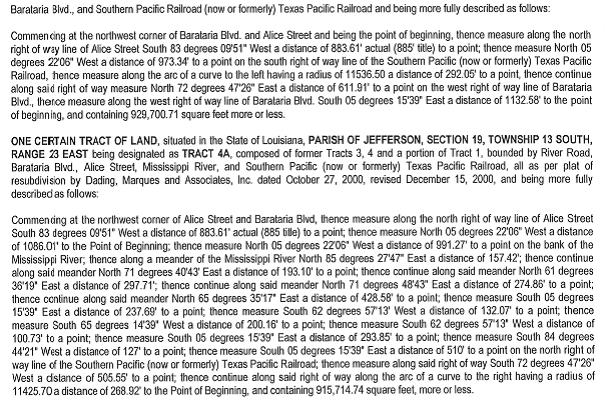

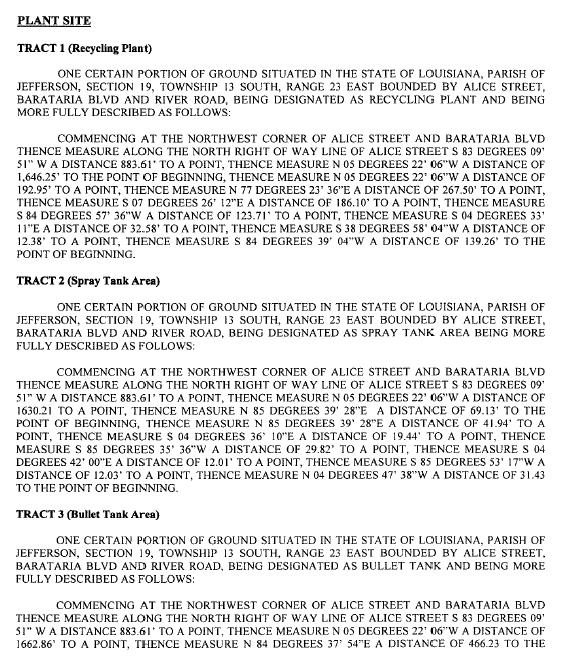

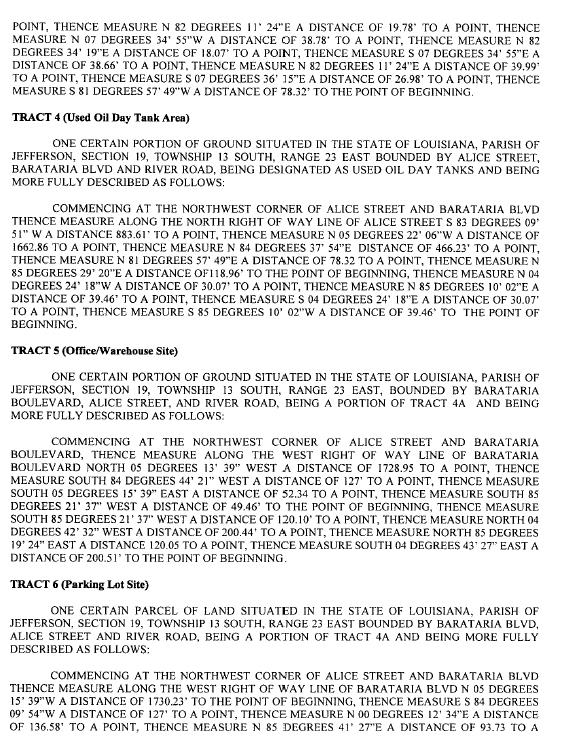

Exhibit A-1 – Description of Land

Exhibit A-2 – Description of Leased Premises

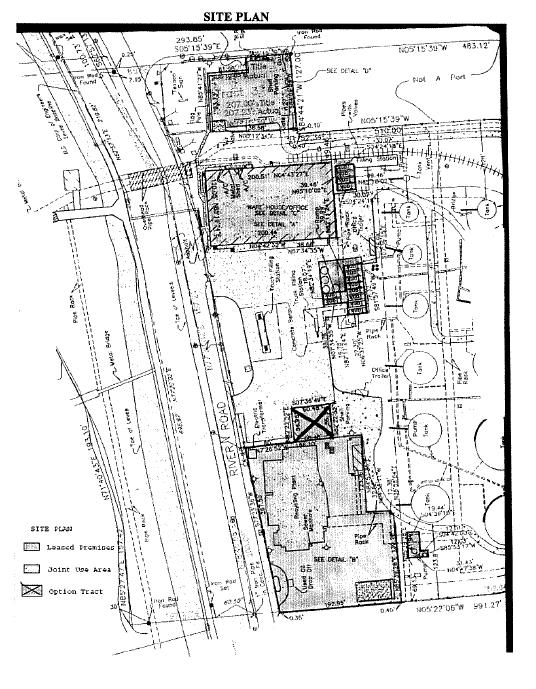

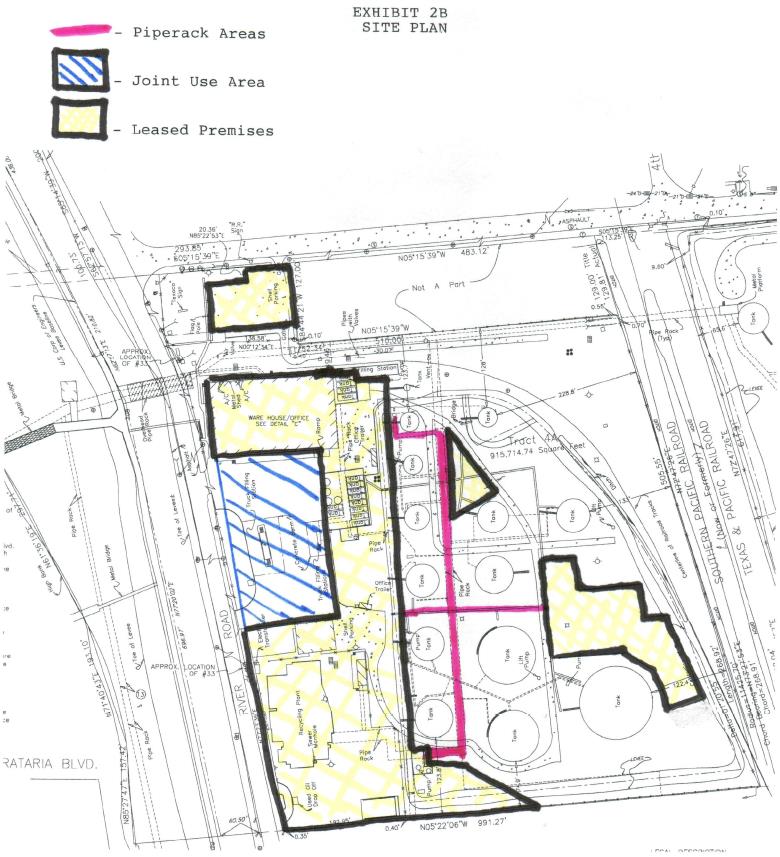

Exhibit B – Site Plan

Exhibit C – Office Space

Exhibit D – Insurance Requirements

Exhibit E – Form of Notice of Lease Agreement

Exhibit F – Tax Matrix

Land Lease Page v

H-

10.22

LAND LEASE

This LAND LEASE (this “Lease”), dated for reference purposes as of the 30th day of April, 2008 (the “Effective Date”), is made by and between MARRERO TERMINAL LLC, a Delaware limited liability company (“Landlord”), and OMEGA REFINING, LLC, a Delaware limited liability company (“Tenant”).

R E C I T A L S

A.Landlord is the owner of a tract of land situated in Marrero, Jefferson Parish, Louisiana on which is located a terminal and storage facility and related assets, and more particularly described in Exhibit A-1 attached hereto (the “Land”) and on which Landlord owns and operates a certain terminal and storage facility (together with the Land, the “Storage Facility”).

B.Tenant is the owner of certain refinery plant assets and equipment for the refining of used motor oil (the “Plant”) situated on a tract of land within the Land more particularly described as Tracts 1, 2, and 4 on Exhibit A-2 attached hereto (“Plant Site”).

C.Landlord is the owner of certain improvements situated on portions of the Land consisting of (i) a structure containing office space and a warehouse (“Office/Warehouse”) located on [Tract 4] described on Exhibit A-2 attached hereto (“Office/Warehouse Site”), and (ii) a parking lot located on [Tract 5] described on Exhibit A-2 attached hereto (“Parking Lot Site”) (the Plant Site, the Parking Lot Site and the Office/Warehouse Site, together with the Office/Warehouse, being referred to herein as the “Leased Premises”)

D.Pursuant to that certain Purchase and Sale Agreement (“PSA”) dated as of the date hereof, between Landlord and Tenant, Landlord has agreed to lease to Tenant the Leased Premises, together with the right to use and access certain common areas within the Storage Facility more particularly described below as the “Joint Use Areas”, on the terms and conditions set forth herein. The various components of the Leased Premises and the locations of the Joint Use Areas are further depicted on the site plan attached hereto as Exhibit B (“Site Plan”).

E.Landlord is also the owner of a portion of the Land located adjacent to the Plant Site and more particularly described in Exhibit A-3 attached hereto (“Option Tract”), for which Landlord has granted to Tenant an option to include as part of the Leased Premises in accordance with the terms provided herein.

