Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Trinseo S.A. | d767932d8k.htm |

| EX-99.1 - EX-99.1 - Trinseo S.A. | d767932dex991.htm |

™

Trademark

Second Quarter 2014

Earnings Summary

August 7, 2014

Exhibit 99.2 |

2

Introductions & Disclosure Rules

Disclosure Rules

The forward looking statements contained in this presentation involve risks and

uncertainties that may affect the Company's operations, markets, products,

services, prices and other factors. These risks and uncertainties include,

but are not limited to, economic, competitive, legal, governmental and technological

factors. Accordingly, there is no assurance that the Company's expectations

expressed in such forward looking statements will be realized. The Company

assumes no obligation to provide revisions to any forward looking statements

in this presentation should circumstances change. This presentation contains

financial measures that are not in accordance with generally accepted

accounting principles in the US (“GAAP”) including Adjusted EBITDA.

We believe these measures provide relevant and meaningful information to

investors and lenders about the ongoing operating results of the Company.

Such measures when referenced herein should not be viewed as an alternative to GAAP

measures of performance. We have provided a reconciliation of Adjusted EBITDA

in the Appendix section of this presentation.

Introductions

Chris Pappas, President & CEO

John Feenan, Executive Vice President & CFO

David Stasse, Vice President, Treasury & Investor Relations

|

3

Agenda

Business Overview

Financial Review

2014 Focus

Q&A |

4

Trinseo Business Overview

Engineered Polymers

Revenue: $266MM

Adj EBITDA: $5MM

Styrenics

Revenue: $590MM

Adj EBITDA: $27MM

Emulsion Polymers

Revenue: $486MM

Adj EBITDA: $64MM

Plastics

Revenue: $855MM

Adj EBITDA: $32MM

#3 Polystyrene Globally

Leading Player

Synthetic Rubber

Revenue: $165MM

Adj EBITDA: $37MM

Top 3 SSBR Globally

Q2’14 Revenue: $1,341MM

Q2’14 Adj EBITDA: $79MM

Latex

Revenue: $321MM

Adj EBITDA: $27MM

#1 Globally in SB Latex

Note: Division and Segment EBITDA excludes Corporate Segment Adjusted EBITDA of

$(17)MM. Totals may not sum due to rounding. End

markets

Market

position

Performance tires

Standard tires

Polymer modification

Technical rubber goods

Coated paper and packaging

board

Carpet and artificial turf

backings

Tape saturation

Cement modification

Building products

$5+ billion in annual revenue, world leader in the production of

latex, rubber and plastics

Appliances

Consumer goods

Construction/sheet

Packaging

Automotive

Consumer electronics

Automotive

Consumer electronics

Construction/sheet

Electrical and lighting

Medical devices |

5

Key Styrene Raw Material Trends

Europe

(1)

Source:

IHS.

(1)

Styrene:

50%

W.

Europe

Spot

Avg

(FOB

W.

Europe)

and

50%

W.

Europe

Contract

Monthly

Market

(Delivered

W.

Europe);

Benzene:

50%

W.

Europe

Spot

Avg

(CIF

NW

Europe

/

Basis

ARA)

and

50%

W.

Europe

Contract

–

Monthly

Market

(FOB/CIF

W.

Europe);

Ethylene:

W.

Europe

Contract

–

Market

Pipeline

(Delivered

W.

Europe).

(2)

Styrene:

NE

Asia

Avg

Spot

Posting

(CFR

China);

Benzene:

NE

Asia

Spot

Avg

(FOB

S.

Korea);

Ethylene:

NE

Asia

Spot

Avg

(CFR

NE

Asia).

