Attached files

| file | filename |

|---|---|

| 8-K - 8-K - NEW JERSEY RESOURCES CORP | d766597d8k.htm |

| EX-99.1 - EX-99.1 - NEW JERSEY RESOURCES CORP | d766597dex991.htm |

| Exhibit 99.2

|

Fiscal 2014 Third Quarter Update

July 31, 2014

|

|

1

Regarding Forward-Looking Statements

Certain statements contained in this presentation are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Words such as “anticipates,” “estimates,” “expects,” “projects,” “forecasts”, “may,” “will,” “intends,” “expects,” “believes,” or “should” and similar expressions may identify forward-looking information and such forward-looking statements are made based upon management’s current expectations and/or beliefs as of this date or a prior date concerning future developments and their potential effect upon New Jersey Resources (NJR or the Company). There can be no assurance that future developments will be in accordance with management’s expectations or that the effect of future developments on NJR will be those anticipated by management. NJR cautions persons reading or hearing this presentation that the assumptions that form the basis for forward-looking statements including, but not limited to, certain statements regarding NJR’s NFE guidance for fiscal 2014, forecasted contribution of business segments to fiscal 2014 NFE and to NFE beyond fiscal 2014, long-term benefits of increased NFE, future NJNG customer growth, future NJNG capital expenditures and infrastructure investments, NJNG incremental utility gross margin, the long-term outlook for NJRCEV, diversification of NJRCEV’s strategy, and the completion of Carroll area wind farm include many factors that are beyond the Company’s ability to control or estimate precisely, such as estimates of future market conditions and the behavior of other market participants.

The factors that could cause actual results to differ materially from NJR’s expectations include, but are not limited to, weather and economic conditions; demographic changes in the NJNG service territory and their effect on NJNG’s customer growth; volatility of natural gas and other commodity prices and their impactonNJNGcustomer usage, NJNG’s Basic Gas Supply Service incentive programs, NJRES’ operations and on the Company’s risk management efforts; changes in rating agency requirements and/or credit ratings and their effect on availability and cost of capital to the Company; the impact of volatility in the credit markets on our access to capital; the ability to comply with debt covenants; the impact to the asset values and resulting higher costs and funding obligations of NJR’s pension and postemployment benefit plans as a result of downturns in the financial markets, a lower discount rate, and impacts associated with the Patient Protection and Affordable Care Act; accounting effects and other risks associated with hedging activities and use of derivatives contracts; commercial and wholesale credit risks, including the availability of creditworthy customers and counterparties and liquidity in the wholesale energy trading market; the ability to obtain governmental approvals and/or financing for the construction, development and operation of certain non-regulated energy investments; risks associated with the management of the Company’s joint ventures and partnerships; risks associated with our investments in renewable energy projects and our investment in an on-shore wind developer, including the availability of regulatory and tax incentives, logistical risks and potential delays related to construction, permitting, regulatory approvals and electric grid interconnection, the availability of viable projects and NJR’s eligibility for federal investment tax credits (ITC), and production tax credits (PTC), the future market for SRECs and operational risks related to projects in service; timing of qualifying for ITCs due to delays or failures to complete planned solar energy projects and theresulting effect on our effective tax rate and earnings; regulatory approval of NJNG’splanned infrastructure programs; the level and rate at which NJNG’s costs and expenses (including those related to restoration efforts resulting from Superstorm Sandy) are incurred and the extent to which they are allowed to be recovered from customers through the regulatory process; access to adequate supplies of natural gas and dependence on third-party storage and transportation facilities for natural gas supply; operating risks incidental to handling, storing, transporting and providing customers with natural gas; risks related to our employee workforce, including a work stoppage; the regulatory and pricing policies of federal and state regulatory agencies; the costs of compliance with present and future environmental laws, including potential climate change-related legislation; risks related to changes in accounting standards; the disallowance of recovery of environmental-related expenditures and other regulatory changes; environmental-related and other litigation and other uncertainties; risks related to cyber-attack or failure of information technology systems; and the impact of natural disasters, terrorist activities, and other extreme events on our operations and customers, including any impacts to utility gross margin and restoration costs. The aforementioned factors are detailed in the “Risk Factors” sections of our Annual Report on Form 10-K filed on November 26, 2013, as filed with the Securities and Exchange Commission (SEC) which is available on the SEC’s website at sec.gov. Informationincludedinthis presentation is representative as of today only and while NJR periodically reassesses material trends and uncertainties affecting NJR’s results of operations and financial condition in connection with its preparation of management’s discussion and analysis of results of operations and financial condition contained in its Quarterly and Annual Reports filed with the SEC, NJR does not, by including this statement, assume any obligation to review or revise any particular forward-looking statement referenced herein in light of future events.

|

|

Disclaimer Regarding Non-GAAP Financial Measures

This presentation includes the non-GAAP measures net financial earnings (NFE), financial margin and utility gross margin. As indicators of the Company’s operating performance, these measures should not be considered alternatives to, or more meaningful than, GAAP measures, such as cash flow, net income, operating income or earnings per share.