F.Concurrent with the execution and delivery of this Lease, Landlord and Tenant have also executed (i) that certain Co-Employer and Shared Services Agreement, as the same may be renewed, extended, modified or amended (the “Shared Services Agreement”) relating to certain agreements of Tenant to provide and Landlord to purchase and pay for certain services to Landlord in connection with Landlord’s operation of the Storage Facility, and (ii) that certain Terminaling Services Agreement, as the same may be renewed, extended, modified or amended (the “Terminaling Agreement”) relating to Landlord’s agreement to provide terminaling and storage services to Tenant at the Storage Facility and Tenant’s commitment to store certain volumes of product at the Storage Facility (the Shared Services Agreement and the Terminaling Agreement are together referred to herein as the “Related Agreements”).

G.As an inducement to Landlord to enter into this Lease, Tenant has agreed to cause its affiliate, CAM2 International, LLC, a Colorado limited liability company, and Hammond Lubricant Works, Inc., an Indiana corporation (collectively, “Guarantor”) to unconditionally guarantee, jointly and severally, all of Tenant’s obligations under this Lease and the Related Agreements pursuant to that certain Guaranty Agreement (“Guaranty”) dated as of the Effective Date.

Land Lease Page 1

H-

10.22

NOW, THEREFORE, Landlord and Tenant agree as follows:

ARTICLE 1 – LEASE

1.1 Lease.

Landlord hereby leases the Leased Premises to Tenant and Tenant hereby leases the Leased Premises from Landlord, for the Term and subject to the agreements, conditions and provisions contained herein.

1.2 Condition of the Leased Premises.

(a) EXCEPT AS PROVIDED IN SECTION 10.4, TENANT HEREBY ACKNOWLEDGES THAT TENANT IS LEASING THE LEASED PREMISES, AND THE LEASED PREMISES SHALL BE LEASED TO TENANT, “AS IS, WHERE IS, AND WITH ALL FAULTS” AND SPECIFICALLY AND EXPRESSLY WITHOUT ANY WARRANTIES, REPRESENTATIONS, OR GUARANTEES, EITHER EXPRESS OR IMPLIED, OF ANY KIND, NATURE, OR TYPE WHATSOEVER FROM OR ON BEHALF OF LANDLORD, INCLUDING, WITHOUT LIMITATION, ANY RELATED TO COMPLIANCE WITH OR LIABILITIES UNDER ENVIRONMENTAL LAW.

(b) WITHOUT IN ANY WAY LIMITING THE GENERALITY OF THE PRECEDING SECTIONS 1.2(A), EXCEPT AS PROVIDED IN SECTION 10.4, TENANT SPECIFICALLY ACKNOWLEDGES AND AGREES THAT TENANT HEREBY WAIVES AND RELEASES ANY CLAIM TENANT HAS, MIGHT HAVE HAD, OR MAY HAVE AGAINST LANDLORD WITH RESPECT TO: THE CONDITION OF THE LEASED PREMISES, EXCEPT FOR ANY ARISING UNDER THE EXPRESS PROVISIONS OF THE RELATED AGREEMENTS, WHETHER SUCH CONDITION IS PATENT OR LATENT; COMPLIANCE WITH OR LIABILITIES UNDER ENVIRONMENTAL LAW; AND ANY OTHER STATE OF FACTS WHICH EXIST WITH RESPECT TO THE LEASED PREMISES.

(c) For purposes of this Lease: (i) the term “Environmental Law” means all Laws that regulate activities, conditions, or substances because of their effect or potential effect on public health and welfare and the environment, including those relating to the emission, discharge, release, treatment, storage, disposal, or transport of chemicals, wastes, or other materials, including without limitation, the Comprehensive Environmental Response, Compensation and Liability Act, 42 U.S.C. § 9601, et seq., the Resource Conservation and Recovery Act, 42 U.S.C. §§ 321, et seq., the Oil Pollution Act, 33 U.S.C. §§ 2702, et seq., the Clean Water Act, 33 U.S.C. §§ 1251, et seq., the Clean Air Act, 42 U.S.C. §§ 7401, et seq., the Toxic Substances Control Act, 15 U.S.C. §§2601 et seq., and the Endangered Species Act, 16 U.S.C. §§1531 et seq. and their state and local counterparts, if any; and (ii) the term “Laws” means all “statutes, rules, orders, ordinances, principles of common law, or other requirements of any governmental or quasi-governmental entity.

1.3 Joint Use Areas.

Landlord hereby grants to Tenant and its customers, agents, invitees and contractors, the non-exclusive right and license to use the Joint Use Areas, in common with Landlord and its customers, agents, invitees and contractors, for purposes of ingress and egress in connection with Tenant’s operation of the Plant or providing services to Landlord pursuant to the Related Agreements. Tenant’s use of the Joint Use Areas shall be subject to Landlord’s reasonable procedures, rules and regulations relating to security and safety for the Storage Facility and Joint Use Areas provided to Tenant in writing from time to time. The

Land Lease Page 2

H-

10.22

term “Joint Use Areas” shall mean those areas shown on the Site Plan as the Joint Use Areas, including the entry and exit areas on River Road, the truck dock and related driveways, and yard area.

1.4 Office/Warehouse and Parking Lot.

Landlord hereby reserves to itself, and Tenant hereby consents to Landlord's use of (a) certain portions of the Office/Warehouse for office and warehouse purposes, to be determined by the parties as necessary for Landlord's use as office and warehouse space from time to time, and (b) the Parking Lot for parking for employees and invitees. Landlord will not initially be charged rent or other costs or fees for such use; provided, however, if Landlord's requirements for use of office space, warehouse space or parking areas increase over time to the point that Landlord's use is substantially greater than it is at the Commencement Date, then Landlord and Tenant agree to amend this Lease to provide for a reasonable and equitable sharing of costs for operation, maintenance and repair of the Office/Warehouse and Parking Lot based on the extent of use by each party. Tenant agrees to use reasonable efforts to accommodate Landlord's needs for additional office or warehouse space or parking spaces, subject to availability and Tenant's needs. Tenant shall provide and pay for all utilities serving the Office/Warehouse and Parking Lot, subject to any future right of reimbursement by Landlord as provided in the previous sentence. Landlord shall provide for its own telephone and data services to any space utilized by it in the Office/Warehouse.

1.5 Option Tract.

Landlord hereby grants to Tenant the right and option to lease the Option Tract on the same terms and conditions as set forth herein. Upon delivery of written notice by Tenant to Landlord, the parties shall execute an amendment to this Lease wherein the Option Tract shall become part of the Leased Premises. No additional Rent shall be due with respect to the Option Tract, except for incremental Impositions that may be due pursuant to Section 6.2.

ARTICLE 2 – TERM AND COMMENCEMENT

2.1 Term.

The initial term of this Lease (and including any renewal term, referred to as the “Term”) shall be for a period commencing on the Effective Date and expiring at midnight on the five (5) year anniversary of the Term Commencement Date. For purposes hereof, the “Term Commencement Date” shall be April 30, 2008.

2.2 Renewal Options.

Tenant shall have the right to extend the initial Term of this Lease for up to sixteen (16) renewal periods of five (5) years each, with each being on the same terms and conditions set forth herein, except that the number of renewal periods remaining to be exercised shall, in each case, be reduced by one upon the exercise of a renewal option. As long as there remains additional rights to renew the Term of this Lease, unless Tenant elects not to exercise a renewal option as provided below, the Term of this Lease shall automatically be renewed for an additional period of five (5) years. If Tenant elects not to renew the Term of this Lease, Tenant must notify Landlord in writing that it is not renewing the Term at least 180 days prior to the expiration of the initial Term, or the then current renewal Term, as the case may be, or the Term will be deemed to be renewed for the next renewal Term.

2.3 Coterminous with Terminaling Agreement.

Land Lease Page 3

H-

10.22

Notwithstanding anything in this Lease to the contrary, upon the expiration or termination of the Terminaling Agreement for any reason, Landlord shall have the right, but not the obligation, to terminate this Lease effective upon the expiration or termination of the Terminaling Agreement.

ARTICLE 3 – RENT

3.1 Base Rent.

(a) Tenant covenants and agrees to pay to Landlord at its address for notice, in lawful money of the United States, without demand, offset or deduction rent (“Base Rent”) in the amounts set forth below during the Initial Term and each renewal Term, as applicable, per year.

(b) During the initial Term, Base Rent shall be payable in the amount of $1,800,000 per year, to be payable in monthly installments of $150,000 per month, in advance, with the first installment to be due and payable on the Term Commencement Date and all subsequent monthly installments to be due and payable on the first day of each month. If the first or last days of the initial Term are not the first or last days of a calendar month, as the case may be, then the Base Rent for such month(s) shall be prorated based on the number of days in the initial Term within such calendar month(s).

(c) During each renewal Term, Base Rent shall be payable in the amount of $1.00 per year, payable in advance on the anniversary date of the Term Commencement Date.

3.2 Operating Expense Subsidy.

As additional consideration for the execution of this Lease, Tenant agrees to pay and reimburse to Landlord, as additional rent, during the initial Term of this Lease (and not any renewal terms), a portion of Landlord’s operating expenses for the Storage Facility in the following amounts for each one year period of the initial Term, commencing with the Term Commencement Date (“Operating Expense Subsidy”):

Year | Operating Expense Subsidy |

1 | $471,000 |

2 | $314,000 |

3 | $235,000 |

4 | $157,000 |

5 | $78,500 |

The Operating Expense Subsidy will be payable monthly in advance, on the same dates as Base Rent, in an amount equal to one-twelfth (1/12th) of the applicable annual Operating Expense Subsidy amount.

