Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - Vertex Energy Inc. | Financial_Report.xls |

| EX-31.1 - EXHIBIT 31.1 - Vertex Energy Inc. | a6302014-ex311.htm |

| EX-10.25 - EXHIBIT 10.25 - Vertex Energy Inc. | ex1025tsa-omegaxmtb.htm |

| EX-32.1 - EXHIBIT 32.1 - Vertex Energy Inc. | a6302014-ex321.htm |

| EX-10.22 - EXHIBIT 10.22 - Vertex Energy Inc. | ex1022landlease-marreroter.htm |

| EX-99.2 - EXHIBIT 99.2 - Vertex Energy Inc. | a6302014-ex992.htm |

| EX-32.2 - EXHIBIT 32.2 - Vertex Energy Inc. | a6302014-ex322.htm |

| EX-31.2 - EXHIBIT 31.2 - Vertex Energy Inc. | a6302014-ex312.htm |

| EX-10.24 - EXHIBIT 10.24 - Vertex Energy Inc. | ex1024omega-operationmanag.htm |

| 10-Q - 10-Q - Vertex Energy Inc. | a6302014-document.htm |

| EX-10.26 - EXHIBIT 10.26 - Vertex Energy Inc. | ex1026omegabangopurchasean.htm |

Exhibit 10.23

COMMERCIAL LEASE

between

PLAQUEMINES HOLDINGS, LLC,

as Landlord

and

OMEGA REFINING, LLC,

as Tenant

Relating to the Myrtle Grove Facility

Located at

278 East Ravenna Road

Myrtle Grove, LA

Dated as of May 25th, 2012

TABLE OF CONTENTS

Page No.

1.1Lease. 1

1.2Condition of the Leased Premises. 1

1.3Office/Warehouse and Parking Lot. 2

2.1Term. 2

2.2Renewal Options. 3

3.1Base Rent. 3

3.2Option to Pay Base Rent in Arrears. 3

3.3Rent Due. 4

3.4Late Charge. 4

3.5Net Lease. 4

3.6Prepayment of Base Rent. 4

3.7Independent Obligations. 4

4.1Quiet Possession. 5

5.1Use. 5

5.2Alterations. 5

5.3Maintenance and Repair of Leased Premises. 5

Land Lease Page i

H-713097_11.DOC

10.23

6.1Personal Property Taxes. 6

6.2Rent and Use Taxes. 6

6.3Delinquency of Payment. 6

7.1Tenant’s Insurance. 6

7.2Landlord’s Insurance 6

7.3Subrogation. 6

8.1Utilities and Services. 7

9.1Compliance with Laws and Permits. 7

9.2Permits. 7

9.3Survival. 7

10.1Hazardous Materials. 8

10.2Notice to Landlord. 8

10.3Indemnification. 9

10.4Disclaimer Regarding Pre-Existing Conditions. 9

10.5Survival. 10

11.1Tenant’s Indemnification, Waiver and Release. 10

11.2Landlord’s Indemnification. 11

12.1Liability of Landlord. 11

Land Lease Page ii

H-713097_11.DOC

10.23

13.1Expropriation of Entire Leased Premises. 11

13.2Partial Expropriation/Continuation of Lease. 12

13.3Continuance of Obligations. 12

13.4Fire and Casualty Damage. 12

14.1Assignment and Subletting. 13

14.2Release of Tenant upon Assignment. 13

14.3Assignment by Landlord. 13

15.1Subordination. 13

15.2Waiver of Landlord’s Lien; Tenant’s Right to Encumber Leasehold Interest and Personal Property. 14

16.1Default. 14

16.2Landlord Remedies. 15

16.3Waiver. 15

16.4Bankruptcy or Insolvency. 16

16.5Waiver by Tenant. 16

17.1Notices. 16

18.1Surrender of Leased Premises. 17

18.2No Surrender During Lease Term. 17

Land Lease Page iii

H-713097_11.DOC

10.23

19.1Successors. 18

19.2Headings. 18

19.3Time of Essence. 18

19.4Invalidity. 18

19.5Attorney’s Fees. 18

19.6Governing Law. 18

19.7Entire Agreement. 18

19.8Authority. 18

19.9Servitudes. 18

19.10Landlord’s Liability. 19

19.11Recording of Lease. 19

19.12Estoppel Certificates. 19

19.13Force Majeure. 20

Land Lease Page iv

H-713097_11.DOC

10.23

EXHIBITS

Exhibit A – Description of Land

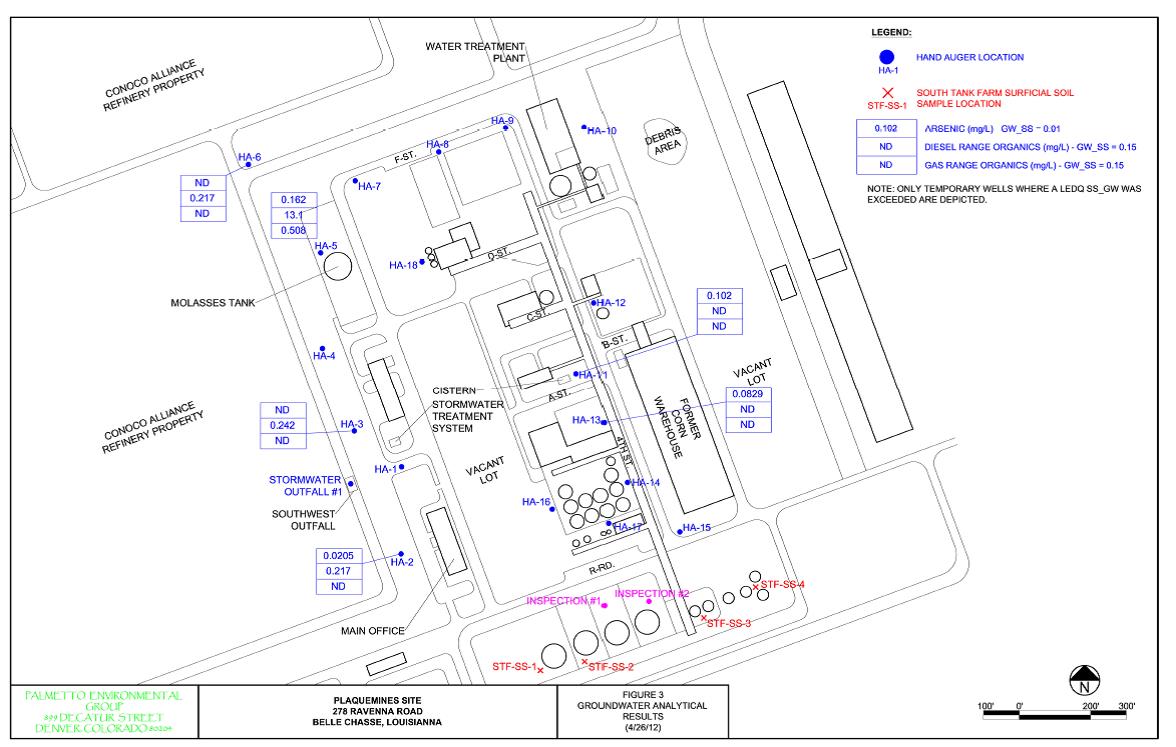

Exhibit B – Site Plan

Exhibit C – Excluded Assets

Exhibit D – Insurance Requirements

Exhibit D – Form of Notice of Lease Agreement

Exhibit E – Environmental Baseline

Exhibit F – Guaranty of Lease

Exhibit G – Removal Agreement

Land Lease Page v

H-713097_11.DOC

10.23

COMMERCIAL LEASE

This COMMERCIAL LEASE (this “Lease”), dated for reference purposes as of the 25th day of May, 2012 (the “Effective Date”), is made by and between PLAQUEMINES HOLDINGS, LLC a Louisiana limited liability company (“Landlord”), and OMEGA REFINING, LLC, a Delaware limited liability company (“Tenant”).

R E C I T A L S

A.Landlord is the owner of a tract of land situated in Myrtle Grove, Plaquemines Parish, Louisiana, and more particularly described in Exhibit A (Description of Land) attached hereto (the “Land”).

B.Tenant intends to build and operate a used motor oil re-refinery (the “Plant”) situated on a tract of land within the Land further described and depicted on Exhibit B attached hereto (“Plant Site”).

C.Landlord is the owner of certain improvements situated on portions of the Land consisting of a non-operating fuel grade ethanol plant and related assets, some portions of which Landlord intends to remove, which ethanol plant and related assets and immovable property are more particularly described in Exhibit C and are excluded from the provisions of this Lease (the “Excluded Assets”).

D.The Land and Plant Site, less the Excluded Assets, are herein referred to as the “Leased Premises”. Landlord has agreed to lease to Tenant the Leased Premises, subject to Landlord’s retained right to use and access certain common areas more particularly described below as the “Joint Use Areas”, on the terms and conditions set forth herein. The various components of the Leased Premises and the locations of the Joint Use Areas are further depicted on the site plan attached hereto as Exhibit B (“Site Plan”).

E.As an inducement to Landlord to enter into this Lease, Tenant has agreed to cause its parent, Omega Holdings Company, LLC, a Delaware limited liability company (“Guarantor”) to unconditionally guarantee all of Tenant’s obligations under this Lease and the Related Agreements pursuant to that certain Guaranty Agreement (“Guaranty”) dated as of the Effective Date and attached hereto as Exhibit G.

NOW, THEREFORE, Landlord and Tenant agree as follows:

Land Lease Page vi

H-713097_11.DOC

10.23

ARTICLE 1 – LEASE

1.1 Lease.

Landlord hereby leases the Leased Premises to Tenant and Tenant hereby leases the Leased Premises from Landlord, for the Term and subject to the agreements, conditions and provisions contained herein.