Net financial earnings (losses) and financial margin exclude unrealized gains or losses on derivative instruments related to the Company’s unregulated subsidiaries and certain realized gains and losses on derivative instruments related to natural gas that has been placed into storage at NJRES. Volatility associated with the change in value of these financial and physical commodity contracts is reported in the income statement in the current period. In order to manage its business, NJR views its results without the impacts of the unrealized gains and losses, and certain realized gains and losses, caused by changes in value of these financial instruments and physical commodity contracts prior to the completion of the planned transaction because it shows changes in value currently as opposed to when the planned transaction ultimately is settled. NJNG’s utility gross margin represents the resultsof revenues less natural gas costs, sales and other taxes and regulatory rider expenses, which are key components of the Company’s operations that move in relation to each other.

Management uses NFE, financial margin and utility gross margin as supplemental measures to other GAAP results to provide a more complete understanding of the Company’s performance. Management believes these non-GAAP measures aremorereflectiveofthe Company’sbusiness model, provide transparency to investors and enable period-to-period comparability of financial performance. For a full discussion of our non-GAAP financial measures, please see NJR’s most recent Form 10-K, Item 7 and most recent Form 10-Q, Item 2. This information has been provided pursuant to therequirementsof SEC Regulation G.

2

|

|

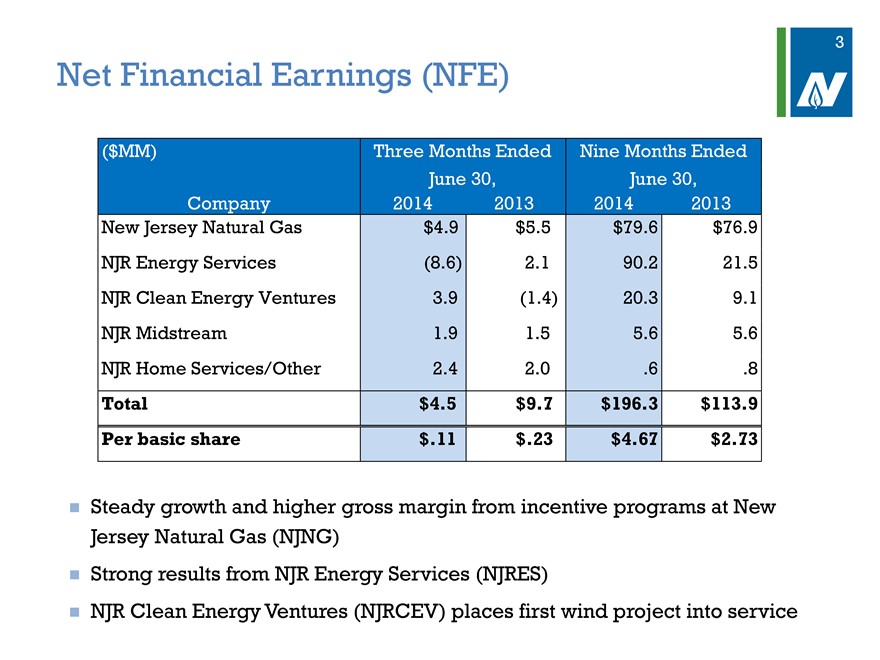

Net Financial Earnings (NFE)

($MM) Three Months Ended Nine Months Ended

June 30, June 30,

Company 2014 2013 2014 2013

New Jersey Natural Gas $4.9 $5.5 $79.6 $76.9

NJR Energy Services (8.6) 2.1 90.2 21.5

NJR Clean Energy Ventures 3.9 (1.4) 20.3 9.1

NJR Midstreamdst 1.9 1.5 5.6 5.6

NJR Home Services/Other 2.4 2.0 .6 .8

Total $4.5 $9.7 $196.3 $113.9

Per basic share $.11 $.23 $4.67 $2.73

Steady growth and higher gross margin from incentive programs at New

Jersey Natural Gas (NJNG)

Strong results from NJR Energy Services (NJRES)