3.3 Option to Pay Base Rent and the Operating Expense Subsidy in Arrears.

(a) Notwithstanding any provision in this Article 3 to the contrary, as long as (i) the Landlord is an affiliate of Pipestem Energy Group, LLC, and (ii) no Event of Default has occurred and is continuing, Tenant may pay Base Rent and the Operating Expense Subsidy (to the extent

Land Lease Page 4

H-

10.22

applicable) quarterly in arrears (instead of monthly in advance as provided in Sections 3.1 and 3.2 above) as set forth below, upon at least ten (10) days written notice to Landlord; provided, however, if during the first three (3) years of the Initial Term, Landlord is no longer an affiliate of Pipestem Energy Group, LLC, Tenant shall have the right to continue to pay Base Rent and the Operating Expense Subsidy quarterly in arrears in accordance with this Section 3.3 through the end of such three (3) year period. Tenant hereby notifies Landlord that it elects to pay Base Rent and the Operating Expense Subsidy quarterly in arrears as of the Term Commencement Date.

(b) If Tenant elects to pay Base Rent and the Operating Expense Subsidy quarterly in arrears, Tenant shall pay all Base Rent and the Operating Expense Subsidy (to the extent applicable) accrued through the last day of each calendar quarter on the first (1st) day of each succeeding calendar quarter, together with interest on the amount of Base Rent and the Operating Expense Subsidy (to the extent applicable) that would otherwise have become due as provided in Sections 3.1 and 3.2 above, accrued at the Applicable Rate (defined below).

(c) Upon the occurrence of an Event of Default, all accrued and unpaid Base Rent and Operating Expense Subsidy (to the extent applicable) that would have become due but for Tenant’s election under this Section 3.3, shall be immediately due and payable without additional notice, and thereafter Base Rent and Operating Expense Subsidy shall be due and payable as set forth in Sections 3.1 and 3.2 above. Effective thirty (30) days following written notice by Landlord of a sale of the Storage Facility to an unaffiliated third party, all accrued and unpaid Base Rent and Operating Expense Subsidy that would have become due but for this Section 3.3, shall be due and payable, and thereafter Base Rent and Operating Expense Subsidy shall be due and payable as set forth in Sections 3.1 and 3.2 above.

(d) As used in this Section 3.3, the term “Applicable Rate” means the lesser of (i) 0.5% in excess of the average rate of interest charged by Landlord’s lenders under Landlord’s acquisition and working capital loan facilities related to its acquisition and operation of the Storage Facility during any period of calculation, and (ii) the highest lawful rate of interest under applicable law. Landlord shall deliver an invoice to Tenant setting forth the calculation of the payment of Base Rent and Operating Expenses Subsidy (to the extent applicable) due hereunder, not less than five (5) days prior to the date such payment is due. If at any time Landlord does not have any debt with respect to the Storage Facility, then the Applicable Rate shall be the lesser of (A) 0.5% in excess of the Prime Rate set forth in “Money Rates” section of The Wall Street Journal, and (ii) the highest lawful rate of interest under applicable law.

3.4 Joint Use Area Costs.

Tenant agrees to pay and reimburse to Landlord, as additional rent hereunder, a portion of Landlord’s costs to operate, maintain and repair the Joint Use Areas (“Joint Use Area Costs”) within thirty (30) days following invoice therefor, such invoice to be accompanied by reasonable supporting documentation of the Joint Use Areas Costs. Landlord shall only invoice Tenant once each calendar year for Joint Use Area Costs, unless an unusually large capital expenditure is necessary. Initially, Tenant’s share of the Joint Use Area Costs shall be 50%, but this percentage shall be equitably adjusted by the parties hereto from time to time to reflect each parties relative percentage use of the Joint Use Areas. Landlord and Tenant agree to reasonably cooperate with each other to determine the appropriate sharing percentage. Landlord further agrees to provide written notice to Tenant of any contemplated capital expenditure for repair or replacement of any portion of the Joint Use Areas in excess of $50,000.

Land Lease Page 5

H-

10.22

3.5 Rent.

All other amounts due by Tenant to Landlord under this Lease (including any amounts that Landlord advances to satisfy any of Tenant’s obligations hereunder) (referred to herein as “Additional Rent”), shall be, unless otherwise provided, due and payable within fifteen (15) days of written notice thereof to Tenant, and all such Additional Rent, together with the Base Rent, the Operating Expense Subsidy and the Joint Use Area Costs, shall be referred to herein as “Rent”.

3.6 Late Charge.

If Tenant fails to pay any installment of Rent or any other amount due hereunder within ten (10) days after the date the payment is due, Tenant covenants and agrees to pay a late charge equal to three percent (3%) of the delinquent rent payment. The late charge shall be paid within ten (10) days after Landlord’s written request therefor.

3.7 Net Lease.

Except as otherwise provided in the Related Agreements, it is the intention of Landlord and Tenant that all rent paid to Landlord shall be absolutely net; that is, all costs, expenses and obligations of every kind relating directly or indirectly in any way, foreseen or unforeseen, to Tenant’s use, occupancy, possession, maintenance, repair and replacement of the Leased Premises, or any part thereof, which may arise or become due during the Term shall be paid by Tenant and that Landlord shall be indemnified by Tenant therefrom. Notwithstanding any provision herein to the contrary, Landlord and Tenant acknowledge that the respective obligations of Landlord and Tenant to the other under this Lease and the Related Agreements are in certain respects interrelated and interdependent, but that a default or breach by Landlord of its obligations under the Related Agreements shall only give rise to a defense to Tenant’s performance, or right of offset against payment, of its obligations hereunder to the extent such claims against Landlord under the Related Agreements have been finally determined by a court of competent jurisdiction or by arbitration under the terms of the Related Agreements to a liquidated sum (an “Adjudicated Claim”).

3.8 Prepayment of Base Rent and Operating Expense Subsidy.

Tenant shall have the right at any time during the initial Term, at its option, to prepay all of the Base Rent and the Operating Expense Subsidy remaining to become due during the initial Term. Such prepayment will be without any discount for time value of money.

3.9 Independent Obligations.

Any term or provision of this Lease to the contrary notwithstanding, the covenants and obligations of Tenant to pay Rent hereunder shall be independent from any obligations, warranties or representations, express or implied, if any, of Landlord herein contained or in the Related Agreements, except to the extent of any Adjudicated Claims.

ARTICLE 4 – QUIET POSSESSION

4.1 Quiet Possession.

Provided no Event of Default (hereinafter defined) by Tenant has occurred and is continuing, Landlord covenants and agrees to keep Tenant in quiet possession and enjoyment of the Leased Premises and the Joint Use Areas during the Term, as the same may be renewed and extended as provided herein.

Land Lease Page 6

H-

10.22

ARTICLE 5 – USE, ALTERATIONS, MAINTENANCE AND REPAIRS

5.1 Use.

Tenant shall be permitted to use the Leased Premises and Joint Use Areas only for uses associated with the operation of the Plant (and other uses provided such uses are similar or related to Tenant’s current use) and performance of the Related Agreements, and Tenant’s use shall be in compliance with all Laws applicable to the Leased Premises and the Joint Use Areas affecting Tenant’s use and the Leased Premises, and for no other use or purpose without the prior written consent of Landlord, which consent shall not be unreasonably withheld, conditioned or delayed.

5.2 Alterations.

Tenant shall be permitted to make such alterations and modifications to the Plant on the Leased Premises as it desires, including by way of example and not limitation, a hydrotreater, a hydrocracker, a propane de-asphalting unit, and miscellaneous grease and lubricant manufacturing equipment ("Proposed Alterations"), , without the consent of Landlord, provided that Tenant gives Landlord reasonable notice and that all such alterations or modifications are performed and completed in a safe and prudent manner, in accordance with all Laws, and in such a manner not to adversely affect or impair Landlord’s operations at the Storage Facility or its ability to perform its obligations under the Related Agreements. Tenant shall be permitted to make alterations and modifications to the Office/Warehouse, the Parking Lot and other improvements on the Leased Premises owned by Landlord, with the prior written consent of Landlord, not to be unreasonably withheld, and provided further that Tenant gives Landlord reasonable notice and that all such alterations or modifications are performed and completed in a safe and prudent manner, in accordance with all Laws, and in such a manner not to adversely affect or impair Landlord’s operations at the Storage Facility or its ability to perform its obligations under the Related Agreements. Tenant will be solely responsible, for any liabilities or obligations arising out of the construction or operation of such alterations or modifications. Landlord will cooperate with Tenant to the extent required by regulatory or other governmental authorities with jurisdiction over any such alterations or modifications at no cost to Landlord apart from administrative assistance, and with respect to any air quality permitting requirements associated with the Proposed Alterations, Landlord agrees that any new construction, alterations or modifications being made or proposed by Landlord to the Storage Facility will not adversely affect Tenant's ability to obtain such air quality permits, it being agreed that the Proposed Alterations will have priority over any alterations to the Storage Facility planned or constructed by Landlord with respect to air quality permits; provided that the Proposed Alterations are completed during the initial Term of this Lease.