1.2 Condition of the Leased Premises.

(a) EXCEPT AS PROVIDED IN SECTION 10.4, TENANT HEREBY ACKNOWLEDGES THAT TENANT IS LEASING THE LEASED PREMISES, AND THE LEASED PREMISES SHALL BE LEASED TO TENANT, “AS IS, WHERE IS, AND WITH ALL FAULTS” AND SPECIFICALLY AND EXPRESSLY WITHOUT ANY WARRANTIES, REPRESENTATIONS, OR GUARANTEES, EITHER EXPRESS OR IMPLIED, OF ANY KIND, NATURE, OR TYPE WHATSOEVER FROM OR ON BEHALF OF LANDLORD, INCLUDING, WITHOUT LIMITATION, ANY RELATED TO COMPLIANCE WITH OR LIABILITIES UNDER ENVIRONMENTAL LAW.

(b) WITHOUT IN ANY WAY LIMITING THE GENERALITY OF THE PRECEDING SECTIONS 1.2(A), EXCEPT AS PROVIDED IN SECTION 10.4, TENANT SPECIFICALLY ACKNOWLEDGES AND AGREES THAT TENANT HEREBY WAIVES AND RELEASES ANY CLAIM TENANT HAS, MIGHT HAVE HAD, OR MAY HAVE AGAINST LANDLORD WITH RESPECT TO: THE CONDITION OF THE LEASED PREMISES, WHETHER SUCH CONDITION IS PATENT OR LATENT; COMPLIANCE WITH OR LIABILITIES UNDER ENVIRONMENTAL LAW; AND ANY OTHER STATE OF FACTS WHICH EXIST WITH RESPECT TO THE LEASED PREMISES. NOTWITHSTANDING THE FOREGOING, TENANT DOES NOT WAIVE ANY SUCH CLAIM RELATED TO THE CONDITION OF THE EXCLUDED ASSETS.

(c) For purposes of this Lease: (i) the term “Environmental Law” means all Laws that regulate activities, conditions, or substances because of their effect or potential effect on public health and welfare and the environment, including those relating to the emission, discharge, release, treatment, storage, disposal, or transport of chemicals, wastes, or other materials, including without limitation, the Comprehensive Environmental Response, Compensation and Liability Act, 42 U.S.C. § 9601, et seq., the Resource Conservation and Recovery Act, 42 U.S.C. §§ 321, et seq., the Oil Pollution Act, 33 U.S.C. §§ 2702, et seq., the Clean Water Act, 33 U.S.C. §§ 1251, et seq., the Clean Air Act, 42 U.S.C. §§ 7401, et seq., the Toxic Substances Control Act, 15 U.S.C. §§2601 et seq., and the Endangered Species Act, 16 U.S.C. §§1531 et seq. and their state and local counterparts, if any; and (ii) the term “Laws” means all “statutes, rules, orders, ordinances, principles of common law, or other requirements of any governmental or quasi-governmental entity.

1.3 Acknowledgment of Co-Tenant; Reservation of Certain Rights. Tenant acknowledges that Landlord has an agreement to lease the Tract identified as Tract “A” on attached Exhibit “B” - Site Plan to Plaquemines Processing & Recovery, L.L.C. (“Plaquemines Processing”) Landlord reserves for the benefit of Plaquemines Processing (or any other tenant of Landlord leasing Tract A which uses said Tract A for industrial purposes in a manner that does not materially and adversely affect Tenant’s use of the Leased Premises) a right of ingress and egress as depicted on the attached Site Plan, utility rights of way through the Leased Premises, to the extent that such rights of way do not materially interfere with Tenant’s operations, and the right to add one or more pipes to the existing pipe rack running from the Leased Premises to the river, to the extent that such rights of way do not materially interfere with Tenant’s operations; provided, however,

Land Lease Page 1

H-713097_11.DOC

10.23

that the rights granted to Landlord are subject to the requirement that Plaquemines Processing (or any other future tenant of Tract “A”) agrees to indemnify, defend and hold harmless Tenant for its use of these rights, and further agrees to carry insurance in the minimum amount of $1 million each occurrence/$2 million aggregate, and which insurance shall otherwise comply with Section 3 of Exhibit D – “Insurance Requirements.” To the extent Plaquemines Processing, or any future tenant, seeks to utilize improvements paid for by Tenant in conjunction with exercising its rights to place pipe on the pipe rack for the purpose of accessing the river or other loading/unloading facilities (including scales), such use shall be conditioned on entering an agreement with Tenant pursuant to which usage and throughput fees are imposed consistent with standard agreements governing similar arrangements in the greater New Orleans area.

1.4 Joint Use Areas.

Landlord hereby grants to Tenant and its customers, agents, invitees and contractors, the non- exclusive right and license to use the Joint Use Areas, in common with Landlord and its lessees, agents, invitees and contractors, for purposes of ingress and egress in connection with Tenant’s operation of the Plant. Tenant’s use of the Joint Use Areas shall be subject to Landlord’s reasonable procedures, rules and regulations relating to security and safety for the property and Joint Use Areas provided to Tenant in writing from time to time. The term “Joint Use Areas” shall mean those areas shown on the Site Plan as the Joint Use Areas, and designated as Site C.

ARTICLE 2 ARTICLE 2– TERM AND COMMENCEMENT

2.1 Term.

The initial term of this Lease (and including any renewal term, referred to as the “Term”) shall be for a period commencing on the Effective Date and expiring at midnight on the five (5) year anniversary of the Term Commencement Date. For purposes hereof, the “Term Commencement Date” shall be the date of the signing of this lease.

2.2 Renewal Options.

Tenant shall have the right to extend the initial Term of this Lease for up to ten (10) renewal periods of five (5) years each, with each being on the same terms and conditions set forth herein, except that the number of renewal periods remaining to be exercised shall, in each case, be reduced by one upon the exercise of a renewal option. As long as there remains an additional right to renew the Term of this Lease, unless Tenant elects not to exercise a renewal option as provided below, the Term of this Lease shall automatically be renewed for an additional period of five (5) years. If Tenant elects not to renew the Term of this Lease, Tenant must notify Landlord in writing that it is not renewing the Term at least 180 days prior to the expiration of the initial Term, or the then current renewal Term, as the case may be, or the Term will be deemed to be renewed for the next renewal Term.

ARTICLE 3 – RENT

3.1 Base Rent.

(a) Tenant covenants and agrees to pay to Landlord at its address for notice, in lawful money of the United States, without demand, offset or deduction rent (“Base Rent”) in the amounts set forth below during the Initial Term and each renewal Term, as applicable, per year.

2

10.23

(b) During the initial Term, Base Rent shall be payable in the amount of $8,000 per month increasing by $3,818.18 per month until the monthly base rent reaches $50,000 per month, which will be the Base Rent for the remainder of the Initial Term. The first installment of $8,000 will be due and payable on the Term Commencement Date and all subsequent monthly installments to be due and payable on the first day of each month thereafter. If the first or last days of the initial Term are not the first or last days of a calendar month, as the case may be, then the Base Rent for such month(s) shall be prorated based on the number of days in the initial Term within such calendar month(s).

(c) During each renewal Term, Base Rent shall be equal to Base Rent during the last year of the immediately preceding term increased by eight percent (8%), resulting in the following schedule of monthly rent payments:

First Renewal Term $54,000 per month

Second Renewal Term $58,320 per month

Third Renewal Term $62,986 per month

Fourth Renewal Term $68,024 per month

Fifth Renewal Term $73,466 per month

Sixth Renewal Term $79,344 per month

Seventh Renewal Term $85,961 per month

Eighth Renewal Term $92,547 per month

Ninth Renewal Term $99,950 per month

Tenth Renewal Term $107,946 per month

3.2 Rent Due.

All other amounts due by Tenant to Landlord under this Lease (including any amounts that Landlord advances to satisfy any of Tenant’s obligations hereunder) (referred to herein as “Additional Rent”), shall be, unless otherwise provided, due and payable within fifteen (15) days of written notice thereof to Tenant, and all such Additional Rent, together with the Base Rent, shall be referred to herein as “Rent”.

3.3 Late Charge.

If Tenant fails to pay any installment of Rent or any other amount due hereunder within ten (10) days after the date the payment is due, Tenant covenants and agrees to pay a late charge equal to three percent (3%) of the delinquent rent payment. The late charge shall be paid within ten (10) days after Landlord’s written request therefor.

3.4 Net Lease.

3

10.23

It is the intention of Landlord and Tenant that all rent paid to Landlord shall be absolutely net; that is, all costs, expenses and obligations of every kind relating directly or indirectly in any way, foreseen or unforeseen, to Tenant’s use, occupancy, possession, maintenance, repair and replacement of the Leased Premises, or any part thereof, which may arise or become due during the Term shall be paid by Tenant and that Landlord shall be indemnified by Tenant therefrom.

3.5 Joint Use Area Costs.

Landlord agrees to pay and reimburse, or cause Landlord’s other tenant(s) on the Land to pay and reimburse, Tenant a portion of Tenant’s costs to operate, maintain and repair the Joint Use Areas (“Joint Use Area Costs”) within thirty (30) days following invoice therefor, such invoice to be accompanied by reasonable supporting documentation of the Joint Use Areas Costs. Tenant shall only invoice Landlord once each calendar year for Joint Use Area Costs, unless an unusually large capital expenditure is necessary. Initially, Landlord’s share of the Joint Use Area Costs shall be 10%, but this percentage shall be equitably adjusted by the parties hereto from time to time to reflect each party’srelative percentage use of the Joint Use Areas. Landlord and Tenant agree to reasonably cooperate with each other to determine the appropriate sharing percentage. Tenant further agrees to provide written notice to Landlord of any contemplated capital expenditure for repair or replacement of any portion of the Joint Use Areas in excess of $10,000. To the extent the Landlord fails to occupy or use Site A, or fails to lease Site A to any third party tenant, for any period more than six (6) consecutive months, Landlord’s obligation to pay and reimburse Tenant under this Section 3.5 shall be suspended and released until such time that Landlord again uses or occupies Site A, or leases Site A to a tenant.