NJR Clean Energy Ventures (NJRCEV) places first wind project into service

3

|

|

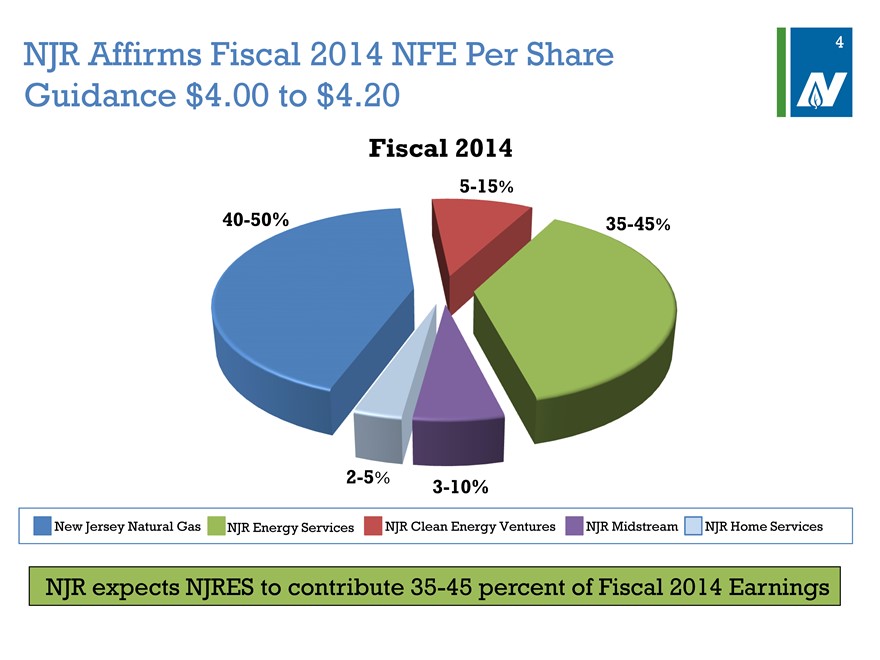

NJR Affirms Fiscal 2014 NFE Per Share Guidance $4.00 to $4.20

Fiscal 2014

5-15%

40-50% 35-45%

2-5% 3-10%

New Jersey Natural Gas NJR Energy Services NJR Clean Energy Ventures NJR Midstream NJR Home Services

NJR expects NJRES to contribute 35-45 percent of Fiscal 2014 Earnings

4

|

|

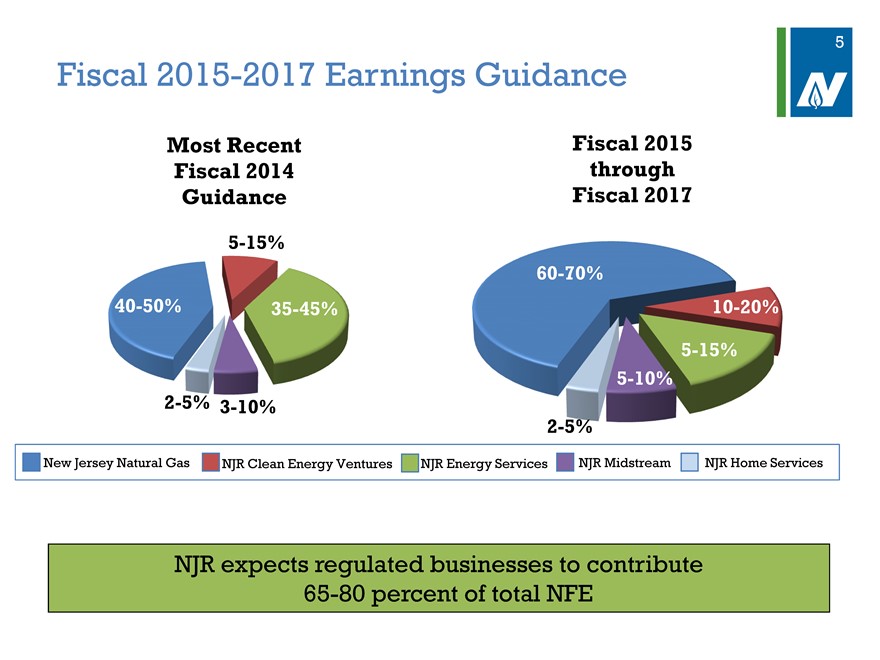

Fiscal 2015-2017 Earnings Guidance

Most Recent Fiscal 2015

Fiscal 2014 through

Guidance Fiscal 2017

5-15%

60-70%

40-50% 35-45% 10-20%

5-15%

5-10%

2-5% 3-10%

2-5%

New Jersey Natural Gas NJR Clean Energy Ventures NJR Energy Services NJR Midstream NJR Home Services

NJR expects regulated businesses to contribute

65-80 percent of total NFE

5

|

|

New Jersey Natural Gas – Our Core Business

Customer growth rate of 1.5 percent exceeds industry average

New construction market continues to expand Healthy mix of new construction and conversions

History of constructive regulatory relationships

Sharing of customer and investor benefits

21 consecutive years with fewest customer complaints with the New Jersey Board of Public Utilities (BPU) of major electric and gas companies

Infrastructure investments to strengthen distribution and transmission system are supported by regulatory riders

