Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Blackstone Group Inc | d757301d8k.htm |

| EX-99.1 - EX-99.1 - Blackstone Group Inc | d757301dex991.htm |

Blackstone’s Second Quarter 2014 Earnings

July 17, 2014

Exhibit 99.2 |

Blackstone

1

“Blackstone’s singular focus on fund investment returns

ultimately drives outperformance for our unitholders.

Record results across the Blackstone platform continue

to demonstrate that.”

Stephen A. Schwarzman

Chairman and Founder |

Blackstone

2

Blackstone’s Second Quarter 2014 Highlights

Blackstone had its best second quarter and first half of the year on strong

performance across all of its funds, driving record financial returns and

asset levels. Economic Net Income (“ENI”) was $1.3 billion

($1.15/unit) for the quarter, up 89% from last year, as Blackstone’s

funds created $9.3 billion of value in the second quarter alone. •

BCP V crossed the preferred return threshold and generated $509 million in

Performance Fees during the second

quarter

with

$5.8

billion

of

realizations

year-to-date.

Distributable Earnings (“DE”) more than doubled in the quarter

year-over-year on a record level of realizations, bringing the

year-to-date total to $1.3 billion ($1.06/unit). GAAP

Net

Income

was

$517

million

for

the

quarter,

net

of

certain

non-cash

IPO

and

transaction

related

expenses and exclusive of net income attributable to non-controlling

interests, primarily inside ownership. Total Assets Under Management

(“AUM”) reached a record $279 billion, up 21% year-over-year despite

returning $50.0 billion of capital to investors over the last twelve months

(“LTM”). •

Gross inflows were $14.5 billion for the quarter and $62.4 billion LTM on record

organic inflows. •

Blackstone’s unmatched portfolio of funds and assets created $37.0 billion

of value LTM. Across Blackstone’s diverse platform, $20.3 billion of

capital was invested LTM, up 31%; investments outside North

America reached 44%, reflecting unique access to global fund mandates and

platforms. |

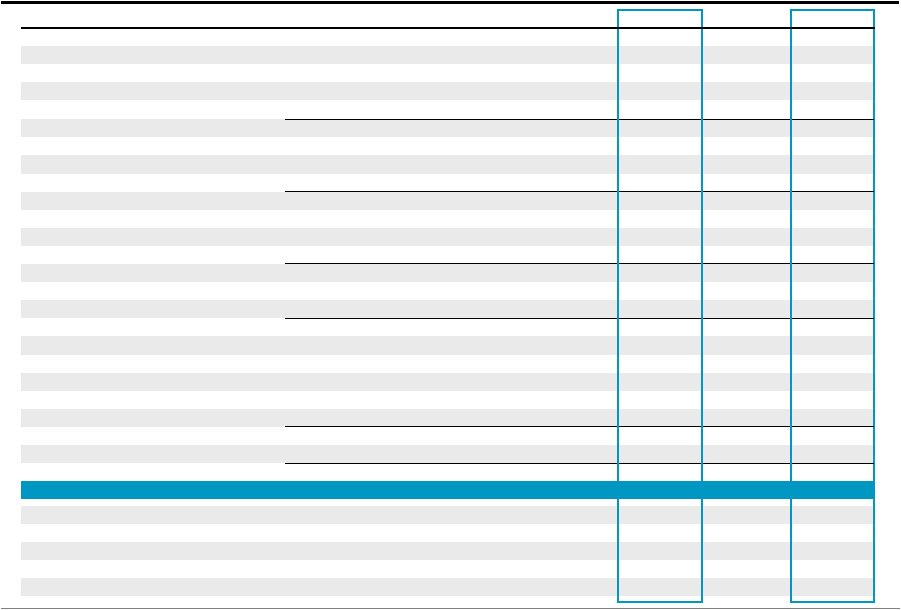

3

Blackstone’s Second Quarter 2014 Earnings

% Change

% Change

(Dollars in Thousands, Except per Unit Data)

2Q'13

2Q'14

vs. 2Q'13

YTD'13

YTD'14

vs. YTD'13

Fee Revenues

616,515

$

662,550

$

7%

1,137,398

$

1,275,888

$

12%

Performance Fees

719,219

1,398,438

94%

1,323,218

2,177,452

65%

Investment Income

97,119

175,971

81%

231,890

292,438

26%

Total Revenues

1,432,853

$

2,236,959

$

56%

2,692,506

$

3,745,778

$

39%

Total Expenses

713,461

885,964

24%

1,334,777

1,569,537

18%

Taxes

16,152

25,032

55%

26,183

36,344

39%

Economic Net Income (“ENI”)

703,240

$

1,325,963

$

89%

1,331,546

$

2,139,897

$

61%

ENI per Unit

0.62

$

1.15

$

85%

1.17

$

1.85

$

58%

GAAP Net Income

211,148

$

517,016

$

145%

378,783

$

782,633

$

107%

Fee Related Earnings (“FRE”)

168,434

$

201,108

$

19%

306,167

$

375,937

$

23%

Distributable Earnings (“DE”)

338,485

$

770,797

$

128%

729,397

$

1,255,909

$

72%

DE per Common Unit

0.28

$

0.65

$

132%

0.62

$

1.06

$

71%

Total Assets Under Management

229,571,741

278,917,713

21%

229,571,741

278,917,713

21%

Fee-Earning Assets Under Management

176,338,947

209,913,760

19%

176,338,947

209,913,760

19%

Blackstone |

4

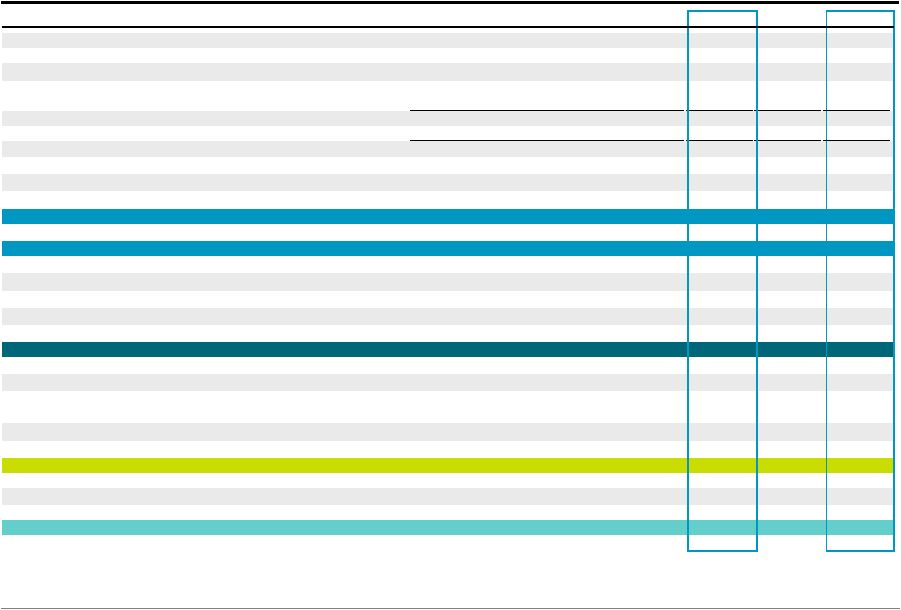

Walkdown of Financial Metrics

(Dollars in Thousands, Except per Unit Data)

2Q'14

YTD'14

Results

Per Unit

Results

Per Unit

Base Management Fees

496,570

$

973,448

$

Advisory Fees

114,914

184,877

Transaction and Other Fees, Net

49,196

109,106

Management Fee Offsets

(20,218)

(36,862)

Interest Income and Other Revenue

28,772

59,813

Compensation

(323,015)

(629,560)

Other Operating Expenses

(145,111)

(284,885)

Fee Related Earnings

201,108

$

0.18

$

375,937

$

0.33

$

Net Realized Incentive Fees

20,782

50,984

Net Realized Carried Interest

381,358

565,583

Net Realized Investment Income

201,140

311,713

Taxes and Related Payables

(44,841)

(75,895)

Equity-Based Compensation

11,250

27,587

Distributable Earnings

770,797

$

0.65

$

1,255,909

$

1.06

$

Net Unrealized Incentive Fees

32,084

69,819

Net Unrealized Carried Interest

546,376

835,974

Net Unrealized Investment Loss

(31,853)

(33,769)

Add Back: Related Payables

19,809

39,551

Less: Equity-Based Compensation

(11,250)

(27,587)

Economic Net Income

1,325,963

$

1.15

$

2,139,897

$

1.85

$

Blackstone

See page 30, Walkdown of Financial Metrics – Calculation of Certain Non-GAAP Financial

Metric Components for the calculation of the amounts presented herein that are not the respective

captions on page 19, Total Segments. 2Q’14 Fee Related Earnings per Unit is based on

1,141,345,729 DE Units Outstanding; DE per Unit is based on 603,270,771 Total Common Units Outstanding; and ENI

per Unit is based on 1,154,055,961 Weighted-Average ENI Adjusted Units (see page 31, Unit

Rollforward). |

Blackstone

5

Private Equity

8.4%

2Q’14 increase in fund carrying value

$212 million

2Q’14 Realized Performance Fees

$1.12 per unit

2Q’14 Net Accrued Performance Fees

Blackstone’s portfolio company operating approach drove results to record

levels and segment appreciation outperformed

the

broader

equity

markets

with

8.4%

appreciation

during

the

quarter

and 28.3%

LTM.