5.3 Maintenance and Repair of Plant and Leased Premises.

Tenant agrees that, at its own expense, it will keep and maintain the Office/Warehouse and the Parking Lot, in a condition and repair similar to, but not less than, its condition and repair on the Term Commencement Date hereof, reasonable wear and tear excepted. Tenant shall be responsible for disposal of its trash from the Leased Premises. Tenant further agrees to keep and maintain the Plant in good and operable condition in accordance with Laws.

5.4 Maintenance and Repair of Joint Use Areas.

Landlord agrees, at its own expense (but subject to reimbursement under Section 3.4), to keep and maintain the Joint Use Areas is good, safe and operable condition in compliance with all applicable Laws.

ARTICLE 6 – TAXES

Land Lease Page 7

H-

10.22

6.1 Personal Property Taxes.

Tenant covenants and agrees to pay before delinquency all taxes that become payable during the Term which are levied or assessed upon the Plant or any of Tenant’s equipment, furniture, fixtures and Tenant’s other personal (movable) property installed or located in or on the Leased Premises. To the extent that the Plant (or portions thereof) are or can be assessed as personal property for ad valorem tax purposes, Tenant shall, promptly following the Term Commencement Date, undertake to have the Plant assessed separately from the Storage Facility such that Tenant is primarily and directly responsible to all taxing authorities that assess taxes against the Plant (as opposed to the Leased Premises) and Tenant receives all tax bills and notices with respect to the Plant.

6.2 Impositions.

Tenant covenants and agrees to pay to Landlord, as additional Rent, the allocable portion of Impositions (hereinafter defined) attributable to the Leased Premises. Landlord and Tenant acknowledge and agree that the Leased Premises is not separately assessed for property tax purposes and Tenant’s allocable share of Impositions allocable to land will be calculated based upon the proportion of the area of the Leased Premises compared to the entire tax parcel on which Landlord’s Impositions are assessed, and that Tenant’s share of Impositions allocable to improvements within the Leased Premises shall be the full assessed value of such improvements. If the improvements located on the Leased Premises are not separately assessed and valued by the taxing authorities, then Landlord and Tenant will cooperate and use reasonable efforts to agree on a value of those improvements or an allocation of such value compared with the value of all improvements located on the Land for purposes of determining Tenant’s allocable share of Impositions attributable to the improvements located on the Leased Premises. “Impositions” as used herein are defined as all real (immovable) property taxes and other charges, impositions, fees, and levies against the Land and any improvements located thereon (including any payments in lieu of taxes), whether any of the foregoing are general or specific, ordinary or extraordinary, foreseen or unforeseen which at any time during the Term may be or may have been assessed, levied, confirmed, imposed upon or become a lien on the Land, or any part thereof. Tenant shall pay to Landlord its allocable share of the Impositions within fifteen (15) days after written request from Landlord, such request to be accompanied by copies of tax statements and a calculation of the amount due. Upon request by Tenant, Landlord shall make available to Tenant and its representatives, Landlord’s books and records relating to the calculation of Tenant’s share of Impositions as reflected in the written request for payment submitted by Landlord to Tenant.

6.3 Rent and Use Taxes.

Tenant covenants and agrees to reimburse Landlord for all charges, taxes or other fees arising out of or in connection with Tenant's use or occupancy of the Leased Premises or Tenant's rental payments to Landlord, other than income or other taxes (excluding franchise or corporate income taxes payable by Landlord as a result of or with respect to this Lease) imposed on Landlord based on Landlord's income.

6.4 Delinquency of Payment.

If Tenant fails to pay Impositions to Landlord within thirty (30) days after written request therefrom, such delinquent amounts shall bear interest until paid at the lesser of the rate of fifteen percent (15%) per annum, or the maximum non-usurious rate permitted by Law (“Default Rate”).

ARTICLE 7 – INSURANCE

Land Lease Page 8

H-

10.22

7.1 Tenant’s Insurance.

Tenant shall maintain the insurance coverages in accordance with Exhibit D.

7.2 Landlord’s Insurance

Landlord agrees to carry or cause to be carried during the term hereof any and all insurance coverages required to be obtained and maintained by Landlord or any of its Affiliates under any of the Related Agreements, and, to the extent not specifically provided therein, commercial general liability insurance providing coverage of not less than the limits for Tenant for such insurance set forth in Exhibit D.

7.3 Subrogation.

Notwithstanding any provisions contained in this Lease to the contrary, each party hereto waives all claims for recovery from the other party, its officers, agents or employees for any loss or damage (whether or not such loss or damage is caused by negligence of the other party) to any of its real or personal property insured under the valid and collectible insurance policies to the extent of the collectible recovery under such insurance.

ARTICLE 8 – UTILITIES AND SERVICES

8.1 Utilities and Services.

Tenant shall pay and arrange for all utilities and other services to the Plant and Leased Premises, at no cost to Landlord. Landlord will reasonably cooperate with Tenant regarding the provision and continuation of all existing utility services serving the Plant and Leased Premises. Except as provided in Section 19.13, in the event Tenant breaches its responsibility under the section, including failing to adequately serve the Plant or Leased Premises, Landlord may notify Tenant of such breach, and, if, within twenty (20) days of receipt of such notice, Tenant fails to cure that breach, Landlord may take steps necessary to cure that breach and Tenant shall be responsible for all costs Landlord incurs to effect that cure.

ARTICLE 9 – COMPLIANCE WITH LAWS AND PERMITS

9.1 Compliance with Laws and Permits.

Except as limited by Section 10.4, and except to the extent any non-compliance may be caused by Landlord’s acts or omissions, Tenant covenants that it shall, throughout the Term of this Lease, and at Tenant’s sole cost and expense, comply or cause compliance with, and prevent liabilities from arising under, Laws, including Environmental Law, applicable or relating to Tenant’s ownership, leasing and operation of the Plant and the Leased Premises, notwithstanding whether the compliance, and the costs and expenses necessitated thereby shall have been foreseen or unforeseen, ordinary or extraordinary, and whether or not the same shall be presently within the contemplation of Landlord or Tenant or shall involve any change of governmental policy, or require structural or extraordinary repairs, alterations or additions by Tenant and irrespective of the costs thereof. In the event any such non-compliance or liabilities should be discovered, Tenant, at its sole cost and expense, shall take immediate steps to cure the non-compliance or to eliminate the liabilities. In the event Tenant breaches its responsibility under the section, including failing to adequately serve the Plant, Landlord may notify Tenant of such breach.

9.2 Permits.

Land Lease Page 9

H-

10.22

Tenant covenants that it shall at its own expense procure, maintain in effect, and comply with all conditions of any and all permits, licenses, authorizations, registrations, and other governmental and regulatory approvals (collectively, “Permits”) required for Tenant’s use of the Leased Premises and the Plant, including, without limitation, those relating to the discharge of stormwater or processing of wastewater, either directly or indirectly through a treatment works owned by a governmental entity, the emission of air contaminants, or the handling of any materials of any kind, including without limitation, chemicals and wastes, that are regulated under Environmental Law (collectively, “Hazardous Materials”), Tenant and Landlord shall cooperate and coordinate with each other as necessary to insure that both the Storage Facility and the Plant obtain and maintain Permits required for each to operate.

9.3 Survival.

The respective rights and obligations of Landlord and Tenant under this Article 9 shall survive the expiration or earlier termination of this Lease.

ARTICLE 10 – HAZARDOUS MATERIALS

10.1 Hazardous Materials.

(a) Except as provided in Section 10.4, Tenant shall, handle, treat, deal with and manage any and all Hazardous Materials in, on, under or about the Leased Premises not only in accordance with all applicable Environmental Law, but also in accordance with prudent industry practices regarding the management of such Hazardous Materials. With regard to the disposal of any Hazardous Materials offsite, Tenant is, and shall be named as, the generator (and in no way shall responsibility for any such materials be attributed to Landlord) and shall be the signatory of any required manifests and shall not dispose of any such materials except in compliance with Environmental Law using authorized transporters and disposal facilities.

(b) Except as provided in Section 10.4, upon expiration or earlier termination of this Lease, Tenant covenants to cause all Hazardous Materials to be removed from the Leased Premises, which shall include decontamination of all equipment, and transported for use, storage or disposal in accordance and in compliance with applicable Environmental Law. In addition, at Landlord’s request, upon expiration or earlier termination of this Lease, Tenant shall remove all tanks and other equipment and fixtures that were placed on the Leased Premises prior to or during the term of this Lease and that contain, have contained or are contaminated with, Hazardous Materials, and shall, at Tenant’s expense, restore the Leased Premises to the same or substantially similar condition as existed prior to the placement of such tanks, equipment or fixtures, normal wear and tear and damage by the elements, fire and other casualty excepted. Notwithstanding the foregoing, Tenant shall not be required to remove the concrete pad underlying the Plant.

(c) Tenant shall not take any remedial action in response to the presence of any Hazardous Materials in, on, about or under the Leased Premises or in any improvements situated on the Leased Premises, nor enter into any settlement agreement, consent, decree or other compromise in respect to any claims relating to or in any way connected with the Leased Premises or the improvements on the Leased Premises without first notifying Landlord of Tenant’s intention to do so and affording Landlord ample opportunity to appear, intervene or otherwise appropriately assert and protect Landlord’s interest with respect thereto.

(d) Tenant shall not place any underground storage tanks on the Leased Premises without Landlord’s prior written consent, which consent shall be in Landlord’s sole discretion.