Rate case to be filed by mid-November 2015

6

|

|

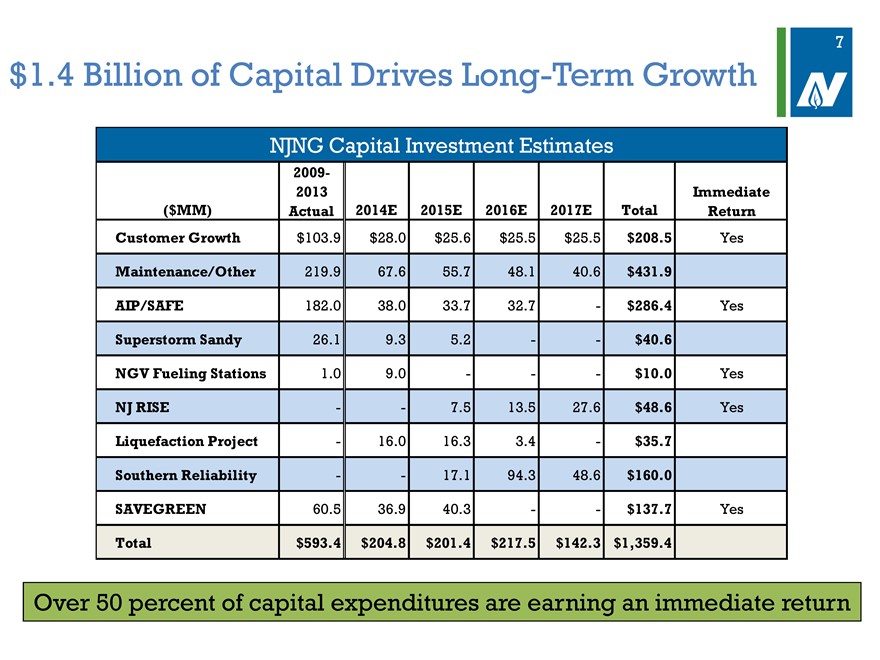

$1.4 Billion of Capital Drives Long-Term Growth

NJNG Capital Investment Estimates

2009-

2013 Immediate

($MM) Actual 2014E 2015E 2016E 2017E Total Return

Customer Growth $103.9 $28.0 $25.6 $25.5 $25.5 $208.5 Yes

Maintenance/Other 219.9 67.6 55.7 48.1 40.6 $431.9

AIP/SAFE 182.0 38.0 33.7 32.7 — $286.4 Yes

Superstorm Sandy 26.1 9.3 5.2 —— $40.6

NGV Fueling Stations 1.0 9.0 ——— $10.0 Yes

NJ RISE —— 7.5 13.5 27.6 $48.6 Yes

Liquefaction Project — 16.0 16.3 3.4 — $35.7

Southern Reliability —— 17.1 94.3 48.6 $160.0

SAVEGREEN 60.5 36.9 40.3 —— $137.7 Yes

Total $593.4 $204.8 $201.4 $217.5 $142.3 $1,359.4

Over 50 percent of capital expenditures are earning an immediate return

7

|

|

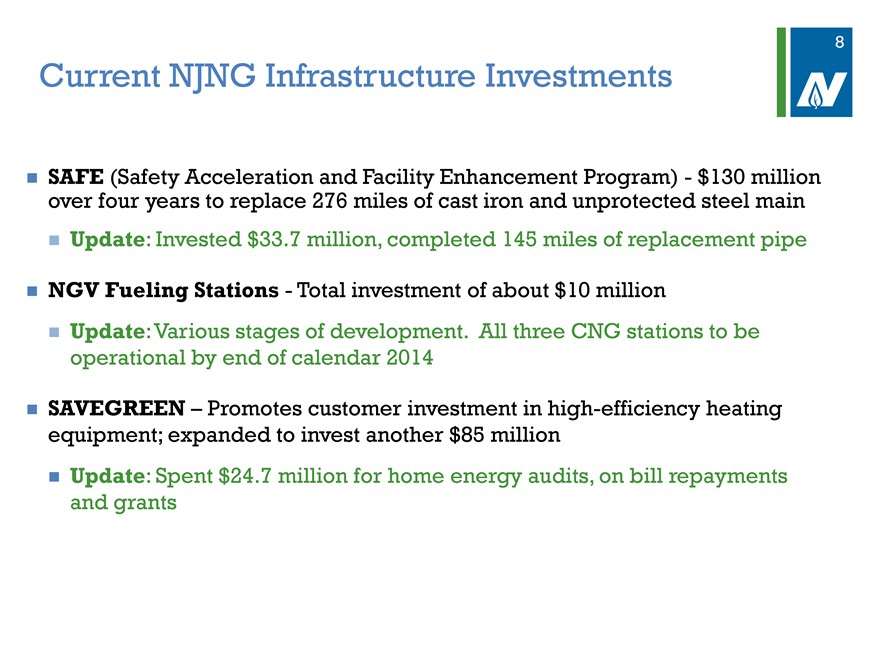

Current NJNG Infrastructure Investments

SAFE (Safety Acceleration and Facility Enhancement Program)—$130 million over four years to replace 276 miles of cast iron and unprotected steel main Update: Invested $33.7 million, completed 145 miles of replacement pipe

NGV Fueling Stations—Total investment of about $10 million

Update:Various stages of development. All three CNG stations to be operational by end of calendar 2014

SAVEGREEN – Promotes customer investment in high-efficiency heating equipment; expanded to invest another $85 million Update: Spent $24.7 million for home energy audits, on bill repayments and grants

8

|

|

9

Planned NJNG Infrastructure Capital Projects

NJ RISE (Reinvestment in System Enhancement)—$102.5 million

NJNG storm response plan filed with BPU on September 3, 2013 Additional pipe to barrier islands and excess flow valves Update: Approved by BPU on July 23, 2014

Liquefaction Project—$35.7 million

Liquefy natural gas for company peak-day use; reduces LNG transportation costs and creates customer savings Update: Equipment manufacturing began June 2014

Southern Reliability Link (SRL)—$130-$160 million

Adding high-pressure natural gas pipeline to support reliability, diversify supplier base and support growth in Ocean County Update: Evaluating route options