3.5 3.6 Independent Obligations.

Any term or provision of this Lease to the contrary notwithstanding, the covenants and obligations of Tenant to pay Rent hereunder shall be independent from any obligations, warranties or representations, express or implied, if any, of Landlord herein contained.

ARTICLE 4 – QUIET POSSESSION

4.1 Quiet Possession.

Provided no Event of Default (hereinafter defined) by Tenant has occurred and is continuing, Landlord covenants and agrees to keep Tenant in quiet possession and enjoyment of the Leased Premises and the Joint Use Areas during the Term, as the same may be renewed and extended as provided herein.

ARTICLE 5 – USE, ALTERATIONS, MAINTENANCE AND REPAIRS

5.1 Use.

Tenant shall be permitted to use the Leased Premises and the Joint Use Areas only for uses associated with the construction and operation of the Plant (and other uses provided such uses are similar or related to Tenant’s current use) and Tenant’s use shall be in compliance with all Laws applicable to the Leased Premises and the Joint Use Areas affecting Tenant’s use and the Leased Premises, and for no other use or purpose without the prior written consent of Landlord, which consent shall not be unreasonably withheld, conditioned or delayed.

5.2 Alterations.

Tenant shall be permitted to construct the Plant on the Leased Premises, provided Tenant presents plans for construction of the Plant to Landlord for its approval (“Plant Construction”). Landlord’s approval of the

4

10.23

Plant Construction shall not be unreasonably withheld, conditioned or delayed. Tenant shall be permitted to make such alterations and modifications to the Plant on the Leased Premises as it desires, including by way of example and not limitation, a wiped film evaporator(s) (or similar distillation equipment), hydrotreater, a hydrocracker, a propane de-asphalting unit, and miscellaneous grease and lubricant manufacturing equipment (“Permitted Alterations”) without the consent of Landlord, provided that Tenant gives Landlord reasonable notice and that all such alterations or modifications are performed and completed in a safe and prudent manner, in accordance with all Laws. Tenant shall be permitted to make alterations and modifications to the office/warehouse, the parking lot and other improvements on the Leased Premises owned by Landlord, without the prior written consent of Landlord provided that Tenant gives Landlord reasonable notice and that all such alterations or modifications are performed and completed in a safe and prudent manner, in accordance with all Laws. Tenant will be solely responsible for any liabilities or obligations arising out of the construction or operation of such alterations or modifications. Landlord will cooperate with Tenant to the extent required by regulatory or other governmental authorities with jurisdiction over any such alterations or modifications at no cost to Landlord apart from administrative assistance.

5.3 Maintenance and Repair of Leased Premises.

Tenant agrees that, at its own expense, it will keep and maintain the Leased Premises, in a condition and repair similar to, but not less than, its condition and repair on the Term Commencement Date hereof, reasonable wear and tear excepted. Tenant shall be responsible for disposal of its trash from the Leased Premises. Notwithstanding the foregoing, Tenant shall not have any such obligation with respect to the Excluded Assets.

5.4 Expansion of Rail and Barge Dock.

Landlord and Tenant shall cooperate with each other and adjacent property owners in obtaining an extension of the existing rail line and additional rail spurs so as to enable Tenant to receive and ship products over and across the Leased Premises in accordance with Tenant’s anticipated Use of the Leased Premises (“Rail Facilities”). Any associated cost related to such extension or expansion of the Rail Facilities will be the sole responsibility of Tenant. Landlord is actively engaged and pursuing permitting of a barge dock with pipeline access connecting with the Leased Premises (“Barge Dock”). Any associated cost related to the design, permitting and construction of the Barge Dock from and after the Effective Date shall be the sole responsibility of the Tenant.

5.5 Maintenance and Repair of Joint Use Areas.

Tenant agrees, at its own expense (but subject to reimbursement under Section 3.5), to keep and maintain the Joint Use Areas is good, safe and operable condition in compliance with all applicable Laws.

ARTICLE 6 ARTICLE 6– TAXES

6.1 Personal Property Taxes.

Tenant covenants and agrees to pay before delinquency all ad valorem personal property taxes that become payable during the Term which are levied or assessed upon the Leased Premises or any of Tenant’s equipment, furniture, fixtures and Tenant’s other personal (movable) property installed or located in or on the Leased Premises (but expressly excluding, for these purposes existing equipment on the Leased Premises owned by or belonging to Landlord).

6.2 Rent and Use Taxes and Real Estate Taxes..

5

10.23

Tenant covenants and agrees to reimburse Landlord for all charges, taxes or other fees arising out of or in connection with Tenant’s use or occupancy of the Leased Premises or Tenant’s rental payments to Landlord, other than income or other taxes (excluding franchise or corporate income taxes payable by Landlord as a result of or with respect to this Lease) imposed on Landlord based on Landlord’s income. In addition, Tenant covenants and agrees to pay all immovable property ad valorem tax assessed against the Leased Premises. Tenant shall pay the immovable property ad valorem tax to LESSOR as an additional amount each month which shall be equal to 1/12 of the total estimated ad valorem taxes on the land and improvements thereto based on the prior year’s ad valorem tax liability against the leased Premises. Upon receipt of the tax bill, Landlord shall provide a copy to Tenant and Landlord shall pay Tenant (or Tenant shall pay Landlord, as the case may be) any difference between the estimated tax payments and the actual tax payments. Landlord shall promptly pay the immovable property ad valorem tax on the Leased Premises when due and shall furnish to Tenant evidence that the taxes have been paid.

Assuming Tenant and Landlord are successful in obtaining a ten (1) year ad valorem “freeze” on the assessment of the Land, Landlord and Tenant agree that the ad valorem taxes on the immovable property shall be allocated 90% to Tenant and 10% to Landlord (or Landlord’s other tenant, as the case may be). After the end of the 10 year term (or, if no ad valorem freeze is available), Landlord and Tenant agree that the assessment of the Land (without any improvements) shall be allocated 90% to Tenant and

10% to Landlord, with all improvements being allocated in kind based on the value of the actual improvements located on each of Tract A and Tract B.

6.3 6.3 Delinquency of Payment.

If Tenant fails to pay use taxes to Landlord within thirty (30) days after written request therefrom, such delinquent amounts shall bear interest until paid at the lesser of the rate of fifteen percent (15%) per annum, or the maximum non-usurious rate permitted by Law (“Default Rate”).

6

10.23

ARTICLE 7 – INSURANCE

7.1 Tenant’s Insurance.

Tenant shall maintain the insurance coverages in accordance with Exhibit D.

7.2 Subrogation.

Notwithstanding any provisions contained in this Lease to the contrary, each party hereto waives all claims for recovery from the other party, its officers, agents or employees for any loss or damage (whether or not such loss or damage is caused by negligence of the other party) to any of its real or personal property insured under the valid and collectible insurance policies to the extent of the collectible recovery under such insurance.

ARTICLE 8 – UTILITIES AND SERVICES

8.1 Utilities and Services.

Tenant shall pay and arrange for all utilities and other services to the Plant and Leased Premises, at no cost to Landlord. Landlord will reasonably cooperate with Tenant regarding the provision and continuation of all existing utility services serving the Plant and Leased Premises. Except as provided in Section 19.13, in the event Tenant breaches its responsibility under the section, including failing to adequately serve the Plant or Leased Premises, Landlord may notify Tenant of such breach, and, if, within twenty (20) days of receipt of such notice, Tenant fails to cure that breach, Landlord may take steps necessary to cure that breach and Tenant shall be responsible for all costs Landlord incurs to effect that cure.

ARTICLE 9 – COMPLIANCE WITH LAWS AND PERMITS

9.1 Compliance with Laws and Permits.

Except as limited by Section 10.4, and except to the extent any non-compliance may be caused by Landlord’s acts or omissions, Tenant covenants that it shall, throughout the Term of this Lease, and at Tenant’s sole cost and expense, comply or cause compliance with, and prevent liabilities from arising under, Laws, including Environmental Law, applicable or relating to Tenant’s ownership, leasing and operation of the Plant and the Leased Premises, notwithstanding whether the compliance, and the costs and expenses necessitated thereby shall have been foreseen or unforeseen, ordinary or extraordinary, and whether or not the same shall be presently within the contemplation of Landlord or Tenant or shall involve any change of governmental policy, or require structural or extraordinary repairs, alterations or additions by Tenant and irrespective of the costs thereof. In the event any such non-compliance or liabilities should be discovered, Tenant, at its sole cost and expense, shall take immediate steps to cure the non-compliance or to eliminate the liabilities. In the event Tenant breaches its responsibility under the section, including failing to adequately serve the Plant, Landlord may notify Tenant of such breach.

9.2 Permits.

Tenant covenants that it shall at its own expense procure, maintain in effect, and comply with all conditions of any and all permits, licenses, authorizations, registrations, and other governmental and regulatory approvals (collectively, “Permits”) required for Tenant’s use of the Leased Premises and the Plant, including, without limitation, those relating to the discharge of stormwater or processing of wastewater, either directly or indirectly through a treatment works owned by a governmental entity, the emission of air

Land Lease Page 7

10.23

contaminants, or the handling of any materials of any kind, including without limitation, chemicals and wastes, that are regulated under Environmental Law (collectively, “Hazardous Materials”), Tenant and Landlord shall cooperate and coordinate with each other as necessary to insure that the Plant obtain and maintain Permits required for it to operate.

