Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Escalera Resources Co. | d739678d8k.htm |

Exhibit 99.1

| Charles F. Chambers, Chairman, President & CEO IPAA OGIS Toronto June 5, 2014 |

| Corporate Disclaimer This presentation may contain projections and other forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended. Any such projections or statements reflect the Company's current views with respect to future events and financial performance. No assurances can be given, however, that these events will occur or that such projections will be achieved and actual results could differ materially from those projected. A discussion of important factors that could cause actual results to differ materially from those projected, such as decreases in oil and gas prices and/or unexpected decreases in oil and gas production, is included in the Company's periodic reports filed with the Securities and Exchange Commission. Cautionary Note to U.S. Investors - The United States Securities and Exchange Commission permits oil and gas companies, in their filings with the SEC, to disclose proved reserves that a company has demonstrated by actual production or conclusive formation tests to be economically and legally producible under existing economic and operating conditions. Effective for the Company's December 31, 2010 Form 10-K, SEC guidelines were changed to also allow for disclosure of "probable" and "possible" reserves. We may use these terms in this presentation. Investors are urged to consider closely the disclosure in our 2013 Form 10-K, File No. 1-33571, available from us at Escalera Resources Co., 1675 Broadway, Suite 2200, Denver, Colorado 80202, attention Investor Relations. You can also obtain this form from the SEC by calling 1-800-SEC- 0330. 2 |

| 3 "Invest in big ideas from small companies." -Statoil Copyright(c)2014 Escalera Resources Co. All rights reserved. |

| Corporate Information NASDAQ:ESCR Shares Outstanding: 14,083,724 Price per Share (as of 5/21/14): $2.64 Market Cap (common): $37.2MM Enterprise Value (common + pfd + debt): >$124MM Average Daily Volume: ^21,000 Executive Office 675 Bering, Suite 850, Houston TX 77057 Corporate Headquarters 1675 Broadway, Suite #2200, Denver CO 80202 Main Field Office 777 Overland Trail, Casper WY 82601 4 |

| Escalera Resources Co. Formerly Double Eagle Petroleum Co. Escalera Resources Co. ("Escalera Resources", "Escalera" or the "Company") owns and operates domestic, on-shore E&P assets Escalera Resources owns and operates domestic, on-shore midstream assets including the existing Wyoming pipeline Escalera International Co. LLC is a wholly owned subsidiary of Escalera Resources Co. and is focused on international E&P and midstream projects Executive offices are in Houston, Texas with Corporate Headquarters in Denver, Colorado, and a regional office in Casper, Wyoming Recent Company changes / new additions: Charles Chambers joined as CEO, President and Chairman of the Board of Directors Richard Dole is now Vice-Chairman of the Company's Board of Directors Neil Bush joined the Company's Board of Directors Susan Reeves on the Board slate for 2014-2015 Eric Icsel is President of Escalera International Co. LLC Adam Fenster joined the Company as CFO Gene Humphrey to be named President of Escalera GTL 5 |

| Proven Execution 6 Low cost growth through the drill bit 2013 production costs, including taxes, of $1.43/Mcfe G&A costs represent 15% of revenue Based on Global Hunter Securities Exploration & Production sector analysis, ESCR outperforms majority of peer group (3 year avg) #1 in acquisition costs per BOE of $0.52 #2 in future development costs per BOE #7 in drill bit F&D costs, $5.71 per BOE #15 in average PV/I #18 in future production costs per BOE |

| Building Shareholder Value 7 Pinedale Anticline * Interest in 184 producing wells * 22% of proved reserves * 260+ future potential wells * Operated by QEP Atlantic Rim CBM * Interest in 283 producing CBM wells * 71% of proved reserves * 1,400 future drilling locations in existing units * Escalera Resources operates Catalina Unit * Other unit operated by Warren Resources Midstream Pipeline * 12.5 miles of pipeline * 20% utilized * Ability to expand north to WIC HIGHLIGHTS 109.3 Bcfe of Proved Reserves (1) $127.1 million PV-10 value (1) 2014 estimate YE production-25.5 Mmcfe/d (1) Reserves based upon revised bank pricing deck as of 12/31/13 |