9

|

|

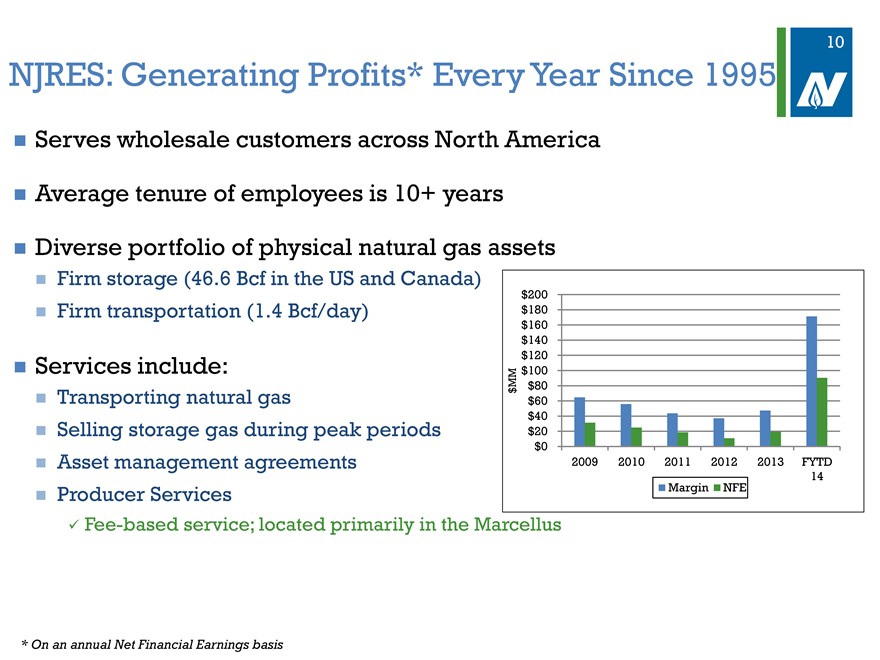

NJRES: Generating Profits* Every Year Since 1995

10

Serves wholesale customers across North America Average tenure of employees is 10+ years Diverse portfolio of physical natural gas assets

Firm storage (46.6 Bcf in the US and Canada) Firm transportation (1.4 Bcf/day)

Services include:

Transporting natural gas

Selling storage gas during peak periods Asset management agreements Producer Services

Fee-based service; located primarily in the Marcellus

assets

$200

$180

$160

$140

$120

$100

MM $80

$

$60

$40

$20

$0

2009 2010 2011 2012 2013 FYTD

14

Margin NFE

Marcellus

* On an annual Net Financial Earnings basis

|

|

NJR Clean Energy Ventures

11

Unique opportunity created in New Jersey

Energy policy drives renewable investment

Strong fundamentals for solar investments

Legislation supports solar investment

Growing Renewable Portfolio Standard (RPS)

Improving Solar Renewable Energy Certificates (SREC) fundamentals

Rising residential solar demand

Goal to diversify from New Jersey Solar

Solar Investment Tax Credits (ITCs) expected to decline to 10 percent in January 2017

Gradual decline in solar capital spending by 2017

$64 million of committed capital for wind projects

Long-term goal to maintain NJRCEV at 10 to 20 percent of NFE

|

|

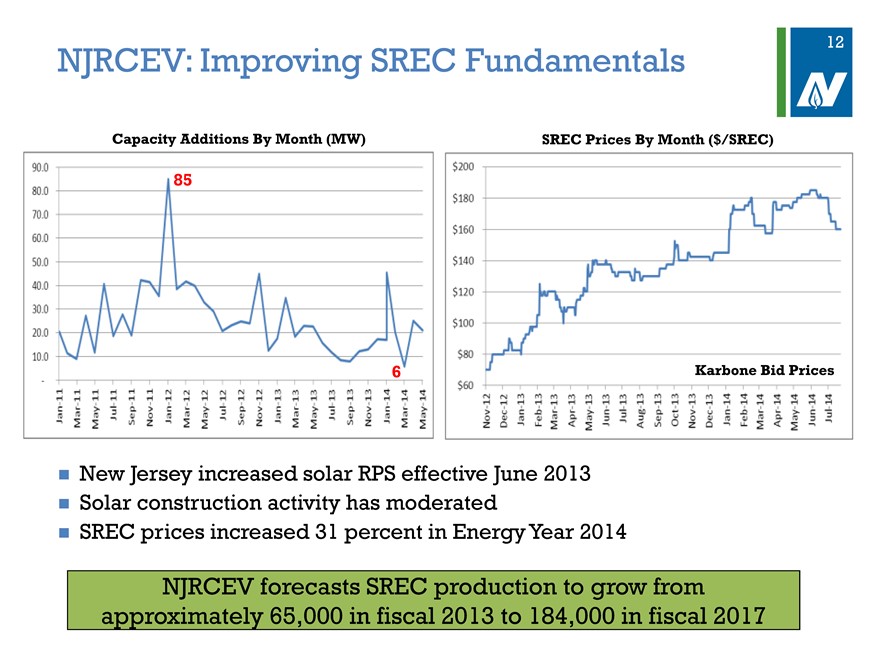

NJRCEV: Improving SREC Fundamentals

12

Capacity Additions By Month (MW)

85

6

SREC Prices By Month ($/SREC)

Karbone Bid Prices

New Jersey increased solar RPS effective June 2013

Solar construction activity has moderated

SREC prices increased 31 percent in Energy Year 2014

NJRCEV forecasts SREC production to grow from

approximately 65,000 in fiscal 2013 to 184,000 in fiscal 2017

|

|

NJRCEV:Wind Strategy

13

Wind Value Drivers

29 states and the District of Columbia have RPS and wind remains the best economic alternative to meeting the standard Production-based tax credits (PTC) Long-term Power Purchase Agreements (PPAs) & PTCs provide annuity-like returns