9.3 Survival.

The respective rights and obligations of Landlord and Tenant under this Article 9 shall survive the expiration or earlier termination of this Lease.

ARTICLE 10 – HAZARDOUS MATERIALS

10.1 Hazardous Materials.

(a) Except as provided in Section 10.4 and Section 10.1(e) below, Tenant shall, handle, treat, deal with and manage any and all Hazardous Materials in, on, under or about the Leased Premises not only in accordance with all applicable Environmental Law, but also in accordance with prudent industry practices regarding the management of such Hazardous Materials. With regard to the disposal of any Hazardous Materials offsite, Tenant is, and shall be named as, the generator (and in no way shall responsibility for any such materials be attributed to Landlord) and shall be the signatory of any required manifests and shall not dispose of any such materials except in compliance with Environmental Law using authorized transporters and disposal facilities.

(b) Except as provided in Section 10.4 and Section 10.1(e) below ,upon expiration or earlier termination of this Lease, Tenant covenants to cause all Hazardous Materials to be removed from the Leased Premises, which shall include decontamination of all equipment, and transported for use, storage or disposal in accordance and in compliance with applicable Environmental Law. In addition, at Landlord’s request, upon expiration or earlier termination of this Lease, Tenant shall remove all tanks and other equipment and fixtures (except the Excluded Assets) that were placed on the Leased Premises during the term of this Lease and that contain, have contained or are contaminated with, Hazardous Materials, and shall, at Tenant’s expense, restore the Leased Premises, including the cleaning of all tanks and other equipment that are to remain on the Leased Premises (other than the Excluded Assets) to the same or substantially similar condition as existed prior to the placement of such tanks, equipment or fixtures (or when placed, as the case may be),, normal wear and tear and damage by the elements, fire and othercasualty excepted. Notwithstanding the foregoing, Tenant shall not be required to remove concrete pads underlying such tanks, equipment, or fixtures.

(b) Tenant shall not take any remedial action in response to the presence of any Hazardous Materials in, on, about or under the Leased Premises or in any improvements situated on the Leased Premises, nor enter into any settlement agreement, consent, decree or other compromise in respect to any claims relating to or in any way connected with the Leased Premises or the improvements on the Leased Premises without first notifying Landlord of Tenant’s intention to do so and affording Landlord ample opportunity to appear, intervene or otherwise appropriately assert and protect Landlord’s interest with respect thereto.

(c) Tenant shall not place any underground storage tanks on the Leased Premises without Landlord’s prior written consent, which consent shall be in Landlord’s sole discretion.

Land Lease Page 8

10.23

(d) Landlord shall solely handle, treat, deal with and manage any and all Hazardous Materials associated with the Excluded Assets, or any Hazardous Materials found within the Leased Premises as a result of the removal of the Excluded Assets in accordance with all applicable Environmental Law, and in accordance with prudent industry practices regarding the management of such Hazardous Materials

10.2 Notice to Landlord.

Tenant shall immediately notify Landlord in writing of (a) any enforcement, clean-up, removal or other governmental or regulatory action instituted, completed or threatened against Tenant, the Leased Premises or any part thereof pursuant to any Environmental Law; (b) any claim made or threatened by any person against Tenant, Landlord or the Leased Premises relating to damage, contribution, cost recovery, compensation, loss or injury resulting from or claimed to result from any Hazardous Materials; (c) any reports made to any environmental agency arising out of or in connection with any Hazardous Materials in, on or about or under the Leased Premises or with respect to any Hazardous Materials removed from the Leased Premises, including, any complaints, notices, warnings, reports or asserted violations in connection therewith; and (d) the discovery of any Hazardous Materials on the Leased Premises that are or may be in violation of Environmental Law. Tenant shall also provide to Landlord, as promptly as possible, and in any event within five (5) business days after Tenant first received or sent the same, copies of all claims, reports, complaints, notices, warnings or asserted violations relating in any way to the Leased Premises or Tenant’s use thereof. Upon written request of Landlord (to enable Landlord to defend itself from any claim or charge related to any Environmental Law), Tenant shall promptly deliver to Landlord notices of hazardous waste manifests reflecting the legal and proper disposal of all such Hazardous Materials removed from the Leased Premises.

10.3 Indemnification.

TENANT SHALL INDEMNIFY, DEFEND, PROTECT AND HOLD HARMLESS LANDLORD AND EACH OF LANDLORD’S OFFICERS, DIRECTORS, PARTNERS, MANAGERS, EMPLOYEES, MEMBERS, SHAREHOLDERS, AGENTS, SUCCESSORS AND ASSIGNS (“LANDLORD PARTIES”) FROM AND AGAINST ANY AND ALL CLAIMS, LIABILITIES, DAMAGES, COSTS, PENALTIES, FORFEITURES, LOSSES OR EXPENSES (INCLUDING, BUT NOT LIMITED TO, ATTORNEYS’ AND EXPERTS’ FEES) FOR DEATH OR INJURY TO ANY PERSON OR DAMAGE TO OR DIMINUTION IN VALUE OF ANY PROPERTY WHATSOEVER, INCLUDING NATURAL RESOURCES AND THE ENVIRONMENT, AND FOR COSTS OF INVESTIGATION, REMEDIATION, AND POST-REMEDIATION CARE, E.G., GROUND WATER MONITORING, AND FOR COSTS OF DECONTAMINATING TANKS AND OTHER EQUIPMENT AND FIXTURES ON THE LEASED PREMISES OR JOINT USE AREAS ARISING OR RESULTING IN WHOLE OR IN PART, DIRECTLY OR INDIRECTLY, FROM THE OPERATION OF TENANT’S BUSINESS ON THE LEASED PREMISES, FROM THE PRESENCE OR DISCHARGE OF HAZARDOUS MATERIALS BY OR ON BEHALF OF TENANT, IN, ON, UNDER, UPON OR FROM THE LEASED PREMISES OR THE IMPROVEMENTS OR EQUIPMENT LOCATED THEREON OR FROM THE TRANSPORTATION OR DISPOSAL OF HAZARDOUS MATERIALS TO OR FROM THE LEASED PREMISES, OR FROM THE ARRANGEMENT FOR DISPOSAL OR DISPOSAL OF ANY SUCH MATERIALS, OCCURING OR ARISING FROM AND AFTER THE TERM COMMENCEMENT DATE, BUT EXCLUDING SUCH LIABILITY TO THE EXTENT IT ARISES FROM OR IS ATTRIBUTABLE TO THE ACTS OR OMISSIONS OF LANDLORD PARTIES. FOR PURPOSES OF THE INDEMNITY PROVIDED HEREIN, ANY ACTS OR OMISSIONS OF TENANT, OR ITS EMPLOYEES, AGENTS, CUSTOMERS, SUBLESSEES, ASSIGNEES, CONTRACTORS OR SUBCONTRACTORS OF TENANT, BUT EXCLUDING ANY EMPLOYEES OF LANDLORD (WHETHER OR NOT THEY ARE NEGLIGENT,

Land Lease Page 9

10.23

INTENTIONAL, WILLFUL OR UNLAWFUL) SHALL BE STRICTLY ATTRIBUTABLE TO TENANT. THE INDEMNITY OBLIGATIONS OF TENANT UNDER THIS SECTION 10.3 SHALL BE THE EXCLUSIVE INDEMNITY PROVIDED BY TENANT UNDER THIS LEASE WITH RESPECT TO THE SUBJECT MATTER OF THIS ARTICLE 10, AND SHALL SPECIFICALLY EXCLUDE AND SHALL NOT OVERLAP WITH THE INDEMNITY OBLIGATIONS OF TENANT UNDER SECTION 11.1. THE INDEMNITY OBLIGATIONS OF TENANT UNDER THIS SECTION 10.3 SHALL SURVIVE THE EXPIRATION OR EARLIER TERMINATION OF THIS LEASE.

10.4 Disclaimer Regarding Pre-Existing Conditions.

Notwithstanding any provision herein to the contrary, Landlord and Tenant acknowledge and agree that (a) Tenant shall not be liable for or be required to remove, remediate, or otherwise deal with, any Hazardous Materials that were existing on the Leased Premises on the date of this Lease (“Pre-Existing Environmental Conditions”), (b) Tenant shall not be liable for or be required to remove, remediate or otherwise deal with any Hazardous Materials that exist on the Leased Premises as a result of Landlord’s removal of the Excluded Assets (“Excluded Asset Conditions”) and (c) Tenant’s indemnity set forth in Section 10.3 above shall not be applicable to Pre-Existing Environmental Conditions or Excluded Asset Conditions; provided, however, that Tenant shall have the burden of proof to establish that any Pre-Existing Environmental Conditions or Excluded Asset Conditions that are the subject of a claim for indemnity under Section 10.3 existed on or were discharged from the Leased Premises prior to the Term Commencement Date or in connection with Landlord’s removal of the Excluded Assets, as the case may be. Pre-Existing Environmental Conditions are identified in the Environmental Baseline, which is attached hereto as Exhibit E. Removal and remediation of the Excluded Asset Conditions by Landlord shall be governed by the Removal Agreement.

10.5 Survival.

The respective rights and obligations of Landlord and Tenant under this Article 10 shall survive the expiration or earlier termination of this Lease.