Total Revenues up 164% to $939 million for the quarter and Economic Income up 278%

to $648 million. BCP V appreciated 10.5% during the quarter and crossed the

preferred return hurdle. •

Net Accrued Performance Fees for BCP V reached $558 million; up 296% from the

prior quarter. Realization activity remains robust with $4.2 billion of

proceeds on ten transactions during the quarter and $14.8

billion on 42 transactions LTM.

Continued

strong

investment

activity

with

$2.2

billion

of

total

capital

invested

during

the

quarter

and

$6.3

billion

LTM as Private Equity continues to utilize its global platform to find

value. Strategic Partners’

sixth secondary fund of funds has closed on $3.2 billion of total capital with a

$4.4 billion target as the business continues to leverage synergies across

the Blackstone platform in its first year. % Change

% Change

(Dollars in Thousands)

2Q'13

2Q'14

vs. 2Q'13

YTD'13

YTD'14

vs. YTD'13

Fee Revenues

126,636

$

131,804

$

4%

240,263

$

277,614

$

16%

Performance Fees

186,825

714,604

282%

242,763

1,001,474

313%

Investment Income

42,674

92,474

117%

98,547

143,976

46%

Total Revenues

356,135

938,882

164%

581,573

1,423,064

145%

Compensation

63,747

73,038

15%

123,950

146,345

18%

Performance Fee Compensation

88,988

178,914

101%

121,853

237,537

95%

Other Operating Expenses

32,178

39,193

22%

61,346

72,199

18%

Total Expenses

184,913

291,145

57%

307,149

456,081

48%

Economic Income

171,222

$

647,737

$

278%

274,424

$

966,983

$

252%

Total AUM

53,287,294

$

68,294,162

$

28%

53,287,294

$

68,294,162

$

28%

Fee-Earning AUM

36,635,224

$

42,888,756

$

17%

36,635,224

$

42,888,756

$

17% |

Blackstone

6

Real Estate

6.0%

2Q’14 increase in fund carrying value

$424 million

2Q’14 Realized Performance Fees

Economic Income rose 32% to $489 million in the second quarter, reflecting strong

global Real Estate fundamentals, including improving rents and occupancy

across Blackstone’s diversified real estate portfolio. Opportunistic

Real Estate funds’ carrying value appreciated 6.0% for the quarter and

28.3% LTM. Record realization quarter, with $6.7 billion of proceeds,

driven by partial realizations in Hilton and Brixmor. •

Net Accrued Performance Fees up 10% from prior quarter to $2.7 billion despite

significant realizations. •

70% of unrealized gains are in public equities and liquidating office

portfolios. Raised $2.0 billion of capital during the quarter, including

$1.0 billion for the Asia fund, $226 million for Core+ and $858 million in

debt strategies. Invested $3.1 billion of total capital during the quarter,

and $11.6 billion LTM. •

An

additional

$2.5

billion

was

committed

not

yet

deployed

at

the

end

of

the

quarter,

which

included

several

scale investments that Blackstone was uniquely positioned to execute.

Blackstone’s

commercial

mortgage

REIT,

BXMT,

finished

the

quarter

with

a $1.4

billion

market

capitalization,

up

from $80 million at the time of its May 2013 re-IPO.

$2.33 per unit

2Q’14 Net Accrued Performance Fees

% Change

% Change

(Dollars in Thousands)

2Q'13

2Q'14

vs. 2Q'13

YTD'13

YTD'14

vs. YTD'13

Fee Revenues

153,823

$

171,472

$

11%

298,188

$

341,575

$

15%

Performance Fees

402,276

539,874

34%

756,617

877,480

16%

Investment Income

49,213

72,227

47%

119,050

108,963

(8)%

Total Revenues

605,312

783,573

29%

1,173,855

1,328,018

13%

Compensation

73,792

85,582

16%

143,251

165,815

16%

Performance Fee Compensation

133,013

172,079

29%

250,691

282,263

13%

Other Operating Expenses

27,617

36,542

32%

56,079

69,649

24%

Total Expenses

234,422

294,203

26%

450,021

517,727

15%

Economic Income

370,890

$

489,370

$

32%

723,834

$

810,291

$

12%

Total AUM

63,919,906

$

80,410,988

$

26%

63,919,906

$

80,410,988

$

26%

Fee-Earning AUM

43,635,493

$

52,823,975

$

21%

43,635,493

$

52,823,975

$

21% |

Blackstone

7

Hedge Fund Solutions

Total Revenues of $166 million for the quarter, up 20% year-over-year,

driven by an increase in Fee-Earning AUM on organic inflows and fund

appreciation. BAAM’s Principal Solutions Composite was up gross 2.0%

for the quarter and 10.6% LTM. Fee-Earning AUM grew by $10.5 billion,

or 22% year-over-year, to $58.1 billion; July 1 subscriptions of

$873

million are not yet included in Fee-Earning AUM.

•

BAAM held an additional closing for its first permanent capital vehicle acquiring

general partner interests in hedge funds, bringing total commitments to

$2.3 billion. •

BAAM launched its second alternative investment-focused 1940 Act mutual fund

for the retail market (Blackstone Alternative Multi-Strategy Fund) on

June 17, raising $300 million of capital in the second quarter. BAAM now

manages $1.5 billion of capital in its 1940 Act mutual funds. 2.0%

2Q’14 Gross Composite Return

$31.3 billion

Incentive Fee Eligible AUM at 2Q’14

$3.4 billion

2Q’14 Fee-Earning Gross Inflows

BAAM’s Principal Solutions Composite does not include BAAM’s long-only equity,

long-biased commodities, seed, strategic opportunities (external investments) and

advisory platforms. On a net of fees basis, the BAAM Principal Solutions Composite was up 1.8% for the quarter and 9.3% LTM.

% Change

% Change

(Dollars in Thousands)

2Q'13

2Q'14

vs. 2Q'13

YTD'13

YTD'14

vs. YTD'13

Fee Revenues

101,084

$

123,740

$

22%

194,856

$

238,545

$

22%

Performance Fees

34,834

38,529

11%

104,044

96,459

(7)%

Investment Income

1,614

3,451

114%

6,379

24,702

287%

Total Revenues

137,532

165,720

20%

305,279

359,706

18%

Compensation

36,844

43,341

18%

70,712

83,912

19%

Performance Fee Compensation

12,782

14,170

11%

37,640

34,202

(9)%

Other Operating Expenses

16,535

25,101

52%

31,694

44,581

41%

Total Expenses

66,161

82,612

25%

140,046

162,695

16%

Economic Income

71,371

$

83,108

$

16%

165,233

$

197,011

$

19%

Total AUM

50,128,028

$

60,672,759

$

21%

50,128,028

$

60,672,759

$

21%

Fee-Earning AUM

47,572,465

$

58,084,020

$

22%

47,572,465

$

58,084,020

$

22% |

Blackstone

8

Credit

$69.5 billion

2Q’14 Total AUM

Investment Performance

Gross Returns

CLOs

Customized Credit

Strategies

Mezzanine

Funds

Rescue

Lending

Funds

Hedge Fund

Strategies

Strong performance across GSO’s diversified platform generated Economic

Income of $104

million in the quarter, up 27% year-over-year.

Fee-Earning AUM grew 16% LTM to $56.1 billion due to robust net inflows

across the platform and several new fund launches despite a heavy pace of

capital returned to investors in the drawdown funds and CLOs.

•

Launched three CLOs during the quarter (two U.S. and one European),

raising $1.9 billion in Fee-Earning AUM.

Invested $374 million of total capital during the quarter, bringing total

capital invested to $1.7 billion LTM, of which nearly half was invested in

Europe, where GSO is well positioned to capitalize on investment

opportunities.