Investment Status – Two Dot

9.7 MW, $22 million utility scale wind farm project located in Two Dot, MT In service, June 14, 2014

Investment Status – Carroll Area

20 farm MW, project $42 million located utility in Carroll scale County, wind IA NJRCEV Spring 2015 expects to begin operations,

|

|

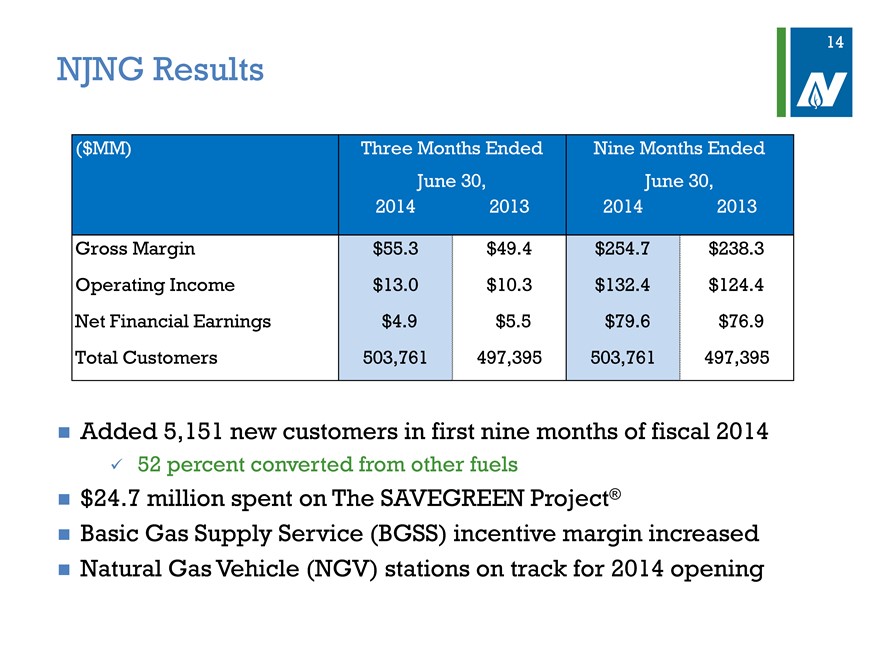

NJNG Results

14

($MM) Three Months Ended Nine Months Ended

June 30, June 30,

2014 2013 2014 2013

Gross Margin $55.3 $49.4 $254.7 $238.3

Operating Income $13.0 $10.3 $132.4 $124.4

Net Financial Earnings $4.9 $5.5 $79.6 $76.9

Total Customers 503,761 497,395 503,761 497,395

Added 5,151 new customers in first nine months of fiscal 2014

52 percent converted from other fuels

$24.7 million spent on The SAVEGREEN Project®

Basic Gas Supply Service (BGSS) incentive margin increased Natural Gas Vehicle (NGV) stations on track for 2014 opening

|

|

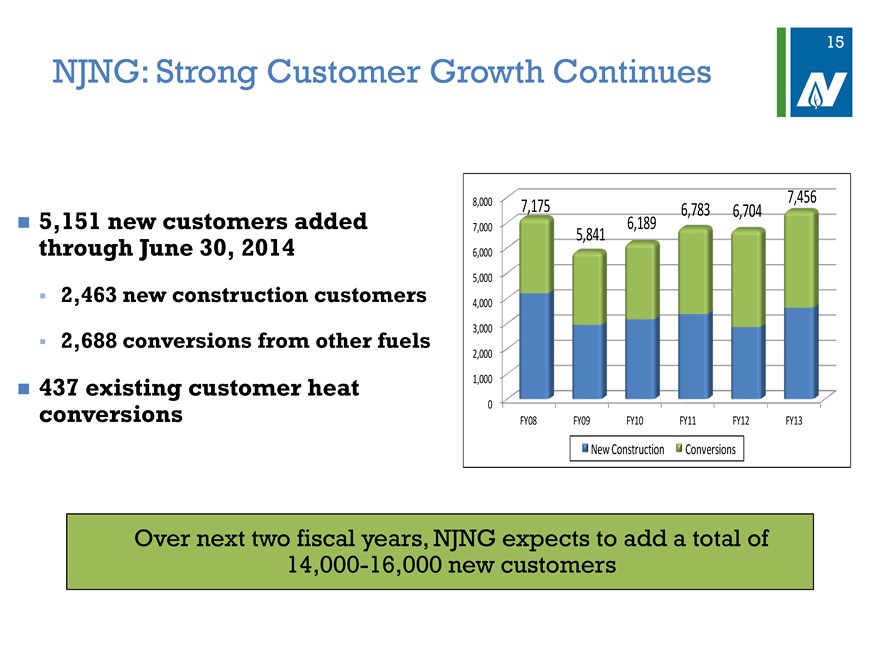

NJNG: Strong Customer Growth Continues

15

5,151 new customers added through June 30, 2014

2,463 new construction customers 2,688 conversions from other fuels

8,000 7,175 6,783 6,704 7,456

7,000 6,189

5,841

6,000

5,000

4,000

3,000

2,000

1,000

0

FY08 FY09 FY10 FY11 FY12 FY13

New Construction Conversions

437 existing customer heat conversions

Over next two fiscal years, NJNG expects to add a total of 14,000-16,000 new customers