| Pinedale Anticline 8 8 Producing Assets Operated by QEP 220 producing wells in three units Mesa A - 50 wells Mesa B - 139 wells Mesa C - 31 wells 4,900 Mcfe/d net production $4.4 million 2014 est cash flow from operations One of the lowest cost gas producing assets in US $1.30/ Mcfe F&D; $0.81/ Mcfe LOE and trans cost (12/31/13) 30 Bcfe of 2P reserves with $39 MM PV-10 (based upon forward strip pricing at 12/31/2013) 43% PD; 35% PUD; 22% Prob Long-lived reserves Upside Potential Mesa C to be drilled up beginning in 2017-2018; 166 potential additional locations. Escalera Resources has a 9% reversionary carried WI Mesa A drilling to begin in 2014; 100 potential additional locations; Escalera Resources has a 0.3125% ORRI |

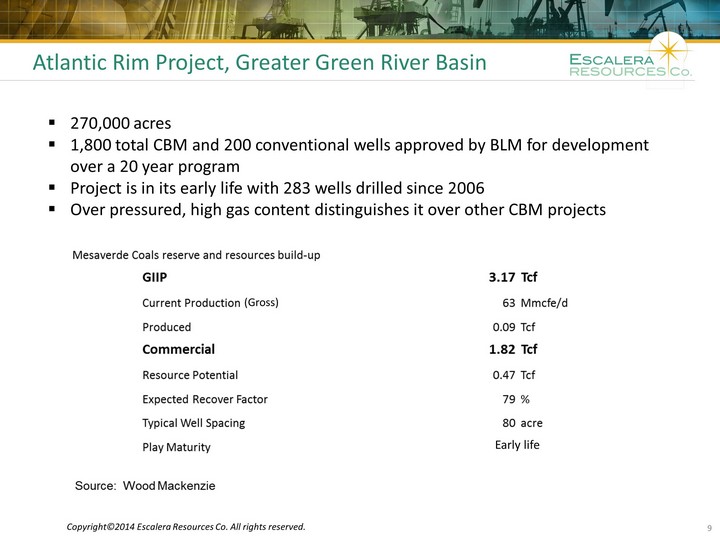

| Atlantic Rim Project, Greater Green River Basin 9 270,000 acres 1,800 total CBM and 200 conventional wells approved by BLM for development over a 20 year program Project is in its early life with 283 wells drilled since 2006 Over pressured, high gas content distinguishes it over other CBM projects (Gross) Early life |

| The Atlantic Rim 10 10 Historical Drilling Activity Catalina Unit 83 gross (64 net) wells ~175 total potential future drilling locations 36.4 Bcfe net proved reserves (based upon forward strip pricing at 12/31/2013) Spyglass Hill Unit (including former Sun Dog/Doty Mtn Units) 200 gross (47 net wells) ~1,225 total potential future drilling locations 22.2 Bcfe net proved reserves (based upon forward strip pricing at 12/31/2013) 2014 Planned Activity Up to 48 gross CBM wells in Spyglass Hill Unit Expected WI of 10-20% for those wells we will participate in, pick up in reserves of 15-23% |

| Building Value Building Value 11 Securing Our Energy Supply |

| Strategic Plan Strategic Plan Operating Framework Strategic Framework Establish Escalera as one of the premier developers in unlocking the trapped value of natural gas resources 1 2 3 4 5 Strong foundation of low-cost producing assets Strong future potential in existing operations Diversity of exploration areas; access to pipelines World-class team; world-class partners Exclusive access to proven technologies 12 Copyright(c)2014 Escalera Resources Co. All rights reserved. |

| Strategic Plan Strategic Plan Strategic Benefits Strategic Solutions Establish Escalera as one of the premier developers in unlocking the trapped value of natural gas resources 1 2 3 4 5 Sustained, long-term end-product demand; ability to adjust to multiple end products based on economic demand Environmentally superior refining process and product Repeatable approach; rapid GTL with lower cost Low risk + managed scale + integrated offering High value rewards, revenues and opportunities We can do something with flared gas that nobody else is doing 6 Business model evolution & growth; new value chains created via off-take channel plays Natural gas converted to diesel is 7.7 times more valuable Delivering energy solutions that enhance lives, improve businesses and communities, and build a better future 13 |

| GAS-to-Liquids (gtl) 14 |

| Only Five GTL Plants Worldwide Only Five GTL Plants Worldwide ? Pearl Bintulu Sasolburg Mosul Bay Oryx Currently, the GTL opportunity is sub-optimized, under-leveraged and lopsided which provides an opportunity for Escalera Resources. 15 |