% Change

% Change

(Dollars in Thousands)

2Q'13

2Q'14

vs. 2Q'13

YTD'13

YTD'14

vs. YTD'13

Fee Revenues

112,391

$

117,717

$

5%

212,932

$

227,985

$

7%

Performance Fees

95,284

105,431

11%

219,794

202,039

(8)%

Investment Income

5,282

6,744

28%

9,703

12,894

33%

Total Revenues

212,957

229,892

8%

442,429

442,918

0%

Compensation

55,941

51,310

(8)%

101,462

102,062

1%

Performance Fee Compensation

52,049

52,675

1%

116,543

101,090

(13)%

Other Operating Expenses

22,961

22,159

(3)%

43,923

54,998

25%

Total Expenses

130,951

126,144

(4)%

261,928

258,150

(1)%

Economic Income

82,006

$

103,748

$

27%

180,501

$

184,768

$

2%

Total AUM

62,236,513

$

69,539,804

$

12%

62,236,513

$

69,539,804

$

12%

Fee-Earning AUM

48,495,765

$

56,117,009

$

16%

48,495,765

$

56,117,009

$

16%

2Q'14

2Q'14 LTM

Hedge Fund

Strategies

2.1%

16.9%

Mezzanine

Funds

3.9%

16.3%

Rescue

Lending Funds

5.3%

31.3%

$7.7

$8.7

$9.3

$23.5

$20.4

Investment Performance represents weighted-average performance of the assets of the

respective flagship funds within each strategy as of June 30, 2014. Hedge Fund Strategies

net returns were 1.4% for 2Q’14 and 12.4% for 2Q’14 LTM, Mezzanine Funds net returns

were 2.8% for 2Q’14 and 11.0% for 2Q’14 LTM and Rescue Lending Funds net returns were

4.7% for 2Q’14 and 24.8% for 2Q’14 LTM. Customized Credit Strategies includes

business development companies (“BDCs”), closed-end funds, commingled funds, the exchange

traded fund and separately managed accounts. |

Blackstone

9

Financial Advisory

Blackstone Advisory Partners year-to-date revenues increased 41% compared

to the prior year on increased merger and acquisition activity as a number

of deals closed in the second quarter throughout a diversified group of

industries (financial institutions, energy, industrials and technology) and

geographies. Blackstone Capital Markets was up substantially

year-over-year on increased underwritings and contributed

meaningfully to the growth in profitability of the Financial Advisory

segment. Restructuring revenues decreased compared to the prior year

quarter, which was the strongest quarter of 2013, reflecting fewer deal

closings, although the pipeline remains steady across a diverse group of industries.

Park Hill’s quarterly and year-to-date revenues were up

significantly and the pipeline remains strong due to demand for

alternative asset placement services. % Change

% Change

(Dollars in Thousands)

2Q'13

2Q'14

vs. 2Q'13

YTD'13

YTD'14

vs. YTD'13

Fee Revenues

122,581

117,817

(4)%

191,159

190,169

(1)%

Investment Income (Loss)

(1,664)

1,075

n/m

(1,789)

1,903

n/m

Total Revenues

120,917

118,892

(2)%

189,370

192,072

1%

Compensation

76,153

69,744

(8)%

134,079

131,426

(2)%

Other Operating Expenses

20,861

22,116

6%

41,554

43,458

5%

Total Expenses

97,014

91,860

(5)%

175,633

174,884

(0)%

Economic Income

23,903

$

27,032

$

13%

13,737

$

17,188

$

25% |

Fee-Earning

Assets Under Management $176.3

$209.9

Private Equity

Real Estate

Hedge Fund

Solutions

Credit

$43.6

$47.6

$48.5

$157.6

$36.6

$38.5

$40.2

$41.8

$37.2

Blackstone

10

2Q'12

2Q'13

2Q'14

$56.1

$58.1

$52.8

$42.9

2Q’14 Fee-Earning AUM Rollforward (Dollars in

Millions) LTM Fee-Earning AUM Rollforward

(Dollars in Millions)

Fee-Earning AUM by Segment

(Dollars in Billions)

Inflows include contributions, capital raised, other increases in available

capital, purchases and acquisitions. Outflows represent redemptions, client withdrawals and

other decreases in available capital. Realizations represent realizations from the disposition

of assets. Market Activity represents gains (losses) on portfolio investments and

impact of foreign exchange rate fluctuations.

Private

Real

Hedge Fund

Equity

Estate

Solutions

1Q'14

41,151

$

53,491

$

55,571

$

53,387

$

203,600

$

Inflows

3,459

2,387

3,442

5,309

14,597

Outflows

(602)

(68)

(1,991)

(831)

(3,491)

Realizations

(1,384)

(2,971)

(9)

(2,086)

(6,449)

Net Inflows (Outflows)

1,474

(652)

1,443

2,391

4,656

Market Activity

264

(15)

1,070

339

1,658

2Q'14

42,889

$

52,824

$

58,084

$

56,117

$

209,914

$

QoQ Increase (Decrease)

4%

(1)%

5%

5%

3%

Credit

Total

Private

Real

Hedge Fund

Equity

Estate

Solutions

2Q'13

36,635

$

43,635

$

47,572

$

48,496

$

176,339

$

Inflows

12,451

15,962

10,986

15,983

55,382

Outflows

(1,337)

(1,376)

(4,842)

(2,933)

(10,489)

Realizations

(5,318)

(5,530)

(475)

(7,540)

(18,862)

Net Inflows

5,797

9,056

5,669

5,510

26,031

Market Activity

457

133

4,843

2,112

7,544

2Q'14

42,889

$

52,824

$

58,084

$

56,117

$

209,914

$

YoY Increase

17%

21%

22%

16%

19%

Credit

Total

Inflows:

Asia

fund

$1.0

billion;

Core+

$226

million;

BREDS

capital raised and/or invested $1.0 billion.

Realizations:

Primarily

from

the

partial

sale

of

public

market

holdings

(Hilton and Brixmor).

Inflows:

$1.3

billion

in

specialized

solutions;

$1.1

billion

in

customized solutions; $561 million in commingled products;

$464 million in individual investor solutions.

Outflows:

$2.0

billion

of

redemptions

reflecting

seasonally

higher

activity in the commingled funds.

Inflows:

$787

million

in

Hedge

Fund

Strategies;

$1.9

billion

in

three

new CLO launches; $1.4 billion in BDCs.

Realizations

/

Outflows:

$1.7

billion

returned

to

CLO

investors;

$340 million returned across Mezzanine and Rescue Lending funds.

Inflows:

Strategic

Partners

VI

investment

period

commencement

with $3.1 billion of third party capital.

Realizations:

Primarily

BCP

V,

including

two

strategic

sales and four

partial public market dispositions (Hilton, PBF, SeaWorld and Nielsen).

Private

Equity

Real

Estate

Hedge

Fund

Solutions

Credit |

Blackstone

11

Total Assets Under Management

2Q’14 Total AUM Rollforward

(Dollars in Millions)

LTM Total AUM Rollforward

(Dollars in Millions)

Private Equity

Real Estate

Hedge Fund

Solutions

Credit

Total AUM by Segment

(Dollars in Billions)

Private

Real

Hedge Fund

Equity

Estate

Solutions

1Q'14

66,143

$

81,334

$

58,263

$

66,006

$

Inflows

2,737

2,478

3,308

6,016

Outflows

(344)

(97)

(1,999)

(887)

Realizations

(4,166)

(6,927)

(11)

(2,277)

Net Inflows (Outflows)

(1,774)

(4,547)

1,298

2,852

Market Activity

3,925

3,624

1,113

682

2Q'14

68,294

$

80,411

$

60,673

$

69,540

$

QoQ Increase (Decrease)

3%

(1)%

4%

5%

Credit

Total

271,746

$

14,538

(3,328)

(13,381)

(2,171)

9,343

278,918

$

3%

Inflows:

Additional

close

of

general

partner

interests

vehicle

with

$2.3

billion

in

total

commitments.

Market

Activity:

BAAM’s

Principal

Solutions

Composite

up 2.0%

gross.