|

|

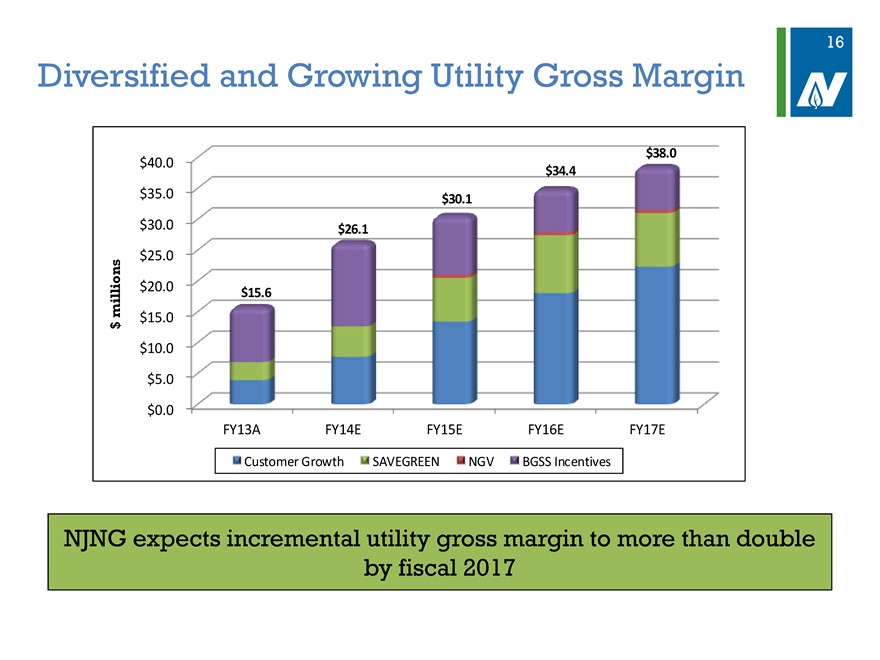

Diversified and Growing Utility Gross Margin

16

$38.0

$40.0 $34.4

$35.0 $30.1

$30.0 $26.1

$25.0

millions $20.0 $15.6

$15.0

$

$10.0

$5.0

$0.0

FY13A FY14E FY15E FY16E FY17E

Customer Growth SAVEGREEN NGV BGSS Incentives

NJNG expects incremental utility gross margin to more than double by fiscal 2017

|

|

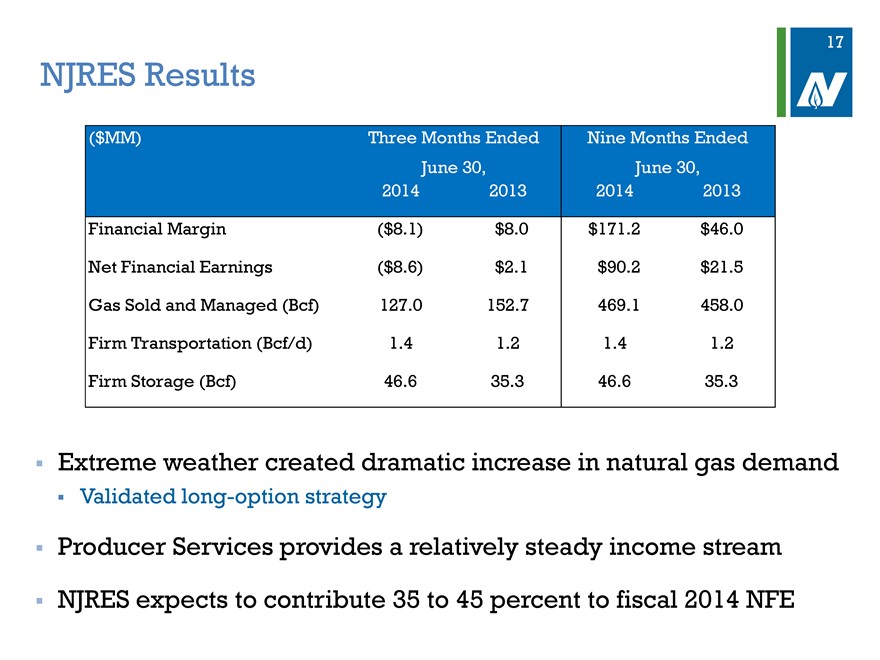

NJRES Results

17

($MM) Three Months Ended Nine Months Ended

June 30, June 30,

2014 2013 2014 2013

Financial Margin ($ 8.1) $ 8.0 $171.2 $ 46.0

Net Financial Earnings ($ 8.6) $ 2.1 $90.2 $ 21.5

Gas Sold and Managed (Bcf) 127.0 152.7 469.1 458.0

Firm Transportation (Bcf/d) 1.4 1.2 1.4 1.2

Firm Storage (Bcf) 46.6 35.3 46.6 35.3

Extreme weather created dramatic increase in natural gas demand

Validated long-option strategy

Producer Services provides a relatively steady income stream NJRES expects to contribute 35 to 45 percent to fiscal 2014 NFE