Styrene

Ethylene

Benzene

Styrene

Ethylene

Benzene

Asia

(2) |

6

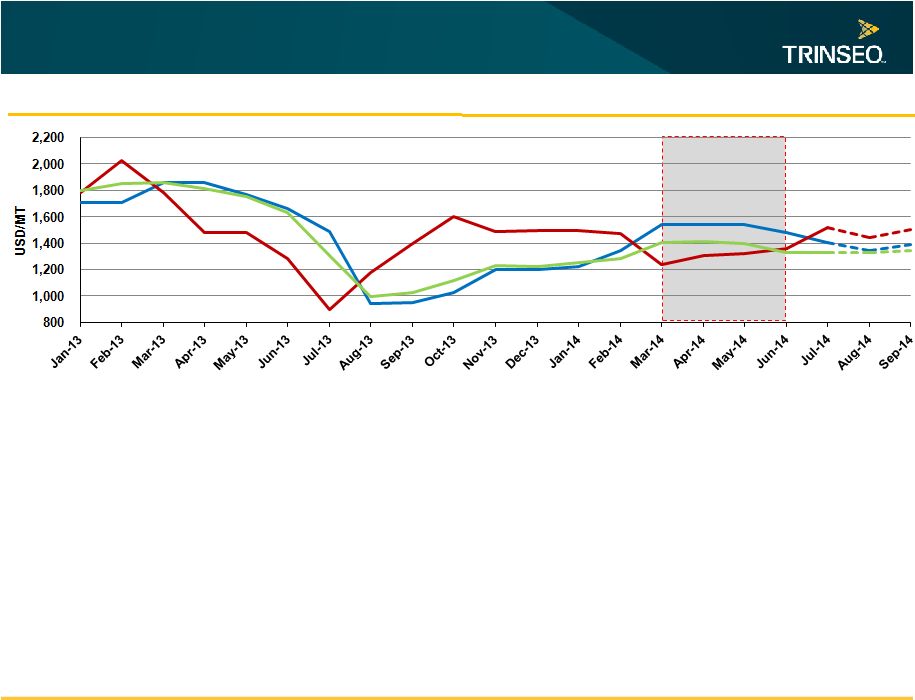

Key Butadiene Price Trends

Butadiene

Source:

IHS.

Asia:

NE

Asia

Spot

(CFR

NE

Asia)

Europe:

W.

Europe

Contract

Market

(ExW/Del

pr09

W.

Europe);

NA:

North

America

Contract

Market

(FOB

US

Gulf

Coast).

Europe

NA

Asia |

™

Trademark

Financial Review

John Feenan

EVP & CFO |

F/(U) vs.

(in $millions, unless noted)

Q2'14

Q1'14

Q2'13

Q1'14

Q2'13

Volume (MMlbs)

1,327

1,344

1,311

Revenue

1,341

1,359

1,362

(1)%

(2)%

Volume

(1)%

0%

Price

(1)%

(5)%

FX

0%

3%

Adjusted EBITDA

79

88

43

Adjusted EBITDA Margin

6%

6%

3%

Adjusted Net Income

11

20

(18)

Wtd Avg Shares Outstanding (000)

38,912

37,270

37,270

Adjusted EPS ($)

0.28

0.53

(0.49)