Private

Equity

Real

Estate

Hedge

Fund

Solutions

Credit

$190.3

$50.2

$42.9

$50.5

$46.6

$229.6

$63.9

$50.1

$62.2

$53.3

$278.9

$68.3

$80.4

$60.7

$69.5

2Q'12

2Q'13

2Q'14

Private

Real

Hedge Fund

Equity

Estate

Solutions

2Q'13

53,287

$

63,920

$

50,128

$

62,237

$

229,572

$

Inflows

17,755

16,549

11,073

17,002

62,378

Outflows

(756)

(1,150)

(4,983)

(3,661)

(10,551)

Realizations

(14,823)

(14,006)

(644)

(9,990)

(39,463)

Net Inflows

2,175

1,393

5,446

3,350

12,364

Market Activity

12,831

15,098

5,099

3,953

36,982

2Q'14

68,294

$

80,411

$

60,673

$

69,540

$

278,918

$

YoY Increase

28%

26%

21%

12%

21%

Credit

Total

Inflows:

Strategic

Partners

additional

capital

raised

of

$1.7

billion.

Market

Activity:

Overall

increase

of

8.4%

in

carrying

value,

driven by

public portfolio appreciation of 7.5% and private portfolio appreciation of

10.4%.

Inflows include contributions, capital raised, other increases in available capital, purchases

and acquisitions. Outflows represent redemptions, client withdrawals and other decreases in

available capital. Realizations represent realizations from the disposition of assets. Market

Activity represents gains (losses) on portfolio investments and impact of foreign exchange

rate fluctuations.

Market

Activity:

Carrying

value

increase

of

6.0%

driven

by

improving

fundamentals

in

the

private

portfolio

by

6.7%

or

$1.9

billion,

and

public portfolio

appreciation

of

4.8%

or

$1.0

billion.

Market

Activity:

Appreciation

in

value

in

BDCs

of

$247

million;

Rescue

Lending

Funds

of

$170

million;

Hedge

Fund

Strategies

of $206

million. |

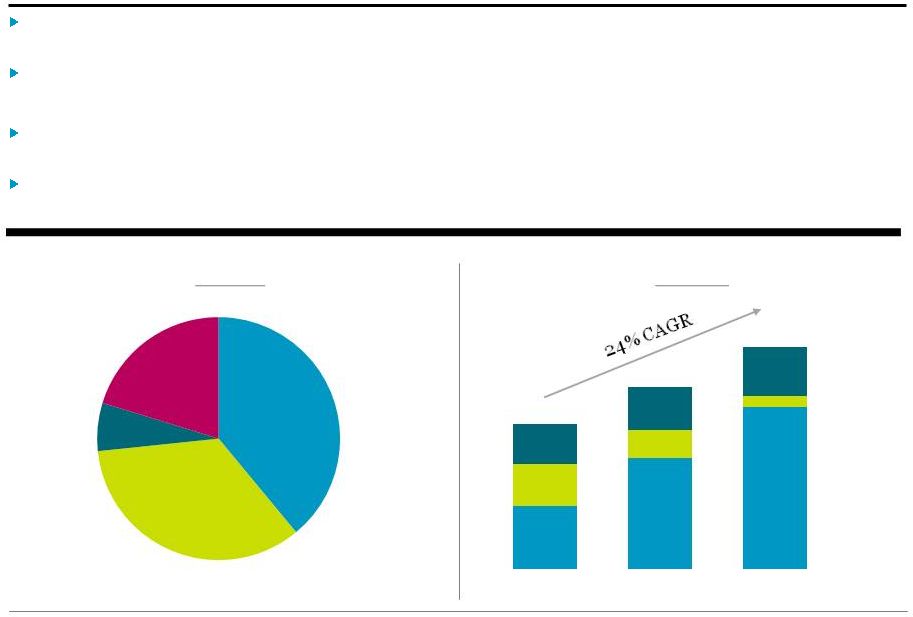

Additional

Capital Detail Global fundraising sourced record levels of capital with

$62.4 billion of gross inflows over the last year, which largely offset the

$20.3 billion of investment activity across the firm. Committed undrawn

capital (“Total Dry Powder”) is $45.3 billion, up 18% from $38.5 billion a year ago.

•

Of the $45.3 billion, $18.6 billion

was eligible but not currently earning Management Fees.

Blackstone manages the public industry’s largest pool of Performance Fee

Eligible AUM across its integrated global platform, which reached $191.0

billion at the end of the quarter, up 22% year-over-year. Strong

investment performance drove a 46% increase in assets currently earning Performance Fees from last year

to $139.7

billion as all of Blackstone’s current and mature funds are generating

Realized Performance Fees. $45 billion 2Q’14 Total Dry Powder

$191 billion Performance Fee Eligible AUM

Uninvested

Not Earning

Fees

Currently

Earning Fees

Credit

Hedge

Fund

Solutions

Private

Equity

Real

Estate

$17.7

$15.6

$2.9

$9.2

$54.8

$95.7

$139.7

$36.1

$23.9

$9.0

$34.0

$37.2

$42.2

$124.8

$156.8

$191.0

2Q'12

2Q'13

2Q'14

Blackstone

12 |

At June 30, 2014, Blackstone had $2.7 billion in total cash, corporate treasury

and liquid investments and $9.8

billion of total net value, or $8.60 per DE unit, up 36% from $6.31 a year

ago. Long-term

debt

of

$2.1

billion

at

quarter

end

resulted

in

a

Debt

to

Adjusted

EBITDA

ratio

of

0.79x

LTM.

On

April

7,

2014,

Blackstone

issued

senior

notes

of

$500

million

(5.00%

coupon)

maturing

on

June

15,

2044.

On May 29, 2014, the maturity date of the $1.1 billion credit revolver, which is

currently undrawn, was extended to May 29, 2019.

Balance Sheet Highlights

(Dollars in Millions)

2Q’14

Cash and Cash Equivalents

$

1,223

Treasury Cash

Management Strategies

1,286

Liquid Investments

141

Illiquid Investments

2,930

Net Accrued Performance

Fees

4,241

Total Net Value

$

9,821

Outstanding Bonds (at par)

$

2,135

A+/A+

rated by S&P and Fitch

$1.1 billion

undrawn credit revolver with

May 2019 maturity

$2.7 billion

total cash, corporate treasury

and liquid investments

Cash and Investments

Net

Performance

Fees

Total Cash

and Liquids

Illiquids

$8.60

$6.31

$4.61

$1.58

$2.24

$3.72

$1.81

$2.06

$1.22

$2.01

$2.32

2Q'12

2Q'13

2Q'14

$2.57

Blackstone

13

Balance Sheet Highlight results are preliminary, and exclude the consolidated Blackstone

funds. Liquid Investments are primarily Blackstone investments in Hedge Fund Solutions

and non-drawdown Credit. Illiquid Investments include Blackstone investments in Private Equity, Real Estate and Other, which were $1.0 billion, $1.5 billion and $412

million, respectively, as of June 30, 2014; $911 million, $1.2 billion and $193 million,

respectively, as of June 30, 2013; and $820 million, $945 million and $248 million,

respectively, as of June 30, 2012. 2Q’14 Cash and Investments are calculated using

1,141,345,729 DE Units Outstanding. |

Net Accrued Performance Fees reached a record $4.2 billion, despite record LTM

Realized Performance Fees of $1.9

billion.

With BCP V fully crossing the preferred hurdle, 100% of Blackstone’s current

and mature funds are in a positive net carry position

inception-to-date. Net Accrued Performance Fees represent nearly

70% of Total Accrued Performance Fees at current values. This

percentage

includes

pre-IPO

investments

in

which

Blackstone

has

a

higher

percentage

than

the

post-IPO

investments’

targeted 45% compensation ratio. Percentages fluctuate from quarter to quarter

depending on specific deal performance.

Performance Fees

$1.9 billion Realized

Performance Fees

$1,119

$1,910

$159

68%

Net Accrued Performance Fees

Related to Public/Pending Exits

32%

Net

Accrued

Performance

Fees

Related to Private Investments

$1.9 billion

Record LTM Realized

Performance Fees

$4.2 billion Net Accrued

Performance Fees

$2,529

$4,241

$1,756

Private Equity

Real Estate

Credit

Hedge Fund Solutions

$221

$518

$407

$905

$107

$228

$385

$259

2Q'12 LTM

2Q'13 LTM

2Q'14 LTM

$533

$633

$1,275

$1,035

$1,635

$2,664

$176

$194

$245

2Q'12

2Q'13

2Q'14

Blackstone

14 |

Blackstone

15

Unitholder Distribution

A

detailed

description

of

Blackstone’s

distribution

policy

and

the

definition

of

Distributable

Earnings

can

be

found

on

page

32,

Definitions

and

Distribution

Policy.

DE

before

Certain

Payables

represents

Distributable

Earnings

before

the

deduction

for

the

Payable

Under

Tax

Receivable

Agreement

and

tax

expense

(benefit)

of

wholly

owned

subsidiaries.