Land Lease Page 10

H-

10.22

10.2 Notice to Landlord.

Tenant shall immediately notify Landlord in writing of (a) any enforcement, clean-up, removal or other governmental or regulatory action instituted, completed or threatened against Tenant, the Leased Premises or any part thereof pursuant to any Environmental Law; (b) any claim made or threatened by any person against Tenant, Landlord or the Leased Premises relating to damage, contribution, cost recovery, compensation, loss or injury resulting from or claimed to result from any Hazardous Materials; (c) any reports made to any environmental agency arising out of or in connection with any Hazardous Materials in, on or about or under the Leased Premises or with respect to any Hazardous Materials removed from the Leased Premises, including, any complaints, notices, warnings, reports or asserted violations in connection therewith; and (d) the discovery of any Hazardous Materials on the Leased Premises that are or may be in violation of Environmental Law, other than Hazardous Materials described and disclosed in Exhibit D to the PSA. Tenant shall also provide to Landlord, as promptly as possible, and in any event within five (5) business days after Tenant first received or sent the same, copies of all claims, reports, complaints, notices, warnings or asserted violations relating in any way to the Leased Premises or Tenant’s use thereof. Upon written request of Landlord (to enable Landlord to defend itself from any claim or charge related to any Environmental Law), Tenant shall promptly deliver to Landlord notices of hazardous waste manifests reflecting the legal and proper disposal of all such Hazardous Materials removed from the Leased Premises.

10.3 Indemnification.

TENANT SHALL INDEMNIFY, DEFEND (WITH COUNSEL REASONABLY ACCEPTABLE TO LANDLORD), PROTECT AND HOLD HARMLESS LANDLORD AND EACH OF LANDLORD’S OFFICERS, DIRECTORS, PARTNERS, MANAGERS, EMPLOYEES, MEMBERS, SHAREHOLDERS, AGENTS, SUCCESSORS AND ASSIGNS (“LANDLORD PARTIES”) FROM AND AGAINST ANY AND ALL CLAIMS, LIABILITIES, DAMAGES, COSTS, PENALTIES, FORFEITURES, LOSSES OR EXPENSES (INCLUDING, BUT NOT LIMITED TO, ATTORNEYS’ AND EXPERTS’ FEES) FOR DEATH OR INJURY TO ANY PERSON OR DAMAGE TO OR DIMINUTION IN VALUE OF ANY PROPERTY WHATSOEVER, INCLUDING NATURAL RESOURCES AND THE ENVIRONMENT, AND FOR COSTS OF INVESTIGATION, REMEDIATION, AND POST-REMEDIATION CARE, E.G., GROUND WATER MONITORING, AND FOR COSTS OF DECONTAMINATING TANKS AND OTHER EQUIPMENT AND FIXTURES ON THE LEASED PREMISES ARISING OR RESULTING IN WHOLE OR IN PART, DIRECTLY OR INDIRECTLY, FROM THE OPERATION OF TENANT’S BUSINESS ON THE LEASED PREMISES OR THE JOINT USE AREAS, FROM THE PRESENCE OR DISCHARGE OF HAZARDOUS MATERIALS IN, ON, UNDER, UPON OR FROM THE LEASED PREMISES OR THE IMPROVEMENTS OR EQUIPMENT LOCATED THEREON OR FROM THE TRANSPORTATION OR DISPOSAL OF HAZARDOUS MATERIALS TO OR FROM THE LEASED PREMISES, OR FROM THE ARRANGEMENT FOR DISPOSAL OR DISPOSAL OF ANY SUCH MATERIALS OCCURING OR ARISING FROM AND AFTER THE TERM COMMENCEMENT DATE, BUT EXCLUDING SUCH LIABILITY TO THE EXTENT IT ARISES SOLELY FROM OR IS SOLELY ATTRIBUTABLE TO THE ACTS OR OMISSIONS OF LANDLORD PARTIES. FOR PURPOSES OF THE INDEMNITY PROVIDED HEREIN, ANY ACTS OR OMISSIONS OF TENANT, OR ITS EMPLOYEES, AGENTS, CUSTOMERS, SUBLESSEES, ASSIGNEES, CONTRACTORS OR SUBCONTRACTORS OF TENANT, BUT EXCLUDING ANY EMPLOYEES OF LANDLORD OR UNDER LANDLORD’S CONTROL PURSUANT TO THE SHARED SERVICES AGREEMENT (WHETHER OR NOT THEY ARE NEGLIGENT, INTENTIONAL, WILLFUL OR UNLAWFUL) SHALL BE STRICTLY ATTRIBUTABLE TO TENANT. THE INDEMNITY OBLIGATIONS OF TENANT UNDER THIS SECTION 10.3 SHALL BE THE EXCLUSIVE INDEMNITY PROVIDED BY TENANT UNDER THIS LEASE WITH RESPECT TO THE SUBJECT MATTER OF THIS ARTICLE 10, AND SHALL SPECIFICALLY EXCLUDE AND

Land Lease Page 11

H-

10.22

SHALL NOT OVERLAP WITH THE INDEMNITY OBLIGATIONS OF TENANT UNDER SECTION 11.1. THE INDEMNITY OBLIGATIONS OF TENANT UNDER THIS SECTION 10.3 SHALL SURVIVE THE EXPIRATION OR EARLIER TERMINATION OF THIS LEASE.

10.4 Disclaimer Regarding Pre-Existing Conditions.

Notwithstanding any provision herein to the contrary, Landlord and Tenant acknowledge and agree that (a) Landlord has acquired the Storage Facility contemporaneous with the execution of this Lease and has not owned or operated the Storage Facility prior to the Effective Date; (b) Tenant has acquired the Plant and is leasing the Leased Premises contemporaneous with the execution of this Lease and has not owned or operated the Plant or leased the Leased Premises prior to the Effective Date; (c) Tenant shall not be liable for or be required to remove, remediate, or otherwise deal with, any Hazardous Materials that were existing on the Leased Premises on the date of this Lease (“Pre-Existing Environmental Conditions”), and (d) Tenant’s indemnity set forth in Section 9.4 above shall not be applicable to Pre-Existing Environmental Conditions; provided, however, that Tenant shall have the burden of proof to establish that any Pre-Existing Environmental Conditions that are the subject of a claim for indemnity under Section 10.3 existed on or were discharged from the Leased Premises prior to the Term Commencement Date; provided, however, notwithstanding the foregoing, Tenant shall be responsible for all claims and conditions, including Pre-Existing Environmental Conditions, to the extent they are covered by Tenant’s indemnity attached as Exhibit D to the PSA (“Omega Indemnity”).

10.5 Survival.

The respective rights and obligations of Landlord and Tenant under this Article 10 shall survive the expiration or earlier termination of this Lease.

ARTICLE 11 – INDEMNIFICATION

11.1 Tenant’s Indemnification, Waiver and Release.

FROM AND AFTER THE TERM COMMENCEMENT DATE, IN ADDITION TO TENANT’S OTHER DUTIES, OBLIGATIONS AND LIABILITIES UNDER THIS LEASE, TENANT HEREBY WAIVES AS TO THE LANDLORD PARTIES (DEFINED IN EXHIBIT D) AND HEREBY AGREES TO INDEMNIFY, PROTECT, DEFEND AND HOLD HARMLESS THE LANDLORD PARTIES FROM AND AGAINST ANY AND ALL LIABILITIES, CLAIMS, CAUSES OF ACTION, FINES, DAMAGES (EXCLUDING CONSEQUENTIAL DAMAGES), SUITS AND EXPENSES, INCLUDING COURT COSTS, EXPERTS' FEES AND ATTORNEYS' FEES (COLLECTIVELY, THE “CLAIMS”), WHETHER ARISING IN EQUITY, AT COMMON LAW, OR BY STATUTE, OR UNDER THE LAW OF CONTRACTS, TORTS (INCLUDING, WITHOUT LIMITATION, NEGLIGENCE AND STRICT LIABILITY WITHOUT REGARD TO FAULT) OR PROPERTY ARISING FROM ANY INJURY TO OR DEATH OF ANY PERSON OR THE DAMAGE TO OR THEFT, DESTRUCTION, LOSS OR LOSS OF USE OF ANY PROPERTY IN ANY EVENT ARISING FROM TENANT’S USE, OCCUPANCY OR ENJOYMENT (OR THE USE, OCCUPANCY OR ENJOYMENT OF ANY TENANT PARTY) OF THE LEASED PREMISES AND ITS FACILITIES FOR THE CONDUCT OF TENANT’S BUSINESS (OR THE BUSINESS OF SUCH TENANT PARTY) AND/OR TENANT’S USE OR ENJOYMENT (OR THE USE OR ENJOYMENT OF ANY TENANT PARTY) OF THE JOINT USE AREAS, AND/OR ARISING FROM ANY DEFECTS IN THE LEASED PREMISES OR IN THE JOINT USE AREAS EXCEPT AS OTHERWISE PROVIDED IN ANY OF THE RELATED AGREEMENTS (UNLESS ANY OF THE LANDLORD PARTIES KNEW OR SHOULD HAVE KNOWN OF SUCH DEFECT OR HAD RECEIVED NOTICE OF SUCH DEFECT AND FAILED TO REMEDY IT WITHIN A REASONABLE PERIOD OF TIME AS PROVIDED IN LA. R.S.