Trinseo Quarterly Results

8

Note: Inventory revaluation EBITDA impact of $3MM, $6MM and $(26)MM for

Q2’14, Q1’14, and Q2’13, respectively. Totals may not sum due to rounding. |

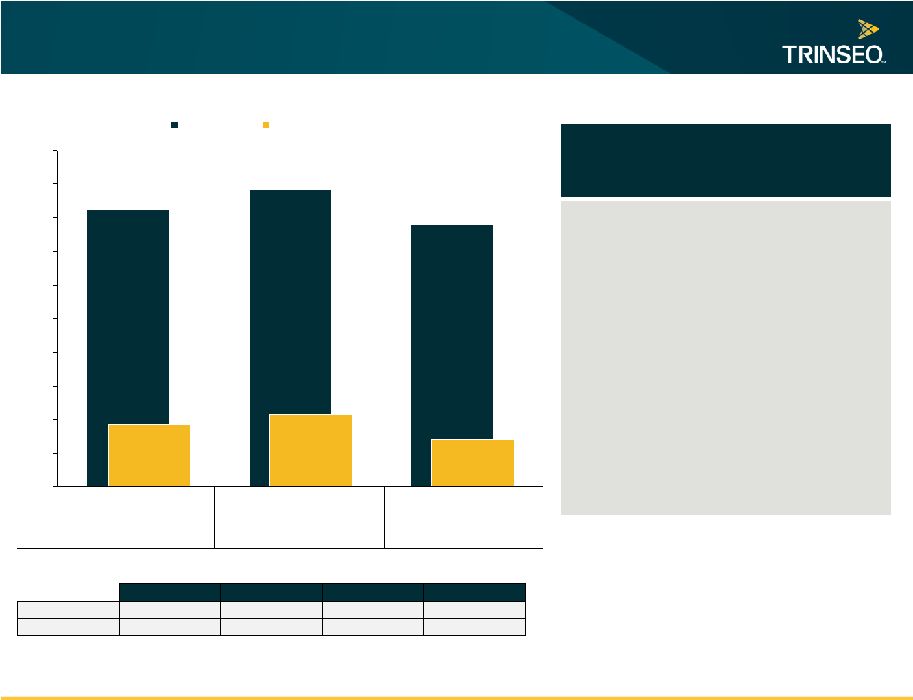

$321

$326

$345

$27

$26

$29

$0

$50

$100

$150

$200

$250

$300

$350

$400

Q2'14

Q1'14

Q2'13

Revenue

Adjusted EBITDA

9

Latex

$MM

Note:

Totals

may

not

sum

due

to

rounding.

Volume

in

millions

of

pounds.

Key Points

•

Difficult conditions in Europe

and North America graphical

paper

•

Offset by growth in carpet,

Asia paper, and

Performance Latex

•

New 25KT reactor in China

on schedule and on budget

Revenue Bridge

Volume

Price

FX

Total

YoY

(3)%

(6)%

2%

(7)%

QoQ

(1)%

(1)%

0%

(2)%

Volume

295

299

305 |

$165

$177

$156

$37

$43

$28

$0

$20

$40

$60

$80

$100

$120

$140

$160

$180

$200

Q2'14

Q1'14

Q2'13

Revenue

Adjusted EBITDA

10

Synthetic Rubber

$MM

Note:

Totals

may

not

sum

due

to

rounding.

Volume

in

millions

of

pounds.

Revenue Bridge

Volume

Price

FX

Total

YoY

14%

(13)%

4%

6%

QoQ

(10)%

3%

0%

(7)%

Key Points

•

Tire demand rebounding in

Europe, China, and North

America

•

Investing in additional SSBR

•

JSR capacity

•

Investing in higher margin

products

•

Ni-PBR to Nd-PBR

•

Generation 4 SSBR

•

>30% YoY SSBR growth

Volume

142

155

125 |

$590

$594

$597

$27

$42

$21

$0

$100

$200

$300

$400

$500

$600

$700

Q2'14

Q1'14

Q2'13

Revenue

Adjusted EBITDA

11

Styrenics

$MM

Note:

Totals

may

not

sum

due

to

rounding.

Volume

in

millions

of

pounds.

Adjusted

EBITDA

includes

earnings

from

equity

affiliate

(Americas

Styrenics).

Revenue Bridge

Volume

Price

FX

Total

YoY

(1)%

(4)%

4%

(1)%

QoQ

1%

(2)%

0%

(1)%

Key Points

•

JV earnings from AmSty

$9MM lower sequentially –

turnaround related

•

Asia styrene margins

compressed end of Q2

•

Q2 was high season for

appliance market

•

Focused on controlling costs

and driving margin in

competitive environment

•

PS margins remain steady

Volume

689

686

679 |

$266

$262

$263

$5

$(2)

$(3)

$(50)

$0

$50

$100

$150

$200

$250

$300

Q2'14

Q1'14

Q2'13

Revenue

Adjusted EBITDA

12

Engineered Polymers

$MM

Note:

Totals

may

not

sum

due

to

rounding.

Volume

in

millions

of

pounds.

Adjusted

EBITDA

includes

earnings

from

equity

affiliate

(Sumika

Styron).

Revenue Bridge

Volume

Price

FX

Total

YoY

0%

(2)%

3%

1%

QoQ

1%

1%

0%

1%

Key Points

•

Global polycarbonate

demand rebounding

•

Polycarbonate restructuring

on track

•

Volume improving in

electronics, medical,

electrical & lighting

•

Strong automotive margins

Volume

201

204

203 |

13

Balance Sheet and Cash Flow

Liquidity –

Q2 End

(excl Cash for Debt Paydown)

Maturities –

Jul 14, 2014

A/R

Securitization

(2)

Revolver

(2)

Senior Secured

Notes

(1)

Free

Cash

Flow

=

cash

from

operating

activities

+

cash

from

investing

activities

–

change

in

restricted

cash

(2)

A/R

Securitization

facility

commitment

of

$200MM

and

Revolving

Credit

facility

commitment

of

$300MM

($293MM

available

at

Q2’14).