ARTICLE 11 – INDEMNIFICATION

11.1 Tenant’s Indemnification, Waiver and Release.

FROM AND AFTER THE TERM COMMENCEMENT DATE, IN ADDITION TO TENANT’S OTHER DUTIES, OBLIGATIONS AND LIABILITIES UNDER THIS LEASE, TENANT HEREBY WAIVES AS TO THE LANDLORD PARTIES (DEFINED IN EXHIBIT D) AND HEREBY AGREES TO INDEMNIFY, PROTECT, DEFEND AND HOLD HARMLESS THE LANDLORD PARTIES FROM AND AGAINST ANY AND ALL LIABILITIES, CLAIMS, CAUSES OF ACTION, FINES, DAMAGES (EXCLUDING CONSEQUENTIAL DAMAGES), SUITS AND EXPENSES, INCLUDING COURT COSTS, EXPERTS’ FEES AND ATTORNEYS’ FEES (COLLECTIVELY, THE “CLAIMS”), WHETHER ARISING IN EQUITY, AT COMMON LAW, OR BY STATUTE, OR UNDER THE LAW OF CONTRACTS, TORTS (INCLUDING, WITHOUT LIMITATION, NEGLIGENCE AND STRICT LIABILITY WITHOUT REGARD TO FAULT) OR PROPERTY ARISING FROM ANY INJURY TO OR DEATH OF ANY PERSON OR THE DAMAGE TO OR THEFT, DESTRUCTION, LOSS OR LOSS OF USE OF ANY PROPERTY IN ANY EVENT ARISING FROM TENANT’S USE, OCCUPANCY OR ENJOYMENT (OR THE USE, OCCUPANCY OR ENJOYMENT OF ANY TENANT PARTY) OF THE LEASED PREMISES AND ITS FACILITIES FOR THE CONDUCT OF TENANT’S BUSINESS (OR THE BUSINESS OF SUCH TENANT PARTY) AND/OR TENANT’S USE OR ENJOYMENT (OR THE USE OR ENJOYMENT OF ANY TENANT PARTY) OF THE JOINT USE AREAS, AND/OR ARISING FROM ANY DEFECTS IN

Land Lease Page 10

10.23

THE LEASED PREMISES OR THE JOINT USE AREAS (UNLESS ANY OF THE LANDLORD PARTIES KNEW OR SHOULD HAVE KNOWN OF SUCH DEFECT OR HAD RECEIVED NOTICE OF SUCH DEFECT AND FAILED TO REMEDY IT WITHIN A REASONABLE PERIOD OF TIME AS PROVIDED IN LA. R.S. 9:3221) AND TENANT FURTHER HEREBY WAIVES AS TO THE LANDLORD PARTIES AND AGREES TO INDEMNIFY, PROTECT, DEFEND AND HOLD HARMLESS THE LANDLORD PARTIES FROM AND AGAINST ANY AND ALL CLAIMS ARISING FROM ANY BREACH OR DEFAULT IN THE PERFORMANCE OF ANY OBLIGATION ON TENANT’S PART TO BE PERFORMED UNDER THE TERMS OF THIS LEASE OR ARISING FROM ANY NEGLIGENCE OR WILLFUL MISCONDUCT OF TENANT OR ANY TENANT PARTY. IN CASE ANY ACTION OR PROCEEDING SHALL BE BROUGHT AGAINST THE LANDLORD PARTIES BY REASON OF ANY SUCH CLAIM, TENANT, UPON NOTICE FROM LANDLORD, SHALL DEFEND THE SAME AT TENANT’S SOLE COST. THE INDEMNITY OBLIGATIONS OF TENANT UNDER THIS SECTION 11.1 SHALL SPECIFICALLY EXCLUDE AND SHALL NOT OVERLAP WITH THE INDMENITY OBLIGATIONS OF TENANT UNDER SECTION 10.3, AND SHALL NOT BE APPLICABLE TO ANY MATTER DESCRIBED IN ARTICLE 10, IT BEING THE EXPRESS INTENT OF THE PARTIES THAT SECTION 10.3 IS THE EXCLUSIVE INDEMNITY PROVIDED BY TENANT WITH RESPECT TO SUCH MATTERS. THE INDEMNITY OBLIGATIONS OF TENANT UNDER THIS SECTION 11.1 SHALL SURVIVE THE EXPIRATION OR EARLIER TERMINATION OF THIS LEASE.

As used in this Lease, “Tenant Party” means any of the following persons: Tenant, any assignees claiming by, through, or under Tenant, any subtenants claiming by, through, or under Tenant, and any of their respective shareholders, members, partners, officers, directors, managers, agents, contractors, employees, licensees, customers, guests and invitees.

11.2 Landlord’s Indemnification.

FROM AND AFTER THE TERM COMMENCEMENT DATE, LANDLORD HEREBY AGREES TO INDEMNIFY, PROTECT, DEFEND AND HOLD HARMLESS THE TENANT PARTIES FROM AND AGAINST ANY AND ALL CLAIMS (AS DEFINED IN SECTION 11.1) ARISING FROM ANY INJURY TO OR DEATH OF ANY PERSON OR THE DAMAGE TO OR THEFT, DESTRUCTION, LOSS OR LOSS OF USE OF ANY PROPERTY IN ANY EVENT TO THE EXTENT ARISING FROM LANDLORD’S (OR ANY LANDLORD PARTY’S) NEGLIGENT OR INTENTIONAL ACTS AND OMISSIONS RELATING TO LANDLORD’S OPERATIONS ON THE LEASED PREMISES. IN CASE ANY ACTION OR PROCEEDING SHALL BE BROUGHT AGAINST THE TENANT PARTIES BY REASON OF ANY SUCH CLAIM, LANDLORD, UPON NOTICE FROM TENANT, SHALL DEFEND THE SAME AT LANDLORD’S SOLE COST AND EXPENSE BY COUNSEL REASONABLY SATISFACTORY TO TENANT. NOTWITHSTANDING THE ABOVE, THIS INDEMNITY SHALL SPECIFICALLY EXCLUDE ANY LIABILITY FOR ANY CLAIMS BROUGHT BY ANY OF TENANT’S EMPLOYEES FOR INJURIES SUFFERED IN THE COURSE AND SCOPE OF THEIR EMPLOYMENT AND FOR WHICH SUCH EMPLOYEE COULD ASSERT A CLAIM FOR WORKER’S COMPENSATION. THE INDEMNITY OBLIGATIONS OF LANDLORD UNDER THIS SECTION 11.2 SHALL SURVIVE THE EXPIRATION OR EARLIER TERMINATION OF THIS LEASE.

As used in this Lease, “Landlord Party” has the meaning given that term in Exhibit C.

ARTICLE 12 – LANDLORD’S LIABILITY

12.1 Liability of Landlord.

Land Lease Page 11

10.23

Landlord shall not be liable to Tenant or to Tenant’s employees, agents, licensees or visitors, or to any other person whomsoever for (a) any injury or damage to person or property due to the Leased Premises, the Joint Use Areas or related improvements or appurtenances or any part thereof becoming out of repair or by defect in or failure of pipes or wiring, or by the backing up of drains or by the bursting or leaking of pipes, faucets, and plumbing fixtures or by gas, water, steam, electricity, oil leaking, escaping or flowing into the Plant or the Leased Premises or the Joint Use Areas unless caused by the gross negligence or willful misconduct of Landlord; or (b) any loss or damage that may be occasioned by or through the acts or omissions of any other persons whatsoever, excepting only the willful conduct and gross negligence of employees, agents and contractors of Landlord; or (c) any loss or damage to any property or person occasioned by theft, fire, act of God, public enemy, injunction, riot, insurrection, war, court order, requisition or order of governmental authority, or any other matter beyond the reasonable control of Landlord. In no event shall Landlord be liable for consequential damages to Tenant of any type whatsoever such as, but not limited to, loss of business. Landlord shall not be liable to Tenant for any damage to or loss of Tenant’s personal property on or about the Leased Premises except to the extent that such damage is the result of Landlord’s acts or omissions. Tenant agrees that all of Tenant’s personal (movable) property upon the Leased Premises shall be at the risk of Tenant only, and that Landlord shall not be liable for any damage thereto or theft thereof except as specifically provided herein to the contrary.

ARTICLE 13 – EXPROPRIATION AND CASUALTY

13.1 Expropriation of Entire Leased Premises.

If, during the Term of this Lease, either (a) the entire Leased Premises, Joint Use Areas, or any portion of the Leased Premises or Joint Use Areas such that Tenant’s ability to operate the Plant is materially and adversely affected and such operations or facilities cannot be relocated to another part of the Land, as reasonably determined by Landlord and Tenant, shall be taken as the result of the exercise of the power of expropriation (either hereinafter referred to as a “Major Taking”), this Lease and all right, title and interest of Tenant hereunder shall cease and come to an end on the date of vesting of title pursuant to the Major Taking and Landlord shall be entitled to and shall receive the total award allocable to the Leased Premises (but not any improvements located therein) with respect to the Major Taking; provided, however, that nothing contained in this Article 13 shall be deemed to give Landlord any interest in, or to require Tenant to assign to Landlord, any award made to Tenant for the taking of the Plant or any personal property belonging to Tenant, reasonable expenses of relocation, and any interest accruing thereon (collectively, the “Tenant’s Recoverable Damages”).

