Attached files

| file | filename |

|---|---|

| 8-K - 8-K - NEW JERSEY RESOURCES CORP | d747670d8k.htm |

New York Financial Community

NJR Chat

NJR Energy Services

June 25, 2014

Exhibit 99.1 |

Regarding Forward-Looking Statements

1

Certain

statements

contained

in

this

presentation

are

forward-looking

statements

within

the

meaning

of

the

Private

Securities

Litigation

Reform

Act

of

1995.

Words

such

as

“anticipates,”

“estimates,”

“expects,”

“projects,”

“may,”

"will,"

“intends,”

“expects,”

"believes,"

or

“should”

and

similar

expressions

may

identify

forward-looking

information

and

such

forward-looking

statements

are

made

based

upon

management’s

current

expectations

and/or

beliefs

as

of

this

date

or

a

prior

date

concerning

future

developments and their potential effect upon New Jersey Resources (NJR or the

Company). There can be no assurance that future developments will be in accordance with

management’s expectations or that the effect of future developments on NJR

will be those anticipated by management. NJR cautions persons reading or hearing this

presentation that the assumptions that form the basis for forward-looking

statements including, but not limited to, certain statements regarding NJR's NFE for fiscal 2014,

forecasted contribution of business segments to fiscal 2014 NFE and to NFE

beyond fiscal 2014, NJR’s long-term NFE per share growth rate goal, and earnings guidance,

NJR’s future dividend growth rate and payout ratio, long-term benefits

of increased NFE, future NJNG capital expenditures, NJNG incremental utility gross margin, NJRES’

estimated margin for fiscal 2014, and NJR’s long-term NFE per share

growth rate include many factors that are beyond the Company’s ability to control or estimate

precisely,

such

as

estimates

of

future

market

conditions

and

the

behavior

of

other

market

participants.

The

factors

that

could

cause

actual

results

to

differ

materially

from

NJR’s

expectations

include,

but

are

not

limited

to,

weather

and

economic

conditions;

demographic

changes

in

the

NJNG

service

territory

and

their

effect

on

NJNG's

customer

growth;

volatility

of

natural

gas

and

other

commodity

prices

and

their

impact

on

NJNG

customer

usage, NJNG's Basic Gas Supply Service incentive programs, NJRES' operations and

on the Company's risk management efforts; changes in rating agency requirements

and/or credit ratings and their effect on availability and cost of capital to

the Company; the impact of volatility in the credit markets on our access to capital; the ability to

comply with debt covenants; the impact to the asset values and resulting higher

costs and funding obligations of NJR's pension and postemployment benefit plans as a result

of downturns in the financial markets, a lower discount rate, and impacts

associated with the Patient Protection and Affordable Care Act; accounting effects and other risks

associated with hedging activities and use of derivatives contracts; commercial

and wholesale credit risks, including the availability of creditworthy customers and

counterparties and liquidity in the wholesale energy trading market; the ability

to obtain governmental approvals and/or financing for the construction, development and

operation of certain non-regulated energy investments; risks associated with

the management of the Company's joint ventures and partnerships; risks associated with our

investments in renewable energy projects and our investment in an on-shore

wind developer, including the availability of regulatory and tax incentives, logistical risks and

potential

delays

related

to

construction,

permitting,

regulatory

approvals

and

electric

grid

interconnection,

the

availability

of

viable

projects

and

NJR's

eligibility

for

federal

investment tax credits (ITC), and production tax credits (PTC), the future

market for SRECs and operational risks related to projects in service; timing of qualifying for ITCs

due to delays or failures to complete planned solar energy projects and the

resulting effect on our effective tax rate and earnings; regulatory approval of NJNG’s planned

infrastructure programs; the level and rate at which NJNG's costs and expenses

(including those related to restoration efforts resulting from Superstorm Sandy) are incurred

and the extent to which they are allowed to be recovered from customers through

the regulatory process; access to adequate supplies of natural gas and dependence on

third-party storage and transportation facilities for natural gas supply;

operating risks incidental to handling, storing, transporting and providing customers with natural gas;

risks related to our employee workforce, including a work stoppage; the

regulatory and pricing policies of federal and state regulatory agencies; the possible expiration of