*$132.5

million

face

amount

of

bonds

at

103

price

plus

$5

million

accrued.

NOTE:

Totals

may

not

sum

due

to

rounding.

Summary

•

Q2 breakeven free cash flow reflects $56 million

outflow resulting from termination of Dow

Emerging Markets JV option and Bain Advisory

Agreement

•

Strong quarter-end liquidity of $675 million (excl

cash used for debt paydown)

•

$142 million cash used for debt redemption on

July 14*

$MM

Unused Borrowing

Facility

Cash & Cash

Equivalents

$MM

$MM

Free Cash Flow

(1) |

™

Trademark

2014 Focus

Chris Pappas

President & CEO |

15

Key Styrene Raw Material Trends

Europe

(1)

Source:

IHS.

(1)

Styrene:

50%

W.

Europe

Spot

Avg

(FOB

W.

Europe)

and

50%

W.

Europe

Contract

Monthly

Market

(Delivered

W.

Europe);

Benzene:

50%

W.

Europe

Spot

Avg

(CIF

NW

Europe

/

Basis

ARA)

and

50%

W.

Europe

Contract

–

Monthly

Market

(FOB/CIF

W.

Europe);

Ethylene:

W.

Europe

Contract

–

Market

Pipeline

(Delivered

W.

Europe).

(2)

Styrene:

NE

Asia

Avg

Spot

Posting

(CFR

China);

Benzene:

NE

Asia

Spot

Avg

(FOB

S.

Korea);

Ethylene:

NE

Asia

Spot

Avg

(CFR

NE

Asia).

Styrene

Ethylene

Benzene

Styrene

Ethylene

Benzene

Asia

(2) |

16

Key Butadiene Price Trends

Butadiene

Source:

IHS.

Asia:

NE

Asia

Spot

(CFR

NE

Asia)

Europe:

W.

Europe

Contract

Market

(ExW/Del

pr09

W.

Europe);

NA:

North

America

Contract

Market

(FOB

US

Gulf

Coast).

Europe

NA

Asia |

17

Second Half Update

Short-term headwinds

Outage-driven benzene spike impacts styrene and polycarbonate

margins in Q3

ESBR turnaround and unplanned outage

Seasonality

Underlying fundamentals remain strong

Replacement tire market rebounding, SSBR growth strong

Latex margins steady

Polycarbonate demand and operating rates rising

New volumes in performance latex, carpet, electrical and lighting

compounds

Expect 2014 Adjusted EBITDA to be

comfortably ahead of 2013 |

18

Sustainability Highlights 2013

SUSTAINABLE PRODUCTS

SUSTAINABLE PERFORMANCE

Potential weight reduction per car

through innovative plastic solutions,

which have been developed and

implemented by Trinseo in 2013

6.7kg

Reduction in energy consumption

by using a LED bulb with Trinseo

plastic lens, compared to traditional

incandescent light

75%

Reduction in fuel consumption

when using low rolling

resistance tires with SSBR

rubber from Trinseo

3%

Reduction in waste

(vs. 2011 baseline)

26%

Reduction in emissions

of volatile organic

chemicals (VOCs) (vs.

2012)

5%

Reduction in emissions

of non-VOC chemicals

(vs. 2012)

2%

Reduction in

electricity use

(vs. 2012)

2%

Percent of Trinseo manufacturing

plants with Triple Zero record: no

injuries, no significant spills, no

process safety incidents

54%

Percent of Trinseo

employees who

completed ethics and

compliance training

97%

Percent of Trinseo

plants with ISO 14001

certification

58%

Percent of Trinseo

sites with ISO 50001

certification

27%

SUSTAINABLE OPERATIONS |

19

Trinseo Value Drivers

Profitable Growth

Structural Changes

Cyclical Upsides |

™

Trademark

Q&A |

™

Trademark

Appendix |

22

US GAAP to Non-GAAP Reconciliation

(in $millions, unless noted)

Q1'12

Q2'12

Q3'12

Q4'12

Q1'13

Q2'13

Q3'13

Q4'13

Q1'14

Q2'14

Net Income (Loss)

30.1

1.9

(1.2)

(0.5)

(9.7)

(28.1)

4.9

10.6

17.1

(44.6)

Interest expense, net

25.7

26.6

28.6

29.1

32.3

33.7

32.9

33.1

32.8

32.6

Provision for (benefit from) income taxes

25.1

(6.1)