Per

Unit

calculations

are

based

on

Total

Common

Units

Outstanding

(page

31,

Unit

Rollforward);

actual

distributions

are

paid

to

applicable

unitholders

as

of

the

record

date.

For

the

periods

presented,

Net

Cash

Available

for

Distribution

per

Common

Unit

equals

the

Actual

Distribution

per

Common

Unit.

Retained

capital

is

withheld

pro-rata

from

common

and

Blackstone

Holdings

Partnership

unitholders.

Common

unitholders’

share

was

$61.2

million

for

2Q’14.

Generated

$0.65

of

Distributable

Earnings

per

common

unit

during

the

quarter,

up

132%

year-over-year.

•

Year-to-date Distributable Earnings per common unit of $1.06, up 71% from

the prior year period. Declared

a

quarterly

distribution

of

$0.55

per

common

unit

to

record

holders

as

of

July

28,

2014;

payable

on

August

4, 2014.

•

85%

payout

ratio

reflects

the

strength

of

the

balance

sheet

and

financial

momentum

of

the

firm.

•

Year-to-date distributions of $0.90, up 70% from the prior year

period. % Change

(Dollars in Thousands, Except per Unit Data)

2Q'13

3Q'13

4Q'13

1Q'14

2Q'14

vs. 2Q'13

Distributable Earnings (“DE”)

338,485

$

312,673

$

820,629

$

485,112

$

770,797

$

128%

Add: Other Payables Attributable to

Common Unitholders

28,498

17,694

58,103

19,856

29,884

5%

DE before Certain Payables

366,983

330,367

878,732

504,968

800,681

118%

Percent to Common Unitholders

51%

52%

52%

53%

53%

DE before Certain Payables Attributable to

Common Unitholders

187,652

170,216

455,291

265,378

423,209

126%

Less: Other Payables Attributable to

Common Unitholders

(28,498)

(17,694)

(58,103)

(19,856)

(29,884)

5%

DE Attributable to Common Unitholders

159,154

152,522

397,188

245,522

393,325

147%

DE per Common Unit

0.28

$

0.26

$

0.68

$

0.41

$

0.65

$

132%

Less: Retained Capital per Common Unit

(0.05)

$

(0.03)

$

(0.10)

$

(0.06)

$

(0.10)

$

100%

Actual Distribution per Common Unit

0.23

$

0.23

$

0.58

$

0.35

$

0.55

$

139%

Record Date

July 28, 2014

Payable Date

August 4, 2014 |

Blackstone

16

Summary Walkdown of GAAP to Non-GAAP Financial Metrics

GAAP

Economic Income

“EI”

Fee Related Earnings

“FRE”

Distributable Earnings

“DE”

Income Before Provision for Taxes

+

IPO and Acquisition-Related Charges

–

Impact of Consolidated Funds

–

Net Performance Fees

–

Fund Investment Income

+

Net Realized Performance Fees

+

Realized Investment Income

–

Taxes and Related Payables

+ Equity-Based Compensation

=

Distributable Earnings

(Dollars in Millions)

See pages 28-29, Reconciliation of GAAP to Non-GAAP Measures for details.

2Q’14

$771

=

Economic Income

=

Fee Related Earnings

$201

$376

$1,256

$1,307

$2,016

$1,351

$2,176

YTD’14 |

Blackstone

17

GAAP Statement of Operations

% Change

% Change

(Dollars in Thousands, Except per Unit Data) (Unaudited)

2Q'13

2Q'14

vs. 2Q'13

YTD'13

YTD'14

vs. YTD'13

Revenues

Management and Advisory Fees, Net

578,723

$

619,523

$

7%

1,060,856

$

1,192,683

$

12%

Performance Fees

Realized Carried Interest

183,288

641,659

250%

477,458

975,282

104%

Realized Incentive Fees

76,104

39,504

(48)%

99,845

83,298

(17)%

Unrealized Carried Interest

456,706

660,682

45%

634,053

991,076

56%

Unrealized Incentive Fees

938

54,639

n/m

106,736

118,872

11%

Total Performance Fees

717,036

1,396,484

95%

1,318,092

2,168,528

65%

Investment Income

Realized

75,490

215,710

186%

117,843

368,736

213%

Unrealized

56,570

10,809

(81)%

162,800

24,309

(85)%

Total Investment Income

132,060

226,519

72%

280,643

393,045

40%

Interest and Dividend Revenue

13,814

15,340

11%

26,371

29,409

12%

Other

(1,163)

(6)

99%

981

863

(12)%

Total Revenues

1,440,470

2,257,860

57%

2,686,943

3,784,528

41%

Expenses

Compensation and Benefits

Compensation

478,981

500,641

5%

930,411

985,992

6%

Performance Fee Compensation

Realized Carried Interest

75,910

260,301

243%

165,347

409,699

148%

Realized Incentive Fees

35,014

18,509

(47)%

45,522

42,144

(7)%

Unrealized Carried Interest

172,824

114,296

(34)%

268,296

155,026

(42)%

Unrealized Incentive Fees

3,084

24,692

701%

47,562

48,223

1%

Total Compensation and Benefits

765,813

918,439

20%

1,457,138

1,641,084

13%

General, Administrative and Other

117,365

136,492

16%

226,671

272,046

20%

Interest Expense

26,956

29,847

11%

54,018

54,514

1%

Fund Expenses

4,628

5,003

8%

12,036

9,988

(17)%

Total Expenses

914,762

1,089,781

19%

1,749,863

1,977,632

13%

Other Income

Net Gains from Fund Investment Activities

40,966

138,585

238%

108,176

208,740

93%

Income Before Provision for Taxes

566,674

$

1,306,664

$

131%

1,045,256

$

2,015,636

$

93%

Provision for Taxes

56,082

83,282

49%

107,075

137,379

28%

Net Income

510,592

$

1,223,382

$

140%

938,181

$

1,878,257

$

100%

Net Income Attributable to Redeemable Non-Controlling Interests in Consolidated

Entities 22,366

22,486

1%

84,682

68,278

(19)%

Net Income Attributable to Non-Controlling Interests in Consolidated Entities

27,944

140,061

401%

18,492

184,022

895%

Net Income Attributable to Non-Controlling Interests in Blackstone Holdings

249,134

543,819

118%

456,224

843,324

85%

Net Income Attributable to The Blackstone Group L.P. ("BX")

211,148

$

517,016

$

145%

378,783

$

782,633

$

107%

Net Income per Common Unit, Basic

0.36

$

0.85

$

136%

0.65

$

1.30

$

100%

Net Income per Common Unit, Diluted

0.36

$

0.85

$

136%

0.65

$

1.29

$

98% |

Appendix |

Blackstone

19

Total Segments

(Dollars in Thousands)

2Q'13

3Q'13

4Q'13

1Q'14

2Q'14

YTD'13

YTD'14

Revenues

Management and Advisory Fees, Net

Base Management Fees

425,674

$

437,294

$

469,092

$

476,878

$

496,570

$

834,421

$

973,448

$

Advisory Fees

120,734

83,602

139,158

69,963

114,914

187,754

184,877

Transaction and Other Fees, Net

66,464

42,806

59,733

59,910

49,196

104,438

109,106

Management Fee Offsets

(10,535)

(8,271)

(43,752)

(16,644)

(20,218)

(20,197)

(36,862)

Total Management and Advisory Fees, Net

602,337

555,431

624,231

590,107

640,462

1,106,416

1,230,569

Performance Fees

Realized Carried Interest

183,288

182,654

283,846

333,623

641,659

477,458

975,282

Realized Incentive Fees

74,867

31,238

343,501

53,837

39,291

99,594

93,128

Unrealized Carried Interest

456,706

290,052

1,233,905

330,288

660,712

634,053

991,000

Unrealized Incentive Fees

4,358

40,992

(173,033)

61,266

56,776

112,113

118,042

Total Performance Fees

719,219

544,936

1,688,219

779,014

1,398,438

1,323,218

2,177,452

Investment Income (Loss)

Realized

54,586

11,492

66,283

111,917

202,199

92,696

314,116

Unrealized

42,533

87,680

290,460

4,550

(26,228)

139,194

(21,678)

Total Investment Income

97,119

99,172

356,743

116,467

175,971

231,890

292,438

Interest Income and Dividend Revenue

15,342

21,539

19,394

22,362

22,094

30,003

44,456

Other

(1,164)

4,708

4,621

869

(6)