Land Lease Page 12

H-

10.22

9:3221) AND TENANT FURTHER HEREBY WAIVES AS TO THE LANDLORD PARTIES AND AGREES TO INDEMNIFY, PROTECT, DEFEND AND HOLD HARMLESS THE LANDLORD PARTIES FROM AND AGAINST ANY AND ALL CLAIMS ARISING FROM ANY BREACH OR DEFAULT IN THE PERFORMANCE OF ANY OBLIGATION ON TENANT’S PART TO BE PERFORMED UNDER THE TERMS OF THIS LEASE OR ARISING FROM ANY NEGLIGENCE OR WILLFUL MISCONDUCT OF TENANT OR ANY TENANT PARTY. IN CASE ANY ACTION OR PROCEEDING SHALL BE BROUGHT AGAINST THE LANDLORD PARTIES BY REASON OF ANY SUCH CLAIM, TENANT, UPON NOTICE FROM LANDLORD, SHALL DEFEND THE SAME AT TENANT’S SOLE COST AND EXPENSE BY COUNSEL REASONABLY SATISFACTORY TO LANDLORD. THE INDEMNITY OBLIGATIONS OF TENANT UNDER THIS SECTION 11.1 SHALL SPECIFICALLY EXCLUDE AND SHALL NOT OVERLAP WITH THE INDMENITY OBLIGATIONS OF TENANT UNDER SECTION 10.3, AND SHALL NOT BE APPLICABLE TO ANY MATTER DESCRIBED IN ARTICLE 10, IT BEING THE EXPRESS INTENT OF THE PARTIES THAT SECTION 10.3 IS THE EXCLUSIVE INDEMNITY PROVIDED BY TENANT WITH RESPECT TO SUCH MATTERS. THE INDEMNITY OBLIGATIONS OF TENANT UNDER THIS SECTION 11.1 SHALL SURVIVE THE EXPIRATION OR EARLIER TERMINATION OF THIS LEASE .

As used in this Lease, “Tenant Party” means any of the following persons: Tenant, any assignees claiming by, through, or under Tenant, any subtenants claiming by, through, or under Tenant, and any of their respective shareholders, members, partners, officers, directors, managers, agents, contractors, employees, licensees, customers, guests and invitees, but excluding any employees of Tenant that are under Landlord’s control pursuant to the Shared Services Agreement.

11.2 Landlord’s Indemnification.

FROM AND AFTER THE TERM COMMENCEMENT DATE, LANDLORD HEREBY AGREES TO INDEMNIFY, PROTECT, DEFEND AND HOLD HARMLESS THE TENANT PARTIES FROM AND AGAINST ANY AND ALL CLAIMS (AS DEFINED IN SECTION ll.I) ARISING FROM ANY INJURY TO OR DEATH OF ANY PERSON OR THE DAMAGE TO OR THEFT, DESTRUCTION, LOSS OR LOSS OF USE OF ANY PROPERTY IN ANY EVENT TO THE EXTENT ARISING FROM LANDLORD'S (OR ANY LANDLORD PARTY'S) NEGLIGENT OR INTENTIONAL ACTS AND OMISSIONS RELATING TO LANDLORD'S OPERATION OF THE STORAGE FACILITY OR THE JOINT USE AREAS. IN CASE ANY ACTION OR PROCEEDING SHALL BE BROUGHT AGAINST THE TENANT PARTIES BY REASON OF ANY SUCH CLAIM, LANDLORD, UPON NOTICE FROM TENANT, SHALL DEFEND THE SAME AT LANDLORD'S SOLE COST AND EXPENSE BY COUNSEL REASONABLY SATISFACTORY TO TENANT. NOTWITHSTANDING THE ABOVE, THIS INDEMNITY SHALL SPECIFICALLY EXCLUDE ANY LIABILITY FOR ANY CLAIMS BROUGHT BY ANY OF TENANT'S EMPLOYEES FOR INJURIES SUFFERED IN THE COURSE AND SCOPE OF THEIR EMPLOYMENT AND FOR WHICH SUCH EMPLOYEE COULD ASSERT A CLAIM FOR WORKER'S COMPENSATION. THE INDEMNITY OBLIGATIONS OF LANDLORD UNDER THIS SECTION 11.2 SHALL SURVIVE THE EXPIRATION OR EARLIER TERMINATION OF THIS LEASE .

As used in this Lease, “Landlord Party” has the meaning given that term in Exhibit D.

ARTICLE 12 – LANDLORD’S LIABILITY

12.1 Liability of Landlord.

Land Lease Page 13

H-

10.22

Except to the extent expressly provided in any of the Related Agreements, Landlord shall not be liable to Tenant or to Tenant’s employees, agents, licensees or visitors, or to any other person whomsoever for (a) any injury or damage to person or property due to the Leased Premises, the Joint Use Areas or related improvements or appurtenances or any part thereof becoming out of repair or by defect in or failure of pipes or wiring, or by the backing up of drains or by the bursting or leaking of pipes, faucets, and plumbing fixtures or by gas, water, steam, electricity, oil leaking, escaping or flowing into the Plant or the Leased Premises unless caused by the gross negligence or willful misconduct of Landlord; or (b) any loss or damage that may be occasioned by or through the acts or omissions of any other persons whatsoever, excepting only the willful conduct and gross negligence of employees, agents and contractors of Landlord; or (c) any loss or damage to any property or person occasioned by theft, fire, act of God, public enemy, injunction, riot, insurrection, war, court order, requisition or order of governmental authority, or any other matter beyond the reasonable control of Landlord. In no event shall Landlord be liable for consequential damages to Tenant of any type whatsoever such as, but not limited to, loss of business. Landlord shall not be liable to Tenant for any damage to or loss of Tenant's personal property on or about the Leased Premises or Joint Use Areas except to the extent that such damage is the result of Landlord's acts and omissions. Tenant agrees that all or Tenant’s personal (movable) property upon the Leased Premises or Joint Use Areas shall be at the risk of Tenant only, and that Landlord shall not be liable for any damage thereto or theft thereof except as specifically provided herein to the contrary.

ARTICLE 13 – EXPROPRIATION AND CASUALTY

13.1 Expropriation of Entire Leased Premises or Portions of the Storage Facility.

If, during the Term of this Lease, either (a) the entire Leased Premises or the Joint Use Areas, or any portion of the Leased Premises or the Joint Use Areas such that Tenant’s ability to operate the Plant is materially and adversely affected and such operations or facilities cannot be relocated to another part of the Land, as reasonably determined by Landlord and Tenant, shall be taken as the result of the exercise of the power of expropriation or (b) all or a portion of the Storage Facility is expropriated such that Tenant’s ability to operate the Plant is materially and adversely affected to such an extent that Tenant can no longer reasonably operate its business at the Plant, as reasonably determined by Landlord and Tenant (either hereinafter referred to as a “Major Taking”), this Lease and all right, title and interest of Tenant hereunder shall cease and come to an end on the date of vesting of title pursuant to the Major Taking and Landlord shall be entitled to and shall receive the total award allocable to the Leased Premises (but not any improvements located therein) with respect to the Major Taking; provided, however, that nothing contained in this Article 13 shall be deemed to give Landlord any interest in, or to require Tenant to assign to Landlord, any award made to Tenant for the taking of the Plant or any personal property belonging to Tenant, reasonable expenses of relocation, and any interest accruing thereon (collectively, the “Tenant’s Recoverable Damages”).

13.2 Partial Expropriation/Continuation of Lease.

If any part of the Leased Premises or the Joint Use Areas shall be taken in an expropriation proceeding other than a Major Taking (“Minor Taking”), then this Lease shall, upon vesting of title in the Minor Taking, terminate as to the parts so taken, and Tenant shall have no claim or interest in the award, damages, consequential damages and compensation, or any part thereof other than for Tenant’s Recoverable Damages. Landlord shall be entitled to and shall receive the total award made in such Minor Taking, Tenant hereby assigning any interest in such award, damages, consequential damages and compensation to Landlord, and Tenant hereby waiving any right Tenant has now or may have under present or future law to receive any separate award of damages for its interest in the Leased Premises, or any portion thereof, or its interest in

Land Lease Page 14

H-

10.22

this Lease; provided, however, that nothing contained herein shall be deemed to give Landlord any interest in, or to require Tenant to assign to Landlord, any award made to Tenant for Tenant’s Recoverable Damages.

13.3 Continuance of Obligations.

In the event of any termination of this Lease as a result of any such Major Taking or Minor Taking, Tenant shall pay to Landlord all Rent and all additional Rent and other charges payable hereunder, justly apportioned to the date of such termination; provided, however, there shall be no apportionment or abatement of Base Rent or the Operating Expense Subsidy during the initial Term for any reason. If this Lease is not terminated, then, from and after the date of vesting of title in such proceedings, Tenant shall continue to pay all of the Rent and additional Rent and other charges payable hereunder, as in this Lease provided, to be paid by Tenant, it being expressly agreed to by Landlord and Tenant that there shall in no event be any abatement or adjustment of any rental amounts due under this Lease as a result of any such proceedings or the exercise of any power of eminent domain.