13.2 Partial Expropriation/Continuation of Lease.

If any part of the Leased Premises or Joint Use Areas shall be taken in an expropriation proceeding other than a Major Taking (“Minor Taking”), then this Lease shall, upon vesting of title in the Minor Taking, terminate as to the parts so taken, and Tenant shall have no claim or interest in the award, damages, consequential damages and compensation, or any part thereof other than for Tenant’s Recoverable Damages. Landlord shall be entitled to and shall receive the total award made in such Minor Taking, Tenant hereby assigning any interest in such award, damages, consequential damages and compensation to Landlord, and Tenant hereby waiving any right Tenant has now or may have under present or future law to receive any separate award of damages for its interest in the Leased Premises, or any portion thereof, or its interest in this Lease; provided, however, that nothing contained herein shall be deemed to give Landlord any interest in, or to require Tenant to assign to Landlord, any award made to Tenant for Tenant’s Recoverable Damages.

13.3 Continuance of Obligations.

Land Lease Page 12

10.23

In the event of any termination of this Lease as a result of any such Major Taking or Minor Taking, Tenant shall pay to Landlord all Rent and all additional Rent and other charges payable hereunder, justly apportioned to the date of such termination. If this Lease is not terminated, then, from and after the date of vesting of title in such proceedings, Tenant shall continue to pay all of the Rent and additional Rent and other charges payable hereunder, as in this Lease provided, to be paid by Tenant, it being expressly agreed to by Landlord and Tenant that there shall in no event be any abatement or adjustment of any rental amounts due under this Lease as a result of any such proceedings or the exercise of any power of eminent domain.

13.4 Fire and Casualty Damage.

If any of the Leased Premises shall be damaged by fire or other casualty, then Tenant shall give prompt written notice thereof to Landlord, and Tenant shall, to the extent of available insurance proceeds, proceed to restore such portion of the Leased Premises that is damaged by the casualty to substantially the same or better condition as on the Term Commencement Date, reasonable wear and tear excepted. Notwithstanding the foregoing, Tenant shall have no obligation to insure, repair or restore the equipment and related facilities in the non-operational ethanol plant that exists on the Land as of the Commencement Date. Tenant shall, to the extent required hereby, commence the restoration and reconstruction work within a reasonable period following the casualty, and shall use reasonable diligence to complete such work as soon as reasonably possible. Tenant shall have the right to adjust and settle all property insurance claims relating thereto, subject to Landlord’s approval, not to be unreasonably withheld, conditioned or delayed. Tenant shall have the sole responsibility for restoring and rebuilding the Plant to the extent of available insurance proceeds, and Landlord shall have no obligation to Tenant and shall not be liable for any inconvenience or annoyance to Tenant or injury to the business of Tenant resulting in any way from such damage or the repair thereof. Tenant shall not be entitled to any diminution in Rent during the time and to the extent any portion of the Leased Premises not devoted to Tenant’s use are unfit for occupancy.

ARTICLE 14 – ASSIGNMENT AND SUBLETTING

14.1 Assignment and Subletting.

Tenant shall not assign this Lease or sublet the Leased Premises without Landlord’s prior written consent, which consent shall not be unreasonably withheld, conditioned or delayed, provided Tenant’s assignee (a) assumes in writing all of the obligations of Tenant under this Lease accruing from and after the date of the assignment, and (b) provides evidence satisfactory to Landlord of its experience in operating businesses such as the Plant and its financial capability to perform Tenant’s obligations under this Lease. For these purposes, in the event any such assignee or transferee has a net worth in excess of $10,000,000, the “financial capability” requirement shall be deemed satisfied. Notwithstanding anything to the contrary contained in this Lease, a transfer to, or an assignment or subletting of all or a portion of the Leased Premises to an Affiliate (defined below) of Tenant shall not be deemed an assignment or sublease under this Section 14.1, provided Tenant and its Guarantor remain responsible for the Tenant’s obligations under the Terms of this Lease. . As used herein, the term “Affiliate” shall mean an entity which is (i) Controlled by, Controls, or is under common Control with Tenant; (ii) any entity with which Tenant has merged or consolidated; or (iii) any entity which acquires all or substantially all of the assets and/or shares of stock, or membership interests, or assets of Tenant. A public offering of Tenant’s stock or a subsequent conversion to a private company shall not be deemed a transfer, assignment or sublease hereunder. “Control”, as used in this Section 14.1 shall mean the possession, direct or indirect, of the power to direct or cause the direction of the management and policies of an entity, whether through ownership of voting securities, by contract, or otherwise. Except as provided in Section 14.2, following any permitted assignment or subletting, Tenant (or the assigning or subletting entity) shall remain directly and primarily liable for the performance of all of

Land Lease Page 13

10.23

the covenants, duties, and obligations of Tenant hereunder, and Landlord shall be permitted to enforce the provisions of this Lease against Tenant or any assignee or sublessee without demand upon or proceeding in any way against any other person.

14.2 Term of Continuing Obligation of Tenant under this Lease. Upon the assignment of this Lease by Tenant to a third party non-affiliate, Tenant and Guarantor shall remain fully responsible for the tenant’s obligations under this Lease for the greater of (a) the remainder of the applicable 5 year term in effect at the time of the assignment; or (b) two (2) years.

14.3 Assignment by Landlord.

Landlord shall have the right to sell, transfer or assign its interest hereunder without the prior consent of Tenant, provided that such purchaser, transferee or assignee assumes Landlord’s obligations hereunder. After such sale, transfer or assignment, Tenant shall, upon presentation of an acceptable Non-disturbance Agreement (as defined below in Section 15.1), attorn to the new landlord and Landlord shall be released from all obligations arising hereunder after the date of such sale, transfer or assignment.

ARTICLE 15 – SUBORDINATION AND LENDER AGREEMENTS

15.1 Subordination.

Provided that Landlord obtains for the benefit of Tenant from each present and future holder of any Mortgage (as hereinafter defined) encumbering the Land, a non-disturbance agreement in reasonable customary form (and in recordable form) agreeing that, among other things, the holder of such mortgage or any purchaser in a foreclosure sale shall recognize and be bound by the terms of this Lease upon a foreclosure or deed in lieu thereof (“Non-disturbance Agreement”), this Lease will be subject and subordinate to the lien of all and any Mortgages, or superior thereto should Landlord and/or its mortgagee so determine (which term “Mortgages” shall include both construction and permanent financing and shall include deeds of trust and similar security instruments), which may now or hereafter encumber or otherwise affect the real estate of which the Leased Premises is a part, and to all and any renewals, extensions, modifications, recastings or refinancings thereof.

15.2 Waiver of Landlord’s Lien; Tenant’s Right to Encumber Leasehold Interest and Personal Property.

Landlord hereby waives any and all constitutional, statutory and common law liens and security interests, and any rights of distraint, with respect to Tenant’s property. Landlord will execute and deliver, on request by Tenant, any and all such instruments, forms and other documents as may be reasonably necessary or required by Tenant’s secured lender, to evidence the waiver of Landlord’s lien for the payment of Rent under any applicable statute to the lien of Tenant’s secured lender in Tenant’s leasehold estate hereunder, or any of Tenant’s property located on the Leased Premises, and providing for such lender’s right to enter the Leased Premises to take possession of and remove Tenant’s personal property, on such terms as are typical and customary in similar transactions.

ARTICLE 16 – DEFAULT

16.1 Default.

Land Lease Page 14

10.23

If any of the following shall occur, Tenant shall be deemed to be in default under this Lease (“Event of Default”):

(a) Tenant shall fail to pay any rent or other sum after same has become due and payable and such failure shall continue for more than fifteen (15) days after Tenant has received written notice of such default;

(b) Tenant shall fail to perform any of the other duties required to be performed by Tenant under this Lease and such failure shall continue for more than sixty (60) days after receipt of written notice thereof by Tenant from Landlord; provided, however, that if such default cannot reasonably be cured within such sixty (60) day period, Tenant shall have such additional time as is reasonably necessary to diligently perform such duty so long as Tenant commences to cure within such sixty (60) day period and continues to diligently perform such cure;

(c) Tenant shall make a general assignment for the benefit of creditors, admit in writing its inability to pay its debts as they become due, file a petition in bankruptcy, be adjudicated bankrupt, or file a petition seeking any reorganization, arrangement, composition, readjustment, liquidation, dissolution, or similar relief under any present or future statute, law or regulation;

or

(d) there is a levy upon or a taking of Tenant’s leasehold estate or any of Tenant’s assets by execution or other process of law that remains in effect and undischarged for a period in excess of one hundred twenty (120) days;

16.2 Landlord Remedies.

If an Event of Default occurs, Landlord shall have, in addition to such other rights or remedies as are contained within this Lease, the right at Landlord’s election, then or any time thereafter, but only if such Event of Default shall continue, to pursue any one or more of the following remedies:

(a) Landlord may (i) terminate this Lease by giving written notice thereof to Tenant, in which event Tenant shall immediately surrender the Leased Premises and Joint Use Areas to Landlord and if Tenant fails so to do, Landlord may, without prejudice to any other remedy which it may have for possession or arrearages in rent immediately institute eviction proceedings in accordance with the provisions of the Louisiana Code of Civil Procedure to expel or remove Tenant and any other person who may be occupying the Leased Premises and Joint Use Areas, or any part thereof, and Tenant shall pay to Landlord on demand an amount equal to one year’s Rent as liquidated damages which Landlord may suffer by reason of such termination, or (ii) accelerate the future Rent due under this Lease, or (iii) allow this Lease to remain in effect and proceed for damages and for the Rent as the same shall become due. Nothing contained in this Lease shall limit or prejudice the right of Landlord to prove for and obtain in proceedings for bankruptcy or insolvency by reason of the termination of this Lease, an amount equal to the maximum allowed by any statute or rule of law in effect at the time when, and governing the proceedings in which, the damages are to be proved, whether or not the amount be greater, equal to, or less than the amount the loss and damages referred to above. All accrued but unpaid sums shall bear interest at the Default Rate.

