Attached files

| file | filename |

|---|---|

| EX-10.1 - EXHIBIT 10.1 - XPO Logistics, Inc. | d774486dex101.htm |

| EX-99.1 - EXHIBIT 99.1 - XPO Logistics, Inc. | d774486dex991.htm |

| 8-K - FORM 8-K - XPO Logistics, Inc. | d774486d8k.htm |

Investor Presentation

August 2014

Exhibit 99.2 |

1

1

Forward-Looking Statements Disclaimer

This document contains “forward-looking statements” within the meaning of Section 27A of

the Securities Act, and Section 21E of the Exchange Act, including such things as the

anticipated closing date of the acquisition of New Breed, and the related financing, the expected impact of the acquisition of New Breed and New Breed’s

anticipated growth, the projected satisfaction of closing conditions to the acquisition of New Breed,

the retention of the New Breed management team, the expected ability to integrate operations

and technology platforms and to cross-sell services, future capital expenditures (including the amount and nature thereof), finding other

suitable merger or acquisition candidates, expansion and growth of the Company’s business and

operations and other such matters. All statements, other than statements of historical

facts, included or incorporated by reference in this offering memorandum, are forward-looking statements. In some cases, forward-looking

statements can be identified by the use of forward-looking terms such as “anticipate,”

“estimate,” “believe,” “continue,” “could,” “intend,” “may,” “plan,” “potential,”

“predict,” “should,” “will,” “expect,” “objective,”

“projection,” “forecast,” “goal,” “guidance,” “outlook,” “effort,” “target” or the negative of these terms or other comparable

terms. However, the absence of these words does not mean that the statements are not

forward-looking. These statements are based on certain assumptions and analyses made by us

in light of our experience and our perception of historical trends, current conditions and expected future developments, as well as other factors we

believe are appropriate in the circumstances.

These forward-looking statements are subject to known and unknown risks, uncertainties and

assumptions that may cause actual results, levels of activity, performance or achievements to be

materially different from any future results, levels of activity, performance or achievements expressed or implied by such forward-looking

statements. Factors that could adversely affect actual results and performance include, but are

not limited to, those discussed elsewhere in this offering memorandum, including the section

entitled “Risk Factors”, the risks set forth in our filings with the SEC and the following: economic conditions generally; competition; our ability to find

other suitable acquisition candidates and execute our acquisition strategy; the expected impact of the

acquisition of New Breed, including the expected impact on XPO’s results of operations; the

ability to obtain the requisite regulatory approvals and the satisfaction of other conditions to consummation of the transaction; the expected

closing date for the acquisition of New Breed; our ability to raise debt and equity capital; our

ability to attract and retain key employees to execute our growth strategy; litigation,

including litigation related to alleged misclassification of independent contractors; our ability to develop, implement and maintain a suitable information

technology system; our ability to maintain positive relationships with our network of third party

transportation providers; our ability to retain our and New Breed’s largest customers;

XPO’s ability to successfully integrate New Breed and other acquired businesses and realize anticipated synergies and cost savings; rail and other network

changes; weather and other service disruptions; and governmental regulation. All forward-looking

statements included in this offering memorandum, or in any document incorporated by reference

herein or therein speak only as of the date of this offering memorandum or the document incorporated by reference, as the case may be. All

of the forward-looking statements made or incorporated by reference in this offering memorandum

are qualified by these cautionary statements and there can be no assurance that the actual

results or developments anticipated by XPO will be realized or, even if substantially realized, that they will have the expected consequence to,

or effects on, XPO or its respective businesses or operations and XPO will not undertake any

obligation to update forward-looking statements to reflect subsequent events or

circumstances, changes in expectations or the occurrence of unanticipated events except to the extent required by law.

This presentation contains certain non-GAAP financial measures. A “non-GAAP financial

measure” is defined as a numerical measure of a company’s financial performance that

excludes or includes amounts so as to be different than the most directly comparable measure calculated and presented in accordance with GAAP in

the statement of income, balance sheet or statement of cash flows of the company. Pursuant to the

requirements of Regulation G, the company has provided a reconciliation of non-GAAP

financial measures to the most directly comparable GAAP financial measure.

The non-GAAP financial measures used are: EBITDA, Adjusted EBITDA and Unlevered Free Cash

Flow. These measures are presented because management uses this information to monitor

and evaluate financial results and trends. Therefore, management believes this information is also useful for investors.

|

2

2

Management Team Presenters

Bradley Jacobs

Chairman and Chief Executive Officer –

XPO Logistics

John Hardig

Chief Financial Officer –

XPO Logistics

Scott Malat

Chief Strategy Officer –

XPO Logistics |

3

3

Agenda

Transaction Overview

1

2

XPO Logistics Overview

3

Financial Overview

4

Appendix |

1.

Transaction Overview |

5

5

Executive Summary

XPO

Logistics,

Inc.