13.4 Fire and Casualty Damage.

If any of the Leased Premises shall be damaged by fire or other casualty, then Tenant shall give prompt written notice thereof to Landlord, and Tenant shall, to the extent of available insurance proceeds, proceed to restore such portion of the Leased Premises that is damaged by the casualty to substantially the same or better condition as on the Term Commencement Date, reasonable wear and tear excepted. Tenant shall commence the restoration and reconstruction work within a reasonable period following the casualty, and shall use reasonable diligence to complete such work as soon as reasonably possible. Tenant shall have the right to adjust and settle all property insurance claims relating thereto, subject to Landlord’s approval, not to be unreasonably withheld, conditioned or delayed. Tenant shall have the sole responsibility for restoring and rebuilding the Leased Premises to the extent of available insurance proceeds, and Landlord shall have no obligation to Tenant and shall not be liable for any inconvenience or annoyance to Tenant or injury to the business of Tenant resulting in any way from such damage or the repair thereof. Tenant shall not be entitled to any diminution in Rent during the time and to the extent any of the Leased Premises are unfit for occupancy.

ARTICLE 14 – ASSIGNMENT AND SUBLETTING

14.1 Assignment and Subletting.

Tenant shall not assign this Lease or sublet the Leased Premises without Landlord’s prior written consent, which consent shall not be unreasonably withheld, conditioned or delayed, provided Tenant’s assignee (a) assumes in writing all of the obligations of Tenant under this Lease and the Related Agreements accruing from and after the date of the assignment, and (b) provides evidence satisfactory to Landlord of its experience in operating businesses such as the Plant and its financial capability to perform Tenant’s obligations under this Lease and the Related Agreements. For these purposes, in the event any such assignee or transferee has a net worth in excess of [$13,800,000], the “financial capability” requirement shall be deemed satisfied. Notwithstanding anything to the contrary contained in this Lease, a transfer to, or an assignment or subletting of all or a portion of the Leased Premises to an Affiliate (defined below) of Tenant shall not be deemed an assignment or sublease under this Section 14.1. As used herein, the term “Affiliate” shall mean an entity which is (i) Controlled by, Controls, or is under common Control with Tenant; (ii) any entity with which Tenant has merged or consolidated; or (iii) any entity which acquires all or substantially all of the assets and/or shares of stock, or membership interests, or assets of Tenant. A public offering of Tenant’s stock or a subsequent conversion to a private company shall not be deemed a transfer, assignment or sublease hereunder. “Control”, as used in this Section 14.1 shall mean the possession, direct or indirect,

Land Lease Page 15

H-

10.22

of the power to direct or cause the direction of the management and policies of an entity, whether through ownership of voting securities, by contract, or otherwise. Except as provided in Section 14.2, following any permitted assignment or subletting, Tenant (or the assigning or subletting entity) shall remain directly and primarily liable for the performance of all of the covenants, duties, and obligations of Tenant hereunder, and Landlord shall be permitted to enforce the provisions of this Lease against Tenant or any assignee or sublessee without demand upon or proceeding in any way against any other person.

14.2 Release of Tenant upon Assignment.

If Landlord approves the assignment of this Lease by Tenant as provided in Section 14.1 above, and such assignment occurs after the end of the initial Term hereof (unless Tenant prepays all Base Rent and the Operating Expense Subsidy for the remainder of the initial Term in connection with such assignment as provided in Section 3.8), Landlord agrees to release Tenant and Guarantors from all obligations arising after the date of such assignment under this Lease or the Related Agreements.

14.3 Assignment by Landlord.

Landlord shall have the right to sell, transfer or assign its interest hereunder without the prior consent of Tenant, provided that such purchaser, transferee or assignee assumes Landlord’s obligations hereunder and under the Terminaling Agreement. After such sale, transfer or assignment, Tenant shall attorn to the new landlord and Landlord shall be released from all obligations arising hereunder after the date of such sale, transfer or assignment.

ARTICLE 15 – SUBORDINATION AND LENDER AGREEMENTS

15.1 Subordination.

Provided that Landlord obtains for the benefit of Tenant from each present and future holder of any Mortgage (as hereinafter defined) encumbering the Land, a non-disturbance agreement in reasonable customary form (and in recordable form) agreeing that, among other things, the holder of such mortgage or any purchaser in a foreclosure sale shall recognize and be bound by the terms of this Lease upon a foreclosure or deed in lieu thereof (“Non-disturbance Agreement”), this Lease will be subject and subordinate to the lien of all and any Mortgages, or superior thereto should Landlord and/or its mortgagee so determine (which term “Mortgages” shall include both construction and permanent financing and shall include deeds of trust and similar security instruments), which may now or hereafter encumber or otherwise affect the real estate of which the Leased Premises is a part, and to all and any renewals, extensions, modifications, recastings or refinancings thereof.

15.2 Waiver of Landlord’s Lien; Tenant’s Right to Encumber Leasehold Interest and Personal Property.

Landlord hereby waives any and all constitutional, statutory and common law liens and security interests, and any rights of distraint, with respect to Tenant’s property. Landlord will execute and deliver, on request by Tenant, any and all such instruments, forms and other documents as may be reasonably necessary or required by Tenant’s secured lender, to evidence the waiver of Landlord’s lien for the payment of Rent under any applicable statute to the lien of Tenant’s secured lender in Tenant’s leasehold estate hereunder, or any of Tenant’s property located on the Leased Premises, and providing for such lender’s right to enter the Leased Premises to take possession of and remove Tenant’s personal property, on such terms as are typical and customary in similar transactions.

Land Lease Page 16

H-

10.22

ARTICLE 16 – DEFAULT

16.1 Default.

If any of the following shall occur, Tenant shall be deemed to be in default under this Lease (“Event of Default”):

(a) Tenant shall fail to pay any rent or other sum after same has become due and payable and such failure shall continue for more than fifteen (15) days after Tenant has received written notice of such default; provided, however, if Tenant is paying Base Rent and the Operating Expense Subsidy pursuant to Section 3.3, Tenant’s cure period shall only be ten (10) days;

(b) Tenant shall fail to perform any of the other duties required to be performed by Tenant under this Lease and such failure shall continue for more than sixty (60) days after receipt of written notice thereof by Tenant from Landlord; provided, however, that if such default cannot reasonably be cured within such sixty (60) day period, Tenant shall have such additional time as is reasonably necessary to diligently perform such duty so long as Tenant commences to cure within such sixty (60) day period and continues to diligently perform such cure, but provided further, if the default is such that the continuation of the default has or may have an material adverse effect on Landlord’s operation of the Storage Facility or result in a material liability or damage to Landlord, and Landlord provides written notice of such (“Damage Notice”), then in no event shall the cure period exceed the greater of (i) one hundred twenty (120) days after Landlord’s initial notice of the default, or (ii) thirty (30) days after Landlord’s Damage Notice;

(c) Tenant shall make a general assignment for the benefit of creditors, admit in writing its inability to pay its debts as they become due, file a petition in bankruptcy, be adjudicated bankrupt, or file a petition seeking any reorganization, arrangement, composition, readjustment, liquidation, dissolution, or similar relief under any present or future statute, law or regulation;

(d) there is a levy upon or a taking of Tenant’s leasehold estate or any of Tenant’s assets by execution or other process of law that remains in effect and undischarged for a period in excess of one hundred twenty (120) days;

(e) a termination of the Terminaling Agreement, for any reason (other than default by Landlord thereunder); or

(f) a default by Guarantor under the Guaranty that is not cured within any applicable cure period provided for therein, if any.

16.2 Landlord Remedies.

If an Event of Default occurs, Landlord shall have, in addition to such other rights or remedies as are contained within this Lease, the right at Landlord’s election, then or any time thereafter, but only if such Event of Default shall continue, to pursue any one or more of the following remedies:

(a) Landlord may (i) terminate this Lease by giving written notice thereof to Tenant, in which event Tenant shall immediately surrender the Leased Premises and Joint Use Areas to Landlord and if Tenant fails so to do, Landlord may, without prejudice to any other remedy which it may have for possession or arrearages in rent immediately institute eviction proceedings in accordance with the provisions of the Louisiana Code of Civil Procedure to expel or remove Tenant

Land Lease Page 17

H-

10.22

and any other person who may be occupying the Leased Premises and Joint Use Areas, or any part thereof, and Tenant shall pay to Landlord on demand an amount equal to one year’s Rent as liquidated damages which Landlord may suffer by reason of such termination, or (ii) accelerate the future Rent due under this Lease, or (iii) allow this Lease to remain in effect and proceed for damages and for the Rent as the same shall become due. Nothing contained in this Lease shall limit or prejudice the right of Landlord to prove for and obtain in proceedings for bankruptcy or insolvency by reason of the termination of this Lease, an amount equal to the maximum allowed by any statute or rule of law in effect at the time when, and governing the proceedings in which, the damages are to be proved, whether or not the amount be greater, equal to, or less than the amount the loss and damages referred to above. All accrued but unpaid sums shall bear interest at the Default Rate.

(b) No eviction of Tenant and repossession of the Leased Premises and Joint Use Areas or any part thereof pursuant to Sections 16.2(a) and 16.2(b) or otherwise shall relieve Tenant of its liabilities and obligations hereunder, all of which shall survive such eviction and repossession of the Leased Premises and Joint Use Areas or any part thereof by reason of the occurrence of an event of default, and Tenant will pay to Landlord the rent required to be paid by Tenant.

(c) No right or remedy herein conferred upon or reserved to Landlord is intended to be exclusive of any other right or remedy, and each and every right and remedy shall be cumulative and in addition to any other right or remedy given hereunder or now or hereafter existing at law or in equity or by statute. In addition to other remedies provided in this Lease, Landlord shall be entitled, to the extent permitted by applicable Laws, to injunctive relief in case of the violation, or attempted or threatened violation, of any of the covenants, agreements, conditions, or provisions of this Lease, or to a decree compelling performance of any of the other covenants, agreements, conditions, or provisions of this Lease, or to any other remedy allowed to Landlord at law or in equity.