10.3

(11.8)

(0.1)

2.2

6.0

13.8

12.8

5.4

Depreciation and amortization

20.9

22.0

20.0

22.7

23.9

24.0

23.2

24.2

23.7

27.2

EBITDA

101.8

44.4

57.7

39.5

46.4

31.8

67.0

81.7

86.4

20.6

Loss on extinguishment of long-term debt

-

-

-

-

20.7

-

-

-

-

-

Other non-recurring items

-

-

(0.7)

-

1.1

-

-

(0.4)

-

32.5

Restructuring and other charges

7.8

0.1

(0.4)

-

-

6.5

2.6

1.8

0.5

2.1

Net (gains) / losses on dispositions of businesses and assets

-

-

-

-

-

3.2

1.0

-

-

-

Fees paid pursuent to advisory agreement

1.1

1.2

1.1

1.2

1.2

1.2

1.2

1.2

1.2

24.2

Asset impairment charges or write-offs

-

-

-

-

-

0.7

-

9.2

-

-

Adjusted EBITDA

110.7

45.7

57.7

40.7

69.4

43.4

71.8

93.5

88.1

79.4

Interest expense, net

25.7

26.6

28.6

29.1

32.3

33.7

32.9

33.1

32.8

32.6

Provision for (benefit from) income taxes - Adjusted

27.1

(4.0)

10.5

1.9

4.9

3.9

5.2

14.4

12.0

10.1

Depreciation and amortization - Adjusted

20.9

22.0

20.0

22.7

23.9

23.9

23.2

24.2

23.7

25.8

Adjusted Net Income

37.0

1.1

(1.4)

(13.0)

8.3

(18.1)

10.5

21.8

19.6

10.9

Weighted Average Shares Outstanding (thousands)

137

3,092

23,679

37,270

37,270

37,270

37,270

37,270

37,270

38,912

Adjusted EPS ($)

270.53

0.34

(0.06)

(0.34)

0.22

(0.49)

0.28

0.58

0.53

0.28

Adjustments by Statement of Operations Caption

Loss on extinguishment of long-term debt

-

-

-

-

20.7

-

-

-

-

-

Selling, general and administrative expenses

8.9

1.3

0.7

1.2

1.2

8.4

3.8

12.2

1.7

26.3

Other expense (income), net

-

-

(0.7)

-

1.1

3.2

1.0

(0.4)

-

32.5

Total EBITDA Adjustments

8.9

1.3

-

1.2

23.0

11.6

4.8

11.8

1.7

58.8 |

23

Selected Segment Information

(in $millions, unless noted)

Q1'12

Q2'12

Q3'12

Q4'12

Q1'13

Q2'13

Q3'13

Q4'13

Q1'14

Q2'14

Latex

330

317

327

301

307

305

310

288

299

295

Synthetic Rubber

125

106

116

130

137

125

128

133

155

142

Styrenics

664

652

679

614

669

679

644

597

686

689

Engineered Polymers

218

201

194

192

199

203

200

199

204

201

Trade Volume (MMLbs)

1,337

1,275

1,316

1,237

1,311

1,311

1,282

1,218

1,344

1,327

Latex

398

422

375

351

357

345

332

308

326

321

Synthetic Rubber

193

175

155

179

176

156

142

148

177

165

Styrenics

528

538

542

541

602

597

576

530

594

590

Engineered Polymers

278

274

255

249

256

263

259

260

262

266

Net Sales

1,396

1,409

1,327

1,320

1,392

1,362

1,309

1,245

1,359

1,341

Latex

27

39

33

27

27

29

27

24

26

27

Synthetic Rubber

44

24

19

24

31

28

13

42

43

37

Styrenics

49

(9)

24

19

25

21

67

52

42

27

Engineered Polymers

16

2

13

0

(1)

(3)

2

2

(2)

5

Corporate

(26)

(11)

(30)

(29)

(13)

(31)

(37)

(27)

(21)

(17)

Adjusted EBITDA

111

46

58

41

69

43

72

93

88

79

Inventory Revaluation

(52)

9

2

2

(0)

26

26

(12)

(6)

(3)

Adjusted EBITDA excl Inv Reval

59

55

60

43

69

70

98

81

83

77

NOTE: Segment balances may not sum to consolidated balances due to rounding.

|