979

863

Total Revenues

1,432,853

1,225,786

2,693,208

1,508,819

2,236,959

2,692,506

3,745,778

Expenses

Compensation

306,477

279,498

262,688

306,545

323,015

573,454

629,560

Performance Fee Compensation

Realized Carried Interest

75,910

60,369

31,485

149,398

260,301

165,347

409,699

Realized Incentive Fees

35,014

14,599

140,794

23,635

18,509

45,522

42,144

Unrealized Carried Interest

172,824

82,341

616,080

40,690

114,336

268,296

155,026

Unrealized Incentive Fees

3,084

11,084

(70,297)

23,531

24,692

47,562

48,223

Total Compensation and Benefits

593,309

447,891

980,750

543,799

740,853

1,100,181

1,284,652

Other Operating Expenses

120,152

122,872

129,171

139,774

145,111

234,596

284,885

Total Expenses

713,461

570,763

1,109,921

683,573

885,964

1,334,777

1,569,537

Economic Income

719,392

$

655,023

$

1,583,287

$

825,246

$

1,350,995

$

1,357,729

$

2,176,241

$

Economic Net Income

703,240

$

640,231

$

1,542,098

$

813,934

$

1,325,963

$

1,331,546

$

2,139,897

$

Fee Related Earnings

168,434

$

178,596

$

260,706

$

174,829

$

201,108

$

306,167

$

375,937

$

Distributable Earnings

338,485

$

312,673

$

820,629

$

485,112

$

770,797

$

729,397

$

1,255,909

$

Total Assets Under Management

229,571,741

$

248,064,888

$

265,757,630

$

271,745,583

$

278,917,713

$

229,571,741

$

278,917,713

$

Fee-Earning Assets Under Management

176,338,947

$

188,649,817

$

197,981,739

$

203,599,604

$

209,913,760

$

176,338,947

$

209,913,760

$

Weighted Average Fee-Earning AUM

173,706,678

$

185,628,676

$

196,309,547

$

200,246,002

$

204,671,392

$

172,372,395

$

205,257,277

$

LP Capital Invested

3,634,404

$

3,378,067

$

5,382,770

$

4,468,527

$

5,426,511

$

5,418,867

$

9,895,038

$

Total Capital Invested

3,757,591

$

3,536,365

$

6,115,856

$

4,807,663

$

5,858,210

$

5,598,065

$

10,665,873

$ |

Blackstone

20

Private Equity

(Dollars in Thousands)

2Q'13

3Q'13

4Q'13

1Q'14

2Q'14

YTD'13

YTD'14

Revenues

Management Fees, Net

Base Management Fees

86,621

$

95,281

$

99,998

$

98,584

$

103,204

$

172,867

$

201,788

$

Transaction and Other Fees, Net

38,348

16,052

18,135

42,847

27,616

62,801

70,463

Management Fee Offsets

(1,950)

(2,080)

(1,173)

(1,713)

(4,246)

(2,430)

(5,959)

Total Management Fees, Net

123,019

109,253

116,960

139,718

126,574

233,238

266,292

Performance Fees

Realized Carried Interest

3,899

85,121

101,081

119,805

212,394

143,791

332,199

Unrealized Carried Interest

182,926

(86,300)

385,560

167,065

502,210

98,972

669,275

Total Performance Fees

186,825

(1,179)

486,641

286,870

714,604

242,763

1,001,474

Investment Income (Loss)

Realized

21,586

11,495

30,783

60,535

74,812

45,748

135,347

Unrealized

21,088

23,621

85,329

(9,033)

17,662

52,799

8,629

Total Investment Income

42,674

35,116

116,112

51,502

92,474

98,547

143,976

Interest Income and Dividend Revenue

3,251

5,231

4,136

5,228

4,666

6,235

9,894

Other

366

1,521

1,948

864

564

790

1,428

Total Revenues

356,135

149,942

725,797

484,182

938,882

581,573

1,423,064

Expenses

Compensation

63,747

55,800

56,370

73,307

73,038

123,950

146,345

Performance Fee Compensation

Realized Carried Interest

877

19,824

2,006

85,771

112,720

17,123

198,491

Unrealized Carried Interest

88,111

(36,198)

274,201

(27,148)

66,194

104,730

39,046

Total Compensation and Benefits

152,735

39,426

332,577

131,930

251,952

245,803

383,882

Other Operating Expenses

32,178

30,024

32,767

33,006

39,193

61,346

72,199

Total Expenses

184,913

69,450

365,344

164,936

291,145

307,149

456,081

Economic Income

171,222

$

80,492

$

360,453

$

319,246

$

647,737

$

274,424

$

966,983

$

Total Assets Under Management

53,287,294

$

62,619,813

$

65,675,031

$

66,142,945

$

68,294,162

$

53,287,294

$

68,294,162

$

Fee-Earning Assets Under Management

36,635,224

$

43,645,106

$

42,600,515

$

41,150,728

$

42,888,756

$

36,635,224

$

42,888,756

$

Weighted Average Fee-Earning AUM

36,675,636

$

43,886,763

$

43,290,792

$

41,815,672

$

43,702,379

$

36,865,792

$

44,235,482

$

LP Capital Invested

749,290

$

524,320

$

1,017,985

$

2,029,019

$

1,857,330

$

1,026,277

$

3,886,349

$

Total Capital Invested

780,339

$

548,173

$

1,330,606

$

2,271,273

$

2,159,178

$

1,071,350

$

4,430,451

$ |

Blackstone

21

Real Estate

(Dollars in Thousands)

2Q'13

3Q'13

4Q'13

1Q'14

2Q'14

YTD'13

YTD'14

Revenues

Management Fees, Net

Base Management Fees

137,000

$

136,721

$

153,115

$

159,336

$

157,869

$

275,346

$

317,205

$

Transaction and Other Fees, Net

19,013

19,205

32,317

13,564

13,514

28,153

27,078

Management Fee Offsets

(6,312)

(2,385)

(6,838)

(9,224)

(7,702)

(13,598)

(16,926)

Total Management Fees, Net

149,701

153,541

178,594

163,676

163,681

289,901

327,357

Performance Fees

Realized Carried Interest

143,481

93,878

180,641

194,658

417,826

212,254

612,484

Realized Incentive Fees

31,102

3,737

7,931

(26)

6,070

34,194

6,044

Unrealized Carried Interest

259,972

340,406

771,246

140,237

119,461

540,048

259,698

Unrealized Incentive Fees

(32,279)

2,481

(1,355)

2,737

(3,483)

(29,879)

(746)

Total Performance Fees

402,276

440,502

958,463

337,606

539,874

756,617

877,480

Investment Income (Loss)

Realized

18,577

928

23,320

31,357

122,664

28,111

154,021

Unrealized

30,636

57,656

201,606

5,379

(50,437)

90,939

(45,058)

Total Investment Income

49,213

58,584

224,926

36,736

72,227

119,050

108,963

Interest Income and Dividend Revenue

4,396

6,060

6,809

6,110

8,009

8,694

14,119

Other

(274)

2,113

1,678

317

(218)

(407)

99

Total Revenues

605,312

660,800

1,370,470

544,445

783,573

1,173,855

1,328,018

Expenses

Compensation

73,792

75,346

75,625

80,233

85,582

143,251

165,815

Performance Fee Compensation

Realized Carried Interest

55,005

38,942

29,027

51,833

143,442

80,868

195,275

Realized Incentive Fees

15,733

1,919

4,502

(16)

3,081

17,457

3,065

Unrealized Carried Interest

78,604

99,323

299,853

56,985

27,339

167,661

84,324

Unrealized Incentive Fees

(16,329)

615

(335)

1,382

(1,783)

(15,295)

(401)

Total Compensation and Benefits

206,805

216,145

408,672

190,417

257,661

393,942

448,078

Other Operating Expenses

27,617

30,614

29,698

33,107

36,542

56,079

69,649

Total Expenses

234,422

246,759

438,370

223,524

294,203

450,021

517,727

Economic Income

370,890

$

414,041

$

932,100

$

320,921

$

489,370

$

723,834

$

810,291

$

Total Assets Under Management

63,919,906

$

68,964,455

$

79,410,788

$

81,333,562

$

80,410,988

$

63,919,906

$

80,410,988

$

Fee-Earning Assets Under Management

43,635,493

$

44,715,985

$

50,792,803

$

53,490,834

$

52,823,975

$

43,635,493

$

52,823,975

$

Weighted Average Fee-Earning AUM

42,523,604

$

44,163,396

$

50,568,609

$

50,954,956

$

48,653,930

$

42,109,834

$

50,579,804

$

LP Capital Invested

2,213,668

$

2,365,224

$

3,986,610

$

1,692,232

$

3,017,193

$

3,389,443

$

4,709,425

$

Total Capital Invested

2,274,853

$

2,438,725

$

4,333,419

$

1,746,460

$

3,128,232

$

3,477,589

$

4,874,692

$ |

Blackstone

22

Hedge Fund Solutions

(Dollars in Thousands)