(b) No eviction of Tenant and repossession of the Leased Premises and Joint Use Areas or any part thereof pursuant to Sections 16.2(a) and 16.2(b) or otherwise shall relieve Tenant of its liabilities and obligations hereunder, all of which shall survive such eviction and repossession of the

Land Lease Page 15

10.23

Leased Premises and Joint Use Areas or any part thereof by reason of the occurrence of an event of default, and Tenant will pay to Landlord the rent required to be paid by Tenant.

(c) No right or remedy herein conferred upon or reserved to Landlord is intended to be exclusive of any other right or remedy, and each and every right and remedy shall be cumulative and in addition to any other right or remedy given hereunder or now or hereafter existing at law or in equity or by statute. In addition to other remedies provided in this Lease, Landlord shall be entitled, to the extent permitted by applicable Laws, to injunctive relief in case of the violation, or attempted or threatened violation, of any of the covenants, agreements, conditions, or provisions of this Lease, or to a decree compelling performance of any of the other covenants, agreements, conditions, or provisions of this Lease, or to any other remedy allowed to Landlord at law or in equity.

(d) Tenant waives all applicable notice requirements in connection with Landlord’s exercise of any remedies under this Article 16.

16.3 Waiver.

The waiver by Landlord of any default or Landlord’s failure to insist upon strict compliance with any provision hereof shall not be deemed to be a waiver of any subsequent default under the same, or under any other term, covenant or condition of this Lease. The subsequent acceptance of any rent by Landlord shall not be deemed to be a waiver of any preceding default by Tenant under any term, covenant or condition of this Lease, other than the failure of Tenant to pay the particular rent so accepted, regardless of Landlord’s knowledge of such preceding default at the time of acceptance of such rent.

16.4 Bankruptcy or Insolvency.

Neither Tenant’s interest in this Lease, nor any interest herein of Tenant nor any estate hereby created in Tenant shall pass to any trustee or receiver or assignee for the benefit of creditors or otherwise by operation of law. In the event Tenant shall become insolvent or become a debtor under the Federal Bankruptcy Code, or make a transfer in fraud of creditors, or make an assignment for the benefit of creditors, or take or have taken against Tenant, any proceeding of any kind under any provision of the Federal Bankruptcy Code or under any other federal or state insolvency, bankruptcy, reorganization or similar act or if a receiver or trustee is appointed for a substantial portion of Tenant’s assets, Landlord shall have the right to terminate this Lease, except that Tenant shall not be relieved of any obligations which have accrued prior to the date of such termination. Upon such termination, the provisions herein relating to the expiration or earlier termination of this Lease shall control and Tenant shall immediately surrender the Leased Premises in the condition required by the provisions of this Lease. Additionally, Landlord shall be entitled to all relief, including recovery of damages from Tenant, which may from time to time be permitted or recoverable under the Federal Bankruptcy Code or any other applicable laws.

16.5 Waiver by Tenant.

Tenant hereby expressly waives, so far as permitted by law, any and all right of redemption or reentry or repossession to revive the validity and existence of this Lease in the event that Tenant shall be dispossessed by a judgment or by order of any court having jurisdiction over the Leased Premises or the interpretation of this Lease or in case of eviction and repossession by Landlord or in case of any expiration or termination of this Lease.

ARTICLE 17 – NOTICES

Land Lease Page 16

10.23

17.1 Notices.

Any notice required or permitted under this Lease must be in writing and will be deemed received when actually received and delivered by (a) United States mail, certified or registered, return receipt requested, (b) confirmed overnight courier service, (c) confirmed facsimile transmission, or (iv) other electronic communication where receipt of the communication has been acknowledged, in each case properly addressed or transmitted to the address of the party set forth below or to such other address or facsimile number as a party will provide to the other party in accordance with this provision:

Landlord: Plaquemines Holdings, LLC

13340 Florida Blvd.

Livingston, LA 70764

Attn: Jeffrey A. Henderson

Telecopy No.:

Tenant: Omega Refining, LLC

1331 17th Street, Suite 800

Denver, Colorado 80202

Attn: James P. Gregory

Telecopy No.: 303.292.9121

ARTICLE 18 – SURRENDER

18.1 Surrender of Leased Premises.

(a) Property and Improvements Remaining with Property (“Remaining Assets).

At the termination of this Lease all, the Excluded Assets and all immovable property (as defined by Louisiana law) and component parts of immovable property (as defined by Louisiana law) constructed or installed by Tenant shall remain with the property and to the extent not then constituting property belonging to Landlord, shall become the property of Landlord without any further act of Tenant. By way of illustration only, and not intended to be exclusive, the following types of property shall constitute “Remaining Assets”:

Any railroad improvements

Dock improvements

Any piping, pipe racks, or related property permanently affixed to the ground

Any storage tanks that are not able to be trucked without significant dismantling

(b) Property to be Removed by Tenant. All other personal property constructed, installed or located on the property by or on behalf of Tenant shall constitute “Removed Assets”, and shall be removed by Tenant in accordance with sub- paragraph (c) below. By way of illustration only, and not intended to be exclusive, the following personal property shall be considered to be “Removed Assets”:

Land Lease Page 17

10.23

All processing equipment that can be transported by truck, including hydrotreaters, hydrocrackers, and other distillation equipment

All tools, inventory, and office equipment,

(c) Upon the expiration or earlier termination of this Lease, Tenant shall vacate and surrender to Landlord the Leased Premises in good, clean and operable condition. Tenant shall cause all of the Removed Assets to be removed from the Leased Premises on or before (a) the expiration date of the Lease, or (b) if the Lease is terminated for any reason prior to the scheduled expiration date (“Early Termination”), six (6) months from the effective date of termination (either date, the “Removal Date”). Nothing herein shall be interpreted to require that Tenant is obligated to remove the concrete pad underlying the Plant. Tenant shall, on or before the Removal Date, remove the Removed Assets in accordance with all applicable Laws, and in accordance with the terms of Section 10.1. With respect to any Early Termination, Tenant’s obligations under this Lease shall be deemed to continue in effect until the later of the Removal Date or the completion of the removal of the Removed Assets (for example, Tenant must continue to maintain insurance, comply with Laws, etc.), but Tenant’s right to use the Leased Premises and Joint Use Areas shall be limited to removing the Removed Assets therefrom. Tenant shall repair any damage to the Leased Premises or Joint Use Areas caused by such removal, and any and all such property not so removed within thirty (30) days after the Removal Date shall, at Landlord’s option, become the exclusive property of Landlord and be disposed of by Landlord, at Tenant’s cost and expense, without further notice to or demand upon Tenant. If the Leased Premises and Joint Use Areas are not surrendered as above set forth, Tenant shall indemnify, defend and hold harmless Landlord against loss or liability resulting from the delay by Tenant in so surrendering the Leased Premises and Joint Use Areas, including, without limitation, the cost of dismantling and disposing of the Plant (if Tenant so chooses) and compliance with Laws with respect thereto. Tenant’s obligation to observe or perform these covenants shall survive the expiration or other termination of this Lease. Tenant shall have no obligation to restore the non-operational ethanol plant that exists on the Land as of the Commencement Date.

All property of Tenant not removed on or before the thirtieth (30th) day after the Removal Date shall, at the option of Landlord, be deemed abandoned to Landlord. To the extent legally permitted, Tenant hereby irrevocably authorizes Landlord to remove all property of Tenant from the Leased Premises and Joint Use Areas thirty (30) days following the Removal Date and to cause its transportation and storage for Tenant’s benefit, all at the sole cost and risk of Tenant, and Landlord shall not be liable in any manner in respect thereto. Tenant covenants to pay all costs and expenses of such removal, transportation and storage. Tenant shall reimburse Landlord upon demand for any expenses incurred by Landlord with respect to removal or storage of abandoned property and with respect to restoring said Leased Premises and Joint Use Areas to good order, condition and repair. In addition, Landlord is hereby irrevocably authorized, to the extent legally permitted, to sell, at public or private sale, with or without legal proceedings, and with or without notice, demand, advertisement, appraisement, or any other formality, any and all of the contents of the Leased Premises, and Landlord may purchase these contents at private sale or for the highest bid at a public sale, and the proceeds of this sale, after deducting all costs, charges, attorney’s fees and expenses of the sale, will be applied to the payment of Rent and all other amounts due to Landlord, with any remaining balance belonging and being paid to Tenant. Tenant’s obligations hereunder shall survive the expiration or early termination of this Lease.

18.2 No Surrender During Lease Term.

No surrender to Landlord of this Lease or of the Leased Premises and Joint Use Areas, or any portion thereof, or any interest therein, prior to the expiration of the Term of this Lease shall be valid or effective to

Land Lease Page 18

10.23

relieve Tenant of any obligations hereunder unless such release is specifically agreed to and accepted in writing by Landlord and consented to in writing by all lenders holding a lien on the Leased Premises, and no act or omission by Landlord or any representative or agent of Landlord, other than such a written acceptance, as aforesaid, shall constitute an acceptance of any such surrender.

ARTICLE 19 – MISCELLANEOUS

19.1 Successors.

The covenants and conditions contained herein shall be binding upon and inure to the benefit of Landlord and Tenant and their respective successors and permitted assigns.

19.2 Headings.

The article and section headings in this Lease are for convenience only, and shall not limit or otherwise affect the meaning of any provision hereof.

19.3 Time of Essence.

Time is of the essence in each and every provision of this Lease.

19.4 Invalidity.

The invalidity or unenforceability of any provision of this Lease shall not affect any other provision hereof.

19.5 Attorney’s Fees.

Should either party hereto commence an action against the other to enforce any obligation under this Lease, the prevailing party shall be entitled to recover reasonable attorneys’ fees from the other.