(NYSE:

XPO)

(the

“Company”

or

“XPO”)

is

a

leading

asset-light

provider

of

transportation logistics services, including truck brokerage, intermodal,

expedited transportation, last mile logistics and freight forwarding

services –

Current

equity

market

capitalization

of

$2.5

billion

as

of

August

8,

2014

(1)

XPO

announced

on

July

29,

2014

that

it

has

agreed

to

acquire

New

Breed

Holding

Company

(“New Breed”) for a purchase price of $615 million

–

The acquisition of New Breed expands XPO’s service offerings to include

desirable sectors of contract logistics services and provides the Company

with significant additional scale, diversified revenue, complementary

services and an enhanced value proposition for blue chip customers

–

Pro forma for the acquisition, XPO will have LTM June 30, 2014 revenues and

adjusted EBITDA

of

$2.7

billion

and

$144

million

(2)

,

respectively

To finance the acquisition, the Company intends to use proceeds from a $500

million senior unsecured notes offering, as well as an ABL draw and

available cash The New Breed transaction is subject to HSR clearance and

other customary conditions and is expected to close in the third

quarter (1)

Assumes conversion of the convertible senior notes into equity

(2)

EBITDA reconciliation is located in the Appendix |

6

6

Sources and Uses and Pro Forma Capitalization

(1)

Atlantic

Central

Logistics

(“ACL”),

a

last

mile

logistics

provider,

was

acquired

on

July

28,

2014

in

an

all

cash

purchase

of

$36.5

million

(~6.1x purchase multiple); ACL has LTM EBITDA of $6 million

(2)

Subsequent to June 30, 2014, $14 million of restricted cash was released after

certain letters of credit were secured by the Company (3)

ABL is secured by all assets and matures on October 17, 2018; availability of $243

million as of June 30, 2014 (4)

Convertible Senior Notes due October 1, 2017 have conversion price of $16.43 per

share of common stock; current XPO share price is $30.74 as of August 8,

2014; Convertible Senior Notes do not have any subsidiary guarantees

(5)

As of August 8, 2014; Assumes the conversion of convertible senior notes into

equity (4)

(3)

(1)

(2)

(5)

(5)

($ in millions)

June 30, 2014

Cum. Mult. EBITDA

% of

Actual

Adj.

PF, as Adjusted

LTM 6/30/14

total cap

Cash and Cash Equivalents

$112

($82)

$30

Restricted Cash

17

(14)

3

$415m ABL Revolving Credit Facility

–

48

48

Senior Unsecured Notes

–

500

500

Miscellaneous Debt

2

–

2

Total Debt (excl. convert)

$2

$550

3.8x

18%

Net Debt (excl. convert)

(110)

520

3.6x

Convertible Senior Notes

121

–

121

Total Debt

$123

$671

4.7x

Net Debt

11

641

4.5x

Equity market capitalization

2,450

–

2,450

82%

Total market capitalization

$2,452

$3,000

100%

PF Adj. LTM EBITDA

$144

($ in millions)

Sources

Uses

ABL draw

$48

New Breed Acquisition

$615

Senior Unsecured Notes

500

ACL acquisition

37

Equity investment by New Breed CEO

30

Fees and Expenses

22

Cash from Balance Sheet

96

Total sources

$674

Total uses

$674 |

2.

XPO Logistics Overview |

8

8

One of the Largest 3PLs in North America

We facilitate over 31,000 deliveries per day

#4 freight brokerage firm and Top 50 logistics company

#3 provider of intermodal services

#1 provider of cross-border Mexico intermodal

#1 manager of expedited shipments

#1 provider of last mile logistics for heavy goods

International and domestic freight forwarder

Growing presence in managed transportation and less-than-truckload

(LTL) After the New Breed acquisition, leading provider of engineered

outsourced logistics Sources for rankings: Transport Topics, Journal of

Commerce and company data |

9

9

Clearly Defined Strategy for Value Creation

Acquire companies that bring value and are highly scalable

Significantly scale up and optimize existing operations

Open cold-starts where sales recruitment can drive revenue

We are ahead of plan in transforming XPO Logistics into

a leading, multi-modal supply chain logistics provider

|

10

10

Precise Execution of Growth Plan

Completed 12 strategic acquisitions and established 23 cold-starts in less

than three years Created leading-edge recruiting and training

programs Introduced scalable IT platform

Added national operations centers for shared services, carrier procurement and

last mile operations

Created a culture of passionate on-time performance

Disciplined focus on operational excellence |

11

11

Massive Commitment to Shipper Satisfaction

Integrated network with cross-company visibility

148 locations in the U.S., Canada, Mexico, Asia and Europe

Approximately 3,100 employees

More than 3,600 owner-operator trucks under contract for drayage, expedited

and last mile subsidiaries

Relationships with an additional 27,000 vetted carriers

Access to 60,000 miles of network rail routes

New Breed will add approximately 7,300 employees and 70 locations

|

12

Founded and led four highly successful companies, including two world-class

public corporations, prior to XPO

United Rentals:

–

Grew EBITDA from $50 million at initial bond offering in May 1998 to $1.1 billion

in 2007 –

Issued over $4 billion in high yield debt through 2007

United Waste Systems:

–

Sold in 1997 for $2.5 billion

Hamilton Resources:

Amerex Oil Associates:

Chairman and CEO Bradley S. Jacobs

Global oil trading company with ~$1 billion revenue

Fifth largest solid waste management business in North America

World’s largest equipment rental company (NYSE: URI)

One of world’s largest oil brokerage firms |

13

13

Brad Jacobs led a $75 million cash investment to assume control of XPO Logistics

in September 2011

Build a multi-billion dollar, non-asset based, third party logistics

business Large and underpenetrated $1 trillion U.S. transportation logistics

industry Scale is a competitive advantage with customers and carriers

Fragmented industry with many quality acquisition targets

Highly skilled management team with talents that fit the Company’s growth

strategy Intense focus on world-class operations to create value for all

stakeholders XPO Investment Premise |

14

14

Sector

North

American

Market

Size

($ billions)

Projected

Growth

(x GDP)

Key

Competitors

XPO

Position

Truck

Brokerage

~$50

2-3 times

#4

Intermodal

~$15

3-5 times

#3

Last Mile –

Heavy Goods

~$13

5-6 times

#1

Expedited

Transportation

~$5

3-4 times

#1

Contract

Logistics

~$55

~3 times

Top 10

(Pro

Forma)

Outsourcing and

technology

Driver shortages increase

brokers’

value proposition

Long-haul rail efficiencies

and near-sourcing of

manufacturing in Mexico

Outsourcing and

e-commerce

Outsourcing trend

Technology advances

Just-in-time

management

Supply chain

complexity

Highly fragmented market

Technology advances favor

larger players with scale

Intermodal growth takes

volume from trucking sector

XPO is clear market leader in

heavy goods home delivery

logistics

Differentiated by end-consumer

experience management

Highly fragmented; top-10

players account for less than

25% of global market

Scale is less of a

competitive advantage

Highly fragmented

Highly-engineered services

create sticky, stable

customer relationships

Source: Armstrong & Associates, Norbridge, Inc., EVE Partners LLC, FTR

Associates, SJ Consulting Group, Inc., Bureau of Economic Analysis, US

Department of Commerce. Strong Fundamentals Across Operating Sectors

Growth Drivers

Competitive Dynamic |

15

15

Services includes truckload, less-than-truckload (LTL) and related

over-the-road logistics For-hire U.S. trucking is a $350 billion

industry –

Estimated 15% ($50 billion) penetration by brokers

Growing at two to three times GDP

–

Favorable shipper trend toward outsourcing

–

Regulatory pressure on shippers

–

Favorable carrier trend toward using brokers to eliminate in-house sales

cost –

Driver shortages are beneficial to brokers

Truck Brokerage: An Underpenetrated Sector

Sources: Armstrong & Associates and EVE Partners LLC

|

16

16

Generated

organic

revenue

growth

of

67%

in

truck

brokerage

in

Q2

2014

YOY

11 brokerage cold-starts on an annual revenue run-rate of more than $220

million –

Up from $90 million 12 months ago

–

Low capital investment can deliver outsized returns

Proprietary IT platform provides cross-company visibility of market

conditions, capacity and carrier performance

–

Sophisticated analytical tools for pricing and load-covering

–

Sales force productivity climbing with technology investments and increase in

tenure Truck Brokerage: Strong Organic Growth

Lane densities and pricing histories added to database with each acquisition |

17

17

XPO facilitates freight movements by rail, typically with truck components at both