the NJNG Conservation Incentive Program (CIP); the costs of compliance with

present and future environmental laws, including potential climate change-related legislation;

risks related to changes in accounting standards; the disallowance of recovery

of environmental-related expenditures and other regulatory changes; environmental-related

and other litigation and other uncertainties; risks related to cyber-attack

or failure of information technology systems; and the impact of natural disasters, terrorist activities,

and other extreme events on our operations and customers, including any impacts

to utility gross margin and restoration costs. The aforementioned factors are detailed in

the “Risk Factors”

sections of our Annual Report on Form 10-K

filed on November 26, 2013, as filed with the Securities and Exchange

Commission (SEC) which is available on the SEC’s website at

sec.gov. Information included in this presentation is representative as

of today only and while NJR periodically reassesses material trends and

uncertainties affecting NJR's results of operations and financial condition in

connection with its preparation of management's discussion and analysis of results of operations

and financial condition contained in its Quarterly and Annual Reports filed with

the SEC, NJR does not, by including this statement, assume any obligation to review or revise

any particular forward-looking statement referenced herein in light of

future events. 1 |

Disclaimer Regarding Non-GAAP Financial

Measures

2

2

This presentation includes the non-GAAP measures net financial

earnings (NFE), financial margin and utility gross margin. As an indicator of the

Company’s operating performance, these measures should not be

considered an alternative to, or more meaningful than, GAAP measures, such as cash

flow, net income, operating income or earnings per share. Net financial earnings (losses) and financial

margin exclude unrealized gains or losses on derivative instruments related to the Company’s unregulated

subsidiaries and certain realized gains and losses on derivative

instruments related to natural gas that has been placed into storage at NJRES. Volatility

associated with the change in value of these financial and physical

commodity contracts is reported in the income statement in the current period. In order

to manage its business, NJR views its results without the impacts of the

unrealized gains and losses, and certain realized gains and losses, caused by

changes in value of these financial instruments and physical commodity

contracts prior to the completion of the planned transaction because it shows

changes in value currently as opposed to when the planned transaction

ultimately is settled. NJNG’s utility gross margin represents the results of revenues

less natural gas costs, sales and other taxes and regulatory rider

expenses, which are key components of the Company’s operations that move in relation

to each other.

Management uses NFE, financial margin and utility gross margin as supplemental

measures to other GAAP results to provide a more complete understanding of

the Company’s performance. Management believes these non-GAAP

measures are more reflective of the Company’s business model, provide transparency to investors

and enable period-to-period comparability of financial performance. For a

full discussion of our non-GAAP financial measures, please see

NJR’s most recent Form 10-K, Item 7 and most recent Form 10-Q, Item 2. This

information has been provided pursuant to the requirements of SEC Regulation

G. |

Current Long-Term NFEPS Guidance

3

New

projected

growth

rate

Prior

projected

growth

rate

$1.00

$1.50

$2.00

$2.50

$3.00

$3.50

$4.00

$4.50

2009A

2010A

2011A

2012A

2013A

2014E

2015E

2016E

2017E

$2.40

$2.46

$2.58

$2.71

$2.73

$3.90 -$4.10

$3.28-$3.71

Previous

New

NJR expects an average long-term growth rate of 5 to 9 percent

annually |

Fiscal 2015-2017 Earnings Guidance

4

NJR expects regulated businesses to contribute

65-80 percent of total NFE

New Jersey Natural Gas

NJR

Clean

Energy

Ventures

NJR Energy Services

NJR Midstream

NJR Home Services

35-40%

5-15%

45-50%

3-10%

2-5%

Most Recent

Fiscal 2014

Guidance

Fiscal 2015

through

Fiscal 2017

60-70%

10-20%

5-15%

5-10%

2-5% |

Capital of Over $1 Billion Drives Long-Term

Growth

5

Over

50

percent

of

capital

expenditures

are

earning

an

immediate

return

*As proposed

($mm)