19.6 Governing Law.

This Lease shall be construed and enforced in accordance with the laws of the State of Louisiana.

19.7 Entire Agreement.

This Lease constitutes the entire agreement between the parties hereto and may not be modified in any manner other than by written agreement, executed by all of the parties hereto and their successors in interest. No prior understanding or representation of any kind dated before the execution of this Lease shall be binding upon either party unless incorporated herein.

19.8 Authority.

Both parties executing this Lease represent that they are fully authorized to execute this Lease on behalf of their respective entities.

Land Lease Page 19

10.23

19.9 Servitudes.

As an appurtenance to the estate created by this Lease, Landlord hereby grants to Tenant, during the Term, non-exclusive (unless otherwise indicated) servitudes and rights-of-way over the parking areas, driveways, walkways, and service lanes shown on the Site Plan for vehicular and pedestrian access, ingress, and egress to and from the Leased Premises and for the use and enjoyment of the Joint Use Areas for use by Tenant, its employees, agents, contractors, invitees, assignees, subtenants, and licensees.

19.10 Landlord’s Liability.

Tenant agrees to look solely to Landlord’s estate and interest in the Leased Premises for the satisfaction of any monetary claim hereunder or the collection of any judgment based thereon, and no other property of Landlord, or any joint venturer, partner, member, shareholder, co‑owner, officer, director or manager shall be subject to levy, execution or other enforcement procedure for satisfaction of such claim or judgment.

19.11 Recording of Lease.

Tenant shall not record this Lease. After the Term Commencement Date, upon the request of a party hereto, the parties shall join in the execution of a Notice of Lease Agreement for the purpose of recordation in the form attached hereto as Exhibit D. Any recording costs associated with the Notice of Lease Agreement shall be borne by the party requesting recordation.

19.12 Estoppel Certificates.

(a) At any time and from time to time, but in no event on less than fifteen (15) days’ prior written request by Landlord or its lender, Tenant shall execute and deliver to the requesting party a certificate certifying: (a) that Tenant has accepted the Leased Premises as being suitable for its purposes (or, if Tenant has not done so, that Tenant has not accepted the Leased Premises and specifying the reasons therefor); (b) the commencement and expiration dates of this Lease; (c) whether there are then existing any defaults by Landlord in the performance of its obligations under this Lease (and, if so, specifying the same); (d) that this Lease is unmodified and in full force and effect (or, if there have been modifications, that this Lease is in full force and effect, as modified, and stating the date and nature of each modification); (e) the capacity of the person executing such certificate, and that such person is duly authorized to execute the same on behalf of Tenant; (f) the date, if any, to which rent and other sums payable hereunder have been paid; (g) that no notice has been received by Tenant of any default which has not been cured, except as to defaults specified in the certificate; and (h) such other matters as may be reasonably requested by Landlord or its lender. Any such certificate may be relied upon by any prospective purchaser, mortgagee, beneficiary, subtenant, assignee, or other nominee third party of the party receiving the certificate.

(b) At any time and from time to time, but in no event on less than fifteen (15) days’ prior written request by Tenant or its lender, Landlord shall execute and deliver to the requesting party a certificate certifying: (a) the commencement and expiration dates of this Lease; (b) whether there are then existing any defaults by Tenant in the performance of its obligations under this Lease (and, if so, specifying the same); (c) that this Lease is unmodified and in full force and effect (or, if there have been modifications, that this Lease is in full force and effect, as modified, and stating the date and nature of each modification); (d) the capacity of the person executing such certificate, and that such person is duly authorized to execute the same on behalf of Landlord; (e) the date, if any, to which rent and other sums payable hereunder have been paid; (f) that no notice has been received by Landlord of any default which has not been cured, except as to defaults

Land Lease Page 20

10.23

specified in the certificate; and (g) such other matters as may be reasonably requested by Tenant or its lender. Any such certificate may be relied upon by any prospective purchaser, mortgagee, beneficiary, subtenant, assignee, or other nominee third party of the party receiving the certificate.

19.13 Force Majeure.

Other than for Tenant's or Landlord’s monetary obligations under this Lease and obligations that can be cured by the payment of money (e.g., maintaining insurance), whenever a period of time is herein prescribed for action to be taken by either party hereto, such party shall not be liable or responsible for, and there shall be excluded from the computation of any such period of time, any delays due to terrorism, strikes, riots, acts of God, shortages of labor or materials, war, laws, regulations or restrictions or any other causes of any kind whatsoever that are beyond the control of such party

19.14 Landlord’s Removal Operations.

Landlord intends to remove some or all of the Excluded Assets from the Land. The rights and obligations of Landlord and Tenant with respect to such removal operations are more particularly addressed in the Removal Agreement attached hereto as Exhibit H, incorporated herein by this reference.

[Remainder of page intentionally left blank.]

Land Lease Page 21

10.23

Executed and effective as of the Effective Date.

(Signature page to Land Lease)

22

Exhibit A

DESCRIPTION OF THE “LAND”

A CERTAIN PORTION OF GROUND located in Alliance and St. Rosalie Plantation, Section 5, T16S, R25E, Southeast District of Louisiana, West of the Mississippi River, Plaquemines Parish, Louisiana in an area bounded by La. State Highway No 23, the Mississippi River, above by Citrus Lands of Louisiana, and below by La. Power & Light co., designated as Tract A-1C and described as follows:

Commence from the intersection of the upper line of La. Power & Light Co. Property and the original easterly right of way line of La. State Highway 23 said point having coordinates X=2,430,858.48, Y=366,504.59 and go North 21°56’19” West a distance of 416.07; thence go North 69°07’01” East a distance of 2111.83 feet to the POINT OF BEGINNING. Thence continue North 69°07’01” East a distance of 210.64 feet; thence go of North 20°52’59” West a distance of 1301.27 feet; thence go of North 69°07’01” East a distance of 1221.80 feet; thence go of South 24°30’41” East a distance of 95.98 feet; thence go South 20°53’09” East a distance of 505.11 feet; thence go of South 13°29’42” East a distance of 159.40 feet; thence go of South 29°50’59” East a distance of 220.75 feet; thence go of South 20°49’56” East a distance of 332.00 feet; thence go of North 69°07’01” East a distance of 170.23 feet; thence go of South 20°43’33” East a distance of 358.55 feet; thence go of South 69°08’57” West a distance of 1397.84 feet; thence go of North 20°47’37” West a distance of 222.20 feet; thence go of North 63°58’24” West a distance of 55.28 feet; thence go of South 69°12’23” West a distance of 186.13 feet; thence go of North 20°52’59” West a distance of 102.66 feet to the POINT OF BEGINNING.

Land Lease Exhibit A – Page 1

H-713097_11.DOC

10.23

Exhibit B

SITE PLAN AND DESCRIPTION OF THE “LEASED PREMISES” AND “JOINT USE AREAS

Description of Leased Premises:

A CERTAIN PORTION OF GROUND located in Alliance and St. Rosalie Plantation, Section 5, T16S, R25E, Southeast District of Louisiana, West of the Mississippi River, Plaquemines Parish, Louisiana in an area bounded by La. State Highway No 23, the Mississippi River, above by Citrus Lands of Louisiana, and below by La. Power & Light co., designated as Tract A-1C and described as follows:

Commence from the intersection of the upper line of La. Power & Light Co. Property and the original easterly right of way line of La. State Highway 23 said point having coordinates X=2,430,858.48, Y=366,504.59 and go North 21°56’19” West a distance of 416.07; thence go North 69°07’01” East a distance of 2111.83 feet to the POINT OF BEGINNING. Thence continue North 69°07’01” East a distance of 210.64 feet; thence go of North 20°52’59” West a distance of 1301.27 feet; thence go of North 69°07’01” East a distance of 1221.80 feet; thence go of South 24°30’41” East a distance of 95.98 feet; thence go South 20°53’09” East a distance of 505.11 feet; thence go of South 13°29’42” East a distance of 159.40 feet; thence go of South 29°50’59” East a distance of 220.75 feet; thence go of South 20°49’56” East a distance of 332.00 feet; thence go of North 69°07’01” East a distance of 170.23 feet; thence go of South 20°43’33” East a distance of 358.55 feet; thence go of South 69°08’57” West a distance of 1397.84 feet; thence go of North 20°47’37” West a distance of 222.20 feet; thence go of North 63°58’24” West a distance of 55.28 feet; thence go of South 69°12’23” West a distance of 186.13 feet; thence go of North 20°52’59” West a distance of 102.66 feet to the POINT OF BEGINNING.

Less and Except:

A 5.29 Acre Tract measuring approximately 475 feet by 485 feet and identified as Site A on the attached site plan of Hugh McCurdy, III, PLS and further described below:

A CERTAIN PARCEL OF GROUND, together with all improvements thereon, and all rights, ways, privileges, servitudes, appurtenances, and advantages thereunto belonging and appertaining, situated in Township 16 South, Range 25 East, Section 5, Alliance Plantation, Plaquemines Parish, Louisiana, and being more fully described as follows:

Commencing at corner common to the properties of Harvest States, Conoco Phillips Alliance Refinery, and Plaquemines Holdings, LLC, having a Latitude of 29 degrees 40 minutes 31.9 seconds West and a Longitude of 89 degrees 58 minutes 05.4 seconds West; thence in a southwesterly direction along the line between Conoco Phillips Alliance

Land Lease Exhibit B – Page 1

H-713097_11.DOC

10.23

Refinery and Plaquemines Holdings, LLC, for a distance of 281 feet to a 6 foot chain link fence and the POINT OF BEGINNING;