ends $15 billion sector in North America

One of the fastest-growing areas of transportation logistics

–

Growing at three to five times GDP

Can lower transportation costs for freight traveling 600 miles or more

–

Rail is more fuel-efficient than truckload for long haul

–

Intermodal can lower shipper’s cost by up to 20%

Intermodal: A Major Market Opportunity

Sources: SJ Consulting Group, Inc. and FTR Associates

|

18

18

XPO gained instant scale in North American intermodal

–

Third largest provider of intermodal services

–

–

Decades-deep relationships with the railroads enhance customer service

Transaction added $980 million of revenue (FY 2013), 31 locations and

approximately 800 employees

Asset-light model: XPO controls over 17,000 containers with access to more

capacity through rails

XPO now manages approximately 10% of all domestic intermodal loads in North

America Intermodal: Acquired Pacer in March 2014

Sources: Bureau of Economic Analysis and US Department of Commerce

#1 provider of cross-border Mexico intermodal, with 30 years’ experience

On track to realize $15 million of targeted synergies from Pacer integration |

19

19

Mexico is fast-becoming the country of choice for manufacturing

near-shoring, compared with China

–

Competitively priced labor force

–

Favorable regulatory and tax environment

–

Faster speed-to-market than overseas locales

–

Supports just-in-time lean production trend

Growth driven by billions of dollars invested by major manufacturers, Mexican

government and the rails

Large opportunity to convert to intermodal: an estimated 2.8 million trucks move

cross- border each year

Intermodal: Cross-Border Mexico Growth

Sources: AlixPartners |

20

20

Arranges delivery and installation of heavy goods to residences and

workplace –

Customers include nearly all of the top 30 big-box retailers

$13 billion market for heavy goods home deliveries

One of the fastest-growing sectors of non-asset, third party

logistics –

Heavy goods home delivery growing at five to six times GDP

–

Strong tailwinds from e-commerce and outsourcing

–

Only 30% currently going through 3PLs

Highly fragmented with many small, regional providers

Last Mile: XPO Leads Fast-Growing Sector

Source: Norbridge, Inc. and EVE Partners LLC |

21

21

Extremely high level of end-customer satisfaction

–

Leading proprietary software for workflow and customer experience management

–

Real-time visibility into customer satisfaction

Strong customer-centric culture built by experienced leaders who now run the

business for XPO

Acquired Optima Service Solutions in November 2013

–

Highly scalable, leading facilitator of complex installations for appliances and

electronics

Acquired Atlantic Central Logistics in July 2014

–

Moves high volumes of e-commerce purchases for mega-companies

Last Mile: Acquired 3PD in August 2013 |

22

22

Estimated $5 billion market

Benefits from toward just-in-time inventories, supply chain

disruptions XPO manages more expedited shipments than any other provider in

North America –

XPO Express –

over-the-road logistics, three decades of experience as

Express-1 –

XPO NLM –

#1 proprietary web-based auction technology

–

XPO Air Charter –

auction-driven, last-minute freight movements

Expedited: #1 Manager of Urgent Shipments

Source: Company data |

23

23

XPO arranges domestic and international shipments, typically by air and

ocean Currently a $200 million player in a $150 billion market

Significant opportunity to grow market share through network of dedicated

offices –

19 Company-owned offices

–

16 independently-owned stations

Provides air transport support to expedited operations

Integrated former Pacer operations in US, Asia and Europe

Freight Forwarding: Global Network

Source: Company data |

24

24

Compelling reasons for the transaction, expected to close in Q3 2014

Contract Logistics: Acquisition of New Breed

Source: XPO Logistics and New Breed company data

Will be transformational

for XPO’s scale and value proposition

Capitalizes on outsourcing trends for reverse logistics, omni-channel

distribution, transportation management, lean manufacturing and aftermarket

support, and supply chain optimization

Will create significant cross-selling opportunities with XPO strategic

accounts, New Breed customers and their vendors

–

Combined company of approximately 10,400 union-free employees and over 200

locations

–

XPO will gain over 300 IT professionals from the combination, doubling XPO’s

IT workforce

–

Gives XPO the industry’s most differentiated supply chain offering

|

New

Breed Is a Preeminent Provider Source: New Breed company data

25

Leads the most desirable sector of contract logistics

Complex, highly engineered solutions for blue chip customers

Targets industries with growing demand for outsourced logistics

–

Technology/telecom, e-commerce/retail, aerospace and defense, medical

equipment, and select areas of manufacturing

Very stable relationships with low cyclicality – performed well in Great Recession

–

Approximately 99% contractual revenue renewal rate over the past three years

–

Weighted average remaining term of existing contracts is 5.5 years (6.5 years for

five largest customers) 25 |

26

26

New Breed’s Attractive Financial Model

38% return on invested capital (FY 2013)

(1)

71% free cash flow conversion (FY 2013)

(2)

Low capex required to maintain business: approximately 2% of sales (total

including growth capex was 4.2% of revenue in FY 2013) and devoted

primarily to IT Majority of facility leases expire at the same time as the

customer contracts Asset-light

based

model

in

line

with

XPO’s

strategy

(1)

Return on invested capital equals ongoing operations EBIT divided by the sum of

net working capital and net PP&E

(2)

Free cash flow conversion equals EBITDA minus capex, divided by EBITDA

Source: New Breed company data |

27

27

Integrated Multi-Modal Growth Model Offers

Attractive Earnings Diversification

No single division accounts for more than 30%

of gross revenue

XPO’s broad service portfolio mitigates

cyclicality, adapts to changes in demand

Large shippers increasingly favor single source

providers with a broad array of capabilities

(1)

Figures

reflect

inclusion

of

New

Breed

for

the

full

LTM

June

30,

2014

period

on

a

PF

basis

Truck

Brokerage

23%

Last Mile

13%

Intermodal

30%

Expedited

5%

Freight

Forwarding

7%

Contract

Logistics

22%

LTM

Pro

Forma

Gross

Revenue

(1) |

Asset-light model allows flexibility to

manage costs in changing economic

climates

–

85% of cash operating costs are

variable

Operating facility rents largely co-

terminus with customer contracts

67% of New Breed contracts are either

fixed-variable or cost plus arrangements

PF Q2 2014

(1)