2Q'13

3Q'13

4Q'13

1Q'14

2Q'14

YTD'13

YTD'14

Revenues

Management Fees, Net

Base Management Fees

100,113

$

103,392

$

113,025

$

113,384

$

123,008

$

192,904

$

236,392

$

Transaction and Other Fees, Net

61

295

263

93

126

65

219

Management Fee Offsets

(714)

(1,200)

(1,149)

(1,455)

(1,531)

(1,038)

(2,986)

Total Management Fees, Net

99,460

102,487

112,139

112,022

121,603

191,931

233,625

Performance Fees

Realized Incentive Fees

13,845

5,320

174,861

39,845

7,973

27,554

47,818

Unrealized Incentive Fees

20,989

29,208

(97,980)

18,085

30,556

76,490

48,641

Total Performance Fees

34,834

34,528

76,881

57,930

38,529

104,044

96,459

Investment Income (Loss)

Realized

13,668

(598)

13,691

16,820

2,394

14,520

19,214

Unrealized

(12,054)

6,439

(7,604)

4,431

1,057

(8,141)

5,488

Total Investment Income

1,614

5,841

6,087

21,251

3,451

6,379

24,702

Interest Income and Dividend Revenue

1,878

2,523

1,988

2,661

2,340

3,094

5,001

Other

(254)

595

262

122

(203)

(169)

(81)

Total Revenues

137,532

145,974

197,357

193,986

165,720

305,279

359,706

Expenses

Compensation

36,844

37,611

28,147

40,571

43,341

70,712

83,912

Performance Fee Compensation

Realized Incentive Fees

5,116

1,954

53,701

13,271

2,918

10,138

16,189

Unrealized Incentive Fees

7,666

10,177

(34,823)

6,761

11,252

27,502

18,013

Total Compensation and Benefits

49,626

49,742

47,025

60,603

57,511

108,352

118,114

Other Operating Expenses

16,535

19,575

15,697

19,480

25,101

31,694

44,581

Total Expenses

66,161

69,317

62,722

80,083

82,612

140,046

162,695

Economic Income

71,371

$

76,657

$

134,635

$

113,903

$

83,108

$

165,233

$

197,011

$

Total Assets Under Management

50,128,028

$

53,162,174

$

55,657,463

$

58,262,659

$

60,672,759

$

50,128,028

$

60,672,759

$

Fee-Earning Assets Under Management

47,572,465

$

50,829,734

$

52,865,837

$

55,571,357

$

58,084,020

$

47,572,465

$

58,084,020

$

Weighted Average Fee-Earning AUM

46,783,727

$

48,933,335

$

51,794,518

$

54,715,882

$

56,793,206

$

46,091,525

$

55,958,185

$

LP Capital Invested

118,323

$

248,422

$

8,681

$

167,170

$

188,236

$

174,172

$

355,406

$

Total Capital Invested

125,000

$

262,309

$

8,681

$

202,674

$

196,348

$

184,000

$

399,022

$ |

Blackstone

23

Credit

(Dollars in Thousands)

2Q'13

3Q'13

4Q'13

1Q'14

2Q'14

YTD'13

YTD'14

Revenues

Management Fees, Net

Base Management Fees

101,940

$

101,900

$

102,954

$

105,574

$

112,489

$

193,304

$

218,063

$

Transaction and Other Fees, Net

9,002

7,058

8,152

3,344

7,064

13,376

10,408

Management Fee Offsets

(1,559)

(2,606)

(34,592)

(4,252)

(6,739)

(3,131)

(10,991)

Total Management Fees, Net

109,383

106,352

76,514

104,666

112,814

203,549

217,480

Performance Fees

Realized Carried Interest

35,908

3,655

2,124

19,160

11,439

121,413

30,599

Realized Incentive Fees

29,920

22,181

160,709

14,018

25,248

37,846

39,266

Unrealized Carried Interest

13,808

35,946

77,099

22,986

39,041

(4,967)

62,027

Unrealized Incentive Fees

15,648

9,303

(73,698)

40,444

29,703

65,502

70,147

Total Performance Fees

95,284

71,085

166,234

96,608

105,431

219,794

202,039

Investment Income (Loss)

Realized

901

496

(627)

3,071

2,223

4,229

5,294

Unrealized

4,381

(1,042)

9,519

3,079

4,521

5,474

7,600

Total Investment Income (Loss)

5,282

(546)

8,892

6,150

6,744

9,703

12,894

Interest Income and Dividend Revenue

4,071

5,288

4,240

5,861

4,892

8,618

10,753

Other

(1,063)

(357)

119

(259)

11

765

(248)

Total Revenues

212,957

181,822

255,999

213,026

229,892

442,429

442,918

Expenses

Compensation

55,941

53,250

31,802

50,752

51,310

101,462

102,062

Performance Fee Compensation

Realized Carried Interest

20,028

1,603

452

11,794

4,139

67,356

15,933

Realized Incentive Fees

14,165

10,726

82,591

10,380

12,510

17,927

22,890

Unrealized Carried Interest

6,109

19,216

42,026

10,853

20,803

(4,095)

31,656

Unrealized Incentive Fees

11,747

292

(35,139)

15,388

15,223

35,355

30,611

Total Compensation and Benefits

107,990

85,087

121,732

99,167

103,985

218,005

203,152

Other Operating Expenses

22,961

23,451

29,566

32,839

22,159

43,923

54,998

Total Expenses

130,951

108,538

151,298

132,006

126,144

261,928

258,150

Economic Income

82,006

$

73,284

$

104,701

$

81,020

$

103,748

$

180,501

$

184,768

$

Total Assets Under Management

62,236,513

$

63,318,446

$

65,014,348

$

66,006,417

$

69,539,804

$

62,236,513

$

69,539,804

$

Fee-Earning Assets Under Management

48,495,765

$

49,458,992

$

51,722,584

$

53,386,685

$

56,117,009

$

48,495,765

$

56,117,009

$

Weighted Average Fee-Earning AUM

47,723,711

$

48,645,182

$

50,655,628

$

52,759,492

$

55,521,877

$

47,305,244

$

54,483,806

$

LP Capital Invested

553,123

$

240,101

$

369,494

$

580,106

$

363,752

$

828,975

$

943,858

$

Total Capital Invested

577,399

$

287,158

$

443,150

$

587,256

$

374,452

$

865,126

$

961,708

$ |

Blackstone

24

Financial Advisory

(Dollars in Thousands)

2Q'13

3Q'13

4Q'13

1Q'14

2Q'14

YTD'13

YTD'14

Revenues

Advisory Fees

120,734

$

83,602

$

139,158

$

69,963

$

114,914

$

187,754

$

184,877

$

Transaction and Other Fees, Net

40

196

866

62

876

43

938

Total Advisory and Transaction Fees

120,774

83,798

140,024

70,025

115,790

187,797

185,815

Investment Income (Loss)

Realized

(146)

(829)

(884)

134

106

88

240

Unrealized

(1,518)

1,006

1,610

694

969

(1,877)

1,663

Total Investment Income (Loss)

(1,664)

177

726

828

1,075

(1,789)

1,903

Interest Income and Dividend Revenue

1,746

2,437

2,221

2,502

2,187

3,362

4,689

Other

61

836

614

(175)

(160)

-

(335)

Total Revenues

120,917

87,248

143,585

73,180

118,892

189,370

192,072

Expenses

Compensation

76,153

57,491

70,744

61,682

69,744

134,079

131,426

Total Compensation and Benefits

76,153

57,491

70,744

61,682

69,744

134,079

131,426

Other Operating Expenses

20,861

19,208

21,443

21,342

22,116

41,554

43,458

Total Expenses

97,014

76,699

92,187

83,024

91,860

175,633

174,884

Economic Income (Loss)

23,903

$

10,549

$

51,398

$

(9,844)

$

27,032

$

13,737

$

17,188

$ |

Blackstone

25

Net Accrued Performance Fees

Net Accrued Performance Fees are presented net of performance fee compensation and do not

include clawback amounts, if any, which are disclosed in the 10-K/Q. Net Realized Performance Fees are included in DE.

When these fees are received, the receivable is reduced without further impacting DE. Per Unit

calculations are based on 1,141,345,729 DE Units Outstanding (see page 31, Unit Rollforward).