| Why Change Natural Gas to Liquids? Energy Information Administration (EIA) expects average 2014 prices for: Crude oil (Brent) to be $104 per barrel One barrel crude has 5.8 MMBtu $104/5.8 = $17.90 per MMBtu for crude Natural gas (NYMEX) to be $3.78 per MMBtu Energy on the same MMBtu basis is almost 5 times more valuable in unrefined liquid form than natural gas Diesel in Rocky Mountains is $3.995 per gallon or $167.79 per barrel Natural gas converted to diesel is 7.7 times more valuable Crude converted to diesel is 1.6 times more valuable 16 |

| Gas-to-Liquids Initiative Value Proposition Gas-to-liquids economic uptake Ability to adjust to multiple end products based on economic demand Repeatability both domestically & internationally Project Risk - risk mitigation by "best in class" partners Supply risk Conversion risk Off-take risk Financial risk 18 |

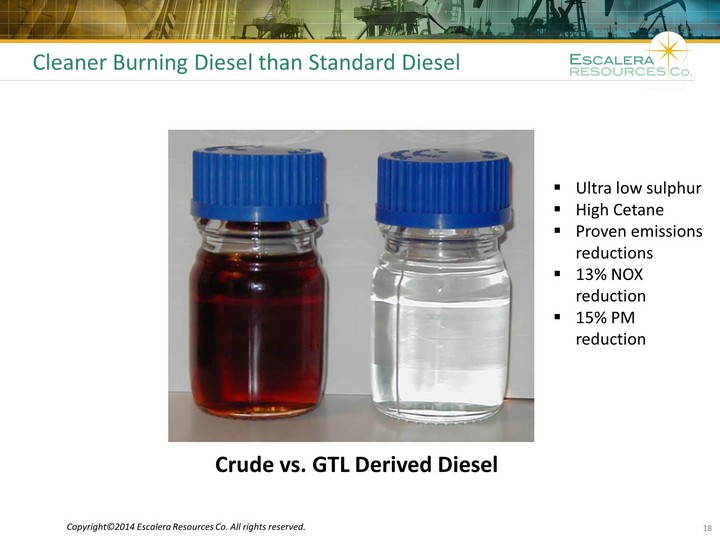

| Cleaner Burning Diesel than Standard Diesel 18 18 Crude vs. GTL Derived Diesel Ultra low sulphur High Cetane Proven emissions reductions 13% NOX reduction 15% PM reduction Copyright(c)2014 Escalera Resources Co. All rights reserved. |

| Escalera = Natural Gas Natural gas is Escalera's primary focus for growth. We have the leading team of global, purpose-driven industry experts from across a range of industries who are unequalled in turning undervalued natural gas resources into high value rewards, revenues and opportunities. Escalera is the developer of choice for those wanting to acquire low cost gas and enhance it's value 8-fold. The strength of Escalera's end-to-end solution is guaranteed by TRUST: Teams of experienced individuals and partners Real world experience Unique combination of our integrated offering (available supply, GTL, superior fuel) Superior & sustainable performance Technology that is innovative, practical, proven and best in class Copyright(c)2014 Escalera Resources Co. All rights reserved. 20 |

| Conclusion Escalera is an integrated E&P company with a focus on natural gas: Strong foundation of assets Proven execution Strong value creation Escalera has a compelling strategy: Unlock trapped value of natural gas Provide leadership in addressing the country's energy supply for the future Escalera has significant new initiatives to deliver growth: Significant natural gas acquisition program Acquire and convert abundant, low cost natural gas to high value diesel using gas-to- liquids (GTL) technology Repeatability both domestically & internationally Escalera is grounded in its purpose: Escalera will be good stewards of our natural resources by enhancing their value and by delivering environmental and economic rewards and opportunities for all 20 Copyright(c)2014 Escalera Resources Co. All rights reserved. |

| Thank You Charles F. Chambers Chairman, President & CEO Escalera Resources Co. 675 Bering, Suite 850 Houston, TX 77057 713-590-9565 cfchambers@escaleraresources.com Tehren Webb Executive Assistant to Charles F. Chambers 713-590-9566 tehren@escaleraresources.com 21 Copyright(c)2014 Escalera Resources Co. All rights reserved. |