|

|

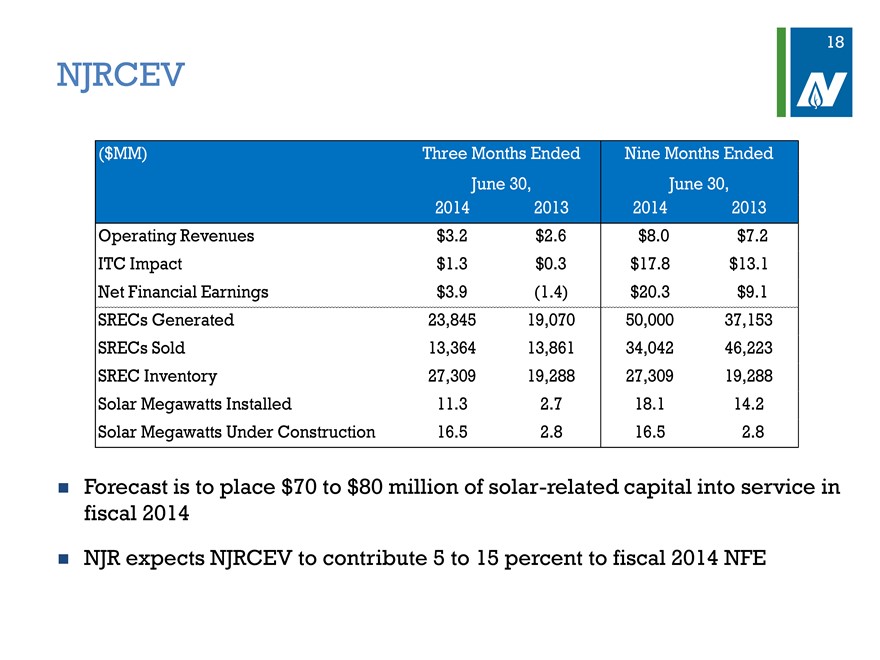

NJRCEV

18

($MM) Three Months Ended Nine Months Ended

June 30, June 30,

2014 2013 2014 2013

Operating Revenues $ 3.2 $2.6 $8.0 $7.2

ITC Impact $ 1.3 $0.3 $17.8 $13.1

Net Financial Earnings $ 3.9 (1.4) $20.3 $9.1

SRECs Generated 23,845 19,070 50,000 37,153

SRECs Sold 13,364 13,861 34,042 46,223

SREC Inventory 27,309 19,288 27,309 19,288

Solar Megawatts Installed 11.3 2.7 18.1 14.2

Solar Megawatts Under Construction 16.5 2.8 16.5 2.8

Forecast is to place $70 to $80 million of solar-related capital into service in fiscal 2014 NJR expects NJRCEV to contribute 5 to 15 percent to fiscal 2014 NFE

|

|

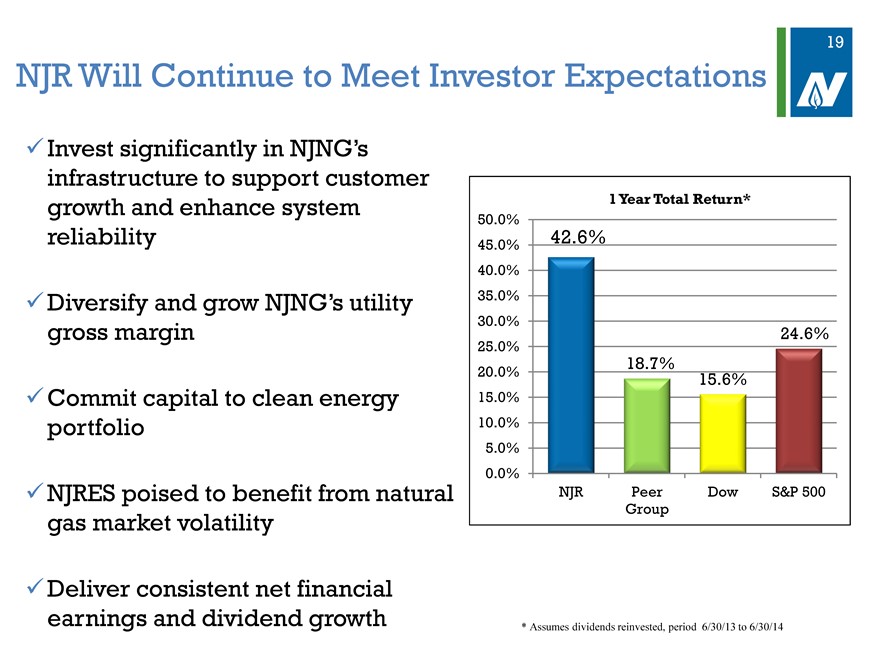

NJR Will Continue to Meet Investor Expectations

19

Invest significantly in NJNG’s infrastructure to support customer growth and enhance system reliability

Diversify and grow NJNG’s utility gross margin

Commit capital to clean energy portfolio

NJRES poised to benefit from natural gas market volatility

Deliver consistent net financial earnings and dividend growth

1 Year Total Return*

50.0%

45.0% 42.6%

40.0%

35.0%

30.0%

24.6%

25.0%

18.7%

20.0% 15.6%

15.0%

10.0%

5.0%

0.0%

NJR Peer Dow S&P 500

Group

* Assumes dividends reinvested, period 6/30/13 to 6/30/14