Cash Operating Expenses

Total

Variable

85%

Highly Variable Cost Base

XPO has a highly variable cost base

(1)

PF for New Breed acquisition

28

15%

19%

66%

Purchased

Transportation

Other Variable

Fixed

28 |

29

29

PF 2013 Capex

(1)

Growth

63%

Low Maintenance Capex Requirements

63% of capex is invested in customer

growth

Growth investments enhance service

offerings and customer retention

Investment in contract logistics

customers only occurs after securing

long-term contract

Maintenance capex represents ~$4.5

million per quarter (~0.7% of sales)

The majority of XPO’s capital expenditures are used to fuel growth

(1)

PF for New Breed acquisition

37%

23%

40%

Capitalized

Software

Other Growth

Maintenance |

30

30

Resilient to Economic Cycles

Freight

brokerage,

last

mile

and

contract

logistics

resistant

to

economic

downturns

Freight brokerage net revenue margins typically expand in economic downturns

XPO Last Mile gained market share as smaller providers struggled

New Breed grew sales and earnings during the Great Recession

|

Longstanding and stable relationships with a

large, diversified base of blue-chip customers

–

More than 14,000 active customer accounts

ranging from Fortune 100 global leaders to

small, privately-held companies

Recognized by customers as leading provider

New Breed’s revenue is 100% contracted for

the rest of 2014 and 88% for 2015

–

Contract renewal has averaged ~99%

since 2007

Diversified Account Base with Low Customer

Concentration

Pro Forma Customers as % of Total Revenue

(1)

(1)

PF for the New Breed acquisition

31

Customer 1, 6%

Customer 2, 5%

Customer 3, 4%

Customer 4, 3%

Customer 5, 3%

Customers 6-10, 11%

Customers 11-20, 15%

All other customers, 53%

31 |

32

32

Attractive cash flow fundamentals

Combined and PF Adjusted EBITDA

(1)

and Margin

Significant FCF Conversion

(2)

Asset-Light Model Generates Strong Cash Flow

($ in millions)

(1)

2012

calculated

based

on

combined

Company

and

New

Breed

metrics.

Such

metrics

do

not

represent

Regulation S-X compliant metrics, and accordingly do not take account of any

PF adjustments thereof. PF metrics (and actual results should New Breed

have been owned by the Company during the period shown) could substantially

differ (2)

Represents

Combined

and

PF

Adjusted

EBITDA

less

total

capex

as

a

percentage

of

EBITDA

$122

$151

$144

5%

6%

5%

2012

2013

LTM

46%

68%

65%

2012

2013

LTM

Asset-light 3PL business model has high

returns and high free cash flow conversion

Low capex requirements and a flexible cost

structure allow the Company to adapt to

prevailing market conditions

Cold-starts require limited initial investment,

typically less than $1 million

Investments in infrastructure and

IT have positioned the Company for

continued growth without significant

increase in capex |

33

33

Common Shares

52.6 million

Preferred Shares

10.5 million

Warrants

7.8 million dilutive

(2)

Convertible Senior Notes

7.3 million shares

(3)

Stock Options and RSUs

1.2 million dilutive

(4)

Fully Diluted Shares Outstanding

79.4 million

Fully Diluted Market Capitalization

$2,450 million

(5)

New Senior Notes

$500 million

Debt-to-Cap

18.3%

(6)

Significant Equity Cushion:

Low Debt to Capitalization

Incentivized management team with ~29%

ownership of the company

(1)

Equity ownership aligns management team

with investors

Significant junior capital cushion

Substantial equity value creation since Brad

Jacobs’

investment in 2011 as company

delivered on its plan

–

Over 500% increase in market cap since

September 2011 investment

(5)

(1)

Based on SEC beneficial ownership calculation as of June 30, 2014; includes

management and directors (2)

Dilutive effect of warrants calculated using treasury method (avg. closing price

of $26.41 for the 3 months ending

6/30/14);

total

warrant

proceeds

of

$74.0

million

(3)

Assumes conversion in full of $120.7 million in aggregate principal amount of

outstanding 4.50% convertible senior

notes

due

2017

(4)

Dilutive

effect

of

outstanding

RSUs

and

stock

options

calculated

using

treasury

method

(avg.

closing

price

of

$26.41

for

the

3

months

ending

6/30/14)

(5)

As of 8/8/14

(6)

Includes $48 million ABL draw and $2 million other debt

Common Stock Equivalent Capitalization as of 6/30/14 |

Management Excels at

Efficient Integrations Disciplined process for integration with minimal disruption to

operations Move acquired operations onto the Company’s IT platform to connect with carrier

and customer bases

Identify synergies in technology, real estate, sales and administrative functions and duplicative

personnel

Go to market as one integrated offering and cross-sell services

Maintain strong communications with employees, customers and carriers

XPO Service Offerings Used by Top 50 Customers

34

21

13

8

7

1

1 Service

2 Services

3 Services

4 Services

5 Services

Number of companies

34 |

3.