2013A

2014E

2015E

2016E

2017E

Total

Customer Growth

$79.4

$24.5

$24.7

$25.6

$25.5

$25.5

$205.2

Yes

Maintenance/Other

177.4

42.5

64.2

55.7

48.1

40.6

$428.5

AIP/SAFE

136.7

45.3

31.6

33.7

39.1

-

286.4

Yes

Superstorm Sandy

-

26.1

5.3

5.2

-

-

36.6

NGV Advantage

-

1.0

9.0

-

-

-

10.0

Yes

NJ RISE

-

-

4.6

13.0

12.0

12.0

41.6

Yes*

Liquefaction/LNG

-

-

16.0

16.3

3.4

-

35.7

Southern Reliability

-

-

2.3

12.3

80.6

34.8

130.0

SAVEGREEN

36.5

24.0

42.5

42.5

-

-

145.5

Yes

Total

$430.0

$163.4

$200.2

$204.3

$208.7

$112.9

$1,319.5

2009-

2012

Actual

Immediate

Return

NJNG Capital Investment Estimates |

Diversified and Growing Utility Gross Margin

NJR expects incremental utility gross margin to more than double

by Fiscal 2017

6

$0.0

$5.0

$10.0

$20.0

$25.0

$30.0

$35.0

$40.0

$45.0

FY13A

FY14E

FY15E

FY16E

FY17E

Customer Growth

SAVEGREEN

NGV

BGSS Incentives

$20.3

$29.3

$36.0

$41.3

$15.6

$15.0 |

NJRES: What We Do

Manage physical natural gas assets

Storage

Transportation

Supply Contracts

Services include:

Transport natural gas to customers

Storage gas used to serve customers when demand is high

Manage other companies’

assets

Producer Services

Fee-based service

Revenue dependent on volume sales, not volatility

Customer relationships

Utilities, power generators, storage operators, pipelines and industrial

customers across North America including Marcellus Shale

7 |

NJRES: Our Track Record

In business since 1995; consistently profitable*

Average tenure of employees is 10+ years

Specializes in managing physical natural gas assets

* On an annual NFE basis

$0.0

$20.0

$40.0

$60.0

$80.0

$100.0

$120.0

$140.0

$160.0

$180.0

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

FYTD 14

Margin

NFE

8 |

9

NJRES: Our Asset Base

Firm Storage

Firm Transportation

Producer Service Area

Typical annual portfolio:

Storage capacity –

Approximately 40 Bcf in the United States and Canada

Pipeline transportation capacity –

Approximately 1.5 Bcf/day |

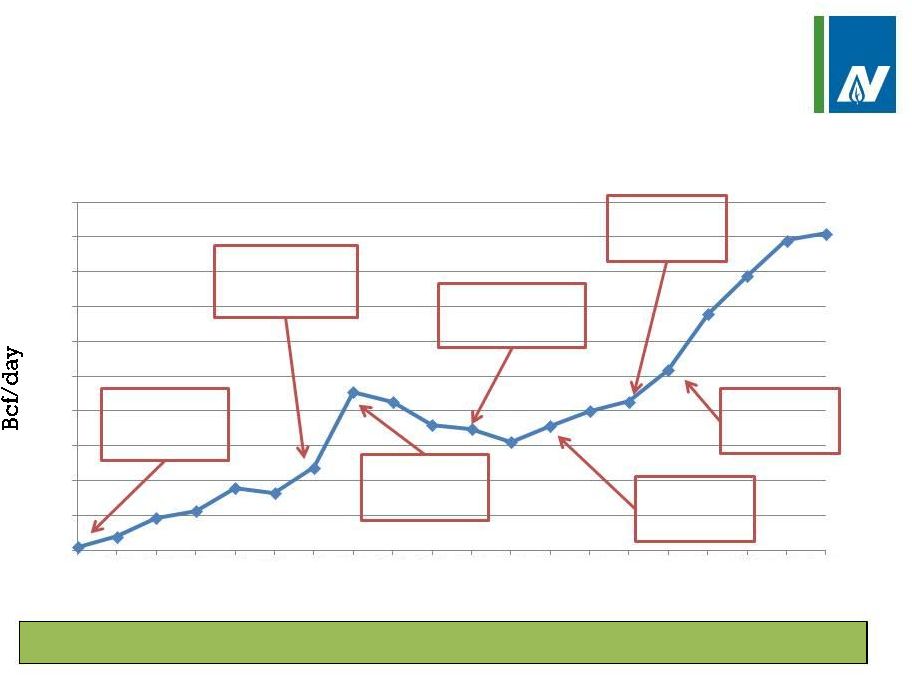

NJRES: How has the Business Changed?