Blackstone had $4.2 billion of accrued performance fees, net of performance fee

compensation and distributed Realized Performance Fees, at the end of the

second quarter. $4.2 billion

Net Accrued Performance Fees at 2Q’14

$3.72 per unit

Net Accrued Performance Fees at 2Q’14

68% increase

in Net Accrued Performance Fees since 2Q’13

Net Accrued Performance Fees

Change vs.

(Dollars in Millions, Except per Unit Data)

1Q'14

2Q'14

Per Unit

1Q'14

Private Equity

BCP IV Carried Interest

437

$

383

$

0.34

$

(54)

$

BCP V Carried Interest

141

558

0.49

417

BCP VI Carried Interest

173

233

0.20

60

BEP Carried Interest

58

81

0.07

23

Tactical Opportunities Carried Interest

10

19

0.02

9

SP V Carried Interest

1

1

0.00

-

Total Private Equity

820

1,275

1.12

455

Real Estate

BREP IV Carried Interest

2

2

0.00

-

BREP V Carried Interest

623

618

0.54

(5)

BREP VI Carried Interest

1,284

1,389

1.22

105

BREP VII Carried Interest

358

459

0.40

101

BREP Int'l I Carried Interest

2

2

0.00

-

BREP Europe III Carried Interest

117

144

0.13

27

BREP Europe IV Carried Interest

3

10

0.01

7

BREP Asia Carried Interest

8

9

0.01

1

Core+ Carried Interest

-

1

0.00

1

BREDS Carried Interest

15

18

0.02

3

BREDS Incentive Fees

3

3

0.00

-

Asia Platform Incentive Fees

9

9

0.01

-

Total Real Estate

2,424

2,664

2.33

240

Hedge Fund Solutions

Incentive Fees

56

57

0.05

1

Total Hedge Fund Solutions

56

57

0.05

1

Credit

Carried Interest

185

176

0.15

(9)

Incentive Fees

61

69

0.06

8

Total Credit

246

245

0.21

(1)

Total Blackstone

Carried Interest

3,417

4,103

3.59

686

Incentive Fees

129

138

0.12

9

Net Accrued Performance Fees

3,546

$

4,241

$

3.72

$

695

$

Memo: Net Realized Performance Fees

94

$

239

$

0.21

$

145

$

|

Blackstone

26

Investment Records as of June 30, 2014

(a)

Notes on next page.

Committed

Available

Unrealized Investments

Realized Investments

Total Investments

Net IRRs (d)

(Dollars in Thousands, Except Where Noted)

Capital

Capital (b)

Value

MOIC (c)

% Public

Value

MOIC (c)

Value

MOIC (c)

Realized

Total

Private Equity

BCP I (Oct 1987 / Oct 1993)

859,081

$

-

$

-

$

n/a

-

1,741,738

$

2.6x

1,741,738

$

2.6x

19%

19%

BCP II (Oct 1993 / Aug 1997)

1,361,100

-

-

n/a

-

3,256,819

2.5x

3,256,819

2.5x

32%

32%

BCP III (Aug 1997 / Nov 2002)

3,967,422

-

-

n/a

-

9,184,688

2.3x

9,184,688

2.3x

14%

14%

BCOM (Jun 2000 / Jun 2006)

2,137,330

199,298

247,105

1.2x

-

2,619,040

1.4x

2,866,145

1.3x

7%

6%

BCP IV (Nov 2002 / Dec 2005)

6,773,138

228,665

3,876,222

2.0x

61%

17,565,752

3.1x

21,441,974

2.8x

45%

37%

BCP V (Dec 2005 / Jan 2011)

21,031,850

1,770,128

19,182,132

1.7x

49%

13,722,497

1.6x

32,904,629

1.6x

8%

8%

BCP VI (Jan 2011 / Jan 2017)

15,184,161

8,624,325

8,187,578

1.4x

19%

1,462,362

1.6x

9,649,940

1.5x

44%

19%

BEP (Aug 2011 / Aug 2017)

2,422,838

1,234,987

1,826,488

2.0x

37%

631,832

1.5x

2,458,320

1.8x

45%

52%

Total Corporate Private Equity

53,736,920

$

12,057,403

$

33,319,525

$

1.6x

42%

50,184,728

$

2.1x

83,504,253

$

1.9x

20%

16%

Tactical Opportunities

5,415,849

3,315,432

2,403,589

1.1x

5%

171,049

1.1x

2,574,638

1.1x

12%

16%

Strategic Partners

15,450,456

5,145,840

6,436,636

1.8x

n/a

10,305,204

1.3x

16,741,840

1.5x

n/a

14%

Other Funds and Co-Invest (e)

1,201,732

28,302

680,613

0.8x

56%

20,890

1.0x

701,503

0.8x

n/m

n/m

Total Private Equity

75,804,957

$

20,546,977

$

42,840,363

$

1.6x

34%

60,681,871

$

1.9x

103,522,234

$

1.8x

20%

16%

Real Estate

Dollar

Pre-BREP

140,714

$

-

$

-

$

n/a

-

345,190

$

2.5x

345,190

$

2.5x

33%

33%

BREP I (Sep 1994 / Oct 1996)

380,708

-

-

n/a

-

1,327,708

2.8x

1,327,708

2.8x

40%

40%

BREP II (Oct 1996 / Mar 1999)

1,198,339

-

-

n/a

-

2,531,613

2.1x

2,531,613

2.1x

19%

19%

BREP III (Apr 1999 / Apr 2003)

1,522,708

-

2,161

0.1x

-

3,325,133

2.4x

3,327,294

2.4x

22%

21%

BREP IV (Apr 2003 / Dec 2005)

2,198,694

-

1,440,888

1.0x

22%

3,092,653

2.4x

4,533,541

1.7x

66%

14%

BREP V (Dec 2005 / Feb 2007)

5,539,418

-

7,033,344

1.9x

17%

4,207,071

2.0x

11,240,415

1.9x

21%

10%

BREP VI (Feb 2007 / Aug 2011)

11,058,605

614,439

16,870,917

2.1x

54%

6,791,824

2.2x

23,662,741

2.2x

17%

14%

BREP VII (Aug 2011 / Feb 2017)

13,440,836

4,817,292

13,274,189

1.5x

3%

1,874,236

1.6x

15,148,425

1.5x

38%

28%

Total Global Real Estate Funds

35,480,022

$

5,431,731

$

38,621,499

$

1.8x

29%

23,495,428

$

2.2x

62,116,927

$

1.9x

26%

17%

Euro

BREP Int'l (Jan 2001 / Sep 2005)

824,172

€

-

€

120,660

€

1.5x

-

1,238,480

€

2.2x

1,359,140

€

2.1x

25%

23%

BREP Int'l II (Sep 2005 / Jun 2008)

1,629,748

50,821

1,400,316

1.2x

37%

392,885

1.6x

1,793,201

1.3x

10%

3%

BREP Europe III (Jun 2008 / Dec 2013)

3,204,714

496,937

3,681,634

1.5x

9%

905,868

2.5x

4,587,502

1.6x

32%

18%

BREP Europe IV (Sep 2013 / Mar 2019)

5,142,757

3,683,469

1,634,057

1.1x

-

115,159

1.2x

1,749,216

1.1x

104%

15%

Total Euro Real Estate Funds

10,801,391

€

4,231,227

€

6,836,667

€

1.3x

12%

2,652,392

€

2.1x

9,489,059

€

1.4x

24%

11%

BREP Co-Investment (f)

5,160,385

$

-

$

8,049,438

$

1.9x

70%

2,052,222

$

2.0x

10,101,660

$

2.0x

14%

17%

BREP Asia (Jun 2013 / Dec 2017)

4,456,988

3,682,829

972,723

1.2x

-

4,400

1.0x

977,123

1.2x

n/a

20%

Total Real Estate

59,231,111

$

14,872,413

$

56,839,535

$

1.7x

31%

29,057,652

$

2.2x

85,897,187

$

1.8x

25%

17%

Core+

1,407,622

$

233,500

$

1,207,991

$

1.0x

-

-

$

n/a

1,207,991

$

1.0x

n/a

n/a

BREDS (g)

6,760,361

$

2,492,341

$

3,148,411

$

1.2x

-

2,828,717

$

1.3x

5,977,128

$

1.2x

15%

12%

Credit (h)

Mezzanine I (Jul 2007 / Jul 2012)

2,000,000

$

139,685

$

1,155,248

$

1.5x

-

3,606,207

$

1.6x

4,761,455

$

1.6x

n/a

18%

Mezzanine II (Nov 2011 / Nov 2016)

4,120,000

2,566,976

1,960,785

1.2x

-

823,420

1.4x