(d) Tenant waives all applicable notice requirements in connection with Landlord’s exercise of any remedies under this Article 16.

16.3 Waiver.

The waiver by Landlord of any default or Landlord’s failure to insist upon strict compliance with any provision hereof shall not be deemed to be a waiver of any subsequent default under the same, or under any other term, covenant or condition of this Lease. The subsequent acceptance of any rent by Landlord shall not be deemed to be a waiver of any preceding default by Tenant under any term, covenant or condition of this Lease, other than the failure of Tenant to pay the particular rent so accepted, regardless of Landlord’s knowledge of such preceding default at the time of acceptance of such rent.

16.4 Bankruptcy or Insolvency.

Neither Tenant’s interest in this Lease, nor any interest herein of Tenant nor any estate hereby created in Tenant shall pass to any trustee or receiver or assignee for the benefit of creditors or otherwise by operation of law. In the event Tenant shall become insolvent or become a debtor under the Federal Bankruptcy Code, or make a transfer in fraud of creditors, or make an assignment for the benefit of creditors, or take or have taken against Tenant, any proceeding of any kind under any provision of the Federal Bankruptcy Code or under any other federal or state insolvency, bankruptcy, reorganization or similar act or if a receiver or trustee is appointed for a substantial portion of Tenant’s assets, Landlord shall have the right to terminate this Lease, except that Tenant shall not be relieved of any obligations which have accrued prior to the date of such termination. Upon such termination, the provisions herein relating to the expiration or earlier termination

Land Lease Page 18

H-

10.22

of this Lease shall control and Tenant shall immediately surrender the Leased Premises in the condition required by the provisions of this Lease. Additionally, Landlord shall be entitled to all relief, including recovery of damages from Tenant, which may from time to time be permitted or recoverable under the Federal Bankruptcy Code or any other applicable laws.

16.5 Waiver by Tenant.

Tenant hereby expressly waives, so far as permitted by law, any and all right of redemption or reentry or repossession to revive the validity and existence of this Lease in the event that Tenant shall be dispossessed by a judgment or by order of any court having jurisdiction over the Leased Premises or the interpretation of this Lease or in case of eviction and repossession by Landlord or in case of any expiration or termination of this Lease.

ARTICLE 17 – NOTICES

17.1 Notices.

Any notice required or permitted under this Lease must be in writing and will be deemed received when actually received and delivered by (a) United States mail, certified or registered, return receipt requested, (b) confirmed overnight courier service, (c) confirmed facsimile transmission, or (iv) other electronic communication where receipt of the communication has been acknowledged, in each case properly addressed or transmitted to the address of the party set forth below or to such other address or facsimile number as a party will provide to the other party in accordance with this provision:

Landlord: Marrero Terminal LLC

c/o PipeStem Energy Group, LLC

3721 Briarpark Drive, Suite 200

Houston, Texas 77042

Attn: Vincent J. DiCosimo

Telecopy No. 713.266.3113

Tenant: Omega Refining, LLC

1331 17th Street, Suite 1060

Denver, Colorado 80202

Attn: James P. Gregory

Telecopy No.: 303.292.9121

ARTICLE 18 – SURRENDER

18.1 Surrender of Leased Premises.

Upon the expiration or earlier termination of this Lease, Tenant shall vacate and surrender to Landlord the Leased Premises in good, clean and operable condition. Tenant shall cause the Plant and all of its personal property to be removed from the Leased Premises on or before (a) the expiration date of the Lease, or (b) if the Lease is terminated for any reason prior to the scheduled expiration date (“Early Termination”), six (6) months from the effective date of termination (either date, the “Removal Date”). Nothing herein shall be interpreted to require that Tenant is obligated to remove the concrete pad underlying the Plant. Tenant shall, on or before the Removal Date, remove the Plant and all of its personal property therefrom in accordance with all applicable Laws, and in accordance with the terms of Section 10.1. With respect to any Early Termination, Tenant’s obligations under this Lease shall be deemed to continue in effect until the later of

Land Lease Page 19

H-

10.22

the Removal Date or the completion of the removal of the Plant and personal property (for example, Tenant must continue to maintain insurance, comply with Laws, etc.), but Tenant’s right to use the Leased Premises and the Joint Use Areas shall be limited to removing the Plant and Tenant’s personal property therefrom. Tenant shall repair any damage to the Leased Premises caused by such removal, and any and all such property not so removed within thirty (30) days after the Removal Date shall, at Landlord’s option, become the exclusive property of Landlord and be disposed of by Landlord, at Tenant’s cost and expense, without further notice to or demand upon Tenant. If the Leased Premises are not surrendered as above set forth, Tenant shall indemnify, defend and hold harmless Landlord against loss or liability resulting from the delay by Tenant in so surrendering the Leased Premises, including, without limitation, the cost of dismantling and disposing of the Plant and compliance with Laws with respect thereto. Tenant’s obligation to observe or perform these covenants shall survive the expiration or other termination of this Lease.

All property of Tenant not removed on or before the thirtieth (30th) day after the Removal Date shall, at the option of Landlord, be deemed abandoned to Landlord. To the extent legally permitted, Tenant hereby irrevocably authorizes Landlord to remove all property of Tenant from the Leased Premises thirty (30) days following the Removal Date and to cause its transportation and storage for Tenant’s benefit, all at the sole cost and risk of Tenant, and Landlord shall not be liable in any manner in respect thereto. Tenant covenants to pay all costs and expenses of such removal, transportation and storage. Tenant shall reimburse Landlord upon demand for any expenses incurred by Landlord with respect to removal or storage of abandoned property and with respect to restoring said Leased Premises to good order, condition and repair. In addition, Landlord is hereby irrevocably authorized, to the extent legally permitted, to sell, at public or private sale, with or without legal proceedings, and with or without notice, demand, advertisement, appraisement, or any other formality, any and all of the contents of the Leased Premises, and Landlord may purchase these contents at private sale or for the highest bid at a public sale, and the proceeds of this sale, after deducting all costs, charges, attorney’s fees and expenses of the sale, will be applied to the payment of Rent and all other amounts due to Landlord, with any remaining balance belonging and being paid to Tenant. Tenant’s obligations hereunder shall survive the expiration or early termination of this Lease.

18.2 No Surrender During Lease Term.

No surrender to Landlord of this Lease or of the Leased Premises and Joint Use Areas, or any portion thereof, or any interest therein, prior to the expiration of the Term of this Lease shall be valid or effective to relieve Tenant of any obligations hereunder unless such release is specifically agreed to and accepted in writing by Landlord and consented to in writing by all lenders holding a lien on the Leased Premises, and no act or omission by Landlord or any representative or agent of Landlord, other than such a written acceptance, as aforesaid, shall constitute an acceptance of any such surrender.

ARTICLE 19 – MISCELLANEOUS

19.1 Successors.

The covenants and conditions contained herein shall be binding upon and inure to the benefit of Landlord and Tenant and their respective successors and permitted assigns.

19.2 Headings.

The article and section headings in this Lease are for convenience only, and shall not limit or otherwise affect the meaning of any provision hereof.

19.3 Time of Essence.

Land Lease Page 20

H-

10.22

Time is of the essence in each and every provision of this Lease.

19.4 Invalidity.

The invalidity or unenforceability of any provision of this Lease shall not affect any other provision hereof.

19.5 Attorney’s Fees.

Should either party hereto commence an action against the other to enforce any obligation under this Lease, the prevailing party shall be entitled to recover reasonable attorneys’ fees from the other.

19.6 Governing Law.

This Lease shall be construed and enforced in accordance with the laws of the State of Louisiana.

19.7 Entire Agreement.

This Lease constitutes the entire agreement between the parties hereto and may not be modified in any manner other than by written agreement, executed by all of the parties hereto and their successors in interest. No prior understanding or representation of any kind dated before the execution of this Lease shall be binding upon either party unless incorporated herein.

19.8 Authority.

Both parties executing this Lease represent that they are fully authorized to execute this Lease on behalf of their respective entities.

19.9 Servitudes.

As an appurtenance to the estate created by this Lease, Landlord hereby grants to Tenant, during the Term, non-exclusive (unless otherwise indicated) servitudes and rights-of-way over the parking areas, driveways, walkways, and service lanes shown on the Site Plan for vehicular and pedestrian access, ingress, and egress to and from the Leased Premises and for the use and enjoyment of the Joint Use Areas for use by Tenant, its employees, agents, contractors, invitees, assignees, subtenants, and licensees.

19.10 Landlord’s Liability.

Tenant agrees to look solely to Landlord’s estate and interest in the Leased Premises for the satisfaction of any monetary claim hereunder or the collection of any judgment based thereon, and no other property of Landlord, or any joint venturer, partner, member, shareholder, co‑owner, officer, director or manager shall be subject to levy, execution or other enforcement procedure for satisfaction of such claim or judgment.

19.11 Recording of Lease.

Tenant shall not record this Lease. After the Term Commencement Date, upon the request of a party hereto, the parties shall join in the execution of a Notice of Lease Agreement for the purpose of recordation in the form attached hereto as Exhibit E. Any recording costs associated with the Notice of Lease Agreement shall be borne by the party requesting recordation.

Land Lease Page 21

H-

10.22

19.12 Estoppel Certificates.