Financial Overview |

Combined and Pro Forma Historical Financials

EBITDA

Revenue

Unlevered FCF

(2)

Capex

(1)

Note:

2012

calculated

based

on

combined

Company

and

New

Breed

metrics.

Such

metrics

do

not

represent

Regulation S-X compliant metrics, and accordingly do not take account of any

PF adjustments thereof. PF metrics (and actual results should New Breed

have been owned by the Company during the period shown) could substantially

differ (1)

Does not reflect capex from ACL

(2)

Unlevered FCF calculated based on Combined and PF Adjusted EBITDA less capex

($ in millions)

($ in millions)

($ in millions)

($ in millions)

36

$2,257

$2,623

$2,769

2012

2013

LTM 6/30/14

$122

$151

$144

2012

2013

LTM 6/30/14

$66

$49

$50

2012

2013

LTM 6/30/14

$56

$102

$94

2012

2013

LTM 6/30/14

36 |

37

37

LTM 6/30/14 EBITDA Bridge

($ in millions)

(1)

Note:

Detailed EBITDA reconciliation located in the Appendix; components do not sum to

totals due to rounding (1)

PF for acquisitions of 3PD, Pacer and New Breed, as well as associated

expenses $91

$144

$14

$7

$6

$14

$11

Adjusted Full-year impact of

EBITDA

certain other

acquisitions

Pacer

restructuring

charges

Non

-cash equity

compensation

Cost savings and

operational

improvement at

Pacer, Optima

and NLM

Non-recurring

costs at New

Breed

Pro Forma

Combined

EBITDA |

38

38

Financial Policy Overview

Strong liquidity

–

Access

to

a

$415

million

revolving

credit

facility

secured

by

the

Company’s

assets

(1)

No current plans for dividend or return of capital

Low capital intensity

–

Asset-light model and flexible cost structure allow the Company to more easily

adapt to prevailing market conditions

Modest leverage appetite

–

Targeted long-term view of total leverage below 3.0x

–

Outstanding debt of $121 million convertible senior notes are trading deep in the

money (1)

Borrowing capacity was $243 million prior to New Breed acquisition

|

4.

Appendix |

40

40

Adjusted EBITDA Reconciliation

12 Months Ended

6 Months Ended

6 Months Ended

12 Months Ended

($ in thousands)

12/31/2013

6/30/2013

6/30/2014

6/30/2014

Net loss available to common shareholders

($51,502)

($33,392)

($43,372)

($96,240)

Preferred dividends

2,972

1,486

1,475

2,961

Net loss

($48,530)

($31,906)

($41,897)

($93,279)

Pacer debt commitment fee

–

–

4,624

4,624

Other interest expense

18,169

6,170

8,837

60,597

Income tax (benefit) provision expense

(22,442)

296

(5,070)

(21,940)

Accelerated amortization of Express-1 trade name

–

–

3,346

3,346

Other depreciation and amortization

20,795

3,349

33,197

137,529

EBITDA

($32,008)

($22,091)

$3,037

$90,877

Pacer transaction and restructuring costs

–

–

11,408

–

XPO Express and XPO Last Mile rebranding costs

–

–

321

321

Adjusted EBITDA

($32,008)

($22,091)

$14,766

$91,198 |

41

41

Pro Forma Adjusted EBITDA Reconciliation

(1)

Includes Adjusted EBITDA from ACL of $6.2 million, from Optima of $1.7 million and

from NLM of $9.6 million prior to their respective dates of

acquisition (2)

Direct, transaction costs related to the acquisitions described in footnote (1)

above and acquisitions not consummated (3)

Restructuring charges related to the termination of employees and closure of

facilities primarily related to the Pacer acquisition in the

six

months

ended

June

30,

2014

and

other

acquisitions

in

the

year

ended

December

31,

2103

(4)

XPO employee non-cash stock compensation expense related to stock options and

restricted stock units (5)

Cost reductions attributable to Pacer for public company costs, executive

headcount reductions, IT headcount reductions; cost reductions have been

fully implemented at the time of this transaction (6)

Advisor costs related to New Breed's attempts at an initial public offering and

other capital market activities (7)

Non-cash compensation expense related to distributions to option holders

(8)

Losses on contracts that will be either terminated or amended such that they are

profitable (9)

Costs

related

to

a

single,

large

claim

that

is

not

normal

in

the

ordinary

course

of

business,

as

well

as

non-recurring

legal

fees

associated with two legal cases

12 Months Ended

6 Months Ended

6 Months Ended

12 Months Ended

($ in thousands)

12/31/2013

6/30/2013

6/30/2014

6/30/2014

Adjusted EBITDA

$100,740

$50,901

$41,359

$91,198

XPO Adjustments

EBITDA

from

certain

acquisitions

(1)

$17,482

$9,060

$3,301

$11,724

Other

acquisitions-related

transaction

costs

(2)