10

Our business has evolved with new products and services

Volumes Sold

Pipeline Asset

Management

(TGPL Block sale)

First LDC

Outsourcing Deal

(NIMO)

Marcellus

Producer

Services

Service

Contract with

Electric Utility

Storage

Management

(Stagecoach)

Barnett

Producer

Services

Geographic

Expansion

(Westbook)

0.00

0.20

0.40

0.60

0.80

1.00

1.20

1.40

1.60

1.80

2.00

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

FTYD

2014 |

NJRES: How Do We Make Money?

Our portfolio consists of two types of physical assets

Storage capacity -

40 Bcf in the US and Canada

Transportation capacity –

1.5 Bcf/day

We optimize transportation and storage capacity

Pipeline transportation allows for natural gas to be purchased in one

location and sold in another; leased for various periods of time

Pipeline transportation provides opportunity to capture locational spreads

Storage transactions allow for the injection of gas which is hedged for future

sale

Storage capacity is leased for various periods and provides opportunity to

realize time spreads

Depending on volatility and market conditions, storage and transportation

hedges can be re-positioned to capture incremental value at any time until

physical delivery

11 |

NJRES: How Do We Make Money? (cont’d)

We manage other companies’

assets

Sharing or fee based

We are focused on long-option strategy and disciplined risk

management

Limits downside

Transactions have upside potential

Profits tend to be higher in the first two fiscal quarters

As assets are added to portfolio, demand charges are incurred

Expenses can outpace revenue for a month or quarter

Recovery of annual demand fees often occurs over three to six month

periods

12 |

NJRES: How We Manage Risk?

Hedge price risk of gas in storage

Disciplined risk management guidelines

Limited open positions

Strict internal controls and credit procedures

Daily compliance monitoring by financial department

IT systems customized to manage physical natural gas assets

Long option strategy

Commodity pricing is hedged

Creates upside when market conditions are volatile

13 |

NJRES: How Do We Maintain a Hedged

Position with Upside Potential?

14

No Market Volatility

Market Volatility

January 2013

July 2014

January 2013

July 2014

NJRES buys 10,000 dth

@ $4.00 and injects

into storage

NJRES sells 10,000 dth

@ $4.50 to meet

physical sale

NJRES buys 10,000

dth @ $4.00 and

injects into storage

NJRES sells 10,000

dth (from storage)

into spot market @

$30/dth and makes

a physical sale

NJRES sells 1 Futures

contract (10,000 dth)

for July 2014 @ $4.50

Futures contract

expires

NJRES sells 1 Futures

contract (10,000 dth)

for July 2014 @ $4.50

NJRES buys 1

Futures contract

(10,000 dth), July

2014 @ $4.70

NJRES earns $.50 on

physical sale and

delivery to customer

NJRES earns $25.80,

composed of $26

gain on sale, less

$.20 loss on futures

expiration

P

H

Y

S

I

C

A

L

F

I

N

A

N

C

I

A

L

R

E

S

U

L

T |

NJRES: What Happened This Winter?

Weather is always the unknown variable

Increased supply created growing physical natural gas market

Created need for physical natural gas services

Market players thinned by:

Regulation -

e.g. Dodd-Frank eliminated financial players

Low volatility and illiquidity –

reduced number of market makers

NJRES remained committed to this business

Increased the geographic size of our book of assets

Added producer services to contribute nonvolatile income

As a result:

Asset prices were cheap

NJRES was able to assemble and retain a greater number of long options

heading into last winter

Executing this strategy created the opportunity for the considerable upside

experienced in Q2 Fiscal 2014

15 |

16

NJRES: Things to Watch –

Causes of Summer

Volatility

Weather is always the unknown variable

Sector demands

Electric generation, industrials, storage refill

Gas storage levels

Historically low end-of-season levels; ~1 Tcf below average

Refill challenges

Lower Canadian imports

Higher exports to Mexico

Cross-commodity pricing

Oil

Coal

Renewables

Natural gas production changes

Shifts in production basins

Daily production of 67-68 Bcf

Natural gas rig count near historical low

New carbon rules |