2,991

1,560

1,094

2,525

Restructuring

charges

(3)

365

–

6,546

6,911

Non-cash

stock

compensation

(4)

4,746

2,147

3,843

6,442

Net

cost

savings,

operating

improvement

synergies

(5)

17,328

8,354

4,704

13,677

New Breed Adjustments

Aborted

capital

markets

transactions

(6)

$1,459

$62

$1,678

$3,075

Option-holder

distribution

(7)

–

–

2,691

2,691

Contract

losses

(8)

3,635

1,306

2,221

4,550

Other

(9)

2,054

1,347

–

707

Pro Forma Adjusted EBITDA

$150,800

$74,737

$67,437

$143,500 |

42

42

Combined EBITDA Reconciliation

12 Months Ended

($ in thousands)

12/31/2012

Net loss available to common shareholders

($23,332)

Preferred dividends

2,993

Net loss

($20,339)

Interest expense

3,207

Income tax (benefit) provision expense

(11,195)

Depreciation and amortization

2,508

Non-cash equity compensation expense

4,398

Adjusted EBITDA

($21,421)

Optima Adjusted EBITDA

2,982

NLM Adjusted EBITDA

6,789

ACL Adjusted EBITDA

2,559

New Breed Adjusted EBITDA

83,822

Pacer Adjusted EBITDA

16,841

3PD Adjusted EBITDA

30,492

Pro Forma Adjusted EBITDA

$122,064

Note:

2012 calculated based on combined Company and New Breed metrics.

Such metrics do not represent

Regulation S-X compliant metrics, and accordingly do not take account of any

PF adjustments thereof. PF metrics (and actual results should New Breed

have been owned by the Company during the period shown) could substantially

differ |

43

43

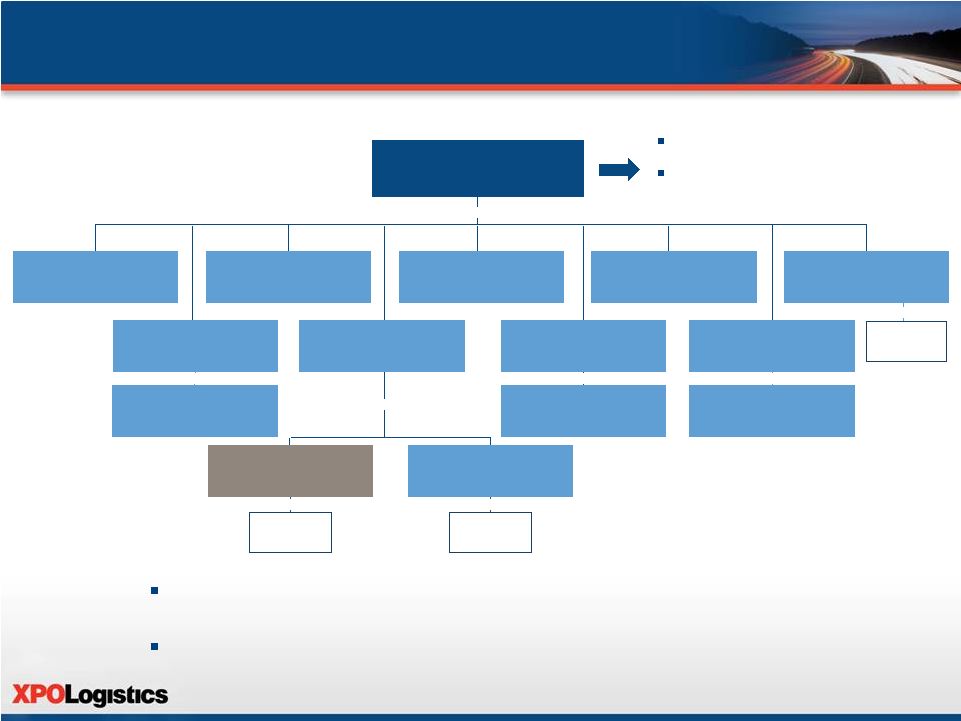

XPO Logistics Corporate Structure

XPO Logistics, Inc. (DE)

XPO Global Logistics Inc.

(Canada, Federal)

Approximately

27 operating

subsidiaries

100%

100%

100%

100%

Approximately

7 operating

subsidiaries

Approximately

12 operating

subsidiaries

100%

100%

All of the Company’s domestic subsidiaries (subject to certain customary

exceptions) will be guarantors of the Notes

Foreign subsidiaries account for less than 4% of total revenues and EBITDA

Note:

The

senior

convertible

notes

due

2017

do

not

benefit

from

any

subsidiary

guarantees

Will be the issuer of the notes

Is the borrower under the ABL

revolver and issuer of the convertible

notes

New Breed Holding Co.

(DE)

3PD Holding, Inc. (DE)

Concert Group Logistics,

Inc. d/b/a XPO Global

Logistics (DE)

XPO Express, Inc.

(fka Express-1, Inc.) (MI)

Bounce Logistics, Inc.

(DE)

XPO Logistics Canada

Inc. (Canada, ON)

Pacer International, Inc.

(TN)

XPO NLM, Inc. (DE)

XPO Air Charter, LLC

(DE)

XPO Dedicated, LLC (DE)

XPO NLM, LLC (DE)

XPO AQ, Inc. (DE)

XPO Logistics, LLC (DE)

100%

100% |

44

44

Skilled Management Team Driving

Performance-Based Culture

Brad Jacobs

Chairman & CEO

Unique track record of building well-run organizations that create dramatic

shareholder

value

–

started

four

highly

successful

companies

from

scratch

and

built each into a billion dollar or multi-billion dollar enterprise:

–

United Rentals (NYSE: URI): current market cap of $10.8 billion

–

United Waste Systems: sold for $2.5 billion in 1997

–

Hamilton Resources: annual revenue of $1 billion; Amerex Oil Associates:

annual gross contract volume of approximately $4.7 billion

Success generated by integrating large numbers of acquisitions and

cold-starts, focusing on organic growth, and delivering on a culture of

world-class service Vice President for United Rentals where he

successfully integrated over 200 acquisitions in the United States, Canada

and Mexico For United Waste Systems he worked with Mr. Jacobs to build an

integrated organization

of

86

collection

companies

and

119

facilities

in

25

states

Troy Cooper

COO |

45

45

Skilled Management Team Driving

Performance-Based Culture (Cont’d)

Managing Director in the Transportation & Logistics investment banking group

with Stifel Nicolaus Weisel

Investment banker in the Transportation and Telecom groups at Alex. Brown &

Sons (now Deutsche Bank)

Has

completed

over

60

M&A

transactions

and

his

teams

have

raised

billions

of

dollars of capital for many of the industry's leading logistics companies

Senior transportation analyst covering air, rail, trucking and shipping at Goldman

Sachs

Analyst with UBS, and internal strategy manager with JPMorgan Chase, where

he worked with several of the bank's business units

Global advisor for The Sharma Group, focused on M&A opportunities

Scott Malat

Chief Strategy Officer

John Hardig

CFO

Vice

President

–

Corporate

Development

with

AutoNation,

Inc.,

where

he

previously

held

positions

as

Vice

President

–

Associate

General

Counsel and Senior Counsel for its Retail Automotive Group

Associate at the law firm of Skadden, Arps, Slate, Meagher & Flom LLP,

specializing in M&A and securities law

Gordon Devens

General Counsel |

Skilled Management Team Driving

Performance-Based Culture (Cont’d)

Will join XPO upon the acquisition to lead the contract logistics operations

Transformed

New

Breed

from

a

regional

business

with

10

employees

into

the

preeminent U.S. provider of complex, industry-defining contract logistics

services Created outsized value by positioning New Breed as an innovator of

customized solutions for world-class companies

Louis DeJoy

CEO, New Breed

Responsible for New Breed’s overall financial management and human resource

function

Former Managing Partner for the Greensboro office of Ernst & Young

Over 35 years of experience with both private and public companies across

diverse industries

Rick Wimmer

CFO, New Breed

Global Controller with GE Energy Services, Inc., a $16 billion revenue division

of General Electric Company

Assistant Corporate Controller with The Home Depot, Inc., and Senior

Manager with PricewaterhouseCoopers

Kent Renner

Chief Accounting

Officer

46

46 |

47

47

Skilled Management Team Driving

Performance-Based Culture (Cont’d)

Vice President of Network Profitability and Management for Pacer

International

Responsible for optimizing Pacer’s intermodal network

Led capacity flow and asset management, market-based pricing, and capacity

planning for rail relationships

More

than

30

years'

experience

in

leadership

positions

with

some

of

the

most

prominent expediters, serving the most demanding verticals in the

transportation industry

President and CEO of Active Aero, senior management positions with Boyd

Brothers Transportation, Caliber Logistics (now FedEx Supply Chain Services)

and Roberts Express (now FedEx Custom Critical)

Paul Smith

President, Intermodal

Chris Healy

President, Expedited

Founded 3PD and built it into an industry leader with an intense

commitment to innovation and service

Developed some of the last mile industry’s most groundbreaking mobile

technologies for real-time visibility and customer experience management

Led Home Depot’s multi-billion dollar delivery business and successfully

transitioned the operations from an in-house to an outsourced model

Karl Meyer

CEO, XPO Last Mile |

48

48

Skilled Management Team Driving

Performance-Based Culture (Cont’d)

More than 25 years' experience in the transportation and logistics industry,

most

recently

as

Executive

Vice

President

of

Sales

and

Marketing

for

Pacer

International's Intermodal Business, acquired by XPO Logistics in 2014

Held senior positions in sales and marketing and national account

management with Union Pacific Railroad

Julie Luna

Chief Commercial

Officer |